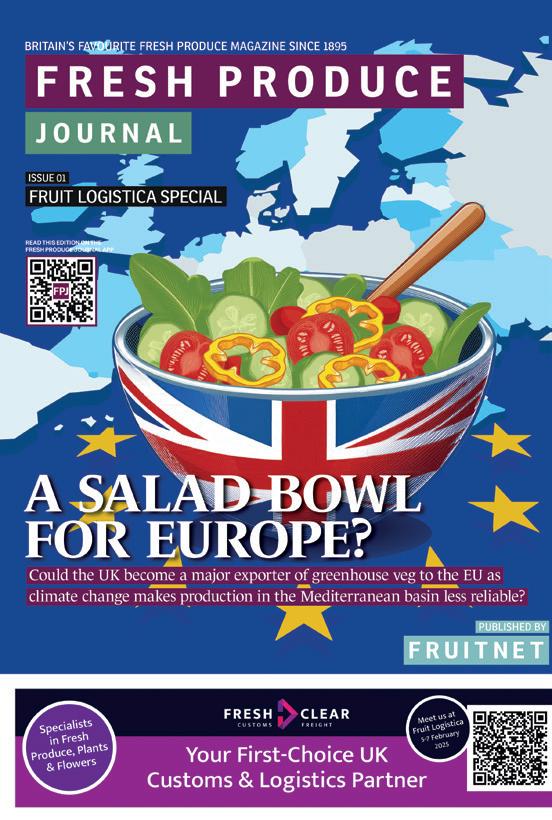

Controlled environment horticulture represents a major opportunity to boost food security in Europe, but governments must lay the foundations for growth

Controlled environment horticulture represents a major opportunity to boost food security in Europe, but governments must lay the foundations for growth

Climate change is undeniably changing the face of global food production. In the past few weeks alone, there have been forecasts of UK brassica shortages in the spring due to mild autumn and winter weather, and the publication of an alarming (but unsurprising) report form the journal Trends in Plant Science warning that without rapid changes to how we develop climate-resilient crops, the world could face widespread food shortages leading to famine, mass migration, and global instability.

The devastating wildfires in Los Angeles were another stark reminder of the destructive force of climate change. And from a food security perspective, the severe autumn floods in Spain and Italy were a wake-up call that in the UK we cannot continue to rely so heavily on countries in the Mediterranean basin for our fresh produce supply.

With this in mind, there are reasons to believe that with the right government support and industry investment, the UK could become a far more significant supplier of greenhouse vegetables – not just to the domestic market, but also to other European countries (see pages 10-11). For this to happen, however, the government must remove the considerable hurdles to planning, investment and labour supply.

In his speech to the Oxford Farming Conference, Steve Reed struck the right tone by promising to build a farming sector with food production at its core. But as the NFU’s Tom Bradshaw points out, the Defra secretary’s long-term vision for agriculture can only be realised if farming businesses are helped to survive the immediate financial challenges. Instead, inheritance tax changes, national insurance hikes, cuts to direct payments, and delays to environmental schemes could combine to force many out of business.

Climate change is a threat to food production all over the world and it calls for a radical rethink of how we grow and source fresh produce. But in some instances, it presents opportunities as well as challenges. Investing in efficient and sustainable controlled environment horticulture in the UK and Northern Europe is one such opportunity as we try to shore up global food security in the uncertain years ahead. fpj

Fred Searle, Editor

Britain’s protected cropping sector faces a number of important challenges, but with the right support, there is belief that the UK could become a powerhouse producer

Manchester wholesaler Barton & Redman has achieved extraordinary growth in recent years, but director Matthew Barton has no intention of easing up

The global fresh produce industry is gearing up for the annual pilgrimage to Fruit Logistica, with special interest in who will pick up a coveted Fruit Logistica Innovation Awards

Wholesale ambition 24 22

The opening of the US market to British beetroot suppliers is raising hopes of a world of opportunity for exporters, driven by the work of the UK’s agri-food attachés

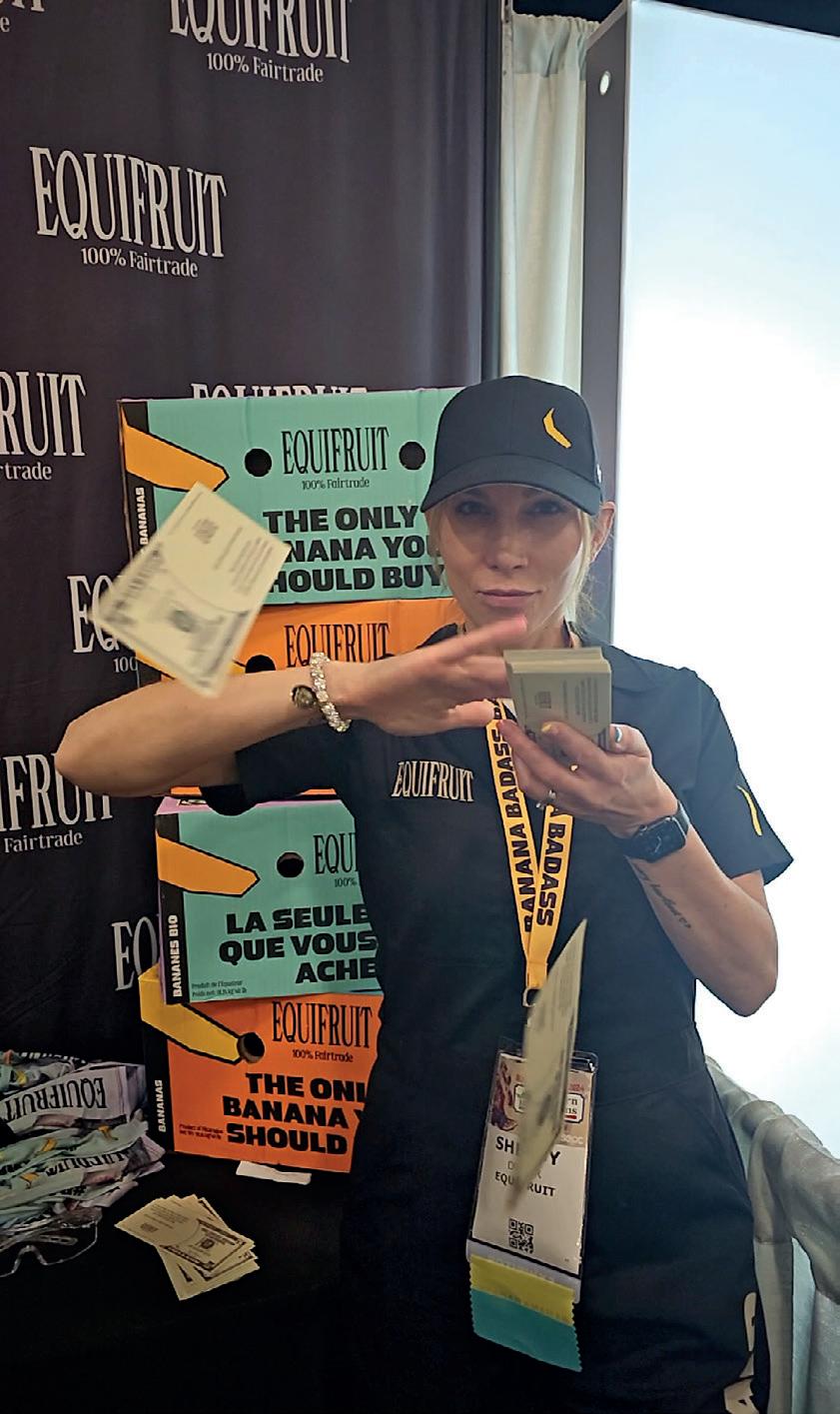

Female-owned Canadian innovator Equifruit is using humour and absurdist marketing to get the world to think differently and give banana farmers a fairer slice of the pie

editor Fred Searle

+44 20 7501 0301 fred@fruitnet.com

contributing editor Michael Barker michael@fpj.co.uk

senior reporter Luisa Cheshire +44 20 7501 3723 luisa@fruitnet.com

features editor Tom Joyce +44 20 7501 3704 tom@fruitnet.com

staff writer Carl Collen +44 20 7501 3703 carl@fruitnet.com

managing editor Maura Maxwell

+44 20 7501 3706 maura@fruitnet.com

design manager

Simon Spreckley

+44 20 7501 3713 simon@fruitnet.com

senior graphic designer

Mai Luong

+44 20 7501 3713 mai@fruitnet.com

graphic designer Asma Kapoor

+44 20 7501 3713 asma@fruitnet.com

finance director Elvan Gul +44 20 7501 3711 elvan@fruitnet.com

accounts receivable Tracey Haines +44 20 7501 3717 tracey@fruitnet.com

finance manager Günal Yildiz +44 20 7501 3714 gunal@fruitnet.com

subscriptions +44 20 7501 0311 subscriptions@fruitnet.com

advertising manager

Gulay Cetin +44 20 7501 0312 gulay@fpj.co.uk

account executive

Lucy Kyriacou +44 20 7501 0308 lucy@fpj.co.uk

head of events and marketing

Laura Martín Nuñez +44 20 7501 3720 laura@fruitnet.com

managing director, fruitnet europe

Mike Knowles +44 20 7501 3702 michael@fruitnet.com

commercial director Ulrike Niggemann +49 211 99 10 425 ulrike@fruitnet.com

managing director, fruitnet media international Chris White +44 20 7501 3710 chris@fruitnet.com

Edwin Reyes promar international Edwin puts the spotlight on Singapore, the modern Southeast Asian city-state that could provide a fruitful export market for British fresh produce analysis–p12-13

Paco Borrás paco borrás consulting Industry expert Paco discusses the current state of play in the Spanish citrus sector, and what will be required to take exports to the next level comment–p44-46

Robert Harris robert harris communications

Robert explains why Koppert’s Natutec Drive is gaining a fanbase in Britain as growers seek cropprotection alternatives report–p28-30

Tom Joyce fruitnet

With climate change adversely impacting orange production in a number of areas, Egypt is eyeing up an opportunity to boost its presence in the UK market report–p48

©2025 Market Intelligence Limited, part of Fruitnet Media International. All rights reserved. Neither this publication nor any part of it may be reproduced, stored or transmitted in any form, including photocopies and information retrieval systems, without the prior permission of Market Intelligence Limited.

