6 minute read

Avatrade Vs Pepperstone 2025: Compared - which is better broker?

from AvaTrade Compared

by ForexMakets

Avatrade Vs Pepperstone 2025: Compared - which is better broker?

In the evolving world of Forex trading, choosing the right broker is crucial for success. Among the top players, Avatrade and Pepperstone often stand out for their competitive offerings and trusted platforms. If you're trying to decide between these two brokers in 2025, you've come to the right place. This deep-dive comparison of Avatrade vs Pepperstone will help you make a smart decision based on detailed analysis, performance metrics, fees, platforms, regulations, and more.

Whether you're a beginner trader or an advanced investor, understanding the differences between Avatrade and Pepperstone can significantly influence your trading journey. Read until the end, as we’ll reveal key insights and strategies to help you choose the right broker ✅.

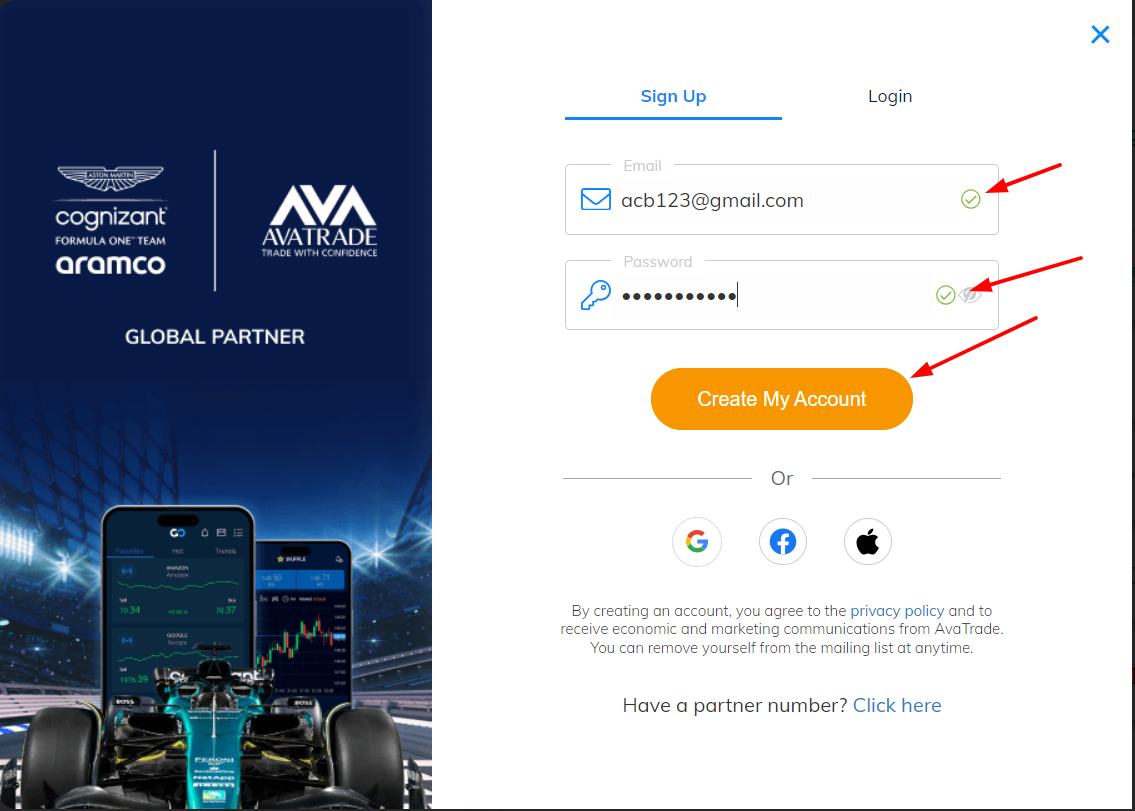

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. Introduction to Avatrade and Pepperstone

Avatrade was established in 2006 and has since grown into a global force with multiple regulatory licenses. Known for its versatile trading platforms and strong educational support, Avatrade is particularly appealing to newer traders.

