Q2 25 market overview

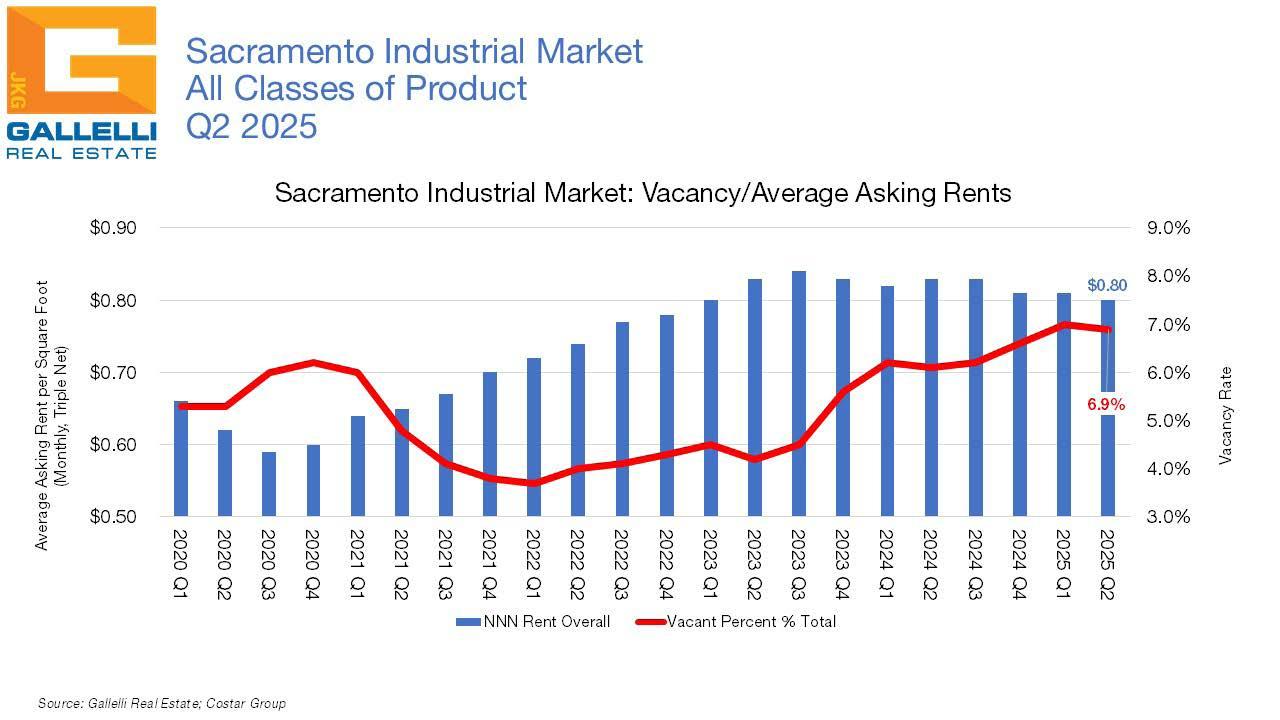

Asking Rate (NNN) $0.80 PSF

DELIVERIES HIT SIX YEAR LOW AS CONSTRUCTION PIPELINE CONTINUES TO EMPTY

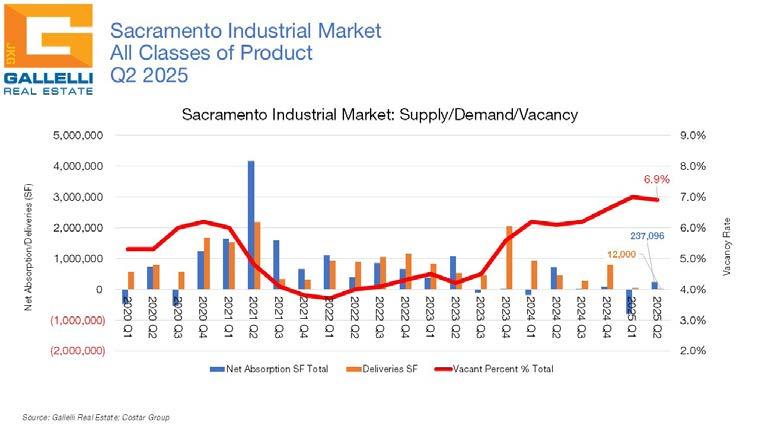

Industrial vacancy in the Sacramento region fell slightly in Q2 2025 from last quarter’s reading of 7.0% to 6.9%. After recording negative occupancy growth on the back of a handful of space givebacks inQ1,themarketrecordedpositivenetabsorptionto the tune of 237,000 square feet (SF) in Q2. Despite being in the black, leasing activity was somewhat sluggish over the past three months. We tracked roughly 1.75 million square feet (MSF) of total gross absorption (deal activity) in Q2—down from the 1.9 MSF reading of Q1. Over the past decade, the Sacramento region has averaged 2.3 MSF of deal activity in any given quarter.We attribute these diminished numbers to two factors; heightened economic uncertainty related to the potential impact of tariffs has resulted in greater caution in the marketplace while the trend away from mega bulk warehouse, distribution and eCommerce fulfillment deals has also intensified.

The largest deal of the quarter was Pacific Coast Producers’ lease of 517,000 SF of space at 1755 E. Beamer Street in Woodland. But we tracked just four deals above 100,000 SF this quarter, which is a far cry from just a few years ago when it was not uncommon for a dozen or more transactions to cross that threshold in any

given quarter. That was when user requirements for eCommerce fulfillment, bulk warehouse and large cold storage facilities peaked. Since then, demand for eCommerce space has fallen overall as Amazon and larger retailers built out their national fulfillment networks. For example, the average deal size we tracked in 2020 was 65,000 SF. Today it is 28,000 SF.

