Fears Alliance plan will mark end of an era

THE era of farmerowned co-operatives dominating ownership of the New Zealand meat industry could be set to end.

On Tuesday morning the Alliance board will reveal its favoured option for a $200 million injection of new capital into the business, with speculation that Irish family-owned Dawn Meats is the front runner to buy into the business.

Reports from the Irish Times are that Dawn Meats, a $5.9 billion family-owned company from Ireland, is prepared to pay $270m for a 70% stake in Alliance.

Massey University senior lecturer James Lockhart said if this comes to pass, the $270m offer would give Alliance a market value of $385m.

Shareholder Andrew Morrison said shareholders were surprised that the rumoured offer valued Alliance at a lot less than they thought.

He said farmers are telling him that “this is like selling your farm on a bad day”.

Tuesday’s release of options by the board will shift discussion from emotion to numbers and facts, he said.

Associate Agriculture Minister and Alliance shareholder Mark Patterson has been following the issue through the media and said he is saddened at the likelihood

that Alliance will no longer be a 100%-farmer owned co-operative.

“I’ve a bit of trepidation really. I’ll be gutted if the co-op is split up,” he said.

Alliance’s 4500 shareholders will vote on the options later this year. If they elect to sell part of the company, it will be New Zealand’s third large, 100% farmer-owned co-operative meat company to lose that status in the past 30 years.

AFFCO, formerly the Auckland Farmers Freezing Company, was a co-op before being publicly floated in 1995 and subsequently bought by Talleys Group in 2010.

In 2016 Silver Fern Farms (SFF) became a hybrid when it sold 50% of the business to Shanghai Maling after shareholders earlier failed to provide sufficient new capital.

Morrison said the release of facts on Tuesday will change the debate.

“It will be the catalyst for a thought process and sense of whether it is the best time to sell a meat company or the best time to buy a meat company.”

If farmers decide not to sell Alliance due to the low price, they will need to write out a cheque themselves.

If they decide to sell a stake in the co-operative, Morrison said, they need to understand the consequences.

Lockhart fears shareholders do not understand what they are losing if they adopt hybrid ownership.

Learning from doing on farm

Farming was the only life Bayden Andersen ever dreamed of. The Hawke’s Bay farm manager, pictured with children Molly, Colby and Phoebe, says running Walmsley Canning Estate is a family affair and he is grateful to have his wife Shaye and children involved in the operation.

Alistair Thom

The ups and downs of Chathams farming

Chatham Island farmer Gary Cameron says his remote farm is in ‘the best place in the world to grow anything but the worst place to sell anything’.

Pāmu sale could unlock money for research, writes Alan Emerson.

Photo:

Neal Wallace NEWS Production

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400 Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY 0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME Delivered by Reach Media Ltd

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269

South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925

National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

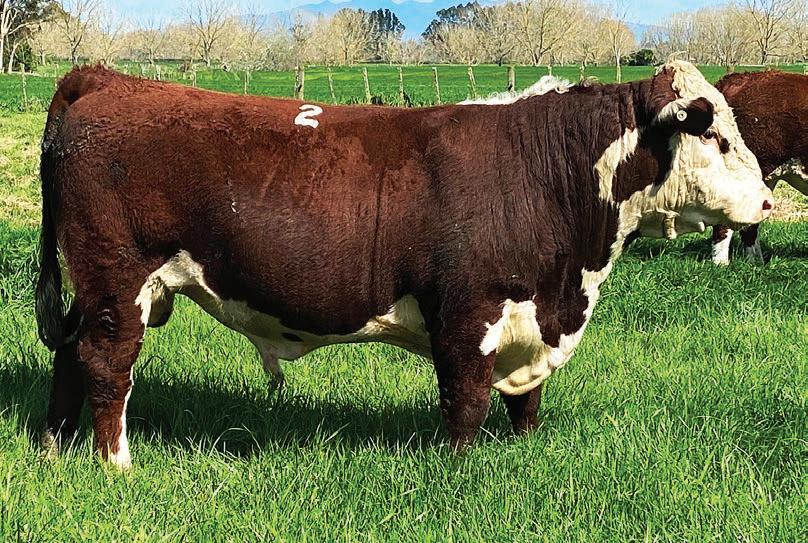

Spring 2025 Bull Sales

News in brief Cheese expansion

Rising demand for cheese in global markets has led Fonterra to upgrade cheese manufacturing at its Eltham plant. The site is upgrading its production lines for processed cheese and adding a new shift for its individually quick frozen mozzarella product. Fonterra Eltham specialises in producing cheese products for the co-op’s foodservice business.

Farmer fined

22

23

24-27

28

A Southland dairy farmer who has already paid more than $300,000 in wage arrears and fines has been penalised further for obstructing an Employment Relations Authority investigation.

Reza Abdul-Jabbar was ordered to pay $5000 and the company, Rural Practice Ltd $10,000 for what the authority terms “serious and sustained” obstruction during the earlier investigation into alleged breaches of minimum employment standards.

Pork contribution

North Canterbury pig farmer Steve Sterne has won NZPork’s Outstanding Contribution Award, recognising his 27 years of dedication to excellence in the sector.

Sterne and daughter Holly run Patoa Farms at Hawarden, New Zealand’s largest pig farming operation. The system, which sees the farm produce about 95,000 pigs a year, allows for the used straw bedding and manure to be recycled and used on other farms throughout the Canterbury region.

Ravensdown’s loss

Impairments and one-off adjustments turned a $13 million operating profit into a $2m net loss for Ravensdown Fertiliser Coop last year.

Financial gains from those higher sales were tempered by squeezed margins from geopolitical issues. Fluctuating product prices, due to the three-month time lag between procuring product and delivery to farms, also tempered financial gains.

Ballance mulls time-out at Kapuni plant

Gerald Piddock NEWS Fertiliser

BALLANCE Agri-

Nutrients is considering temporarily closing its Kapuni plant for as long as four months as it faces unaffordably high gas prices.

Ballance CEO Kelvin Wickham said the business is planning for a range of eventualities and working to keep options open should it not secure gas before its current fiveyear contract ends on September 30.

“While New Zealand’s gas market is dynamic, the increasing pace of declining gas supply and the impact of this on price will continue to pose challenges for the energy sector and for New Zealand.

“Although we remain optimistic about securing short-term supply, we’re also pragmatic and planning for other outcomes. Right now, it’s prudent to plan for a short-term shutdown.”

Ballance uses natural gas in urea production. The Kapuni urea plant in Taranaki, which has been in operation since 1982, employs around 120 people. It manufactures one-third of New Zealand’s urea for fertiliser – some 260,000 tonnes a year.

Gas is a significant cost in urea production and Ballance has to be able to make urea to match the international pricing as well

Continued from page 1

“I suspect any number of Alliance’s reasonably broad shareholder base have moved on or do not necessarily understand the merits of a dominant co-operative.”

Ideally the board will present shareholders with more than one option so a comparison

as pay a carbon tax, Wickham said.

“It’s getting harder and harder to meet that international price using the high cost of New Zealand electricity energy.

“It’s a challenge for us and we need reliable, consistent gas at an affordable price to enable us to continue to produce urea in New Zealand,” he said.

As gas supplies in New Zealand dwindle, companies are prepared to pay a lot more for it, and Ballance is unable to compete.

“There is some supply available, but we have been outbid so far by people who can pay a lot higher for gas.”

While Wickham is unable to reveal numbers around what it is costing the co-operative as it is currently negotiating contracts, he pointed to a recent Energy News article that used Ministry of Business, Innovation and Employment data showing prices jumped across all sectors in the year to March.

Those prices were 20.5% higher in the March quarter than they were a year earlier, hitting a record $33.59 per gigajoule in the commercial sector.

While he is reasonably confident at finding a short-term contract solution, Wickham is uncertain about long-term gas prices in New Zealand.

“We are hopeful we can run the plant beyond October 1, say for three to four months, then if we

can be made, but he notes SFF shareholders were given only a single option, that of selling half the company to Shanghai Maling.

Patterson said Alliance has been caught out by wider sector issues such as excess processing capacity and an industry mentality of the last man standing.

Prior to his political career Patterson was active in the Meat

have to do a shut down, we will do so for three or four months. Then the question is, what does the world look like then – and that’s the unknown.”

We have additional urea on the water now in case we cannot operate.

Kelvin Wickham Ballance Agri-Nutrients

The plant’s staff were briefed on the situation on August 7. Ballance will keep the plant’s 120 staff on the payroll if the closure takes place, he said.

“If we don’t get something in place in the next month or so, we will have to start planning to shut down, as these things take a bit of time.”

Gas alternatives such as electrolysis using water are still seven to 10 years away from being viable and would require a power supply of a city of the size of Hamilton to make it work, as well as an estimated $1 billion in additional infrastructure.

Wickham said the possible closure will not affect urea pricing or supply, with spring and summer fast approaching.

