Deer industry on path to better things

FONTERRA has produced sizzling third-quarter financial results while keeping farmgate milk price expectations on the simmer for this season and the next.

Farmer-shareholders and unit investors will be counting their cash dividends to come – 60c a share capital repayment in August and perhaps another 40c after the end-of-year financials are announced in September.

But farmers will be nervous about the current downward trend in milk prices, given the uphill gallop of input costs and interest repayments.

The new season will begin in one week with an $8/kg midpoint forecast, down 20c from the old season and down $1.30 from 2021-22.

On the plus side, Fonterra has increased by 30c the new Advance Payment Rates, which will begin at

$6 for the first seven months of the season.

This will be 75% of the mid-point of the forecast range, compared with 60-65% historically.

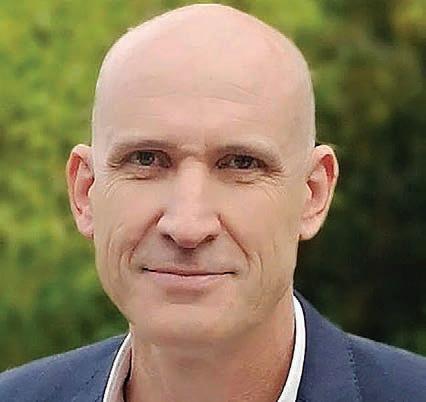

CEO Miles Hurrell said the strength of Fonterra’s balance sheet enables it to get more cash to farmers earlier, to help with the rising tide of costs.

The balance sheet is in a very strong position, incorporating the proceeds from the sale of Soprole, enabling the capital return of $800 million to be brought forward to August.

Regarding the market outlook, Hurrell said the new milk price forecast reflects gradually rising demand for whole milk powder in China as its economy continues to recover from covid.

“However, the timing and extent of this remains uncertain, with China’s in-market whole milk powder stocks estimated to be above normal levels following increased domestic production.

Continued page 3

Dogs wait patiently on the back of a vehicle at the New Zealand Sheep Dog Trial Championships at Warepa, near Balclutha. Look out for a wrap of the event in next week’s edition.

Geraldine High School students, from left, Matthew O’Connor, Quinn Foley-Smith and Aidan Christie, were part of a Fencing Contractors Association project at Ōtāne in Hawke’s Bay, working to make a dent in the re-fencing of farms hit by Cyclone Gabrielle. The students are part of the Primary Industry Academy.

PEOPLE 7

An AgriHQ initiative aimed at attracting young people to the primary sector will launch next month.

NEWS 9

Mānuka honey producers will stand together and battle on, they say after bruising trademark loss.

MARKETS 10

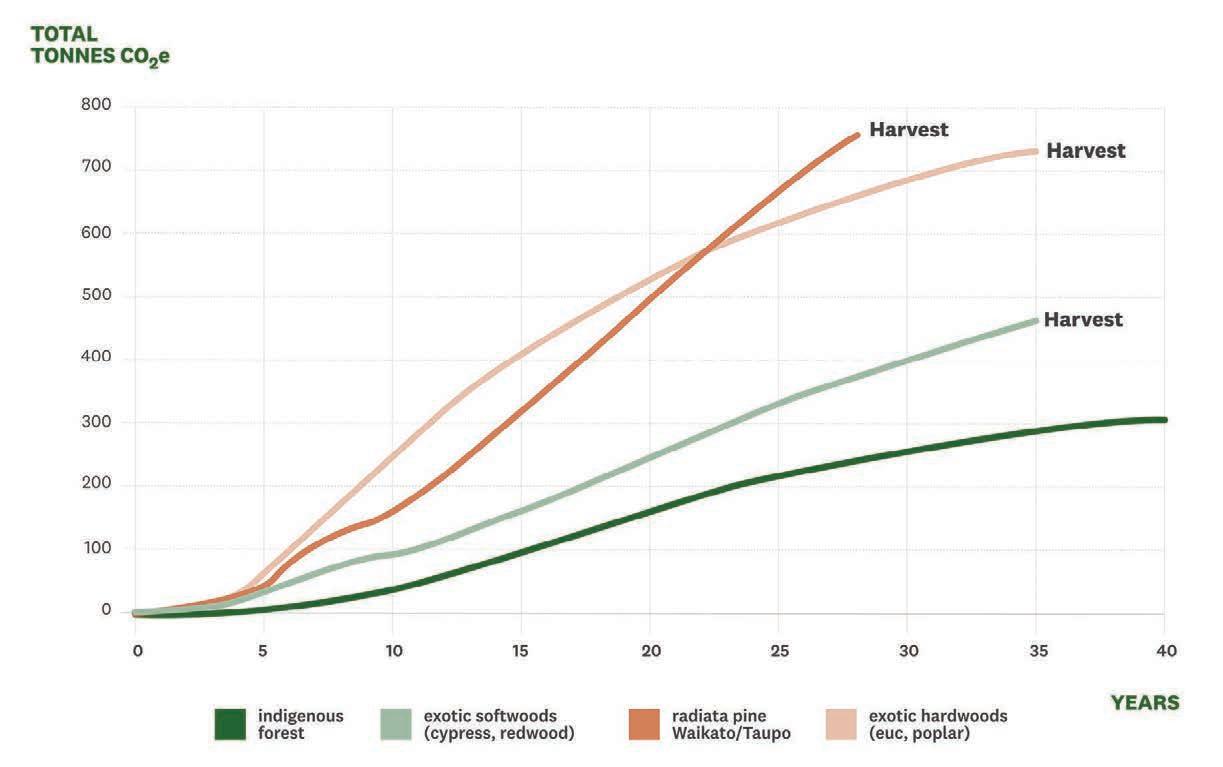

Farmers Weekly unpacks the carbon sequestration implications of various on-farm tree scenarios.

TECHNOLOGY 18

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469

Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor

claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 09 432 8594

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS

0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by Stuff Ltd

Delivered by Reach Media Ltd

Andy Whitson | 027 626 2269 Sales & Marketing Manager andy.whitson@agrihq.co.nz

Steve McLaren | 027 205 1456 Auckland/Northland Partnership Manager steve.mclaren@agrihq.co.nz

Jody Anderson | 027 474 6094 Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095 Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Omid Rafyee | 027 474 6091 South Island Partnership Manager omid.rafyee@agrihq.co.nz

Debbie Brown | 06 323 0765 Marketplace Partnership Manager classifieds@agrihq.co.nz

Grant Marshall | 027 887 5568 Real Estate Partnership Manager realestate@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

The New Zealand Food Safety Authority has banned the sale of two commonly used animal boluses and announced a full investigation into all anthelmintic slowrelease ruminal boluses.

Bionic Plus and Bionic Plus Hogget are banned, and all 13 boluses registered for use in sheep and three for cattle will be reassessed, after an incident last year when sub-therapeutic levels of the boluses’ active ingredients were being released.

Strong demand across the board for fish species has produced improved net profits for listed fisheries company Sanford for the six months ended March 31.

Net profit after tax has risen from $6.1 million in 2022 to $11.1m this year and adjusted earnings before tax rose 38.7% to $26.6m. Revenue was up 2.5% to $277m and Sanford reported that its salmon division had a particularly strong 45% lift in profitability.

Auckland’s Nic Kearney has been crowned the 2023 Beef + Lamb Young Ambassador Chef.

Kearney, Jacob Aomarere-Poole from Feilding and Max Loh of Wellington contested the final. Kearney emerged the victor with his two dishes, Stuffed Lamb Saddle with Kawakawa, Parsnip and Lamb Neck Beignet, and Steak and Mushroom Pie with Sirloin and Bone Marrow Butter.

New Zealand reported a seasonally adjusted trade deficit of $1.4 billion in April as imports continue to outstrip exports. Imports were $7.7bn, down 1.1% compared with March, while exports were $6.3bn, up 8%. In the year ended April, the annual trade deficit was $16.8bn, far larger than it has been for the year ended April in the past decade.

results from consumer products are encouraging and recovery is underway.

FONTERRA’S profit after tax in the nine months to April 30 was up 180% to $1.326 billion as returns from protein products greatly outstripped those from milk powders and fats.

Earnings per share were 81c and, when normalised for the net gain from divestments, were 65c, up from 28c.

These are extraordinary numbers in Fonterra’s two decades and may not last as price relativities come back into balance between reference and non-reference products, CEO Miles Hurrell said.

The earnings contributions from ingredients were up 100% and from foodservice businesses were up 130%, although consumer products fell.

That included impairments on Asian brands and Fonterra Brands domestically, announced in the half-year results.

