BE IN TO WIN ONE OF THREE TRIPS TO THE CALGARY STAMPEDE 2024*

More details over the page!

BE IN TO WIN ONE OF THREE TRIPS TO THE CALGARY STAMPEDE 2024*

More details over the page!

Forage brassicas can provide high quality winter feed to carry stock numbers during winter while pasture production is at the lowest. It can also reduce your dependence on bought-in feed such as baleage and an excellent lead-in for re-grassing.

Key points when considering growing a winter brassica:

Will you require resource consent for growing a winter brassica?

Do you know the soil type and fertility status?

Do you have issues with Clubroot?

Have you considered sowing dates and crop maturity dates?

Will the brassica variety suit the stock class that will be grazing it?

Will you be following this crop with a brassica?

Have you considered suppliments for this stock while grazing the crop?

To get the most out of your forage brassica crop this season, consider using Milestone from Corteva to control a wide spectrum of broadleaf weeds, or Korvetto herbicide for more re-cropping flexibility.

For pests, Sparta plus Transform offers outstanding control for caterpillars and aphids, while protecting beneficial insects. Remember to always check labels before use. Seed

SovGold kale from Agricom is a reliable, high yielding variety. With a large Cleancrop portfolio offering, PGG Wrightson Seeds are renowned for their brassica range. Plus, Invitation swedes are now available in pelleted form, perfect for precision drilling.

FONTERRA chief executive

Miles Hurrell says he is hopeful Chinese dairy demand may lift in the new year as the last of the New Zealand-China free trade agreement milk powder duties fall away on January 1.

Demand has been sluggish so far this season, resulting in Fonterra reducing its milk price forecast from $8/kg milk solids midpoint in May to $6.75/kg MS on August 18. However, buyers will be wanting to take advantage of the FTA with that 10% duty coming off after that date. Within contract periods one to five, it is periods four and five that will have product landing in China after January 1, Hurrell said.

“That’s why you’re also seeing a situation where there are not too many Chinese buyers looking to buy in contract periods one, two and three because they would be lumped in with that higher duty –that’s another piece that’s in play here.”

This is giving him confidence that demand will lift, confidence will rise and there may be an improvement in the milk price in the new year.

Hurrell said the Chinese economy had come off its peak from its pre-covid highs and went through a severe lockdown, which did impact on dairy demand last year, particularly in the food service sector.

“As they came out of covid in the early part of 2023, we saw demand rebound and come back relatively strong as people started going out and about and consumers were doing their thing.”

At the same time, there was significant growth in Chinese domestic milk production.

Hurrell said a lot of the milk that was produced during that growth/lockdown phase was dried because it was surplus to requirements.

“That started to bleed out into the Chinese market at a time when we were seeing demand rebounding.

“So, you had a hit of surplus milk

Continued page 3

An hour from the choking sprawl of central New Delhi is a world of villager-farmers and landowners, the backbone of India.

NEWS 10

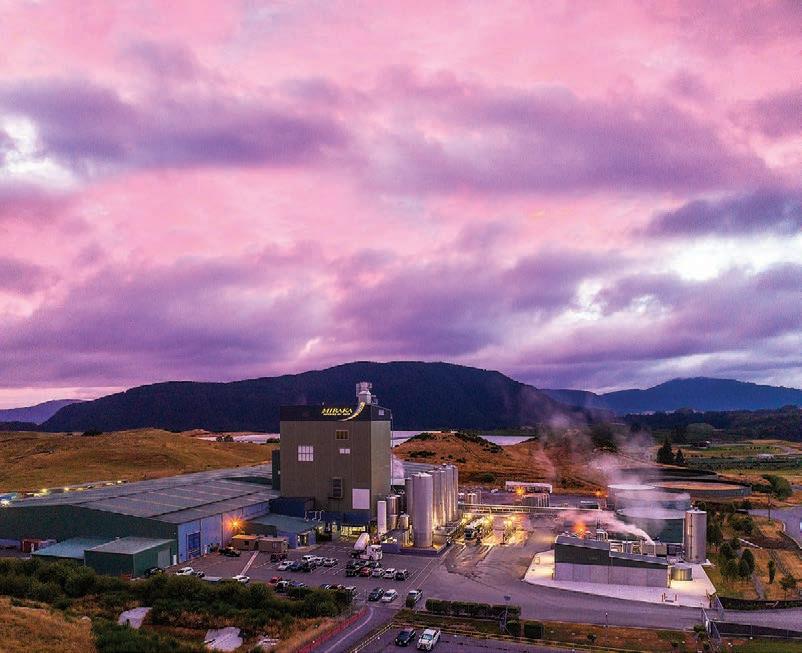

Miraka chair Kingi Smiler left a glittering career in corporate NZ to use his skills to build up his whānau and the wider whenua.

PEOPLE 20

Consolidation is a must if the strong-wool industry is to thrive again, Feds wool chair says.

NEWS 9

Exports will suffer if NZ fails to meet Paris targets – and it can’t do so by mitigation alone.

NEWS 12

Sheep farmers have endured a year of depressed prices and they’re not out of the woods yet.

MARKETS 36

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469

Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 09 432 8594

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS 0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by Stuff Ltd

Delivered by Reach Media Ltd

Andy Whitson | 027 626 2269 Sales & Marketing Manager andy.whitson@agrihq.co.nz

Steve McLaren | 027 205 1456 Auckland/Northland Partnership Manager steve.mclaren@agrihq.co.nz

Jody Anderson | 027 474 6094 Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095 Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Omid Rafyee | 027 474 6091 South Island Partnership Manager omid.rafyee@agrihq.co.nz

Debbie Brown | 06 323 0765 Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print)

ISSN 2463-6010 (Online)

Beef + Lamb New Zealand is calling on farmers to take part in a groundbreaking Facial Eczema research project by collecting sheep dung.

The three-year study will help BLNZ understand how widespread Facial Eczema is in New Zealand.

Those participating in the study will be required to collect samples 16 times, roughly every two weeks, from their mob of sheep each year of the study.

Dr Liz Shackleton has been appointed chief executive of Animal and Plant Health New Zealand. Shackleton has been leading the DairyNZ Biosecurity team, including the Mycoplasma bovis programme team, since 2018, and held leadership roles in the pharmaceutical sector after starting her career as a rural veterinarian.

She is a chartered member of the NZ Institute of Directors and a board member of the NZ Veterinary Council.

The ASB Commodities Index in United States dollar terms has fallen to its lowest level in three and a half years, dragged down by the latest drop in world dairy prices.

The recent fall in the value of the New Zealand dollar to US59c has only partially cushioned the decline in commodity prices, as the index in a is now the lowest in two and a half years. The indexes for sheep, beef, forestry and fruit fell about 1% each.

Cropping farmers have ticked the Yes box, giving the green light for the continuation of the Foundation for Arable Research. The results show strong support for continued investment in research and extension for the arable industry.

FAR received the declaration of result on Monday August 28, following its sixth referendum of growers.

DESPITE a tough year, Tairāwhiti farmers pulled together to once again support the Gisborne-East Coast Cancer Society stock drive, as they have done for 25 years.

Held at the Matawhero saleyards each year, the stock drive attracts support from a wide breadth of people.

The principal sponsor is ANZ and relationship associate Michelle Hawea does the mahi to organise the event, following in the footsteps of founder Andy Woolfield. But Hawea said the success of the event lies with the absolute generosity of the farmers, auctioneers and purchasers.

“I want to relay gratitude and thanks to not only the area co-ordinators and donors in our community, who have had such a rough year, but also

Continued from page 1

enter the market at a time when people were starting to come back from their covid restrictions.”

Overlaying all of this are economic indicators that suggest the economy is slowing down faster than many anticipated.

“There are a few things in play and what you see in a Chinese context is that when there is a little bit of uncertainty as we see now in that economy, people are starting to save more so their consumption drops and their saving patterns go up.”

It has seen the saving rates of Chinese consumers lift significantly.

“All of those things have put a damper on the industry that we play in.”

Within the market itself, the slowdown in demand is mostly affecting Fonterra’s ingredients business because of the stockpiling of China’s domestic supply.

