EUROF RUIT

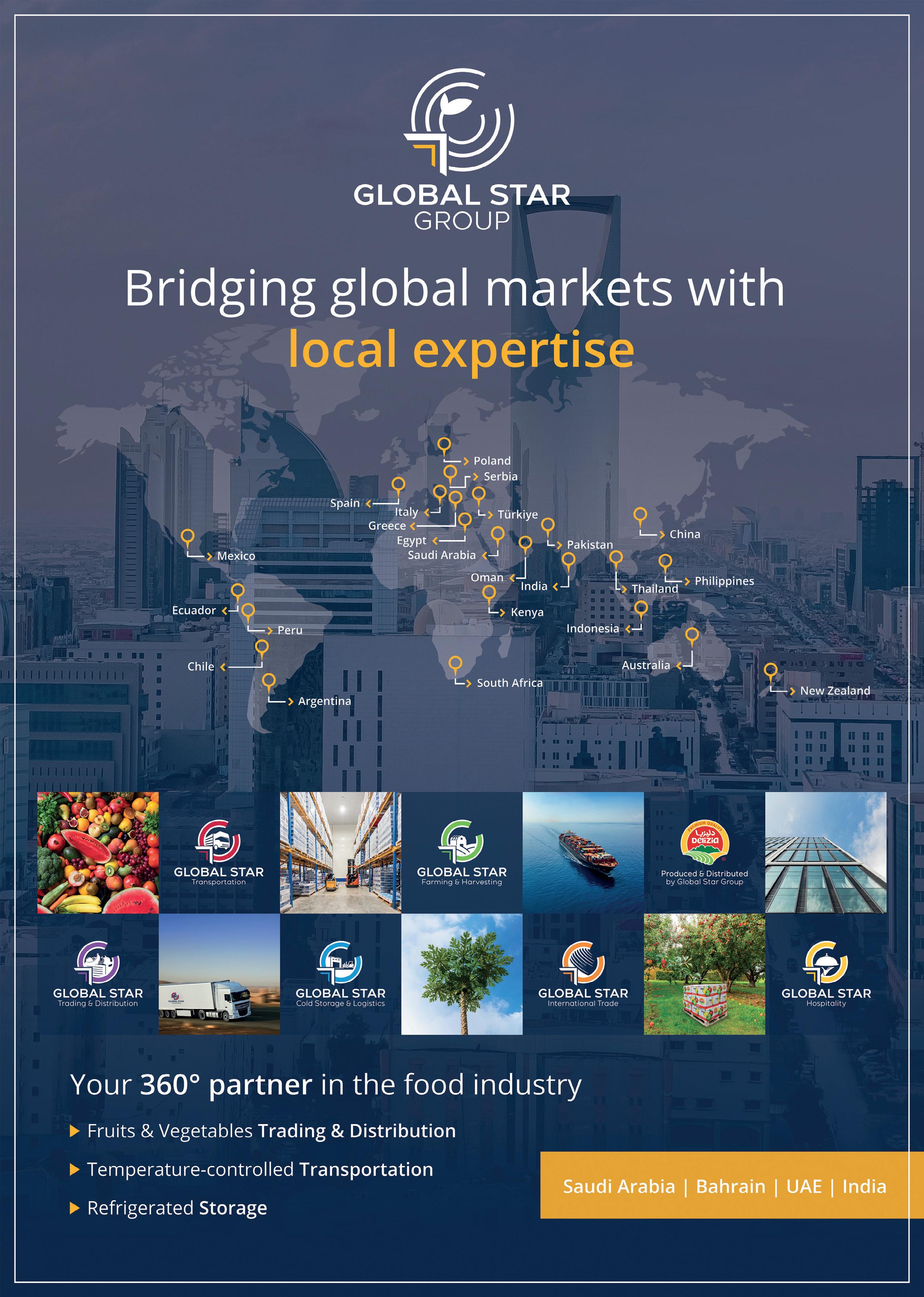

PUBLISHED BY

PUBLISHED BY

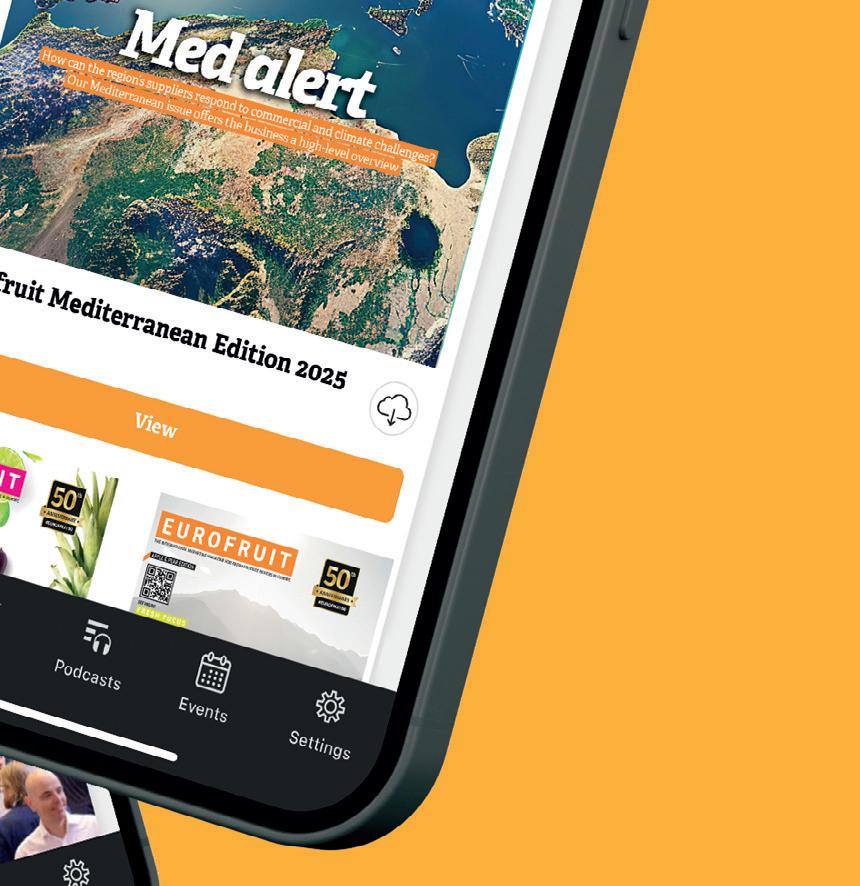

How can the region’s suppliers respond to commercial and climate challenges? Our Mediterranean issue offers the business a high-level overview

Emerging suppliers in the Mediterranean need to remember: get your marketing message right and the fruit will sell itself

Iwrite this having just returned from the Fruitnet Berry Congress in Rotterdam, where the general atmosphere was distinctly upbeat. Turns out the berry business is in rude health – and with consumer confidence and spending on the rise and new genetics driving improvements in quality and consistency, the feeling is that there is still plenty of room for further growth in the category. New supply sources across the Mediterranean region are brimming with potential – Egypt and Tunisia to name just two – while now established producers like Peru are undergoing a dramatic varietal transformation. The business has identified two consumer trends, health and snacking, as key drivers of growth and are fine-tuning their messaging to ensure they make the most of this opportunity. It’s an example that other categories would do well to follow. Next week takes us to Valencia for the first-ever Fruitnet Citrus Congress, where the theme is how to identify better ways of selling citrus and making the category more profitable. As Genesis Fresh’s recent FLIA win with Onix shows, there’s plenty of innovation in citrus. And big strides are being made with branding too. Will the business find the right way to communicate this to consumers? Watch this space… E

Media International GmbH, Lindemannstrasse 12, 40237 Düsseldorf, Germany

8 US tariffs on EU exports

Veg exporters “closely monitor” situation

10 News in Brief

All of the latest key developments

16 Fruit Logistica Innovation Award

AMFresh picks up main award for Onix

18 Anecoop enjoys record turnover

Spanish cooperative presents 23/24 results

20 EU simplifies rules on sustainability

Mixed reaction to revised CSRD rules

22 BayWa picks new chief executive

Frank Hiller is named chief executive

23 Shaffe appoints its next leaders

Nathan Hancock becomes president

24 New tomato source in Central Asia?

Why Uzbekistan could sell more in Europe

25 Chilean cherries face tough questions

Chinese market collapse poses challenge

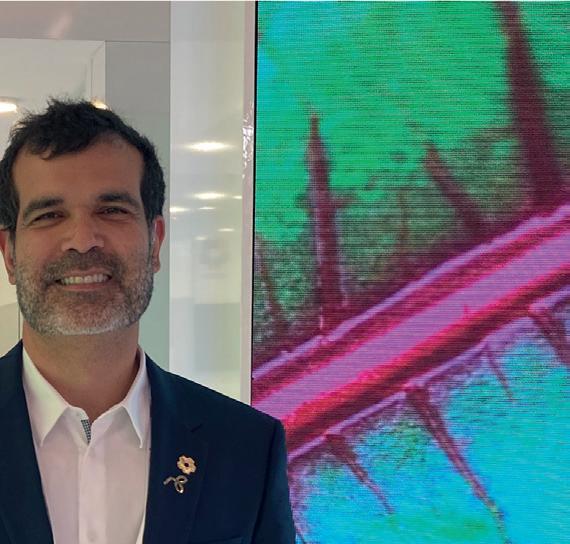

26 Interview: Bernardo Calvo, Sun World

”Golden age” for grape variety development

30 New leadership for South African grapes

Alwyn Dippenaar is new Sati chairman

32 Spain puts in strong performance

Produce exports are on the up, says Fepex

33 Grupo Lomar remains positive

Growth in store for onions and garlic

34 Anecoop unveils Red Bouquet

Blood orange brand gets Berlin launch

36 Spanish retail wants more domestic fruit

Supermarkets opt for local apples and pears

38 Cosmic Crisp freshens up online presence

New web portal aims to build community 40 Battaglio forms pineapple venture

Importer invests in Costa Rica

Tough road ahead for Greek kiwifruit

Price pressures cause frustration

Israeli start-ups prioritise sustainability

Food security remains front of mind

Alanar shifts focus to own production

Turkish exporter adopts new strategy

France and Morocco reach deal

Compromise on tomato competition?

