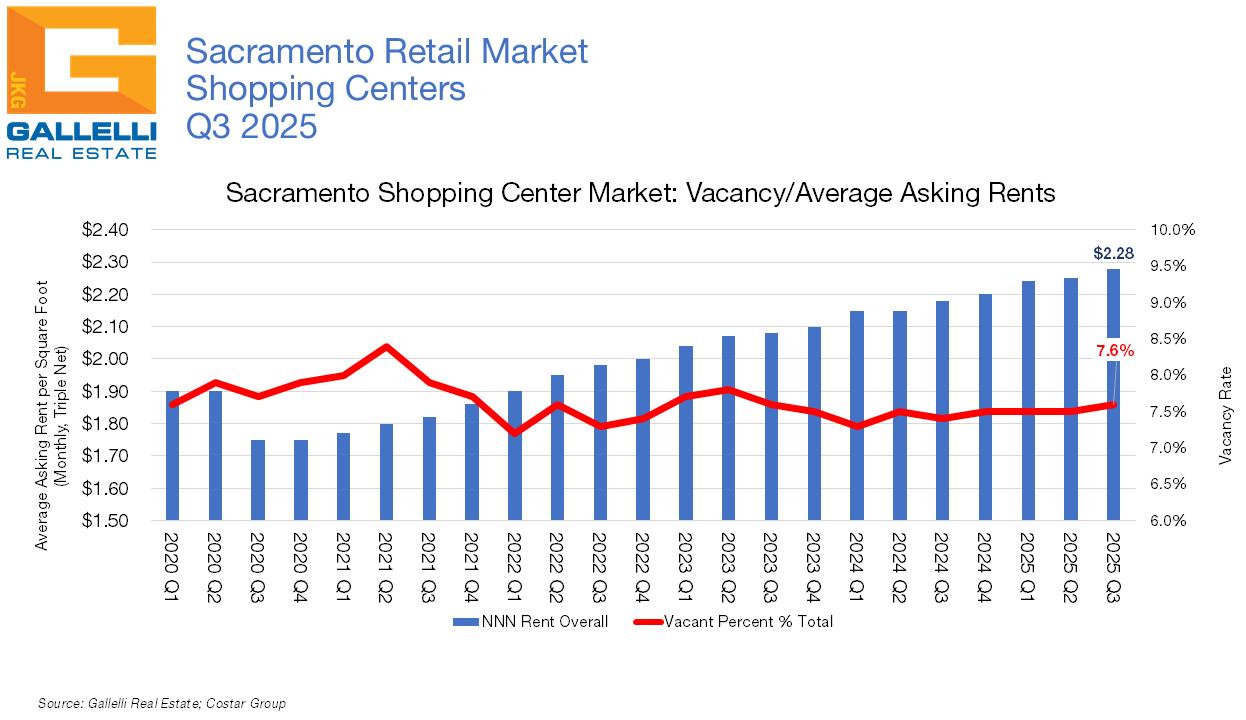

Vacancy for shopping center space in the Sacramento region stood at 7.6% as of the end of Q3 2025, up slightly from last quarter’s reading of 7.5% and from the 7.4% rate that was in place exactly one year ago.

The market continues to hold its own despite a rising spate of retail bankruptcies and closures. As this report went to press Rite Aid had just closed its final locations following their second bankruptcy in two years (they closed approximately 1,400 stores this year), while furniture and furnishings retailer At Home had just emerged from Chapter 11 proceedings where they shed 28 stores. Q3 2025 bankruptcies include Claire’s/Icing, Bravo Brio, Pinstripes, Abuelo’s, Iron Hill Brewery, Razzoo’s Cajun Café, Mattress Land, CMX, and Opa! Restaurant Group are all among the concepts that have filed for Chapter 11 protection over the past three months, with various levels of store closures. This is in addition to bankruptcies earlier this year from Joanna’s, Forever 21, Hudson’s Bay, Party City, TGI Friday’s, Hooters and others. Meanwhile, there remain some major chains that are not at eminent risk of failure, but that are strategically closing stores.

CVS will close at least 300 stores this year, Walgreens is closing 700 – 750 units. Torrid, Advance Auto Parts, Kroger (some banners), Kohl’s, Fossil, and dozens of others are downsizing. What may be most notable is that Starbucks announced plans in September to close 400-500 units across the US. In this century, Starbucks closed stores only in 2001 (recession), 2008 (Great Financial Crisis), 2020 (Pandemic). In every other year since 1999, they have added a minimum of 100 units annually, averaging at least 150 stores per year in most years.