👉 Read our in-depth AvaTrade Review to see if it's the right broker for your trading needs.

Pepperstone, founded in 2010, quickly rose to prominence by offering raw spreads, lightning-fast execution, and support for advanced platforms like MetaTrader 4, MetaTrader 5, and cTrader. It has become a go-to broker for scalpers and algorithmic traders.

The battle of Avatrade vs Pepperstone is not just about branding—it's about performance, trust, and long-term profitability.

2. Regulation & Security

In 2025, traders are more aware than ever of the importance of regulation. Here’s how these two brokers compare:

Avatrade is regulated in multiple jurisdictions including Ireland (Central Bank of Ireland), Australia (ASIC), Japan (FSA), UAE (ADGM), South Africa (FSCA), and more. ✅

Pepperstone is licensed by ASIC (Australia), FCA (UK), CySEC (Cyprus), DFSA (UAE), CMA (Kenya), and BaFin (Germany). ✅

Both brokers offer strong regulatory coverage. However, Pepperstone's regulation by FCA and BaFin may be more attractive for traders in Europe seeking additional deposit protection.

3. Trading Platforms & Tools

Avatrade provides access to:

MetaTrader 4

MetaTrader 5

AvaTradeGO (mobile app)

AvaOptions (for options trading)

WebTrader

Pepperstone offers:

MetaTrader 4

MetaTrader 5

cTrader

TradingView integration

Capitalise.ai for automation

While both support MetaTrader, Pepperstone's inclusion of cTrader and TradingView gives it a technical edge for experienced traders. ✅

4. Account Types

Avatrade offers a simple structure:

Standard Account

Islamic Account (Swap-free)

Professional Account (upon qualification)

Pepperstone provides more flexibility:

Razor Account (raw spreads, low commission)

Standard Account (no commission)

Islamic Account (Swap-free)

If you're a scalper or EA user, the Razor Account from Pepperstone is ideal due to tighter spreads and faster execution ✅.

5. Trading Costs & Spreads

In Forex trading, costs directly impact profits. Comparing Avatrade vs Pepperstone, here’s the breakdown:

Avatrade: Typical EUR/USD spread is 0.9 - 1.3 pips. ❌ No commission, but higher spread.

Pepperstone: Razor account spreads can go as low as 0.0 pips with a small commission per lot ✅.

For high-frequency traders, Pepperstone offers a more cost-efficient model.

📊 Discover how Forex Markets operate and how you can trade smarter—only on our dedicated page.

6. Deposit & Withdrawal Methods

Both brokers support multiple payment methods including:

Bank Wire

Credit/Debit Cards

E-wallets (Skrill, Neteller, etc.)

Avatrade processes withdrawals within 1–2 business days. Pepperstone generally processes withdrawals within 24 hours ✅.

For traders who value faster fund access, Pepperstone has a slight advantage.

7. Range of Markets Offered

Avatrade provides access to:

Forex

Stocks

Indices

Commodities

Cryptocurrencies

ETFs

Options

Pepperstone offers:

Forex

Indices

Commodities

Shares (via MT5)

ETFs (via MT5)

Crypto CFDs

If you're seeking options trading or broader instruments, Avatrade is more versatile. ✅

8. Trading Experience & Execution Speed

Pepperstone is known for:

Ultra-low latency

Equinix server locations in NY and London

Ideal for HFT and scalping ✅

Avatrade has a user-friendly interface, but execution may be slower during peak volatility ❌.

Advanced traders will prefer Pepperstone for speed and infrastructure.

9. Mobile Trading Experience

AvatradeGO is intuitive, beginner-friendly, and integrates well with educational tools ✅.

Pepperstone's mobile access via MetaTrader and cTrader apps offers powerful tools and indicators.

