THE VOICE AND RESOURCE FOR IOWA’S FUEL INDUSTRY

GRASSROOTS ADVOCACY pg. 4

NEW FACES AT THE TABLE pg. 8

ROADMAP FOR SUCCESS pg. 12

2025 AST UPDATE pg. 18

GRASSROOTS ADVOCACY pg. 4

NEW FACES AT THE TABLE pg. 8

ROADMAP FOR SUCCESS pg. 12

2025 AST UPDATE pg. 18

Dear FUELIowa Members,

I am honored and excited to serve as your Chair for 2025. Having previously served as both Vice Chair and Treasurer, I know firsthand the strength and dedication of our association. Thanks to the leadership of my predecessor, Keith Olsen, and the commitment of our outstanding board members and staff, FUELIowa is in a strong position to build on past successes and embrace new opportunities.

As we move forward, my focus is clear: engaging our members. Whether through our committees, grassroots advocacy efforts, or the FUELIowa PAC, we must ensure that every business type within our membership has a voice and a seat at the table. The work we do together shapes the future of our industry, and your participation is vital. As you know, our priorities this legislative session are to Extend Iowa's Biofuel Tax Credits for Ethanol and Biodiesel, and to Codify Property Tax Relief for Aboveground Tank Owners.

I want to extend my heartfelt appreciation to those who have already advocated in support of our priorities by attending our Welcome Back Legislator Reception and Grassroots Advocacy Dinner in January, as well as those who have generously donated to the PAC. Your involvement strengthens our mission and amplifies our collective voice.

As we embark on this journey together, I encourage each of you to engage, advocate, and invest in the future of our industry. With collaboration and commitment, we will continue to drive meaningful progress. Together We FUELIowa

Chad Besch Director NEW Cooperative Algona | 515-295-2741

Don Burd Director Otter Creek Country Store Cedar Rapids | 319-533-1825

Wade Fowler Associate Director Core-Mark Midcontinent, Inc. DBA Farner-Bocken Carroll | 641-777-0308

Cara Ingle Associate Director Unified Contracting Services Des Moines | 515-266-5700

Dennis Jaeger Director Mulgrew Oil & Propane Dubuque | 563-845-8359

Brett Kimmes Director Kimmes Country Stores Carroll | 712-775-2202

Tessa Anderson Chair Rainbo Oil Dubuque 563- 526-1179

Nate Lincoln Vice Chair Lincoln Farm & Home Service LLC Glenwood 712-527-4833

Jason Stauffer Treasurer NEWCENTURY FS Ames 515-370-3127

Keith Olsen Immediate Past Chair Olsen Fuel Supply Atlantic 712-243-2340

Scott Moore Director Western Oil, Inc Omaha | 402-618-2238

Scott Richardson Director Key Cooperative Roland | 515-291-0623

Nate Stumpf Director HTP Energy Onalaska, WI | 608-779-6624

Ed Rogers Associate Director Midwest Petroleum Equipment Des Moines | 515-330-2959

By Gary Koerner, CEO, FUELIowa

At FUELIowa, advocacy is more than just an initiative—it’s a movement. In 2025, we are raising the bar, strengthening our grassroots efforts, and ensuring our industry’s voice is heard at every level of government. Through enhanced engagement, strategic events, and increased PAC participation, we are building a stronger, more influential network to protect and advance the interests of all FUELIowa members.

Before the legislative session even begins, we are making sure our members are informed and prepared. This year, we moved our Legislative Lunch & Learns from In-Session, to Pre-Session, allowing engagement with legislators and more efficient coordination of PAC fundraising. The Lunch and Learns offer key insights into upcoming policy discussions, equipping members with the knowledge and tools they need to advocate effectively.

On January 14 th, we held our Welcome Back Legislative Reception which was very well attended by legislators, lobbyists, and industry leaders. Following the reception, we held our new Grassroots Advocacy Team Dinner for FUELIowa members who have volunteered to serve as advocates throughout the session. This dinner allowed us to thank those for their time, expertise, and financial support, and allow for strategic discussion and planning. The next morning, we held our “Breakfast with the Board of Directors”, including guest speaker, Senator Adrian Dickey. It is our hope that this new approach will foster engagement and encourage more FUELIowa members to join our Grassroots Team.

As you may know, FUELIowa Board Members attend zoom meetings each week during session to stay informed on the status of our priorities and other developments happening at the Capitol. This year, John Maynes, President of Government Affairs, will add periodic zoom meetings for nonboard members willing to volunteer and invest the time on grassroots advocacy in their districts. Keeping our members informed and engaged in real-time is critical and we will provide regular insights into key policy developments, helping members stay engaged no matter where they are.

Throughout the year, we will activate our Grassroots Team to engage with legislators on issues that directly impact FUELIowa

businesses. Whether it is sending emails, making phone calls, attending events, or meeting oneon-one with lawmakers at your place of business, our collective voice will help educate lawmakers on the liquid fuels industry and drive positive change.

Advocacy requires action—and financial support. Our PAC Committee is working to grow the FUELIowa PAC, ensuring we have the resources needed to support lawmakers who champion our industry.

We cannot do this alone. To take our advocacy efforts to the next level, we need your support. Contributions to the FUELIowa PAC help us build strong relationships with policymakers, influence key decisions, and protect the future of our industry. Just call us at 515-2247545 or email gary@fueliowa.com and make a pledge today.

Join us in making 2025 a year of action, engagement, and impact. Together, We FUEL Iowa!

VISIONARY($5,000+)

As of 12/12/2024

$8,920DonBurd-OtterCreekCountryStores*

$5,470 Paul Fahey &Tessa Anderson-RainboOil*

$5,000 Larry Bentler, JetGas*

LEADER ($2,500-$4,999)

$3,375 Keith Olsen -Olsen Fuel Suppl y

$2,750 JasonMcDermott -McDermott Oil*

$2,600 Todd Kanne -Community Oil*

$2,540 JimEwing– FUELIowa

$2,500 Thom as Fl ogel -Mulgrew Oil

$2,500Bev& HenryJessen – Cylinder Express

$2,500 JenniferLikes– Harm sOil

$2,500 Cl iff& Dave Reif -Reif Oil*

$2,500 Randy& AndrewWoodard- ElliottOil*

PARTNER ($1,000-$2,449)

$2,030 Nate Lincol n – Lincol n Farm &Home

$2,000 SteveKim mes- KimmesEnterprises LLC

$1,600 John Maynes– FUELIowa

$1,500 Josh &JohnGilroy- GryssonOil

$1,500 Eric Tayl or -TaylorQuikPik

$1,000David& Matt Scheetz -The DepotExpress

$1,000 RichardWeiner– Cartersville Elevator

$1,000 MichaelHildenbrand – CHS, Inc

$1,000 Marc Beltrame -Bel tram eLaw Firm

$1,000 Gary Koerner– FUELIowa

FRIEND ($500-$999)

$630 JasonFloy

$600 Nate Stumpf

$525 SarahBowman

$500 Travis Buhman

$500 SamHoefl er

$500 Jeff Wade

$500 Doug Coziahr

CONTRIBUTOR($0-$499)

$490 TiaEischeid

$400 Chad Besch

$400 JasonStauffer

$400 Dustin Jones

$350DavidSpooner

$295 Dennis Jaeger

$250 SteveDemmer

$250 ScottRichardson

$220 Mike Grzeslo

$200 Mike Frederick

$200 Adam Gardiner

$200 Adam Gisch

$200 Joseph Miller

$200 BruceUrman

$190 Josh Vanevery

$120Dale Boeckman

$120 JacobJessen

$120 ScottSpencer

$110 Ed Rogers

$100 Jared Baker

$100 Stratton Benscoter

$100 Al lenBoeckman

$100 Kale Bulloch

$100 Wade Fowler

$100 Rick Graber

$100 ReoMenning

$100 ScottMoore

$100 Daniel Sprague

$50Dean Onken

$25 Martin Bast

$20 Adam Bowles

$20DanJustin

$20 JoeMadsen

$20 Robert Mast

$20 Matt Mlynarczyk

$20 Tera Petersen

$20 Tony Whitaker

$10Dave Lakner

VISIONARY ($5,000+)

