China’s beef import plans alarm sector

ENigel Stirling MARKETS Sheep and beef

XPORTERS are on edge as details seep out about moves being contemplated by the Chinese government to cap its beef imports.

Complaints from its beef industry led China’s Commerce Ministry to begin an investigation into imports from six countries, including New Zealand, a year ago.

Multiple sources have told Farmers Weekly that draft findings could be released as early as this week and that Chinese authorities have already floated two mechanisms to limit imports – both ending the unlimited tarifffree access for NZ beef exports to China under the 2008 NZ-China Free Trade Agreement.

Imagine trying to compete with the Brazilians.

New Zealand meat exporter

It is understood one mechanism involves “country-specific” quotas calculated according to each country’s beef sales to China in 2024. In NZ’s case this equates to 150,000 tonnes of tariff-free quota annually. Anything more would incur tariffs.

The alternative involves a global quota of 2 million tonnes allocated

to exporting countries annually on a “first-come, first-served” basis. Anything more would trigger new tariffs. Under both scenarios China would administer the quotas.

Exporters are disappointed and surprised by the proposals.

Although such moves are allowed under both the GATT system of global trade rules and the NZChina FTA, it was hoped that NZ would be left out of any safeguard action given that it makes up just 6% of China’s beef imports.

“Brazil is up something like 35% and they are 50% of imported beef into China and we are 6% and stable,” a director of one major meat exporter said.

“We are not contributing to increased beef into China.”

Others were concerned that 2024 could be used as the base year for country-specific quota allocations.

Statistics NZ data shows that NZ beef exports to China halved from more than $2 billion in 2022, to $1.045bn in 2024, as exporters chased higher returns from the United States and the Chinese economy struggled to recover from the pandemic.

“It would not necessarily have a significant impact right now but if this was to stay around for the next five years we could easily hit those safeguard levels based on what we were sending to China when it was our No 1 beef market,” another exporter said.

Equally, there is the risk NZ

Continued page 3

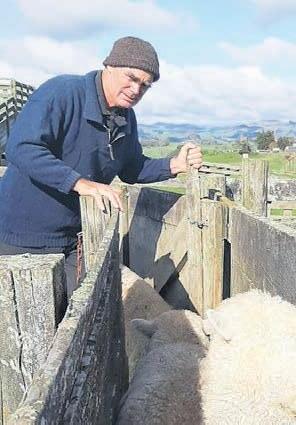

Walking

on water

Farmers Weekly contributing photographer Tim Cuff has been recognised in the 2025 Oceania Photo Contest, named runner-up in the New Zealand climate category. Cuff’s photograph was taken in June following extensive flooding on the outskirts of Nelson. But, as the image shows, the floodwaters didn’t stop these girls from taking their horses out for some exercise.

SECTORFOCUS

Alliance back in black after challenging few years.

NEWS 3

Tourism adds up for farmers

From the woolshed to the farm shop, Marlborough farmers Fred and Nikita Gane, and children Jonty, Katie, Frankie and Poppy, are sharing their passion for sheep and wool with visitors from around the world.

SHEEP & BEEF 21-24

Lactalis still living and breathing dairy 92 years on.

MEETING THE MARKET 4

Geography can’t change but planning can, says David Eade. OPINION 19

Photo: Tim Cuff

Get in touch

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240 Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346 Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400 Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003 Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256 Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570 Journalist nigel.g.stirling@gmail.com

Isabella Beale | 027 299 0596 Multimedia Journalist isabella.beale@agrihq.co.nz

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY 0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME

Delivered by Reach Media Ltd

Advertise

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269

South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

Fonterra Sale:

Contents

Opinion

Sector Focus

1-17

18-19

21-24 Federated Farmers . 25-28

29-39

40-41

Livestock

Markets

Weather

41-43

44-47

48

RECOGNISED: Dr Shannon Clarke, principal scientist at the Bioeconomy Science Institute, has been awarded the McMeekan Memorial Award, one of the most prestigious honours in New Zealand agricultural science.

News in brief Appeal lodged Revolving credit

The Environmental Law Initiative has lodged an appeal against a High Court ruling that upheld the Environment Protection Authority’s decision finding no grounds to reassess glyphosate or glyphosate-containing herbicides. ELI’s director for research and legal, Dr Matt Hall, said new scientific evidence continues to emerge about glyphosate’s risks. Without a clear framework for reassessment, the public cannot be confident that regulatory decisions are based on the best available science.

Synlait has temporarily increased its banking facilities for working capital after what the dairy company called manufacturing challenges early in 2025. It has arranged a revolving credit of $50 million for the period November 14 to March 31, 2026. Synlait said it remains on track to deliver a significant reduction in debt by using the proceeds of the sale of Pōkeno and Auckland assets to Abbott Group, due on April 1.

Hornet hunt

Biosecurity New Zealand is ramping up its campaign to locate and eliminate the invasive yellow-legged hornet. This follows confirmed detections on Auckland’s North Shore. To date, 10 queen hornets, two workers and seven nests have been located and removed from the Glenfield and Birkdale areas. A technical advisory group, comprising independent scientific experts from countries that have successfully managed hornet incursions, is supporting the response.

NZPork appointment

Canterbury farmer Sean Molloy has been appointed to the New Zealand Pork Industry Board, following a director election.

Molloy, who farms in the Selwyn district, will be a producer representative for NZPork’s Region 3, covering the South Island.

The Fonterra Mainland Group sale has been approved now it’s time to look ahead

Join Forsyth Barr’s free webinar with Senior Analyst Matt Montgomerie as he breaks down what the sale means for Fonterra suppliers, shareholders, and the wider dairy sector

Matt will also discuss practical next steps from paying down debt to building flexibility and exploring off-farm investment opportunities

Webinar details: Thursday 27 November, 11:30am - 12:30pm Online | Free to attend Register now: forsythbarr.co.nz/federatedfarmers Can’t make it live? Register to receive the on-demand replay

Back to basics puts Alliance back in black

Neal Wallace NEWS Production

THE Alliance Group’s finances are back in the black following two years of sizeable deficits, with the company reporting a $24.6 million net profit after tax for the year to September 30.

Chair Mark Wynne attributed the $93m financial turnaround in just one year to a back-to-basics approach by management, focused on growing value and increasing its beef business.

He said the result was timely given the newly inked $270m investment by Irish meat processor Dawn Meats, which now owns 65% of the business.

“After two very challenging seasons, it’s pleasing to return to profit.

“This result reflects the hard decisions we’ve made as part of our ruthless back-to-basics strategy,” said Wynne.

“We have also worked hard to reduce our reliance on sheepmeat by strengthening our beef capabilities, diversified our market mix and enhanced transparency with our farmer-shareholders.”

This is a significant turnaround for Alliance, which for the previous two years accumulated

$166m of after-tax losses, $95.8m in 2023 and $70.2m in 2024.

As at the 2024 balance date, interest-bearing debt and borrowings reaching $232.7m.

The 2024 loss includes a oneoff $51.3m cost for closure of its Smithfield plant at Timaru.

Wynne said following a business reset, Alliance has become more disciplined and focused on growing market value.

We have also worked hard to reduce our reliance on sheepmeat by strengthening our beef capabilities.

Mark Wynne Alliance Group

“Over the past 12 months, Alliance has strengthened its financial position by reducing costs and optimising processing capacity,” he said.

“We have enhanced farmer offerings, invested in smarter technology, reduced inventory levels by around half compared with the same time last year and improved sales velocity.

“For the first time in many years, the company also funded capital expenditure on fixed assets

Continued from page 1

exporters would be squeezed out of the Chinese market, still NZ’s second largest, should the quota be allocated on a first-come, first-served basis.

One exporter cited the US’s “other countries” beef quota. The US provides this to countries without a countryspecific quota. By the end of January Brazil had grabbed almost all of 2025’s allocation of 65,000 tonnes, leaving “a few kilograms of Wagyu for the Japanese”.

“Imagine trying to compete with the Brazilians,” the exporter said.

directly from free cash flow.”

Chief executive Willie Wiese said operational improvements have lifted yields across all species through better plant performance and processing reliability.

“These changes have already made a tangible difference to farmgate returns,” he said.

He said technology also played a role in Alliance’s turnaround.

“The rollout of a new Enterprise Resource Planning (ERP) system improved transparency, strengthened control, and enhanced decision-making across the business.

“Combined with disciplined cost management, sharper execution and improved processing performance, these changes have created a leaner and more agile business, capable of responding quickly to changing market conditions.”

He said the past year has been about improving organisational effectiveness, running the business more efficiently, making better use of every dollar, and rebuilding trust and confidence with farmers.

“There’s still work to do, but the foundations are now in place.”

Revenue for the 2024-25 year was $2.1 billion, arresting two years of decline due in part to fluctuating market prices.

