Stronger branding, product diversification and strategic new partnerships could help turn this setback into an opportunity.

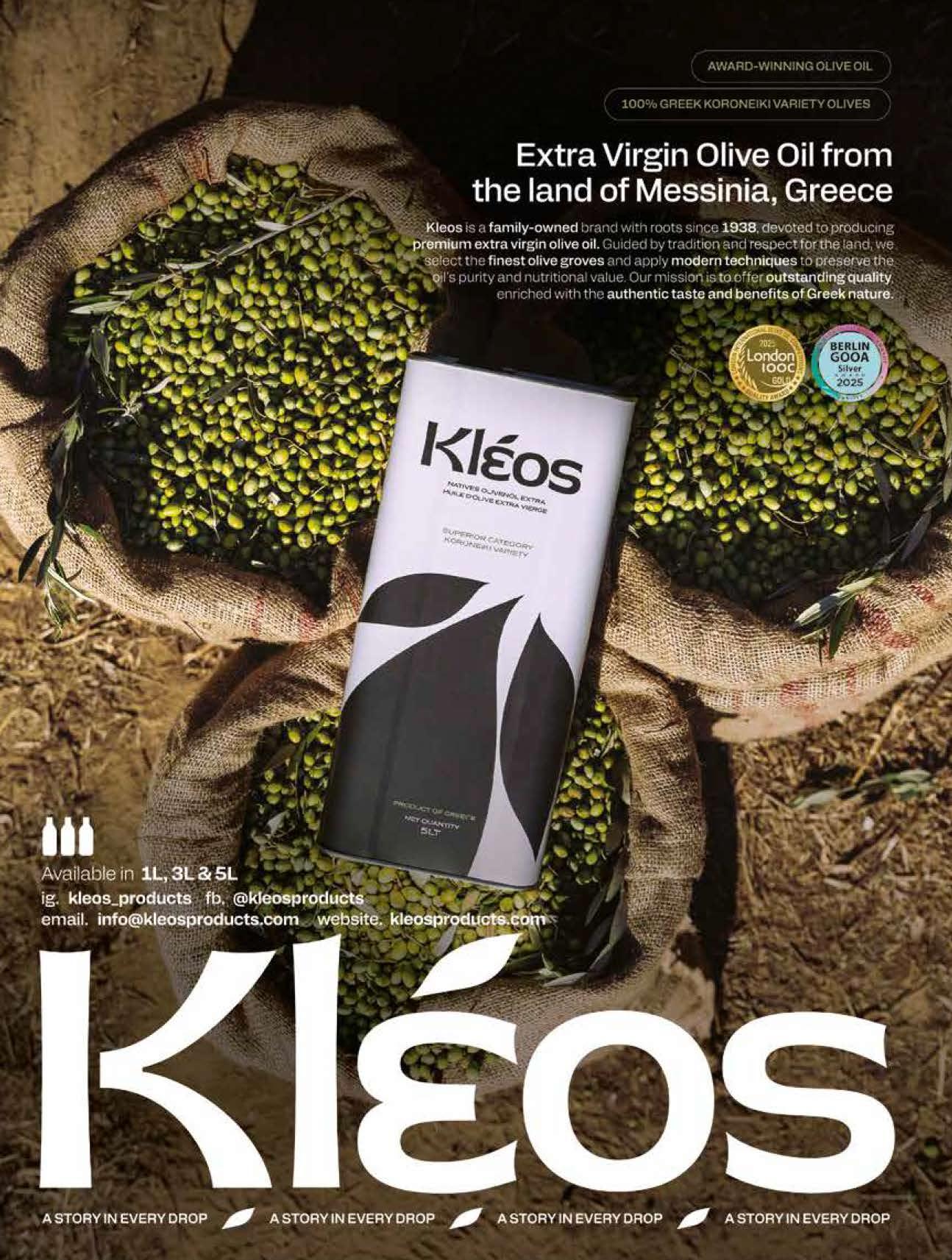

Greek gastronomy has long been one of the country’s most valuable cultural and economic assets. Products such as feta, olive oil, olives, wine, peaches, and yoghurt have found a firm foothold in the American market over the past two decades, riding a wave of demand for authentic Mediterranean foods. Yet, the new tariffs imposed by the Trump administration have created a cloud of uncertainty, threatening to slow down or even reverse years of growth. The Trump tariffs (from 10% to as high as 30% on selected EU products) have shaken one of the pillars of Greece’s export economy —its food and beverage sector. Feta, olive oil, peaches, olives, and wine all face steep hurdles in the American market, threatening farmers, cooperatives, and exporters alike.