However, the food service and consumer brands business are

to the incredible support of PGG Wrightson manager Jamie Hayward, stock agents, auctioneers

Chris Hurlstone, Neville and Cody Clarke, and the many generous purchasers who often pay above

continuing to go from strength to strength, he said.

“There’s still a large portion of the population out there spending and doing their thing and we have a very strong position in out-ofhome consumption.”

Fonterra’s consumer brands business is also faring well, though it has small presence in that market.

When it was sending as much product into those markets as it could, Fonterra’s products sat at the top end of that market and it would not be possible to convert all of its products from ingredients to food service, he said.

Other markets are also starting to pick up some of that slack, but not to the same degree.

“We are seeing the Middle East and Africa emerge as an important market for us and East Asia is still going strong and other parts of Asia, like Japan and Korea, are going very strong.

“But it wasn’t enough to pick up the slack in what is an important market for our key ingredients business.”

market prices to support the day,” she said.

“They really contribute to the success seen year on year. The rural community we have here is unreal – they are generous and

Those markets are faring well in the midst of talk of a global economic slowdown, but demand is not strong enough to pull prices up.

It is too early to tell what it will mean in the short term with the peak milk period fast approaching as farmers look to cut costs because of the low milk price, he said.

“How we see that play out in terms of supply is yet to be determined.

“It’s a bit too early in the season for us to have any sort of gauge. Clearly it’s been wet through the back end of winter and it’s looking like it’s continuing to be wet for a period.

“We are not seeing the milk growth we anticipated and whatever farmers do between now and Christmas will have a huge bearing on what happens in the new calendar year.”

Hurrell said he recognises that the situation inside the farmgate is extremely tough with the current midpoint well below what is considered a break-even milk price for most farmers.

humble beyond words.”

The stock drive was held on August 25 and 313 sheep were donated by local farmers on the day. Subsequent sales will also sell lines donated to the Cancer Society.

The 313 was made up of 105 prime sheep, 218 lambs and seven store sheep.

A total of $33,583 (excluding GST) was raised with one line of 53 lambs from one annual donor selling for $215 per head, the highest commercial lamb price nationwide this season.

PGG Wrightson regional livestock manager Jamie Hayward said this year was always going

to be harder, but the results were fantastic.

“All buyers were generous with their bids in what is a tough market environment.”

Lines sold above market value, but all money raised at the stock drive stays local, which gives added incentive to support the cause.

Over the past 25 years, more than 8000 sheep have been donated and around $1.1 million raised.

Shay Podjursky from the Cancer Society echoed Hawea and Hayward’s comments.

“We are very grateful to those people that contribute to this event. Twenty-five years of donations makes a real tangible difference to our local community and we are so appreciative of the ongoing support, especially given how rough the year has been.”

The money raised most often goes to supporting cancer patients through counselling, therapy and transportation.

Gerald

Gerald

MILES Hurrell has defended the cooperative’s decision to put its new season opening forecast at a $8/kg MS midpoint, only to slash it three months later.

The Fonterra CEO said the cooperative made the decision with the best information it had at the time and is operating in a volatile commodity market.

“Our job is to try look through that the best we can and recognise that we are in a market and the markets will move accordingly.”

He said Fonterra’s job is to find the most accurate forecast it can.

Demand was still strong when it set its new season forecast and while some indicators were starting to show that the Chinese economy was starting to weaken, it was

“certainly not to the extent that we’re seeing now”, he said. “Hindsight is wonderful, but at the same time we have to put our best foot forward.

“We do get asked sometimes why don’t we go more conservative at the start and ramp it up later, but that’s not how we are operating – we’re operating to give the best forecast that we can.”

Hurrell said Fonterra is dealing in a commodity market that is subject to huge volatility and that dairy prices have been relatively stable for the past three to four years. “You can try and predict the future, but at the same time, we are dealing in a market and buyers and sellers will make their own decisions based on their own economic position on the day.”

MORE: See Letters to the editor, page 16

‘We’re giving the best forecast we

Piddock MARKETS Dairy

All buyers were generous with their bids in what is a tough market environment.

Jamie Hayward PGG Wrightson

GREEN Party coleader James Shaw does not support the government’s new agricultural emissions pricing policy, but as climate change minister will work to implement it, he says.

Farming groups also appear to have hardened their attitude to the policy, using terms such as “tone deaf”, “thoughtless” and “dismay”, a far cry from last December when they stood alongside then prime minister Jacinda Ardern to announce the proposals as part of the He Waka Eke Noa (HWEN) climate action partnership.

The change is due in part to the timing of the policy announcement. Farming groups were given details less than 24 hours before they were publicly released.

There is also unhappiness about the lack of detail about pricing and the decision to not include a review of targets or the methodology for measuring methane.

Shaw told Farmers Weekly he does not support the policy, but as climate change minister he is bound by Cabinet responsibility and will work to implement it.

The government’s policy includes farm-based emissions pricing, development of systems to measure and report emissions, retaining a split gas approach and delays to reporting on emissions until the fourth quarter of 2024 with pricing starting in the fourth quarter of 2025.

HWEN has not yet responded to the policy announcement. Last December it was receptive to the policy direction.

“This is a high-level, directionsetting [set of proposals] and does not have all the detail farmers and growers will need, but it is

an important milestone,” HWEN independent chair Sarah Paterson said at the time.

“It confirms that HWEN has been successful in putting the case for a farm-level split gas levy instead of including agriculture in the New Zealand Emissions Trading Scheme.

“It shows the government is listening to sector and Māori views and is taking action to address concerns.

“This shows the value of working together.”

HWEN programme director Kelly Forster told the Carbon Forestry conference this week that pricing remains the most contentious element of the policy.

She welcomed work to combine 11 greenhouse gas emission calculators into one and the greater recognition of sequestration.

DairyNZ chair Jim van der Poel said in an interview last week that the government’s focus on pricing agricultural emissions ignores the fact they are falling.

Without first settling on a standardised system to measure emissions, Van der Poel said, there is no way of knowing the scale of reduction required or whether that requires an emissions price.

“Once we know our number we can then see how we are tracking to meet our targets and what is left to be done.”

There are only two reasons to ever impose a levy, he said: to fund research and development, which the primary sector is doing, or to incentivise the adoption of new technology.

As Green Party co-leader, Shaw has reservations about the policy, saying it is overly bureaucratic and based on what he called “heroic modelling assumptions”.

With sheep and beef farmers having narrow profit margins, he said, prices ensure viability while also reducing emissions.

The price should not be left for ministers to set.

“Ministers setting a price generally has not worked out well in the past.

“My view is that the pricing mechanism proposed will not be effective and we need a much more market-oriented, less bureaucratic approach to the whole thing, and as Green Party co-leader I want to build such a system.”

He is proposing a tradeable quota system for methane and nitrous oxide emissions, whereby those who reduce emissions more than required can trade rights to their surplus emissions to those who cannot.

He gave the example of a farmer who has to reduce emissions from 100t to 99t, but actually reduces them to 98t.

That would give the farmer a tonne to trade with another farmer.

Such a system would be market-

MISGIVINGS: Climate Change Minister and Green Party co-leader James Shaw says the government’s proposed pricing mechanism ‘will not be e ective’.

led and encourage innovative thinking, he said. It is a proposal that was supported by some in the industry but not by government officials or HWEN.

Shaw said the concept is not foreign to Fonterra shareholders, who trade shares on the NZ Stock Exchange through the Fonterra Shareholders’ Market.

THE ASB Commodities Index in United States dollar terms has fallen to its lowest level in three and a half years, dragged down by the latest drop in world dairy prices.

The recent fall in the value of the New Zealand dollar to US59c has only partially cushioned the decline in

commodity prices, as the index in NZD is now the lowest in two and a half years.

ASB reports the dairy index fell 6.5% after the latest Global Dairy Trade auction, and that component help pull the USD Index down 3.5%.

The indexes for sheep, beef, forestry and fruit fell about 1% each.

“Last week’s dip in dairy prices might have been the most dramatic illustration of

softer demand for NZ’s key export commodities, but prices remain weak across the board,” ASB economist Nat Keall said. “The common theme remains the soft Chinese outlook.

“Chinese consumer confidence is still very weak, with no major stimulus measures yet to be unveiled.

“This remains a major headwind for NZ’s exports and broader commodity prices more generally.”

