From repairs to preventative maintenance, Crafco is dedicated to supporting your success with the most reliable and durable pavement preservation materials and equipment.

It’s

We

Subcribe to the twice monthly Blacktop Update newsletter, and stay on top of all the latest howto articles, new products, industry events, the upcoming Pavement Awards 2025, videos like the No Edge Lines series, and SO MUCH MORE! Scan the QR code below and sign-up TODAY!

The longterm prognosis for the sealcoating side of the industry hasn’t been great, never returning fully to the heights it once enjoyed.

Striping

Does size matter? It’s an age-old question, and for commercial asphalt contractors looking at rollers, it can make a world of difference.

Watch the video at: https://pavemg.com/pt445x9r

Poor drainage infrastructure design leads to costly delays. Learn how the right design of drainage system can improve project efficiency.

Read more at:

https://pavemg.com/fv37nzk8

The PM620, PM622, PM820, PM822, and PM825 models are the latest upgrades - providing multiple operator comfort, efficiency, and equipment management upgrades compared to their previous models.

Read more at: https://pavemg.com/a7nv5mmt

ADVISORY BOARD

Agua Trucks Inc .................................................................... Wickenburg, AZ, Scott Duscher

Asphalt Contractors Inc., Union Grove, WI ............................................... Robert Kordus

Published and copyrighted 2025 by IRONMARKETS. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage or retrieval system, without written permission from the publisher.

Individual subscriptions are available without charge in the U.S. only to pavement maintenance contractors, producers and government employees involved in paving or pavement maintenance; dealers, and distributors of pavement maintenance equipment or materials; and others with similar business activities. Complete the subscription form at www.forconstructionpros.com or use your company letterhead giving all the information requested. Publisher reserves the right to reject nonqualified subscribers. One year subscriptions for nonqualified individuals: $35.00 U.S.A., $60.00 Canada and Mexico, and $85.00 all other countries (payable in U.S. funds, drawn on U.S. bank). Single copies available (prepaid only) $10.00 each (U.S., Canada & Mexico), $15.00 each (International). Pavement Maintenance & Reconstruction (ISSN 1098-5875), is published eight times per year: January, February, March, April/May, June/July, August/September, October/ November, December by IRONMARKETS, 201 N. Main St. Ste 350, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI and additional entry offices.

POSTMASTER: Please send change of address to , 201 N. Main St. Ste. 350, Fort Atkinson, WI 53538. Printed in the USA.

PAVEMENT MAINTENANCE & RECONSTRUCTION is proudly supported by these associations:

Asphalt Restoration Technology Systems, Orlando, FL Connie Lorenz

Brahney Paving, Hillsborough, NJ

Steven Brahney

Eosso Brothers Paving; Hazlet, NJ Tom Eosso

Maul Paving/Concrete/Sealcoating, PLainfield, IL

Chris Maul

Parking Lot Maintenance, Lake St. Louis, MO Todd Bruening

Petra Paving, Hampstead, NH Chris Tammany

Pioneer Paving, Albuquerque, NM Don Rooney

Roberts Traffic, Hollywood, FL Lisa Birchfield

Show Striping Inc. (SSI), Wisconsin Dells, WI Amber Showalter

T&N Asphalt Services, Salt Lake City, UT Nick Howell

Young Sealcoating Inc, Lynchburg, VA Steve Young

The Paving Lady Mauro Comuzzi

JMP Excelsior Services

Jim Panzenhagen

Sweeping Industry Veteran .................................................................................. Gabe Vitale

Flat Nickel Management .................................................................................. Michael Nawa

Wis-Coat Asphalt Maintenance ....................................................................... Marvin Joles

Warren Johnson

Clear Choice Sealing

Jacketta Sweeping Services Debbie Jacketta

Royal Pavement Solutions Kenneth Roy III

ASSOCIATION REPRESENTATIVES:

Pavement Coatings Technology Council Brian Riggs, Executive Director

W. R. MEADOWS got its start helping to "Build America" in the 1920s. And now - just as thenW.R. MEADOWS is a source you can trust for quality building materials for all your airport, bridge, highway and water treatment plant projects.

Our product line includes:

• Concrete curing and sealing compounds for highways

• Epoxies and repair mortars for restoring and strengthening existing concrete

• Expansion joint materials for easing the expansion and contraction of concrete slabs

• Waterproofing for bridge decks and foundations

• Joint sealants for asphalt and concrete surfaces

W.R. MEADOWS: Founded and Flourishing in America for 99 years. Visit www.wrmeadows.com or call 1-800-342-5976 for more

Iconsider myself an”ideas person.” I have way more ideas than I have time or energy to execute them. In my professional life I’ve often just thrown as many ideas at the wall as I could, and whatever sticks--sticks.

Maybe some readers also follow our magazine social media accounts on Facebook, Instagram, and LinkedIn, and you’ve seen some of the video content that goes out under the name “No Edge Lines.” But maybe some of you aren’t familiar.

Brandon Noel, Editor

No Edge Lines is a video series that I created two years ago with the help of Kenny Roy of Royal Pavement Solutions. The purpose of the show was basically an excuse for me to get out on the jobsite and start learning how to do the work that you all do everyday, but that I just write about.

bNoel@iron.markets 234-600-8983

From day one, it just felt inauthentic to be the editor of this magazine, but not have any hands-on experience with the real work of Pavement Maintenance. What began as just an excuse for me to visit jobsites, though, has grown into something much more to me.

First off, if you have seen any episodes of the show, then I’m going to put a QR code at the top of this page for you to scan and go watch the latest episode. Then you should subscribe to the YouTube channel so that you don’t miss a single new episode that comes out. As of the publication of this issue, we will have already starting shooting season 3!

At first, when I showed up on a jobsite, it was just about getting a feel for the work. The choreography and the rhythms that go into something like a mill-and-fill. Then it got more difficult as I started spending time operating rollers, pavers, and even some excavators. Each new contractor I spent time with, taught me new things, new ways of thinking about the work.

And that’s kind of why I’m writing this right now. Sure, I am trying to advertise the show too, but I am hoping to, perhaps, capture the attention of a few contractors who read the magazine but that weren’t aware of the show before now. Maybe that’s you!

I’m looking for some new places, new faces, and new challenges to capture for future episodes of the No Edge Lines series. I’ve spent a lot of time on the east coast, for one, and I’m anxious to see what the industry looks like in the mid-west or out towards the western United States.

I’m looking for some contractors who would be brave enough to let me come out to one of your jobsites, with a couple of cameras, and let me learn how it is you do things. But it doesn’t stop there. I also want to capture what makes your neck-of-the-woods special and different. What’s your story? What’s the story of your business? What’s the story of your city?

Everytime I go somewhere new, my knowledge grows in ways I never anticipated, and I’m ready for new challenges. If you’re interested, first, scan the QR code -- see if it’s something you’d like to be apart of -- then email me at Bnoel@iron.markets and let’s get a conversation stared.

See you on the road! ■

EDITORIAL

Editor Brandon Noel bnoel@iron.markets

Content Director, Marketing Services Jessica Lombardo jlombardo@iron.markets

Managing Editor Allyson Sherrier asherrier@iron.markets

AUDIENCE

Audience Development Director Angela Franks

PRODUCTION

Senior Production Manager Cindy Rusch crusch@iron.markets

Art Director April Van Etten

ADVERTISING/SALES

Brand Director Amy Schwandt aschwandt@iron.markets

Brand Manager Megan Perleberg mperleberg@iron.markets

Sales Representative Sean Dunphy sdunphy@iron.markets

Sales Representative ..................................................... Kris Flitcroft kflitcroft@iron.markets

IRONMARKETS

Chief Executive Officer Ron Spink

Chief Revenue Officer Amy Schwandt VP, Finance Greta Teter VP, Operations & IT Nick Raether VP, Demand Generation & Education Jim Bagan

Corporate Director of Sales Jason DeSarle

Brand Director, Construction, OEM & IRONPROS Sean Dunphy

Content Director Marina Mayer Director, Online & Marketing Services .... Bethany Chambers Director, Event Content & Programming Jess Lombardo

CIRCULATION & SUBSCRIPTIONS

201 N. Main St. Ste. 350, Fort Atkinson, WI 53538 (877) 201-3915 | Fax: (847)-291-4816 circ.pavement@omeda.com

LIST RENTAL

Sr. Account Manager Bart Piccirillo | Data Axle (518) 339 4511 | bart.piccirillo@infogroup.com

REPRINT SERVICES

Brand Manager Megan Perleberg mperleberg@iron.markets | (800) 538-5544

Published and copyrighted 2025 by IRONMARKETS. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any information storage or retrieval system, without written permission from the publisher.

@PAVEMENTMAGAZINE

@PAVEMENTMAGAZINE

@PAVEMENTMAGAZINE

@PAVEMENTMAINTENANCE

WWW.FORCONSTRUCTIONPROS.COM/PAVEMENT Published by IRONMARKETS 201 N. Main St. Ste 350, Fort Atkinson, WI 53538 (800) 538-5544 • IRON.MARKETS.COM

If you’re awarded infrastructure or large construction projects, profitability hangs on efficiency. These days, controlling dust, dirt and debris is a must, so your mechanical sweeper better not mess around.