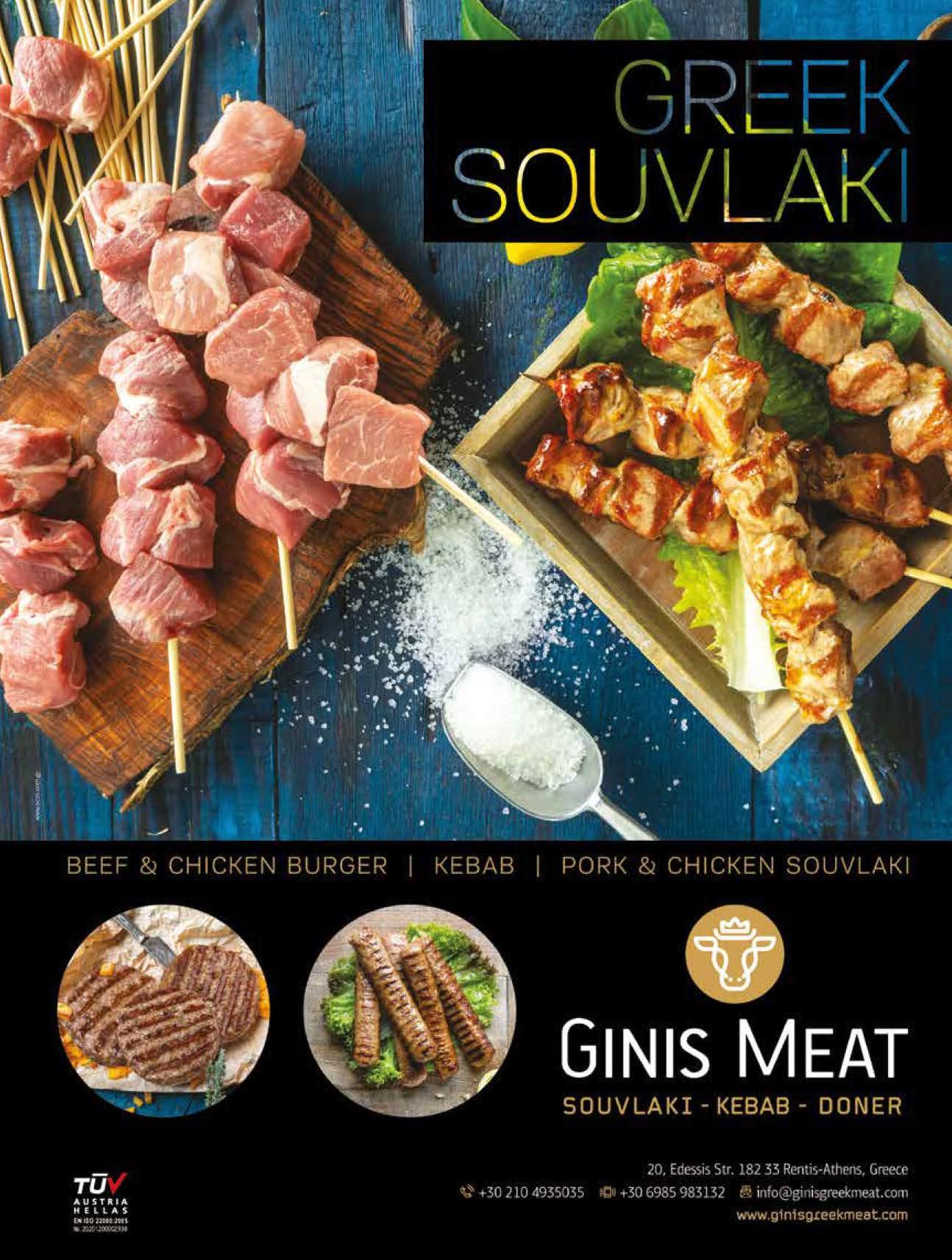

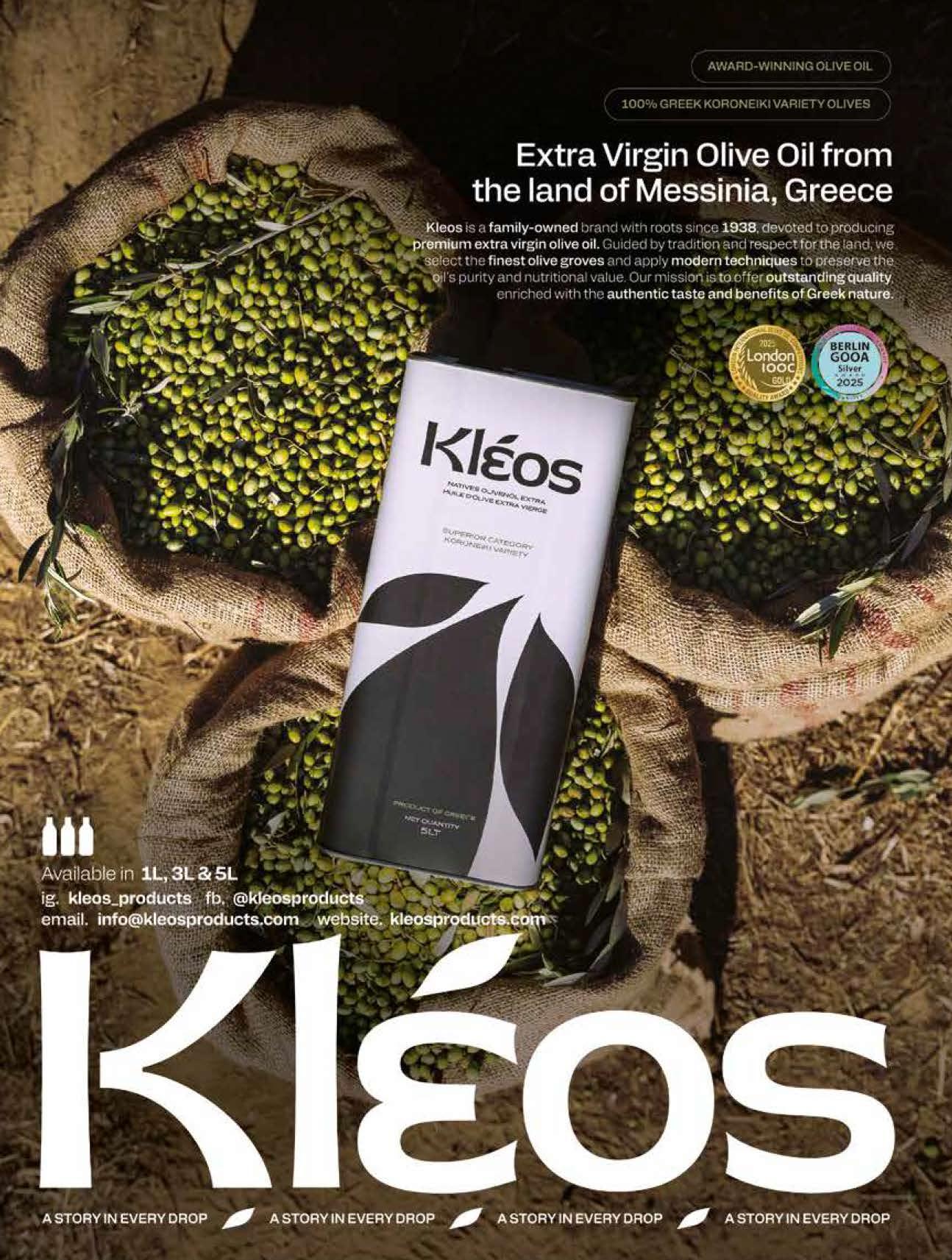

Feta cheese, one of Greece’s top export successes, has doubled its U.S. sales in recent years. Now, tariffs could reduce exports by as much as 50%, undermining an €800 million annual industry. Olive oil, with 45,000 tons shipped yearly to the U.S., risks losing up to 40% of its market. Meanwhile, canned peaches, heavily reliant on American consumers, face one of the sharpest declines, with major consequences for Greek farmers and processors. Other products such as olives, yoghurt, and wine are also less competitive, as price-sensitive American retailers look to alternatives.

The U.S. is Greece’s third-largest non-EU export market, with sales reaching €2.4 billion in 2024. Yet, the trade surplus has shrunk dramatically, from €618 million in 2023 to €268 million in 2024. Analysts warn that continued tariff pressure could shave 0.4% off Greece’s GDP by 2026.

Producers and policymakers are responding on multiple fronts. Greece is lobbying for exemptions, especially for PDO products like feta and extra virgin olive oil. Exporters are exploring new destinations such as India, China, and Canada to offset losses, while the EU is under pressure to provide financial and diplomatic support. Some companies may attempt to absorb tariff costs themselves, though this reduces already thin profit margins.

Despite the challenges, the crisis may push Greece to innovate. Stronger branding, product diversification, and strategic partnerships outside the U.S. could help turn this setback into an opportunity. For now, however, uncertainty dominates, and the ability of Greek gastronomy to maintain its foothold in the American market will depend on swift adaptation.

Thanassis Gialouris Publishing Director

CEO

Thanassis Panagoulias

CFO

Stratos Apostolakos

Publishing Director

Thanassis Gialouris gialouris@forumsa.gr

Commercial Director

Katia Molfeta sales@forumsa.gr

Managing Editor

Eva Touna et@forumsa.gr

Editor

Kyriaki Moustakidou k.moustakidou@forumsa.gr

Senior Art Director Nikos Kartalias

Project manager

D. Michalochristas

Sales Department

T. Belekoukias, A. Kaliantzi, N. Koumanis, I. Margelis

N. Mastichiadis

M. Mellios, A. Mourati

I. Polychronopoulou

G. Theodoropoulos

Int’l & New Business

Director

Filippos Papanastasiou

Marketing Director

Eleftheria Kampa

Communication Mgr

K. Konstantopoulou

Digital Marketing Mgr

Michalis Ampatzidis

Coordination & Events Director

Angela Zampakola

Advertising Coordinator

M. Spichopoulou

Publishing Dept.

Secretary E. Samara magazines@forumsa.gr

Printed by Baxas SA

Published by FORUM SA

Member of NürnbergMesse Group

ISSN 2623-4661

“The

The pathway towards a more resilient future”

In an era of global upheaval, marked by intense geopolitical turbulence, intensive climate crisis, and rapid developments in technology- especially artificial intelligence, a new landscape is emerging at international level. Combined with new regulations urging the green transition, layers of bureaucracy concerning investments and severe interventions, the industries’ prospects are marked by continuous uncertainty.

While fragile dynamics continue to unfold, the Food and Drink Industry remains the main industrial sector in Greece and a fundamental pillar of the Greek economy. With a turnover of around 20 billion euros, 7 billion in exports, and 376,000 employees, with high education and specialization, well above the average of the other sectors of the economy, it continues to grow steadily.

Acknowledging the responsibility of its leading position and as a positive force of dynamic change, the Food and Drink Industry manages to ensure long term food sufficiency and security for our country, remaining a key employer and a responsible partner towards more sustainable food systems. With a commitment to providing safe, high-quality products, affordable for every household, it continues to adapt and evolve with society, investing tangibly in sustainability and innovation to withstand international competition.

To that end the businesses constantly focus in developing products using advanced methods, in line with sustainable growth, while also offering consumers innovative choices with added value and a lower environmental footprint. At the same time, by preserving and promoting traditional, time-honored products, the food and drink sector not only safeguards cultural heritage but also draws international interest.

In these times of new challenges, SEVT (Federation of Hellenic Food Industries) leads efforts to support Greece’s Food and Drink sector. Recognizing the need for stability and trust in such a dynamic environment, the Federation is dedicated to fostering a resilient and competitive landscape for the companies that operate in our country. By engaging in constructive policy dialogue, offering essential resources, and encouraging collaboration, SEVT helps to steer the industry through the complexities of the current landscape, ensuring that the Greek Food and Drink Industry remains robust and well-positioned to thrive.

IOannis Yiotis President of the Federation of Hellenic Food Industries

376,000 EMPLOYEES WITH HIGH SPECIALIZATION

€7 BILLION EXPORTS

Georgios Tosounis, director of B1 Directorate of Extroversion Planning and Coordination of Extroversion Bodies, at the Greek Ministry of Foreign Affairs, shares his insights into Greece’s vibrant Food and Drink industry, which continues to grow and expand its international footprint.

Interview: Eva Touna

What are the main challenges currently facing Greek food and beverage exports, both within the EU and in international markets?

It is important to highlight the quality of the Greek food and beverage products, which is also the core strength of the Greek brand. The Greek Food & Drink industry is a dynamic, competitive and extrovert industry, with significant investment activity in Greece, the Balkans and throughout Europe. According to a study by the Foundation for Economic and Industrial Research (IOBE), food & drink covers 28.1% of all Greek manufacturing companies, which ranks it first among Greek manufacturing industries. This is reflected not only in the number of businesses and employees, but also in the gross added value of these industries in Greek manufacturing.