Once we know our number we can then see how we are tracking to meet our targets and what is left to be done.

Jim van der Poel DairyNZ

Farmers Weekly rst saw the light of day on September 3 2003. Over the 20 years since then we have appeared regularly in the mailbox of every New Zealand farm, carrying essential market data, holding sectoral leaders and agribusinesses to account and keeping farmers, growers, investors and regulators informed. Charlie Williamson reports.

TWENTY years ago this week the first edition of New Zealand Farmers Weekly landed in the mailbox of every farmer in the country.

Since that first edition the primary sector has experienced transformation in almost every respect, from the technology we use to the way we farm and the organisations that connect Kiwi farmers with the world.

Veteran agricultural journalist Hugh Stringleman MNZM, who reported on not only the past 20 years in agribusiness but the 20 before that as well, said it has been a tale of gradual improvement.

“There have been the ups and downs of farmers’ incomes, especially with the major downturns, the Global Financial Crisis in 2008 and then the dairy price collapse in 2013/14.

“But in between that farmgate prices have gradually increased and profit margins have improved, and the industry has consolidated.

“We also have some excellent agricultural science inputs into farming and horticulture. So it’s been a gradual improvement in the whole sector from my perspective.”

Stringleman said an important feature of the past 20 years has been the rise of co-operatives like Fonterra, which were being formed around the same time Farmers Weekly began.

“NZ is unusual in that we have all these primary sector co-ops that are not quite as much a

feature in Australia or the US or the UK.

“Farmers are both shareholders and users of those services, so they like to have independent reporting on what those co-ops are doing and how well they are doing it.

“And I think we have a very good track record in the Farmers Weekly of doing just that.” Stringleman has been a contributor to the paper since the beginning, when Dean Williamson and Tony Leggett, co-owners of what was then Country-Wide Publications, launched it in September 2003.

Nigel Stirling was working as a journalist on another publication when he was appointed to lead the editorial team on the new weekly.

“Dean and Tony saw a gap where farmers were getting their news, which in some cases was two weeks old, and when you’re competing with online media you just can’t really sustain that,” Stirling said.

“Then I felt, too, that there was a bit more of a role for a businessfocused paper, and I was quite strong on that. Because when you think about it, agribusinesses – these are some of the biggest businesses in New Zealand.

“And they weren’t perhaps being scrutinised as well as they should have been with a business reporter’s eyes.”

The agribusiness-focused paper took shape immediately when two top-level business reporters, Alan Williams and Andrea Fox, were brought on board alongside

experienced writers such as Hugh Stringleman and Richard Rennie.

“It was just about finding our own niche, and that was our focus early on. Being a weekly paper you’re going to get a lot more scrutiny of the current issues, as you can keep the heat on a bit better than the fortnightlies which were going around at the time,” Stirling said.

“So we all built it together, and it became a very good offering that we had.”

NZX bought Farmers Weekly in 2009, and in 2018 original cofounder Dean Williamson and his wife Cushla bought it back from the stock exchange.

The Williamsons also purchased the AgriHQ market insights business from the stock exchange, and it has become a crucial component of the weekly paper, providing in-depth analysis and key data from its team of analysts and data collectors.

Over the past two decades the paper has grown to become an industry mainstay, but Dean Williamson said it wasn’t smooth sailing in that first year of operations.

“There were many weeks where we lost $15k-$20k in a week over the first few months,” he said. “We borrowed, and borrowed some more, against our farm, and then from my father. However, by “March 2004 it started to turn a profit. The rest is history.”

Williamson said he is proud of

the effort that goes into every edition, and, given the current dissension in the sector, hopes the paper can play a part in connecting the farming community rather than dividing it.

“My hope is that Farmers Weekly can play a big part in creating a framework where our community is connected, informed and engaged in the decisions that matter to their farming businesses,” he said.

“Right now our sector is divided

and sometimes looks and feels dysfunctional. We’re struggling to have the conversations together we need to be having, and our leadership is struggling to futureproof us.

“Every conference I’ve been to for the last 20 years has talked about us needing to collaborate more and tell our story better. Well, we can, but only with good communication.”

MORE: See page 16

FROM the start Farmers Weekly has had an online presence as well, and this year our website, farmersweekly.co.nz, received a perfect credibility score from a top international news rating system.

NewsGuard awards the High Credibility 100% score to sites whose reporting is credible and transparent, based on nine apolitical criteria.

These include “Does not repeatedly publish false content”, “Gathers and presents information responsibly” and “Handles the difference between news and opinion responsibly”.

Farmers Weekly digital editor Carmelita MentorFredericks said that in an age when “it’s getting harder and harder for the public to differentiate between fake news and credible sources, having an

organisation like NewsGuard hold the media accountable provides the public with a tool to separate the wheat from the chaff”.

“Farmers Weekly will always endeavour to uphold these standards,” she said.

Farmers Weekly managing editor Bryan Gibson said the newspaper’s goal “is to provide farmers with the best information we can, so they can make the best decisions for their businesses. Media is a rough and tumble game sometimes but at Farmers Weekly we focus on the simple things – verifying claims and facts, holding power to account and advocating for our audience.”

– Staff reporter

NEW Zealand has acknowledged that it needs a new approach to relations with India, with a long-term relationship built on stronger mutual benefits likely to deliver greater returns than any a quick free trade agreement.

Agriculture and Trade Minister

Damien O’Connor underscored his lessons on NZ-Indian diplomacy on his fourth visit to the subcontinent last week, and provided a four-point plan for a greater co-operation between the two countries.

“If we have learnt anything about the last 10 years, it is that a short-term narrow approach will not work,” he said. The four priority areas he outlined are based heavily on

a recent India-NZ Business Council report that confirmed NZ has significant work to do in its relations with the fast-developing, populous country.

“We can learn from our Aussie mates. Sustained contact between ministers at all levels has been the key,” O’Connor said. Australia this year secured a free trade agreement with India that has 85% of Australian exports there now tariff free.

The first of the four priority areas involves building better relationships through greater diplomatic and business level contact, which could involve an annual NZ-India business summit, similar to the one held with China every year.

“This will galvanise government action and attract senior leaders.”

Better air connections are another high priority area, and O’Connor intended to meet with the CEO of Air India while in New Delhi.

Having a direct link between Auckland and Delhi would put the sub-continent on an equal footing with the rest of NZ’s vital Asian trading partners.

The third priority area is in building capability, and O’Connor said work planned between Zespri and India’s kiwifruit growers may provide a good template for others to follow.

Education and investment by NZ institutions to help India build its own education sector in partnership arrangements are also seen as vital.

Meanwhile, as India ramps up preparations for hosting the G20 summit in September, a free trade deal between it and United Kingdom appears imminent. The timing marks a quick turnaround on a deal that has been in negotiations only since January 2021.

The India-based Economic Times is reporting this week that the 12th round of negotiations between the

two countries is entering its final phase, coinciding with the subcontinent chairing the G20 for the first time.

Trade officials are reported as saying they are “laser focused” on goods, services and investment in the deal.

Estimates are bilateral trade between the two countries was worth about £36 billion (about $77bn) in 2022.

Expectations had been for an FTA between the two countries to be signed last year, but UK political turmoil disrupted plans.

THREE days of negotiations and meetings between New Zealand officials and exporters and their Indian counterparts have delivered some useful building blocks for greater trade between the two countries, trade consultant Stephen Jacobi says. A joint statement issued by Trade and Export Growth Minister Damien O’Connor and his counterpart Shri Piyush Goyal outlines the positive progress made in establishing direct air links between NZ and the subcontinent. It also proposes restating the lucrative log trade to India, and opens the door for horticultural and agricultural collaboration.

“We are at least starting to see

a few building blocks come into place,” Jacobi said.

“However, we would like to see a more comprehensive response on how the government will continue to develop this from here.”

He cautioned that despite the solid business support from the 50-strong delegation, the government is operating under tight fiscal conditions, likely to further stretch already sparse resources across the region.

He pointed out that the Ministry of Foreign Affairs and Trade “has had $35 million cut from its budget, so it is difficult to see how they will achieve all they wish. Money is tight, so what investment will the government be able to make to expand relationships?”

Delegates pointed to Australian investment in its diplomatic presence throughout India, with the states of New South Wales and Queensland having more staff in

India than NZ’s entire diplomatic team across the India-Asia region. The log trade with India, valued at $250m at its peak, collapsed when NZ banned the use of methyl bromide, India’s only approved treatment.

Money is tight, so what investment will the government be able to make to expand relationships?

Stephen Jacobi Trade consultantMinisters have confirmed efforts are afoot to find a feasible alternative to enable trade to resume in this area.

There are plans for horticultural collaboration that could include Zespri working with Indian

kiwifruit growers. A regular CEO forum between business leaders of both countries was also mooted, along with the annual joint trade committee meeting.

“It is a good idea, but they [CEO summits] are not simple, cost a lot, and take time to arrange. I would like to see a truly joined up effort with the government,” Jacobi said.

The reality of a direct air link between Auckland and New Delhi holds strong appeal, with estimates of a 40-50% increase in people travelling between the two countries.

O’Connor was positive about his meeting with Air India’s CEO during the visit. The two signed a memorandum of understanding to liberalise the route.

In June Air India confirmed orders for almost 500 new planes valued at US$70 billion ($117bn). However, NZ delegates were also aware that jet allocation is a

numbers game, and the NZ-India route is tiny against high-volume continental connections.

The delegation has established valuable momentum in the relationship, something Jacobi is confident will be carried over, regardless of who forms a government after the election.

“And it is good to see five business organisations all working together, something that is quite unusual.”

Jacobi also said he was surprised at India’s level of receptiveness to NZ, and particularly welcomed support from Tapan Mazumder, the director-general of foreign trade.

“He has been extremely positive towards us.

“When everything is added up, they do not amount to a comprehensive FTA of course, but they have impact, and give confidence.”

THE first stage of Wool Impact’s environmental impact work is complete and the entity charged with rejuvenating the strong-wool industry is confident it is on track to assure consumers of environmentally friendly practices in the wool industry.

Chief executive Andy Caughey said demand is increasing from global consumers, brands, stakeholders, architects, designers and specifiers seeking transparent information about products and materials to inform their decisions.

“To make it easier for people to say ‘Yes’ to wool products, the many great natural qualities of wool need to be well supported with evidence of wool’s contributions to and impacts on the wellbeing of people and the environment.”

Commercial fit-outs and tenders from the likes of the Ministry of Education increasingly need declarations of a product’s environmental impact.

“We did work with Wools of New Zealand on the [recent conroversial] schools contract but at that stage we weren’t quite there with the required declaration,” he said.

Caughey said Wool Impact is supporting brands by understanding the on-farm environmental footprint of producing NZ strong wool.

Working with AgResearch, Wool Impact has completed the first phase in this area,

measuring the carbon footprint for 1kg of greasy NZ strong wool.

“This was to undertake an initial carbon footprint while carefully considering the different ways of measuring emissions and removals on farm through sequestration and allocation between meat and wool to accurately assess the environmental impact of strong wool.”

The findings contribute to ongoing

discussions regarding carbon footprint methodology and efforts towards environmentally friendly practices in the wool industry.

“The work has given us confidence that to date, LCA [life-cycle assessment] databases have overstated wool’s impact relative to actual data collected from NZ farms.”

One of the key insights from a recent trip to the United States is that specifiers recognise carbon is only one metric and the wellbeing of the climate, land, water, animals and people need to be accounted for.

Future research will further analyse the impact of different methodologies, furnish the carbon work with information on other impacts such as water and take the work through to the wool scour.

Alongside measurement, Wool Impact is building tools to communicate the existing high standards of care evident in growing NZ strong wool.

“We are aware farmers are increasingly being asked to do more.

“We acknowledge farmers are doing good things now but we need to package all that good stuff up to be used effectively in marketing and by the brands.”

Caughey and Wool Impact marketing executive Gretchen Foster recently spent time in the US with a focus on wool’s relevance in global architecture and design.

Wool is not widely recognised for flooring in the US, but Caughey said the visit was met with enthusiasm from potential partners.

Insights shared by brands suggest the building and design industry knows it needs to change and that architects and designers play a critical leadership role in orchestrating this change, designing for both planetary and human health.

“The US manufactures 50% of the world’s carpet and of the total volume only 1% of that carpet is in natural fibre.

“While NZ strong wool is not about the volume, there is great opportunity in the boutique, niche and luxury space, away from the massive volume market, to premium.

“We can romance the story at retail level and capture consumers.”

Wool Impact is building partnerships with global brands of influence that are able to design a well-evidenced wool story into buildings for the future.

“While the greatest call to environmental action remains a reduction in the embodied materials and operational carbon in buildings, one of our key insights was

Andy Caughey Wool Impactthat specifiers recognise carbon is only one metric and there are other factors in environmental and human resilience that need to be considered.

“It makes sense to us, now it’s time for action.

“Wool brands need to understand how decades of research into wool’s performance translates into healthy interiors today, where the gaps of knowledge are and how they can be filled.”

Caughey said it’s been a challenging first 12 months for Wool Impact.

“It’s been foundational but now we have substantial evidence our projects are going to materialise and given time, make a difference.

“We are well aware of the urgency with farmers having no appetite to be mucked around.

“It takes time, projects are coming into operational mode and we are confident now to engage with the grower community,” Caughey said.

make a di erence.

We are well aware of the urgency with farmers having no appetite to be mucked around.UNDERWAY: Wool Impact chief executive Andy Caughey says there’s substantial evidence that projects are going to materialise and given time,

Williams does not necessarily believe a return of the wool levy is the answer, but it could contribute.

CONSOLIDATION is a must if New Zealand’s strong-wool industry is to thrive again, Federated Farmers Meat and Wool chair Toby Williams says.

“What we have got is silos and none are bringing returns to the farmer. We need contracts,” he said.

Contracts could build farmer confidence.

“I’m not saying $10, that’s pie in the sky, but even $4 a kilogram for your wool meeting required specification – growers get a guaranteed price and the buyer and the end user get guaranteed quality of product.

“My biggest concern at the moment is the commercial interests are there but will pay just enough for farmers to keep growing wool, but we need to make money.”

Farmers’ frustration levels are such they are walking away.

“We are losing farmers from the industry and we will lose more. It’s too hard and they can’t be bothered any more, so they walk.”

A decision by farmers in 2004 to rule out the wool levy led to the dissolution of the Wool Board and left the sector without a wellresourced body promoting wool. Without a governing body for almost 20 years, there have been a lot of factions.

“We have Wool Impact but we have not gone anywhere and while a wool levy is not going to make the change needed, it could be one way of funding a new leadership structure and it provides a market budget.”

Williams alluded to a wool levy when he addressed the August meeting of Parliament’s Primary Production Select Committee.

“I did throw it in as maybe deserving debate but we have got to be very careful about this.

“Levies have failed in the past and organisations that rely on them continue to be under threat.

“The people who control the levies, the boards and management around them don’t always listen to what the levypayers want them to do, or fail to deliver.

“Farmers abandoned the Wool Board because they didn’t like the leadership, now we still have the same leadership but under different umbrellas in different silos.

“We need change and we need it urgently. Twelve months is too late.

“We want to be a Zespri, or a Fonterra.

“Nothing has changed in that respect and it won’t until we get a whole new level of new leadership. Just bringing in the same ones over again is taking us nowhere.

“Look at Wools of NZ: we had $9 million invested in funds equity. In the latest report that has turned into $2m; $7m lost less than a year ago.

“They followed the wrong things. We are not going to make

money out of flooring, that’s fairly obvious and they are going to run out of money.

“It’s been too much about each silo protecting its own patch. Well, unfortunately that patch is disappearing.”

Williams said it is 10 years since he last made money off wool.

“It costs me $40,000 to shear my sheep every six months, so that’s $80,000 for 6000 sheep.

“Our return this year on the last

shear was $30,000, a 25% loss.” Williams doesn’t expect the government to rescue the industry.

“The sector’s responsibility is to get its own house in order in terms of a workable single body and leadership structure before it looks to government for more investment.

“Federated Farmers, as an organisation batting for growers’ interests, can take a lead bringing people together on that mission.”

While a wool levy is not going to make the change needed it could be one way of funding a new leadership structure.Toby Williams Federated Farmers

FARMING on the edge of New Delhi’s 32 million sprawl of people, Gulab Singh feels at times that he and his fellow farming villagers are under inexorable urban siege.