“Supply is covered as we have been running scenarios and contingencies, and we have additional urea on the water now in case we cannot operate.

“We are very confident we have

Industry Excellence group that sought changes to the meat industry.

He said he hopes the lack of grassroots resistance evident in this debate could still eventuate.

“Maybe when the stark reality is in front of shareholders of whether to let the co-op go or not, it could be a catalyst for a wider conversation and shareholder vote.”

He said farming is a multigenerational business and needs long-term consideration.

I’ve a bit of trepidation really. I’ll be gutted if the co-op is split up.

Mark Patterson Associate Agriculture Minister

“Is this a smart strategic [move], to let the last co-operative go?”

Patterson and Morrison both praised the efforts of Alliance chair Mark Wynne and his board, saying they were dealt a difficult hand.

Pāmu chief executive Mark Leslie said like other shareholders, Pāmu will assess the merits of any offer once it is presented.

Dawn Meats unsuccessfully bid for SFF in 2016. Established in 1980 by three farming families in County Waterford, it operates 11 sites in Ireland and 13 in the United Kingdom and each year processes 3.5 million sheep and 1 million cattle supplied by 40,000 farmers.

CONTINGENCY: Ballance Agri-Nutrients chief

supply for our farmers to cover a potential shutdown.”

Wickham said he does not want to speculate if this was a result of the previous government’s ban on oil and gas exploration, preferring to focus on the situation at hand.

The current government is

informed of the situation, and he said they were open at looking at ways on how they can assist Ballance.

More information about the future of the Kapuni plant should be revealed when Ballance releases its annual financial result later this month, he said.

Upton slams RMA farm, freshwater proposals

Gerald Piddock NEWS Environment

PARLIAMENTARY Commissioner for the Environment Simon Upton has taken aim at the government’s proposed changes to the Resource Management Act, saying they are without a coherent strategy and unlikely to provide the stability of an enduring freshwater management system.

In his 23-page submission on changes for the RMA’s Package 2 and Package 3, which cover the primary sector and freshwater, Upton said the constant changes to National Policy Statements (NPS) on freshwater are leading to confusion and disengagement from landowners.

“From conversations in the paddock with many groups of farmers who are trying to make a difference, I can confirm that the latest round of changes is having a chilling effect that is leading people to lose interest. Over a decade’s engagement and commitment risks being lost.”

The proposed changes to the NPS on highly productive land to encompass only Class 1 and 2 rather than 1,2 and 3 are based on a classification system that is out of date and unfit for the regulatory instruments it underpins, he said.

He also slated as “extremely poor” the evidence for changing stock exclusion rules around wetlands so that they do not apply to non-intensively grazed beef cattle and deer. There is limited information on wetlands and not enough evidence to base a regulatory change, he said.

The proposal also undermines

CONFUSION: Parliamentary Commissioner for the Environment Simon Upton says constant changes to national policy statements on freshwater are leading to confusion and disengagement from landowners.

the claims New Zealand likes to make about the environment in which it produces its food, he said.

“I doubt many farmers in possession of wetlands would like their products advertised as being ‘produced at the expense of threatened indigenous biodiversity’.”

Upton called out the proposals for freshwater as not representing a well-considered approach,

“They are unlikely to provide the stability of an ‘enduring freshwater management system’.”

Overall, the proposal to “rebalance freshwater management” is weakening environmental considerations when managing freshwater across the country, so will likely have significant environmental impacts, he said.

ENGAGE: Alliance shareholder and Associate Agriculture Minister Mark Patterson says that ‘maybe when the stark reality is in front of shareholders of whether to let the co-op go or not, it could be a catalyst for a wider conversation and shareholder vote’.

executive Kelvin Wickham says the possible closure would not impact the urea price or supply with spring approaching.

Bugs for grubs could replace lost toxins

Richard Rennie TECHNOLOGY Pests

THE looming gap in grass grub control prompted by the removal of two key chemicals on the market could be filled with a solution developed by AgResearch scientists, should it gain regulatory approval.

The Environmental Protection Authority recently announced the organo-phosphate chlorpyrifos will be banned over the next 18 months. Its alternative treatment diazinon is also scheduled for phase-out by 2028.

Studies by AgResearch indicate grass grub’s impact on the pastoral sector now ranges from $300 million to $815m a year in lost pasture production.

Headed up by AgResearch scientist Mark Hurst, scientists have developed a biological control based on a strain of the Serratia proteamaculans bacteria proven to infect the larvae of both grass grub and mānuka beetle.

“In 2014 Serratia proved to be consistently better than other biological controls we were assessing at the time.”

Hurst said its effectiveness even out-rated the proven synthetic chemicals it could replace.

“It also deals to the mānuka

beetle, which is a big problem on the West Coast, north Otago and Taranaki.

Hurst said his team, in conjunction with Grasslanz and Midlands Holdings staff, filed their research and trial data dossier on Serratia to the Agricultural Compounds and Veterinary Medicines (ACVM) unit last August, seeking commercial release approval.

This included data from over 20 field trials across NZ. Hurst is uncertain how long the approvals process will be.

We hope it comes out of the pipeline at some stage, but don’t know when yet.

Tim Chapman Grasslanz

Gaining approval for new actives through ACVM has proven to be a fraught pathway. It is now subject to intense scrutiny, including a Ministry for Regulation review making 16 recommendations to streamline product release in New Zealand.

Agrichemical giant Bayer has wound up its research site and team in NZ, while Syngenta remains committed to NZ but is avoiding releasing new chemicals

here due to significant delays in getting approval experienced in recent years.

New Zealand Food Safety deputy director-general Vincent Arbuckle confirmed New Zealand Food Safety (NZFS) has received an application for the registration of the trade name product AGR96X under the ACVM Act.

“It contains the bacterium Serratia proteamaculans as the active ingredient for the treatment of grass grubs.

“NZFS expects to complete assessment of the application before the end of the Chlorpyriphos phase-out period for use on grass grubs on January 10 2027.”

Grasslanz business development manager Tim Chapman said he believed the applicants did a good job submitting to ACVM.

“We hope it comes out of the pipeline at some stage, but don’t know when yet.”

Grasslanz proved to be a successful commercial vehicle for the AR37 endophyte released in 2007.

“We believe it [Serratia] would fit comfortably.

“Grass grub is definitively a NZ issue, and it adds a nuance to this product that Mark and his team discovered it as a very specific, targeted treatment for this problem pest.”

He suspects the biggest challenge should it gain

Muffled cheers: wool acoustic panels to ship across Tasman

Neal Wallace MARKETS Food and fibre

ANOTHER step has been taken to improve strong wool returns with a Wellington company about to export its first container load of acoustic panels made from New Zealand wool to Australia.

This is T&R Interior Systems’ first foray into the Australian market for its sound-proofing acoustic panels. Ultimately, it wants to secure a portion of the $27 billion global acoustic panel market.

Tom O’Sullivan, a wool advocate, former farmer and now business development manager for T & R’s FLOC wool acoustic brand, said its acoustic products have just received an Environmental Product Declaration (EPD) endorsement.

It is the first solely wool-based building product in NZ to achieve that recognition.

The independently verified EPD shows it meets ISO standards, provides third-party assessment of their environmental footprint and confirms its full life cycle impact from manufacturing to end of life.

O’Sullivan said architects and designers were enthusiastic about natural acoustic products but were waiting for the EPD endorsement. It took two years and significant cost to achieve.

T&R’s FLOC sound-absorbing products include wool-based

wall coverings that can be hung like wallpaper and 3D geometric shapes and panels that are attached to walls or ceilings.

“There are a lot of hard surfaces in buildings – glass, wood and metal, which make these buildings very noisy,” said O’Sullivan.

While wool prices are improving and he is optimistic new products will underpin a recovery in wool prices, it is too early to see a significant shift just yet.

“I’m more optimistic than ever,” he said.

“We’re not turning the dial just yet because we have only been selling in NZ, but I am optimistic.

EATEN: The Serratia bacteria discovered by AgResearch targets grass grub and mānuka beetle, attacking the larvae. It has proven at least as effective as synthetic pesticide alternatives.

commercial approval would be scaling up bulk manufacture of it.

Liz Shackleton, CEO of Animal & Plant Health NZ, said the grass grub chemicals phase-out reinforces the urgency to get new solutions to growers and farmers.

“Several R&D companies have signalled that New Zealand is not under active consideration for many of their pipeline products, including for grass grub,” she said.

“The companies that make these products say regulatory delays are disincentivising and stopping further investment in New Zealand,” she said.

This week’s poll question:

Do you have confidence in NZ’s ability to combat pests and diseases such as grass grub?

Have your say at farmersweekly.co.nz/poll

Aus scientists develop new FMD vaccine

Neal Wallace TECHNOLOGY Disease

AUSTRALIAN researchers have developed a vaccine to protect livestock during an outbreak of foot and mouth disease.

