THE

VOICE AND RESOURCE FOR IOWA’S FUEL INDUSTRY

WHY YOU SHOULD ATTEND UMCS pg. 4

EXCITING THINGS AT FUELI owa pg. 10 E15 ACCESS REMINDER pg. 12

p (515) 224-7545

f (515) 224-0502 info@FUELIowa.com www.FUELIowa.com

WHY YOU SHOULD ATTEND UMCS pg. 4

EXCITING THINGS AT FUELI owa pg. 10 E15 ACCESS REMINDER pg. 12

p (515) 224-7545

f (515) 224-0502 info@FUELIowa.com www.FUELIowa.com

Dear FUELIowa Members,

In today’s digital age, it’s easy to rely on email and virtual meetings, but nothing replaces the value of face-to-face interactions. As members of FUELIowa, our success is built on relationships—connections that strengthen our businesses, our industry, and our collective voice.

FUELIowa events provide the perfect opportunity to engage, learn, and make a difference. They offer valuable education, networking, and fundraising for important causes and we continue to strive to make our events the best in the business.

We have three exciting events coming up:

• Upper Midwest Convenience Store & Energy Convention (UMCS) – April 7-9, St. Paul, MN

Connect with industry leaders, learn from our great speakers and workshops, and have some fun at Casino Night!

• Annual FUELIowa Golf Benefit for Camp Courageous – June 9, Finkbine Golf Course, Iowa City

Enjoy a day of golf while supporting Camp Courageous. FUELIowa has been partnering with the camp for over fifty years. Let’s do it for the kids.

• Annual Summerfest – August 11-12, Des Moines

Now in Des Moines and timed with the Iowa State Fair (August 11-12), this event promises our largest turnout yet. Dinner, drinks, bags tournament, golf and the Iowa State Fair. Great opportunities for you to connect and enjoy Des Moines’ East Village nightlife.

I encourage you to step away from screens and join us in person. Let’s connect, celebrate, and support our industry together. I look forward to seeing you there!

563- 526-1179

Chad Besch Director NEW Cooperative Algona | 515-295-2741

Don Burd Director Otter Creek Country Store Cedar Rapids | 319-533-1825

Wade Fowler Associate Director Core-Mark Midcontinent, Inc. DBA Farner-Bocken Carroll | 641-777-0308

Cara Ingle Associate Director Unified Contracting Services Des Moines | 515-266-5700

Dennis Jaeger Director Mulgrew Oil & Propane Dubuque | 563-845-8359

Brett Kimmes Director Kimmes Country Stores Carroll | 712-775-2202

Scott Moore Director Western Oil, Inc Omaha | 402-618-2238

Scott Richardson Director Key Cooperative Roland | 515-291-0623

Nate Stumpf Director HTP Energy Onalaska, WI | 608-779-6624

| 515-330-2959

By Sarah Bowman Director, Communications & Events FUELIowa

The Upper Midwest Convenience Store and Energy Convention (UMCS) stands as one of the most anticipated industry events of the year for convenience store owners, operators, and energy professionals across the region. Whether you're looking to stay ahead of industry trends, explore new technologies, or connect with like-minded professionals, UMCS offers an invaluable platform to do just that. Here's why attending should be on your radar.

The convenience store and energy industries are evolving at an unprecedented pace, driven by consumer demand, environmental considerations, and technological advances. At UMCS, attendees gain exclusive access to workshops discussing the latest market trends, insights from industry experts, and in-depth discussions on key topics such as sustainability, fuel innovation, digital payment solutions, and consumer behavior shifts.

Our Monday featured speaker will address Artificial Intelligence, the Keynote Speaker on Tuesday will address company branding. This convention is a must for anyone serious about staying competitive in today’s rapidly changing industry.

One of the most valuable aspects of any industry convention is the opportunity to network. UMCS provides attendees with ample opportunities to connect with peers, suppliers, vendors, and industry leaders. Whether you’re looking to establish partnerships, expand your supply chain, or learn from others’ best practices, the relationships you forge here can be pivotal to the growth and success of your business.

With hundreds of professionals gathered in one location, you'll meet everyone from small independent store owners to large suppliers, creating an environment rich with potential for collaboration and business development. Open bars, dinner, comedians and casino night offer multiple opportunities to network!

3. Exhibition Floor: The Heart of Innovation

The UMCS exhibition floor is a showcase of the newest products, technologies, and services designed to help convenience stores thrive.

From state-of-the-art point-of-sale systems and payment technologies to energy-efficient refrigeration and fuel management solutions, attendees can explore a wide variety of offerings to streamline operations and enhance customer satisfaction.

It’s also an excellent opportunity to meet with suppliers face-toface, discuss your specific needs, and learn how their solutions can be tailored to fit your business. Whether you're looking to upgrade your in-store experience or find cost-effective energy solutions, the exhibition floor is the place to make it happen.

4.

UMCS is not just about showing off new products—it’s about helping attendees grow professionally. The event features a wide array of educational sessions and workshops designed to equip you with the knowledge and skills needed to excel in your business. Topics covered range from digital marketing strategies, inventory management, and customer service excellence to the integration of renewable energy sources and compliance with new environmental regulations.

These sessions are led by industry experts and offer practical, actionable takeaways that can be implemented immediately to improve your store’s performance. With tailored content for both new and seasoned professionals, there’s always something to learn.

For convenience store owners, navigating the ever-changing regulatory landscape is one of the biggest challenges. The UMCSEC provides invaluable information on emerging regulations, compliance requirements, and government policies that directly affect convenience stores and energy industries.

Whether it's new fuel tax policies, environmental standards, or changes in energy pricing, this convention offers a chance to hear from policymakers and legal experts who can help you understand how these changes might impact your business and how to stay ahead of them.

UMCS is a hub for the Upper Midwest, bringing together businesses from states like Minnesota, Iowa, Wisconsin, and the Dakotas. It offers a unique opportunity to showcase local innovations, connect with regional suppliers, and strengthen business ties within the community. By attending, you're supporting the growth of the regional economy while expanding your reach within the local market.

While the conference offers plenty of educational and networking opportunities, it's also about the experience. UMCS hosts fun social events and a welcoming environment that fosters camaraderie among attendees. It’s a great chance to take a break from your busy routine, relax, and bond with others in the industry.

