Quick commerce is booming in India. What opportunities does it present for fresh produce marketers?

Rather than just taking share from other channels, quick commerce players are creating a space of their own by servicing latent demand

Quick commerce is booming in India. Consumers across the major cities have embraced the convenience of ultra-fast deliveries – from grocery items to everyday essentials. Fresh produce is a new frontier for the leading players such as Blinkit, Swiggy Instamart and Zepto. As our keynote interview with QuikRelations’ Sachin Khurana details (see p26-30), q-commerce has already begun to reshape shopping habits, shifting fresh produce purchases from weekly bulk purchases to on-demand buying in smaller packages. Indeed, industry sources indicate these platforms are selling far more fresh produce than traditional supermarket chains. Rather than just taking share from other channels, however, the q-commerce players are creating a space of their own by servicing latent demand that was previously never served. Much of this owes to their ability to access a segment of consumers seeking premium categories such as berries and avocados. The unique data they have enables them to micro-target products and tailor shopping baskets to personal buying habits – to target even a single consumer in a specific pin code. This is a powerful platform, and one that must excite fresh produce marketers. India has been a notoriously difficult market to crack for premium fresh produce brands, with marketers often struggling to secure the requisite price premium. Could q-commerce hold the key? It appears so, but the sector still has much work to do to develop its premium offering, not least by maintaining quality in last-mile logistics. The good news is that these players have deep pockets, they’re investing it in infrastructure, and they’re willing to learn and partner. We look forward to hearing first-hand from top q-commerce players at Fresh Produce India on 3-4 April (p32-33) about what the future holds, and to nurturing those partnerships A

John Hey, Editor SINCE

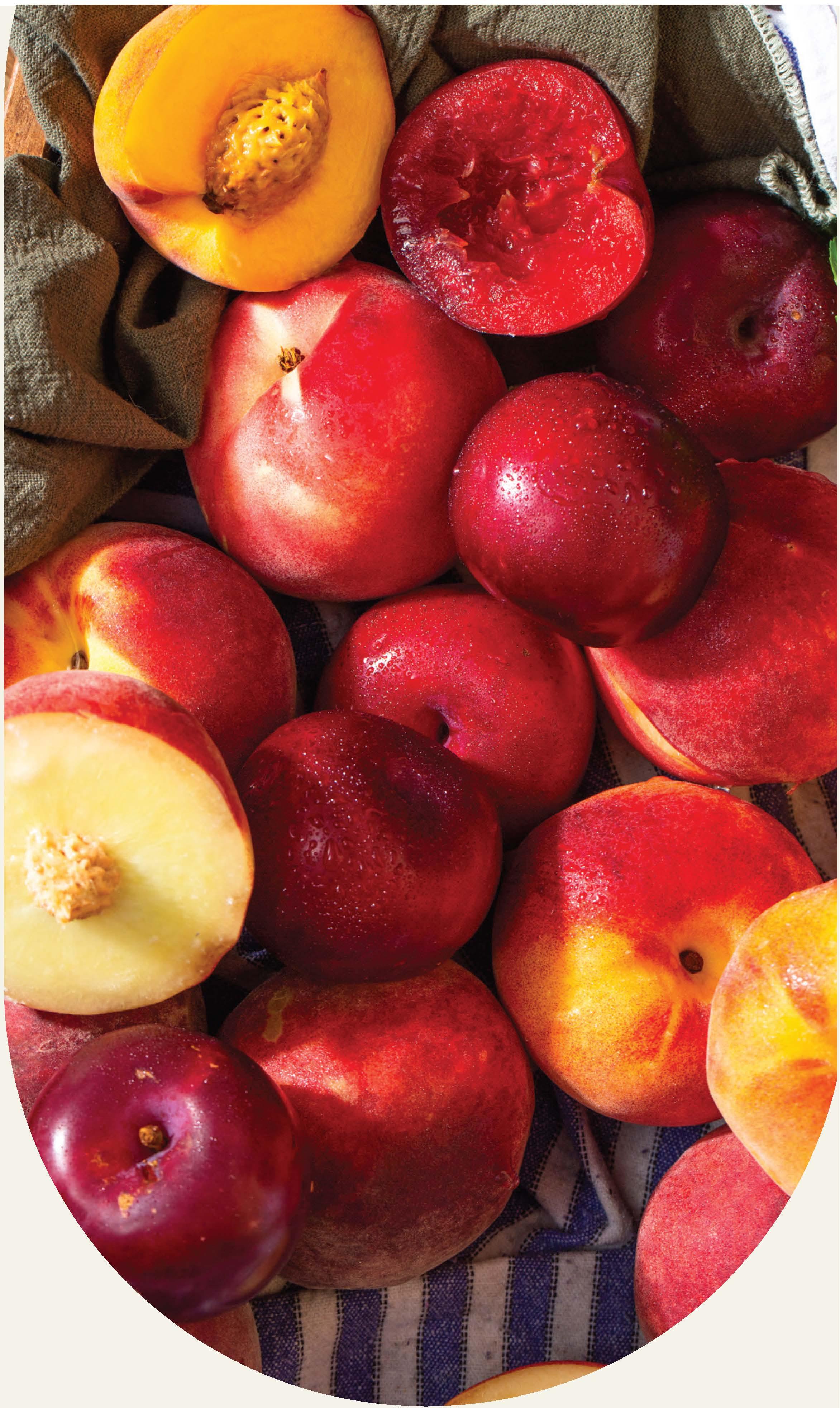

From juicy nectarines and oranges to sweet grapes and smooth buttery avocados, Australian fruit and fresh produce brings you the best of nature – sustainably grown, naturally delicious, and packed with nutrients.

Discover the wide range of tastes, textures, and flavours that Australia has to o er!

Get it Fresh. Get it Now.

For trade opportunities, contact india@austrade.gov.au

Rather than just taking share from other channels, quick commerce players are creating a space of their own by servicing latent demand

Quick commerce is booming in India. Consumers across the major cities have embraced the convenience of ultra-fast deliveries – from grocery items to everyday essentials. Fresh produce is a new frontier for the leading players such as Blinkit, Swiggy Instamart and Zepto. As our keynote interview with QuikRelations’ Sachin Khurana details (see p26-30), q-commerce has already begun to reshape shopping habits, shifting fresh produce purchases from weekly bulk purchases to on-demand buying in smaller packages. Indeed, industry sources indicate these platforms are selling far more fresh produce than traditional supermarket chains. Rather than just taking share from other channels, however, the q-commerce players are creating a space of their own by servicing latent demand that was previously never served. Much of this owes to their ability to access a segment of consumers seeking premium categories such as berries and avocados. The unique data they have enables them to micro-target products and tailor shopping baskets to personal buying habits – to target even a single consumer in a specific pin code. This is a powerful platform, and one that must excite fresh produce marketers. India has been a notoriously difficult market to crack for premium fresh produce brands, with marketers often struggling to secure the requisite price premium. Could q-commerce hold the key? It appears so, but the sector still has much work to do to develop its premium offering, not least by maintaining quality in last-mile logistics. The good news is that these players have deep pockets, they’re investing it in infrastructure, and they’re willing to learn and partner. We look forward to hearing first-hand from top q-commerce players at Fresh Produce India on 3-4 April (p32-33) about what the future holds, and to nurturing those partnerships A

John Hey, Editor SINCE

fruitnet.com/freshproducevietnam Fresh Produce Vietnam, the brand-new international event for Vietnam's fresh and vegetable business, tales place on 13-14 May in HCMC. View the agenda online.

instagram.com/fruitnet

Follow Fruitnet's Instagram page for regular photos and updates from the Fruitnet team.

fruitnet.com/asiafruit Asiafruit's news website provides regular updates on all the top stories from Asia's fresh fruit and vegetable business.

asiafruitchina.net

Visit Asiafruit's Chinese-language portal for all the latest news in Mandarin. Sign up to our newsletter, Asiafruit News and find us on WeChat. Our WeChat ID is asiafruit.

Expand your network of professional contacts and join the fresh produce conversation by visiting the Asiafruit LinkedIn account. LinkedIn

linkedin.com/showcase/asiafruitmagazine

x.com/asiafruit Keep up to date with news, opinions and developments from around the Asia's fresh produce trade by following our dedicated X account. X

desktop.asiafruitmagazine.com

Download the new Asiafruit app onto your smartphone or tablet from the App Store or Google Play. Stay informed on the latest fresh produce industry developments, and enjoy our magazines in new user-friendly digital formats.

https://bit.ly/3eHjlS0

Download Fruitnet's podcast series hosted by managing director Chris White in London. The Fruitbox podcast features conversations and interviews with leading industry experts.

