海迅引領中國緊固件全球化:產能、質量與價格完美制勝

In recent years, the number of Chinese fastener exhibitors at international trade shows has surged dramatically, highlighting the rapid global expansion of Chinese fasteners. Riding this wave, Hisener has become a trusted fastener partner for global buyers by leveraging strong production capacity, excellent quality control, and highly competitive pricing strategies.

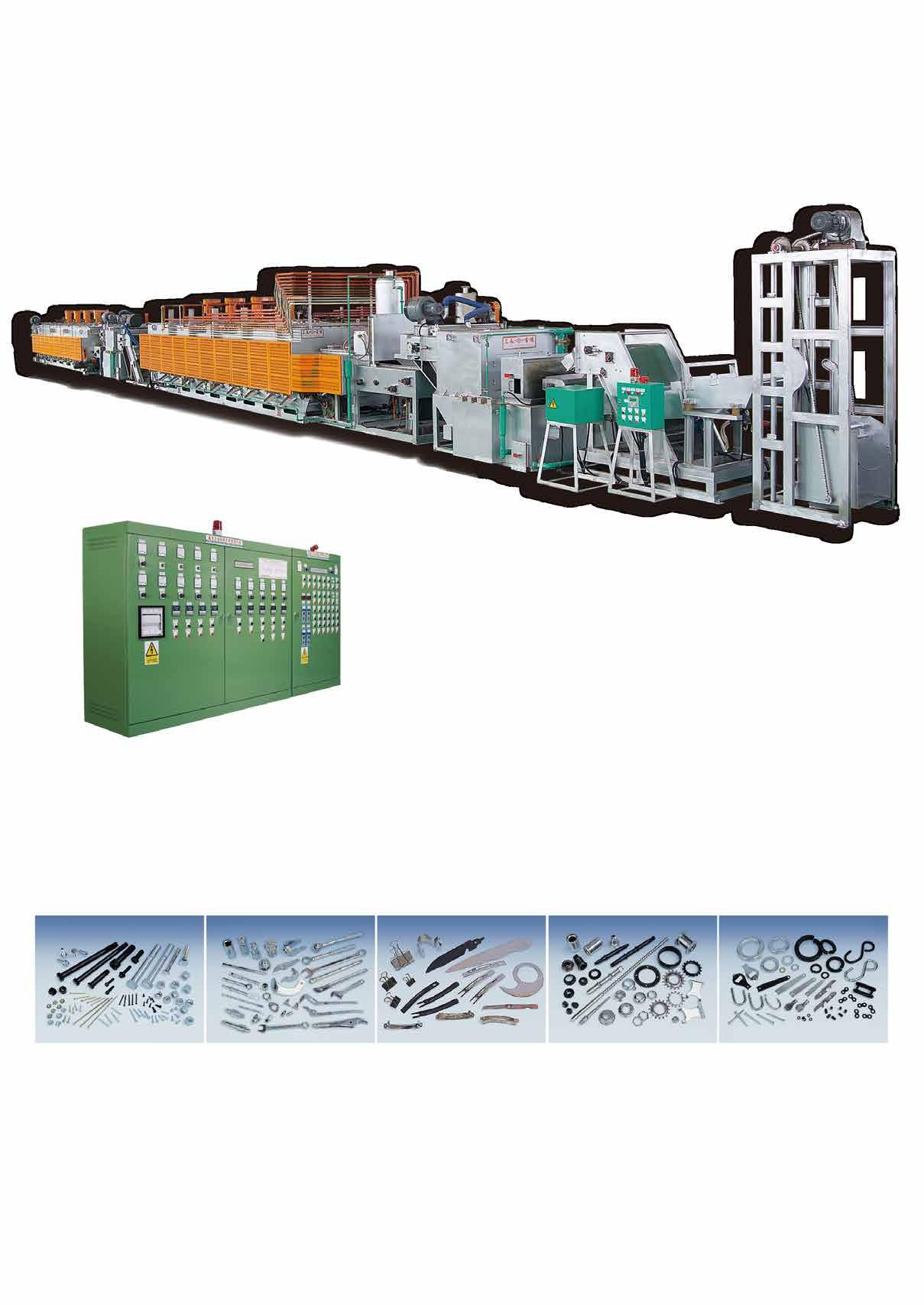

Hisener has continuously expanded its production capacity in recent years. The automated smart factory launched in 2022 has significantly improved production efficiency. In early 2025, a new stainless steel product plant was built, equipped with 50 sets of high-efficiency equipment, achieving a monthly output of 300 tons. The total stainless steel monthly capacity has exceeded 500 tons, bi-metal screws maintain a monthly output of 150 tons, and carbon steel products remain stable at 1,500 tons, forming a complete and flexible production system.

This highly efficient and large-scale production setup allows the company to quickly respond to different market and customer needs, providing stable and timely supply assurance. The advanced data monitoring and production process optimization of the smart factory ensure consistent product quality and stable performance with every batch. One of Hisener’s core competitive strengths lies in its strict quality control. The company uses 304, 316, and 410 types of stainless steel materials. Its products cover screws, threaded rods, bolts, nuts, washers, anchor bolts, pins, and fasteners for solar photovoltaic panels, meeting the needs of multiple industries.

Its stainless steel deck screws have obtained the EU CE certification, and its stainless steel wood screws have earned the ETA 22/0584 construction certification. The company is equipped with salt spray and acid rain corrosion resistance testing equipment to conduct uninterrupted 24-hour corrosion resistance tests on every product batch, ensuring excellent performance in harsh environments. The bi-metal screws successfully developed in 2023 combine the properties of stainless steel and alloy steel, showing a maximum penetration force of 12.5 millimeters and strong pull-out resistance. They offer outstanding performance and excellent cost-effectiveness and are widely used in construction, solar energy, and machine manufacturing.

Utilizing mature processing technology and smart production, the company has successfully lowered production costs while maintaining highly competitive prices without sacrificing quality. General Manager Simon Liang said, "Creating maximum value for clients with high cost-performance during economic downturns is key to our continuous growth and expansion in the global market. Whether in the best or the worst times, Chinese fasteners and Hisener have become indispensable partners in the global industrial chain." Hisener not only solidifies its position in the Chinese market but also effectively penetrates Europe, America, and emerging countries, becoming an essential procurement choice for global buyers.

Hisener actively practices ESG by integrating sustainable management concepts throughout its corporate governance and production processes. It focuses not only on environmentally friendly product performance but also emphasizes fulfilling social responsibilities, aiming to create long-term value for clients and partners through green manufacturing and good governance. In today’s complex and ever-changing global economic environment, it upholds the belief that "whenever there is demand, the Hisener team will be there." With a passion for quality and flexible market responsiveness, Hisener has laid the foundation for the Chinese fastener industry to advance globally, opening a bright future for the international expansion of Chinese manufacturing.

Simon Liang, General Manager simon@hisener.com

Copyright owned by Fastener World / Article by Dean Tseng

專訪美國緊固件經銷商協會 (NFDA)理事長Ed Smith

Compiled by Fastener World

Q1:First of all, congratulations on your new appointment as NFDA president. Could you please share your thoughts on being elected as president of the association for 2025-2026? At the same time, could you please briefly talk about your professional background and past industry experience, and how these background and experience will help you play the new role?

A:Thank you, it's truly an honor to give back to an industry that has given me so much over the past 30 years. I got my start in the fastener business as a young man working in a warehouse, learning the ropes of products, operations, and everything in between. I spent nearly two decades in master distribution with Porteous Fastener Company and continued with Brighton-Best after the acquisition. For the past 10 years, I've been part of the Procurement team at Wurth Industry USA.

Having grown from warehouse roles to regional sales at Porteous, I’ve had the opportunity to work closely with a wide range of distributors and develop a strong understanding of their needs. Now, on the procurement side at Wurth, I’ve gained a new perspective on the challenges facing distributors—both large and small—and how those challenges continue to evolve.

Q2:Tariffs against all steel and aluminum imports and exchange rates are the top concerns for global fastener manufacturers in 2025. Based on your observation, what are the main impacts of these two issues on the US fastener industry (incl. manufacturers/distributors/importers)?

A:I believe there’s still a fair amount of uncertainty when it comes to tariffs and exchange rates. Tariffs are intended to protect national security and support the revitalization of domestic manufacturing. However, rebuilding the infrastructure needed for steel production—and developing a skilled workforce for fastener manufacturing—will take years. In the meantime, market demand remains steady, and imported fasteners will continue to play an essential role. As for the impact, we’re seeing rising costs and a variety of approaches in how those increases are being passed through different distribution channels.