The $20 million, fiveyear research project was a partnership between Meat & Livestock Australia (MLA), Tiba Biotech and the NSW government, which has created a biodegradable vaccine.

Michael Lawrence, programme manager for animal wellbeing at MLA, said a pre-emptive mass vaccination is not planned but the vaccine will primarily be used in the event of a foot and mouth disease (FMD) outbreak.

The acoustic market, which is worth $27 billion a year and growing, will use a hell of a lot of strong wool.”

O’Sullivan was a farmer but left to work for Campaign for Wool to try to improve wool returns. About 18 months ago he joined T&R Interiors, seeing new products such as acoustic panels as an alternative use for strong wool to the traditional floor covering market.

O’Sullivan said those new uses need to be in bespoke high-end applications that add value if they are to drive up returns to farmers.

“While Australia remains FMD-free, the vaccine could potentially be used as part of a proactive biosecurity strategy,” he said.

New Zealand’s Ministry for Primary Industries website notes there are seven strains of FMD, each with their own sub-types.

There are already FMD vaccines and Lawrence said this new product is for the Type O strain, but the platform on which it’s been developed allows ready adaptation to confront new strains of that type.

It uses mRNA technology to induce an immune response, rather than an actual virus, a process he said has proven safe for animals and consumers, helps with managing an outbreak and allows for a quicker recovery of trade.

A statement from MLA said preliminary trials in Germany found the vaccine demonstrated “strong, effective immune response and safety”.

Vaccinated cattle did not contract FMD when exposed to the disease and, importantly, did not shed the virus.

Following these trials, the vaccine will now undergo an evaluation process with the Australian Pesticides and Veterinary Medicines Authority before approval for use on livestock.

MLA managing director Michael Crowley said the research represents a proactive approach to managing biosecurity risk.

“FMD is present in countries near to Australia and is front of mind for industry in terms of potential biosecurity risks,” he said.

Dr Fleur Francois, Biosecurity New Zealand’s director of diagnostics, readiness and surveillance, said the organisation is watching the vaccine development with interest.

WOOL ADVOCATES: Tom O’Sullivan, the business development manager for T & R’s FLOC wool acoustic brand, and King Charles, the patron of the Campaign for Wool.

Mānuka in meltdown as more honey firms fail

Richard Rennie NEWS Apiculture

AMELTDOWN in Mānuka honey processing is continuing through winter with the recent liquidation and receivership of two major operators adding to a roll call of casualties in the sector’s premium honey product market.

In late July King Honey Limited and King Honey Holdings were placed into liquidation and receivership.

The closures came as King’s NZX-listed parent company

Me Today – which acquired the company for $36 million in 2021 –failed to make a profit for the fifth consecutive year since listing.

The liquidation puts the company’s 70-plus staff out of work and its 18,000 hive operation across the North Island and upper South Island wound down. About 440 tonnes of multi-year-old honey remains to be disposed of to pay creditors owed about $13m.

The company had leveraged off some high-profile personalities to promote its product, including

All Black Beauden Barrett as a brand ambassador. Former prime minister Sir John Key featured in online promotions for the brand in full beekeeping regalia.

King’s failure follows the receivership, also announced in July, of Settlers Honey in Whanganui, a major employer and operator in the region.

The loss of Settlers was not as expected. As a company they did a lot for the community up the Waitotara Valley.

Jason Prior Manawatū

Receivers were appointed on July 14 by BNZ and included Settlers Honey owner Henry Raymond Matthews.

The honey business was part of the family’s wider agri business operations on the 40,000 hectare Makowhai station.

The loss of these two operators comes after the failure of Tauranga-based TRG Natural Pharmaceuticals late last year and

Mānuka Bioscience in late January. Meantime for the second year in a row the industry’s largest player, Comvita, has advised of expected net losses before tax of between $20m and $24m ahead of results due for publication late this month.

Manawatū honey producer Jason Prior said there had been expectations in the industry that time was limited for the King Honey operation.

“But the loss of Settlers was not as expected. As a company they did a lot for the community up the Waitotara Valley. That even included getting the local rugby club started again and employing a lot of people in a district where farming has been struggling for years.”

The failure of the two companies has come against a background of continuing depressed prices for Mānuka honey, with significant quantities of product being quit well below the $13 per kilogram break-even point.

Iwi investment in the sector has also diminished recently as Ngāi Tahu closed down its Oha Honey operation in the North Island. It

SLUMP: After the boom period of 2017-2019 the entire honey industry has witnessed a slump in hive numbers from the unsustainably high 1million to nearer 500,000.

relocated assets to Kaikoura but has now pulled out there also.

After the boom period of 20172019, the entire industry has witnessed a slump in hive numbers from the unsustainably high 1 million to nearer 500,000.

But despite the tighter supply, prices continue to struggle for both multifloral and Mānuka.

Despite growing multifloral volume exports by 14% in the first half of this year, value dropped 10% compared to the same period in 2024.

GDT index rises despite butter price slide

THE first August Global Dairy Trade event produced modest gains for the market index and milk powder prices but the continuation of a slide downwards for butter.

As the high retail prices of butter in New Zealand have become something of an embarrassment for Fonterra, the inevitable market correction is now confirmed underway.

The GDT butter index has fallen 10% over the past three months since early May, from its all-time high just under US$8000/tonne.

Middle Eastern competition for NZ butter has dried up in the past two GDT events, NZX dairy analyst Lewis Hoggard said.

China took two-thirds of the butter offered in the latest GDT auction and exports to Saudi Arabia are up 35% year-to-date compared with plus 10% for China, he said.

After a three-week hiatus, the GDT price index rose 0.7%, boost-

ed by whole milk powder up 2.1% and skim milk powder up 0.4%.

At US$4012/tonne WMP prices are the highest they have been in August since 2013 and the third highest at the beginning of spring since GDT began in 2008.

Dairy farmers will begin spring calving and milking confident in the forecast farm gate milk price of $10/kg milksolids, awaiting Fonterra’s next announcement when the FY25 results are published on September 25.

Fonterra’s managing director for co-operative affairs, Matt Bolger,

said it is early days but a great start to the season.

“We are seeing strong demand across China, southeast Asia and Middle East and it is good that momentum from last season is continuing.

“We still expect plenty of volatility with strong supply in New Zealand and impact of tariffs yet to play through,” Bolger said.

Hoggard said Chinese inventories of WMP were up 19% month-on-month in the most recent update for June, however down 63% year-on-year which

Total Mānuka exports for the same period lifted 22%, but the average price of $21 a tonne was down 7% on 2024.

Apiculture NZ CEO Karin Kos said the sector is still working its way through the hard times that followed covid and high supply volumes.

“But by all accounts, the market is starting to move, although prices are not as high as the past.

“Beekeepers I talk to say there is definitely good demand there for quality fresh honey.”

Dairy farmers will begin spring calving and milking confident in the forecast farmgate milk price of $10/kg milksolids.

continues to be a bullish sign.

The price index of anhydrous milk fat rose 1.2% and its historical parity with butter is being re-established.

The prices of cheddar and mozzarella fell slightly.

Hugh Stringleman MARKETS Dairy

Please vote in the Summer fruit Commodit y Levy referendum before 25 August

Summerfruit growers have until Monday 25 August to vote in the 2025 Summerfruit Commodity Levy referendum

The referendum is a measure of support for Summerfruit NZ and the activities it carries out on behalf of growers

The referendum proposes that the Summerfruit Commodity Levy continues unchanged in order to fund:

• product development

• research, including market research

• market development

• protection or improvement of plant health

• biosecurity activities

• development and implementation of quality assurance programmes

• education, information, or training

• grower representation

• the day-to -day administration of Summerfruit NZ

If you have not received voting papers, either by mail or email, please immediately phone: Andrew Bristol, Summerfruit NZ Communications Manager: 021 021 62 021

If you would like to discuss the referendum, please phone:

Trudi Webb, Summerfruit NZ Chair: 027 296 6092

Dean Smith, Summerfruit NZ Chief Executive: 027 461 6020

To find out more about the referendum, you can go to the Summerfruit NZ website: www.summerfruitnz.co.nz/ commodity-levy-renewal/

