THE VOICE AND RESOURCE FOR IOWA’S FUEL INDUSTRY

CHAIRMAN'S PERSPECTIVE pg. 3

VAPOR PRODUCTS pg. 4

SUPPORT FOR BIOFUELS pg. 12

FUTURE OF FUELSA UMCS PRESENTATION pg. 14

CHAIRMAN'S PERSPECTIVE pg. 3

VAPOR PRODUCTS pg. 4

SUPPORT FOR BIOFUELS pg. 12

FUTURE OF FUELSA UMCS PRESENTATION pg. 14

Having attended UMCS 2024 in Minnesota in April, it’s evident that liquid fuels and the liquid fuels industry are strong. However, we must continue to advance liquid fuels and ensure their long-term sustainability and preservation. The best way to achieve this goal is through creating and nurturing strategic partnerships.

By forming these strategic partnerships with associations, groups, and businesses that have a vested interest in the success of liquid fuels, we can collectively work towards developing innovative policies that promote the advancement of liquid fuels. As we look forward into the future, FUELIowa members are best positioned to succeed in a market where liquid fuels are the preferred source of transportation energy among consumers. With a collaboration approach, we can move toward this goal with a unified voice among stakeholders through a clear message.

Together with our partners, we can create a policy environment that encourages the support of the liquid fuels industry, to ensure a stable energy supply now, and for future generations.

Together We FUELIowa

Keith

Chris Biellier Associate Director Seneca Companies Davenport | 563-332-8000

Chad Besch Director New Cooperative Algona | 515-295-2741

Don Burd Director Otter Creek Country Store Cedar Rapids | 319-533-1825

Tia Eischeid Director Al’s Corner Oil Co Carroll | 712-673-2723

Wade Fowler Associate Director Core-Mark Midcontinent, Inc. DBA Farner-Bocken Carroll | 641-777-0308

Cara Ingle Associate Director Unified Contracting Services Des Moines | 515-266-5700

Keith Olsen Chair Olsen Fuel Supply Atlantic 712-243-2340

Tessa Anderson Vice Chair Rainbo Oil Dubuque 563- 526-1179

Nate Lincoln Treasurer Lincoln Farm & Home Service LLC Glenwood (712) 527-4833

Dave Reif Immediate Past Chair Reif Oil Company Burlington 319-752-9809

Dennis Jaeger Director Mulgrew Oil Dubuque | 563-845-8359

Scott Moore Director Western Oil, Inc Ohmaha | 402-618-2238

Scott Richardson Director Key Cooperative Roland | 515-291-0623

Jason Stauffer Director NEWCENTURY FS Ames | 515-370-3127

By John Maynes, Director of Government and Regulatory Affairs, FUELIowa

By John Maynes, Director of Government and Regulatory Affairs, FUELIowa

Vapor products are a category within convenience stores showing tremendous promise as a profit center. As traditional sales of tobacco products like combustible cigarettes, chewing tobacco, and snuff have seen sales stagnate, alternative nicotine products, including vapor products, provide a promising path forward for retailers looking to rejuvenate the tobacco category inside their stores.

The positive outlook for alternative nicotine products, including vapor products, appears to be backed by research and investment dollars from the major tobacco companies. These factors point toward the tobacco category in convenience stores moving down the path of alternative nicotine products in the future. As manufacturers continue to invest research and development dollars into non-combustible forms of nicotine delivery, the future points toward manufacturers going all in on these categories. Further evidence of manufacturers future vision for this category is the push to create a tiered excise tax structure favoring alternative nicotine products classified as a reduced harm product. More to come on that conversation in the future.

In recent years, conversations with FUELIowa members about vapor products has painted a consistent picture. The market has become flooded with vapor products and what has ensued is mass confusion among convenience stores owners on the types of products they can sell legally inside their stores. Running parallel to the confusion facing retailers is a growing problem among teenagers who are using vapor products at an alarming rate. Rightfully so, the growing problem with vaping among teenagers has led to a public campaign designed to draw attention to the growing vape problem among young people. Paired together, these factors have discouraged many FUELIowa members from engaging in the sale of vapor products.

Although many members have exercised restraint in entering the vapor product category, these products remain readily available. Therein lies the problem. The lack of a state regulatory structure overseeing vapor products has created inequity in the marketplace. As a result, we are seeing illegal vapor products being sold at an alarming rate with new businesses specializing in the sales of these products opening their doors on a seemingly daily basis. In a recent conversation with a FUELIowa member who resides in a town of roughly 8,000 people, this member shared he has six competitors offering vapor products which are illegal for sale to the public.

Bundled together, these factors create inequity in the marketplace and to be blunt, the lack of regulation and enforcement is drawing customers away from our member stores. House File 2677 and

its focus on the regulation of the vapor products category is an effort to stem the tide on the illegal sale of vapor products and bring equity back to this product category.

House File 2677 provides the Department of Revenue with the right to inspect the premises of any permit holder within the state of Iowa where vapor products are stored, transported, sold, or exchanged. The scope of these inspections includes an examination of records.

Building upon the enforcement provisions above, House File 2677 creates a state-administered vapor products registry. The Vapor Products Registry will operate similar to the registry created for CBD products. Permit holders will be able to view the Vapor Products Registry electronically. Products listed on the state registry will have received authorization by the state after proper steps have been completed by manufacturers and distributors to achieve authorization with the state for the sale of the products they intend to enter the market for sale.

The creation of the registry should lead to transparency for any retailer analyzing the registry for the product offerings they intend to make available in their stores. Due to the increased regulatory structure and enforcement provided by House File 2677, FUELIowa successfully advocated for an electronic notice requirement to be included in the legislation. As changes occur to the registry, permit holders will be notified electronically of changes to the registry. The intent of this provision is to help retailers navigate the everchanging landscape of products meeting FDA approval and now

concurrently, state approval.

In addition to the creation of the state administered vapor products registry, new penalty provisions and requirements for compliance checks are also included in the legislation. Penalty provisions are scaled upward similar to penalties for the underage sale of alcohol and/or tobacco products:

First violation: A civil penalty of three hundred dollars per day for each vapor product offered for sale until the offending vapor product is removed from sale or until the vapor product is listed on the directory.

Second violation within two years: $1500 or a 30-day suspension of license.

Penalties increase as the frequency of violations continue. Upon a fifth violation within a period of four years, the retailers permit shall be revoked. Similar enforcement provisions are included in the legislation targeting manufacturers and distributors.

Along with the penalty structure outlined above, House File 2677 adds statutory language requiring compliance checks. Each distributor or retailer that distributes or sells vapor products in Iowa shall be subject to unannounced compliance checks conducted by the Department of Revenue or peace officers. Peace officers conducting compliance checks shall share results of compliance checks with the Department of Revenue. Revenues generated from the payment of fees and penalties outlined in House File 2677 will be paid to the state Health Care Trust Fund.

FUELIowa anticipates the Vapor Products Registry to be available and online late in the summer of 2024, likely by August 1st.

FUELIowa will be engaged in the rulemaking process implementing the statutory language in House File 2677 and will provide members with updates throughout the process. As we move toward the implementation of this regulatory framework overseeing vapor products, FUELIowa members are encouraged to contact the association with competitors you know are selling vapor products illegally. Together we can stem the tide of illegal sales and take back control of this product category and reinstitute a competitive balance within the vapor product category. Although targeted enforcement is unlikely to occur until at least October 1, 2024, gathering this information now will help to benefit the Department of

Revenue as it gears up for its enforcement blitz.

VISIONARY ($5,000+)

$5,000 Paul & Tessa Fahey - Rainbo Oil*

$5,000 Larry Bentler, Jet Gas*

$5,000 Don Burd - Otter Creek Country Stores*

($2,500-$4,999)

$4,000 Robert Mast - Mast ATM

$2,500 Thomas Flogel - Mulgrew Oil

$2,500 Todd Kanne - Community Oil*

$2,500 Randy & Andrew Woodard - Elliott Oil*

$2,500 Jason McDermott - McDermott Oil*

$2,500 Cliff & Dave Reif - Reif Oil*

$2,500 Keith Olsen - Olsen Fuel Supply

($500-$999)

$500 David Scheetz

$500 Matt Scheetz

$500 Jeff Wade

CONTRIBUTOR ($0-$499)

$200 Joseph Miller

$100 Stratton Benscoter

$100 Rick Graber

$25 Martin Bast

PARTNER ($1,000-$2,449)

