Direct Vacancy Rate

948 UNITS 3,825 UNITS 4.1% 6.2%

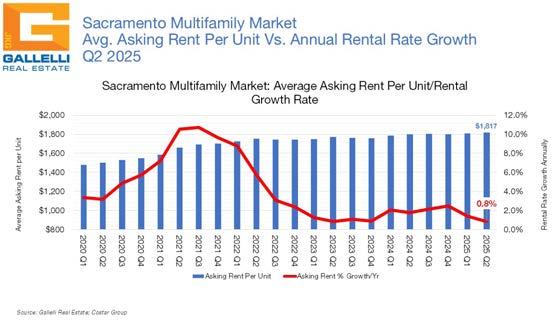

$1,817/UNIT

Average Asking Rate (NNN)

DESPITE ECONOMIC CLOUDS, MULTIFAMILY WELL-POISED

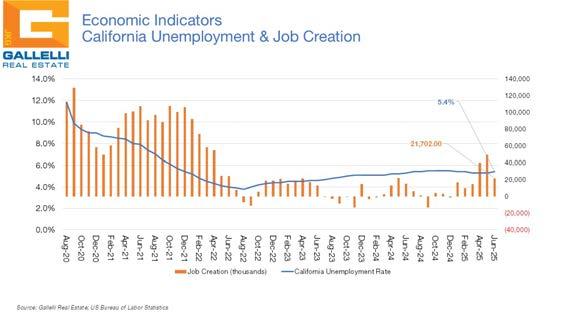

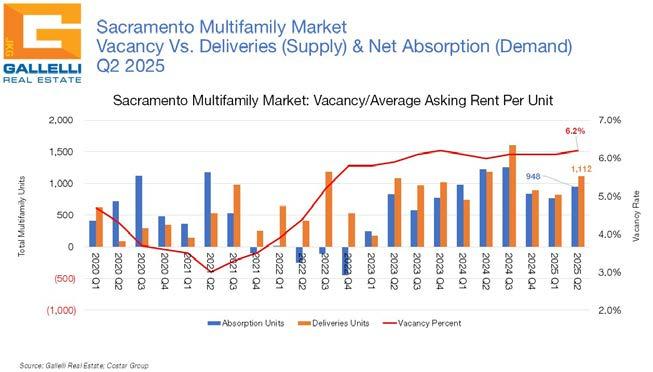

Sacramento apartment vacancy stood at 6.2% as of 2025’s midyear mark. This is up slightly from the 6.1% rate of three months ago, but this metric has remained relatively stable for the past two years. Since Q2 2023, vacancy has hovered within 20 basis points of its current rate. This is even though development levels for 2023 and 2024 were among the most aggressive in 20 years. The market added 4,426 new multifamily units in 2024, the most locally since 2000. Developers added 3,249 units in 2023, at the time a 20-year high. Yet, demand (net absorption) has largely kept up. Since 2023, new projects have added an average of 1,049 new housing units per quarter, while occupancy growth has averaged 915 units per quarter.

In both cases, upswings in population growth have been a factor. In the early 2000s, Sacramento saw a surge of in-migration from the Bay Area following the tech crash and eventual post-9/11 recession of 2001. Likewise, the Golden State’s capitol city experienced another wave of (mostly) Bay Area migrants in the wake of the 2020 pandemic. While the popular narrative continues for many that California is hemorrhaging people, the reality is its population decreased modestly in the years 2020, 2021, and 2022. It returned to growth in

3,4825 UNITS

2023 and the latest data estimates from the Census Bureau suggest that California’s population increased by 108,000 people in 2024. Those numbers mask a larger trend, which is continued population declines in the Los Angeles and Bay Area metros with most of the former residents of those metros moving inland for more affordable housing. Sacramento remains among the fastest growing large cities in California. Among medium-sized cities (30,000 people or more), Folsom and Rancho Cordova were the fourth and fifth fastest growing in 2024, with respective growth rates of 4.0% and 3.2%. That trend of Bay Area in-migration appears to be slowing, but so too is the region’s development pipeline.

