8 minute read

Is Avatrade Regulated in South Africa

from Avatrade Review

by ForexMakets

Is Avatrade Regulated in South Africa

1. Introduction

As a forex trader, it's crucial to choose the right broker that offers not only competitive pricing and reliable platforms but also the proper regulation to protect your funds. Avatrade, one of the most popular online forex brokers, has expanded its presence globally. But how secure is it for South African traders? Are they regulated in South Africa? In this article, we will dive deep into these questions, providing a comprehensive analysis of Avatrade's regulation in South Africa. By the end, you’ll have a clear understanding of whether Avatrade is the right broker for your trading needs.

Looking for the right Forex broker? 👉 Check out our in-depth Review Forex Broker to make the smart choice today!

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

2. Overview of Avatrade

Founded in 2006, Avatrade has grown to become one of the world’s leading online trading platforms. This broker offers a range of financial products, including Forex, stocks, cryptocurrencies, and commodities. With its headquarters in Dublin, Ireland, Avatrade operates across multiple jurisdictions and provides access to advanced trading tools and resources.

Key Features of Avatrade:

User-Friendly Platforms: Avatrade provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and their proprietary trading platform, AvaTradeGo.

Wide Range of Assets: Traders can trade over 250 instruments, including Forex, indices, stocks, and cryptos.

Competitive Spreads: The broker offers tight spreads, which can be appealing for active traders.

Learn more: Avatrade Review

3. Regulatory Framework in South Africa

Before we explore whether Avatrade is regulated in South Africa, let’s take a look at the regulatory environment in the country. South Africa has one of the most developed financial markets on the African continent, overseen by several regulatory bodies. The most important authority when it comes to forex trading is the Financial Sector Conduct Authority (FSCA).

The FSCA:

Role: The FSCA oversees financial institutions, including forex brokers, to ensure that they comply with South African law.

Protection for Traders: Regulation by the FSCA ensures that traders’ funds are protected, and brokers follow ethical and transparent practices.

Legal Requirements: Brokers operating in South Africa must adhere to strict capital requirements, risk management protocols, and transparency standards.

4. Is Avatrade Regulated in South Africa?

Currently, Avatrade is not regulated by the FSCA (Financial Sector Conduct Authority) in South Africa. Although Avatrade is a global player with regulation in various jurisdictions, such as the Central Bank of Ireland (for European clients) and ASIC (for Australian clients), it does not hold an FSCA license.

What Does This Mean for South African Traders?

While Avatrade’s lack of regulation in South Africa might raise some concerns for certain traders, it doesn’t necessarily mean the broker is unsafe. However, traders should be cautious and aware of the regulatory gaps, especially when considering the protection of their funds.

FSCA Regulation: Without an FSCA license, South African traders may not benefit from the same level of legal protection that comes with FSCA-regulated brokers. This includes protection in case of disputes or issues with withdrawals.

Global Regulation: Even without FSCA regulation, Avatrade is regulated in several well-known jurisdictions, such as Ireland, Australia, and Japan.

5. The Importance of Regulation for Forex Traders

Why is Regulation Important?

Regulation is essential when choosing a forex broker because it ensures that the broker adheres to industry standards, offering a safe trading environment. Here are some reasons why traders should prioritize working with regulated brokers:

Fund Protection: Regulators often require brokers to segregate client funds from their operating capital, ensuring that traders’ money is protected.

Fair Trading Conditions: Regulators impose rules that prevent market manipulation, unfair spreads, or other unethical practices.

Transparency and Accountability: Regulated brokers are required to provide transparent pricing and comply with reporting standards.

❌ Risks of Trading with Unregulated Brokers

Risk of Fraud: Unregulated brokers might engage in unethical practices, such as misappropriating funds or refusing to process withdrawals.

Lack of Accountability: Without regulation, brokers are not required to maintain transparent operations, which increases the risk of manipulation and exploitation.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

6. How to Verify a Forex Broker's Regulation

Verifying a forex broker’s regulation is an essential part of ensuring a safe and secure trading experience. Here are a few steps to follow when checking the regulation status of any broker:

Check the Broker’s Website: Reputable brokers will display their regulatory licenses and registration numbers clearly on their website.