$2,000 Steve Kimmes - Kimmes Enterprises LLC

$1,500 John Gilroy - Grysson Oil

$1,500 Eric Taylor - Taylor Quik Pik

$1,000 Marc Beltrame - Beltrame Law Firm

$1,000 Gary Koerner – FUELIowa

$1,000 Jim Ewing – FUELIowa

By Sarah Bowman, Communications Director , FUELIowa

By Sarah Bowman, Communications Director , FUELIowa

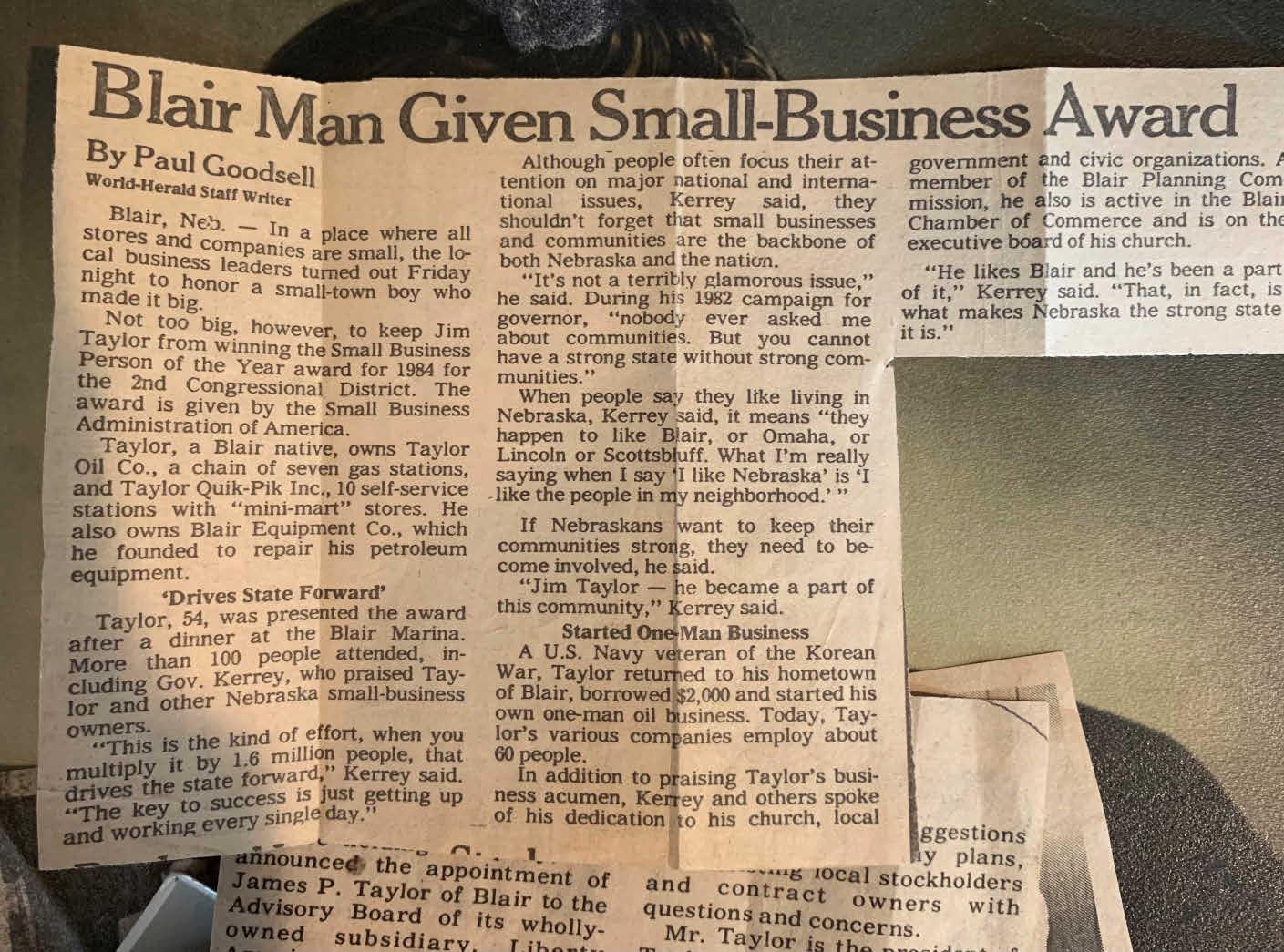

Taylor Quik Pik is a third-generation family-owned chain of convenience stores founded on the principles of hard work, respect, embracing challenges, learning from mistakes, giving back to the community, simplicity, and striving to be the best.

Founded in 1954 by James Paul and Rae Taylor, Jim grew up as a farm kid

eager to take on the world to figure out his place in it. He left the farm and enlisted in the Navy to serve our country during the Korean War. Rae, an Arkansas coal miner’s daughter, met Jim while he was docked in San Diego, CA. When Jim’s tour ended in 1954, Rae and Jim came back home with ambition to start Taylor Oil Company, supplying farmers and service centers with the fuel

they need. Not long after, he took a chance at operating convenience stores known as Taylor Quik Pik, with the help of a $2,00 small business loan (see picture on page 11). At its height, with the help of their son Brad, his wife Laura, and team, Taylor Quik Pik grew to 31 stores throughout Eastern Iowa and Western Iowa.

Since its peak of 31 stores, it could be argued that Taylor Quik Pik lost its way. With divestiture lurking, the company turned around and focused on the future of the industry with it being a part of it. While having big dreams, concentrating back on its core principles is what was the medicine.

Eric Taylor, the third-generation of the company, is helping manage the family business along side his sister, Brooke Shallberg. But managing the family business wasn’t always his plan.

Graduating from Blair High School and the University of Nebraska (Lincoln), Eric’s true passion is construction, which has helped him with the store remodels. During high school, he would help out at the families Blair, Nebraska stores, stocking coolers

and taking out the trash. Eric shared, “the number of lives I’ve changed by showing how to break down and open cardboard boxes with your hands is stunning.”

“Most of the time in life it is best to concentrate on the simple things and always be transparent.”

Eric graduated high school, and left Blair, Nebraska to attend the University of Nebraska (Lincoln) and major in his passion of Construction Management. It wasn’t until the conclusion of his first year of college, he realized his desire was to return to the family business, and he changed his major.

Now, with a growing family, Eric shared that his wife and children fuel the fire to make his family proud and obtaining an important work/life balance. He’s found it important to have a solid team of employees that give them the ability to keep growing and create efficiency. So much so, that there is a staffing waitlist of people who would like to join the Taylor Quik Pik family. Eric shared, “it’s all because we truly live and run our business based on our core values.”

The Director of Operations for Taylor Quik Pik lived in Oakland, Iowa, and

often mentioned that Eric should be interested in the location. A few years (and more suggestions by others to entertain the idea) went by and Eric decided to introduce himself to the Oakland owner, Keith Rattenborg.

Eric recalls “One day I woke up and had the urge to drive to the site unannounced and ask the site owner if he’d entertain selling. I walked into the store; saw he was talking with a friend. So I went to the cooler, grabbed a water and quickly tried to think how I was going to tackle this. I walked up to the counter to pay him, and he asked if that was all. I replied “no, are you Keith by the way”.

Keith replied, “what is there a warrant out for me”. I laughed and said, “no, I‘m curious if you would be interested in selling your site”.

The room got really silent, and his friend looked at him and said, “well I’m going to take off, have a good day, Keith.” Keith struggled to ring up my water correctly, cleared his throat and said, “would I like to sell my site, well I’m not getting any younger.”

After that, Keith and I established a lasting bond that I will cherish forever.”

Keith passed away on February 28, 2024. In his obituary, he requested his family and friends donate to the Riverside Food Pantry in Oakland and give back to those in need.

Eric and his family knew what they had to do for Keith, and for the community. In remembrance of Keith, Taylor Quik Pik donated all of the Oakland Store inventory to the Riverside Food Pantry –an impressive donation of nearly $7,000 worth of food, drinks, and supplies.

Eric shared, “We look to honor the legacy of Keith Rattenborg by doing things the right way and continuing to treat our employees and guests as family.”

“By being a great place to work and visit for many. You never know what is on a person’s mind or what they are going through when they walk through our doors.

From customers to vendors to employees, we want everyone to leave our sites feeling reset and ready to tackle their day.”

Currently at 12 stores, acquiring 7 sites within 4 years, Taylor Quik Pik is still rising from the ashes. Including the Oakland site, they will be adding 6 sites in 2024, bringing their total to 17. Now with comfort food infiltrated, a robust back office, a team that believes, and curious customers.

“We believe in rural communities being the backbone of America and want to be considered home for many. We get the chance to turn around so many others lives, daily.”

Eric said, "We can't wait for our next adventure!" We at FUELIowa can't wait to see what they do!

Because Together, We FUELIowa.

By John Maynes, Director of Government and Regulatory Affairs, FUELIowa

By John Maynes, Director of Government and Regulatory Affairs, FUELIowa

Now more than ever, the liquid fuels industry needs to unite behind our common goal of advancing liquid fuels and ensuring the preferred source of transportation fuel among consumers remains liquid fuels for the foreseeable future. With alternative sources of energy currying favor within the current Congress, the unification of liquid fuel stakeholder groups behind policies which position the products their members produce and sell is critical. The ethanol and biodiesel industry will play a critical role in that effort.