We are aware of only one new building being delivered in Q2: a 12,000 SF warehouse from Clark Cooperative at 9154 Elkmont Way in the Elk Grove/Laguna submarket. This is the lowest amount of new construction to come online locally since Q3 2019—a year that saw only 235,000 SF of new space delivered. That would change with the surge in new development that took off in 2020, with deliveries topping 3.6 MSF that year. The market added 4.4 MSF in 2021, 4.0 MSF in 2022, 3.9 MSF in 2023 and 2.4 MSF last year. But the construction pipeline has continued to dwindle. We are currently tracking just over 1.25 MSF of space in development with deliveries through next year.

Meanwhile, there are multiple large deals in the pipeline where users will be taking occupancy in the months ahead; Rivian, Trader Joe’s, Wheel Mart and Costco will all be taking down large blocks of space. In the case of Costco, the membership club retail giant bought 90 acres at Metro Air Park where they a 950,000 SF build-to-suit distribution facility will start construction in the next few months. Though we anticipate the development pipeline to increase by the end of this year, most of that increase will come from projects where tenants are already committed.

The current average asking rent for industrial space in the Sacramento market is $0.80 per square foot (PSF) on a monthly triple net basis. This metric stood at $0.83 PSF a year ago (down -3.6%). While slower deal velocity certainly plays into this, there is another factor at play here. Most industrial (and retail) deals are transacted regionally on a triple net basis, meaning that in addition to rent tenants are responsible for the cost of property taxes, insurance and utilities. While the average asking rent for industrial space has doubled since 2015, net expenses have effectively done so over roughly the past five years. Ultimately, this puts a limit on how much rental rate growth a property can command.

Anecdotally, we are seeing instances where the $0.09 PSF nets of a few years ago are suddenly $0.18 PSF nets, or $0.12 PSF nets are now moving in on $0.25 PSF. While both the cost of insurance and utilities have skyrocketed in recent years, increased property taxes have been a major driver of this trend. This is particularly the case for properties that have recently sold, triggering the reassessment process and giving some pricing advantages to long-term landlords.