Verify with the Regulatory Authority: You can cross-check a broker’s license by visiting the official website of the regulatory authority. For example, in South Africa, visit the FSCA website to verify a broker’s registration.

Read Reviews and Forums: Check third-party websites and forums for feedback from other traders about the broker’s regulatory status and reputation.

7. Avatrade's Regulatory Bodies

Although Avatrade is not regulated in South Africa, it is licensed in multiple jurisdictions globally, providing a level of security for traders worldwide.

Key Regulatory Authorities for Avatrade:

Central Bank of Ireland (CBI) – Avatrade is regulated in Europe under the Central Bank of Ireland.

Australian Securities and Investments Commission (ASIC) – Avatrade holds an ASIC license for Australian traders.

Financial Services Agency (FSA), Japan – Avatrade is regulated by the FSA in Japan, ensuring a high standard of operations for Japanese clients.

British Virgin Islands Financial Services Commission (FSC) – Avatrade operates in regions like the British Virgin Islands under the FSC.

These licenses ensure that Avatrade adheres to strict regulatory standards and provides protection for traders across multiple markets. However, South African traders must be aware that their local regulatory authority, the FSCA, does not regulate Avatrade.

8. Advantages of Trading with a Regulated Broker

There are several benefits to trading with a broker that is regulated by a reputable authority. Here are some of the most significant advantages:

Safety of Funds: Regulated brokers are required to keep client funds in segregated accounts, minimizing the risk of loss due to company insolvency.

Transparency: Regulatory bodies require brokers to be transparent about their pricing, execution, and business practices.

Dispute Resolution: When trading with a regulated broker, there is often a formal mechanism in place to resolve disputes.

Risk Management: Brokers regulated by authorities like the FSCA are required to implement risk management practices that protect traders from excessive losses.

9. Risks of Trading with Unregulated Brokers

Although some unregulated brokers may offer attractive spreads or promotional deals, trading with them can expose traders to serious risks:

No Legal Protection: Without regulation, traders have no recourse for resolving issues such as fraudulent activity or withdrawal problems.

Risk of Fraud: Unregulated brokers may not be subject to the same scrutiny as regulated ones, making it easier for them to engage in fraudulent practices.

Lack of Trust: It can be challenging to trust an unregulated broker, especially if they do not offer transparency in their operations or have questionable reputations.

