6 minute read

Avatrade Vs eToro 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs eToro 2025: Compared - which is better broker?

In 2025, the global forex market is more competitive than ever, and two names consistently rise to the top: Avatrade and eToro. Both platforms offer unique benefits for retail traders, institutional investors, and beginners alike. But the question remains: Avatrade vs eToro – which broker truly dominates in 2025? ✅

Whether you're a beginner in forex trading or a seasoned trader looking to switch brokers, this in-depth analysis will help you make an informed decision.

Tap into real-time forex opportunities—explore the insights shared on our Forex Markets page.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. Overview: Who Are Avatrade and eToro?

Both Avatrade and eToro are long-standing names in the forex and CFD trading industry, with over a decade of market presence. While Avatrade is known for its regulatory compliance and robust platforms, eToro revolutionized trading with its pioneering social trading features.

Avatrade: Founded in 2006, headquartered in Dublin, Ireland. Regulated across six jurisdictions.

eToro: Founded in 2007, headquartered in Tel Aviv, Israel. Known for its social trading community and crypto offerings.

These brokers have continually adapted to market demands, improving their platforms, tightening spreads, and enhancing trader education.

📌 Choosing a Forex broker is crucial. Don’t miss our honest and updated Review Forex Broker to help you decide wisely.

2. Platform Comparison: UX, Tools & Features

A platform’s design can make or break a trader’s experience.

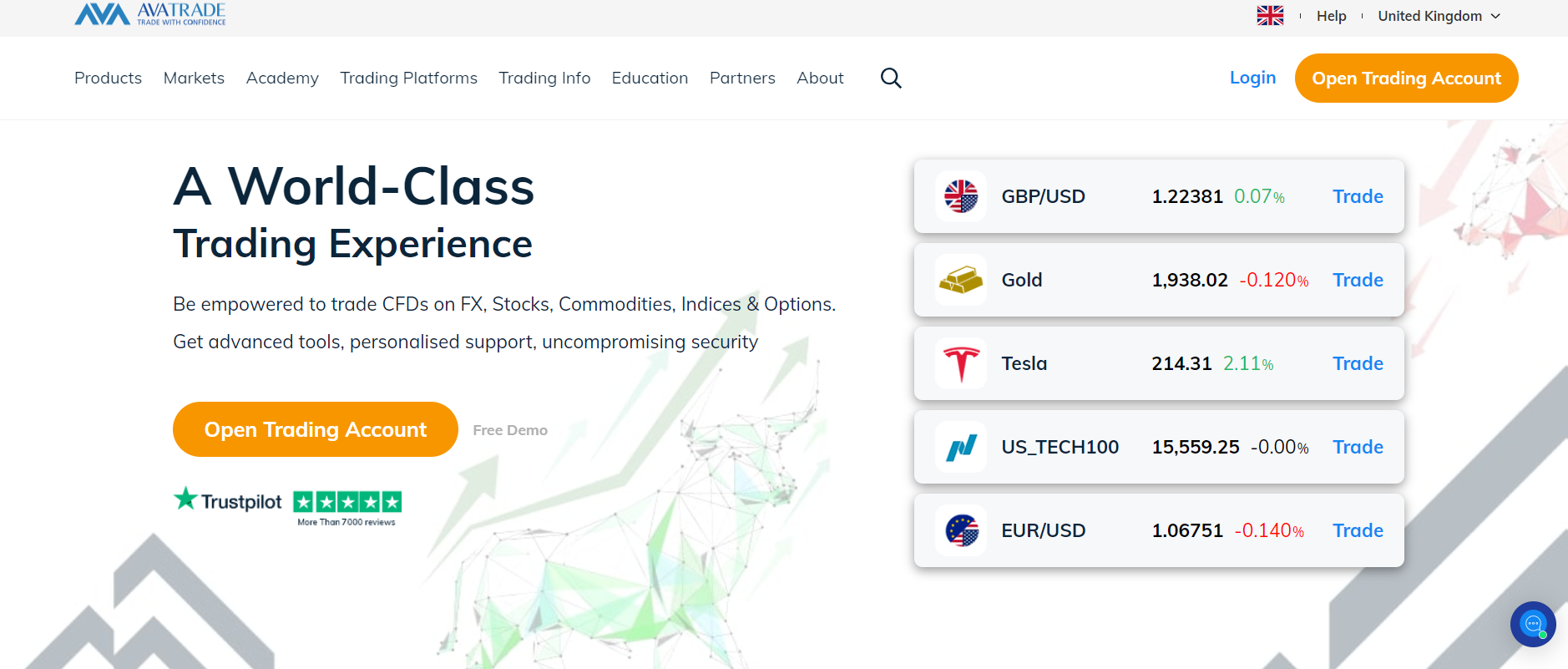

Avatrade offers platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaTradeGO, and WebTrader – ideal for advanced traders.

eToro, on the other hand, features a custom-built platform that supports social trading, copy trading, and a user-friendly dashboard.

✅ eToro is preferred by beginners due to its intuitive layout.❌ Avatrade’s UI may be overwhelming for first-timers, though it caters excellently to pros who demand customization.

3. Trading Instruments & Market Coverage

Both brokers cover forex, stocks, commodities, indices, and cryptocurrencies. However, there are key differences:

Avatrade provides access to over 1,250 financial instruments, including vanilla options.

eToro boasts over 3,000 tradable assets, especially real stocks and crypto (not just CFDs).