Q3:Apart from steel and aluminum tariffs and exchange rates, what other issues and trends are also worth paying attention to in the US fastener industry at present?

A:

Business acquisition and consolidation continue to be major trends in the industry. We’re seeing increased activity from private equity firms acquiring companies, as well as closures driven by a range of factors—such as owners retiring or a slowdown in demand forcing businesses to shut their doors.

Q4:(Following Q2 and Q3) Have US fastener distributors and importers responded to these challenges and trends in any way?

A:

That’s a tough question, as the challenges can vary widely depending on where you are in the market. That said, given the ongoing uncertainty, I believe it’s essential for U.S. fastener distributors and importers to stay informed about tariffs, understand how they may impact their business, and be prepared to adapt accordingly.

Q5:Based on the latest market research reports and data indices, which fastener-demanding industries in the US do you think have a potentially growing market?

A:

I believe the markets will continue to be diversified with the growing segments being tied to modernization, sustainability, and high precision manufacturing –namely EV automotive, aerospace/defense, construction/infrastructure, electronics and renewables. Demand is driven by material innovation, manufacturing automation and reshoring of key industries.

are the main plans and goals you wish to accomplish during your tenure as president (internally and externally)?

It’s simple: we must stay true to our mission of helping members thrive in a global marketplace. This means continuing to grow our membership by offering fresh and meaningful learning and networking opportunities at our in-person events. We also want to provide resources that support our members in developing their teams, with a strong focus on attracting and retaining talent in the industry. Additionally, I’d like to see NFDA become more inclusive by welcoming anyone interested in what we offer, even if they feel they don’t quite fit the mold. Give NFDA a chance and let us help change your perspective.

Q7:NFDA maintains close ties with major associations in Europe, the U.S., and Asia, and many NFDA members have close partnerships with overseas fastener manufacturers. How do you plan to assist NFDA members in strengthening their collaboration with key overseas suppliers (especially those in the Taiwanese supply chain) in the future?

A:Many of our members work closely with overseas suppliers, particularly in Taiwan, a key player in the global fastener market. As an association, we aim to support these relationships through open communication and industry collaboration. It’s about giving members the tools to make informed sourcing decisions, wherever opportunity aligns with their needs.

Q8:As Taiwanese fastener manufacturers or other Asian manufacturers are part of the US fastener supply chain, what advice would you give them?

A:My advice is to stay the course and maintain open, frequent communication with your U.S. customers. While we may see shifts in certain commodity products, demand for fasteners produced in Asia and around the world will continue.

Q9:What other important activities or training courses does the NFDA have planned for 2025 and 2026?

A:

We have two events coming up to close out 2025: a virtual session on Fastener Certifications and Test Reports on October 1st, and our Executive Summit in Key West, FL, from October 15th to 17th. Currently, no virtual events are scheduled for 2026, but our Learning Committee is actively reviewing key industry topics and will announce the upcoming schedule soon. Looking ahead to June 2026, we’ll gather in Indianapolis, IN, for our Annual Meeting and ESPS.

Q10: What are your expectations for the market outlook for 2025-2026?

A:I expect market demand to remain steady, with moderate growth through 2026, driven by core industries such as automotive, construction, aerospace, and high-tech manufacturing. Tariffs and exchange rates will continue to be top of mind and will undoubtedly influence sourcing strategies as we adjust to what feels like a new normal.

Q11: Is there anything else you would like to share with our readers?

A:Thank you for the opportunity to participate in this interview. I’ve been a longtime reader of Fastener World Magazine, and it’s an honor to share some of my insights with fellow readers. I appreciate your time and the chance to contribute.

Source: Commercial Times, Aug. 2025, Top 1,000 Taiwanese Enterprises in China

Sorted by net revenue

Compiled by Fastener World

In the category of fastener manufacturers, a total of 9 companies are ranked in the top 1,000. This is 4 companies more, compared with 5 companies listed last time by Commercial Times. Zhejiang Tong Ming Stainless Steel Products and Gem-Year Industrial continue to remain the top two Taiwanese fastener companies in China. After dropping out of the ranking last year, Xiamen Boltec jumped to third place this year and replaced Suzhou New Best Wire Tech.

The 2025 ranking list includes 4 more entrants than in 2024: Xiamen Boltec, which produces and sells fasteners; Gem-Safe, which sells fasteners; new entrant Xiamen Bolwir (specializing in coiled wire drawing and spheroidizing processing); and new entrant Suzhou Yeswin (producing and selling standard fasteners and parts). Additionally, Zhejiang Tong Ming Stainless Steel Products, Gem-Year Industrial, Suzhou New Best Wire Tech, and Chun Yu (Dongguan) Metal Products have all been on the list continuously for the past three years. Except for Zhejiang Tong Ming, the other three have even appeared on the list for the past four years, making them regulars on the ranking list.

In 2025, the entrants, which are a total of 4 companies, with increased revenue are marked with an upward red arrow. This number stays the same with last year. In terms of revenue growth, Suzhou New Best Wire Tech experienced the highest increase, reaching 3.79%, while Gem-Safe saw the largest decline, dropping by as much as 23.19%. Regarding pre-tax profit margin, the new entrant Suzhou Yeswin ranked the highest, achieving 15.50%.

In 2025, there are 4 companies on the list with revenues exceeding RMB 1 billion, doubling the 2 companies in 2024. Moreover, the total number of entrants has nearly doubled, indicating that the revenue competitiveness of leading Taiwanese-owned fastener companies in China has improved over the past year. Notably, up to three of the listed companies are subsidiaries of QST International, whereas in 2024, QST International had no subsidiaries ranked among the top 1,000. This demonstrates strong revenue growth momentum for QST International in the past year. Gem-Year Industrial also has two subsidiaries on the list. On the other hand, the parent companies of the listed entrants are almost the same as in 2024, revealing that the market of Taiwanese-owned fastener companies in China is overall divided among six dominant players: Tong Ming Enterprise, Gem-Year, New Best Wire Industrial, Tycoons Group Enterprise, Chun Yu Works, and QST International.

Founded in 2005, CHINFAST boasts two wholly-owned factories, namely Joystart Automotive Parts (Zhejiang) Co., Ltd. and Haiyan Yousun Enterprise Co., Ltd., with an export volume of 8,000 containers in 2023. Deeply rooted in the fastener industry, CHINFAST has established business relationships with more than 500 enterprises worldwide. To further strengthen its connection with the demands of first-tier retailers and distributors in Europe and the United States, CHINFAST Co., Ltd., which has been specializing in industrial fastener production for nearly 20 years, has actively expanded its business over the past five years. It has extended its business from the original focus on the manufacturing of multi-purpose wood screws, timber screw and decking screws to DIY fastener packaging services, aiming to create a new milestone for the sustainable development of the enterprise in the ever-changing global market.

The main products of CHINFAST are multi-purpose wood screws, trumpet head wood screws, and various window fastener series. Its patented pointed tail design offers superior speed performance compared to ordinary screws. Meeting the 1,200-hour salt spray requirement allows customers with anti-corrosion and rust-proof requirements to use them with greater peace of mind. CHINFAST is currently developing a product with a double-cut tail, which is in the trial production stage. The patented double-cut tail design elevates the product's performance

to a new level. This product combines the advantages of wood screws, self-tapping screws, and self-drilling screws, providing customers with a brand-new and efficient user experience.

The ERP smart factory management system ensures the traceability of all products from production to packaging. CHINFAST is equipped with double first-class laboratories, and the production process strictly follows the ISO9001 system. With 15 QC personnel, each batch of products must undergo initial inspection, process inspection, warehousing inspection, packaging inspection and final inspection, with records kept online for each step to ensure traceability. The responsibility of CHINFAST's QC team is to prevent any defective products reaching customers. CHINFAST is equipped with advanced cold heading equipment imported from Taiwan, China, which has more stable performance. At the same time, the workshop is equipped with automatic high-rise warehouses, automatic packaging lines and AGV robots, which play an important role in the company's production and packaging of high-quality fasteners.

Europe is one of the main markets of CHINFAST. In the future, CHINFAST will continue to develop deeply in Europe and expand into the South American and Australian markets. It is believed that with the expansion of these markets, CHINFAST's export volume will reach a new high.