With a surging growth rate of over 2% a year for the past decade, the city is rapidly consuming the countryside it depends upon to feed it as it becomes the planet’s largest urban mass.

It is also rapidly consuming itself within its own boundaries, with Delhi’s forested city area having declined by half to 5800ha in the 20 years to 2018.

Gulab, with wife Shalu and three daughters, Geetila, Charu and Mansi, live in the small village of Bazidpur Saboli only an hour, give or take in the city’s chaotic traffic, from the city centre.

They are typical of India’s smallholding farmers, who combined amount to 85% of the country’s landowners, despite only owning 45% of the farmed land area.

To New Zealand eyes their halfhectare block may seem closer to a smallish lifestyle section than a farm, but for the Singh family and millions like them it’s food on the table and the opportunity to help

the next generation fulfil their aspirations.

“For us, we have had three generations farming here. But I have often been offered quite a lot of money by land buyers to buy the property, and we see this happening more and more,” Gulab said.

He said he has no intention of selling, with the ties that bind him to the land and the village he grew up in proving stronger than the lure of a lump of capital, and family agreement is also required before it could happen.

too have the opportunities for Gulab to build another business. In the past couple of years he started Incredible India by Car, offering guiding services to westerners and compatriots around Delhi and the northern states.

His daughters, all aged in their teens, have mastered the family motor scooter, with the two eldest busy studying in the city, one in public affairs and the other to become a cardiologist.

“To become any larger, that is something I really do not wish to do. With the size of the farm it is, Shalu and I can still run it, and I can also run my other business,” Gulab said.

The Singh property has a spectrum of feed crops growing, some to feed the family’s Sahiwal cow, milking buffalo and two heifers.

The incentive to keep the land in farming is helped somewhat by a tax on land sales that varies, depending upon what it is to be used for when sold, with no tax paid if it remains farmland.

But the proximity to the sprawling city also holds some prospects for farmers like Gulab wanting to hold fast against its creep.

As the city has crept closer, so

Persists graze after graze... after graze... after graze...

On the boundary a maize type of grass grows high; it is cut daily to be fed to the cattle who also enjoy a high-energy seasonal rye-type grass that springs up over the monsoon season that finishes next month.

Their diet is further supplemented by a stew of lentils and chickpeas Shalu cooks up every day. She has cranky livestock if they miss out on their daily brew.

A small crop of rice is coming along well after the good monsoon rains, growing about 20t and due

for harvest in October. Gulab also looks to turn the remaining land over for wheat in the coming season.

While trying to be as organic as possible, he supplements the dried cattle muck fertiliser they spread with light applications of urea and DAP, both subject to significant government subsidies in India.

“For urea and DAP the prices farmers pay are fixed by the

government. For urea that is 300 rupees [about $6] for a 45kg bag, for DAP it is about 1500 rupees for a 50kg bag.”

It is a rate that would gobsmack most kiwi farmers, equating to about $130/t for urea and $600/t on DAP.

While Gulab’s use is sparing, India’s policy of subsidising urea to the tune of 200% has resulted in excessive consumption, with nitrogen pollution a major problem in his state of Haryana. In the past 50 years it has surged to account for 80% of Indian farmers’ total fertiliser use, up from 10%.

The Singhs’ property is also bedecked with abundant crops of lauki, a type of cucumber used in cooking, and ladyfinger or bindi, similar to okra.

Being Hindu and vegetarian, all their dietary needs are met from their farm, with the cow and buffalo generating abundant milk for lassis, yoghurts, cheeses and cooking.

For Gulab and his family, greater scale is far from the goal; rather it is preservation of the family plot as his key motivation for continuing to farm and live where he does.

“I have a pretty simple life, I enjoy my family, my friends and my land.”

PERENNIAL RYEGRASS

Hustle is one of New Zealand’s best performing perennial ryegrasses; purpose-bred to deliver high quality feed that persists. ORDER RAGT’S HUSTLE PERENNIAL RYEGRASS

I have often been offered quite a lot of money by land buyers to buy the property, and we see this happening more and more.Gulab Singh Farmer

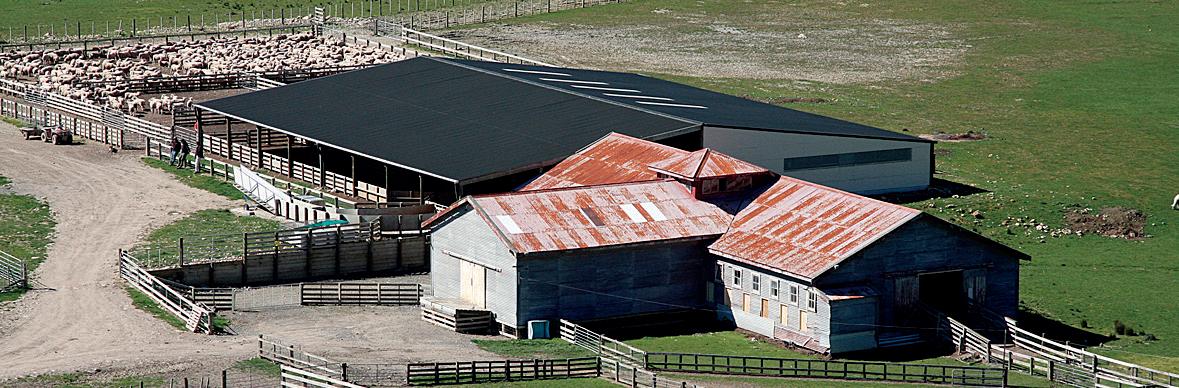

The Nichol family have been farming their land at Clark’s Junction, Otago, since 1871. With a strong connection to the land, Steven and Kellie consider guardianship a priority. Together with farm manager Grant Bezett, this award-winning team has the drive to move their business forward through the highs and lows.

These Future Farming Conversations are proudly brought to you by Ballance Agri-Nutrients through the Farmers Weekly In Focus podcast. Ballance is committed to helping you farm productively and sustainably, with the future in mind.

Meet our podcast guests

We’re well positioned in terms of our sustainability story and to capture the market’s expectations to be more proactive in this space. Sheep and beef farms hold a lot of New Zealand’s remaining biodiversity, and farmers are already making a great effort to protect and maintain these areas. In my opinion, our discerning and affluent customers are willing to pay more for this.

| 0800 222 090

One of the key things we want to achieve is to celebrate... taking the time to pause and reflect on your journey and what you’ve achieved over the last few years, or in many cases decades of farming and growing.

Steven Nichol BFEA 2023 National Ambassador. Sheep & Beef Farmer, Central Otago

Warwick Catto Ballance Science Strategy Manager & BFEA judge

Steven Nichol BFEA 2023 National Ambassador. Sheep & Beef Farmer, Central Otago

Warwick Catto Ballance Science Strategy Manager & BFEA judge

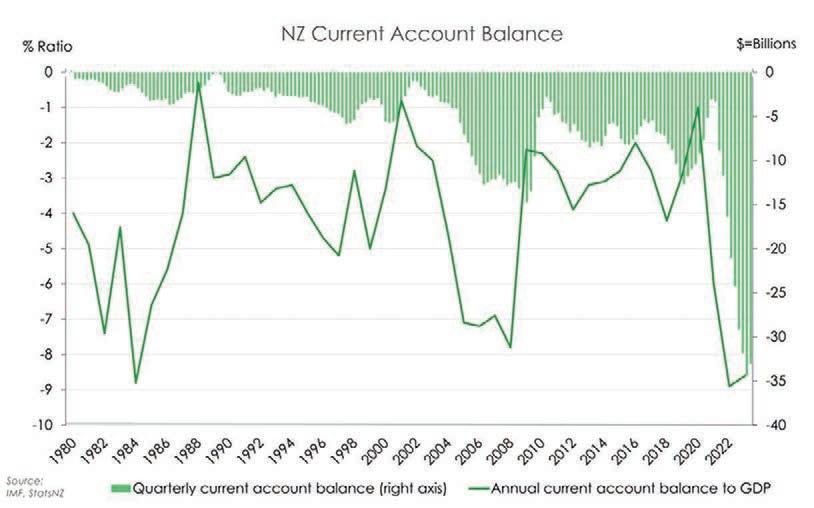

NEW Zealand could be in the international market for millions of tonnes of carbon offset credits to meet its obligations as a signatory to the Paris Agreement on climate change.