When there’s no time for downtime, it’s time for Broom Bear ® or Broom Badger ® .

Elgin brings 100+ years of hustle and reliability to every job-site. Broom Bear® and Broom Badger® are built for you — fast and dependable, with the best customer service in the business.

The 4CX Pro is JCB’s most powerful and versatile backhoe. With equal-sized wheels for superior traction, it offers four-wheel steer for exceptional maneuverability in confined spaces. The heavy duty lift cylinders delivers increased lift capacity and breakout force, making it ideal for demanding applications.

Updates across the line include four-wheel drive and an automatic torque lock, improving traction and reducing fuel consumption when roading. Highflow hydraulics system allows operators to run powered attachments efficiently, expanding its versatility across different applications. The Parallel Lift Loader Arms ensure that materials stay level during lifting, improving precision and reducing spillage.

All new models have the six-speed transmission for enhanced operator control, while the high-capacity hydraulic pump allows for smooth, efficient operation even under heavy loads. The redesigned cab features a 7-inch display, Bluetooth connectivity, ergonomic joystick controls, and improved visibility through larger mirrors and LED work lights. This ensures that operators stay comfortable and focused throughout their shifts.

Bobcat Co.

The B760 backhoe loader features a lift capacity of more than 2,200 lbs. at full reach, digging depth of 18 ft., 5 in. and nearly 180 degrees of backhoe swing for less repositioning. The backhoe loader comes with a standard-equipped extendable arm that provides up to 8 in. of additional dig depth. The front-end loader provides a lift capacity of 7,985 lbs. with its standard, general purpose bucket. Powered by a turbocharged 3.4L Bobcat engine, the B760 delivers powerful, high-torque performance. It achieves emissions compliance without the use of a diesel particulate filter(DPF). Features include:

• Ride control for reduced bucket spillage

• Automatic return-to-dig positioning

The BW 100 SC-5 is a light tandem roller designed for soil compaction and asphalt patching. Designed for footpaths, repair work, medium to small building projects, and finishing work in road construction. Compact BOMAG tandem rollers can also be used in landscaping. For compaction work with side restrictions (e.g. house walls) the rollers are also available with open-sided drums (BW 90 SC/ 100 SC).

• Weighs 3,748 lbs. / Working width of 41.7 in.

• The articulation joint is not welded to the frame and is easily accessible in case of emergency. All machines are equipped with the crabwalk function.

• BOMAG Fleet Management helps optimize the operation of machinery and maximize the uptime of fleets.

• The spacious operator‘s platform with a compact steering wheel has a dashboard with large switches, intuitive operation via a soft-responsive control lever and a view of the drum edges.

• The ECONOMIZER shows the operator the degree of compaction on a displaythis avoids unnecessary passes, saving time and money.

• Wind-protected sprinkler nozzles ensure even wetting of the bandages in all conditions.

Moasure 2 PRO was developed to eliminate the pain of measuring complex outdoor spaces for asphalt, concrete, and site prep work, now with over 100,000 users. Using motion-based technology, contractors can walk and measure– no tripods, lasers, or extra gear required. The Moasure app displays real-time drawings, with instant feedback on slope, elevation, area, and cut/fill volumes. Moasure data can be exported directly to CAD or as a PDF report, making it ideal for job quotes and documentation. It’s a faster, simpler way to measure and communicate on and off site.

• Eight work lights for long days of loader and backhoe operations

• A 1.4-cu.-yd. general purpose loader bucket for jobsite versatility

Astec Industries Inc.

Astec Industries announced the launch of the SiteLine operator environmental awareness camera system for its cold planers.

Key Features:

• The SiteLine system provides a custom panoramic view of mobile equipment, starting with the cold planer products.

• Advanced image processing stitches multiple camera feeds together, creating a natural and uninterrupted view for the operator- helping to identify and avoid potential hazards.

• Improved situational awareness allows operators to work more efficiently and confidently, leading to faster project completion times.

• Ability to tap any one of the camera screens to zoom in and get a close-up look at a specific area of the machine, then return to bird’s eye view.

Introducing the new E-Z Grader skid-steer attachment which boasts a built-in roller compactor, retractable ripper shanks, and deployable wings for superior performance. The attachment is designed for seamless compatibility with all top skid-steer brands. The E-Z Grader is a multifaceted attachment designed to deliver precise grading across a wide range of projects with the ability to grade in both 2D and 3D. This tool is perfect for various applications, including warehouses, parking lots, and athletic fields.

LeeBoy’s Heavy Commercial pavers deliver a host of features and benefits to the paving professional above the competition. LeeBoy’s best in class designs represent the highest production pavers minimizing power losses with more efficient hydraulic systems.

Built for serious production, the Macropaver is one of the fastest and most efficient micro surfacing machine on the market. From highvolume roadways to demanding municipal work, it’s engineered to deliver unmatched output and reliability.

At the core is the EZ-OP PRO—a contractor-focused control system designed for simplicity, precision, and full visibility. With real-time material monitoring and responsive production controls, operators can dial in performance and keep quality locked in from start to finish.

The fixed aggregate gate ensures consistent material flow and application accuracy, eliminating constant adjustments and keeping crews moving.

And now, telematics come standard. With remote access to machine health, productivity stats, and usage data, you’re equipped with the insights to manage jobs smarter and maximize uptime.

If you’re looking for a machine that delivers speed, control, and results—the Macropaver sets the standard.

Macropaver: Built to Perform. Powered by Precision. Chosen by Contractors.

Staar Companies, LLC

Bio-based Asphalt Solvent and Cleaner

Bio-based Trick Shot Sustainable Products Asphalt SOLVENT AND CLEANER has been specifically developed as an EPA allowed alternative for the asphalt production, paving, and maintenance industries. Trick Shot is a high-performance product that dissolves bitumen, tar, oil, and tack from paving machinery, equipment, and tools without harsh chemicals. Trick Shot leaves behind a slick, long-lasting film that prevents asphalt from sticking and lubricates moving parts. Trick Shot does not release harmful fumes, is non-flammable, safe for contact with skin, and is even registered NSFH1 food safe making it extremely worker friendly.

Although relatively new to the industry, Trick Shot is already becoming known for its superior performance, our open pricing model, and your easy purchasing options on our website(www.itdoesthetrick.com), Amazon, or through our distribution partner Unique Paving Materials. Trick Shot Asphalt Solvent and Cleaner is available in sizes from 16oz sprayers to 275 Gallon Totes.

Trick Shot SOLVENT AND CLEANER exceeds requirements for Biodegradability, Toxicity, and Bioaccumulation as an EPA Environmentally Acceptable Lubricant. Trick Shot’s low evaporation rate means hardened deposits can be soaked overnight and asphalt will not stick through multiple loads. 1333

Versatile controls allowing automatic or Versatile allowing automatic or manual operation manual operation

Sales: Sales: 815-732-2116

Sales: Sales: sales@etnyre.com

Parts/Service: 888-586-1899 888-586-1899

Two sealant loading doors for easy access

Two sealant loading for easy access

Enclosed high-pressure diesel-oil burner

Enclosed high-pressure diesel-oil burner with automatic ignition with automatic ignition

faster heating with direct hot oil

faster heating with direct hot oil coils

Environmentally friendly flush-free system

Environmentally friendly flush-free system

Sealant tank capacity of either 250 or 400

Sealant tank capacity of either or 400 gallons gallons

Just before World of Asphalt 2025, the biggest annual trade show for the asphalt industry, it was revealed by Dynapac North America that Jamie Roush would be stepping away from his role as president, a role he assumed in September 2021.

During his more than three and a half years leading the company, he oversaw many new initiatives and products in the North American market, expanding the company’s footprint and brand awareness.

Today, a new era for Dynapac North America, a FAYAT Group company, begins with the appointment of Yann Monnet as the new President and General Manager. He arrives with almost thirty years of international experience in finance and supply chain management. Dynapac says that he has a proven track record of executive leadership and operational excellence spanning the United States, Mexico, and France.

The transition comes, however, at a tumultuous time not only in America but for international trade in general. The Trump Administration just completed its first 100 days, and several key economic indicators show the economy contracted during this period.

“I am honored to join Dynapac and lead the North American team during this exciting time of growth and innovation,” said Yann Monnet, President and General Manager of Dynapac North America.“I look forward to working alongside a talented team to strengthen our operations further, support our customers, and drive sustainable success across the region.”

Yann is fully committed to Dynapac’s unique identity, values, and vision.

Taking place in Washington, D.C., May 14-16, 2025, the Association of Equipment Manufacturers(AEM) brings together policymakers, construction organizations and equipment manufacturers for a multiday Celebration of Construction on the National Mall. Now in its second year, the event exhibits the industry’s latest innovations, workforce development efforts and work in sustainability. This year’s event will showcase advancements in emissions technology, alternative power sources, building materials and efficient construction methods, along with worker safety enhancements. According to AEM, policymakers can expect authentic discussions on critical regulations with industry stakeholders and agency officials. Additionally, the association has extended an invitation to the general public interested in hearing from equipment manufacturers and other industry professionals. The association notes that with policymakers in Washington set to debate several issues critical to off-road equipment manufacturers in the coming year, the event is an opportunity to educate those who impact the industry.