As of 1/27/25

$10,000 - Bev & Henry Jessen - Cylinder Express*

$9,200 - Don Burd - Otter Creek Country Stores*

$5,000 - Tessa Anderson - Rainbo Oil Company*

$5,000 - Larry Bentler - Jet Gas Company*

LEADER ($2,500-$4,999)

$2,500 - Keith Olsen - Olsen Fuel Supply*

$2,500 - Thomas, Jackson & Davis Flogel - Mulgrew Oil & Propane*

$2,500 - Todd Kanne - Community Oil Co*

$2,500 - Jason McDermott - McDermott Oil*

$2,500 - Andrew Woodard - Elliott Oil Company*

PARTNER ($1,000-$2,449)

$2,000 - Brett & Steve Kimmes - Kimmes Enterprises

$1,500 - Marc Beltrame - Beltrame Law Firm

$1,500 - Josh Gilroy - Grysson Oil

$1,500 - Gary Koerner - FUELIowa

$1,000 - Jim Ewing - FUELIowa

$1,000 - John Maynes - FUELIowa

$1,000 - Dave Reif - Reif Oil Company

$1,000 - David & Matt Scheetz - The Depot Express

FRIEND ($500-$999)

$500 - Doug Coziahr

CONTRIBUTOR ($0-$499)

$250 - Scott Richardson

$250 - Jason Stauffer

By Sarah Bowman Director, Communications & Events FUELIowa

In the fast-paced world of association leadership, the arrival of new board members is always an exciting moment. Fresh perspectives, expertise, and leadership can propel the association into its next chapter of innovation, growth, and success. This December, FUELIowa members elected new board members, and their diverse experiences and skills promise to make an impact on both strategy and culture. Let’s meet the new faces at the table.

Brett Kimmes is the VP of Marketing and Digital Media/ Co-owner of Kimmes Country Stores, headquartered in Carroll, Iowa. They operate 14 locations in Iowa.

Brett has been in this role, among many others, for

almost 11 years. Prior to his current endeavor, he worked in a variety of roles with different retailers like Hy-Vee, Target, Dollar General and Kum & Go where he spent most of the early years of his career going all the way back to when he was 11 years old.

Brett is a graduate of Dowling High School in West Des Moines and attended college at Iowa Western Community College in Council Bluffs. His wife Marie is the CFO for their family business and the mother to their three children Brayden (10), Parker (9), & Evelyn (7). In his free time, he enjoys golfing, attending concerts and sporting events, as well as spending large amounts of time with this family and all their activities.

Nate Stumpf has worked in the fuel industry for 13 years, the last 8 with HTP Energy. Nate started as a representative for Iowa, and now serves customers nationwide. He has made many long-lasting friendships with his customers in Iowa, and is proud to represent them on the FUELIowa Board of Directors.

Nate said, “I was contacted by a few customers to serve on this board and let their voices be heard. I think that is our job as board members to listen to the struggles that the fuel marketers

Brett shared, “As a company, we have been members of FUELIowa for many years. I believe it is time for me to step up in a higher capacity to be more involved in the legislative and regulatory issues that our industry faces and be an advocate for other businesses like ours."

Brett said, "I believe that serving on the board gives me a great opportunity to learn and be more involved with the people who make decisions that have an effect on Iowa businesses. FUELIowa as a representative of its members, helps to be a driver of those conversations.

As a first-time member of the board, I hope to be a strong advocate for our members and speak on their behalf when tackling the various issues and tasks that are put in front of us.

I hope to learn from the other board members and listen to what thoughts and concerns other members have as we work together towards our common goals.”

of Iowa face every day. With that information we can do our very best to help, make sure their voice is heard both locally and nationally.”

Nate is passionate about his family and his work. He and his wife Brianna have 4 children, stepdaughters Hannah and Claire- (14-year-old twins –prayers appreciated), sons Kaleb -11 and Boe- 8. Nate attended Concordia College in Moorhead Minnesota, played football and wrestled during his time there. When he is not at work, he

can be found hunting or fishing, spending time with family, or volunteering coaching his two sons’ teams in football or wrestling.

Nate said, “Every day our way of earning a living to feed our families moving gas, diesel and propane seems to be under attack in some shape or form. I think the mission that Fuel Iowa has is very exciting because we can help educate those that do not know what it takes to bring fuel to market. Help them understand how important our job is to their everyday life; and meet in the middle on legislation

and keep it fair for everyone involved.

I come into the board with a drive to serve, I am here to help as much as I can. I do not have a specific role in mind, I will treat it just like all of us

Ed Rogers has worked in the petroleum industry for over 25 years in various roles including Lead Installer, Senior Service Technician, Service Manager overseeing Des Moines & Nebraska branches, Corporate Service Manager (8 branches) & Key Account Manager. He managed many large-scale projects, and his most noteworthy year included nine new convenience store builds in multiple states with a value of over $8M for the petroleum portion. Ed played an integral part of the company acquisition process that expanded the company’s footprint in several states and grew the organization to $250M with over 100 service technicians.

do at HTP Energy, if there are things that need to be done, we just do it. I am a team player and want nothing more than this organization and our members to be successful.

I want to build long lasting relationships with board members, and Fuel Iowa Members. I want to understand what Fuel Iowa members are dealing with during their day-to-day operations and do what ever I can on the board to help them. I am honored to be thought of by so many to be voted into office and I look forward to my time serving on this distinguished board.”

In his current role as Vice President of Business Development he supports and grows key accounts, leads sales & estimating team members and promotes company expansion. He enjoys his role because it enables him to provide customers with the best equipment and exemplary service while building strong, long-lasting partnerships. The petroleum industry is exciting because it presents challenges that allows him to learn and grow both as an individual and a professional.

Ed served on the PEI Service Ten Group as a chairman for four years and was an active member on the Gilbarco Service Advisory Council for two years.

Ed and his wife, Jamie have three sons together: Hunter, Slade and Channing. They’ve been married for over 17 years and love traveling, riding his motorcycle and boating on Lake Okoboji in the summer.

Ed said, “I feel it is a great opportunity for me to share my knowledge I’ve gained over the years and contribute to the team as I can. Over the years I have participated in FUELIowa events and felt the missions that FUELIowa is trying to implement, and support is important to this industry. I didn’t realize everything that FUELIowa is involved with, so I had my eyes opened at the legislative reception and got very excited to be part of the team.

Everything that I have learned so far that FUELIowa has in place and is being worked on excites me. I look forward to meeting the legislators that will help support the 2025 agenda. Seeing the bills that get passed and contributing wherever I can.

At this time, I have much to learn from the other individuals that have been with Fuel Iowa for some time so I am hoping that over time I can help wherever I am needed and learn where the best placement would be for me to help support everything that we are working towards. I believe my petroleum knowledge and years of experience will help with supporting grant opportunities for customers to upgrade their locations and become compliant with future grade opportunities. Another area I feel I can contribute would be understanding the regulatory requirements in place and assisting with any new rules that get implemented.

I am excited to learn about all facets of FUELIowa and support any/all agendas that we will be working on in 2025. I look forward to working with the different committee members and learning how they contribute and how I can help. Working with state legislators is very exciting to me and getting to know each of those individuals.”

At the FUELIowa Board of Directors Meeting on January 15th, the new board members were seated. The executive board was elected, with former Vice Chair, Tessa Anderson (Rainbo Oil) elected as Chair, former Treasurer Nate Lincoln (Lincoln Farm & Home LLC) elected as Vice Chair, and Jason Stauffer (NEWCENTURY FS) elected as Treasurer. Keith Olsen (Olsen Fuel Supply) will serve as Immediate Past Chair, having served as Chair in 2024.

