CEO Marc Werner discusses Costa Group’s plans for the future following its transition to

At The Fresh Connection, our reputation and commitment are something we don’t compromise. With that reputation, we source produce from growers across six of the seven continents in the world with offices in the US, Mexico, South America, South Africa, Lebanon, India, Australia, and New Zealand. We have the ability to source the fruits and vegetables that suit your year-round needs with quality assurance teams that have standards just as high as your own. Combine this with experienced sales, procurement, and operational professionals, you can rely on The Fresh Connection for produce that fits your global needs. Take a closer look at thefreshconnection.com

One constant is the excitement the first week of June brings as the industry gathers for Hort Connections

Change is inevitable in the fresh produce business. Often it’s slow and incremental, taking seasons, but other times the turn in a new direction can be more immediate. In this edition, we get a view of both angles as we bring you all the news you need to know ahead of another highly anticipated edition of Hort Connections.

Our cover spotlights a significant change to the Australian fresh produce industry’s landscape, the sale of Costa Group, ending its nearly nine-year run as a publicly listed company. We sat down with CEO Marc Werner to discuss what this next chapter means for the company and he shared the opportunities on offer for Costa under new ownership. Change has also come for Muirs, another industry staple. The company’s new name and brand positioning ‘Grow Forward’ provides a fresh but familiar feel to a business that has remained family-owned and operated through four generations and nearly 100 years. Our citrus feature details an industry hoping for a change in fortunes after a tough few years, meanwhile, our packaging and grading coverage analyses how automation and sustainability are driving evolution.

Amidst all this change, one constant is the excitement the first week of June brings as the industry gathers for Hort Connections. The 2024 Seeka Marketer of the Year Award Finalist Showcase at 11:30am on 4 June is shaping up as a highlight with three first-class campaigns selected as finalists. Don’t miss the chance to see how the fresh produce industry’s top marketers are changing the game with innovative strategies. Can’t wait to see you all there! n

EDITORIAL

editor Liam O’Callaghan +61 3 9040 1605 liam@fruitnet.com

staff journalist Bree Caggiati +61 3 9040 1606 bree@fruitnet.com ADVERTISING

head of asia pacific sales Kate Riches +61 3 9040 1601 kate@fruitnet.com

SUBSCRIPTIONS

subscriptions +44 20 7501 0311 subscriptions@fruitnet.com

editorial director John Hey +61 3 9040 1602 john@fruitnet.com

commercial director Ulrike Niggemann +49 211 99 10 425 ulrike@fruitnet.com

managing director Chris White +44 20 7501 3710 chris@fruitnet.com DESIGN

Simon Spreckley Qiong Wu Mai Luong Asma Kapoor

CONTRIBUTORS

John Hey Wayne Prowse

Need a bite-sized guide to what’s new in the Australian and New Zealand markets? The team rounds up the latest news and views from the industry.

AUSTRALASIAN INVESTMENT FUND CENTURIA CAPITAL GROUP ACQUIRES KATUNGA FRESH GLASSHOUSE FACILITY

Australasian real estate fund manager, Centuria Capital Group has expanded its agriculture portfolio with the acquisition of Katunga Fresh’s 21ha glasshouse facility in Katunga, Victoria.

The transaction increases Centuria’s total agriculture assets under management to more than A$650m with a total glasshouse portfolio of more than 100ha.

The asset will be owned by the unlisted, openended Centuria Agriculture Fund (CAF). CAF’s portfolio now encompasses five large-scale Australian tomato glasshouse infrastructure facilities including P’Petual Holdings in South Australia.

The off-market sale-and-leaseback transaction was secured on a 20-year triple-net lease. Operator, Katunga Fresh, is one of Australia’s largest suppliers of tomatoes and it has operated from this site for 20 years, supplying Australia’s major supermarkets with year-round produce.

“The Katunga facility is a high-quality precision farming asset, which aligns perfectly with our investment strategies and is backed by a strong tenant

covenant,” said Jason Huljich, Centuria joint chief executive. “We aim to continue expanding CAF into one of Australia’s largest, sector-specific agriculture funds providing Centuria investors with access to high quality real estate opportunities, which in our view are critical Australian food bowl infrastructure assets.”

02 03

LEADERBRAND OPENS LARGE-SCALE GREENHOUSE PROJECT IN TAIRĀWHITI NT MANGO OPERATION CHEEKY FARMS FOR SALE

LeaderBrand has officially opened its completed 11ha greenhouse project in Tairāwhiti with a ceremony attended by New Zealand’s minister for regional development, Shane Jones.

The project aims to accelerate more sustainable crop growth year-round by reducing weather impacts, fertiliser and water usage as well as protecting soil structure. It also contributes to job security and supports Tairāwhiti’s NZ$62.5m horticulture industry.

One of the largest mango plantations in the Northern Territory, Cheeky Farms, is for sale. The significant horticultural aggregation is operated across four properties and includes 283ha of well-developed mango orchards.

The orchards, which are located an hour from Darwin, are predominantly planted with Kensington Pride and R2E2 mango varieties.

PRODUCERS CALL ON GOVERNMNENT TO SCRAP BIOSECURITY LEVY

Representatives of Australia’s agriculture industries have voiced their opposition to the Australian government’s Biosecurity Protection Levy (BPL) following the first meeting of the Sustainable Biosecurity Funding Advisory Panel (SBFAP).

The SBFAP is part of the Australian government’s efforts to increase funding transparency for growers and importers ahead of the proposed A$1bn Sustainable Biosecurity Funding model which includes the proposed BPL. Following the meeting, a National Day of Action calling on the government to scrap the tax altogether was held on May 8.

APAL PARTNERS WITH MONTAGUE ON PILOT EDUCATION PROGRAMME

Apal has worked with Montague to develop a pilot education programme for primary school-aged students, to help inspire and attract the next generation to a career in the apple and pear industry.

Through the development of a suite of workbooks and various interactive activities, lesson plans, and on-site excursions, the programme aims to educate students about the journey of fruit production and help them better understand the seasons, life cycles, food waste, innovation, technology, and the industry supply chain.

SCALES PURCHASES BOSTOCK ORCHARDS

Scales Corporation has announced the acquisition of 240ha of planted orchard area, including 110ha of Dazzle, and a stake in juice concentrate operation Profruit from Bostock Group for NZ$47.5m.

Mr Apple – which is part of Scales’ horticulture division – will also sell around 186ha of its own orchards as part of a strategy to improve margins.

“By acquiring the Bostock orchards and selling these existing orchards, Mr Apple will broadly maintain its total orchard area while achieving a meaningful uplift in its premium variety volumes,” Scales said in a release.

RUGBY STAR TO PARTNER WITH FIRST FRESH

First Fresh, has announced New Zealand rugby star Renee Holmes (pictured) will be the company’s first-ever brand ambassador. The two-year deal commenced in early April, just as the 2024 fruit supply season got underway.

The campaign will be largely based around social media and include giveaways and competitions for consumers.

Horticulture New Zealand (HortNZ) has announced the resignation of chief executive Nadine Tunley effective 30 August, which coincides with the peak industry body’s annual conference in Tauranga.

The organisation’s board said it was disappointed to lose Tunley but she leaves HortNZ with a strong team, structure and direction.

“While the timing of a valued chief executive’s departure is never ideal, the board and Nadine feel it is important that with a new commodity levy proposal about to be voted on, HortNZ is able to recruit a replacement chief executive that can lead the organisation and deliver the strategic outcomes for the next six years, with the full energy required,” the board said in a statement.

“You can be assured that the board and HortNZ team will continue to take the organisation forward in line with the strategy and plan.”

The board recognised the significant contribution Tunley made during her tenure, commending

her steadfast leadership during challenging times including the Covid-19 lockdowns and Cyclone Gabrielle’s devastation.

Tunley said leaving was not an easy decision as she loved working

Hort Innovation has appointed Jesse Reader as its new head of investment growth and commercial commencing 15 April.

Reader joins from his most recent role as commercial manager – agtech and innovation for Costa Group where he led the growth and enhancement of the group’s technology-related initiatives and elevated

the profile and potential of ag-tech within the broader enterprise.

Reader has worked across the Australian research and development landscape with time spent in organisations such as Robert Bosch (Australia), Ag First and Apple and Pear Australia.

Hort Innovation chief executive Brett Brett Fifield said Reader was already known to many of the team as a collaboration partner and would be involved in a new-look Hort Frontiers.

“In his new role, Jesse will play a key leadership role in the transformation of our non-levy investment fund Hort Frontiers which is now at a very exciting point thanks to the hard work of our team over the last 12 months,” said Fifield.

with such dedicated growers. “You have continued to inspire me with your commitment and determination, even when the chips are down, and it has been a pleasure and a privilege to support you,” she said.

Citrus Australia’s annual awards have recognised outstanding achievements and contributions made by members of the Australian citrus industry.

The awards were presented at the gala dinner, held at the end of the Australian Citrus Congress.

The prestigious Hall of Fame Award was presented to recently retired Queensland grower, Nick Ulcoq, along with husband-andwife team Greg and Sue Chislett of Chislett Farms.

“This year’s award recipients epitomise the values and characteristics that make our industry a world leader,” said Citrus Australia chief executive Nathan Hancock. “Congratulations to all our winners.”