Nonetheless, the sector faces challenges, mainly the small business size and market limitations. Ninety percent of the businesses in the sector are classified as very small, employing a staff of less than 10 people, while only 1 percent are medium-sized businesses, with a workforce of 50 to 249 people. Therefore, improving the competitiveness of the Greek food industry must be our priority in order to enhance its footprint in the international markets. Furthermore, enhancing human resources, skills and the degree of specialization, is another important factor for international recognition. Special attention must be given to adopting and applying new technologies, innova-

tion, research and development. Further crucial steps towards supporting the Greek Food & Drink industry include promoting the quality and diversification of the Greek cuisine, linking the food industry with the domestic agricultural production and the services sector (restaurants, hotels, catering services etc.). Synergies with the tourism sector are instrumental for reshaping and advancing the food industry. Foreign visitors become more and more familiar with Greek products and help spread their reputation abroad, thus facilitating their presence and circulation in international markets.

Τhe Ministry of Foreign Affairs conducts the country’s foreign policy, and within this policy, advocates the Greek economic interests abroad. To that end, the Ministry supports the Greek extrovert business entities through its Diplomatic Missions abroad and more specifically with the services offered by the 60 Economic and Commercial Affairs Offices that operate in 51 countries for more than 50 years. In a daily basis, these Offices inform the international community about the possibilities for economic and business cooperation with Greece and Greek companies in various sectors of the Greek economy. At the same time these Offices also inform the Greek business community of the business environment overseas and of any

THE QUALITY OF THE GREEK FOOD AND BEVERAGE PRODUCTS IS ALSO THE CORE STRENGTH OF THE GREEK BRAND

opportunity for business collaboration with a foreign counterpart. The B1 Directorate has the task of coordinating and monitoring the activities of these Offices, implements economic diplomacy, facilitates the presence of Greek businesses abroad and with the aid and support of “Enterprise Greece”, our national Investment and Trade promotion Agency which is supervised by the Ministry, attracts Foreign Direct Investments and promotes our national economic interests.

B1 also gathers and analyzes information from businesses and business bodies and submits substantiated proposals for improving the existing legal framework for further promoting international economic and trade cooperation.

B1 Directorate, in coordination with the Diplomatic Academy organizes seminars for our Trade and Economic Officers, and for the Ministry personnel responsible of International Economic Relations. It also organizes informative events regarding access to foreign markets, participates or facilitates public or private activities with the aim of enhancing international trade, and it is constantly in communication and coordination with the Greek Business Bodies, such as Chambers of Commerce, Associations, Unions etc.

B1 is also closely following and monitoring through our Offices abroad, the implementation of EU trade regulations and directives, including those concerning the protection of products with a Geographical Indication. Finally, it is carrying out the extremely important task of striking the right balance between minimizing risks for Greek and European economic security and maximizing the overall attractiveness of Greece and the EU as an international investment destination.

IMPROVING THE COMPETITIVENESS OF THE GREEK FOOD INDUSTRY MUST BE OUR PRIORITY IN ORDER TO ENHANCE ITS FOOTPRINT IN THE INTERNATIONAL MARKETS.

How important do you consider PDO and PGI certifications of Foods and Beverages, and what measures are needed to protect certified Greek products from imitation?

The EU’s register of certified food products includes 120 PDO and PGI Greek products. Furthermore, 147 Greek wines have been granted PGI and PDO status, while 15 other alcoholic beverages enjoy PGI status as well. On 13 May 2024, a new EU regulation on GIs for wine, spirit drinks, and agricultural products, entered into force. Names of products registered as

GIs are legally protected against imitation and misuse within the EU and in non-EU countries where a specific protection agreement has been signed. As a standard practice, our Diplomatic missions and especially the Economic & Commercial Affairs Offices monitor international markets and record cases of circulation of counterfeit products that appear to be Greek or misuse Greek geographical indications in their labeling. In cases of violations, after consultation with the Greek pertinent authorities (mainly the Ministry of Rural Development & Food) they take appropriate action towards the foreign authorities and also towards the local EU Delegation. In addition, the Ministry of Foreign Affairs systematically monitors the effective implementation of existing EU Free Trade Agreements with third countries with a focus on the protection of Greek geographical indications that fall within their scope. Also, in cases where such an Agreement is under negotiation, the competent Directorates of the Ministry of Foreign Affairs with targeted interventions try to achieve the highest possible level of protection for the Greek geographical indications in that third country.

the Greek Economic and Commercial Affairs Offices abroad. How do you see this new institutional framework contributing to the growth of Greek food and beverage exports?

Strengthening extroversion is a strategic pillar for the sustainable development of the Greek economy. Today, 80% of Greek exports come from just 20% of businesses, which highlights the need to expand our national export base and better exploit the comparative advantages of each Region. In a constantly changing international environment, being able to exchange information, to enhance synergies, to attract investments and to coordinate specific actions, is a key parameter for a successful extrovert strategy. It must be noted that in order to have the best outcome from this initiative, all competent Directorates of the Ministry, the Economic and Commercial Affairs Offices, the Enterprise Greece and the Export Credit Greece, must work together. And indeed, we are working together, we have joined forces and we transfer our experience, knowledge, expertise and know-how to the Regional Offices. Through these Offices, we provide specialized support to local entrepreneurship, promote exports, help expand local businesses in international markets and attract investments. The first Extroversion Offices will operate -initially on a pilot basis- in the Regions of Central Macedonia, Western Greece, the Ionian Islands, Eastern Macedonia & Thrace, as well as Crete with the aim of promoting extroverted culture and formulate the first Strategic Extroversion Plan. By using digital tools and by organizing educational programs and seminars,

local entrepreneurs and executives will be informed on the prospects and benefits of international presence. The next steps of the initiative include the expansion of the operation of Extroversion Offices to the rest of the country's Regions."

What types of initiatives do you consider particularly important for the successful implementation of National Strategic Plan for Extroversion 2025?

The National Strategic Plan is a versatile and effective tool used by our Economic Diplomacy, in order to enhance our business footprint overseas, attract foreign investments, increase our exports, assist the extroversion of the Greek small and medium size enterprises, accelerate the digitalization and minimize the bureaucratic complexity of international trade procedures. The National Strategic Plan for 2025, includes 649 extrovert actions and strategically aims at specific international markets. It also includes 64 multilateral actions (active participation in European and International Organizations and fora) for promoting and safeguarding out national interests, 61 actions regarding hosted buyers programs and participation in International Fairs & Exhibitions, 524 bilateral actions for promoting bilateral cooperation and networking, attracting investments and promoting our products in foreign markets. Lastly, it includes 50 actions for maintaining our market-share in countries where traditionally we have strong trade relations (Europe, North America, Balkans, North Africa and Middle East) and for targeting new markets in the emerging economies of South-East Asia, Central and Latin America and sub-Saharan Africa.

The Ready-to-Eat category is growing steadily, yet dynamically. A multitude of factors drive this trend, with Generation Z serving as its main ambassadors. Greek cuisine is an essential player: RTE options with traditional recipes elevate the taste experience to a new level.

Article: Kyriaki Moustakidou

From the initial concept of Ready-toEat food to the modern variety of RTE solutions, years of innovative research and development have passed. The first cans, tentatively introduced in the early 19th century, gave way to home ready meals in the 1950s in the USA, marketed as TV dinner –"a convenience food you could eat while watching television". Nowadays, Ready-to-Eat meals are an emerging global trend, as people look for maximum easiness regarding meal consumption without compromising quality or taste.

This shift in consumer behavior is evidently reflected in market data, highlighting how convenience has a powerful effect on purchasing decisions. Recent research, conducted and published by Circana, showcases the increasing popularity of RTE options in Europe. According to the report, 37% of the total amount spent on food and beverages last year was dedicated to “immediate consumption” products across both retail and foodservice channels. Once considered a minor option, this category has now become a real competitor across the broader F&B landscape.

The growing popularity of ready meals can be easily explained. Firstly, the driving factors behind consumer behavior have changed. Nowadays, most decisions are guided by convenience and cost, criteria that place RTE products in a superior position. As younger generations tend to move away from cooking as a daily habit or traditional ritual, ready meals become a competitive player in the modern food universe.

Besides the wallet-friendly aspect of ready meals, growth can also be seen as a result of the changes in household composition. People now are used to

living alone rather than as members of extended families, making RTE solutions suitable for them. At the same time, these meals help reduce food waste by providing single portions, eliminating the need to cook large quantities that might end up in landfill.

Moreover, even those who enjoy cooking at home and consider it a relaxing activity often see their plans altered by the fast pace of everyday life. Whether at the office or commuting, people seek alternative choices beyond a simple snack. They want the opportunity to enjoy a proper on-thego meal, without having to dedicate hours to its preparation.

Gen Z leads the way

Gen Zers, people born between the mid-1990s to around 2010, have been heavily criticized for being unwilling to grow up, lazy, or even coddled. Nevertheless, they belong to a generation that values speed and pragmatism as much as selfcare and authenticity.