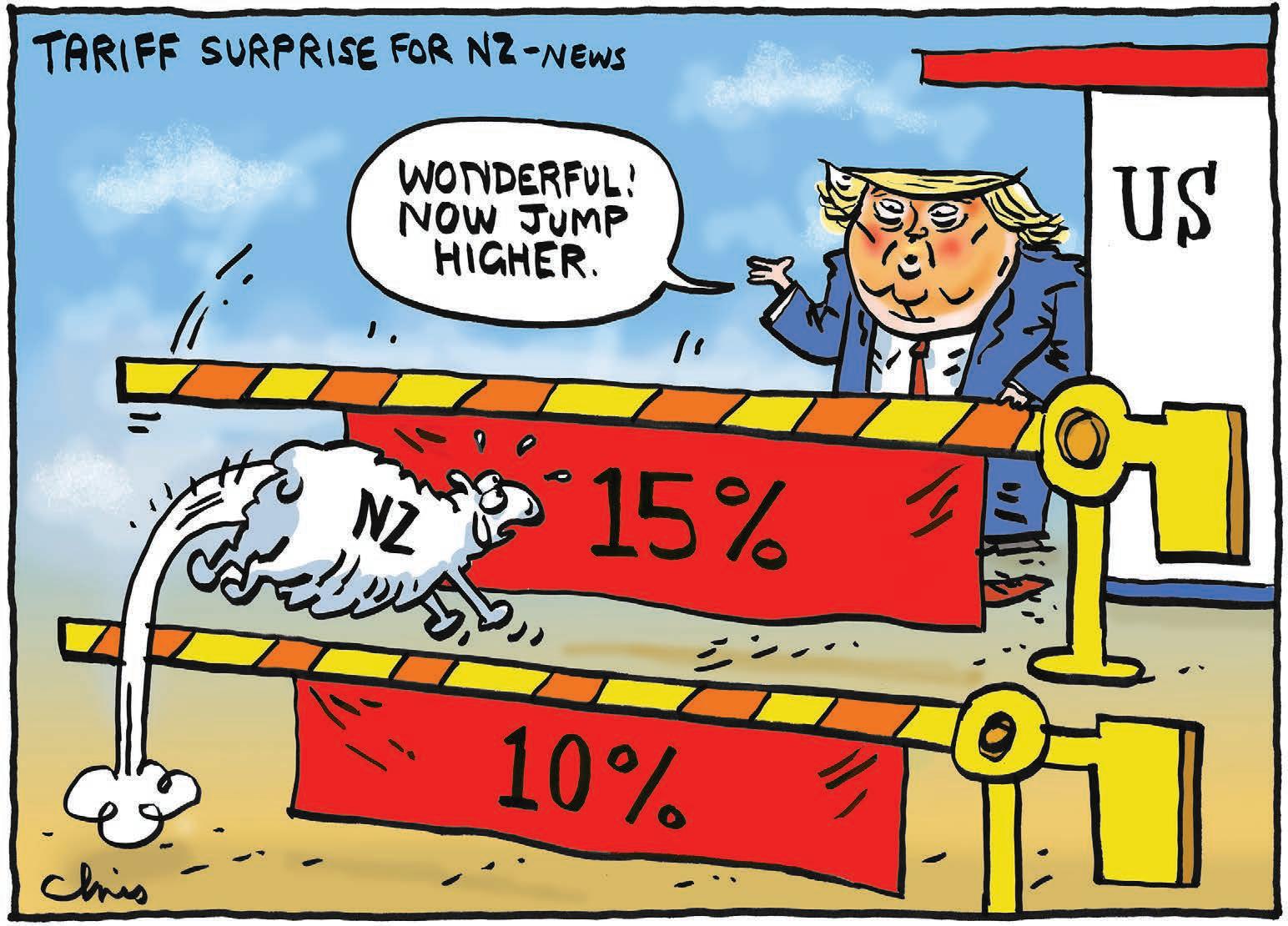

Exporters work to quantify US tariff pain

Neal Wallace NEWS Trade

THE imposition of a 15% tariff on New Zealand exports to the United States could cost the red meat sector an estimated $300 million and wine exporters $112m. Dairy is still to quantify the cost. Of added concern for the competitiveness of meat and wine, US President Donald Trump has limited to 10% the tariff on key New Zealand competitors Australia and Argentina.

The European Union’s trade agreement with the US imposes a 15% tariff ceiling on most European exports to the US.

It also promises to address nontariff barriers on trade in food and agricultural products, including streamlining requirements for sanitary certificates for US pork and dairy products.

The base tariff rate for NZ started out at 10% but Trump increased it to 15%.

The executive director of the Dairy Companies Association of NZ, Kimberley Crewther, said it is too early to quantify the cost of the tariff to dairy, but she said lower rates for some other countries will disadvantage NZ.

The new rates will be added to existing tariffs, which vary between products.

Last year NZ’s exports to the US totalled $2.2 billion of meat, $1.2bn of dairy and $790m of wine.

Beef + Lamb NZ chair Kate Acland said last year the US took 46% of NZ’s beef and 18% of our lamb. She said the concern is that key competitors, Australia and Argentina, both have 10% tariffs, five percentage points lower than NZ’s.

She expects companies to start

looking for alternative high value markets even though prices in the US have been historically high.

A global shortage of protein and the free trade agreement with the United Kingdom may help offset some of NZ’s disadvantage.

NZ can export about 18,000 tonnes of tariff-free beef to the UK a year and Acland expects that quota to be fully used.

NZ companies can also export about 4400t of beef to the EU.

Acland speculated that Australia might have received a better tariff deal than NZ due to the lifting last month of import restrictions on US beef, which were imposed in 2003 due to fears of bovine spongiform encephalopathy.

Crewther said the new tariffs are in addition to existing rates and mean NZ infant formula faces a 32% tariff and butter about 35%.

For proteins, which have low existing tariffs, it will be about 15%.

The change means key NZ dairy products will be at a price disadvantage compared to competitors.

NZ protein will be more expensive than product from Canada and the country will be at a similar

LABELS: Sarah Wilson, NZ Wine’s manager of advocacy and general counsel, says the US is a very significant market and the 15% tariff is a significant cost

disadvantage for butter and infant formula compared to product from the European Union.

It is up to individual companies whether they can absorb the new rates but she said global demand continues to outstrip supply.

Simon Tucker, Fonterra’s group director for global external affairs, said the co-operative is working through the implications for its business.

“However, global demand for dairy remains strong and Fonterra’s size, scale, and broad product portfolio and market mix means we are well positioned to navigate changes in market dynamics.”

Sarah Wilson, NZ Wine’s manager of advocacy and general counsel, said in March before Trump announced any new tariffs, the cost of the existing rates per bottle of NZ wine was less than 10c.

It is now about $1.10/bottle which, based on last year’s sales, will cost the sector $112m.

“The US is a very significant market and this is a significant cost.”

Wilson said exporters will need to decide whether to pass that cost on, absorb some or all of it or look to divert product elsewhere.

McClay off to argue for lower tariff

Nigel Stirling MARKETS Trade

some of those we compete against in that market [like] the UK and Australia,” McClay told Farmers Weekly.

TRADE Minister Todd McClay says he has “no expectations” about his chances of overturning the hike in tariffs on New Zealand exports to the United States when he travels to Washington DC this month.

US President Donald Trump updated tariff rates for goods entering the US from 69 countries by executive order on August 1, hiking NZ’s rate from 10% to 15%, effective from August 7.

NZ was notified of the increase before the official announcement from the White House and McClay spoke to Trump’s Trade Representative, Jamieson Greer, on Saturday morning.

“I was able to express to him our disappointment and what it does to trade and the relationship [and] the harm that could be done to NZ exports, particularly compared to

It is being reported that Trump sorted countries into three categories: nations who bought more from the US than they sold to it, who will pay a 10% tariff, including Australia; those who had reached agreements with the Trump administration and who the US had modest trade deficits with, who will face tariffs of 15%; and those with no agreements and who the US had large trade deficits with, who will face higher tariffs.

NZ’s top trade official, Vangelis Vitalis, has already left for Washington ahead of an expected meeting between McClay and Greer in the next one to two weeks.

McClay said he had told Greer on the call that the $500 million trade surplus in NZ’s favour last year was not a fair reflection of the trade history of the two countries.

“I was making the case to him that there are often times where the US has had a large trade surplus against NZ when we buy aircraft, and Air NZ has said that will happen again soon.”

I was able to express to him [Greer] our disappointment.

Todd McClay Trade Minister

McClay said officials had had “another look” at the average tariff rate applied to US exports to NZ and found it was just 0.3%.

“That says we don’t protect. That actually [trade] can flow freely.”

Asked whether he would push Greer in Washington to restore the 10% tariff, or something lower, McClay said Trump’s latest announcement suggested 10% might now be the best NZ could hope for.