Year-Round Vertical Integration

Premium Avocado Origins & Diversified Supply

35+ Years of Proven Market Expertise

editor John Hey

+61 3 9040 1602 john@fruitnet.com

digital editor

Liam O'Callaghan +61 3 9040 1605 liam@fruitnet.com

staff journalist

Bree Caggiati

+61 3 9040 1606 bree@fruitnet.com

china editor

Yuxin Yang +61 3 9040 1604 yuxin@fruitnet.com

DESIGN & PRODUCTION

design manager

Simon Spreckley

+44 20 7501 3713 simon@fruitnet.com

senior designer

Qiong Wu

+61 3 9040 1603 wobo@fruitnet.com

senior designer Mai Luong

+44 20 7501 3713 mai@fruitnet.com

graphic designer

Asma Kapoor

+44 20 7501 3713 asma@fruitnet.com

EVENTS & MARKETING

head of events and marketing

Laura Martín Nuñez

+44 20 7501 3720 laura@fruitnet.com

events executive Maria Santamaria Peláez +44 20 7501 3719 mariasan@fruitnet.com

ADMINISTRATION

finance director

Elvan Gul +44 20 7501 3711 elvan@fruitnet.com

accounts receivable

Tracey Haines

+44 20 7501 3717 tracey@fruitnet.com

finance manager

Günal Yildiz

+44 20 7501 3714 gunal@fruitnet.com

subscriptions +44 20 7501 0311 subscriptions@fruitnet.com

asia pacific

Kate Riches

+61 3 9040 1601 kate@fruitnet.com

europe & middle east

Artur Wiselka

+44 20 7501 0309 artur@fruitnet.com

greater china, thailand & philippines

Jennifer Zhang +86 21 6136 6010 jennifer@fruitnet.com

uk, ireland, belgium, greece, turkey & south-east europe

Giorgio Mancino

+44 20 7501 3716 giorgio@fruitnet.com

us & canada

Jeff Long +1 805 966 0815 jeff@fruitnet.com

south africa

Fred Meintjes +27 28 754 1418 fredmeintjes@fruitnet.com

italy

Giordano Giardi +39 059 786 3839 giordano@fruitnet.com

commercial director

Ulrike Niggemann +49 211 99 10 425 ulrike@fruitnet.com

managing director

Chris White +44 20 7501 3710 chris@fruitnet.com

Chris White fruitnet

As the founding editor of Asiafruit Magazine, Fruitnet's managing director reflects on the past 30 years as the publication celebrates three decades in print, and much more. asiafruit 30–p22-23

Desh Ramnath hortiroad2india Desh unpacks some of the thinking behind the sustainable, high-value food production projects HortiRoad2India will present at this year's Fresh Produce India. india–p46

Yemee Fernandes

four pillars trading

Yemee provides key insights for businesses targeting Indian consumers, including an Australian macadamias case study, which has seen recent success in the market.

india–p44

Fred Meintjes fruitnet

South Africa correspondent

Fred has prepared Fresh Focus South African Table Grapes 2025, Asiafruit's annual special profiling the industry and its advances in Asia.

rsa table grapes–p55

South-East Asia to increase exports in a bid to meet China’s growing demand for the “king of fruits”, amid increased border control due to contamination concerns late last year.

by Bree Caggiati

ABOVE—Auramine O residue was detected in a shipment of Thai durian OPPOSITE—China’s high demand for durian shows no signs of slowing down

The year is already off to an eventful start for China’s durian trade. Following an unparalleled year in 2024 which saw, according to customs data, China import a record 1.56mn tonnes of durian at an all-time record value of US$6.99bn, competition for the world’s largest durian market has intensified.

In recent years, Thailand has lost its dominant position in the race to supply this growing demand as its neighbouring South-East Asian countries have lobbied for market access. Despite the increase in suppliers, China’s market still has plenty of growth potential, according to BMI Country Risk and Industry Research shared by Xinhua

“We expect growth to continue in the medium to long term given the relatively low maturity of the market and the increasing popularity of the fruit,” the forecaster says.

It sees continued growth for suppliers too, particularly Malaysia

and Vietnam.

“We expect Malaysia to become an increasingly important exporter of fresh durian to China thanks to the agreement (last year),” BMI says.

Meanwhile Vietnam has plans to boost its exports, according to VNExpress, with a goal of reaching a total export value of US$3.5bn. Durian exports already accounted for nearly half of the country’s total fruit and vegetable export value in 2024.

The Indonesian government has also increased efforts to gain market access with Liferdi Lukman, director of floriculture at the Indonesian Agriculture Ministry’s Horticulture Directorate General telling the Jakarta Post fresh durian would be audited by China’s General Administration of Customs (GACC) in Central Sulawesi “around the end of February 2025 to prepare a fresh durian export protocol”.

Elsewhere, BMI says Laos is showing signs of continued investment into its own durian supply chain.

This rising competition comes

as drought in Thailand has caused a significant drop in production over the last year. The country’s durian industry faces further challenges following the detection of Auramine O in durian shipments to China late last year.

According to reporting from the Bangkok Post, the GACC discovered Auramine O residues in seven containers carrying durian and two containers containing longan from Thailand. The substance, also known as Basic Yellow 2 (BY2), is classified by the WHO as a Group 2B carcinogen and is suspected to have been used to enhance the colour of the fruit to make it appear more yellow.

Following the discovery, the GACC introduced stricter measures requiring durian exporters to supply certification of pre-export screening for the substance. It will also carry out spot checks at entry points by land, sea and air.

The requirements, introduced on 10 January, have caused major disruptions to trade, with hundreds of containers from Thailand and at least 170 tonnes of durian from Vietnam blocked at border checkpoints for lack of testing, according to VietnamNet. The new rules have also led to significant processing delays, with sources reporting China is spot testing up to 50 per cent of its imports.

The situation looks to be improving somewhat with China approving testing facilities in Thailand and reports of shipments successfully clearing checkpoints. Though it is likely to be some time before the new process runs completely smoothly. A

The beginning of February saw the world’s fresh produce trade converge in Berlin for Fruit Logistica. The three-day event brought together more people than ever before, welcoming over 2,600 exhibitors from more than 90 countries. This included record numbers from China, Turkey and Egypt, and notable increases for Spain and Peru solidifying the event’s place as the world’s most international, influential, and innovative fresh produce trade fair.

AMFresh held off strong competition to win the prestigious Fruit Logistica Innovation Award 2025 for its Onix orange. According to the Spanish group, the deep burgundy orange “combines stunning multicolour beauty with a seedless, velvety pulp, rich in antioxidants”. Meanwhile, Israel’s Fermata Technology won the FLIA Technology prize, impressing voters at the event with Croptimus. Croptimus is a SaaS solution tailored for greenhouse vegetable production, utilising advanced AI coupled with computer vision to identify pests and diseases early.

Southern Hemisphere apple production is up, while pear production is down. That’s the headline from Wapa’s latest forecast, which compiles data from Argentina, Australia, Brazil, Chile, New Zealand and South Africa. In New Zealand, apple and pear exports have just topped NZ$1bn for the first time. And in South Africa, exporter Tru-Cape predicts a strong start to its European

campaign after a good harvest. The country has also just shipped its first apples to Thailand under a new access agreement, opening an important new market.

OPPOSITE—Stonefruit has helped to boost Australia’s horticulture exports

LEFT—AMFresh won the Fruit Logistica Innovation Award

BELOW TOP—Agrovision has harvested its first commercial blueberries in China

BELOW BOTTOM—Southern Hemisphere apple production is up

Agrovision has harvested its first commercial crop of blueberries in China, less than a year after it reached a deal to establish a largescale farm in Yunnan province. Fellow berry marketer Driscoll’s has revealed it plans to introduce its premium range Sweetest Batch in new markets like the Middle East, Germany and eventually the UK after successful rollouts in the US and Australia. Hortifrut has obtained Leaf Marque certification for its farms in Morocco

and Peru, something which is expected to increase availability for European markets. And berry breeder Planasa has acquired ABZ Seeds, owner of the F1 seedpropagated, hybrid strawberries.

Zespri’s strong demand combined with its largestever crop (190mn trays) has put the group on track to exceed its global revenue target of NZ$4.5bn this season. And included in that figure are more than 3mn trays of RubyRed kiwifruit, which means the variety will be available for the first time in some markets. In Greece, meanwhile, exporter Zeus Kiwi has reported growing demand in new markets like Brazil.

Two new partnerships could bring new success for the produce trade between India and Australia. Exporters AgroStar and Kay Bee Exports have shipped the firstever commercial trial shipments of premium Indian pomegranates to Australia by sea. And Australia’s macadamia industry has welcomed a revised protocol for exports to India, which has removed the requirement for methyl bromide fumigation. Led by macadamias, almonds, avocados, stonefruit, and citrus, Australia’s horticulture exports grew 8.7 per cent to almost A$3bn in 2023/24, according to new data released by Hort Innovation.

Vietnam’s fruit and vegetable exports are set to be worth more than US$7bn this year, according to a new report, as exporters benefit from better access to China, as well as opportunities in Thailand and the US.

Chinese authorities have rejected the entire cargo from the Saltoro, the Maersk ship stranded in the Pacific for more than 20 days, due to the poor condition of the fruit. The vessel was carrying 1,300 containers of Chilean cherries valued at more than US$120mn. Chile’s cherry industry is set to rack up losses of at least US$1.6bn in the 2024/25 season, according to analysis by consulting firm Colliers. In China, which takes more than 90 per cent of Chile’s cherry output, prices collapsed following record shipment volumes.

A new investigation has found that inefficient logistics cost South Africa’s citrus industry R5.27bn last season, a figure that CGA chair Justin Chadwick

describes as “a debilitating loss of foreign revenue”. John Giles’ exclusive analysis for Fruitnet suggests there is a renewed wave of optimism sweeping across South Africa’s fruit business as the year progresses.

The Southern Hemisphere Association of Fresh Fruit

Exporters has named Nathan Hancock of Citrus Australia as its new president, and Jorge de Souza of Abrafrutas in Brazil as vicepresident. Meanwhile, Michael Simonetta, chief executive of leading Australian fresh produce marketer Perfection Fresh, has announced his retirement set for the end of June. Rod Quin has been appointed his successor. A

OPPOSITE TOP—Zespri has produced more than 3mn trays of RubyRed OPPOSITE BOTTOM—Australian macadamias have secured an improved protocol to India

ABOVE—Maersk ship Saltoro arrived in Nansha 28 days later than planned

BELOW—Michael Simonetta has stepped down as Perfection Fresh CEO

Once considered a “fruit for royals”, cherries have now become a common favourite in many households. With a vibrant red colour, crunchy texture, sweet taste, and high nutritional value, cherries are the ideal gift for loved ones during the Chinese New Year holiday. This season, Chilean cherries experienced a bountiful harvest, with increased supply to the Chinese market driving prices to more accessible levels. For this reason, many consumers were delighted to find that they could enjoy “cherry freedom” ahead of the Spring Festival.