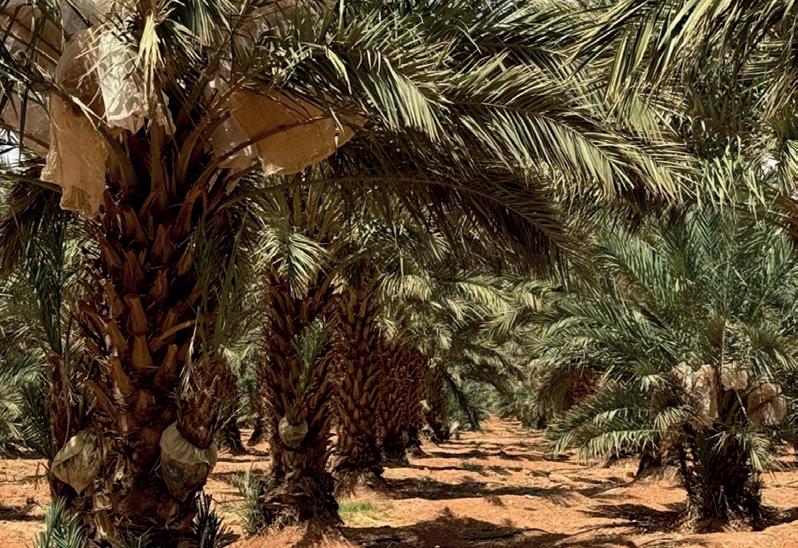

Jordan’s date industry takes off

Exporter confirms ‘massive’ investments

47 Opportunities for Côte d’Ivoire mangoes

48

ADF Agro targets premium market

Saudi Arabia seeks partners

Topian commits to reshaping production

50 Where next for Chilean kiwifruit?

53

Sector could thrive with right varieties

Zespri gets through to consumers

Kiwifruit brand reaches 100mn households

54 Justin Chadwick set for retirement

CGA’s chief executive takes a look back

56

58

60

62

68

69

70

74

76

New Spanish orange protocols for India

Cold treatment to be allowed in transit

European avocado consumption

New heights reached, says WAO

Kenyan avocados ripe for growth

Enzispring spies export opportunities

Interview: Wim Destoop, Westfalia

Positive future for avocados

Pink Lady lays out ambition

Goal for 100mn annual consumers by 2030

Blue Whale revamps apple aisle

Consumer-centric effort working in France

Interview: Matthiew Maxant, Sakata

Vegetable seed firm shares innovations

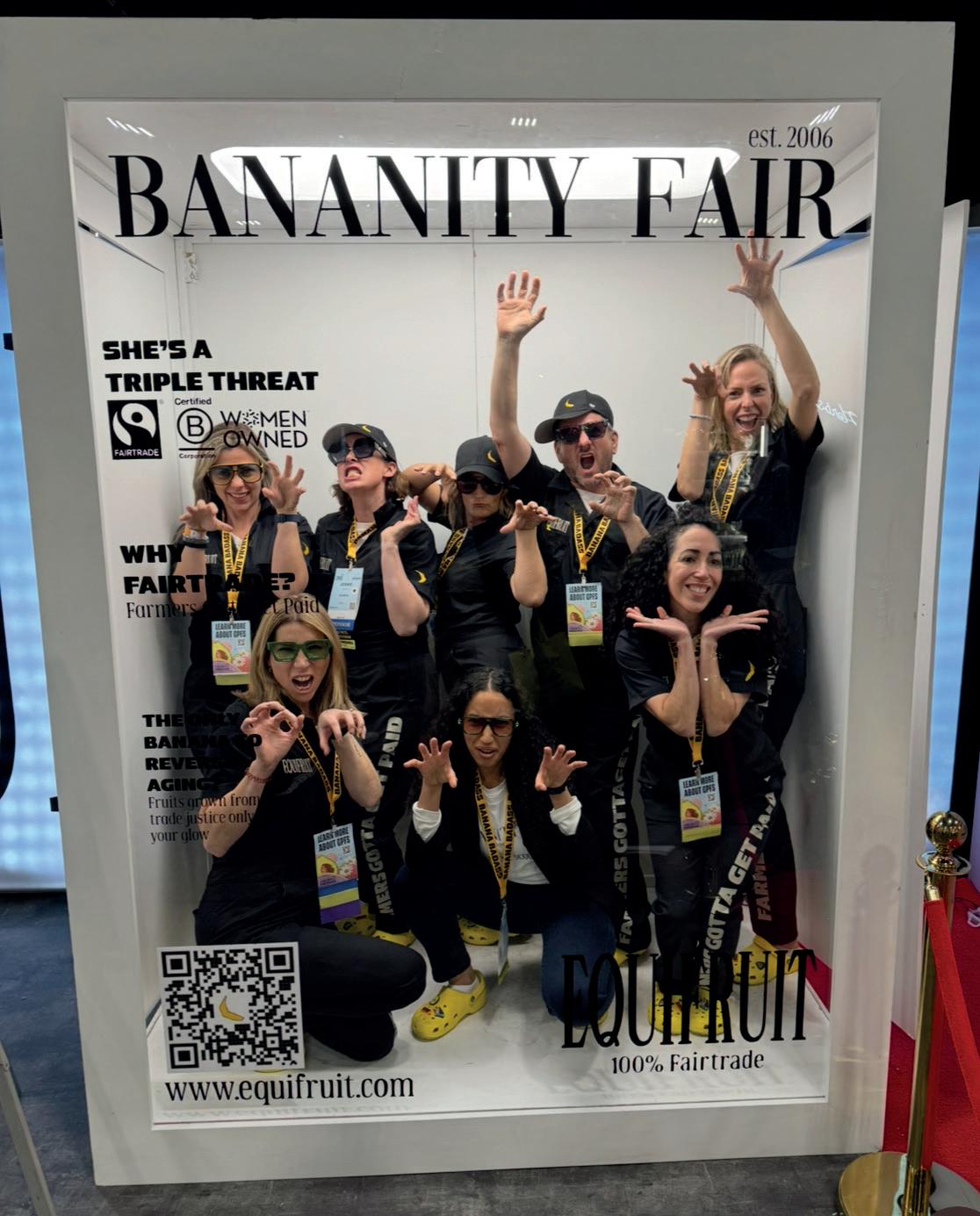

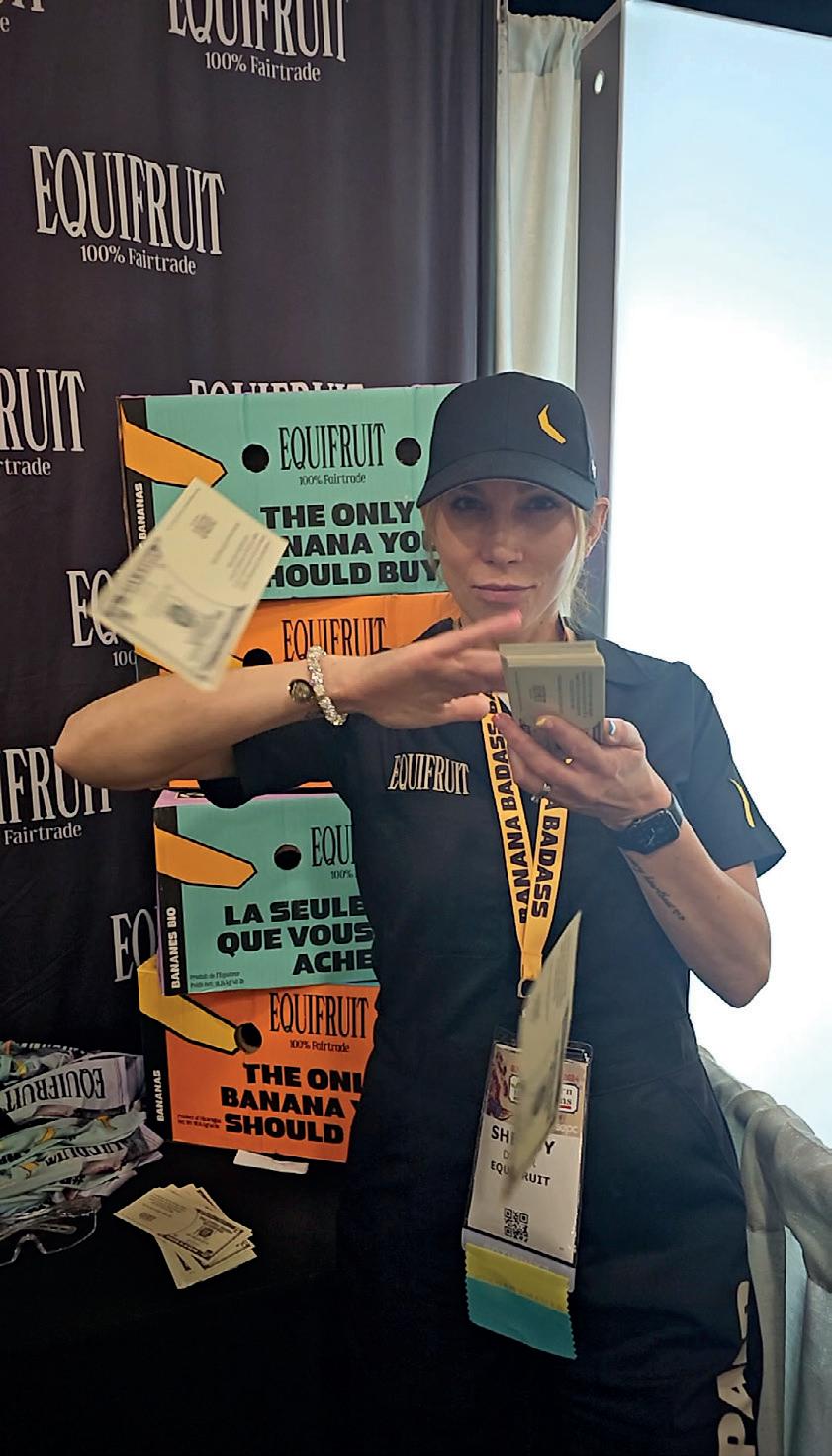

‘Banana Badasses’ take on world

Canada’s Equifruit intent on disruption

IFPA implores US Congress

‘Bipartisanship’ needed to help growers

78

80

Fresh Take: Madrid, Spain

A shift in the country’s balance of trade

Store Check: Woolworths

Kiwi grocer puts on innovative display

fruitnet.com/berrycongress

Fruitnet Berry Congress brought together leading players from the global berry category to connect and share in-depth experience and expertise, whilst exploring new ideas.

instagram.com/fruitnet

Follow Fruitnet's Instagram page for regular photos and updates from the Fruitnet team.

fruitnet.com/eurofruit eurofruit's news website provides regular updates on all the top stories from the European fresh fruit and vegetable business. News

https://desktop.eurofruitmagazine.com

Download the new Eurofruit app onto your smartphone or tablet from the App Store or Google Play. Stay informed of the latest fresh produce industry developments, and enjoy our magazines in new user-friendly digital formats.

