Red-hot red meat prices just the start

Neal Wallace MARKETS Sheep and beef

SOARING global meat prices may not have peaked.

Brett Stuart and Simon Quilty, co-founders of market intelligence and analysis company Global Agritrends, told the Red Meat Sector Conference in Christchurch last week that declining global stock numbers, the impact of geopolitical disruption and sustained consumer demand have created what they called an “extraordinary time for the sheep and beef sector”.

It is demand driven not a boom and bust cycle, they said.

“We are seeing record global meat prices but they are sustainable prices and we are at the start of the journey not the end,” said Quilty.

Several meat company leaders agreed, saying privately they had never seen market conditions so positive.

Quilty and Stuart forecast that New Zealand steer prices would rise a further 15% in the coming year, following a 34% year-onyear price increase in the past 12 months.

Quilty said he expects global beef prices, which hit record levels in April, will continue to increase for the next two years. It was a similar story for

sheepmeat, with NZ prime lambs forecast to hit $10/kg this August, $10-$11 in June next year and $9 in November-December next year.

Quilty forecasts the Australian sheepmeat kill next year will be 34% lower than 2024, from 38 million to 25 million, before recovering to 35 million in 2028.

Global sheepmeat demand and prices are improving but not to the extent of beef prices, which hit record heights in April.

The current alignment of supply and demand is new territory.

In 20 years I have been analysing markets, I have never seen a more extraordinary time for the sheepmeat and beef industries.

Brett Stuart Global Agritrends

“In 20 years I have been analysing markets, I have seen a more extraordinary time for the sheepmeat and beef industries,” said Stuart.

Globally, beef and sheepmeat supplies are tight.

United States and Brazilian herds are rebuilding and the Australian beef kill is picked to tighten this year.

Add to this scenario geopolitical manoeuvring and tension – an

Continued page 3

Strong calf market comes with caveats

NZ Farmers livestock agent Steve Emile in action at the Frankton saleyards during its feeder calf sale last week. Record numbers of stock were on offer, pointing to increased calf-rearing action – but old hands warn of hidden costs and capacity challenges.

8

Listed primary sector companies expected to report strong results.

NEWS 3

Photo: Gerald Piddock

Farming deer, beef, sheep – and data

Te Anau sheep and beef farmers David and Jackie Stodart and son Shaun are a family hungry for ideas and ways to improve their farming skills.

12-13

After some tough times, farm employment levels are finally stable. NEWS 5

New Zealand’s Taxonomy: Jo Kelly explains what it really means.

OPINION 17

EDITORIAL

Bryan Gibson | 06 323 1519

Managing Editor bryan.gibson@agrihq.co.nz

Craig Page | 03 470 2469 Deputy Editor craig.page@agrihq.co.nz

Claire Robertson

Sub-Editor claire.robertson@agrihq.co.nz

Neal Wallace | 03 474 9240

Journalist neal.wallace@agrihq.co.nz

Gerald Piddock | 027 486 8346

Journalist gerald.piddock@agrihq.co.nz

Annette Scott | 021 908 400 Journalist annette.scott@agrihq.co.nz

Hugh Stringleman | 027 474 4003

Journalist hugh.stringleman@agrihq.co.nz

Richard Rennie | 027 475 4256

Journalist richard.rennie@agrihq.co.nz

Nigel Stirling | 021 136 5570

Journalist nigel.g.stirling@gmail.com

PRODUCTION

Lana Kieselbach | 027 739 4295 production@agrihq.co.nz

ADVERTISING MATERIAL

Supply to: adcopy@agrihq.co.nz

SUBSCRIPTIONS & DELIVERY 0800 85 25 80 subs@agrihq.co.nz

PRINTER

Printed by NZME Delivered by Reach Media Ltd

SALES CONTACTS

Andy Whitson | 027 626 2269

Sales & Marketing Manager andy.whitson@agrihq.co.nz

Janine Aish | 027 300 5990

Auckland/Northland Partnership Manager janine.aish@agrihq.co.nz

Jody Anderson | 027 474 6094

Waikato/Bay of Plenty Partnership Manager jody.anderson@agrihq.co.nz

Palak Arora | 027 474 6095

Lower North Island Partnership Manager palak.arora@agrihq.co.nz

Andy Whitson | 027 626 2269

South Island Partnership Manager andy.whitson@agrihq.co.nz

Julie Hill | 027 705 7181

Marketplace Partnership Manager classifieds@agrihq.co.nz

Andrea Mansfield | 027 602 4925

National Livestock Manager livestock@agrihq.co.nz

Real Estate | 0800 85 25 80 realestate@agrihq.co.nz

Word Only Advertising | 0800 85 25 80 Marketplace wordads@agrihq.co.nz

PUBLISHERS

Dean and Cushla Williamson Phone: 027 323 9407 dean.williamson@agrihq.co.nz cushla.williamson@agrihq.co.nz

Farmers Weekly is Published by AgriHQ PO Box 529, Feilding 4740, New Zealand Phone: 0800 85 25 80 Website: www.farmersweekly.co.nz

ISSN 2463-6002 (Print) ISSN 2463-6010 (Online)

28-31

CONSUMERS: Jim Delegat says Delegat Wines recently reached an agreement for its 26 distributors in the United States to pass on the current 10% tariff to consumers.

News in brief Medical support

Hauora Taiwhenua Rural Health Network has welcomed the government’s backing of a third medical school at Waikato University.

Hauora Taiwhenua’s CEO, Dr Grant Davidson, said the network is thrilled that the government has met its election promise to provide a rurally focused medical training programme. The Waikato programme will see an extra 120 doctors trained each year starting in 2028.

LIC profit

LIC has reported strong financial results for the 2024-2025 financial year, with net profit after tax at $30.6 million, up from $7.7m the previous year.

Its total revenue lifted 10.4% to $295.1m and released a dividend of $17.4m or 12.22c a share, representing 80% of underlying earnings. LIC board chair Corrigan Sowman said the co-operative was pleased to deliver such a positive result for farmer owners.

Farming success

Taranaki sheep and beef farmers Jarred and Sarah Coogan are the winners of this year’s Silver Fern Farms Plate to Pasture Award.

The Coogans, together with Sarah’s parents Bryan and Helen Hocken, farm 470 hectare MataRata Downs at Tarata, east of Inglewood, where they run 2400 ewes and 300 trading cattle. Judges were impressed by the family’s clear understanding of customer and consumer needs while having an eye on improving the environment.

Bikes back

Electric bike company UBCO is back in business, emerging from receivership with a new business model focused on producing vehicles designed for work.

Its business assets have been acquired from the receivers by Utility Fleet Vehicles. Majority-owned and operated in New Zealand, Utility Fleet Vehicles has retained a team of 21 people and is centred on building high-performance work bikes.

Sun shines on rural firms’ reporting season

Hugh Stringleman NEWS Agribusiness

LISTED primary sector exporters and rural service companies are expected to report strong results over the next two months, with increased earnings from favourable trading conditions and good weather during the 2025 financial year.

As beef and sheep farmers and orchardists have enjoyed higher product prices, their co-operatives and processing companies have lifted gross margins and banked better profits.

The notable industry exceptions are the meat companies, burdened with overcapacity and falling livestock numbers, but there are no listed companies among them.

New Zealand has a small representation of listed companies in the primary sector, considering the sector’s importance to export earnings and regional economies.

Among the 15 companies listed on the NZX, seven have seen healthy share price increases over the past 12 months as commodity prices have bloomed.

These seven have boosted the

Continued from page 1

example of which can be found in China cancelling US beef export licences – and Stuart said it has created a complex but favourable picture for global red meat trade.

Redirected Brazilian beef exports are largely meeting Chinese demand as the South American country faces the prospect of an extra 50% US tariff, potentially taking the total US trade tax on its beef to an unviable 76%.

That leaves NZ and Australian beef exports backfilling demand in the US and elsewhere.