STICKY

Learning from doing

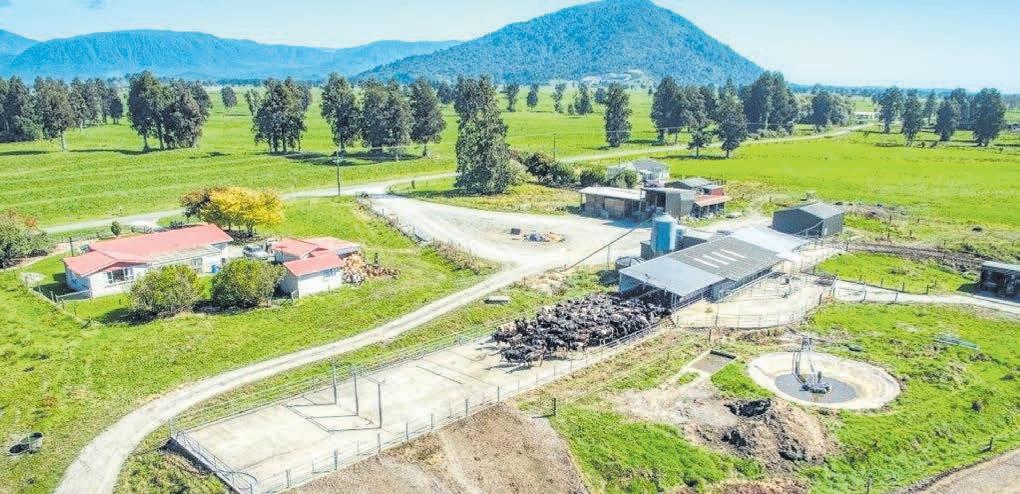

FARMING was the only life Bayden Andersen ever dreamed of, and it’s one he’s forever grateful for.

“I was very lucky to know what I wanted to do at a young age and it’s all that I’ve ever wanted to be,” he says.

Andersen manages a 470 hectare effective Walmsley Canning Estate, a sheep and beef operation in southern Hawke’s Bay, with wife Shaye and children Phoebe, Molly and Colby.

Andersen grew up in the region and feels fortunate to have had a childhood in the country.

“I grew up not far from here as a kid, and then we moved into the Ōmakere district. And then, yeah, farmed around Ōmakere for years, and then done a stint down in Weber.”

Despite this rural upbringing, Andersen set his sights on Smedley Station’s cadet training programme and was accepted in Year 13.

“I worked for some people as a teenager that had been to Smedley, and they loved their time

there. So it was just a place that I was really attracted to going to.”

It was a smart move, Andersen said.

“It was good to go from knowing the basics of farming and having a grounding and farming, to seeing many different farming practices. I hadn’t dealt with deer, I hadn’t dealt with Friesian bulls, I hadn’t done anything with forestry.

Being able to run someone else’s land as though it’s your own is the greatest privilege I’ve ever had, other than being a dad.

Bayden Anderson Pōrongahau

“The people I worked for were good, traditional farmers that were breeding and finishing, but I hadn’t done a trading component. So it just rounded out those skills –the paperwork side was good too.”

After a couple of years’ shearing, Anderson felt the call of the farm and went shepherding.

He’s about to start his sixth year at the estate and is grateful for the

opportunity to farm it.

“Being able to run someone else’s land as though it’s your own is the greatest privilege I’ve ever had, other than being a dad,” he said.

The community is another of the reasons the Andersens love what they do.

“The kids are our life. We chase every opportunity we can get for those children, in sport and education, and thankfully we get to bring them up in such a beautiful place like this.

“Rugby and netball are a big part of our lives in the winter, and recreation in the summer, with diving and fishing.

“We’ve got some really good friends around here that we’re very fortunate to have, and we get to spend time doing stuff we love.

“This community pumps, Pōrangahau is paradise.”

And running the farm is a family affair, with the Shaye and the kids often pitching in.

“It’s great to have them here and getting them involved, and learning – learning from doing.”

But Andersen worries his paradise is being paved with pine trees, which could have lasting impacts on the community.

“The biggest challenge in agriculture at the moment is carbon farming,” he said.

“It’s taking away job opportunities, land ownership opportunities and community opportunities.

“This community is thriving and the trees aren’t hurting us right now but they’re going to at some point.

“It will take some kids out of a school, money away from the community, and jobs. That’s the biggest challenge we’ve got,

especially at our age, with wanting to progress into equity. It’s moved the goal posts, that’s for sure.”

–This article was made possible with support from AGMARDT and the Smedley Foundation.

Bryan Gibson ON FARM Sheep and beef

TOGETHER: The Andersen family, Phoebe, Shaye, Colby, Bayden and Molly. Photos: Alistair Thom

CARBON: Bayden Anderson says the biggest challenge in agriculture at the moment is carbon farming. ‘It’s taking away job opportunities, land ownership opportunities and community opportunities.’

CONNECTION: The Andersens love the Pōrangahau community, with good friends close by despite its remoteness.

PARADISE: The Andersens enjoy kids’ sports in winter and fishing and diving in the summertime.

Contractors add their voice to bale-wrap rumble

Gerhard Uys NEWS Environment

ASOUTH Otago

contractor is backing calls for better on-farm disposal of plastic bale wrap to protect livestock and machinery, saying he is getting frustrated with the sheer amount he sees on some farms.

Fraser Leslie told Farmers Weekly he submitted on proposed reforms to the national take-back and recycling scheme because he has become frustrated with the amount of plastic discarded on some farms.

Some paddocks cannot be cultivated because of the amount of plastic in them, he said.

He once counted 283 small pieces of bale wrap in a 2 hectare paddock he was roller drilling, Leslie said.

Plastic ends up in paddocks during the cutting, carting and feeding out phases.

Leslie said he has seen many instances where livestock consume plastic, and he does not understand why there is a fine if an animal arrives at the works lame, but no fine for an animal whose rumen is full of plastic. He said a plastic recovery scheme would have to be practical to be successful.

Recently Alliance Group asked farmers to remove plastic baleage wrap and twine from paddocks after feeding out.

We strongly encourage farmers and rural contractors to work together to ensure all plastic wrap is removed from paddocks.

Richard McColl MIA

The processor said it is seeing an increasing number of cases where wrap is making it through to processing after livestock eat it, and key equipment is being blocked.

The regional director at Vetsouth, Mark Bryan, said twine causes more harm than plastic as it is long and causes entanglement in the gut.

Veterinarians see more sheep affected by it than cows, and in acute cases animals are beyond help.

He said more often than not vets are called out to cases where an animal is slowly wasting away, but beyond help. Autopsies show “a significant mass of plastic and netting in the rumen”.

The commercial manager at plastic recycler Plasback, Neal Shaw, told Farmers Weekly that recycling is voluntary and that many farmers still bury or burn their farm plastics, which is against many council rules.

Rural Contractors New Zealand chief executive Andrew Olsen said there needs to be alignment between district councils or district plans on how ag recovery is handled.

Without council alignment there

ACCC looks into bid for Fonterra assets

Gerald Piddock NEWS Dairy

BEGA Cheese has launched a joint bid with FrieslandCampina NV to acquire some of Fonterra’s consumer, food service and dairy ingredients businesses.

If the joint bid is successful, Dutch dairy giant FrieslandCampina will acquire the segments of Fonterra’s global businesses that it is selling outside of Oceania, and Bega will acquire the Oceania businesses that are being sold.

The bid has been registered with the Australian Competition and Consumer Commission (ACCC), which is seeking public feedback on the proposal as it investigates its impact on competition within that country’s market.

The Australian consumer

watchdog’s investigation centres on whether the bid will reduce competition in the acquisition and processing of raw milk where the two parties overlap and if it would reduce competition of the wholesale supply of dairy products and ingredients.

In July, the ACCC said it did not oppose French dairy giant Lactalis from purchasing Fonterra’s consumer business globally, and its dairy ingredients and food services businesses in Australia.

ASX-listed Bega is one of Australia’s largest purchasers of raw milk, collecting 1.3 billion litres of raw milk annually under more than 600 farmer supply contracts and employing around 3900 staff across 19 manufacturing sites and corporate offices.

It earned A$3.52 billion in revenue in the 2024 financial year and its EBITDA was A$165 million.

As well as the Bega brand, Bega’s retail brands in Australia include Dairy Farmers, Farmers Union and Pura.

Bega also supplies dairy products to businesses in the food service sector, under brands such as Dairy Farmers and Farmers Union.

In addition, Bega manufactures a range of dairy ingredients, such as milk powders and whey powders, which it supplies primarily to food manufacturers.

Fonterra has around 650 Australian farmers in Victoria, Tasmania, and parts of South Australia and New South Wales.

Fonterra’s retail brands include Mainland, Western Star and Perfect Italiano, and it holds a licence to use the Bega brand to sell certain packaged cheese products in Australia. Fonterra also supplies milk, cream, cheese and butter products to food distributors through its Anchor Food Professionals brand.

The two companies overlap in various parts of the dairy supply chain, including acquiring milk from farmers in Victoria and Tasmania, in processing and production and in the supply of dairy products and dairy ingredients to retailers and food service outlets.

Feedback to the ACCC’s investigation closes on August 15 and the provisional date for announcement of its findings is September 25.

said there is no infringement fine specific to the presence of plastics in the stomachs of farmed animals.

The Ministry for Primary Industries’ presence at meat processing plants across the country shows it is relatively rare for plastics to be discovered in farmed animals, he said.