Thank you

Thank you to Chris Biellier (Seneca Companies) and Tia Eischeid (Al’s Corner Oil) for your eight years of service on our board of directors. Chris Bieller received a plaque at the

dinner held at Embassy Suites the evening before the board meeting.

As 2025 unfolds, it’s clear that the new faces around boardroom tables are more than just decision-makers; they’re the catalysts for change. The members that have recognized the

importance of bringing on board members with diverse perspectives, cross-industry experience, and forward-thinking ideas are setting themselves up for longterm success. These new board members are not just filling roles— they’re charting a bold course for the future of our association.

In the end, it’s not just about FUELIowa’s next big move—it’s about creating an environment where bold ideas are welcomed, collaboration thrives, and innovation becomes second nature. With these fresh voices at the helm, the future looks bright. Because Together, We FUELIowa.

By Douglas M. Beech Sr. Assistant General Counsel & Director of Government Relations

G eneral Stores

Douglas M. Beech served on the UST Fund Board of Directors for over 20 years with over a decade of service in the role of Board Chairman leading up to the closure of the Fund.

What does it look like when a government program achieves its goal? For a government program to stop collecting taxes and shut itself down when no longer needed? It is every citizen’s dream but rarely a reality. Original intent gets skewed, funds get diverted, and competing legislative priorities shift resources. You know the story. Yet, on July 1, 2024, the Iowa Comprehensive Petroleum Underground Storage Tank Fund (UST Fund) ceased to exist after decades of working to accomplish its mission. How did a government program meet its goals, stop collection of a tax no longer needed and return funds back to the state? It was a great example of how to run a program.

In the mid-1980’s, Congress granted the Environmental Protection Agency (EPA) the authority to regulate underground storage tanks (USTs).

The EPA published regulations in 1988 setting forth the new regulation of USTs, which included leak detection standards, release reporting, financial responsibility, and new tank standards, among other requirements. The EPA recognized that, because of the size and diversity of the regulated community, state governments were in the best position to oversee USTs. UST owners and operators also wanted state approval of UST programs, so they did not have to deal with two sets of statutes and regulations.

In response to the new federal regulations, in 1989 the Iowa Legislature established the UST Fund. The legislative intent for the UST Fund had three objectives:

1. Assist petroleum retailers in meeting new federal regulations;

2. Remediate existing petroleum leaks; and

3. Prevent future petroleum leaks.

The legislation also established a board to oversee the new program called the Iowa Comprehensive Petroleum Underground Storage Tank Fund Board (Board). It required Board representation from the government, impacted industry, and laypersons.

The Board quickly adopted administrative rules and developed plans to accomplish its three goals.

1. To assist owners and operators and to meet new federal regulations the Board established an insurance program to help petroleum retailers meet federally mandated financial responsibility and storage tank requirements;

2. Established a remedial program to provide funding for cleanup of past petroleum UST leaks;

3. Preventing future petroleum releases. The Board set up a Loan Guaranty Fund to help gas station owners fund upgrades to USTs and minimize damages and cost to the State for future releases.

To fund these goals, the Iowa Legislature established the Environmental Protection Charge (EPC). The EPC was essentially a one cent per gallon increase to the state gas tax that was deposited into the Road Use Tax Fund. A large portion of this revenue was then returned to the Board to pay for accomplishing its mission. Beginning in 1996, the funding from the EPC was $17 million a year, and later reduced to $14 million a year until the EPC charge for the Fund was ended on December 31, 2016.

To ensure the funding for the program was used responsibly, the Board implemented policies and procedures to ensure cost effectiveness and fiscal discipline. From the beginning, the Board contracted with a third-party to handle day-to-day administration so the Board could focus on oversight. This oversight included requiring prior contract approval for any work done with the program funds. This requirement allowed the Board to validate contracts to make sure the services needed would be completed and the proposed expenditures were fiscally prudent prior to contractors

beginning work. The Board also approved and reviewed all major expenditures of the Fund to make sure they were meeting the Program’s objectives.

Once these procedures and practices were set, the Board focused on accomplishing its three goals. To accomplish the first goal, the Board worked with the private sector. After establishing the insurance program, the Board, approximately ten years later, transferred the insurance program to the Petroleum Marketers Mutual Insurance Company (PMMIC), a mutual insurer domiciled in Iowa in the year 2000. This action allowed the Fund and the state to get out of the private UST insurance market. Since the transfer of the insurance program, Iowa gasoline station owners can either self-insure their stores or obtain insurance through PMMIC or other private carriers. Thus, eliminating a non-core function of the state.

To meet the second goal, the Board was aggressive in cleaning up and remediating existing contaminated UST sites. Through the remediation process, the Board distributed more

than $296 million for corrective action costs and cleaned up and closed nearly 6,000 remedial claims with the Fund.

Here again, the Board worked with the private sector. The Board, on several occasions, transferred a portion of the outstanding remedial claims through a loss portfolio transfer process. Some existing remedial claims were transferred on locations that shared liability with the Fund and PMMIC. This allowed for the private sector to handle certain types of UST claims through a mutual beneficial transfer process which moved the Board toward its goal of cleaning up leaking UST sites in the state.

To meet the third goal, a loan guaranty program was set up for gasoline station owners to assist in financing upgrades to their sites to make them safer for the environment. The loan guaranty program provided up to a 90 percent guaranty to the lender to assist operators to pay for remediation expenditures to assist in the upgrade of their UST systems. The loan guaranty program ended on December 31,

1999, after the last loan was repaid. Over the 34-year history of the UST Fund, the program was supported financially through the EPC charge and other funding sources totaling more than $410 million. In addition to the EPC charges, the Fund received almost $180 million from bonding and $40 million from cost recovery actions against mostly major oil companies. In addition, the Fund earned more than $90 million in interest. The Board accomplished its mission with this funding despite over $80 million of the program’s funding being diverted to other non-program related legislative priorities.

Beginning with the 2021 Legislative Session, the Board communicated to the Legislature it was in a position to close and transfer its remaining reserves to end the Fund. After several attempts, this was accomplished with the passage of two pieces of legislation during the 2024 Legislative Session. Senate File 2414 allocated the remaining reserves of the Fund to the Iowa DNR to resolve the

few outstanding claims left to be remediated and to assist gasoline station owners with programs like tank closures, fuel quality inspections, and no further action re-openers. The Board officially ended through the passage of Senate File 2385, a bill that made sweeping changes to Iowa Boards and Commissions.

The successful completion of the Fund by its Board is a good roadmap on how government programs can provide needed services and can still be done in a cost-effective manner. The key to the program’s success was having clear goals, establishing oversight responsibility and setting up policies to achieve those objectives. The policies the Board put in place established cost controls to make sure Iowa taxpayer money was spent for its intended purpose.

mission remained the same.

Successful government programs are possible. The chances of success greatly increase by applying the lessons learned from the UST Fund and its oversight Board. The lessons learned are as follows:

Just think of the problems that could be solved if this same structure was put in place to accomplish the challenges our State faces today and in the coming decades.

JUNE 9, 2025

Finkbine Golf Course

Iowa City, IA

in Iowa City, Iowa. This is a 4-person scramble with shotgun start complete with pin prizes and a putting contest. Beverage carts will keep

Meet up in the club house after the 18th hole to tell everyone about your great shots. We will have cocktails, a short program, prime rib dinner and dessert and prizes. Don’t forget to purchase your 2025 Camp Courageous / FUELIowa

211 campers attending in the summer of 1974. Today, Camp Courageous serves over 7,000 individuals with disabilities in a year-round program. Learn more about the Camp online at campcourageous.org.

ABOVE GROUND STORAGE TANKS

If you are up for some friendly competition and bragging rights, the

Fuel & Other Flammable Liquids

Horizontal or Vertical

UL Listed Storage Tanks

Single or Double Wall

C-Store owners and general managers come to Westmor when they don’t know how to build, expand or remodel their store. Oftentimes they’re frustrated with the lack of transparency with the cost of building a new store and they have too many contacts to keep the project efficient.