The Upper Midwest Convenience Store and Energy Convention is not just another industry event—it’s a transformative experience. From discovering the latest trends and innovations to connecting with a vast network of professionals and learning from top-tier experts, attending this convention is an investment in your business’s future. Whether you're a store owner, an energy professional, or a supplier, UMCS offers the resources, insights, and connections that will help you stay ahead of the curve in this everevolving industry. Don't miss out— register today and make sure to be part of this premier event!

MONDAY, APRIL 7 TUESDAY, APRIL 8

1:00 - 3:00 PM

Business Owner and Management Track:

1:00 - 2:00 Succession & Strategic Planning in Today's Environment - Brian Schoenborn, Federated Insurance

2:00 - 3:00 Top Claims of 2024 and How to Prevent Them From Happening at your Business - Renee Andres, EMC Insurance

1:00 - 3:00 PM Tank Track:

1:00 - 2:00 An Analysis of Aging Tank Systems - Pat Rounds, PMMIC

2:00 - 3:00 SPCC Spill Plans Latest News and Updates - Have you reviewed your plan lately? Are you compliant? - Jeff Leiter, EMA & Marty Bonnell, Brams Engineering

1:00 - 3:00 PM Fuels Track:

1:00 - 2:00 Renewable Diesel, SAF and Biodiesel - What does the Future Hold?Dan Short, Marathon Petroleum

2:00 - 3:00 State of the Industry - Tia Sutton, API

3:00 - 4:00 PM

Monday Featured Speaker | RC Me, Myself and AI - Aaron Brossoit, Golden Shovel Agency

5:00 - 6:30 PM

Welcome Reception & Silent Auction | IC Open Bar & Appetizers - Preview Silent Auction Items

8:00 PM - 12:00 AM

Hospitality Night & Silent Auction | IC Open Bar & Snacks

10:00 PM Silent Auction Bid Winners Announced | IC

Tracks and Times Subject to Change

Registration Desk Open 8am - 4pm

8:00 - 8:45 AM

State Association Meetings | RC

9:00 - 10:00 AM

Tuesday Keynote Speaker - Ernie HarkerAuthor of "Your Brand Sucks"

10:00 - 4:30 PM - Exhibit Hall Open | RC

12:00 - 1:00 PM - Lunch | RC

2:30 - 4:30 PM

Happy Hour(s) on Show Floor | RC

Complimentary Beer, Wine, Soda

6:00 - 7:30 PM

Cocktails & Plated Dinner | IC

Great Food, Fun & Open Bar

6:15 - 6:45 PM

Federal Issues - Joint Iowa and Minnesota

Discussion - Rob Underwood, President, EMA | IC 6:45 - 7:30 PM

Comedians - Mary Mack & Tim Harmston | IC

7:30 - 12:00 AM

Casino Night, Hospitality & Entertainment | IC

Open Bar, Snacks & FUN!

Comedy duo

Tim Harmston & Mary Mack - an amazing night of comedy bliss!

WEDNESDAY, APRIL 9

8:00 - 9:00 AM

9:00 - 12:00 PM

Exhibit Hall Open | RC

9:30 - 11:45 AM

Driver Track:

Prayer Breakfast - Dick Bremer, The Voice of the Minnesota Twins

Prayer Breakfast - Dick Bremer, The Voice of the Minnesota Twins 9:30 - 10:45 AM Bulk Transport 101 - Scott Mehman, OPW Civacon | Show Floor

Roadside Inspection on Show Floor - Tomasz Krolak, Minnesota State Patrol

9:30 - 10:45 AM Bulk Transport 101 - Scott Mehman, OPW Civacon | Show Floor

10:45 - 11:45 AM

Roadside Inspection on Show Floor - Tomasz Krolak, Minnesota State Patrol

12:00 - 1:00 PM - Lunch | RC

12:00 PM Exhibit Hall Closes

12:30-1:30 2025 Cannabis and Hemp - Where Have We Been & Where are we going? -

12:30 - 2:30 PM

Hot Topics Track:

12:30-1:30 2025 Cannabis and Hemp - Where Have We Been & Where are we going?Kirsten Libby, Libby Law

1:30 -2:30 Management Excellence - TBA

12:30 - 3:30 PM

Training Track:

12:30-1:30 The Ins and Outs of your Automatic Tank Gauge (ATG) Equipment - Bob McDonald, Minnesota Petroleum Services

1:30 - 2:30 Your Underground Storage Tank System’s Monthly Walkthrough InspectionsAre you Fulfilling Your Requirements? - MPCA

12:30 - 3:30 Operator A/B Training - Fueling Minnesota - PRE-REGISTRATION REQUIRED

12:30-1:30 The Ins and Outs of your Automatic Tank Gauge (ATG) Equipment - Bob McDonald, 1:30 - 2:30 Your Underground Storage Tank System’s Monthly Walkthrough Inspections12:30 - 3:30 Operator A/B Training - Fueling Minnesota - PRE-REGISTRATION REQUIRED Monday Featured Speaker - Aaron Brossoit, Tuesday Keynote SpeakerErnie Harker, “Your Brand Sucks”

Monday Featured Speaker - Aaron Brossoit, “Me, Myself, and AI” Tuesday Keynote Speaker -

speakers, workshops, exhibitors, and entertainment. This event is an excellent opportunity to learn about industry trends, explore innovative solutions, and network with fellow professionals.

By Gary Koerner, CEO, FUELIowa

At FUELIowa, we are committed to advancing our members' interests and ensuring the success of our industry. While advocating for our 2025 legislative priorities at the Capitol, we are also driving exciting initiatives to benefit our members.