In 2022 Alliance turned over

$2.2bn on the back of lamb prices that rose 24% and beef, up 19.8%, but the following year after prices fell by a comparable amount, turnover was $2bn and last year it was $1.8bn.

The rising cost of debt servicing and the growth in core debt became an issue for Alliance, prompting the company’s banking syndicate to demand repayment of its debt.

In response, shareholders last

month overwhelmingly agreed to sell 65% of the company to Dawn Meats.

Wynne said that partnership will strengthen Alliance’s financial position and long-term competitiveness.

“The partnership will ensure Alliance has the financial strength, scale, market reach and capability to thrive in global markets while safeguarding the interests of our farmers.”

Falling GDT raises fears for milk price forecasts

Hugh Stringleman MARKETS Dairy

GLOBAL Dairy Trade prices have fallen for the seventh auction in a row, losing 3% in the price index and a chunky 7.6% for butter and 5% for anhydrous milk fat.

The GDT index has not moved positively since early August and the prices of dairy products have dropped 13%, raising concern that dairy companies will have to lower

There is also the question of how the NZ government would respond to any curtailment of market access negotiated under the FTA.

In its submission to China’s Ministry of Commerce, the Ministry of Foreign Affairs and Trade said both the FTA and World Trade Organisation rules “allow” NZ beef exports to be excluded from safeguards should they be proven not to be causing injury to Chinese producers.

A former trade negotiator said it is arguable how much injury could be attributed to NZ exports, but it would be a big step to sue NZ’s largest trading partner.

their $10 farmgate milk price forecasts.

Fonterra is expected to revise on December 4 when it releases the first quarter FY2025 trading results, followed by the Dairy Industry Restructuring Actstatutory forecast later in the month.

In the latest GDT auction the price of whole milk powder dropped 1.9% and has now fallen 21% since its most-recent peak in May. Skim milk powder was down 0.6% and cheddar and mozzarella down 2.7%.

NZX head of dairy insights Cristina Alvarado said the GDT prices fell further than had been expected by the futures market before the auction.

The seventh consecutive fall in the GDT index is consistent with market conditions of oversupply and softening demand towards the end of the calendar year.

“Milk availability is expected to remain solid in the near term, adding further pressure to prices if demand does not strengthen.”

FALLING: NZX head of dairy insights, Cristina Alvarado, says GDT prices fell further than had been expected by the futures market before the auction.

FOCUS: Alliance Group is back in the black, reporting a $24.6m net profit for the year ended September 30.

LIMITS: It is understood Chinese authorities have floated two different mechanisms to limit imports – both ending the unlimited tariff-free access for New Zealand beef exports to China under the 2008 NZ-China Free Trade Agreement.

Living and breathing dairy 92 years on

Neal

Wallace in Laval MARKETS Dairy

THE potential new owner of Fonterra’s consumer brands business has not ventured from the dairy industry since its founding in Laval in 1933.

Lactalis, which is still based in Laval, a 90-minute train trip west of Paris, was established by André Besnier to produce camembert cheese.

It remains a dairy processor 92 years later.

Revenue in 2024 was NZ$62 billion, of which 39% came from cheese, 22% from liquid milk, 16% chilled dairy and 12% butter and cream.

During a visit to the site by Farmers Weekly in early November, Lactalis managers could not

The company’s growth strategy has been to buy dairy businesses in different countries but retain local teams to manage them.

talk specifically about the purchase of Fonterra’s consumer branded business due to the regulatory approval process currently under way.

Fonterra shareholders last month overwhelmingly agreed to sell the co-op’s global consumer and associated businesses, Mainland Group, to Lactalis for $4.22 billion.

A Lactalis spokesperson said the company’s growth strategy has been to buy dairy businesses in different countries but retain local teams to manage their brands, production, distribution and retail networks.

The world’s largest cheese manufacturing company, it has four international brands: Président, launched in 1968, Galbani, Kraft and Parmalat.

It operates 266 processing plants in 51 countries, and its brands are sold in 150 countries.

André Besnier’s son Michel took over the business in 1955 and oversaw the company’s first international expansion into the United States, in 1981.

On his death in 2000, his son Emmanuel took over as chair and accelerated the international expansion with acquisitions throughout Europe, parts of the

Middle East, North and South America, Malaysia and India.

That includes a joint venture with Nestlé in selected markets.

Today it employs 85,500 people and handles 22.6 billion litres of milk a year.

In 2023 Europe generated 53% of its revenue, 31% came from the Americas and 16% from Africa, Asia and the Pacific.

In 2024 its Africa, Asia and Pacific businesses collected 3.3 billion litres of milk, which was processed in 44 production sites, generating revenue of NZ$9.4 billion.

Europe collected 12.2 billion litres, which was processed through 156 sites and earned $32.1bn in revenue while the comparable figures for the Americas are 7.3 billion litres handled by 66 sites earning revenue of $20.5bn.

One of its plants is at Vitré in Brittany. It employs 420 people who process 280 million litres of milk a year into a range of UHT milk and cream products for consumption by everyone from infants to the aged. It is supplied by 450 dairy farmers within a 50km radius who provide milk all year round.

Romain Laforce, the head of operations at Vitré, said production peaks in April with flows 15% greater than the average for the remaining 11 months.

The composition of protein in milk can increase 20% over winter due to a shift in cow diets to feed with more starch and sugar.

The more than 269 million finished products the factory generates are in both bottles, which are manufactured on site, and cardboard bricks.

Laforce said UHT milk is popular in France due to its longevity, and is also exported around the world.

MORE: See pages 13, 14

• Wallace’s Meeting the Market tour has been made possible with grants from Fonterra, Silver Fern Farms, Rabobank, Zespri, Alliance Group, Meat Industry Association, Wools of NZ, Beef + Lamb NZ, NZ Merino, the European Union and Gallagher.

https://www.farmersweekly.co.nz/ meeting-the-market/

PRODUCTION LINE: UHT milk on a production line at the Lactalis Vitré factory in western France.

MANAGEMENT: Senior factory managers at the Lactalis Vitré factory in France Nicolas Begoin, left, the industrial director, and Romain Laforce, the head of operations.

DELIVERY: A milk tanker delivery at the Lactalis Vitré factory in western France.

A2MC announces $300m special dividend

Gerald Piddock NEWS Dairy

SHAREHOLDERS of The a2 Milk Company will receive a $300 million special dividend next year as it marks its 25th year in business. The announcement was made at a2MC’s annual meeting in Auckland and is the result of the transactions it made in August when it acquired the milk processing facility in Pōkeno and sold its majority stake in Mataura Valley Milk to Open Country.

“These transactions strengthen our strategic position and provide greater certainty over future capital needs,” a2MC chair Pip Greenwood said.

The dividend is subject to regulatory approval and further details on it are expected over the next 12 months.

It is expected to be unimputed and fully franked.

A2MC managing director and CEO David Bortolussi said that by 2030, the two transactions will deliver over $100m of additional brand sales, and over $60m of additional EBITDA.

Greenwood said the 2025

financial year had been a year of strong execution. He said the financial performance was “outstanding” with group revenue up 13.5% and earnings per share up 20.9%.

“We continue to make meaningful progress against our medium-term financial and nonfinancial goals and remain on track to achieve the vast majority of our targets.”

The year saw the introduction of a dividend policy. Total dividends of 20 cents per share were announced for 2025, representing a payout ratio of 71% and equating to $145m being returned to shareholders, she said.

Bortolussi said a2MC’s growth was driven by the China and Asia market, led this year by Englishlabel infant milk formula and other nutritionals.

Since 2021, a2MC has grown its China and other Asia sales by a compound annual growth rate of 22%.

The company’s sales in Australia and New Zealand were flat, with growth in its Australian liquid milk business offsetting declines in the daigou channel.

Its United States business continued its strong growth, and

Mataura Valley Milk experienced a significant increase in external ingredient sales, mainly due to higher GDT pricing and milk volumes, he said.

Total infant milk formula (IMF) sales grew 10% with its Englishlabel product the standout performer, up 17%, and its China label product up 3.3% with record market share.

Bortolussi said it was a very good result in a market that declined by 5.6%, and achieved while also having to manage supply constraints.

Liquid milk sales grew by 14% in total and other nutritionals continued to grow at a fast rate, up 23%.

A2MC’s overall China IMF market share continued to reach record levels, resulting in a2MC rising to the No 4 brand position in the world’s largest IMF market with 8% overall market share.

“This is a major milestone for our company, which launched its first IMF product only 12 years ago, competing against the global leaders in the category, and strong domestic players,” he said.

Looking ahead to the 2026 financial year, Bortolussi said the company has made a strong start

The dividend is a result of the transactions a2MC made earlier this year which are projected to deliver over $100m of additional brand sales, and over $60m of additional EBITDA by 2030.

We remain on track to achieve the vast majority of our targets.