As a leading brand in the premium fruit industry, Joyvio Cherries has carefully observed market demand and consumer trends for the holiday season. Leveraging the gifting tradition of Chinese New Year, Joyvio Cherries proactively promoted its brand. With a more robust and stable supply chain, superior freshness and quality, and innovative marketing campaigns, Joyvio Cherries sparked a nationwide buying frenzy, driving cherry consumption. The brand’s slogan, “Joyvio Cherries – The Perfect Gift for Every Occasion”, was widely embraced, setting a new standard for premium gifting.

From November to February each year, Chilean cherries hit the market in large quantities, coinciding with peak consumption during major holidays such

as New Year’s Day and the Spring Festival. As one of the most established cherry brands in the industry, Joyvio Cherries has consistently maintained a leading position in the market. The first batch of Joyvio Cherries for the 2024 season arrived in China by air as early as November, allowing Chinese consumers to enjoy highquality Chilean cherries sooner than ever.

While early-season cherries often face quality instability, Joyvio Cherries has managed to uphold exceptional standards with large fruit sizes (JJJ and JJJJ), an average sweetness of over 17o Brix, and firmness greater than 70P. This consistent quality – combined with the fruit’s crunchiness, sweetness, and freshness – earned widespread praise upon release.

To meet the high demand for fresh, premium Chilean cherries during Chinese New Year, Joyvio Cherries reached peak import volume in mid-January. With an abundant supply and stable quality, the brand ensured ample stock and steady pricing throughout the holiday season, perfectly catering to consumer demand for high-end cherries during this festive period.

Behind the stability in quality and supply is a mature value chain and innovative international logistics. Joyvio Cherries has established long-term partnerships with premium orchards in Chile, ensuring top-quality cherries from the source. The brand adheres to rigorous standards in harvesting, packaging, transportation, and storage, following its five fresh principles – freshness in cultivation, picking, transportation, packaging, and consumption –ensuring that each cherry retains

its natural flavour and nutritional value. Enhanced international logistics enabled a multi-port import model in China, drastically reducing the time from Chilean orchards to Chinese dining tables, making “cherry freedom” an easily accessible reality for consumers.

Renowned for its high-quality products, the Joyvio Cherries brand has earned the trust of consumers. After its collaboration with the Chinese women’s volleyball team, the brand became a strategic partner of China’s aerospace industry, leading the freshness revolution with aerospace-level standards.

In the face of a complex Chinese New Year gifting market, Joyvio Cherries creatively integrated traditional Chinese cultural elements with its premium brand image. By highlighting traditional culture and creating a “healthy New Year gifting” scenario, the brand solidified its position as the perfect gift for every occasion.

In 2024, after launching a collaborative gift bag with the Palace Museum’s Mythical Creatures, Joyvio Cherries continued the theme of imperial elegance by partnering with the iconic Chinese drama Empresses in the Palace.

This collaboration blended the refined aesthetics of traditional palace culture with the exceptional quality of Joyvio Cherries. Featuring auspicious red gift bags and the slogan, “This is Truly

Excellent”, the campaign resonated deeply with consumers.

To further elevate the collaboration, Joyvio Cherries introduced a series of themed gift sets, including Empresses in the Palace blind boxes, characterthemed stickers, and festive red envelopes, creating a celebratory atmosphere that delighted consumers and drove sales.

Chinese New Year marks the peak sales season for markets and supermarkets across China. With its festive colours, delightful taste, large size, and elegant packaging, Joyvio Cherries emerged as the top choice for gifting this year.

In major wholesale fruit markets and supermarkets across Guangzhou, Beijing, Tianjin, Zhengzhou, Xiaogan, and Wuhan, Joyvio Cherries hosted Spring Festival marketing events under the theme “Joyvio Cherries: Start the Year with Good

OPPOSITE LEFT—Joyvio Cherries is known for its quality OPPOSITE BOTTOM—Joyvio Cherries collaborated with Chinese drama Empresses in the Palace on Chinese New Year packaging LEFT—Sales are high during the Chinese New Year festive period

BELOW—Joyvio Cherries participated in Chile Week in 2024 with live interviews with key stakeholders

Fortune”. Interactive experiences and tasting sessions significantly boosted sales.

Many shoppers commented that, “Joyvio Cherries are excellent quality. I buy them every year for myself and as gifts for friends”.

While offline sales are booming, online platforms have also seen a surge in demand. On major e-commerce platforms like Pinduoduo, Douyin, Kuaishou, and Tmall, Joyvio Cherries captivated consumers with festive marketing campaigns and influencer-driven live-streaming events.

Notably, Joyvio Cherries made its debut at the 2024 Chile Week, co-hosting a cherry release and livestreaming discussion with the Chilean Embassy in China, the Ministry of Agriculture, InvestChile, Frutas de Chile, and Wumart. These initiatives created a buzz both online and offline, driving strong sales and marking a successful start to the Chinese New Year.

Joyvio Cherries was there to usher in another year of prosperity. With insightful market analysis, a steadfast commitment to freshness, and innovative marketing strategies, Joyvio Cherries has stood out in China’s competitive Chinese New Year gifting market.

As Chilean cherries enter peak import season, Joyvio Cherries continue to bring joy and vitality to consumers during moments of family reunions, visits, and gatherings, offering unparalleled taste and health benefits. The brand remains at the forefront of premium gifting, inspiring consumers to choose Joyvio Cherries as the perfect gift for every occasion.

Acquisition will see Roc Partners invest significantly in the company’s growth with Freshmax maintaining its existing structure and leadership.

by Bree Caggiati

Freshmax Group, a leading player in the Australasian fresh produce industry, has announced its acquisition by Sydney-based alternative investment manager, Roc Partners.

The move comes after Freshmax Group revealed it was seeking a strategic partner in May 2024 to help drive the future growth and development of the business.

Roc Partners plans to invest significantly in the company’s growth and development while maintaining the business’ existing structure and leadership, a Freshmax release explains.

The investment manager specialises in private market investments, with approximately A$9bn capital funds under management across private equity, private credit and real assets.

Roc Partners currently manages A$2.5bn in assets in its food and agriculture portfolio and maintains a dedicated agricultural investment team. The acquisition underscores its commitment to driving growth in the sector.

“This milestone marks the beginning of an exciting new chapter for Freshmax,” says Freshmax Group chief executive, Murray McCallum.

“Roc Partners’ deep expertise and proven track record in food and agriculture make them an ideal partner for the next phase of our journey. Together, we will look to

“We are committed to leveraging our resources and expertise to support Freshmax in achieving its ambitions”

explore new growth opportunities, while continuing to deliver exceptional value to our supplier and customer partners around the world.”

Roc Partners vice president - food and agriculture, Todd Winkley says Freshmax represents “a compelling opportunity” for investment due to its growth and experienced management team.

“We intend to use this strong foundation as a platform for further expansion,” Winkley says.

“We are committed to leveraging our resources and expertise to support Freshmax in achieving its ambitions, nurturing continued

innovation, and strengthening its position in the global fresh produce market.”

Glenn Wallace, Freshmax Group chairman, adds: “The acquisition by Roc Partners ensures a stable and strategic future for Freshmax. Their understanding of the food and agriculture sectors and their commitment to sustainable growth perfectly align with our vision. We look forward to seeing Freshmax thrive under their stewardship”.

The sale process was conducted by Kidder Williams, a leading corporate advisory firm in food and agribusiness transactions. A

Latin American export nation the Official Partner Country for 2025 edition of event, as Asia Fruit Logistica gears up to launch Peru Meet Up this October.

by John Hey

Asia Fruit Logistica has announced that Peru is the Official Partner Country for the 2025 edition of the event, underlining the Latin American nation’s growing role as a leading global fresh produce exporter.

The announcement was made during Fruit Logistica in Berlin. The announcement ceremony took place at the iconic Funkturm (Radio Tower), where over 100 highlevel industry professionals gathered for an evening of networking, business discussions, and a gala dinner.

David Ruetz, senior vice president and advisory board member of Messe Berlin, underscored Peru’s remarkable achievements in the fresh produce sector, which have cemented the country’s growing presence in the international market, particularly in China.

“The strength of Peru’s agricultural sector is a key driver of its growing influence in international markets,” said Ruetz. “The country is committed to expanding its footprint and fostering new international partnerships, especially in Asia.”

Peru’s agricultural sector continues to enjoy

rapid growth, with large-scale initiatives such as the Chancay Port development set to deliver a major boost to trade efficiency. This project, a Sino-Peruvian collaboration, will radically reduce shipping times and costs, further enhancing Peru’s ability to meet the growing demand for fresh produce in Asia.

In conjunction with this announcement, Asia Fruit Logistica revealed plans to launch the Peru Meet Up, taking place on 28-29 October 2025, in Lima. The new event will serve as a vital platform for connecting Latin American fresh produce exporters with key buyers and partners from Asia and

around the world.

This inaugural Meet Up will take place in Peru and it will feature a focused showcase of top Latin American fresh produce with an emphasis on connecting them with Asian buyers.

It will also include a highlevel content programme offering insights from leading industry experts on fresh produce exports and cold chain logistics.

The Peru Meet Up is organised by Asia Fruit Logistica in partnership with Fruit Logistica and Fruitnet, Asia Fruit Logistica’s Knowledge Partner.

Chris White, managing director of Fruitnet, said the launch of the Peru Meet Up comes at the perfect time for the local, regional and international industry.