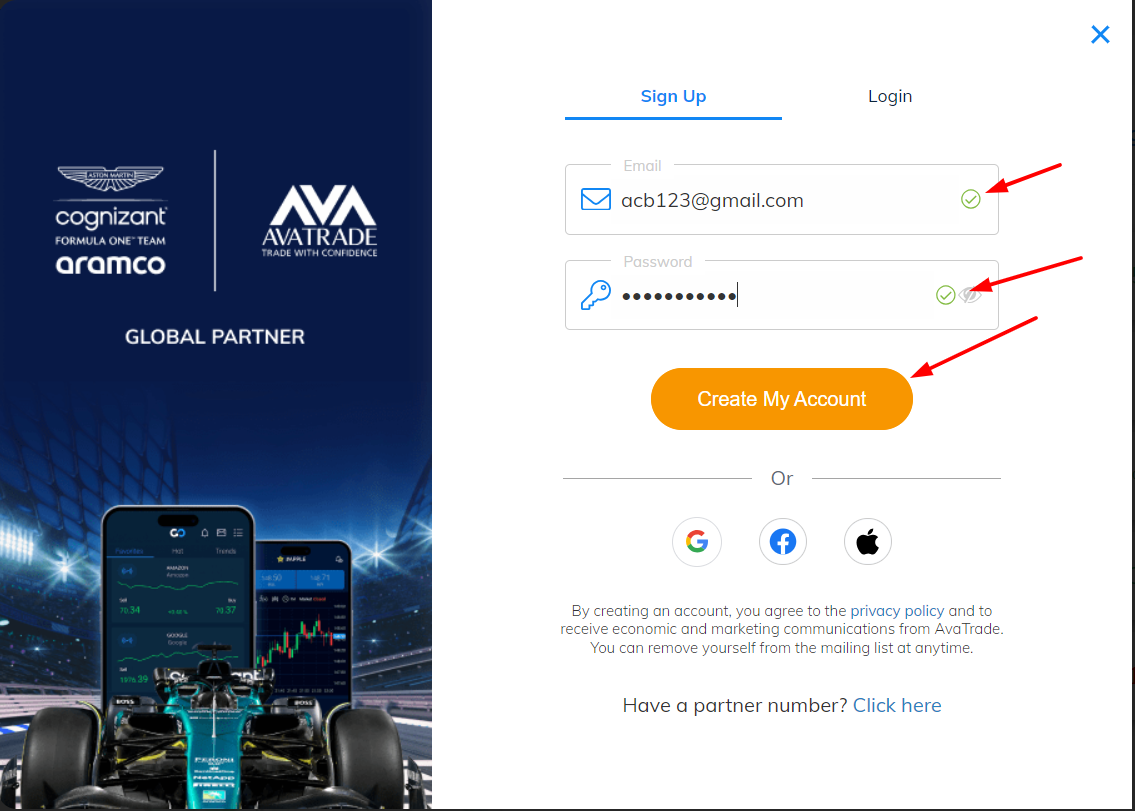

10. How to Open an Account with Avatrade

To get started with Avatrade, follow these simple steps:

Visit the Avatrade Website: Navigate to their official website.

Register an Account: Fill out the registration form with your personal details.

Verify Your Identity: Submit the required identification documents for account verification.

Deposit Funds: Choose your preferred deposit method and fund your account.

Start Trading: Once your account is funded, you can start trading.

11. Customer Support and Resources Provided by Avatrade

Avatrade offers several resources to support traders:

24/7 Customer Support: Available via live chat, email, and phone.

Educational Resources: Free webinars, tutorials, and e-books to help traders improve their skills.

Demo Accounts: Test strategies and practice trading with virtual funds before committing real money.

12. Conclusion

In conclusion, while Avatrade is regulated in several major jurisdictions, it is not regulated by the FSCA in South Africa. South African traders should be aware of the potential risks involved in trading with an unregulated broker in their home country. Despite this, Avatrade remains a reputable choice for traders seeking a global trading platform, as it is regulated by authorities such as ASIC and CBI.

Traders should carefully evaluate the risks and benefits of trading with Avatrade and consider whether they are comfortable with the lack of local regulation. For traders who prioritize local regulation, choosing a broker licensed by the FSCA might be the better option.

13. FAQs (Frequently Asked Questions)

Is Avatrade a trustworthy broker?

Yes, Avatrade is regulated in multiple jurisdictions and offers competitive spreads and a wide range of trading instruments.

Can South African traders use Avatrade?

Yes, South African traders can use Avatrade, but they should be aware that it is not regulated by the FSCA.

What are the risks of trading with an unregulated broker?

The main risks include lack of legal protection, exposure to fraud, and difficulty in resolving disputes.

How do I verify a broker’s regulation?

You can verify a broker’s regulation by checking the official website of the relevant regulatory body.

Does Avatrade offer a demo account?

Yes, Avatrade offers a demo account for traders to practice their strategies risk-free.

Can I open an account with Avatrade in South Africa?

Yes, South African traders can open an account with Avatrade.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

What trading platforms does Avatrade offer?

Avatrade offers MetaTrader 4, MetaTrader 5, and AvaTradeGo.

Is Avatrade safe for beginner traders?

Yes, Avatrade provides user-friendly platforms and educational resources suitable for beginners.

Can I trade cryptocurrency on Avatrade?

Yes, Avatrade offers cryptocurrency trading along with other assets.

How do I contact Avatrade’s customer support?

You can contact Avatrade’s customer support 24/7 via live chat, email, or phone.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

💥 Read more:

Avatrade South Africa Review 2025: Pros & Cons A Comprehensive Review

Avatrade Broker Review 2025: Pros & Cons A Comprehensive Review