Significantly, Brazil does not have access to the key NZ beef markets of Japan and South Korea.

S&P/NZX Primary Sector Index by 21% in United States dollars and 27% in NZ dollars.

Forsyth Barr equities analyst

Matt Montgomerie said market sentiment around rural companies is positive right now and market analysts are upgrading their earnings forecasts, implying that good results will persist a while.

“Commodity prices are cyclical, but part of the upgrading story is good operational execution in companies like A2 Milk, Fonterra, Sanford,” he said.

Australian beef volumes will also tighten this year but adding to the complexity is the likelihood that next month it will exceed its dutyfree export quota access to China, or what is called a safeguard.

Once that is triggered, Australian beef exports face a 12% tariff.

Despite the high prices, Stuart said demand remains steady in the US.

“As shocking as it is, Americans are not done yet.”

There has been some consumer shift to chicken in response to the higher prices, with fast food restaurants launching new chicken products, but chicken meat prices are also increasing.

Compared to average 2016-19 prices, US retail beef prices are

Fonterra has led the way, its shareholders fund unit prices growing 70% to $6.60 because of good dividends and a market expectation of a capital return of $1 or more when the divestment of its consumer businesses is completed.

The farmer-only co-operative group supply shares have also risen, by a slightly more subdued 63% to $4.74.

Fonterra has already forecast a record $10/kg milk price and earnings of 65-75c a share, from

51% higher, chicken 33% higher and pork 31%, but Stuart said US consumers are still mostly eating beef.

Stuart said US cattle supplies will tighten further next year with beef prices expected to peak before moderating from 2027-28, before numbers increase again in 2029-30.

He said the current US demanddriven market will become supply driven, evident in soaring live cattle prices.

A 250kg prime animal is making NZ$14-$15/kg or NZ$3538/head, a 340kg beast $11.50/kg or $3910/ head while 680kg fed cattle, which are finished in feedlots, are making $8.28/kg or $5630/head.

which it could declare a full-year dividend of 50c, following 55c in FY24.

Milk may be flourishing but honey is not, evidenced by Comvita’s share price fall of 60% in the past year.

Yet another restructuring and an expected $20m loss will not make good reading when FY25 results are announced in late August.

Horticultural companies are flowering, reflected in the 66% share price increase for Seeka, 40% increase for Scales Corporation and 45% for T&G Global, boosted 60c of late by takeover talks.

Fishing has been good business also, with Sanford up 40% in share price, net profit doubled in the interim results in mid-May and a financial year that ends September 31.

PGG Wrightson will open the 2025 reporting season on August 12 with a guidance of $54m operating earnings already announced, up $10m on last year.

This should prompt a dividend considerably better than the 2.5c interim back in February and help settle down the majority shareholder Agria of Singapore, which caused governance disruption last year.

A2 Milk will follow on August 18 with a first full-year dividend in its 20-year history, widely expected to match the 8.5c a share interim paid in February.

Net profit should be over $200m and revenue around $1.7 billion, which the company achieved in FY20 before covid disrupted its channels to China.

Fellow A2 milk processor Synlait won’t report until late September, around the time of Fonterra, and it is expected to consolidate a return to profitability, perhaps modest, after paying out up to $10.48/kg to hold onto its milk suppliers.

Primary sector companies with more subdued expectations for results include Delegat, caught up in tariffs for its US market, reflected in 30% drop in share price over the past 10 months.

The much smaller Foley Wines reported increased case sales in the interim results but profit after tax was down 35% and its share price has languished 20% over the past year.

Skellerup always pleases investors with its solid repeat sales of dairy industry rubberware, and it declared record half-year results in February, and should be on track for 25c full-year dividend.

PROSPER: Simon Quilty expects global beef prices, which hit record levels in April, will continue to increase for the next two years.

HEALTHY: Among the 15 primary sector companies listed on the NZX, seven have seen healthy share price increases over the past 12 months as commodity prices have bloomed.

CONCERN: In only two weeks here, says

MD

he has been asked several times if his company will be following Bayer out of New Zealand.

Syngenta stays staunch in NZ

THE Australasian head of the world’s second largest agri-chem company has assured New Zealand farmers that his company intends to remain here, despite the departure of rival Bayer.

Syngenta’s Australia-New Zealand director, David van Ryswyk, told Farmers Weekly the closure of Bayer Crop Science’s New Zealand research and technical division was not good for farmers and growers.

“It is disappointing that farmers and growers are going to lose access to good world leading technology.”

Bayer’s decision followed ongoing frustration and challenges in trying to introduce new crop actives to the NZ market.

It is disappointing that farmers and growers are going to lose access to good world leading technology.

Van Ryswyk has just spent two weeks travelling through NZ and said he had been frequently asked if his company would be following suit. While assuring industry this is not the case, he said his company’s frustration at NZ’s regulatory environment was no less.

In a letter obtained by Farmers Weekly from Van Ryswyk to the Environmental Protection Authority, he confirmed NZ was no longer a “priority country” for the introduction of new Syngenta products.

The structural delays have prompted Syngenta to avoid NZ registrations for several treatment types, including those to address some common pests here including fall armyworm, grass grub, crow rot, fusarium and nematodes.

The need for new grass grub control has taken on a new urgency with the recent EPA

announcement that insecticide chlorpyrifos will be banned. The main alternative, diazinon, is also being removed from the market in 2028.

“We remain committed to NZ, but we do need to get these regulatory issues fixed,” Van Ryswyk said.

During his visit he met with government officials and felt there was finally good alignment between department heads to get results.

“And I believe this is the first time we have seen this. I have some comfort that people are now aware of these issues.”

He said he would like to see results by the end of this year.

“These could include fast tracking what we can (for approval). I am not talking about taking shortcuts, but if the active has been proven elsewhere then it should be moved along.”

He is concerned about products not on a priority list for entry to NZ, and what growers may end up missing out on altogether.

“One example is nematodes. I have spoken to people in the vegetable sector who have said they need products that work in that space. Also, a large seed company requires a nematode product for pastures.

“We are in the process of getting nematode registration in multiple markets in Australia. It should be the same here too.”

Biological controls are also an emerging market where companies including Syngenta are investing millions to develop as adjuncts or replacements for synthetic chemicals.

Meantime Syngenta intends to keep its four team members involved in R&D in NZ, negotiating through the regulatory challenges.

“It is a considerable investment, almost half our team are in the R&D space here.”

Earlier this month the EPA’s acting CEO, Sarah Watson, announced new goals for EPA staff to meet, including increasing the number of new active ingredients, aiming to complete nine assessments by June 30 next year.

She said the goals were in response to the Ministry for Regulation’s review last year.

Meat companies are working together: Guy

Neal Wallace NEWS Production

MEAT companies are collaborating to address issues such as excess processing capacity more than they have done historically, says Meat Industry Association chair Nathan Guy.

In his address to the Red Meat Sector conference, Guy said the necessary structural reform has to be driven by companies and their boards.

“The war stories of the last 40 years are best left to history.”

Beef + Lamb NZ (BLNZ) chair Kate Acland said meat companies need to be profitable but that could become a greater challenge with excess processing capacity and the loss of stock numbers.

“We have more plant and more processing lines than we have livestock to sustain them efficiently, and it risks getting worse,” Acland said.

She said greater collaboration is needed among meat companies to address sector issues.

“If we want a future-fit industry, we need to be bold about optimising capacity and about how we collaborate.”

Given buoyant meat prices, she said, the decline in stock numbers is a lost opportunity.

“Our exports would have been hundreds of millions higher if the supply had been there.”

Pending sector issues of surplus processing capacity and Alliance

Group’s recapitalisation were otherwise hardly mentioned as the conference instead focused on trade issues and the fallout from geopolitical tensions.

The conference marked the 40th anniversary of the formation of the Meat Industry Association and the launch of a joint BLNZMIA study that showed nontariff barriers cost the sector $1.5 billion a year.