“Peru has emerged rapidly to become one of the world’s top fresh produce exporters. Now it is poised for an exciting new phase of growth as large-scale irrigation and logistics projects take shape,” said White.

“Peru is also set to become a key regional logistics hub with massive new port investments. We look forward to discussing these landmark developments for the local and regional trade at the Peru Meet Up.”

The Peru Meet Up is supported by a range of leading players in the fresh produce industry, who joined the organisers on stage at the ceremony.

Partners include the International Fresh Produce Association (IFPA), Promperu, Abrafrutas, Guangzhou Jiangnan and Shanghai Huizhan wholesale markets, CORPEI, ProEcuador, ProColombia and the Banana Cluster from Ecuador, represented by AEBE. A

Leading vertically integrated citrus grower/shipper in North America, with complete control of our fruit, from seed to store

Highest industry standards for quality

Best-in-class brands that consumers know and love

Deeply invested in innovation, sustainability, and our communities

Complete customer-centric services and expertise: Transportation, sales, marketing, merchandising, agronomy and more

In the first of a series of articles to mark Asiafruit Magazine’s 30th anniversary year, founding editor Chris White reflects on the publication’s remarkable journey, and looks ahead to a bright future.

CHRIS WHITE Fruitnet Media International Managing director

Thirty years already? We launched Asiafruit Magazine in 1995 on a simple idea. Our business model had worked in Europe with

Eurofruit Magazine. Surely, it would work in Asia too? We were right. Asia was ready for business news and insight about the fresh fruit and vegetable

LEFT—The first edition of Asiafruit Magazine rolled off the press in May 1995 OPPOSITE ABOVE— The magazine is now published in print and digital formats with the app edition for the smartphone OPPOSITE ABOVE & BELOW—Asiafruit Congress launched in 1998 and was the platform for Asia Fruit Logistica, which has become the biggest trade show in Asia

market. And Asia was more than ready for a regular place to meet and do business.

Asiafruit Magazine and Asiafruit Congress have helped to create the market for fresh fruits and vegetables in Asia. They have provided a platform that helped the fresh produce business in Asia to grow. They have brought suppliers from around the world in direct contact with fresh produce buyers in Asia. And, very importantly, they have helped to build confidence in the Asia market.

Thirty years ago, China was a different country. This is true of so many countries right across Asia. Their economic transformation has been remarkable.

These are now markets that take the best produce from growers. They are some of the best paying markets in the world. And their systems of retail and distribution can teach lessons to everyone.

We started Asiafruit Magazine before email and the internet. Now you can read our news and insight

via an app on your smartphone. And you can still hold the magazine in your hands. It really is the best combination.

Asiafruit Congress was the platform for Asia Fruit Logistica. Our partners at Fruit Logistica in Berlin shared our confidence in the opportunity of Asia.

Together we have built the biggest and best fresh produce

business trade show in Asia. And there are many exciting years ahead of us.

It has been the absolute privilege of my career to have spent so much of it working in Asia. Thirty years is a very long time and they are full of many happy memories of Asia. I am very proud of the opportunity my work has created for John Hey and his team at Asiafruit and for David Axiotis and his team at Asia Fruit Logistica.

Our future is bright and full of promise because it is Asia’s future too. A

Sachin Khurana, director of agribusiness and trade marketing consultancy QuikRelations, discusses the rapid rise of quick commerce in India and the opportunities it is creating for fresh produce marketers.

by John Hey

LEFT—Sachin Khurana says q-commerce is reshaping consumer habits in fresh produce BELOW— Consumers have embraced the convenience of ultra-fast deliveries

Can you give us a snapshot of the quick commerce sector in India? How big is the market and what kind of growth rate is it seeing?

Sachin Khurana: Quick commerce (q-commerce) in India is an ultrafast delivery model, typically fulfilling orders within 10-15 minutes. It primarily serves urban

markets, supplying grocery items, fresh produce, and daily essentials. The key players include Zomatobacked Blinkit, Swiggy Instamart, and Zepto. We have also seen new players enter the market and traditional players jumping onto the bandwagon. These include Amazon, Flipkart, BigBasket and Reliance. The sector has seen explosive growth, with the Indian

e-commerce market projected to reach US$5.5bn by 2025, growing at a compound annual growth rate of 27 per cent, according to a 2023 report from RedSeer Consulting.

Indeed, q-commerce appears to have taken the Indian consumer market by storm over the past few years. How do you explain its rapid growth? Why is it performing so

LEFT & BELOW— Q-commerce presents opportunities for premium products such as berries and cherries

well in India as compared to other countries?

SK: India’s q-commerce boom is driven by high mobile penetration and digital adoption, with India now home to 750mn smartphone users. But there are several other key drivers. First, last-mile delivery – India has a large working population capable of fulfilling the massive manpower needs for last-mile delivery. Second, our dense urban population – our urban cities provide the demand density needed for micro fulfilment centres. Third, consumer habits, with rising disposable income and demand for convenience. Finally, venture capital funding and competitive pricing – heavy investments by venture capitalists enable companies to subsidise costs and scale rapidly.

How is q-commerce reshaping consumer behaviour, particularly when it comes to buying fresh produce?

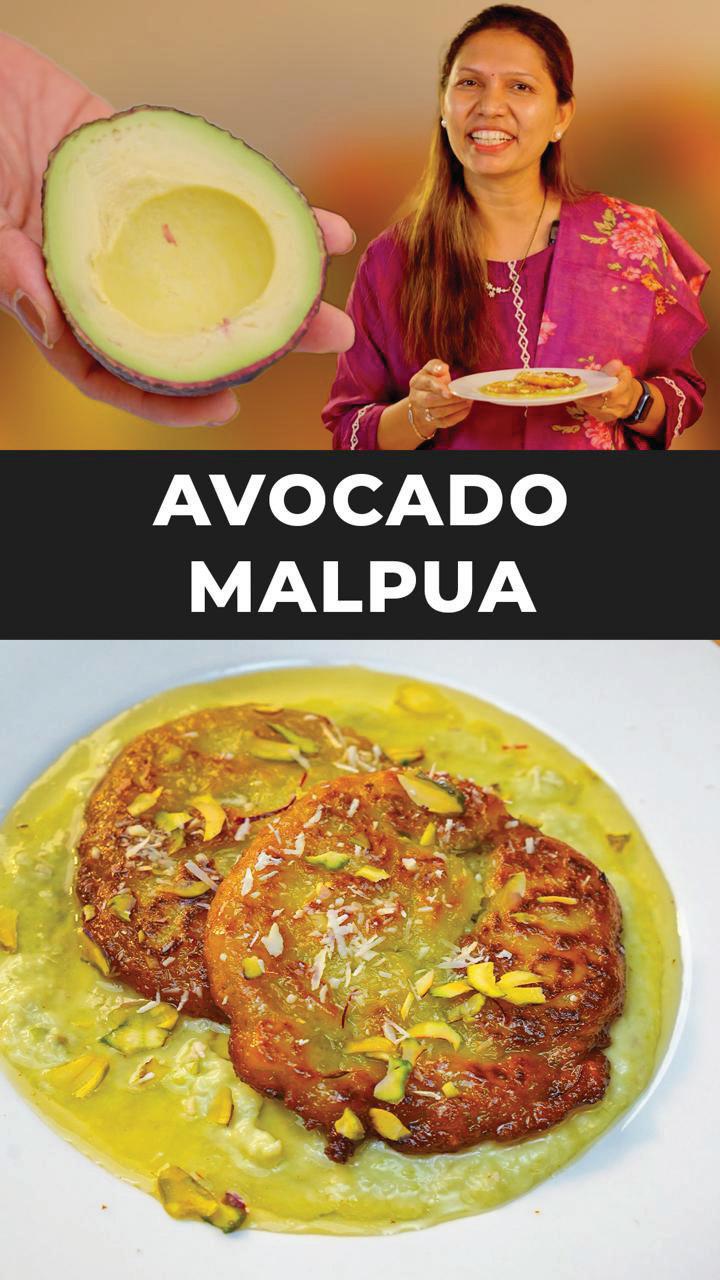

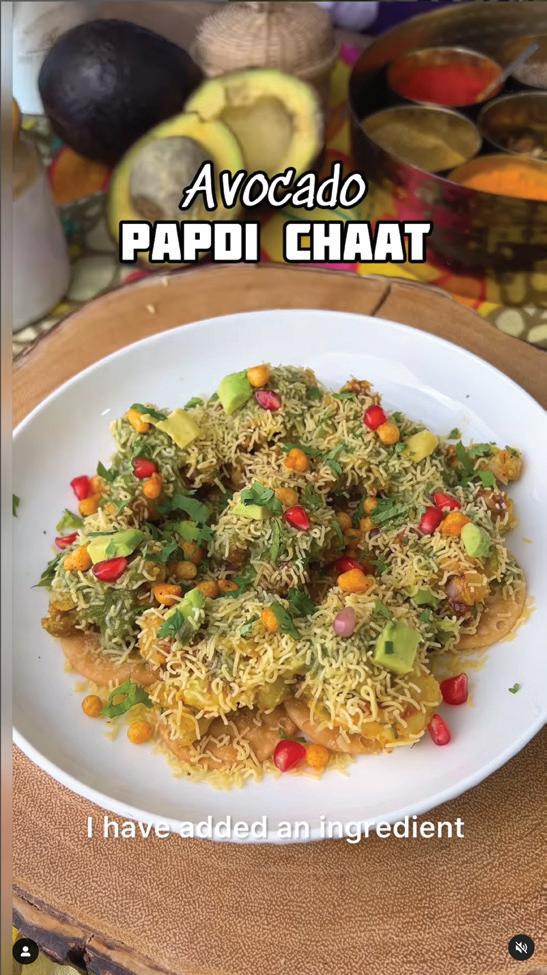

SK: Q-commerce has reshaped purchasing patterns by shifting fresh produce purchases from weekly bulk shopping to on-demand buying. Consumers are now accustomed to ordering fresh fruit and vegetables in smaller quantities, leading to higher purchase frequency. Also, the ability to micro-target products and shape your basket around your personal buying habits gives q-commerce a unique leverage over other traditional modes of buying. Q-commerce also has access to a unique set of buyers looking for premium products. The ability to target high-value produce to a specific consumer base has helped q-com to grow premium categories like berries and avocados much faster than traditional retail.