As the president of Jiaxing Fastener Import and Export Association, General Manager Yu Fengming has spared no effort to develop the fastener export business. CHINFAST is an enterprise with 20 years of experience in fastener exports, holding ETA and CE certifications, as well as SMETA and BSCI reports. The automated production and packaging standards of JOYSTART also provide a guarantee for CHINFAST to explore

emerging markets. At the same time, as a factory with an average antidumping tax rate in Europe, YOUSUN benefits a larger number of European customers. CHINFAST is familiar to the needs of various markets and can quickly and accurately meet customer requirements, providing customers with high-quality after-sales service. In addition, CHINFAST has an experienced DIY packaging team, which has unparalleled competitiveness in terms of both financial strength and product professionality.

Contact: Mr. George Yu

Email: george@chinfast.com

Article by Gang Hao Chang, Vice Editor-in-Chief of Fastener World

Copyright owned by Fastener World

惠達特搜全球新聞

compiled by Fastener World

Dongguan Hardware & Electrical Chamber of Commerce and Fastener Industry Association Deepen Collaboration

東莞五金機電商會與緊固件行業協會深化合作交流

On September 10, the Dongguan Hardware & Electrical Chamber of Commerce and the Fastener Industry Association held a deep discussion on overseas market expansion, employment, and collaboration. They identified growth opportunities in overseas markets like Thailand, the Middle East, and Africa, recommending risk assessments and collaborative strategies. The domestic Chinese market faces intense competition and talent shortages, with high demand for skilled and cross-disciplinary professionals, but recruitment difficulties and high labor costs persist. Both parties pledged to integrate exhibition resources and establish talent platforms to promote skill training and information sharing, jointly fostering industry development and supporting regional economic stability and employment security.

墨西哥擬提高中國進口關稅

浙江省緊固件行業協會發佈碳足跡團體標準

On September 2, 2025, Zhejiang Fastener Industry Association released the group standard titled "Greenhouse Gas Product Carbon Footprint Quantification Methods and Requirements – Fasteners." Led by China Components Test, the standard involved 20 enterprises and 31 industry experts. Initiated in June 2024, the 15-month process included research, company visits, opinion collection, and expert reviews. This standard represents not only a technical guideline but also an industry commitment to shift from quantity to quality and green development. It provides companies with a roadmap to future challenges, bridging Chinese manufacturing with national strategies and the global market, advancing sustainable growth in the fastener industry.

The Mexican government plans to raise tariffs on Chinese imports in its 2026 budget to protect domestic industries from cheap imports and meet U.S. demands. These higher tariffs are expected on goods like cars, steel products, textiles, and plastics to reduce dependency on China and other Asian countries. Mexico’s trade deficit with China has grown, and increased tariffs could boost revenue and ease the budget deficit while improving relations in the USMCA trade agreement with the U.S. and Canada. Chinese cars have gained popularity in Mexico, making it the top global market for these vehicles, but higher tariffs may increase prices and reduce affordability. Industry experts suggest quotas for low-tariff Chinese cars to balance consumer access and international pressure. Mexico currently imposes tariffs ranging from 5% to 50% on many Chinese goods, and the planned tariffs aim to further shield its domestic industries.

德國汽車業遭美國關稅衝擊 裁員超 5 萬

Germany’s automotive industry faces severe challenges due to U.S. tariffs and other factors. A recent report by consulting firm Ernst & Young Global shows that approximately 51,500 jobs were lost in Germany’s auto sector over the past year, accounting for nearly 7% of total positions, making it the hardest-hit industrial sector. Major manufacturers like Mercedes-Benz and Volkswagen, along with suppliers such as Bosch, Continental, and ZF, have announced costcutting plans, while Porsche plans to significantly reduce its battery-powered vehicle business.

As of June 30, 2025, total industrial employment in Germany fell by 2.1%, equivalent to about 114,000 jobs, with industrial sales declining for eight consecutive quarters, dropping 2.1% year-on-year in Q2. Ernst & Young Global predicts this downward trend in industrial employment will continue.

Industry insiders cite U.S. tariffs, high energy costs, and weak domestic demand as major pressures. Ernst & Young Global’s Germany managing partner Jan Bruecher highlights a steep decline in exports to the U.S., posing clear risks to Germany’s industrial sector and underscoring the need for caution amid ongoing challenges.

Hebei Steel Supply

河北鋼鐵供應鏈平臺運營,降低緊固件採購成本 28%

Hebei’s steel industry supply chain platform has been operational for over a month, significantly cutting procurement costs for upstream and downstream firms and advancing the sector’s shift from traditional manufacturing to integrated services. The platform’s group purchasing model reduced fastener procurement costs by 28%, while streamlining the procurement process for greater convenience and efficiency. The platform has improved purchasing convenience and reduced expenses.

The platform consolidates orders from over a dozen steel mills, cutting freight, sorting, and warehousing costs. During the trial run, companies pooled nearly RMB 100 million to purchase spare materials, achieving a 28% average price drop on fasteners, 22% reduction on process parts like thermocouples and samplers, and 10% cut on valves. A 20% sales increase and significant logistics savings is gained after collaborating with the platform.

澳洲終止對華可互換夾緊螺栓夾頭反補貼調查

On August 11, 2025, the Australian Anti-Dumping Commission announced the termination of the anti-subsidy investigation on Chinese imports of interchangeable bolted clipping system clip heads. The decision was based on the negligible subsidy margins found for Ningbo Fenghui Metal Products and other Chinese exporters, making the subsidy impact insignificant.

The investigation began in June 2024 following a complaint by Australian company Abey Australia Pty Ltd. It covered imports from April 1, 2023, to March 31, 2024, with the injury period starting April 1, 2020. In March 2025, the Commission issued a preliminary affirmative anti-dumping determination, imposing provisional dumping duties calculated ad valorem at 31.5% for Ningbo Fenghui and 76.8% for other exporters. However, due to insufficient evidence for subsidies, the anti-subsidy probe continued until now.

The product’s Australian customs code is 7326.90.90.60. The termination of the anti-subsidy investigation provides short-term relief to Chinese exporters, improving their competitive position in the Australian market.

All steel companies in Hebei have joined, covering over 15,000 suppliers and 5,000 customers, and cooperating with more than 60 financial institutions. The platform fosters industrial chain coordination, cost reduction, and competitiveness enhancement. This model provides vital support for the transformation and upgrades of Hebei’s steel industry.

現代汽車 2025 年第二季因美國關稅損失 6 億美元

Hyundai Motor reported a 16% drop in operating profit for Q2 2025, reaching 3.6 trillion KRW (about USD 2.64 billion), down from 4.28 trillion KRW the same period last year. U.S. tariffs on vehicles and parts negatively impacted profits, causing a loss of approximately 828 billion KRW (USD 606 million) in Q2. The company expects even greater impact in the third quarter. The CFO noted the U.S. tariff rate on Korean cars might slightly decrease from the current 25%, though the extent is uncertain. This tariff challenge highlights ongoing trade policy risks for the automotive sector, with Hyundai actively adjusting strategies to sustain competitiveness.

英國汽車產量創 1953 年以來新低

UK car and van production in the first half of 2025 has hit its lowest level since 1953 (excluding Covid lockdowns). Car output fell 7.3%, while van production dropped 45% due to Vauxhall’s Luton plant closure. Uncertainty over US tariffs caused some manufacturers to slow or halt production. A US-UK tariff deal reducing automotive tariffs from 27.5% to 10% took effect at the end of June, boosting June production slightly.

Electric vehicle production grew 1.8%, reaching a record 25% of total output. The UK government reinstated EV grants of up to £3,750, but unclear eligibility criteria have confused manufacturers and consumers. SMMT CEO Mike Hawes described the period as “depressing” but hopes it marks the industry’s bottom. He noted that to meet the government’s target of 1.3 million vehicles per year by 2035, the UK needs one or two new carmakers.

While EV grants aim to support the market, qualification depends on carbon emissions and verified targets, with details yet unclear. The UK automotive sector is tackling challenges from US tariffs and growing Chinese competition.

正山智能成功研製 718

Zhengshan Manufacturing Innovation recently announced successful product validation of 718 nickelbased alloy bolts, marking a significant breakthrough in domestic high-end fasteners and breaking longterm foreign monopolies. The bolts use high-temperature resistant alloy materials with carefully balanced iron, nickel, chromium, and molybdenum, offering excellent pressure and corrosion resistance suitable for aerospace, petrochemical, and other advanced sectors. Supported by a national laboratory and over 50 advanced testing devices, the company achieves over 99% product testing coverage. Their self-developed digital management platform ensures over 95% equipment connectivity, enhancing R&D efficiency and product quality. The company holds three intellectual property rights related to data and optimizes production costs through multi-process integration. It plans to continue advancing technological innovation, expand global competitiveness, and promote the domestic substitution of high-end fasteners.

超捷股份 2025 上半年營收增長 36.8%

Essence Fastening reported revenue of 391 million RMB in the first half of 2025, a 36.8% increase year-on-year, with net profit rising 21.86% to 21.7 million RMB. The company develops high-strength precision fasteners and special connectors, mainly used in automotive turbochargers, transmission controls, exhaust systems, and new energy vehicle battery modules. Essence Fastening is advancing import substitution and expanding into high-end markets through innovation and differentiated strategies.

Notably, its fasteners are now applied in aerospace and robotics, with small-volume orders for humanoid robots. The company plans to adjust capacity based on demand, steadily growing its aerospace sector.

飛沃科技積極培育太空緊固件業務

Finework achieved RMB 1.165 billion in revenue in the first half of 2025, up 81.42% year-on-year, with a net profit of approximately RMB 29.6 million, turning profitable. Wind power fastener shipments continued to grow, supported by low steel prices which improved profit margins. The company specializes in high-strength fasteners mainly used in wind power, while expanding into aerospace, gas turbines, and other high-end sectors.

Finework expects the global wind power market to grow rapidly, projecting an 8.8% CAGR from 2025 to 2030. To diversify, it launched an aerospace fastener production line, entering key domestic supply chains. In June, the company signed a strategic deal with Germany’s Heggemann to enhance aerospace fastener design, verification, and manufacturing.

In June 2025, Jiangsu Zhenjiang New Energy Equipment announced plans to establish subsidiaries to expand its overseas business. Its subsidiary will set up a holding company in Hong Kong with a USD 5 million investment. This Hong Kong entity will then establish a subsidiary in Saudi Arabia with an investment of about RMB 35.81 million.

The Saudi Arabia subsidiary aims to leverage the stable political environment and strong economy in Saudi Arabia, the largest economy in the Middle East and North Africa, to capture growing demand for photovoltaic fasteners in the regional new energy market. This move also helps JZNEE address escalating U.S. and European tariff barriers and strengthen its global market presence.

JZNEE’s 2024 report showed fastener business revenue of RMB 335.18 million with a 24.58% gross margin, up 1.13% year-on-year. Overseas revenue accounted for 76.8% of total sales, about RMB 2.94 billion, underscoring the company’s export strength. This overseas investment marks a strategic step to deepen JZNEE’s internationalization and expand in the Middle East new energy sector.

Fastenright 慶祝 15 周年 助力南非重大工程

Fastenright, South Africa’s leading stainless steel fastener supplier, celebrates 15 years of steady growth and success. Founded with a vision to provide unmatched quality and service, Fastenright now stocks about 10,000 products across four warehouses, with a fifth under construction, ensuring swift delivery for diverse industries where even small fastener failures can cause costly downtime.

Managing Director Rainer Lutz reflects on the challenges of building a specialized supplier and credits his team and key partners for their dedication. Fastenright’s products are vital in major projects, such as supplying over 15,000 fasteners for Milnerton’s historic wooden bridge restoration and securing the corrosion-resistant MeerKAT radio telescope in Northern Cape.

The company specializes in high-grade stainless steels including acid-resistant A4-80 and duplex grades 2205 and 904L, with select sizes stocked for urgent orders. Fastenright also supplies fasteners for water treatment, marine, and industrial applications.

Looking ahead, Fastenright aims to expand in renewable energy sectors, particularly solar, by partnering with global leaders to offer a reliable local alternative with extensive inventory and fast delivery. Lutz reaffirms the company’s commitment to quality, service, and lasting customer relationships in South Africa and beyond.

Optimas 推出 QuickShip 計劃 解決緊固件庫存短缺 問題

Optimas Solutions launched its QuickShip program to solve inventory shortages affecting OEMs and distributors. Operating from their Wood Dale, Illinois facility, the program offers a rapid lead time of 1 to 4 weeks for externally threaded fasteners sized 2mm to 20mm diameter and 5mm to 220mm length.

QuickShip integrates Optimas’ engineering, tooling, cold heading, threading, and local secondary processing—including heat treatment and plating—to dramatically reduce the usual 8 to 16-week lead times. Daniel Harms, CEO of Optimas Americas, said the program offers a seamless, efficient solution that prevents downtime from part shortages.

Featuring over 40 thread styles and 6 licensed drive types with IATF and ISO certifications, QuickShip ensures highquality parts. VP Chris Martens emphasized the program’s agility and cost-effectiveness, enabling manufacturers to quickly access precision-engineered components to keep operations smooth.

Ranked 8th in fasteners on MDM’s 2025 Top Distributors list, Optimas reported USD 635 million in 2024 revenue, reflecting its strong position in the market.

Riverspan 收購 United Titanium 推動特殊合金緊固件市場發展

Riverspan Partners has acquired United Titanium, a leading manufacturer of fasteners and components for aerospace, defense, and medical industries. Founded in 1962 and headquartered in Wooster, Ohio, United Titanium offers over 14,000 SKUs made from specialty metals like titanium, zirconium, and tantalum. Products include hex head bolts, socket head cap screws, and pipe fittings, used where corrosion resistance and strength are critical.

Led by President Mike Reardon, United Titanium has built strong market positions and long-term customer relationships. Riverspan partner Dave Thomas expressed commitment to enhancing innovation and service to support continued growth. According to Verified Market Research, the global titanium fasteners market was valued at USD 4.3 billion in 2023 and is projected to reach USD 7.2 billion by 2031, growing at a CAGR of 7.5%. Growth is driven primarily by aerospace and defense demand for lightweight, strong, corrosion-resistant materials, along with expanding automotive, medical, and marine sectors.

Founded in 2022 and based in Chicago, Riverspan focuses on lower middle-market industrial companies with EBITDA between USD 5 million and USD 35 million. This acquisition positions United Titanium for further expansion and strengthens Riverspan’s industrial portfolio in specialty alloy fasteners.

San Diego fastener distributor Mesa Fastener Inc. was acquired last month by investment firm Raymond Capital Management, according to a recent announcement from the company’s advisory firm.

Generational Group stated that Mesa, founded in 1977 as a provider of tapping screws for mobile home awnings, now stocks over 10,000 unique products and supplies commercial threaded fasteners— including blind rivets, bolts, nuts, anchors, washers, and other specialty items— to various industries across the Southwest.

The announcement noted that Raymond Capital Management builds “resilient, high-performing industrial brands” through acquisitions and expertise. The St. Louisbased firm offers distribution, inventory management, custom manufacturing, and analytics capabilities.

The deal, which closed on August 11, did not disclose its terms.

Jiangsu ZSA Industry is a leading high-tech enterprise in China specializing in non-standard manufacturing. It is dedicated to the research, production, and sales of nickel-based high-temperature alloy fasteners, precision mechanical components, and petrochemical fittings. Its products serve industries including petrochemical, dyeing and textile, aerospace, nuclear power, marine shipping, and new energy sectors. With a comprehensive and scientific quality management system and ISO9001 quality certification, it has established a robust quality assurance that is highly trusted in the industry.

The factory covers over 9,000 square meters and is equipped with more than 60 sets of advanced machinery, including machining centers, CNC lathes, wire-cutting machines, forging machines, threading machines, tapping machines, as well as heat treatment and inspection equipment. Monthly production capacity stabilizes at 50,000 pieces, supporting a wide range of customization needs. Such formidable capacity not only improves delivery efficiency but also helps clients accelerate project advancements.

The company leverages strong technical expertise to produce a diverse range of fasteners, from 12-point bolts and nuts, hex flange bolts and nuts, to all-metal lock nuts, internal star screws, and even custom non-standard parts made to drawings or samples. These products are used in stringent industrial environments such as petrochemical and aerospace sectors, where requirements for high and low temperature resistance, corrosion resistance, high strength, and fatigue endurance are extremely demanding.

Its INCONEL 718-grade 12-point bolts are especially notable, reaching strength grades of 12.9 and even 14.9, while maintaining excellent mechanical properties at ultra-low temperatures, used in oil extraction and aerospace applications. The recently launched 14.9-grade high-temperature alloy fasteners, along with internal and external hex bolts and self-locking products, demonstrate the company’s deep mastery in processing mid-to-high grade materials.

The company’s main markets are the UK, Germany, and the USA, accounting for 35%, 15%, and 10% of sales respectively, fully proving its products’ quality and technical standards meet high-end international market demands. It is actively applying for CE certification and has begun obtaining API certification for some products, strengthening its competitiveness and recognition in global markets.

It understands client needs, maintains intensive communication and feedback, and enforces strict quality inspection to ensure every product meets client expectations. It emphasizes full staff participation in quality control and continuously improves quality and client satisfaction through the adoption of new technologies and process optimization, maintaining a leading position in the industry.

Looking ahead, it continues investing resources to strengthen R&D capabilities, expand advanced equipment introduction, and optimize product performance. It plans to continue expanding its product lines and focus on building its own brand "ZSA," moving decisively toward becoming an internationally recognized manufacturer of high-end fasteners.

Copyright owned by Fastener World / Article by Dr. Sharareh Shahidi Hamedani, UNITAR International University

China’s HSR network reached ~48,000 km by the end of 2024. China State Railway’s public targets indicate ~60,000 km by 2030, embedded in a broader rail network goal of ~180,000 km by that date, while earlier planning set an ambition of ~70,000 km of HSR by 2035.

This pipeline matters because fastener consumption scales directly with trackkilometers (not just route-kilometers). Most Chinese HSR corridors are double-track, so every new route-km usually implies 2 trackkm of fastener-intensive rail. A 12,000-km increase in operating HSR mileage from 2025 to 2030 therefore likely translates to ~24,000 track-km of new fastener demand, with additional volumes for turnouts, station throats, and depots.

China’s HSR foundation technology is dominated by ballastless (slab) track—CRTS I/ II/III variants—engineered for high speed, low maintenance, and tight geometry control. These designs rely on resilient fasteners that clamp the rail to baseplates or directly to concrete slabs; materials and pad stiffness are tuned to speed, axle load, and bridge/tunnel dynamics.

Spacing and unit counts per kilometre: In slab-track HSR, rail fastening assemblies are typically placed at intervals of ~0.60–0.65 m along each rail. Academic and industry references show common sleeper/rail-seat spacings near 0.60 m for high-speed applications, while Chinese research and tests often use 0.65 m for CRTS II field experiments and modelling.

Using 0.65 m as a baseline spacing:

• Positions per rail-km = 1,000 m / 0.65 m ≈ 1,538 fastening points.

• Each track-km has two rails, so ≈ 3,076 fastening assemblies per track-km.

• If we assume double-track construction, a typical route-km then consumes ≈ 6,152 assemblies (not counting turnouts/special trackwork).

• To show the sensitivity, a 0.60 m spacing would increase counts by ~8%:

• 1,000 / 0.60 = 1,667 per rail-km, or 3,334 per track-km; 6,668 per route-km.

These densities are directionally consistent with UIC/HSR engineering norms for resilient fastenings in high-speed service.

Projecting 2025–2030 new-build demand: From ~48,000 km (the end of 2024) to ~60,000 km by 2030, net operating HSR increases by ~12,000 km. Treat that as new double-track put into service (the practical reality may include phased openings and upgrades, but the aggregate impact on fastener demand is similar).

• Track-km added ≈ 12,000 route-km × 2 = 24,000 track-km.

• Fastener assemblies (baseline 0.65 m): 24,000 × 3,076 ≈ 73.8 million assemblies.

• Range (0.60–0.65 m): roughly 73–80 million assemblies for the same build-out.

This excludes turnouts, where special fasteners (switches, crossings, guard rails) have higher density and specialized parts, and station/yard complex geometry. Factoring those in can add several percent to totals depending on corridor design.

While rail-seating fasteners represent the single largest category by count, high-speed rail projects in China consume vast numbers of additional steel fixings across multiple domains. Bridges and viaducts stand out as particularly intensive consumers, since Chinese HSR networks are heavily elevated on long viaducts and box-girder bridges. For instance, approximately 1,268 kilometers of the Beijing–Shanghai high-speed railway is ballastless, and around 87 percent of that corridor runs on elevated structures. This design choice implies a massive demand for structural connections and embedded anchors. Expansion joints, bearing fixings, parapets, access walkways, noise barriers, inspection gantries, and drainage hardware all rely on bolts and anchors engineered to withstand vibration, thermal cycling, and long-term corrosion exposure.

Tunnels also add significantly to fastener demand. In these underground environments, fixings are essential for anchoring cable trays, emergency systems, track slab dowels, and equipment cabinets. High-speed tunnel aerodynamics present unique challenges, as pressure pulses and crosswinds at portals exert dynamic forces that increase performance requirements for fasteners and their supporting structures.

The overhead contact system (OCS), the backbone of electric traction, is another major consumer of fasteners. Every mast, cantilever, bracket, insulator, steady arm, and sectioning device depends on structural and electrical fixings. Given that typical HSR mainline span lengths range from 50 to 60 meters between supports, each kilometer of double-track line can require 17 to 20 masts, depending on terrain and design. Each of these installations translates into

hundreds of structural fasteners for baseplates and ancillary hardware, with the numbers varying according to wind zones, bridge versus earthwork alignments, and the specific contact wire configuration

Stations, depots, and mechanical and electrical (M&E) facilities also constitute a vast consumption base. Platform screen doors— where deployed—require precision-engineered fasteners, while HVAC systems, cable trays, fire suppression infrastructure, signaling racks, and traction power equipment demand large volumes of stainless steel or corrosion-protected bolts and anchors to ensure reliability and safety.

In parallel, signaling and communications systems add their own requirements. The deployment of CTCS-3 train control, lineside cabinets, and extensive fiber-optic networks involves mounting hardware and vibration-rated fasteners designed for both stability and longevity under continuous service conditions.

Quantitatively, lifecycle replacement is an increasingly significant factor. Under normal operating conditions, elastic fasteners (e.g., WJ-8 family) require inspection every 2–3 years, with partial replacement cycles typically every 8–12 years depending on corridor speed, axle load, and climate. Assuming an average 10% replacement of assemblies per decade, the existing network of ~45,000 km implies demand for at least 40–45 million replacement fasteners by 2030—independent of expansion. As the network grows toward 60,000 km, cumulative replacement needs could reach 60–65 million units per decade, effectively creating a permanent parallel market alongside new construction. By 2035, if 70,000 km of HSR is realized, annualized demand could average 8–10 million replacement fasteners per year, rivaling new-build consumption even if expansion moderates.

China’s high-speed rail program continues to stand out as a uniquely large, policy-anchored engine for fastener demand.

The near-term bellwether is progress toward the 60,000-kilometer milestone by 2030, which would add an estimated 74–80 million rail-seat fastening assemblies under standard spacing assumptions.

This figure grows substantially when one accounts for turnouts, overhead contact system hardware, and the immense volumes of bridge, tunnel, and station-related fixings. Beyond 2030, the vision of reaching 70,000 kilometers by 2035 remains a credible long-range anchor, provided policy momentum and fiscal support remain steady.

Even if network expansion slows or flexes with broader fiscal realities, the scale of China’s HSR infrastructure ensures that inspection, replacement, and upgrade cycles will sustain a large and durable market for fasteners well into the next decade. By 2035, the interplay of expansion, lifecycle management, and technical evolution positions the fastener sector as both a critical enabler of reliability and a beneficiary of one of the most ambitious transportation programs in modern history.

References

https://english.www.gov.cn/news/202501/02/content_WS67764b48c6d0868f4e8ee732.html?utm_source=chatgpt.com https://www.reuters.com/article/world/china-plans-to-expand-railway-network-to-200000-km-before-2035-idUSKCN2590RM/?utm_source=chatgpt.com https://uic.org/IMG/pdf/uic-railway-induced-vibration-report-2017.pdf?utm_source=chatgpt.com https://academic.oup.com/iti/article/doi/10.1093/iti/liac023/6883951?utm_source=chatgpt.com&login=false https://www.researchgate.net/publication/346381558_Analysis_on_mechanical_characteristics_of_welded_joint_with_a_new_reinforced_device_in_high-speed_railway https://pmc.ncbi.nlm.nih.gov/articles/PMC10450751/?utm_source=chatgpt.com

China has become the undisputed leader in global wind power. By the end of 2024, its installed wind capacity exceeded 520 GW, accounting for more than one-third of the world’s total. Offshore projects have expanded particularly fast, reaching nearly 40 GW, making China the largest offshore wind market worldwide. As the country pushes toward its carbon neutrality target by 2060, this momentum will only intensify.

Behind every turbine stands a vast ecosystem of industrial suppliers. Among the most critical yet often overlooked components are fasteners, bolts, nuts, studs, and other elements that hold together towers, nacelles, and blades. Their performance directly affects the stability, safety, and service life of wind installations. For China, which already commands a strong industrial fastener base, this presents a major growth opportunity in both domestic and export markets.

By late 2024, China had surpassed 520 GW of wind power capacity, reinforcing its position as the world’s largest market. Offshore wind alone grew from less than 5 GW in 2018 to nearly 40 GW in 2024. This rapid expansion means demand for specialized fasteners has surged.

Each utility-scale turbine requires thousands of fasteners, many of which must withstand extreme vibration, high mechanical loads, and harsh weather conditions. As turbines increase in size, with offshore models now exceeding 15 MW, fasteners must be larger, stronger, and equipped with advanced coatings to prevent corrosion. These requirements elevate the sector from a commodity market to a field of highly engineered, high-value components.

The global wind power fasteners market has grown in lockstep with the rapid expansion of wind energy capacity worldwide. Fasteners are critical to the structural performance of turbines, ensuring that towers remain stable, blades securely attached, and nacelles properly aligned. As turbine designs evolve and offshore projects scale up, the demand for advanced fasteners is increasing significantly.

According to industry research, the global wind power fasteners market was valued at USD 5.2 billion in 2023 and is forecast to reach USD 8.7 billion by 2032, registering a CAGR of 6.5%. This growth reflects both the sheer scale of new wind installations and the rising technical requirements for components.

• Demand drivers: Over 127 GW of new wind capacity was added globally in 2024 alone, an all-time record, with more than 23,000 turbines installed. Each turbine requires tens of thousands of fasteners, many of them oversized or customized for structural applications.

• Technical shift: As turbines surpass 15 MW capacity offshore, the size and grade of fasteners must increase accordingly. Larger diameters, higher strength classes, and advanced coatings are now the industry norm.

• Offshore premium: Offshore installations represent the fastestgrowing segment of the wind industry. They require marine-grade bolts, studs, and nuts with anti-corrosion coatings that can endure saltwater and humidity for decades.

Geographically, the Asia-Pacific region leads the market, accounting for the largest regional share. China dominates installations, representing more than one-third of global wind capacity. This leadership translates into unmatched demand for wind fasteners, both for onshore and offshore projects.

With its vast industrial production base, China is uniquely positioned to not only supply its own projects but also shape the global supply chain of wind-certified fasteners. The combination of large-scale demand, advanced engineering requirements, and export potential underscores why AsiaPacific, and China in particular, sits at the center of the global market for wind fasteners.

a) Industrial base: China’s overall industrial fastener market exceeded USD 12 billion in 2024, projected to double by 2032. With strong manufacturing capabilities, the transition toward higher-value fasteners tailored for wind applications offers significant margin expansion.

b) Offshore wind growth: With nearly 40 GW of offshore capacity already installed, China is the world’s largest offshore wind market. Offshore turbines, operating in corrosive marine environments, require advanced coatings and materials. Demand for marine-grade bolts, studs, and nuts will grow rapidly as more projects move from planning to construction.

c) Technical innovation: Next-generation turbines demand longer, stronger bolts and advanced coatings such as Dacromet and hot-dip galvanization. High-strength grades (8.8–12.9) and oversized diameters (20–42 cm) are increasingly becoming standard. This creates opportunities for suppliers capable of producing specialized products with consistent quality and certification.

d) Export potential: As Chinese turbine manufacturers expand globally, they are creating export channels for domestic fastener suppliers. International certification and compliance with ISO and IEC standards will be essential for success in these markets.

While opportunities are vast, the sector faces significant challenges that must be addressed to ensure sustainable growth. Wind power fasteners operate under some of the harshest conditions in the industrial sector. They must resist constant vibration, cyclic fatigue, and in offshore projects, severe marine corrosion. These requirements raise the stakes for quality control and standardization.

Another challenge is cost volatility. Steel and alloy prices fluctuate widely, squeezing margins for manufacturers. At the same time, pressure from turbine OEMs to lower component costs often conflicts with the need for higher-quality fasteners. Balancing price competitiveness with durability and compliance is a delicate challenge for suppliers.

Finally, maintenance and logistics remain problematic. Turbines are often located in remote inland regions or offshore waters, where replacing defective fasteners is difficult and costly. This underscores the need for products that minimize replacement cycles and extend service life.

Key barriers include:

• Cost pressures from raw material fluctuations.

• Lack of uniform standards and certification among smaller suppliers.

• Harsh operating environments that complicate installation and maintenance.

Despite these barriers, the market holds strong opportunities for players that innovate and align with evolving industry needs. The most promising areas are linked to offshore wind expansion, the growing size of turbines, and the global trend toward higher engineering standards.

Chinese manufacturers, already experienced in producing industrial fasteners at scale, can capture premium value by focusing on specialization rather than volume. By developing advanced coatings, larger-diameter bolts, and even smart monitoring solutions, they can establish leadership not only domestically but also globally.

Segment Opportunity

High-strength bolts & studs Required for oversized turbines, fatigueresistant and certified.

Offshore applications Rising demand for marine-grade fasteners with advanced anti-corrosion coatings.

Coating technologies Development of zinc-aluminum, ceramic, or polymer coatings to extend lifespan.

Export channels Aligning with ISO/IEC standards to supply international wind projects.

Smart fasteners Sensor-enabled fasteners to monitor stress and loosening in real time.

The outlook for wind power fasteners in China is highly positive, but success will depend on moving beyond commodity production. The opportunity lies in engineering excellence, certification, and integration into global supply chains.

Strategic recommendations for market players include:

• Shift up the value chain: Focus on high-performance products for utility-scale and offshore turbines rather than generic fasteners.

• Invest in R&D: Explore new alloys, advanced coatings, and even smart monitoring systems to meet evolving demands.

• Prioritize certification: Compliance with ISO, DIN, and IEC standards will open both domestic mega-projects and export opportunities.

• Build partnerships: Collaborate closely with turbine OEMs and EPC contractors to secure long-term supply agreements.

China’s ambition in renewable energy ensures that demand for wind fasteners will grow steadily through the next decade. For suppliers willing to innovate, specialize, and internationalize, the sector represents one of the most dynamic and profitable opportunities in the industrial fastener industry today.

References

• DataIntelo (2024). Global Wind Power Fastener Market Report.

• Credence Research (2024). China Industrial Fasteners Market Report.

• Global Wind Energy Council (2025). Wind Turbine Suppliers Deliver Record Volume.

• China Energy Administration (2024). National Power Capacity Statistics.

• JNZCSB (2025). Outlook of the Power Generation Fasteners Market.

垚林創新設計 成就自動加料機品質標竿

Amid the global wave of industrial automation, Dongguan Yaolin

Machinery has emerged as a highly regarded expert in machinery manufacturing for the hardware and fastener industry through continuous innovation and standardized processes. From its founding, Yaolin recognized that existing auto-feeding machines on the market were generally simple in structure, inefficient, and spaceconsuming. Therefore, the company invested heavily in R&D to optimize these machines, creating standardized specifications and outstanding performance. Its design philosophy has become an industry benchmark followed by many to improve quality.

The company operates a 1,500-square-meter factory on a 3,000-square-meter site, integrating design, R&D, production, and sales. Its main products include three types: auto-feeding and packaging machines, vision sorting machines, and factory automation feeding lines. These products not only greatly enhance clients' production efficiency and product quality but also effectively optimize processes to save costs and improve the cleanliness and aesthetics of manufacturing space, offering clients a full-range upgrade experience.

Among the company’s flagship products, auto-feeding machines and packaging machines stand out as indispensable production tools in the fastener and hardware processing industries. Yaolin’s vision sorting machines, leveraging advanced optical technology, have received high industry acclaim, helping users achieve highprecision sorting, reduce defect rates, and maintain excellent final product quality.

In terms of R&D investment, the company has spent over 10 years developing a standardized platform, laying the foundation for large-scale production and support services. Compared with other machinery manufacturers who can produce only three to five units, Yaolin can deliver between 200 to 500 machines, offering mature, customizable solutions tailored to various working conditions to ensure clients receive the most suitable automated systems. Yaolin’s machines are maintenance-free with low failure rates, and all parts are standardized for fast supply and interchangeability, effectively reducing costs. The company also provides thoughtful after-sales service with a lifetime product warranty, ensuring a worry-free user experience.

Yaolin’s clients are widely distributed, with products marketed globally. The company has achieved great success in Southeast Asia and Japan and is actively expanding into the Turkish market. Its main service sectors include fasteners, roller bearings, motor cores, and capacitors. Moving forward, Yaolin will continue to expand production capacity and sales scale, actively exploring global markets and partnerships. The entire team is committed to becoming clients’ most trusted productivity partner, supporting continuous growth and innovation. Yaolin sincerely looks forward to collaborating with more industry leaders to jointly create a bright future of smart automated manufacturing.