For far too long, the liquid fuels industry has been mired in an internal power struggle over market share. The infighting has largely occurred between biofuel advocacy groups and the upstream segment of the petroleum industry. Due to the volume of noise and conflict created by the infighting between these liquid fuels advocacy groups, progress in advancing forwardthinking energy policy centered on liquid fuels has been challenging. For years, advocacy groups in the liquid fuels industry have argued over policies like the Federal Renewable Fuel Standard (RFS) and regulatory

issues like the EPA’s summertime RVP regulatory control period.

While a policy such as the Federal RFS or a regulation like EPA’s RVP regulatory control are important issues within the liquid fuel industry, the focus and noisy discord surrounding these issues has drawn away from issues far more critical to the growth of the liquid fuels industry. Infrastructure is the perfect example. Biofuels infrastructure cost has long been the primary barrier facing the growth of biofuels and yet the issue has largely gone unaddressed for the last twenty years. FUELIowa is hopeful the narrative is about to change, and we want to highlight the great work of Iowa Representative Marianette MillerMeeks (R-IA 1) in agreeing to make biofuel infrastructure a priority moving forward.

With Senator Joni Ernst (R-IA) and Senator Amy Klobuchar (D-MN) sponsoring bi-partisan legislation in the Senate to amend the Farm Security and Rural Investment Act of 2002 to improve biofuel infrastructure and agriculture

product market expansion, Representative Mariannette Miller-Meeks has stepped forward in the United States House of Representatives as a lead sponsor of the companion legislation in her chamber. FUELIowa is extremely grateful for the attention to this issue provided by Representative Miller-Meeks team and the swift commitment agreeing to sponsor this critical piece of legislation.

The legislation would amend the Farm Security and Rural Investment Act and reauthorize funding to be used for the expansion of biofuel infrastructure at retail sites, bulk storage facilities, and home heating oil distribution facilities. The goal of this legislation is to build off the success of the USDA High Blend Infrastructure Investment Program and extend the program beyond its current sunset date of September 30, 2024. To date, the USDA HBIIP program has been the most lucrative, and in turn the most successful, biofuel infrastructure investment program in history. Capitalizing on the success of the HBIIP is critical to the future growth of biofuels.

With three of five applications now complete, over 2,600 applications nationwide have been submitted through the USDA HBIIP program and all applications serve the dual purpose of advancing biofuel sales while preserving the liquid fuels market.

FUELIowa is grateful for the leadership shown by Senator Ernst, Representative Miller-Meeks and their teams toward biofuels and recognizing the reality that biofuels do not make their way into the fuel tanks of consumers without retail infrastructure in place to store and dispense the product. We encourage all FUELIowa members to show their support and appreciation for Representative Miller-Meeks and Senator Ernst foresight on this issue. FUELIowa staff and a contingent of members met with Representative MillerMeeks on May 16 to discuss this issue and express our gratitude for her commitment to the future of the liquid fuels industry.

By Gary Koerner, EVP FUELIowa with permission from John Eichberger, Executive Director of the Transportation Energy Institute

By Gary Koerner, EVP FUELIowa with permission from John Eichberger, Executive Director of the Transportation Energy Institute

I recently had the pleasure to invite John Eichberger as a featured speaker to our recent Upper Midwest Convenience Store & Energy Convention in St. Paul. John is the Executive Director of the Transportation Energy Institute, a non-partisan “think tank” focused on the transportation sector, energy, and fuel.

After UMCS, many people contacted me about John’s presentation so I thought it would be a good idea for an article for those of you unable to attend UMCS this year. Fortunately, John was gracious enough to allow me to share with FUELIowa members some of the key takeaways that really resonated with me and those of us who were fortunate to hear him speak.

There is no such thing as a “zero emissions vehicle”.

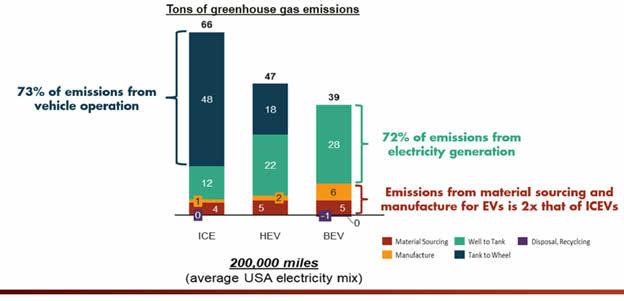

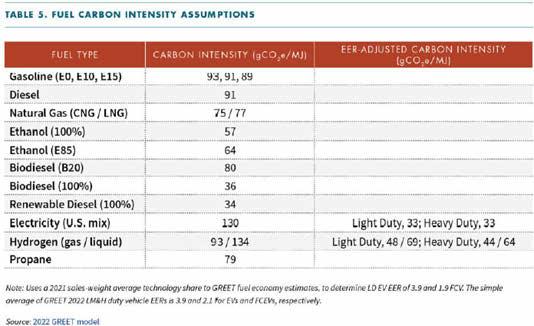

John pointed out that good policy must consider and address emissions where they originate throughout the lifecycle of a vehicle. While an Internal Combustion Engine (ICE) generates 73% of its emissions during vehicle operation, Battery EV’s (BEVs) emissions come primarily from electricity generation, manufacturing, and material sourcing.

We need to consider our electric grid

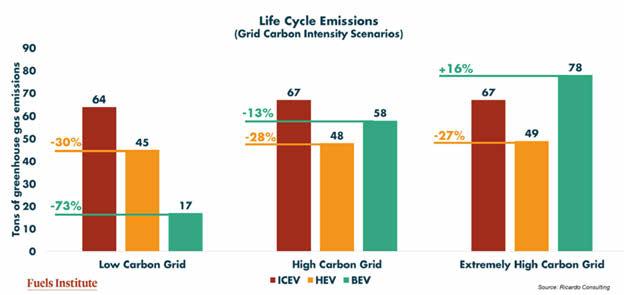

As we know, different areas of the country are positioned to produce electricity with less carbon intensity than other areas. Additionally, where a Battery EV is charged makes an enormous difference. In fact, in an extremely high carbon electricity grid region, an ICE is actually “cleaner” than a BEV.

We also know that in many areas, the electrical grid is ill-prepared to manage the load from rapid expansion of EV’s and some states produce more electricity from wind, solar, and hydro.

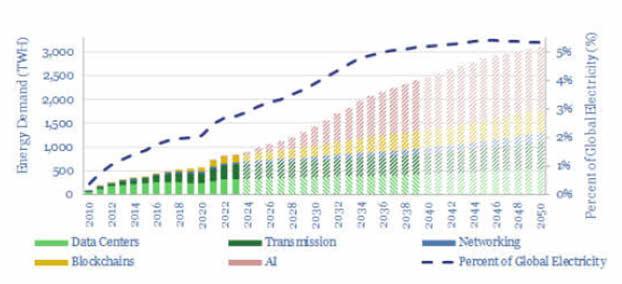

Further, consider the electricity demands on our grid to accommodate the massive demands from not only EV’s, but the tremendous requirements coming for Artificial Intelligence and Crypto-Mining.

The Internal Combustion Engine is not going away any time soon.

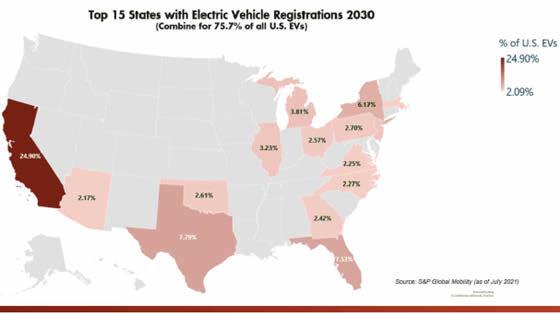

EV’s continue to gain share, but the growth has slowed now that the early adopters are saturated. Even as EV prices have come down much closer to ICE’s, the combustion engine continues to dominate.

Additionally, the long, life cycle of vehicles coupled with how expensive they are these days, people are keeping their vehicles longer. So, even if certain states ban new sales of ICE’s, there are a lot of ICE’s out there for the near future.

There is a role for alternative fuels.

If the combustion engine is going to be around and retrofitting the existing fleet is simply not feasible, we must reduce the life cycle carbon intensity of the combustion engine. Fortunately, we can make an impact with fuel diversity.

We need to encourage diversity and innovation to address our fuel, transportation & electricity challenges.

In summary, there is no silver bullet for addressing carbon emissions and our energy needs at the moment. New fuel options being explored and developed today show tremendous promise and that is why all options must be supported to foster innovation. Given the varying degrees of viability and timing uncertainties, a portfolio approach for vehicle decarbonization is advisable.

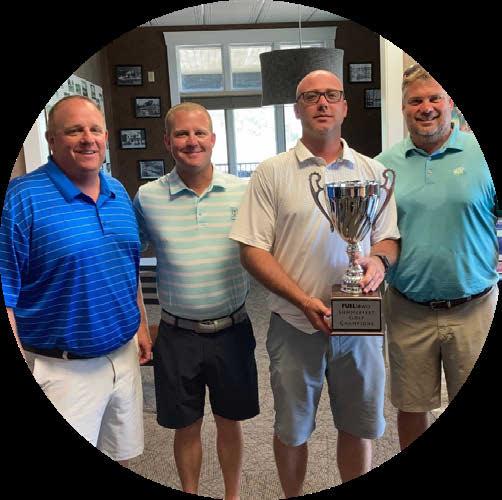

The pictures you see on social media (like those below) are mostly fun and fellowship, but this article does show that education is a key part of the UMCS program.

