7 minute read

Is Avatrade Legal in Pakistan

from Avatrade Review

by ForexMakets

AvaTrade is not directly regulated in Pakistan but operates legally through international licenses under ASIC, FSCA, and the Central Bank of Ireland. Pakistani traders can safely trade forex and CFDs with AvaTrade using its global platform.

Introduction

In recent years, online forex trading has gained significant popularity in Pakistan. Traders are increasingly seeking reputable brokers to engage in currency trading. One such broker is AvaTrade, an international online trading platform. This comprehensive guide delves into the legal aspects of trading with AvaTrade in Pakistan, providing insights into its legitimacy, regulatory compliance, and suitability for Pakistani traders.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Understanding Forex Trading in Pakistan

2.1. Legal Status of Forex Trading

Forex trading is legal in Pakistan. The Securities and Exchange Commission of Pakistan (SECP) oversees the financial markets, including forex trading activities. However, it's essential to note that while forex trading is legal, the SECP does not regulate offshore forex brokers. Therefore, Pakistani traders often engage with international brokers like AvaTrade.

2.2. Regulatory Authorities

The primary regulatory bodies overseeing financial activities in Pakistan include:

Securities and Exchange Commission of Pakistan (SECP): Regulates capital markets and corporate sector activities.

State Bank of Pakistan (SBP): Regulates the country's monetary and credit system.

While these bodies regulate domestic financial activities, they do not oversee offshore forex brokers.

2.3. Taxation on Forex Trading

Profits earned from forex trading are subject to taxation in Pakistan. Traders must report their earnings to the Federal Board of Revenue (FBR) and pay taxes accordingly. The tax rate varies based on the income bracket and other factors.

AvaTrade broker: An Overview

3.1. Company Background

AvaTrade was established in 2006 and has since become a prominent player in the online trading industry. The company offers a wide range of financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies.

3.2. Global Regulation and Licensing

AvaTrade operates under the regulation of several reputable financial authorities worldwide:

Central Bank of Ireland (CBI): Regulates AvaTrade EU Ltd.

Australian Securities and Investments Commission (ASIC): Regulates Ava Capital Markets Australia Pty Ltd.

Financial Services Commission (FSC), British Virgin Islands: Regulates Ava Trade Markets Ltd.

Cyprus Securities and Exchange Commission (CySEC): Regulates DT Direct Investment Hub Ltd.

Financial Services Agency (FSA), Japan: Regulates AvaTrade Japan K.K.

Financial Sector Conduct Authority (FSCA), South Africa: Regulates AvaTrade South Africa (Pty) Ltd.

Abu Dhabi Global Market (ADGM): Regulates AvaTrade Middle East.

These licenses ensure that AvaTrade adheres to stringent financial standards, providing a secure trading environment for its users.