That was the sobering message from Nigel Brunel, the head of commodities at Jarden, who told the Carbon Forestry conference last week that NZ is never going to meet the carbon reduction targets committed to at the 2015 Paris conference by relying solely on domestic measures.

On current projections the Treasury estimates NZ needs to buy 99 million metric tonnes of carbon units at a current cost estimated by Brunel at about $8 billion over about eight years.

He estimated that equated to 1% of government spending over that period.

Ignoring the agreement is not an option, as to do so would run the risk of violating newly signed free trade agreements and exposing NZ’s exporters to tariff-type taxes.

Brunel said NZ should use its expertise to help developing countries decarbonise – initiatives that can be used to offset our own emissions, and are allowed under

the Paris agreement.

He told the conference he cannot find what – if any – such projects NZ is currently involved in.

Free trade agreements such as that recently signed with Europe include a requirement to adopt acceptable climate change reduction measures, and Carbon Border Adjustment Mechanisms (CBAMs), effectively a tariff on imports, can also be imposed.

“If you don’t have decent carbon policy, you are likely to be hit by

CARBON

CASH: Jarden commodities head Nigel Brunel says that on current projections NZ will have to spend $1 billion a year for the next eight years buying carbon units.

CBAMs if you want to have free trade policies,” Brunel said.

He suspects this is a reason Australia has in three years shifted from being a country that wasn’t doing much internationally to a country that is doing more than NZ.

Brunel said in seven weeks the price of NZ Units traded on the Emissions Trading Scheme (ETS) fell from $88/tonne before collapsing to $34/t, but in recent weeks it has recovered to $68/t.

CARBON foresters have called for a moratorium on consultation and government policy reviews related to the sector.

Andrew Cushen, the chief executive of the Climate Forestry Association, told the Carbon Forestry conference that in the past year the sector has had to make multiple submissions on proposed changes to legislation.

The list included the introduction of fees for the Emissions Trading Scheme and a review of that scheme, changes to the Resource Management Act and a review on the status of

permanent forestry category.

“Over the last six to 12 months we have not been having a policy conversation, but we have seen an ideological crusade about something that offers a perfect climate outcome,” he said.

“You may have gathered I am a bit angry about that.”

Cushen told the conference that this constant policy tinkering runs counter to the benefits carbon forestry provides.

These, he said, include financial returns for some classes of land and a greater number of jobs than agriculture provides, giving Māori landowners a return on their land, a pathway to re-establishing permanent native forestry at no cost to taxpayers and carbon sequestration at pace and scale.

“They are outcomes for which I think we should all pat ourselves on the back.”

But instead, he said, members are constantly under the scrutiny of policymakers.

In addition to a policy moratorium, Cushen called for an

He said NZ will not decarbonise at $68/t and international studies estimate real change will happen at about $175/t.

The government is establishing what he called guardrails for the ETS to ease such fluctuations.

Brunel said from next year the government will not sell units when the price hits $64/t, and at $180/t it will release more units onto the market to ease pricing pressure.

NZ’s largest carbon farmer told the conference the country does not have an oversupply of carbon credits as has been claimed by government officials.

NZ Carbon Farming business manager Scott Pollard told the conference that too few trees have been planted to offset our emissions, meaning the taxpayer will need to buy international credits.

He put some of the blame on nimbyism (not in my backyard) when it comes to forestry, when in reality productive farmland can be balanced with areas of commercial or permanent forestry, helping landowners economically and with their lifestyle and land use.

The company’s manager, Peter Casey, said it has 67,000ha of commercial and permanent forestry, mostly in the North Island.

Land in permanent forestry is in

the process of regenerating from exotic to native forestry, a process that can take 75 years.

At age 30, exotic species sequester carbon at five to 10 times the rate of natives, which provides annual income to fund further projects and the regenerative process, which he said is expensive.

If you don’t have a decent carbon policy, you are likely to be hit by a Carbon Border Adjustment Mechanism if you want to have free trade policies.

Nigel Brunel JardenCasey said the regenerative process followed depends on the climate, topography, altitude and soil of each forest.

It requires thinning of exotic trees to improve sunlight, nurturing the native under-storey regrowth through weed, pest and fire control, and helping regrowth by introducing native plants, an annual cost of about $200/ha.

Casey said NZ Carbon Farming plants 120,000 native trees a year to effectively push the regeneration process.

OUTCOMES: Andrew Cushen, chief executive of the Climate Forestry Association, says there are carbon forestry outcomes ‘we should all pat ourselves on the back’ for.

end to the ETS review, which he said could be damaging, does not make sense and could make the scheme unaffordable.

He called on the sector to collectively stand up and promote about what the industry does and what it has achieved.

We have not been having a policy conversation, but we have seen an ideological crusade about something that offers a perfect climate outcome.

Andrew Cushen Climate Forestry Association

A2 MILK increased its net profit by 26% to $144.8 million in the 2023 financial year – as the Chinese infant formula market declined because of fewer babies and lower product prices.

China accounts for 70% of a2 Milk’s sales and revenue, which was up 10% to $1.592 billion.

The outlook for FY2024 is a double-digit decline in the China

infant formula (IMF) market but a2 Milk expects to deliver a low singledigit revenue growth and a gross margin similar to last year.

The alternative dairy company is still recovering from the covid lockdowns between 2021 and 2023 when IMF sales slumped and the parcel-post “daigou” sales channel from Australia and New Zealand to China collapsed.

Managing director and chief executive David Bortolussi said he is proud of the team effort behind 10% sales growth when the core market, IMF in China, declined by 14%.

China-label sales exceeded English-label sales for the first time and total IMF sales were $1.1bn.

The daigou sales of English-label IMF fell by 40% and a2 Milk has turned to channels over which it has more control.

as a result of lower birth rates and increased competitive intensity.

“Notwithstanding, we are well positioned to continue to invest and grow share in FY24 to emerge in a stronger position when the market recovers.”

The Mataura Valley Milk processing subsidiary made a larger earnings loss of $26.5m, compared with $18.8m in FY22, with revenue of $114m.

The a2 share price dropped nearly 50c after the results were published, now down in the range $4.80 to $4.90, the lowest level since early 2022, when the full covid impacts first became apparent.

In recent times the price peak has been around $7.40, so clearly the share market is not yet convinced that the a2 pathway to profitability is sustainable.

David Bortolussi A2 Milk“The China IMF market has become increasingly challenging

Pre-covid a2 Milk had peak revenue of $1.7bn and peak profit of $386m.

MĀNUKA honey company

Comvita has reported record revenue of $234 million in the financial year ended June 30, including more than $100m from China for the first time.

Sales income rose by 12% and net profit after tax was up 2.8% to $13.1m.

Comvita will pay a fully imputed final dividend of 3c a share, in addition to 2.5c interim earlier in the year.

Sales through ecommerce accounted for 42% of the total, up 19% on the previous year.

Comvita chair Brett Hewlett said the record revenue performance was achieved despite material disruption including covid reopening delays in China

Comvita will pay a fully imputed final dividend of 3c a share, in addition to 2.5c interim earlier in the year.

and terrible weather during summer for the apiary division. The apiary division broke even despite the major loss of honey extraction along the east coast from Cyclone Gabrielle.

The listed company’s share price is currently $3.30, steady on its position 12 months ago, and there was no change following the results release.

Equities analyst Christian Bell, of Jarden, said the results were confirmation of the company’s path of transformation and he nominated a target price of $4.65 with a buy recommendation.

LISTED leading wine company Delegat Group sold 9% more cases in the 2023 financial year to reach record sales of 3,676,000 cases, of which 97% were exported.

Operating net profit after tax (Npat) was $59.3 million, up 2% on the year before.

Reported NPAT was $64.8m, up 3%, and revenue was up 15% to $376m.

The company will pay a fully imputed dividend of 20c a share on September 13. It did not pay an interim dividend back in February.

Chief executive Steve Carden said Delegat Group is aiming to increase case sales by 4% in the current financial year and increase operating profit to between $62m and $67m.

The biggest market is the United States and Canada, where 1.747 million cases were sold, followed by the United Kingdom, Ireland and Europe with 1.237 million cases.

In the premium US market the company’s No 1 brand, Oyster Bay, outperformed industry growth with four varietals: sauvignon blanc (up 16%), chardonnay (up

EARNINGS and profits for two large listed horticultural companies, Scales and Seeka, were cut in half by adverse weather –and the ongoing rebuilding efforts and costs are significant, too.

Interim financial results for the first half of FY2023 for both companies disclosed impacts on numbers ranging from 20% to 60% below the previous corresponding period.

For Scales it was the diversified worldwide Global Proteins division, making petfood ingredients, that rescued its financial performance. It contributed 75% of the $41.5 million earnings before interest, tax, amortisation and depreciation (EBITDA), while the horticultural division struggled to contribute $11.4m.

Scales said the Mr Apple crop was down to 2.9 million tray carton equivalents (TCEs) compared with 3.3 million in 2022. Only 26% of the crop has been sold so far.

As most revenue is gained in the first half, full-year net profit before tax is forecast by Seeka to show a loss between $20m and $25m. Scales is forecasting a small profit within the range of $14m to $19m.

Neither company will pay interim dividends.

The Seeka share price is steady on $2.60, down from $4 at this time last year.

The Scales share price is $3.26, down 25% over the past 12 months.

Growers and fruit handlers across all sectors are contending with a large drop in yields, which is impacting revenues and profitability.

Michael Franks Seeka14%), pinot noir (up 8%) and pinot grigio (up 26%).

Adding in two other varietals, merlot and rosé, Oyster Bay is ranked No 1 NZ premium wine in 16 out of 28 categories – four or six wines in five export markets.

It is ranked No 2 or 3 in a further 11 categories.

Pinot grigio and rosé are not ranked in Ireland.

Chair Graeme Lord said the results are strong in an international market showing flat wine sales, global inflationary pressures and severe weather events in New Zealand.

“We are well positioned for

The company will pay a fully imputed dividend of 20c a share on September 13. It did not pay an interim dividend back in February.

substantial future sales growth and are confident our continued investment programme will create additional value for shareholders.”

The share price is around $8.36, having fallen 30% over the past year. Two years ago the share price was up at $14.

During Cyclone Gabrielle, three orchards in Hawke’s Bay were extensively damaged, and one moderately so, and 165ha had to be cleared of silt and debris before replanting.

Produce packer Seeka suffered 14% drop in revenue that led to a 55% reduction in first-half net profit, to $13.6 million.

“The warm winter of 2022, followed by a wet summer, cyclones Hale and Gabrielle and autumn hail, all had a major impact on the horticultural industry,” Seeka chief executive Michael Franks said.

“Growers and fruit handlers across all sectors are contending with a large drop in yields, which is impacting revenues and profitability.”

SETBACKS: Seeka chief executive Michael Franks says a wet summer, cyclones Hale and Gabrielle and autumn hail, all had a major impact on the horticultural industry.

We are well positioned to emerge in a stronger position when the market recovers.TOP-UP: The group is aiming to increase case sales by 4% in the current nancial year.

MY WIFE and I have been farmer shareholders of Fonterra Co-operative since the start, so have ridden a few highs and lots of lows.

This issue of Fonterra dropping the payout by $1.25 in two weeks has surprised me. What is going on at board and senior management level?

I was aware in February of the problems starting to unfold in China as one of its largest property development companies defaulted on a bond option.

I took it upon myself to investigate what was happening to one of our largest trading partners.

First was a shrinking population in China by 80-100 million people, projected to keep falling.

I found 22% youth unemployment in China and now this has grown, though not confirmed, to 40%.

During and after covid-19, major manufacturing companies shifted back to their home countries from China.

The raw milk market within China has grown and it is believed to be self-sufficient from all our exported heifers and some of the farms Fonterra set up.

TWENTY years ago I was at journalism school, a wide-eyed apprentice despite being one of the older students at 29.

The Rugby World Cup was being held in Australia and I had a week’s placement in the sports department at what was then the Dominion Post.

Jim Kayes was at the Cup so I sat at his desk, being schooled in the craft by Peter Bidwell, Toby Robson and Jonathan Millmow.

It was a great learning experience and over the past two decades so much has changed for me.

While Australia was breaking Kiwi hearts at the RWC, something else was happening.

Farmers Weekly was launched as a rural publication in September of 2003 by Dean Williamson and Tony Leggett.

Looking back on the launch, it seems that while some things change, others remain the same.

The Farmers Weekly ethos was to provide farmers with clear, balanced news about the agribusiness world so that they might have the information needed to make sound business decisions.

That’s still the mantra will live by today.

I’ve been lucky enough to lead the Farmers Weekly editorial team for almost half of its life.

I was fortunate to inherit an experienced team that helped me learn the ropes and grow as a person and a journalist.

There have been many changes along the way, of mastheads, ownership, content delivery channels – but one thing has never changed.

We will always hold power to account, seek out the stories that matter to readers and advocate for them.

Sometimes that work can be a challenging read, because we always look at a specific issue with a wide-angle lens. We don’t just ask what something means to our rural communities but also what it might mean for the rest of New Zealand and the global markets we depend upon.

What never wavers is our commitment to tackling issues with curiosity and without anger or preconceived ideas.

Farmers Weekly is what it is because of the people.

Dean and Cushla Williamson’s circleback to the company after leaving it for a time seems like something from a story, but in some ways they never left because the spirit of what they started never left. Since 2018, thankfully, they’ve been back to inspire us to do even better work.

The news team that includes Hugh Stringleman, Richard Rennie, Gerald Piddock, Neal Wallace, Annette Scott and Craig Page is the most experienced and respected in our industry.

The wider team that makes the Farmers Weekly engine run each day is inspiring in its dedication.

Looking back over some old editions recently it was interesting to see that, while farming has changed a lot in the past 20 years, many things are just the same.

There’s another Rugby World Cup to enjoy soon, this time in France.

New Zealand has won two more titles since that 2003 edition of the contest.

But while the All Blacks have a proud tradition and ethos to drive them, they know success is about turning up to do the work every day.

It’s the same here at Farmers Weekly. Each week we say goodbye to one edition and turn our attention to the next.

To our readers, advertisers, contributors and supporters – thank you for taking an interest in what we do.

Because at the end of the day, we do it for you, the farmers of New Zealand.

The property market now has crashed and the Chinese hold a lot of their wealth in property.

The housing debt in China is US$5 trillion. Compare that with the United States, which has $800 billion – to put it into perspective, it looks like a major Ponzi scheme.

Fonterra has offices in Shanghai, Beijing and Chengdu with senior managers on salaries that as farm owners we only dream about.

The point is, if Fonterra didn’t know all these issues and there was surplus of product not sold and demand had fallen off, somebody needs to put their hand up to take responsibility for setting the forecast payout for 2023-24 and getting it so wrong.

Responsibility needs to be taken for such poor decision-making and lack of understanding of this business and the drivers that impact the bottom dollar.

Farmers are suffering now from increased costs, and contracted feed for the whole season

Send your letter to the Editor at Farmers Weekly P.0. Box 529, Feilding or email us at farmers.weekly@agrihq.co.nz

Continued next page farmersweekly.co.nz

Forbes Elworthy

Elworthy is co-founder of agricultural investment company Craigmore Sustainables, and founder and chair of global agricultural data platform Map of Ag

SUSTAINABILITY and ethical investing trends are throwing up a number of opportunities for farmers.

Around 20 years ago, private sector-sponsored farm sustainability programmes began to emerge in many food markets. Companies like Whole Foods sprang up in the United States. Customer demand pushed food producers to introduce organic, gluten-free and other health foods or sustainably grown products.

Food brands marketed by BirdsEye, General Foods, Unilever, Nestlé, along with food retailers and distributors, began to enhance their offering with food marketed as more responsibly or sustainably grown.

More recently the intensity of farm GHG emissions has become a focus of agri-food firms. In 2021, Craigmore committed to developing a net-zero dairy farm by 2035. Fonterra and Nestlé announced they will develop a

Continued from previous page

has been locked in based on the first payout advice from Fonterra.