By John Maynes, Director of Government and Regulatory Affairs, FUELIowa

By John Maynes, Director of Government and Regulatory Affairs, FUELIowa

The 2024 Iowa Legislative Session saw two major fuel policy bills move through the legislative process. Ultimately, both achieved passage. House File 2687 served the dual purpose of rolling back Iowa’s E85 equipment compatibility standard for equipment installed above the shear valve, while simultaneously removing the installation of E85 compatible equipment as an eligibility criterion for applicants to Iowa’s Renewable Fuel Infrastructure Grant Program (RFIP).

Concurrently, House File 2691 provided for changes to Iowa’s RFIP. House File 2691 includes a $10 million dollar appropriation to the RFIP paired with a $2 million onetime allocation bringing the total appropriation for state fiscal year 2025 (July 1, 2024 – June 30, 2025) to $12 million dollars.

Additionally, a separate $2 million appropriation was made to the RFIP providing for retroactive payments to applicants for ethanol projects dating back to January 1, 2022. Of most importance to FUELIowa members, House File 2691 provides for an increase to the RFIP cost-share from $50,000 to $75,000 regardless

of an applicant’s gasoline throughput. The modest increase to the cost-share ceiling is a step in the right direction but falls short of even addressing the impact of inflation on the cost associated with Iowa’s E15 Access Mandate. Like any policy change, every action has a reaction. I will attempt to explain the policy changes in detail using a frequently asked questions format below:

When will the equipment compatibility changes in House File 2687 take effect?

The rollback of Iowa’s E85 equipment standard will take effect upon enactment. “Upon enactment” means upon the Governor’s signature. The bill was signed into law by Governor Reynolds on May 17.

Describe the rollback of Iowa’s E85 equipment standard?

For starters, the rollback applies to any underground storage tank system component above the shear valve. In laymen’s terms, the rollback is intended to apply to dispensers and hanging hardware. The rollback should reduce the per dispenser replacement costs in Iowa by $7,500 to $10,000 per unit.

Walk me through the timeline associated with the rollback?

Upon receiving the Governor’s signature, Iowa’s equipment compatibility standard will revert to a compatible with the product stored standard which matches federal regulatory requirements. For example, if the product

stored and dispensed through the system being installed, replaced, or converted is E15, the installed, replaced, or converted components need only be E15 compatible. This standard remains in effect through December 31, 2025.

On January 1, 2026, Iowa’s compatibility standard for components above the shear valve moves to an E40 standard. The E40 standard will remain in effect until December 31, 2029. On January 1, 2030, Iowa’s compatibility standard will move back to an E85 standard.

Wayne dispensers are currently E40 compatible, and Gilbarco has indicated their dispenser line will be E40 compatible by quarter 1 or quarter 2 in 2025.

On January 1, 2026, will I have to replace my dispensers to meet the E40 standard?

No. Components will be grandfathered as we cross the compatibility dates outlined above. Only components installed, replaced, or converted for storage and dispensing of E15 (and higher blends) will be required to meet the new standard. For example, an E15 compatible hose cited by a Weights and Measures inspector for weather-checking will be required to be replaced with an E40 hose beginning on January 1, 2026. In this scenario, neither the dispenser nor the other hanging hardware components would need to be replaced.

Will the rollback of the E85 equipment compatibility standard apply to underground tanks,

piping, and associated equipment?

No. All underground components remain subject to an E85 compatibility standard.

Previously, I was told the law would not allow me to install E15 upfit kits on my dispensers for the sale of E15. I would be required to install E85 compatible dispensers. Does this change allow me to install E15 upfit kits?

Yes! You can install E15 upfit kits to facilitate the storage and dispensing of E15 at your location through December 31, 2025. As a reminder, the E15 upfit kits are eligible costs under Iowa’s RFIP program.

My application to the Iowa Renewable Fuel Infrastructure Grant Program includes E85 compatible dispensers and hanging hardware. Is E85 compatible infrastructure still an eligibility requirement for applicants seeking cost-share grant funding through the RFIP?

No. House File 2687 rolls back the E85 equipment compatibility requirement for above grade components through December 31, 2025. Underground components submitted to the program for costshare funding will still need to be E85 compatible.

Existing applicants, including those with applications awaiting review and those with applications which have been reviewed and approved, may reapply to the program and I encourage you to do so to realize the cost-savings from the rollback and the increased cost-share opportunity ($50,000 - $75,000).

I have two sites where I applied for grant funding to the RFIP in the past two years, both were ethanol projects. One application has been reviewed and approved by the RFIP Board, another is pending review by the Board. Both projects are incomplete due to equipment backlogs and contractor shortages. I’ve heard rumblings about retroactive payments, how do I take advantage of the increased cost-share opportunity?

Avoid the retroactive payment discussions, rescind your applications, and reapply to the RFIP program. Applicants have 1 year from the date your equipment is placed into service to apply to the RFIP for costshare grant funds. You are not required to be approved within the 1-year window; you need only have submitted a completed application.

By rescinding your applications, you avoid having to satisfy the elements of retroactivity under House File 2691. Your application will move to the back of the line for review. However, the RFIP has a program balance far exceeding the demand for funding at $75,000 per project and I do not foresee any issues preventing the timely receipt of cost-share funding.

House File 2691 provides for corrective amounts to be awarded to past applicants. What were lawmakers correcting and how can I access the corrective amount?

Great question. Apropos choice of wording by lawmakers here by using the term corrective. To be eligible to receive an award

for a corrective amount, an RFIP applicant must have received an RFIP grant award for an ethanol project dating back to January 1, 2022. Additionally, only E85 compatible components are eligible for a corrective amount, and last, a retail dealer shall not be awarded a corrective amount AND financial incentives under the RFIP to improve the same infrastructure. In consult with legislative staff and the Department of Agriculture, in an effort to make the corrective amounts permissive to previous applicants, applicants will not have to show proof of new infrastructure being installed beyond the scope of what was originally submitted to the RFIP.

An applicant receiving a $50,000 award for a $588,000 project may resubmit their previous project and expect to receive a corrective amount up to $25,000, and you may replace E85 compatible dispensers with a more costeffective option.

*please note this section was changed following a conversation with IDALS on May 30, 2024. Previously, on May 1, 2024, IDALS had indicated that the statutory language covering corrective payments required new infrastructure to be installed beyond what was originally submitted in an approved grant application.

Lawmakers were sold this mandate by advocates like the Iowa Renewable Fuels Association in part on the availability of waivers for small business retailers. Do the changes in House File 2687 and 2691 impact my ability to obtain a Class II Waiver?

Yes. Two years after passage of Iowa’s E15 Mandate, the Iowa Department of Agriculture and Land Stewardship has taken the position that dispensers may not be included in a gasoline retailer’s application for a Class II waiver. This position by the Department coincides with the rollback of the E85 dispenser requirement in House File 2687.

For the purpose of the Class II Waiver from Iowa’s E15 mandate only, the Department of Agriculture’s position is that any E10 dispenser is compatible with the sale of E15 and may not be included in a retailer’s application to receive a Class II waiver.

The analysis involved with the Class II waiver review asks, “how much money will it cost the small business retailer to make E15 available at a site through a single dispenser?” By removing the cost of a dispenser from the analysis, the Department of Agriculture is narrowing the scope of facilities eligible for the Class II Waiver by artificially lowering costs and simultaneously broadening the scope of facilities forced to comply with the mandate.

Previously, a Class II Waiver would be granted to a retailer whose waiver application was co-signed by a licensed installer showing the cost of making E15 available at a single dispenser exceeded $71,430. With the cost-share under the RFIP increasing to $75,000 per site for ethanol projects, the new cost threshold for a Class II waiver is $107,143 to make E15 available at a single dispenser.

How does the Department of Agriculture’s position on E10 dispensers selling E15 impact my requirement to meet federal pollution liability coverage minimums at my retail site?

First, the Department of Agriculture’s regulatory authority does not extend beyond the scope of the Class II Waiver and into insurability. When asked how a retailer should proceed in a scenario where a Class II waiver is denied by the Department and simultaneously, an application for binding pollution liability coverage is denied because the UST system components are not compatible with the product stored, the Department’s response is “that is a business decision” and does not fall under the Department’s purview.

FUELIowa strongly encourages

members to confirm that all components of your UST system are compatible with the product you intend to store in the eyes of your insurance provider before proceeding with the sale of any product. This confirmation should be included on your declarations page within your insurance policy before entering the product into your UST system.

Will biodiesel applications be eligible for the increased cost share or corrective amount?