Quick commerce operators have already impressed Indian consumers with their fresh produce offerings, and there is massive potential for them make further strides with new supply chain investments to improve quality in the last-mile delivery.

That’s the view of Jayan Lohani, director of DJ Exports (pictured right), which supplies a range of leading q-commerce platforms with fresh produce.

“The response to fresh produce offerings on q-commerce platforms has been overwhelmingly positive, with strong demand for both staples and premium products,” Lohani explains.

“Many players are witnessing double-digit growth in fresh produce sales, and we expect this momentum to continue as supply chains improve and customers grow more accustomed to the model.”

DJ Exports supports q-commerce platforms by sourcing premium fresh produce items and brands, and providing a range of other services, Lohani says.

“We supply innovative packaging solutions to enhance shelf-life and maintain product integrity,” he says. “We ensure temperature-controlled transportation from farm to warehouse to maintain freshness, and we also offer custom supply solutions. We tailor our supply to the unique needs of each platform, including demand forecasting and real-time replenishment.”

Lohani says one of the main challenges for the q-commerce model is maintaining freshness and quality, particularly in the last mile.

“While we ensure a cold chain up to the platform’s warehouses, last-mile delivery is often conducted in ambient conditions, which can impact quality,” he says. “Additionally, price sensitivity sometimes leads to compromises in product selection.

“We are actively working with the top management of these platforms to address these issues by enhancing packaging, improving cold storage at last-mile hubs and refining quality control measures.”

How would you describe the fresh produce offerings of q-commerce operators? And how are consumers responding? Are they gaining the trust of consumers?

SK: The q-commerce sector is investing heavily in building its own supply chains for domestic and imported fresh produce. Operators have improved sourcing by partnering directly with leading importers and farmers, farmer producer organisations (FPOS), and wholesalers, ensuring fresher inventory turnover. Companies like Zepto and Blinkit have introduced ‘farm-to-fork’ models and qualitychecking systems to build trust. The larger players are also setting up their own facilities to help them serve better quality to their customers.

How important is fresh produce as a sector for the q-commerce companies in terms of share of their sales and in customer acquisition? What growth opportunities and challenges do they face?

SK: Fresh produce accounts for 15-20 per cent of total q-commerce sales, serving as a customer acquisition driver due to its high repeat purchase rate (RedSeer, 2023). Growth opportunities lie in premium, organic, and exotic produce, while challenges include logistics inefficiencies and wastage due to perishability.

It must be challenging for q-commerce companies to service consumer demand for high-quality fresh produce with the lack of cold chain in India and perishability of the product. How are they managing this issue?

SK: They’re taking a range of measures. They’re using micro-

“Q-commerce provides a datadriven marketing advantage over traditional retail. It can offer hyper-local targeting”

fulfillment centers (MFCs) to ensure faster inventory turnover. AI-driven demand forecasting reduces overstocking and wastage. Cold storage hubs and last-mile innovations (such as insulated delivery bags) are improving supply chain efficiency. Farm partnerships help optimise sourcing, ensuring a steady supply of fresh produce. Planned investments in logistics and their own infrastructure among all three leading players will help them overcome several of these challenges.

What unique opportunities does q-commerce offer for fresh produce marketers compared to other channels?

SK: Q-commerce provides a datadriven marketing advantage over traditional retail. It can offer hyperlocal targeting: companies analyse demand patterns to push regionspecific produce. Premiumisation is another strength: platforms promote high-margin products like organic, imported, and exotic fruits through personalised recommendations. Brand collaborations are the other part - fresh produce brands can leverage app promotions and bundled offerings.

Questions have been raised about the profitability of q-commerce companies and whether they

can secure a sufficient return on investment. Will they have to start charging consumers (more) for the extra convenience? How do you see this playing out?

SK: Q-commerce companies face significant profitability challenges due to high operational costs, delivery subsidies, and warehousing expenses. Industry analysts predict firms will gradually reduce discounts and introduce premium delivery models such as subscription plans for express service. Despite these challenges, Zepto and Blinkit have indicated that unit economics are improving with scale and operational efficiencies.

Overall, how do you see the prospects for q-commerce in India? What are the key trends to look out for over the next few years?

SK: The q-commerce sector will continue to evolve. We’ll see geographic expansion beyond the major metros into tier-two and tier-three cities; tech advancements in AI-driven inventory management; and sustainability initiatives, including eco-friendly packaging and optimised logistics. The sector is also likely to face regulatory challenges, particularly in respect of labour laws and gig worker policies. A

The convenience offered by quick commerce operators has been a game changer for grocery shopping in India, and the future is very bright for them if they can achieve profitability. So says Gagan Khosla of NGK Trading, a key supplier of fresh produce imports to the sector.

“The biggest factor in their success is convenience,” says Khosla (pictured). “You can order any time of night or day and product is delivered to your home in 15 minutes tops. It’s neatly presented, the quality is reasonable, and prices are sharp. You can’t get any better than that for the consumer.”

Indeed, Khosla says q-commerce has changed consumers’ buying habits when it comes shopping for fruit and vegetables. “Dual-income households find this the best way to shop,” he says. “They don’t need to go out to a store, haggle with a street vendor or depend on domestic help to shop for them. The fact these players use competitive pricing and deliver good quality means the customer has quickly bought into the idea and they’re expanding at light speed.”

Despite their compelling fresh produce offer, Khosla sees some room for improvement for quick commerce players. “They are good with commodity products, but they struggle with upmarket lines like stonefruit or cherries,” he says. “We’re engaging with these operators to increase their range of products and drive towards premiumisation, which should help them grow faster.”

Looking ahead, he says one of the key challenges for q-commerce is to become operationally profitable. “If they’re not profitable, then they will lose steam unless the consumer is willing to pay for the extra convenience,” he says. “We’ll know in 24 months, but they have deep private equity-funded pockets so I am hopeful they’ll succeed, and it will help grow the fruit import segment further.”

Aamras, Mango Chia, Valencia Orange, Mango Coconut, Pomegranate, Apple, Mix Fruit, Kokum, Apple Beetroot Carrot, Berry Delight, Watermelon, Guava Chilli, Sugarcane, Coconut Water, Aam Panna, Pineapple, Jamun, Gold Kiwi Blast.

200ml, 250ml, 1L ( pet bottles/pouches ) 3L ( pouches )

India’s premier business event is back in Mumbai on 3-4 April with an exciting line-up of top speakers, unique experiences and first-rate networking opportunities.

by John Hey

Delegates to Fresh Produce India 2025 can look forward to a wideranging programme of expert talks, insightful meetings, immersive tours and much more this April in Mumbai.

Organised by Fruitnet with official partner Asia Fruit Logistica, India’s premier business event for fresh produce professionals returns to the Trident Nariman Point Hotel in Mumbai on 3-4 April.

Fresh Produce India combines a non-stop business networking

expo with a packed programme of talks, presentations, interviews and tastings on Day One. Day Two offers hosted tours to top fresh produce distributors and food retail stores in Mumbai.

Fresh Produce India opens with two unique experiences designed to nourish both body and mind, hosted by Avocados Australia and Summerfruit Australia. Celebrated yoga teacher and author Ira Trivedi hosts an early morning yoga and wellness session by the poolside at the Trident Nariman Point Hotel. A

LEFT—Fresh Produce

India’s bustling networking expo

ABOVE—

Celebrated yoga instructor Ira Trivedi will host an early morning yoga and wellness session

RIGHT—Clockwise from top left: Speakers include Richard Mills of Haygrove, Marc Peyres of Blue Whale, Innoterra’s Anup Karwa and Michael Schadler of Washington Apple Commission

Welcome Breakfast follows with celebrity chef Amritra Richand featuring Australian avocados, plums and nectarines.

Fresh Produce India’s high-energy content programme then kicks off, bringing together leading experts to discuss a range of exciting market trends and opportunities.

The opening session spotlights India’s quick commerce revolution and how it is reshaping fresh produce retail. Sachin Khurana of QuikRelations unpacks the remarkable growth of the sector. He is then joined by a panel of top players including Zepto’s Ramlingha Rajoo

Elsewhere on the programme, Fresh Produce India features case studies on cutting-edge technologies with the potential to change the game for the industry.

Anup Karwa of Innoterra BioScience explains why the new T4-resistant banana variety it has identified could provide a solution to one of the banana industry’s biggest challenges. Meanwhile, Frigotec’s Roland Wirth discusses its AI innovation Softripe which ripens tropical fruits such as avocados, mangoes and bananas naturally with superior flavour and shelflife.

HortiRoad2India also hosts a special session featuring business pitches that promise to revolutionise retail in India. The session, led by director of the Dutch public-private partnership Desh Ramnath, showcases fresh produce and solutions with the potential to make retailers leaders in offering fresh, clean, residue-free exotic fruit and vegetables yearround.

The packed content programme wraps up with a supplier spotlight on South Africa, which is making impressive inroads on India’s fruit import market. A panel of industry leaders discusses South Africa’s future as a supplier to India in both established and emerging products. Speakers include Werner van Rooyen, COO of Fresh Produce Exporters’ Forum, Hortgro’s Jacques du Preez, Derek Donkin of Subtrop, and NGK Trading’s Gagan Khosla.

and Swiggy Instamart’s Raunak Shetty to discuss the future market opportunities and challenges.