“If our vets identify this as a concern, it is flagged for follow-up with the originating farm.”

The manager for industrial operations, data and insights at the Meat Industry Association, Richard McColl, said from time to time plastic baleage wrap gets caught in machinery at meat processing plants.

would be “leakage”, he said.

Contractors want a “clean shot” while they are working and would prefer not to have to cultivate where there is plastic, he said.

New Zealand Food Safety deputy director-general Vincent Arbuckle

“We strongly encourage farmers and rural contractors to work together to ensure all plastic wrap is removed from paddocks. It might seem minor, but even small amounts can cause problems down the line.”

Farm sales soar in key areas

Neal Wallace MARKETS Real estate

IMPROVED product prices and lower interest rates drove a significant recovery in farm sales in the year to the end of June.

Compared to the previous year, the number of dairy farms sold improved in all key regions, but were significantly higher in Southland, up 100%, and Canterbury, 53.5% higher, according to Real Estate Institute of New Zealand (REINZ) rural spokesperson Shane O’Brien.

The median sale price was mixed, increasing 20% in Manawatū-Whanganui, 6.4% in Waikato and 4.6% in Canterbury, but falling 14.7% in both Southland and Taranaki.

More grazing blocks were sold in the year under review, 358 compared to 290 a year earlier, with activity especially busy in Otago-Southland and Hawke’s Bay.

O’Brien attributes the interest to improved red meat prices and demand for support blocks but notes marginal land struggled to attract buyers and environmental

compliance concerns remain a factor.

Prices paid for grazing properties were mixed, led by Manawatū/Whanganui, up 21.3%, and Northland, 1.7% higher. Prices were lower in Southland, 13.3%, Otago, 10.6% and Waikato 1.1%.

Firming commodity prices and favourable seasonal conditions prompted interest in finishing farms with the most active regions Manawatū-Whanganui, 113 sales, Canterbury, 104, Southland, 95, Waikato, 74, and Otago, 66.

There was a notable difference between the median price per hectare in the North Island compared to the South Island. Manawatū-Whanganui and Waikato both had notable drops in price, 26.5% and 23.5% respectively, while Canterbury, 17.4%, Otago, 16.4% and Southland 14% all increased in price

The arable sector had limited activity at just 79 sales, of which 58% occurred in Canterbury.

Canterbury’s median price per hectare declined slightly to $44,000 (down 0.9%), while Waikato’s increased to $60,370 (up 26.7%).

BURIED: South Otago Fraser Leslie says even when paddocks look clean there is often plastic in the soils.

SUFFERING: Last month Alliance Group asked farmers to remove plastic baleage wrap and twine from paddocks after feeding out. Netting and bale wrap in the guts of this cow meant it had to be put down.

Ravensdown’s robotic soil testing lab opens

Annette Scott TECHNOLOGY Soil

ANEW, purpose-built soil testing laboratory in Canterbury will boost the sector’s productivity while ensuring precise and efficient nutrient use.

Fertiliser co-operative Ravensdown officially opened the new Analytical Research Laboratory (ARL) facility in Rolleston under its portfolio company, venture arm Agnition.

ARL provides accredited analysis of soil, plant and feed samples for farmers and growers nationwide. Its test results help inform decisions on nutrient use, pasture performance and environmental management.

The new facility replaces ARL’s previous site in Hawke’s Bay, which was destroyed during Cyclone Gabrielle in 2023.

After operating from a temporary site in Hastings for two years, Ravensdown chief executive Garry Diack said, the decision was made to relocate and re-establish in Canterbury, closer to key research partners in the heart of the South Island’s core

farming communities, while also supporting regional growth.

The Rolleston lab is 50% larger than the previous site and includes automated robotics, with five custom-built machines developed by the ARL team, making it the most technologically advanced soil lab in NZ.

These improvements are expected to double the lab’s soil testing capacity over the next five years, ARL general manager Suzan Horst said.

Accurate, timely data is essential. It allows farmers to apply nutrients only where needed.

Suzan Horst ARL

“This new lab positions us to meet the growing demands of modern farming.

“Accurate, timely data is essential. It allows farmers to apply nutrients only where needed, which is good for the environment and increases crop production and pasture growth.”

The lab employs 30 people, including seven staff who

relocated from the original Napier team. There are more than 50 tertiary qualifications across the team, including five PhDs.

The lab currently processes 80,000 samples per year, mostly soil.

Horst said the new lab is capable of doubling that in soil samples alone while expanding testing capacity for plants, crops, and feed samples.

ARL conducts more than 500,000 tests annually across 50 different test types with most demand focusing on elements such as sulphur, magnesium, phosphorous and potassium, essential to efficient fertiliser use and soil health.

ARL independently tests and has direct APIs with many organisations, including Hawkeye Pro, Ravensdown’s digital mapping and nutrient management platform.

These tools turn results from the lab into applicable tools farmers can use to effectively manage their farms.

Ravensdown general manager innovation Jasper van Halder said the new ARL facility in Rolleston adds to the growing scientific and technical infrastructure

of Canterbury, reinforcing the region’s position as a hub for agricultural innovation.

“This lab is about more than rebuilding, it’s about strengthening the systems that support farmers, researchers, and land managers across the country.

“We are now set up for growth and smarter farming; if you know more you can grow more.”

Associate Minister of Agriculture and Selwyn MP Nicola Grigg said as she officially opened the facility, “Science like this has the ability to adopt the application so important

to our food provenance story to offshore markets.

“Soil and plant science is the absolute foundation for success of our agriculture sector and this an exciting opportunity to demonstrate how our seed performs in the soil with huge opportunity for growth as farmers test more often in line with precision agriculture.”

Selwyn District Council deputy mayor Malcolm Lyall said the state-of-the-art robotic lab is a major win for agriculture in the region.

TESTING: Selwyn MP Nicola Grigg tests a soil sample under the watchful eye of lab operations manager Joe Holloway at the new Analytical Research Laboratory facility in Rolleston. Photo: Annette Scott

‘Best place to farm, worst place to sell’

Annette Scott NEWS Agriculture

HATHAM Island farmer

CGary Cameron says his remote farm on the southern coast is in “the best place in the world to grow anything but the worst place to sell anything”.

The handbrake is that the one and only ship to service the island keeps breaking down.

But Cameron, like all island farmers, is hopeful that the Chatham Island Farmers Association Incorporated Society, incorporated in May this year, will help drive the farming industry forward.

Cameron, as chair, is supported by listed key officers, prominent Chatham Island farmer Tony Anderson of Wharekauri Station and Raewyn Gregory-Hunt a ninth generation Pitt Island farmer and livestock agent.

“In days gone by we had Federated Farmers, with which I was heavily involved,” Cameron said.

“We are keen to progress something similar again. Times are tough, we all have to tighten our belts but most of all we need unity among the farmers.

“This catchment group idea we are working on with the Ministry for Primary Industries under the incorporated society is about getting that unity with transparency for all farmers when it comes to the likes of livestock shipping quotas, which is a huge and contentious issue right now.”

Cameron and his wife Eileen farm Durham Farm, a 440 hectare operation running 1600 Romney based Suffolk-Texel breeding ewes and 100 breeding cows, on the coastal fringe on the island’s more fertile land.

A former stud breeder, “one of the last standing”, Cameron now pays “good money” for his rams from reputable stud breeders on New Zealand’s main islands.

But it’s one thing to pay good money and breed good stock on the best of the island’s farmland; Cameron, too, faces the challenge that meets every other farmer – of getting his stock and produce to market.

“In the 90s I used to put lambs on the ship straight to the works and they would dress out at 18kg.

“Now all the lambs go store. With the unreliability and inability to get rid of stock I wouldn’t even contemplate prime stock.”

When it comes to wool, fleece is the only wool Cameron sends to market.

“While we are the best place in the world to grow anything we are the worst place to sell anything.

“It costs $120 a bale to get wool out so unless you make $1.50/ kg it’s not worth doing, so I only send fleece wool and that’s very marginal in these times.”

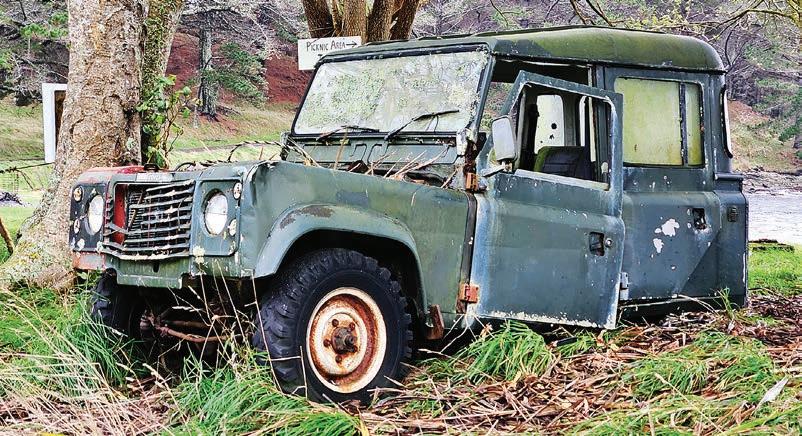

Rust is an ever-present problem for farmers, with the salt spray during the windy weather not only attacking vehicles and machinery but even eating away staples on

A drive around the island to Kaingaroa Station finds eighth generation farmer and Hokotehi Moriori Trust-owned station farm manager Levi Lanauze.