I knew the problems in China, so I assumed Fonterra had this covered with our Co-operative Difference long-term contracts and therefore had diverted to new markets.

How can these factors not have been understood by the senior management?

These poor decisions seem to be continually occurring and in such a large business that is, frankly, unacceptable.

We cannot keep surviving with poor decision-making within Fonterra and the lack of awareness of international affairs impacting our business.

The CEO and board work for us, the co-op owners, and with poor leadership and inadequate foresight they are driving people out of the industry.

A well run co-operative adds wealth and prosperity to all shareholders.

Is a change of guard required?

There is a huge lack of confidence going forward in our industry and we require strong, well-informed leaders to take us forward.

It all starts at the top.

commercially viable net-zero carbon emissions dairy farm by 2032.

We expect that biodiversity will be the next major theme alongside carbon. This is emerging already in the financial markets with the launch of the Taskforce on Nature-related Financial Disclosures this year.

It is not easy farming in the face of these waves of supply chain requirements partly because, when adding a new focus area, food brands do not allow growers to give up earlier gains. As soon as water and carbon outcomes improve, a new wave of requirements, like biodiversity, emerge. Operators like Craigmore cannot rest on our laurels.

The United Kingdom’s sustainable food journey began 30 years ago when boutique high-end grocers Waitrose and M&S incorporated human and environmental health values into their brands. The larger UK grocers began losing market share to these disruptors and had to adopt their own sustainability strategies.

Other countries with food markets shaped by the tastes of middle-class households are following the same path. Leading grocers and food brands

POSITIVE GROWTH: Society is increasingly demanding new and positive services from a finite amount of land, Craigmore cofounder Forbes Elworthy says.

in Western Europe, North America and Australasia began to incorporate claims around welfare, human health, environmental health and emissions into their brands.

A list of net-zero commitments by leading agri-foods illustrates how widespread this has become.

The investment industry came later to the same trends.

Ethical investing takes a number of forms, the most widespread being scoring the environmental, social and governance (ESG) merits of investments – often by external agencies. Closely related are responsible investment policies, which prohibit investors from providing capital to sensitive sectors such as tobacco companies or coal miners.

Impact investment strategies, which seek to make a positive

difference, are rarer. Impact strategies such as those undertaken by Craigmore involve planting trees and protecting biodiversity as core aspects of the investment thesis.

Other such ventures build social infrastructure such as social housing or schools, or invest in renewable technologies, green steel and other low carbon/ climate-positive products.

Despite starting late, ethical investing has come a long way. These days 30% of European savers have selected savings products with ESG criteria.

Farmers in western countries experiencing these trends have been challenged and, in some cases, bruised. Farmers rightly see themselves as hard-working guardians of nature and of the nutrition of society. They are suspicious of changes that they often see as having been unfairly imposed on them, while the rest of society continues to enjoy the benefits – for example widespread fossil fuel usage.

Farmers’ fears are understandable. As an active farmer and landowner myself, however, I’m confident that the greening of agriculture will be of net benefit to the farming community. Society is increasingly demanding new and positive services from a finite amount of land. New industries are springing up, such as planting trees on former marginal grazing land. In the hills of the North Island and in Scotland this has already doubled the price of the least productive farmland.

One positive result is that environmental demands for land use change may help us farmers rein in our habit of industry over-production.

The best land will continue to be used to produce food. On this

farmland, regenerative techniques are now steadily expanding. These use lower synthetic nitrogen, cover and multi-species crops, zero-till and precision machinery to enable less environmental damage per unit of farm output.

In particular, technologies that reduce methane and nitrous oxide emissions per kilogram of produce are beginning to make progress. For example, Craigmore has invested in a tool under development by Ruminant Biotech that will significantly reduce emissions of biogenic methane from livestock.

In arable farming, regenerative tools and techniques are being used to reverse a century of carbon depletion and to capture carbon back to the soil. Some growers are seeking to sell these gains as offsets – or to inset other on-farm emissions.

Service businesses are springing up to drive these agendas and to help farmers. At Map of Ag, a sister business to Craigmore, data integration helps farms measure and improve animal welfare, to reduce on-farm chemical usage, and to help deliver on retailer netzero commitments.

One of our animal welfare programmes has helped Sainsbury’s reduce the incidence of mastitis in its dairy supply herd by 50% over 10 years. We also help national livestock industries to measure and reduce the use of antibiotics and other antimicrobials in farm animals. These changes will not occur overnight – farming is a large super-tanker to turn around. However, this sustainability journey is now well underway. Farmers who can adjust their farming systems may, in many cases, reap financial rewards as well as enhancing the land in our care.

THE genetically modified ryegrass project is a costly miscalculation and has not improved the quality and resilience of the agricultural system for farmers. After 17 years of promises, the benefits remain to be seen.

In “Genetically modified ryegrass research ‘promising’” (July 17) and other articles, AgResearch science team leader Dr Richard Scott says that HME ryegrass looks highly promising compared to other forages.

Please can he be more specific about what forages he is comparing HME ryegrass to?

Please can he provide a link to the studies on increased animal nutrition and methane reduction – or is the “highly promising” only hopeful possibilities?

He says possible nitrogen reduction in nitrous oxide comes from improving animal nutrition –but this will only be known when we do animal feeding trials. This statement is not scientifically confirmed. The reduction is only potential.

Scott says the five years of trials

were intended only to assess the shift of traits from containment to field. This is in direct contradiction to a statement made to DairyNZ, which gave funds to support a trial that is costing $25 million of farmers’ money. In 2018 we were led to understand by Dr Greg Bryan, speaking to journalists covering the AgResearch trial in the United States, that it was to look at growing enough fodder to conduct “realistic rather than simulated animal nutrition studies”.

The trial was also to evaluate the possible potential environmental benefits, such as reduced methane emissions and nitrogen excretion. This would be conducted on 26 cows.

The grass did not perform to the expectation and so the animal feeding trials were not conducted.

It was hoped that the Australian application would go ahead. However, the application was withdrawn due to insufficient data on allergies from the sesame gene.

The greenhouse in Palmerston North will hopefully grow enough grass to feed to small ruminants.

In other words, to say that GE ryegrass will reduce greenhouse

gases when fed to cows has no scientific basis.

It was claimed that HME ryegrass will influence the composition of soil microbes to benefit the nitrogen cycle. As studies were not conducted, there is no science to support the claim.

Scott rejected GE Free New Zealand’s comment that GE ryegrass changes the composition of milk. Yet he goes on to say it might have an influence on fat composition and that lactating cows are influenced by seasonal changes in forage. This supports GE Free NZ’s statement that milk composition is altered.

“HME ryegrass did struggle in extreme hot, dry summer conditions,” the article reads. This contradicts reports that the threeyear trial’s average maximum temperature was 28.9degC and the average daily temperature was 23degC. The summers go well above these temperatures in Canterbury and east coast farms, so this shows that performance is impaired in hot weather and the grass is not suitable for NZ summers.

The article reads: “Scott said that GE Free NZ claims that HME

ryegrass has genes from sesame seed and nasturtium containing para influenza and E coli vectors, are dated.” The trials GE Free NZ referred to were the trials conducted in the US. The data given to the permitting US body, Aphis, the BRS interstate/release permits and notifications state clearly that the HME GE ryegrass plants contained these molecules.

It is a problem if AgResearch tells the public and regulators that their GE plants contain certain genes and vectors when they don’t. It is misleading and a gross falsification if data given to regulators to assess is different to the GE plant that is being grown. We need to know how these genes have disappeared, integrated and changed the plant.

NZ has spent valuable research money on GE when we are struggling to keep farmers farming.

If NZ wants to be a scientific world leader in plant science, the sector should be supporting valuable conventional research into existing forage cultivars instead of wasting money on costly, poor-outcome genetic engineering biotechnologies.

and would ask why, especially as National voted for the current, repressive firearms laws.

National has regularly changed its agricultural spokesperson and I’m unaware of any of them achieving much.

With Labour, I don’t agree with the taking of GST off fruit and vegetables as it seems an administrative nightmare. I’m no fan of co-governance or of taxing belching ruminants. I also believe the so-called reform of the Resource Management Act is a shower.

I don’t agree with the roading/ transport policies of either National or Labour.