AvaTrade's Availability in Pakistan

4.1. Account Opening Process

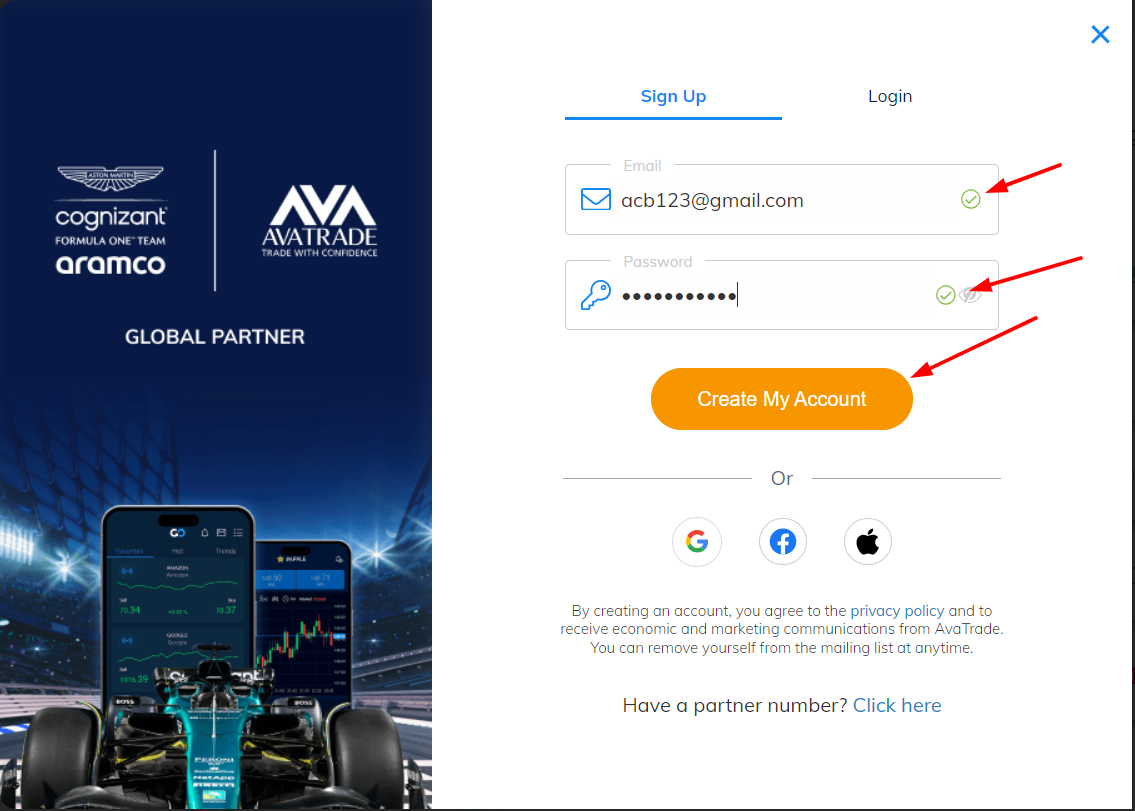

Pakistani residents can open trading accounts with AvaTrade. The process involves:

Online Registration: Filling out an online application form on the AvaTrade website.

Identity Verification: Submitting necessary documents, such as a national ID card or passport.

Account Approval: Once verified, the account is activated, allowing traders to deposit funds and commence trading.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

4.2. Deposit and Withdrawal Methods

AvaTrade offers various methods for depositing and withdrawing funds:

Bank Wire Transfers: Direct transfers from Pakistani banks.

Credit/Debit Cards: Visa and MasterCard options.

E-Wallets: Platforms like Skrill and Neteller.

It's important to note that while these methods are available, the processing times and fees may vary.

👉Minimum Deposit for Avatrade in ZAR

Trading Platforms Offered by AvaTrade

5.1. MetaTrader 4 (MT4)

MT4 is a widely used trading platform known for its user-friendly interface and robust charting tools. It allows traders to execute trades, analyze markets, and automate trading strategies.

5.2. MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering additional features such as more timeframes, improved charting tools, and an economic calendar. It supports a broader range of financial instruments.

5.3. AvaTradeGo

AvaTradeGo is AvaTrade's proprietary mobile trading app. It provides traders with real-time market data, advanced charting tools, and the ability to execute trades on the go.

5.4. AvaOptions

AvaOptions is a platform designed for trading options. It offers a range of options strategies, including vanilla options, one-touch options, and range options.

Islamic Account Options

AvaTrade offers Islamic accounts to its Muslim clients in Pakistan. These accounts comply with Sharia law by:

No Interest Charges: Eliminating swap rates on overnight positions.

No Hidden Fees: Ensuring transparency in all transactions.

These accounts provide a halal trading environment for Muslim traders.

👉 Open your AvaTrade account today

Advantages of Trading with AvaTrade

Regulatory Compliance: AvaTrade is regulated by multiple reputable financial authorities, ensuring a secure trading environment.