These include sanitary and phytosanitary measures, which can be applied inconsistently and are neither scientific nor transparent.

An example was what the study called poorly designed and implemented deforestation supply chain regulations set by the European Union.

They require suppliers of products such as beef and leather

to prove they do not come from areas that had been deforested. Minister of Agriculture and Trade Todd McClay conceded attempts to reverse that policy have so far been unsuccessful, but said officials were still working on it.

He estimated $900 million of non-tariff barriers impacting primary sector exporters had been removed in the past 18 months.

McClay was also unequivocal about NZ not leaving the Paris Accord on Climate Change, saying to do so would disadvantage exporters and hand our competitors a huge advantage.

“We are going to be very sensible as a government, but we have to meet our international obligations and our customers and consumers demand it.”

CHALLENGE: Beef + Lamb NZ chair

Kate Acland says meat companies need to be profitable but that could become a greater challenge with excess processing capacity and the loss of stock numbers.

Bremworth spends $6m on ‘smarter’ Napier plant

Annette Scott NEWS Food and fibre

CARPET manufacturer Bremworth is set to expand production with a $6 million investment in its Napier production plant as it smartens operations to meet growing demand.

The reconfigured site will give Bremworth the ability to scale quickly in response to export growth, including new interest from the United States and Australian markets, Bremworth chief executive Craig Woolford said.

CAPACITY: Bremworth chief executive Craig Woolford says rebuilding smarter will allow the carpet manufacturer to ramp up yarn capacity as demand grows.

The expansion at the Napier plant comes more than two years after the site was heavily damaged by Cyclone Gabrielle, marking a key stage in its return to full domestic production of its woollen yarns and a boost to local employment.

The $6m investment in the Hawke’s Bay facility will reinstate key yarn making equipment in a move designed to ensure greater efficiency, product and quality control and significant lead time improvements, while avoiding excess capacity.

The plan is to operate three shifts 24 hours a day, every weekday, employing up to 40 new

staff to accommodate expected demand.

“As a result of the cyclone, most of our Hawke’s Bay facility was taken offline,” Woolford said.

“To maintain carpet production, we introduced a hybrid yarn supply model, which saw increased quantity of our yarns processed externally, including offshore.

“Rather than just reinstating everything, we’ve taken the opportunity to rebuild smarter, in the process allowing us to ramp up yarn capacity as demand grows.

“We’re bringing back the core pieces of equipment needed to give us flexibility and headroom while keeping costs down.”

The reinstated capacity will bring Bremworth back to full operational strength, with both mills able to meet current demands and support the company’s plans to scale for growing international demand.

The first stage of the current equipment reinstatement is expected to be operational by the end of August, with a second stage three months later.

Richard Rennie NEWS Agribusiness

David van Ryswyk Syngenta

COMMON

Syngenta

David van Ryswyk,

Sector well placed for staff in year ahead

Gerald Piddock NEWS Employment

WHILE job seekers in cities face some of the toughest conditions in years, employment levels in the primary sector are back to near normal after a chaotic few years dominated by severe worker shortages.

With calving underway across the North Island in the dairy industry, staffing levels have become more stable and the industry is in a much better position than it was during the peak of covid, DairyNZ people lead Jane Muir said.

As of late July there were around 280 roles being offered on FarmSource, ranging from farm assistant through to sharemilker.

“That’s well down on what it was – that’s four times less.”

The peak in 2021 saw widespread job shortages and huge numbers of roles advertised in the industry.

While the market has tightened, Muir said there is still a place for people with the right skills and attitude within the dairy industry

and who want to make it a career.

“There are always roles available, we’re a people-dependent industry and there’s always a level of turnover in any sector.”

Farmers and the sector have worked hard to make dairy jobs more appealing in terms of wages, housing, rostering and other conditions and one of the reasons there has been a fall in job numbers is higher levels of staff retention.

We’re holding onto our people better, we have better retention than we used to have.

Jane Muir DairyNZ

“We’re holding onto our people better, we have better retention than we used to have.

“The number of people who are staying in the sector and working on farm longer and the number of people who are staying in individual farming businesses – both of those trends are very positive for dairy.”

The higher retention rates also mean fewer opportunities for new entrants.

That being said, like any sector there will always be a degree of turnover, she said.

Muir questioned whether the tough job market has given people pause before considering changing jobs.

“I’m sure that’s not unique to dairy. If you have a good job it might be a tougher time to move not knowing where you would go next.”

In the contracting industry, RCNZ chief executive Andrew Olsen said they are still waiting to hear from the government about a possible multi-year multi-return visa being created for those who hire farm machinery drivers from the northern hemisphere.

For the new season, all indications are that there will be around 450-500 overseas workers arriving in the country in late September to work for around nine months, which is around the typical level of staffing for that industry.

Federated Farmers employment spokesperson Karl Dean said there have been very few people

contacting their organisation complaining about labour shortages, describing it as an “average” year.

This there will always be some farmers who have issues, but so far there have been no major issues, he said.

“But there will be a lot of visas that need to be renewed in the next six to 12 months.”

Farmers are still trying to run systems that are as lean as possible rather than take on new staff, even though commodity prices are high, he said.

Dean said he is surprised there is not more interest from city-based people for some of the jobs being advertised, given how tough the job market is.

This week’s poll

Do you think it has become easier to attract people to work in the food and fibre sector over the past year?

Have your say at

Foresters lick wounds in Tasman after storm events

MAJOR logistical and infrastructural headaches face foresters in Tasman as they grapple with damage and loss across the region’s forests after two major storm events in two weeks.

Forest Owners Association

CEO Elizabeth Heeg told Farmers Weekly the storms had caused damage across at least 4000 hectares of planted forests and

had not discriminated between large holdings and small, privately owned wood lots.

Heeg said the 4000ha of damaged forest was “substantive”. Based off the national exotic forest survey that reports 27,000ha of standing forest, it would amount to 15% of the region’s total forested area.

“The greatest level of damage appears to be around the Motueka River catchment area and is largely wind throw, where trees have blown over entirely or snapped off at their base.”

She noted much of the damage along ridge lines reflects the unusual northerly direction of the high-speed winds.

The loss of quality pruned timber stands is also going to have significant downstream impacts, with that timber intended for local processing mills.

“It is a real kick in the guts for local mills.

“We also have plenty of reports about the complete losses suffered by some smaller woodlot holdings. For some people these will

represent their retirement funds, wiped out.”

Contractors in the region are starting to assess the salvageability of the fallen timber.

Aerial surveys underway this week will hopefully deliver foresters a more granular picture of damage depth and help lay out a recovery plan.

“But back of envelope estimates are we could be looking at $50 million to $80m of damage, and that does not count the downstream impact of timber loss.”

Damage to Rocks Road, a major link through to the port, also needs attention to safely restore connectivity.

Forestry consultant Roger May said while wind-borne damage was dominant, there was also evidence of forest slash debris impacting some areas, particularly in gullied areas.

He likened the event to Cyclone Gita in February 2018, the most intense tropical cyclone to ever impact Tonga. It brought $26m worth of damage.

STAFFED UP: Staffing levels in the dairy industry have become a lot more stable after the extreme shortages during the covid years.

Richard Rennie NEWS Forestry

We asked our farmers:

How do you make it count?

At Ballance , we get to know you and your farm goals to create a tailored plan. Working together to make sure you get ever y thing you need, and nothing you don’ t .

Talk to your Nutrient Specialist today, and make this season count.

ballance .co.nz/make -it-count

0800 2 2 2 090

“ When you trust your gut , and the advice you get.”

“ Through regular soil testing to remove the guess work . ”

“By tailoring the best plan for my farm.”

David, Dair y Farmer

“By making good decisions early in the season.”

Louise, Sheep & Beef Farmer

Dan, Dair y Farmer

Cornel, Dair y Farmer

Banks not colluding on net-zero policies

THE

Commerce

Commission has investigated and found no evidence to support a complaint by Federated Farmers of collusive behaviour by major banks in what is called the NetZero Banking Alliance.

