7 minute read

What is the Minimum Deposit for Avatrade in ZAR

from Avatrade Review

by ForexMakets

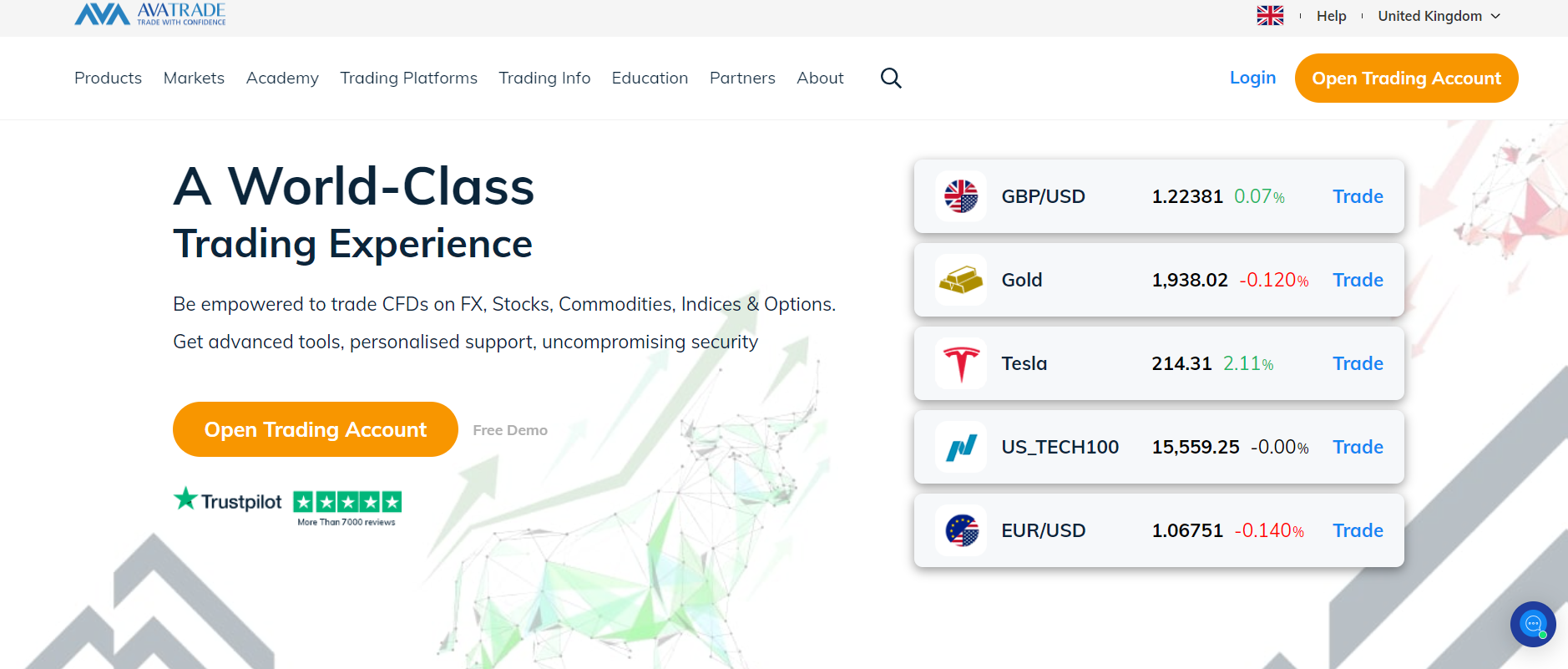

For South African traders considering AvaTrade as their forex broker, understanding the minimum deposit requirement in South African Rand (ZAR) is a crucial first step. AvaTrade, a globally recognized and regulated broker, offers a range of trading instruments and platforms tailored to both beginners and experienced traders. But how much capital do you need to get started if you're funding your account in ZAR? In this guide, we’ll break down AvaTrade’s minimum deposit requirements for South African clients, explore supported payment methods, and discuss whether the initial funding amount offers real value for your trading goals.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Introduction to AvaTrade in South Africa

If you're a South African trader wondering whether AvaTrade is a safe and affordable entry into the world of forex, you're not alone.

AvaTrade has grown into one of the most trusted forex brokers worldwide, and its presence in South Africa has brought new opportunities for traders looking to grow wealth through global markets. But one question constantly echoes among new traders:

"What is the Minimum Deposit for Avatrade in ZAR?"

In this comprehensive breakdown, we’re going to decode this question and much more.

This article is your go-to source whether you're just getting started or looking to switch brokers for better ZAR support, lower minimum deposit requirements, and high-growth potential.

What is the Minimum Deposit for AvaTrade in ZAR?