Wide Range of Instruments: Traders have access to a diverse set of financial instruments, including forex, stocks, commodities, and cryptocurrencies.

User-Friendly Platforms: AvaTrade offers intuitive trading platforms suitable for both beginners and experienced traders.

Islamic Account Options: Muslim traders can engage in halal trading through AvaTrade’s Islamic account offerings.

Multilingual Support: AvaTrade provides support in several languages, making it easier for Pakistani traders to communicate effectively.

Educational Resources: From video tutorials to market analysis and trading eBooks, AvaTrade offers a rich library of learning materials to help traders at all levels.

✅ Strong security protocols and encrypted transactions give users peace of mind when dealing with financial data and capital.

Disadvantages of Trading with AvaTrade

While AvaTrade is a robust platform, there are some limitations to consider:

No SECP License: AvaTrade is not licensed by the Securities and Exchange Commission of Pakistan. ✅ This means it's not under direct regulation from local authorities, which could be a concern for traders prioritizing domestic legal frameworks.

Limited Account Base Currency Options: Pakistani Rupee (PKR) is not available as a base currency.

❌ Inactive Account Fee: AvaTrade charges a fee for inactive accounts after a certain period.

Withdrawal Processing Time: Although efficient, some users report delays, especially when using wire transfers.

Marketing and Promotions

AvaTrade runs frequent promotions to attract and retain traders. Their marketing strategy is designed to appeal to both beginners and seasoned traders through:

Welcome Bonuses: New users often receive deposit bonuses (subject to region and regulation).

Referral Programs: Invite friends and earn rewards.

Exclusive Webinars: For users who open accounts, AvaTrade hosts expert-led webinars covering market trends, strategies, and platform walkthroughs.

✅ Open your free AvaTrade account now and gain instant access to a world of financial markets.

Conclusion

So, is AvaTrade legal in Pakistan? ✅ The answer is: Yes, but with conditions. AvaTrade is a globally regulated broker that legally allows Pakistani residents to open and manage trading accounts. However, it’s important to understand that AvaTrade is not directly licensed by Pakistani authorities such as the SECP.

Still, for the savvy Pakistani trader, AvaTrade presents a powerful opportunity — offering security, a wide variety of instruments, and features such as Islamic accounts that make it a viable choice for compliant and ethical trading.

Frequently Asked Questions (FAQs)

1. Is AvaTrade regulated in Pakistan?❌ No, AvaTrade is not regulated by Pakistan's SECP but is licensed by several international regulatory bodies.

2. Can I legally trade forex with AvaTrade from Pakistan?✅ Yes. Pakistani residents can legally open accounts and trade via AvaTrade, although it’s recommended to stay informed about local financial policies.

3. Does AvaTrade offer Islamic accounts for Pakistani traders?✅ Yes. AvaTrade provides swap-free Islamic accounts that comply with Sharia law.

4. How do I deposit money into my AvaTrade account from Pakistan?You can use bank wire transfers, debit/credit cards, and e-wallets like Skrill or Neteller.

5. Are AvaTrade profits taxable in Pakistan?Yes. Traders are legally required to declare and pay taxes on profits as per FBR regulations.

6. Does AvaTrade support Pakistani Rupees (PKR)?❌ No. AvaTrade currently does not offer PKR as an account base currency.

7. What is the minimum deposit to start trading on AvaTrade?The minimum deposit is typically $100, but this may vary depending on the funding method.

8. Is AvaTrade a safe broker?✅ Absolutely. AvaTrade is regulated by multiple international bodies and uses high-grade security systems.

9. Can I trade cryptocurrencies with AvaTrade from Pakistan?Yes. AvaTrade offers cryptocurrency CFDs like Bitcoin, Ethereum, and more.

10. How long does it take to withdraw funds from AvaTrade in Pakistan?Withdrawal times vary by method:

E-wallets: 1–2 business days

Credit/Debit cards: 3–5 business days

Bank transfers: Up to 7 business days

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

See more: