Sector zeroes in on growing role of data

TECHNOLOGY

won’t change the fundamentals of farming but it will remove some of its more onerous roles, says a tech leader.

AgriTech NZ chief executive Brendan O’Connell said farming in 20 to 30 years will still be underpinned by animal husbandry skills, but tools such as Halter and automated milking will remove some of the time-demanding, monotonous roles.

DairyNZ estimates farmers spend about five hours a week on compliance.

Hayley Morris, Fonterra’s business transformation digital lead, said the co-operative is on track to reduce by half the 1 million hours its suppliers and shareholders spend inputting data each year.

To date she estimates changes to its on-farm audits and annual farm diary records have saved them 507,000 hours, and Fonterra aims to hit its target within a year.

O’Connell imagines farmers in the future will have constant access to a digital assistant that, together with artificial intelligence (AI), will provide pertinent, up-todate information and data.

“It will be like a digital farmhand.”

O’Connell said a recent AI trial successfully scoured Pāmu’s farm

records to collate a report on greenhouse gas emissions without requiring any new information.

He likens the current state of technology to the human equivalent of teenage years, but believes we are entering a new stage of maturity as it becomes less clunky and awkward to use and developers start enabling it to interact with other programmes.

Farming leaders say technology must be appropriate to the task it seeks to address and provide information that is relevant to the person using it.

A 2022 report commissioned by AgriTech NZ into digital adoption in the primary industries found 59% of those surveyed were leaning towards adopting digital technology – but 41% saw little value for their business.

While there were trailblazers, it found farmers were generally less inclined to be early adopters than other sectors.

“Proudly traditionalist farmers and growers are reluctant to change what has worked for their land for many years,” the report said.

Most were happy to share data but many believed it had little value to someone else.

Managing business accounts, payroll and health and safety were areas with the biggest technology uptake, with lower adoption for management of water, irrigation, plant, crop and effluent.

Continued page 3

Cause and effect at MataRata Downs

Whether it is growing pasture, pine trees, native plantings or poplars, every inch of Jarred and Sarah Coogan’s 470ha Taranaki farm is effective. Photo: Bryan Gibson ON FARM 14-15 Big ideas come from

Freshwater farm plan changes could face first test in Canterbury. NEWS 3

Little Farms

A city girl and now an organic grower, Alex Morrissey began Little Farms from a desire to create a more sustainable food system.

HORTICULTURE 18-19

Community backlash prompts police to delay restructure decision. NEWS 4

Persuading shareholders to sell Alliance not easy, says Allan Barber.

OPINION 17

Neal Wallace TECHNOLOGY On farm

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400

Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY 0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME Delivered by Reach Media Ltd

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269 South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925 National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

News in brief

Record trading

Listed fruit-growing and post-harvest operator Seeka has reported record trading results from its first six months of 2025. Revenue was up 8% to $307.9 million, earnings up 22% to $83.5m and net profit after tax up 121% to $37.8m. Seeka directors have lifted their net profit before tax guidance for the full financial year by $2m to $35m-$39m and have declared a 15c interim dividend to be paid on October 15.

Green means go

Green kiwifruit has become the first fresh fruit to receive an authorised health claim from the European Commission. The commission has approved the health claim that “consumption of green kiwifruit contributes to normal bowel function by increasing stool frequency” – based on a daily intake of two fresh green kiwifruit providing a minimum of 200g of flesh.

Levy vote

DairyNZ’s six-yearly vote on whether it can continue with a farmer levy will be held next year, from Monday February 16 to Friday March 13.

DairyNZ chair Tracy Brown said the levy underpins sector science, research, on-farm support and advocacy, ensuring investment in activities that are relevant to farmers now and in the future. Before the vote, the DairyNZ board and management will visit regions to meet with farmers.

Wool hits $4

Crossbred wool hit the $4 mark several times at the latest Christchurch auction sale, with well-prepared fleece in strong demand.

PGG Wrightson South Island auction manager Dave Burridge said market demand rewarded good clip preparation with improvement across most crossbred types. “We saw an excellent offering of pre-lamb shorn fleece and oddments with the wellprepared and best styles most affected and several lots exceeding 400c/kg clean.”

RMA tweak to blot up many Canty consents

Neal Wallace NEWS Regulation

GOVERNMENT changes

to the certification and auditing of freshwater farm plans could face their first test in Canterbury, where Federated Farmers says up to half the region’s farmers would otherwise require a land use consent.

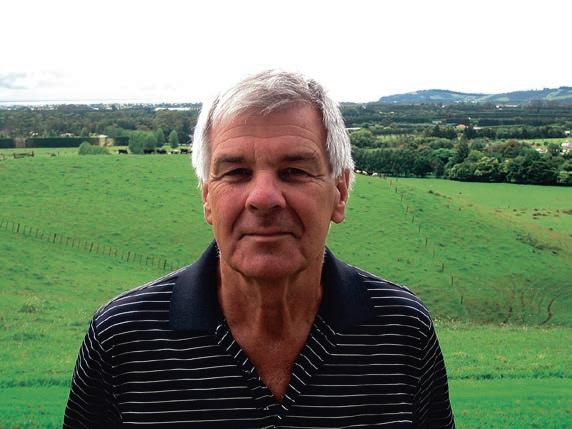

Colin Hurst, national vicepresident of the federation and a Canterbury farmer, estimates up to 3000 of the region’s 6000 farmers could require a land use consent to farm without the law change. He said the legislative changes should negate the need for most of these consents.

“The belts and braces of farm plans are that they are certified and independently audited, which is like resource consents.”

Hurst said consents can cost tens if not hundreds of thousands of dollars.

Continued from page 1

The biggest barriers were cost, a reluctance to move from manual or written systems and the belief it will not provide a return on investment.

The report predicted that technology uptake would increase as new, more tech-savvy generations start running farms, people seek a better work-life balance, the shortage of skilled labour continues to bite and farmers seek to produce more from fewer animals.

Data in itself will not transform a farm’s performance, said Ryley Short, the brand manager, monitoring, for SenseHub Dairy.

“Farmers who invest in technology need to understand what it is telling them and what changes they need to make in response.”

She said cow collars and sensors

The government has introduced legislation giving authority to the minister for the environment to determine if environmental plans administered by processors and industry bodies meet the standards necessary to certify and audit freshwater farm plans.

If farmers and industry groups are already doing good work to identify and manage risks, we want to recognise that rather than force more paperwork on them.

Andrew Hoggard Associate Environment Minister

Associate Environment Minister Andrew Hoggard said it will reduce duplication of documentation, lower costs for farmers, negate the need for some resource consents and for certification and auditing by regional councils.

monitor milk production and show the ideal time for newly calved cows to go back into the milking herd, while tracking rumination rates can reveal potential issues with their diet.

Short said dairy farmers investing in technology typically begin with automatic drafters, collars or EID and then move on to animal monitoring systems.

Brian Rose, Gallagher head of animal performance and traceability, said the trend is for more precision technology to generate data and the use of AI to help interpret that information.

“It will not get to the place of telling farmers what to do but will identify trends and provide guidance.”

Increasingly the trend is to take technology to animals, such as in-paddock scales, but also to employ tech for monitoring parasite burden, animal health and parentage.

Hoggard said industry assurance programmes that could qualify include Horticulture New Zealand’s NZGAP, Fonterra’s Tiaki sustainable dairy, Synlait’s Lead with Pride and the Farm Assurance Programme Plus.

“If farmers and industry groups are already doing good work to identify and manage risks, we want to recognise that rather than force more paperwork on them.”

Farm plans will address actual farm risks and practical actions farmers can do to reduce those risks and impacts.

Hoggard gave examples of intensive winter grazing and nutrient management as farm risks that can be managed by farm plans.

“This is another step towards ensuring farmers can continue to feed the world without getting tied up in complex resource consents, and balances this with protecting the environment.”

The changes also increase the minimum size from 20ha to

These roles are improving the uptake by sheep and beef farmers.

MORE: See pages 10-12

50ha of sheep and beef, arable, orcharding and viticulture farms that require a plan.

This removes the farm plan obligation for an estimated 8000 small properties, most of which are lifestyle blocks, he said.

The changes should be law next year.

Agriculture Minister Todd

McClay said this change is part of the government’s continued overhauling of the Resource Management Act to accommodate both environmental stewardship and growth.

“Farmers are already doing a huge amount of work investing in freshwater management,”

said.

Post-season lift to Fonterra milk price

Hugh

Stringleman

NEWS Dairy

This week’s poll question:

Do you think access to more technology and data tools is key to New Zealand’s farming success?

Have your say at farmersweekly.co.nz/poll

FONTERRA has increased the 2024-25 farmgate milk price forecast by 15c, to $10.15/kg milksolids, a month ahead of its financial results announcement and the finalisation of that milk price.

The latest forecast has a range of $10.10 to $10.20.

The increase will provide a welcome cashflow lift in the retro payments to farmers in September and October applying to the dairy season ended May 31.

Fonterra has also lifted its forecast range for certified organic milk from $11.70-$12.30

per kgMS to $12.30-$12.40 per kgMS.

The final organic milk price for FY25 is expected to be a record high of $12.35 per kgMS.

Chief executive Miles Hurrell said the increase in the FY25 forecast is a pleasing end to the 2025 season, ahead of the financial results due out on September 25.

“GDT prices continue to be strong, supporting the $10 forecast midpoint for the current season.

“However, it’s still early in the season and the risk of volatility remains, which is reflected in the wide forecast range.”

The FY25 forecast earnings of 65-75 cents a share remain unchanged.

McClay

COSTLY EXERCISE: Federated Farmers national vice-president and Canterbury farmer Colin Hurst says land use farm consents can cost tens if not hundreds of thousands of dollars.

Outcry prompts rethink on policing proposal

Annette Scott NEWS Community

COMMUNITY backlash has prompted a “push out” for decision

D-day on the proposed new Canterbury rural policing structure.

Canterbury District Commander Tony Hill said submissions on Canterbury Police’s redesign proposal closed on Monday, and the police are now working their way through “over 1000 pieces of feedback”.

“The engagement is really heartening, we are very grateful for all the feedback, it shows there’s very real interest in the way do our job in rural policing,” Hill said.

“We will look at our demands across the rural sector, it is important to us, in the services we provide, that we make sure all the facts are considered and there’s a reasonable amount to look through and we will need more time to do that thoroughly.

“Local police leaders need to ensure our people and resources are well organised to meet the

community’s needs and the safety of our staff.”

About 200 staff submissions and 800 submissions from the public or external parties, including some petitions, were received.

“Staff sent in very well considered, high quality feedback, and members of the public have also sent in some outstandingly articulate and thoughtful feedback which demonstrated people have taken the time to look over the proposals in detail.

The perspective is real, this is not the private sector, it most definitely is not fait accompli.

District Commander Tony Hill Canterbury

“All this feedback has been invaluable and has reinforced for me that we need to take more time with some aspects of the proposal and to keep tracking with others.”

Hill said all voices, both staff and public feedback, are now in the melting pot “to discuss what parts may not be quite right”.

“The perspective is real, this

is not the private sector, it most definitely is not fait accompli.

“I have never been involved yet in something like this where there has not been some sort of change.”

The initial decision date was August 25 and while no new date has been set, Hill said it will be several weeks before a final call is announced.

Meanwhile, Federated Farmers national vice-president Colin Hurst said farmers Canterburywide, while deeply disappointed by the proposals, welcome the extended time.

“I’m flabbergasted by what Canterbury Police wants to do to their rural police, as it’ll gut our ability to respond to rural crime and protect our people.”

Under the proposed restructure, small rural towns right across Canterbury would lose their local cops. They would be replaced by rural liaison officer positions, effectively drive-in, drive-out officers from urban centres.

Hurst said farmers already perceive police as being stretched, with the 2023 Federated Farmers rural crime survey showing nearly half of victims didn’t bother reporting crime because

Gas woes trigger $88m

Kapuni write-down

Staff reporter NEWS Energy

UNCERTAINTY over the future of gas supply has led to an $88 million write-down of Ballance Agri-Nutrients’ gas to urea plant in Taranaki, taking the shine off an otherwise solid 2025 financial result.

The fertiliser co-operative had strong underlying earnings of $38m, a 4% revenue lift to $965m as commodity prices softened, strong operating cash flows of $136m and debt reduced by $78m.

Our strong balance sheet, shareholder equity and reduced debt mean we’ve been able to absorb this one-off write-down.

Duncan Coull

Ballance Agri-Nutrients

The write-down meant it was prudent not to pay a rebate, Ballance chair Duncan Coull said.

While underlying earnings were strong, the co-operative is taking a cautious approach in writing down the Kapuni plant given the uncertainty over future gas supply agreements.

“Nonetheless we remain committed to finding a gas

supply solution for Kapuni.

Although it’s disappointing, it’s the appropriate thing to do.

“Our strong balance sheet, shareholder equity and reduced debt mean we’ve been able to absorb this one-off writedown, which is reflected by our nominal share value remaining unchanged at $9 per share.

“Most importantly, the business remains in a strong position to continue to deliver affordable and reliable nutrients for farmers and growers.”

Despite challenges during the past year, with global commodity price increases and uncertain New Zealand gas supply, Ballance’s core business continued to perform well, he said.

“This meant we could partially protect our farmers and growers from global price increases and show the strength and resilience of our co-operative.”

Ballance chief executive Kelvin Wickham said the issues with gas supply at Kapuni had taken the gloss off what had otherwise been a good year.

“It was disappointing to have that after what had been a really strong year. The balance sheet is strong enough to absorb it; we’re moving on and we really want to get onto the focus on spring.”

The co-operative was always expecting to transition off gas

BALLANCE SHEET: The cooperative is taking a cautious approach in writing down the Kapuni plant, given the uncertainty over future gas supply agreements, Ballance chair Duncan Coull says.

but had thought this would take a decade. The uncertainty over supply has brought that forward.

He was still confident they can secure a short-term contract to secure gas but at present there was “no ink on paper”.

More information will be released in early September on securing short-term gas supply to take the plant through to January.

they didn’t believe police were resourced well enough to respond.

“So how many more crimes won’t get reported if the police service is whittled back even further?”

Hurst would like to see the

formation of a crime partnership initiative where rural community groups such as Feds and Rural Women meet regularly with police for all to keep on the same page around needs and issues in rural policing.

Flocks in holding pattern

Neal Wallace MARKETS Sheep and beef

SHEEP farmers could be waiting for another year of improved lamb prices before starting to rebuild their ewe flocks, says AgriHQ senior analyst Mel Croad.

She was commenting on Beef + Lamb NZ’s 2025 stock survey, which revealed a slowing in what have been successive sharp declines in sheep numbers.

Croad believes farmers will be cautious before increasing ewes, given the cyclical nature of lamb prices.

“They’ve seen it so often: they have a great year often followed by a notso-great year.”

BLNZ chair Kate Acland describes the survey as a “mixed bag” with overall numbers better than expected despite breeding ewes down 1.9% to 14.28 million.

The report reveals an expected spring lamb crop of 19.29 million –120,000, or 0.6%, less than last year’s 19.41 million.

Total sheep numbers were back 1%, which follows three previous years of declines of 2.3%, 3.1% and 3.2%.

The survey projects the number of beef cattle to rise 4.4% to 3.84 million as farmers opt for lower input animals.

It predicts an increase in breeding cows from 990,000 to 1.02 million and the number of beef calves expected to be born this spring to be 2.8% higher at 871,000.

Meat companies said the forecasts are broadly in line with their projections of an increase in prime

cattle, although some thought sheep numbers could have fallen further.

Croad described the 0.6% decrease in lambs as minimal and the best that could be hoped for. It provides meat companies with some certainty.

“It’s more positive than we have seen in previous years.”

Croad said the first new season sales of ewes with lambs at foot all counted have sold for $120-$125, well up on the $80 paid this time last year.

She was not surprised beef numbers had increased given international prices have been stable for several years due to global demand.

BLNZ is forecasting a 2.8% increase in beef calves and Croad said there are more dairy-beef calves being raised, both of which will increase the beef kill in the next few years.

Murray Behrent, Alliance’s manager of livestock and shareholder services, said prime beef availability will increase in coming years given a significant decline in the number of bobby calves being processed this spring.

Behrent said the year-on-year decline in bobby calves being processed in the North Island was 11.9%, and 16.4% in the South Island. In two years’ time he expects a significant increase in the number of prime cattle ready for processing.

Silver Fern Farms’ chief supply officer, Jarrod Stewart, said the company is entering the new season with confidence and the need to be flexible to match capacity to livestock flows.

He said markets and pricing are expected to remain favourable for the new season, providing farmers with much-needed confidence.

KEEN INTEREST: Waimate mayor Craig Rowley and Federated Farmers vice-president Colin Hurst addressed a packed public meeting at the Waimate Event Centre, one of several such meetings held across Canterbury in the past two weeks.

Age no barrier in premium produce market

Richard Rennie in Tokyo MARKETS Horticulture

AN aging demographic and shrinking population may not paint an encouraging picture of Japan as an export destination, but Hawke’s Bay produce company Freshco continues to see growth, margin and opportunity in the country.

With apples, buttercup or kabocha squash and cherries Freshco’s main export produce, Japan has been a long-time export customer. It is valued for its consistency and the trust built up over 35 years with Freshco’s Japanese partners.