Meanwhile, data tracking firm Coresight predicts that major chain store closures in 2025 will top 15,000. This is more than double (7,300) the number they recorded in 2024 when they declared it the worst year for chain store closures since the pandemic in 2020.

Yet, vacancy has barely ticked up locally. The story is the same at the national level. According to the Costar Group, the national vacancy rate for retail real estate (this includes both shopping centers and freestanding buildings), now stands at just 4.3%, up from 4.1% at the start of the year. Their data suggests neighborhood shopping center vacancy has climbed from 5.9% to 6.4%, power center vacancy has inched up from 4.2% to 4.6%, and strip centers have seen this metric climb from 4.6% to 5.0%.

Though closures are clearly heightened, the market is absorbing most of the space coming back. The drug store sector alone will return more than 2,200 stores to market this year. While many older Rite Aid stores on the west coast (former Thrifty locations) are 20,000 SF or greater and can land active junior box players like Trader Joe’s, Sprouts Farmers Markets or even off-price apparel concepts looking to go small, most of the CVS and Walgreens stores coming back to market are more challenging. Typically, between 13,000 and 17,000 SF, these buildings are not large enough to fit the preferred template of traditional junior box users that may be in growth mode and too large for the rich pool of smaller space users active in the marketplace. Yet, opportunistic players are

stepping up for deals. For example, shoe store chain Skechers—which usually prefers footprints below the 10,000 SF threshold, has been gobbling up vacant drug store spaces where the price is right. Five Below, and Harbor Freight have also been active. Meanwhile, dollar stores, urgent care, veterinary concepts and even car wash concepts have emerged as the primary takers of this space.

The tenant and data tracking division of Gallelli Real Estate, The Brown Book, tracks growth plans for both traditional and non-traditional retailers, reports that most traditional merchant chains entering 2025 in expansion mode have since pulled back on growth plans amidst heightened economic uncertainty. But, that most of the growth planned this year came from just a few traditional merchant sectors, like beauty, discount, grocery (particularly small-format, discount, ethnic, or organic), and off-price apparel. Both fitness and restaurant chains have remained in growth mode overall this year (though both categories include some players in contraction mode). But some of the most aggressive growth plans are coming from concepts that weren’t even considered retail space using categories a few years ago like aesthetics/MediSpa concepts, cannabis dispensaries, car washes, urgent care, or quasi-medical and veterinary concepts all remain highly active.

There is another reason the market has only seen modest upticks in vacancy despite the number of closures occurring. New development remains rare, with few proposed projects going forward and no new speculative development occurring without substantial leasing commitments in place from anchors and often inline tenants. According to the Costar Group, the US added an average of 66.9 million square feet (MSF) of space annually from 2013 through 2019. From 2020 through 2024, the market averaged 27.0 MSF of new deliveries and in 2025 the market is on pace to add 24.0 MSF of new product.

The reason is simple; elevated construction and financing costs continue to challenge development fundamentals. Construction costs are still 30% to 40% above where they stood just a few years ago, with those costs outpacing achievable rents for all but the most coveted new projects. This dynamic is creating strong rent growth dynamics for existing Class A centers and the most desirable corners with little in the way of new inventory to lure tenants away. Most of what is being built today are pad sites, or expansions of existing centers though the Sacramento market is home to some notable exceptions.