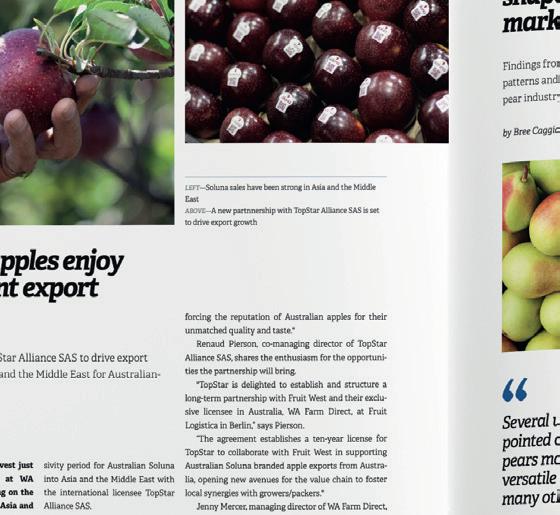

Chief executive of Costa Group Marc Werner speaks exclusively to Produce Plus about the leading Australian fresh produce company’s transition to new ownership and how it plans to leverage the change to accelerate expansion.

by Liam O’Callaghan

Costa Group entered a new phase of ownership on 26 February when a consortium led by private equity firm Paine Schwartz Partners

acquired the leading Australian fresh produce company.

Costa’s shareholders voted in favour of accepting a cash offer of

LEFT—Marc Werner took over as chief executive of Costa Group on 1 March

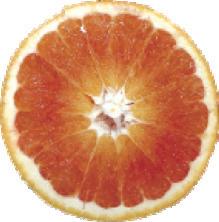

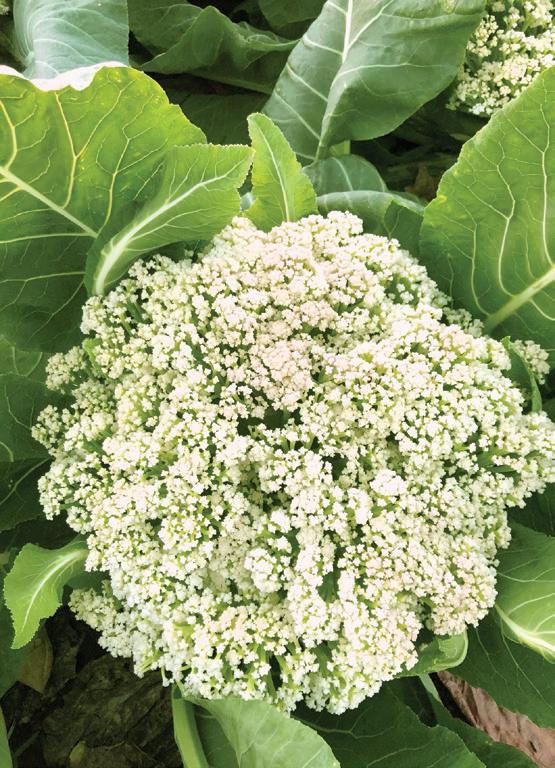

OPPOSITE TOP—

Costa plans to invest in further expanding its citrus plantings in Australia

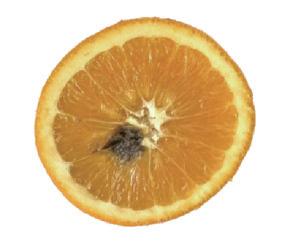

OPPOSITE BELOW—

The group already has berry farming operations in China and is eyeing opportunities in neighbouring countries

A$3.20 (US$2.10) per share from the experienced North American-based consortium, which is made up of Paine Schwartz, Driscoll’s and British Columbia Investment Management Corporation (BCI) – a transaction worth around A$1.5bn (US$989m). The change in ownership means Costa is now a private company again after listing on the Australian Securities Exchange (ASX) in July 2015. In addition to its new ownership, Costa has a new chief executive, with Marc Werner taking the reins from interim CEO Harry Debney on 1 March. Werner joined Costa in August 2022 in the role of chief operating officer and was appointed deputy CEO in July 2023. In this exclusive interview with Produce Plus, he outlines Costa’s plans for growth under its new ownership.

Now the ownership transition is complete how does it feel to begin this new era at Costa Group?

Marc Werner: It’s really exciting, not only for the executive team, but for the broader management team and arguably the entire workforce.

There are a lot of synergies if you look at the broader Paine Schwartz portfolio including their investments into companies such as Bloom Fresh in table grapes, but also in the British Columbia Investment Management Corporation (BCI) portfolio from a mushroom and citrus perspective.

Then we have the very broad Driscoll’s partnership opportunity which we have leveraged in the past already.

Going forward there will certainly be an opportunity to leverage these partnerships and accelerate growth, which should translate into increasing market share.

What vision does the new ownership group have for Costa Group?

MW: At the moment the very clear agenda is to grow the existing portfolio. That's the clear mandate that I have, as well as the management team.

Berries and citrus are two of the key priorities for us going forward. In berries, our ambition is to grow together with Driscoll’s and become an even more relevant player in places like Europe, as well as China, where we are only scratching the surface at the moment.

Citrus is the other category in our portfolio with an opportunity to transform and accelerate growth opportunities, not only from a domestic perspective, but also in export markets.

We've so far been extremely successful with our export programme into Asia, namely, China, Korea, and Japan, but there are even further opportunities if you look at other markets in Indonesia, Vietnam, Thailand, and the like.

This new partnership and ownership structure will provide us not only with an opportunity to accelerate in that space, but will also provide funds for us to make strategic investments into our domestic farming footprint.

It's not all about size though, it's also about automation and mech-

anisation of some of our still fairly manual operational processes.

We are focused on working with our key suppliers to get more automation in our packhouse operations and trialling new technology such as autonomous spraying, mulching and mowing. We're also looking at trialling very innovative automated picking solutions from other categories.

Are you fully committed to staying in your current categories?

MW: Our clear strategy going forward is to continue being a portfolio company with eight, nine, potentially ten different categories. The company has had substantial success over previous decades with that kind of approach.

There are always downward cycles and upward cycles and if you have the luxury of diversifying the risk among various categories, then you are actually very well placed. That's what we see as one of the key differentiators when it comes to Costa Group’s position as a leading grower in this country.

The research and development of new genetics has been a driver of growth for Costa Group. What role do you see this playing in developing new opportunities?

MW: As a grower there are two key priorities. The first is how you differentiate your product on an ongoing basis, and that comes down to genetics. The second one is being a low-cost operator, hence the focus on mechanisation and automation. Genetics is an area where we want to put even more emphasis to provide the best produce for our customers.

How will the footprint of the new ownership group aid Costa Group on this front? s

MW: It is about leveraging the footprint and joining the dots in terms of what Driscoll’s and Costa bring to the party with our unique breeding programme and the same holds true for table grapes with Paine Schwartz’s investment in Bloom Fresh. In mushrooms BCI together with Paine Schwartz have substantial ownership in Amycel in the US, which provides us with a unique opportunity to accelerate genetics development on the mushroom front.

How is the transition process tracking and do you expect to see much operational change under the new ownership?

MW: Paine Schwartz in particular, as the lead company in the consortium, knows Costa really well. Paine Schwartz has previously been a part of Costa including taking the company to an IPO. It has re-joined this company in order to accelerate certain investments, but there is a commitment to continue what we’re doing on a day-to-day basis. At the same time, we are running through a process reviewing our entire portfolio with a key question, ‘how can we accelerate growth both domes-

tically as well as internationally?’, which is the clear agenda.

How do you plan to harness the new ownership group’s assets on a domestic front?

MW: The domestic produce segment will still be a key part of our portfolio going forward. Just as we have done in the past we’ll need to find the right balance, but we need to put more effort into addressing the cost of farming, in particular.

The rising labour costs we have seen over the past three to four years are not sustainable and we need to address these as a matter of urgency. Genetics will be a big opportunity as is our partnership with Driscoll’s. It’s also important to talk about our glasshouse operation.

We recently opened the Costa Innovation Centre at our glasshouse facility in Guyra, New South Wales. We want to expand our current portfolio from tomatoes into some of the more innovative and more diversified glasshouse-grown produce varieties. That is not going to happen overnight, but we see opportunities not only for domestic demand, but also for interna-

LEFT—Costa plans to deepen its focus on genetics and proprietary varieties to further differentiate its offer

tional demand. We're already talking to some of our existing export customers about how we can supply glasshouse-grown products to them.

How will we see Costa Group leverage the international footprint of the new ownership group?

MW: We already have quite a significant international berry footprint with operations in China, as well as in Morocco and we are currently investigating production opportunities in some of the countries neighbouring China.

We want to become an even more relevant international player by setting up farming operations in other geographies, as well as potentially setting up sales and marketing desks in those countries especially when it comes to coordinating sales activities in Asia on the citrus and table grape side of things.

We could have done this in the past, but we've come to the realisation that we now have a critical mass in terms of volume, revenue and profitability, which provides us with the opportunity to rethink some of our organisational structures. With the backing of the new ownership consortium, we can continuously look at opportunities in order to strengthen our business both from a domestic as well as an international perspective.

We are also working to accelerate some of the market access opportunities. In Japan for example, we have a full schedule of products under review. We are talking about improved varietal access for Australian table grapes, market improvements for additional citrus varieties and last but not least avocados.

What will the ownership change mean for the people behind Costa Group?

MW: Our people are our best asset. We are a 24/7 operation and we rely on our people, our growers and our broader team day in day out. They are the key reason why Costa is so successful.

We are putting even more emphasis on people, and the new ownership structure provides us with some exciting opportunities when it comes to reshaping talent development programmes, career pathways, international assignments and expatriate opportunities. We have actually initiated an internal programme with the objective of becoming the most attractive employer in the fresh produce industry. n

Chief executive Murray McCallum tells Produce Plus the Australasian fresh produce group is well positioned for growth as it begins search for new partner.

by John Hey

BELOW TOP— Freshmax CEO Murray McCallum

BELOW BOTTOM—

Tangold mandarins are one of the group’s key IP varieties

OPPOSITE— Freshmax is building the Blue Royal brand of blueberries in New Zealand

Australasian fresh produce heavyweight Freshmax Group is seeking a strategic partner as it targets investment to help drive the future growth and development of the business.

The company has appointed Kidder Williams, a Melbourne-based corporate advisory firm specialised in food and agribusiness, to secure a strategic partner.