No. Biodiesel projects remain eligible for a cost-share of up to $50,000 per project with no opportunity for a corrective amount. Fortunately, we were successful in increasing the annual cap on biodiesel projects approved by the Board from $1.25 million annually to $1.75 million

annually. The additional $500,000 available to the Board to spend on biodiesel projects will help alleviate the backlog facing biodiesel applicants.

If I amend my RFIP grant application to realize the cost savings from the rollback of the E85 equipment standard, does it impact my application to the USDA HBIIP program?

If you are not changing the scope of your project, replacing E85 dispensers in your federal application with E15 compatible dispensers does not change the scope of your project and therefore, should not impact your eligibility under the USDA HBIIP program. With the time sensitivity of this question, I encourage members falling into this situation to contact Jeff Carpenter with USDA (jeff.carpenter@usda. gov).

Delaney's Auto & Ag Center & Repair, located in Farley, IA, automotive, agricultural and semi repair center. We'll keep you moving!

Maverik, Inc., creating the coolest convenience-experience on the planet.

FUELIowa Fashion is Available!

Men or Womens Jacket:

Port Authority® Packable

Puffy Jacket

Color: Black

Sizes: XS-4XL

Men or Womens Vest:

Port Authority® Packable

Puffy Vest

Color: Black

Sizes: XS-4XL

Email Jim Ewing at jim@fueliowa.com to order your FUELIowa fashion.

Little Sioux Corn Processors, an ethanol plant in Marcus, IA has the capacity of 165 million gallons per year which is the 10th largest ethanol plant in the United States.

Welcome New Bronze SponsorFoster Group financial advisors are a resource of comprehensive financial and investment expertise, and working with an advisor may help you bring clarity to your own unique vision of financial fulfillment, maybe even expand on what you think is possible.

Kwik Trip will discontinue bagged milk in May

in Wisconsin, announced Wednesday that Nature's Touch bagged milk will be discontinued at all stores beginning in May.

Kwik Trip said in a news release that "guest preferences and purchasing patterns have indicated a substantial declining demand for this product compared to milk sold in jugs."

John McHugh, vice president of external relations, said Kwik Trip has begun to contact groups who had special promotional coupons for bagged milk and have offered a new solution with other milk offerings.

"This is an end to a product that was associated with the Kwik Trip brand for many years, but after evaluating the need and cost for new equipment to replace our antiquated bagged milk equipment, and the decreased customer demand, we made the tough decision to discontinue Nature’s Touch milk in the bag," McHugh said.

Casey’s Acquires Panther Travel Center

Kwik Trip and bagged milk.

It was a partnership going back more than 40 years, however the convenience store chain, founded

Retailer will rebrand Cedar Falls, Iowa, location, building new convenience store nearby

Convenience-store retailer Casey’s General Stores Inc. has acquired

Panther Travel Center in Cedar Falls, Iowa, with plans to open the location under the Casey’s brand next month.

“Casey’s is purchasing the Panther Travel Center located at 1525 West Ridgeway. The plan is to open it as a Casey’s by April if timelines remain on track,” Casey’s spokesperson Katie Petru told CSP Daily News. “The travel center will serve our delicious, handmade pizza as well as other food items from our kitchen, and it will carry convenience item products and have eight fuel dispensers.”

The 14,560-square-foot travel center opened in 2020, according to a report by The Courier. Its last day in operation as Panther Travel Center is March 26, when the companies expect the sale to close, said the report. They did not disclose the price tag on the deal.

Hy-Vee to Acquire Indiana-based Grocery Chain

Strack & Van Til is expected to maintain its name and operate as a subsidiary of Hy-Vee.

The acquisition is expected to be finalized in early May.

Hy-Vee currently has more than 550 stores, including grocery stores, drugstores, pharmacies, restaurants and convenience stores.

incredible success story, but I really believe this is the right decision at the right time for Maverik and me," Maggelet said in the video. "Serving more than seven years as Maverik's chief adventure guide has been the best job on the planet. No doubt."

Under his guidance, the Salt Lake City-based convenience store chain acquired Des Moines, Iowa-based Kum & Go last year. When the deal closed in August, Maverik more than doubled its footprint throughout the western United States and Rocky Mountain region, growing to more than 800 locations and 14,000 employees.

Crystal Maggelet, chairman and CEO of Maverik's parent company FJ Management Inc. (FJM), will be stepping into the CEO role temporarily while the company begins a "rigorous and robust" search for a full-time replacement, she said in the video.

DES MOINES, Iowa (KCRG) - Iowabased supermarket chain, Hy-Vee is expanding into Indiana with the acquisition of the Strack & Van Til Food chain.

Leaders with Hy-Vee said the acquisition will add 22 stores, and about 2,800 employees into the HyVee family.

Chuck Maggelet oversaw the company's acquisition of Kum & Go last year, a move that doubled the c-store chain’s store count.

SALT LAKE CITY — Executive leadership changes are coming to Maverik — Adventure's First Stop.

Chuck Maggelet will retire as the company's CEO and Chief Adventure Guide effective May 1, according to a video posted Friday on Maverik's YouTube page.

"To say this was a challenging decision is an understatement. As you hopefully know by now, I think Maverik is a truly special place. The work we do, the people doing it, and the bold decisions we make have created an

Crystal has served 12 years on Maverik's board of directors. Her great uncle, Reuel Call, founded the c-store chain in 1928 when he opened a two-pump gas station in Afton, Wyo., with the money he earned from renting roller skates. The business soon grew, and he started providing fuel to surrounding towns and ranches.

Under Crystal's guidance, Maverik's parent company has grown into a diverse portfolio of businesses, including convenience retailing, petroleum, healthcare and hospitality. Along with Pilot Corp. and Berkshire Hathaway, FJM was a joint owner of Pilot Flying J and Maverik.

This isn't the first time Crystal has

stepped in as CEO at a company. In 2008, she took on the executive leadership role at Flying J, which is currently the largest travel center operator in North America, selling approximately 14 billion gallons of fuel and $3 billion in food and merchandise a year.

She said she's ready now to keep the momentum going at Maverik. "We'll continue to focus on having fun together, building the coolest convenience experience on the planet. I'm thrilled to be more involved with Maverik and keep the momentum going," she said. "You can also expect me to continue my passion for giving back to the communities in which we operate through charitable efforts like our partnership with Feeding America. Our companies are some of the best in their industries, and I'm excited to lead us into another best year ever."

Casey’s recently announced that it donated $100,000 to the Des Moines Area Community College’s (DMACC) Transportation Institute. According to the program website, the DMACC Transportation Institute Commercial Vehicle Operator Training course is comprised of two separate courses: an online theory course and a behind-the-wheel driving course. The total program meets the FMCSA standards and regulations for EntryLevel Driver Training.

The retailer said in a LinkedIn post that with hundreds of truckers at Casey’s, the company is grateful for programs like the DMACC’s Transportation Institute. “Attracting and training a talent pipeline for drivers is key to our future workforce and the transportation network for many companies,” the retailer wrote.

The $100,000 donation will go toward upgrading and expanding the DMACC Transportation Institute. “The new building and concourse will serve the CDL training program and double student capacity, resulting in more fully certified truck drivers,” Casey’s said in the LinkedIn post. “We can't wait to see it and celebrate with the students later this year!”

The money will go toward a new building and concourse, doubling student capacity. April 03, 2024

In February, Casey’s partnered with Celsius and Feeding America to help fight hunger. In a campaign that ended yesterday, April 2, Casey’s guests were able to round up at the register, supporting children and families impacted by food insecurity across the Midwest and South.

By Sarah Bowman, Communications Director , FUELIowa

By Sarah Bowman, Communications Director , FUELIowa

The 2024 UMCS show was a huge success – thank you to the sponsors, exhibitors, attendees, committee members and staff who made it such an incredible event.

The use of the mobile app was up over the previous years, and 98% of the people who downloaded the app, used it to plan their convention, message attendees, and share pictures. Attendees were excited for the return of casino night, to hear from EMA President Rob Underwood, Keynote Speaker Frank Kelly, Featured Speaker John Eichberger, and the show floor was BUSY at all times!

In the two weeks leading up to UMCS, staff pivoted and moved the auction online and the money raised by FUELIowa for EMA doubled. These funds will be used to strengthen our voice with the Iowa delegation at the federal level.

By Ashlee Vieregger, The Foster Group

By Ashlee Vieregger, The Foster Group

As an advisor, I help families of all shapes and sizes answer some of life’s biggest financial questions. Many of the clients I work with are involved in a family business. Some are founders, some are next generation leaders, some are actively working in their business, and some are retired. Though each family and business is unique, there is something that all family businesses have in common: They face a series of unique challenges throughout their life cycle, from startup, to growth phase, to maturity, to exit strategy.

For many family businesses, the lack of clear succession plans is the most significant challenge. Some 43% of family businesses surveyed by consulting firm, PwC, in 2016, did not have formal succession plans in place.1 Much is written about what a family business owner can do to defy that trend and put a workable plan

in place; Amazon sells 757 books on this topic. But relatively little is written about what PwC calls, “the missing middle,” the gaping strategic hole between startup and succession planning.