From that perspective, it comes as no surprise that Gen Z has a growing appetite for healthy food. According to the latest annual report by McKinsey & Company and pan-European trade confederation EuroCommerce, Generation Z shows the highest intent (45%) to focus on healthy nu-

trition compared to other age groups, younger or older than them.

The same report, which examines the supermarket sector and the trends that will emerge in 2025 and beyond, states that 77% of Gen Z consumers buy ready meals at least once a week. These statistics combined are quite self-explanatory as to why the ready-to-heat-and-eat category of meals no longer includes only frozen pizzas and chicken nuggets but also cooked vegetables, legumes and soups. One might say that Gen Zers have set the tone for a complete transformation of these products' future on a global scale.

Totally aligned with the Mediterranean diet, Greek cuisine naturally fits into this trend. Indeed, this has been the case: several Greek companies grabbed the opportunity within this market and invested to establish a strong presence.

The numbers confirm their choice. Over the two-year period from 2022 to 2024, the size of the Greek heatand-eat product market grew by nearly 22%, reaching a turnover of €118.75 million last year. Driven by this fact, Greek companies are expanding their portfolios, experimenting, and launching ready meals made with high-quality ingredients and crafted with a creative touch.

For three decades now, Hellenic Cuisine – Brakopoulos has been producing a wide variety of ready meals inspired by traditional Greek recipes, along with innovative vegan dishes. Their authentic taste brings joy to Mediterranean diet enthusiasts around the world.

Moussaka, the true ambassador of Greek gastronomy, is the compa ny’s leading product. However, ready meals such as stuffed vegetables, classic "lade ra" dishes, and the vegan versions of moussa ka and pastitsio have also built its diverse ex port identity. Prepared with extra virgin olive oil and free from industrial substitutes, these dishes stand out for their handmade approach. Committed to the consistent quality at its core, Hellenic Cuisine – Brakopoulos uses no pre servatives or artificial flavor enhancers, relying instead on advanced freezing methods to pre serve the meals’ taste and quality just like the day were cooked. In that way, people in coun tries where the Mediterranean diet is popular (Spain, Germany, France, Central and Northern Europe), as well as consumers in the USA, the Middle East, and Latin America, immerse them selves in the world of Greek culinary tradition.

By creatively adapting to global food trends, the Athens-based company has formed its strategy around them. Responding to the increasing global demand for ethnic flavors, plant-based and vegan options, and healthy foods, Hellenic Cuisine – Brakopoulos has tailored its offerings to enter new markets. The shift toward authentic, alternative plant-based options has been a key driver in the company’s export growth. For example, vegan moussaka and vegan "ladera" dishes hold a superstar status in the eyes of food lovers internationally.

Since 2023, when the company acquired their own facilities and upgraded their production equipment, Hellenic Cuisine – Brakopoulos has laid the foundation for further expanding its presence abroad. With ongoing investments in production technology, smart product diversification, and strategic partnerships, they are formulating a new era without ever losing the Greek authenticity centered at the heart of their brand. Without a doubt, the company’s future is international, forward-thinking, and driven by innovation.

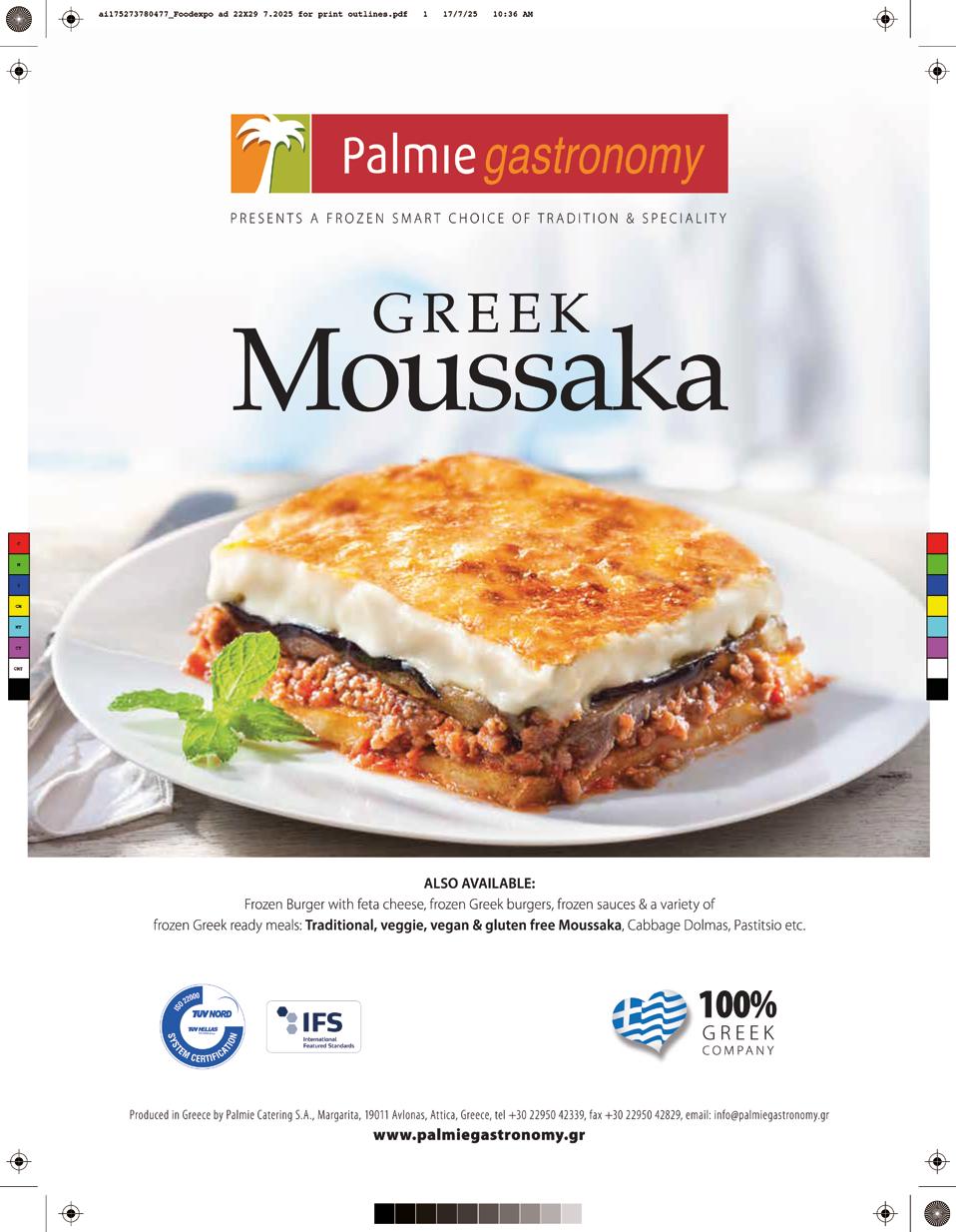

In 2015, Greek ready meals by Palmie Gastronomy began their exciting journey into international markets. Since then, the company has effectively enriched its product range, adding vegan and glutenfree options to meet the needs of contemporary consumers.

Palmie Gastronomy has been active in the food sector since 2007. As a proud member of the Palmie Bistro Group, which has a multiannual presence in the foodservice and entertainment industries, the company brings both the know-how and the creative touch that this field demands.

Today, with traditional Greek moussaka as its flagship product, cooked with handmade béchamel sauce, and also available in a gluten-free version, Palmie Gastronomy offers an extensive variety of ready meals. Its portfolio includes dishes such as pastitsio, stuffed vegetables, cabbage rolls, vegetable moussaka, and soutzoukakia, all available in both individual portions and HO.RE.CA trays.

Over the past year, Palmie Gastronomy has expanded its offerings to include a special vegan selection. This range features plant-based versions of classic Greek dishes, as well as vegan burgers and gyros. It should be noted that their plant-based ground “meat” used in these products is made from jackfruit – particularly known for its meat-like texture. Another product enjoying remarkable success is the ready-to-heat tortilla wrap, filled with pork or chicken gyros, sauce, and vegetables.

As the pace of daily life has changed and people dedicate less time to cooking, there is strong potential for growth in the ready-meal market. If one adds to this equation the rise in single or two-person households, it’s often more afford-

able for consumers to indulge in RTE options. Palmie Gastronomy has carefully assessed the above factors, integrating the human geography of its target markets into its strategic planning. These markets currently include several European countries, but the company also aims to expand its operations on the continent and explore new opportunities in other regions, such as Africa.

The timeless treasure of Greece flourishes in global markets offering authenticity and a unique flavor that delights palates. Greek dairy companies, committed to innovation and investments, are redefining the future of Feta.