Freshmax has undergone a process of rationalisation over recent years, according to chief executive Murray McCallum. “We’re a capital-light business today,” McCallum tells Produce Plus. “We don’t have farms that use a lot of capital and we’re debt-free.”

Freshmax has sharpened the focus of the business on three core areas, he explains – its Asia-focused international export business; its IP partnerships centred on core categories; and its pre-packing, ripening and logistics services for retailers in Australia.

The company has exited the wholesale business in Australia, selling its wholesale stands in Brisbane Markets in 2021 and Melbourne Markets earlier this year.

Freshmax has also divested its farming interests. In September 2022, it sold its New Zealand pipfruit business, which included extensive orchard operations, to GTP Orchards. Last year, the group also sold Murrawee Farms, a sizeable stonefruit orchard with some citrus plantings in Swan Hill, Victoria, to Laguna Bay-owned Cutri Fruit.

While Freshmax previously had more of a domestic market focus on Australia and New Zealand, McCallum says the business is very much an “international player” today.

“We can offer premium fruit supply year-round, sourcing from both Southern and Northern Hemispheres. We supply markets globally, but Asia is our major focus,” he says. “We have excellent people in our sales offices across Australia, New Zealand, North America and South America as well as an in-market presence in key Asian markets.”

Intellectual property (IP) varieties also remain a major focus for Freshmax. Through its IP business, Innovar, the company owns Australian and/or New Zealand production or marketing licences to several leading breeding programmes and varieties. Freshmax focuses on five core product categories – namely cherries, berries, citrus, avocados and pipfruit – as well as table grapes and Australian bananas, and its IP partnerships underpin this.

“Our IP partnerships give us

the ability to be vertically integrated in terms of locking in supply and building brands,” says McCallum. “Good examples of this are Tangold mandarins, which are working really well with retailers in Australia and export markets, and Blue Royal blueberries grown in New Zealand, which are part of our licensing agreement with Mountain Blue.”

Freshmax also has significant IP in cherries, and while the group’s partnerships have focused on plantings in Australia and New Zealand to date, it is now looking at expanding some of these programmes internationally into the US and China.

The other key part of the Freshmax business is its warehousing, packing and distribution services in Australia. The company has distribution centres on Australia’s East Coast, including facilities in Derrimut on Melbourne’s western fringes, Marsden Park in Sydney and Brisbane near the city’s central markets. These temperature-controlled facilities offer ripening, pre-packing and logistics services, both for Freshmax customers and key third-party clients including Zespri, Perfection Fresh and Costa, McCallum explains.

“There’s certainly been a rationalisation and consolidation of these type of services businesses, so we’re in a really good position now with state-of-the-art facilities in all three major cities,” he says. “We see this business as a growth engine for the

group going forward.”

McCallum says the process of finding a strategic partner is expected to take “a few months”, adding that it will remain “business as usual” for Freshmax in the meantime. n

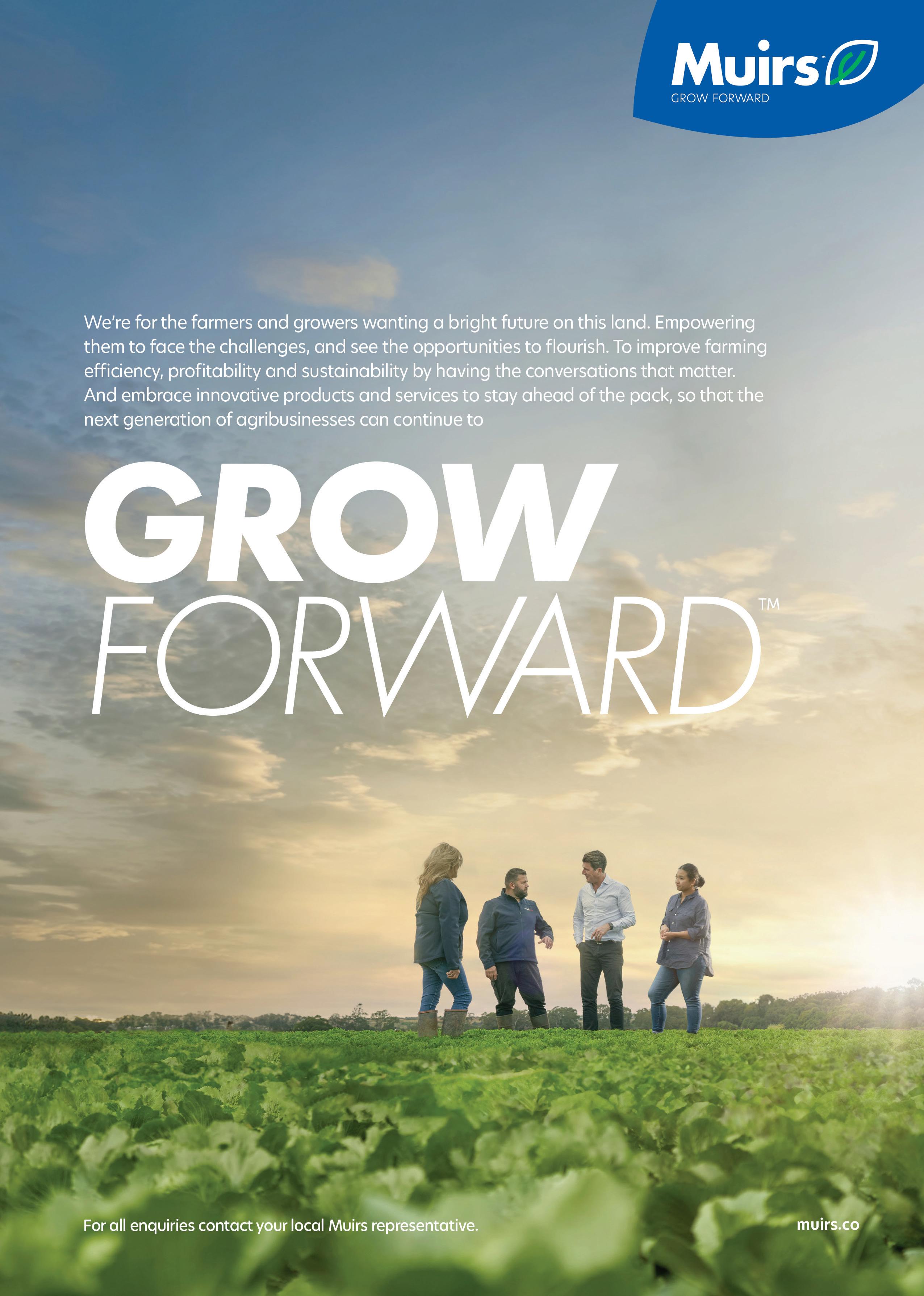

Muirs CEO Andrew Muir discusses the leading familyowned agribusiness’ decision to change its name to Muirs and introduce a new brand position of ‘Grow Forward’.

by Liam O’Callaghan

ABOVE—Muirs

‘Grow Forward’ is the company’s new brand positioning

LEFT—Muirs chief executive Andrew Muir

the perfect time. It represents a new forward-looking mentality and a deliberate shift to focus on innovative, sustainable products and practices.

ulation of this to our clients, supply partners and our people, and is supported by our company values which encourage our team to passionately innovate, create value and grow while remaining authentic and respectful towards our customers and other stakeholders in the industry,” he says.

Muir sat down with Produce Plus to discuss the company’s ongoing evolution.

Can you please provide an overview of Muirs’ footprint in the fresh produce industry?

Andrew Muir: As a business, our traditional retail network has always been centred on our offer to the horticulture market and to our fresh produce clients. We started in the Victoria Market in 1927 and all of our business was centred on fresh produce. In 1969 we moved to the Melbourne markets, and in 2000 we moved to Laverton. Through the late 70s and 80s we started expanding our retail brand and that was centred on vegetables and fresh fruit. We now have more than 40 outlets across the country.

It was very important for us to be in the market and we will always use a retail channel to support our clients from an agronomic point of view, but also from a commercial point of view.

It has very much been a mandate of the family and the business traditionally, to be as forward facing as we possibly can, and we’ve got more agronomists per customer than any other business servicing the fresh produce industry.

We know that as the expectations of our clients change, we need to be able to change and respond to them. There are more zones that we'd like to be present in from a retail point of view, so we'll continue to expand closer to our customer base.

You have announced a new name, Muirs, and brand position, ‘Grow Forward’. How did this refresh come about?

AM: A number of things have led up to this point and the timing is just right with the modernisation of the business. We are looking to use new channels to get through to the market. It won’t change the traditional brick-and-mortar channel we have always relied on, but we will start to leverage more of the digital position. Before we got there, we wanted to present ourselves in line with the ‘Grow Forward’ sentiment so we can effectively communicate what we want to achieve.

It is not a simple decision to update a brand built on nearly 100 years and four generations, but Muirs chief executive Andrew Muir says the first change to the company’s name in nearly 30 years comes at s

“Grow Forward is a clear artic-

Our new brand representation recognises and celebrates the changes we’ve already made to improve our organisation. It is a great endorsement of who we

are, and a significant progression as we build on our legacy.

We also had consideration for the number of brands we have and wanted to refine and leverage the positioning of the retail, forward facing brand, hence the simplification to Muirs. And the more we thought about it, many of our customers already call us Muirs so we took their lead.

How else does your business continue to evolve?

AM: We have three main pillars of our business strategy that we’re

working through: expansion, value creation and modernisation.

Our business is always connected to where our customers are growing and what they are growing. We keep a close eye on any changes they see as a result of changing climate or water availability and look at what type of portfolio people are utilising in their crop production as well. We've also got a real focus on making sure we transition from standard inputs towards more sustainable inputs.

When it comes to value creation we are in a sweet spot with our vertical integration. While we’ve got

our retail business, we also have supply chain brands that we utilise to get to market. Agreva and our Natural Solutions business focus on that portfolio and we source internationally from really technically capable manufacturers making non-traditional crop protection inputs. We are also rearing beneficial bugs for integrated pest management-based inputs.