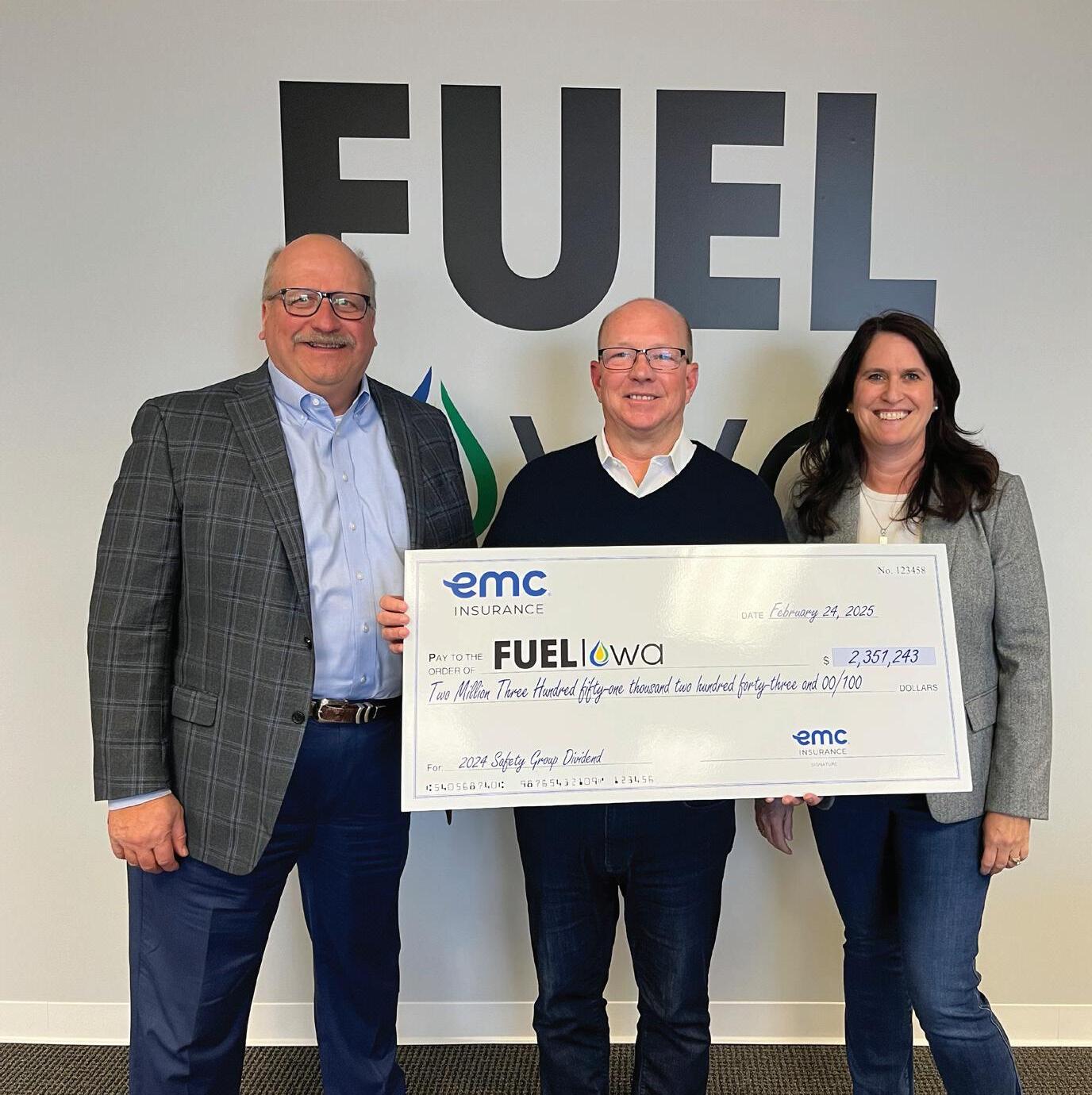

One major achievement this year is the record-setting $2.3 million dividend distribution for members enrolled in our Property/Casualty Program with EMC. This milestone highlights the strength of the program and our commitment to delivering value. Personally delivering some of these checks during member visits allowed us to connect directly and witness the program’s impact. Engaging with members at their businesses was incredibly rewarding, and we look forward to continuing these visits throughout the year.

We are also preparing for the Upper Midwest Convenience Store and Energy Show (UMCS) on April 7-9 in St. Paul. We have collaborated with Fueling Minnesota to assemble a fantastic lineup of

In addition to advocacy and industry events, we have more exciting gatherings planned. Join us on June 9th at Finkbine Golf Course in Iowa City for our Annual Golf Benefit for Camp Courageous. FUELIowa members have supported the camp since the 1970s, and this event is always special and sells out quickly.

We are also thrilled to announce our Annual Summerfest Event in Des Moines on August 11-12 during the Iowa State Fair. We will celebrate downtown in the East Village with dinner, drinks, comedian Greg Warren, and our annual bags tournament. The next day, members can choose between a golf outing or a day at the Iowa State Fair. We hope to see you there!

As we move forward in 2025, we remain focused on initiatives that create value, foster collaboration, and strengthen our industry. Our advocacy efforts, member engagement, and events are making a real difference. We encourage everyone to take advantage of

the many opportunities FUELIowa provides, from insurance programs to networking and educational events.

We look forward to seeing many of you at the UMCS Show and throughout the year during our member visits. Thank you for being a part of FUELIowa—Together We FUELIowa!

are required to offer E15 from a minimum of one gasoline fueling position unless the site is eligible for one of three waivers available through and approved by the Iowa Department of Agriculture and Land Stewardship (IDALS).

By John Maynes, President, Government Affairs, FUELIowa

Calendar year 2025 marks the final year before the full implementation of Iowa’s E15 Access Standard. Enacted on July 1, 2022, Iowa’s E15 Access Standard serves as a mandate on fuel retailers to sell E15 gasoline by January 1, 2026. Retailers unable to meet the mandate championed by groups like the Iowa Renewable Fuels Association, the Iowa Farm Bureau, POET, Growth Energy, and the national Renewable Fuels Association are subject to fines of $1,000 per day and the revocation of their Retail Fuel License.

Since its passage in the spring of 2022 and enactment in July of the same year, Iowa’s E15 Access Standard has remained unchanged. Following enactment, Iowa’s law requires any retail gasoline station removing and replacing an underground storage tank containing gasoline to meet a state mandate requiring 50 percent of gasoline fueling positions to offer E15. Moving forward, beginning on January 1, 2026, retail gas stations which have not replaced an on-site gasoline storage tank

For a gasoline retailer, the first step in assessing your facilities compliance with the E15 Access Standard is a determination of your system’s compatibility with the safe storage and dispensing of E15. The assessment must be completed by an installer certified with the Iowa Department of Natural Resources (Underground Storage Tank Section). Completing the assessment with your licensed installer will provide owner/ operators with three things to help navigate your way toward compliance with the E15 Access Standard:

1. A list of your system components which are not compatible with the safe storage and dispensing of E15 and the cost associated with replacement, including time, labor, and materials.

2. The age of your underground storage tanks.

3. Combined, the information revealed in items 1 and 2 above will serve as valuable information for any owner/operator seeking to pursue one of the three waivers offered by the Iowa Department of Agriculture and Land Stewardship from the requirements of Iowa’s E15 Access Standard.