Pip Greenwood The a2 Milk Company

to the financial year with its IMF, other nutritionals and liquid milk product categories all trading ahead of expectations.

Changes to currency rates are also expected to inflate sales and expenses.

As a result a2MC revised its guidance for revenue growth from a high single-digit percent to low double-digit percent.

“We have also reconfirmed EBITDA percent margin guidance to be approximately 15-16% and increased our net profit after tax guidance to now be slightly up on F2025 reported.”

Firearms lobby applauds proposed amendments

CHANGES to firearm laws should not affect law-abiding users and owners – but may offer some relief after what some are calling six years of the sector being “demonised”.

NZ Deerstalkers Association chief executive Gwyn Thurlow hopes the changes will alter the attitude of politicians and police towards law-abiding firearm users by acknowledging and respecting their rights.

“If you are already among the 230,000 law-abiding, licensed firearm owners and users, it

probably doesn’t mean much of a change.”

Thurlow said that after the Christchurch mosque attacks, police and the government demonised all firearm owners, and have not apologised for doing so.

“It’s been a political football played out in Wellington. The sooner that ends the better.

“We hope it will remove the

We hope it will remove the demonisation of the firearms community.

Gwyn Thurlow NZ Deerstalkers Association

demonisation of the firearms community.”

Associate Justice Minister Nicole McKee announced that a proposed rewrite of the 1983 Arms Act includes establishing a specialist firearms regulatory agency hosted by the police but over which they will have no control, and a new appeals process for those who have lost their licence.

Thurlow welcomed the new appeal and review process for those who are on the fringe of the law or could lose their licence due to temporary personal difficulties.

Previously people had to go to court to get their licence returned.

The new Act should encourage people, previously discouraged by

an overly bureaucratic process, to seek a licence, he said.

This will ultimately help the country contain its growing feral pest problem, which Thurlow said requires 500,000 licensed firearm owners to address.

Council of Licensed Firearm Owners spokesperson Hugh Devereux-Mack said removing the police from the licensing process will help restore confidence and address the feeling among licensed firearm owners that they are being treated as criminals.

“The trust and confidence since 2019 has bottomed out and can’t get any lower.”

multi-user agreement, so specified employees of biosecurity and pest control organisations can share prohibited firearms.

In announcing the proposed amendments, McKee said changes to firearm storage rules will clarify that they can be stored at any premises approved by the regulator; this could be at another secure but more suitable location.

“The current law has been modified dozens of times since it came into force over 40 years ago with many of those changes being rushed through with little to no scrutiny,” McKee said.

NO CRIMINALS:

Council of Licensed Firearm Owners spokesperson Hugh DevereuxMack said removing the police from the licensing process will help restore confidence and address the feeling among licensed firearm owners that they are being treated as criminals.

Devereux-Mack also welcomed the new appeals process for those who have lost their licence, saying current legislation gives the police enormous power to decide who keeps their licence and who does not.

He said he was recently contacted by a pensioner in their 70s who is a life member and coach of a clay target shooting organisation and has had their licence revoked because they failed to pass their driver’s licence.

Four armed policemen removed his firearms, despite his never having been in trouble with police, Devereux-Mack said.

He welcomed the new provision that, when a licence expires, if renewal is delayed due to a processing backlog, it remains current.

Endorsements for specialist firearms used by pest control operators are extended from 2.5 years to five years and include a

“The result is a complex, confusing and bureaucratic patchwork that makes it difficult for licensed firearm owners to comply while not adequately keeping the public safe.”

This week’s poll question:

Will changes to the Firearms Act encourage more people to seek a licence?

SHARE:

Neal Wallace NEWS Regulation

Investment Diversification for Farmers - why act

By Andrew Watters

In our most recent article “Beyond the Farm Gate: Diversification or Expansion for NZ Farmers?” we explored succession planning and diversification strategies for New Zealand farmers as the sector faces a major intergenerational wealth transfer. Drawing on Rabobank’s 2025 white paper on succession, it highlighted several tactics including how offfarm investments could enhance business resilience, assist with financial security through commodity cycles and assist with family succession. The article emphasised that there is no onesize-fits-all solution; a tailored approach is needed on whether or not combining core on-farm activities with diversified income streams will best suit family goals, resources, and risk tolerance.

Ultimately, the case was made that proactive, thoughtful diversification can provide for the successful succession of family ownership in New Zealand’s agricultural sector.

We now continue this article series with our thoughts on diversification for New Zealand farmers and why the time for this is now.

‘V’ for Volatility

New Zealand farmers are no strangers to risk, with every season bringing its own set of challenges: milk payout swings, weather extremes, rising input costs, and regulatory changes, just to name a few. For decades, the strategy has been simple: own more land, milk more cows or run more cattle, and ride out the cycles. However, in the current climate, depending exclusively on dairy or sheep and beef farming leaves families vulnerable to broad, industry-wide risks that remain outside the control of even the most skilled producers.

Consider the last decade. The dairy payout has ranged from $3.90/kgMS to $10.16/kgMS. Lamb prices have increased from $115 per head to close to $200 per head. Fertiliser and feed costs have surged by 40–60% in some years. Climate variability is increasing, with droughts here and overseas impacting on supply, demand, pricing and farm profitability.

When your entire wealth and income depend on the success of one or two commodities, you’re effectively betting the farm on forces outside your control. While this is the ‘lot’ of being a farmer, there are other options for businesses generating profits and free cashflow to contemplate growth and diversification.

Diversification as Insurance

Diversification isn’t about abandoning farming, it’s about protecting what you’ve built. Think of it as an insurance policy that pays you back. By allocating a portion of equity into off-farm assets, farmers can create a second or third-income stream that has the potential to cushion against downturns and provide for the future.

There are several compelling reasons why diversifying into off-farm investments is worth considering today.

First, investment in assets such as kiwifruit orchards, solar projects, forestry and commercial property can be obtained through managed funds, providing farmers with a diversified source of income, potentially helping to stabilise cash flow when agricultural returns fall.

Second, these sectors are backed by their own robust market fundamentals. Demand for healthy fruit products continues to grow globally, with the shift towards electrifying our total energy system utilising renewable energy accelerating, and despite some changes to regulations, mixed use forestry still appears an important contributor to the economy to 2050 and beyond.

A third advantage is this: some investments are quite tax efficient, which might be welcome at times of higher on-farm incomes. For example, an investment in solar can provide cash returns without taxable income over the first ten years due to depreciation allowances on solar panels and related materials.

These all point to income sources outside of farming potentially improving financial flexibility for major life events. Whether it’s planning for succession, preparing for retirement, or ensuring fair settlements among

“Rural

family members who are not involved in the farm, off-farm income can help to make these transitions smoother and less stressful for you.

Case Study: A Farmer’s Hedge

A Waikato farming family with $10 million in equity, with an allocation of 10% ($1.0 million) into a kiwifruit fund investment and a solar fund.

• Annual forecast distributions from off-farm investments: $70,000 –90,000 combined.

• Exposure to SunGold kiwifruit and Zespri returns and renewable energy, not just milk/meat prices.

• Flexibility: If income drops from the farmer’s own property, the orchard and solar returns can help supplement lost income.

• Future optionality: these are separate assets to the farming business and as such can help support family during retirement which could be useful assets when it comes to succession planning.

Practical Steps to Start

Clarify priorities: Is the surplus intended for debt reduction, farm development, family needs, expansion, or off-farm investment? Each goal has a different risk and return profile. A good place to start is understanding your cashflow and benchmarking your performance and debt levels.

Evaluate Debt Reduction: Paying down high-interest or short-term

debt increases liquidity and reduces the product price at which your farm breaks even.

Consider On-Farm Investment. Invest in projects with proven payback at conservative prices (e.g. pasture improvement, water reliability, effluent systems).

Ensure you have a buffer: Hold enough cash to cover operating costs through unexpected events before chasing higher returns.

Explore Off-Farm Investment Diversification: To reduce exposure to farming cycles, weather, and sector shocks, these assets can be more easily split among family members or used to support retirement and may offer tax efficiencies.

Set an allocation target: Start small, 5–10% of equity may be enough to make a difference.

Engage Trusted Partners and Advisors. Work with financial planners, investment syndicates, and sector experts to tailor strategies to your risk tolerance and goals. Make sure the risks of any investment are well known and there are mitigations in place.

Document and Communicate the Plan. Ensure investments fit with family wills and keep all stakeholders informed.

Monitor and Review Regularly. Review investments and farm projects against benchmarks and adjust as needed. Be agile and reallocate capital as market conditions and family needs

evolve.

There is no one-size-fits-all response when it comes to managing any free cashflow that your are generating. The best strategy is one that aligns closely with your family’s unique objectives, appetite for risk, and available resources. In New Zealand, many farmers are choosing a balanced approach by continuing to focus on their core farming operations while also seeking new opportunities to diversify their income. Achieving long-term success in this area requires careful planning, thorough market research, and the guidance of trusted professionals.