India is emerging as a production hub for ‘newer’ fruits like berries and dragon fruit, while new genetics are invigorating established categories such as table grapes. Richard Mills of Haygrove Growing Systems discusses India’s rise in berries and the key role for protected cropping systems. He is joined by Tarun Arora of IG International, who explains the

group’s large-scale investments in production of dragon fruit and other new crops.

India is now one of the world’s top apple importers, and the market continues to evolve rapidly. A panel of top global apple marketers, including president of the Washington Apple Commission Michael Schadler, Blue Whale’s Marc Peyres, and Nicola Zanotelli of IG International, share their expert insights on how to build an apple brand in India.

Fresh Produce India’s content programme takes place in the same space as the bustling business networking expo. Delegates can enjoy a wide range of activities to maximise networking and connect with industry leaders throughout the day. They can hold meetings in the exclusive business lounge powered by Austrade; enjoy an avocado-themed networking lunch hosted by Westfalia; sample Thirty33 cold-pressed juices at the coffee and juice station sponsored by Surifresh Extract; and wind down and relax at the evening cocktail hosted by Fruit South Africa.

Fresh Produce India 2025 also stages the launch of the brand-new Fresh Produce India Awards, a series of prestigious accolades recognising outstanding achievement in India’s fresh fruit and vegetable business.

Day Two offers a range of exciting tours to choose from. Delegates can get exclusive behind-the-scenes access to some of India’s state-of-the-art fresh produce distribution operations with hosted visits to the facilities of DJ Exports and Suri Agro Fresh. A visit to one of Reliance’s premium Freshpik formats also offers a guided tour of the experiential gourmet food store. A

New segments are emerging in India’s fresh produce market as suppliers and retailers meet different consumer needs such as health, value and convenience, says IG International’s head of procurement, Shubha Rawal.

by Liam O’Callaghan

Are there any recent key developments from your company you would like to share?

Shubha Rawal: IG International continues to strengthen its

position as a leading fresh produce importer in India. Recently, we have expanded our sourcing network, adding new origins for key categories such as apples, citrus, and berries to ensure year-round availability.

LEFT—IG International’s head of procurement Shubha Rawal

ABOVE—Health is playing an important role in consumer decision making

BELOW—Brands like Turkey’s IGet are finding success

OPPOSITE—Affluent urban consumers still seek out premium fruit

We have also invested in cold storage infrastructure and logistics to enhance supply chain efficiency, ensuring better quality and extended shelf life for our customers.

Additionally, our focus on digital transformation is enabling more seamless operations and better customer engagement

What has the overall imported fruit market looked like in India over the past 12 months?

by citrus, kiwifruit, and grapes. Despite economic concerns, Indian consumers are increasingly prioritising health and wellness, sustaining demand for high-quality imported produce.

What kind of trends are you seeing in the consumer market?

by affluent urban consumers who prioritise quality over cost. Additionally, there is a growing preference for packaged and ready-to-eat fruits, especially in metropolitan areas, where convenience is key. Health consciousness is also driving demand for nutrient-rich fruits such as berries and avocados.

What trends are you seeing in the imported apple market?

SR: The imported apple market in India is evolving with shifting supply dynamics and changing consumer preferences. Washington apples continue to be a dominant force, particularly in the premium segment. However, competition from Turkey, Iran, and Europe has intensified, especially in the mid-tier and pricesensitive segments. Turkey has gained market share due to its competitive pricing and strong supply of Red Delicious apples, while Iran continues to play a role in filling gaps in the lower price range.

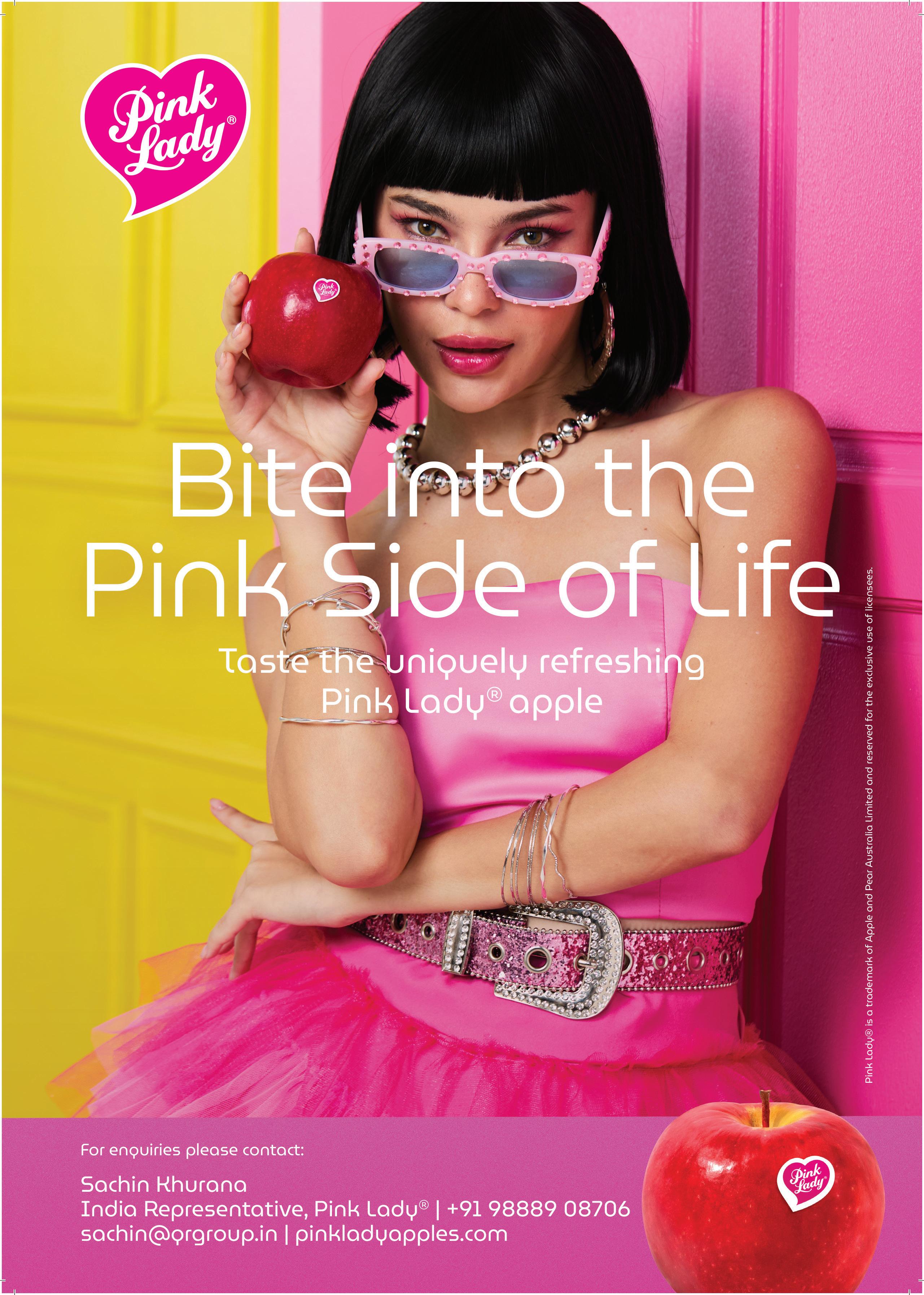

In terms of varieties, Red Delicious and Royal Gala remain a staple, but there is growing interest in premium varieties like Pink Lady, Cosmic Crisp, Envy, and Jazz. The premium segment is witnessing steady growth, driven by health-conscious and affluent consumers who prioritise taste and quality over price. While overall market demand remains stable, fluctuations in pricing and supply chain disruptions have impacted trade dynamics. However, as disposable income rises and awareness of premium apples increases, high-end varieties are expected to gain further traction.

Beyond apples, what are some standout developments in citrus, kiwifruit, and pears?

SR: Citrus remains a strong category, with increasing imports of Egyptian oranges and South African soft citrus. Kiwifruit demand is growing, driven by rising awareness of its health benefits, with SunGold kiwifruit seeing significant success. Pears, particularly from South Africa and Belgium, are holding steady, though competition from domestic production is increasing. The expansion of cold storage infrastructure is helping to maintain fruit quality, further supporting category growth.

SR: The past year has seen steady demand for imported fruits in India, though consumer buying patterns have evolved. While volume growth has been moderate, premium categories have continued to perform well. Market fluctuations, currency exchange rates, and supply chain challenges have influenced pricing and availability. Apples remain the dominant category, followed »

SR: India has not been immune to global inflationary pressures, but fresh produce remains a priority for many consumers. While some price sensitivity is evident, the premium segment has held steady, driven

Which of the smaller growth categories are standing out?

SR: Berries and avocados are two of the fastestgrowing categories in India. Blueberries have gained popularity, driven by increased consumer awareness of their health benefits and their growing presence in

modern retail and quick commerce platforms. Demand is also being fuelled by the influence of social media, where berries are often associated with wellness and premium lifestyles.

In addition to imports, local berry production is steadily expanding. Our Indian-grown blueberries are making their way into retail, helping to improve availability and price accessibility. As domestic production scales up with improved farming techniques and better postharvest management, local berries are expected to become a more significant part of the market.

Avocados, though still niche, are gaining traction. Hass avocados remain the most demanded variety. Consumer education and affordability remain key challenges for wider adoption, but as awareness grows – especially among younger, health-conscious buyers –demand is expected to rise.

Which brands, varieties and suppliers are finding success in India at the moment? And what do you think is driving this success?