In a complaint made last December it was alleged that banks were engaging in potentially anti-competitive, coordinated and cartel-like behaviour.

Federated Farmers raised concerns that this alleged coordination could reduce farmers’ access to capital, resulting in higher borrowing costs and stricter lending terms.

Commerce Commission general manager of competition, fair trading and credit Vanessa Horne said the complaint was thoroughly investigated and the commission concluded that the banks had made their own, independent decisions.

“We found no evidence of unlawful coordination between the banks or with the Net-Zero Banking Alliance, either relating to the banks joining or in meeting their obligations under this alliance.”

The Commerce Commission will

therefore take no further action.

The banks concerned are ANZ, ASB, BNZ, Rabobank and Westpac.

Rural loan broker NZAB has not seen any evidence of lending to farmers being turned down on emissions data, director Andrew Laming said.

“Lending to dairying is growing right now, compared with three or four years ago,” he said.

If trading banks start to withdraw from farm lending because of sustainability concerns,

other finance pools will replace the business, he suggested.

Federated Farmers supports the intent of two Members’ Bills currently before Parliament, introduced by Andy Foster of NZ First and Mark Cameron of ACT, which aim to prevent financial institutions from making lending decisions based on ideology or reputational risk.

The MPs think banks could be prevented from walking away from customers that don’t

meet environmental, social and governance policies.

The Financial Markets (Conduct of Institutions) Amendment (Duty to Provide Financial Services) Amendment Bill passed its first reading in Parliament on May 21 and the finance and expenditure committee is now considering public submissions on the Bill.

Federated Farmers has also come out strongly against what is called the Sustainable Finance Taxonomy being developed by the Centre for Sustainable Finance and the Ministry for the Environment. It includes draft thresholds so low no working NZ farm could realistically qualify, even though they are among the most emissions-efficient food producers in the world, the federation’s finance spokesperson, Mark Hooper, said.

While the Net-Zero Banking Alliance has over 120 member banks worldwide it has this year lost some big players that have questioned the aim and effectiveness of its approach.

The major principle was to align bank assets and activities with the 2015 Paris Agreement to limit global warming to 1.5degC above pre-industrial levels.

Recently the NZBA voted in favour of a less onerous 2degC target and giant banks like HKBC are setting their own polices.

NZBA was set up in 2021 with the leadership of Mark Carney, then governor of the Bank of England and now Canadian prime minister.

The Commerce Commission said joining the Net-Zero Banking Alliance is voluntary, and any signatory may join or withdraw at any time.

Lending to dairying is growing right now, compared with three or four years ago.

Banks that choose to become signatories to this alliance make a public statement of an intention to align the greenhouse gas emissions from their lending and investment portfolios with netzero pathways by 2050 or earlier. The NZBA does not prescribe targets that signatories should set. Instead, it provides signatories with a framework for target setting, resources, global expertise, and tools to help them individually assess the emissions within their portfolios and understand ways that the shift of capital towards low-carbon activity might be accelerated.

Hugh Stringleman NEWS Emissions

EVIDENCE: Rural loan broker NZAB has not seen any evidence of lending to farmers being turned down on emissions data, says director Andrew Laming.

Photo: Pexels

Andrew Laming NZAB

Strong calf market comes with caveats

Gerald Piddock MARKETS Livestock

IT WAS a sea of black and white at the Frankton saleyards in a record yarding of feeder calves at its Tuesday sale.

There were 2400 mostly Friesian bull calves yarded along with a sizable number of dairy beef calves.

Among the bull calves, the top price achieved was $495 for a pen of Hereford-Friesian calves while the best of the Friesian bull calves made $350. The second cut made $240 and $100 for those at the bottom.

Other dairy-beef bull calves ranged from $290 to $485. Among the heifer calves, the best of the Hereford/Friesian calves sold for $320 while the rest made $260 and $170. Hereford-Jersey calves sold for $190, $170 and $115.

AgriHQ senior analyst Mel Croad said the early high prices are likely drawing more calves into these sales but equally demand in these early sales has been strong.

“If buyers have the opportunity to fill their requirements earlier than normal then prices may start

to come off these peaks especially if numbers on offer continue to outpace previous years.”

So far this season, calf numbers sold through the yards in Waikato/ Bay of Plenty total 8300, versus 5600 in 2023 and 6200 in 2024.

Everybody is rearing calves – everybody I have talked to, every farmer, they are rearing.

Phil Addison Matamata

The top price for Friesian bull calves 12 months ago at Frankton was $210, while the more average cattle made $150 and those at the bottom tier sold for $60, highlighting the big lift in prices.

“Despite the higher numbers, prices are still very strong for the good quality calves, signalling higher demand currently,” Croad said.

PGG Wrightson saleyard operations manager Neil Lyons said the market on the calves held up all the way through with only seven individual animals being sold for pet food.

There was a large group of buyers from Waikato, King Country, Taupō, Hawke’s Bay, Northland and Manawatū, consisting of both rearers and dairy farmers – many of whom were selling bull calves and buying dairy-beef calves to rear, Lyons said.

Matamata dairy farmer Phil Addison said is still expensive to rear calves with high milk powder prices and animal health costs.

This means he will have to make at least $700-$800/calf to make a profit on a purchase.

While he acknowledged that this is what weaner calves are currently selling for, he feared the influx of rearers this season could sink that price.

“Everybody is rearing calves –everybody I have talked to, every farmer, they are rearing.”

“What’s going to happen at the other end?” he asked.

He planned on buying some calves and raising them all the way through to be finished as two-year-olds.

NUMBERS: AgriHQ senior analyst Mel Croad said the early high prices are likely drawing more calves into sales but equally demand in these early sales has been strong.

This includes calves that in previous years would have been put on bobby trucks, he said.

While that is understandable given the prices, he questioned whether some had stepped back and looked at the longer term.

“In three months’ time you have to have food for all of these calves – that’s a lot of grass.

“The government has let too many farms go into trees – big farms that would have raised these.”

If farmers are going to rear these calves, they needed to have a contract, he said.

Another farmer pointed out that the surge in calves being sold for rearing means there will be thousands more animals that will need to be finished once they reach weaning weight.

Small-scale calf rearers Karen and Neil Wightman were there looking at some dairy-beef calves which they rear to contract for a finisher, focusing on buying quality rather than quantity.

“You are guaranteed there is a market, and hopefully the premium will hold onto them,” Karen said.

She feared those buying the calves at the cheaper end might not make a profit off them once the rearing costs are factored in.

Many of these are hidden, Neil added.

“You have bedding, you have the teats, you have disinfectant, drenches.”

When dairy and beef prices are high, both dairy farmers and beef finishers make good money – all of the corresponding costs that rise are generally those associated with rearing – feed, bedding and animal health, she said.

“The margins are still very tight for rearers.”

BULL CALVES: PGG Wrightson agent Rhys Mellow sells another pen of Friesian bull calves at the Frankton Saleyards.

Photos: Gerald Piddock

Tariff threat a major concern for winemaker

UNigel Stirling MARKETS Viticulture

NCERTAINTY over United States President Donald Trump’s upcoming tariff announcements is causing “major concern” for one of New Zealand’s largest wine exporters.

Trump has floated the idea of lifting the baseline tariff for all countries from 10% currently to 15-20% when he makes new tariff announcements on August 1. He said he has already settled on tariffs of 30-35% on imports from the European Union, Mexico and Canada, and 50% on Brazil.

Jim Delegat, the billionaire majority owner of NZX-listed Delegat Wines whose iconic Oyster Bay brand is one of the top two NZ wine brands in the US, said the winemaker recently reached agreement for its 26 distributors in the US to pass on the current 10% tariff to consumers.