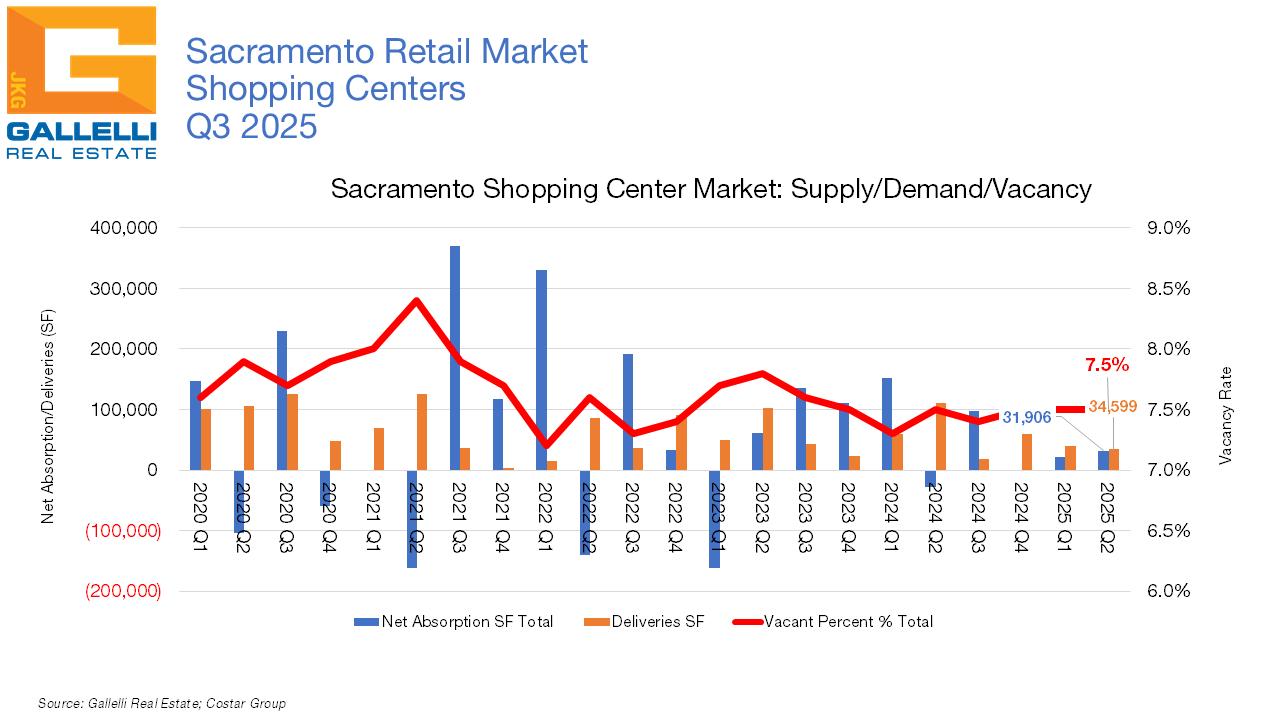

The Sacramento market recorded 129,000 SF of positive net absorption in Q3, marking the strongest single quarter for growth that the market has experienced since Q1 2024. This is the third consecutive quarter of occupancy growth, with the market having recorded 181,000 SF of positive net absorption over the past year. Despite those occupancy gains, vacancy climbed in Q3 from 7.5% to 7.6% as developers brought 168,000 SF of new supply to market, narrowly outpacing growth (demand).

Vacancy has now hovered in the 7.0% range for 17 consecutive quarters. But while we would typically define market equilibrium (where there is enough available space to offer opportunities for immediate growth, but not so much as to deter rental rate growth) as being closer to the 6.0% mark, this has not been a factor either locally or nationally.

The current average asking rent for shopping center space in the Sacramento region is $2.28 per square foot (PSF) on a monthly triple net basis. This number is up 4.6% annually and has been steadily growing since the market emerged from the pandemic in 2021. This is even though bankruptcies and closures, after reaching record low levels in 2021 and 2022, have been gradually climbing for three consecutive years. As mentioned earlier, one factor that has enabled the market to absorb recently vacated space with only modest impacts on vacancy and no impact on rental rate growth has been a lack of new development.

But development is picking up. Sacramento will close this year with roughly 420,000 SF of new shopping center space. The last year that developers added more than 400,000 SF of new product was in 2018 when 843,000 SF of new space (mostly at Delta Shores in the South Sacramento submarket) came online. We anticipate deliveries to drop back to 200,000 SF to 300,000 SF range in 2026, but the region’s largest new shopping center since Delta Shores is about to start construction. Baseline Marketplace, a 744,000 SF power center in West Roseville, is about to begin construction with a scheduled delivery date of early 2027. Construction is already underway for Costco, which will anchor the site with a 161,000 SF store that will rank among the largest in the chain. Meanwhile, local media has reported that both Home Depot and Target are in talks as potential co-anchors of that project.

Meanwhile, developers added 168,000 SF of new space to market in Q3 and there was an additional 180,000 SF under construction as this report went to press. This includes a 95,000 SF shopping center in the Roseville/Rocklin submarket that will come online in Q4 2025 that will be anchored by a 43,000 SF Nugget grocery store in that town’s Whitney Ranch neighborhood. That project reportedly has leased, or is close to leasing, all its available space. This will mark the second new store for regional grocer Nugget this year. The Woodland-based elite grocer opened their 18th store in the region in August in a former Walmart Neighborhood site at the corner of Douglas Boulevard and Sierra College Boulevard in Roseville.

Grocery has been in robust growth mode in the Sacramento market this year. The other new shopping center under construction (and slated for Q4 delivery) is The Village in Elk Grove. This 111,000 SF project from Pappas Investments will be anchored by a new Whole Foods and is reportedly nearly 100% leased already with commitments in place from Chick Fil-A, Yard House, Shake Shack, Mendocino Farms, Love Sac, and other tenants. Elk Grove saw the addition of a new Safewayanchored center at the close of 2024—at the new Laguna Reserve Marketplace at the corner of Whitelock Parkway and Bruceville Road in Elk Grove. That 93,000 SF shopping center has since leased up. Safeway opened another new 56,000 SF store in March of this year at the newly developed West Roseville Marketplace Center.