The event will highlight construction equipment, components and interactive displays between the Capitol Building and Washington Monument. The exhibition will span from the American History Museum and the Smithsonian Castle, with exhibitors highlighting the equipment used to Build a Stronger America, this year’s theme. Among the many manufacturers signed on to participate are Bobcat Company and Liebherr.

Trimble announced Murphy Tractor& Equipment Co., Inc. as the newest Trimble Technology Outlet. Based in Park City, Kansas, Murphy Tractor is the first John Deere dealer to become an authorized Trimble civil construction reseller.

Murphy Tractor will now sell Trimble machine control, site positioning systems and correction services technology directly to customers using Deere and Hamm earthmoving equipment, including dozers, excavators, motor graders, soil compactors, mini-excavators and compact track loaders. .

By adding authorized resellers representing a wide variety of manufacturers to the Trimble distribution channel, it becomes easier for users of all machine types to purchase, install and utilize Trimble technology for improved jobsite productivity and profitability.

“We are excited to announce Murphy Tractor as our newest technology outlet and the first to sell and support Trimble solutions for both Deere and Hamm equipment,” said Ron Bisio, senior vice president, field systems at Trimble.“Murphy has grown into one of the largest John Deere equipment dealers in North America through its commitment to meeting its customers’ needs through equipment, technology, service and support. We look forward to working with them to continue that commitment by adding Trimble solutions to their technology portfolio.”

Since its introduction, the Weiler P385 has set the standard for commercial pavers. The P385C raises that standard.

Variable speed and reversible conveyors and augers and a 25% increase in tunnel height provide optimal material output.

Increase to 120 hp with the Cat® C3.6 Tier 4F/Stage V engine.

Modular conveyor drive and sealed chain case increase feeder system reliability and life.

Enhanced heat system performance with direct-drive hydraulic generator and elimination of GFCI breakers.

By Brandon Noel, Editor

Almost every industry sector for pavement maintenance saw healthy rates of economic growth, but one strange trend that emerged has me concerned.

The complex economic factors at work in our industry are impacted by many outside forces. Even with all the data we collect for this survey, the future isn’t a sure thing. We make forecasts and predictions, and everyone can have their say about what might happen next, but there are always surprises.

For instance, last year for the TC 2024, which economically was based on data from the CY 2023, the industry contracted. That makes sense when you remember recent economic history. In June of 2022, the inflation rate peaked at 9.1% and that was when everyone was nearly in a panic. Fuel prices went through the roof, cost overruns for materials became a daily occurance, and, at the same time, labor started to become much more scarce.

It is clearer now that the ramifications from that inflationary spike carried through the entire 2023 season which followed it. Commercial, residential, and private markets took a confidence hit. With all the uncertainty and fear that the inflation could kick back up at any moment, 2023 was a year that people played it safe.

As inflation gradually came down, and hit it’s lowest in December of 2024 at 2.9% confidence obviously improved, because even though it was an election year, which often drives more conservative business decisions, the CY 2024 season-- and subsequently the TC 2025 survey-- shows, perhaps, the biggest overall growth in a twelve month period.

While I was working on this analysis, one contractor called me, and when I mentioned how good last year’s growth was, his immediate reply was, “Yeah, we’ll probably see a correction to that this season.” I added that here, because I am interested to see if his prediction comes true.

But either way, right now we can celebrate an incredible year for the pavement maintenance industry.

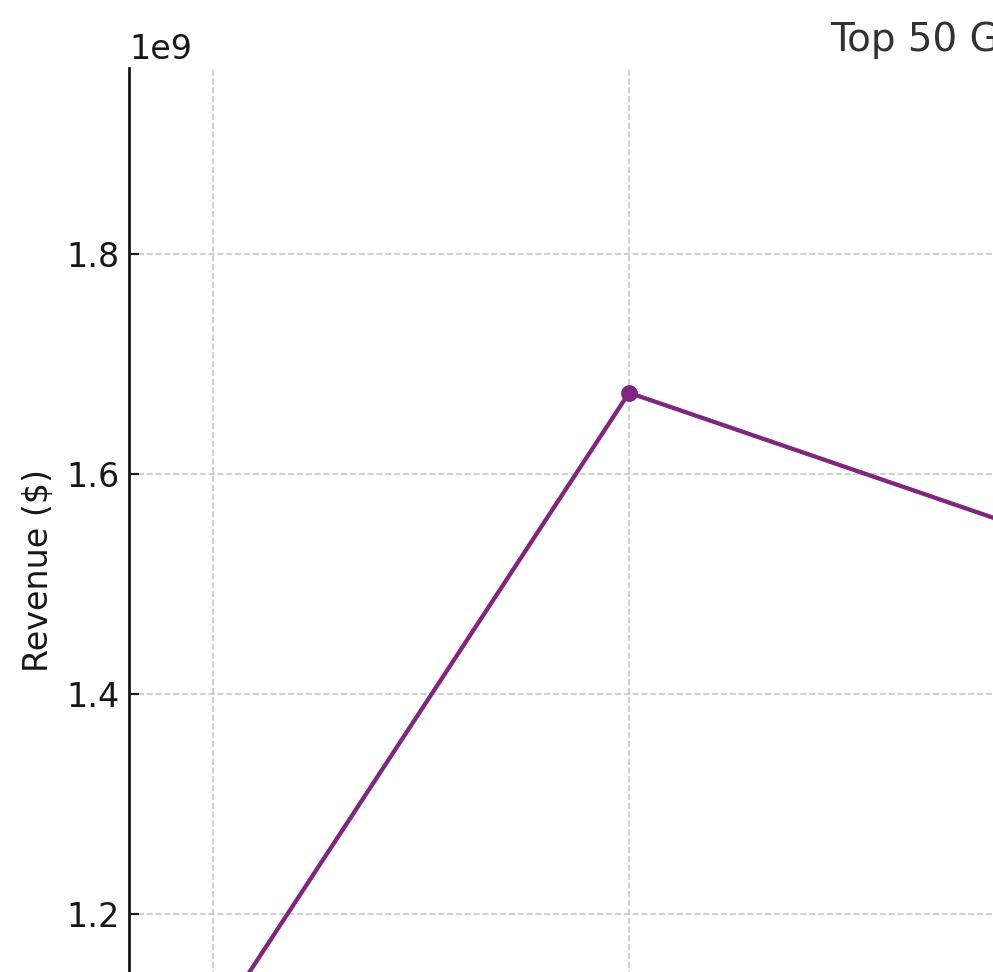

The compound annual growth rate (CAGR) for the Top 50 Gross Revenue from 2021 to 2025 is approximately 15.17% per year. This strong growth reflects a robust recovery and an overall upward trend in the blacktop sector as the industry continues to rebound from pandemicand inflation-related disruptions. [See graph on p.15]

The increase in gross revenue over the past few years is driven by both the rebound of the pavement industry and

contractors adapting to new market conditions and opportunities. Despite some fluctuations, the longterm growth trajectory indicates a sector that is poised for continued expansion in the years to come.

Looking specifically at the change from TC 2024 to 2025, we see a significant increase in gross revenue. The total revenue for TC 2025 stands at $1.928 billion, marking a 21.41% growth from the $1.588 billion in TC 2024.

• Pavement Repair Top 50: $1.698 in total sales compared to $1.544 billion in 2024

This growth represents an increase of $340 million from the previous year, signaling a strong surge in business for the Top 50 contractors. This sharp rise underscores the resilience of the sector, with TC 2025 potentially benefiting from a more favorable economic environment and increased demand for pavement-related services as infrastructure spending continues to grow.

I just want to take a moment to remind you, though, that our data is dependant on the contractors who take the time to fill out our annual survey. Not everyone is comfortable, has the time, or desire to do so. However, the more contractors that participate, the more accurate my data analysis becomes.

Let’s briefly examine each category’s gross total revenue numbers:

• Paving Top 50: $1.906 billion in 2025 total sales compared to $1.614 billion in 2024

• Striping Top 50: $1.827 billion in total sales compared to $1.435 billion in 2024

• Sealcoating Top 50: $1.811 in total sales compared to $1.448 billion in 2024

While all of this, on the surface, shows strong growth all around, when you break down the financial data per segment, there was still one category that contracted, and did so for the second year in a row. That was the Paving-Only category:

• Paving-Only sales dropped to $698,446,768 compared to $844,813,039 in 2024

• Striping-Only sales exploded to $134,120,870 compared to the $89,944,736 generated in 2024

• Sealcoat-Only sales saw healthy growth to $165,760,074 compared to $152,812,614 in 2024.

• Pavement Repair-Only sales absolutely crushed it by almost doubling to $557,230,541 from the previous all-time high of $285,633,743 in 2024

More good news, however, was that the average contractor in our Top 50 generated $38 million in gross total sales, which was $6 million more than last year’s average of $32 million, and just narrowly surpasses the previous height of TC 2023’s $35 million average.

The Top 50’s segmented average revenue stream breakdown is as follows:

• Paving: 42% (49% 2024)

• Striping: 12% (10% 2024)

• Sealcoat: 12% (12% in 2024)

• Pavement Repair 22% (18% in 2024)

• Other: 11% (9% in 2024)

• Surface Treatments: 1% (>1% in 2024)

The average contractor’s time was split up as follows:

• Driveways: 7% (4% in 2024)

• Highways: 6% (3% in 2024)

• Parking Lots: 62% (72% in 2024)

• Residential/City Roads: 20% (17% in 2024)

• Other: 4%(4% in 2024)

The average contractor’s customer mix broke down as follows:

• Commercial/Industrial: 57% (60% in 2024)

• Municipal: 17% (13% in 2024)

• Multi-family/HOA/etc: 19% (19% in 2024)

• Single Family: 5% (6% in 2024)

• Other: 3% (2% in 2024)

One area that fell beneath the 2024 average for the Top 50 Contractors, was that in 2025 they earned an average of 25% of their gross sales working as a subcontractor, a drop of 2%. But that is still an increase over TC 2023’s previous high of 24% and continues the upward trend from TC 2022’s 17%. ■

By Brandon Noel, Editor

We are getting closer to a greater understanding of the ebbs and flows of the paving sector, but we still need more data for the picture to become clear.

Last year (TC 2024), ahead of the data from the Top Contractor survey coming in, I was predicting a moderate amount of paving specific growth. So, I was surprised when the data showed just the opposite, and the sector contracted by $68.3 million, or shrank about 7.5% from the TC 2023 figure. Unfortunately, this trend continues for this year.

From a peak of $913 million in TC 2023, the segment fell to $698 million in TC 2025. If the current rate continues, and this is obviously a really BIG “if,” then revenues are projected to drop to approximately $611 million in 2026 and $534 million in 2027.

This trend could reflect factors like decreased infrastructure investment, shifting market demand, or intensified competition. I’m not going to be making any predictions of growth in this category anytime soon. I’m hoping that next year, when we have a real data point to add, it shows it leveling off, at the very least.

Compared to the other individual industry categories in the survey, paving-only sales was still the highest earning, followed by pavement repair services at $557,230,541 ($285,633,742 in 2024) and sealcoating work at $165,760,074

($152,812,613 in 2024) and then by striping sales at $134,120,870 ($89,944,735 in 2024).

Some notable trends:

• Average Gross Sales: ~$30.9 million

• Average Subcontracting Revenue Share: ~22%

• Self-Performance: ~95% of companies self-perform more than 50% of their work

• The paving market is dominated by mature firms with high selfperformance rates.

• A significant portion operates at strong profit margins(16–20% or higher).

• Most firms manage high job volumes and invest heavily in fleets, indicating a capital-intensive but profitable segment.

The Top 50 Paving contractors reported $1.906 billion in total sales, a huge increase from 2024’s massive $1.614 billion. A gain of approximately $202 million, a shockingly high growth rate year over year of more than 18%, but that big growth belies some steady declines, according to our data for the paving sector.

Just two years ago, the paving only sales came to a total of $913 million, then in TC 2024 it fell to $845 million, and this year it came in as $698 million. That’s three consecutive years of declining paving-only sales. That’s a decline of ~17% year over year, and an average loss over three years of more than 8%.

That loss of paving-only sales, is very close to the percent growth of

total revenue. This might indicate a shift in revenue stream away from paving to other services that were more in-demand.

This year’s $1.906 billion is a large step up from the $1.614 billion from 2024 and if we skip 2023 and go back another year, it shows an overall increase from the 2022 total of $1.331 billion(based on a Top 75), and now TC 2025 takes the crown from what was a previous high of 2023 in $1.723 billion. These figures show that the industry is still growing in terms of gross revenue for the Top 50 Paving Contractors at an average rate of 12.96%, even if the paving only category continues its downward trend. If we look at these totals, year-by-year, for the past seven, this is what we see:

While this doesn’t determine the cause, our survey results suggest a cyclical pattern of growth. There are periods of significant increases followed by one or two years of relatively lower but steady markets, followed by another substantial surge. What could be the reason behind this pattern? In the absence of comprehensive economic statistics, it could indicate that customer paving needs follow a cycle that mirrors the typical lifespan of asphalt pavement, in conjunction with general new construction and community development.

We first hypothesized this cycle last year, and so we included a new question this year concerning how much paving was considered a “new” pavement, and how much was a replacement surface. From the Top 50 Paving Contractors, 80% of their completed work was done on existing pavements, and only 20% was conducted as wholly new surfaces.

While this data is very interesting, it will take a few years for a larger contextual picture to take shape. As profit margins shift, how will this balance move with it? And will this shed light on the theoretical pavement cycle? Time will tell.

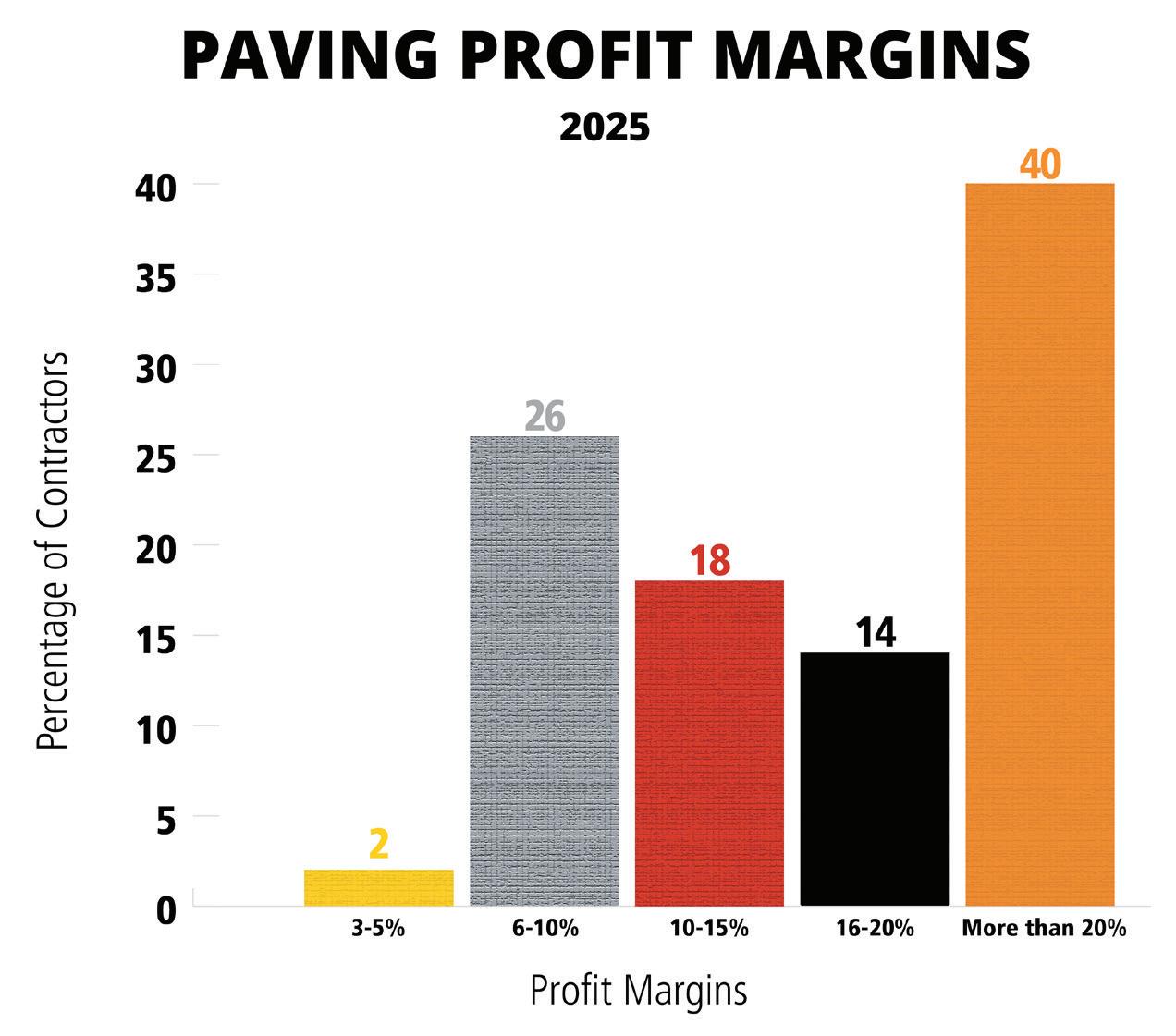

As noted last year, we continue to shift our profit margin ranges in an effort to normalize the distributions, and get a better sense of what this data can really tell us. A quick recap of last year, TC 2024:

• Only 30% of contractors ranked in the highest profit margin range of more than 20%

• 22% ranked in the 16-20% range

• 30% contractors in the 10-15% range

• 16% contractors in the 6-9% range

• Only 2% contractor at 5% or less If you look at the graph in this section, you’ll see the slight 1% shift we’ve made for TC 2025, and how it is impacted the data this year:

• 40% of contractors now rank in top profit margin range of more than 20%, an increase of 10% over last year, indicating possibly that material prices stabilized from their exorbitant costs the year before, but contractors were able to maintain their pricing levels.

• 14% of contractors ranked in the 16-20% range

• 18% of contractors fell into the mid range of 10-15% profits margins

• 26% were in the 6-10% range

• 2% with a 5% or less range

This tells us that, according to this distribution, the middle of the profit margin pack shifted away to either higher or lower ranges. One possible explanation could be that smaller

contractors were taking on less work for higher profits, and/or some larger contractors were doing an increased amount of work for slightly less of a margin. Either way, companies moved out of the mid pack, causing the top earners to earn more.

Same as the year before, every contractor in the Paving 50 did at least some parking lot work, but the average of their work fell from 72% (2024) to 61% (2025), there was one outlier that only derived 5% of their work from parking lots

That same outlier did the fully remainder of their work(95%) in paving roads, combining their residential streets and highway work, which was the highest at 80%, and threw off that average since only 28% of contractors did any highway work at all. Though, that was an increase from the 16% in 2024, this could be the result of more federal funding trickling down into the market.

29 contractors did some driveway construction at an average of 20% of their total work composition.

While every contractor did work in the commercial/industrial space, the lowest being from one contractor who only did 8% of their work in commercial spaces, but the overall average was 54% the

exact same percentage as TC 2024. That sector is holding steady.

• 41 contractors completed work for cities or municipalities at an average of 19% of their work composition, a 3% increase.

• 46 did work for multi-family residences at an average of 21% of their work composition, a drop of 8%.

• 27 contractors completed work for single-family residence at an average of 16% of work composition, a 2% increase.

• 8 Contractors did”other” uncategorized work, at a rate of 18% of their mix.

• 48 of the Top 50 Paving contractors self-performed at least 50% of their work, but interesting 46 of the Top 50 did work as a subcontractor for someone else, and generated almost 25% of their gross revenue from acting as a sub.

• Fleet Value Over $2M: ~54%

• Fleet Value $1M–$2M: ~25%

• Smaller fleets(<$1M): ~21%

With the rising costs of equipment, and the implementation of import tarrifs this year, expect this range to increase and change for next year, 2026. But, for now, there were 34 contractors reporting it requires more than $2 million to replace their current fleet of machines. Ten companies reported it would require between $1- $2 million, 2 between $500,000- $1 million, and 2 apiece for the ranges between $250K$500K and less than $250K. ■

Hi tting the roads with power and precision! Built to take on the toughest jobs, laying down Bitumen emulsions, Asphalt Cement (AC), and asphalt cutback with accuracy and efficiency. No wasted material, just smooth, even coverage every time.

MID-SIZE SRV-2 DELIVERS FULL-SIZE BENEFITS

The new StarJet™ SRV-2 offers superior pavement marking and rubber removal with small-job maneuverability. Its mid-size design features a frontmounted SpinJet® arm for efficient cleaning, excellent cab visibility, and a 40,000 psi NLB pump with HydraFlex™ closed loop hydrostatic drive — providing dry shut-off with

and

By Brandon Noel, Editor

The

longterm prognosis for the sealcoating side

of the

industry

hasn’t been great, never returning fully to the heights it once enjoyed.

The numbers are hard to argue with, and it makes it even more difficult knowing that sealcoating is such a cash-cow product for many contractors. Despite a good year for both individual categorical revenue growth and profit margin increases, the long-term forecast is still showing a downward trend over the last decade.

Is there a cause for concern? In short, I think so. Is it an emergency? Probably not. But let’s take a closer look at the numbers.

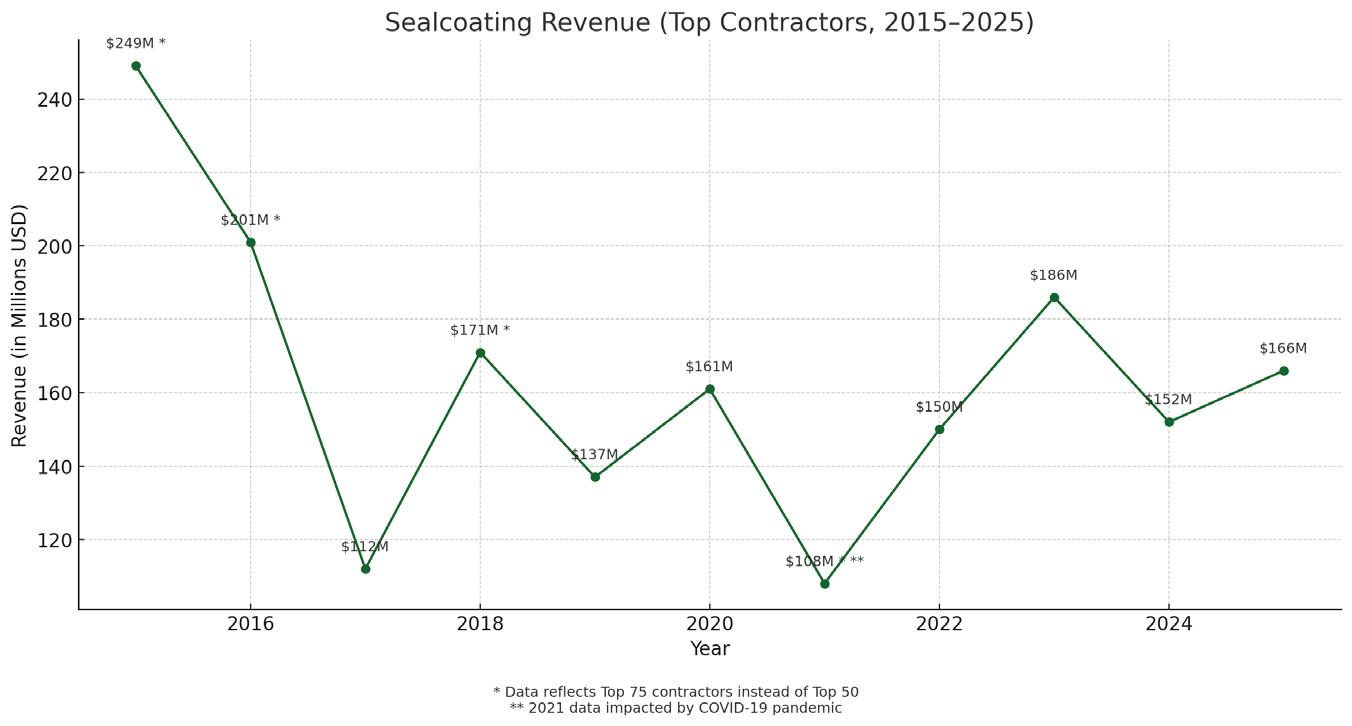

These are the plots for the Top Sealcoating Contractors dating back to 2015 to present. Based on the data provided for top contractor revenue in sealcoating from 2015 to 2025, the Compound Annual Growth Rate (CAGR) over this 11-year period is approximately -3.97%. This indicates a steady long-term decline in annual revenue for this service segment.

Year over year, the sector actually grew by $14 million in TC 2025 at $166 million, going from TC 2024’s $152 million. Additionally, it’s still a dip in revenue from TC 2023 by $20 million (-10.75%) which was $186.1 million and the highest since 2016.

The sealcoating sector has seen volatility: large drops (e.g., 2017, 2021) followed by partial recoveries.

• Despite recent growth from 2021–2025, the overall trend from 2015

Sponsored by

shows contraction, especially when comparing the peak of $249M in 2015 to $166M in 2025.

• Structural industry factors—such as changes in pavement management strategies, increased durability of materials, or budget shifts to other service areas—may be contributing to this slow erosion in demand or revenue share.

Assuming this average annual rate of decline continues, and that there are not major or unforeseen disruptions, the next three years might look like this for the Sealcoating Top 50 Contractors:

• 2026: ≈ $159.4 million

• 2027: ≈ $153.1 million

• 2028: ≈ $147.0 million

In 2025, the total sales revenue for the Top 50 Sealcoating Contractors reached $1.811 billion, a notable rebound from $1.59 billion in 2024. Despite this increase in overall revenue, the actual income derived from sealcoating services tells a different story—just $166 million in 2025. That figure represents only 9.2% of the total sales, a further decline from 11% in 2024 and 22% in 2023. This indicates a clear and consistent trend: even companies recognized for their sealcoating work i about the s increasingly relying on other service lines to drive their revenue. The sealcoating segment continues to shrink as a share of

their business portfolios, possibly due to shifting demand, longer pavement lifespans, or more lucrative alternatives like paving or pavement repair.

This shift suggests that sealcoating is transitioning from a core revenue source to a more supplementary service. While two outliers still generate more than 90% of their income from sealcoating, they are exceptions in an industry where diversification is a key to stability and growth over time.

Most of the Top 50 contractors seem to be treating sealcoating as just one part of a broader service offering. This dilution of sealcoating’s share may also reflect broader market forces— such as budget constraints in property management or evolving infrastructure priorities—that are pushing contractors to focus on higher-margin or more in-demand services.

As this pattern continues, it may further marginalize sealcoating as a primary revenue stream, signaling a long-term structural shift within the pavement maintenance industry. The days of sealcoaters trucking around and making a living off that alone may be coming to a definitive end.

Despite the decline in sealcoating’s share of total revenue, the sector maintains relatively strong profitability. According to 2025 data:

• 46% of the Top 50 Sealcoating contractors reported profit margins exceeding 20%.

• 14% in the 10–15%range.

• 28% earning 6–10%.

• 2% fell between the 3-5% range. This indicates that while sealcoating may represent a shrinking slice of their revenue mix, it is still often a highmargin service. The high profitability, particularly among contractors with diversified service offerings, may explain why companies continue to keep sealcoating in their portfolios—even as its contribution to total revenue declines. It remains a strategically valuable line

of work, especially when bundled with other services that allow for operational efficiencies and upselling opportunities. But I think that something is clearly happening between the lines. The middle of the pack is slowly eroding. As the years have progressed, more and more of the Top 50 Sealcoating Contractors have either found w*ays to maximize the efficiency and profitability, pushing them to the top end, or the service has fallen down as merely a supplementary service or an add-on. But there’s a third possibility too.

Our survey question about self-performance versus subcontracting doesn’t specify based on category. It’s a general revenue question. It could be possible that the drop in revenue, but steady hold in profitability is due to larger dominant contractors subbing out their sealcoating to smaller companies. I’m not basing that on anything other than a supposition, so don’t quote me on it, but it is a possibility.

When comparing the 2024 and 2025 profit margin data for the Top 50 Sealcoating Contractors, a clear upward shift in profitability emerges.

In 2024, 34% of contractors reported profit margins greater than 20%, but in 2025, that number jumped to 46%, indicating a substantial increase in toptier profitability. Additionally, the share of contractors in the 16–20% range dropped from 22% to 10%, suggesting many companies moved into the highest margin category.

The middle tier(10–15%) also declined slightly from 24% to 14%, while those in the lower brackets(less than 10%) fell significantly—from 20% in 2024 to just 2% in 2025. This shift suggests a few possibilities for why the middle-zone of profitability is slowly ebbing away. It could be from improved operational efficiencies, a more beneficial pricing power, or service bundling within the industry.

This year municipal work did see a small rise in the clientele mix, but, without a doubt, the commercial and industrial customers dominate the demand for this service. Additionally of note, the multi-family/HOA sector completely cratered this year from 22%(TC 2024) to just 3% this year:

• 100% of contractors worked for commercial clients at an average 58%.

• 82% worked for municipal customers at an average 15%.

• 96% worked for multi-family homes/ HOAs at an average rate of 3%.

• 62% worked for single-family residential clients at12% of sales

• 94% worked as a subcontractor for someone else at an average rate of 23% of their gross total sales

• 16% did work for”other” undefined types of clients outside of these at a mix of 18% ■

Sponsored by

By Brandon Noel, Editor

Sponsored by

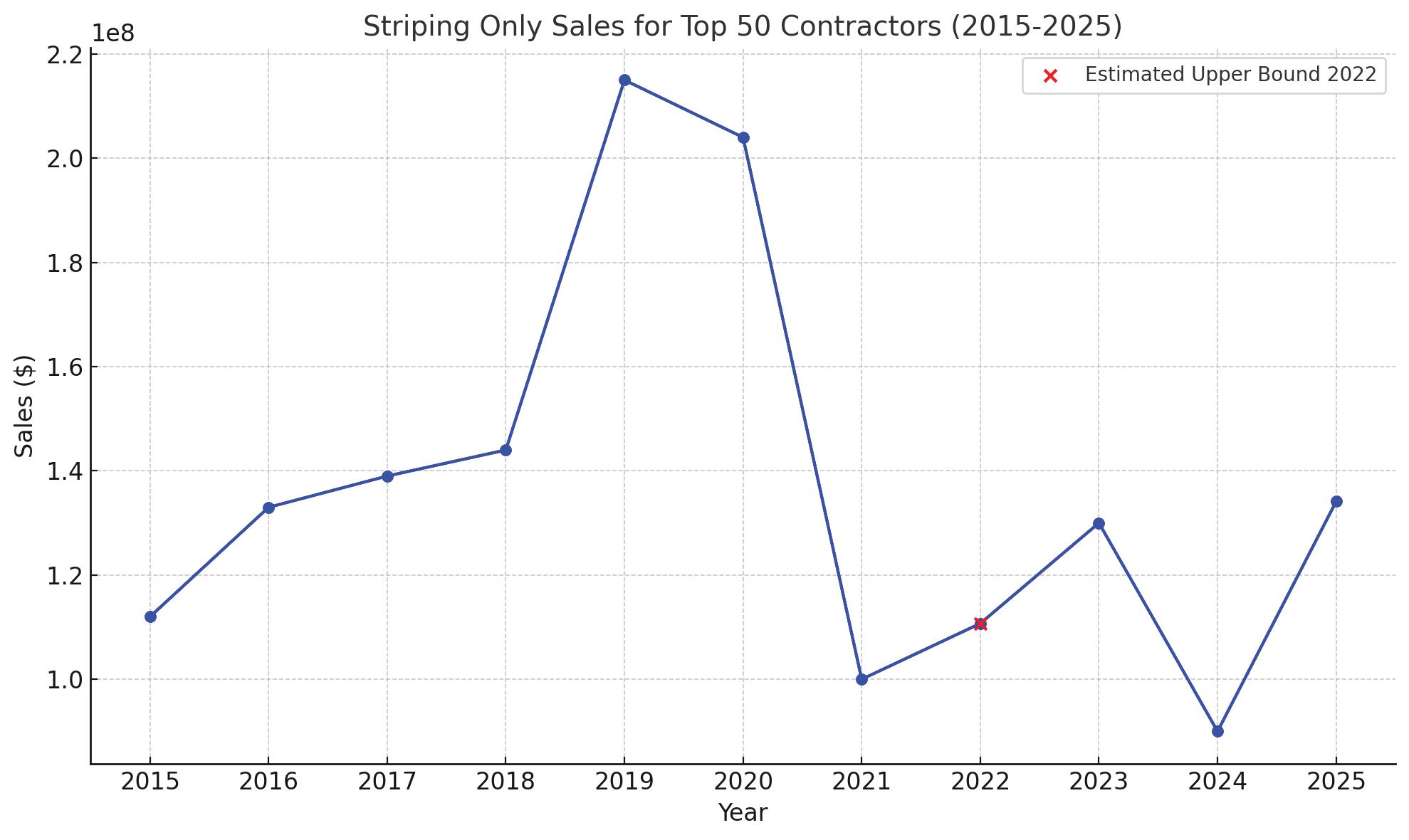

Striping represents one of the healthiest and least uncertain growth markets for the pavement maintenance industry.

The growth rate for the striping industry from TC 2024 to TC 2025 is marked by a significant increase in sales, rising from a fairly disappointing $90 million last year to $134.12 million for 2025. This reflects an approximate 48.9% increase from the previous year, indicating a robust recovery and growth in the striping segment.

Striping is booming though, not just numerically, but as an industry it continues to expand into new growth markets, new industries, and it’s lower barrier to entry makes it somewhat more accessible to those interested in it as a business model. Out of all the categories for Top Contractor, this has probably been the least volatile history.

This dramatic jump is noteworthy, especially considering the downward trend observed from 2022 to 2024, where sales were notably impacted by economic factors, including the postpandemic recovery phase and potentially industry-specific slowdowns. Despite the sharp decline in 2024, the growth in 2025 highlights a possible rebound, signaling renewed demand and possibly larger projects or shifts in regional market dynamics that favor the striping sector.

Tthe overall growth in the industry between 2015 and 2025 has a compound annual growth rate (CAGR) of 1.82% per year, which is steady, healthy

progress, not counting the fluctuations of the pandemic and its aftermath. Notably, the 2022 outlier at $534 million skewed the trend, creating an unsustainable spike. However, removing that anomaly reveals a more moderate growth trajectory, with a noticeable dip in 2021 due to pandemic disruptions.

Every year we have to address the outlier figure for 2022, and it bothers me, because we still use it as our published number, but we also know that what caused it was ultimately from an unverified financial survey. This happened before my time as editor, but I want to correct it.

If we take the data from years 20152020, the Striping sector showed a growth rate of 12.74%. That’s massive! It was going to the moon. Then the pandemic hit, and it hit so hard that if

you add that year to the calculation, it tanks the CAGR down to-1.87%. If we split the difference, it gives us an average CAGR of 5.44%. If we recalculate the 2022 outlier year using this CAGR, and add a +/- 5% margin of error, that would bring the projected 2022 striping only sales to $110.71 million. A new graph with that figure looks like this: This will be the figure we use starting next year. This is a”normalized” version of the graph, extrapolating a reasonable striping only figure, based on the history of the sector up to that point, including the pandemic’s impact.

The total gross sales for all work done by the 2025 Top 50 Striping contractors came to $1.827 billion, a growth

of $392 million from TC 2024’s $1.435 billion, or approximately a 21% recovery. That’s good news, after the contraction from TC 2023’s $1.584 billion, which was a negative change of about $148 million.

Only one of the Top 50 Striping contractors received 100% of their revenue from striping, with the industry average coming in at 15.66% of their sales mix. Additionally, only 3 contractors made more than 50% of their revenue from striping only sales, meaning 92% of the Top 50 Striping contractors earned less than half their revenue from striping.

This has trended downwards over the last three years, which could mean a few things. It could possibly be the result of more sub contracting out by the top earners in the industry, and it could mean that the pricing has grown with the other industry categories, while costs remained flat. Let’s take a look at the profit margins to add some more context.

The profit margin distribution for the Striping Top 50 continues to be a fascinating sector to watch evolve every year. This year things continued their longstanding trend, and one we’ve seen start to emerge in other sectors like Sealcoating as well recently, where the middle of the herd is disappearing.

If striping has become increasingly subbed out by the larger contractors, it might overrepresent itself for the most well established companies as a high profit margin service, and then it might show up again on the lower end by the sub contractors. It might explain why the middle is gone.

• Those who reported the highest profit margins, more than 20%, represented 36% of the field, a growth of 4% from TC 2024.

• The 16-20% profit margin range completely collapsed this year with only 12% of the Top 50, compared to 22% in TC 2024.

• Additionally, the 10-15% profit margin range dipped to 20% from

the 24% of the Top 50 in TC 2024, continuing the multi-year trend from 28% in 2023 and 37% in 2022.

• The 6-10% range is where things start to grow again, up to 30% from TC 2024’s 20%.

• The lowest range of 5% and less remained flat at 2% year-over-year.

The mix of work is slightly misleading in this case, because it isn’t really a reflection of where the Top 50 Striping contractors did striping per se, but a breakdown of the places they completed any type of work. It’s still interesting, and worth taking a look at:

• 54% contractors performed work on driveways, up 2% from last year, at an average rate of 9% of their work mix.

• 24% of contractors completed some highway work, also up, and at an average rate of 18% of their work mix.

• Unsurprisingly, 100% of contractors completed parking lot work at an average rate of 34% of their work mix composition, which was surprisingly a small drop of 3% of their mix.

• 82% completed residential street projects, up 6%, at an average rate of 22%

• 46% completed work in undefined“other” areas, more than double from last year, making up about 10% of their mix.

• Same as last year, 100% of contractors did work for commercial and/or industrial clients, at a rate of 57%.

• 86% of contractors did work for municipalities at an average customer mix of 18%

• 90% of the Top 50 completed work for multi-family, residential properties at an average mix of 22%

• 54% of the list did some work for single-family residential properties at an average mix of 9%

• 14% did work for”other” type of customers at an average rate of 18%

This is an extremely top heavy section of data.

• 2% reported it would take less than $250,000 replace their company fleet.

• 6% of contractors reported it would only take between $250,000-$500,000

• 8% reported it would require between $500K- $1 million

• 26% would need between $1 million$2 million

• A staggering 58% would need more than $2 million to fully replace their current fleets, down from 64% last year. ■

TAPE

Measure the lot with Auto-Layout ™ II

CHALK Put down premark dots with Automatic Guns

By Brandon Noel, Editor

by

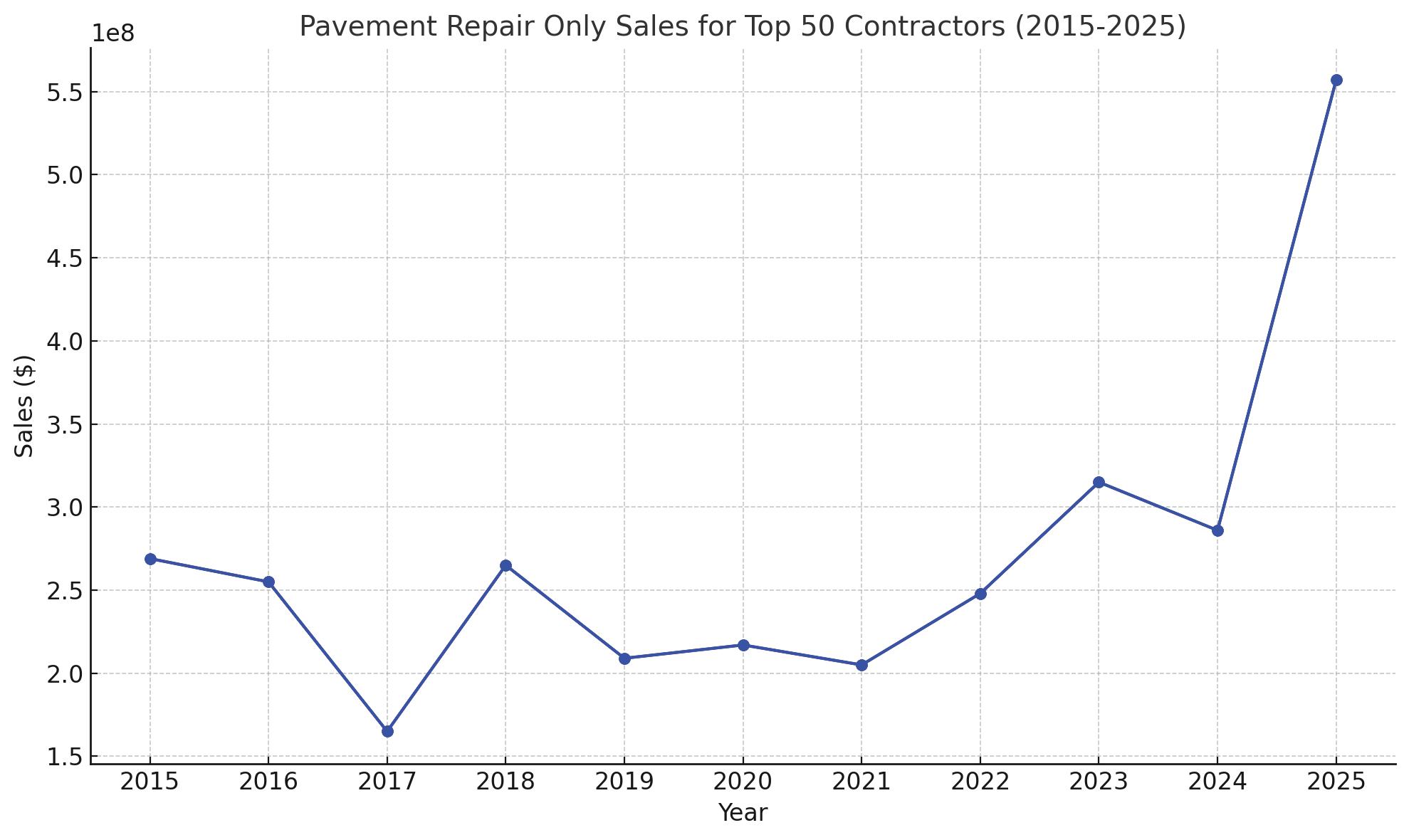

The pavement repair category has always been strong, consistent, and resilient to outside forces. This year it exploded in growth!

Over the 10-year period, there are notable fluctuations in the sales figures for pavement repair services, reflecting both market conditions and the broader economic environment. From TC 2015 to TC 2016, the sector saw a slight decline of approximately 5.2%, with sales dropping from $269 million to $255 million.

However, this decline was followed by a significant drop of 35.3% in TC 2017, when sales fell to $165 million. This sharp decrease likely reflects a variety of challenges, such as regional market slowdowns, supply chain disruptions, or reduced infrastructure spending during that period. Despite this dip, the sector recovered in TC 2018, with sales rebounding to $265 million, nearly matching 2015 levels.

The period from TC 2019 to TC 2021 saw moderate sales fluctuations, with a slight decline from $265 million in 2018 to $209 million in 2019, followed by a recovery to $217 million in 2020, likely driven by ongoing infrastructure needs despite the pandemic. In TC 2021, sales continued to decline to $205 million, possibly due to the lingering effects of the COVID-19 pandemic and its impact on construction and maintenance budgets.

However, TC 2022 marked a strong recovery, with sales reaching $248 million—an increase of nearly 21% from 2021, as demand for pavement repair services surged, possibly driven by post-pandemic recovery and government infrastructure initiatives. The 20232025 period saw a remarkable surge in sales, peaking at $557 million this year, a 76.5% increase from TC 2024, and marks the highest point for this sector ever recorded.