» Single source solution for your entire project

» Full cost transparency

» Turn-key construction experience

» Be involved as much or as little as you would like

» Keep your project on time and budget

By John Maynes, President, Government Affairs, FUELIowa

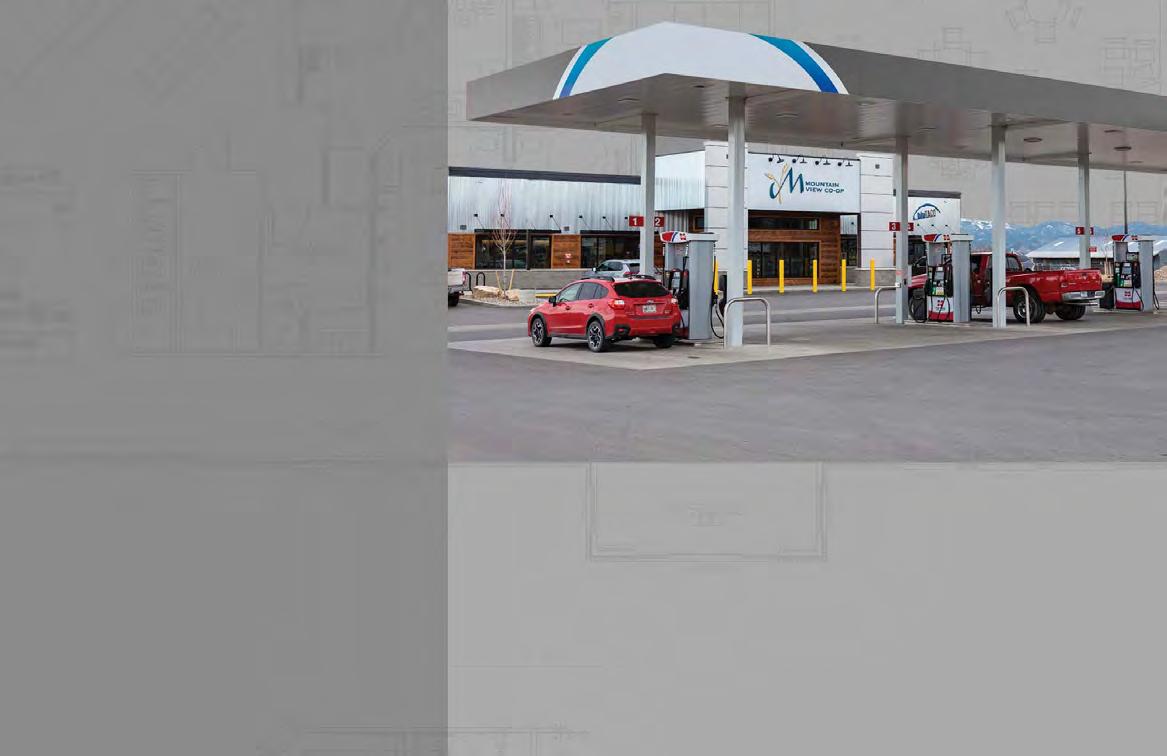

With the 2025 Iowa Legislative Session now in full swing, the FUELIowa Board of Directors has made property tax relief for owner operators of aboveground storage tanks (ASTs) one of the association priorities this session. The association’s effort to secure property tax relief for AST owners was born out of an appeal filed in Dubuque County District Court on behalf of McDermott Oil Company and their bulk storage facility located just outside of Cascade, Iowa.

Although McDermott Oil’s challenge was unsuccessful in Dubuque County District Court, a subsequent appeal to the Iowa Court of Appeals was successful. Upon issuing their decision on February 16, 2022, the Iowa Court of Appeals stated that the undisputed evidence in the McDermott case shows the tanks owned and operated by McDermott Oil are the kind of equipment ordinarily removed when the owner moves to another location and therefore not subject to taxation under the Iowa Code.

Fast forward nearly three years and despite the broad ruling by the Iowa Court of Appeals and the many parallels between the McDermott Oil property and the properties of hundreds of FUELIowa members with similarly situated ASTs, many members have yet to be granted the relief we believe they should be afforded following the McDermott decision. For this reason, the FUELIowa Board of Directors has prioritized

pursuing statutory relief codifying the McDermott decision through the passage of legislation.

Following the McDermott decision, county assessors repeatedly denied AST owners the property tax relief afforded by the Iowa Court of Appeals decision. Assessors and County Boards of Review routinely denied AST owners relief based on several irrelevant criteria including the orientation of the tanks, the content of the tanks, tank size, and my personal favorite, the Iowa Court of Appeals decision is only applicable in Dubuque County, the original jurisdiction where the McDermott case was filed.

County Assessors and their local Board of Review were attempting to accomplish was to deny relief and force small business owners into District Court believing the cost of securing legal counsel and incurring attorney fees would deter many small business owners and they would drop their appeal. County Assessors and their local Board Review were correct in their analysis.

And that’s exactly where FUELIowa was ready to step in. Upon FUELIowa learning of the tactics being

deployed by County Assessor’s, FUELIowa partnered with Mulgrew Oil and Propane to file District Court challenges at five bulk storage facilities in five counties. FUELIowa is pleased to report that all five appeals have been settled prior to trial with all ASTs, regardless of orientation, size, or the products they contain, being removed from Mulgrew Oil and Propane’s Assessments. Counties where relief was secured include Buchanan, Clayton, Clinton, Dubuque, and Jackson counties.

Additionally, FUELIowa is aware of successful appeals filed by FUELIowa members in Cerro Gordo and Sac County. Building upon the momentum gained from the McDermott decision and subsequent appeals from Mulgrew Oil and Propane, FUELIowa member Growmark, Inc. received relief via an appeal to the Iowa Property Assessment Appeals Board (PAAB) involving a location housing eleven 90,000-gallon tanks in Chickasaw County. In the appeal involving Growmark, Inc. and the Chickasaw County Board of Review, the Iowa PAAB relied heavily on the Iowa Court of Appeals decision from the McDermott appeal.

Looking forward to the months ahead, formal assessments will be forthcoming. This means your assessment will be accompanied by a right to appeal. Formal assessments should start to appear this year around March 1. We encourage you to plan for an appeal. If your bulk aboveground storage tanks are included in the assessment you receive around March 1, the best course of action is to contact your county assessor to confirm the same. Thereafter, if your bulk aboveground storage tanks are set-up or installed in a manner where they are held in place by gravity and only connected through piping which can be easily reversed, you should move forward by appealing your assessment, specifically the inclusion of any AST on your property.

As mentioned earlier, odd-numbered years provide FUELIowa bulk plant owners with a right to appeal your assessment. A template for the appeal for is included on page 20. FUELIowa members will check box number three and, in the space provided, should write or type “equipment not attached.” Taking this step will preserve your initial right to appeal with your local board of review and set a course toward securing a further right to appeal should your local board of review deny your initial request for relief. Assuming your local board of review denies your appeal, their denial will trigger your right to appeal to your District Court or the Iowa Property Assessment Appeals Board (PAAB). Fortunately, both venues now have case precedent available to support your appeal.

If you are forced to challenge your tax assessment beyond your local Board of Review, you will need to follow the procedure established by

your County Assessor’s office and Iowa law. FUELIowa encourages members to retain an attorney to ensure proper procedure is followed during the appeal process. If your local Board of Review denies you relief and forces you to continue your appeal in District Court or before PAAB, please reach out to FUELIowa. We may want to notify your state Senator and Representative of the actions of your county assessor and local Board of Review.

We are hopeful

that course of

action. For that reason, we

are invested in codifying the decisions of the Iowa Court of Appeals and the Iowa PAAB relative to the assessment of ASTs.

FUELIowa will continue to provide members updates on our pursuit

of property tax relief at your bulk storage facilities. Our goal is to have the relief granted by the Iowa Court of Appeals and the Iowa PAAB to aboveground tank owners applied uniformly across all of Iowa’s 99 counties. Today’s checkerboard application of the Iowa Court of Appeals decision and now an Iowa PAAB ruling has created inequity in the marketplace county to county and we have discovered instances where the assets of competitors in the same county are not being assessed on equal footing. We plan to keep pushing for relief.