It’s natural for family businesses to focus on the key question of who will run the business when the founder or current leader retires or exits. It’s more difficult for family businesses to answer the broad, open-ended strategic question of, “What do we want the family enterprise to look like in ten years?” According to PwC, what many family businesses lack is precisely that, a strategic plan “that links where the business is now to the long-term and where it could be.”

As an advisor, I want to help the business owner families I serve find their own “missing middle,” and that begins with asking the right

questions. Understanding our clients’ unique motivations and values is key to understanding what characteristics they want their business to embody. In life and in business, I want to understand what “winning” looks like to them. Successful handoffs of the business, caring for family, taking care of employees, and bettering the local community, are top priorities for many of the clients I serve.

If you’re a business owner and want to explore the “missing middle” for your company, ask yourself if there is a peer firm or competitor that you particularly admire and why. Maybe it is their ability to develop new and innovative products or reach new sales markets. Maybe it is their ability to attract and retain talent or care for their employees. Your answer may hint at some longer-term strategic hopes for your company and provide a great starting point for further consideration.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION at www.fostergrp.com/disclosures. A copy of our written disclosure Brochure as set forth on Part 2A of Form ADV is available at fostergrp.com.

Passage of this bill would be a heavy lift, especially with a Democratically controlled Senate, but if enacted it would eliminate any estate taxes or any generation skipping tax, both of which as longtime Republican goals. Meanwhile, CVR Energy Inc. submitted a petition for rulemaking to the Biden administration to prohibit nonobligated parties from possessing and trading Renewable Identification Numbers (RINs), reviving a push for changes to the Renewable Fuel Standard. CVR Energy argues the current approach disadvantages independent and merchant refiners such as its Coffeyville Resources Refining & Marketing, LLC and Wynnewood Refining Company, LLC, because they are obligated to fulfill annual biofuel blending targets even though they lack sufficient blending capacity to generate tradable credits known as RINs required to show compliance with the quotas. CVR is leveraging a November ruling by a

By Risk Improvement Department, EMC Insurance Companies, Des Moines, Iowa

By Risk Improvement Department, EMC Insurance Companies, Des Moines, Iowa

Tanker truck drivers are exposed to obvious hazards (e.g., traffic collisions and hazardous materials) as well as hazards that are harder to spot (e.g., overexertion from moving awkward equipment or falls while climbing onto the truck). Help keep your drivers safe and on the job by focusing on these four areas.

Hire the right tanker truck drivers

Driver error is responsible for up to 94% of auto accidents, so choosing qualified drivers should be the foundation of your safety strategy. Make sure your employees have the required licenses, certifications,

and training. If you’ve got a new driver, it’s a good idea to include a ride-along with a more experienced driver as part of their training program.

Drivers should use three-point entry/exit

Truck steps are often slick with ice, water, or mud. To help prevent slips and falls, drivers should always use at least three points of contact (one hand and two feet, or two hands and one foot) when entering or exiting the truck cab. The safest way to exit the cab is by backing out—avoid stepping out sideways, facing forward or jumping straight to the ground.

Avoid distracted driving

Federal rules now restrict the use of cell phones by commercial drivers to only hands-free devices (some states ban all cell phone use while driving). To comply with the federal rules, the phone must be in a location where the driver doesn’t have to reach for it, and they may only make or receive a call if they can do so by pressing a single

button. Sending or reading text messages while driving is banned entirely. Despite the regulations, the safest thing to do for your drivers is to institute a policy that prohibits all cell phone use while behind the wheel.

The very nature of your drivers’ jobs can make it difficult for them to maintain a healthy diet and activity level, and research shows that poor health can impact driver fatigue and performance (and therefore, the risk of an accident). You can help keep your drivers healthy by promoting wellness on the job and at home. DrivingHealthy.org is a wellness site aimed at commercial motor vehicle drivers. It includes information about managing health conditions that are common among truck drivers and tips for eating healthy and exercising while on the road.

Article courtesy of the Loss Control Department, EMC Insurance Companies, Des Moines, Iowa. For more information, go visit emcins.com and select Loss Control.

JUNE 10, 2024

FUELIOWA BENEFIT FOR CAMP COURAGEOUS

Finkbine Golf Course, Iowa City, Iowa

AUGUST 1-2, 2024

SUMMERFEST AND ANNUAL MEETING

Bridges Bay Resort, Okoboji, Iowa

HEALTHAlliance offers industry leading health & wellness plans exclusively designed to meet the needs of fuel marketers, convenience stores, and associated businesses. With partners like Blue Cross & Blue Shield, Delta Dental & more, our members enjoy the finest coverage at low rates due to the combined buying strength of our membership.

By

By

Sarah Bowman, Communications Director, FUELIowa

On Thursday May 9, a second grant workday was held at the Iowa Corn offices in Johnston. Following the success of the first workday, a second workday was held to assist convenience store owners navigate the complicated USDA grant process for infrastructure funding for FUELIowa members.

FUELIowa Board Member Chad Besch attended the workday and shared his thoughts about his time spent.

“The workday was great! It was a huge help, with grant writers who would spend time one on one with us to answer questions. It allowed me to spend some dedicated time to get our project moving forward.”

Thank you to Growth Energy, and Iowa Corn for their collaboration and partnership in this process. Together, We FUELIowa.

Friday, April 26, 2024 - The Biden Administration announced today it delayed its plan to ban menthol cigarettes. In 2021, the Biden Administration began pursuing a ban on menthol cigarettes, but the plan was delayed as the White House mulled its political repercussions especially among the black community. Health and Human Services Secretary Xavier Becerra did not say when or if the administration would revisit the issue, nor did he mention the fate of a related proposal to ban flavored cigars. “This rule has garnered historic attention, and the public comment period has yielded an immense amount of feedback, including from various elements of the civil rights and criminal justice movement,” he said. “It’s clear that there are still more conversations to have, and that will take significantly more time.”

Late last year, EMA President Rob Underwood, along with EMA Convenience Store Committee members Jonathan Tang (Ira Philips, Inc., Gadsden, Alabama) and Brian Lohman (ASAP Energy; Weatherford, Oklahoma), met with the White House

Office of Management and Budget to call on the Biden Administration to abandon the proposed menthol ban. EMA highlighted FDA’s failure to enforce its ban on flavored vapes which has led to a flood of illegal, disposable vapes manufactured in China and marketed to children. A menthol prohibition will drive legitimate transactions out of stores and into the illicit market, hurting small businesses and funding violent crime. There is no scientific evidence to support a nationwide public health policy that would treat menthol cigarettes differently than other cigarettes. EMA also highlighted the proposed menthol ban’s impact on small businesses across the country. Banning the use of menthol in cigarettes could also have a cascading effect on companies who supply fuel to independently owned and operated small business gas stations. Retailers may be unable to pay for their next load of fuel and pay for EV charging equipment unless they raise prices on in-store items and/or fuel due to the potential major revenue loss from a menthol flavor ban.

aid to Ukraine, Israel, Taiwan, and bolsters U.S. operations in the Middle East.

When the House and Senate return to Washington next week, we can expect increased pressure on Biden Administration policies. For example, domestic battery companies and a bipartisan group of lawmakers are calling on the Biden Administration to close loopholes in the electric vehicle (EV) tax credit rules. The foreign entity of concern rules are designed to prevent Chinese suppliers from accessing the lucrative EV tax credits, but the companies argue the rules don’t go far enough to cut out Chinese battery suppliers. Frank Fannon, who served as Trump’s assistant secretary of State for energy resources, said cracking down on Chinese battery suppliers could be a top target for Donald Trump if he wins a second term — and he likely wouldn’t have any qualms about the impacts on EV adoption. “I think it will be politically very challenging [for Trump] to allow for this kind of loophole to continue.”

Inside the Beltway April 26, 2024

Perhaps the most impactful activity in Washington this week were major decisions coming out of the Federal Trade Commission (FTC) and U.S. Department of Labor (DOL). On Capitol Hill, the House and Senate were scheduled to be in the states campaigning, however, the Senate remained in Washington to pass a $95 billion supplemental spending measure. The legislation, which passed the House over the weekend, provides

The National Petroleum Council (NPC), an advisory committee within the Department of Energy comprised of roughly 200 industry representatives, delivered a hydrogen report to Energy Secretary Granholm. The report finds that low-carbon intensity hydrogen could reduce U.S. carbon emissions by 8 percent by 2050 if the government pursues policies that help make it cost competitive. The NPC recommended pursuing hydrogen production using natural gas with carbon capture in the short term and scaling up production with renewables in the long term.

The Federal Trade Commission (FTC) voted 3-2 along party lines to approve its new rule on non-competes. The new rule, which will take effect in 120 days, essentially bans non-competes for all workers, finding them “an unfair method of competition – and therefore a violation of Section 5 of the FTC Act.”