We are currently tracking 3,143 multifamily under construction throughout the Sacramento region. This is the lowest level of new development to be in the pipeline since Q1 2020. The first of these projects to come online will be Hines’ 303-unit Ona project in the Natomas/North Sacramento submarket before the end of August 2025. The remainder of these developments are slated to come online through May 2027.

Largest among them is the 269-unit Grove at Woodlake in Natomas/Northgate from Greystar, the 261-unit Gibson Drive Apartments in the Roseville/Rocklin submarket from FPI Management and the 260-unit Pierside Apartments in West Sacramento from Fulcrum—all of which are slated for 2026 deliveries.

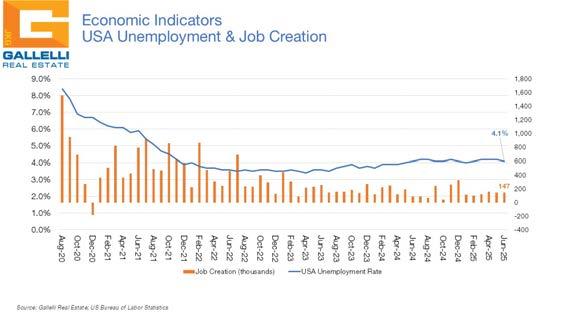

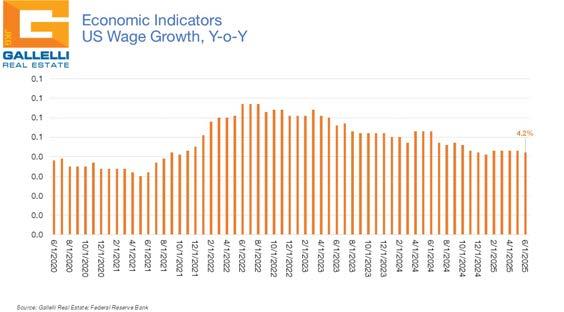

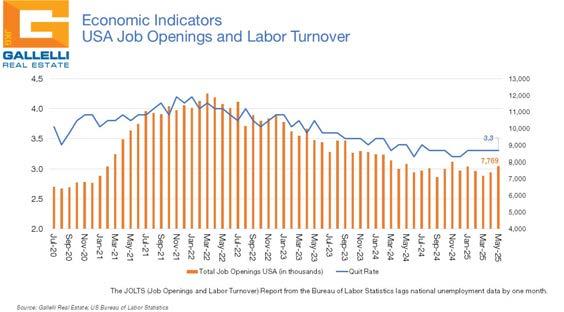

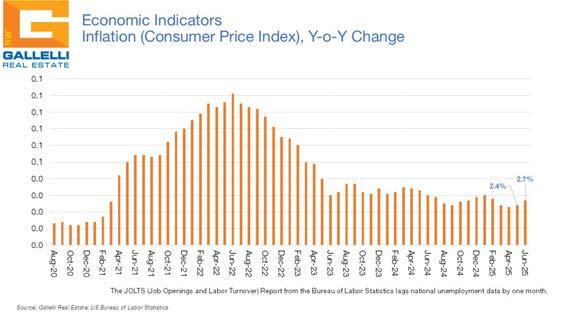

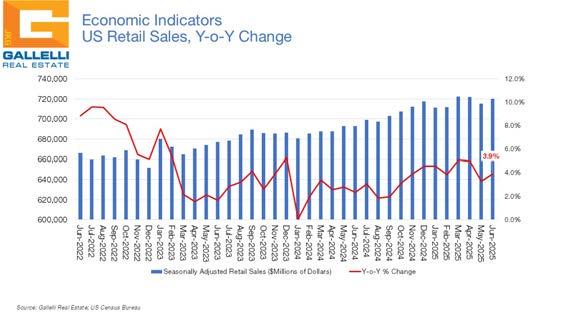

Our tracking of remaining 2025 deliveries includes Cypress Apartments from D&S Development (Downtown, 96 units), Medley from Blue Mountain Enterprises (Natomas/North Sacramento, 160 units), Hopes Landing from Hope Cooperative (South Sacramento, 70 units), Four40 West from Mark Pruner (West Sacramento, 106 units), On Broadway from EAH Housing (Downtown, 140 units), Pleasant Grove Apartments from Mercy Housing (Roseville/ Rocklin, 98 units), the Residency by the Sutter Capital Group (South Sacramento, 38 units), and the West Gateway Place II from the Jamboree Housing Corporation (West Sacramento, 66 units). Most of these projects are slated for Q3 delivery, but in total 774 units are likely to be delivered during the final half of the year, less than half the recent quarterly average of 1,049 units per quarter. Though the economy remains in a highly uncertain place thanks to continued uncertainty surrounding tariffs and the actual impacts of those tariffs finally about to play out, multifamily will be the most insulated of commercial real estate property types should we enter a down cycle for the very simple reason that people need a place to live. While the job market has weakened in recent months (both in terms of job creation and available positions), unemployment remains below the 5.0% threshold— typically what most economists define as full employment. For the current (July 2025) unemployment rate of 4.2% to increase by a full percentage point to 5.2%, the economy would have to lose 1.7 million jobs. For unemployment to hit 6.2%, it would have to lose 3.4 million positions and for it to hit 7.2% we would have to see 5.1 million more people out of work than today. Barring a “black swan” cataclysmic event that could move these numbers swiftly, the employment market (perhaps the most important underlying metric for multifamily investment stability) remains in solid shape even if the economy may be facing a bumpy road ahead. Unless we start to see unemployment rapidly climbing into the 5.5% and above range, we anticipate renter demand to remain at, or near, current levels. With the development pipeline declining substantially, vacancy is likely to fall in the months ahead.

SUBMARKET REVIEW