Printed by Drukarnia Know-How, Modlnica, Poland) Fruitnet Media International

The Food Exchange, New Covent Garden Market London SW8 5E, United Kingdom tel +44 20 7501 3700 info@fruitnet.com fruitnet.com

The government is promising “a new deal for farmers” that puts British food production front and centre with policies designed to support profitability and nature restoration.

Addressing the Oxford Farming Conference on 9 January, Defra secretary Steve Reed announced Labour’s “farming roadmap”, which he said will be the “most forward-looking plan for farming in our country’s history, a blueprint that will make farming and food production sustainable and profitable for the decades to come”.

The roadmap will be built on three strands –putting food production at the core, allowing businesses to diversify and make a profit, and recognising that restoring nature is essential to food production rather than in competition with it.

In his speech, Reed spoke of tearing down barriers to exports, expanding global trade opportunities, and implementing regulation for the fresh produce sector to guarantee fairness. He pledged to introduce reforms that will allow farmers to improve and diversify their businesses more easily. The secretary of state also announced “the biggest-ever budget for sustainable food production in our country’s history”, with a total of £5 billion invested over the next two years to help all farmers transition to more naturefriendly farming methods.

Reed rounded off his speech by stating that the government will work with farmers, growers, manufacturers, processors and supermarkets to shape the long-term plan for the future of farming.

Reacting to the government’s “new deal”, NFU president Tom Bradshaw said there were positive elements to Reed’s announcement, but warned that it “fundamentally fails to recognise that the industry is in a cash-flow crisis with the lowest farmer and

ABOVE—Defra secretary Steve Reed RIGHT—UK salad veg production is under threat due to post-Brexit border checks

OPPOSITE TOP— Supermarkets slashed the price of Christmas veg in December

OPPOSITE MIDDLE— Nador Cott Protection is taking legal action against another major UK retailer

grower confidence ever recorded”. He added: “Many are worried about making it to the end of 2025, never mind what happens 25 years down the line.”

Bradshaw highlighted the controversial inheritance tax changes, national insurance hikes, cuts to direct payments, and delays to environmental schemes as reasons that many farm businesses will fail to survive and benefit from the “new deal”.

“It’s great that government thinks farming and growing businesses should be more profitable and sustainable in the long term,” Bradsaw continued. ”It’s also good to hear the government say the primary role of farmers and growers is to produce food, but how is it going to ensure food production is profitable when thousands of farmers and growers are questioning whether they’ll still be in the industry in the next year?

“The government must now face up to the reality of the fierce policy headwinds and challenging market conditions the industry is facing into and act to secure the future of British farming.”

British greenhouse growers are imploring the government to help UK producers stay in business and ensure domestic salad crops remain on UK shelves. UK tomato, cucumber and pepper growers warned in December that they were “extremely concerned” about the viability of 2025’s crop due to delays caused by post-Brexit checks on imported seeds and plants at the UK-EU border.

The group of producers, known as British Protected Edibles Growers, said new Border Target Operating Model (BTOM) controls are posing a substantial threat to plant and seed health, and are causing significant delays to seed and plants reaching their final destinations. Phytosanitary checks taking place at government border control points (BCPs) should instead be conducted by member businesses, the group argues.

The UK retail price war hit a new fervour over the festive period with many supermarkets selling vegetables for mere pennies.

Tesco said it had invested millions of pounds in offering seven key veg lines at Clubcard Prices in large stores. A 1kg bag of carrots, 2kg of potatoes, 500g of Brussels sprouts and 500g of parsnips, as well as broccoli, swede and red cabbage, were all sold for just 15p each. Asda went even lower with its reductions, with 2kg of potatoes, 1kg of carrots,

500g of sprouts, 360g of broccoli and 500g of parsnips each selling for only 8p up until Christmas Eve. Lidl’s festive veg prices were pitched at 15p. And at Morrisons from 18-24 December, shoppers with a More card were able to pick up 1kg of carrots, 500g parsnips, 500g of sprouts, or a whole swede for 10p each.

Nador Cott Protection (NCP) has revealed that it has taken legal action against a second major retailer in the UK over what it says is the “unauthorised sale” of Tango/Tang Gold mandarins.

In January 2024, NCP also began proceedings against UK retailer Sainsbury’s, with a settlement being reached in October.

This new infringement action represents an intensification of NCP’s efforts to protect its rights over the Nadorcott variety, not least concerning the use of Tango/Tang Gold.

Branston will be hosting one of two low-carbon concept farms for Tesco, aimed at trialling new sus-

tainable farming techniques.

The potato supplier, along with livestock processor ABP, will explore current and future innovations such as low-carbon fertilisers, alternative fuels, state-of-the-art cold storage, and carbon-removal techniques, as well as innovation in other areas including soil health, grazing management, biodiversity assessment and management, and genetic improvements.

The farms will aim to provide farmers in Tesco’s supply network with a practical demonstration of a route to net zero, helping pave the way to more low-carbon farms in the future. fpj

• Average household spending on take-home groceries hit a record high this Christmas at £460. Overall take-home sales rose by 2.1% year on year in the four weeks to 29 December.

• December was the busiest month for footfall at the retailers since the pre-lockdown rush in March 2020. The average household made nearly 17 separate shopping trips.

• Sales growth for branded goods accelerated to 4.2%, while premium own-label lines jumped by 14.6%.

• The latter now account for a record 7% of all sales, as nine in 10 households bought at least one of these products in December.

Retailer market share. Source: Kantar, 12 w/e 29 December 2024

Source: Kantar

Chile’s avocado exports for 2024/25 are estimated at 116,000 tonnes, up 29.8% on the previous marketing year due to higher production volumes. This is according to a report from the USDA’s Foreign Agricultural Service, citing data from the Chilean Avocado Committee. Overall production is expected to hit 200,000t in 2024/25 thanks to favourable weather conditions, the report stated.

• More people chose to do some of their Christmas grocery shopping online this year, with 5.6mn households opting for delivery or click-and-collect services at least once.

• Online spending reached a record £1.6bn in December.

• Despite the festive cheer, grocery price inflation ticked up to 3.7%, its highest level since March 2024.

• Britain’s largest grocer Tesco saw growth across its convenience, superstore and online channels, contributing to a 5% increase in sales over the 12 weeks to 29 December.

• Its 0.8% share gain was the biggest of any supermarket, increasing its hold of the market to 28.5%.

• Sainsbury’s achieved its highest share since December 2019, at 16%, thanks to sales growth of 3.5%, which outpaced the market.

• Lidl and Aldi achieved their highest-ever Christmas shares at 7.3% and 10% respectively

• Lidl had the fastest footfall growth of any retailer as spending increased by 6.6%.

The Central Association of Agricultural Valuers calculates that

more farmers will be hit by inheritance tax due to inflation and frozen reliefs

The festive season proved a sparkling success for the grocery sector, with sales surpassing an unprecedented £13 billion in December. This milestone, achieved during the crucial four weeks of December, highlighted a nation in the mood to celebrate, despite grocery price inflation climbing to 3.7 per cent, its highest level since March 2024.

While the rest of the high street faced reports of dwindling footfall, supermarkets enjoyed a bustling December. The average household made nearly 17 shopping trips, creating the busiest month for grocery retailers since the pre-lockdown panic of March 2020.

Unsurprisingly, Monday, 23 December stood out as the biggest shopping day of the year, boasting sales 30 per cent higher than on any other day in 2024.

Britons were not only shopping more but also spending more. Sales of branded goods grew by 4.2 per cent, while premium own-label products surged by a staggering 14.6 per cent. These premium lines now account for seven per cent of all sales, with nine in 10 households indulging in at least one such product.

Christmas promotions also encouraged

White potatoes (2kg)/Budgens (east) +£1.50

Retail price continuum

LAURA FRY

Consumer insight director for produce Kantar Worldpanel

shoppers to upgrade, particularly in the produce sector, where premium own-label goods emerged as the fastest-growing tier, with 17.3 per cent growth.

Promotions had a marked impact, reducing the average price of produce staples by 33p per kilogram, an enticing incentive for shoppers. This strategy drove an eight per cent rise in value and a two per cent increase in volume sales of fresh produce.

Cauliflower stole the show as the fastest-growing Christmas item, boosted by a 10p per kilogram price rise and a wider presence in British households. Interestingly, non-Christmas produce categories led growth outside the festive season.

This Christmas, grocers demonstrated their ability to adapt and attract shoppers through promotions, product ranges and own-label lines, which also made people’s Christmas last year. fpj

Source: BG Insights, 13 January 2025

Okra (175g)/ Sainsbury’s (east) +£1.10

Parnsips (500g)/ Budgens (east) +80p

Small onions (1kg)/Budgens (east) -60p

Plums (x6)/ Morrisons (West Midlands) -£1

Tenderstem (160g)/ Asda (southwest) -£1.05

Source: BG Insights, 13 January 2025

Despite a general decline in fresh produce self-sufficiency in recent years, there appears to be genuine potential for the UK to start growing, and even exporting, more protected crops. Fred Searle reports

Fred Searle

The UK’s greenhouse and vertical farming sectors have had a rough ride in the past three years. The Russian invasion of Ukraine in 2022 and the subsequent energy crisis, combined with insufficient retail prices, forced a number of growers out of production, particularly in the cucumber category. And although energy prices have since stabilised, there is a widely held view that both the government and supermarkets could be doing more to support controlled environment horticulture (CEH) in Britain.

Against this backdrop, it might seem incongruous to speak of the possibility of scaling up British greenhouse and vertical production, but that is exactly what the NFU’s Horticulture and Potatoes Board chair Martin Emmett thinks will happen over the next few years. And climate change has a lot to do with it.