As FUELIowa pursues this issue through the state legislature, we will provide updates as the issue matures and moves forward through the legislative process. Members with questions are encouraged to contact John Maynes in the FUELIowa office (john@fueliowa.com, 515-421-4043).

II by Modern

• Compatible with all biofuels and additives – no peeling, flaking, or cracking

• Customizable multi-compartment design options to meet your specific storage needs

• Does not rely on backfill for structural support

• Capacities up to 70,000 gallons

• 30-year limited warranty

This petition must be filed or mailed to your city or county assessor from April 2 to and including April 30. It must be postmarked no later than April 30. Contact information for all assessors can be found at the Iowa State Association of Assessors website: (www.iowa-assessors.org).

For use by Board of Review only

Petition number: _____________________

Class: ______________________________

Parcel number: ______________________

To the Board of Review for (jurisdiction) _______________________________________ of the State of Iowa, the undersigned (print name), _____________________________________ , as owner or aggrieved taxpayer of the following described real estate: ________________________________________________________ with the property address: _________________________________________________________________ and as such, liable for the payment of taxes thereon, do hereby respectfully object to the assessment made against said real estate as of current year January 1, 20 ______________________, in the sum of (enter total assessment) $ _____________________________ for the following reasons, and upon the following grounds: Check and complete all grounds that apply—see instructions on back.

☐ 1. That said assessment is not equitable as compared with assessments of other like property in the taxing district. Address and assessment of representative number of comparable properties (optional): _________________________________________ Assessed at: $ __________________________________

☐ 2. That said property is assessed for more than the value authorized by law. Actual value (optional): $ _________________

☐ 3. That said property is not assessable, is exempt from taxes, or is misclassified Reason for exemption, misclassification, or non-assessment (optional): ______________________________________________

☐ 4. That there is an error in the assessment. List of errors (optional): ________________________________

☐ 5. That there is fraud or misconduct in the assessment. State specifically the fraud or misconduct (required): ____________________________________________________________________________________

I, the undersigned respectfully request that the assessment made against said real estate be adjusted accordingly based upon the facts presented. I declare under penalties of perjury or false certificate, that I have examined this document, and, to the best of my knowledge and belief, it is true, correct, and complete. An oral hearing is requested: Yes: ☐ No: ☐

Mailing address: __________________________________________________________________________

City: __________________________________________ State: ___________ ZIP: ___________________

Signature (Owner or Duly authorized agent): ____________________________ Date: __________________ Day Phone: ___________________ Cell: __________________ Email: _____________________________

Action Taken: _____________________________________________________ Date: __________________

By Sarah Bowman Director, Communications & Events FUELIowa

FUELIowa’s annual legislative reception is one of the most anticipated events on the calendar for policymakers, FUELIowa board of directors, and our members. FUELIowa teams up with other associations to host this event, but what exactly happens at the annual legislative reception?

Why Does our Legislative Reception Matter?

1. Building Relationships:

One of the main objectives of our annual legislative reception is to create and strengthen connections. Lawmakers are often inundated with meetings and discussions about a wide range of issues, and these receptions allow them to connect on a more personal level with their constituents and our members. These interactions foster trust, cooperation, and mutual understanding— critical elements in the legislative process.

Legislative receptions also provide an opportunity for advocates and interest groups to educate lawmakers about specific issues. This year, our members were given a small card with our 2025 legislative priorities, giving our members the tools necessary to show a united message with lawmakers. The most effective advocates know how to approach lawmakers respectfully and thoughtfully.Preparation is key: knowing the key issues, having clear talking points, and understanding the broader context of legislation can make these exchanges much more productive.

Ultimately, our legislative reception helps influence the direction of public policy. This event allows our members to put their concerns on the radar of lawmakers. Engaging in these conversations can encourage legislators to consider issues more deeply and advocate for changes that align with the needs of our members.

Attending the legislative reception can be an empowering experience, as well as an opportunity to network with other FUELIowa members. It offers a chance for members to take a proactive role, showing up not just as voters, but as active participants in the policymaking process. Members

can use these opportunities to voice concerns, ask questions, or thank legislators for their work, in a relaxed atmosphere. Following the reception, we gathered to watch Governor Reynolds “Condition of the State.”

Our annual legislative reception serves as a bridge between the government and FUELIowa. It allows legislators to hear directly from those they represent, while offering our members a chance to ensure their voices are heard. Whether the focus is on a specific piece of legislation or broader policy concerns, these receptions are valuable opportunities for fostering communication, collaboration, and change.

Consider attending next year’s legislative reception, because Together, We FUELIowa.

The Second Trump Administration hurled to a start this week with President Trump signing nearly 40 Day One executive actions on topics ranging from energy to immigration to federal hiring policies. Most notably, President Trump signed an Executive Order (EO) Monday evening on “Unleashing American Energy,” which among other things, revokes 13 Bidenera energy policies, directs federal agency heads to expedite and streamline permitting processes, and promotes liquified natural gas (LNG) export projects and domestic mining and processing. The EO also targets electric vehicles (EVs) and the Green New Deal, pausing funding under the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA) for EV-related programs. Additionally, President Trump ordered EPA to "consider issuing emergency fuel waivers to allow the year-round sales of E15 gasoline to meet any projected temporary shortfalls in the supply of gasoline across the nation." The federal spending bill back in December would have allowed yearround E15 without the waivers, but that language was stripped out of the bill before lawmakers voted.

While the long-term impacts on clean energy and EV programs remain

unclear, this move signals a clear federal pivot toward traditional energy sectors. Additional EOs issued this week include requiring federal employees to return to in-office work, withdrawing from the Paris Climate Agreement, eliminating federal DEI offices, and ordering the declassification of files related to the assassinations of John F. Kennedy, Robert F. Kennedy, and Martin Luther King Jr.

In addition, this week, over one hundred organizations – including the Energy Marketers of America –signed a letter in support of making permanent the Section 199A deduction for small- and family-owned businesses. President Trump again met with congressional leaders this week including Speaker of the House Mike Johnson and Senate Majority Leader Thune as Republicans continue to debate how and when to advance their legislative agenda on tax, energy, immigration, and federal spending. This is just the start of President Trump’s desire to meet face-to-face with every House Republican by the end of next month. House and Senate Republicans have made little progress on deciding whether to pursue one or two reconciliation bills in 2025 and continue to wrestle over the projected cost of extending their signature 2017 tax cuts, as well as President Trump’s campaign promises on eliminating tax on tips and Social Security benefits.

Meanwhile, Members of Congress and other stakeholders continue to make the case for inclusion of their tax priorities in the final legislation. The House Freedom Caucus (HFC) is reportedly less aligned with President Trump than before, proposing

alternative reconciliation strategies that challenge Speaker Johnson’s single-bill approach. Leadership aims to finalize reconciliation instructions quickly, navigating tough votes and demonstrating progress on tax reform, spending cuts, and growth initiatives, while tensions persist over internal GOP dynamics and coordination with the White House. Meanwhile, and more time sensitive, appropriators are negotiating FY25 top-line funding levels amid pressure to avoid a shutdown before federal funding expires is approximately six weeks. On President Trump’s promised trade maneuvers, tariff implementation targeting China, Mexico, and Canada is anticipated by April.

With a packed agenda and tight deadlines, the administration and congressional Republicans are navigating significant challenges to align their legislative and policy goals in the early days of Trump’s second term.

With a new White House Administration, the FDA has withdrawn

two proposed rules that would ban the sale of menthol cigarettes and flavored cigars. As a result, these proposals are no longer under consideration.