One of the other things that we've done more recently is develop our own sustainability strategy.

We think it’s really important that our customers are producing clean and green for the market, so we continue to lead the charge, challenging our growers on the sustainability of the inputs they're using.

There is a lot to sustainability, but where we think we can deliver gains to the marketplace is through portfolio and the difference we can make around the types of inputs people use.

We are also running a project on corporate accounts. A lot of our traditional business has been dealing with family businesses, but we recognise that the marketplace is changing and we need to be able to adapt to it.

How does your footprint aid you in servicing your customers?

AM: We think we've got a global perspective on what's happening in the industry. We’ve got somebody in Europe to keep a view on developments and represent portfolio for companies out of the US too.

We want to make sure we are at the forefront of the curve in Australia, so we can deliver these options to our customers, and that then flows through to their customers.

We’re constantly sharing information through our crop group platforms and leverage as much of the success internally as possible, and that information gets shared across the board.

Muirs recently invested in vegetable seed company Murray River Seed Co. How do investments like these fit into your business strategy?

AM: Our investment into Murray River Seed Co fits nicely into the area of value creation. We've been investing in areas where we think we can be more involved in the whole supply chain and become more vertically integrated.

From a seeds point of view, there's been quite a lot of change that hasn't been led by us in the marketplace. A lot of the big multinational seed businesses have gone direct into our customer base so our response to that will be to reposition ourselves.

The cost of production is one of the main challenges facing the industry at the moment. How are you seeing this issue play out and how have you able to help your customers on this front?

AM: It's a challenge that all businesses are having to contend with at the moment. We've seen it with our customer base, they've really had to bear the brunt of some fairly significant price increases.

There's no simple or single answer. But if we can continue to assist people to grow the best quality produce, not necessarily with the cheapest inputs, but with the most efficient use of inputs, that gives the best outcome. Then our customers are more likely to be able to make money when the price of produce is good.

When prices aren't good for our growers it's a challenge across the board and that certainly flows onto us. I haven't seen it more directly than what we've seen over the last 18 months.

How important are your people to the success of the business?

AM: You just can't overemphasise how important it is to have the right team in place and that goes across the board, whether it's in our branch network, or in our central support office.

It's one thing to have business values, it's another thing to live your business values. By having a familyowned and run business you can instil more of those deep cultural values into your people.

There's no question that most people growing produce have been doing it for a long time and being able to have a consistent relationship with our clients is so important to delivering the best outcome.

It does still feel like a very direct

relationship game, particularly with fresh produce where intergenerational families still represent the largest segment of the sector. While it is beginning to change – we're seeing some more corporatised ownership of our customer base – it still very much feels like a serviceorientated business.

Muirs remains a family-owned business. How do you manage to maintain engagement as we see some long-time family businesses leave the sector?

AM: It's a constant evolution, but in terms of family businesses, succession planning is critical for ownership, board and management. A lot of planning in succession goes a long way. When my generation entered the business we knew what the future would look like. It's quite daunting to bring a fifth generation into a bigger business and what the roles might be, but we're certainly going to be owners of the business in the future. n

OPPOSITE—Muirs is working to help its customers use more sustainable inputs

BELOW TOP—

People play a key role in the company’s success BELOW BOTTOM—

The Muir family is actively involved in the business

Top three campaigns to be showcased at Hort Connections in Melbourne.

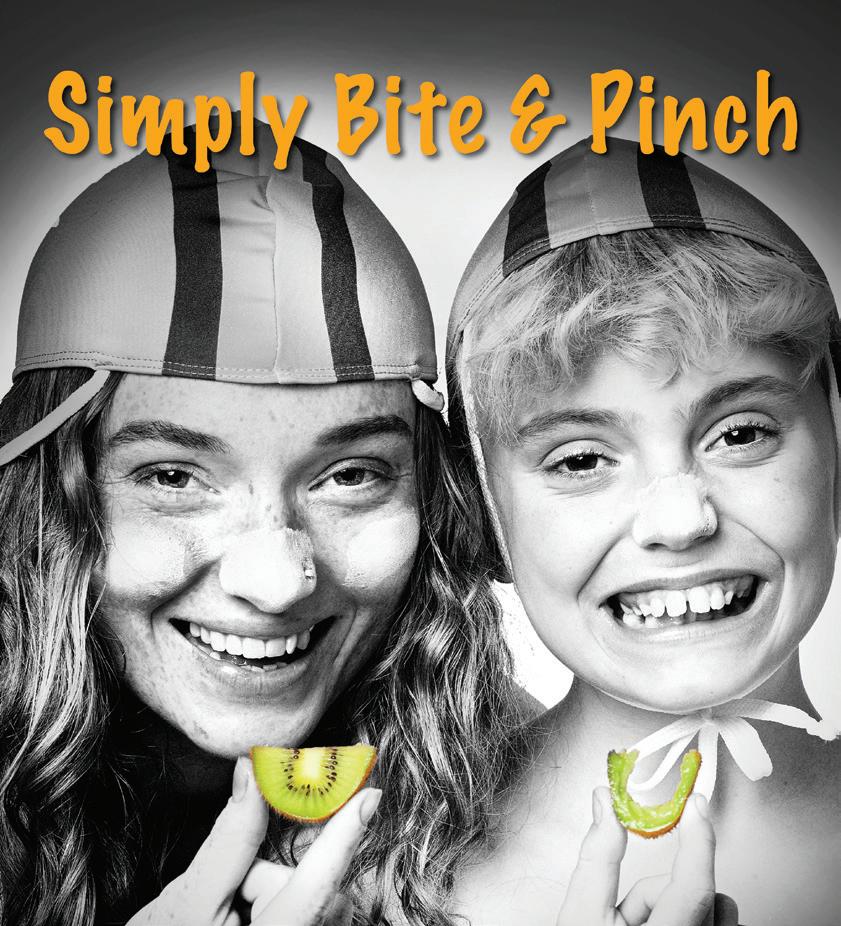

The International Fresh Produce Association Australia New Zealand (IFPA A-NZ) and Produce Plus Magazine are pleased to announce the finalists for the 2024 Seeka Marketer of the Year Award (MOYA).

Now in its thirteenth year, the premier award for marketing excellence in the Australasian fresh produce and floral industries attracted an impressive field of entries from all points of the value chain, with the MOYA judges having their work cut out to select three finalists.

The 2024 finalists in no particular order are:

Each entry was assessed on how compelling the campaign was, its unique features, how appropriate the marketing tools were to the product and target audience, how well it was targeted at the particular market segment, and evidence of its success.

See the three 2024 MOYA finalists present their campaigns as part of a showcase event at Hort Connections at the Melbourne Convention Centre.

Date: Tuesday 4 June Time: 11:30am-12:10pm.

Location: Plant Pavilion – Expo Halls 14-20

marketers to overcome obstacles through use of new technologies and mediums to reach their audience and grow consumption.”

Seeka chief executive Michael Franks congratulated the finalists. “Seeka is proud to support the award and it is great to see such a strong group of finalists,” said Franks.

“The depth and breadth of this year’s entries was impressive,” said Produce Plus editor Liam O’Callaghan. “Our judges found it tough to pick just three finalists which is a testament to the quality of the entries and the excellent work that is being done across the industry to market fresh produce.”

• Australian Macadamias for the Macadamias Make it Special campaign

• Fresh Markets Australia - A better choice! for the Julie Goodwin AI campaign

• Kristie Emerson of Perfection Fresh for the Quke O’Qlock campaign

“This year’s finalists exhibit best in class marketing strategy and execution,” said IFPA managing director A-NZ Ben Hoodless. “It shows produce marketing can match it with other industry sectors. It also demonstrates how dynamic our industry is and the ability of our

The three finalists will showcase their campaigns on the trade show floor at Hort Connections on Tuesday 4 June. The 2024 Seeka Marketer of the Year Finalist Showcase will be held at the Plant Pavilion from 11:30am-12:10pm.

The winner of the 2024 Seeka Marketer of the Year Award, presented by IFPA A-NZ and Produce Plus, will be announced at the Hort Connections Gala Dinner the following evening (5 June).

IFPA A-NZ and Produce Plus congratulate this year’s finalists and thank all nominees for their impressive entries. n

IFPA-Produce Plus Marketer of the Year Award

Australia and New Zealand’s largest horticulture conference and trade show continues to grow, bringing together all corners of the fresh produce industry.

by Liam O’Callaghan

Hort Connections returns to Melbourne on 3-5 June at the Melbourne Convention Centre and promises to be another impressive edition.

More than 3,300 delegates are anticipated to attend from across the entire supply chain, with the trade show host to 200 exhibitors and over 40 expert speakers discussing the big issues facing the industry on the conference programme.

Ausveg national manager –events and partnerships Nathan McIntyre says Hort Connections is a must-attend event.

“The Hort Connections trade show continues to build, and this year we are excited to deliver our largest-ever exhibition. The growth of the event cements Hort Connections as the largest conference and

trade show for the horticulture industry in the Southern Hemisphere,” he says.

“The Hort Connections conference programme and affiliated events such as the Annual Vegetable Industry Seminar give attendees access to groundbreaking research and the latest trends from industry experts, and are an unparalleled opportunity to network with others in the Australian horticulture industry.”

Hort Connections has obtained funding from the Department of Agriculture, Fisheries and Forestry to support grower attendance, which McIntyre says allows more of the industry to take advantage of what the event has to offer.

“While it’s tough for many to be away from the

LEFT—This year will be Hort Connections’ largest-ever edition

ABOVE—(l-r) Craig Emerson and Lucy Bloom are speaking at this year’s event

farm, the Grower Funding programme is a great avenue for financial support to help growers access the many opportunities on offer at Hort Connections,” says McIntyre.