Interested in finding out more? MyFarm offers a range of off-farm investment opportunities to wholesale investors, including our current offer: a lease-based rural commercial property investment, forecast to pay monthly distributions of 7.5% p.a.

To find out more, visit myfarm.co.nz

Disclaimer:

The information contained in this article is for general information purposes only. Any reliance you place on such information is strictly at your own risk. It is not intended to constitute legal or financial advice and does not take your individual circumstances and financial situation into account. We encourage you to seek assistance from a trusted financial adviser, legal or other professional advice.

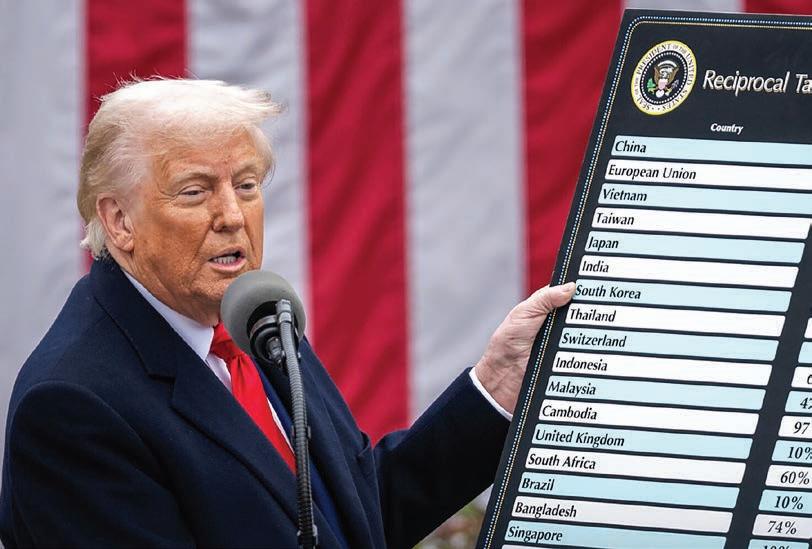

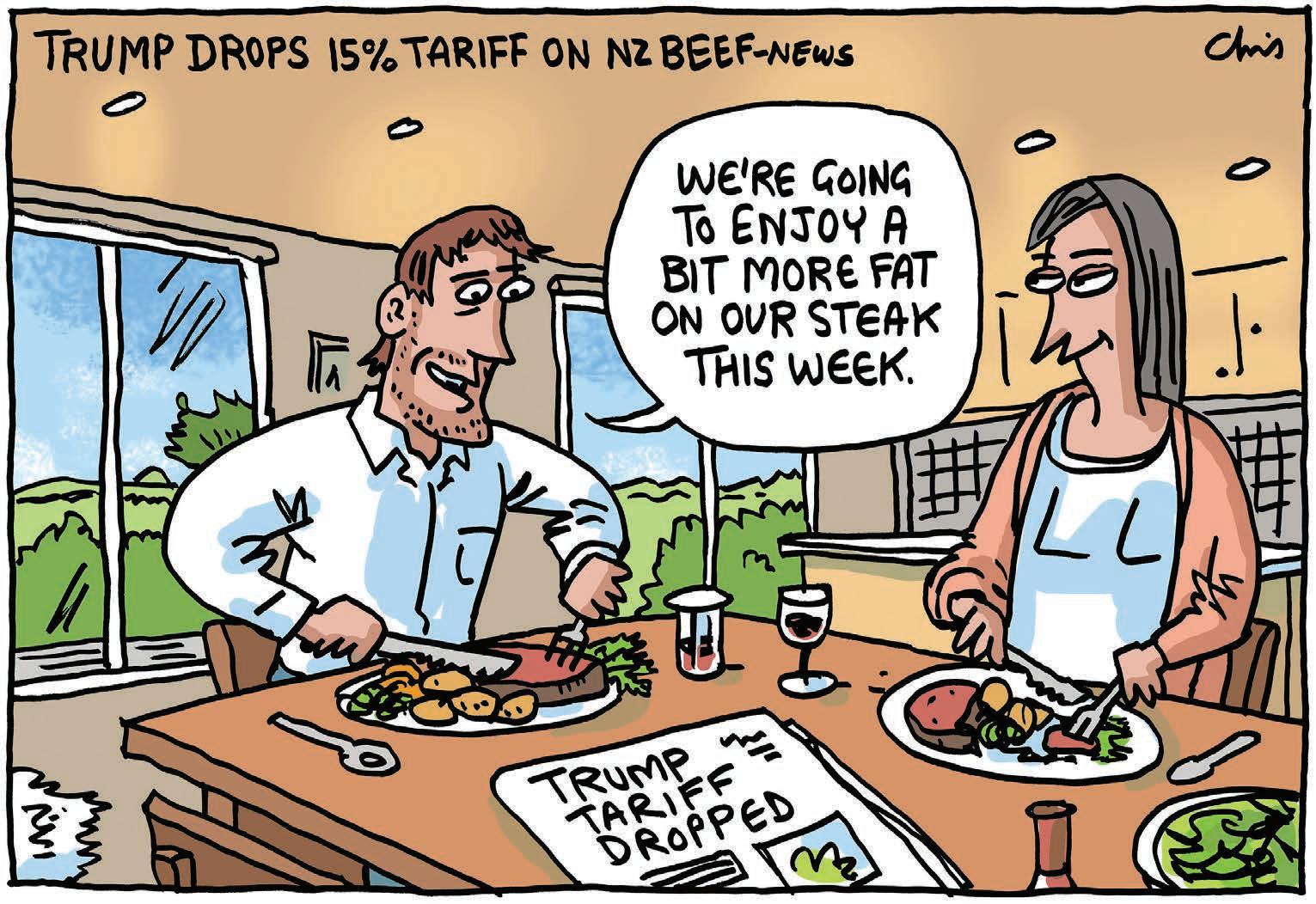

NZ beef wins big in Trump tariff U-turn

UNITED States President

Donald Trump’s decision to largely exclude Brazil from his beef tariff backdown has been described as a “win-win” for New Zealand’s meat exporters.

Trump responded to concerns his tariffs were feeding the recent surge in US consumer inflation by scrapping them on a range of imported food items.

Meat Industry Association chair Nathan Guy said this year’s increase in tariffs on all NZ exports to the US, first to 10% in April before rising to 15% in August, had left NZ beef exporters at a competitive disadvantage

to Australian rivals, who had remained on 10%. Beef export volumes from NZ to the US had fallen year-on-year since April despite strong demand and surging prices. The cost of tariffs on NZ beef to the US had topped $300 million over that time.

“This means that our beef will go back to facing a tariff of less than 1% under our WTO countryspecific tariff rate quota and will restore a level playing field with our key competitors,” Guy said.

Crucially, the reversal applies only to the so-called reciprocal tariffs Trump has used in his bid to even up trade flows with countries with trade deficits with the US.

This leaves in place the 40% tariff Trump hit Brazilian imports with in July as payback for the sedition charges brought by the Brazilian

government against former Brazilian president and Trump ally Jair Bolsonaro.

In addition, Brazil exceeded its US beef quota for 2025 during January, leading to an additional 26.4% out-of-quota tariff for the rest of this year, meaning the total tariff on the country’s beef exports to the US remains at a whopping 66.4% after the removal of its own 10% reciprocal tariff last week.

Meat exporter ANZCO’s general manager of sales and marketing, Rick Walker, said Trump’s reversal on tariffs on Australian and NZ beef while simultaneously keeping their biggest competitor on the sidelines is a “great outcome” for the two countries.

“Australia and NZ are the winners without a doubt,” Walker said.

Walker expected the tariff reduction, like the previous hikes, to be shared along the beef supply chain. However he doubted it would be enough to reduce prices for US consumers.

“The price the consumer pays is going to continue to go up because the vast majority of beef in the US is domestic and there is a dramatic shortage of domestic beef.”

Walker estimated beef prices in the US could increase another 2030% as the ongoing impact of the 70-year low in the US beef herd overwhelmed the effect of tariff reductions.

Comvita back to drawing board as Florenz vote fails

Staff reporter NEWS

Apiculture

COMVITA has confirmed that the proposal for it to be acquired by Florenz will not proceed after failing to reach the necessary 75%

majority following a vote held at a special meeting on November 14.

The final tally of votes was 54.34% in favour and 45.66% against.

If passed, it would have seen Florenz acquire Comvita by way of a scheme implementation

agreement. That SIA has now been terminated.

The Comvita board is working with its lenders and advisers to determine the most appropriate next steps, and all available options are being assessed, the company said.

Comvita chair Bridget Coates said the board is continuing to advance alternative options.

“Our current intention is to assess options to recapitalise the company.