There has been recent news and court action you may have read about this week on the Corporate Transparency Act. But, as of January 24, 2025, companies are still not currently required to file reports with Treasury’s Financial Crimes Enforcement Network (FinCEN). The U.S. Supreme Court yesterday (1/23/25) issued a stay of the “universal” or “nationwide” preliminary injunction that was stopping enforcement of the CTA (Texas Top Cop Shop, Inc. v. McHenry—formerly, Texas Top Cop Shop v. Garland). But, FinCEN published a further note on its website today (https://fincen.gov/ boi) that it recognizes and accepts a separate nationwide stoppage issued by a different federal judge in Texas (Smith v. U.S. Department of the Treasury).

Therefore, companies are not currently required to file beneficial ownership information with FinCEN despite the Supreme Court’s action yesterday. The Fifth Circuit Court of Appeals still

is considering the constitutionality of the CTA. This remains a very uncertain process, and we will continue to keep you posted as developments unfold. Again, to reiterate, despite recent news, FinCEN is communicating that the federal reporting requirement is still paused pending further court action.

Keep in mind that the Supreme Court’s stay focuses solely on the propriety of the universal preliminary injunction and in no way addresses the constitutionality of the CTA. Click here for Wall Street Journal story.

Please note that EMA partnered with Wolters Kluwer earlier this year to prepare marketers to file through BizFilings’ BOI reporting tool which reduces filing times and errors through a streamlined, secure and automated workflow. BizFilings offers EMA member companies a 12 percent discount off BOI report filings.

On Wednesday, the Energy Marketers of America congratulated President Donald Trump and Vice President JD Vance on becoming the 47th President and 50th Vice President of the United States. We commend their continued dedication to promoting energy independence, job creation, and economic growth across the nation.

President Trump has shown unwavering leadership on energy issues, advocating policies that prioritize American energy producers and secure the role of liquid fuels in our nation’s energy portfolio. His administration’s efforts to streamline regulations and ensure fair treatment for liquid fuels have been instrumental in supporting the energy sector and the millions of workers it employs.

On behalf of our members and the men and women in the liquid fuels industry, we look forward to partnering with the Trump administration to further strengthen energy infrastructure, advance innovation, and ensure a stable and reliable future for liquid fuels.

EMA remains committed to serving as a voice for energy marketers and advocating for policies that support the vitality of the liquid fuels industry. As the administration embarks on its second term, EMA looks forward to collaborating on initiatives that bolster energy independence and secure a prosperous energy future.

This week, EMA joined 230 other business groups in support of legislation to make permanent the 20-percent pass through business tax deduction

(Section 199A). The letter was sent to Senator Steve Daines (R-MT) and Rep. Lloyd Smucker (R-Pa.), the lead sponsors of the Senate and House Main Street Tax Certainty Act of 2025, legislation to make permanent the 20-percent deduction for smalland family-owned businesses. This legislation would provide certainty to the millions of S corporations, partnerships and sole proprietorships that rely on the Section 199A deduction to remain competitive. Despite its importance, the Section 199A deduction is scheduled to sunset at the end of 2025, even as the businesses it supports continue to struggle with rising prices, labor shortages, and supply chain disruptions. A recent Ernst & Young study found the loss of Section 199A would put 2.6 million jobs at risk. Making the Section 199A deduction permanent will help Main Street compete with large public corporations, lead to higher economic growth and more employment, and help prevent a significant tax hike on the businesses that drive our economy. Numerous studies by economists Barro and Furman, the American Action Forum, DeBacker and Kasher, Ernst & Young and others found Section 199A permanence would result in improved parity for Main Street businesses and higher levels of economic growth. The more quickly Congress acts to make Section 199A permanent, the sooner petroleum marketers can shift their focus to economic growth and job creation. EMA looks forward to working with Congress to see the legislation enacted this year.

The top story in Washington this week is the inauguration of Presidentelect Donald Trump on Monday, January 20. Preparations for the Trump Administration are already underway in the Senate. This week,

the Senate held confirmation hearings for 13 Trump Administration cabinet nominees, including Secretary of Energy nominee Chris Wright, Secretary of Transportation nominee Scott Duffy, Secretary of Interior nominee Doug Burgum, and Environmental Protection Agency Administrator nominee Lee Zeldin. Before the Senate Energy & Natural Resources Committee, Wright stressed the importance of energy affordability, noting that Americans struggle to pay to fill their car with gas or heat their home. In response to a question from Sen. Ed Markey (D-MA) on reducing dependence on fossil fuels, Zeldin noted that he supports allof-the-above energy, while expressing interest in utilizing the cleanest greenest energy sourced possible. The Senate is expected to quickly confirm several of President Trump’s key cabinet nominees during the first week of the Trump Administration.

House and Senate Republicans continue to meet with their respective conferences on strategy to enact sweeping tax, energy, and immigration legislation through budget reconciliation procedures. This week, Speaker Mike Johnson (R-LA) presented a proposed timeline to enact a budget resolution – the first step in the budget reconciliation process – to House Republicans. The timeline proposes House Committee consideration of a budget resolution the week of February 3 with House floor consideration of the resolution the week of February 17. Meanwhile, House Republican leadership has urged the incoming Trump Administration to delay several executive orders rescinding Biden-era policies, including policies on electric vehicle incentives and fuel economy standards, to preserve opportunities for cost-saving provisions in forthcoming tax and spending legislation.

This week, the State of California withdrew its remaining requests to the U.S. Environmental Protection Agency for federal waivers under the Clean Air Act to limit greenhouse gas emissions from semi-trucks and diesel-powered trains. The California Air Resources Board’s (CARB) decision to withdraw the requests came less than a week before President Biden leaves office and in anticipation of opposition from the incoming Trump administration.

California submitted its Advanced Clean Fleets (ACF) waiver request to EPA in November 2023, which would have required trucking fleets in the State to transition to zero-emission vehicles beginning in 2024, and that all fleets be fully zero-emissions between 2035 and 2042, depending on several factors. ACF also mandated that all new heavy-duty trucks sold in California to be zero-emissions by 2036.

The ACF rule was intended by CARB, in part, to incentivize fleet purchases of zero-emission vehicles. Its counterpart, California’s Advanced Clean Trucks (ACT) rule, was granted a federal waiver by EPA in March 2023. The ACT rule regulates the types of truck OEMs can sell into the California market. EMA is one of the petitioners challenging the ACT waiver in federal court.

The other waiver requests pulled this week by California included a 2023 regulation that would have phased out the sale of new diesel-powered semi-trucks and buses by 2036. Another rule, which CARB also promulgated in 2023, would have banned locomotive engines more than 23 years old by 2030, and would have increased the use of zero-emission technology to transport freight from ports and in rail yards in California.

“CARB’s abandonment of its ACF rule waiver request is welcome news to energy marketers and consumers across the country,” said EMA President Rob Underwood. “This mandate was unachievable since day one.” “We look forward to working with the Trump administration on commonsense approaches for nationwide emissions standards that are achievable and deliver the promised environmental benefits, including reversing the unworkable waiver EPA granted last month to California for its Advanced Clean Car II (ACC II) rule,” Underwood added.

The ACC II rule is a set of requirements for model years 2026 through 2035 for on-road light- and medium-duty engines and vehicles. The ACC II rule includes revisions to both California’s Low Emission Vehicle and Zero Emission Vehicle (ZEV) regulations. The ACC II ZEV provisions specify future zero emission vehicle requirements in California as a percent of annual new vehicle sales. This requirement increases from 35% in model year 2026 to 100% in model year 2035. The Trump administration likely is going to start regulatory efforts to rescind the Biden EPA’s ACC II waiver, while Congress may entertain disapproving it under the Congressional Review Act.

California’s withdrawal of its EPA waiver request for the ACF rule

will resonate beyond California, because states can adopt CARB’s EPA-approved vehicle emission rules. CARB’s action does not affect the antitrust lawsuit recently brought by EMA, the State of Nebraska, and others against California and the truck OEMs for their Clean Truck Partnership. For more information, please contact EMA Regulatory Counsel: Jeff Leiter and Jorge Roman

The FDA issued the first PMTA authorizations for nicotine pouches when it issued Marketing Granted Orders (MGO) for 20 Zyn pouch products. The FDA cited that Zyn’s PMTA applications demonstrated substantially lower amounts of harmful constituents than cigarettes and most smokeless tobacco products and provided evidence from a study showing that a substantial proportion of adults who use cigarette and/ or smokeless tobacco products completely switched to the newly authorized nicotine pouch products.