Hurrell said the third-quarter

Reflecting a nearly US$2000/ tonne premium for cheese over reference products, the earnings guidance for FY2023 has been increased from 55c-75c to 65c-80c.

“This is due to strong performance in our ingredients channel, with continued higher margins in our cheese and protein portfolio, particularly casein and caseinate,” Hurrell said.

The 15c range in the guidance is to leave room for valuations and end-of-year inventories, he said.

“Our products made and sold are baked in but there is still a lot to do in the fourth quarter before the new season’s milk begins to flow.”

In the nine months of FY2023, revenue was up 16% to $19.7bn, gross margin up from 14% to 18% and normalised operating expenses up 23% to $2bn.

“Operating expenses are up in part due to the impact of impairments reported in our FY23 interim results in March, as well

as ongoing inflationary pressures,” Hurrell said.

Return on capital has shown an extraordinary leap from 5.7% to 11.7%.

Fonterra’s dividend policy is to pay 40-60% of the normalised net profit, which would indicate a dividend of 40c for the full year at the upper end of the range. An interim dividend of 10c

Continued from page 1

“This is reflected in our wide opening forecast range for the season.”

Coming up on five years as CEO, Hurrell has delivered on the big measurable financial targets set in Fonterra’s change of strategy following financial losses in 2018-19.

The targets were an average farmgate milk price between $6.50 and $7.50; return on capital 9% to 10%, debt gearing down to 33%, dividends of 40-45c a share and 50% increase in operating profit.

He expressed personal satisfaction that most of the goals have been met and said a renewed strategy will be published later this year.

“But the price relativities

has already been paid.

Fonterra Co-operative supply shares are trading on the stock exchange at $3, up 50c from March and up 10c immediately after the very good third-quarter results.

Fonterra Shareholders Fund investment units are at $3.65, up from $3 in March and 20c on the day the Q3 results were announced.

between protein products and milk powders are a great help and we would assume those will even themselves out.”

Fonterra is well aware that farm costs are up considerably and that an $8 milk price in some cases may be below break-even, Hurrell said.

But “fertiliser prices are coming off their highs and maybe the OCR [official cash rate] has reached a peak, according to the Reserve Bank governor”.

Milk collection to the end of April was 1405 million kg milksolids, only a whisker below the tally for the same period in the previous season.

April itself saw a 7% increase, month on month, according to figures from the Dairy Companies Association of New Zealand.

INVESTMENT:

Fonterra has contributed $1.8 million towards a start-up producer of a slow-release, biodegradable, methaneinhibiting bolus.

Fonterra announced a $1.8 million investment in start-up Ruminant Biotech, through the Centre for Climate Action Joint Venture.

This is aimed at potent inhibitors for delivery from intra-ruminal capsules that could be used by New Zealand farmers to reduce methane emissions from their grazing ruminant livestock.

Hurrell paid tribute to farmers in many parts of the country where storm impacts, drought and excessive rainfall played havoc.

Fertiliser prices are coming off their highs and maybe the OCR has reached a peak, according to the Reserve Bank governor.

“Overall milk production has been okay, but we shouldn’t lose sight of the fact that it has been tough on groups of farmers,” he said.

have to find the balance between trade and protection.

IF ARABLE wants a future it has to stand up and be counted, industry leader Alison Stewart has told the Women in Seed forum in Christchurch.

“Growers and industry need to stop being under the radar, those days are gone,” the chief executive of the Foundation for Arable Research (FAR) told the 150 people in attendance.

“If you want recognition and reward, verify it, stand up and be counted, tell your story, get out there and promote what you are doing.”

As a research body FAR can only do so much.

“We can’t dictate to our growers; all we can do is research and provide the resources.

“It’s not our job to enforce them, we don’t have the levers for that like the meat and the milk companies.”

Touching on the sector’s biosecurity issues, Stewart pulled no punches.

“Biosecurity has the potential to derail the industry overnight, and imported seed is the main pathway for biosecurity incursions.

“Every day counts when in an incursion. The risk is huge if you don’t act soon enough and hold government officials to account to get decisions. The wait could cost the industry $300 million.”

Imported seed is the challenge.

“We want to have the seed coming in because we want to build our seed industry but the opportunities in doing that increase the biosecurity risk so we

“The seed companies need to step up. There’s a lot we can do to better manage those imported pathways.”

Aiming to better drive industry innovation, FAR has established Cultivate Ventures to support arable-focused agri-tech and agri-food companies in delivering benefit to the sector that can be used by growers to improve their profitability.

“This is an investment fund to create disruptive technologies to move our industry forward.

“We have got to do something different, take risks and open opportunities, we need to bring something to the table including a more robust biosecurity framework.”

FAR can give clear guidance but it can only facilitate going forward.

“Growers and industry need to get out from under the radar to get the recognition and reward.”

Fuelled by her passion for global macro trends and their impact on New Zealand’s prosperity, NZX head of insight Julia Jones told the forum it’s time to rediscover ambition.

“We used to have great ambition, now we are whingers.

“We have lost ability to give the sense of hope for future generations to inspire confidence in change.

“You can’t slow change, it’s societal, it’s bigger than us. The more you fight change the more you wear down.

“We need to listen to what the world is telling us.”

It is about adapting, growing things in the right place using the land in the best way.

“We need to focus on what we can control, support farmers to manage the micro needs of their business.”

NZ isn’t going to feed the world; it wasn’t set up for that.

“But we need them to buy our product.

“Create the narrative, [don’t] be assigned one. Navigate and adapt change, convince those who have not lived it through before that we can do it, we have done it and we can do it again.

“Hardship, yes at times, but don’t flip-flop that into non-reality.

“Negativity is not leading. Lead by navigating reality and positivity.

“There will be things you hate because you can’t change them but have the wisdom to know the difference to have the conversations to make change positively.

“The [primary] sector has a great deal of hope and massively cool future.

“Find the passion, find the ambition,” Jones said.

Looking to the longer term, ANZ agricultural economist Susan Kilsby said New Zealand leaves a lot of value on the table in terms of what it produces.

Global resources for food production are tightening and consumers are seeking the

sustainability attributes that NZ is well placed to deliver.

“Information about how we produce food and fibre in NZ must be passed thorough the supply chain to consumers so we can deliver sustainable returns to our producers.”

To achieve this, farmgate prices will differ between producers and a larger proportion of supply will be contracted.

More fixed prices for income and costs will be achieved through forward contracts and use of derivative products.

“Going forward we will see big change in farmgate prices depending on what we are producing on farm to meet contract and market specifications. “Regulatory change is happening at pace and we have to move forward to meet consumer expectation,” Kilsby said.

The sector has a great deal of hope and massively cool future. Find the passion, find the ambition.Julia Jones NZX

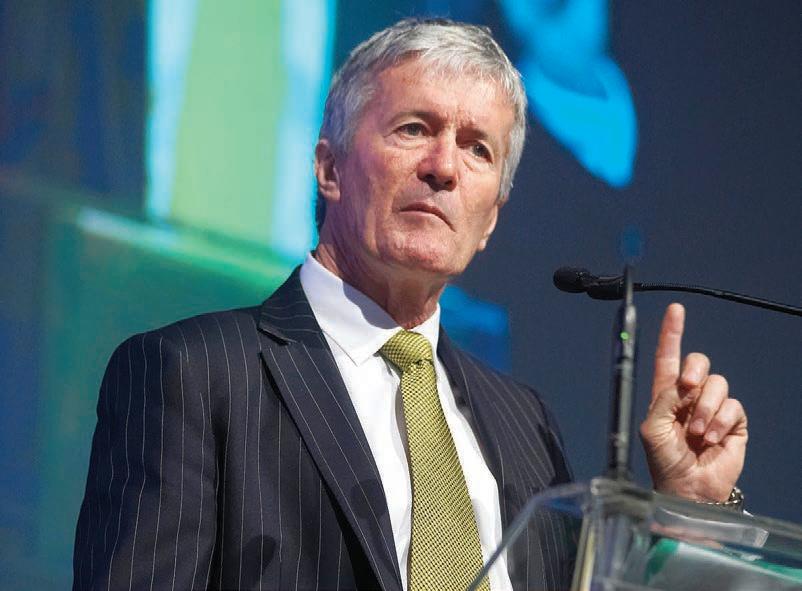

WHILE New Zealand is not yet out of the woods, the Mycoplasma bovis eradication programme has reached its halfway mark meeting expectations. But now, as the programme enters the critical phase of hunting down the last case of infection the country will need to keep a finger on the pulse, Biosecurity and Agriculture Minister Damien O’Connor said. In May 2018, the government announced NZ would work to eradicate M bovis in partnership with DairyNZ and Beef + Lamb NZ. The 10-year programme is jointly funded by the government, 68%, and DairyNZ and BLNZ, 32%.