“After a challenging year in the horticulture sector, Hort Connections 2024 will be an important opportunity for growers and the broader industry to come together to share knowledge, hear from world-class speakers, network, and acknowledge the achievements that make horticulture great.

“Australian growers are forging ahead, embracing cutting-edge technology such as automation, big data and autonomous vehicles. Global agriculture technology providers are responding, and we see that in a Hort Connections 2024 exhibitor list that includes many of the largest ag-tech businesses in the world.”

The speaker programme is packed full of more than 40 exciting and informative speakers spread across two days and multiple stages. Highlights include the Plenary Sessions on 5 June, which feature the State of the Industry Panel, plus Craig Emerson - Independent Reviewer, Food and Grocery Code of Conduct. The always popular Perfection Fresh Breakfast returns on 4 June.

“This year’s Perfection Fresh Breakfast will be headlined by our keynote speaker Lucy Bloom, the former chief executive of Sunrise Cambodia and Hamlin Fistula Ethiopia,” says McIntyre. “The Perfection Fresh Breakfast is always very well attended, and is a fantastic way to dive into the three days of networking and learning that Hort Connections offers.”

The event will finish on the evening of 5 June with the Hort Connections Gala Dinner which features the presentation of the Horticulture Awards for Excellence including the 2024 Seeka Marketer of the Year Award.

“The Hort Connections Gala Dinner is a great way to finish the event, it is a chance to come together and celebrate some of the outstanding achievements within our industry,” says McIntyre. n

Hort Connections will host 200 exhibitors at the Melbourne Convention Centre as part of its tradeshow. Produce Plus profiles some of the highlights.

by Liam O’Callaghan

Farm technology provider AgPick Technology will showcase a prototype of its new crop work app, currently in development, along with the capabilities of its original AgPick tool, at Hort Connections 2024.

The beta version of AgPick Crop, launching later this year, will capture hourly and piece-rate work such as weeding, planting, pruning and cutting runners and more in a standalone app. Its development was driven by growers’ need for greater flexibility and deeper levels of detail in recording time spent on non-harvest work.

AgPick will also highlight its facial recognition app, AgPick ID, which uses biometric technology to protect growers, suppliers, and workers from the implications of ID fraud, save time and ensure piecerate compliance.

Specialist sustainable agriculture supplier ProdOz International and partners Levity Crop Science, Ecomix and Seawin Biotech are exhibiting a range of patented fertilisers at Hort Connections 2024.

This includes Lono, the flagship product developed by UKbased Levity Crop Science, which has been trialled around Australia for the past two years. Trial participants claim it is shaping up as an affordable and sustainable solution that reduces nitrogen inputs which can, in turn, reduce environmental damage while boosting productivity and yield.

Sumitomo Chemical Australia is launching Excalia, a significant new fungicide developed to tackle key

LEFT—AgPick Technology will showcase a range of solutions at Hort Connections

BELOW— David Marks (pictured right) inventor of Levity Crop Science’s Lono

diseases in potatoes and bananas at Hort Connections 2024.

Excalia was developed by parent company Sumitomo Chemical, Japan to fight the leading disease Rhizoctonia solani (black scurf) in potatoes and key disease Yellow sigatoka in bananas.

Sumitomo Chemical Australia will also share news of its US-based subsidiary Valent BioSciences’ acquisition of FBSciences – a recognised leader in biostimulants – marking Sumitomo Chemical Australia’s foray into marketing biostimulants. The team will showcase three new biostimulants – Transit Duo, Zicron and GroMate. All are broad-ranging, with Zicron and GroMate ideal for tree crops.

Veg Education is highlighting an array of educational sessions aimed at empowering growers and industry professionals at Hort Connections. At the Annual Vegetable Industry Seminar on 3 June Alana Ryan of NS8 Lawyers & Advisors will lead a session on industrial relations laws, which will incorporate authentic 'onfarm footage' to illustrate key concepts and enhance understanding.

On 4 June the Fresh Produce Safety Network Panel will be held at 12:20pm at the Cultivation Corner as part of the Supply Chain and Consumers stream. The panel – led by Sarah Oxford, a senior researcher at Monash University and featuring Veg Education’s Catherine Velisha – will discuss actionable strategies for advancing safety standards within the industry. Veg Education will also host its own information sessions focusing on skills, succession and safety at its stand. n

solution.

by Bree Caggiati

New Zealand-headquartered ABC Software will launch its latest Software-as-a-Service (SaaS) product, ABCquality, at Hort Connections 2024.

The new mobile-friendly online quality assurance and control solution provides growers and farm managers with on-the-spot recording and remote viewing of checklists and assessments.

While originally designed for the requirements of the packhouse, ABCquality is applicable to any sector as it uses flexible user-defined templates. It operates standalone or can be integrated with any external system for auto-inputs.

ABCquality joins ABC Software’s growing product suite which now includes ABCgrower for onfarm worker and inventory man

agement; ABCspray, a digital spray diary for all agrichemical applications and consumable inventory management; and ABCpacker, one packhouse system that offers a full post-harvest solution.

While ABC Software has had a presence at Hort Connections in previous years, including last year’s digital automation presentation from founder and managing director Sharon Chapman, this will be the company’s first time exhibiting at the event.

ABC Software says it continues to enjoy growth in the Australian market and Chapman and her team look forward to making new connections, catching up with clients, and hearing all the latest industry news at Hort Connections n

Christian Bajonat

NielsenIQ Australia

Christian.Bajonat@nielseniq.com

Christian Bajonat is an associate director at NielsenIQ with over five years’ experience at the company. In his role he partners with fresh and packaged goods manufacturers to deliver strategic consumer insights and thought leadership.

With Australians now deep into the current cost-of-living crisis, they have been tested in more ways than one over the past few years. Rising food and utilities costs remain the top concerns for households which have resulted in consumers becoming increasingly mindful of their spending

intentions (NIQ Consumer Survey 2024). This has resulted in Australians planning to reduce their spend on non-essentials such as holidays, socialising and out of home activities instead focusing more on their weekly groceries (NIQ Consumer Survey 2024). Shoppers are not only re-pri-

oritising grocery spend with nonessentials such as holidays and out of home entertainment, but they are also re-prioritising across the supermarket.

Categories such as alcoholic beverages, snacks and confectionery are most at risk with consumers intending to spend more on s

fresh produce, dairy and dry and canned grocery products (NIQ Consumer Survey 2024). This highlights the growing focus from households to manage their overall grocery spend.

When analysing this year’s Produce Plus-NIQ Top 20 Fruit & Vegetables, a common trend evident among households was sticking with familiar favourites through this challenging period. At the top of the list remains fresh salads, which just edged out bananas for a second consecutive year.

Fresh salads includes a variety of products such as pre-washed salads, kale, and salad bowls/mixes. The segment managed to achieve minor value growth over the past year (+0.4 per cent) despite reach slightly declining to 88 per cent penetration (-1.5 penetration points), this was primarily through households increasing their consumption of fresh salads over the past year*.

This increased consumption also highlights that in response to the cost-of-living crisis consumers are intending to reduce their spend on dining at restaurants or cafes, and instead spending more on their home meals (NIQ Consumer Survey 2024).

NIQ Homescan data shows strong growth in categories related to eating out such as roast coffee

and certain meat cuts.

For instance, scotch fillets, a pre mium steak cut which has experi enced double digit growth this past year and can be viewed as a viable alternative for dining out (NIQ Con sumer Outlook).

Bananas on the other hand saw significant growth in value (+10.9 per cent) even while experiencing a small decline in household penetra tion (-1.5 penetration points).

In a relatively stable Top 20 the berry category stood out with significant growth.

Much of this was driven through an increase in average price, with bananas now on average costing A$4.62 per kg, which is 16 per cent higher than this same period last year.

This represented the high est rise in average price across the Top 20, with the majority decreas ing over the past year. This trend of declining prices in the category contrasts with the consumer expe rience across their local supermar ket, where the impacts of inflation are still highly evident*.

Throughout the remainder of the top ten, the results demonstrat ed stability with many of the prod ucts retaining their positions over the past year, with ranks four to nine remaining unchanged.

Berries in general performed well, with blueberries cracking the top ten through an 18.2 per cent uplift in value sales over the past

year. This was largely due to more households purchasing more frequently as prices declined by 16.6 per cent. Raspberries are also the only newcomer to this year’s list and experienced the highest value growth found in the Top 20 (+25.4 per cent in value). This growth was also fuelled through a combination of growing penetration and shoppers buying more often, with Australian households now buying raspberries on average nine times per year*.

The two categories that saw the most significant decline in value were capsicums (-14.2 per cent) and mandarins (-16.5 per cent). The key driver for both was a decline in average price.

For capsicums, this growing affordability resulted in households increasing consumption and propelling volume growth. Unfortunately, for mandarins this pricing dynamic did not drive consumption with fewer households also purchasing less frequently*.

From the Top 20, we can observe that Australians continue to prioritise fruits and vegetables as household essentials. The rankings demonstrate stability, with the top performers mostly remaining unchanged from last year.

NIQ will be eagerly monitoring the underlying consumer trends in the fresh produce industry to understand

Simon Raj CCO Tripod Farmers

Fresh salad has retained top spot in the Produce Plus-NIQ Top 20. What do you think makes it such a successful category?

Simon Raj: Australians seem to love eating fresh salads all year round. While there is a slight migration away from salads during the colder months, Australians still like to have a salad offering with many meals throughout the week. As a nation we also eat out very often and the standard of salad products available

*NIQ Homescan Service for the fresh fruit and vegetables for 52 weeks to 24 Mar 2024, NIQ Consumer Survey and NIQ’s Consumer Outlook Report 2024, for the Total Australia market. Copyright © 2024, Nielsen Consumer LLC. All rights reserved. n

to restaurants means it easily compliments what a chef will plate up and consumers are looking to recreate this at home.

What do you see as some of the factors that have contributed to the increasing consumption?