Emmett predicts that climate volatility in the Mediterranean basin, where the UK sources large volumes of salad vegetables (such as tomatoes, peppers, cucumbers and leafy salads), will prove a catalyst for growth in the UK’s own protected horticulture sector. And he sees a genuine opportunity for Britain to not only become more selfsufficient, but also to evolve into a

major exporter of these crops.

“I am confident we will make more of a contribution to global food supply in years to come,” he says. “If we look at the situations in Spain – where there has been extreme drought, flooding and temperatures over the past year –you can no longer confidently find anywhere in the world where you can be sure of reliable production. In fact, in many respects the UK now has one of the more predictable climates.”

The tomato shortages from Morocco and Spain in early 2023 were further evidence that even protected production in these key sources isn’t immune to climate volatility.

Emmett reveals that we will soon see significant growth in the UK’s greenhouse and vertical farming sectors thanks to investments in a couple of large-scale but asyet-undisclosed projects. “We are seeing some big money coming into these sectors, both from existing producers and new players, so watch this space.”

According to Emmett, the greatest potential for protected production growth exists in tomatoes, peppers and cucumbers, as well as some further expansion in leafy salads. James Lloyd-Jones of major vertical farming business Jones Food Company (JFC) echoes his optimism, eyeing potential for the

UK’s heavy dependence on lettuce and herb imports to eventually “swing the other way”. This can be achieved through investment in co-located greenhouses and vertical farms, sharing a renewable energy source, he believes.

Thanet Earth’s technical director Rob James sees opportunities in tomatoes in particular as retailers invest in quality and availability. However, he says bell peppers, which are mainly sold in commoditised triple packs, are a lower-margin product that is less likely to attract major investment.

Aside from salad vegetables, strawberries are the other crop with real potential for greenhouse expansion. Indeed, many in the UK fresh produce industry will be aware of the recent exploits of The Summer Berry Company, which now produces strawberries all year round thanks to its sustainable energy systems

and advanced LED lighting. Dyson Farming, meanwhile, produces almost year-round – with gaps in February and August – and says it is scaling up production to begin growing a significant volume of strawberries for the full 52 weeks.

Berries are the “most logical” crop to see further investment in 52-week greenhouse production, says Dyson Farming’s commercial director Steve Barker, who cites the capital investment required and high value of the crop.

“The berry category also gives greater opportunity to differentiate quality compared with an imported product,” he says. “Our experience of growing strawberries tells us consumers are willing to pay more for high-quality British fruit during periods where imported fruit had been the only option. Compared to the summer peak, retail sales of strawberries can reduce tenfold in winter. And quality is one of the main drivers of this volume reduction.”

Quality and value are the most important considerations for UK shoppers, Barker stresses, arguing that British provenance alone is not enough to persuade consumers to choose your product.

“We cannot just view UK production through the lens of food miles and food security,” he says. “It must be a better product than the imported alternative to create a shift in purchasing behaviour, which ultimately drives demand.”

Despite all this potential, the road to CEH production growth is a rocky one. The big limiting factor,

OPPOSITE TOP—Thanet Earth sees strong potential for more UK tomato production OPPOSITE—Martin Emmett says CEH in the UK is set for significant growth ABOVE—Dyson Farming has extended the availability of British strawberries

according to Emmett, is Biodiversity Net Gain, a government policy to ensure habitats for wildlife are left in “a measurably better state” than they were before a new development. He points out that this approach can greatly expand the footprint required to build or expand a greenhouse. And he laments the barrier this creates to investments in protected cropping, which has the important environmental benefit of reducing the UK’s reliance on imports.

Planning restrictions can also be a stumbling block, and at the Oxford Farming Conference Defra secretary Steve Reed promised to “speed up the system” to help vegetable growers upgrade or expand greenhouses. Emmett highlights that such reforms should look at removing restrictions on building heights and enabling associated infrastructure developments such as connections to the national grid.

The other big hurdle, especially regarding year-round production, is labour availability. Seasonal workers are especially hard to come by over Christmas and New Year when most travel home, according to Lee Stiles of the Lea Valley Growers Association. This labour uncertainty “far outweighs” concerns about additional energy costs associated with 52-week production, he says.

That said, securing enough investment for out-of-season production is far from straightforward, and David Sanclement of The Summer Berry Company is keen to see better government support for CEH in Britain. “We would like to see a strategy about the UK’s food production and security that is supported by a longterm investment proposal,” he says. “The current process of opening grant funding at short notice and with a short application period does not make long-term investment planning easy. We would like clarity on the future role of producer organisations in the UK, along with a well-thought-through broader policy on green energy and land utilisation in the UK.”

James of Thanet Earth notes that the Dutch greenhouse sector has benefitted from collaborative industry networks, government support, and access to robust R&D. For the UK, “adopting a similar approach to investment, fostering stronger collaboration in the industry, and creating a supportive policy framework could significantly enhance the sector’s ability to scale and compete internationally”.

The focus, according to Lloyd-Jones, should not be on subsidising shiny new greenhouses and vertical farms, but instead on making CEH more enticing for private sector investment. The government could do two simple things to turbocharge protected horticulture, he says. Firstly, include horticulture in the Energy Intensive Industries scheme to remove the commodity costs from growers’ energy bill. And secondly, offer businesses a large capital allowance of 200-300 per cent over a three-year period for horticultural investments. These changes would then free up money for growers to invest more in automation and related staff training. “Let the private sector do it,” he says. “They’ll do it better and more efficiently and cheaper than the government trying to subsidise the sector.” fpj

Edwin Reyes of Promar International analyses the Singaporean market and explores its growing potential for British fruit exporters

Since leaving the EU, the UK has been focused on establishing its own trade policies and agreements independently, with the goal of enhancing its global trading position. These initiatives are part of a broader strategy to bolster the UK’s economic resilience and global influence.

Southeast Asia is a region that has gained significant interest due to its substantial economic growth over the past few decades. The Association of Southeast Asian Nations (ASEAN) is projected to become one of the world’s largest economic blocs in the near future. As a result, Singapore, a founding member of ASEAN, is among the countries attracting increasing interest from UK fresh produce businesses.

prehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has also increased interest in the region. This is a free-trade agreement between 12 countries in Asia and the Pacific. The UK joined the CPTPP in 2024, becoming the first non-founding country to do so.

BELOW—Singapore is a major re-export hub for the Southeast Asia region

OPPOSITE—Apples are potentially a product of interest for UK exporters

Singapore is also a popular tourist destination, attracting just over 19 million visitors annually – more than triple its local population, with Chinese tourists (Singapore’s largest source of visitors) playing a major role in this.

Interest in Singapore is further boosted by the fact that it maintains one of the most liberal trading regimes in the world. Additionally, its own limited land area means that around 90 per cent of its food supply needs to be imported. The UK and Singapore also share a common language and have strong historical ties. Both economies have similar business and legal practices and share similar technical standards.

For strawberries, imports are much more modest, at just under 4,000t per annum. The supply is dominated by the US, South Korea and Australia, which together account for 85 per cent of total supply. Although UK exports of strawberries have been growing Analysis

The development of the Com-

Despite having a population of just under six million, Singapore boasts a very high per-capita income and serves as a re-export hub for the Southeast Asian region. Countries such as Indonesia, Malaysia, Cambodia, Vietnam, Myanmar and Hong Kong are all common targets for re-export trade from Singapore. The country has a well-established and highly consolidated grocery retail market, with modern retail accounting for approximately 80 per cent of the sector. This market is dominated by three major players: NTUC FairPrice, DFI, and Sheng Siong. However, smaller companies like Red Mart, Lazada, Don Don Donki, and Hao Mart are expected to see faster growth through 2027.

Some products of interest for UK fresh fruit producers/exporters include apples, strawberries and cherries. In the apple sector, around 38,700 tonnes are imported annually. This market is dominated by China, which accounts for almost 40 per cent of total imports over the last 10 years. Other significant sources of apple imports are South Africa (21 per cent), New Zealand (17 per cent), France (nine per cent), and the US (eight per cent). Over the past decade, UK exports of apples to Singapore have been low and inconsistent, with the highest levels reaching around 65t a year.

rapidly, the volumes remain small, increasing from no exports before 2015 to around 60t currently.

In the case of cherries, imports are also modest but have slightly increased from 1,800t in 2014 to just under 2,500t.

The US, Australia and Turkey account for almost 90 per cent of

total cherry imports over the last 10 years. Indeed, at the moment, UK exports of cherries are hardly on the radar at all.

British food and drink products have steadily gained popularity in Singapore over the past decade.

This trend has accelerated since the advent of Brexit, creating a ripe market for UK exports. In fact, the UK exported almost £15 billion of goods to Singapore last year, and the country has recently entered the top 15 export markets for Britain.

As previously stated, Singapore presents clear opportunities for UK suppliers, but it also poses significant challenges. The current low levels of UK exports – along with strong competition from well-established fruit producers and increasing interest from EU countries – make this a demanding market to penetrate. UK businesses will need to work hard to develop this market. Nevertheless, the presence of companies such as Driscoll’s UK (formerly Berry Gardens) and Worldwide Fruit in Singapore shows success is achievable.

Growth in overall imports is likely to increase, given the expected rise in consumer incomes, as the Singaporean economy continues to recover from the Covid pandemic and tourism rebounds. However, to succeed in this market, a long-term strategy is needed. It is vital for companies to have a clear understanding of the target market. This helps in identifying opportunities and potential challenges. fpj

UK exports have a key role to play in strengthening the British horticulture industry and strengthening global food security, as Luisa Cheshire reports

hen it comes to UK vegetable exports, it is fair to say that 2024 went out with a bang. On 30 September, the NFU announced a major coup: British beetroot growers had won access to the US market for the first time.

The breakthrough came after a two-week US visit by an NFU delegation and nearly a decade of campaigning by UK growers, specifically East Anglia-based salad veg producer G’s, which has also run an American beets business in Rochester, New York, since 2016.

The long-awaited victory was swiftly followed by another export success. On 4 October, G’s hosted a visit from US ag-trade o cials to discuss further opportunities

for British vegetables in the States. Matthew Palmer, the deputy chief of mission at the US Embassy in London, and Anita Katial, the embassy’s counsellor for agricultural a airs, toured G’s farming operations in Cambridgeshire, where they discussed shipping UK beetroot, celery and radish to America with members of the G’s team.