Wuxi Wuda Machinery Technology focuses on advanced thread technology and innovative product R&D, striving to elevate thread inspection capabilities to top international standards. They not only break through the limitations of conventional steel threaded inserts but also develop special wires and elastic threaded fasteners. By combining self-designed fastening structures, they effectively enhance tensile strength, high and low-temperature resistance, and corrosion resistance, while also addressing anti-loosening and rapid installation.

Wuda’s plant covers 7,500 square meters, with a building area of 5,000 square meters, equipped with nearly 120 advanced production machines. They produce 500 million threaded parts and inserts annually, widely supplying lightweight new energy, military, aerospace, and automation industries. They mainly export to Singapore, the U.S., and Norway, actively expanding its international sales network.

They have strong independent R&D capabilities, designing high-speed coiling machines, wire drawing machines, and dies, while applying digital technology to strictly control raw material supply, rough threading and fine threading quality. Through environmentally friendly cleaning, optical CCD sorting, and digital coating processes, they produce outstanding quality comparable to imported products, while also meeting clients’ customization requirements.

Looking ahead, they adhere to the "5S" management philosophy, aiming to become the best enterprise in the hearts of clients, suppliers, shareholders, employees, and society. Not only leveraging expertise, specialization, uniqueness, and excellence in technology to continuously promote the upgrade of the threaded insert industry, they also hope to create value growth for every trusting clients through innovation and integrity, becoming an irreplaceable leader in the industry. Wuxi Wuda is shaping a new quality for fasteners with professionalism and innovation, leading China’s thread technology into a new golden age!

Wuxi Wuda Machinery Technology’s contact: Jenny Chen Email: jennychen@5shardware.com

Copyright owned by Fastener World / Article by Dean Tseng

With 24 years of experience and a global perspective, Shanghai Malaxy Industry expands into emerging markets for China’s fastener export opportunity and succeeds with its "pain point resolution + value co-creation + leveraging universal advantages" strategy. Founding its first plant in 2001 in Haiyan, it started with fastener surface treatment chemicals for upstream technical support. Its 2nd factory in 2006 tapped into full-line stamping parts and screws, integrating supply with manufacturing. In 2021, Malaxy as its window for global export was established by merging the two factories’ capacity and technology, supplying quality fasteners utilizing manufacturing, export, and service.

Products include self-tapping/drilling screws, wood screws, machine screws, and stamped parts, offering DIY customized packaging, materials, and printing to satisfy constructors, distributors and marts. The 8,000 sqm facility completed with cold heading, drill point, thread rolling, auto-packaging, 300-ton stamping machines and lathes ensures products meet top standards through the quality inspection unit and lab.

Taking most orders from Germany, UK and Australia and exporting to Europe and Latin America, Malaxy sees potential in emerging markets and locks on Russia and Latin America. In Russia, it resolves payment and settlement issues through compliant payment processes and leverages CE-certified products with consistent quality, boosting customer confidence. In Latin America, it leverages local experience to ensure smooth customs clearance and reduces sea freight by 15-20% through container consolidation and booking strategies. With stable

Shanghai Malaxy Industry’s contact: Max Ho, General Manager Email: ok@malaxygroup.com

production, customization, DIY packaging, and responsive delivery (standard parts shipment in 3-5 days, custom parts in 5-14 days, urgent orders responded in 24 hours), it provides cost-effective, flexible solutions strengthening market position.

Malaxy strives for over 3.0% annual sales growth in emerging markets and enhances local language support to gain 20% response speed. It plans 4 additional auto-packaging lines and laser sorting machines to improve capacity and quality inspection, shortening lead times. Malaxy seeks working with more partners, ushering in a new golden age for the fastener industry.

China's aerospace sector has expanded rapidly, fuelling demand for highperformance fasteners. And fasteners in this sector must withstand immense stresses, temperature extremes, and vibrations to secure critical parts of aircraft, spacecraft, and military systems.

Globally, the aerospace fastener market was valued at approximately USD 6 to 7 billion in 2024, with projections to reach USD 10 to 12 billion by 2030. China’s domestic aerospace fastener market currently represents over 8% of the global market, translating to more than USD 530 million in 2024. Looking ahead, industry reports anticipate China’s market size exceeding USD 3 billion by 2030, reflecting a robust CAGR of over 8%.

Domestic Aerospace Expansion, such as China’s aerospace industry encompassing commercial (e.g., COMAC C919), military (J-20, J-31), and space exploration endeavours, is on an aggressive growth trajectory.

- Order Backlog & Ambitions

As of 2024, the COMAC C919 had an order book of 1,000 units, valued at roughly USD 100 billion COMAC aims to capture 20% of the global narrowbody market and 33% of the domestic Chinese market by 2035, projecting 2,000 sales of the C919 by 2037.

Boeing is forecasting that China will need 8,560 new commercial airplanes through 2042 , driven by economic growth well above the global average and increasing demand for domestic air travel. China's commercial airliner fleet will more than double to nearly 9,600 jets over the next 20 years, according to Boeing's Commercial Market Outlook (CMO), the company's long-term forecast of demand for commercial airplanes and related services.

- J-20 Production & Future Projection

Production has ramped significantly since inception. Estimates show:

• End of 2023: over 200 J-20s produced, with more than 70 added between mid-2023 and mid-2024. Mid-2024 estimates range between 195 aircraft in service up to 250 produced, with an annual output rate of about 100 aircraft/year. A conservative projection suggests up to 800 J-20s by 2030.

• Additional expert commentary notes the J-20 production is running at ~100 aircraft per year.

• Space Technology Market: China’s space technology market was valued at USD 53.8 million in 2024, with forecasts projecting growth to USD 95.4 million by 2030— a CAGR of ~10.6%.

• China contributes approximately 11.5% of the global space technology market and is expected to lead the Asia-Pacific region in revenue terms by 2030.

• Commercial Space (Low-Altitude Economy & Satellites)

The broader “low-altitude economy,” including drone operations and emerging commercial airspace services, is expected to grow fivefold to RMB 3.5 trillion (approx. USD 490 billion) by 2035.

• The commercial space sector is projected to reach RMB 2.8 trillion (US$389 billion) by 2025, driven by satellite constellations, reusable launch tech, and deep-space investments.

- Space Situational Awareness

The market for satellite tracking, space object detection, and related services in China was estimated at USD 45.16 million in 2023, and is projected to grow to USD 386.56 million by 2035, reflecting a robust CAGR of ~20.8%.

- Satellite Infrastructure (Mega-constellations)

China is planning a massive satellite initiative— launching 648 satellites by end-2025 as part of a 1,296-satellite first construction phase, leading up to a total constellation size of 15,000+ satellites.

- Civil Space Achievements

Under CNSA oversight, China’s space program has achieved milestones such as:

o Landing on the far side of the Moon (Chang'e 4),

o Lunar sample return missions (Chang'e 5 & 6),

o Successful Mars rover operation (Tianwen-1),

o Ongoing asteroid exploration (Tianwen-2)

(a) Technical Gaps: Despite rapid growth, many Chinese fastener manufacturers still operate with early-generation designs using basic materials like carbon structural steel. High-end applications—such as in nuclear power, automotive, and aerospace—require advanced, high-strength, fatigue-resistant fasteners, where domestic R&D needs enhancement.

(b) Competitive Pressure & Supply Chain Vulnerabilities: The market features intense competition from both local and global players. Profitability is squeezed amid raw material price volatility and geopolitical uncertainties that can disrupt supply chains.

(c) Import Dependence for Advanced Materials: Cutting-edge aerospace applications often still depend on imported materials or components. Ensuring quality while developing local substitutes remains a growing but challenging objective.

In the Chinese aerospace fastener market, innovation is increasingly shaped by the adoption of advanced materials, smarter manufacturing processes, and environmentally compliant surface treatments. One of the most prominent shifts is the growing use of titanium alloys, high-performance superalloys such as MP35N , and composite materials. These advanced materials not only contribute to significant weight reduction but also enhance strength and thermal stability—key requirements in both commercial and military aerospace applications (Global Market Insights Inc.; Mordor Intelligence; Credence Research Inc.). Their integration into China’s production ecosystem reflects the country’s determination to align its fastener industry with international performance benchmarks.