“We are on track. We are down to one infected property. We expect that to be cleared in a couple of weeks. We have been down to zero and we will get back to that but it will take everyone to keep the finger on the pulse,” O’Connor said.

“The expectation is that the next five years, even less, we will be able to say we are [M bovis] disease free.

“But nothing is guaranteed until we get through the next five years.”

O’Connor acknowledged there had been some “horrific scenarios” for many individual farmers because of uncertainty in the early stages.

“A lot of lessons have been learnt. At the beginning we were in catch-up. A lot of improvements have been made right across the board. The focus now is to keep

ahead and ensure there is no lapse of practice creeping in.

“We must keep on top of it now, not sit back and take anything for granted.”

The programme is nearing the end of its delimiting stage before moving into stage two, provisional proof of absence – the holding pattern.

“This is when we can’t find any more [infection] but we are still doing the monitoring through the bulk milk tank [BTM] testing and ongoing background surveillance.”

The national surveillance programme, including the beef surveillance programme and the BTM testing, have provided confidence that M bovis is no longer widespread in NZ.

The surveillance programme has played a significant role in finding pockets of infection outside the

Scheme by default if no alternative mechanism is agreed to means there is an urgent need to finalise a pricing structure.

known network. The budget for the 10-year programme was $870 million.

From July 1 2018 to March 31 2023, $641m, 71.4% of the estimated total cost, was spent on eradication.

“There will be ongoing costs but they will taper off and I think we can come in under that $870m figure.”

O’Connor is quietly confident the programme’s goal will be reached, possibly even before the end of the next five years.

“The goal to eradicate has

absolutely been worth it, the impacts of bovis have been worth the effort and I will continue to do what I think is right and that is to make sure at the end of five years we are clear.”

In the programme’s first five years 184,000 cattle off 280 farms were culled, from 210 farms in the South Island and 70 in the North, comprising 149 beef, 68 dairy and 63 others, including lifestyle properties.

A total of $239.7m in compensation from 2879 claims has been paid out.

TIME is running out to finalise a system to price agricultural emissions, Agriculture Minister Damien O’Connor says.

Questions remain about the

He Waka Eke Noa (HWEN) industry agreement on reducing agricultural greenhouse gas emissions, chiefly around the level of pricing, how to recognise the various forms of sequestration and creating a single, internationally recognised emissions calculator for farmers to use.

At present there are 11 calculators.

O’Connor pointed out that legislation putting agriculture into the Emissions Trading

Money raised from pricing agricultural emissions will be invested back into research and development and O’Connor told Farmers Weekly that will include identifying and recognising onfarm sequestration, including the role of soil.

There is a view that New Zealand’s young soils do not have much capacity to absorb carbon, but O’Connor is of the view that sequestering even small amounts of carbon is possible and worthwhile.

“There is clearly potential but in NZ it is more complex, which is why we need a reliable source of money which HWEN is designed to

do, to generate cash for research and development.”

Similarly, the use of plantain, breeding from low-emitting animals and pending technology such as boluses and feed additives will all assist.

“These things all add up to hitting the target of a 10% reduction in methane by 2030.”

O’Connor hopes to announce an update in the next month or two on the development of Freshwater Farm Plans. The release of these plans, which are an alternative to resource consent for farmers who intensively winter-graze stock, has been delayed.

Meantime, the government hopes to know within two weeks how to deliver individual support for cyclone-hit Hawke’s Bay and Tairāwhiti farmers and growers.

8- 9.5%

O’Connor acknowledged there is still much recovery assistance needed following Cyclone Gabrielle, and he is awaiting information from which to build a package of targeted assistance.

“We are preparing a comprehensive recovery package to get growers and farmers back at operational levels,” he said.

That information will come from growers, farmers, banks, insurance companies, councils and central government, and be based on LiDAR laser sensing of the landscape and Hawke’s Bay Regional Council plans.

For growers, O’Connor said, the focus is on those who still have a crop to harvest this season, to ensure their business and the regional economy continue to benefit.

Others are still clearing their orchards and properties and could be a year or two away from resuming production – and some will not recover.

O’Connor said money has been granted to regional councils to assist with silt disposal along with assistance for landowners to remove silt from orchards and farms.

Canterbury to Hawke’s Bay to join 25 contract fencers who spent two days replacing fences destroyed by Cyclone Gabrielle.

Christie was fencing, to the point he has entered competitions and secured a part-time job with local fencing contractor Ben Haugh.

IT WAS a chance for Aidan Christie to put his fencing skills into practice in the most useful way.

The Geraldine High School deputy head boy and two classmates travelled from South

Christie, 17, Quinn Foley-Smith, 17, and Matthew O’Connor, 16, are all studying a Primary Industry Academy course, a high school course linked to the Primary Industry Training Organisation. One course that attracted

It’s the reward of seeing the fruits of a day’s work that he finds attractive.

“It’s rewarding to look back at what you’ve been doing for the day.”

When the call went out from the New Zealand Fencing Contractors Association for fencers to help farmers in Hawke’s Bay, the three raised funds to travel north.

Christie said the damage was devastating.

“It was so sad to see those farms ruined, covered in silt. It must be so hard for them.”

He estimates the students helped replace about 2km of fencing, which they erected under the guidance of some of the country’s leading fencers.

“They gave us lots of advice, how to tidy our work and how to be more efficient.”

Christie’s family runs a sheep and beef farm and he plans to attend Lincoln University next year to study a Diploma of Agriculture and Diploma in Farm Management while continuing to fence as he can.

He credits his school’s Primary Industry Academy with introducing him to farming skills such as fencing.

“Without the course, I would not be where I am today.” He hopes to travel north again in spring when association members plan another trip to help replace damaged fencing.

It was so sad to see those farms ruined, covered in silt. It must be so hard for them.

The season began with sales of exotic bulls and prices and clearances were good for vendors, agents say.

OPAWA Simmental at Albury, South Canterbury, started the bull sale season in the south with a top price of $21,000 for Opawa Kamikaze, sold by the Timperley family.

David Timperley said the purchaser was Rowan Sanford, from Hawke’s Bay.

Opawa put up 23 bulls this year, eight more than last year, and sold them all for an average price of $7300.

Gold Creek Simmental, Mātāwai, East Coast, had a top price of $13,000 and other sales for $11,000 and $11,500.

The Sanson family’s offering was 31 bulls and 29 of those sold at auction for an average price of $7070.

Ruaview Simmental and Angus at Ohakune had a top price of $15,000 for Ruaview Henry 210010 and $8000 for Powerhouse 210019.

The average paid was $5140 for

18 bulls sold out of 31 offered. Kerrah Simmentals, Wairoa, had an excellent sale of 72 bulls out of 73 offered and an average of $8285.

Top price was $18,000 paid for Kerrah K429 and $17,000 was paid for Kerrah K269.

Glenwood Angus, Taieri, had a top sale of $10,000 and two at $9000, among nine sold of 11 offered and an average price of $7666.

At the same time Loch Lomond South Devon sold two at $7800 and $5000.

Puketoi Angus, Central Otago,

What will you do with your cows if it gets really wet this winter?

We’ve worked out our options

The team knows what to do

We’re ready to move

Good wintering is great farming

dairynz.co.nz/wintering

sold 18 out of 19 bulls offered with a top price of $11,500 and two sold at $10,000. The sale average was $7333.

Penvose Angus at Wedderburn had a top price of $16,000 and sold two at $15,000. There was a full clearance of 30 bulls for an excellent average price of $10,800, some $3000 ahead of last year.

Inaugural online vendor Dave Warburton in Hawke’s Bay sold Hollow Top Angus bull DG2111 for $16,000 and another for $4000. He also sold two Waiohine Hereford bulls for $3500 each.

Delmont Angus, at Clinton, sold 28 of 30 bulls offered with a top price of $12,000 and an average price of $7242.

Coleman Farms Charolais at Kaikohe sold 15 out of 16 at auction with a top price of $7250 and an average price of $5150.

Kaimoa South Devon at Eketāhuna sold 15 out of 20 with a top price of $11,500 and an average of $7833.

Beresford Simmental, Owaka, had a top price of $19,000 for Beresford 1205210013, paid by Jon

Continued page 8

TECHNOLOGY Beef

TECHNOLOGY Beef

WINTER grazing of livestock can play an important role on cropping farms, a crowd of 140 farmers were told at a recent Foundation for Arable Research and Beef + Land New Zealand field day.

FAR chair Steven Bierema hosted the event at his Mitcham farm near Rakaia, which is fully cropped in summer and finishes 4000 lambs as well as winter grazing dairy cows.

Bierema, who farms in partnership with his son Pieter Taco Bierema, grows ryegrass, clover, pak choi, garden peas, marrowfat peas, maize, barley and milling and feed wheat.

Pieter said the finishing of lambs is closely linked with ryegrass, with the lambs coming in autumn and the last sold to the meat works in mid-October when the final paddock of ryegrass is closed for seed production.

Lambs are grazed on former clover seed paddocks until the end of May.

Left to regrow after being harvested in February, these

paddocks produce 3000kg of dry matter a hectare and post grazing are sown in milling wheat, utilising the extra nitrogen in the soil from the nitrogen-fixing clover.

The lambs are grazed on greenfeed oats in the winter, which are drilled after either peas or cereal crops while the dairy heifers are winter grazed on kale and some short-rotation Italian ryegrass after peas.

“It sounds complicated, but it isn’t. The cropping and the lambs in winter really complement each other.

“We try to maximise it as much as possible with the farm in full production all year.”

Arable farmers need sheep farmers to breed lambs for them to graze, while sheep farmers need an outlet for store lambs they are not able to finish themselves.

“We need each other,” Pieter said.

Erica Callaghan, one of three other farmers on a panel, said moving to an arable-livestock system presented an opportunity to increase returns and spread cashflow on the family farm at Fairlie.

It sounds complicated, but it isn’t. The cropping and the lambs in winter really complement each other. We try to maximise it as much as possible with the farm in full production all year.

Continued from page 7

Beresford vendor Warren Burgess put up 18 bulls and sold 11, with an average of $7410.

Leafland Simmental, Mosgiel, sold 11 of 22 bulls offered with a top price of $7000 and an average of $5090.

Angus

Lot 2 was Kincardine 21115 and he sold to Matukituki Station, Wānaka for $18,000. Two lots made $16,000 and the sale average was $10,850 for 16 sold out of 18 offered.

“Historically we have done quite a lot of winter grazing but now with livestock integration part of the overall system we are cropping 1800ha with 50% wheat, 30% linseed and the rest in barley, clover, kale or forage.”

Store lambs come in from March to the end of July with 100 R2 calves also part of the livestock component.

“The biggest challenge we have is the environmental regulations, farming under land use consent and now winter grazing,” Callaghan said.

Hamish Marr runs his 500ha operation at Methven as two agronomically separate entities

with 400ha arable growing peas, wheat, red clover, oats, barley and vegetable seeds, and 100ha pastoral carrying replacement dairy heifers stocking 3.5 animals to the hectare on greenfeed cereals, rape and swedes.

“We used to trade lambs. Some years we made money, some years we didn’t.

“Now we have an arrangement with a neighbour for 4000 lambs and that fits in with arable every year.

“It’s a simple thing, grazing

animals, and something the soil biology can convert into the next crop.

“Animals are very low risk. Think of them as another crop – they are not at risk of frost or hail and they certainly don’t roll along the paddock on a windy day, and you can bank on their income every year.

“It’s agronomics versus economics – you can chase the finances all you like but you have got to balance what fits your system,” Marr said.

When Daryl Oldham put in irrigation 10 years ago, he looked at how he could best integrate it into the farming system.

“The breeding ewes didn’t stack up. We did winter grazing cows for five years, then moved to lambs, and we have found they give a lot more flexibility in the cropping system.

“I see the biggest issue going forward, with fewer and fewer breeding ewes around, will be the supply of store lambs,” Oldham said.

Craig Page NEWS Education

Craig Page NEWS Education

ANEW AgriHQ initiative aimed at attracting more young people to agriculture will be launched next month.

AgriHQ’s successful Ag&Ed programme has been revamped and is poised to return to Farmers Weekly, this time in partnership with the Ministry for Primary Industries (MPI).

Starting in June, a double-page Ag&Ed education programme will appear in Farmers Weekly for six weeks.

The pilot programme will culminate in a two-day innovation challenge in Manawatū aimed at Year 11 pupils from throughout New Zealand.

Twenty pupils will be selected to take part in the challenge, which will team them up with industry leaders to develop strategies and models aimed at solving agri-sector challenges.

well. We want to make sure that our youth understand that agriculture is the fabric of every New Zealander.”

Craig said the weekly publication will have modules for students, teachers, parents and children to learn more about agriculture.

“It’s an exciting space to be in and one that will continue to carry New Zealand forward for future generations.”

The Ag&Ed challenge will highlight a current on-farm problem and students will join with industry experts to help create solutions “that our ag sector will listen to and use”.

“Our aim at AgriHq is to create avenues

for our youth to engage in and participate with those in our ag space. We’ll look to run Ag&Ed across the school year and have multiple challenges tied to field days across New Zealand,” said Craig.

The new look Ag&Ed will have the same strong content, with QR codes for students to learn directly from the source.

Students wanting to be involved in the innovation challenge can apply through www.agrihq.co.nz, where they will complete a short application form.

“We have devised a few questions to help us narrow down to the initial 20 students, who we will call and speak with individually.

What we are mainly looking for are students who have a passion for all things agriculture. They are curious, looking to help push the sector forward and are open to being challenged.”

Craig said it is exciting to have MPI on board, and this is an opportunity to showcase the work it does.

“Our partnership is highlighting MPI’s capability across the entire ag sector, and this pilot is focused on PIAS, or Primary Industry Advisory Services. We’re looking to upskill our youth around MPI’s trusted advisor network, showing this as a true career pathway.”

Dave Ag&Ed project manager

Ag&Ed project manager

At the completion of the challenge teams will present their plans to judges in a Dragon’s Den-type scenario.

Ag&Ed project manager Dave Craig said it is hoped the initiative will cement a partnership with MPI and help attract young people into a primary industry advisory career.

“Ag&Ed was devised to complement our agri-business teachers in the great work they do in our schools.

“Our pilot programme, powered by MPI, is focused on showing current agri students that becoming a primary industry advisor is a legitimate and rewarding career after school. Agriculture isn’t just about farms, cows and sheep, as we know too

“ The gains we’ve seen are better reproduction, better six week in-calf rate and less empties.”

Mel Lilley, Mid Canterbury

Our pilot programme, powered by MPI, is focused on showing current agri students that becoming a primary industry adviser is a legitimate and rewarding career after school.

CraigBUZZING: Ag&Ed supports the agriculture curriculum in high schools and this new programme will target those who want to go onto advisory roles in the sector. Richard Rennie NEWS Apiculture

TRANS-Tasman legal wrangle of “extraordinary proportions” over trademark rights has gone against New Zealand mānuka honey producers trying to protect the term “mānuka honey”.

Intellectual Property Office of NZ (IPONZ) assistant commissioner for trademarks Natasha Alley in her ruling noted the scale, complexity and length of the challenge, with Kiwi producers pitted against Australian mānuka producers, who claimed “mānuka honey” was not a distinctive, NZonly trademark.

The trademark commissioner’s ruling agreed, meaning that under the Trade Mark Act 2002 it could not be used as a certification mark in NZ.

The Australian opposition came from producers in the form of the Australian Mānuka Honey Association (AMHA), pushing back against the NZ based Mānuka Honey Appellation Society (MHAS).

Earlier this year NZ producers lodged an appeal to the equivalent office in the United Kingdom. As with the NZ ruling, the UK office found there was a lack of definition in the term.

The lucrative mānuka honey

business valued at almost $300 million a year in 2021 has been fraught with trans-Tasman tension since NZ lodged its first application to protect the brand “mānuka honey” back in 2015.

The commissioner noted it was a challenging task, particularly when distinctiveness between the two sources was minimal, and NZ fell short in establishing the necessary distinctiveness.

The decision has been met with disappointment by the honey sector, which is now mulling over its options, including making an appeal.

“Today’s finding reflects the technicalities and limitations of conventional IP law to protect indigenous rights,” said Pita Tipene, chair of the Mānuka Charitable Trust.

“It is disappointing in so many ways, but our role as kaitiaki (guardians) to protect the mana, mauri, and value of our taonga species, including Mānuka on behalf of all New Zealanders, is not contestable.”

He said the law had proven to be an ass in this instance, with IPONZ limited to the legal criteria laid out in the Act.

The assistant commissioner noted that while tikanga (customary) principals were relevant, they could not override the clear provisions of the Trade Marks Act, with its requirements of distinctiveness.

She noted her “considerable sympathy” for NZ producers because of mānuka honey’s cultural significance. She observed there did not appear to be widespread use of the term in Australia until after NZ’s success took off, and well after the antibacterial properties were discovered in NZ in the 1980s.

“However, by the time MHAS applied for this certification mark in 2015 there was clear use of ‘mānuka honey’ in Australia.”

She noted a late start by

Australia did not mean MHAS should be able to monopolise use of a wholly descriptive term, and savvy marketing by the Australians did not equate to dishonesty on their part.

Jason Prior of Down Under Honey in Cheltenham said the case has proven just how difficult it is to protect terms that have become commonly used.

“It is not because there is no case there, it’s just the law does not work with more generic terms.”

He likened it to trying to protect

the term “Jandals”, well after they had been invented and the phrase had fallen into common use to describe the rubber sandal.

“But what the Australians are doing is like trying to call a leather sandal a Jandal, it’s quite different.”

He believed NZ producers could have a good pathway using Geographical Indication (GI) protection, similar to what the French use to protect Champagne, or the Italians’ Parmigiano Reggiano, and he is keen to see the NZ government work to bring in such a protection system.

Apiculture NZ CEO Karin Kos said the industry will be making a united stand on a decision it wholly disagrees with, but she would not be drawn on whether an appeal would be lodged at this point.

She is also optimistic about the potential role GI may play in protecting NZ mānuka honey, at least within the European Union.

GIs were a key part of the NZEU free trade agreement, where distinctions over certain cheeses’ provenance are made.

The EU FTA includes the definition of mānuka and a separate tariff recognising the distinctiveness of it as a taonga species solely from NZ.

NZ wines are also globally protected under GIs, setting out the regions and production claims that can be made by winemakers.

loan, which requires its borrower to commit to key environmental, social and governance targets.

a further intention of sending zero waste to landfill by 2030,” Trevelyan said.

TAKING his company’s longtime approach to sustainability and attaching it into a financial instrument was a natural next step for Trevelyan’s Pack & Cool managing director James Trevelyan when he signed the family firm on to a sustainabilitylinked loan.

The Te Puke-based packhouse operator is the first post-harvest company in New Zealand to sign on for an ASB sustainability-linked

Borrowing costs are adjusted based on subsequent performance against those targets.

Trevelyan said it was a natural next step for the firm which has been focused on a sustainability pathway for almost a decade. The company has been publishing annual sustainability reports since 2014, covering the same key areas as the loan’s parameters.

“One of our goals is to reduce our waste to landfill by 10% a year based on a 2021 baseline, with

There were some sound economic reasons for the landfill reduction focus. He said pursuing a “business as usual” approach would cost the company $200,000 a year in landfill fees. These have been reduced down to $15,000.

“This is where we have managed some of our biggest wins. We make a dollar out of it, so why would you not do it?”

The company has managed to find uses for most disposable products, down to hair nets worn

by packing staff. He said the push onwards with sustainability, particularly around packaging and materials, could often include having to have some frank and firm conversations with material suppliers.

“We would have supplies asking us why are we pushing back on a certain material, that they are not getting that from anyone, anywhere else.”

One example is the unwanted backing from fruit stickers that contributes 50t a year to landfill in NZ, just from kiwifruit.

He said the ASB loan has

sharpened their focus on sustainability even further, putting some firm metrics around their targets across four key performance indicators.

“I was initially a little sceptical, but now we are in it, it has finetuned our decisions here.”

ASB head of sustainable finance James Paterson said ASB is progressing well on its mission to support industry transition with a cumulative sustainable lending target of $6.5 billion by 2030 for green, social, and sustainabilitylinked lending across commercial and rural sectors.

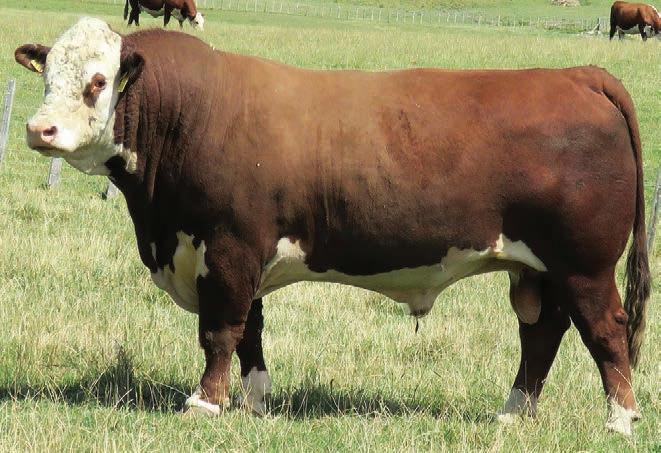

LAST month youth from all over motu gathered in Wairarapa to take part in New Zealand

Hereford Youth’s annual three-day development forum.

Launched in 2021, the development forum focuses on creating an event where youth can immerse themselves in all aspects of the beef industry.

One does not need to be a Hereford Youth member to attend the forum, or even be from a farming background. It is open to people aged six to 30 years old.

“The only criteria are that you need to be keen to learn about the beef industry and have a give-it-ago attitude,” NZ Hereford Youth co-ordinator Sage Harding said. This year’s forum kicked off with a visit to a local business, Homegrown Butchery. Owner Ali Kilmister explained that the butchery’s job is only done once

the stock leaves the farm gate to supply homes around the country with meat. The butchery grows, trucks, processes and sells meat from the farm.

He explained what to look for and the implication when things are not quite right in an easy and methodical way. Even the youngest youth member, who was 10 years old, was able to follow along.

The business embraces the idea of “eating how farmers eat” and allows customers to connect to where their food comes from. While there, the Hereford Youth youngsters were shown how to butcher a lamb. The butcher took the group through ways they could improve their own home kills.

The group also visited a commercial farm, Te Rangi Station in Whangaehu Valley, where they were given a tour of the farm and learnt how it uses Angus, Herefords and Charolais in its breeding programme. The day ended with Hereford Prime patties on the BBQ at Te Taumata Stud.

Day two of the forum was an early start as the group headed to Otapawa Poll Herefords, which sits in the foothills of the Puketoi Ranges. Despite the wet ground conditions, they managed to have a good look around the wellmaintained farm.

The group remarked on what an eye-opening experience it was, as from one of the high points it was easy to see that Otapawa Station was being surrounded by pine forests.

The group enjoyed sharing in the Robbie family’s farming passion, as their breeding stud ticks on despite ongoing pressures from forestry companies.

The farm tour was followed by two workshops, on structural assessment and EBVs/Genetics.

Otapawa Station owner Stuart Robbie took the group through structurally assessing cattle, passing on a wealth of knowledge.

“He explained what to look for and the implication when things are not quite right in an easy and methodical way. Even the youngest youth member, who was 10 years old, was able to follow along,” Harding said.

The Otapawa Station workshop set the group up perfectly for the last day of the forum.

Day three saw the group’s knowledge tested when they participated in a stock-judging competition, and those over 16 had herdsperson leadership interviews.

Two lines of Te Taumata heifers were put up for the stock judging, and everyone had to rank the lines based on their structure and give the reasons behind their decision. The public-speaking aspect of the judging was out of most of the youngsters’ comfort zones, but stock judge Peter McWilliams said

he thought everyone did very well. The herdsperson interviews were a chance for the older members of the group to test their knowledge about the industry.

The three-day forum concluded with a farm tour around Te Taumata Herefords.

“Overall, very impressive weekend,” tour attendee Georgie Moody of Manawatū said. “Awesome guest speakers and breeders – such a privilege to be able to tap into their knowledge.”

Plans are already in motion for next year’s development forum and there are still events to be held throughout the year.

THE New Zealand Merino Company has advised ZQ programme growers that pain relief will soon be required on their properties for tailing or docking lambs.

New Zealand Merino Company (NZM) general manager global supply Matt Hand said adapting to remain in step with consumer and brand values has allowed NZM growers to maintain market position, keep a step ahead of legislation and continue to enable long-term contracts positioning wool at a premium.

“As previously indicated, the next step in ZQ’s story will be the implementation of pain relief for specified painful animal husbandry procedures.

“Pain relief will be required on your property from June 2025,” Hand said in a letter to growers.

He noted that, while not yet legislated in New Zealand, pain relief is recommended as best practice in the Ministry for Primary Industries (MPI) code of welfare.

“The NZM team has worked hard with brand partners and the wider market to ensure their understanding of key animal husbandry procedures and to gather insights as to key reputational risks that we as an industry need to consider.

“Now is the time to adapt to what the market needs or risk falling behind,” Hand said. Textile Exchange, which administers the Responsible Wool Standard (RWS), introduced pain relief as a mandatory requirement for painful procedures in 2020.