While shipping transit times and distributors’ variable levels of pretariff inventories mean it is too

soon to gauge the reaction from consumers, Delegat said he isn’t expecting too big a hit to demand from the 10% price rise.

Depending on retailers’ profit margins, the retail price impact could be expected to be between US$1-$1.50, taking the average bottle price to US$16-$16.50 for the NZ brand, he said.

“We are very confident that we will continue to offer good value,” Delegat told Farmers Weekly.

If we were hit with a 30% tariff as he is threatening the EU with, it is unlikely we would be able to shift that volume of wine to other markets.

Jim Delegat

Delegat Wines

“NZ’s cool climate wine styles ... offer refreshing consuming [and] they are very much in favour and we still have a long way to go in terms of attracting more consumers in the US market.”

CONSUMERS: Jim Delegat says Delegat Wines recently reached an agreement for its 26 distributors in the US to pass on the current 10% tariff to consumers.

However, if tariffs rise to 15% or 30%, “we are going to have to reflect on that”, he said.

“For Oyster Bay it is 1.4 million cases of wine to the US and if we were hit with a 30% tariff as he is threatening the EU with, it is unlikely we would be able to shift that volume of wine to other markets. The uncertainty is a major concern to us.”

Delegat sees limited upside for NZ should EU wines be priced out of the market by Trump’s tariffs.

“Italy is 80% red as is Spain and we are 90% white,” he said.

Fallout for the US hospitality industry means there has to be considerable uncertainty over

whether the planned tariffs on European wines will go ahead, Delegat said. Thousands of Italian, Spanish, and French restaurants in the US rely on reasonably priced wine to survive.

“A 30% tariff on a US$50 bottle of wine in a New York restaurant would suddenly make it a US$80 bottle of wine with distributor mark-ups and everything that goes with it.

“The consumer would not look at that positively to the point that ... I think the Trump administration would be facing a lot of business closures and enormous employment disruption in those industries.”

Asked whether US winemakers would be capable of filling the gap if imports dried up, Delegat said he doubted they would be.

“I don’t think they can go out in central California and plant a whole lot of sauvignon blanc.

“[In terms of climate] and soil types they are quite different.”

As for the tariff imposed in April, shipping times of up to 60 days, added to the 90-120 days of inventories carried by most distributors, mean it will be August at the earliest before the impact on demand from passing the 10% tariff onto retail prices will begin to be felt, Delegat said.

No wriggle room for Canada in new NZ deal

TNigel Stirling MARKETS Dairy

HE settlement of a long-running dairy quota dispute contains provisions to prevent Canada from wriggling out of its commitments again.

Trade Minister Todd McClay announced the agreement after threatening retaliatory tariffs on Canadian goods entering New Zealand if Canada did not live up to its commitments made under the Comprehensive and Progressive TransPacific Partnership trade agreement in 2018.

We will be watching implementation closely.

The NZ government brought a case under the CPTPP dispute settlement provisions in 2022, alleging the Canadian government illegally allocated an import quota specifically created for NZ dairy products to local processors.

By refusing to release the quota to importers wanting to buy NZ products the processors ensured the percentage filled of the 16 quotas created for NZ dairy products was routinely in the single digits. Without access to the quota, buyers of NZ dairy products faced tariffs of up to 400%, effectively shutting NZ exporters out of the Canadian market.

In September 2023 a panel of judges ruled the obligations of Canada under the CPTPP had not been complied with.

McClay, who had threatened the Canadians with retaliatory tariffs last year unless they complied with the panel ruling, said the settlement announced earlier this month meant they now would.

He said the settlement was worth $157 million annually to NZ dairy exporters.

The Dairy Companies Association of NZ (DCANZ) welcomed the changes agreed to by the Canadians and congratulated the government on finally reaching a settlement.

Changes included earlier dates in the year for any unused quota to be handed back to the Canadian government for reallocation, along with penalties for holders of unused quota.

DCANZ said it would have preferred an “on demand” system of quota allocation but said the changes are an improvement on the status quo.

“The improved administrative provision that will result from this agreement will make the quotas commercially more usable and valuable for our exporters,” DCANZ executive director Kimberly Crewther said.

Canada has a reputation for agreeing to remedy illegal trade practices only to re-introduce them later substantially unchanged but under a different name.

Under pressure from Donald Trump during his first term as United States president, in 2018 Canada scrapped its Milk Class 7 payments system. Competitors in the US and NZ claimed the milk classification resulted in subsidised skim milk products

flooding global markets in contravention of a World Trade Organisation ban on export subsidies.

Milk Class 7 was replaced with Milk Class 4 (a) and subsidised Canadian nonfat dairy products have continued to flood onto global dairy markets, undermining returns for rival producers, the US, NZ and Australian industries claimed in a letter to their respective governments earlier this year.

However, Crewther said the agreement

SETTLEMENT: The Dairy Companies Association of NZ has welcomed the changes agreed to by the Canadians and congratulated the government on finally reaching a settlement.

with the Canadians over its administration of NZ’s dairy import quotas under CPTPP included provisions to prevent similar backsliding.

“We will be watching implementation closely,” she said.

“Significantly, if those changes don’t work, there is also provision that quota allocation could move to our first preference of an ondemand system.”

The agreement enters into force on January 1, 2026.