The products for which the FDA issued MGOs are the following, each with two nicotine strengths (3 milligram and 6 milligram): ZYN Chill, ZYN Cinnamon, ZYN Citrus, ZYN Coffee, ZYN Cool Mint, ZYN Menthol, ZYN Peppermint, ZYN Smooth, ZYN Spearmint and ZYN Wintergreen (note: these MGOs are specific to these Zyn products only).

In the remaining days of the Biden Administration, the FDA has published a proposed rule that would establish a maximum nicotine level. The product standard will set a maximum nicotine level of 0.7mg nicotine/gram and will apply to cigarettes (other than non-combusted cigarettes, such as heated tobacco products), cigarette tobacco, roll-your-own tobacco, cigars (other than premium cigars), and pipe tobacco (other than waterpipe tobacco). This proposal would have a devastating impact on tobacco retailers.

To propose a new regulation such as this one, a federal agency is required to follow a multi-year, nine-step process that involves identifying the need for a new regulation, drafting the regulation, having the White House Office of Management and Budget review the proposed regulation under applicable executive orders, publishing the proposed regulation for public comment, reviewing all public comments, making any changes deemed necessary to the regulation, obtaining final White House Office of Management and Budget approval, and publishing the final regulation with an effective date. With the publication of the proposed rule, the FDA is currently on the fifth step of this ninestep process.

The next step in the regulatory process is the public comment period, which will be open for 240 days. EMA encourages all members to file comments on the negative economic impact and unintended consequences of this proposal and will have a template to use soon.

The National Association of Tobacco Outlets (NATO) intends to file comments to the federal docket and highlight findings from a study NATO commissioned and was compiled by Chmura Economics and Analytics that shows the significant negative economic impact of the proposed FDA rule limiting nicotine content of cigarettes and other combusted tobacco products. The study measures the substantial economic impact on retail sales (tobacco products and ancillary sales), federal excise tax, state and local excise tax and sales tax revenue, jobs, and Master Settlement Agreement payments to the states. The report also details how every single state will be negatively impacted by the proposed FDA rule. The economic impact report can be found on NATO’s website at the following link: NATO: LegislativeCigarette Nicotine Limits Economic Impact Study.

On Monday, the U.S. Department of the Treasury and the Internal Revenue

Service issued long-awaited guidance regarding the implementation of the Section 45Z Clean Fuel Production Tax Credit pursuant to the Inflation Reduction Act. Effective since January 1, 2025, the 45Z regime provides a credit of up to:

• $1.00 per gallon for the production of over-the-road biofuels (e.g., biodiesel, renewable diesel)

• $1.75 for the production of sustainable aviation fuel.

Important for EMA marketers, the new tax regime shifts the incentives from blending to production and calculates the credits based on the carbon reduction attributes of the fuel. The production tax credit is available for each gallon of fuel produced domestically after December 31, 2024, and sold before January 1, 2028.

The guidance delineates forthcoming implementing regulations, including definitions applicable under the framework, the filing process, and general rules to clarify credit calculation, such as how to measure fuel and emission rates. For instance, proposed regulations will specify that the volume of a liquid fuel would be measured based on gallons adjusted to ambient pressure and temperature of 1 atmosphere and 60 degrees Fahrenheit. The guidance also provides the methodology for calculating the life cycle greenhouse gas emissions of fuels for purposes of obtaining tax credits.

Renewable heating fuels may possibly qualify for the credit, although the proposed regulatory language is ambiguous. In short, heating fuels would have to be “suitable for use” in a highway vehicle or aircraft. While the fuels do not have to be used

in such applications, “possible” or “rare” uses, standing alone, are not enough to demonstrate practical and commercial fitness for use as a fuel in a highway vehicle. If another “step” is necessary to make it suitable, such as the type of additization normally found in diesel fuels, it may not qualify. EMA will seek further clarification on this issue and will continue to push for an inclusive framework.

EMA is carefully reviewing the guidance and will continue to monitor developments, as the Trump administration is likely to revise this regulatory matter. For now, comments on the guidance are due by April 10, 2025.

EMA opposes a “production” as opposed to a “blender” credit because producer credits are unlikely to be passed through to blenders and consumers downstream. EMA continues to advocate on Capitol Hill for an extension of the Biodiesel Blenders’ Tax Credit to prevent supply chain disruptions, sustain carbon reduction benefits, and maintain lower prices at the pump.

“The 45Z tax regime is rife with deficiencies and uncertainty. Ultimately, EMA advocates for a strategic biofuel tax policy that promotes regulatory certainty, energy security, environmental benefits, and affordability at the pump. A longterm Blender framework is the right policy approach. We will continue to make this case to the incoming administration,” said Rob Underwood.

Important: The Section 40A Biodiesel Tax Credit, which accrued to fuel blenders, expired on December 31, 2024.

For more information, please contact EMA Regulatory Counsel: Jeff Leiter and Jorge Roman

This week, the Supreme Court said that it will not get involved at this time with the heated legal fights over whether the oil industry is responsible to pay state, county, and local governments for their claimed costs in responding to climate change impacts.

The Court declined to review a 2023 Hawaii Supreme Court ruling that allows Honolulu officials to advance claims in State courts that fossil fuel producers knowingly misled the public about the danger of their products and that the appropriate relief should be money damages based on emissions caused by burning the fossil fuels.

The Court’s decision not to hear the Hawaii case will allow nearly 40 cases across the country to continue against the major oil companies and other parties. These climate liability cases largely emulate successful fights against tobacco and opioid manufacturers and have been tied up for years with procedural delays.

“From EMA’s standpoint, the state law climate litigation clashes with basic constitutional principles and is not good energy policy,” said EMA President Rob Underwood. “We expect the justices to step back into the climate liability fray when it has a better case to come before the Court.”

Republican attorneys general from 18 states have a case pending before the Supreme Court to quash the climate liability lawsuits. Their request invokes the Court’s exclusive jurisdiction in litigation between states.

Justice Samuel Alito, who has consistently recused himself in the climate liability cases, did not take part in deliberations on the Hawaiian case.

January 10, 2025

The 119th Congress officially kicked off on January 3 with the swearing in of members and election of Mike Johnson (R-LA) to continue his role as Speaker of the House. On January 6, despite the federal government being closed due to a winter storm, a joint session of House and Senate members convened to certify the election of Donald Trump. While Congress organizes for the 119th Congress, attention will soon focus on the second inauguration of President Trump, which will be held on Monday, January 20.

Expect President Trump to hit the ground running with administrative action while House and Senate Republicans continue to negotiate their strategy for forthcoming budget reconciliation legislation – bills which will allow Republicans to enact tax, debt limit, and other legislative priorities without Democratic votes in the Senate. On Wednesday, President-elect Donald Trump met with Senate Republicans to discuss differences between House and Senate strategies but declined to endorse an approach. Generally, House Republicans, including Speaker Johnson, favor one reconciliation bill addressing tax, immigration, energy, and other Republican priorities, while Senate Republicans support two

reconciliation bills, with consideration of a bill focused on immigration, border security, and spending cuts occurring in early 2025 followed by a tax bill in late 2025. President-elect Trump will meet with various factions of the House Republican Conference this weekend in Florida to continue negotiations on reconciliation strategy and tax priorities.

This week, the Senate Energy and Natural Resources Committee tentatively scheduled confirmation hearings for Secretary of Interior nominee Doug Burgum and Secretary of Energy nominee Chris Wright for Tuesday, January 14, and Wednesday, January 15, respectively. House Democrats also filled several vacancies on the House Energy and Commerce Committee. Reps. Alexandria Ocasio-Cortez (D-NY), Kevin Mullin (D-CA), Troy Carter (D-LA), Jennifer McClellan (D-VA), Gregs Landsman (D-OH), Jake Auchincloss (D-MA), and Robert Menendez (D-NJ) will serve on the Energy and Commerce Committee for the 119th Congress.