Article: Kyriaki Moustakidou

OF THE TOTAL FETA PRODUCTION IS NOW BEING EXPORTED

Feta, apart from being an irresistible delicacy, is also considered the old est recorded cheese in history. Greek mythology and historical excerpts set its first appearance in the 8th century BC, when Homer’s Odyssey was written. Accord ing to the Greek ancient author’s epic poem, the one-eyed Cyclops Polyphemus discovered a prim itive form of feta cheese by accident. From this verbal depiction rooted in antiquity to relatively recent 2002 AC, when the Protected Designa tion of Origin (PDO) status granted to Greek feta, safeguarding that only cheese made in specific regions of Greece* can legally be called authentic feta, its nationality has been proven several times. Nowadays, Feta triumphs in exports as it has shown a significant increase during recent years. "Especially in the last four years, it has scored a mid-double-digit yearly increase (12%), reaching a value share of €785 million in 2024 with a vol ume of 97,000 tons. The total amount of Feta produced in Greece is about 140,000 tons, which means that more than 65% of the total production is now being exported, a percentage that was an unattainable goal a few years ago", stated the President of the Association of Greek Dairy Industries (SEVGAP), Mr. Christos Apostolopoulos, talking to Ambrosia Magazine.

MILLION IS THE VALUE SHARE FETA REACHED IN 2024

The top 5 export destinations for Feta are Germany, Italy, United Kingdom, France and the USA. Citizens of these countries seem to truly love the tangy and slightly salty flavor of the unique Greek cheese, which holds an esteemed place in their

THE TOP 5 EXPORT DESTINATIONS FOR FETA ARE GERMANY, ITALY, UK, FRANCE AND THE USA. THEIR CITIZENS TRULY LOVE ITS TANGY

hearts. On top of that, the aforementioned success is the result of the systematic effort by Feta producers who managed to apply and follow a concrete strategy, amplifying their presence.

The dairy sector in Greece is both constantly growing and reshaping the way people around the globe perceive the product variety of the industry. During this creative journey, domestic dairy companies deal with certain challenges, such as

the unprecedented imitation of Feta, to which many dairy industries abroad have indulged, often far exceeding the limits of legislation and ethical practice.

Regarding this critical issue, Mr. Apostolopoulos summarized the latest efforts and victorious steps made by SEVGAP to defend its PDO status. "The battles fought recently by SEVGAP concerned the protection and recognition of the uniqueness of Feta in third countries. Specifically, 4 battles were fought against giant multinational and American

interests Consortium that reacted in every way (objections, dispute, etc.) to the above protections in Singapore and Chile. Despite the inequality of these battles, we have won all of them based on the unique reputation and quality of our national product", he explained to Ambrosia Magazine. In addition, the original Greek Feta has been targeted by the US Government. The Office of the US Trade Representative (USTR) applies pressure on the European Union to abolish its system of geographical indications for agricultural products. Mr. Apostolopoulos, among other points, commented: "it is difficult for anyone to follow America's recent announcements – let alone determine whether they reflect actions of tactics or a shift in philosophy regarding market products. Its latest completely absurd demand for the abolition of PDO products (including Feta) reveals deep ignorance and total lack of respect. The worst

thing of all, however, is that these demands don’t make any real commercial sense, since all the imitations of Feta that are produced in 10 times the quantity of imported Greek feta, are never going to be threatened by the one and only Greek Feta. Quite simply, production of real Feta cannot be scaled up arbitrarily, as it is, by definition, a Protected Designation of Origin (PDO) product. As for the possibility of exporting the so-called American "feta" to Europe, with its higher price point (not to mention its incomparable quality), such an idea is unrealistic at best".

BATTLES WERE RECENTLY FOUGHT AND WON FOR PDO STATUS OF FETA

* Feta is produced in the traditional way in mainland Greece and Lesbos Prefecture, made from sheep milk, or from a mixture of sheep milk and up to 30% of goat milk.

Despite all the challenges, Greek dairy companies continue to draw a wellrounded strategy to expand their presence at even more international markets. The vehicle to achieve it and reach their goals is innovative investments and proactive product development to meet customer needs on a global scale.

Operating since 1965 from its facilities in Arta (Epirus), Kristalli has been crafting traditional dairy products using pure, locally sourced milk. With deep-rooted expertise in cheese making, passed down through generations of craftsmen in the Bafas family, the company’s exports have steadily grown over the past thirty years. At the heart of these exports is their signature barrelaged feta, known for its slightly salty and tangy flavor, matured in beech barrels.

"Our presence at the Food Expo trade show has

played a crucial role in helping us network and increase our international clients", Giorgos Bafas shared, talking to Ambrosia Magazine.

In the near future, Krystalli plans to invest in expanding its packaging and Feta production facilities, with a long-term goal of strengthening its international footprint. "We have seen a growing demand for our barrel-aged feta, and we are moving forward with scaling up production", Mr. Bafas noted. "Our products primarily reach the USA and Canada, but we are also exporting to a range of other international markets, including France, Germany, Romania, Switzerland, Sweden, etc.", he added.

Moreover, it should be noted that Krystalli company was the first traditional dairy industry in Greece to produce gruyere cheese in various flavors. These Artisanale premium products include gruyere cheeses with elements such

as pepper, chili, black garlic, forest herbs, and black truffle. They represent an innovative approach to cheesemaking, blending naturally with the traditional barrel-aged feta, which is the company’s star product and main vehicle for conquering global markets.

Hellenic Dairies SA describes PDO Feta as a key pillar of its export activity. Focusing on analyzing the needs of each foreign market and listening to customer needs, they expand their presence abroad. "We closely monitor emerging consumer trends and develop products and packaging tailored to the unique preferences and priorities of each country. That’s how we offer a complete range of authentic Feta (classic, organic, barrelaged, lactose-free, low-salt, and 100% sheep’s milk) in a variety of taste profiles and in environmentally friendly, practical packaging", stressed the Deputy CEO of Hellenic Dairies Group, Mr. Stergios Sourlis, talking to Ambrosia Magazine. They have also invested in doubling production capacity while ensuring the highest quality standards for PDO Feta. "We have implemented a major investment program at the TYRAS facility in Trikala (where our Feta is produced) focusing on upgrading production lines, installing robotic automation systems, and expanding our logistics center infrastructure. At the same time, we are taking steps to boost the production of highquality sheep and goat milk through a multi-level program that provides logistical and technical support to Greek livestock farmers", he explained.

Karalis Dairy, the largest producer and exporter of Kefalograviera PDO cheese, kicked off its international journey in 1982. To this day, functioning as a traditional family-run business, it places great emphasis on the quality of its products and continues to process sheep’ s milk sourced from Epirus.

"Recently, we completed a €7.5 million investment in brand-new facilities for producing PDO feta, including a pasteurization line and milk storage silos, designed to upgrade our production capacity. On top of that, we have launched a fresh in-

KARALIS

Starting in 1963, the Kalavryta Cooperative has been producing high-quality products from sheep and goat milk. Although the Cooperative invests annually in facilities and equipment serving the vision of its 1,200 breeders – members, the past few years have been particularly representative of its progress in this field.

In 2021, an ambitious investment program was launched. Over the four years up to 2024, the implemented projects included, among others, new maturation rooms for PDO Feta, the optimization of its production line and a new Feta packaging unit from scratch, which is especially important for exports.

ITS PACKAGING CAPABILITIES, AS THE DEMAND FOR FETA IN SMALLER PORTIONS IS

vestment program to boost our packaging capabilities: the demand for packaged feta (especially in smaller portions) is spreading fast worldwide", said Konstantinos Karalis, the leading figure of the company for decades.

The company aims to satisfy the rising demand for its products in countries where it has already established its presence, such as Canada, the USA, Australia, Germany, and others.

According to the President of Kalavryta Cooperative, Pavlos Satolias, their export efforts started in 2024, when they joined two EU programs promoting PDO Feta. In Kalavryta Cooperative’s efforts to indirectly strengthen its leverage in the international Feta market, investments in vertical integration play a significant role. The most notable of them is the new animal feed factory, built to produce and supply high-quality feed to the 1,200 breeders - members and support them with machinery and equipment for their mountainous farms. "Furthermore, investments in a photovoltaic park providing self-sufficiency energy, along with a new biological treatment unit, make our Cooperative resilient in facing current challenges", Mr. Satolias added.

The year 2024 left an indelible mark on Greek fruit export performance, reaching the unprecedented total value of €1.35 billion. This impressive trajectory is being carried on, with exports for the first five months already hitting the outstanding amount of €712 million.

Article: Kyriaki Moustakidou

In 2024, Greek fruit exports were led by kiwis (€308 million), oranges (€206 million), strawberries (€172 million), peaches & nectarines (€117 million), and mandarins (€104 million). Strong performances were also recorded for cherries & sour cherries, watermelons, and bananas. The final top 10, in terms of value, was filled in by grapes and apples, while apricots, figs, and pears, showed quite promising growth. When it comes to markets, Romania and Germany emerged as star players, together accounting for 26.6% of Greece’s total fruit exports. Poland, Italy, and Bulgaria completed the top 5, followed by Spain, the UK, Ukraine, the Netherlands, and Cyprus. USA and Serbia, even though they missed the top 10 seats, are filled with health-conscious consumers who have an undeniable appetite for Greece’s delicious fruit.