linkedin.com/showcase/eurofruitmagazine

Expand your network of professional contacts and join the fresh produce conversation by visiting the eurofruit LinkedIn account. LinkedIn

x.com/eurofruit

Keep up to date with news, opinions and developments from around the European fresh produce trade by following our dedicated X account.

fruitnet.com/freenewsletter

Fruitnet Daily News is the fresh produce industry's leading source of news, information and insight. Available free to all, it is essential reading for those who need to keep track of developments and trends in the international fruit and vegetable business.

https://anchor.fm/fruitbox

Listen to Fruitnet's podcast series hosted by managing director Chris White in London. The Fruitbox podcast features conversations and interviews with leading industry experts. Fruitbox

SINCE 1973

managing director, fruitnet europe

Mike Knowles

+44 20 7501 3702 michael@fruitnet.com

managing editor Maura Maxwell

+44 20 7501 3706 maura@fruitnet.com

deputy editor

Carl Collen

+44 20 7501 3703 carl@fruitnet.com

features editor

Tom Joyce

+44 20 7501 3704 tom@fruitnet.com

staff writer

Fred Searle

+44 20 7501 0301 fred@fruitnet.com

design manager

Simon Spreckley

+44 20 7501 3713 simon@fruitnet.com

senior designer

Qiong Wu

+61 3 9040 1603 wobo@fruitnet.com

senior graphic designer Mai Luong

+44 20 7501 3713 mai@fruitnet.com

graphic designer

Asma Kapoor

+44 20 7501 3713 asma@fruitnet.com

head of events and marketing

Laura Martín Nuñez

+44 20 7501 3720 laura@fruitnet.com

events executive Maria Santamaria Peláez +44 20 7501 3719 mariasan@fruitnet.com

MANAGEMENT

commercial director Ulrike Niggemann

+49 211 99 10 425 ulrike@fruitnet.com

managing director

Chris White

+44 20 7501 3710 chris@fruitnet.com

sales director

Artur Wiselka +44 20 7501 0309 artur@fruitnet.com

senior sales manager

Giorgio Mancino +44 20 7501 3716 giorgio@fruitnet.com

us & canada

Jeff Long +1 805 448 8027 jeff@fruitnet.com

italy

Giordano Giardi +39 059 786 3839 giordano@fruitnet.com

spain, latin america, middle east

Belén Barbini +34 615 051 357 belen@fruitnet.com

spain, latin america, middle east

María del Mar Valenzuela +34 671 378 856 maria@fruitnet.com

germany, austria, switzerland, middle east

Heike Hagenguth +20 100 544 5066 heike@fruitnet.com

morocco, france, tunisia Cristina Delof +34 93 000 57 54 cristina@fruitnet.com

south africa

Fred Meintjes +27 28 754 1418 fredmeintjes@fruitnet.com

asia pacific

Kate Riches

+61 3 9040 1601 kate@fruitnet.com

finance director

Elvan Gul +44 20 7501 3700 elvan@fruitnet.com

accounts receivable

Tracey Haines +44 20 7501 3717 tracey@fruitnet.com

finance manager

Günal Yildiz

+44 20 7501 3714 gunal@fruitnet.com

subscriptions +44 20 7501 0311 subscriptions@fruitnet.com

Christian Abud abud y cía

Christian says disease has kept kiwifruit production growth in check in Chile –but with the right varieties and rootstocks, the sector could thrive.

kiwifruit–p26-28

Fred Meintjes eurofruit

Fred catches up with Justin Chadwick, who will soon retire as chief executive of the Citrus Growers Association, to look back at three decades of service.

citrus–p54-55

Gerry Kelman

freelance journalist

Gerry looks at Israeli start-up companies who showcased their food security and sustainability solutions at January’s Food Sec & Tech conference.

mediterranean–p42-43

Michael Barker

fresh produce journal

Michael speaks to Canadian supplier Equifruit, which is using innovative marketing in its drive to secure fairer returns for banana producers.

north america–p74-75

With Kiwi Vision 3 and UNIQ Kiwi your kiwifruit have more value. Nothing is left to chance thanks to an efficient and complete sorting of the qualities: external quality and internal quality, in addition to weight, optical size and color

FRESKON

Thessaloniki, Greece

April 10-12, 2025

Pav.15 - Booth C2-C3

UNITEC Headquarters Via Prov.le Cotignola, 20/9 - 48022 Lugo RA - Italy - Ph. +39 0545 288884 - unitec@unitec-group.com unitec-group.com

The potential impact of Donald Trump’s tariff wars remains highly uncertain, but for European vegetable exporters targeting the US market, much may depend on the availability of alternative sources.

by Tom Joyce

Export volumes of European vegetables to the US may not be massive, but the imposition of a 20-25 per cent tariff on EU imports would certainly create challenges for those targeting the US market.

Many European vegetable exporters have been increasing their focus on the US market in recent years, and this measure risks hurting their competitiveness, according to Steve Alaerts of Antwerp, Belgium-based logistics service provider Foodcareplus.

Alaerts foresees various possible eventualities, not all of them negative, but argues fervently against such obstacles to fair trade.

“At Foodcareplus, we strongly support fair and thriving international trade, and we align with the International Fresh Produce Association’s (IFPA) position, which states that fair trade expands markets, drives prosperity and ensures access to fresh, nutritious foods worldwide,” he said. “While tariffs can sometimes address trade imbalances, their broad application

disrupts supply chains, raises costs for consumers and places unnecessary strain on growers and producers. Instead, IFPA advocates for swift and meaningful regulatory relief and reform as the most effective way to support agriculture and strengthen food security.”

Research from ABN Amro predicted that Dutch food exports to the US — worth around €2.3bn in 2023 — would be more than halved were a 25 per cent import tariff fully passed on to customers, according to Financieele Dagblad.

Only Spain sends more vegetables from the EU to the US, but Dutch vegetables have already seen a decline to the market in recent years. Exports stood at 8,850 tonnes in 2024, according to statistics from Eurostat, nearly half the volume sent to the US in 2019. France was in third place in 2024, sending 2,412 tonnes

of vegetables to the US, including shallots from the region of Brittany.

According to Pierre Gélébart of marketer Prince de Bretagne, French shallots have already faced a tax of 100 per cent that has caused export volumes to plummet over the years.

“Shallots produced on the West Coast of the US are sent by truck to the East Coast,” he explained, “but it’s actually cheaper to ship French shallots by container across the Atlantic.”

A silver lining for fourth-placed Belgium is that its vegetable exports to the US remain limited, falling to just 739 tonnes last year, according to Nele Van Avermaet of VLAM, Flanders’ Agricultural Marketing Board.

“There are some exports of vegetables, but these have been

LEFT—Many European vegetable exporters have been increasing their focus on the US market

BELOW—Steve Alaerts of Foodcareplus

declining year after year, mainly due to decreasing volumes of Belgian endives,” she told Eurofruit “Additional tariffs might be the final blow to these already limited export volumes.”

However, there is good news for Belgian endives. Van Avermaet pointed to a Rabobank study on the importance of price elasticity in determining the impact of tariffs on a given product.

“If a product operates in a highly competitive price market, higher tariffs will have an impact, as buyers will simply look for the product from another supplier or within their domestic market,” she said. “However, if a product is price inelastic and the market does not react to price increases (Rabobank uses EU olive oil as an example), the impact of the tariffs will be less significant.”

Van Avermaet fears that many Belgian and European fruits and vegetables are fairly easily replaceable by alternative sources. Certain products, on the other hand, including Belgian endives and celeriac, are mainly produced in the affected regions of the EU, Canada, China and Mexico, she observed. E

Geopolitical antagonism in North America and Europe looks set to make things a little rough for the fresh produce business in the next few months and years. North America’s importers are “concerned” about the impact that US President Donald Trump’s tariffs on imports from Canada, Mexico, and potentially the EU, could have on fruit and vegetable prices, the health of consumers, and the longterm sustainability of the region’s fresh produce trade. And as trading partners retaliate, the outlook for US produce exports looks bad. In Canada, for example, there are already signs that consumers plan to boycott US imports.

Writing for Fruitnet, former Pear Bureau Northwest CEO Kevin Moffitt said the negative consequences in terms of US market prices could soon be all too apparent. “Fruit and veg prices could be impacted very quickly, making popular imported berries and avocados from Mexico more expensive to American consumers for example,” he explained. US fruit exporters also stand to lose out as a result of retaliatory duties imposed by Canada and Mexico in response to the US import tariffs, he suggested.

The Southern Hemisphere’s apple production is up, its pear production is down. That’s the headline from Wapa’s latest forecast, which compiles data from Argentina, Australia, Brazil, Chile, New Zealand and South Africa. In New Zealand, apple and pear exports have just topped NZ$1bn for the first time.

Spain appears to be producing less fresh produce, exporting more, and importing more. Egypt, Indonesia

and Ukraine have all overtaken the country when it comes to fruit and vegetable output. Faostat data shows its output fell by 10 per cent between 2020 and 2023, from 31mn tonnes to 28mn tonnes. And a separate report reveals that Spain spent more on fresh produce imports in January-October 2024. Morocco was the country’s leading supplier, but Peru and France have both caught up, with Portugal in fourth place.

“When there is an excess of supply, prices go down and when there is less supply, prices go up.” The words of Antonio Walker, president of Chile’s National Association of Agriculture and former agriculture minister, after this year’s record cherry export volume triggered a 50 per cent drop in prices ahead of the Chinese New Year festival. New data shows a 75 per cent increase in the country’s cherry export sales for this campaign, to US$1.1bn. But a 158.7 per cent rise in volume underlines the trade’s devaluation.

Peru’s mango exports seem to have recovered strongly after a disastrous 2023/24, according to new analysis. Exports reportedly totalled 129,115 tonnes worth US$184mn to December 2024, up 530 per cent in volume and 240 per cent in value compared with the year-earlier period.

In Argentina, producers in Río Negro warn that tens of thousands of tonnes of apples and pears could go unharvested in the first quarter of 2025. That’s because their costs are prohibitively high, they say, the result of exchange rates, falling consumption, oversupply, increased input costs, high taxes and a general decline in export volumes.

China could play a greater role in the international table grape market as a supplier, according to Riaan Swart of Dole. “The country has increasingly become a net exporter of grapes over the last three to four years and is still growing,” he commented.

Rwanda appears to be getting in on the avocado act. According to new government figures, weekly exports have risen from 2-3 tonnes in 2021 to 15-20 tonnes in 2023/24, driven by strong international demand.

ABOVE—It’s been a challenging season for Chile’s cherry exporters

British berry growers face an uncertain future as energy and labour costs increase. Despite record UK sales and strong sales growth, some argue unfair retail contracts threaten their survival. Meanwhile, David Sanclement, CEO of The Summer Berry Company, says the market could soon enjoy more year-round local supply, especially strawberries.