While many of Iowa’s retail gas stations have pursued a path forward centered on investing in E15 compatible infrastructure, for the remainder, the return on investment simply will not make sense, and the pursuit of a waiver will become necessary. Iowa’s E15 Access Standard provides retail gasoline stations with three separate waiver paths.

The first waiver addressed in this article is the volumetric exemption available to retail gas station owners. Under a volumetric exemption, a retail gas station with gasoline sales of 300,000 gallons annually or less may apply to the Iowa Department of Agriculture and Land Stewardship for a waiver. When considering gasoline sale volumes, a waiver applicant will total gasoline sales from all grades of gasoline offered for sale during calendar years 2020, 2021, and 2022. Sales volumes will be averaged across the three calendar years for purposes of determining waiver eligibility.

More recent sales data may be considered if circumstances warrant. If you are unable to produce sales during this period, please contact FUELIowa, we have resources available to assist with obtaining sales volumes during this period.

The second waiver and its analysis centers on your underground storage tanks conveying gasoline. If your underground storage tank records are incomplete, the Iowa Department of Natural Resources Underground Storage Tanks database is one resource available to owners to

determine the age and material construction of your tank. Your pollution liability coverage provider and your certified petroleum equipment company are two additional resources that can assist in identifying the age and material construction of the tanks located on your site. The following classes of tanks are eligible for a statutory exemption from Iowa’s E15 Access Standard, regardless of whether the tank is compatible with E15 or not:

1. Steel tanks installed during or prior to 1985.

2. Single wall fiberglass storage tanks installed during or prior to 1996.

3. Double-wall fiberglass storage tanks installed during or prior to 1991.

*Please note, the tank classes listed reflect Iowa’s statute and do not serve as a true guide for tank compatibility. Tanks falling outside the statutory exemptions listed above which are not compatible with E15 may be included in the cost-analysis waiver referenced below.

The final waiver, unofficially called the cost analysis waiver, is the most difficult waiver to obtain and its accessibility has been narrowed strategically since passage of the E15 Access Standard in the spring of 2022. For the cost analysis waiver, an owner obtains a quote from a petroleum equipment installer certified with the Iowa Department of Natural Resources, highlighting the costs associated with upgrading a site to make E15 available at a single fueling position. If the owner’s cost to

make E15 available at a single fueling position equals or exceeds $107,143, the owner may apply for a cost waiver. Conversely, if the owner’s cost is $107,142 or less, they are required to offer E15 by January 1, 2026, or face fines of $1,000 per day and the loss of their Retail Fuel License.

Two important caveats to consider when analyzing a site’s eligibility for a cost-analysis waiver:

1. After the E15 Access Standard was signed into law, the state of Iowa took the position that dispensers compatible with E10 are considered compatible with E15 and shall not be eligible to be included in a cost-analysis waiver.

2. The inclusion of any cost beyond the scope

involved with making E15 available at a single fueling position is not eligible for consideration within a cost-analysis waiver.

The timing for waiver submissions is as follows, waivers are required to be in place prior to January 1, 2026. Because waivers will need to be approved by the Iowa Department of Agriculture and Land Stewardship, waivers should be submitted to the Department by December 1, 2025, for review and approval prior to January 1, 2026. If you need assistance submitting a waiver, please contact John Maynes in the FUELIowa office (515-421-4043; john@fueliowa. com).

One final detail to make note of as we move forward in 2025 and prepare for the full

implementation of Iowa’s E15 Access Standard on January 1, 2026. Beginning on January 1, 2026, state law will require all aboveground equipment (dispensers, hanging hardware) installed for the sale of E15 to be compatible up to an E40 blend. This requirement is not retroactive. The requirement only applies to newly installed equipment or equipment that is being replaced on or after January 1, 2026. On January 1, 2028, this requirement will evolve into an E85 compatible requirement for aboveground equipment. Again, this requirement is not retroactive.

Currently, any installation of belowground equipment is required to meet an E85 compatibility standard. As always, thank you for taking the time to read this article and please do not hesitate to contact the association with any questions. Together we FUELIowa.

JUNE 9, 2025

Finkbine Golf Course

Iowa City, IA

Enjoy 18 holes at Finkbine Golf Course, a premier golf facility in Iowa City, Iowa. This is a 4-person scramble with shotgun start complete with pin prizes and a putting contest. Beverage carts will keep you cool all day.

Meet up in the club house after the 18th hole to tell everyone about your great shots. We will have cocktails, a short program, prime rib dinner and dessert and prizes. Don’t forget to purchase your 2025 Camp Courageous / FUELIowa commemorative car.

If you are up for some friendly competition and bragging rights, the traveling trophy is at stake. Who will win this year?!

Camp Courageous of Iowa is a year-round respite care and recreational facility for individuals of all ages with disabilities. The camp was established in 1972 with the first 211 campers attending in the summer of 1974. Today, Camp Courageous serves over 7,000 individuals with disabilities in a year-round program. Learn more about the Camp online at campcourageous.org.

C-Store owners and general managers come to Westmor when they don’t know how to build, expand or remodel their store. Oftentimes they’re frustrated with the lack of transparency with the cost of building a new store and they have too many contacts to keep the project efficient.

» Single source solution for your entire project

» Full cost transparency

» Turn-key construction experience

» Be involved as much or as little as you would like

» Keep your project on time and budget

Secretary Naig Presents 2025 Renewable Fuels Marketing Award to Sparky’s One Stop

ROCKWELL CITY, Iowa (Feb. 7, 2025)

– Iowa Secretary of Agriculture Mike Naig presented the 2025 Renewable Fuels Marketing Awards to two fuel retailers that are leaders in promoting biofuels in Iowa. Al’s Corner Oil, which operates Sparky’s One Stop, a chain of convenience stores in western and northwest Iowa, is the Secretary’s 2025 awardee for ethanol marketing.

Secretary Naig presented the award to Sparky’s One Stop during a visit to their convenience store location near Rockwell City on Friday, Feb. 7.

“I want to congratulate and thank Sparky’s One Stop for their leadership in promoting biofuels –an industry that does so much to strengthen Iowa,” said Secretary Naig. “Biofuels are a win-win for everyone. Consumers get access to more affordable, cleaner burning fuels. Our farmers have more markets for their crops, and we generate more economic activity in our rural communities. That’s why the State of Iowa is partnering with fuel retailers to expand infrastructure and

increase the availability of higher biofuel blends around the state, giving drivers even more homegrown choices at the pump.”