Meanwhile, Q3 saw Hispanic specialty grocer El Super is taking a portion (53,000 SF) of the former Sears space at 5901 Florin Road within Florin Towne Centre, which has been vacant since the collapse of that chain seven years ago. Other grocers active in the region over the past year have included Grocery Outlet, Trader Joe’s, SF (Shun Fat) Supermarket and H Mart (which has a site under construction in South Sacramento with an early 2026 delivery schedule).

But grocery concepts have not been the only active players in Sacramento. Experiential retail is on the march in the Golden State’s capitol city. Iin Q2, popular experiential concept Topgolf received approval for a proposed 48,000 SF facility in South Natomas adjacent to Interstate 5. Delivery timetables are still unknown, but if this project moves forward, it would be the chain’s second local unit (in addition to Roseville) and would likely be delivered in late 2026 or 2027. Meanwhile, Placer County is in the process of considering a planned new surf park from Alchemy Surf Resort. Project plans call for a surf lagoon, bungalows, action sports hub, and 100-room hotel on 32-acres near Placer One Boulevard and Foothills Boulevard. If approved, its’ backers are hoping for an opening date of late summer 2027.

Meanwhile, after closing its doors in March of this year, the former Macy’s department store at 414 K Street downtown sold in July 2025. This store, once the anchor tenant to Downtown Plaza, remained open

as that project was redeveloped as Downtown Commons and the Golden 1 Center (home to the local NBA franchise, The Sacramento Kings). But in February 2024, Macy’s announced plans to close 150 underperformers across the US through 2026 with this as one of their earlier closures. The building was purchased by the Shingle Springs Bank of Miwok Indians for a reported $15 million in July 2025. The tribe, affiliated with the Red Hawk Casino near Placerville, also owns the adjacent property at 301 Capitol Mall. That property was home to the failed Towers on Capitol Mall project, which was to consist of two 53-story mixed-use towers featuring a 200-room Intercontinental Hotel, 804 luxury condominiums and ground floor retail. Funding for that project collapsed in 2007 as foundation work had just begun leaving an empty lot behind instead of the region’s tallest towers. The tribe has not disclosed plans for the combined two-block site yet, but most speculation is focused on the potential of a new Downtown casino and resort, though the regulatory path for approval would likely be challenging. Some mix of hospitality and retail, as well as a potential sports venue, are ideas also reportedly all in consideration. While it remains to be seen what gets built here, we think this is a project to watch. While the daytime office worker population of Downtown Sacramento has yet to recover, outsized growth of the local housing stock and a steady stream of quality retail has been quietly transforming the Downtown/Midtown neighborhoods in recent years.

Initial economic uncertainty regarding tariff impacts appears to be fading, with many companies that had paused moves earlier in the year returning to dealmaking. Or as one developer told us, “It just seems like the last few years we have had a greater level of economic uncertainty baked into the cake. In 2023 and 2024, that question of ‘recession or not,’ was about inflation and interest rates and could the Fed engineer a soft landing. Now that’s the same thing but it’s about the tariffs. After a while you just start to tune it out. I mean, other than deals taking a little longer to get done, we’ve been holding our own and doing ok.”

So far, consumer spending has continued to hold up far better than most early economist predictions, though many warn that the full impact of many tariffs has yet to hit the market. As this report went to press, the Federal government was entering into the second week of a shutdown that has no end in sight and could create its own economic issues the longer it goes on. One issue is that the Census Bureau is not gathering and publishing retail sales numbers currently, but data from credit and debit card tracking firm Affinity Solutions indicates that September retail sales were up a robust 5.4% annually, meaning that consumers are still showing up.

But risks remain. The question of how much the current tariff policies will negatively impact inflation remains—though increases

so far have been minimal. Meanwhile, though unemployment remains near 50-year lows, employment growth has been slowing substantially in recent months. September interest rate cuts from the Federal Reserve may help to change that, but the economic picture heading into the final months of 2025 remains cloudy. While US stock indices are all at or near historic highs, much of those gains in 2025 have been driven by companies at the forefront of artificial intelligence (AI) creation—with AI increasingly being cited as a driving force for layoffs and flattening employment growth. That trend is only likely to increase heading into 2026.