Since then, things have gone fairly quiet on the UK vegetable export front. Speaking to FPJ in early January, G’s Group communications director Anthony Gardiner said the firm was preparing to send a test-load of British beetroot to the US in the next month or two. But, he reported that there had been no further progress in securing US access for British celery or radish, of which G’s is a major supplier. “We worked with Defra and lobbied the US agencies to gain UK beetroot access for probably at least eight years. These things take time.”

That said, Gardiner emphasises that having a strong business case for a product can certainly facilitate the export access process. “When we

September

spoke to US trade o cials about exporting UK beetroot, presenting a clear objective was really important in terms of influencing their decision to let these products in,” he says. “With our Love Beets processing factory in Rochester we were able to clearly show a customer demand pull for the product we wanted to export. This clear market opportunity helped to prioritise the US-UK beetroot deal.”

Martin Emmett, chair of the NFU Horticulture and Potatoes Board, echoes this point about having a producer-led initiative when it comes to identifying what, when and where to export. British vegetable growers can then approach the Defra international trade team to explore how to access specific markets.

Emmett also highlights the importance of Defra’s overseas agri-food attachés in winning new export markets for UK produce. He singles out Will Surman, UK agriculture attaché to Washington, as pivotal in clinching the UK-US beetroot deal last year.

“It shows the type of wins we’re able to achieve with the UK’s expanded network of agriculture attachés following a number of years of campaigning by the NFU for the creation of these positions,” he says. “I think it

is a really good demonstration of the impact of having that person on the ground in these overseas marketplaces. Someone who can develop a network and can understand what the blockers to access are.

“More often than not, with the US market it’s not about tariffs, it’s about sanitary and phytosanitary (SPS) measures. Will [Surman] was able to work on the ground as an ‘unblocker’ to assist with an effort that had been going on for the last eight years or so.”

Thanks to recent NFU campaigning, there are now 16 attachés based in British embassies and consulates around the world (Canada, Mexico, US, Brazil, Kenya, The Gulf, India, Japan, China, Thailand, Vietnam, Northern Europe, Southern Europe, South Korea, Australia and New Zealand). This is up from 11 in 2023, and the original 11 helped resolve 42 agrifood barriers worth an estimated £340 million in 2023 alone, according to Defra statistics.

Emmett believes the role of agri-food attachés has never been more vital to UK horticulture. “The general blockers to UK fruit and veg exports are SPS issues. And, since Brexit, we are no longer benefitting from arrangements made with the EU. It is a case of having to fight our own corner,” he says. “At the same time, better access to global markets would be something that improves confidence in the UK horticulture sector.”

But how can better access be achieved in today’s postBrexit climate? Guy Poskitt of Yorkshire carrot producer MH Poskitt says seizing trade opportunities in Europe has become “a huge challenge” since Brexit. “Historically, we have been a spot carrot exporter to Europe, supplying crop when there are shortages,” he tells FPJ. “But in

order to export anywhere outside the UK now, you have to have your product phyto-tested by a Defra inspector. This can take up to three days unless you can do it in-house, by which time the export opportunity has gone.”

This barrier to trade is reflected in the gap between pre- and post-Brexit horticultural exports. In 2023, vegetable exports – including re-exports –were down by 47.6 per cent in volume compared to 2019, according to government figures.

Emmett believes a shift in government policy is essential to turn this around. And, he is cautiously optimistic that change is on its way. “The Labour government has talked about a potential new SPS agreement with Europe to bring exports back to pre-Brexit levels. But it does take time to negotiate this type of thing,” he says. “Horticulture operates as a very globalised sector, and to be competitive we need a government that has a globalised perspective.”

In Emmett’s view, strengthening UK fresh produce exports is not only important for the future of British production, but also to international food security. “As UK enterprises get bigger, they are going to face far more significant problems when there are surpluses in supply. So, if they can build export markets into their business model, it can help address part of that challenge,” he says. “Added to that, we are living in a world where we must play our part in global food security as well.” fpj

Will Surman, the UK’s agri-food attaché in Washington, gives FPJ the lowdown on the recent UK-US beetroot access deal.

“I’m delighted that we’ve secured this important win for our horticulture sector, opening a new and exciting market to our growers and exporters,” he says. “The great thing about our market access for beetroot is that it’s as beneficial to the US as it is to UK producers. Our growers can provide top-quality beetroot outside the US season and supplement any shortfall in domestic supply during the rest of the year, ensuring the growing popularity of beetroot among US consumers can be met.

“What’s more, much of the beetroot we’ll be sending to the US is destined for a UK-owned processing plant in upstate New York with over 100 employees, so it’s supporting US jobs and UK enterprise. I was able to make this clear to decision-makers in the US thanks to my strong relationships within the US government. Having UK ministers and senior stakeholders amplify that message was key to getting this over the line.”

He adds: “Since I arrived in Washington, I’ve learned exactly how the system here works and fostered ties with the people in it. It’s only by doing so that I can influence and overcome trade barriers for the UK.

“I’m working hard to continue this momentum, to unlock access for celery, radish, spring onions and potato mini-tubers, and other agrifood goods. And I’m eager to hear about new opportunities that UK exporters have identified in the US and to work through any regulatory obstacles to help realise those.”

MIDDLE—The Summer series apricots are all high-Brix and juicy BOTTOM—The Temptation Valley packaging is themed on the Garden of Eden

New Zealand apricot exporter Ardour Valley Orchards invites shoppers to move through the exhilarating stages of a summer romance with its new branded range

Ardgour Valley Orchards, New Zealand’s largest exporter of specially bred Summer series apricots, draws from the emotive themes of a summer romance in its new brand, Temptation Valley.

The first five apricots in the series, bred specifically for New Zealand’s growing conditions, are Summer Spark, Summer Desire, Summer Charm, Summer Passion, and Summer Blaze. They were launched with Garden of Eden-themed Temptation Valley branding on the world stage and domestically over the summer.

“Summer series apricots are uniquely New Zealand, moreish and tempting,” says Ardgour Valley Orchards’ international sales and marketing manager Sharon Kirk. “The Temptation Valley brand describes the stages of summer love through the progressive seasonal timing of the Summer series.

“The story starts with a promise of what’s to come as the season progresses. First you meet someone and there’s a spark, so the first to ripen is Summer Spark. That spark turns into desire (Summer Desire), then the charm develops as you get to know someone (Summer Charm). As you fall in love, there’s a passion (Summer Passion), and finally a blaze (Summer Blaze).

“We have the most beautifullooking, delicious apricots and

we want people to ‘fall in love’ with every bite of every apricot by remembering what it’s like to fall in love. It’s a beautiful, upbeat brand that matches the vibrancy of the apricots. The packaging is delightful, attractive and conveys richness and irresistibility.”

All Summer apricots are highly blushed, juicy and sweet, with Brix of around 14-plus, compared with the industry standard of 9-11, yet each has its own distinct eating attributes. “Over time, apricot lovers will develop a taste for their favourite, just as they have with other well-known apricot varieties,” Kirk says.

Central Otago-based Ardgour Valley Orchards also produces Kioto apricots, as well as four cherry varieties, including the distinctive white-fleshed, redblushed Stardust, and red varieties Lapin, Kordia and Sweet Georgia.

Temptation Valley apricots are presented in deep blue boxes (3kg and 5kg) and are available from December to February.

Of the approximately 150 tonnes of apricots harvested during the 2024-2025 summer, about 100 tonnes is destined for Canada, the US, the UK, Dubai, Saudia Arabia, Malaysia, Singapore and Thailand. This is more than double the volume produced last season thanks to tree age and the ideal conditions during blossoming and fruit-set.

Ardgour Valley Orchards has a 56 per cent share of the Summer series market and grows apricots under licence to NZ Summerfresh. Plant & Food Research released the varieties for commercialisation two years ago. fpj

Climate woes in Southern Europe and a post-Brexit trade advantage could work in Belgium’s favour as the country looks to cement its reputation as a supplier of the finest fresh produce. Fred searle reports

Fred Searle

Maintaining a reputation for growing and exporting high-quality fresh produce is no small task. It requires passion, care and precision right the way through the supply chain. And this is exactly what Belgium continues to demonstrate as it looks to capitalise on new export opportunities in the

UK, Europe and Asia.

Belgium is a small country. Indeed, at its widest stretch from the North Sea coast to the GermanyLuxembourg border, it is only about 290km wide. But what it lacks in size, it makes up for with efficiency, coordination, and modern growing techniques. From its well-oiled grower cooperatives and auction clock sales, to its highly automated and sustainable greenhouses and packhouses, there is much to be admired about the country’s fresh produce industry.

When it comes to trade, pears and tomatoes are by far Belgium’s most valuable fruit and vegetable exports. The two products were worth €343.1mn and €320.1mn respectively in 2023, according

BOTTOM LEFT—Pears are Belgium’s biggest fresh produce export

BOTTOM RIGHT—Maarten Verhaegen of BelOrta sees a chance for export growth in various European markets

OPPOSITE TOP—Maarten de Paep and Yasmine Smeets are trialling Xenion

OPPOSITE MIDDLE—Bert Depoortere has boosted quality and yield with hydroponics

OPPOSITE BOTTOM—Jeroen Buyck reports export growth to Spain and Italy

to Eurostat and VLAM, Flanders’ Agricultural Marketing Board. It is in these products and others – notably peppers, leeks, cucumbers and strawberries – that Belgium’s leading cooperatives and exporters see opportunities to grow trade. And there are good reasons to believe they will be successful.

Climate change in Southern Europe – leading to extreme temperatures, drought and flooding – is creating opportunities for Belgium to send more produce to countries such as Spain and Italy. Indeed, these emerging opportunities were highlighted in Septem-

ber and October when production in both countries was hit by devastating floods.

Jeroen Buyck is the CEO of Calsa, one of Belgium’s leading fresh produce exporters. His company has witnessed significant export growth to Spain and Italy in the past two to three years, particularly in leeks, cabbage and pears. “Product quality is really important in both markets,” he says, “which has given Belgium an advantage”.