Secretary’s Ethanol Marketing Award

– Sparky’s One Stop (Al’s Corner Oil Company)

FUELIowa Director of Membership and Business Services, Jim Ewing, attended the award presentation and presented Tia Eischeid with a plaque recognizing her for her 8 years of service on the FUELIowa Board of Directors. Thank you for your work, Tia! Together We FUELIowa.

Al’s Corner Oil Company, with its home office in Carroll, has been a family-owned business since 1934. They operate Sparky’s One Stop, a chain of convenience stores found throughout communities in western and northwest Iowa. Their locations include Arthur, Auburn, Battle Creek, Bayard, Breda, Carroll, Cherokee, Guthrie Center, Harcourt, Jefferson, Lake City, Lake View, Lytton, Mallard, Newell, Onawa, Rippey, Rockwell City, Schaller, Storm Lake, Vail and Westside. Currently, Sparky’s One Stop markets E15 and E85 to their customers at seven locations with plans for significant expansion of these consumer offerings throughout 2025. Al’s Corner Oil also offers farm fuel and propane delivery for both commercial and residential customers. Sparky’s One Stop is a long-time supporter of biofuels and believes in the value that these homegrown products deliver to their local communities and the families that call them home.

At Iowa Central, a new facility sets the standard for fuels

the new lab on A Street West in Fort Dodge.

Iowa Central President Jesse Ulrich said the facility is the nation’s only independent fuel testing lab.

It is also the official fuel testing lab for the Iowa Department of Agriculture and Land Stewardship. Ensuring the purity of fuel sold in the state is one of that department’s many responsibilities.

Feb 9, 2025

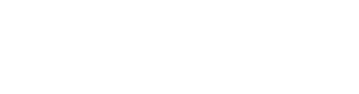

Don Heck, left, director of the Iowa Central Community College Fuel Testing Laboratory, shows Iowa Gov. Kim Reynolds some of the equipment in the new lab.

FUELIowa members spotted on The Hill! Jordan Alm, Bev and Jacob Jessen (Cylinder Express and Johnson Propane) visited with FUELIowa lobbyists Marc Beltrame and David Peck, as well as Sydney Gangestad, lobbyist for The Iowa Propane Gas Association.

FORT DODGE — Anyone standing in the lobby of the Iowa Central Fuel Testing Laboratory can look through big windows to see the scientific equipment at the heart of the facility’s operation.

All those devices filling the big main lab floor ensure that fuel Iowans put in their vehicles is a pure product that will power cars and trucks without ruining their engines.

And that isn’t all. The lab staff will use all that equipment to ensure the quality of ethanol and biodiesel used throughout the nation. Very soon, it will also be testing sustainable aviation fuel.

“This lab will drive innovation in one of Iowa’s most important industries,”

Iowa Gov. Kim Reynolds said Friday afternoon during a ribbon-cutting ceremony marking the debut of

Ulrich described Kersten as the “most persistent human being I have ever met.”

Reynolds added,

“That guy doesn’t stop.”

Iowa Secretary of Agriculture Mike Naig said the new lab is a “testament to a lot of partnerships and creative financing.”

The concept of a fuel lab emerged in 2018. It started in an old greenhouse on the college’s main campus, moved into the Bioscience and Health Sciences Building and finally to the new building, which was specifically designed and constructed to be a fuel testing lab.

“I do have to say some things are worth the wait,”

Ulrich said.

Reynolds recounted how the lab concept grew from a partnership between the college and Decker Truck Line Inc. based in Fort Dodge. The trucking company wanted to check the efficacy of biodiesel. The resulting test was called the Two Million Mile Haul.

The governor described it as “a groundbreaking study” that showed biodiesel was every bit as good as its petroleum-based counterpart.

When the Two Million Mile Haul made the need for a testing lab apparent, college leaders began working with public and private entities to make that happen. Jim Kersten, the college’s vice president for external relations and government affairs, was key in the effort.

The lab’s work to independently verify the quality of biofuels “goes a long way to support consumer confidence.” He reminded the group at Friday’s event that a building is just that, a building. He said it is the people who work in that building that accomplish the fuel testing missing.

Two former state lawmakers who secured the initial funding for the lab spoke Friday.

“Everybody wins in a renewable fuel program — the farmer, the consumer and the Iowa economy,”

said former state Sen. Daryl Beall, D-Fort Dodge.

Former state Rep. Helen Miller, D-Fort Dodge, said she was on “every committee that made a difference for what we wanted to do here.”

Getting the funding for the lab involved fending off legislators, especially from eastern Iowa, who wanted the lab in their districts, she said.

“We

prevailed.”

VISIONARY ($5,000+)

$10,000 - Bev & Henry Jessen - Cylinder Express*

$9,200 - Don Burd - Otter Creek Country Stores*

$5,000 - Tessa Anderson - Rainbo Oil Company*

$5,000 - Larry Bentler - Jet Gas Company*

LEADER ($2,500-$4,999)

$2,500 - Keith Olsen - Olsen Fuel Supply*

$2,500 - Thomas, Jackson & Davis Flogel - Mulgrew Oil & Propane*

$2,500 - Todd Kanne - Community Oil Co*

$2,500 - Jason McDermott - McDermott Oil*

$2,500 - Andrew Woodard - Elliott Oil Company*

PARTNER ($1,000-$2,449)

$2,000 - Brett & Steve Kimmes - Kimmes Enterprises

$1,500 - Marc Beltrame - Beltrame Law Firm

$1,500 - Josh Gilroy - Grysson Oil

$1,500 - Gary Koerner - FUELIowa

$1,000 - Jim Ewing - FUELIowa

$1,000 - John Maynes - FUELIowa

$1,000 - Dave Reif - Reif Oil Company

$1,000 - David & Matt Scheetz - The Depot Express

FRIEND ($500-$999)

$500 - Doug Coziahr

CONTRIBUTOR ($0-$499)

$250 - Scott Richardson

$250 - Jason Stauffer

The Senate is driving the news in Washington this week as Members of the House are back in their home states for a district work period.

On Thursday, the Senate kicked off floor consideration of their “skinny” budget resolution on border security and military funding. Prior to final passage of the resolution the Senate will hold a “vote-a-rama” where Senators may offer an unlimited number of amendments on the resolution. The House is expected to vote on their own budget resolution next week. House Republican leaders – who can only afford to lose one Republican vote on the House floor – are continuing to whip votes in support of their resolution. However, House leaders received a significant boost from President Trump this week, who reiterated his support for the “one beautiful bill” approach adopted by the House. Senate Republicans, undaunted by President Trump’s comments, continue to view their proposal as a necessary backstop given the slim House majority.