During the first five months of the current year, exports have reached an impressive €712 million. Among the top-performing products, one can find strawberries, kiwis, and oranges leading the way, maintaining their prestigious position in global markets. They are closely followed by oth-

er distinctive seasonal exports such as bananas, watermelons, and mandarins, which also show steady demand. Germany, Romania, and Poland have been the main importers of Greek fruit so far this year, reflecting an upward trend in Central and Eastern Europe. These countries remain reliable trade partners, asserting once again their strong interest in high-quality Greek agricultural products.

According to the President of SEVE – the Greek Exporters Association, Symeon Diamantidis, “this success is largely attributed to the unquestionable quality of Greek fruit, along with the flexibility and adaptability of exporters who respond not only to market needs, but also to the strategic diversification of export destinations”. He also added that “in order to further enhance the extroversion of the agricultural sector, additional support is needed in crucial areas. These include improvements to transport and storage infrastructure, targeted incentives, and easier access to new financing tools, especially for small and medium-sized exporters”. On top of that, he highlighted the importance of penetrating into new, non-EU markets, with particular focus on the Middle East and Asia.

Apples

€31,381,016 56,639,306 kg

Grapes

€64,938,104 53,212,991 kg

Bananas

€74,328,573 86,497,839 kg

Watermelons

€80,692,743 172,565,574 kg

Kiwis

€308,075,655 189,730,759 kg

Oranges

€206,188,329 324,704,804 kg

Source: Eurostat

Data processed by the Institute of Export Research and Studies (SEVE - ΙΕRS)

Strawberries

€172,262,308 82,970,676 kg

Peaches & Nectarines

€117,193,251 143,618,630 kg

Cherries & Sour Cherries

€103,627,185 41,188,387 kg

WHAT ABOUT 2025?

Mandarins

€104,240,332 133,614,589 kg

NEW RECORD LEVELS ARE PROJECTED

As 2025 has already shown great potential for further growth, the data so far seem to validate the projections. According to George Polychronakis, Advisor – Representative of Incofruit Hellas, export volumes are expected to be slightly positive and, more significantly, export values are projected to show an upward trend, possibly setting another record.

“To maintain the strong reputation of Greek products in international markets, we should

put emphasis on origin and traceability as they are increasingly influencing global demand. While the importance of a healthy diet remains a deciding factor in consumers’ minds, there is also a need for hygienically packaged options – Greek fruits are adequately positioned to meet these consumer expectations. To sum up, safeguarding Greek fruits’ reputation is vital to developing existing markets and entering new ones”, he stated, talking to Ambrosia Magazine.

With a rich agri-food heritage and a crystal-clear vision for global expansion, Thessaly is creating a strong culture of extroversion. Following carefully designed steps, it continues to improve its presence on the international Food and Beverage map.

Article: Kyriaki Moustakidou

OF THE TOTAL PDO FETA EXPORTS comes from thessaly 56%

thrive in this demanding market”, said Dimitri os Tsetsilas, Deputy Regional Governor for the Primary Sector and Rural Economy of the Region of Thessaly, talking to Ambrosia Magazine.

MILLION IS THE VALUE OF THESSALY'S F&B EXPORTS

Committed to the belief that agri-food is a cornerstone of Thessaly’s growth, the Region of Thessaly follows a multi-layered strategic approach to advance the sector. For instance, in close collaboration with local farmers, they are promoting a crop restructuring program designed to boost resilience and self-sufficiency. Furthermore, they are aiming to bridge the gap between science and agriculture by building partnerships with universities and research institutions, ensuring that academic expertise directly supports production. At the same time, they are actively working to take Thessalian products to the global stage through targeted promotional campaigns and active participation in major international trade fairs. Specifically, to strengthen export activities, the

Region has established a dedicated Agri-food Promotion Department. They have also doubled the promotional budget (from €150,000 to €400,000) to support participation in over 20 domestic and international trade fairs, directly benefiting over 100 Thessalian F&B businesses. Additionally, among other initiatives, they plan to launch an Export Academy for Businesses. This program will offer a structured education in international trade practices tailored to the needs of Thessalian food and beverage companies. Through the Export Academy, participants will pick up the skills needed to roll out export strategies that fit the nature and scale of their businesses.

As Mr. Tsetsilas stressed to Ambrosia Magazine, agricultural products from Thessaly hold a competitive edge in global markets, as they are filled with undeniable advantages. Apart from the €396

1. Arnaki Elassonas (lamb)

2. Katsikaki Elassonas (goat)

3. Feta (cheese)

4. Manouri (cheese)

5. Graviera Agrafon (cheese)

6. Batzos (cheese)

7. Kasseri (cheese)

8. Galotyri (cheese)

9. Firiki Piliou (apple)

10. Konservolia Piliou Volou (table olive)

11. Mila Zagoras Piliou (apple)

12. Messenicola (wine)

13. Anchialos (wine)

14. Rapsani (wine)

The ongoing registration process covers 12 other traditional local products seeking PDO/PGI designation under EU Regulation No 1151/2012. One can find among them: Achladi Kristalli Tyrnavou (pear), Amygdalo Tempon (almond), Kastano Ampelakion (chestnut), Aktinidio Delta Pineiou (kiwi) etc.

fact that they carry prestigious European quality labels and certifications, these products grow in the region’s fertile plains, with rich water resources lending them their unique taste, aroma, and texture. This ideal environment gives them a gourmet flair, necessary for dazzling food enthusiasts around the world.

Moreover, Thessaly can maintain large-scale production, intensifying in that way its “brand” as a reliable sourcing destination. Many examples prove that point: Thessaly is Greece’s leader in cotton and industrial tomato production, ac-

15. Tyrnavos (wine)

16. Elassona (wine)

17. Thessalia (wine)

18. Karditsa (wine)

19. Magnisia (wine)

20. Ouzo (spirit)

21. Tsipouro of Thessaly (spirit)

22. Tsipouro of Tyrnavos (spirit)

counting for 38% of the country’s cotton and 52.8% of its industrial tomatoes. It also has substantial output in cereals and animal feed, offering strong export potential for food processing, textile, and livestock industries.

Another precious advantage is the strong cooperative tradition that is incorporated in Thessaly’s soul. Famous cooperatives operate as established brands with direct access to export channels. They ensure product consistency, certified quality, stable pricing, and dependable supply, building long-lasting partnerships with buyers across the globe.

Last but not least, the region is seeing steady growth in organic farming (olive groves, vineyards etc.) and environmentally conscious production with a reduced carbon footprint. This aligns with rising demand in markets like Germany, Scandinavia, and the USA, where sustainability is strictly expected.

A strong investment strategy plays a crucial role in scaling up the expansion of high-quality agri-food products beyond national borders. In the case of Thessaly, a strategy like that is vital.

A landmark step in this direction was the official launch of DigiAgriFood in November 2024 in Larissa, the first European Digital Innovation Hub (DIH) focused exclusively on the agri-food sector. Backed by the Region of Thessaly and the University of Thessaly, it is designed to speed up the digital and green transition of the agri-food value chain.

Additionally, €20 million in funding has already been secured for Thessaly through Greece’s Strategic Plan under the Common Agricultural Policy 2023–2027, supporting investments such as modernizing greenhouses and building accessible shelters for plant production.

One example of a Thessaly-based company investing in sustainability and innovation is Loulis Food Ingredients, a significant company in the Greek Flour Industry. This three-century old business from Magnesia has been steadily growing its exports at a rate of 7%, now shipping its products

To further strengthen its exports, the company has invested in upgrading its Quality Control Department and completing targeted investments in technology, sustainability, and nutritional innovation.

For instance, Loulis has integrated AI tools to optimize raw material management and storage processes. At the same time, it has committed to reducing its environmental impact: 100% of the energy used in its facilities comes from renewable sources, and the company is actively investing in solar energy systems to further reduce its carbon footprint and support long-term sustainable production. Thanks to these forward-looking initiatives, the company’s product lines (Loulis Mills, St. George Mills, Kenfood, Kaizen) are now produced exclusively using green energy.

Since 1961, the Tyrnavos Cooperative Winery & Distillery has traced a successful path in the Greek agri-food sector and continues to grow. The Cooperative produces over 80 different wines and spirits, all crafted exclusively from its 450 members’ grapes. Looking to step up its export activity, the Cooperative has targeted key international markets, including the USA, Canada, Albania, Sweden, Germany, and the UK. To support this expansion, it has recently completed a €2.1 million investment focused on infrastructure, upgrading buildings, tanks, and modern production equipment to boost capacity and elevate product quality.

The products of Aegean Cuisine spellbind visitors from all over the world, engaging them in a constant pursuit of this culinary paradise –even long after they’ve returned home.