Japan country manager Jessica Tisch said the company’s squash business, comprising 12,000 tonnes a year, tends to fly below the radar back home, given the crop’s niche nature.

“Squash is consumed quite differently to how we would eat pumpkin in NZ. It is used as an ingredient, both savoury and sweet, including cooking with a sweet sauce, or sliced in tempura, for example.”

Sixteen years ago, the company formed the Three Good Men brand for its squash marketing. Investment in the brand includes hosting retail buyers in NZ each year and working to develop retail plans.

“It has helped build a high level of trust between all parties. After an event like Gabrielle, which took out 50% of the crop, there was a lot of sympathy and understanding from our customers, and efforts to help us

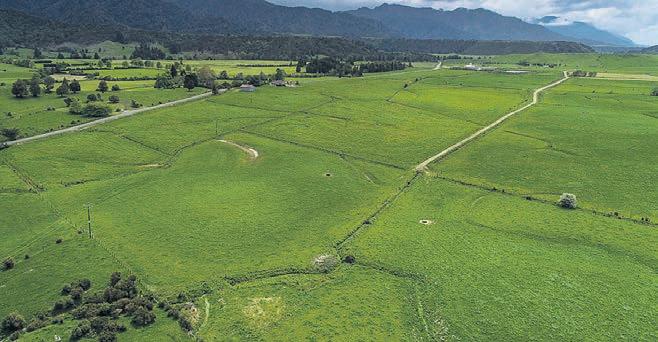

Dairy farm sales take off in Canterbury

Annette Scott MARKETS Real estate

CANTERBURY dairy is on the move, clocking up 40 farm sales over the past 12 months.

On top of that, the region is on the verge of another dairy conversion boom with word of up to 30 applications being proposed.

In a Canterbury rural roundup, general manager of rural for Property Brokers Conrad Wilkshire said since the covid hiatus, high inflation, interest rates and challenging monetary policies impacting on farm costs have “pretty much rectified”.

Fonterra is also in a very strong position, with skyrocketing milk prices triggering strong market indicators and driving the boom in Canterbury dairy farm activity.

“Our winter market is well up, seeing month-on-month growth sales not only outstripping the

manage over a very tough season.”

Freshco’s apple business includes three proprietary brands, early-harvested Breeze, Sonya and Cheekie, a relatively new variety.

Japanese consumers have been very much occasion eaters for apples, consuming fruit at the end of a meal, often at the end of the day.

“The opportunity is for us to offer more eating occasions. People are looking for more convenience, like pre-chopped, pre-peeled fruit.”

The opportunity is for us to offer more eating occasions. People are looking for more convenience, like prechopped, pre-peeled fruit.

Freshco has been working closely with its in-market processing partner and the ubiquitous 7-Eleven chain in Japan to get apples processed in that way onto shelf. Its apples are now in 20,000 stores nationally, selling in convenient 80g bags for on-the-go eating.

“For us it is a win-win solution. The larger fruit are perfect for processing and because the apple is peeled, it is a great value-add sales channel.”

On shelf in Tokyo, local apples retail for NZ$3 each, compared to a Freshco offering of four for NZ$5.50, in a smaller size more suited to an older, single-dwelling demographic or families.

“Japanese growers are also facing more challenges from climate

GOLDEN EXPORT OPPORTUNITIES IN

JAPAN

change, with heat levels higher, and less winter chilling impacting on crops.”

Rather than disrupt local growing, Freshco has been working with growers to help improve their techniques in response to these challenges.

“Consumers here like to eat local, and to eat seasonally, so our work really helps to lift the entire market’s prospects,” said Tisch.

NZ apple sales to Japan have grown 60% in the past year, with Freshco having about half the market for exports here.

Japan’s tough phytosanitary standards have deterred other countries from getting a foothold, but the perseverance of NZ exporters has paid off, she said.

“The tariff level under the CPTPP is also now less than 4%. Zespri paved the way for apples to some extent, increasing consumers’ knowledge of NZ produce, and the nutrient value in our fresh fruit.”

Japan’s food retail outlets are complex and fragmented, with stores holding little stock due to space, making direct retail relationships less common, and with good distributor relationships vital for restocking.

United States retail giant Costco is a valuable customer for Freshco, with the chain’s bulk-buying focus a popular alternative means of shopping for Japanese consumers more accustomed to small, daily local buying.

same time last year but also matching the 10-year average for the number of farms sold,” Wilkshire said.

Figures obtained from Property Advisers Canterbury show 40 dairy farm sales in the past 10 months, up from just 12 in the previous 12 months and 16 in the 2022-2023 year.

“The state of the industry has not exactly been business as usual this past six months,” Wilkshire said.

“There is no question that the improved affordability of bank funding and forward confidence in the commodity cycle are playing a significant role in all this.”

Wilkshire said farmers are also increasingly confident as the regulatory settings in which their

STANDARDS: Despite Costco’s bulk buying focus, its high standards set the company up well to succeed in other markets, says Freshco’s Jessica

“It may be a bulk outlet, but it is not a discounter, placing emphasis on high quality products and a real ‘experience’ outing for members.

“Its standards are very high, and the discipline we have gained supplying them plays well into all other markets.”

Tisch said Freshco is far from daunted by Japan’s declining population.

“It is still over 120 million

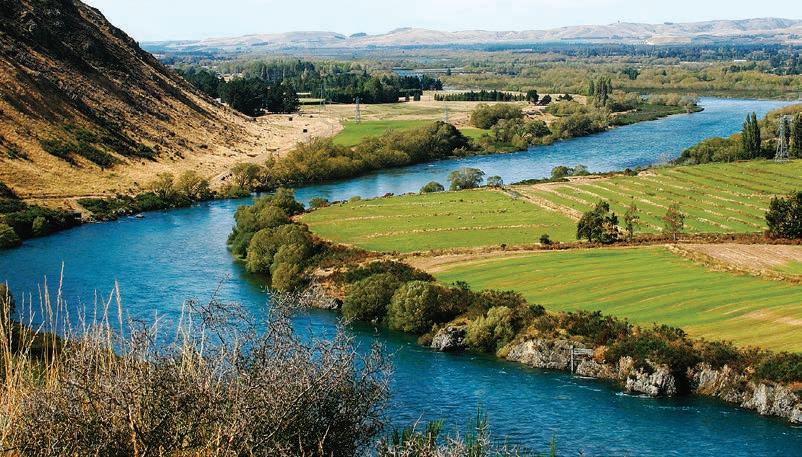

ON THE UP: Figures obtained from Property Advisers Canterbury show 40 dairy farm sales in the past 10 months, up from just 12 in the previous 12 months and 16 in the 2022-2023 year.

businesses operate now appear more aligned to supporting production rather than hindering it.

The current New Zealand dairy environment is characterised by historically strong milk prices, record cow yields and a clear focus on environmental responsibility.

“Businesses need to be viable to be sustainable and that’s clearly a sign of the current times.

“I don’t believe this year is a one-off. Farms have recapitalised with investment in environmental compliance aiding value capture now, not just for sellers but also buyers who can operate on what a property can actually produce rather than competing head-on with alternative land uses or yet another policy statement limiting land use options.”

people, and many of them have yet to experience both NZ apples and squash.”

• Richard Rennie’s Meeting the Market tour has been made possible with grants from Fonterra, Silver Fern Farms, Rabobank, Zespri, Alliance Group, Meat Industry Association, Wools of NZ, Beef+Lamb NZ, NZ Merino, European Union Commission and Gallagher. https://www.farmersweekly.co.nz/ meeting-the-market/

Skellerup returns record results

Hugh Stringleman NEWS Agribusiness

SKELLERUP has announced record results across operational divisions and for revenue, earnings and net profit, enabling a 25.5c a share full financial year dividend, 50% imputed.

In the 2025 financial year ended June, revenue was up 7% to $353.5 million, earnings before interest and tax were $78m, up 7%, and net profit after tax was a record $54.5m, up 9% on FY24.

BOOTS AND ALL: Skellerup’s agricultural division, which makes rubberware for the dairy industry, achieved earnings of $35.3 million, a record result and up 15% on the previous corresponding period.

It was the ninth consecutive year of earnings growth.

The agricultural division, which makes rubberware for the dairy industry, achieved earnings of $35.3m, a record result and up 15% on the previous corresponding period.

Chief executive Graham Leaming said demand for essential consumables for the global dairy industry was consistently strong throughout FY25, in contrast to FY24, when the first half of the year was impacted by customer destocking.

This year sales in the home market were up 6% and in international markets were up 10%.

“Over the past 18 months, we have successfully launched new high-performance milking liners in the [United States] market and the first products from our Thriver calf feeding range into NZ and international markets.”

The industrial division had earnings of $48.4m, a fifth consecutive record result.

Skellerup said it has a very strong balance sheet with minimal debt and is looking at in-market capability and plans for the additional capacity at existing plants.

Tisch, left, pictured with Japan marketing manager Susie Krieble.

Photo: Richard Rennie

Jessica Tisch Freshco, Japan

Everything you need for spring . Only from Ravensdown.

G et ting spring right is crucial to your farm’s succe s s With Rave nsdown, you’ll get eve r y thing from agronomy advice to top - qualit y nutrie nt s and te ch to ols like HawkEye. We’re the complete package, g uiding eve r y de cision and delive ring m ore from your inve stm e nt.

G et s p ring rig ht . C all 0800 100 12 3 o r t alk to your A g ri Manage r to day.

Dawn Meats plays up Alliance synergies

ALLIANCE Group joining forces with Dawn Meats would enable yearround supplies of red meat to global markets, says the head of the Irish company seeking to buy 65% of the New Zealand farmer-owned co-operative.

In a letter to Alliance shareholders, Dawn Meats chief executive Niall Browne says both companies process quality, grass-fed meat, and the opposite seasonal production would allow for year-round supply.

Dawn Meats has strength in beef, selling predominantly into markets in the United Kingdom and Europe, and Browne believes NZ beef could achieve the same favourable status with consumers in those markets as NZ lamb.

Alliance’s strength is in lamb production and markets in the UK, Europe, Asia, China and North America.

“Meanwhile, Dawn Meats would benefit from greater access to North American and Asian markets,” Browne said. New or improved free trade agreements have opened access for NZ meat exports to the United Arab Emirates, as have regional agreements with multiple Asian and Pacific countries and bilateral trade deals with Thailand,

Singapore, Hong Kong, Taiwan, South Korea and Malaysia.

Dawn Meats is offering $250 million for a 65% stake in Alliance, with shareholders to vote on October 20 on whether to accept the offer.

Given NZ’s free trade agreements

Wool Impact granted extension

Annette Scott WOOL Food and fibre

WOOL Impact, the entity tasked with driving export growth for the New Zealand strong wool sector, has been extended a lifeline on its initial three-year runway to get projects off the ground and in operation.

In July 2022, the government invested $4.5 million to back the new venture. Under new industry body Wool Impact, the $11.4m programme was designed to facilitate innovation and support growth to enable a unified voice for strong wool in NZ while growing existing and generating new demand for strong wool consumer brands, products and services.

Wool Impact is a collaboration between the government and industry sector partners under the Sustainable Food and Fibre Futures (SFFF) fund.

The three-year programme, designed to last until June 30 2025, included sector partners WoolWorks and sheepmeat

processing entities contributing $6.9m on top of the government’s $4.5m investment.

“It’s been a three-year sprint, we have evolved as an organisation with knowledge and maturity.

Wool Impact will remain active for the next 12-24 months to build on initiatives currently underway,”

Wool Impact chief executive Andy Caughey said.

“This will enable Wool Impact to continue to develop new demand for NZ strong wool and support the sector in converting demand into higher prices for woolgrowers.”

At the same time, Caughey said, Wool Impact will advance the development of an enduring model for the sector in partnership with Campaign for Wool and the Wool Research Organisation of NZ (WRONZ).

“We are playing catch-up on 20 years of underinvestment in wool support services so what we are trying to achieve takes time and effort.

“Progress is being made and this work will need to continue in some form if we want to deliver

sustained improvements for strong wool.”

With the end of the initial three years, several board appointments and roles came to an end.

“We now have a fittingly lean board” comprising chair Stuart Heal, Nick Aubrey, Steve Penno and Mike Stephens, both from the Ministry for Primary Industries.

There is also an expanding governance responsibility through the collective partnership with Campaign for Wool and WRONZ.

Funding remains the same, meantime on a “stretched out budget,” with expectation of announcing new funding partners in the coming months.

Caughey said that included in the wide range of work in the three years to date has been brand and value change engagement and support both domestically and internationally, alongside innovation enablement.

“Brand connectivity has been our main focus on developing greater connection with brands and influencers of demand and value for wool products and our wool.”

Looking ahead, Wool Impact

with the UK and European Union, Browne said, joining Dawn Meats would give Alliance greater access to blue chip customers in both regions.

“It would also allow for the sharing of expertise, operational practices, insights and innovations,” he said.

Founded in County Waterford in Ireland in 1980 by three farming families, Dawn Meats has grown to become one of Europe’s most significant red meat processors. It operates as Dawn Meats in Ireland and as Dunbia, through a subsidiary company, in the UK.

Browne said the company has the same approach to each new acquisition.

“Our approach is to continue to develop and protect the heritage of any business we partner with or acquire, achieving growth through further innovation and advanced processing and logistics operations.”

In 2017 it entered a joint venture with the UK company Dunbia, which was driven by the need to remain competitive, particularly in light of Brexit.

In 2023 it acquired Kildare

It would also allow for the sharing of expertise, operational practices, insights and innovations.

Niall Browne Dawn Meats

Chilling, a lamb and beef processing business in Ireland, into which it has invested NZ$20m.

This financial year Dawn Meats will generate revenue of nearly NZ$6 billion.

It employs more than 8000 staff in 10 countries, operating 11 sites in Ireland and 13 in the UK. These include four retail packing facilities producing fresh, frozen, value-added and cooked retail and foodservice packs, and two frozen burger facilities, one of which is dedicated to supplying McDonald’s.

Each year it processes about 1 million cattle and 3.5 million sheep for supermarkets, foodservice and manufacturing businesses in more than 50 countries.

remains focused on three key outcomes – demand, value and leadership.

“This is about developing opportunities with brands new to wool as well as supporting growth of brands currently using wool.

“Global reporting requirements need traceability. This supports more direct sales mechanisms and more transparency through value chains. We’re enabling this.”

Several grower field days are in the planning, kicking off in Southland and Otago on August 27 and 28.

“Wool Impact was set up for the benefit of our wool growers. We need them to be involved, and that includes anyone who wants to see sheep farming prosper so farmers can invest in sustainability of their land and the vibrancy of their communities.”

Price index steady as GDT spreads the demand

RESILIENCE: Mozzarella was down 2.7% in the latest Global Dairy Trade auction.

Hugh Stringleman MARKETS Dairy

DEMAND resilience in some regions of the world is keeping Global Dairy Trade auction prices stable ahead of the New Zealand spring surge in milk production.

In the latest GDT auction the overall price index dropped 0.3% but whole milk powder prices were up 0.3% and anhydrous milk fat was up 0.1%.

Prices for the other commodities

were down across the board –mozzarella minus 2.7%, skim milk powder minus 1.8%, butter minus 1% and cheddar down 0.5%.

None of these negative components, nor their sum, were enough to counteract the WMP lift and push the GDT index into negative territory.

NZX head of dairy insights Cristina Alvarado said the resilience of demand is notable given the growing availability of dairy products from NZ, the United States and Europe.

“With softer prices, ongoing tariff discussions, and varying regional buying patterns, the market has so far managed to absorb higher product offerings without significant downward pressure,” she said.

Regional demand shifts included the Middle East growing to 14% compared with 9% in the previous auction, and more purchasing from Europe and Central and South America, to help balance the market and counter the fall from China, down from 43% to 34%.

Neal Wallace NEWS Production

ALL YEAR: Dawn Meats chief executive Niall Browne says Alliance Group and Dawn Meats together could achieve year-round supplies of red meat to global markets.

WOOL GATHERING: Andy Caughey, seated left, says wool will only contribute meaningful profit to NZ sheep farming systems if industry works together.

A2 Milk Co kicks its cans down the road

THE spate of buying and selling of milk processing plants by

The a2 Milk Company is critical to expand its China-label infant formula product range and de-risk and diversify, according to equity analysts.

Mataura Valley Milk in Southland will be sold to Open Country and the Yashili plant in Pōkeno, south Auckland, purchased, along with its Chinese product registrations that could be converted to a2.

The crucial milk supply with a2 beta casein protein and not the a1/a2 combination found in regular milk has been secured from Fonterra in the upper North Island.

“We view this as strategically and financially sound,” Forsyth Barr analysts Matt Montgomerie and Ben Crozier said.

The three apparent benefits are vertical integration and margin gain, access to new Chinalabel products, and the exit

from the loss-making Mataura Valley.

Craigs Investment Partners also noted the improvement in marriage data in China from which higher birth rates are expected from 2026 onwards.

South Island a2 milk processor

Synlait, a 20% subsidiary of The a2 Milk Company (ATM), said it is in discussions with a party regarding its Pōkeno plant, alongside that of Yashili, but discussions are incomplete, no binding terms are signed and there is no certainty a transaction will occur.

We view this as strategically and financially sound.

Synlait said it would not respond to further media speculation about the possible sale of Pōkeno. That speculation mentioned multinational Abbott Laboratories, already a non-dairy processing customer at Pōkeno.

ATM said it will invest up to $500 million to buy the Pokeno plant for $282m, conditional on the Chinese registrations being transferred, $100m in capex to expand production and $120m in additional working capital and product development.

Its sale of 75%-owned Mataura Valley will net $100m.

ATM has also announced an intention to pay a special dividend of $300m upon the successful completion of these plant moves and product registrations, which would be about 40c a share.

Nearing 25 years old, having been established by founder Dr Corran McLachlan on the controversial thesis that a2 beta proteins in milk are healthier than a1, ATM only began paying a 20c dividend for the first time in FY25.

It has a very strong balance sheet, with cash reserves over $1 billion before the transactions just announced.

Now some 20% of all infant formula sales in China are a2 products and that segment of the market grew 12% in FY25, the company said.

ATM has the fourth largest infant formula sales value share in China, being 8% of the total market, and this is forecast to improve to 10% over the coming five years.

Its revenue in FY25 was $1.9bn, of which $1.3bn came from China and other Asian markets, $316m from Australia and New Zealand, $140m from the United States and $144m from Mataura Valley.

Liquid milk accounted for $346m of sales, in ANZ and the US, and $1.274bn from infant formula.

The ATM share price has risen 40% over the past six months to sit around $9.20 presently, but still well below its speculative peak pre-covid.

MORE: See page 16

SOUTHERN EXPOSURE: Open Country CEO Mark de Lautour says the purchase will give the ability to commit further to the Southland and south Otago regions.

Open Country to acquire Mataura

Valley Milk

THE country’s second largest dairy company, Open Country, has entered into a conditional agreement with Mataura Valley Milk’s shareholders to acquire the business.

Mataura Valley Milk is located near Gore and is majority-owned by The a2 Milk Company alongside its minority partner, China Animal Husbandry Group.

The acquisition would give the company the ability to commit further to the Southland and south Otago regions, Open Country CEO Mark de Lautour said.

“The deep south is an important region for Open Country and is an area we have previously announced as targeted for significant capital investment.

“This site is a strategic investment for Open Country given its advanced, high-tech design.

“Its capabilities give us the opportunity to produce a different array of higher value products that will complement our current Awarua site product range.”

Open Country currently has six production sites across New Zealand and a head office location in Auckland.

The agreement includes a supply arrangement with The a2 Milk Company whereby the Mataura Valley Milk site will continue processing A1 protein-free milk to produce A1 protein-free milk powder.

Milk supply agreements with current farmer suppliers remain unchanged.

“We look forward to working with the team at Mataura Valley Milk to fully utilise the site’s capability. In doing so, there will be an exciting opportunity for new farmers to add to the existing supply group and join the wider Open Country family of farmer suppliers,” he said.

De Lautour and Open Country’s board chair, Laurie Margrain, will join The a2 Milk Company CEO David Bortolussi to meet with Mataura Valley Milk staff and current farmer suppliers on August 26.

“At Open Country we are focused on ensuring we are in a position to provide dairy farmers with genuine choice – choice that benefits farmers, our staff and the New Zealand dairy industry as a whole.

“This has flow-on benefits to the New Zealand economy and the communities in which we operate given our 100% New Zealand ownership,” De Lautour said.

Hugh Stringleman NEWS Dairy

Matt Montgomerie and Ben Crozier Forsyth Barr

SPECULATE: Synlait says it will not respond to further media speculation about the possible sale of Pōkeno.

Dairy Goat Co-operative sets out new strategy

THE Dairy Goat Co operative is embarking on a new strategy based on growing its infant formula range, and embarking on a capital raise where it seeks $40 million from investors.

The Hamilton-based company set out the strategy to its 50 farmer-shareholders in May as a way of climbing its way out of the severe financial issues it faced during and after the covid-19 pandemic.

In the year prior to the pandemic, around 55-60% of the co-op’s sales were in China, and half of them came from the Daigou channel.

That market disappeared when borders were shut during covid. Compounding the issue was that the co-op then failed its SAMR registration in 2022-2023, which is required to export infant formula to China.

That shut down the remaining access to that market for the Dairy Goat Co-operative (DGC).

“Between those two events, which happened in the course of

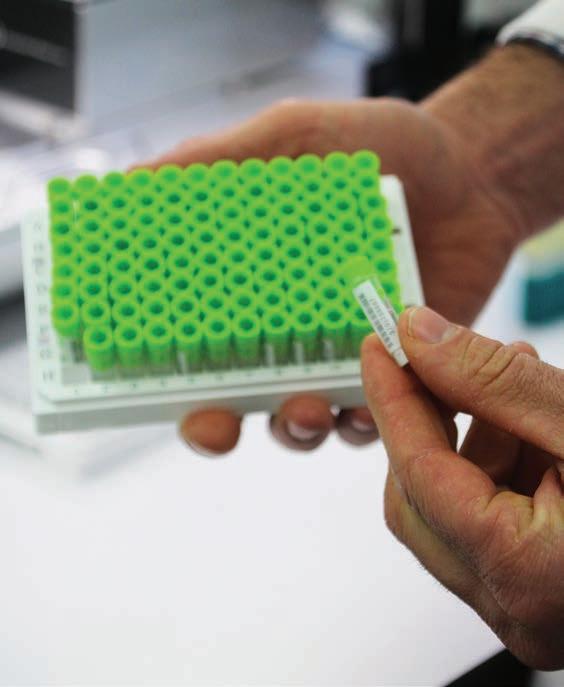

LIFT: Cans of infant formula powder on the process line at the Dairy Goat Cooperative’s factory in Hamilton. The factory is currently running at 50-60% capacity but CEO Alastair Hulbert wants that lifted to 90%.

two and a half and three years, we lost all of our infant formula sales,” DGC CEO Alastair Hulbert said.

At the same time, it continued to collect and convert goat milk into powder, which built up its inventories. At its peak, the co-op had around 23 months’ worth of powder.

The farmers were paid for this milk, meaning DGC had the corresponding debt on its balance sheet.

We need to be very commercially focused and focused on our markets. We’re open for business and the doors are open.

Alastair Hulbert Dairy Goat Co-operative

Compounding this was that many farmers during the 20162019 boom years had expanded their farms and were carrying high debt levels.

The payout to farmers dropped and it all put the co-op and farmers in an extremely dire economic position.

“It was almost the perfect storm,” Hulbert said.

It triggered changes within the DGC. Rene Burri was appointed DGC chair and Hulbert CEO in May last year.

The new leadership also forced a company culture change. Its reputation of being an insular and extremely private company could no longer work if it wanted to tell its story in the export market, he said.

“We need to be very commercially focused and focused on our markets. We need to collaborate with other people in the industry both within the goat industry and sheep milking.

“We’re open for business and the doors are open.”

To reduce its inventory, DGC started selling its powder as a whole milk powder ingredient into China, which did not require a SAMR certification. This enabled the co-op to pay off $18m of debt last year.

It also lifted the payout for farmers by 35% for the June 2024May 2025 season.

The forecast for the new season is $12.50-$14.50/kg MS. Excluding debt servicing, the average DGC farmer’s operating expenses sit around $12/kg MS.

On the back of the new strategy, there is a degree of optimism for the future among the farmershareholders. It has also given them clarity its future.

“It’s not going to be an overnight fix. It’s going to be two to three years of grind to get through it.”

Focusing on infant formula provided the DGC the best growth avenue and returns for its farmers, allowing it to get back to what it is best at, Hulbert said.

“We have an immediate focus on getting farmer returns up and the real focus for the next five years needs to be on infant formula.”

It is a high-value product that sits in the premium end of the

market and there are good margins to be had.

Supporting that is better asset utilisation at DGC’s plant in Hamilton. The factory is currently running at 50-60% capacity.

Hulbert wants that lifted to 90% and this process is already underway.

“We need to fill the factory up because it helps the overheads and that in turn increases returns to farmers.”

Third-party contract manufacturing and continuing with ingredients sales are lifting that utilisation.

A dual payment system for its farmers has been introduced. One is an entitlement based on a farmers’ shares that reflects the value given for infant formula.

The other is WMP sales, in terms of which farmers receive a commodity milk payment – a fixed price payment for a set volume of milk that is around 30% lower than the infant formula payment.

As infant formula sales grow over time, it is hoped that the ingredients payments will decline as farmers chase higher value, he said.

Critical to the strategy’s success is returning to the Chinese infant formula market in 20282029 because renewing a SAMR registration is a $15m, three-year process.

China aside, the co-op also wants to build market share in its existing markets and build its presence in emerging markets such as Mexico, Vietnam and Canada, among the 23 countries it sends its products to.

Hulbert also has eyes on the United States market despite the prospect of paying a 31% tariff. It also requires completing a US$4m FDA approved clinical trial on babies, which takes 18 months to complete.

Being at the premium end of the market means it can absorb the tariff and still make a profit.

Driving that growth in those two key markets required extra capital which was why the DGC has embarked on the capital raise, which began in May.

Hulbert was tightlipped about it, citing confidentiality, apart from saying DGC is targeting strategic investors and it is a 12-month process.

He is optimistic about the future in spite of the recent struggles the co-op has faced. DGC has a great product that is backed by science and in demand from consumers, he said.

“We have a great story to tell. We invented infant formula from goat’s milk. The foundations for the future of the industry are really exciting.”

Pride in their work drives rural contractors

Annette Scott NEWS Agribusiness

RURAL contractors are a key cog in driving efficiencies across the agricultural sector, according to Lincoln University researchers. They say contractors are an essential part of the rural economy, growing in importance, offering farmers greater efficiencies through their specialist skills.

Yet, despite their importance, there’s been little formal research into this sector.

While some might think external factors such as competition are the main drivers affecting a rural contractor’s business, this is not the case, according to the contrac tors themselves, the researchers say.

“Instead, operational excellence,

their commitment and knowledge to do a job well is what they believe drives success most, with effective and efficient management and delivery of services to farmers as most critical,” said Dan Smith, co-author of the report Small Rural Farm‑Support Agribusiness: Strategies to survive and thrive.

Twelve Canterbury rural contractors specialising in hay baling, fertiliser application, fencing, spraying and cultivation were interviewed with Canterbury chosen as it contains most land uses present in New Zealand, including dairy farming, sheep and beef farming, arable and forestry, spread over differing soil types and geography.

“The challenges I identified through this research included input costs, seasonality and the time pressures associated with

an owner-manager having to be across all aspects of the business,”

Smith said.

“Plus, rural contractors often need to operate expensive,

specialised assets and machinery, which accrue both debt and the need for constant maintenance.”

To help counter these challenges,

Smith said, rural contractors look to mitigate risks through specialisation, which can help manage the seasonality of many on-farm tasks.

If a contractor has one specialisation, they are most focused on forming positive relationships with farmers, their staff and extending into the community.

“Those with more than one specialisation care most about operational excellence while the largest businesses, with five or more staff, placed the greatest focus on the care and maintenance of their assets.

“So, the size of the business, and if they specialised in one or more activities, dictates their greatest priorities.

“The good news is that the majority of those interviewed reported low stress levels.”

NANNY STATE: Dairy Goat Co-operative CEO Alastair Hulbert says the focus on dairy goat infant formula provides DGC with the best growth avenue and returns for its farmers, allowing it to get back to what it is best at.

SKILLED: The researchers shining a light on rural contractors suggest they are an essential part of the rural economy, growing in importance, offering farmers greater efficiencies through their specialist skills.

Gerald Piddock NEWS Dairy

Farming with Data

Getting data input to serve farm output

Richard Rennie TECHNOLOGY Agriculture

LIZ Muller and Jeremy Bryant oversee two businesses at the sharp end of data generation on farms, producing millions of kilobytes of data points that, when managed properly, can help farmers make better choices.

Bryant’s start-up company, Aimer, enables farmers to use their smart phone to video pasture, creating images that can be used to deliver cover estimates, feed wedges and grazing plans for their next rotation. Muller’s company, Herd-i, scans cows to determine body condition score, using artificial intelligence (AI) to track changes over time.

Muller said it is the “mashing” together of multiple data sources that will deliver farmers more highly valued decision-making options in years to come.

Taking multiple sets of farm, weather, animal and financial data will mean tricky, vital decisions such as when to dry off are made with no money left on the table that season, while not robbing any from the next.

“This is all on our future

pathway, but we are not there yet,” she said.

“There is still an element there now on questioning ‘What do I do with this data?’, on turning it into meaningful insights.”

She also notes there remains a gap between farmers taking the data at hand and trusting AI to do something meaningful with it for them.

“Some may trust it, but many won’t.”

Bryant cautions that farmers risk entering a period where “a lot of data is there, but it is just noise to them”.

“There’s really a need there to get these tools that take that data and say ‘Okay, what do I need to do over the next week, or two weeks, to transform things?”

He said it requires a finely nuanced system to accommodate the dozens of small on-farm decisions farmers make every day that cumulatively are worth thousands of dollars a year in gained or lost income.

“And of course the decision to do nothing over two to three days at prime periods like spring, that can cost thousands.

“And they want to measure in a way that is cost effective, they do not want x hardware leading to y

DECISIONS: Liz Muller, CEO of

says ultimately the multiple data streams companies like hers generate will be threaded together for farmers to make actionable decisions quicker.

There’s really a need to get these tools that take that data and say ‘Okay, what do I need to do over the next week, or two weeks, to transform things?’

Jeremy Bryant Aimer

cost. This is why we’ve lent into the smart phone – everyone has one, and it’s always on hand.”

He said there has been good work done in interoperability between different data gathering companies in recent years.

“But the question is now ‘Where to from here?’”

He sees the next step being to link animal data to farm data, effectively creating the farm’s “digital twin”. This is now a reality with greater use of wearables on cows by farmers.

“We are focusing on alignment with other data gatherers. There is no reason why everyone needs to be a master of everything.”

Early integration work his company has done includes taking a farmer using Allflex collars and linking it with Aimer pasture data.

“You get heat, health detection, and information on rumination and paring, while Aimer manages the pasture side on available feed allocation to match this.”

Rather than “one platform to rule them all”, Bryant believes tech platforms are better

positioned being agnostic to the hardware they pair with as deeper communications between equipment becomes possible.

“Working with other companies will see some problems solved quicker than trying to do it yourself. Collaboration can be challenging as a business, but it is a better way to work.”

Possible next steps include “AI agents” working for farmers. This is tech that works within specific data sources, rather than casting itself into the entire internet as its data source.

“Rather than learning from the internet, it is aware of your data sources. It keeps data secure and removes that impact of open AI that incorporates biases and uses sources not as relevant to NZ pastoral farming.”

Farm data revolution comes with a ‘but’

Richard Rennie TECHNOLOGY Agriculture

WELL into his second decade dealing with electronic farm data, Tony Walters says he is circumspect about New Zealand’s promised farm data revolution.

Walters and his wife Marlene dairy farm near Waiuku, South Auckland, and were crash test dummies for the likes of Fonterra and Spark in the early days of remote data sensing and transmission.

“We were the first farmers in NZ to have a 3G modem for broadband when our cell tower was upgraded,” Walters said.

Following this came a “LoRaWAN” network, a low range comm system that enabled the (then) emerging Internet of Things (IoT) technology, where remote sensors could communicate via the web.

His on-farm sensor network extended to a weather station, soil/milk temperatures, and water tank levels.

“They were just trying to see where the tech could be taken, trialling all sorts of stuff.

Unfortunately, covid saw it get knocked on the head.”

Today, though, the Walters have doubled down on their data gathering, having put Irish Dairy

Master brand wearable collars on their herd four years ago.

He picked up the equipment from a Northland farm that failed to integrate it effectively, and sold

it to him at a significant discount.

He continues to monitor and download weather data collected through his Harvest Electronics remote weather system.

“But what has surprised me is how long it has taken to be able to integrate data. We were talking to Fonterra about this back in the early 2000s, about allowing it into your farm diary. But it’s only just happening now in 2025, and we still can’t put our weather data in.”

He believes there has been too much squabbling between companies on who owns farmers’ data, and how it will be shared.

He said this has prevented farmer customers from getting the full benefit of data they generate.

“FarmiQ was going to be the perfect tool to have taken data further to integrate, but it did not seem to get there.”

But despite this he has found benefits having the herd on wearable tech and would not be without it.

Two years ago a poor mating period was able to be traced back using the wearable data to a shift in the herd’s rumination pattern, caused by a sudden change in diet.

“Our local vets, Franklin Vets, are

in the process of working out how they will use this data for farmers, sitting down to help identify problems the wearable data alerts them to.”

He cautions though the tech is not infallible.

“It will only be as good as the data, like calving dates, you put into it.”

But what has surprised me is how long it has taken to be able to integrate data.

Tony Walters Waiuku

For Walters the single biggest advance has been having 4G connectivity at the farm dairy to enter cow data as it comes in and not having to do it at home at night.

“But I am a bit disappointed overall on where things are at.

“We do have better connectivity but data usability still lags, and industry has not sorted out data ownership and that common platform.”

Herd-i,

SHARE: Tony Walters believes there has been too much squabbling between companies on who owns farmers’ data, and how it will be shared.

Photo: Richard Rennie

Wearable hardware a data driver

Richard Rennie TECHNOLOGY Data

COW wearables are the main generators of the surge in farm data with New Zealand dairy farmers investing significantly more in them in recent years.

A DairyNZ survey conducted in 2023 found farmers with rotary dairies were the biggest investors, with a 24% increase in the number of herds wearing the technology since 2018.

This took the total number of herds then to 16% of all farms, but industry estimates today have the adoption rate even higher, at about a third of all herds.

Based on the survey, collars have proven the most popular, accounting for 80% of the tech, with ear tags the rest.

Since the DairyNZ survey, the wearable sector has had a significant lift in awareness, largely off the back of high-profile products like the Halter tech and

Gallagher’s eShepherd that have gained attention with their “virtual paddock” mapping tech.

Jeremy Bryant, founder of Aimer pasture-estimating technology, told Farmers Weekly farmers are also becoming more discerning about the tech available.

“A number have said they can get the likes of Aimer and a wearable

Facial recognition tech trialled in sheep

Neal Wallace TECHNOLOGY Sheep and beef

A TRIAL using facial recognition technology on sheep shows it could have a role in monitoring their performance, says Paul Crick.

The Wairarapa farmer says it could potentially be a costeffective way to improve per-head production.

Facial recognition technology on farm is still at a trial stage and involves a camera photographing the face of individual sheep prior to it being weighed.

This provides a quick record of their identity so that new and updated information such as weight

can be subsequently added and stored.

Crick also uses EID tags in his sheep but said if facial recognition were sufficiently accurate, it could be a cost-effective alternative.

Very early trials show its accuracy is currently above 50%.

He was recently involved in trial for a worm app that highlighted the benefits of identifying individual sheep.

The app was linked to weighing scales and had algorithms that recorded information such as egg counts and weight gain, which he used to make management decisions.

Crick said that information became the basis of a drench

NUMERATED:

Wearable hardware is generating more data for dairy farmers, but more remains to be done to better understand and integrate that data into farm decisionmaking.

at 20% of the cost of virtual fencing tech, and being happy to work with that.”

Heat detection for mating proved by far the main reason for employing the tech, with some interest in health monitoring and virtual paddock use.

Wearables also featured high on the list for farmers with rotary and herringbone sheds, as the most

preferred investment to make, funds allowing.

Work by DairyNZ senior scientist Paul Edwards took a deeper dive into outcomes from wearable tech on breeding decisions made by farmers. Analysing data from 141 herds with wearables and 1150 without, comparisons were made on three-week submission rates, and six-week calving rates between the two herd types.

Interestingly, the results indicated that while the tech is a valuable labour-saving device, it is not necessarily a magic bullet solution to lifting a herd’s repro performance.

Lower performing herds showed no repro performance gains after adopting wearables.

However, the tech did allow for longer artificial breeding periods and wearable herds had a lower non-return rate after the tech’s adoption, possibly because they had longer AM periods that were made easier with the tech’s presence.

But after accounting for mating

trial in his ewe lambs and to determine which of three mobs they were put into – control,

no drench and drenched.

Over a four- to five-month period, the mob that were not

A number have said they can get the likes of Aimer and a wearable at 20% of the cost of virtual fencing tech.

Jeremy Bryant Aimer

length, there was no statistically significant difference.

The report’s authors noted future use of wearables may extend beyond reproduction to include more indvidualised animal management including grazing, while future outcomes may improve as farmers better understand how to use data from wearable systems effectively.

They cautioned that, given the lack of significant positive or negative evidence on in-calf rates, it was advisable not to place value on improved repro performance when assessing return on the tech investment.

drenched continued to grow and saved him $2.70/head over the control mob.

He said technology enabling the quick and affordable monitoring of body condition scores in sheep could potentially have commercial benefit.

Research shows ewes with a body condition score of three prior to lambing but which subsequently reduced by 0.5 or one body condition score from lambing to pre-mating, are the most productive.

Crick said the size and scale of most sheep flocks mean individually identifying those that are the most productive can be daunting and require a change in mindset.

But tailoring the management to use these high-performing ewes can financially be very rewarding. Last spring his best performing sheep, identified by body score, lambed at 172% ewes mated.

FACE TIME: Wairarapa farmer Paul Crick was recently involved in trial for a worm app that highlighted the benefits of identifying individual sheep.

Bring farmers data tech they can actually use

Neal Wallace TECHNOLOGY Agriculture

HO is a farmer?

WThe answer, according to Danny Donaghy, Massey University’s professor of dairy production systems, is not as clear as it may appear – and answering it is relevant for technology developers.

Is a farmer the owner, manager, second in charge, herd or block manager, farm staff, vet, adviser or, in a corporate structure, the board or their consultant?

Donaghy said the other question developers need to answer is who needs what information and in what form.

He said there are plenty of tools being developed, but to be useful they need to talk to each other to avoid the need for multiple dashboards or phone apps.

Some welcome the volume of data supplied to these devices, but other feel overwhelmed.

A study on data use by Australian dairy farmers some 15 years

ago found many were turned off.

“All they wanted were cup removers or automatic teat sprayers, whatever would save them time.”

The message was that farmers want technology that saves time, effort and money, such as enabling the precision application of fertiliser.

While technology and the information provided have evolved, Donaghy said tech developers need to ensure it is relevant and useful to the bulk of farmers.

It keeps coming back to who needs what information, in what format and when?

Prof Danny Donaghy Massey University

“It keeps coming back to who needs what information, in what format and when?”

As for areas where technology would make a significant difference, Donaghy said these

would involve the measuring and allocating of pasture, crops and fruit, monitoring animal health and wellbeing and integrating sensors for the management of soil and water.

Such technology could be applicable to monitor yields for arable, winter feed and horticultural crops.

Manually monitoring soil and water condition is time consuming, so having sensors that talk to each other would simplify the process, give real-time results and in a format that could be provided to regulators.

AgFirst chief executive James Allen said farmers need to be clear on what problem they are trying to solve, what tool is needed to solve it and how that tool can be best used.

Allen said there is potential for farmers to be overwhelmed by the volume of data, but it will be key for adopting precision agricultural systems.

“If we want precision farming we will need to farm on a per-square metre and per-animal basis and that means using a lot of data.”

REWARDS: Danny Donaghy says a study on data use showed farmers want technology that saves time, effort and money.

He said specific soil fertility and pasture production information will have a significant role in farm management.

A farm growing an average of 12 tonnes of drymatter per hectare would have a range over the property of eight to 20 t/DM/ ha, so data will allow focused management.

Equally, it would be useful having real-time alerts that an animal has health issues before symptoms became obvious, or the ability to decide grazing patterns

by the current state of soil or vegetation.

There is potential for farmers to be overwhelmed and his challenge to developers is to ensure it provides relevant data insights.

Allen said there is a greater willingness among IT companies to share data and systems but it will not happen quickly or without a cost.

He said returns from using data may not be financial, but from greater animal or plant efficiency or saved time.

Tech easing the chore of on-farm data entry

Richard Rennie and Neal Wallace TECHNOLOGY

Data

FONTERRA is doubling down on its goal of halving the time its supplier shareholders spend wading through data entry chores, hoping to hit that target in a year’s time.

Hayley Morris, Fonterra’s business transformation digital lead, said based on a DairyNZ workplace productivity survey, farmers have been spending about five hours a week on compliance recording, generating a lot of negative sentiment.

To date, Fonterra has saved its suppliers 507,000 hours a year in input time, halfway towards the target of 1 million hours saved. Farmer data is needed to satisfy

growing requirements from customers and regulators for transparency and assurance of the product source and supply chain security.

Morris said two main target areas had been identified as key pain points.

“The on-farm audit is now at a point where we are the only dairy processor not requiring a full assessment if you have a strong track record of quality data, assessment performance and milk quality.”

The other area is the annual farm diary records that require key farm activities including animal treatments, fertiliser and feed inputs to be logged.

Waiuku farmer and long-time data user Tony Walters told Farmers Weekly he had found the diary system clunky when it

came to entering data like PKE deliveries, requiring a photo of the delivery docket to be taken, and in turn uploaded to the diary.

“And we only get an update of all activities at the end of the season, so you can’t use that useful information through the season.”

Morris said to make data more seamless and updated more regularly, Fonterra has built data partnerships with the likes of Ravensdown, CRV, LIC and Ballance, and also recently integrated with Trev and FarmIQ systems.

Ultimately, she said, farmers won’t have to update their data manually, instead most data collection will simply be automated in the background as events occur.

“We are at a stage where industry is now more united when it comes to data sharing.”

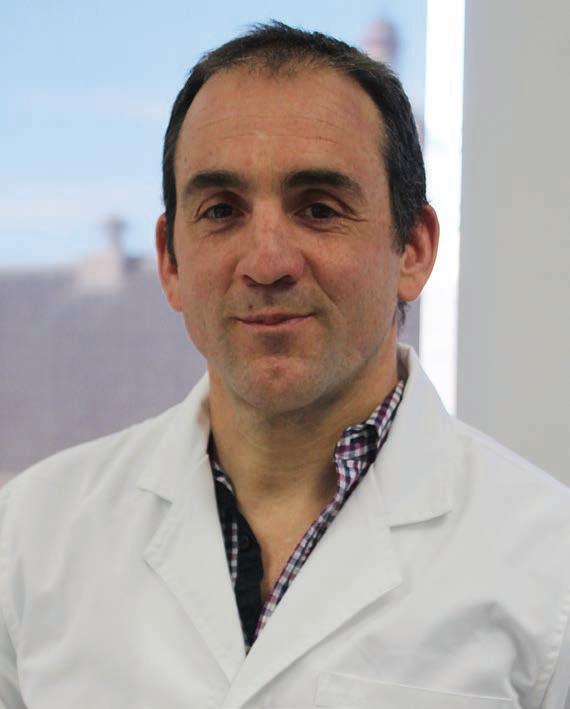

PARENTAGE: Animal parentage can be proven from a simple skin test, said Totogen co-founder Tim Hore.

TESTS: Skin tests awaiting analysis to determine parentage lines at Totogen’s Dunedin lab.

Ten years ago the notion of farmers taking their phone with them was foreign, but today it is an essential tool, said Dan Brier, Beef + Lamb NZ’s manager of farming excellence.

With artificial intelligence (AI) enabling access to historic data and information, Brier said technology is like having a farm consultant in your pocket.

The volume of data could potentially overwhelm, so to be useful it must relate to a farm’s environment, animals and operations, identify patterns, risks or opportunities and drive action or improve operational efficiency.

It must also support the wellbeing of workers, animals and the environment.

Because sheep and beef farmers

do not have daily interaction with their stock, sensors in paddocks measuring pasture growth and soil health, parasites or walkover scales that weigh animals in paddock, are useful for identifying trends, he said.

Facial recognition technology could replace ear tags and allow individual animals to be identified.

Companies such as Dunedin start-up Totogen provides farmers with parentage tests to assist with selection and breeding programmes.

Totogen co-founder Tim Hore said testing of a piece of skin punched from the ear of animal determines it parentage, reducing the need for hands-on recording at lambing.

Meat companies are providing meat eating and carcase quality

information to assist with breeding, feeding and stock management decisions.

Alliance Group uses probes on the chain to gather meat eating quality information and then uses AI to analyse intramuscular fat in lamb and marbling in beef.

Silver Fern Farms (SFF) also collects carcase eating information, which is then integrated into farm management software to help interpret it.

On-farm data and performance helps with forecasting livestock flows.

SFF also uses imagery from satellite company Prism to verify native vegetation and production systems to support its Nature Positive and Net Carbon Zero meat branded programmes.

thank yous!

You’ve strengthened our belief.

The most satisfying thing about breaking through the 1000 barrier of voluntary subscribers is seeing the calibre of the people who are on that list. They’re many of our best farmers and farming leaders. Thank you for your belief.

1029 of you have started your voluntary subscription. Thank you! We’re well on our way to the target of 8000. Knowing that you appreciate the work we do, and that you are prepared to back us, reinforces our belief that we will get there.

Other media companies have downsized their newsrooms. We’re determined not to, but we need at least 7000 more voluntary subscriptions to remain strong, take on junior reporters and grow.

Farmers Weekly is read by more than 150,000 people online and lands in 74,000 rural letterboxes every week. We believe most of you know it’s worth $2.50 a week, or $120 a year, fully taxdeductible.

You can email or call us, and we’ll send you an invoice. Please subscribe today to help us keep delivering news and insights online, and to every letterbox, every week, ‘free’.

No paywalls. No locked content. No newsroom cuts. Just a promise to keep believing and continue delivering your Farmers Weekly for another 22 years and beyond.

Kind regards,

Dean Williamson – Publisher dean.williamson@agrihq.co.nz 027 323 9407

BECOME A VOLUNTARY SUBSCRIBER

Start your voluntary annual subscription today. $120 for 12 months. This is a voluntary subscription for you, a rural letterbox-holder already receiving Farmers Weekly every week, free, and for those who read us online.

Choose from the following three options:

Scan the QR code or go to www.farmersweekly.co.nz/donate

Email your name, postal address and phone number to: voluntarysub@farmersweekly.co.nz and we’ll send you an invoice

Call us on 0800 85 25 80

Note: A GST receipt will be provided for all voluntary subscriptions.

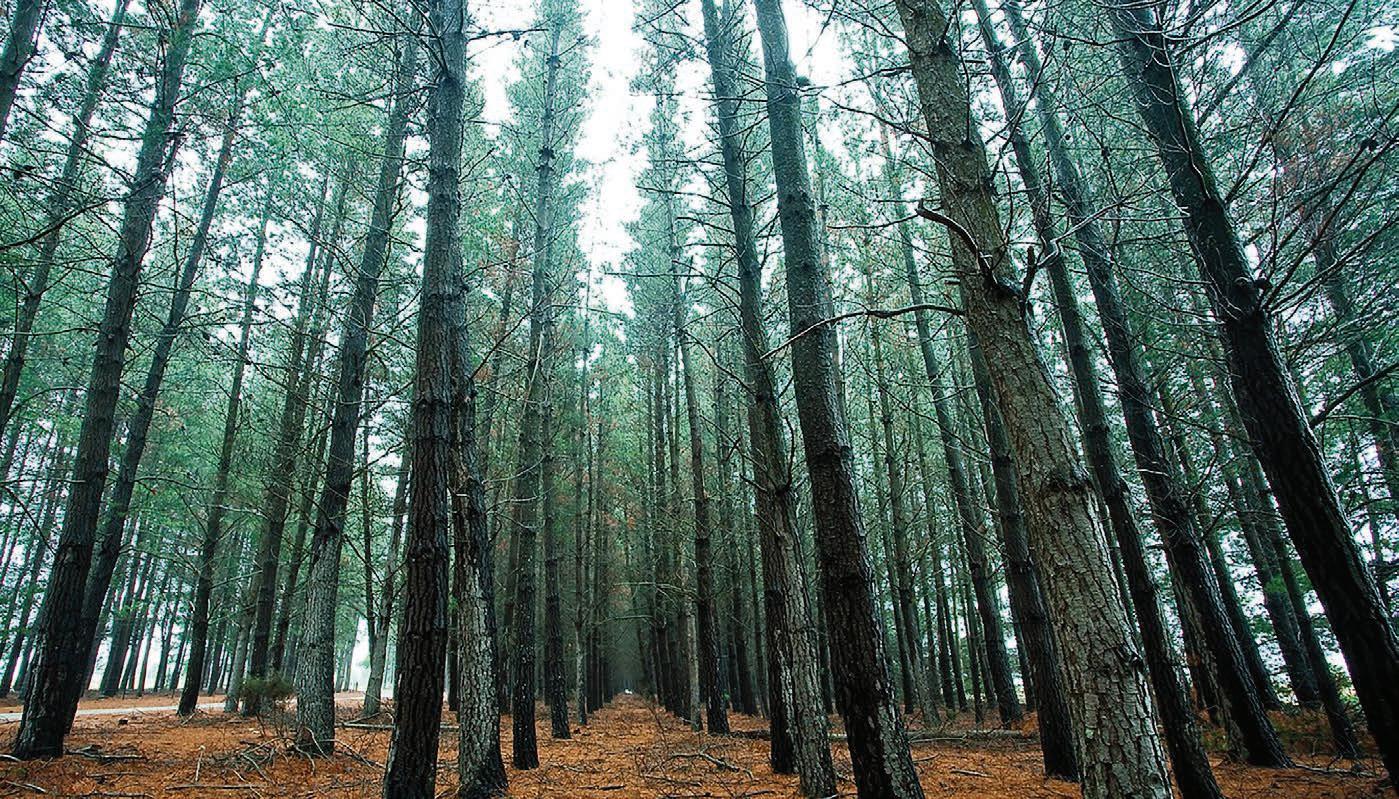

Cause and effect at MataRata Downs

Whether it is growing pasture, pine trees, native plantings or poplars, every inch of Jarred and Sarah Coogan’s 470ha farm is effective. The winners of this year’s Silver Fern Farms Plate to Pasture award tell Bryan Gibson how they’ve redefined value on farm.

WHEN describing MataRata Downs, Jarred Coogan used to say what most farmers do.

“It’s 470ha,” he’d say. “425 effective.”

But an exchange with one of the Silver Fern Farms Plate to Pasture judges changed all that, and he now views the farm he and wife Sarah have run for the past 10 years through a different lens.

“He said ‘No, that’s not right, your whole farm is effective. It’s doing something on your farm, whether sequestering carbon or providing biodiversity – just because it’s not grazing an animal doesn’t mean that it’s not effective.’ And I’d never really thought about it like that before.”