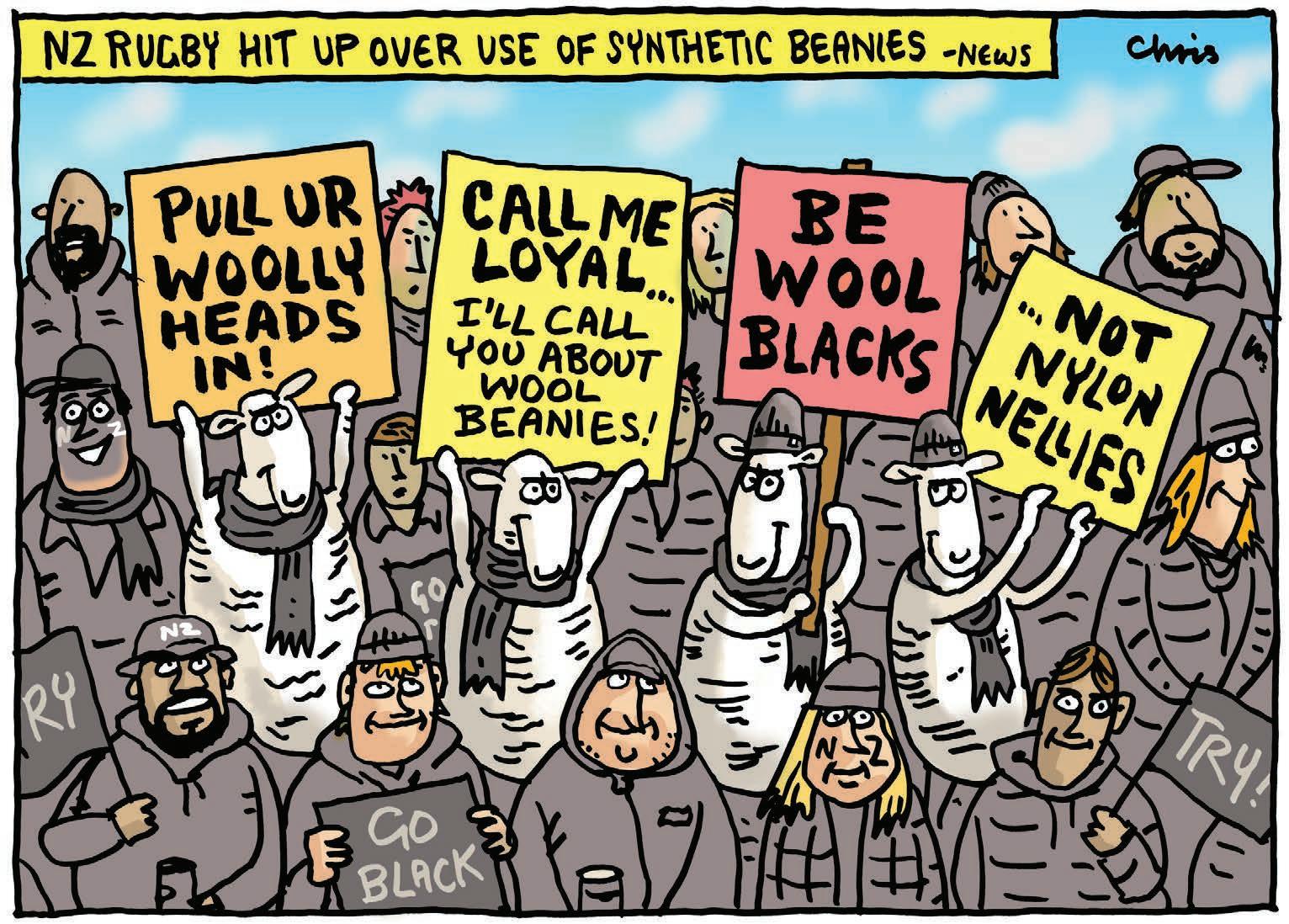

Push for NZ woollen beanies opens talks

Gerald Piddock NEWS Food and fibre

NEW Zealand Rugby has asked to speak with Norsewear owner Tim Deane after he posted a cheeky open letter on social media to the country’s rugby governing body, questioning why All Black supporters are wearing synthetic beanies rather than wool.

The letter, which Deane wrote and shared on Instagram, Facebook and LinkedIn, said:

“It was obviously good humoured, but there was a serious message behind it,” he said.

He also posted it on his own LinkedIn page, where it received 50,000 impressions in less than 24 hours.

“It obviously struck a chord. I had no idea it would go off like this.”

While he knows they will never be putting socks on the All Blacks, he was pleased NZR was prepared to discuss other options.

If it raises the consciousness of people to purchase New Zealand wool products over synthetic, then that would be a win for the industry, he said.

“We want the All Blacks, your board your executive and your supporters to feel the warmth and quality of New Zealand wool. We want those heads full of brains, living and breathing strategy and tactics, to be cosy at all times.”

NZR has since got in touch with Deane to see if they can have a meeting.

“They were very good natured about it, they said they did smile, and they would love to have a chat to see if there is something we can do with them,” he said.

Deane said it all stared when an All Blacks fan came into possession of a beanie at the second test match against France only to discover that it was 100% synthetic and made offshore.

“They posted something asking why aren’t the AB’s supporting wool?”

It was forwarded to Deane, who decided to write the letter and post it on his company’s social media pages.

HEAD IN THE GAME: Norsewear owner Tim Deane is pleased New Zealand Rugby is prepared to discuss woollen beanie options.

The bigger message from this was the downstream effect it could have on the wool industry: “If New Zealanders choose to go with our beanie instead of an imported synthetic one, then we can buy more wool from New Zealand farmers because we buy wool directly from farmers through our wool integrity programme in partnership with PGG Wrightson.

“We get that wool spun, it comes back as yarn and we make it here, so if more people buy our stuff, then we’ll buy more wool and we can pay the farmers a little bit more, we can employ more people at Norsewood and that’s good – and we have a better product out there for consumers.”

NZR did not respond to a request for comment.

Kimberly Crewther Dairy Companies Association of NZ

Farming deer, sheep, beef – and data

DNeal Wallace ON FARM Sheep and beef

AVID and Jackie Stodart relish a challenge.

In the early days a prominent Southland stock agent, the late Trevor Wilson, provided them with guidance and challenged their thinking about how they managed their farm.

Later their son Shaun, who was working as a Silver Fern Farms livestock agent at the time, asked them to rethink the way they sold their prime stock, suggesting they use contracts.

Changes they have made from being challenged have shaped how they farm Crown Lea on the edge of Fiordland National Park, and have reinforced their own values as stewards of the land.

The Stodarts run sheep, beef and deer on the 750 hectare (650ha effective) property near Manapouri in Northern Southland, a flat to rolling property in the Te Anau Basin.

It lies between the lee of the craggy Takatimu mountains to the east, with Lake Manapouri and Fiordland National Park further to the west.

Keen fishers and hunters, the Stodarts know they live in a very special part of New Zealand, but

one that can be challenging to farm.

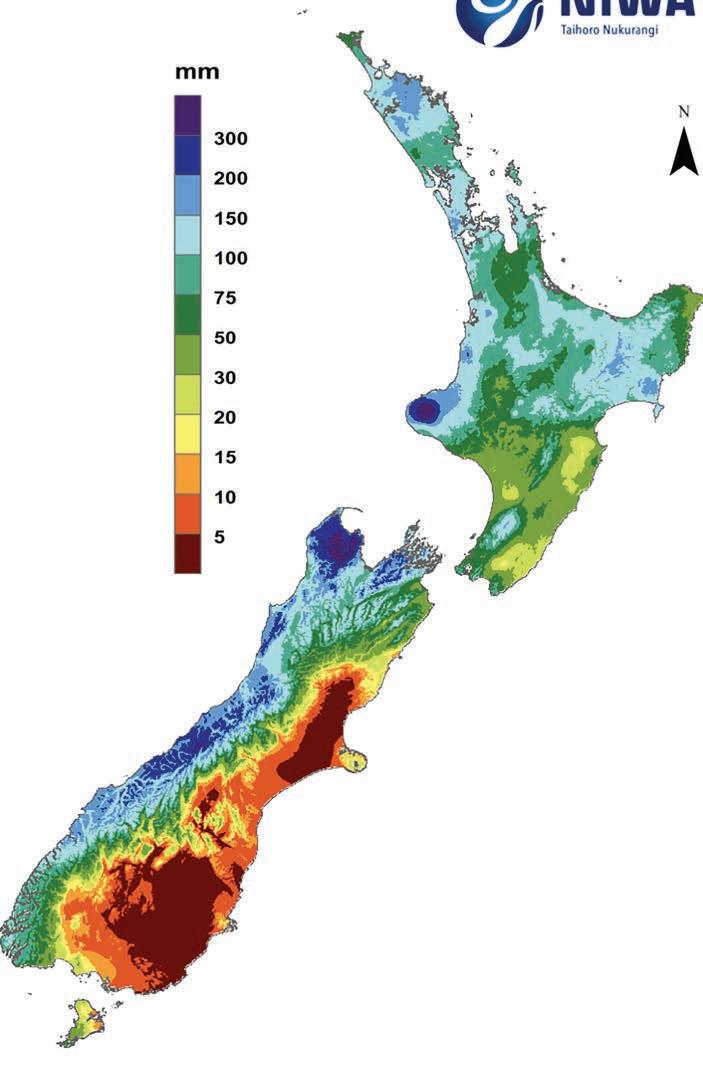

The average annual rainfall is more than 1.2 metres and hot and dry summers can mean short growing seasons.

They are fortunate to be on heavy soils and most years finish all their stock as prime.

David and Jackie said their careers have benefited from having someone from outside the business looking in.

We’re old school but we knew change had to come.

Jackie Stodart Te Anau

David recalls how Wilson, who was a trustee of his late father’s estate, would visit their farm asking questions and offering advice on how they could improve their performance.

“He was a forward thinker with extensive knowledge who challenged us,” said David.

Later son Shaun took over some of that role, introducing them to farm data, technology and supply contracts.

“He’s taught us a lot,” said Jackie.

“We’re old school but we knew change had to come.”

They may consider themselves old school, but they are always seeking knowledge from reading and attending conferences.

“We’re still learning. Everyday we’re learning something,” said Jackie.

“When you get off the farm and see what other good farmers are doing, it opens your eyes,” said David.

They were reassured how common having outside input was, seeing it in the Silver Fern Farms Plate to Pasture award finalists.

The Stodarts won the award in

2024 and were judges this year.