APRIL 7 – APRIL 9, 2025

UMCS

St. Paul, Minnesota

JUNE 9, 2025

FUELIowa Golf Benefit for Camp Courageous Finkbine Golf Course, Iowa City, Iowa

AUGUST, 2025

SUMMERFEST

Des Moines, Iowa

UPGRADES, NEW INSTALLATIONS, LICENSED ELECTRICAL CONTRACTORS, CATHODIC PROTECTION SERVICES, VACUUM TRUCK SERVICES, EQUIPMENT SALES, DISPENSER SERVICES, ENVIRONMENTAL & COMPLIANCE. WE

at the Upper Midwest Convenience Store & Energy Convention, the largest show for fuel marketers in the upper Midwest! By partnering with the Convention, your company will reach an intensely loyal, well-educated audience with buying power, and will be showcased as an integral part of the entire experience.

Complimentary Registrations

Logo Recognition at Your Level

On Show Website (sponsor page)

All Show Signage

Show Convention Program

On Badge Holder

Recognized at Opening Session & Banquet

On Home Page of UMCS.ENERGY

On Thank You/Save the Date Email Blasts

Advertisement in Convention Program

Access to VIP Intercontinental Room Block*

VIP Intercontinental Suite Block **

20% Booth Discount

Network with all attendees in a fun and inviting atmosphere by sponsoring a hospitality tent on both Monday and Tuesday nights (8 PM until midnight). Your tent will be right in the action and a destination for your customers. What’s included? Beer, wine, soda, dry snacks, tables and chairs, and five registration badges as well as access to the room block at InterContinental Saint Paul Riverfront*. Email us at info@umcs.energy for more details. First come, first serve (17 available).

Signage and Logo recognition on show floor at station. Co ee vendor preferred but not required. Option to supply the co ee possible, call for details.

Signage and logo recognition for hosting beer, wine, and sodas on show floor.

send high resolution logo to

Sign_____________________________ Date_______________

MONTICELLO — After more than 45 years, the chief executive officer of Camp Courageous is stepping down to make way for new leadership. Charlie Becker started as executive director in April 1980, the month before the Camp Courageous Perpetual Fund was started by volunteer Dr. Earl DeShaw. Using interest from the fund to help operating expenses, DeShaw, then 80, told the camp board he would devote his life to Camp Courageous and the Perpetual Fund.

But, as it turns out, he wouldn’t be the only one dedicating so much time to the camp for people with disabilities and their families.

During Becker’s time as CEO, the camp has grown from five buildings to 35 buildings; from 40 acres to 400 acres; and from a few hundred campers to nearly 10,000 a year. Now, after dedicating most of his working life to Camp Courageous, Becker shift his entire attention on the foundation that supports the recreational and respite facilities in Monticello, where he has also served as CEO since 1980. The Perpetual Fund continues to be the primary funding source of Camp Courageous, which has always been run on donations without government support.

Campers pay a fee to attend Camp Courageous, which represents less than 10 percent of the cost to care for the camper. No campers are turned away for inability to pay.

Q: How did your journey start with Camp Courageous?

A: I was a teacher in southeastern Iowa (for three years) and had a desire to return to northeastern Iowa. I had student-taught in Monticello, and thought it was a nice community to raise a family.

I replied to a help-wanted ad I saw in the Des Moines Register. I had gone to a Y camp and leadership camp when I was young and as an American government teacher, I would use my free period to take those with disabilities to our local Y to learn to swim. In addition, I helped raise money to send these students to a camp in Des Moines.

Q: Which hats (positions) have you worn over the years?

A: Camp Courageous is a small and humble organization, so we all wear all the hats. In the early years, the staff was very small, so I helped to register campers on Sundays and also assisted with maintenance or facilities when it was needed.

Q: Forty-five years is an unusually long time for anyone to be with one organization, especially in today's world. What has compelled you to dedicate yourself to Camp Courageous and stick with it for so long?

A: Originally, I thought I would be in the position for two years, like the

Peace Corps. But the relationships grew from the board, campers and staff to the volunteers.

We were at rock bottom, and we began to see light in the tunnel. I think a secret to Camp Courageous' success has been longevity in key positions from the board, staff and volunteers.

Jeanne Muellerleile, camp’s director of programs, was with camp nearly 40-years; Sharon Roller, the camp’s medical director, was with camp fulltime for over 30 years; and the list goes on and on.

The philosophy has been recruiting the best, treat them the best, and hope they retire at camp. It is all about the people and Camp Courageous has been blessed with exceptional friends, board members, staff and volunteers.

Q: What are some of your proudest accomplishments in your time with Camp Courageous?

A: I have been very pleased with the growth of the camp.

The camp has grown from 211 campers served in a summer program in 1974 to nearly 10,000 campers in a yearround program today. It has grown from 40 acres to 400, five buildings to 35 buildings, and from a staff of 12 to 100. In addition, it has grown from a few hundred volunteers to thousands.

It gives me great joy when campers, along with their family and friends, say coming to Camp Courageous is the highlight of their loved one’s year.

Q: Over the decades, there has been a shift in the way society approaches and cares for folks with disabilities. How has the mentality and reallife application on caring for folks with disabilities changed, from your perspective?

A: One of the proudest perspectives I’ve seen change in the past 45 years has gone from separating individuals with disabilities to mainstreaming in our school systems. When I came in 1980, Camp Courageous was not accepted like it is today.

It humbles me that today, schools will travel for as much as an hour to have their proms at camp — or a wedding. The stigma has greatly lessened and that is huge.

Q: Most organizations evolve over time, and people with your tenure have the privilege of seeing and holding the institutional knowledge of that evolution. How has Camp Courageous adapted and evolved over the years to overcome challenges and changes?

A: COVID was a huge wake-up call for me. No matter how well we had every aspect of Camp Courageous down to a science, COVID turned it upside down, particularly with hiring staff — the key to camp’s success.

In 45 years I have seen just about everything, so nothing gets me too excited.

The beauty of the management of Camp Courageous is that it can turn on a dime. There isn’t a lot of hierarchy, just good people doing what is best for the campers.

Q: What has been your favorite part of the job and the mission you serve?

A: At the end of each weeklong session, there is an awards ceremony where every camper will receive an award for something that made them special. It is an activity parents/ guardians are welcome to attend.

There are many tears in the audience as each camper receives their award. And the true joy felt at that time is so heartwarming.

Q: What prompted this transition to dedicate your time solely on the foundation?

A: The short answer is I am ready and camp is ready. It is beautiful to have this happen when I’m feeling 100 percent, mentally and physically. I am excited to help with the smooth transition.

Q: Tell us what this transition will look like as a new CEO takes over at Camp Courageous. Who will be affected, directly and indirectly?

A: As Camp Courageous transitions to new leadership, the first few months will be heavily focused on helping

this person build strong relations with our staff, campers, families, volunteers and donors. It will be a gradual handoff of every aspect of camp to the new person and when the new person is ready, they take the reins, and I will step aside and give 100 percent attention to the foundation.

Q: What are your biggest hopes and dreams for this organization as new leadership takes the baton?

A: It is my hope and desire for Camp Courageous to touch more lives than ever before with it continuing to be the highlight of the year for those campers who attend.

I would like to see it continue to be 100 percent run on donations and with a huge volunteer influence. And continue to grow in all areas, facilities, staffing, volunteers, and programs.

Maybe camp’s travel program will bring the first camper to the moon!

Q: What will you miss most as you leave this position to focus solely on the foundation?

A: The day-to-day interaction with an exceptional board, staff, campers, volunteers and supporters.

The beauty of Camp Courageous is one can see it, one can feel it, one can be a part of the joy it brings to so many.