The Senate continued its swift confirmation of key Trump Administration officials and is beginning to consider the last remaining cabinet-level nominees.

This week’s Senate confirmations include Howard Lutnick for Secretary of Commerce and Kelly Loeffler for Administrator of the Small Business Administration.

Meanwhile, Congress continues to barrel toward the March 14 deadline to avert a federal government shutdown. This week, several congressional leaders suggested that time is running short to come to agreement on appropriations topline spending amounts. A further continuing resolution (CR) to fund the government past mid-March is increasingly likely.

On the other end of Pennsylvania Ave., President Trump continued to make headlines through executive actions. This week, President Trump announced a new 25% tariff on steel and aluminum imports into the United States will take effect on March 12. In addition, the White House announced it will also impose tariffs of at least 25% on automobile, semiconductor, and pharmaceutical imports in the coming months.

Congress remains laser focused on a reconciliation bill to advance Republican priorities, extend the 2017 Trump tax cuts, and repeal targeted Inflation Reduction Act (IRA) programs. Meanwhile, government funding is set to expire on March 14, 2025. However, Thursday night, President Trump took to Truth Social to express his support for a Continuing Resolution that would extend current Fiscal Year 2025 government funding levels through the end of September 2025. In his post, President Trump criticized “Sleepy Joe

Biden” for the chaos surrounding the current state of government funding.

Late Wednesday night, the House narrowly adopted its budget resolution (required to unlock the reconciliation process) after Speaker Johnson (R-LA) eroded hardliner opposition by emphasizing the vote as the first procedural step to deliver on Republican priorities rather than a final product. The House vote tees up tough negotiations with the Senate on a path forward. The Senate is unlikely to accept the House’s approach, focusing instead on making the 2017 tax cuts permanent, meaning a compromise will require negotiations between chambers. Senate consideration of the House resolution may prompt a second “vote-a-rama” where Democrats can offer unlimited amendments to the resolution to slow consideration. A modified resolution out of the Senate will also require additional House votes - further complicating Speaker Johnson’s ability to whip the necessary Republican votes in the House.

Reconciliation is an arduous process and passage of the House resolution is a positive sign for moving forward. However, the House and Senate dynamic over the past 10 days indicates that congressional leaders remain far apart on key tax and spending priorities, raising doubts about whether Congress can meet its mid-April target for final passage. It’s possible that consideration could move to mid-May and make for an active week during EMA’s Day on the Hill!

Republicans in Congress continue to pursue legislation to pull back on

many IRA incentives - notably those related to Electric Vehicles (EVs). Similar to the Senate bill introduced earlier this month, the House Transportation Committee is drafting a plan to impose a $150 annual fee on electric vehicles, with the funds going to the Highway Trust Fund to help address a projected $280 billion deficit by 2034. The fee is intended to match what the average gas-powered vehicle owner pays in gas taxes, and it would be implemented through the states, with federal support to help set up the system. While many states already charge EV fees, a coalition of industry groups is urging Congress to pass a national EV fee to ensure all drivers contribute to infrastructure funding, though they acknowledge it would only partially address the Trust Fund’s financial issues.

When Congress passed the IRA in 2022, it added seven new sections to the Clean Air Act (CAA). President Biden and the Democrats on the Hill intended the new statutory language to enhance the durability of the Obama administration’s endangerment finding by including language that expressly deemed greenhouse gas emissions (GHGs)—including carbon dioxide, methane and hydrofluorocarbons— to be pollutants for purposes of the amended sections of the CAA, which included the additional program for clean heavy-duty vehicles. For background, in 2007, the U.S. Supreme Court ruled that GHGs are "air pollutants" under the CAA, which required EPA to determine whether they pose a danger for regulatory purposes. In 2009, the agency published an Endangerment Finding, concluding that various GHGs threaten public health and contribute to climate change. This determination serves as the foundational authority for GHG emissions regulation for both mobile sources (e.g., vehicles) and stationary

sources (e.g., power plants).

These statutory determinations of GHGs as pollutants likely will complicate EPA’s determination by revisiting the endangerment finding. Congress would need to consider repealing the IRA provisions as part of the budget reconciliation process.

Pursuant to 49 C.F.R. § 382.701, FMCSA mandates that all employers follow specific requirements for using the Drug and Alcohol Clearinghouse. The Clearinghouse is a secure, online, searchable electronic database containing all drug and alcohol violations from CDL drivers. The Clearinghouse provides employers, CDL drivers, medical review officers (MRO), substance abuse professionals (SAP), state drive licensing agencies (SDLA), and enforcement authorities real-time information about CDL drivers’ drug and alcohol program violations. The Clearinghouse contains various records, including positive drug or alcohol test results, test refusals, completion of return-to-duty (RTD) processes, and follow-up testing plans. CDL driver, employer, MROs, SAPs, and SDLAs must all register to use the database.

Energy marketers as employers are required to perform annual

queries for current employees and pre-employment queries for new employees. Note that the Clearinghouse mandate does not change any existing substantive regulation related to drug and alcohol testing beyond the use of the online database for queries.

For more information, please contact EMA Regulatory Counsel: Jeff Leiter and Jorge Roman

On Monday EPA announced it will maintain the Biden Administration’s decision to permit several Midwestern states to remove the one-pound per square inch (psi) Reid vapor pressure (RVP) volatility waiver for E10 blends in their states. This puts E15 on equal footing with E10 blends, creating an artificial boutique fuels market in those and in nearby jurisdictions during the summertime.

The implementation of the E10 volatility “opt-out” is set for April 28, 2025, after the agency initially delayed the effective date of the rule due to concerns over insufficient supply of gasoline. However, EPA is offering states the option to delay implementation for one year if they need more time to comply. Ohio has already requested this delay, and other states must submit

At the federal level, EMA will meet with EPA in the coming days to continue elevating the voice of marketers in the development of long-term biofuels policy. EMA will also seek legislative action on this issue.

“Not the response we were looking for, but EMA will continue to express marketers’ serious concerns regarding the effects of allowing the establishment of boutique fuels markets without adequate infrastructure and preparation, as well as the need for legislative action,” said EMA President Rob Underwood.

For any questions, contact EMA

President Rob Underwood or EMA Regulatory Counsel Jeff Leiter or Jorge Roman.