David was raised on a 977ha farm at Avondale in Central Southland and Jackie is the daughter of a coal mining family from Ohai in western Southland.

On leaving school David returned to the family farm. When

PLATE TO PASTURE: Te Anau sheep and beef farmers and winners of the 2024 Silver Fern Farms Plate to Pasture award David and Jackie Stodart and son Shaun.

On Farm Story

At a glance

Crown Lea, Manapouri, Northern Southland.

Run by David and Jackie Stodart, son Shaun and partner Grace. 750ha.

686 hinds, 220 velveting stags. 2800 ewes, 750 hoggets. 120 beef cattle and 100 dairy grazers.

he was 21 his father died, and David and his elder brother Allan ran the farm until they were joined by younger sibling Brian.

In 1989 the trio formed a partnership. The same year David and Jackie were married.

The couple have three children, who are all farming: Hayley Isteed is dairy farming in west Otago with her husband Glen, and Aimee and Graham Levett manage a dairy runoff in Southland.

Shaun is on the home farm with his partner Grace, a nurse who works at Southland Hospital and the Te Anau Medical Centre.

David and Jackie have four grandchildren, Monty, Walker, Harriet and Finley.

In 2006 David and Jackie went farming on their own, buying a 215ha block adjacent to the Avondale farm and leasing another 80ha off the home property.

They ran sheep and red deer. They have always enjoyed working with deer, which are still a key contributor to their business.

Later they extended their deer business, buying 155ha at Mossburn, which became a breeding unit with stock finished on their home farm.

“That required a lot of travelling,” said David.

In 2012 they sold the central Southland farm and bought Crown Lea, then a 364ha farm at Manapouri.

Soon after they sold Mossburn and bought two farms adjacent to Crown Lea, Mararoa and Titiroa, creating the current 750ha property.

They run 7500 stock units made up of 686 hinds, 220 velveting stags, 2800 ewes, 750 hoggets, 120 beef cattle and 100 dairy grazers.

Most seasons all stock are finished as prime, but for the past two years they have been hampered by a dry autumn and last year an exceptionally wet spring, which meant 400 lambs had to be sold as store to ease the pressure.

“We have a short fattening season,” said David.

“We’ve got to be on our game to keep moving.”

That is where Shaun’s interest in data comes into play.

Stock are regularly weighed to ensure they are on target to meet contracts and qualify for premium payments.

“It’s taken some getting used to,” said Jackie.

But it means they know the exact condition of their stock and when they will be ready for slaughter, and it also puts them in a position to supply animals on short notice if required by their processor.

It also allows them to manage feed, helps with cashflow and also means they work closely with their SFF livestock representative, Barry Brown.

This fine-tuned tracking and genetics have seen the average kill date for their venison stags, which are contracted for the spring to Christmas period, come significantly forward.

“We enjoy seeing the weight gains and animal performance and it gives us confidence in what we’re doing,” said Jackie.

David enjoys the benefit of monitoring stock weight, but concedes that he struggles with the hands-on information technology, which is the domain of Jackie and Shaun.

“I can see the advantages of it,” he said.

“It’s a no-brainer with the likes of Gallagher and Resolution having the information on the phone when needed.”

Last year they killed 460 deer

with yearling red stags averaging 56.4kg carcase weight and hinds 55.4kg. The two-year-old velvet stags cut 3.5kg and mixed aged 6.3kg of primary growth velvet and a further 3.5kg of regrowth.

Their target weight for lambs is 18kg. Last season the 2305 lambs sold averaged 17.9kg in addition to the 400 sold as store. Like prime stock, any sold as store are done so through SFF channels.

They also killed 44 18-month steers at 302kg and 26 18-month heifers at 263kg.

The Stodarts target SFF’s 100% Angus Prime contract and last season achieved their goal of half their offering qualifying for the programme.

When you get off the farm and see what other good farmers are doing, it opens your eyes.

David Stodart Te Anau

They remain committed to wool, saying that last year income matched costs for the first time in two years.

Their passion for farming and for their land still burns bright but their values, as stewards of the land, continue to broaden and evolve.

Those values were written on the wall of their workshop several years ago and are still relevant:

“To passionately develop and improve our land and livestock to secure our family’s future.”

And: “Our business will have a strong balance sheet with two developed farms in the Te Anau basin that will provide enough income for our chosen lifestyle.”

Those values govern the way they manage Crown Lea and their business but David and Jackie said equally as important is that their values align with SFF’s.

“Our farm values align with SFF’s values around stock and the environment, which creates a great partnership,” said Jackie.

Most cultivation is done by direct drill. They regularly aerate the soil and are embarking on several riparian planting programmes.

They have fenced off 28ha of peat bog to conserve it, with more to follow.

They are also planning to build a wintering feed pad for cattle to reduce their impact on paddocks.

Water testing on their farm returned good results.

They were surprised at how much marine life was in farm creeks and rivers following a study.

This environmental interest has encouraged Jackie and she intends joining the Waiau Landcare Group

“If you don’t look after the land, it won’t look after you,” she said.

As judges of this year’s the Plate to Pasture Awards, the Stodarts were impressed at the extent of environmental initiatives underway by farmers throughout the country.

Another influence came from a 17-day tour of key meat markets, a prize for winning the 2024 award.

It took them to Dubai, the United Kingdom and Europe and showed them how NZ red meat is

handled, marketed and displayed.

Previously they questioned why country-of-origin signage was not displayed at counters, but learnt supermarkets charge for this and limit such displays to a day.

The also gained insight into buying patterns.

“We learnt that people do not buy big portions of meat and that they go to the supermarket every day.”

It confirmed how marketable the NZ story is.

“We have got to keep telling that story, what we do on farm, how we are managing animal health, everything we’re doing from the day a lamb is born until it’s processed.”

They saw how discerning customers are.

“We watched people at the counter turn a tray of meat over and read the label.

“They would put it down, walk away then come back again and pick it up and put it in their basket.”

Visiting markets has changed their perspective.

“It’s made us more aware that what we do is relevant from the time you put the ram, bull or stags out.”

David and Jackie are working through their succession plan, something they started decades ago at the suggestion of Wilson.

Jackie said they are grateful that they started planning early as it can be complex.

“You have got to start early on it,” said Jackie.

But, as with managing their farm, they are willing to learn.

STOCK: Finishing cattle on the Stodart’s Te Anau family farm. The Stodarts run 7500 stock units made up of 686 hinds, 220 velveting stags, 2800 ewes, 750 hoggets, 120 beef cattle and 100 dairy grazers.

PROTECTED: Wetland areas on Crown Lea are being fenced off and protected by the Stodart family.

CONTRIBUTOR: Deer buried in a crop of chou moellier on Crown Lea. The Stodarts have always enjoyed working with deer, which are still a key contributor to their business.

EXPANSION: Crown Lea farm near Te Anau. The Stodarts bought it in 2012, adding two neighbouring farms soon after.

Māori kiwifruit shipment a first for UAE

Richard Rennie MARKETS Horticulture

ACONSIGNMENT of kiwifruit about to land in United Arab Emirates marks another step in joint Zespri-Māori kiwifruit marketing efforts in new or emerging markets.

Anaru Timutimu, the chair of Māori Kiwifruit Growers Incorporated (MKGI), said the export of 10 containers of fruit marks the second initiative in collaborative marketing between iwi and Zespri, coming after the group kicked off with a project exporting to Hawaii two years ago.

The Hawaiian effort drew strongly on the shared cultural heritage of Hawaiians and Māori, incorporating the Amokura bird, a navigation symbol, into the marketing campaign there.

As for the UAE, “we have the 10 containers on the water and have worked with Mr Apple, which has about 70 containers going up there. We started talks with UAE a year ago, so it’s moved along pretty quickly,” said Timutimu.

Having recently returned from UAE, Timutimu said he was struck at how multicultural UAE was, and the size of the expat community there.

Expatriates make up over 80% of the nation’s population, which has soared to over 10 million, doubling in less than 15 years.