“As the ZQ standards are aligned to RWS, creating further market advantage for your wool, we must follow suit to remain relevant and ensure your wool is optimised.

“While we have been running trials with NZ growers since

2016, it is now time to roll out the requirement for pain relief more widely across NZ.”

This will be staged over the next three seasons, starting with growers supplying via contract into markets that are the most sensitive and that have the greatest exposure to these pressures.

The design of the stepped pathway was led by market pressure, which is expressed most directly through the ZQ contracts, particularly in the fashion, luxury and active outdoor space.

Federated Farmers meat and wool chair Toby Williams has called on NZM to retract the advice until such time that regulations have caught up with

available technology and the appropriate consultation has been conducted with the wider sheep industry.

Williams said Federated Farmers are strong advocates for animal welfare, closely following the standards required and best practice guidelines.

“Our concerns with the NZM requirements are they are not currently included in the animal welfare standards for sheep and beef animals and nor are they included in the new standards currently being worked on.

“NZM has got the cart before the horse here.

“We are 100% behind the principle, but currently the technologies do not exist to a level that allows this to occur.”

Guidance from MPI states no pain relief is needed for lambs younger than six months.

Williams said decisions around the use of pain relief need to be led by MPI and need to include all of the sheep industry participants to ensure an appropriate set of guidelines and procedures

will ultimately have the desired outcomes for animal welfare.

“With companies coming out with their own rules and regulations there is a serious risk of an ad-hoc approach, not to mention it undermines the whole animal welfare code that our farming systems are built on.

“The issue appears to be a market access one as opposed to an animal welfare one and it should not be up to individual farmers and companies to solve these issues.

“It should be an industry wide discussion to ensure we have a robust and effective set of rules that farmers are able to follow and supply lines for the required technology and product are readily available.

“It is my understanding that available technology and regulations for NZ are possibly up to 10 years away,” Williams said.

Managing director of Veterinarians for Animal Welfare Aotearoa (VAWA) Helen Beattie said pain relief for tailing is a complicated issue.

“The principle of doing it is great, a step in the right direction, but rolling it out will be just a bit tricky.

“It has to be defined from a nonsteroidal to a local anaesthetic or a general anaesthetic.”

Beattie said applying pain relief to a large number of animals such as a mob of hundreds of lambs will require new innovation in the delivery mechanism, equipment used and new fasteracting drugs.

It will be important to understand exactly what is required, given the difference between superficial pain and deep pain.

“There will be limitations, what is proposed will not be comprehensive pain relief. “The only way to completely eliminate deep pain is epidural or general anaesthesia – completely impractical.

“It does throw down the challenge with how we deal with these painful animal husbandry procedures with pain relief in the future.”

THE call is out to recognise the skills, talent and innovation that make New Zealand’s red meat industry world leading.

Beef + Lamb NZ has announced the annual industry awards will be held in Christchurch in October.

“We have so much to be proud of and these awards give us the opportunity to shine a light on the many people who contribute so much both locally and nationally,” BLNZ chair Kate Acland said.

“This an opportunity for the red meat sector to come together and celebrate its people and technologies.

“I encourage anyone with an interest in the red meat sector to mark the date in their diary and book travel and accommodation early.

“It is a fantastic night which is guaranteed to make everyone feel very proud of our sheep and beef industry.”

Encouraged by the success of last year’s inaugural awards ceremony in Napier, BLNZ is this year looking forward to

bringing the event to the South Island.

Nominations for the eight national award categories open next month.

“Start thinking about the people on your farm, within your wider business, in your communities and in regional and national organisations who often work behind the scenes to ensure our industry thrives.

“When nominations open, put their name forward or self-nominate. It is important we take every opportunity to showcase the fantastic work happening in our sector,” Acland said.

Farmlands is again partnering as a key sponsor and there are seven other category sponsors. Entries open on June 1 and close on July 23 with judging commencing in August.

Finalists will be named on September 8 with winners announced at the awards dinner on October 19 at Te Pae Convention Centre, Christchurch.

MORE:

For more information about the B+LNZ Awards go to: www.bee ambnz.com/Awards

BEHIND: Gemma Jenkins says farmers and industry stakeholders recognise that beef genetics have lagged behind sheep and dairy genetics.

COMMERCIAL beef farmers are increasingly seeking new tools as they turn their focus to genetic traits.

Research from the Informing New Zealand Beef (INZB) programme, which aims to boost the sector’s profits by $460 million over the next 25 years, shows farmers want more information to enable them to better compare functional genetic traits.

The research, part of the Beef + Lamb NZ-funded INZB programme, also revealed a lack of understanding about Estimated Breeding Values (EBVs).

An annual industry survey of farmers, beef breeders and rural professionals, including agricultural consultants and facilitators, stock agents and vets, found farmers are becoming more aware of genetic tools.

INZB programme manager Gemma Jenkins said the research

highlights the importance of the work already being undertaken, such as the across-breed beef Progeny Test and development of a NZ-specific genetic evaluation.

“Farmers have told us the new areas they want to focus are traits such as fertility and Body Condition Score.

“These should be included in NZ-specific genetic evaluations and indexes to ensure we’re making genetic progress on them,”

Jenkins said.

Research also found that a lack of understanding about EBVs limits farmer uptake.

Jenkins said INZB has a strong focus on education and extension and is delivering resources to support greater understanding and use of EBVs.

“That includes our field days, an online beef breeder workshop to discuss maternal productivity and reproduction, better beef breeding workshops for commercial farmers and an online learning module.”

Research respondents recognised that beef genetics have lagged behind sheep and dairy

genetics and welcomed the work being undertaken by INZB, with growing awareness among farmers of the tools the programme is developing.

INZB is a seven-year Sustainable Food and Fibre Futures partnership supported by BLNZ, the NZ Meat Board and the Ministry for Primary Industries.

Farmers have told us the new areas they want to focus are traits.

Gemma Jenkins INZBIt is developing a beef genetic evaluation system that includes traits that are important to NZ beef farmers, supporting a sustainable beef farming industry.

The programme is also creating easy-to-use tools that enable data to be efficiently collected, managed, analysed and used by farmers to make profitable decisions for their operation.

will remain

FOR far too long farmers have been paying for government schemes such as TBfree, NAIT and M-Bovis, whose departments are managed with such competence as to ensure their perpetuity.

The leadership of the TBfree [programme] has already passed from father to son. The level of TB has not changed for over a decade.

I have always been impressed by farmers who speak out about the cost and absurdity of these government impositions, which have been coming thick and fast recently. I am surprised there are so few farmer voices for farmers.

If a ute lasts five or six years the new ute tax means the government is taking another $50 million a year from farmers.

It was sad to see Andrew Luddington, “Status quo can’t continue” (May 22), chastise the Groundswell people for having the courage to speak out about these injustices, even going so far as to call them “selfish”!

Bryan Gibson Managing editor

Bryan Gibson Managing editor

FOR farming to thrive it needs to attract the next generation of trailblazers to use their skills, knowledge and outside-the-box thinking in the pursuit of excellence.

To do that we need to understand what matters to that cohort of humanity and what might be holding them back from choosing food production over other career options.

But that doesn’t mean just looking at a list of traits and bending our current systems a little to fit them in.

We need to build new systems that are grounded in those values and give these people the best chance of success and fulfilment.

We need to look at food production through younger eyes and embrace the technologies that will help us evolve.

There are some fantastic programmes already underway that are doing just that.

The agribusiness curriculum developed by Kerry Allen at St Paul’s Collegiate School offers pupils across New Zealand the opportunity to get a taste of the many ways they can contribute to the primary sector.

Our own Ag&Ed initiative, relaunching next month with the support of the Ministry for Primary Industries, will also help support that search for new talent.

But the industry itself needs to work on its image.

In the marketing sector, consumers, communities and stakeholders are often given a persona that best represents the collective thinking of the group.

If we were to give our sector a persona, I doubt it would be one that many high school pupils would relate to.

Research tells us young people seek jobs with a purpose and that one of their primary concerns is climate change and the environment.

Yet if they turn on the radio they’ll hear farming leaders arguing that food producers are somehow exempt from playing their part. Lines from the Paris Accord are often quoted out of context to support this view. That’s no way to welcome young people to our industry.

Last week NZX’s Julia Jones told the Women in Seed forum that it is time to rediscover our ambitions.

“We have lost ability to give the sense of hope for future generations to inspire confidence in change,” she said.

“You can’t slow change, it’s societal, it’s bigger than us. The more you fight change, the more you wear down. We need to listen to what the world is telling us.”