If you're new, AvatradeGO offers a smoother mobile start, but advanced traders may prefer Pepperstone’s ecosystem.

10. Educational Resources

Avatrade shines in this area:

Video tutorials

eBooks

Daily market analysis ✅

Webinars

Pepperstone also provides quality education, including:

Webinars

Trading guides

Trading community via TradingView

For beginners, Avatrade offers more structured content.

11. Customer Support Quality

Both brokers provide multilingual support via:

Live chat

Email

Phone

Avatrade has localized support centers in Europe, Asia, and Africa ✅. Pepperstone is praised for its prompt, professional live chat.

Your choice may depend on personal responsiveness preference.

12. Pros & Cons of Avatrade

Pros:

Strong regulation

Excellent educational resources ✅

Diverse assets including options

User-friendly platforms

Cons:

Spreads are wider ❌

Limited platform tools for advanced strategies

13. Pros & Cons of Pepperstone

Pros:

Razor-thin spreads ✅

Fast execution speeds

Access to cTrader, MT4, MT5

Strong for algorithmic trading

Cons:

Education less structured than Avatrade ❌

Fewer asset types than Avatrade

14. Who Should Choose Avatrade?

Choose Avatrade if you are:

A beginner trader wanting guidance ✅

Interested in options or ETFs

Seeking strong educational content

15. Who Should Choose Pepperstone?

Choose Pepperstone if you are:

A scalper or algo-trader ✅

Interested in raw spreads and fast execution

An advanced trader needing powerful tools

16. Final Verdict: Avatrade vs Pepperstone 2025 ✅

In 2025, both Avatrade and Pepperstone remain strong choices. Your decision ultimately depends on your trading style:

For low-cost, fast execution, and advanced platforms, Pepperstone wins.

For educational support and asset diversity, Avatrade is the better fit.

If you're serious about trading, open an account with the broker that matches your strategy. ✅

📌 Want to avoid scams and find a trusted broker? ✅ Head over to our Review Forex Broker section for verified insights and comparisons.

17. FAQs: Everything Traders Ask

Q1: Is Pepperstone safer than Avatrade? A: Both are highly regulated, but Pepperstone’s FCA and BaFin regulation offer extra deposit protection in the UK/EU.

Q2: Does Avatrade offer commission-free trading? A: Yes. Avatrade includes costs in the spread, so there are no added commissions.

Q3: Can I scalp with Avatrade? A: While allowed, Pepperstone is far more optimized for scalping strategies.

Q4: Which has better mobile trading? A: AvatradeGO is better for beginners. Pepperstone’s MT4/cTrader apps are better for advanced users.

Q5: Which broker is better for crypto trading? A: Both offer crypto CFDs, but Avatrade provides more crypto pairs.

Q6: Are demo accounts available? A: Yes, both brokers offer free demo accounts.

Q7: Who has tighter spreads? A: Pepperstone's Razor Account offers industry-leading low spreads.

Q8: Which broker is better for automation? A: Pepperstone with cTrader and Capitalise.ai is ideal for automated trading.

Q9: Does Avatrade support social trading? A: Yes, through DupliTrade and ZuluTrade.

Q10: Can I open an Islamic account with both? A: Yes, both Avatrade and Pepperstone offer swap-free accounts.

Ready to elevate your Forex trading? 👉 Choose the broker that aligns with your goals. Whether it's Avatrade’s educational focus or Pepperstone’s pro-level execution, the right decision can transform your results. ✅

💥 Read more:

Avatrade Vs Eightcap 2025: Compared - which is better broker?

Avatrade Vs Fusion Markets 2025: Compared - which is better broker?

Avatrade Vs FBS 2025: Compared - which is better broker?

Avatrade App Review 2025: Pros & Cons A Comprehensive Review

Avatrade Demo Account Review 2025: Pros & Cons A Comprehensive Review

Avatrade Broker Review 2025: Pros & Cons A Comprehensive Review