The Aegean Cuisine network consists of several restaurants across the South Aegean islands, dedicated to delivering an authentic local food experience. Supported by the Professional Chambers of Cyclades and Dodecanese, with the crucial contribution of the South Aegean Region, they aim to highlight the unique culinary identity of the Aegean providing unforgettable taste experiences. Additionally, more than 100 local producers offering over 500 food and beverage products hold a prominent place within the network. By linking gastronomy with primary production, these exceptional products have earned the Aegean Cuisine Recommended label. From cheeses, vegetables, fruits and herbs to nuts, beverages, pasta, and honey – all items are either cultivated in the Aegean environment or crafted in small local companies. A great majority of them have already found their way to international markets.

Hopping from island to island, through the Cyclades and the Dodecanese, travelers could easily trace the shared DNA of flavors. At the same time, however, they recognize the significant differences that transform each island destination into a diverse paradise for the palate. The rich tapestry of Aegean cuisine is vividly reflected in the array of products that form the central backbone of this culinary culture, encompassing cosmopolitan influences and a deep-rooted Greek identity. The land of the Aegean offers a great variety of incomparable, delicious products that hold Protected Designation of Origin (PDO) status. Take for example, the Santorini Tomato which

has been thriving on the Cycladic island since the late 19th century and adds a flavorful touch to every summer salad. The Santorini Fava, with its velvety texture and sweet taste, coming from the seeds of the plant named Lathyrus clymenum L., which has been growing locally in a special way for over 3,500 years. In the Cycladic capital, one can find Syros’ San Michali Cheese, which has a balanced flavor, both salty and sweet. It is made from pasteurized Syros cow’s milk and matures for 4 to 8 months. Another PDO product is Mykonos Kopanisti, with its creamy texture, intensely spicy flavor and rich aroma. When it comes to wines, two noteworthy selections are the Monemvasia of Paros, made from Monemvasia variety, which participates in both the white and red PDO Paros wines, and of course, the Assyrtiko of Santorini, a world-class white variety and one of the most important in the Mediterranean. Each island maintains its distinct character: while staying true to the ''heart'' of Aegean Cuisine, there are experiments and a

different composition and nature of the raw materials in each region. For example, the Tinos Artichoke upgrades several local dishes, and it can even be pickled. The Milos Peltes, made from the pureed flesh of the sun-dried tomatoes, is known for its unique density and intensity, elevating any recipe. On Serifos and Sikinos, thyme honey plays a leading role from breakfast to dessert, while the wild herbs of Folegandros and Iraklia have enjoyed for years a glorious reputation. In fact, the list goes on, counting many other local products, such as the Sour Cheese from Kea, the Ios Skotiri, the Almond Sweets from Kythnos and the Rakomelo from Amorgos. All these eloquently convey the culinary heritage of Cyclades and Dodecanese. Every visitor, as well as every true gastronomy lover around the world who seeks magic in their bite, gets impressed by the revelatory and rewarding Aegean Cuisine. Every person is captivated by the rewarding experience of Aegean Cuisine.

Whether you are savoring a delicious meal by the sea or exploring anywhere the unique products that define each island of Cyclades and Dodecanese, the taste of the Aegean Sea will always be an experience that engages all of your senses.

Retsina, one of the most iconic Greek wines, is enjoying a true “renaissance” thanks to a new generation of winemakers who are creating unique products of remarkable finesse, rich in aromas, flavors, and aftertastes.

Born on the land of Greece four thousand years ago, retsina gradually became an integral part of Greek culinary culture. Traditionally crafted from Greek grape varieties - most often Roditis - it owes its name and distinctive flavor to the addition of pine resin (retsini), which was initially used to seal amphorae, preventing the wine from spoiling. Besides sealing the vessels, the resin was soon discovered to enrich the wine with a distinctive aroma – resulting in a delightful, differentiated product. Eventually, it began to be added intentionally into the must, giving birth to a style that would accompany Greeks for centuries. Yet, as global tastes shifted towards other types of wine – with fruitier notes and more delicate profiles – retsina gradually fell out of favor. Today, however, it is reclaiming its place at the table. A group of visionary winemakers has elevated the product to new heights, winning international awards and reshaping its reputation. “Greek resinated wine is being relaunched on the international stage with a profile that harmonizes tradition and contemporary oenology,” says Afroditi Antoniou, marketing manager at Greek winery Kechris near the Port of Thessaloniki. “With deep roots in Greece’s wine history, retsina is now presented to global buyers as an authentic product of unique character, proudly carrying PGI certification.”

This renewed identity is underlined by Mrs. Antonia Papagiannakos, of the Papagiannakos Winery, in Mesogaia, Attica: “Modern Greek retsina

A GROUP OF VISIONARY WINEMAKERS HAS ELEVATED THE PRODUCT TO NEW HEIGHTS, RESHAPING ITS REPUTATION

is now presented as a high-quality gastronomic product with historical roots and distinctiveness. It is not just a traditional drink but a true expression of terroir and expertise.” According to her, “its superior quality can be certified by awards in international competitions and positive feedback from sommeliers and wine critics who recognize the refined, contemporary identity of retsina. It is also verified by quality certifications from producers who follow strict standards, ensuring both origin and production methods.”

For Kechris Winery retsina is not just part of its portfolio, it is the foundation of its vision. This is why its promotion as a unique Greek wine of great history and cultural significance is a priority and a pillar of its development strategy. “Our mission has been to prove that retsina deserves a place among the world’s great wines”, says Mrs Antoniou: “The role of Kechris Winery in relaunching the unique qualities of retsina but also of the Greek wine in general, domestically and abroad, has

been crucial. It is the only winery in Greece that invests in dedicated research on retsina, working alongside institutions such as Aristotle University of Thessaloniki. By combining a scientific approach and long expertise in producing traditional wine, it has created four PGI retsina labels, which are not just contemporary expressions of a traditional product; they inspire a new generation of wine lovers, offering an experience of exceptional aesthetic and flavor.”

According to Mrs. Antoniou, one of the main characteristics that make Kechris’ retsinas stand out is the meticulous selection of grape varieties. More specifically, grapes of Xinomavro and Assyrtiko are picked from specific vineyards, ensuring highquality raw material and authentic expression of the terroir: “Fermentation is completed under controlled temperature conditions, maintaining the varietal aromas of the wine. The use of pine resin is executed with absolute precision. It is not seen merely as an element of tradition, but as an ingredient of unique character. The resin is collected and added to the must during fermentation in small quantities, complementing the grape aromas without dominating the result. The final product is a retsina of complete balance: fruity fresh aromas come first, while subtle notes of pine, thyme, rosemary, and mastic emerge.”

A similar philosophy guides Papagiannakos Winery, a family-owned estate – the first bioclimatic winery in the Attica region – with a history dating back to 1919: “We are deeply connected to our land and native grape varieties, which we showcase with respect for tradition while employ-

ing innovative winemaking methods”, notes Mrs Papagiannakos. Our retsina, Origins, is a flagship expression of this philosophy, blending the authentic identity of retsina with a modern, clean, and fresh approach. Retsina is unique due to the addition of pine resin during fermentation, which imparts aromas of freshness and earthy distinctiveness. Our retsina stands out because it is made from carefully selected Savatiano grapes grown in old vineyards in the Mesogeia region. The resin is added with great care and precision, ensuring balance with the fruit and acidity without overwhelming them. Modern vinification at controlled temperatures with minimal intervention results in a refined, expressive, and well-balanced character that appeals even to consumers unfamiliar with retsina".

This new profile of retsina, which embodies both the history of the product and its contemporary identity, is driving retsina’s expansion abroad. “Our winery is present in key markets such as the USA, UK, Canada, Germany, and Australia, where there is growing interest in authentic and traditional Greek products”, says Mrs Papagiannakos. “Our goal for the near future is to strengthen our presence in Scandinavia and Asia –markets that value naturalness, quality, and the uniqueness of a product with authentic identity.”

Similarly, Kechris Winery has also gained traction abroad, according to Mrs. Antoniou: “We produce 11 wine labels, exporting 30% of our products to 31 countries in Europe, America, Australia, and Asia. Our vision is to make retsina a true landmark on the global wine map”.