According to Maarten Verhaegen, sales division manager at Belgium’s largest fruit and vegetable cooperative BelOrta, there are also opportunities to expand in the French market “by a couple of per cent”, since the country’s greenhouse technology is generally quite old. Germany, however, which is one of Belgium’s biggest fresh produce markets, is becoming more self-sufficient in some fruits and vegetables, so Verhaegen expects opportunities in certain products to decline slightly there.

The lucrative Norwegian market, meanwhile, is being targeted by VLAM in a new promotional campaign.

UK trade, meanwhile, has been turbocharged by Brexit due to the country’s geographical proximity, streamlined logistics, and comparative advantage in terms of freshness. This despite the added regulation and administrative burden caused by Brexit.

BelOrta, for one, is keen to advance its position in the UK market. Since Brexit, the co-operative has increased the share of its exports destined for the UK – from 2-3 per cent to 10 per cent. And Verhaegen says BelOrta wants to reach a 15-20 per cent share in the next few years.

He sees opportunities for Bel-

gian fresh produce companies to reach new customers in other parts of the country, as well as continuing to focus on well-established supply relationships at London’s wholesale markets.

Looking further afield, Asian markets might only account for relatively small volumes from Belgium, but they are evolving quickly. China and Hong Kong are the fastest-growing markets for Belgian pears – predominantly in Conference but also in premium varieties such as the red-blushed Sweet Sensation.

Indeed, when Fruitnet visited BelOrta’s state-of-the-art packhouse in Borgloon in November, special packaging for Chinese New Year was coming off production lines in time for the celebration on 29 January.

Belgian pear growers have a particularly strong reputation around the world, especially in the Conference variety, which accounts for roughly 90 per cent of total production. The country’s temperate maritime climate is perfectly balanced for pear production, says Diether Everaerts, who looks after BelOrta’s fruit sales.

He reports a marked shift from apple to pear production in Belgium over the past few years. This is largely due to higher prices for pears – since the global apple market is highly competitive – but also because of the wide range of packaging required by different apple markets and customers.

According to VLAM’s provisional 2024/25 figure, from the Association of Belgian Horticultural Cooperatives, the surface area dedicated to Belgian pear production (10,700ha) is more than double

that for apples (4,500ha). Ten years ago, by contrast, production of the two fruits was roughly equal (9,000ha of pears versus 7,000ha of apples). »

In tomatoes, too, there are considerable opportunities for export growth, and Belgium’s cooperatives and exporters will be encouraged by Eurostat figures revealing a steady increase in fresh tomato exports to the UK market since 2010.

As it stands, some of main tomato varieties offered by the cooperative are beef variety Baron, round tomato Prince, and vine tomatoes Elite and Princess – as well as speciality varieties such as roma vine tomato Ruby Red and new premium high-Brix variety Aromia. Verhaegen says there is plenty of new varietal development in progress, with BelOrta monitoring around 200 varieties each year from various breeding programmes.

A major focus at the moment is on switching to ToBRFV-resistant varieties that also deliver on taste. Verhaegen notes that most of the resistant varieties currently in commercial production globally have a slightly inferior flavour compared to previous cultivars, but he says BelOrta’s growers have some promising new varieties lined up

for production next season.

“In the next two to three years, we are looking at supplying more premium varieties, not only in tomatoes but also in cucumbers, snacking cucumbers, and other specialities,” says Verhaegen. “There is a lot of business to develop in the UK and the rest of Europe. And we want to give BelOrta an even stronger reputation for premium produce.”

Looking ahead, Belgium also has a growing focus on hi-tech greenhouse production – not just in tomatoes, but also in other key crops such as strawberries and lettuce. Not only are more growers trying to shield themselves from the unpredictability of climate change, but they are also seeing the financial sense of investing in more efficient and sustainable production systems, requiring less manual labour. Despite a general problem with succession, this transition is also helping to attract young people to the industry.

Bert Depoortere is a secondgeneration lettuce grower in the

There is a lot of business to develop in the UK and the rest of Europe. And we want to give BelOrta an even stronger reputation for premium produce

Flemish town of Ardooie for the REO Veiling cooperative. Since 2016, his business has switched to 100 per cent hydroponic production, growing 4ha of butterhead and multicolour lettuce in a highly automated greenhouse.

Robotic systems move pots and trays, while sensors monitor heat, light and moisture so that irrigation levels and greenhouse shading can be adjusted as required. Modernising production in this way has greatly improved shelf life, quality, and yield, as well as removing the need for pesticides, says Depoortere.

It’s a similar story for some of Hoogstraten’s key strawberry growers, two thirds of whom now grow under glass. And as well as embracing the greater reliability and consistency of indoor production, a number of the co-op’s growers, including Maarten de Paep and Yasmine Smeets, are trialling new technology to combat powdery mildew.

The Xenion robot from Belgian-Dutch agritech firm Octiva is a fully autonomous platform that can navigate through a glasshouse independently and carry out various plant treatments. Among Hoogstraten’s strawberry growers, the technology is being used to control powdery mildew with UV-C. And Hoogstraten’s soft-fruit category marketer Eva Vanmarcke says growers have found it both effective and easy to use.

As Belgium looks to mitigate climate and labour challenges, and expand in export markets around the world, technologies like these could prove crucial to its efforts to establish itself as a country to turn to for top-quality produce. fpj

LEFT—Belgian leeks are being exported to Southern Europe in higher volume

Around 90% of production takes place in the Orange River region of the Northern Cape, in the depths of the Kalahari Desert. This area experiences very hot summers, very cold winters, and on average just 6 days of rainfall a year. The optimal climate, along with abundant supply of water, land, and labour, creates ideal conditions to grow and produce the highest quality and tastiest raisins, with world-leading shelf life.

The majority of fruit is either completely residue-free or well below the legal MRL requirements. The very hot, dry climate minimizes the risk of disease and pests, and with world-class agronomy, usually no artificial treatments are required.

South Africa uniquely supplies all major raisin product categories, including: Thompsons, Organic Thompsons, Goldens, Currants, SA Sultanas, OR Sultanas, Flames, Midnights and Crimsons.

Barton & Redman has quietly risen to become one of the biggest operators in UK fresh produce wholesale. Owner Matthew Barton tells Michael Barker how they’ve done it

Barker

In these changing times for the UK wholesale sector, where businesses are having to find new ways of working to survive and thrive, one company believes it has hit on a winning formula.

Barton & Redman, based at Manchester’s New Smithfield Market, is fusing tried-and-trusted techniques with a commitment to modern working that has seen the company enjoy extraordinary growth and plot a course to the upper echelons of UK fresh produce supply.

The company was founded in 1964 when Thomas Barton and his close friend Jack Redman set out to supply local chip shops with the best-quality potatoes. And the business went on to flourish as it met soaring demand from the burgeoning Asian produce trade. Today, the fi rm supplies a range of customers with around 2,500 product lines, has an office in Spain, runs 25 vehicles, and employs 73 staff in what is a far cry from those humble beginnings.

Barton & Redman has seen hugely impressive growth over the past 15 years in particular. Back in 2010, turnover was £28.8 million, but that has since nearly tripled to £71.3mn today.

And that’s just the start: owner Matthew Barton’s ambition is to break into the FPJ Big 50 Companies in the next edition – it just missed out this time around – and double revenue again to an eye-opening £150mn within five years.

A major reason for the optimism is centred around the construction of a new 46,000 sq ft warehouse in 2024, a flagship facility for the company that includes temperature-controlled chambers, office facilities, and external service yards. The investment more than doubles the company’s presence at New Smithfield, where it already has a 25,000 sq ft warehouse on the east of the market.

Third-generation family member Matthew, who is joined in the business by his sister Nicola and father Paul, got involved straight from school, and continues to love every minute of the job. “It gets me out of bed and I will do a 16 or 18-hour day, no problem,” he says. “I don’t see it as a job, I see it as a hobby – the thrill of always trying to beat last week’s sales. It’s all I know.”

Starting at midnight and not being able to get any people working for you – that’s the oldfashioned way of doing things

Barton says his hunger for the job, passion for seeking out new custom, and not getting down when things don’t go well have served him well, and it’s refreshing to hear about old-school people skills bringing success in an era of artificial intelligence, algorithms and business by numbers. That attitude very much extends to his team too: “Having the right people around me is essential,” he adds. “We

have a fantastic team of staff here. They are not just work colleagues, they are friends. And it’s not just on the selling side either, it’s what the office staff do, the delivery drivers – we pride ourselves on keeping our customers happy and having a personal relationship with them.”

Barton expands on the point further, dismissing the suggestion that wholesale is all about price and insisting that only by building those relationships is it possible to provide the bespoke service that many of his customers desire.

With that focus on people in mind, Barton & Redman has decided to take a modern, flexible approach to recruitment. Wholesalers across the country are struggling to find staff for the unsociable nighttime hours that market employees traditionally work, but rather than stick to

the old ways of doing things, the firm has instead tried to adapt to the next generation.

“It’s very difficult to get young people to come into the industry,” Barton admits. “Good salesmen are retiring and there aren’t young people prepared to get out of bed at 2am and work until 1pm, so we are trying to build a 24-hour operation. If somebody is coming into the industry and would rather start at 6am, that’s no problem.

“Starting at midnight and not being able to get any people working for you – that’s the oldfashioned way of doing things. There’s nothing stopping the industry moving it forward 12 hours. So now we have lads starting at all different times.”

Barton is also debunking the idea that wholesalers have to work 80-hour weeks, and says it makes more sense to double the

workforce and let people work standard five-day, 40-hour weeks if they prefer.

Barton sees the new warehouse as the cornerstone of the firm’s growth over the coming years. And despite the fact that an ageing demographic could see a number of wholesalers quit the business over the coming years, he doesn’t anticipate dipping into the acquisition market.

“When you buy a company, unless you’re buying a warehouse or wagons, you’re not really getting anything. There’s no obligation for their customers to continue working with you,” he says. “I’ve seen it many times where someone has bought a business and then within 12 months the customers have gone and sourced from somewhere else. So it makes sense to just wait and pick up that business for free.”