EMA Urges Congress to Support the House Budget Resolution and Make 199A Tax Deduction Permanent

This week in advance of the House vote on the budget resolution, EMA joined over 100 other business groups in support of making the 20-percent pass through business tax deduction (Section 199A) permanent. The letter was sent to Speaker Johnson and Minority Leader Jeffries.

The bottom line: Congress needs to act before the end of this year to prevent a massive tax hike on Main Street businesses by making Section 199A permanent.

While the nationwide injunction prohibiting the enforcement of the Corporate Transparency Act (CTA) has been lifted, FinCEN announced that the agency “will not issue any fines or penalties or take any other enforcement actions” against companies for failing to comply with the March deadline. The discretionary policy of non-enforcement will last until a forthcoming interim final rule becomes effective, outlining the new relevant due dates for BOI filings. See FinCEN Announcement here.

This development comes after FinCEN extended the reporting deadline to March 21, 2025 , citing Treasury’s concerns over regulatory burdens on businesses. See the notice here: FinCEN Notice, FIN-2025-CTA1, 2/18/2025. The agency now plans to publish an interim rule by that date to provide compliance clarity. While the rule will take effect soon after publication, the new reporting deadlines remain uncertain. Additionally, FinCEN will also start a public comment period to solicit input on potential revisions to existing BOI reporting requirements. FinCEN intends to launch a more comprehensive rulemaking process to balance national security concerns with regulatory burden reduction, acknowledging that the current regime has failed to strike the right balance.

Meanwhile, Congress is considering legislation to delay the reporting deadlines by a year. The House recently unanimously passed legislation, H.R. 736, which would postpone the CTA reporting requirements until January 1, 2026. In the Senate, a group of Republicans led by Senator Tim Scott (R-SC), introduced a companion bill (S. 505).

EMA is actively monitoring developments inside the Beltway and at the agencies to ensure that small businesses, including energy marketers, benefit from burden reduction mechanisms. EMA will keep you updated on any official actions.

EMA partnered with Wolters Kluwer last year to prepare marketers to file through BizFilings’ BOI reporting tool which reduces filing times and errors through a streamlined, secure and automated workflow. BizFilings offers EMA member companies a 12 percent discount on BOI report filings. The discount can be accessed via a dedicated EMA-member landing page below. Wolters Kluwer has created a new BOI Promotional Toolkit to ensure marketers can comply with the CTA by the new deadlines. The benefit of this kit is to help educate your small business customers/members on the

reinstated CTA BOI filing requirements and encourage filings using the BizFilings’ BOI platform.

President Trump made waves on both sides of Pennsylvania Avenue this week as his Administration continues enacting its second term agenda at full speed.

On Tuesday, President Trump addressed a Joint Meeting of Congress to outline his early accomplishments and his legislative priorities, including on the border, social issues, taxes, tariffs, and other issues. Trump’s speech, the longest in modern history, was met with applause from Republicans and at times provoked jeers and protests from Democrats. On trade, President Trump emphasized tariffs as a key tool in his economic strategy, calling them a "beautiful word" that would “make America rich again” and protect American jobs. President Trump’s remarks were the first of many statements on tariff actions by the President and cabinet officials this week as the White House continues to propose and modify tariffs on goods from Canada and Mexico, prompting confusion among policymakers and financial markets.

On tax policy, President Trump reiterated support for congressional action on several tax proposals from his presidential campaign, including making his 2017 tax law permanent and restoring full expensing, allowing businesses to immediately deduct the full cost of certain business investments, retroactive to January 20, 2025. Trump urged Congress to address expiring tax cuts prior to the end of 2025 and challenged congressional Democrats to support extending expiring tax cuts for individuals. Next week, House

Republicans will begin drafting key provisions of their much-anticipated tax bill in two closed-door meetings on Monday and Wednesday.

Before acting on President Trump’s legislative agenda, however, Congress must avert a pending government shutdown and pass a Continuing Resolution (CR) before March 14. House Republicans are expected to release the text of a stopgap funding measure over the weekend prior to a series of votes on the CR next week. It is unclear whether House Republicans can advance the stopgap bill without the support of Democrats. Several conservative House Republicans and defense hawks have threatened to withhold support for a CR. However, several Democrats may cross party lines to avoid a government shutdown despite broader Democratic concerns over the Department of Government Efficiency (DOGE) and the Trump agenda. A CR will also require the support of several Senate Democrats for final passage.

Meanwhile, legal challenges to several Trump Administration actions and orders continue. On Thursday, the Government Accountability Office (GAO), a congressional agency, ruled that Congress cannot use the Congressional Review Act (CRA) to overturn Clean Air Act waivers granted to California by the Biden Administration, setting up a potential legal challenge. The Trump Administration has maintained that Congress can utilize the CRA to overturn the Biden-era waivers, which allow California to implement stringent pollution requirements.

In addition, on Thursday a federal judge in Rhode Island blocked the Trump Administration from freezing federal grants and loans in two dozen states in response to a lawsuit filed by Democratic Attorneys General.

President Trump made waves on both sides of Pennsylvania Avenue this week as his Administration continues enacting its second term agenda at full speed.

On Tuesday, President Trump addressed a Joint Meeting of Congress to outline his early accomplishments and his legislative priorities, including on the border, social issues, taxes, tariffs, and other issues. Trump’s speech, the longest in modern history, was met with applause from Republicans and at times provoked jeers and protests from Democrats. On trade, President Trump emphasized tariffs as a key tool in his economic strategy, calling them a "beautiful word" that would “make America rich again” and protect American jobs. President Trump’s remarks were the first of many statements on tariff actions by the President and cabinet officials this week as the White House continues to propose and modify tariffs on goods from Canada and Mexico, prompting confusion among policymakers and financial markets.

On tax policy, President Trump reiterated support for congressional action on several tax proposals from his presidential campaign, including making his 2017 tax law permanent and restoring full expensing, allowing businesses to immediately deduct the full cost of certain business investments, retroactive to January 20, 2025. Trump urged Congress to address expiring tax cuts prior to the end of 2025 and challenged congressional Democrats to support extending expiring tax cuts for individuals. Next week, House Republicans will begin drafting key provisions of their much-anticipated tax bill in two closed-door meetings on Monday and Wednesday.