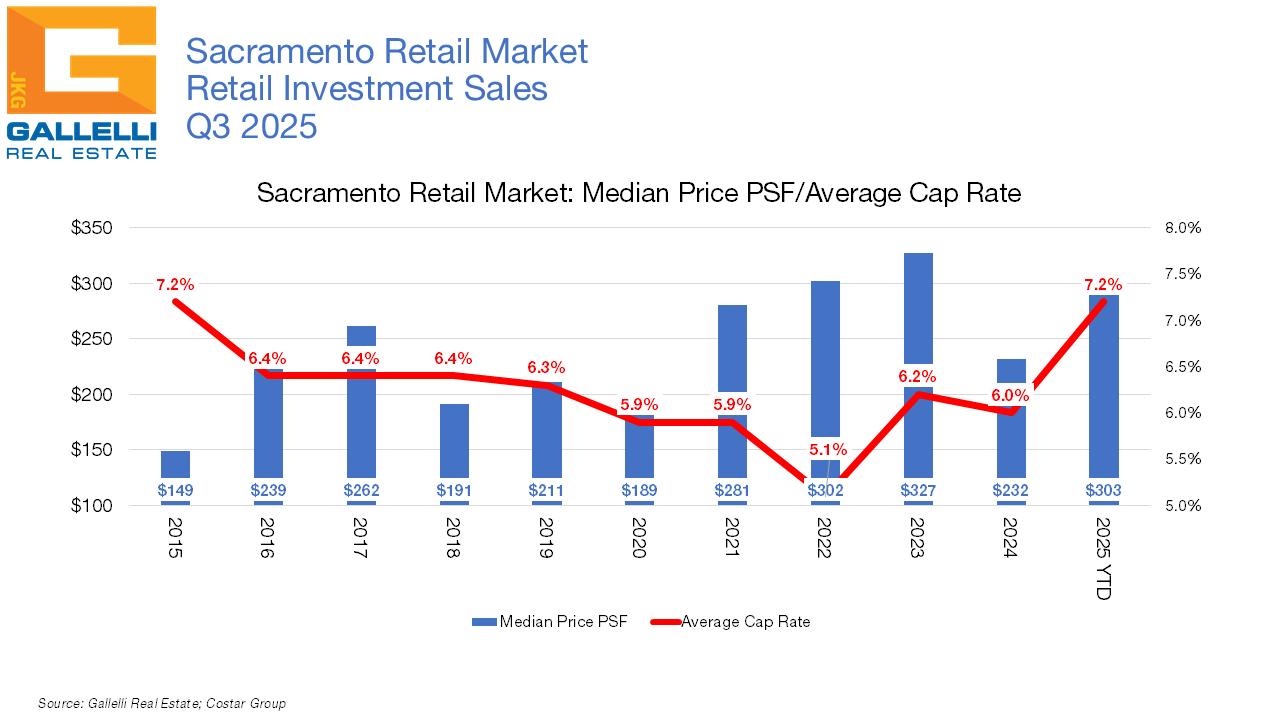

But the September interest rate cut by the Fed will likely be a boost in the arm for real estate and will almost certainly be the first of multiple cuts. That cut—a 25-basis point reduction—isn’t likely to set off a flood of investment activity. But as this report went to press, Fed Chair Jerome Powell said that the Fed would likely cut its key interest rate at least two more times this year stating that “rising downside risks to employment have shifted our assessment of the balance of risks.” We think this is likely to spur increased activity heading into 2026.

As for retail fundamentals going forward, retail bankruptcies and closures are already elevated but the challenges have been concentrated in a few categories (drug stores, furniture/furnishings, crafts, party stores, etc.) where there are either structural issues or unique challenges, or it’s been with legacy chains struggling to maintain relevance with today’s consumer. Should the current level of closures continue or increase it is hard to see a dynamic where vacancy levels won’t be climbing more visibly in 2026.

The final quarter of 2025 will be an inflection point for retail heading into 2026. We still do not know what the full impact of tariffs will be, but if impacts are not starting to play out in the coming weeks, then it is likely concerns have been overblown. Meanwhile, the timing of potential price increases and/or the possibility of inventory shortages could present some weaker chains with a make-or-break scenario this holiday shopping season.

Criteria based on: Retail in a Shopping Center. Includes Existing, Under Construction, Proposed, Final Planning

Gallelli Real Estate is a private firm that specializes in commercial real estate services and property management. We believe that as a boutique firm whose understanding of the business runs as deep as our core values, our advantage is large. We take pride in our unique approach to offer more individual solutions that address the ever changing needs of our clients and the industry. After all, our success is measured by the success of our clients and the strength and longevity of our relationships.

rosborne@gallellire.com

Land/Investments ebenoit@gallellire.com