While we haven’t yet seen an influx of major foreign ownership in the wholesale sector, as

is happening among big supermarket suppliers, there are some seriously large-scale operators such as Premier, which broke ground as the first wholesaler to be listed in the FPJ Big 50 Companies.

With Barton & Redman now on the verge of making the Big 50 itself, does Barton expect to see more mega businesses going forward? “I think the bigger businesses are going to get stronger, yes, and unfortunately some of the smaller ones eventually won’t survive,” he says. “Some older owners will retire, and others are struggling to afford the rents.”

Barton insists that however big his company becomes, it won’t be at the expense of maintaining personal relationships, and supporting local growers and farmers. It’s a philosophy that has served the business well and there’s no intention of that changing as the company continues on its upward journey. fpj

CENTRE— Matthew Barton at the company’s 60th anniversary and warehouse opening party in November ABOVE— Paul and Matthew Barton

Innovative new varieties, new marketing concepts and smart technologies are all in contention to win coveted Fruit Logistica Innovation Awards in Berlin next month

Fruit Logistica has unveiled the finalists for this year’s Fruit Logistica Innovation Awards (FLIA). The judges have whittled down almost 70 entries to select five nominations each for the Fruit Logistica Innovation Award and FLIA Technology prize, introduced last year to celebrate outstanding innovations in machinery and technology. Winners will be selected by a vote among visitors to the show.

The nominees for the Fruit Logistica Innovation Award 2025 are:

This organic avocado from Eosta/ Nature & More is said to be the first available all year round, and the first to be grown using rainwater and without artificial irrigation.

Aldina is the brand name of Aldi Süd’s German-grown strawberry variety that guarantees producers purchases throughout the season. Aldi’s aim is to boost strawberry production in Germany, offering long-term economic benefits to producers through transparent pricing and purchase guarantees, and the promise of consistently good flavour for consumers.

Marketed by AMFresh, Onix is a

ABOVE—Zucchiolo won the Fruit Logistica Innovation Award in 2024

Spanish-grown premium pigmented orange withattractive external colouring, high internal pigmentation and long shelf life. The pulp is juicy, features natural pigments, has a strong flavour, and is rich in antioxidants and vitamins.

Halloweena is a brand-new pumpkin-shaped mandarin variety developed by Genesis Fresh as an attractive and healthy alternative to sugary Halloween treats. The variety, which ripens just before the October festival, is easy to peel, sweet and practically seedless.

Bejo Zaden’s Samantha is the world’s first savoy cabbage with a pointed head. Weighing less than 500g, its compact shape, firm leaf structure and distinct colour mean it stands out on shelves and can be used in many ways, including in salads, woks and BBQs.

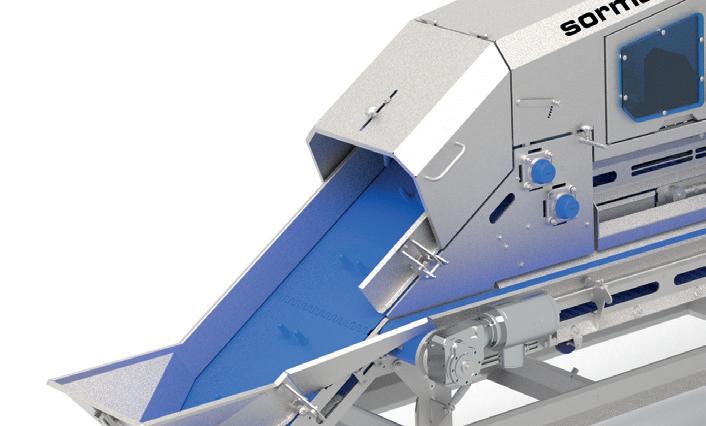

The nominees for the Fruit Logistica Innovation Award Technology 2025 are:

ABZ Innovation equips drones for use in orchards and vineyards with a LiDAR-based situational awareness system. Thanks to real-time 3D mapping, the drones recognise even minor obstacles, such as thin wires or hazards and maintain dynamic height control.

The FarmRoad Irrigation Module helps farmers optimise their water consumption. The dashboards are AI-driven and combine local climate data with sophisticated water-demand models. Using automated drip and runoff calculations, farmers can adapt their irrigation planning to crop needs and local conditions.

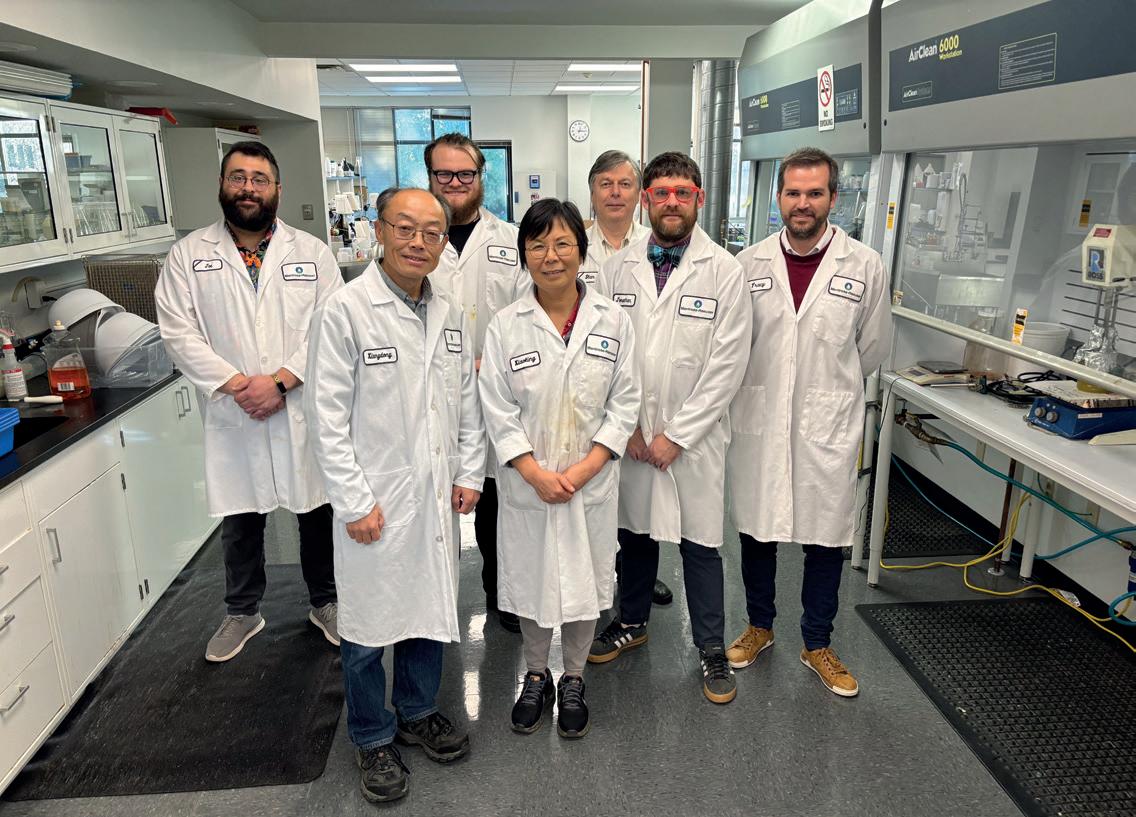

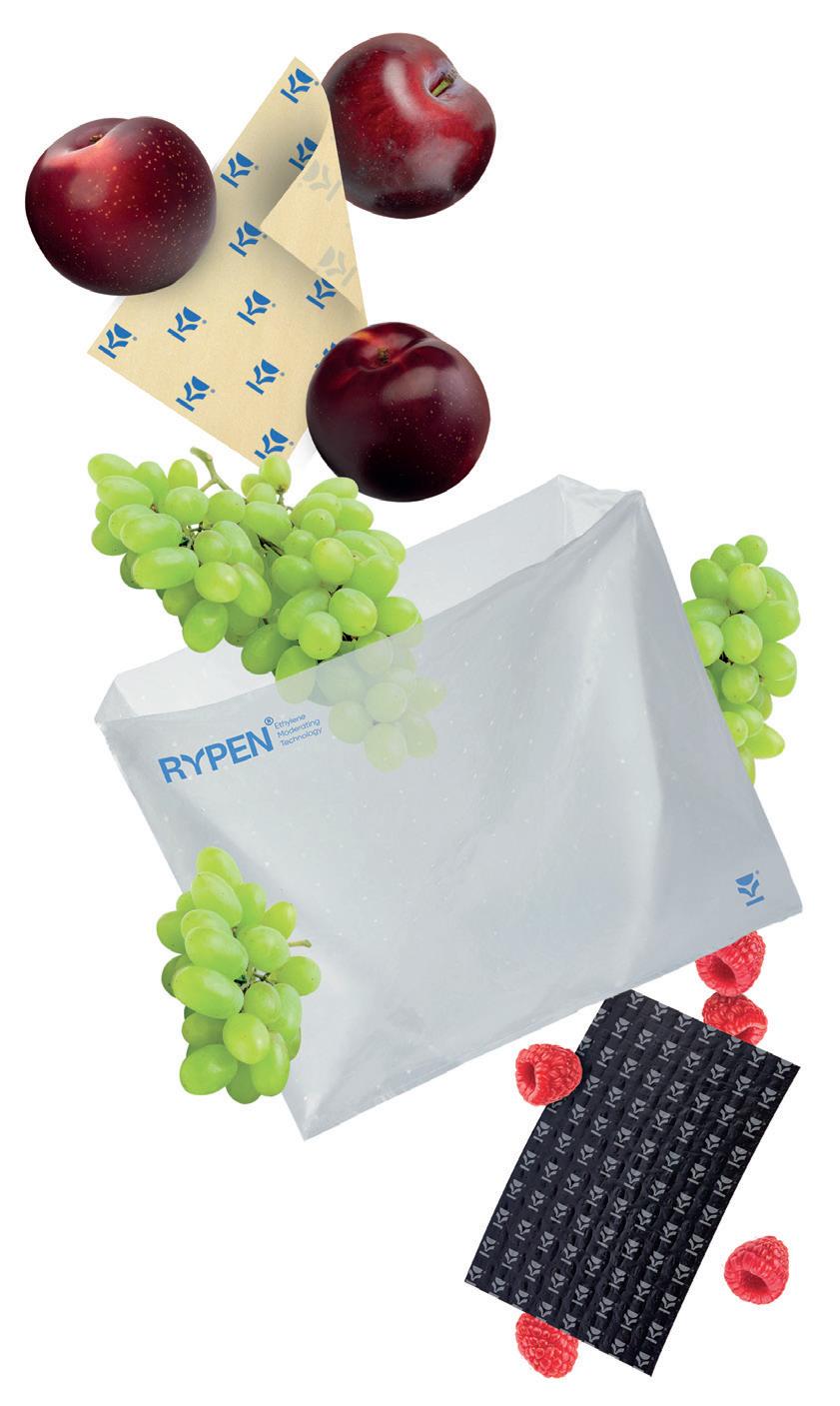

The RYPEN Case Liner keeps fruit in transport crates fresh and crisp for longer. It’s Fresh says that on average customers have observed 85 per cent fewer defects on grapes transported with RYPEN. The technology captures excess ethylene molecules inside the crates and binds their structure.