LOOKING AHEAD

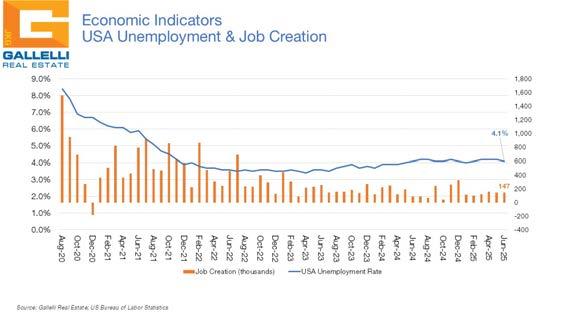

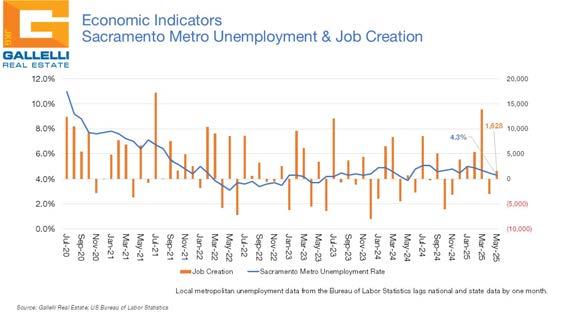

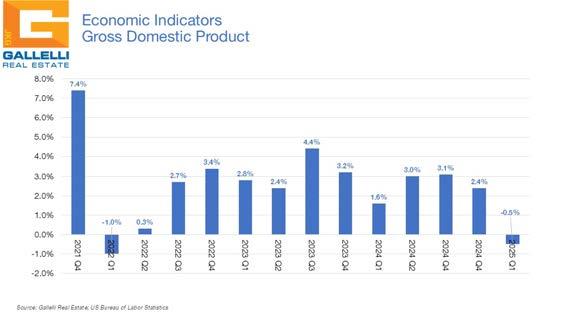

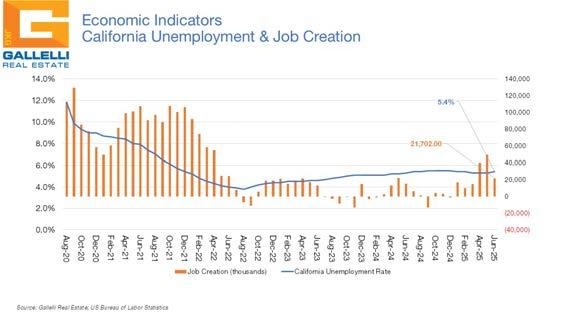

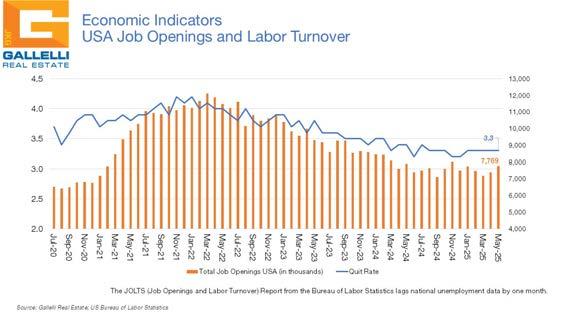

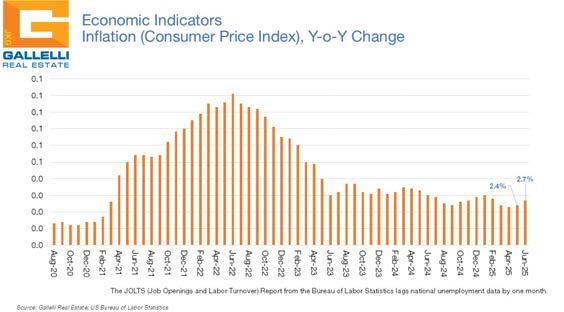

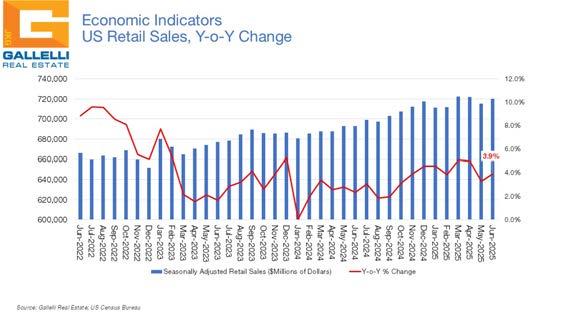

Through the first half of 2025, uncertainty surrounding the effects of tariffs initially left many industry leaders cautious. Economists and pundits issued dire warnings, and the stock market fell sharply following the tariff announcement. However, as of this report, the three major indices—the Dow, Nasdaq, and S&P—are all trading well above their pre-announcement level.

Despite early concerns, little increase in the cost of goods has been observed since tariffs were imposed so far. Meanwhile, though recent data from outplacement firm Challenger, Grey & Christmas showed U.S. employers

announced 744,000 layoffs through the first half of 2025. Notably, nearly 287,000 of those were attributed to cuts by the Department of Governmental Efficiency (DOGE), skewing the headline number.

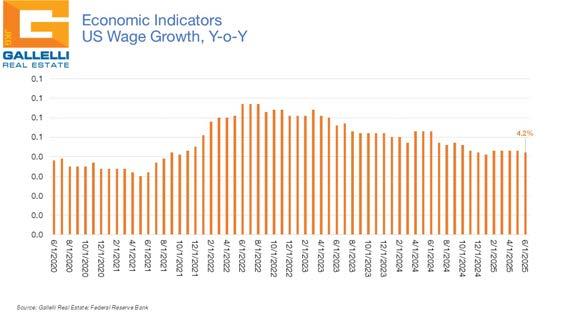

While the short-term impact of tariffs remains in flux, some longer-term benefits are beginning to take shape. Tariffs have boosted tax revenues on foreign products, and, more importantly, they are encouraging reinvestment in domestic operations that should ultimately result in the creation of solid, middle-class jobs. Numerous corporations have committed to expanding U.S. facilities and manufacturing capacity. For instance, Apple has pledged more than $600 billion towards building U.S. based facilities, while TSMC has committed $100 billion to semiconductor manufacturing on American soil. Many other companies have made similar commitments or are actively evaluating new investments.

Ultimately, the level of headwinds the tariff policy creates for the greater economy remains in flux. Looking to the final half of the year, barring any unforeseen “black swan” events, the state of the overall economy will depend overwhelmingly on the kind of trade deals the administration is able to cut in the months ahead.

Against this backdrop, the industrial market is well situated to ride out any economic turbulence. The region’s emptying development pipeline, combined with continued strong demand from tenants in the 20,000 SF to 50,000 Sf range would normally be a recipe for declining vacancy rates and a possible return to rent growth. But this assumes that the overall economy doesn’t get in the way. Still, the current vacancy rate of 6.9% means that the market is already arguably at a place of equilibrium between supply and demand and would be in a better position to absorb any shocks should a downturn occur.

4335 Pacific St, Rocklin

ECONOMIC INDICATORS

Leases

/

industrial market report

Gallelli Real Estate is a private firm that specializes in commercial real estate services and property management. We believe that as a boutique firm whose understanding of the business runs as deep as our core values, our advantage is large. We take pride in our unique approach to offer more individual solutions that address the ever changing needs of our clients and the industry. After all, our success is measured by the success of our clients and the strength and longevity of our relationships.

GALLELLI BROKER TEAMS

rosborne@gallellire.com

Land/Investments ebenoit@gallellire.com