Luddington is a tree fanatic. Planting native trees has been a NZ trend for some decades now and Luddington is cashing in on his trendiness by signing up to yet another government scheme called “carbon credits”.

He has calculated his future earnings to the last kilogram per hectare but who will speak up for him when the government takes over control of his property because it is pock-marked with Significant Natural Areas?

I would really like Luddington to dismount from his high horse long enough to explain just how his profiting from the carbon credit scheme is going to slow the march of his “existential worldwide climate change”.

Jones has been a vital voice in farming leadership for a while, saying the things that need to be heard, yet she and other women are often subjected to ugly rhetoric and dogwhistles for daring to speak.

That needs to change.

It doesn’t mean that the voices of men, Generation X or the Baby Boomers should be silenced; what we’re after is a conversation that lets new speakers in.

It’s a fact of life that every generation has doubts about the next.

But it’s also true that those doubts have usually been proven wrong.

It’s called evolution and we’re doing it whether we like it or not.

THE same genetic technologies that helped create effective covid vaccines in record time can also help us reduce farming emissions, improve water quality and improve animal welfare.

But New Zealand’s regulations regarding the use of these technologies – and the more recent gene editing in particular – are outdated and are holding back research and the bringing of products to market.

With a score of 4 out of 10, NZ ranks poorly on the Food & Crops Gene Editing Index produced by the international Genetic Literacy Project. Best in class countries such as the United States, Israel, Japan, Brazil and Argentina score 10. Despite being way ahead of NZ, Australia only gets a score of 8. When we think of the climate challenge, there is an urgent need for new products that will help reduce emissions. Gene editing is a safe and effective enabler for developing such products.

Grass, and growing it efficiently, underpins NZ’s livestock farming sector. An essential component

of our pasture grasses are their associated endophytes, which are fungi that live inside the leaves and are essential for persistence by protecting the grass from pasture pests. We are so good at producing pasture that we already lead the world in low emissions per kilogram of our animal food products. But we can get even better.

So what is gene editing in grasses? In very simple terms it is a way to fast-track selective plant breeding.

Selective breeding is the old way of identifying a number of plants that seem to grow faster or survive a drought better and then crossbreeding them in the hope of producing a much better plant. Very hit and miss and slow, but nevertheless the way in which the world has managed to increase food production. Gene editing adds precision to plant and endophyte breeding, with no remaining introduced DNA being involved, by enabling gene sequences to be “cut” and the break repaired by the organism, resulting in a mutation that typically disables the function of the gene.

Today we can map the genome of plants and endophytes and determine which gene sequences confer the traits that a better performing plant or endophyte would need to have. Gene

editing technology enables these microscopic gene sequences to be changed within species.

Let’s look at a real example where gene editing has been used to simply delete a gene’s function.

The Endophyte Gene Editing Programme led by AgResearch is aimed at producing grasses with endophytes that are better at deterring a range of bugs from eating them while being more palatable and safe for our farmed animals. At present we have

endophytes that do deter the bugs but typically they make the grass not as palatable to our grazing animals as we would like and they sometimes cause staggers, a distressing and wasteful condition whereby the endophyte toxins temporarily affect the animals’ brain and nervous system.

The AgResearch programme has some great scientists on board and has gone exceptionally well and is running ahead of schedule. But there is a problem. The work has moved past what can be done in containment glasshouses in NZ. For field trials, it has had to shift to Australia where the regulations regarding gene editing are far more enlightened than in NZ. A future pathway to commercialise this breakthrough advance in NZ is very uncertain because of our outdated regulations.

So how do better endophytes help with emissions reductions?

It is all about productivity and efficiency. Improved grass utilisation and no staggers means animals will produce milk and meat with less emissions per kilogram of output. And there are many more opportunities to use gene editing aimed at reducing emissions and nutrient leaching. A combination of small percentage gains from such improvements can add up to a lot over time.

In meeting NZ agriculture’s

emissions reduction challenge, it is highly unlikely that a single “silver bullet” breakthrough product will emerge. Gene editing is the closest thing to a “silver bullet” that we have. And it is only an enabling technology. We have to be able to use it.

In the past five years the government has been great at running talkfests for the primary sector to “create visions” and “value statements” while at the same time doing little if anything to make changes such as implementing an up-to-date set of regulations for gene editing. Seems like Nero fiddling while Rome burned.

Where to from here?

We need a law change in NZ to remove unnecessary restrictions on the use of gene editing and the commercialisation of gene edited products. NZ needs to align with the more progressive genetic technology and gene editing laws in most other countries. As easy as cutting and pasting Australian law.

massive $71 billion over the next five years and I support that. In addition, there’s $6bn set aside for a National Resilience Plan and $1bn for cyclone recovery. I expect the government will end up spending a lot more than just $1bn over the cyclones.

The pre-Budget announcement of getting 5G into the provinces is certainly welcome infrastructure. It will improve our communication significantly.

Alan EmersonUNLIKE many of my colleagues, I thought the recent Budget was okay. Going further, for an election year Budget I’d suggest it was restrained, which is unusual in New Zealand.

In many ways the government’s hands were tied. The massive damage caused by Cyclone Gabrielle saw to that. It was labelled a nofrills Budget and it certainly fitted that description.

My strong belief is that many Budgets have, in the past, been there for show and politics and not for either boosting the economy or looking after constituents. What that has achieved is that for far too long our basic nuts and bolts, the infrastructure we rely on, has been ignored. It’s a little like local councils with their water, sewage and wastewater.

Now we have infrastructure in the process of being boosted by a

In my opinion that expenditure is positive and much needed. Infrastructure isn’t sexy but without it we’d lurch quickly into the status of a developing nation.

I also enthusiastically support the establishment, as announced in the Budget, of multi-institution science hubs. There’s $400 million in capital and $5m in operations, which should improve our scientific outputs.

Scientist friends of mine have been hugely critical of the current scientific silos, where little collaboration has occurred. There will be three hubs, each with a different focus. Hub one will be climate change and disaster resilience, with two being health and pandemic readiness. The third hub will focus on technology and innovation.

Getting scientists of different disciplines working together has got to be good.

I also support the 20% tax rebate for gaming. Philosophically the approach does nothing for me but practically it is a necessity. Our top game developers are being lured offshore by similar incentives and I don’t see any difference between the Hipkins government supporting gamers and the Key

General government debt

Total, % of GDP, 2022 or latest available

THRIFTY: Alan Emerson points out that New Zealand’s net indebtedness is just 18% of GDP, putting it in the bottom third of OECD countries for government indebtedness.

We continually hear plaintive cries of NZ spiraling into uncontrolled indebtedness. I don’t share those concerns.

government courting Hollywood.

The reaction to the Budget has been interesting. Federated Farmers said it had asked for absolutely nothing in the Budget and that the government had exceeded its expectations. It wanted a “stop to impractical, unpragmatic and unfair regulations” and I support that.

ACT has been consistent in its approach and true to form with the party’s philosophy and policies.

ACT leader David Seymour was highly critical of the government deficit, which I’ll come back to. He was also concerned about inflationary pressures. He said that ACT is the only party putting out an agenda and he made no apology for that.

In the ACT alternative budget

there are massive tax cuts and a huge reduction in government spending. It has certainly done its homework. Go onto its website and have a look for yourself.

Correspondingly, the National response was messy.

I saw Paul Goldsmith on the AM Show unconvincingly going on about the deficit.

Nicola Willis told me National would restore the $5 prescriptions cost the government had scrapped.

I was surprised at that approach as it certainly won’t win any votes.

That changed to a targeted approach with all the administrative costs that will be incurred.

We are reliably informed by an Otago University study that poorer people weren’t picking up their prescriptions because they couldn’t afford them, which made them liable for sickness and hospitalisation.

The figure given was 153,000 and that’s considerable.

The cost of that hospitalisation would be a far greater drain on the taxpayer than the elimination of a $5 prescription charge.

Willis also told me that the Budget had encouraged “a blow out in spending, there is a blow out in deficits, and there is a blow out in debt”.

Much was made by both National and ACT of the evils of New Zealand’s level of debt. We continually hear plaintive cries of NZ spiraling into uncontrolled indebtedness. I don’t share those concerns.

The level of NZ’s net indebtedness in June 2023 will be just 18% of GDP. We’re in the bottom third of the OECD for government indebtedness. While I’d prefer no debt, 18% isn’t large and is considerably lower than many of our past debt levels.

By comparison the United States has a debt level of 96% of GDP. It is picked to rise to 110% by 2028.

So, my simple position is that we need to invest heavily in infrastructure or be prepared for the status of a developing nation. We have the ability to borrow to maintain our developed-nation status and we should be doing just that.