The Croptimus platform provides growers with image-analysis technology that enables them to detect diseases or pest infestations on vegetables in the greenhouse at an early stage. Cypriot company Fermata markets Croptimus as software as a service (SaaS).

The CATsystem from Citrosol is an intelligent consumption system for use in the post-harvest sector. The evaluation system measures concentrations of fungicides and other solution components in production facilities online and in real time and then adjusts them. fpj

FRUIT LOGISTICA 2025

Britain will be well represented in Berlin next month. FPJ speaks to some of the exhibitors to hear their plans for the show and the year ahead

For AgriCoat, Fruit Logistica is a “must-attend” event where it reconnects with partners and meets new clients across the globe. The business has been a part of the show for 30 years, and believes the event plays a key role in bringing global recognition for its range of solutions.

The cornerstone of its foodprotection solutions is NatureSeal, which is designed to extend shelf life and preserve quality in fresh-cut fruits and vegetables. The products are free from sulphites, allergens and GMOs, and are certified for organic use.

With the rise of avocado-based recipes, the firm will also be high-

“In 2025, we aim to capitalise on the increasing global demand for sustainable, eco-friendly solutions to minimise food waste –an area that is becoming a major driver for our business across all markets,” says director Simon Matthews.

lighting its solutions for longerlasting prepared avocado, from slices and dices to guacamole and smash. In addition, it will showcase its plant-based coatings that protect wholehead fruit after harvest, helping to cut food waste and ensure freshness.

Cocogreen describes Fruit Logistica as “a tentpole event in the global agriculture sector”, and one that represents an essential opportunity to convene its international team, strengthen relationships with existing partners, and create new connections with growers who have an appetite for clean tech solutions.

Senior brand marketing manager Andrew Hudson says the company always sees great interest in its Moisture Control Technology (MCT), which significantly reduces water and fertiliser consumption, and also enhances the overall efficiency and effectiveness

of substrate usage. This allows growers to extract further value through crop volume and quality.

“Our goal is to deepen our engagements in current markets and expand our reach to new regions,” Hudson explains. “We’re ready to continue momentum to build on immense potential in Latin America, and we are eager to extend the benefits of our substrate solutions to more growers in Europe, MENA, Oceania, and North America.”

Back at Fruit Logistica for the second year, Elsoms is looking to build on its transformation from a UKfocused vegetable company into a truly global player, working with customers on every continent.

“Fruit Logistica is the ultimate platform for us to connect with existing clients and forge new relationships with potential partners from around the world, all in one dynamic space,” says head of marketing Grant Hawkins. The company is particularly looking forward to showcasing its sweetcorn and pea portfolio, in partnership with Crookham Seeds on sweetcorn and Crites Seeds on peas. “Beyond that, our own vegetable-breeding programmes are delivering

exceptional brassicas, herbs and root vegetables with unique market potential on a global scale,” Hawkins adds.

The company’s latest developments include the acquisition of a European seed-distribution company based in Dublin, which gives the business a more efficient service to EU customers.

Soft-fruit and polytunnel equipment supplier Haygrove is putting its Advantage Range at the centre of its stand at Fruit Logistica 2025.

The range includes field-scale polytunnels with advanced venting systems for optimal climate management, with options including Total Vent, EZvent and EZ Top Vent technologies.

Supporting customers through times of climate change is high on the company’s agenda, says marketing manager Laura Bailey. “We’ve just started in India and Colombia, and we look forward to meeting more growers in these new territories,” she explains. “Following on from our first project in Jordan, we’re keen to develop the Middle East as a new region for Haygrove. Additionally, we’ll continue living our mission, balancing people, planet and profit through our triple bottom line approach.”

The company also aims to scale up adoption of Hortiplanet, its online tool for measuring carbon and environmental impact.

Shelf-life extension expert It’s Fresh! sees Fruit Logistica as the perfect stage to showcase its new brand RYPEN, with the range’s case liner having been shortlisted for the 2025 Fruit Logistica Innovation Award in the technology section.

Originally designed for the table grape industry, the RYPEN case liner offers growers and exporters benefits such as reduced bunch weight loss, lower levels of waste, and better condition on arrival. “We’re also working on a new product format that could bring our technology to another use-case entirely, so we hope our planned 2025 milestones for that development work progress well this year,” says marketing associate Nicolas Shaw.

In further news, the company has extended its distribution and warehousing arrangements in both South America and South Africa.

Mission Produce offers year-round avocado and mango programmes, following a diversified sourcing strategy to allow it to provide reliable and consistent supply.

The business is also a leader in ripening, and its exclusive Mission Control technology in the UK improves ripening consistency by as much as 38 per cent, according to the company.

“In 2025, we will continue to leverage our diversified sourcing strategy to supply avocados and mangoes year round,” emphasises Paul Frowde, MD of Mission Produce Europe & UK. “With our continued expansion into new growing regions, we plan to keep growing our customer base and bring more avocados and mangoes to the UK and European markets.”

Fruit Logistica is a chance to connect with both customers and partners, he adds. “With upcoming avocado and mango production out of our vertically integrated farms in Peru, we’re looking forward to communicating the Mission advantage in supply reliability and quality control.”

At Fruit Logistica 2025, Packaging Automation is partnering with its distributor Het Packhuys to bring what it describes as “a groundbreaking showcase of automation solutions” to the event.

For the first time, Packaging Automation and Het Packhuys will exhibit a complete automated packaging line, featuring the seamless integration of denester, weigh system, sealer, and case packer technologies. This compact, high-output line has been designed to help food producers and packhouses dramatically reduce labour costs while enhancing efficiency and productivity.

In Berlin, visitors will have the opportunity to experience live demonstrations of the fully automated system and discover how it can transform their packaging operations. “This collaboration with Het Packhuys demonstrates our shared commitment to delivering cutting-edge automation solutions to the fresh produce industry,” says Neil Ashton, managing director at Packaging Automation.

“By combining our expertise with Het Packhuys’ deep understanding of the Netherlands, Belgium, and Luxembourg markets, we’re able to showcase the future of packaging automation in a way that is both innovative and impactful. We appreciate that space is at a premium when deciding on processing and packaging automation solutions, and we will demonstrate that high throughputs can be achieved without compromising on space.” fpj

A novel application system for natural predators is revolutionising control of key pests in UK strawberry crops, as Robert Harris reports

Natutec Drive, Koppert’s applicator for predatory mites and other biocontrol agents in protected crops, has gained a strong following among UK strawberry growers just four years since its launch.

Over 30 machines are now on farm, and feedback from growers highlights the cost-effectiveness and heightened efficacy of the system compared with traditional hand-application, says Koppert UK’s commercial manager Darren Bevan.

ABOVE—There are more than 30 Natutec Drive machines currently in use on farms

BELOW—Mark Davies says the technology is a major boost for growers

ing spider mite, thrips and aphids, he says.

“Growers are facing a continued reduction in the availability of active ingredients for crop protection, as well as the ongoing impacts of increased labour costs and low output costs. We believe Natutec Drive is an obvious counter to this margin squeeze.”

The strawberry crop version of Natutec Drive is typically mounted on a tractor-drawn triaxle trailer. Product is fed from a 30-litre drum through a patented dispersal system into an airstream for distribution through boom-mounted tubes.

This gently applies equal amounts of natural predators to each crop row to deliver effective pest control. The operator can select product and dose accurately and quickly, using touch screen controls mounted on the tractor.

This has helped underpin the use of natural predators as a mainstream precision tool to control key strawberry pests, includ-

Natutec Drives are custom built and available on lease hire from Agrovista, Koppert UK’s partner on fruit crops in the UK. Agrovista’s head of fruit, Mark Davies, says: “Over the 15 years we have been working with Koppert UK we have focused on the quality and efficacy of biological controls.

“That has given us access to excellent quality, fresh beneficials and now, thanks to Natutec Drive, every row and every plant receives an even application at the right time, which is a massive help to growers when it comes to implementing our agronomists’ recommendations.”

Salih Hodzhov, chief operating officer at Kent-based berry producer Chambers, agrees. Strawberries are a key crop for the business, producing about 3,500 tonnes per year from 80ha across four sites, mostly from sixrow tabletop systems under plastic. Crops are in production Crop protection

ABOVE—Natutec Drive gently applies equal amounts of natural predators to each crop row

RIGHT—The machine is typically mounted on a tractor-drawn trailer

from February to November, so pests cannot be allowed to gain a foothold, he says.

“We started with one Natutec Drive in 2021. Now we have three, and will have another this year, one for each site to reduce downtime.

“Any biocontrol product that can be applied by machine on strawberries will go through a Natutec Drive – about 80 per cent of the programme.”

Given the ongoing loss in traditional plant protection products, they are a welcome

development. “It’s not just the loss of actives, but the fact we have fewer to work with,” Salih explains. “That makes it harder to implement rotation strategies, so the risk of resistance is increasing. We’ve seen that with thrips.