SR: Global brands such as Stemilt

(apples), IGet (apples from Turkey) Zespri (kiwifruit), Jaguar, and Taj (citrus from Egypt), are performing well due to their strong brand positioning and consistent quality. Indian consumers are increasingly brand-conscious and prefer trusted names. Suppliers that offer reliable quality, strong marketing, and innovative packaging are gaining an edge. Additionally, suppliers who adapt their offerings to suit Indian consumer preferences – such as smaller pack sizes or tailored marketing strategies – are seeing better traction.

How is fresh produce retail evolving in India?

SR: The retail landscape is rapidly shifting, with quick commerce emerging as a key player in fresh produce sales. Platforms like Blinkit, Zepto, and Swiggy Instamart are making high-quality fresh fruits accessible to urban consumers in minutes. Traditional retail remains dominant, but online and organised retail are growing rapidly. The key to success in q-commerce is maintaining cold chain efficiency, ensuring quality, and offering competitive pricing.

Are there any other notable trends in India’s fresh produce market?

SR: Consumers are increasingly seeking transparency in sourcing, driving demand for traceable and sustainably sourced produce. Organic and pesticide-free fruits are gaining attention, though price remains a limiting factor. Additionally, the influence of social media and digital marketing is playing a crucial role in shaping consumer preferences. Subscription-based fresh produce delivery services are also on the rise.

Is there anything else you would like to add?

SR: India remains one of the most dynamic fresh produce markets globally, with immense potential for growth. While challenges such as logistics, import regulations, and price fluctuations persist, the long-term outlook remains positive. Companies that can balance affordability with premium quality, leverage digital platforms, and educate consumers about the benefits of fresh produce will continue to thrive. A

From Our Orchards to Your Table Australia's diverse climate and rich soils create the perfect recipe for juicy, sweet, and sun-ripened summerfruit. Every piece is hand-picked at peak ripeness, delivering a burst of flavor in every bite.

Indian consumers are displaying an appetite for higher value fruits, and they’re prepared to pay a premium, says Reliance Retail’s AVP fruits, Saurabh Raina.

by John Hey

Leading Indian supermarket chain Reliance Retail has seen remarkable growth in consumer demand for higher value fresh produce imports – from blueberries to branded apples – in the past year.

So says the retail giant’s assistant vice president fruits, Saurabh Raina. “Every two or three years, we see new consumer trends emerge. The latest in fresh produce is the rise of newer product lines such as mandarins, blueberries

and avocados,” says Raina. “We’re seeing really strong demand for the imports of these items, despite their premium prices.

“Take mandarins – they’re 30 per cent more

Reliance is mainly importing mandarins from South Africa, Australia and China, with Egypt also supplying fruit for a month or two, according to Raina.

“The main varieties from South Africa and Australia are Nadorcott (Afourer), Murcott and Tango, but we also bring in some seeded varieties from China which are similar to Orri,” says Raina.

“Imports have been growing strongly, and I think they’re gaining impetus from the fact India produces easy peelers too.”

It's a similar story with

charge for imported blueberries, according to Raina. The Andean nation has been shipping large volumes by air with very positive results. “The quality is outstanding,” he says. “They’re priced around US$23 per kg and they’re still selling really well.”

Peru’s gains have been fuelled by production of new proprietary varieties of low- and no-chill blueberries, which offer improved flavour, crunch and shelf-life, according to Raina. “These no-chill varieties can yield a crop within a year, so they’ve quickly made an impact,” he says.

India’s own blueberry production is also taking off, but Raina sees the growth in domestic supply only helping to expand the overall market. “Indian blueberries are helping to create awareness

for imported blueberries,” he says. “I don’t see Indian blueberries competing with imported fruit – I think they’re complementing it.”

Avocados is another newer product catching on with Indian consumers. “We’re working closely with Westfalia Fruit to develop the category with in-store promotions and samplings,” says Raina. “They’re supplying us with ripened and unripened product.”

Raina also sees a bright future for imports of more established products such as apples, with consumers showing growing interest in club varieties.

“Apple imports are continuing to grow, and the volume now equates to around 20-25 per cent of Indian apple production.”

Raina says club varieties such as Pink Lady, Red Pop and Inored are now coming into the market, adding excitement to the apple category. “There’s a segment of consumers willing to pay a premium for different varieties,” he observes.

Reliance’s upmarket Fresh Pik and Signature superstores, which curate a gourmet food experience for shoppers, serve as the ideal platform to trial these premium varieties, he notes. A

Our entire team, at our farms, packing plants and of ces, works towards our shared goal of offering fruit of the highest quality, freshness, and most delicious taste year round to Camposol´s partners and consumers around the world. Our commitment to innovation, consistency, traceability and integrity ensures our fruit will always provide an excellent eating experience.

Cost of living pressures are being felt by consumers and their search for value is influencing retailers and suppliers.

by Liam O’Callaghan

Price sensitivity is not a new trend in the Indian fresh produce market but the economic stresses that are putting pressure on consumers across the globe are certainly being felt.

Gagan Khosla of NGK Trading says retailers are trying to grapple with consumers’ budgets and remain an attractive option.

“Cost of living is definitely a factor,” he says.

“Retailers in India are looking to ‘mediocritise’ the market. They are not interested in premium products and [instead] offer the lowest prices,” says Khosla.

“In general, I think they are trying to find their feet and we need to be patient with them. Logistics is also a nightmare.

“I am hopeful that they will eventually realise the equation between quality, availability and pricing and consumption growth.”

Consumer shipping habits are also changing with a focus on convenience, particularly in more urban and affluent areas, a trend that has fuelled the emergence of quick commence.

“In urban areas, grocery shopping has been relegated to the house help, this tends to lower consumption at the household level and also push price points down. If people don’t go out and see what’s new at the fruit stand then they tend to buy the basic staples such as apples bananas and mangoes etc. They tend not to investigate cherries, berries or newer apple and pear varieties,” says Khosla.

“Quick commerce may soon outgrow brick and mortar, but even they are not trying to premiumise their game.”

The effects of this trend can be seen in the apple market where higher-cost suppliers such as the US and Chile have lost some market share according to Khosla.

“On the lower price point, Iran is king and Turkey’s volume is soaring as well. Poland is fast replacing Italy and France on Gala. South Africa has picked up significant share of the Southern Hemisphere pie and I see this growing. People’s purchase habits need to change to increase the premium market size,” he explains.

Despite these challenges, some smaller categories are finding success. The likes of avocado and berries continue to grow and Khosla notes health as a running theme.

“Avocados are a success story because of changing food habits to healthier options. Berries and mandarins are also growing because of convenience and of course the associated health benefits. Cherry penetration, though low at the moment, is beginning to grow as it is for plums,” says Khosla. A

YEMEE FERNANDES Managing director, Four Pillars Trading

Traditional marketing strategies often fall short in a market as diverse and dynamic as India. With its rich blend of cultures, languages, and evolving consumer behaviours, success demands more than just surface-level engagement. To truly resonate, brands must move beyond the ordinary, investing in deep, localised insights and crafting authentic connections.

In a cluttered marketplace, execution is the ultimate game-changer. Success isn’t just about pushing a product; it’s about creating meaningful partnerships. Seamless collaboration with online and offline retailers, distributors, and stakeholders is essential. Understanding their challenges, aligning on opportunities, and co-creating value at every step ensures lasting impact.

Marketing doesn’t operate in isolation – it weaves together business functions, sales, supply chains, and consumer engagement into a unified strategy.

An integrated approach is key to unlocking long-term success.

When launching Australian macadamias in India, our strategy was built around demand creation. Our goal? To educate, excite, and inspire consumers with the story behind Australian macadamias – premium, unique, native to Australia and indulgent

We crafted a compelling brand narrative, ensuring every touchpoint – from digital engagement to in-store experiences – reflected our core values. By localising our messaging for Indian audiences, we fostered authentic connections and built excitement around the product.

We launched the first-ever Australian Macadamia Festival in Mumbai (2023), bringing together top chefs and the food service industry demonstrating the versatility of the nut.

We partnered with ITC Fabelle to create an exclusive Australian macadamia chocolate range, elevating brand visibility and consumer interest.

We designed purpose-driven activations, from digital campaigns to in-store experiences, ensuring a unified and impactful brand presence.

The other key part was engagement with retailers such as Reliance, Foodsquare, Cred, and Amazon to name a few in order to drive sales and loyalty.

By prioritising education, collaboration, and storytelling, we didn’t just introduce a product –we built a movement. The success of Australian macadamias in India underscores the power of a fresh, insight-driven approach to market entry.

For brands looking to crack the Indian market, the lesson is clear: deep localisation, authentic storytelling, strategic partnerships, and an integrated marketing approach aren’t optional – they’re essential. A

DESH RAMNATH Director, HortiRoad2India

At Fresh Produce India in April, HortiRoad2India will pitch five concrete projects of farmers producing high-value crops while resolving the challenges faced by stakeholders across India’s fresh produce supply chain, paving the way for success, and giving them the competitive edge they seek.

Imagine your company can provide strawberries yearround to any city in India within a couple of minutes with the best quality, taste, aroma, and nutrition, and without residues. That your company can become a

welfare, public health, food security, and food safety, paving the way for a cleaner and more profitable food system in India.

The Indian economy is on the rise. India is leading the way in many industries while adopting new ones. With that economic growth, new investment potential arises giving way to innovations and profitability. Yet in the end, as the Indian

trusted partner for healthier and happier living and a healthier planet while growing your business and profit.

Imagine your top-notch, fresh, long-shelf-life exotics are always delivered on time and in full year-round, without blemishes at your store or distribution centre, and have the best nutritional value, taste, quality, and sustainability in India.