“This work is progressing with urgency and discipline to secure a solution that stabilises the business, positions it to grow again, and reduces ongoing risk to shareholders.”

The mānuka honey company will hold its annual meeting on December 17 in Papamoa, where a business update is expected.

U-TURN: United States President Donald Trump responded to concerns his tariffs were feeding the recent surge in US consumer inflation by scrapping them on a range of imported food items last week.

Nigel Stirling MARKETS Sheep and beef

Time to dose dogs as sheep measles spikes

ASPIKE in the infection rate of C ovis – or sheep measles – has prompted a warning to farmers to keep on top of measures to control the spread of the disease.

Ovis Management project manager Michelle Simpson said data for carcases processed across the country in October shows 1.21% were recorded as being infected.

Sheep measles is caused by the Taenia ovis tapeworm.

Although it poses no risk to human health, it can cause blemishes in sheepmeat, which is undesirable for consumers

thrive.

and particularly for the export market.

“October was the first month

of the new C ovis management season and we do expect the figures to come down but we

are also seeing it occurring from farms that have not had it before,” Simpson said.

“It is really important that farmers keep up to date with regularly dosing all dogs on farm with the required tapeworm treatments and also ensure any visiting dogs or hunting dogs have been treated at least 48 hours before coming on farm.”

That treatment to manage the risk of sheep measles is for all farm dogs to be treated monthly with cestocidal (tapeworm) drugs containing the ingredient Praziquantel – a cheap and effective treatment – and an All Wormer every three months.

There is no obvious cause for the spike in cases, but warm wet weather across much of the country has provided ideal

Dan Billing to chair BLNZ Farmer Council

DAN Billing has been elected national chair of the Beef + Lamb NZ Farmer Council.

Billing was elected unopposed. He will replace Paul Crick, who led the Farmer Council for the past six years.

BLNZ’s general manager

for farming excellence and extension, Dan Brier, said Crick had made an outstanding contribution on behalf of BLNZ and farmers, and his efforts have been instrumental in strengthening farmer representation and engagement.

“Paul has brought a real focus on ensuring BLNZ is hearing the voice of our farmers and has contributed right across the

organisation. He has participated in our farmer research advisory group, industry people and capability/vocational training policy and programmes and as a chief judge of the BLNZ Awards.

“Paul can step down knowing he has made a real impact on sheep and beef farming in New Zealand through his work with BLNZ.” A formal farewell and thank-

you for Paul Crick will take place at the Out the Gate event in May 2026.

Dannevirke farmer and experienced banker Billing brings a wealth of expertise to the role. He has worked on farms and agribusiness across the eastern North Island, and served on the BLNZ Eastern North Island Farmer Council for eight years.

conditions for the C ovis parasite to thrive, Simpson said.

“Keeping to that regular dosing routine is really critical because the C ovis tapeworm eggs can survive on pasture for up to 300 days.

“It is not enough to dose your dogs and think ‘That’s it’.”

Dogs become infected with the tapeworm by eating untreated meat or offal infected with live cysts. C ovis is then spread to sheep through tapeworm eggs in dog faeces left in grazing areas. Eggs can also be spread from dog faeces over large areas, mainly by flies.

Raw sheep or goat meat should also be either frozen to -10°C or below for at least 10 days or cooked thoroughly before being fed to dogs.

THRIVING: Ovis Management project manager Michelle Simpson says the warm wet weather across much of the country has provided ideal conditions for the parasite that causes sheep measles to

SECTOR: New BLNZ Farmer Council chair Dan Billing has worked on farms and in agribusiness across the eastern North Island.

‘The

way we are using drenches is broken’

Annette Scott NEWS Disease

THERE are ways to manage drench failure in livestock and the world will not end if some animals are left un-drenched, Lincoln University researcher Andrew Greer says.

“That’s the hard thing to get across to farmers that must love doing it (drenching) because they are doing it all the time, especially sheep farmers,” the senior agricultural science lecturer said.

RESPONSIBLE:

AgResearch scientist Robyn Dynes says future-focused farming systems must be informed by science that listens, learns and leads responsibly.

Addressing the recent New Zealand Institute of Agricultural and Horticultural forum, Greer said anthelmintic resistance is not a new issue, and the problem is not the drenches.

“The issue is our reliance on them. They are a finite resource and we need to use them wisely.

“The problem is wasteful drenching. The way we are using drenches is broken. We need to change, be smarter and stop doing stupid things.

“System changes to reduce reliance are needed while we still have a safety net.”

Thisbig.

On average, each new active anthelmintic has roughly a 10-year useful life expectancy before widespread failure.

“It’s all too common: drenching regularly regardless of need, wasteful drenching by the calendar and drenching all animals if they don’t need it.

“Lots of farmers are working on a monthly regime for their sheep and cattle. This all must stop.”

Greer urged farmers to get into targeted selective treatments and decide what part of the mob to drench using options around liveweight gain, body condition score and performance.

“The key is not all animals need to be drenched all the time; the world does not end if you leave some un-drenched. If they are doing well, don’t drench.”

Less than a third need to be treated twice in a row and nearly three-quarters do not need to be treated next time.

The added benefits are more resilient animals that grow better and require fewer treatments. Those needing fewer treatments have better index values and survival. There will likely be marketing advantages following responsible use of chemicals.

“Overseas is shocked at how much we are drenching in NZ,” Greer said.

“We need evidence that we can drench less and reduce use, while saving time, cost and labour.”

Reducing reliance on drenches is about interruption of the lifecycle outside the host. This includes forage types, biological control, grazing management and intensity.

“Now is the time to be changing: accept lower term protection for longer term benefit.”

“The right kind of science where growers and industry can be viable needs investment,” AgResearch principal scientist Robyn Dynes said.

“The key principles of biological systems exist but as a small country we need to be sharp and smart to take us into the future

SHOCKING: Lincoln University ag science researcher Andrew Greer says ‘overseas is shocked at how much we are drenching in NZ’.

with less short-term fixes and the right kind of science.

“Science and technology must deliver new tools, and numbers behind tools are essential; science must prove it will work in the way intended for farming systems to be profitable and resilient in a more complex and difficult future.

“We need a transdisciplinary approach because complex systems cannot be resolved in one – responsible innovation, starting by understanding everyone in the ecosystem being prepared to change, doing the science we need to do not the science we want to do

“It’s about profitable, flexible and future-focused farming systems working with nature, not against it; [being] resilient, adaptive and equitable, informed by science that listens, learns and leads responsibly.”

As farmers know, Californian Thistle is incredibly difficult to eradicate. That ’s due to its unusually deep root system, which can burrow as deep as 2.4 metres – that ’s taller than S amuel Whitelock.

Not only that, lef t unchecked, each stem can produce up to the length of a foot y field in root ever y year; up to 4,000 kilometres per hectare! And the fact that they are perennials, unlike their annual thistle cousins, means they just keep coming back (as you know too well!)

B ut you can tackle the problem once and for all, with Tordon PastureBoss.

We recommend following a three-spray programme with Tordon Pastureboss as the anchor product, followed by a second application of phenoxy (MCPA) and then spot sprays of Tordon PastureBoss for lasting results

And of course Tordon PastureBoss can be used on a wide range of other hard-to-kill pasture weeds

S ee our website for details.

To view the Technical Manual or download the label scan the QR code. Always read the label before use

e d th l el fo

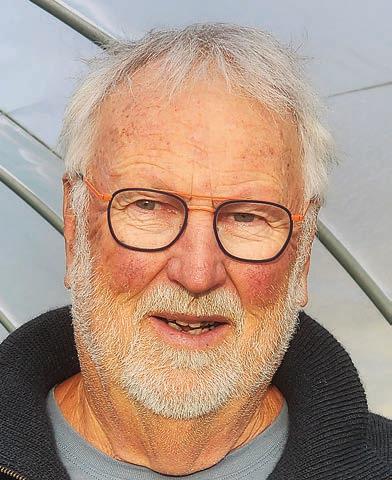

Making tracks key to a happy retirement

PETER Winter might be 94 years old, but he’s still handy with a shovel and is happy to head into the Canterbury back country to help Department of Conservation rangers upgrade walking tracks.

Winter is part of the Mount Somers Walkway Society, founded around 40 years ago.

The volunteer group of mainly retired farmers is described as the “third arm” of DoC, spending hundreds of hours looking after the Mount Somers tracks and biodiversity. They’ve just helped build a new zigzag walk on the very popular Woolshed Creek Track.

DoC Geraldine operations manager Tony Preston said Winter and the Mount Somers Walkway Society are the most productive, passionate and committed community group he has ever worked with.

“As well as Woolshed Creek, they constructed a new walk to Sharplin

Falls (funded and managed by them), plus they’ve done an enormous amount of broom and gorse control in the Mount Somers area,” he said.