“Having the right biological controls and being able to implement them effectively is crucial for the business, and is now a mainline strategy for us.”

Improved timeliness and better application accuracy have been key benefits compared with hand application. “When you are investing several hundred thousand pounds a season in biocontrol products you want them to work to the optimum,” he says.

“If it’s too hot, humid or windy, this can affect product performance and placement. But we can

Koppert is expanding the Natutec Drive system into other protected crops and field situations, mounting modules into a range of customised vehicles and even drones.

“The strawberry machine is just one platform within a suite of products,” says Bevan. “Currently we have several handheld devices that can be used across a range of crops, in glasshouses and polytunnels, and two new raspberry machines will be on farm at WB Chambers this year.

“We are developing a growing family of products that we believe will be real game-changers for crop protection in protected crops and eventually, in open-field situations too.”

now treat the whole farm over three days, so we can afford to wait for better conditions.

“We can now be much more prescriptive and precise in our use of biocontrols. We can go little and often to top up predator levels, concentrating on preventative treatment.”

Reduced labour costs are a further benefit. Salih calculates a machine can do about 15ha per day, which would take at least 10 people to do by hand, costing about £1,500 per day.

“The machines cost next to nothing to run, and I reckon they will save the business over £70,000 this year, and labour costs are only going to go one way.”

The availability of labour, or lack of it, is even more pressing, he adds. “The last thing we want is to have to use 30 people on doing biocontrol – we want them to be picking.” fpj

let’s grow together

A Canadian supplier is using innovative marketing in its drive to secure fairer returns for banana producers. Michael Barker hears all about it

When a company speaks of wanting to dominate global banana supply, it conjures up images of a soulless dollar-chasing corporation that will do anything to boost the bottom line.

However, when it comes to innovative Canadian disrupter Equifruit, nothing could be further from the truth. Using

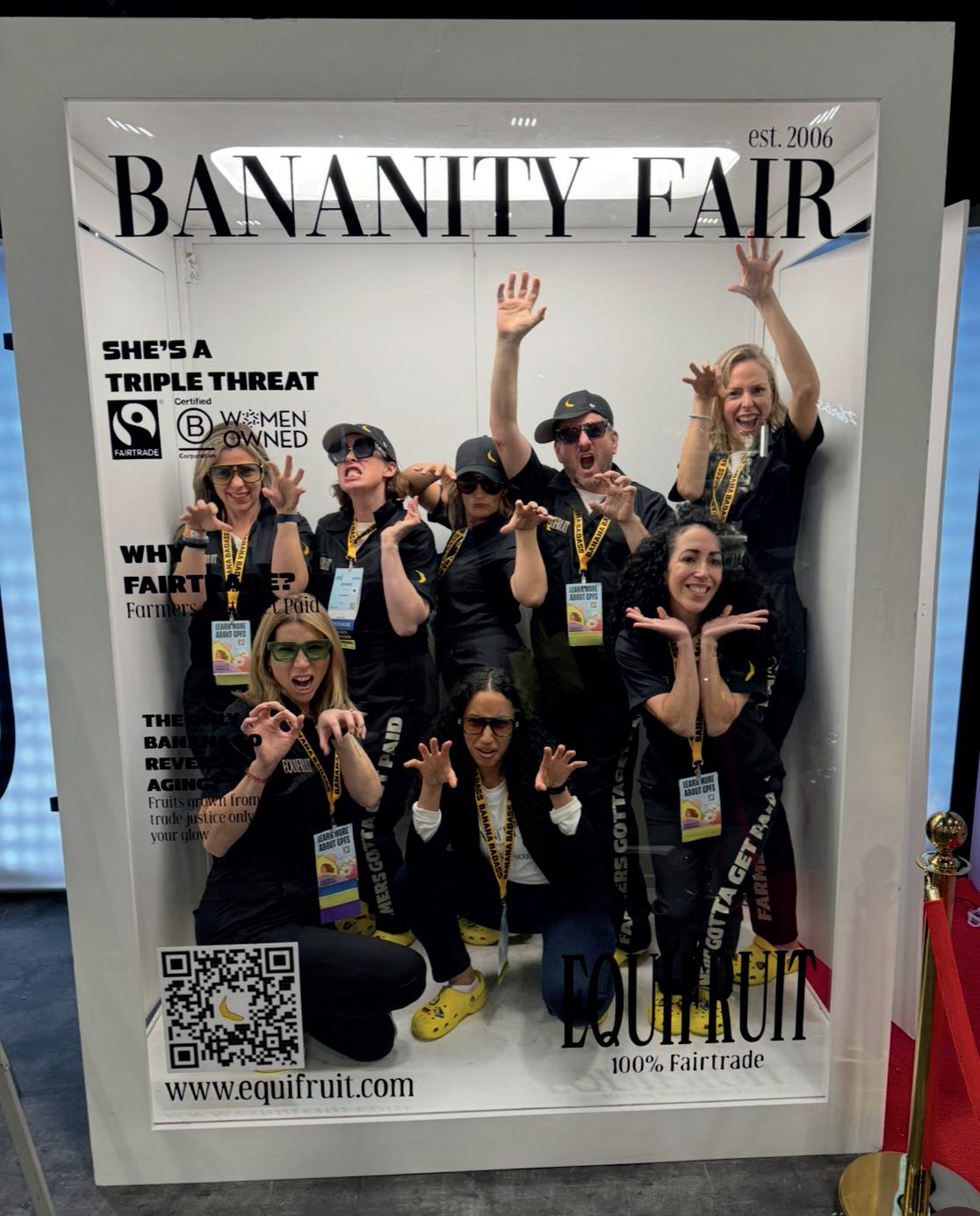

humour and absurdist marketing, the Montreal-based, all-women-owned B Corp is starting to gain significant traction in its drive to open the world’s eyes to a fairer system of banana supply.

Led by charismatic president Jennie Coleman – who was recently named one of Canada’s Most Admired CEOs by Waterstone Human Capital – the busi-

ness has been supplying 100 per cent Fairtrade bananas to the North American market since its founding in 2006. Sourcing from growers in Ecuador, Peru, Colombia, Nicaragua and Mexico, it has already achieved a market leadership position in the North American Fairtrade segment. But it feels like a drop in the ocean given Fairtrade bananas have only a paltry two per cent share – a far cry from the inroads that have been achieved by the Fairtrade and fairer pricing movements in both the UK and EU.

Speaking to Fruitnet at the Global Produce & Floral Show in Atlanta in October, Coleman said the company’s goal is simple, if highly ambitious: “Our vision is global Fairtrade banana domination,” she said. “Only four per cent of the global market is bought and sold on Fairtrade terms and we just can’t accept that. There has been a hundred-year business model [in banana sourcing] which we think belongs to the last century, and ours is one that prioritises a fairer distribution of value along that supply chain. It starts with small growers and plantation workers back in producing countries, and our role really is to be the representatives of those growers, to find them export markets on Fairtrade terms.”

It’s not easy to stand out and convince retailers, and ultimately consumers, to pay more for a product as homogenised as bananas – but that’s where Equifruit really shines, through innovative communication and telling a story that resonates. In Atlanta, the company set up a photography booth in the style of a Vanity Fair (or ‘Bananity Fair’ as it was cutely labelled) magazine cover, where visitors could get snapped in fun poses to share on social media.

At a previous show in Nashville, Equifruit printed fake $5 bills and left them around a hotel complex, put them in a Crystal Maze-style dome to be caught, and fired them out of a gold money gun. The message? That the average American eats 27lbs of bananas per year, and with a Fairtrade banana programme estimated to raise prices by about 20c per lb, that adds up to a total of only about five bucks a year.

The Equifruit team are masters of marketing and their zany humour and unbridled enthusiasm under the hashtag #BananaBadass is already turning heads across social media. Doubling down on their core message from the Nashville campaign, the team used an email signoff that highlighted frivolous things that they’ve spent more on in the past year than the $5 Fairtrade premium – such as a single fancy coffee, hot sauce, glitter slime or sunglasses for their dog.

“There’s all this emotion and stress built into raising the price of bananas when the end effect is so negligible for the vast majority of the market,” Coleman points out. “If we spent just $5 more per year, then banana farmers would have working toilets in their children’s school washrooms.”

Equifruit’s approach is to use

the silly to highlight the serious. “We are doing all sorts of crazy things,” Coleman says. “We really lean heavily on humour and the absurd to grab people’s attention, but we always bring the message back to getting farmers paid fairly.

“Our aim at a trade show is brand awareness. We know bananas are a very weighty decision for a retailer. It takes them a while to think differently about their banana supply chains, pricing and merchandising strategies. If we can bring them here and make them laugh, it’s a way for them to find the confidence that if they do a programme with Equifruit we’ll also find a way to communicate to their consumers to tell the story.”

Coleman admits that getting retailers – particularly in the US market where relationships with the big multinational suppliers go back decades – is no easy feat. Buyers are concerned that if consumers notice a price increase on bananas, then that will set their price perception for the entire store, and it takes shock tactics such as Equifruit’s marketing approach to get them to consider a new path.

“We want retailers to have the courage to try something different, something that has tangible impact,” Coleman adds. “We really have to work at winding back the model, and changing the mind-

set of the buyer is critical for the impact we can have.”

Building consumer brand awareness is still in the early stages, and remains part of a longer-term strategy. While Equifruit is active on Instagram and TikTok, it is still predominantly a trade-facing brand. And Coleman is philosophical enough to realise that only by winning contracts can the company make a difference. She readily admits it’s not easy to be the people dropping truth bombs and also the ones that want to sell you bananas.

“You don’t want to put people on the defensive, so we use humour to bring tension down and get people a little bit more comfortable with the idea that we are doing something different,” she explains. “And then we always come back with this message about the importance of Fairtrade and paying farmers fairly.”

The focus right now is firmly on the vast North American market, where low Fairtrade uptake and higher acceptance of brands by retailers gives plenty to aim at. But ultimately, Coleman is not putting limits on where the company can go.