Greek Cooperatives have been exhibiting an outstanding performance in terms of exports in recent years. Part of their success in building a strong brand name, both in Greece and abroad, is Hello Greece, an initiative that has been promoting established businesses as well as tourist destinations for 35 years, through DK Advertising company.

portfolio

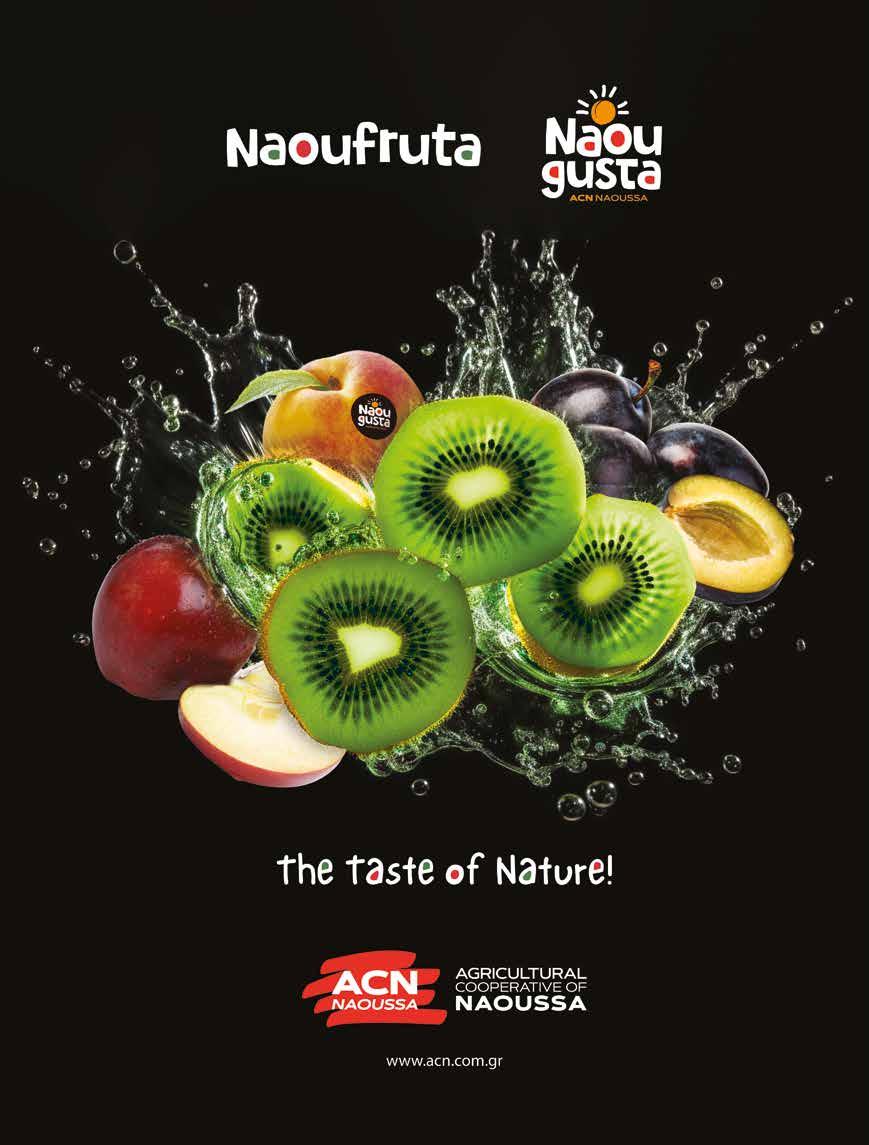

Hello Greece’s portfolio highlights the expertise on Cooperatives, given that some of the best PDO and PGI products in Greece have been promoted by DK Advertising through this initiative: the award-winning Naxos graviera PDO, product of the Union of Agricultural Cooperatives of Naxos, the ZAGORIN apples PDO, product of the Agricultural Cooperative of Zagora of Pelion, the black Corinthian currant Vostitsa PDO and the extra virgin olive oil Eliki PDO from the Panaegialios Union of Cooperatives, the Krokos Kozanis PDO, a saffron also known as the red gold of the Greek land, produced by the Compulsory Cooperative of Saffron Producers of Kozani, the famous peaches of Naoussa PDO, product of the Agricultural Cooperative of Naoussa, the exceptional PDO & PGI wines of AAOS (Vaeni Naousa), the exceptional wines of "Dimitra" Cooperative of Nea Anchialos and the high-quality wines from the Papagiannakopoulos winery in Nemea.

Advertising through Hello Greece is a good idea

Highlighting the initiative’s focus, all the above mentioned Cooperatives exhibit intense export activity in many countries around the world. As for Hello Greece itself, it participates as a sponsor in the largest exhibitions in Greece and abroad, successfully advertising businesses, destinations and Greek products through brochures, banners and journalistic content. The added value in advertising through Hello Greece is that all prospective clients enjoy publicity privileges such as advertisements and articles in widely distributed media publications in Greece and abroad, radio, TV and Internet contests, TV and radio spots. Among DK Advertising clients, one can find some of the most popular tourist destinations in Greece, such as Skyros, Rhodes, Kos, Lesbos, Katerini, Kythira, Serifos, Sparta, Symi, Syros, Chios, Alexandroupolis, Kavala, Messinia, Olympus, Naxos, Nisyros and Evia. °

GLOBAL PACK, the major International Packaging Exhibition in Greece and Southeast Europe, is making a powerful comeback! From November 7th to 10th, at Metropolitan Expo (Athens, Greece), the 2nd GLOBAL PACK EXPO is aiming to lead the whole industry to a new era. Market pioneers will showcase tailor-made packaging solutions and innovative concepts across the food, beverage, confectionery, bakery, pharmaceutical, cosmetics, non-food & industrial goods sectors. So, if you are a CEO, buyer, logistics, R&D, product or intralogistics manager, and you are keen on exploring sustainable solutions and new technologies to digitally transform your packaging line or optimize your warehouse storage system, GLOBAL PACK is the ideal place to be! Save the date and don't miss the opportunity to attend!

•To find solutions for the entire packaging chain, from materials and machinery to technologies, all the latest designs and printing innovations.

•To discover new practices and cutting-edge technologies that support sustainable packaging design.

•To see first-hand digital tools and valuable breakthroughs that allow you to digitally transform your packaging line for immediate productivity improvement and cost reduction.

•To find the latest megatrends and emerging technologies that cover all steps from the processing of raw materials to the final product, helping your business to reduce costs, to grow and innovate.

•To learn about solutions for the production and processing, designed to integrate your business into the future of industry 4.0, making it more competitive and profitable.

•To get to know storage and transport ideas for your products.

The Hosted Buyer Program will provide you with the opportunity to conduct high level networking and investment-driven discussions. Join now the program and be part of an elite group of Buyers that will enjoy amazing benefits such as complimentary airplane tickets, accommodation at a 4 or 5-star hotel, prescheduled B2B meetings with the exhibitors, etc. Visit globalpackexpo.gr, click at ''Be a Hosted Buyer'' tab and discover more!

FOODTECH, the premium biannual International Trade Show focusing on the production, processing and handling technologies of the Food & Beverage sector, is back again! As a well-rounded exhibition, it offers insightful answers to the F&B industry's need for modernization and evolution. This year's event is going to be held from 7 to 10 November at Metropolitan Expo (Athens, Greece), showcasing the next era of food manufacturing, and giving the industry the opportunity to connect, learn, engage, and move to a more sustainable and efficient future. If you are a professional of the F&B industry, who is always looking for advanced technologies and practical solutions to improve, develop and automate your business production line, FOODTECH is the next can't-ignore date on your calendar! Find out more at foodtech.gr and come to visit the exhibition!

GLOBAL PACK and FOODTECH are the new commercial hub for the packaging industry & food technology in S.E. Europe. During your visit, you will meet under one roof 350+ market leaders and discover innovative solutions for packaging, and cutting-edge technologies for the F&B production.

The FOODTECH 2025 exhibition will host the 7th International Conference on Food Science & Technology on November 8th and 9th. The event is organized by the Hellenic Association of Food Technologists (PETET) with scientific guidance from both the Department of Food Science & Technology at the International Hellenic University and the corresponding department at the University of West Attica. At the same time, it is held under the auspices of the Hellenic Food Authority (EFET) and supported by the Federation of Hellenic Food Industries (SEVT), the Association of the Greek Manufacturers of Packaging & Materials (AGMPM), and the Greek Cold Storage & Logistics Association.

The conference topics

For information about the organizing committee, speakers, the full program, and ticket reservations, please visit the official conference website: foodtechnologycongress. com

This year's conference theme, ''Food Science & Technology: Innovation and Sustainability Challenges'', reflects the quest of new scientific and technological ideas to creatively approach the sector's perpetual changes. The main topics to be discussed are:

SATURDAY November 8th

10.00 – 12.10

Novel Foods and Sustainable Development | Keynote Speaker: Paola Pittia

12.30 – 14.00

Emerging Technologies in Food Production: Adaptation to Industry 4.0 and AI | Keynote Speaker: Jan Van Impe

15.00 – 18.00

Food Safety Culture, Food Reformulation and Authenticity / Keynote Speaker: Photis Papademas

SUNDAY November 9th

09.10 – 12.00 & 16.10 - 17.30

Novel Foods and Sustainable Development | Keynote Speaker: Christina M. Rosell

12.20 – 14.10

Food Safety Culture, Food Reformulation and Authenticity / Keynote Speaker: Fatih Ozogul

15.00 – 16.00

Packaging Materials in a Circular Economy Environment