Key takeaway:If you’re focused on diversification across asset classes, eToro might be a better fit.But if you're looking for forex-focused trading with deep tools, Avatrade is superior.

4. Account Types and Accessibility

Both brokers offer a single live account and a demo account, simplifying onboarding. However:

Avatrade is more flexible with account types via MT4/MT5 customizations.

eToro focuses on social trading accounts with features like CopyTrader and Smart Portfolios.

✅ Avatrade provides Islamic account options, which is ideal for traders observing Shariah law.❌ eToro currently lacks this flexibility.

5. Regulations and Security Measures

Trust and security are key in choosing a broker.

Avatrade is regulated by ASIC, FSCA, FSA Japan, Central Bank of Ireland, and more.

eToro is licensed under CySEC, FCA, ASIC, and FinCEN in the US.

Both brokers have top-tier protections such as segregated accounts and negative balance protection, but Avatrade is slightly ahead in global regulatory footprint ✅.

6. Trading Fees, Spreads & Commissions

Both brokers are commission-free for most trades, but the fee structures differ.

Avatrade has tighter forex spreads (as low as 0.9 pips on EUR/USD).

eToro charges a spread plus overnight fees and a withdrawal fee of $5.

✅ Avatrade benefits high-frequency traders due to lower spreads.❌ eToro's non-trading fees can add up.

7. Deposit & Withdrawal Methods

eToro accepts PayPal, bank transfers, credit/debit cards, and e-wallets.

Avatrade supports similar methods, with faster processing on withdrawals in many regions ✅.

Both brokers offer minimum deposits around $100-$200, making them accessible to new traders.

8. Social Trading: eToro vs Avatrade

This is where eToro dominates:

Over 30 million users.

Ability to copy trades of top investors.

Access to community insights, leaderboards, and sentiment tracking.

❌ Avatrade’s DupliTrade is limited to MT4 users and not as socially dynamic.

If social trading is your priority – eToro wins hands down. ✅

9. Educational Resources & User Support

Avatrade offers:

Free eBooks

Trading tutorials

Market analysis

eToro provides:

Webinars

Interactive trading guides

Social education via the community feed

Both provide 24/5 customer service, but Avatrade's multilingual phone support gives it an edge ✅.

10. Mobile Trading Experience

AvatradeGO is optimized for performance, order management, and real-time analytics.

eToro’s app is built for simplicity and engagement, especially with social features.

✅ AvatradeGO is better for technical traders.✅ eToro is superior for beginners and social engagement.

11. Performance & Execution Speed

Avatrade has slightly faster execution speeds due to its STP/ECN models.

eToro, while stable, may experience latency during high volatility.

Scalpers and day traders may prefer Avatrade ✅.

12. User Sentiment in 2025

According to recent surveys and community feedback:

Traders appreciate eToro for its ease of use and community trading.

Professionals lean towards Avatrade for its trading tools and tighter spreads.

13. Pros and Cons ✅❌

Avatrade Pros ✅

Advanced platforms (MT4, MT5)

Low spreads

Strong regulations

AvaProtect risk management

Avatrade Cons ❌

Complex for beginners

Limited social features

eToro Pros ✅

Industry-leading social trading

Access to real stocks & crypto

Beginner-friendly platform

eToro Cons ❌

Higher non-trading fees

Fewer tools for advanced trading

14. Which Broker Suits You?

Choose Avatrade if:

You are a technical trader

Prefer lower spreads

Need Islamic accounts or MT5 integration

👌 If you choose Avatrade, 👉 Click here to open an account

Choose eToro if:

You are a beginner or social trader

Want to copy successful traders

Focus on real asset investment and crypto

15. Top 10 FAQs About Avatrade Vs eToro

1. Which broker is safer, Avatrade or eToro?Both are highly regulated, but Avatrade has slightly broader regulatory coverage ✅.

2. Does eToro offer MetaTrader?❌ No. eToro uses a proprietary platform.

3. Is copy trading better on Avatrade or eToro?✅ eToro is superior for social and copy trading.

4. What is the minimum deposit?Both require around $100 to $200.

5. Who has lower spreads?✅ Avatrade generally offers tighter spreads.

6. Can I trade crypto on both platforms?Yes, but eToro offers direct crypto (not just CFDs).

7. Which is better for day trading?✅ Avatrade, due to lower latency and execution speed.

8. Which platform is more beginner-friendly?✅ eToro, thanks to its intuitive design.

9. Is Avatrade suitable for Muslim traders?Yes, Islamic accounts are available ✅.

10. Can I withdraw money easily?Yes, both support smooth withdrawals, but Avatrade processes faster in some regions.

Ready to Start Trading? ✅

Choosing the right broker is a critical step in your trading journey. Whether you value community-driven trading or robust professional tools, both Avatrade and eToro offer compelling platforms.

Want to experience low spreads, powerful tools, and regulated safety?👉 Open your trading account with Avatrade today and take control of your financial future!

👌 If you choose Avatrade, 👉 Click here to open an account

Prefer a more social, intuitive platform to learn and grow?👉 Get started with eToro and copy top-performing traders now!

💥 Read more:

Avatrade Review India 2025: Pros & Cons A Comprehensive Review

Avatrade Signals Review 2025: Pros & Cons A Comprehensive Review

Avatrade Copy Trading Review 2025: Pros & Cons A Comprehensive Review

Avatrade Vs FBS 2025: Compared - which is better broker?

Avatrade Vs HFM 2025: Compared - which is better broker?

Avatrade Vs CMC Markets 2025: Compared - which is better broker?