A new generation farmer, Lanauze has been managing the 4800ha station running 4500 Romney ewes and 400 cattle since 2020, when he returned to the Chathams after 12 years away.

“I definitely came home with a different lens to see new opportunities and you don’t have to think too far out of the square to be different here.”

He also said being bound by shipping challenges makes it a hard place to farm.

Lanauze’s new farming practices stand in something of a contrast to the islands’ traditions and are not necessarily accepted by all, but he is driven to make changes for the better.

“I have recently sent off a planeload of lambs, and it not only saved $2 a lamb, it got the lambs away when they needed to go.

fence posts, fencing wire and hinges on gates.

Where on the main islands fences can last up to 80 years, on the Chathams they rarely last 1015 years.

But it is shipping that lingers as “an old, sore point”, and securing something as basic as a reliable ship remains the core focus.

Over the years farmers have looked into chartering their own ship, but found it too expensive, with past reviews having concluded that the Chathams economy can’t support two shipping lines.

But the government is supposedly on the case and there’s understanding that there’s a short list down to three for a new ship, hopefully very soon.

“I have had 92 cattle booked for nine months and they’ve still not gone.”

He has moved lambing dates, getting the ram out earlier, with lambs ready to go on the boat when no others are ready.

Shearing twice a year is proving worth it. “I made money on the wool this year.”

He recently introduced the shedding Wiltshire, but is yet to be convinced they will be a fit.

Breeding heifers for larger profit is another change for Kaingaroa.

A former beekeeper and fencer in Canterbury, shepherd in the Scottish Isles and station manager in Alberta and Canada, Lanauze is proud of his wide experience and is very keen to draw on it to make a difference for future farming generations on the Chathams.

I have recently sent off a planeload of lambs, and it not only saved $2 a lamb, it got the lambs away when they needed to go.

Levi Lanauze Kaingaroa Station

The shipping news

CHATHAM Islands Shipping is responsible for delivering the islands’ shipping services, averaging 28-30 sailings over a calendar year.

• Its vessel, the 40-year old Southern Tiare, increasingly requires major maintenance. The age of the ship is the primary problem impacting reliability.

• Both Chatham Islands Shipping and the Chatham Islands Enterprise Trust have battled for five years for a replacement vessel. They want a purpose-built vessel that enables a consistent and affordable service, capable of carrying a much larger capacity of livestock, as well as scale in the future to adapt to growth on island farms while also being capable of adapting to changing freight needs to enable the islands economy to grow alongside it.

• The government appropriated $35.1 million for a replacement vessel in the 2022 Budget, of which $5.1m was intended to be spent on getting the vessel through survey. Given the time that has lapsed, the vessel has required additional surveys, including major maintenance to meet operating regulations.

• The government has narrowed proposed tenders down to three – Chatham Islands Shipping, Aucklandbased McCullum Bros, and Bass Straight Freight Australia.

Annette Scott NEWS Transport

LESSONS: Levi Lanauze is more than keen to use his international experience to make a difference for future farming generations.

Photos: Annette Scott

LOOKING AHEAD: Gary Cameron is hopeful that the newly established Chatham Island Farmers Association Incorporated Society will help drive the farming industry forward.

GENERATIONS: Kaingaroa Station is managed by eighth-generation farmer and Hokotehi Moriori Trust-owned station farm manager Levi Lanauze. The 4800ha station runs 4500 Romney ewes and 400 cattle.

NEVER SLEEPS: Rust is an ever-present problem for farmers with the salt spray during the windy weather not only attacking vehicles and machinery but also eating away staples on fence posts, fencing wire and hinges on gates.

Are you with us?

Be part of the growing community that has opted in to an annual voluntary subscription with us. Your support means more than you might realise. You’re backing more than just a 22-year-old newspaper, you’re backing belief, and we want you to know how much our entire team at Farmers Weekly would appreciate your support.

It’s become clear in the last few years that the era of quality, free community newspapers is over. That model is broken.

So we had two options:

1. We cut costs. We’ve already tightened our belts, but going further would mean fewer journalists, less content, and less support for the food and fibre sector. Cue the trolls on social media cheering on the slow death of the media.

2. We keep believing, and here’s what we believe:

• We believe in the need for a strong, independent farming media that reaches every farmer. In today’s world of algorithm-powered misinformation, that is more important now than ever.

• We believe everyone should have access to reliable market information and insight. Many of you tell us you turn to the business end of Farmers Weekly first.

• We believe the work of your advocacy groups should be visible to everyone. That’s why we partner with Federated Farmers and others.

• We believe in holding on to our team of seasoned agri-journalists, and employing and training new ones.

• We believe you value Farmers Weekly, both print and online.

While other media companies shrink their newsrooms, we’re determined not to, but we need your voluntary subscription. Already, 932 of you have started your voluntary subscription. Thank you! This support is why we continue to believe.

Farmers Weekly reaches more than 150,000 people online every month and lands in 74,000 rural letterboxes every week. We believe at least 8000 of you know it’s worth $2.50 a week, or $120 a year, fully tax-deductible. So become a Friend of Farmers Weekly and sign up to a voluntary subscription.

In return we’ll continue to deliver you, and every farmer in the country, the best value we can for your annual $120 voluntary subscription.

Please contact me at any time if you have any questions (or ideas on how we can reach our 8000 target any quicker!)

Dean

Williamson

– Publisher dean.williamson@agrihq.co.nz

– 027 323 9407

BECOME A VOLUNTARY SUBSCRIBER

Choose from the following three options:

Scan the QR code or go to www.farmersweekly.co.nz/donate

Start your voluntary annual subscription today. $120 for 12 months. This is a voluntary subscription for you, a rural letterbox-holder already receiving Farmers Weekly every week, free, and for those who read us online. Note: A GST

Email your name, postal address and phone number to: voluntarysub@farmersweekly.co.nz and we’ll send you an invoice Call us on 0800 85 25 80

subscriptions.

From the Editor

TNeal Wallace Senior reporter

HERE is a saying that you don’t know what you have until it’s gone.

That could well be the case for Alliance shareholders with the board announcing on Tuesday its preferred option to inject $200 million in new capital into the co-operative.

There were early rumours that could be from Saudi Arabia, but the most recent speculation has been Ireland’s Dawn Meats, with a report in the Irish Times that they are prepared to pay $270m for a 70% stake in Alliance.

That is pure speculation, but if true would present a difficult sales pitch, asking shareholders in a 100%-farmer owned cooperative to sell 70% of the business and create a relationship that would not be one of equals.

Certainly any offer has to be considered on what, other than cash, a buyer brings to the table and what the alternatives are.

The implications of Alliance’s recapitalisation is also a vote – or not – of confidence in co-operative ownership.

Remaining a 100% farmer-owned co-operative, a moniker Alliance has extensively and proudly used in marketing and promotion, appears over.

Its co-operative status has been tarnished in Alliance’s heartland of Southland, due to lingering shareholder disquiet that stock traders in some cases receive more for stock than loyal suppliers.

Alliance reduced its reliance but justified it as providing certainty of supply when stock flows were low.

Faced with shareholder anger at increasing retentions on stock killed, the Alliance board last year abandoned attempts to recapitalise with shareholder funds, and with it any notion of remaining a 100% farmer owned co-operative.

publicly floated in 1995 and subsequently bought by Talleys Group in 2010.

In 2016 Silver Fern Farms became a hybrid when it sold 50% of the business to Shanghai Maling.

Unlike meat companies, the dairy industry has co-operative ownership at its core, with Fonterra accounting for 80% of total milk collections.

The appetite of sheep and beef farmers for 100% farmer-owned co-operative companies is wavering due to frustration with performance, uncompetitive pricing and disquiet over the use of traders.

Our ancestors established co-operatives last century to break the hold of the then United Kingdom-owned meat companies and to ensure ready access for shareholder’s stock.

What emerges in the coming months will reshape the sector and is likely to see a more commercial, less flexible procurement model.

This week’s poll question (see page 4):

Do you have confidence in NZ’s ability to combat pests and diseases such as grass grub?