HortiRoad2India would like to introduce several sustainable food production projects that will contribute to a healthier society and planet, strengthen the Indian economy, and increase farmer incomes directly and indirectly. The upside of these projects is that they are very profitable by agricultural standards. That means they tick the boxes of economic growth, impact, farmer

government recently described, economic growth and innovation are driven by consumerism. Therefore it is important to increase the spending power of all Indians. The danger of consumerism on the other hand is the damage humanity inflicts on the planet and its other inhabitants. So consumerism should go hand in hand with doing good business, sustainable innovation, and responsibility for the future. Simultaneously the Indian retail market is expanding and changing

rapidly due to the growing economy, awareness, innovations, consumer wishes, tourism, and global trends for a healthier lifestyle and more sustainability.

In India, a large part of the population that is not yet benefitting from the economic revolution in India is working in the agriculture sector. It is vital those people can create a better life and add value to the economic and social development of India. At the same time, the agriculture sector in India has the biggest negative impact on nature, biodiversity, sustainability, soil, and air quality. Innovations that give rise to economic growth and sustainable food production for the growing population are the answer. The government needs stakeholders’ support and therefore obliges the financial industry to invest in the primary sector in India.

HortiRoad2India is working with Indian agri-entrepreneurs to supply high-quality, highly nutritious, sustainable, residue-free exotic produce using expertise, technology and knowledge from the Netherlands – produce that will always be delivered on time and in full, with the same high quality and consistency year-round, fulfilling customer demand, and meeting government rules and regulations on clean work environments, higher farmer income, and sustainability. A

ABOVE—HortiRoad2India has partnered with Indian agri-entrepreneurs to create sustainable supply solutions for retailers

State-of-the-art facilities feature automated ripening rooms and packing lines as well as integrated low-oxygen chambers to enhance shelf-life.

by Bree Caggiati

Indian ag-tech company, Superplum, has opened its own fruit distribution centres in Delhi and Bangalore.

The facilities have expanded the company’s distribution and ripening capabilities, which Superplum says will help consumers receive better quality fruit.

Superplum was initially founded in a bid to address India’s fresh produce supply chain challenges. The company set out to design and build an all-new supply chain process, digitising the farm-to-store network and delivering consumers fresh and fully traceable food that is free of pesticides and gives farmers a better deal.

The new centres play a key role in this comprehensive, technology-driven and temperaturecontrolled supply chain. Both centres feature cuttingedge infrastructure that addresses the critical challenges in the current fruit distribution ecosystem.

Key features include automated ripening rooms that utilise the company’s Freshmanager software, automated packing and labelling lines which integrate

ABOVE—The new facilities feature cutting-edge infrastructure BELOW—Superplum’s automated packing and labelling line

with the company’s produce management systems, and integrated low-oxygen chambers to enhance shelf-life and reduce wastage.

According to Superplum, this modern and safe ripening system represents a significant step forward for India’s distribution landscape.

“Our new distribution centres represent a refreshingly new approach to fruit handling in India,” says Shobhit Gupta, Superplum co-founder and chief executive.

“Indian consumers are demanding better quality fruit, and we are making investments and innovating to keep up with growing expectations.” A

Devi Prasad, chief owner representative – India at Sinotrans Container Lines, discusses the China-owned shipping group’s expansion into India.

by John Hey

RIGHT—Devi Prasad, Sinotrans’ chief owner representative –India

BELOW—Sinotrans is expanding its reefer market coverage

Please can you give us an overview of Sinotrans Container Lines and its presence in India?

Devi Prasad: Sinotrans Container Lines is part of China Merchant Group, a Fortune 500 company founded in 1872. Sinotrans is a Chinese state-owned enterprise established in Shanghai on 28 May 1998. It is mainly responsible for the centralised operation of the container transportation business covering all the main coastal ports such as Shanghai, Ningbo, Dalian, Qingdao, Xiamen, Shekou, Nansha and Hong Kong. It has good coverage of inland and river ports, which is one of our competitive advantages.

We started our service into the East Coast of India from China in September 2023 covering Chennai

and Visakhapatnam. Our West Coast coverage into Nhava Sheva and Mundra from China started from October 2024. We are known as a world-class shipping enterprise with a comprehensive global port coverage and smart logistics platform. Our particular strengths are the China, Far East, Japan, Australia and India sectors.

What are your main freight services or routes? And which ones are most important for the fresh produce trade?

DP: Sinotrans provides one of the best services with the fastest transit times from the east and west coasts of India to China, Japan, Australia and the Philippines. Our head office plans to expand our coverage from India to include more parts of South-East Asia, the Gulf, the Middle East and East Africa. This will give us greater network coverage and expand our services for our customers in India both on the import and export fronts. Currently, our reefer exports from both south and west India are predominantly into China and Japan. We expect our reefer market coverage to grow to cover all our serviceable sectors in the future.

The Red Sea issues have seriously impacted shipping times and services for Indian fresh produce exporters seeking to reach important customers in Europe and beyond. How has Sinotrans been managing this issue?

DP: The Red Sea issues have not impacted Sinotrans much. In fact, our growth on key sectors has only increased against all odds and we remain committed to managing all challenges to provide the best service to our esteemed customers.

The Indian government is making massive investments to upgrade port, road and rail infrastructure across the country. How do you see this changing the logistics landscape?

DP: Over the next ten years, India’s performance on the global stage is crucial to overall maritime growth. Our company is fully committed to being part of the India growth story. New ports are coming up in India such as Vizhinjam Terminal which will become a major transshipment hub out of India, and the Vadhvan Terminal project, which is being developed in Maharashtra state. Projects like these will boost India’s global connectivity by making it easier for large container vessels to call at Indian ports. A

Hong Kong 3|4|5 Sep 2025

Asia's fresh produce trading hub

Knowledge Partner

Official Partner Country

Booth No. 14 Visit us in Fresh Produce India

Asia's premier fresh produce event returns to Hong Kong on 3-5 September 2025 - and the buildup gets under way with roadshow of Meet Ups across key markets.

ASIA FRUIT LOGISTICA, Asia's leading trade show for the fresh fruit and vegetable business, is back in Hong Kong on 3-5 September 2025.

Join Asia's largest gathering of the global fresh produce business and showcase your products to top international buyers and decision-makers from the entire value chain and across the world.

ASIA FRUIT LOGISTICA reaff irmed its status as the premier international trade platform for Asia's fresh fruit and vegetable business on 4-6 September 2024 with another vibrant, sell-out show in Hong Kong.

The event drew over 13,000 high-calibre trade visitors from more than 70 countries and regions. They explored an impressive array of premium products and services showcased by over 760 exhibitors from 42 countries and regions.

In 2024, ASIA FRUIT LOGISTICA launched the Retailer's Club which significantly enhanced business and networking opportunities. Retail buyers and exhibitors took advantage of ASIA FRUIT LOGISTICA's innovative Speed Dating service and enjoyed substantial benefits.

Furthermore, attendees acquired invaluable business insights and information at ASlA FRUIT LOGISTICA through the launch of the ASIAFRUIT KNOWLEDGE CENTRE.The brand-new content hub, powered by Asiafruit Magazine, was another highlight on the show floor.

“We were thrilled with the success of ASlA FRUIT LOGISTICA 2024,”said David Axiotis, managing director of Global Produce Events, the organiser of ASIA FRUIT LOGISTICA.“The energy, innovation, and business growth opportunities were unmatched. lt's truly rewarding to witness the fresh produce industry come together in such a dynamic way, driving forward the future of the trade in Asia.”

ASIA FRUIT LOGISTICA is building even more momentum for this year's trade show with its roadshow of Meet Ups in key markets across Asia.

The series of content-backed networking events showcase industry innovation and deepen ASIA FRUIT LOGISTICA's connections across the region, adding value for visitors and exhibitors.

Save the dates below and for more information, visit: https://www.asiafruitlogistica.com/ meet-ups-2025/

● India: Mumbai, 3-4 April 2025

● Vietnam: Ho Chi Minh City, 13-14 May 2025

● Thailand: Bangkok, 25 June 2025

● China: Guangzhou, 8-9 September 2025

● Peru: Lima, 28-29 October 2025

Meet up with us on the way to Hong Kong and get ready for Asia's biggest gathering of the global fresh produce business on 3-5 September 2025.

Exhibitor can register to book their stand at ASlA FRUIT LOGISTICA. Register online today to secure your location https://www.asiafruitlogistica.com/why-exhibit/

Exhibitor can register to book their stand at ASlA FRUIT LOGISTICA. Register online today to secure your location https://www.asiafruitlogistica.com/ why-exhibit/

Various sponsorship and onsite advertising opportunities available to maximize exhibitors' exposure https://www.asiafruitlogistica.com/become-asponsor/

Various sponsorship and onsite advertising opportunities available to maximize exhibitors'exposure htps:/www.asiafruitlogistica.com/become-a-spon sor/

To become a sponsor of ASIA FRUIT LOGISTICA or any of the ASIA FRUIT LOGISTICA Meet Ups series, contact our senior business development manager, Kay Kwok: kay@gp-events.com

Please visit us in Booth No. 14

PUBLISHED BY

South Africa’s sustainable approach to export development sees the leading table grape supplier balance traditional markets with Asian expansion

PRODUCTION

EXPORTS

MARKETING

VARIETIES

LOGISTICS

CERTIFICATION

TABLE GRAPES OF OUTSTANDING QUALITY AND TASTE, WHICH ARE RESPONSIBLY GROWN IN SOUTH AFRICA TO MEET THE HIGHEST GLOBAL STANDARDS, START THE JOURNEY FROM THE FOOT OF TABLE MOUNTAIN TO REACH MARKETS AND TABLES AROUND THE WORLD.