The minimum deposit for AvaTrade in ZAR is approximately R1,800, which is equivalent to $100 USD at current exchange rates. However, this amount may vary depending on:

Your deposit method

Real-time ZAR/USD conversion

Type of account you choose

✅ Quick Fact: AvaTrade accepts deposits in ZAR for South African clients, but the platform converts it into the base currency of your trading account (typically USD or EUR).

This conversion process means your actual trading funds may slightly vary depending on the exchange rate and potential processing fees by your bank or card provider.

Why Minimum Deposit Matters for Forex Traders

Many beginner traders believe that starting with a small deposit is safer, but this isn’t always true. Here’s why the Minimum Deposit for AvaTrade in ZAR plays a critical role in your trading success:

Margin and Leverage: You need enough funds to cover margins, especially when using leverage.

Position Size: Larger deposits allow better risk management and position scaling.

Psychological Comfort: Underfunded accounts often lead to panic-driven decisions.

Access to Better Tools: AvaTrade may unlock additional features or bonuses for higher deposits.

❌ Mistake to Avoid: Depositing too little and expecting big profits quickly. Forex requires capital and strategy—not luck.

Currency Conversion: How AvaTrade Handles ZAR

While AvaTrade does not currently offer a ZAR-based trading account, South African traders can:

Deposit in ZAR

Have funds converted to USD/EUR/GBP (depending on account setting)

Start trading immediately

✅ AvaTrade uses competitive exchange rates, and there are no deposit fees charged by the broker itself. However, banks or credit card companies might charge a currency conversion or international transaction fee.

👉 Tip: Always check with your payment provider to avoid surprises when depositing.

AvaTrade Account Types and Their ZAR Requirements

AvaTrade offers several account types tailored to different levels of traders. Here’s how they relate to your ZAR deposit:

Standard Retail Account

Minimum Deposit for AvaTrade in ZAR: ~R1,800

✅ Best for beginners

AvaTrade Islamic Account

Same minimum, but Sharia-compliant

✅ Perfect for faith-based trading with no swaps

Professional Account

❌ Minimum Deposit: Much higher (R100,000+)

Requires proven trading experience and qualifications

Demo Account

No deposit needed

✅ Ideal for practice before real deposit

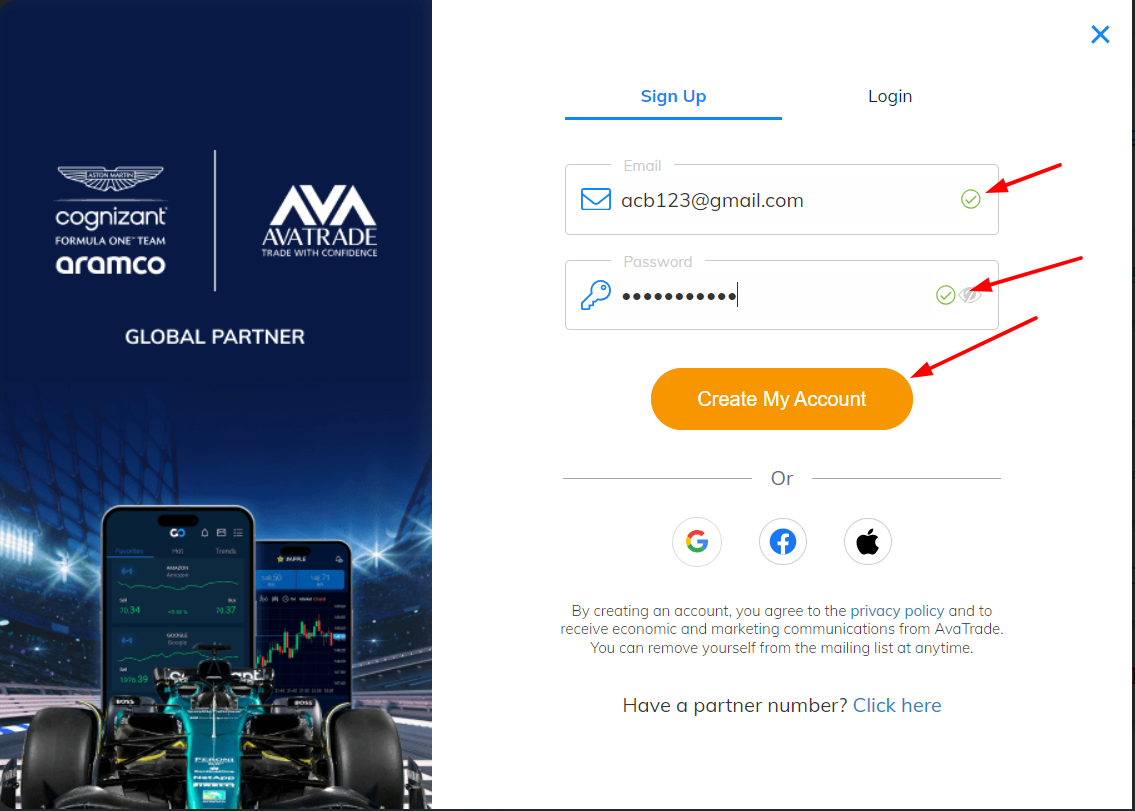

How to Make a Deposit in ZAR on AvaTrade

Making a deposit in ZAR is simple and secure:

Register a free AvaTrade account

Select your preferred deposit method:

Credit/Debit card

Bank wire transfer

E-wallets (Skrill, Neteller)

Choose ZAR as your deposit currency

Submit payment and wait for confirmation

It usually takes less than 24 hours to reflect in your trading account.

💥💥💥 If you do not have an Avatrade account, please: 👉 Open An Account or 👉 Go to broker

✅ Bonus Tip: Use a credit card or instant EFT to speed up the deposit process and start trading faster.

✅ Pros of AvaTrade for South African Traders

Supports ZAR deposits via local banks

Globally regulated, including FSCA in South Africa

No deposit fees from AvaTrade

Tight spreads and leverage up to 1:400

User-friendly platforms including MT4, MT5, AvaTradeGO

Negative balance protection

❌ Cons and Considerations Before Depositing

❌ No ZAR-based trading account

❌ Currency conversion losses may occur

❌ High leverage can be risky for beginners

❌ Inactivity fees apply after 3 months

Is AvaTrade Regulated in South Africa?

Yes. ✅ AvaTrade is fully regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 45984. This makes it one of the most legit and trustworthy brokers for South African residents.

You can trade confidently knowing that your funds are held in segregated accounts and the broker adheres to strict regulatory standards.

ZAR vs Other Deposit Currencies – Which is Better?

While depositing in ZAR is convenient for local traders, some still prefer depositing in USD to:

Avoid conversion at every transaction

Align with major currency pairs

Reduce slippage during fast markets

However, for beginners, ZAR deposits are often safer and easier to manage.

Bonus Offers and Promotions Based on Deposit

AvaTrade frequently offers bonus credits, cashback, or zero-fee trading periods based on your first deposit.

✅ Example: Deposit over R5,000 and receive a bonus up to 20% in credit (depending on the campaign and region)

But remember: Bonuses often come with terms and conditions like minimum trading volume before withdrawal.

Minimum Deposit for AvaTrade in ZAR: Case Study Examples

Case 1:Lebo, a beginner from Cape Town, deposited R2,000 via credit card. After conversion, he started trading with ~$105 and grew his account to over $300 in two months by trading USD/JPY.

Case 2:Thabo, an experienced trader, deposited R50,000 into his AvaTrade account, accessed advanced tools, and qualified for VIP support. His profitability increased by 30% thanks to tighter spreads.

Common Mistakes Traders Make When Depositing

❌ Depositing the bare minimum and expecting big results

❌ Ignoring currency conversion rates

❌ Using unsupported or slow deposit methods

❌ Not reading bonus terms

❌ Overleveraging due to low initial balance

How to Increase Your Forex Potential with the Right Deposit

The Minimum Deposit for AvaTrade in ZAR is just the starting point.

To truly maximize your potential, consider these pro tips:

Start with at least R3,000–R5,000 to gain margin flexibility

Use AvaTrade’s risk management tools

Scale your position sizes responsibly

Practice first on demo

Avoid overtrading

✅ Your success begins with smart funding, not risky gambling.

FAQs – Minimum Deposit for AvaTrade in ZAR

1. What is the minimum deposit for AvaTrade in South Africa?Around R1,800 depending on exchange rates.

2. Can I deposit ZAR into my AvaTrade account?Yes. AvaTrade accepts ZAR, then converts it to USD.

3. Is there a ZAR trading account option?❌ No, only deposits are accepted in ZAR. Trading accounts are in USD/EUR.

4. Does AvaTrade charge for ZAR deposits?No, AvaTrade does not charge deposit fees.

5. What is the fastest way to deposit in ZAR?Using a credit card or local EFT.

6. Is AvaTrade regulated in South Africa?✅ Yes, by the FSCA.

7. What’s the best deposit amount to start with?At least R3,000 to R5,000 is recommended.

8. Are there promotions for larger deposits?Yes. Bonuses may apply for first-time deposits.

9. Can I withdraw in ZAR?Funds are converted back from USD to ZAR during withdrawal.

10. Is AvaTrade safe for South African traders?✅ Absolutely. It’s one of the most regulated brokers globally.

Final Thoughts – Should You Open an AvaTrade Account Today?

If you're a South African looking to step into the world of forex trading, AvaTrade is one of the most accessible, secure, and feature-rich platforms available. With a minimum deposit starting around R1,800, you can begin your journey with confidence.

✅ Regulated✅ ZAR deposits accepted✅ Beginner-friendly platform✅ Transparent fee structure

Don't let hesitation cost you opportunities.

👉 Open your AvaTrade account today and take the first step toward financial freedom through forex.