Alongside material innovation, automation and digitalization are transforming Chinese production lines. Modern manufacturing methods now incorporate robotics, real-time traceability systems, and advanced digital monitoring. These technologies are vital in ensuring the precision, reliability, and safety demanded by aerospace regulations, and they also improve productivity and quality control across local manufacturers. As China ramps up aircraft production and invests in high-end aerospace programs, these digital innovations are becoming critical enablers of competitiveness.

Another area of technological progress is coatings and process innovation. Globally, aerospace manufacturers are moving away from traditional cadmium plating due to environmental and health concerns, favoring alternatives such as zinc-nickel coatings. This trend has direct implications for Chinese producers, who are increasingly adopting environmentally compliant processes to meet both domestic regulatory changes and international export requirements. By embracing

these new coating technologies, Chinese aerospace fastener companies not only address sustainability concerns but also strengthen their position in the global supply chain.

China’s aerospace fastener market is poised for strong expansion through 2030 and beyond, with projections indicating growth from approximately USD 480 million in 2023 to over USD 3 billion by the end of the decade (P Market Research; Fastener World). This trajectory is being fueled by rapid advances in the domestic aerospace sector, robust policy support, and the increasing potential for exports. The coming years will be defined by several transformative forces. High-performance materials are expected to gradually replace legacy designs, ensuring that Chinese fasteners meet the stringent demands of modern aviation. At the same time, advanced manufacturing—particularly the widespread adoption of automation and digitalization—will be critical for scaling production to global standards. Strategic global integration, including supply-chain diversification and international partnerships, will further strengthen the competitiveness of local producers. Equally important, regulatory convergence with international aerospace norms will prepare Chinese fastener manufacturers to compete on the global stage.

Taken together, these dynamics underscore that the Chinese aerospace fastener industry stands at an inflection point. With government backing, a rapidly growing aerospace ecosystem, and rising emphasis on quality and innovation, the sector is transitioning from a peripheral role to becoming a major global contributor. Although technical and competitive challenges remain, the projected CAGR of over 8% and a market valuation surpassing USD 3 billion by 2030 highlight a path of significant momentum. The ability to innovate in materials, manufacturing processes, and international alignment will ultimately define the next generation of China’s aerospace fastener industry.

References:

1 https://table.media/en/china/newsen/airlines-order-one-hundredc919-from-comac

2 https://boeing.mediaroom. com/2023-09-19-Boeing-Fastgrowing-China-domestic-airtravel-driving-20-year-demand-for8,560-airplanes

3 https://www.grandviewresearch. com/horizon/outlook/spacetechnology-market/china?utm_ source=chatgpt.com

4 https://en.antaranews.com/ news/308787/commercialaerospace-the-next-launchpadfor-the-chinese-economy?utm_ source=chatgpt.com

Recently, China's National Development and Reform Commission (NDRC) consecutively held two important meetings, clearly listing "comprehensively transforming to promote green and low-carbon development through dual carbon emission control" as a key task for the second half of the year and the "15th FiveYear Plan" period. The "dual carbon" (carbon peak and carbon neutrality) related work has been further strengthened, reflecting a major transformation in China's energy governance. The key point is that these meetings mark China's shift from past "energy consumption constraints" to "carbon emission constraints. " Simply put, in the past, enterprises focused mainly on how much energy they consumed; now the focus is on how much carbon dioxide they emit. This is not a small change but a historic turning point. Previously, controlling only energy consumption may have restricted some new energy industries because some new energy projects might have high initial energy consumption but very low carbon emissions. Now, by shifting to carbon emission constraints, green and low-carbon development will be promoted more scientifically, ensuring economic growth and actualizing environmental goals.

Starting September 1, companies must first "calculate their carbon emissions" before project approval, because a veto is no joke. The core of this policy change lies in the officially implemented "Measures for Energy Conservation Review and Carbon Emission Evaluation of Fixed Asset Investment Projects" from September 1. Despite its lengthy name, its contents are closely related to enterprises, mainly reflected in three aspects.

First, a major system adjustment. For all fixed asset investment projects, a "control report on energy and carbon" incorporating carbon emission evaluation into the full lifecycle management of the project must now be simultaneously submitted. This means that enterprises must "calculate their carbon emissions" clearly from the start of project establishment, with fossil energy consumption and carbon emission intensity being key review points. If the carbon emission is unclear or does not meet standards, the project may be "vetoed outright." Previously, companies might have focused mainly on whether a project was profitable or technically feasible; now whether the carbon emissions meet standards is an additional criterion. This requires companies to consider environmental factors from the outset and control carbon emissions at the source.

Second, goal upgrade. According to the Chinese State Council's plan, by 2025, a solid validating foundation must be built; during the "15th Five-Year Plan" period, a dual control mechanism focused on emission intensity control supplemented by total emission volume control will be implemented. After reaching carbon peak, the focus will shift to the management prioritizing total volume. This design is quite reasonable—it accommodates current economic development needs and leaves buffer space to achieve carbon peak before 2030. For example, like personal weight loss, one might first focus on body fat percentage (intensity), and after stabilizing physical condition, shift to controlling total body weight (total volume). Enterprises will similarly first gradually adjust carbon emission intensity, then progressively control total volume, easing pressure so it does not overwhelm them suddenly.

Third, technology empowerment. The "Measures" require establishing a carbon emission monitoring network covering national, local and enterprise levels, using high technologies such as satellite remote sensing and blockchain for real-time data tracking. This is like equipping carbon emissions with "telephoto lens" and "recorders," making data falsification much harder. Enterprises' carbon emission status can be accurately monitored, which also pressures companies to earnestly work on emission reductions. China's domestic carbon market is soaring in activity, with the price of carbon emission allowances nearly doubling, increasing companies' incentives to reduce emissions.

With the advancement of the "dual carbon" policy, China’s domestic carbon market has become increasingly mature. In 2021, the average price of carbon emission

allowances was 46.60 RMB per ton; by 2024, it had risen to 91.82 RMB per ton, nearly doubling. What does this mean? Carbon allowances are becoming more valuable.

Driven by national policies, China’s carbon market mechanisms have improved steadily, and the implementation of carbon indicators has given real value to carbon allowances. Previously, companies might have seen emission reductions as an extra burden; now it’s different. Carbon allowances that are saved through emission reductions can be sold, greatly boosting enterprises’ motivation to cut emissions.

For example, if a company reduces its carbon emissions through technological upgrades, the saved carbon allowances can be sold to companies exceeding their emission limits. This is a win-win: making money while contributing to environmental protection. The carbon market acts like an invisible hand, using market mechanisms to drive companies to voluntarily reduce emissions—more effective than mere administrative orders. The rising carbon price also shows growing market confidence in the “dual carbon” goals. Everyone recognizes emission reductions are a major trend, and demand for carbon allowances will increase, naturally pushing prices up. This further encourages more companies to join the emission reduction effort, creating a virtuous cycle.

The fastener industry is entering a positive phase. Fastener companies should pay attention to equipment manufacturers in the chemical sector and those involved with clean carbon reduction and environmental recycling equipment, which will embrace good opportunities.

First is biomass fuel and biodieselrelated equipment. With policy promotion, domestic demand for these clean energy sources will definitely rise. Equipment companies with substantial technological accumulation in biomass energy will see considerable potential for fastener demand as the market grows, expected to develop further benefits under the policy.

Second are companies in the recycling sector. With high engineering and technical content and strong technical capabilities, they provide robust technical support for the industry. As leaders in recycling plastics equipment, they hold significant advantages in resource circular utilization, aligning well with the trend of green development. While policies are favorable, market risks should not be ignored. Although the “dual carbon” policy brings many opportunities to fastener companies, some risks also require attention.

First, the intensity of policy implementation may fall short of expectations. No matter how good the policy is, it is ineffective if not properly implemented. If local governments dilute enforcement or companies respond passively, emission reduction targets may be difficult to achieve, affecting the development of the fastener industry and companies.

Second, the effectiveness of policy implementation may be less than expected. Even if policies are pushed hard enough, actual effects may fall short. For example, monitoring technology failures could lead to inaccurate data, or costly emission reduction measures might disrupt normal corporate operations, all reducing policy effectiveness.

Third, risks from supply and demand changes. As the carbon market develops, supply and demand dynamics for carbon allowances may fluctuate. Oversupply could lower prices, weakening companies’ motivation to reduce emissions; sudden demand surges could cause price spikes, imposing extra burdens on some companies. Additionally, supply-demand changes in biomass fuels, recycled plastics, and related products will also impact the performance of relevant fastener companies.