SR: Quality, quality and quality! People have definitely become more discerning and insist on fresh produce that is more than just acceptable, it needs to delight. Consumers also insist on products that perform from a longevity perspective once they get them home.

Consumers seek out products that last and still taste and smell fresh at the end of their use by date, or even beyond. Once home, it still needs to further deliver and not just look nice, otherwise they just won’t buy it again and you won’t see

sustained growth within our category.

How can the category maintain these existing drivers of growth?

SR: We need to respect what we put in the bag and on the shelves. For Tripod Farmers, that looks like investing in a state-of-the-art salad processing facility or a cutting edge LaserWeeder and leveraging the experience of third- and fourth-generation farmers in the daily decisions we make and how we build our strategies for the future.

What opportunities do you see to drive new growth for fresh salad?

SR: As farming within our environment continues to be more and more challenging, cutting-edge technology will be at the forefront of making sure our products are the best quality, have the best texture and deliver consistently every time.

Culture and how we treat each other within our business is also paramount as this logically drives our teams’ performance and overall care factor. n

Collaboration plays an important role in making the horticultural supply chain more sustainable for all players.

by Liam O’Callaghan

Businesses, now more than ever, are relying on trading partners to help achieve their sustainability goals and targets. Suppliers are prioritising how they meet, report and monitor their environmental impacts and customers are seeking the same information while assessing their own footprint.

This is increasing right along the horticultural value chain from growing, packing, processing as well as

transport, packaging, consumption to disposal at end of use.

The imperative to be more sustainable is a shared responsibility according to Chep Australia. The company established an ambitious regenerative strategy and sustainability targets which have been supported by a global decarbonisation programme since 2020. Chep is working to not only lower the environmental footprint of its opera-

BELOW—(l-r) Chris Georgopoulos, director of GVIP and Paul Canning, business development manager, produce at Chep

tions, but also that of its customers and their customers.

Supporting Chep’s Path to Net Zero by 2040 is its dedicated decarbonisation programme which analyses and identifies a range of operational projects to further eliminate emissions and waste. This multi-year programme has helped the company to address the challenges of climate change and waste on top of its inherently sustainable equipment pooling business model.

Chep has for some time now invested in expert, peerreviewed life cycle assessments (LCAs) for its customers which quantify the environmental impacts of Chep reusable platforms compared to common single-use alternatives. According to Chep, the company’s reusable foldable bins underwent an LCA evaluation which calculated 49 per cent less emissions, 76 per cent less waste to landfill and 83 per cent less water use.

Shepparton East’s GV Independant Packers (GVIP) is a family-run business with over 600ha of orchards producing high-quality apple, pear and stonefruit varieties.

Chep Australia has worked with GVIP to help the company transition from single-use packaging to Chep reusable plastic containers. A transition Chep says provided significant environmental benefits including a reduction of up to 68 per cent in carbon emissions, 99 per cent in waste to landfill and 85 per cent in water use compared to common one-way alternatives*.

Chris Georgopoulos, director of GVIP says the business has been using crates since 2010, preferring crates over single-use packaging because of their sustainability benefits, compatibility with automation, efficiency, and supply chain savings. Georgopoulos says GVIP has also been collaborating with Coles Group to increase investment in automation, a strategy that is delivering strong sustainability and efficiency gains. n

*Environmental impacts communicated are calculated using ISO 14044 compliant peer-reviewed Life Cycle Assessment studies conducted by RMIT that compare to common single-use alternatives.

Long-standing Tomra customers implement AI-powered LUCAi platform to enhance packhouse performance.

by Bree Caggiati

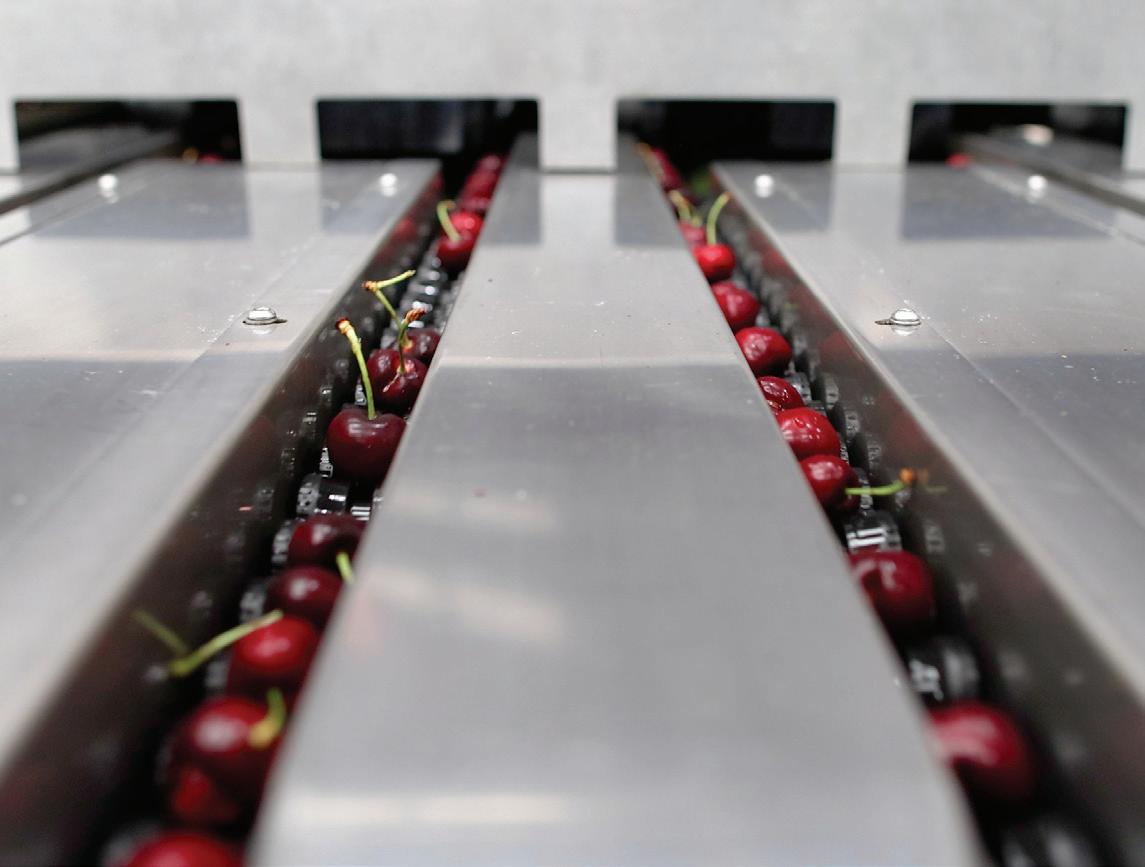

New Zealand cherry grower-packers Dunstan Hills and Panmure Orchards have been using Tomra equipment for almost ten years.

According to Tomra, the Central Otago-based companies share the challenge of meeting growing

demand for consistent, high-quality cherries amplified by the short season from early- to mid-December to late-January.

Tomra says after one full season using the LUCAi platform, both Dunstan Hills and Panmure

TOP—LUCAi works with the InVision2 grading platform and uses Tomra’s deep learning technology to identify defects BOTTOM—Tomra says LUCAi will continuously improve as it takes in new data through use

Orchards benefited from higher productivity, enhanced quality selection with consequent higher margins for their customers, and reduced food waste.

“With LUCAi we achieved better grading and increased throughput [of] around 10 per cent,” says Ian Nicholls, operations manager of Dunstan Hills.

Nicholls says LUCAi does a better job at deciding whether fruit should be destined for export or the local market. It’s helped Duston Hills deliver consistent quality and meet the specific requirements of its customers while also increasing productivity.

“With LUCAi making more accurate decisions, we are able to put more fruit in front of the sorters,” he says.

LUCAi works with the InVision2 cherry grading platform and has been “pre-trained” using vast amounts of data and real images of cherries collected by Tomra from different regions across the world. It uses Tomra’s deep learning technology to accurately identify an extensive range of defects including edge cracks, ‘Pacman’ cherries, open sutures, cosmetic blemishes and stem pulls as well as spurs, cracks and all defects around the stem.

Jeremy Hiscock, managing director of Panmure Orchards says he is impressed with the accuracy.

“We have seen a significant increase in the quality of machine graded fruit with LUCAi,” he says. “We would be devastated to not have access to this technology.”

According to Tomra, the platform will continuously improve as it keeps learning from the data it collects while running in a customer’s operation, futureproofing businesses. Users are also able to customise defect models according to their specific needs and quality requirements with the support of Tomra’s service team.

“LUCAi caters to a diverse range of preferences and customisations, providing a comprehensive solution poised to revolutionise the industry landscape and enable our customers to achieve unprecedented success in the cherry industry,” says Benedetta Ricci Iamino, Tomra Food’s global category director – cherries.

“LUCAi excels at handling various cherry qualities with precision, consistently segregating fruit classes for different markets, even in challenging batches, thus preventing fruit waste and potential market claims. Thanks to LUCAi, the era of compromise is a thing of the past.” n

The TOMRA Spectrim with LUCAi® grading platform boosts profitability and minimizes operational instability with the power of Deep Learning technology.

Detects and eliminates over 95% of apple stem-related imperfections

Effectively mitigates up to 99% of total apple stem defects

Prevents accidental downgrades and eliminates manual grading delays

Ensures consistency across seasons, batches, varieties, and operators

Achieve higher productivity with fewer grading errors and keep your apple production running seamlessly this upcoming season – talk to a TOMRA expert today.

Scan the QR Code to learn how Spectrim with LUCAi® can improve your apple packing line.