» LEFT—Washington apples at a supermarket in Canada (Photo: Hoang Bao Nguyen)

Avocados are the latest product in the fresh produce department that Aldi South Group has introduced to its new responsible sourcing model. Listen online to the latest episode of Fruitbox to hear our exclusive interview with Franka Rodriguez, director of global sourcing at Aldi South Group.

UK market leader Tesco says papaya is now its fastest-growing fruit line, with demand for fruit rocketing by 160 per cent in a year. Tesco has also teamed up with AMT Fresh and Bloom Fresh to create new packs that categorise grapes by tropical flavour, candy flavour, or crunchiness.

New research published by GroentenFruit Huis shows that shoppers in the Netherlands spent less on precut vegetables last year and instead spent more on cheaper meal kits that combine different vegetables needed for specific recipes.

BerryWorld has agreed terms with Tropic Cool Israel to establish Rwanda Berries, a commercial-scale berry farm in Rwanda. The venture plans to export to nearby markets in the Middle East, Europe and Central Asia.

Dutch cooperative Zon has added several new members – all of them major suppliers of fresh produce with their own large-scale retail contracts –in a sign of further consolidation in the Netherlands’ fresh produce supply base. Fellow Dutch marketer The Greenery, meanwhile, has just secured new subsidy funding to support its growers and help them develop more sustainable supply chains.

In neighbouring Belgium, Greenyard has posted a 5.6 per cent increase in sales for the nine months to 31 December, taking its net revenue to €3.95bn.

Mission Produce has added more than eight sources to its global sourcing network in the last year, as it seeks to meet growing global demand for products including avocados and mangoes.

Berry breeder Planasa has acquired ABZ Seeds, a breeder of seed-propagated F1 hybrid strawberry varieties.

ABOVE—Papayas are Tesco’s fastest-growing fruit product LEFT—Berryworld’s blueberry portfolio includes Mountain Blue variety Eureka Sunrise

»

Italian company Battaglio has consolidated its historic ties with the Corrales family-run pineapple plantation in Alajuela, Costa Rica, to form export joint venture Agricola El Camino. The new company will operate around 500ha of production in what is regarded as one of the best-suited areas for pineapples in the country.

Freshmax Group, a leading player in the Australasian fresh produce industry, has announced its acquisition by Sydney-based alternative investment manager, Roc Partners.

In the US, Vanguard Group International has added citrus – including mandarins and oranges from South America, Egypt, Israel, Morocco, and South Africa – to its North American sales and distribution arm, Vanguard Direct.

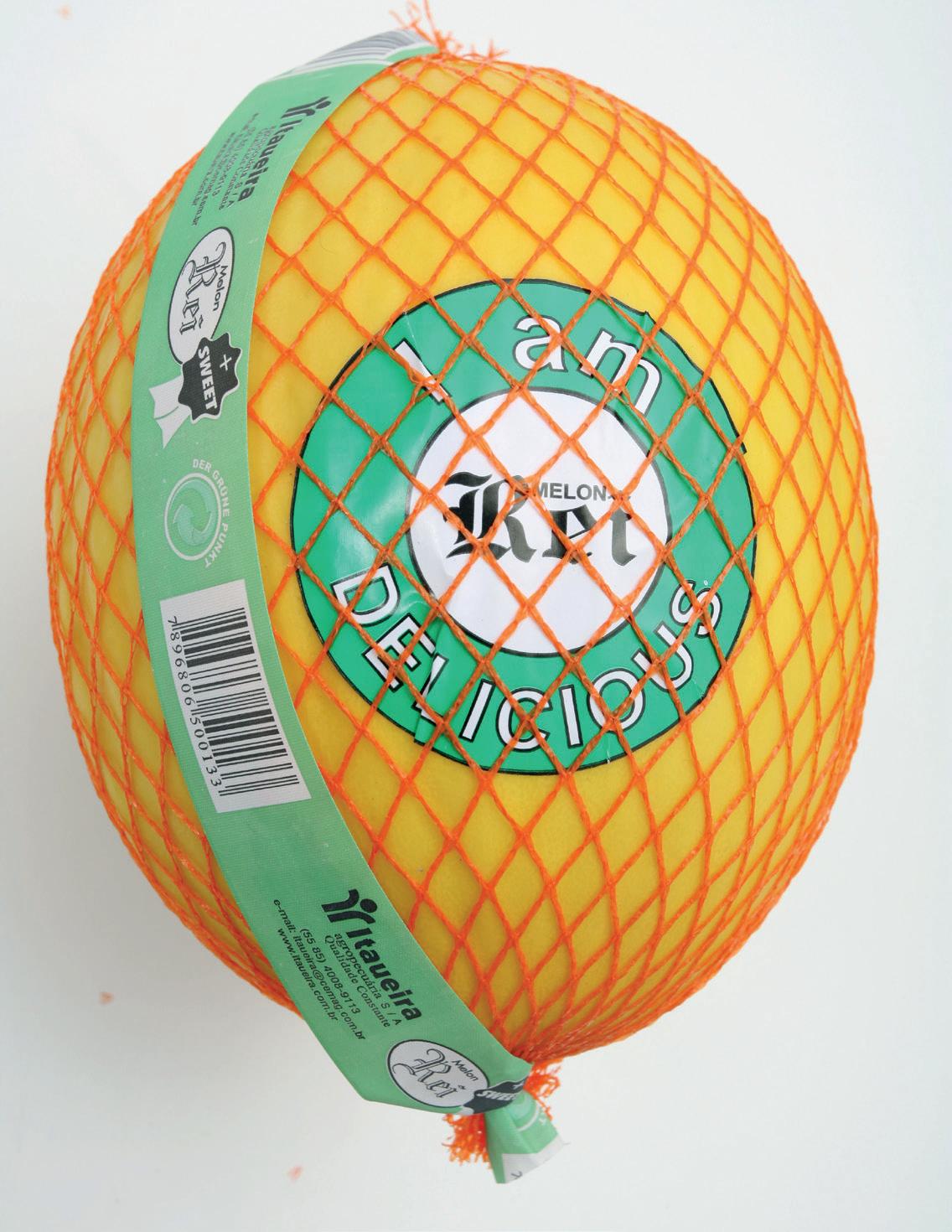

Itaueira says it will export its Rei-branded yellow melons again, after a seven-year break. The Brazilian supplier is just one of many that aim to capitalise on new international demand.

The Southern Hemisphere Association of Fresh Fruit Exporters (Shaffe) has named Nathan Hancock of Citrus Australia as its new president, and also appointed Jorge de Souza of Abrafrutas in Brazil as vice-president.

The president of Sun World International, Bernardo Calvo, has been promoted to chief executive officer, with David Marguleas moving to executive chair.

Planasa has appointed Hans Liekens as global head of innovation. He was previously value chain and retail manager at blueberry variety brand Sekoya, and before that worked as commercial manager for EMEA at Fall Creek Farm & Nursery.

Giulia Montanaro, former head of international relations at the country’s apple industry association Assomela, has joined Italian apple brand Sambòa as its general manager.

The California Table Grape Commission has appointed Alexandra Merritt as director of global marketing and Lisa Massie as director of international marketing for Asia, following the recent retirement of Susan Day

Oppy’s John Anderson will join a list that includes eight US presidents – including Ronald Reagan and Jimmy Carter – when he receives the International Humanitarian Ellis Island Medal of Honor. The ceremony takes place on 10 May.

Berry marketer Driscoll’s plans to introduce its premium range Sweetest Batch in new markets like the Middle East, Germany and eventually the UK after successful roll-outs in the US and Australia.

Strong demand combined with New Zealand’s largestever (190mn trays) – and earliest-ever – crop has put the kiwifruit exporter Zespri on track to exceed its global revenue target of NZ$4.5bn this season. Included in that figure are more than 3mn trays of RubyRed kiwifruit, which means the variety will be available for the first time in some markets.

Nador Cott Protection has taken legal action against a second unnamed British retailer over what it says is the “unauthorised sale” of Tango/Tang Gold mandarins.

Spanish tropicals specialist Montosa says it has reduced its use of plastic packaging by 90 per cent in the last three years, substituting it for a number of other types.

In the UK, Sainsbury’s is switching its own-brand avocado twin-packs from plastic to paper packaging, in a move it says will eventually save 20.2mn pieces of plastic a year.

Officials in China are to destroy the 1,300 containers of Chilean

OPPOSITE TOP—Brazilian exporter

Itaueira’s Rei-branded melons are set to return to export markets this year

OPPOSITE BOTTOM—Giulia Montanaro has joined apple brand Sambòa LEFT—Jana Lehmann shows off the new Driscoll’s packs at Fruit Logistica 2025

cherries left in poor condition when the Maersk vessel Saltoro was stranded in the Pacific for more than 20 days. The consignment included more than 24,000 tonnes of fruit valued at more than US$120mn.

Greenyard subsidiary Bakker Barendrecht has started construction on a new commercial facility in the Netherlands. The building will include mechanised warehousing, meal-kit production, new production lines, and the largest ripening centre in Europe.

Contecon Guayaquil has opened Ecuador’s first on-dock coldstorage facility in partnership with Cool Carriers. The hub is expected to offer a faster, seamless cold chain for the country’s banana exports.

A new report says inefficient logistics cost South Africa’s citrus industry R5.27bn (€270mn) last season, a figure that outgoing CGA chair Justin Chadwick describes as “a debilitating loss of revenue”. E

AMFresh landed the Fruit Logistica Innovation Award 2025 for Onix, with Croptimus by Fermata Technology taking the FLIA Technology prize.

by Carl Collen

AMFresh held off strong competition to win the prestigious Fruit Logistica Innovation Award 2025 in Berlin for its Onix orange.

According to the Spanish group, the deep burgundy orange “combines stunning multicolour beauty with a seedless, velvety pulp, rich in antioxidants”. Sized 85–105mm, it is available loose or in premium three- or five-piece packs and is sustainably grown in Spain.

It triumphed over four other innovations, including Aldina, a marketing concept for a strawberry variety from Frutania offered exclusively by Aldi Süd; Halloweena, a mini pumpkin-shaped mandarin from Genesis Fresh in Spain; Eosta’s Organic Raingrown Avocado which is produced in regions where natural conditions are ideal; and Samantha, the world’s first pointed headed cabbage with a savoy texture, from Bejo Zaden in the Netherlands.

“This is fantastic,” said Patricia Sagarminaga, global director marketing and communications at AMFresh Group. “We have this amazing, out-of-this-world fruit that is grown in the sunny orchards of Spain, and being able to deliver that to the world is such a gift. To win this award is a tremendous recognition for the breeder, the grower, and for everyone at AMFresh and Genesis Fresh.”

Meanwhile, Israel’s Fermata Technology won the FLIA Technology prize, impressing voters at the event with Croptimus.

Croptimus is an SaaS solution tailored for greenhouse vegetable production, utilising advanced AI coupled with computer vision to identify pests and diseases early.

Other nominees for the technology award were ABZ Innovation’s Lidar based sensing system for a spraying drone, the Catsystem from Productos Citrosol, WayBeyond’s FarmRoad Irrigation Module, and the Rypen Case Liner from It’s Fresh in the UK.

“I feel amazing,” said Valeria Kogan, founder and CEO of Fermata. “It’s my first time at Fruit Logistica, and I’m very impressed by the scale and quality of the event. We are absolutely privileged to be part of it and to be recognised by it as well.” E

“To win this award is a tremendous recognition for the breeder, grower, and everyone at AMFresh and Genesis Fresh”

BELOW—The victorious companies, AMFresh and Fermata Technology, celebrating in Berlin BOTTOM—Patricia Sagarminaga of AMFresh signs the ‘winners wall’ following the announcement

The agri-food cooperative presented results for 2023/24 at its AGM in Algemesí, with turnover and sales volumes increasing.

by Carl Collen

Anecoop has revealed turnover growth of 11.6 per cent for the 2023/24 season, up to a record €945mn. The results were presented at the cooperative’s AGM, which was held in Algemesí. Volumes sold climbed 13.7 per cent year-on-year, it reported, up to more than 740,000 tonnes.

The combined turnover of all Anecoop Group companies also recorded its best-ever result, reaching €1.126bn – “significant growth” of 12.5 per cent compared to the previous campaign, with a total sales volume exceeding 1.1mn tonnes.

Anecoop said the result meant it had strengthened its position as “the leading Spanish company in the marketing of fruits and vegetables”, increasing its national export share to 5.04 per cent.

“This growth has been possible thanks to a series of management improvements we have implemented, including the reorganisation of the logistics department, greater digitalisation, the streamlining of some processes, and a reduction in expenses,” said Anecoop CEO Joan Mir.

Anecoop noted that the greatest challenges of the campaign had been rising costs, reduced labour availability and a higher incidence of pests and diseases, which were “increasingly difficult to combat”.

Furthermore, there had been

a decrease in fruit and vegetable consumption in Europe, the cooperative explained, customer supply policies with higher demands and a general trend toward fewer suppliers, and “increasingly fierce competition”.

The company sold 265,155 tonnes of citrus in 2023/24, representing a 5.53 per cent increase compared to the previous campaign. The fruit segment showed the strongest results, both in volume (277,996 tonnes, up 35.41 per cent) and in revenue, exceeding €346mn (up 31.85 per cent).

Persimmons performed well while melons and watermelon volumes recovered, Anecoop noted, while “significant growth” was recorded in stonefruit sales for the second consecutive year. The volume of berries increased by nearly 50 per cent, and vegetables also saw

The greatest challenges were rising costs, reduced labour availability and a higher incidence of pests and diseases

growth, rising 5.52 per cent in volume and 4.33 per cent in revenue to 177,855 tonnes and €285mn respectively.

Anecoop said that, in the face of the fragmentation of the sector, it was promoting integration and cooperation as key to improving the scale of agri-food cooperatives to become more competitive and profitable.

“We continue to be committed to integration and cooperation to face the challenges of a global and competitive economy,” said Anecoop president Alejandro Monzón. “This challenge for the sector goes alongside the adaptation to climate change, innovation, digitalisation, the transition to more sustainable agriculture, investment in R&D, and the promotion of generational renewal.” E

Fruitnet Live specialises in creating high quality, content rich, commercial networking conferences for the fresh produce industry held around the globe. These live events provide the best arena to connect with present and future clients, discover new trade opportunities and to shape the future of your business.

The European Commission’s proposed Omnibus simplification package would slash the number of businesses impacted by regulations like the CSRD and EU Taxonomy.

by Tom Joyce

The European Commission has announced a new package of proposals aiming to “simplify EU rules, boost competitiveness and unlock additional investment capacity”.

“This is a major step forward in creating a more favourable business environment to help EU companies grow, innovate and create quality jobs,” the Commission stated.

However, critics said that limiting the Corporate Sustainability Responsibility Directive (CSRD) would be a backward step for EU sustainability and raised questions over how the EU’s Green Deal could be achieved.

The CSRD requires companies to disclose information about their environmental and social impact,

to boost sustainability and increase transparency for investors and consumers.

Robin Hodess, CEO of the Global Reporting Initiative (GRI), commented: “If the Commission aims to make European business more competitive, then cutting the ambition of the CSRD is a backward step, given the crucial importance of sustainability data in driving innovation and investment into Europe. It also raises serious questions about how to achieve a climate-neutral EU as the cornerstone of the Green Deal.”

The CSRD is currently designed to cover around 50,000 companies with more than 250 employees. By only applying to firms with more than 1,000 employees, the proposed changes would remove around 80 per cent of companies from the scope of CSRD. The same exemption would be applied to the EU’s “taxonomy”, which defines what can be considered a climate-friendly investment.

Ursula von der Leyen, president of the European Commission, announced: “Simplification promised, simplification delivered!”

The EU Commission argued that the proposals would bring savings of around €6.3bn and mobilise investment capacity of €50bn.

“By bringing our competitiveness and climate goals together, we are creating the conditions for EU businesses to thrive, attract investment, achieve our shared goals – such as the European Green Deal objectives – and unlock our full economic potential,” the Commission said.

However, the GRI urged the Commission to continue showing global leadership on the issue of sustainability, not least for the bloc’s economy.

“Promoting sustainable business is a strategic imperative and an area in which Europe has long shown global leadership,” the GRI stated.

“The Commission, EU institutions and Member States must maintain the ambition of the CSRD during the upcoming negotiations. Only then can they enable effective reporting that meets the needs of stakeholders, including investors, and supports a sustainable and resilient EU economy.”

The legislative proposals are set to be submitted to the European Parliament and Council for their consideration and adoption, with EU member states and Parliament still in a position to block the changes. E

ABOVE—Critics say limiting the CSRD is a backward step for the EU’s Green Deal

Organic farming means complying with the rules governing organic farming. These rules, based on general and specific principles, aim to promote environmental protection, preserve biodiversity in Europe and increase consumer confidence in organic products. And these are marked with a special logo for organic farming, the eco-label (Green Leaf). The EU organic logo makes it easier for consumers to recognise organic products and helps farmers to market them throughout the EU.

These regulate all areas of organic farming and are based on several basic principles such as the ban on GMOs, the ban on ionising radiation, and the restriction of the use of chemical fertilisers, herbicides and other chemical plant protection products. Consequently, organic producers must take various measures to maintain soil and crop fertility: crop rotation, growing nitrogen-fixing and other crops as green manure to restore soil fertility, banning the use of mineral nitrogen fertilisers; and to reduce the impact of weeds and pests, organic farmers choose resistant or more tolerant varieties and practices that promote natural pest control.

These play an important role in informing consumers about the origin and characteristics of the products. Such labels can contain key symbols and indications that the product meets certain environmental standards. In Europe, for example, the Euro leaf is a popular label. An additional label is also ‘GMO-free’, which means that the product does not contain genetically modified organisms. The manufacturer or supplier can also provide information on the labels about how the production and packaging of the product impacts the environment. The production conditions can be indicated, while other information can relate to quality. These labels help consumers make informed purchasing decisions while supporting sustainability and environmental protection.

The organic food logo, the Green Leaf, provides the EU with a unified

visual identity for organic products sold on the old continent, and must meet strict conditions regarding their production, transport and storage. This helps EU consumers recognise organic products and makes it easier for farmers to market them in all EU countries.

The labelling of organic products has a significant impact on the market on several levels, such as increasing consumer awareness of the origin of products and their impact on the environment, which in turn increases their interest in organic products. Demand for organic products supports farmers and producers who use environmentally friendly farming practices. Growing trust in products with the Green Leaf label can ultimately lead to stronger brand loyalty and higher profitability, while products labelled as organic can be sold at higher prices, creating a premium segment.

In response to the challenges of the rapidly developing organic market and to create an effective legal framework for the sector, the EU has adopted new rules for the organic sector, which apply from 1 January 2022. Examples of changes introduced with the new organic rules include strengthening the control system and thus increasing consumer confidence in the EU’s organic production system; new rules for producers that will make it easier for small farmers to switch to organic farming; new rules for imported organic products to ensure that all organic products sold in the EU meet the same standards; and a wider range of products that can be marketed as organic.

Board says Hiller and new CFO Matthias Rapp “identify strongly” with goals of becoming more robust and profitable as group faces up to financial challenges.

by Carl Collen

BayWa AG has announced that its supervisory board has approved the appointment of Dr Frank Hiller as chief executive officer and Professor Dr Matthias Rapp as chief financial officer.

Hiller and Rapp were appointed to the board of management on 1 March, the group confirmed.

Supervisory board chairman Gregor Scheller said that, with BayWa undergoing a strategy of transformation, the new officers “identified strongly” with its goals – adding that Hiller and Rapp had experience when it came to leading companies facing difficulties.

“BayWa is undergoing the greatest transformation in its history,” Scheller stated. “The company needs to become sustainably more robust and profitable, and to do so it is focusing on its core business areas. We are therefore delighted to welcome the two new members of the board of management, who identify strongly with these goals.

“Dr Frank Hiller has an impressive track record and extensive experience in managing various companies in difficult times,” he continued. “Above all, however, he is a manager who puts the customer first. We on the supervisory board are convinced that he will shape the strategic development of the company along the defined guidelines and successfully implement the associated ideas. The management

team will thus lead BayWa into a solid and successful future.”

Scheller pointed out that Rapp had “extensive expertise” in financial management.

“He has proven time and again that he can successfully lead companies through difficult financial challenges and has strong communication skills,” he noted.

“Both gentlemen have assured the supervisory board that it is their personal goal to lead BayWa back to success for the benefit of our customers, suppliers and employees.”

Hiller said he was excited to be joining BayWa and was ready to take on the challenges faced by the group.