DoC ranger Chad Adams said they’re a key partner in the projects his team needs to get done.

“A lot of the work we do would be very difficult to achieve without them. We see them as one of us. It means we can focus on other areas. These guys are always ‘naturing’, there wouldn’t be a day go by when one of these guys isn’t out doing something. Peter’s a classic. He’s amazing at 94 to be going strong and what an inspiration,” Adams said.

Mount Somers Walkway Society president Robert Schikker said they get a huge amount of satisfaction from the work with DoC.

“Being retired farmers, we love hard physical work. Peter’s a real character and he’s been around for a long time. He’s apparently never been to the doctor. I reckon it’s this outdoor work and staying fit that keeps him going.

“We all enjoy a day out and bonding with each other and we love the idea that we are creating something that others can enjoy,” he said.

Adams said having the group upgrade popular tracks is vital, especially heading into the busy summer season.

“These tracks get masses of use,

Cider ready for next steps

THE New Zealand cider industry is poised for growth, with some orchardists already grafting trees to tap into the premium cider market.

Director at Cider Apples New Zealand Allan White told Farmer’s Weekly cider makes up 15% of the NZ wine market, up from only 3% a decade ago.

Most local cider is made from either apple juice concentrate or process grade eating apples, but over the past few years the sector has been investigating whether there’s demand for growing apple varieties specifically for premium ciders, White said.

In contrast to the sweet ciders from concentrate, premium ciders are dry, and have specific tannins similar to those of dry white wine. White said about 15,000 trees could be planted for commercial purposes in 2026, with a number

of apple orchards indicating they are interested in supplying the cider market.

The cider industry is at the same place the wine industry was in the 1980s, he said.

White said in the ’80s the industry made wine from grapes that wouldn’t even be considered today.

Locally produced premium dry ciders have been popular when market tested in the United Kingdom, the United States, Australia, Japan and China.

Because there are fewer cosmetic requirements for cider apples than for fresh fruit apples, the cost to grow cider apples is lower, with fewer chemicals used, fewer hours of labour required and less finicky harvesting.

Hawke’s Bay apple grower Paul Paynter told Farmers Weekly he grows cider apples because they fetch high prices.

Paynter echoed White’s view that the industry is in the same place the wine market was in the 1980s. For growers that means

HOUSE CIDER RULES: Pure Blossom, PremA021, is grown on a trial plot at Cider Apples New Zealand. The apples were used to produce cider that recently won gold and silver at the Fruit Wine and Cedar Makers Association awards.

trying to determine what apple varieties are best for cider.

Paynter grows 5 hectares of cider apples, producing about 200 tonnes per year.

He said he hoped university-age cider drinkers will mature with the cider market and drink premium ciders as they grow older.

An industry roadmap published last year showed premium cider orchards and cideries could be profitable.

“For this to happen, the orchardist would need to earn $1/kg or more for cider apples, and a cidery, with a million litre/ year capacity, would need to earn revenue of $8/litre or more.

“With a distribution and retail margin of 50%, the implied retail price is at least $12 per litre. This is about $1/litre more than current New Zealand supermarket prices for cheaper cider made from apple concentrate.”

Greenfields orchards could make a profit, but converting existing orchards would be more profitable, the roadmap said.

We all enjoy a day out and bonding with each other and we love the idea that we are creating something that others can enjoy.

Robert Schikker Mount Somers Walkway Society

weekend to attract younger people.

Adams is keen to emphasise how much DoC values their work and how much more there is to be done.

“DoC is always busy. There’s a very long list,” he laughed.

and we want to make sure they’re safe and well maintained. The Woolshed Creek Track is an ideal entry-level tramp for families with the kids, as it’s an easy walk to a bookable DoC hut, meaning you’re guaranteed a bed,” he said.

The Mount Somers group wants more volunteers so is considering scheduling working bees in the

“It’s hard work but it’s also good for your physical and mental health and you get to visit some very special spots. These guys all have big smiles on their faces, especially sitting on the hut verandah after a hard day’s track building.”

Winter said it’s this type of work that keeps him feeling young.

“I just love it,” he said.

Help defeat resistant bacteria, vets urge

Staff reporter TECHNOLOGY

Animal health

ANIMAL owners can help protect life-saving antibiotics from resistant bacteria by keeping their animals healthy, says the New Zealand Veterinary Association Te Pae Kīrehe.

The warning comes during World Antimicrobial Resistance (AMR) Awareness Week, and is part of global action plan to tackle the growing problem of AMR, where pathogens such as bacteria become resistant to critical antimicrobial medicines like antibiotics.

Dr Annabel Harris, chair of the NZVA AMR committee, said judicial use of antibiotics is a priority for the animal health sector.

“Bacterial infections that are resistant to antibiotics can affect our pets and our livestock, and transfer between animals and humans and into the environment.

“We need to manage AMR as a One Health issue – that is, that humans, animals and the environment are all connected.

And we all have a role to play.

“Part of that is preventing the need to use antibiotics by keeping our pets healthy through good nutrition, good hygiene, regular health checks and vaccinations. And when antibiotics are prescribed by a veterinarian it is essential to give them to your pet as directed.”

Harris said New Zealand is already a low user of antibiotics and is making good progress reducing its use.

Since 2017, antibiotics sales figures for plants and animals have dropped by nearly 50% thanks to a concerted effort by veterinarians, farmers, industry and New Zealand Food Safety.

“We should be proud of that. However, AMR is not going away. Bacteria that become resistant to antibiotics not only go on to reproduce survivors but can buddy up with other bacteria to share that resistant genetic material.”

Harris said for farmers, managing AMR requires a more holistic approach where antimicrobials like antibiotics are just one part of an integrated disease control programme.

PRIORITY: Dr Annabel Harris, chair of the NZVA Antimicrobial Resistance Committee, says judicial use of antibiotics is a priority for the animal health sector.

BACK COUNTRY: Retired farmer Peter Winter and DoC ranger Chad Adams on the Woolshed Creek track.

Photo: DoC

Gerhard Uys NEWS Horticulture

GROWING SHARE: Director at Cider Apples New Zealand Allan White says New Zealand cider is 15% of the wine market, up from only 3% a decade ago. Cider Apples New Zealand is a breeding and IP management company.

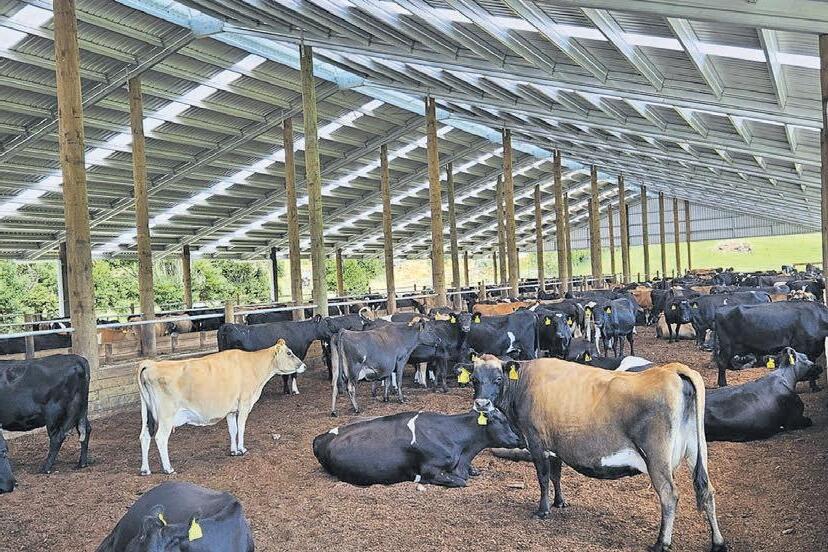

Barn life suits stock and farmers

It’s all about lifestyle – for humans and cows – at Rene and Ereine Vos’s Huntly dairy farm, with the addition of an Aztech composting barn.

The barn has given them an extra tool in the toolbox, taking the stress out of winter on their farm, which is prone to getting very wet, and will provide relief from the heat in summer.

Life is easier for staff, cows are warm, dry and content, and feed utilisation is improved. Most importantly, they can save their paddocks ready to head into spring with optimal production.

The couple milk 320 cows twice a day. The farm milking platform is 130 hectares, with the total farm size at 230ha, giving them a self-contained unit to run young stock and rear beef animals.

They rear about 70 heifers as replacements and the beef system comprises of 80 yearlings, 80 R2 and 80 calves, which are taken through to finishing.

Their Artificial Breeding (AB) policy means they breed from the top of their herd, using recorded bulls over their youngstock to breed better animals with good genetics. Ereine explains that their AB is more precise now with the use of sexed semen in the top of the herd, as well as some nominated straws. They tail off using Hereford bulls, which gives them good beef animals to rear and finish.