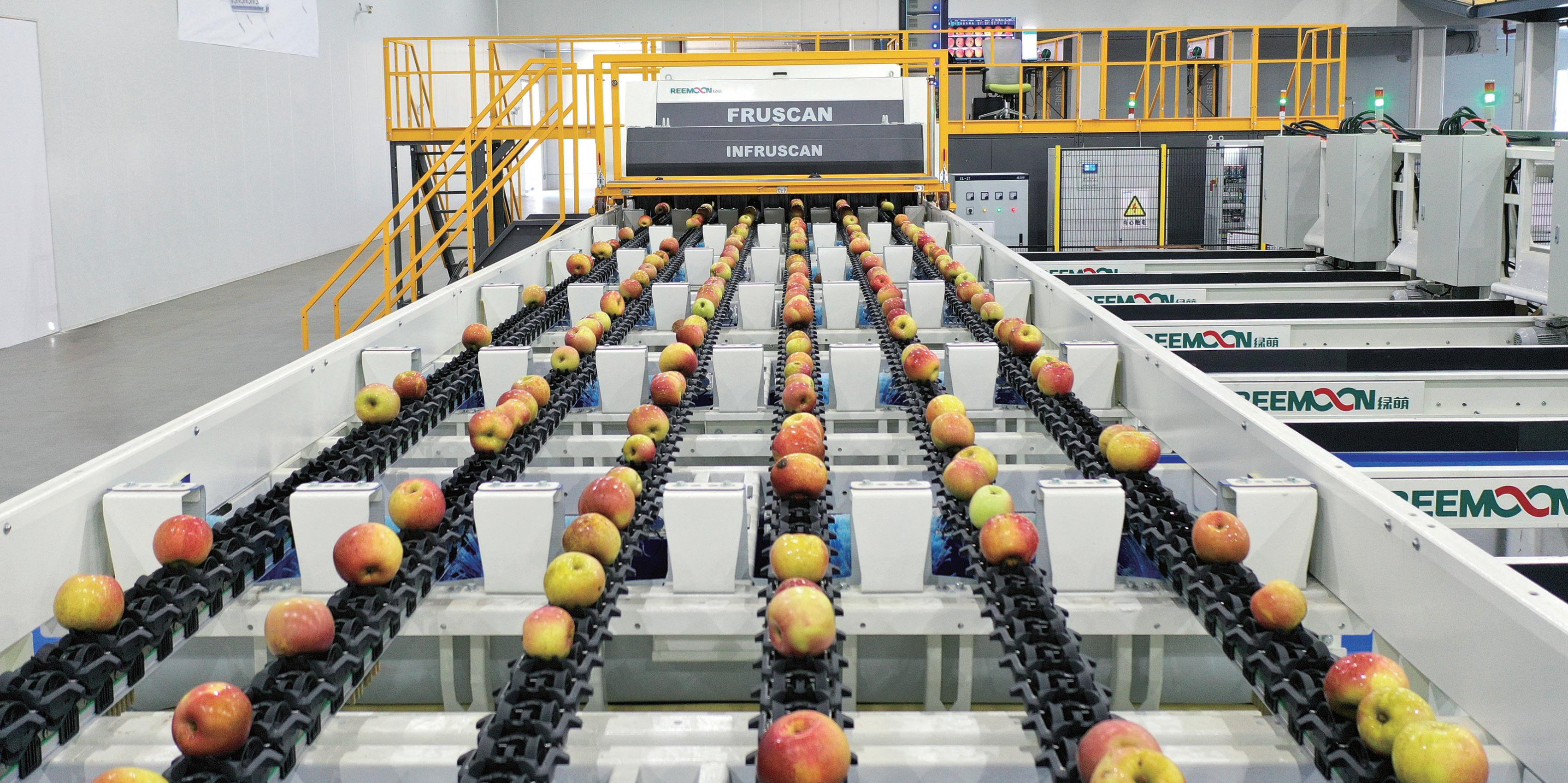

Maf Oceania is installing state-of-the-art technology in packhouses across Australia with fresh produce businesses looking for improvement.

by Liam O’Callaghan

As the fresh produce industry battles rising costs, businesses are determined to squeeze any extra value out of their operations.

In the experience of Maf Oceania – a subsidiary of Maf Roda Agrobotic in France – the answer is often found in the packhouse. Business development manager Jonathon

Muculj says Maf Oceania has doubled the number of personnel in its service department over the last 12 months as it works to meet the demands of the Australian market with end-to-end solutions and service, which includes domestic manufacturing.

One of Maf Oceania’s most

significant recent projects has been its work on Redland’s state-of-the-art packing facility in Shepparton which is fitted with apple and citrus lines.

“The facility combines Globalscan 7 electronic grading modules, a 5,200 bin fully automated ‘high-bay’ integrated with a monorail which eliminates forklifts and reduces the space,” explains sales director Frederic Scellier.

“It includes additional packing lines, robotic pattern packing lines and robotic punnet packing lines. All controlled through a Maf centralised operating system.

“However, the project continues to grow with two new citrus packing lines, six automatic box fillers and automatic speed packers on the way.”

Other notable projects include upgrades at Red Rich Fruits’ packhouse in Batlow and Ontario Mango Farming in Queensland. Both of these installations include Maf’s Globalscan 7 which provides external defect detection and size and colour grading.

Scellier says the Globalscan 7 harnesses the latest developments in AI to further enhance its effectiveness. n

Turnkey installations increase automation and deliver value across multiple categories.

by Liam O’Callaghan

Labour challenges are driving increasing demand for automation in fresh produce packhouses and Maf New Zealand – a subsidiary of Maf Roda Agrobotic in France – is addressing these needs with turnkey solutions.

is also an opportunity to reduce labour at the same time.

ABOVE—

ager Chris Bray says Maf New Zealand has completed a number of recent installations for multiple categories including kiwifruit, apples and avocados. Growing production volumes across these industries in New Zealand has fuelled the need for increased capacity, but there

“We saw a huge rise in the need for automation during Covid as the backpackers that our customers rely on weren’t here. This along with the rises in wages led to customers requiring automation,” says Bray.

Automation is delivering gains in the packhouse

NZ business development man- s

“We installed our largest automation line last season at Mount Pack & Cool (Mpac) and part of this project was installing 30 box fillers, over 750 conveyors and 1,100 motors, which has enabled Mpac to pack up to 100 boxes per minute. Mpac has reduced its labour requirement by

up to 70 per cent.

“Now it can rely on a smaller dedicated team rather than trying to source labour it hopes will stay for the season. Automation enables customers to have reliability and consistency, they no longer have to worry about if people will turn up

TOP—Kiwifruit packers are increasing capacity to handle production growth

MIDDLE—Maf Roda continues to make advancements in its Globalscan 7 grading system

BOTTOM—Labour pressures are also forcing changes in the packhouse

or their productivity levels etc.”

Maf New Zealand’s projects range in size and equipment Bray says the company’s ability to provide end-toend solutions makes it an attractive option for packers. Its 24/7 on call service also adds value once the installation is complete.

“We are as close to a one-stop-shop that you can get in the post-harvest packing of produce in New Zealand and customers enjoy dealing with only one supplier for the vast majority of their requirements,” says Bray.

“This ease of integration and design means customers have better control over project timelines and helps to eliminate any potential hiccups.”

In the past 12 months, Maf New Zealand has worked with Golden Bay Fruit on a new kiwifruit line which consists of an end-to-end solution with a robotic bin tip that can be used for apples and pears in future. It also fitted out DMS Progrowers’ new packhouse in Te Puke with an end-to-end solution and plans for more automation are underway.

“Already we are fully booked for installations for the 2025 kiwifruit season with projects in Motueka, Riwaka, Te Puke and Opotiki plus opportunities with apple, citrus and cherries which is exciting for us,” notes Bray.

Maf Roda continues to make advancements in its grading system Globalscan 7 which is engaging customer interest and Bray says more of the company’s Robotic IT packers are going into kiwifruit packhouses as they integrate non-Maf sizers. Gentle box fillers are also in demand.

“In collaboration with Maf France we are always trying to develop solutions to assist our customers. Currently we have a prototype tray/box closer, labeller and printer which is gaining a lot of interest and should be in the market for next season,” says Bray. n

With sustainability packaging targets closing in, Naturpac is educating industry on the importance of change.

by Liam O’Callaghan

In Australia’s fresh produce market landscape, sustainability and circularity have become focal points of growth as the industry seeks to reduce waste, improve packaging and find holistic solutions that meet environmental and commercial needs. This focus is sharpened by the fast approaching 2025 National Packaging Targets.

Naturpac has carved a niche in providing sustainable packaging solutions specifically designed for the fresh produce industry. From

compostable trays to bioplastics and innovative film wraps, the company focuses on ensuring a balance between functional and eco-friendly with its solutions.

Naturpac’s longstanding commitment to the environment is evident – not only in its product range but its collaboration with sustainability leaders and industry groups.

As the 2025 targets draw closer, Naturpac is deepening existing relationships in an effort to simplify the process of implementing sustainable solutions at a grower and

produce supply chain level.

One of these relationships is with the Australian Packaging Covenant Organisation (Apco), an independent, not-for-profit organisation that brings together businesses, government, and industry to collaboratively improve the sustainability of packaging in Australia. Apco has been charged by the government to facilitate the delivery of the 2025 targets including the goal for all packaging to be reusable, recyclable, or compostable.

At the core of both Naturpac and Apco is a shared vision for a circular economy where packaging is no longer disposable but part of a regenerative cycle. The fresh produce market, with its high packaging demand, is a critical sector where this vision can have a significant impact.

Naturpac and Apco are currently mapping out a new level of partnership to help facilitate the standardisation of compostable packaging across the fresh produce sector. This standardisation could smooth the way for the industry to grow well past the 2025 targets and transition seamlessly to a compostable benchmark, according to Naturpac.

“By working closer together, Naturpac and Apco will seek to develop a comprehensive roadmap for helping fresh produce supply chain operators in achieving a circular economy for fresh produce packaging,” states Michael Williams, GM of Naturpac.