than Class A or B properties. Future mixed-use redevelopment at Sunrise Mall (multifamily will be a substantial part of the project) and a potential reimagining of Arden Fair Mall (recent buyer Centennial specializes in mixed-use revivals of mall properties nationally) could add some muchneeded newer inventory to the Arden Arcade and Carmichael/Citrus Heights submarkets, but not for at least a couple of years.

Meanwhile, the Natomas/North Sacramento submarket is just recently starting to see development levels tick up. Nearly all the ongoing and planned construction is along the I-5 corridor between Downtown and Sacramento International Airport. Development here was robust until the 2008 Great Financial Crisis and was off the table in the 2010s as the Army Corps of Engineers improved the adjacent levee to meet mandated 200-year flood protection levels.

The Davis submarket consistently reports among the region’s lowest vacancy rates because it is home to the natural demand driver of the University of California at Davis and happens to be a community notorious for an anti-growth stance extending back decades. These artificial constraints not only result in Davis consistently recording the highest occupancy levels but commanding the highest rents in the region. The current average asking rent of $2,216 per unit compares to an overall average of $1,817 per unit for Sacramento overall.

Sacramento’s multifamily market consists of 12 distinct submarkets (in which there can be significant variances from neighborhood to neighborhood). Against the current market-wide vacancy rate of 6.2%, there is an equal mix of six trade areas where vacancy levels are below the average and six where they are above. Development, or lack thereof, has been the primary factor at play.

The Arden Arcade (5.2%), Carmichael/Citrus Heights (5.0%), Davis (5.8%), Natomas/North Sacramento (5.4%), Roseville/Rocklin (4.8%), and South Sacramento (4.7%) all currently report tighter vacancy rates than the overall Sacramento region.

Arden Arcade, Carmichael/Citrus Heights, and South Sacramento are all more mature markets where land for new development is limited. All three share an aging inventory and a greater preponderance of Class C projects

The Roseville/Rocklin submarket is second in the region in terms of rents, with a current average asking rate of $2,190 per unit. Placer County boasts the highest per capita income demographics of any of the Counties in the extended six county Sacramento metro area and is among the wealthier counties in the state of California. It is a pro-development community, dominated by Class A and B projects, with new projects typically leasing up briskly upon delivery in normal to good economic times. We see strong potential ahead as the community of Roseville starts building out its currently largely undeveloped northwestern quadrant.

At the other end of the scale, the Downtown (10.3%), El Dorado Hills (6.7%), Elk Grove (6.6%), Folsom (8.8%), Rancho Cordova (8.6%) and West Sacramento (9.8%) submarkets are all experiencing vacancy levels above the market wide total. All of them have experienced significant development activity in recent months.