This hard-working couple, who both grew up in town, were share milking on three farms. “We were busy and we started out doing the beef to use them as topping machines on the farms, rather than running around with the tractor. Now, we still use the same sort of principle.”

With their milking shed being only 24 aside they would prefer to have a smaller number of milking cows, and the beef complements the milking operation nicely.

Having given everything to farming over the last 25 years, it was time to make life a bit easier, and that’s where the Aztech composting barn comes in.

“It’s time for the farm to give us something. This was the goal, to have our own farm, and we want to enjoy the goal,” Rene says.

They did their homework before making the commitment to build a composting barn and the main reason, initially, was to give them more control in winter.

“Our farm gets very wet and we have never been able to feed out. We wanted to have somewhere to stand the cows off and feed them, to take the winter stress away. Winter is supposed to be a quieter time, but we always seemed to be just as busy because the cows were making a mess of the paddocks,” Rene says.

“Making mud was the one thing that was really stressing Rene out in winter. We

wanted to leave the paddocks in good health so we could get good production in spring,” Ereine adds.

They looked into feed pads, but felt a composting barn gave them more options, as they were not keen on standing cows off on concrete for long periods.

With the addition of the composting barn ahead of this winter, they found they were also able to calve everything inside. This eliminated running around looking for calves in the mud and getting the bike stuck in the process.

“All we needed to do was check them and sort them out after breakfast. This made life much easier for staff, the cows were warm, dry and content and we were amazed by how little feed was needed to keep them happy.

“There was no feed wastage. Now we would be feeding 7-8 kilograms of maintenance feed in the barn and that’s it, with a bit of hay and palm kernel or maize. We can focus all of the grass into the milking cows.”

The barn is designed in two halves, allowing them to run two herds in winter, with 160 cows on each side of the barn. As they started calving, springers were housed on one side, milkers on the other.

Rene says it was basically like having two feed pads.

The big benefits here were saving grass and better feed utilisation. The change in diet means they have reduced the amount of money spent feeding the cows in the milking shed. They now spend the same amount of money per cow, but feed double the amount.

“We have better control of our costs and our production has been up around 100kg milk solids (MS) per day steadily for most of the season. We are doing .2 to .3 per cow a day more.”

While it is early days, they have seen gains already, and believe there are further gains to be made in summer when the farm gets dry and cows can come under heat stress, dropping production.

“We can drop 50 MS a day out of production when the heat comes on in December. It will add up quickly,” Ereine says.

“Over summer they will come in during the heat of the day. I think it will make a big difference and I’m excited to see what happens,” Rene says.

“It’s a real animal welfare thing in summer. In winter it’s more about looking after the farm and in summer it’s about the cows, and not over-grazing. If we don’t hammer the grass as hard, we will be growing more grass.”

They chose to go with Aztech for their build for a number of reasons. They wanted a permanent structure, which they felt was more aesthetically pleasing. They also liked the idea of the Smart Ridge Vent on the Aztech barn, providing passive ventilation and airflow, while ensuring everything stayed dry inside.

They spent a year and a half researching barns and visiting different structures to understand what worked, and what didn’t, before settling on Aztech.

“We had built with them previously, a six-bay calf shed, which went really smoothly. We were impressed with their professionalism.”

Rene ‘rips’ (tills over) the self-composting bedding, which is a mixture of woodchip and sawdust, daily to aerate it. They are careful to keep the outside edges, where the cows are feeding, clean and hope they can get four to five years out of the compost.

“Hopefully, if we take care of it, it will last. It’s dry as anything and looks really good.” They have been amazed how warm the compost is, when you dig down, indicating the presence of good bacteria. And there is no odour at all.

It’s the little things that add up for the Vos family, all the benefits coming together to make the whole farm system run smoothly and profitably. “It seems to be more enjoyable. At lunchtime the cows just come running to the barn by themselves for a feed before milking. There is no more following a slow herd to the shed.”

The barn means no more sleepless nights for Rene in winter. He can lie in bed listening to the rain on the roof happy in the knowledge the cows are tucked up and his paddocks are not being churned into a bog hole.

“This is the first winter that I haven’t had to be out of the house before 8am to move the cows. That’s been an underestimated bonus, it’s given me a few months of the year where I can take it easy. Being able to listen to the rain at night and it was a good feeling – you can’t put a dollar value on that.

“You have to enjoy what you do. We really built it (the barn) to have more control over the whole farm, and I like being able to fine tune the cows and the farm. Seeing everyone happy and the cows happy, that’s the main thing.”

At Vos Farms, Rene and Ereine Vos worked with Aztech to design a composting barn that keeps cows warm, dry and settled while protecting paddocks and lifting overall efficiency.

The Vos Farms Aztech composting barn, 45.5m wide and 66m long built for year-round cow comfort and smarter winter management.

Pressures grow for Zespri rethink on China

Richard Rennie in Chengdu NEWS

Horticulture

ZESPRI’S recent victory in China in a major plant variety rights case over local orchardists growing its protected G3 SunGold variety also comes at the end of the marketer’s five-year study on where to head with the illegally grown fruit.

A grower vote taken back in 2021 rejected proposals to conduct a collaborative marketing trial with Chinese growers in Sichuan to market their fruit under Zespri’s brand to complement NZ fruit sales. Issues causing NZ growers concern included loss of IP and the perceived quality of Chinagrown fruit.

We regard Zespri as the gold standard to meet.

Yan Zhiqiang Chengdu Kiwifruit Growers Association

But since then crop volumes have only grown.

Now estimated to be up to 7500 hectares throughout China and about 5000ha in Sichuan province, the planted area is closing on New Zealand’s G3 planted area, while estimated production of 41 million trays is comparable to Zespri’s total G3 sales to the market.

This is a clear challenge to Zespri’s market share at certain

times of the year, and the NZ industry is under pressure to revisit the vote as the volumes from China continue to rise.

Sichuan province, with a population of 94 million, is a key kiwifruit-growing region, comprising about 50,000ha of which 30,000ha is in Red, and the remainder in Gold, including about 5000ha of G3 and most of the rest as the local Jinyan variety.

Zespri’s monitoring project included observing the development of orchard plantings of the illegally imported G3 variety, while also exploring options to ensure fruit quality could be maintained, should a collaboration get the green light.

This had included originally identifying 20 orchardists growing a total of about 1000ha of G3 as possible first candidates to engage with to supply fruit in a collaborative trial.

While Zespri is buoyed by the latest court victory, the high cost of such actions could leave the marketer exposed to an expensive game of whack-a-mole, given the sheer volume of plantings now in the ground.

On a recent Farmers Weekly visit to the province, local growers were well aware of the court victory awarded to Zespri and believed it may slow, but not stop, continued planting of G3 vines.

Yan Zhiqiang is the director of a new packhouse company processing unauthorised G3 fruit alongside local kiwifruit, and also head of the Chengdu Kiwifruit Growers Association.

He told Farmers Weekly his growers emulate Zespri standards, often watching videos on orchard techniques and buying trays at retail to sample and compare to their own.

“We regard Zespri as the gold standard to meet, and middle-class families in China want to buy Zespri fruit. We know Chinese fruit is not as high quality as Zespri’s, but it is still relatively good.”

With the Chinese government recently allowing growers to increase their area in fruit, including kiwifruit, he sees Sichuan

Rogue growers long to be in Zespri fold

Richard Rennie in Chengdu NEWS

Horticulture

KIWIFRUIT orchardists growing the Zespri G3 variety in Sichuan province are keen to have their fruit sold under the label of the company it was taken from.

A recent China court ruling has confirmed China’s commitment to upholding its newly boosted plant variety protection rules, with the defendant being fined NZ$1.3 million and ordered to pull out his 260-plus hectares of G3 vines. The grower is appealing the judgement. However, there is tacit acknowledgement within the industry that the cost of taking case-bycase court action rules out ever being able to rein in growers of an estimated 5000ha in Sichuan alone.

For local husband-and-wife growers Mr Chen and Miss Xu, obtaining G3 rootstock presented an opportunity to turn their bare 4ha block of heavy soil into a kiwifruit orchard. Four years on

they say they are still learning the intricacies of the crop and are working hard to meet “NZ standard” fruit.

“The local Red variety – Donghong – and other local varieties are better suited to this soil. But we wish to continue with G3, in the hope we may be able to supply Zespri with it in the future,” said Miss Xu.

Their orchard is one of 20 Zespri included in its recently concluded five-year monitoring and observation programme in the Chengdu region.

A key drawcard for the couple wanting to supply Zespri with G3 to meet counter-seasonal supply to complement NZ supply is the premium Zespri fruit gain in the Chinese market. Typically, the difference can be double what local varieties of Gold fruit get per kg, and 30% above the unauthorised local G3 fruit.

“But we are also very interested in receiving advice from Zespri on ways to improve our crop and our practices.”