“We are facing a fundamental transformation that has been triggered by major financial challenges,” he said. “BayWa is firmly rooted in agriculture and has always enjoyed an excellent reputation among its customers. Our top priority will be to restore BayWa’s good name in the market. I will do everything in my power to lead the company back to its usual stability and commitment,” Hiller commented. “This is what our customers, our shareholders and our employees expect.” E

“BayWa needs to become sustainably more robust and profitable, and to do so it is focusing on its core business areas”

TOP—BayWa’s new chief executive officer Frank Hiller

ABOVE—Chief financial officer Matthias Rapp

Southern Hemisphere Association of Fresh Fruit Exporters appoints Nathan Hancock as president with Jorge de Souza vice president.

by Carl Collen

The Southern Hemisphere Association of Fresh Fruit Exporters (Shaffe) has unanimously elected a new president and vice-president.

Shaffe’s presidents and vicepresident serve two-year terms, and in February 2025, Marta Bentancur’s term as president of the association ended. Shaffe said that, over the past two years, Marta had “reinvigorated” the association and “secured its financial and administrative stability”.

“Bentancur led the association into very active times by setting up various working groups focusing on, for example, logistics, sustainability and market access,” the association outlined.

“In addition, Marta drove the improvement of the association’s new collection and reporting system for statistical data on exports and production of fresh fruits in the Southern Hemisphere, which remains one of the group’s core activities.”

The association’s staff and members expressed their gratitude for the work Bentancur had done to enable the association to tackle all future challenges through open dialogue and collaboration between all players in the Southern Hemisphere fruit industry.

Taking over from Marta is Nathan Hancock, CEO of Citrus Australia, the peak industry body representing Australian citrus growers. In his position, Hancock

“As Shaffe’s president and vice-president, Nathan and Jorge will work to further professionalise the association”

plays a key role in supporting growers and exporters through market development, biosecurity initiatives, and industry advocacy.

Hancock also serves as the chair of the Plant Health Australia Plant Industry Forum and as the chair of the Horticulture Council Market Access Committee, “demonstrating his leadership in plant health and international trade policy”.

Jorge de Souza, technical and project manager of Abrafrutas in Brazil, will serve as vice-president.

“As Shaffe’s president and vice-president, Nathan and Jorge will work to further professionalise Shaffe and grow its role as the representative of the Southern Hemisphere fruit industry, enhancing collaboration between players in the industry and addressing key global trade and production challenges,” the association commented.

Shaffe represents the leading fresh fruit production and export associations in Australia, Brazil, Chile, New Zealand, Peru, South Africa, Uruguay and Zimbabwe. E

As European buyers look to diversify their supplies of tomatoes, Exim Agro’s Yorkin Inamov believes Uzbekistan has an opportunity to grow its share of the market.

by Tom Joyce

As European tomato production faces mounting challenges, from climate instability in Spain to growing logistical difficulties, Uzbekistan is emerging as an alternative source, according to Yorkin Inamov, founder of exporter Exim Agro, since the Central Asian country’s climate offers optimal conditions for tomato cultivation.

Inamov highlighted the country’s four-season environment, where hot summers and cool nights stress the plants, resulting in tomatoes that offer exceptional flavour.

“The tomatoes from Uzbekistan are unlike anything you’ve tasted,” said Inamov, “especially varieties like Pink Paradise, which has a natural sweetness and depth that makes it stand out.”

Currently, Uzbekistan exports a range of products, including fresh and freeze-dried tomatoes, with a primary focus on markets like Russia. However, with shifting global dynamics, the company is expanding its reach to Europe, particularly as the continent grapples with tomato shortages.

Inamov points to the importance of diversifying sourcing to countries like Uzbekistan, which offer both high-quality products and stable production conditions.

The growth of the Uzbek tomato industry has not been without

challenges. Water availability and the rising cost of energy are issues, but the government has supported the sector with initiatives, helping producers like Exim Agro to gain a foothold on the global stage.

“One of the biggest problems for the European market has been that the majority of Europeans didn’t know that such a country as Uzbekistan existed,” said Inamov.

However, as Uzbekistan’s tomato exports grow, Inamov believes the country could become a significant player, particularly in the UK and Germany, where there is increasing interest in sourcing tomatoes from alternative regions. E

After the collapse of the Chinese market this season, who will absorb Chile’s extra production volume in the coming years?

by Maura Maxwell

Chile’s cherry industry is facing renewed calls to seek greater market diversification after this season’s disastrous results in China. The sector is set to rack up losses of at least US$1.6bn in 2024/25 according to analysis by the consulting firm Colliers. With exports now concluded, manager Rodrigo Gil said the signs are “not encouraging”, despite the industry previously forecasting that this would be its best season ever.

In China, which takes more than 90 per cent of Chile’s cherry output, prices collapsed following unprecedentedly high shipment volumes. Exports grew 60 per cent compared to last season, saturating the market and causing prices to fall by 50 per cent from 2023/24.

To add to Chile’s woes, the Chinese authorities confirmed that they had rejected the entire cargo from the Saltoro, the Maersk ship stranded in the Pacific for more than 20 days, due to the poor condition of the fruit. The vessel was carrying 1,300 containers of cherries valued at more than US$120mn.

“Based on the average expected returns of previous seasons, and the results that are we are seeing in the current one, the losses for producers and exporters are estimated at around US$1.6bn,” Gil said.

The estimate is based on average net return values of US$5/ kg to the producer in the past three

BELOW—Losses from the breakdown of the Maersk Saltoro run into tens of millions of dollars

BOTTOM—Chilean cherry exports are projected to reach 200mn cartons by 2030

seasons, and an estimated return of US$2.5/kg in the most optimistic of scenarios for the current season.

Colliers cited several reasons for the losses, chief among them the dramatic increase in exports–which went from 83mn cartons in 2023/24 to 120mn cartons in 2024/25 – and the heavy concentration of arrivals ahead of the Chinese New Year at the end of January.

“An early Chinese New Year (29 January), the subsequent rush of Chinese importers to receive fruit and a rather cold spring season in Chile meant that the bulk of the first fruit shipments were cherries of not the best quality, mainly due to lack of ripeness, and this caused them to be quoted at a lower value than in 2024 and slowed down demand in China,” Gil explained.

He added that even when the fruit did arrive in its optimal state of ripeness, it did so in such large quantities and faced such a high

volume of accumulated stock that prices were unable to recover.

With nearly 80,000ha of cherries planted in Chile and export volumes projected to reach 200mn cartons by 2030, producers face an uncertain outlook in the coming years. What is clear is that banking on Chinese consumers to absorb this extra volume is no longer an option. E

Sun World’s newly appointed CEO, Bernardo Calvo, heralds the arrival of a golden age for varietal development and what it means for growers worldwide.

By Maura Maxwell

Bernardo, congratulations on your appointment. What can we expect to see from Sun World in 2025?

Bernardo Calvo: Thank you! I’m grateful for the opportunity to lead a company that’s in exponential growth mode and has been for quite some time. We’re busy on a number of fronts and excited about what’s coming up in the year ahead.

We’re focused on new varietal offerings in 2025, particularly in table grapes. Last year we announced three brands that are now planted and commercially available in most countries in 2025. We’re encouraged

that Ruby Rush, Epic Crisp and Applause are generating strong retailer interest.

Demand for Autumncrisp grapes continues to escalate even beyond our bullish expectations, so that brand remains one of our top priorities. So much so that we’ve begun work on an a ractive Autumncrisp franchise extension to magnify the potency of that brand.

We are also very excited about the new opportunities we have with citrus, mangoes and avocados a er our successful acquisition of Biogold last year. This gives us the opportunity to offer our customers a broader portfolio to fulfil their needs and an opportunity for quick geographical expansion.

More broadly, our genetics pipeline is extraordinarily robust because of the work being done at our Centre for Innovation. I’m inspired by our incredible scientists and technicians every time I visit our labs. So, there’s a lot for our licensees to particularly look forward to in the decade ahead.

What are your key priorities in terms of R&D and new fruit variety development?

BC: Is it ok to say ‘everything’? There’s been a sea change in fruit variety development and we believe we are experiencing something of a Golden Age in our work. Emerging technologies and advances in science are facilitating innovation leapfrogs in breeding – especially when it comes to breeding efficacy – and this is powering the development of high-value adjacent crops; cra ing germplasm to mitigate climate change; and shortening time-to-market.

We’ve been investing in and prioritising new

technologies to drive quality and efficacy in all ways. And we were particularly happy to add Ellio Grant to our board as a proof of that intent. Ellio , the former CEO of Google’s Mineral, is a globally recognised “big thinker” in the application of artificial intelligence in agriculture. He serves as an advisor to prestigious organisations who are always thinking about what’s next – which is both Sun World’s tagline and mantra.

From an R&D and development perspective, 2025/26 will be important at Sun World with the release of new pipeline varieties. I’ve mentioned our new table grape offerings. And, as you can imagine, there’s a lot of

OPPOSITE—Bernardo Calvo, CEO of Sun World International

THIS PAGE—The company’s consumer grape brands – Autumncrisp, Ruby Rush, Epic Crisp and Applause – are generating strong interest from retailers

anticipation around our new citrus and seedless lemons becoming more broadly planted and offering more weeks of supply to retailers. But looking ahead, we’re convinced we can be an important global supplier of mango genetics.

Our 2023 acquisition of the Kankun mango license was our initial step into this highest-ofhigh-potential crops. But Sun World’s mango category was simply transformed through our 2024 acquisition of the world’s largest mango breeding programme and the world’s largest collection of mango genetics. The la er is currently under evaluation via Sun World mango breeding centres in South Africa and California.

We expect to soon begin releasing and commercialising mango germplasm. This will happen both in geographies where we have existing table grape business, as well as through the opening of new markets like Brazil and Mexico, which are already globally prominent mango growing regions.

How do you plan to develop Sun World’s geographical footprint in

the coming years? What countries and regions really excite you?

BC: At the moment we have more than 40,000ha of different crops planted in 18 countries which keeps us plenty busy. Beyond that, Sun World isn’t alone in recognising the extraordinary market for high-quality fruit in Asia, particularly in China.

We’re excited to have built the beginnings of a very solid organisation there and, as is Sun World’s way, we’re “commercialising carefully”. We want to make certain we’re aligning with partners with whom we can form long-term relationships, which I like to think is one of Sun World’s strengths. We’re also significantly expanding our footprint in Europe and LatAm and are pursuing other geographies in an exploratory way.

With that said, a very important synergy opportunity we have is to expand citrus and mango offerings in countries and customers where the former Biogold team didn’t have access and vice versa. We’re already starting to see demand traction with table grape growers asking for citrus and citrus growers asking for grapes.

Is Sun World exploring further partnerships or acquisitions to strengthen your market position?

BC: Always. Our executive chair David Marguleas is highly focused in this area. Our 2024 Biogold acquisition was major and there’s still an incredible runway to maximise our expanded portfolio. I’ve always called this a smooth “un-transition” of two like-minded companies, but we’re still fully optimising this exciting multiplier.