Have your say at farmersweekly.co.nz/poll

LAST WEEK’S POLL RESULT

MORE than 95% of voters thought the government did not need to regulate the chores children are allowed to do on family farms. Most voters thought it was an unnecessary imposition. “It’s not needed, parents are able to look after their own children’s wellbeing,” one said. “This is nobody’s business but the parents’. How many cases of overworked exploited children have been found on NZ farms? This is a solution looking for a problem,” said another.

“Most farmers would not put their children in a situation without knowing they were capable,” another voter said. “Most farm kids under 10 have better common sense and stock knowledge than a lot of adults. I would be interested to see the amount of workplace accidents from kids helping their parents on farm.”

Last week’s question: Does the government need to legislate what chores children can do on family farms?

That aside, there still appears to be sufficient support for retaining a degree of co-operative ownership, making any bid to sell 70% of the company challenging.

Alliance is destined to be the third large co-operatively owned meat company in the past 30 years to change its structure.

AFFCO, formerly the Auckland Farmers Freezing Company, was a co-op before being

The days of a co-operative wearing the cost of putting on early chains because it has stopped raining or finding space for a farmer needing to get rid of animals at short notice, could well be over.

With the injection of more commercially focus partners, farmers may encounter more rigid, less flexible supply contracts.

A relatively quiet decade in the meat industry is about to be thoroughly upended. Once the ownership of Alliance is settled, the next challenge will be addressing excess processing capacity.

Lessons from elephant eaters: Alan Livingston

In this series, the regular Eating the Elephant contributors ask big questions of food & fibre New Zealanders with a history of taking on big challenges.

ALAN Livingston has provided a lifetime of community service from his farming base on the northern slopes of the Waikato’s Mt Pirongia.

A believer in investing time in community, he has been involved with Waipa District Council, Waikato Regional Council, QEII Trust, Waikato River Authority, Sport Waikato, Magic Netball and the Te Awamutu Theatre.

In these places, he saw firsthand the power of community working together.

Why did you choose a life in food and fibre?

My family are longtime sheep and beef farmers, although at 18, I wanted another string to the bow so Lincoln University and rural banking provided a strong foundation before full-time farming.

What are you most proud of and why?

Naturally a beautiful wife, three successful children and nine grandies spring to mind. However, I hope my career of community service, initially in my local Te Pahu community, then Waipa District then Waikato Regional Council and QEII Trust, has made a difference.

Local cinemas, sports clubs and conservation organisations need help. I have found helping has been extremely rewarding.

What is something unusual about yourself that you love?

While not unusual in my day, but more so today is the importance and strength of family, both immediate and extended. Blood really is thicker than water.

What is the best investment that you’ve ever made?

Education, even if I didn’t fully appreciate that when I was younger. Lincoln taught me to think and to value your contacts ... Good advice, I think.

What two books changed your life and why?

Lochore and Give that Man a Horse, on the lives of Sir Brian Lochore and Sir Patrick Hogan, who were two men I knew personally. With Sir Patrick, the lesson was not to compromise on quality. With Sir Brian, it was on leading by example, teamwork and being adaptable.

What advice would you give to a young person today?

Get educated and take the opportunities life presents. This requires positivity, risk-taking and

adaptability. Develop your people skills and don’t forget to give back to your family and community.

What will the food and fibre sector of 2040 look like?

There will be four Rugby World Cups by 2040. The All Blacks will win one, while a first-time winner will be crowned in 2039. Now for my predictions ...

Diversity will provide our biggest opportunity and will look like niche products, crops not presently grown in New Zealand, demand from new emerging nations (especially India), eco-tourism and the ability to work remotely to increase off-farm income.

Diversity will come from science and technology too –like increased automation, more efficient rotational grazing due to livestock data-chips and virtual fencing. Diversity for climatic reasons will see sub-tropical crops in the far north and traditional crops grown further south.

By 2024, thankfully, politicians will have recognised that regulatory regimes must set realistic targets and time frames and be practical and affordable to work.

As I have seen with QEII and regional council, biodiversity enhancement and improved water quality are not quick fixes, but can

improve on an intergenerational time horizon.

As a lifelong sheep fan, wool will hit the jackpot (just in time) as scientists devise ways to utilise its unique thermal resistance and moisture absorption properties.

Pests – deer, goats, pigs, cats, possums, wallabies – will reach endemic levels, affecting farm production and creating biosecurity risk.

Technology will produce bait that affects the female reproductive system and renders them sterile, but this will need work to minimise unintended consequences to other species.

A massive investment in relationships will be required with the hunting fraternity to ensure we are managing both biodiversity and wild game hunting effectively. We will want more bush unimpacted by feral animals, while at the same time having pockets where game animals can be hunted.

IMPACT: Alan Livingston hopes his career of community service, initially in the local Te Pahu community, then Waipa District then Waikato Regional Council and QEII Trust, has made a difference.

Regional and local government will be reorganised to 12-15 unitary authorities. The new water authorities (drinking and wastewater) established by councils in 2025-27 will prove a financial millstone to urban ratepayers due to the unforeseen capital works costs and extremely high costs to meet environmental standards.

But another water, flooding, will prove a significant financial challenge – especially to farmers, due to the relatively low number of directly benefitting ratepayers. Carbon farming of pine trees will reduce as financial incentives are removed, poor management, disease, fires (particularly on the east coast of the North Island) and the resurgence of wool will see good contour land returning to sheep and cattle.

Pāmu sale could unlock money for research

farms developed and then sold.

Pāmu is now the nation’s largest farmer, with 112 farming units over 356,048 hectares.

Alan Emerson Semi-retired Wairarapa farmer and businessman: dath.emerson@gmail.com

THE recent news of Pāmu’s profitability is welcome. I’d make two observations, however.

The first is that if you can’t make a profit with current prices you shouldn’t be in business. The second is that the return on investment is still distinctly average.

Landcorp Farming Ltd came into being in 2001, followed by Pāmu in 2015. Previously there was the Department of Lands and Survey, which developed farms for sale. They did it well with many

It is currently in the news with cries for the organisation to be sold, and those cries have been around almost since Pāmu’s inception.

Various politicians over the years have promoted the sale. We’ve had promises of farms being sold to young Kiwis as a way of getting them started. There were concerns about foreign ownership and the suggestion of a private corporate buyer.

They’ve all come to nothing.

The current campaign has been promoted by agribusiness accountant Pita Alexander, who claimed “Pāmu has passed its useby date and outgrown its original purpose”.

He also claimed that the sale would give the government $2 billion, suggesting that the “return on investment is now too low to make the company viable”.

Those favouring a sale claim that the private sector can manage a farm better than Pāmu can. That it isn’t a core government business and there are better ways to invest $2bn.

Those wanting the status quo to remain point out that Pāmu makes a solid contribution to

the sector. Its work in the fields of genetics and farm system innovation, among other things, can be applied across much of the country.

It is certainly a leader in workplace training and development.

My view is to support the sale of Pāmu because, as Alexander said, it has passed its use-by date. Yes, it makes a non-financial contribution to provincial New Zealand but it does so at a cost.

The Treasury completed an independent review of Pāmu back in 2021. It told the state-owned Enterprise that under the SOE Act Pāmu is to be “as profitable and efficient as a comparable business that is not owned by the Crown”. Pāmu obviously isn’t as profitable as a comparable business so selling the organisation does make financial sense.

The previous SOE minister wasn’t happy with Pāmu. In March this year Simeon Brown wrote a letter to the chair setting out the government’s expectations.

He noted that Pāmu’s returns “have not met its costs of equity for at least 10 years”.

If a farmer had a similar economic performance they would be finished.

The minister said that he expected “Pāmu’s business

planning documents to deliver a bold challenging turnaround plan to improve value and return to the Crown”.

Also, the SOE is to “reduce corporate overhead spend”.

How Pāmu will deliver “a bold challenging turnaround plan” and “improve value and return to the Crown” will be interesting. Having said that, this year’s result is encouraging.

The point I’d make is that, yes, it does an excellent job of staff development and training but there are a plethora of other agencies in the same field.

Its work on genetic improvement and its work on sustainability and reducing its climate impacts are all good and solid stuff but again they are replicated in the private sector. For example, the genetic development of Derek Daniell with all his breeds has been described as “world class”.

In addition, when there was a need to change, for example to self-shedding sheep, he was in the vanguard.

My position, as I’ve stated, would be for the sale of Pāmu but with some provisos. For example, I’d want the purchaser to be a bona fide Kiwi.

Second is that the farms are sold for top dollars.

Finally, I want an established

portion of the funds from the sale to be re-invested in the sector through the reformed Crown Research Institutes.

We need research and not just that where you can spend a dollar today to get two back tomorrow.

We need long-term scientific research and a share of the profits from a sale of Pāmu could be exactly what is needed.

Currently the agricultural research sector has been described as having a crisis of confidence that has been fuelled by shrinking budgets.

What that means is that we’re sacrificing future gains on the altar of today. Last month’s budget cut $212 million from the science, sector which prioritised current research funding to commercially focused science.