They say the G3 is less vulnerable to many diseases than local varieties of kiwifruit.

The heavy soils receive organic

and chemical fertilisers and approved insecticides.

Psa disease does not affect their G3 as it does the local Red variety.

They say, however, that a key challenge is fruit dropping off vines just prior to harvest.

But they see more upside in G3’s yield potential, harvesting about 37 tonnes of fruit a hectare compared to most NZ orchards’ 45t/ha. To protect fruit and aid ripening, all fruit is bagged on the vine prior to harvest.

They say they have generated a “reasonable” profit to date.

With their hope of being taken into a collaborative partnership dashed when the 2021 NZ grower vote went against a China production trial, the couple are in something of a holding pattern.

“It would depend upon what Zespri was to do for us whether we would commit or not,” said Miss Xu.

For fellow orchardist Zhang

province holding plenty of promise for greater areas of Gold and local varieties of Red fruit plantings.

He believes Zespri’s Ruby Red now coming into China could be a game-changer for Chinese kiwifruit consumption, particularly among younger consumers.

In terms of working under a Zespri label, he said the time is ripe for collaboration.

“The Chengdu government is really supporting growers and farmers and the industry. It has a strong budget and the city is a new ‘First Tier’ city, with local

government also supporting Zespri coming to Chengdu.”

Regardless of Zespri engagement with local packhouses and growers, the sector is not slowing down on its investment pathway.

Investment at a government level includes nine “agri-park” sites around Chengdu focusing on research and sector infrastructure.

Sichuan orchardist

says she and her

are very keen to continue growing G3 fruit, hoping to collaborate with Zespri to supply out-of-season fruit to complement NZ growers’ produce.

Ping, the incentive for planting G3 several years ago on 3.5ha was the potential for co-operation with its source company Zespri. He closely researched orchard layout and fruit type, opting for Bounty rootstock as better suited to his heavy soil and offering good disease resistance.

As an ex-government employee, he has come to orcharding having had enough of office work, and is keen to leave a legacy for his two children. He said his income from

kiwifruit growing is higher than what he made in the government job.

Being new to orcharding he found plenty of technical support to help him learn to grow kiwifruit better, and said his biggest challenge is finding workers year round, while labour costs have also risen 15% in the last two years.

“Growers are around with lots of expertise, and they are happy to share their information and experience.”

FOOD AND SECURITY IN CHINA

FOOD AND SECURITY IN CHINA

BETTER: Head of Chengdu Kiwifruit Growers Association Yan Zhiqiang acknowledges China-grown Gold kiwifruit is not as good as Zespri’s but says growers are working hard to lift their game.

KEEN:

Miss Xu

husband Mr Chen

Wool faces stiff competition underfoot

AN EXTREMELY competitive floor covering market in Europe continues to squeeze financial margins, according to the head of one of the continent’s largest wool covering producers.

Duarte Oliveira, executive manager of Portuguese carpet manufacturer Lusotufo – a key Wools of NZ customer for more than a decade – said wool carpets remain niche, and despite consumer intentions to shun fossil fuel or plastic carpets, cost still ultimately drives many purchasing decisions.

Lusotufo, a third-generation family-owned business based near Porto, Portugal’s second largest city, specialises in manufacturing wool carpets and wool carpet yarn. It is Europe’s second largest carpet producer and the third or

fourth largest producer of carpet yarn.

Floor covering markets such as the United Kingdom continue to favour wool but given the option of paying €2/m sq for polyester or €5-€6 for wool, many customers are driven by price.

“It’s always a balance between price and demand,” Oliveira said.

“It’s a completely different price point.

“There is a lot of talk from a lot or people aware of the problems with plastic, but at the end of the day you are seeing more and more plastic products coming onto the market in both carpets and garments.”

While European and New Zealand markets are stable, the Australian market is growing.

Lusotufo sources wool from

Europe, the United Kingdom and NZ, and Oliveira said all wool growers are facing low incomes.

Merino wool producers in Spain and Portugal three years ago received €1.90/kg. This year it is €60c.

The other factor facing wool carpet manufacturers is the dominance of Chinese wool buyers and their influence on price.

If they are active in the market, Oliveira said, the wool price rises. If they are not, the price is lower.

“Every time China gets busy prices go up. When China goes quiet prices go down.”

Lusotufo buys scoured NZ wool from merchants and says it is already the most expensive in the world.

When prices increase, there is consumer resistance and manufacturers are reluctant to develop and release new ranges and new products.

He is confident there will always be demand for wool carpets due to their quality, but it will be niche and the market will be buffeted by economic conditions, which will impact what they can pay growers.

Its carpets are a blend of NZ and UK wool, which improves its resilience, and each square metre uses 1.5-2kg of wool depending on the depth of pile.

Oliveira said paying growers a further 50c to $1/kg for scoured wool adds significantly to the retail price.

“I’m not saying it’s too expensive and farmers are getting too much money, but sheep farmers should not count on wool to drive their business.”

NZ supplies the best quality

The day NZ quality declines to the quality of other wool, NZ loses its advantage.

Duarte Oliveira Lusotufo

carpet wool and Oliveira urged farmers to maintain high standards such as minimising black fibre and vegetable matter.

“Please take care to get quality as high as possible.

“The day NZ quality declines to the quality of other wool, then NZ loses its advantage.”

Currently China is actively buying wool and Wools of NZ chief executive John McWhirter said prices are double what they were at the end of the covid pandemic.

McWhirter said Wools of NZ has been trying to improve supply

chain efficiency to reduce the price differential between wool and plastics, which is about $2000 to $4500 to carpet a house, a gap that is a major deterrent for using wool. It has been reduced in some markets to about $1000 but he has a target of $500-$700, which still preserves a premium that recognised the merits of wool.

“It should be more expensive because it’s better.”

McWhirter said the strong wool sector is facing the consequences of not promoting the fibre for the past 25 years.

• Wallace’s Meeting the Market tour has been made possible with grants from Fonterra, Silver Fern Farms, Rabobank, Zespri, Alliance Group, Meat Industry Association, Wools of NZ, Beef + Lamb NZ, NZ Merino, the European Union and Gallagher.

https://www.farmersweekly.co.nz/ meeting-the-market/

Grower goes beyond gate with Gold kiwifruit

Richard Rennie in Chengdu NEWS Horticulture

THE growing popularity of Red and Gold kiwifruit among Chinese consumers is seeing a new generation of Chinese orchardists taking their fruit beyond the farm gate, building brands and marketing campaigns around them.

In Sichuan near the provincial capital Chengdu orchardist Wang Yi has leveraged off his organic fertiliser business to develop a 12 hectare orchard planted in Zespri G3.

The G3 orchard complements his Red orchard in the neighbouring district. It is also a demonstration orchard used to trial new methods to share among other growers in the district.

While Wang has established the orchard, he has also worked on building his own kiwifruit brand, Shang Yi, to market the G3 fruit.

“The G3 delivers a 25% lower yield than our local Gold variety (Jinyan) but it gains a higher price. The local Gold variety’s flavour is not as good as the G3, and locals prefer the G3 fruit, although the G3 is harder to grow.”

Chinese G3 tends to be harvested at a higher Brix (sugar) level, and at 18% dry matter compared to about 15% in NZ.

Typically, the local Gold variety will fetch about half what Zespri SunGold fruit are worth, while locally grown G3 sell at about twothirds of what Zespri SunGold sell for.

The local Gold variety’s flavour is not as good as the G3, and locals prefer the G3 fruit, although the G3 is harder to grow.

Wang Yi Sichuan kiwifruit grower and marketer

While working on his own brand, Wang said he would welcome the opportunity to co-operate with Zespri, given the higher premium the fruit commands with a Zespri label and the esteem it is held in by consumers. He sees the potential to complement Kiwi growers by being able to fill gaps in their off-season supply with his fruit.

During a recent Farmers Weekly visit to China the China Daily, the official foreign language media

FOOD AND SECURITY IN CHINA

mouthpiece for the Chinese government, reported on Zespri’s successful prosecution of a local grower and distributor in the Wuhan courts for the growing and sale of unauthorised Zespri G3 fruit.

The defendant was ordered to pay around NZ$1.3 million in compensation to Zespri and required to pull out 260-plus hectares of G3 fruit.

The grower is appealing the judgement.

The case’s publicity in the China Daily is significant, with the article signalling the Chinese government’s desire to prove it is following up on stricter plant variety protection laws.

The government has also ramped up its investment in “agri-park” research and infrastructure facilities in Sichuan province, with an aim to attract more investment, and proof of law enforcement boosts that attraction.

Wang said local growers are well aware of the court case and its implications.

He said it is likely it could lead to

a slowdown in the planting of G3 in Sichuan.

But it remains likely that the volume of kiwifruit grown in the province – which has long been a traditional growing area for Gold and Red varieties – will only increase.