Naturpac has already done significant work to educate the supply chain, including running EcoChoice sustainability sessions and developing the online eco learning platform EcoPlay. The company is now exploring ways to cross pollinate this with Apco’s educational resources to create new avenues aimed at building practical knowledge and tools for businesses and consumers alike.

In the meantime, Naturpac continues to work across the fresh produce supply chain to help businesses meet compliance requirements. This includes extensive certification support, ensuring that producers can confidently label their packaging as compliant with national sustainability standards. n

LEFT—Australia’s 2025 National Packaging Targets are fast approaching

Leading fresh produce solutions provider continues to expand its offering as customers look for new ways to add value.

by Liam O’Callaghan

LEFT—The Aporo has been a success story for J-Tech

BELOW—Shelflife extending products help reduce fruit waste

OPPOSITE TOP— J-Tech sources the latest sustainable solutions

OPPOSITE

BOTTOM—StePac is a leader in developing modified atmosphere packaging solutions

A customer-driven approach often has J-Tech Systems at the cutting edge of innovation in the fresh produce industry. General manager Michael Williams says whether it is in automation, packaging, labelling or any other of the areas J-Tech services, the company is always looking at new ways it can meet demand.

“We always focus on what our customers need, that’s number one,” says Williams. “We work with our customers to understand their goals in business and what’s needed, then we come up with effective and practical solutions to those needs.”

Currently automation is one of the big trends driving change in the industry, according to Williams. Solutions can range from entire custom-designed line installations through to single units and J-Tech is delivering at both ends of the spectrum.

“Automation is often the most cost-effective solution and can be implemented in stages to suit almost everyone,” he says.

Automation sales executive Matt Williams says J-Tech is the Australian supply partner for some of the world’s leading automation companies and has the service team to support customers beyond installation.

“We have robotics, like the Aporo produce packer, that are making a massive impact in packing sheds. Metal and weight detectors, packaging gear, weighers and palletisers are just a few of the solutions we offer, in fact, we have pretty much everything a packing shed needs. We can deliver the whole line from start to finish,” Matt Williams says.

“With our national service team, we look after every piece of machinery and automation we install.”

Michael Williams says the Aporo has been a major success story for J-Tech. It has helped customers manage labour costs and delivered efficiencies by automatically packing apples and stonefruit, but new advances are on the horizon.

‘We’re heavily involved in the ongoing development of Aporo and it’s getting close to being able to pack other fruits like kiwifruit, avocado and pears, and that’s exciting. It’ll open up whole new segments of the industry,” says Michael Williams.

Packaging is another area of focus for J-Tech which is experiencing plenty of change.

J-Tech Systems packaging sales manager, Mitch Pursehouse, says the company is active in its pursuit of the latest solutions in the marketplace.

“Right across our business, we’re always on the lookout for the best packaging solutions that are available both for our domestic and export market,” says Pursehouse.

“We’ve got the most advanced solutions with modified atmosphere, and active packaging, which extends the shelf-life of fresh produce.

“Plus, we only supply 100 per cent rPET punnets, and have the latest environmentally sustainable solutions that are available in the market at the moment.”

Pursehouse says one of the major growth areas in the packaging segment at the moment is solutions that keep products fresher for longer.

“Our supply partners with the development of modified atmosphere and active packaging solutions are StePac and GreenKeeper. They are absolute leaders in technology development for extending

shelf-life and reducing food waste and are already having a big impact in the industry,” says Pursehouse.

“At Hort Connections this year we’ll have a couple of representatives from GreenKeeper, on our stand so customers can talk to the experts on how to keep their fresh produce fresher.”

Michael Williams says J-Tech has products and solutions for most issues fresh produce businesses might face and is prepared to help customers with any problem they cannot immediately service.

“If we don’t know the answer, we’ll go and see what’s available out there and try to solve the problem. Of course, that’s not always possible, but we’ll give it a damn good go,” says Michael Williams. n

Costa Group strives for practicality and sustainability as it develops new packaging options.

by Liam O’Callaghan

Sustainability is an increasing focus for all players in the fresh produce supply chain and Costa Group’s commitment to lead the way on this issue has seen the company collaborate to develop new packaging options.

Bananas and citrus are two of the categories Costa has found success in so far. For bananas, it collaborated with Woolworths on paper-based recyclable bands for kids-sized bananas. Matt Hives, Costa’s national sales manager, avocado and bananas, says the band allows smaller bananas sold in bunches of five to be differentiated from its main range of larger loose bananas.

"Costa has been tirelessly working towards a solution for packaging for the kids size bananas that embodies efficiency, commercial viability, and sustainability. After an extensive research and development period, in partnership with Woolworths, we are thrilled to introduce a banana banding solution that meets these criteria,” says Hives.

“This initiative is a testament to our dedication to sustainability and innovation in the fruit and vegetable industry. We believe this new packaging will not only please our environmentally conscious customers but also set a new standard for the banana industry.”

Nic Hines, Woolworths’ avocado and banana category manager, says the new packaging delivered strong results in a trial and will now be deployed on a wider scale.

"At Woolworths, we take pride in our commitment to sustainability and are constantly seeking innovative solutions that benefit both the environment and our customers. It's been a rewarding journey to collaborate closely with Costa, and together, we've crafted a new banana banding solution that not only supports our green initiatives but also captures the eye of consumers with its aesthetically pleasing design,” says Hines.

“After a successful in-store trial phase, we are enthusiastic about the upcoming broader rollout. This development marks a significant milestone in our ongoing efforts to lead the market in sustainable practices while delivering exceptional products to our consumers.”

Costa is also working to implement new solutions for its citrus category. It harnessed some of the concepts used in a paper bunch bag the company developed for its premium Vitor-branded Autumncrisp table grapes and applied them to citrus.

"Our citrus category is focused on innovation and we are committed to being industry leaders in

developing new sustainable packaging solutions. By keeping tabs on the latest global sustainable practices, we're bringing home cutting-edge, eco-friendly packaging solutions for the Australian consumer,” explains Craig Greenhalgh, Costa’s national sales and operations manager.

“A standout in our innovative line-up is our new fully recyclable paper bag with a paper front mesh that’s completely sealed—specially designed for citrus products.

“We are very proud of our achievements in delivering on our sustainability goals. We are constantly learning from successful strategies across our business, which helps us to continually enhance our packaging techniques. Our citrus range is grown with passion and determination, and we are equally passionate about how we package our produce.” n

ABOVE—The bands help differentiate mini bananas

BELOW—Costa’s new citrus bags take inspiration from packaging it developed for table grapes

by Gilad Sadan

Making sustainability irresistible not only serves the planet but also significantly enhances the appeal and sales potential of products.

As The Packaging Hippie I am a staunch advocate for ecofriendly practices. I believe that sustainability in today’s market is a given. The real challenge – and opportunity – is integrating these practices in ways that captivates consumers and influence their purchase decisions.

“Sustainability is now a baseline, not a bonus,” I often say. The task at hand is to present it in a way that’s visually engaging and undeniably attractive. When consumers see a product with eco-friendly packaging that’s also sleek and stylish, it sends a powerful message about quality and care, encouraging

Gilad Sadan

The Packaging Hippie gilad@navicoglobal.com

Gilad is The Packaging Hippie, a creative with a focus on sustainability and packaging as a marketing tool.

them to make a purchase that feels as good as it looks.

Sustainable packaging isn’t just about reducing harm; it’s about adding value. ‘Better product, better packaging’ is a philosophy that resonates deeply with today’s consumers. By transforming traditional packaging constraints into creative opportunities, brands can change the perception of their products. This proactive approach not only meets but anticipates consumer expectations, fostering loyalty and expanding market share.

In our pursuit of sustainability, those of us who succeed will be the ones who make eco-friendly choices irresistible to consumers – proving that what’s good for the planet can also significantly enhance our bottom line. n

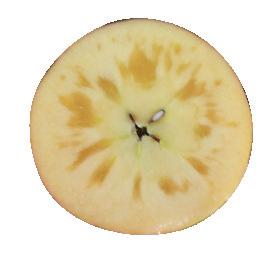

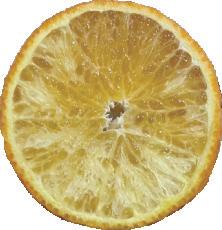

Industry hopeful for a return to high quality following back-to-back challenges in recent years.

by Bree Caggiati

“All signs point to a good season, which is likely to start two weeks earlier than last year”

Australia’s citrus industry has had difficulty bouncing back to its pre-Covid highs. With rising production costs, freight and logistics issues, and poor weather affecting volumes and quality – including issues with albedo breakdown and small sizing – the industry has struggled through a string of challenging seasons.

“The past few seasons have been really difficult,” says Legacy Packing chief executive Brett Jackson. “Quality hasn't been great. The markets have been flat coming out of the other end of Covid-19 and we’ve struggled with albedo and small size – it's been a real headache.”

But as the 2024 season ramps up, the situation appears to be improving, largely due to better weather conditions.

“I think all the quality issues we've had for the last few years due to wet weather have hopefully subsided,” Jackson says. “We had a much friendlier spring this year.”

He says Legacy Packing is seeing improvements to sizing and he’s hopeful quality and taste will follow suit. Others in the industry are similarly optimistic.

“Quality appears to be good and the sugar to acid ratios look better than last year,” says Daniel Newport, marketing manager at Pinnacle Fresh. “All signs point to a good season, which is likely to start two weeks earlier than last year across most varieties.”

While an early season isn’t always beneficial, as less time on the tree means growers and packers are forced to speed up their timelines, sending fruit to a potentially congested market, Jackson says there won’t be a high risk of overlap this season.

“I don’t think the markets should be too clogged with late US fruit, which is always good for us,” he says.

Ryan Smith, director at Valleyfresh, agrees and says a lack of late-season US fruit is increasing demand for Australian exports.

“The citrus season ahead is showing good demand from Australia’s export markets,” he says.