»

Additionally, we’ll continue to expand our genetics range in a prudent way and with the needs of our licensees in mind. Potential alignments with world class breeding organisations are a constant for us and we’ve been in discussion with a large number of businesses. We’re always eager to talk to enterprises with a genetics innovation element. We also assess the potential to acquire or partner with other breeding programmes, plus one-off opportunities like the Kankun mango.

UK retailer Tesco is trialling a new approach to table grape marketing by selling grapes with flavour and texture labels such as ‘tropical flavour’, ‘candy flavour’ and ‘crunchy texture’. Do you think this is the future of the category?

BC: Sun World has been extolling the opportunities in table grape branding for the last decade. While consumption has accelerated, most consumers still choose grapes by colour. That is beginning to evolve. We believe the apple industry, which has brilliantly marketed by brand, is a model for what table grapes can be with appropriate support. Sun World absolutely believes this is part of the future of the table grape category. We’ve

focused in a major way on ‘crunch’ which you mentioned, through investment in Autumncrisp. Crunch feels like an enduring consumer desire as opposed to a fad and it’s one of the traits that’s made Autumncrisp a Sun World flagship.

And we developed both our Sable Seedless and Applause table grape varieties to satisfy consumer interest in the tropical flavour profile you mentioned, also in high demand.

Your early ripening cherry varieties are one of the highlights of your breeding programme. What other gaps are you looking to fill in the stonefruit category?

BC: Low-chill plums commercialised under the Black Diamond brand,

LEFT—Early-ripening cherry varieties are one of the highlights of Sun World’s breeding programme

BELOW—Visitors at one the company’s recent table grape open days

and nectarines and peaches, continue to be important to Sun World. We’re focused on the development of early-ripening varieties that can be grown in very early, hot environments like North Africa and the Coachella Valley in the US to fill production gaps that ma er to our licenses.

Our customers and their consumers, continue to be keenly interested in Sun World’s red-fleshed, blackskinned plum line with its exceptional flavour and antioxidant profile so that’s a priority as well.

There have been major strides in genetics in recent years. How is this influencing the commercial landscape in fruit breeding? How critical is speed to market when it comes to the success of a new variety?

BC: You’re absolutely right and I already mentioned the degree to which advances in science and technology are propelling our business. In a world where things happen lightning-fast, and where consumers are open to trying new and be er produce, increasing speed-to-market is the Holy Grail of variety development.

Maximising the intelligent and intentional use of data; the optimal deployment of AI; and the introduction of molecular breeding and sophisticated gene-editing tools are just three examples of important new drivers in efficacy in variety development.

Accelerating processes to achieve desirable fruit traits is something Sun World has long been laser-focused on and historically, that’s been a painstaking, labourintensive effort. But with the emerging technologies we now employ, we believe our years-to-commercialisation has the potential to be cut by at least 30 per cent. That’s real progress. E

FESTIVAL OF FRESH 2025 takes place at the home of FreshLinc in the vegetable-growing heartland of Spalding, Lincolnshire in June. We’ll be just across the road from Worldwide Fruit, who will host tours of their cutting-edge facility. So don’t miss your chance to be involved in the UK’s best fresh produce industry event!

For more information, contact us at festivalo resh@fruitnet.com or visit fruitnet.com/festivalo resh

Organised by

Alwyn Dippenaar, the new chairman of Sati, walks in the footsteps of many grape farmers from South Africa’s remote Orange River region.

by Fred Meintjes

In the mid-1980s, reaching Blouputs in the Lower Orange River region was quite an ordeal. When you turned off the main road from Augrabies to Pofadder, and headed down to the river, you had to open many farm gates.

For unsuspecting supermarket buyers who visited farms, one leading grower had the practice of letting them open the gates, and once they drove through, pretending to forget them in the desolate, neardesert landscape.

Today there is a tarred road and Blouputs has cemented its position in the world of table grape production. This is where we find the home of the Dippenaar Group which during the past 30 years has grown into one of the leading grape growing organisations in the country.

Alwyn Dippenaar is one of three sons of the founders of the business, Paul and Neeltjie Dippenaar, back in

1982. Currently there is 329ha in production with plans for considerable further expansion soon. The company has also invested in infrastructure and today the farms have modern pack houses with state-of-the art pre-pack facilities.

The aim is to talk to Alwyn Dippenaar, who also built up Dippenaar Choice Fruit as marketing division, but now has a greater industry function as chairman of Sati. His term, he says, is the continuation of the work done by the previous chairman and the Sati board.

“There are many important projects which we as a board and the industry have been working on for some time and they will continue,” he explains. “I am also excited that we have such a dynamic Sati team, led by the exuberance of youth coupled with experienced staffers, who will lead us forward.

“There are however several very important focus areas that is particularly relevant as the industry enters 2025,” he notes.

Dippenaar points to Sati’s focus on logistics and the role the new logistics model will play in stabilising logistics operations.

“We cannot solve these problems ourselves, but the information that we will derive from this model will be crucial to assist all role-players to contribute.”

“There are many important projects which we as a board and the industry have been working on for some time”

Sati is also determined to maintain progress in new markets, but 2025 will probably see greater efforts to grow sales in the US.

“Over time we have seen demand for our grapes grow in the US and Canada and we see special opportunities from December to February which we now need to take advantage of,” he adds. E

ABOVE—Alwyn Dippenaar, sixth from the right, with the rest of the Sati board

Exports increased in volume and value compared to the previous year.

by Maura Maxwell

Spanish fruit and vegetable exports grew by 8 per cent in volume and 5 per cent in value in 2024. The latest customs data, published by Fepex, shows that 12.3mn tonnes of produce worth more than €17.7bn was exported last year. Ninety-seven per cent of shipments were destined for the European Union.

A total of 5.7mn tonnes of fresh vegetables worth €8.044bn were exported, an increase of 10 per cent and 2 per cent respectively on the previous year. Peppers, cucumbers and lettuce topped the table, pushing tomatoes into fourth place.

Pepper exports grew 13 per cent to 804,126 tonnes in volume and 3 per cent to €1.564bn in value; cucumber exports totalled 745,726

tonnes (+12 per cent) and €979mn (-2 per cent); lettuce exports reached 745,699 tonnes (+5.5 per cent) and €920mn (unchanged), and tomato exports grew 21 per cent in volume to 674,426 tonnes but fell 6 per cent in value to €1bn.

Overall exports of fresh fruit grew 7 per cent in volume to 6.6mn tonnes and 8 per cent in value to €9.658bn. In the stonefruit category, nectarines were up 13 per cent in volume and 11 per cent in value at 339,085 tonnes and €495mn, while flat peach exports grew 10 per cent in volume and 17 per cent in value to finish on 204,276 tonnes and €315mn.

Strawberry exports totalled 255,375 tonnes worth €788mn – an increase of 4 per cent in volume and 12.5 per cent in value. Watermelon exports also performed well, growing by 16 per cent in volume and 11 per cent in value to 789,733 tonnes and €552mn, making them the third most exported fruit after oranges and mandarins. Fruit and vegetable imports in 2024 grew 6 per cent year-on-year to 4.4mn tonnes worth more than €5mn. Vegetable imports were up 15 per cent in volume

LEFT—Lettuce

exports grew 5.5 per cent in volume last year

and 12.5 per cent in value at 2.1mn tonnes and €1.587bn, while fruit imports totalled 2.2mn tonnes worth €3.414bn – a dip of 0.4 per cent and increase of 11 per cent respectively.

By destination, Europe was the top market, taking 11.9mn tonnes worth €17.171bn, an increase of 8 per cent in volume and 5 per cent in value compared to 2023.

“The data on fruit and vegetable foreign trade show that the EU continues to be the mainstay of the positive development of the sector, compared to third countries that only represent 3 per cent of exports, and with very limited growth possibilities, due to the protectionist policies based on phytosanitary barriers of some of these countries, such as the US, where Spain exported only 32,468 tonnes, or 0.2 per cent of the total,” Fepex said.

“Furthermore, the globalisation of the community market requires an ever-increasing investment effort to maintain competitiveness, which is why we are calling for an investment financing policy that is more in line with sectoral needs.” E

Despite ongoing challenges, the La Mancha-based company anticipates strong growth in onion and garlic sales.

by Maura Maxwell

Water restrictions, falling demand and climate change are just some of the challenges facing Spain’s onion and garlic industry according to leading producer Grupo Lomar.

The La Mancha-based company, which has been supplying garlic and onions for more than 50 years to its wholesale and supermarket customers throughout Spain, reported a turnover of €48.1mn last year – 13 per cent down on the previous year’s record results, but 48.2 per cent above 2022 levels.

Onion production fell by 14.9 per cent compared to the previous year. “The average sales price has normalised, driven by an increase in supply at a national level that has exceeded demand. This has caused the average price to stand at €0.43/kg, lower than the peak reached in 2023 (€0.74/kg), but well

above previous levels, which allows profitability to be maintained,” the company said.

In garlic, Grupo Lomar’s production grew 37.5 per cent compared to 2023, while average prices increased by 21.6 per cent to €3.32/kg. CEO José López de la Fuente said the upward trend in prices was due to higher production costs forcing many companies to

plant less, resulting in a shortage of supply.

“Irrigation restrictions led us to cut back on sowing, which reduced production. This, together with high demand and the inflationary context, has driven up prices, especially for garlic,” he said, adding that this had also impacted consumption.

Despite the challenges it faces, the company said it expected the sector to maintain a positive trend and for sales to increase in 2025. “We expect production and turnover to grow significantly. The price of onions will rise in the short term due to the increase in the costs of preserving the product, while garlic could experience a slight downward adjustment in the second half of the year with the new campaign,” López de la Fuente noted.

Nationally, the onion and garlic sector faces challenges such as increased production costs, difficulties in accessing water, price volatility and a lack of specialised labour. Nevertheless, Grupo Lomar remains confident that the implementation of sustainable agricultural practices, technological innovation and the development of new, more resistant varieties can strengthen the sustainability and competitiveness of the sector in the future.

Grupo Lomar said a decision to concentrate all its production processes within a 60km radius of its headquarters in Zarza de Tajo, Cuenca has allowed it to generate a high-quality, local product, significantly reducing the costs and times of transporting the goods to the country’s main logistics centre, Mercamadrid, while also helping to cut carbon emissions.

“With a market in full evolution, the garlic and onion sector faces 2025 with expectations of recovery and growth, anticipating greater stability in production and maintaining competitive prices,” the company said. E

TOP & LEFT—

Grupo Lomar has been supplying garlic and onions to retail and wholesale customers for more than 50 years

New range of blood oranges taps into consumer trends of health and innovation.

by Maura Maxwell

Red Bouquet is the name of Anecoop’s new blood orange brand, which made its debut at last month’s Fruit Logistica.