Notably, a non-compete clause is broadly defined by the new rule as a “contractual term or workplace policy that prohibits a worker from, penalizes a worker for, or functions to prevent a worker from seeking or accepting work in the United States with a different person where such work would begin after the conclusion of the employment or operating a business in the United States after the conclusion of the employment.”

The new rule applies retroactively to prior agreements, other than those for senior executives earning more than $151,164 a year in a “policy-making position.” Employers must provide notice to other workers subject to noncompete agreements that they are no longer enforceable.

Not limited to employees, the noncompete ban extends to independent

contractors, externs, interns, volunteers, apprentices, and sole proprietors who provide a service to a person. It does not include non-competes entered into pursuant to a bona fide sale of a business entity or in a franchisorfranchisee relationship.

While the rule is final, expect legal challenges to follow. For example, the U.S. Chamber of Commerce, the nation's largest business lobby, told reporters it plans to sue over the rule, claiming the FTC is not authorized to make this rule, that non-competes are not categorically unfair, and the rule is arbitrary. The Chamber's thoughts were echoed by the opposing Republican FTC Commissioners, who cited concerns about the FTC's authority.

While employers' protectable interests are often a concern, it is important to note that this rule does not ban non-disclosure and confidentiality agreements.

Stay tuned for more information on the developing regulations for noncompetes and the legal challenges that will follow.

The U.S. Department of Labor (DOL) announced on Wednesday the release of a final rule raising the minimum annual salary threshold for overtime pay eligibility. This primarily applies to executive, administrative, and professional employees, commonly referred to as the “White Collar Overtime Exemptions.”

The Fair Labor Standards Act (“FLSA”) is a federal law that regulates when employees must be paid minimum wage and overtime. Under the FLSA, overtime pay, which is due to all employees who do not fall within a specified exemption, is one and one-half times an employee’s regular pay rate for every hour that is worked beyond 40 hours in a work week. While hourly workers are generally entitled to overtime pay, salaried workers are not if they earn above a certain pay level and supervise other workers, use professional expertise or judgment, or hire and fire workers.

Currently, salaried workers making less than $35,568 annually qualify for overtime pay when they work more than 40 hours in a week. Starting July 1, 2024, the threshold will increase from $35,568 to $43,888 per year. It will then

increase again to $58,656 on January 1, 2025.

The change will be most critical for employers which are now claiming an overtime exemption for employees earning more than $35,568 annually, but less than $58,656 annually. Upon enactment, these employees, occupying this $23,088 band, would lose their current status as overtime exempt. Please note that the DOL did not change how bonuses are treated. Consistent with the current regulations, employers can still satisfy up to 10 percent of the new salary levels through the payment of nondiscretionary bonuses and incentive payments (including commissions) paid annually or more frequently.

The new standard will likely be challenged in court by affected industry groups including EMA that have argued that excessively raising the standard exceeds the Labor Department’s authority. Unless and until there is court intervention, employers should prepare as follows:

• Review salaried employee classifications to confirm compliance with new salary thresholds to remain exempt.

• Review salaried employee classifications to determine whether employees should be reclassified as nonexempt.

• For employees reclassified as nonexempt, ensure all hours worked are properly recorded.

• For employees reclassified as nonexempt, review budgets, set hours expectations, and development policies for approval of overtime.

Barnes & Thornburg LLP, who represents the Small Business Legislative Council (SBLC) in which EMA is a member, will keep marketers apprised of industry challenges to the Final Rule. For additional information, please contact: Matt Morgan at mmorgan@btlaw. com.

The biggest news this week was that Congress finally released its long-awaited Federal Aviation Administration (FAA) Reauthorization bill, which is critical as FAA funding is set to expire on May 10 barring Congressional action. The bill will provide five more years of funding for the FAA and will make tweaks to a broad range of aviation-related policies. While the FAA bill is the next piece of must-pass legislation Congress will consider - and perhaps its last for a while - House and Senate stakeholders also released draft text of the Farm Bill, which is also a five-year reauthorization and is set to expire September 30, 2024. Both the FAA and Farm Bill include provisions related to Sustainable Aviation Fuel (SAF) tax credits. Relatedly, the White House also announced guidance this week that would enable ethanol and other feedstock to qualify for the Inflation Reduction Act-established SAF tax credit. Suffice to say, with all these actions impacting SAF, we expect this to a be a more complicated legislative effort as the White House guidance and Farm Bill move further towards finalization.

In addition to SAF, Sens. Durbin (DIL) and Marshall (R-KS) are pressing forward with a plan to try to include the Credit Card Competition Act in the FAA bill, making it part of a must-pass effort. Unfortunately, given the bill has already been pre-conferenced by

House and Senate leaders, it is unlikely amendments will be considered on the floor as Senate leaders fear any amendments could jeopardize the must-pass FAA bill. However, stranger things have happened so there remains an opportunity!

In other news, more than two dozen House Republicans, led by Rep. Andrew Clyde (R-GA), introduced a resolution to overturn the EPA's Light Duty Vehicle Tailpipe Emissions Standards under the Congressional Review Act. In the coming weeks, it is expected that Sen. Pete Ricketts (R-NE) will introduce a companion bill in the Senate. At some point, we also expect similar action to attempt to overturn the EPAs Heavy Duty Vehicle Tailpipe Emissions Standards in the same manner. Similarly, Rep. Warren Davidson (R-OH) and Sen. Tommy Tuberville (R-AL) will be leading legislation to repeal the Corporate Transparency Act, which requires private businesses to report beneficial ownership information - whoever owns them - to the Financial Crimes Enforcement Network. Despite this action, we do not expect a lot of impact. With a Democratic President and Senate, we expect these efforts will fail. But it is still a good indicator of the priorities of the Republican Party if it can grow its majority in the 2024 election. To that end, while we do not expect much legislation to pass between now and the election, we do expect a lot of messaging bills indicating each party's priorities ahead in November. Anything unaccounted for by then, including FY 2025 appropriations, will likely be completed after the election.

Separately, the White House took several other actions this week. First, it was announced they would reclassify Marijuana from a Schedule I to a Schedule III narcotic. Rescheduling has

little effect on the ability to purchase marijuana in states where it is illegal. However, the announcement created excitement in the marijuana industry as it would allow state-legal business to qualify for business tax deductions. Importantly, if finalized, rescheduling would not do anything to existing U.S. Department of Transportation drug and alcohol driver rules at this time. The White House also announced this week that it would allow car manufacturers time to convert existing battery supply chains to those fully compliant with the EV tax credit. In other words, companies will still be able to purchase graphite and other battery components from China for the time being and still qualify for the EV tax credit, much to the chagrin of U.S. graphite producers. Unfortunately, it was determined that the current supply of North American graphite is insufficient at this time, so the purge of Chinese graphite will be delayed until 2027.

The EPA this week announced that it is withdrawing its previous proposal to sunset the Energy Star specification for oil and gas fired furnaces. Instead, the agency is moving forward with

an updated oil fired and gas Energy Star specifications in a new proposal. Energy Star certification is important because it promotes high efficiency appliances that consumers often favor due to lower operational costs. The EPA proposed to remove the Energy Star certification from oil and gas fired furnaces last year as part of the Biden Administration's move away from fossil fuels in favor of carbon neutral renewable fuels. EMA submitted comments to the EPA opposing the sunset of oil-fired furnaces and asked for a new Energy Star specification for dual fuel heat pump and oil-fired furnace systems that customers prefer in colder regions in the Northeast.

Key parts of the EPA's new proposal include:

• An increase in stringency for the oil furnace requirement to 87 AFUE. While more stringent than the eligibility requirements for federal tax credits, this level offers a consumer pay back of less than two years.

• An increase in stringency for the gas furnace requirement to 97 AFUE.

• A proposal to eliminate the regional distinction for Energy Star furnaces, to align with current minimum efficiency standards and simplify program administration and participation. Sales data reported to the EPA indicates that consumers are generally not taking advantage of the U.S. South performance level.

• Finalize a test procedure, evaluate performance data and develop a proposed specification for heat pump/oil furnace dual fuel heating systems. Since the furnaces in these systems will run on a limited basis, the EPA is considering a lower furnace efficiency in the interest of overall cost.

According to the EPA, increasing the gas furnace efficiency requirement will align the Energy Star specification with eligibility requirements for Section 25C tax credits established under the Inflation Reduction Act. Energy Star certified oil furnaces will remain eligible for 25C tax credits. EMA will file comments in support of the updated EPA proposal. The EPA has posted a new webinar detailing the new Energy Star specifications for oil-fired and gas furnaces.

This week, EMA joined over 100 organizations, representing millions of small businesses, in a letter of support of legislation sponsored by Senator Tommy Tuberville (R-AL) and Rep. Warren Davidson (R-OH) to repeal the Corporate Transparency Act (CTA). "The Repealing Big Brother Overreach Act" would put an end to the poorly constructed and onerous CTA reporting regime. As a reminder, under the CTA, companies must disclose the identities and other information about anyone who owns a stake of at least 25 percent or exercises significant control over the company. Existing companies have until the start of 2025 to file their disclosures.