I’ve enjoyed it, but after eight years it’s time for someone else to take on the role.

There are 11 regions in the awards.

The East Coast region is the only one to span two territorial authorities: the Hawke’s Bay Regional Council and the Gisborne District Council.

Their land management teams work with us helping to run the judging process and other jobs and bring enthusiasm and knowledge, so are great to work with.

championing good farming practice.

Here on the East Coast, we had got our judging done just before Cyclone Gabrielle but post the cyclone, not only were we all left reeling, but our region was cut in two with the Napier-to-Wairoa road closed for quite some time.

ANOTHER little job I’m giving up shortly is chairing the East Coast region of the Ballance Farm Environment Awards.

The size of the region is a challenge for us as I live on the southern boundary near Takapau, and Hicks Bay to the north is about a seven-hour drive when the roads are open.

The New Zealand Farm Environment Trust facilitates the awards. The trust promotes sustainability through

It wasn’t a hard decision to postpone our awards function as a consequence, but we ended up having a trimmed down version where we linked the two regions by technology in late March and still went ahead with the awards.

Greg and Gail Mitchell are dairy farmers from Pātoka and were convincing winners, picking up five of the awards as well as the title of Supreme Winners for this region.

Continued next page

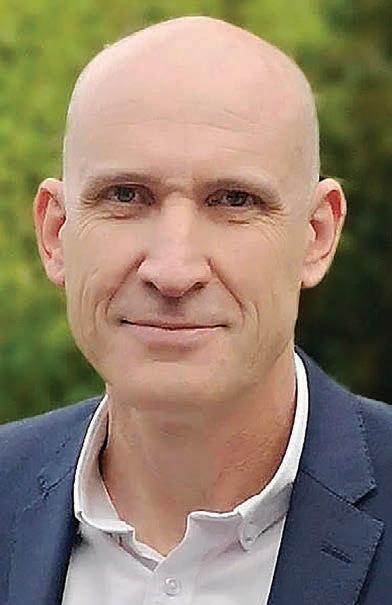

DEER farming is one of New Zealand’s biggest little industries. We’re heavyweights when it comes to deer velvet production and our venison is eaten in restaurants all over the world –particularly in European countries with strong hunting traditions. But as was the case with a lot of other industries, covid kicked our butts when restaurant trade globally ground to a halt. Prices for our venison halved between 2019 and 2020, and prime cuts sat unsold in freezers.

However, the silver lining of that cloud comes from the hard graft done by our marketers to forge new revenue streams and expand the markets for NZ venison. As a result, the industry has a better spread of markets today than it had before, and prices to farmers are well above the long-term average, at just under $9 /kg.

As an industry, we accept that waterways need protecting but would like the flexibility to attend to the situation on a case-bycase basis.

It’s well-known business wisdom to never plan strategy in a crisis, but we are out of the pandemic woods now, so to speak, and it’s time for the industry to set its sights on the future.

My job is to put our farmers’ levies to work on key priorities. The deer industry is working hard to market itself abroad to create greater demand for our product. In particular, marketers have developed a North American retail programme to get products into supermarkets – tough customers. This requires ongoing investment if we want to see repeat purchases and increased sales.

They are the third dairy farmers to win our region’s supreme title from 12 and given this region only has about 90 dairy farms, dairy is doing well to promote wise and sustainable land use here.

Given the ravages of the cyclone, I thought we would be delaying the field day until sometime next summer, but the Mitchells reckoned they would be able to run a day by mid-May, which we held last week.

It’s been three tough months since the cyclone and getting anywhere in this region remains difficult.

My usual route to Pātoka is travelling from Fernhill to Puketapu but the Tutaekuri River obliterated the Puketapu bridge. The Tutaekuri also destroyed the

Products like drinks, pastes and chews are sold for a high unit price and are taken on a daily basis. Velvet is used to treat a wide variety of conditions, but mostly as preventative medicine to promote energy and boost immune health.

Deer Industry NZ is supporting those health food companies and some of the pharmaceutical companies producing products using NZ deer velvet, which is recognised for its food safety credentials and animal welfare standards.

Venison in North America is regarded as a natural meat because it is not intensively farmed. The work we do with marketing and export companies is directed at assisting the promotion of their brands to grow those micro-niches of consumers who want naturally raised, lean and healthy red meat.

Our deer are raised primarily in the high country and are finished on low-country pasture. They are grass-fed and processed at a young age with full traceability. High in iron, and rich in macronutrients, it’s a superpower food. This is the story we are telling.

Deer velvet is another major success story for our industry. NZ is the largest producer globally, despite our tiny size. We export over $100 million worth of deer velvet a year – a third of total industry exports. We are, in fact, a velvet “superpower”.

Velvet is most commonly viewed as a traditional ingredient in Chinese medicine due to the collection of extraordinary compounds found in this self-regenerating tissue; it’s increasingly used in South Korea and China in foods or as a health supplement.

bridge further down at Waiohiki, so getting to Taradale that way is not possible.

If you have been through the Esk Valley on the now opened SH5 and are shocked by the devastation, the Dartmoor Road beyond Puketapu is equally as bad if not worse.

It remains a very tough and bleak situation for any land and homeowners in areas like these.

This was the first time since

There’s huge potential for NZ deer products around the world. But current government policy settings, as for most other farmers, are something of an overwhelming proposition. It’s not the direction of travel – our farmers take responsibility for their impact on the environment and emissions – but sometimes it feels like a freight train is coming at us, with a pace and scale of changes that are unmanageable for most farmers.

Stock exclusion rules are a good example of this, as are putting trees on hill country farms. Steep land is great for deer and is an efficient way of producing highquality, nutrient-dense food.

Deer fencing is a costly business, and more expensive than sheep and beef fencing at

between $25,000 and $30,000 a kilometre. The requirement to fence all streams is not always the best solution, particularly when the sector has already developed alternative management systems that reduce the impact of deer on water quality.

As an industry, we accept that waterways need protecting but would like the flexibility to attend to the situation on a case-by-case basis.

Similarly, the current urge and

regulatory drivers to plant up much of our hill country with pine often feels blinkered and ideological. The price we pay as a country is losing productive farmland, along with the native biodiversity that occurs on these properties.

Putting a price on emissions when no commercially realistic mitigations exist simply forces farmers to abandon the land in favour of pines, especially at the prices being offered – one only needs to peruse the decisions made by the Overseas Investment Office on a regular basis to see the number of farms going up for sale. Sadly, we are losing key farming infrastructure that’s unlikely to ever be rebuilt.

NZ is well suited to deer farming. Our breeding hinds do very well in hill country. We provide high-quality, nutrientdense, natural food to markets that are willing to pay a premium for that. This is a more balanced use of land than monocultural forestry.

Deer farming brings diversity to our farming landscape. The future is bright if we can slow down the reforms and get the government to work more closely with us so that policy is targeted and effective, rather than an expensive exercise in compliance.

the cyclone that I’d been over the Mangaone River at Rissington given this bridge had also been swept away.

They had managed to fashion fords then culverts and now have a Bailey bridge reconnecting a large rural area.

The Mangaone had wreaked havoc along its own watercourse and as I drove towards its headwaters one could see the impact of 500-600mm falling within a few hours onto this large catchment of the Pātoka and Puketitiri districts.

A lot of work had gone into repairing the roading to regain access and the ash soils had held together better than I expected on the hills under that deluge but still not pretty, as is the case in plenty of other districts all over the east coast.

The weather played ball for the field day as it remained dry for a change.

Because no milk was able to be collected, the cows had been dried off after the cyclone and Fonterra has continued to pay the dairy farmers in this district.

This has allowed the Mitchells to use their team in the recovery and re-instatement of their property so it is ready for the milking season ahead.

This is not the case with the surrounding sheep and beef farms, which, because of the scale and lower labour units available, have several years of hard work ahead of them.

The scale and momentum of this farming business was truly impressive. They had given up their careers in 1992 to buy 12 hectares of land in south Waikato

and now own and milk 2500 cows on 870ha and have just purchased a 230ha runoff.

Alongside this they have been mindful of the environmental impacts of dairy and have put a lot of money and energy into mitigating those impacts.

For example, 10,000 natives are planted each year and the waterways are protected with fencing and sediment traps. This district has had a very tough time over the last three months, so it was great to gather and have a good news story for a change, and then of course share in some fellowship over a drink at the end of the day.

If you have a good story and want to help our industry tell those stories to the wider world, consider entering these awards when the next cycle is promoted.

If you have been through the Esk Valley on the now opened SH5 and are shocked by the devastation, the Dartmoor Road beyond Puketapu is equally as bad if not worse.

If