Before acting on President Trump’s legislative agenda, however, Congress must avert a pending government shutdown and pass a Continuing Resolution (CR) before March 14. House Republicans are expected to release the text of a stopgap funding measure over the weekend prior to a series of votes on the CR next week. It is unclear whether House Republicans can advance the stopgap bill without the support of Democrats. Several conservative House Republicans and defense hawks have threatened to withhold support for a CR. However, several Democrats may cross party lines to avoid a government shutdown despite broader Democratic concerns over the Department of Government Efficiency (DOGE) and the Trump agenda. A CR will also require the support of several Senate Democrats for final passage.

Meanwhile, legal challenges to several Trump Administration actions and orders continue. On Thursday, the Government Accountability Office (GAO), a congressional agency, ruled that Congress cannot use the Congressional Review Act (CRA) to overturn Clean Air Act waivers granted to California by the Biden Administration, setting up a potential legal challenge. The Trump Administration has maintained that Congress can utilize the CRA to overturn the Biden-era waivers, which allow California to implement stringent pollution requirements. In addition, on Thursday a federal judge in Rhode Island blocked the Trump Administration from freezing federal grants and loans in two dozen states in response to a lawsuit filed by Democratic Attorneys General.

As Congress remains preoccupied with disagreements over federal funding priorities and budget reconciliation

strategy, the Trump Administration continues to shakeup federal agencies and dismantle longstanding federal regulations. This week, the Trump Administration continued its push to reduce the size and scope of federal agencies, with agencies required to submit plans for large-scale layoffs and budget cuts. These plans may tee up additional layoffs and largescale reorganizations in the coming weeks. As with other early Trump Administration executive actions, the termination of employees at several agencies has prompted legal challenges, with a federal judge on Thursday ordering the Trump Administration to reinstate thousands of fired probationary employees at the Departments of Agriculture, Energy, Interior and the Treasury, among others.

Earlier this week, House Republicans successfully advanced a continuing resolution to fund the government through September. Speaker Mike Johnson successfully overcame widespread Democratic opposition to the stopgap funding measure by securing the votes of over two dozen House Republicans who have historically opposed all shortterm funding bills. The CR passed the House along party lines, with just one Republican voting against the funding bill and one Democrat voting in favor. The bill initially faced uncertain odds in the Senate, where several Democratic Senators announced plans to vote against a procedural motion on the bill without assurances from Republicans to hold a test vote on a one-month funding patch. However, on Thursday, Senate Democratic Leader Chuck Schumer (D-NY) announced he would vote to prevent a government shutdown, effectively neutralizing the Democratic opposition to the funding bill.

The House and Senate also continued to deliberate tax legislation this week, with House Ways and Means Committee Republicans holding closed door meetings on Monday and Wednesday to discuss their priorities for upcoming tax legislation and Senate Finance Republicans meeting with President Trump on Thursday to discuss reconciliation strategy.

And last but not least, EMA and other industry groups sent a letter to the House Ways and Means Committee urging Congress to extend the Section 40A Biodiesel Tax Credit to support the advanced biofuel industry and prevent price increases.

On March 12, EPA announced sweeping deregulatory actions as part of the Trump administration’s policy of unleashing American energy resources. While most of the regulatory relief directly affects upstream energy producers, EPA’s reconsideration of its 2009 Greenhouse Gas (GHG) Endangerment Finding is a significant development. This move is central to many of the planned regulatory rollbacks, including automotive emission standards and refinery regulations. It is worth noting that the withdrawal of the Endangerment Finding and the following deregulatory

actions will undoubtedly result in protracted litigation.

EPA’s authority to regulate GHG emissions under the Clean Air Act (CAA) hinges on the Endangerment Finding. The Obama-era EPA concluded that GHG emissions threaten public health and the environment, legally obligating the Agency to regulate these emissions. If EPA finalizes the withdrawal of the Endangerment Finding, the legal basis for the dependent regulations goes away. Further, with the recent Supreme Court decisions reversing the Chevron Doctrine and setting out the Major Questions Doctrine, it will be difficult for EPA to regulate GHG emissions under many CAA programs.

Tailpipe emission standards would be among the first on the chopping block based on EPA’s announcement. While policies encouraging the use of biofuels are not directly connected to the Endangerment Finding, GHG reduction concerns are embedded in those programs.

As federal climate policy enters a period of relaxation, states are pursuing bold GHG reduction initiatives. State Climate Superfund laws, which seek to impose strict and retroactive financial liability on fossil fuel producers based on GHG contributions, are part of a larger trend in which states seek to capture funding from carbonintensive operations to finance climate mitigation and resilience projects.

Market-based carbon pricing regulations, such as cap-and-trade programs, are also expected to grow at the state level. Thirteen states already participate in the Regional Greenhouse Gas Initiative, the first multi-state mandatory cap-andtrade program to limit carbon dioxide emissions from the power sector. At

the fuels level, New York is preparing to launch a robust cap-and-invest program, in which the state will set declining caps to meet reduction targets, requiring fuel distributors to purchase state-issued allowances. Other states are also considering setting declining caps to tackle in-state fuel combustion by pricing emissions across the value chain, many of which accrue outside state boundaries.

Meanwhile, several states and private petitioners continue to file lawsuits against oil companies demanding compensation for climate impacts. The U.S. Supreme Court has declined to hear state climate lawsuits as recently as this week, signaling deference to states to handle climate policy and disputes. The bottom line is that states will increase regulatory efforts to close the federal gap, potentially setting rules that could meaningfully shape the liquid fuels market.

“EMA fully supports EPA’s actions to lower prices at the pump by addressing electrification mandates,” said EMA President Rob Underwood. “EMA will continue to remain vigilant as climate policy develops at both the federal and state levels to ensure motor fuel and heating oil markets can thrive.”

EMA’s annual Washington Conference and Day on the Hill will be held in Washington, DC from May 14-16 at The Mayflower Hotel. Our industry continues to have many important legislative and regulatory issues to discuss, and the Day on the Hill remains the primary focus of this conference for you to meet with your members of Congress and network with other marketers from across the country!

Hotel reservations will close the earlier of April 23 6:00 pm Eastern or when the room block is sold out. EMA’s room block is currently sold out for Tuesday, May 13, Wednesday night (21 available), and Thursday night (8 available). We will most likely SELL OUT.

Registration must be received by April 23 to be included in our hotel guarantee.

APRIL 7 – APRIL 9, 2025

UMCS

St. Paul, Minnesota

JUNE 9, 2025

FUELIowa Golf Benefit for Camp Courageous Finkbine Golf Course, Iowa City, Iowa

AUGUST 11-12, 2025

SUMMERFEST

Des Moines, Iowa