This sharp rise is indicative of a robust recovery and possible expansion in the infrastructure and repair sectors, likely spurred by increasing investments in road maintenance and repair projects. For the decade, the annual growth rate is an incredibly strong 7.55%, which is the highest growth rate of all four Top Contractor categories. People are using their funds to fix what they have, and

this is supported by the fact that across our entire survey, not just the Top 50, 80% of revenue for all contractors came from work on existing pavements, and only 20% from new construction. This shift is consistent with the ongoing recovery in infrastructure spending and possibly federal or statelevel initiatives targeting aging infrastructure in many regions. The large growth in 2025, following a relatively slower period, demonstrates the potential volatility in the sector, but also suggests that the market for pavement repair is improving significantly after the challenges posed by the pandemic and the disruptions in the early 2020s.

The total gross sales for the Top 50 Pavement Repair contractors came in

at $1.698 billion, a growth spurt of $155 million, or 10.05% up from the TC 2024 total of $1.543. It is also a slight improvement over the previous high from TC 2023 of $1.672 billion. Here are the gross revenues going back five years. You can see that the trend is really positive, representing a growth rate of 14.03% over half a decade.

The Pavement Repair category continues to be strong, I believe, because of the influx of federal dollars from the previous Administrations focus on infrastructure spending. That money may start at the top, going to road builders and State DOTs, but it eventually does trickle down, unlike in the corporate sector.

It will be fascinating to see what happens as we approach the end of the funding period for IIJA, which provided billions in spending for projects, which concludes with CY 2026.

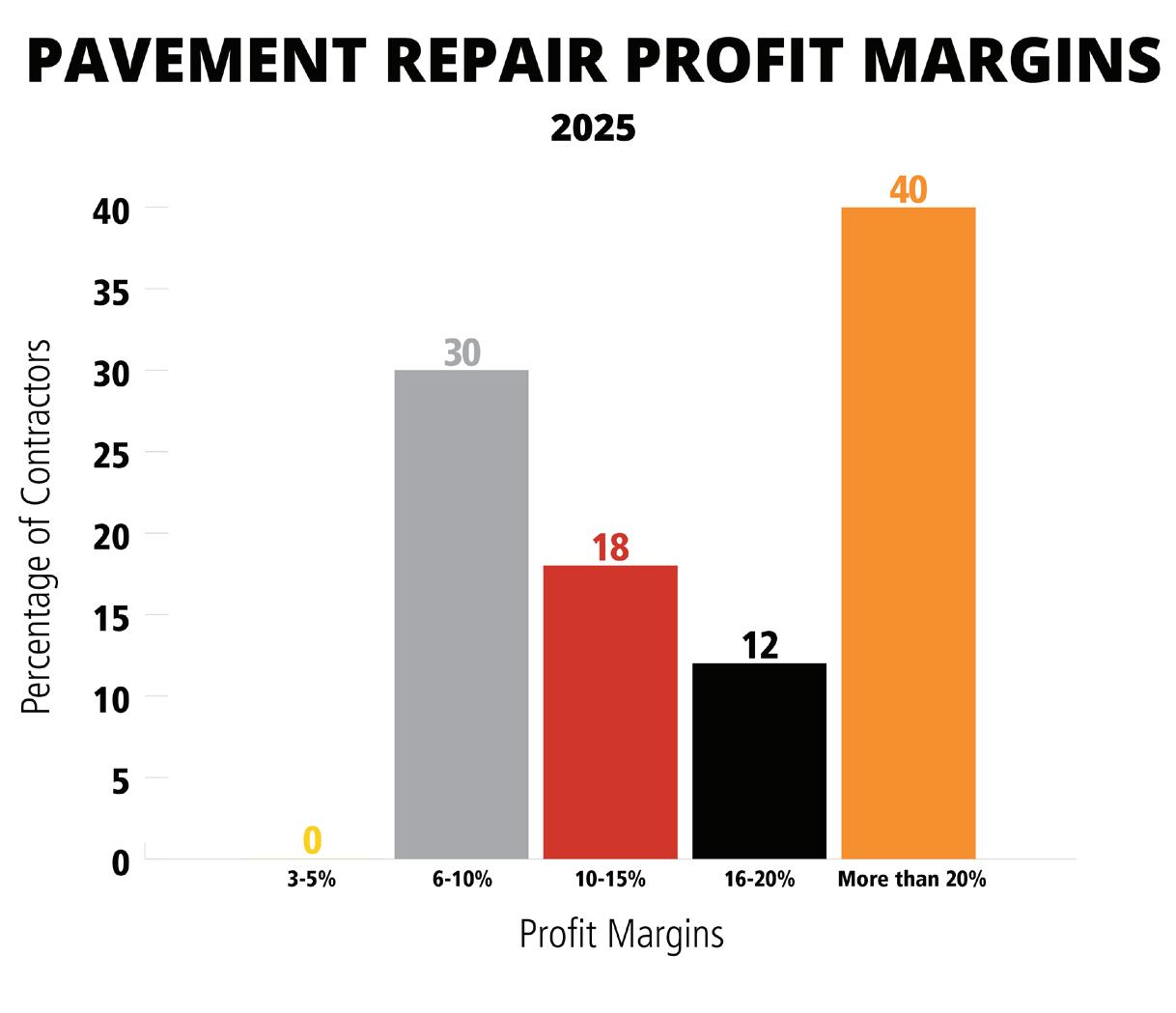

So, I’m kind of confused by this years profit margin breakdown, and it’s starting to make me wonder if I shouldn’t have fiddled with the system as it was. I do that alot, and sometimes I just can’t help myself. But last year it seemed to redistribute the graph in a way that made sense. The figures weren’t as top heavy.

We shifted them just slightly again this year, though not as major, but the same trend has emerged as in the other categories. The middle is getting squeezed out. You’re either in the top or the bottom. However, it is important to know that before we made the change, in TC 2022 the highest profit margin range contained 56% of contractors. So even though the top percentile has gone back up, it still is a better distribution that it was before:

• 40% of contractors reported profit margins greater than 20%, up 4% from last year.

• 12%(6) ranked in the 16-20% range, a decrease of 6%.

• That means 52% were in the highest range of profits, compared to TC 2023 which saw 56% in the above 15% range.

• 18% of contractors reported profits in the 10-15% range, a drop of 10% from last year! That’s a huge change.

• 30% of contractors fell into the 6-9% profit range, nearly doubling from last year with an increase of 14%.

• 0% were in the lowest bracket at 5% or less profit margins. This might be a first. There were no contractors in the Top 50 of Pavement Repair to have below a 6% profit margin.

• 58% of the Pavement Repair Top 50 completed work on driveways at an average rate of 13% of their job mix composition.

• 28% of this Top Contractor category completed highway work, the lowest of all list groups, at an average rate of 21%.

• 100% of the contractors completed some parking lot work at an average rate of 63%, a slight dip.

• 80% of contractors also did residential street or roadwork at an average rate 24% of the job mix.

• All 50 of the Pavement Repair Top 50 completed work for commercial

and/or industrial customers at an average rate of 55% of client mix.

• 88% of contractors on the list completed some municipal work at an average rate of 18% of client mix, a jump of 10%!

• 94% of the Top 50 did work for multi-family residence or HAOs at an average rate of 22%, which were the same exact stats from TC 2024.

• 54% worked for single-family homes at an average rate of 10% of mix.

• 16% did work for other unspecified types of clients at a rate of 6%.

This distribution doesn’t surprise me, as the trend for the last three years since I started as the editor, has shown this keeps pushing higher. Expect a change for this question next year to better represent the costs of modern equipment.

• 4% would need less than $250,000.

• 4% said it requires between $250K$500K to fully replace their fleets.

• 4% said that it would require twice that, between $500K- $1 million.

• 24% stated that it would take between $1 million- $2 million

• The remaining 64% said it would need more than $2 million to fully replace their fleets ■

They may never know how hard you work, but we do. Thank you for making sure our most critical infrastructure lasts. We’re here to help.

Sponsored by

The Premier Educational Conference & Networking Program for Pavement Business Owners & High-Level Managers

WEDNESDAY 03

4:00 PM – 5:00 PM Your Future Leader with Giselle Chapman

THURSDAY 04

9:00 AM – 10:00 AM

Adapting to Customer Behavior Workshop

10:00 AM – 11:00 AM Overcoming Challenges in Scaling Up & Building a Resilient Organization

11:15 AM – 12:15 PM

Staying Ahead of Risk with Josh Ferguson

1:15 PM – 2:15 PM Navigating the Digital Transformation & Your Role as a Leader

FRIDAY 05

9:00 AM – 10:00 AM

Evolve or Be Eliminated: How Forward Thinking Businesses Thrive in Uncertainty

10:15 AM – 11:45 AM Controlling the Controllables with Jake Thompson

DOUBLE YOUR PRODUCTION BY CUTTING YOUR SEALCOATING TIME IN HALF

• Spend time on the jobsite “Applying Sealer” rather than “Mixing Sealer”

• Avoid injuries from lifting heavy sand bags

•

Finally, a pavement sealer that is truly “READY TO APPLY.”

No need to add sand, water or additives.

Everything is factory blended for consistency and optimum performance.