The second-tier cooperative’s range of red-skinned and redfleshed oranges were developed at Anecoop’s trial farm in Museros, Valencia. They have an extra-high antioxidant value thanks to the elevated levels of anthocyanins.

The company says the new brand serves a double objective: to restore the historical value of bloody oranges that were traditionally grown in Valencia but have almost disappeared, and to expand its varietal offer, thus guaranteeing broader and more homogeneous commercial programmes for this type of orange.

After studying several varieties over a number of years, Anecoop selected its current range, which includes Ippólito, known for its intense exterior and interior colour and its larger size, and Tarocco Rosso.

“Although these are very wellknown and marketed varieties elsewhere in Europe, in Spain they still have a long way to go

because for many years it has been difficult to find them on the market,” Anecoop says. “In addition, they arrive at a very attractive commercial moment, with consumers receptive to new developments in both eating and juicing oranges.”

Anecoop is targeting the retail and wholesale channels in Spain, as well as countries where blood oranges are already well known, such as Italy, France and Germany, all markets in which the company’s oranges and Bouquet brand already have a significant presence.

“The red oranges marketed under this new brand respond to our effort to adapt the varietal offer to the tastes and demands of the consumer, to extend the calendar and the range and to recover traditional flavours,” says Anecoop’s president Alejandro Monzón.

“The objective: to consolidate the competitiveness of our citrus fruits throughout the world and to boost the economic performance of our farmers, who are our reason for being.”

Red oranges owe their characteristic colour to the high presence of anthocyanins,

show the varieties have high

a bioactive component that develops thanks to the contrast in temperatures between day and night that occur during the cultivation process.

According to recent studies carried out within the framework of the collaboration agreement between Anecoop and the Complutense University of Madrid, the varieties of red orange marketed by Anecoop have a high content of vitamin C, fibre and anthocyanins, antioxidants that are very valuable for health.

Under this agreement, both parties are carrying out further studies to better understand their nutritional composition along with the benefits they provide. E

TOP—The range was developed at Anecoop’s trial farm in Museros, Valencia

The essential meeting for the Fruit and Vegetable sector in France

23 & 24 April 2025

Parc des Expositions - Perpignan, France

250 Exhibitors expected

5,000 Decision-making visitors expected 100% sustainable practices

50 International Top buyers

6 Exhibition sectors

1,500 Business Meetings during the show

4 Summer fruit harvests forecast

23 Conferences including 1 Exclusive Big Debate

Spanish production accounted for 61 per cent of total apple and pear sales last year.

by Maura Maxwell

Spanish supermarkets sell a higher proportion of homegrown apples and pears today than ten years ago, new research from Catalan fruit association Afrucat shows.

Barcelona, Lleida, Zaragoza and Madrid, while the most recent report also includes data from Donosti, La Coruña, Valencia, Sevilla y Tenerife.

€0.59 to €0.92. Last year, national apples retailed for €2.55/ kg on average, while imported ones sold at €3.47/kg.

Afrucat’s general manager, Manel Simon, said: “Data shows that while the volume of imported apples sold since 2004 has been fairly constant, there has been a significant increase in the supply of domestic apples on the shelves. This leads us to value the approach that supermarkets have taken towards local production, but it also makes us wonder where all these imported apples that continue to arrive are being sold”.

Simon acknowledged that there is still a lot of work to be done in traditional stores, which represent 30 per cent of total sales. “We are talking about the small neighbourhood shop that is mainly supplied by wholesale markets, where we find a large amount of imported fruit and, above all, fruit that is not correctly labelled, preventing the consumer from exercising their right to be informed and to choose national products,” he said.

The association recently presented the latest findings of its retail monitoring service Infolineal, which tracks retail produce sales across Spain.

The report noted that the price of imported apples not only remains higher than national apples, but that the price difference has increased over the last ten years, rising from

In 2015 – the first year Infolineal was published – more than half of the apples on sale in Spanish supermarkets were imported, while 47 per cent were grown domestically. Last year, national production accounted for 61 per cent of apple and pear sales.

Afrucat qualified the findings by noting that the first Infolineal only collected store data from four cities,

In pears, the situation is different. In 2015, homegrown pears accounted for half of the sales in 100 per cent of the surveyed retailers, while in 2024, some supermarket chains sold less than 50 per cent of local product. Imported pears accounted for 21 per cent of total pear sales.

“This situation is closely related to recent years of inclement weather, droughts, heat waves and frosts, which have drastically reduced Spanish pear production and have favoured the increase in imports,” Afrucat said.

It noted that the price difference between national and imported pears is smaller than for apples and has been reduced in the last 10 years, going from €0.68 in 2015 to €0.52 last year. This meant national pears cost an average of €2.81/kg, while the imported ones cost €3.33/kg. E

ABOVE LEFT—

Domesticallygrown apples sell for considerably less than imported ones

LEFT— The supply of homegrown apples has risen sharply in the last 20 years

PlantSeal® coatings increase the shelf life of limes, reducing aging symptoms such as wrinkling in the stem area and calyx browning. Weight loss mitigation is spectacular, far superior to other coatings on the market, with control of up to 50%.

With PlantSeal®, the yellowing that occurs in limes during refrigerated transport and throughout their shelf life is reduced, meaning the fruit can remain green for longer in the supermarket.

PlantSeal® coatings are plant based and certified as both organic and suitable for vegan consumption, this is particularly important in the case of the lime, as the rind is a highly prized ingredient in cooking and for cocktails.

www.citrosol.com

Apple brand’s new-look website offers ”an engaging, interactive and personalised experience”.

by Carl Collen & Mike Knowles

The Cosmic Crisp brand returned to European markets in early 2025, supported by a range of special events and marketing initiatives designed to persuade young, city-dwelling consumers to enjoy it “under any sky, from sunrise to sunset”.

Total supply of the fruit across Europe is set to rise to 21,000 tonnes, ensuring availability from mid-January through to mid-autumn. And with its enhanced storage capabilities, its marketers are confident Cosmic Crisp will maintain exceptional freshness throughout both spring and summer.

he companies behind Europe’s production of Cosmic Crisp apples have announced that the brand’s dedicated website now has a completely new look, which they describe as a ”game-changer approach exploring new horizons in the areas of interactivity, engagement and brand community”.

managers at Vog and VIP, the two Italian companies that are licensed to grow and sell the apple in Europe.

“The aim is to construct a community around the brand and

“We are really excited to once again be able to meet the demand for Cosmic Crisp on all reference markets in Europe,” Tauber and Laimer comment. Their joint campaign kicks into high gear during the spring and summer months in Italy, Spain, and Germany, encouraging consumers to discover the “heavenly taste

to replicate the pleasure we get from biting in to this exceptional apple,” they add.

“Adopting an original approach for the fruit and vegetable industry, we wanted to create an interactive and modern website perfect for the Cosmic Crisp target audience of young urban consumers on the lookout for new products,” explain Hannes Tauber and Benjamin Laimer, marketing

The new Cosmic Crisp website aims to involve consumers ”right from the homepage”.

“Thanks to its qualities and brand positioning, Cosmic Crisp is changing the European apple category,” note Tauber and Laimer. “With the relaunch of the website, we take consumers into its heavenly world in a completely original way.”

of Cosmic Crisp” and enjoy the fruit at any time of the day.

“Thanks to our multichannel campaign, we are able to attract new consumers to the apple category,” Tauber and Laimer conclude. “In order to achieve this, Cosmic Crisp has positioned itself as a lifestyle product on the fruit and vegetable market thanks to special events, on-trend merchandising, and online and Instagram campaigns: communications aimed at a young urban target.” E

Company’s latest investment puts it on path to further growth as Southern Hemisphere supply base continues to expand.

by Mike Knowles

Italian company Battaglio has formed Agricola El Camino, a new joint venture pineapple supplier in Costa Rica.

The investment further strengthens the Turin-based company’s production portfolio, at a time when demand for tropical fruit is increasing across much of Europe.

Situated in San Carlos, a canton in Costa Rica’s Alajuela province, the new company will operate around 500ha of production in what is regarded as one of the bestsuited areas for pineapples in the country.

“We decided to take this step together, to build something solid and valuable, in a sector that offers great opportunities”

“The name Agricola El Camino is symbolic for us,” commented group president Luca Battaglio.

“It represents the path we have undertaken together with the Corrales family, evolving from a simple customer-supplier relationship to a real strategic alliance. We decided to take this step together, to build something solid and valuable, in a sector that offers great growth opportunities.”

According to Battaglio, the 50:50 joint venture will be led by Alexander Bolaños, who also manages a number of companies in leading Costa Rican group Caribe.

Battaglio has made a number of investments in the past decade to expand its international supply base and complement its domestic production and procurement.

These include the creation of Colombian avocado export business Agricola Persea in partnership with CI Tropical in 2018, and the formation three years later of a partnership with South Africa’s Sundays River Citrus Company, to produce citrus fruits, including lemons and oranges.

The group also has operations in Argentina, where in 2022 it bought Rio Negro-based Agricola Alto Valle to expand its apple and pear sourcing. E

LEFT—Alexander Bolaños, Luca Battaglio, and Estéban Corrales

The Greek exporter is enthusiastic about new markets for its kiwifruit as the company expands production, but pricing and climate pressures continue to cause frustration.

by Tom Joyce

BELOW—Antonis Ioannidis and Christina Manossis of Zeus

Greek exporter Zeus Kiwi is seeing growing demand for its kiwifruit in new markets this campaign, including in Brazil, but the company says it will have to be patient for the arrival of its new plantings before it can make a sizeable dent in such a giant market.

“Even if the profit is good, if the volume isn’t there, what can you do?” asks Christina Manossis, general manager of Zeus Kiwi. “You can’t serve a market if you don’t have the fruit to do so. Climate change is playing a part in this too.

“We are almost halfway through the season, and we wish we had more fruit. We always have more demand than we can supply, and that’s a good problem to have, but it does present challenges.”

“We are looking to expand both in green and yellow kiwifruit,” explains Ioannidis. “We have new fields and volumes of Kikokà that will be commercially available within the next two to three years, and of course there are new plantations of green kiwifruit as well.”

With disappointment Ioannidis points out that the price of kiwifruit this year has not reflected the shortage of supply on the market. “The pricing is not as high as it should be, especially considering that the quantity is

“We have new fields and volumes of Kikokà that will be commercially available within the next two to three years”

lower than usual,” he comments. “Something was not quite right at the start of the season, but so far we are thankfully doing quite well at Zeus Kiwi.”