The CTA was designed to help law enforcement prevent money laundering by requiring shell companies to report information regarding their beneficial owners (BOI) to the Department of the Treasury. The law, however, defines a shell company as any legal entity with 20 or fewer employees or $5 million or less in revenues - in other words, every

small business in the United States. The concept of beneficial owner is broadly defined as well, and includes owners, senior management, members of the board and any employee or outside consultant exerting significant control over the businesses' operations.

Covered entities must report and regularly update the personal information of their "beneficial owners" to the Treasury Department's Financial Crimes Enforcement Network (FinCEN) or face significant fines and jail time. As a result of this broad sweep, FinCEN expects to collect over 32 million submissions just this year, with an additional five million annual submissions thereafter. Multiply 32 million by the number of beneficial owners per entity, and it becomes apparent that the CTA reporting regime is likely the biggest data collection regime in the history of the federal government outside of the tax code.

Last month, the District Court for the Northern District of Alabama ruled the CTA exceeded the Constitution's enumerated powers and was therefore unconstitutional, but the resulting injunction applies to the plaintiffs onlymembers of the National Small Business Association. As a subsequent notice from FinCEN made clear, all other covered entities are still required to file their BOI reports by the end of the year. This decision will not be the end of the matter. EMA expects the U.S. government will appeal the decision to the Court of Appeals for the Eleventh Circuit. Marketers should understand that court cases can be lengthy and uncertain processes, and this could easily be overturned by the Eleventh Circuit. Full legislative repeal of the Act would provide a complete solution; therefore, EMA is urging congress to pass "The Repealing Big Brother Overreach Act."

May 10

As we plan for EMA’s Day on the Hill next week, we wanted to provide a high-level update on the current state of play in Congress and the Administration. First, Congress has cleared most of its must-pass legislation for the time being, with the exception being the FAA Reauthorization, which requires a short-term extension or House passage before midnight on May 10. While House and Senate stakeholders had released agreedupon legislation a few weeks ago, the Senate was stalled all week over amendments but managed to pass the legislation Thursday evening. Despite efforts to include the DurbinMarshall Credit Card Competition Act as an amendment to the FAA bill, Senators ultimately decided to reject any amendments not directly related to the FAA.

On this note, the Credit Card Competition Act continues to face roadblocks created by Visa, Mastercard, and big banks. Late Thursday afternoon, we learned that the House Financial Services Committee plans to mark up a series of bills next Thursday. Included is a bill introduced by Rep. Andy Barr (R-KY) that would raise the asset threshold over which banks are subjected to the regulated debit rate under the Durbin Amendment. This would represent a weakening of the law that has been so beneficial and could drive up the costs of debit acceptance if enacted.

Once the FAA bill is done, Congress will move fully into FY 2025 Appropriations legislation, the National Defense Authorization Act, and the Farm Bill, which reauthorizes America’s agricultural and food programs. While this is all critical legislation

that will eventually be passed, it is not something that must be passed soon. So, with the election looming larger and larger, members will begin drafting legislation to set the table now, they are unlikely to pass any significant legislation until later this Fall. Still, action will begin now, with appropriators working through Congressionally Directed Spending requests and other priorities now. At the same time, members of the House and Senate Committees on Agriculture will start preparing their final draft texts soon. House Agriculture Committee Republicans are expected to release their draft farm bill text on Friday, May 17, in advance of the Committee’s markup on May 23. Despite recent Farm Bill momentum, there is a strong consensus, on both sides of the aisle, that a Farm Bill will not reach the President’s desk before the election.

Also, in classic Washington fashion, while there is a lot of serious work to be done, Rep. Marjorie Taylor Greene (RGA) introduced her motion to vacate the Speaker. This would have been the second time this Congress (and ever) that a Speaker was removed from office in this manner. But the issue was put to bed as swiftly as it was brought forward, with most Republicans and Democrats moving to table the motion. So, for now, Speaker Johnson survives.

Tuesday, May 21, 2024 - After the VISA/ MasterCard case was filed over 18 years ago, and over 5 years since the court approved the September 18, 2018 Class Settlement Agreement, the Class Administrator of the $5.5 billion payment card interchange fee settlement fund has mailed out claim forms to retailers/ marketers who may be eligible for a share of the Settlement Fund. On May 14, 2024, the Court granted an extension of the claims-filing deadline. The deadline to submit claims is August 30, 2024.

1. CLAIMANTS must have accepted VISA and/or MasterCard as payment for their sales of goods or services between January 1, 2004 and January 25, 2019. Claim Forms must be submitted by August 30, 2024.

2. Branded marketers should submit a claim, for branded sales, even though there is currentlya dispute about whether they or their branded supplier is entitled to recover the settlement share for credit card sales through their branded supplier’s respective systems. As previously reported by the Energy

Marketers of America (EMA), a Special Master has been appointed by the court to hear appeals from denials of eligibility, such as claim denials based on the alleged status of branded retailers as indirect payers.

3. THE CLAIMS The actual claim amount, per $ of sales approved, will be calculated after the Claims Administrator calculates the total amount of the Claims submitted. If you receive a claim form in the mail, fill it out and return it to the Settlement Administrator in accordance with the instructions on the form using the assigned Claim ID number. If your claim is denied, you will be able to bring it before the Special Master for review.

While EMA has not secured the procedures to be utilized by the Special Master, a determination of ineligibility obtained by accessing the abovereferenced login information should be sufficient as a denial of your claim to warrant an appeal to the Special Master.

Please note that the “Court Approved

Claim Form" is only 1 page long. Other than claimant identification, it only contains one substantive question. It requires a claimant to fill in the blank for "Class Period (Jan.1 2004-Jan. 25, 2019) Interchange Fees Paid.” Marketers should not need any assistance in completing or filing their claims. A fund this large attracts firms who think of inventive ways to obtain some of the settlement. We have heard from several marketers who have received solicitations to assist with their claims due to the anticipated long delay until payout. Given that this case was filed in 2005, the time until payout is unknown but it will likely be lengthy. Marketers may of course choose their own path but should understand that filing their claim form is simple.

If your claim is denied on the ground that you are an “indirect payer,” and you wish to lodge an appeal, you may want to first seek guidance from your attorney, although you are free to file your appeal without attorney assistance. The primary basis for any such appeal would be that you are, in fact, a direct payer of the interchange fees paid on each card transaction.

By Sarah Bowman, Communications Director , FUELIowa

By Sarah Bowman, Communications Director , FUELIowa

You don't want to miss out on any of the activities that FUELIowa has planned. Our summer activities are the perfect way for you and your employees to network, have fun, and make lasting memories. From golf and bags tournament to Okoboji night life, FUELIowa has something for everyone. Don't miss out on the adventure!

First on the calendar is the ever popular benefit for Camp Courageous. Finkbine Golf Course hosted the golf event last year, and it was so well received that we have decided to return there again this year. Camp Courageous of Iowa is a year-round respite care and recreational facility for individuals of all ages with disabilities. The camp was established in 1972 with the first 211 campers attending in the summer of 1974. Today, Camp Courageous serves over 7,000 individuals with disabilities in a yearround program.

This partnership has special meaning for FUELIowa and its members. You can find information regarding sponsorships and registrations as well as contact information for the event on the following pages.

Mark your calendar for Monday, June 10th, at Finkbine Golf Course in Iowa City, Iowa. All proceeds from this event go directly to Camp Courageous, and will help ensure that people with disabilities are able to benefit from its programs. We hope you'll join us and support this great cause.

FUELIowa's annual fundraiser for the PAC will be held in Okoboji on August 1-2. Join us for networking, Annual Meeting, bags tournament, golf, auction and more.

SUMMERFEST will raise funds for FuelIowa PAC, a political action committee (PAC) focused on

helping elect candidates who support the oil and gas industry in Iowa.

Don't miss out on this opportunity to support FuelIowa PAC. We look forward to seeing you in Okoboji!

JUNE 10, 2024

Finkbine Golf Course Iowa City, Iowa

Enjoy 18 holes at Finkbine Golf Course, a premier golf facility in Iowa City, Iowa. This is a 4-person scramble with shotgun start complete with pin prizes and a putting contest. Beverage carts will keep you cool all day.

Meet up in the club house after the 18th hole to tell everyone about your great shots. We will have cocktails, a short program, prime rib dinner and dessert and prizes. Don’t forget to purchase your 2024 Camp Courageous / FUELIowa commemorative car.

If you are up for some friendly competition and bragging rights, the traveling trophy is at stake. Who will win this year?!

Camp Courageous of Iowa is a year-round respite care and recreational facility for individuals of all ages with disabilities. The camp was established in 1972 with the first 211 campers attending in the summer of 1974. Today, Camp Courageous serves over 7,000 individuals with disabilities in a year-round program. Learn more about the Camp online at campcourageous.org.

A fun filled day of golf for a great cause – Camp Courageous of Iowa. This year we will be returning to the beautiful Finkbine Golf Club in Iowa City, IA for networking, cocktail reception, golf awards, and a prime rib dinner.