Construction, trade, healthcare and hospitality are the main expat employment groups, with the largest portion coming from India.

“Provenance and the story of where the products come from seems to be strong, and we intend

BRANDED: Chair of Māori Kiwifruit Growers Incorporated

Anaru Timutimu says the latest collaborative kiwifruit marketing effort to the UAE aims to tap into a high level of appreciation of native culture and connection.

to incorporate more of this into our campaign there this year.”

A Zespri spokesperson said the UAE programme supports a country-of-origin retail promotion for Zespri and Mr Apple, led by Māori Kiwifruit Growers Incorporated with a focus on connecting local customers to Te Ao Māori in a region where Māori culture resonates strongly.

“Zespri is supporting 24 collaborative marketing programmes currently, collaborating with 14 other companies to export NZgrown kiwifruit in the Zespri brand to markets around the world.”

The programme with MKGI is designed to help increase demand for fruit and is an effort to support Maori grower aspirations, building more successful, resilient and connected industry.

In 2025 about 5.7 million trays or 2.66% of the total crop volume will be sold through such collaborative marketing partnerships.

Are we still underfeeding peak milk potential?

In my view

Chris Balemi Balemi is founder and managing director of Agvance Nutrition

TODAY’S cows are bred to perform, with milk production per cow having steadily increased across New Zealand herds, thanks to better genetics and herd management. But as potential grows, so does the challenge to keep pace by improving our feeding strategies.

Many cows are expected to hit peak milk while still playing catch-up nutritionally.

Despite how much we know about the importance of meeting the requirements of early lactation, the gap between what the cow needs and what she’s getting in many cases is still undermining her performance.

Cows hit peak milk around four to six weeks post-calving, while dry matter intake doesn’t peak until around weeks 10-12.

That gap often puts the cow into a negative energy balance at a critical time just prior to mating.

Cows are producing more, but often doing so on systems designed for lower outputs. In our pasture-based herds, this disconnect isn’t always obvious, but it can quietly drag performance down.

If peak production is lower than expected or cows are dropping condition quickly, there’s a good chance nutrition is playing a part.

When energy and nutrients fall short, cows mobilise body fat to make up the difference. In small amounts, that’s normal. But when the deficit is too great, subclinical ketosis can be an issue.

A 2014 NZ study found herdlevel subclinical ketosis of 14.3%, between seven and 12 days post-calving (this was occurring on 60% of farms). That same study noted poorer reproductive performance later in the season due to these early metabolic issues.

Subclinical ketosis doesn’t always show up in the vat, but it reduces appetite, affects milk let-down, and sets cows back for weeks. The long-term impacts on reproduction, condition, and next lactation are hard to reverse once they’re in motion.

If a cow peaks at 22L instead of 25L, you might not notice it in the shed. But over a season, that shortfall can mean 18-25kg less milk solids per cow. Multiply that across a herd, and the numbers grow quickly. In pasture systems, where there’s less dietary control than in TMR systems, those lost litres can be hard to trace back to a cause.

There’s a clear line between feeding for maintenance and feeding for output, and early lactation is where that difference matters most. This is when the cow is under the most pressure as she recovers from calving, rebuilds her appetite, and produces more milk by the day.

Feeding to potential means supplying enough energy, protein, fermentable carbohydrates, and bioavailable minerals to support both milk production and metabolic recovery. It also means timing those inputs to meet the cow’s needs, not just relying on pasture quality to fill the gap.

TMR trials and pasture-based studies show gains in milk yield, better metabolic health, and steadier body condition when cows are fed to meet demand. It’s not about volume alone, but about feeding quality feeds that the cow can use efficiently.

Key performance data to monitor includes body condition loss post-calving, milk production curves, blood ketone levels (BHBA) and milk urea levels.

If cows are losing condition too fast or production isn’t tracking as expected, check the nutrition they’re getting. Regular monitoring allows for earlier tweaks and earlier gains. Getting early lactation right can lift the whole season. While the signs aren’t always obvious, the benefits of hitting that peak show up everywhere, from milk production to reproduction and beyond.

CATCH-UP: Many cows are expected to hit peak milk while still playing catch-up nutritionally, says Chris Balemi.

VOLUNTARY SUBSCRIPTION

1. We’ll keep Farmers Weekly posted to you and every farmer, every week.

2. You’ll continue to get your comprehensive bundle of information; News, opinion, on farm stories, sector coverage, market insights, real estate, marketplace, livestock and weather.

3. The Farmers Weekly team is first class. They’re upcoming and veteran journalists with invaluable experience and institutional knowledge. Let’s work together to keep that capability.

4. We’ll continue to support the farming community in every way we can.

5. The paper and website combine to give you all the farming industry news that matters.

6. You, and every farmer, are kept right up to date with Federated Farmers and other sector advocate activities.

7. Farmers Weekly informs with curated, thoughtful news that is chosen to be insightful, not to enrage. You don’t get clickbait.

8. Our journalists hold your political and industry leaders to account.

9. The jokes are mostly funny.

10. Digital might be cheaper, but for most of us, the newspaper is still perfect with smoko.

11. Most of the team here at Farmers Weekly are farming or off farms. We care as much as you do.

See below for payment options. Thank you!

Your 100% voluntary subscription helps ensure rural New Zealand stays informed, connected, and never left out of the conversation.

farmersweekly.co.nz/donate | 0800 85 25 80 | voluntarysub@farmersweekly.co.nz

Start your voluntary annual subscription today. $120 for 12 months. This is a voluntary subscription for you, a rural letterbox-holder already receiving Farmers Weekly every week, free, and for those who read us online.

Choose from the following three options:

Scan the QR code or go to www.farmersweekly.co.nz/donate

Email your name, postal address and phone number to: voluntarysub@farmersweekly.co.nz and we’ll send you an invoice.

Call us on 0800 85 25 80

Note: A GST receipt will be provided for all voluntary subscriptions.

From the Editor

Tough stance on trade pays off

ANigel Stirling Senior reporter

RE tariffs always wrong? Can they sometimes be the circuitbreaker needed to get countries to the negotiating table and seriously consider opening up their markets to more competition?

Last week was a case in point.

Canada finally agreed it should give New Zealand exporters a fairer crack at its highly protected domestic dairy market as it committed to do when it signed the Comprehensive and Progressive TransPacific Partnership (CPTPP) trade agreement back in 2018.

That access is estimated to be worth $157m annually to NZ exporters.

And what did it take to get the breakthrough? More diplomatic niceties? No. Yet more photo opportunities with the two countries’ prime ministers, complete with carefully worded but ultimately empty statements about “shared values” perhaps? Again, no.

It took a successful lawsuit, and when

LAST WEEK’S POLL RESULT

that was ignored, pulling out the big bazooka of retaliatory tariffs and aiming it at nearly a billion dollars of Canadian imports entering NZ.

As one Beehive insider put it: “You have got to stand up for yourself, right? Because if you don’t, others will do what they want and we continue to face threats and challenges over access all over the world all of the time.”

The same high-level source told Farmers Weekly that NZ’s muscular approach to the dispute has been noticed.

“Since we have done that there are a few countries that we have smaller issues with that have settled as a result.”

The tough stance with the Canadians, kicked off by Labour Trade Minister Damien O’Connor, and followed up by his National Party successor, Todd McClay, may yet have an even larger payoff.

Confidence in the World Trade Organisation to effectively carry out its dual roles of liberalising global trade rules and adjudicating disputes between its 166 members is ebbing away and countries are looking for alternatives.

One insider said Canada’s decision to play by the rules may give the long line of countries interested in joining the CPTPP the confidence they need to finally make good on their intentions and apply for membership of the 12-country free trade bloc.

Countries circling the agreement but

More than 75% of voters thought central government did not contribute enough to rural communities after severe weather events. Many put it down to a general neglect of rural communities.

“I think central government needs to consider the serious repercussions of neglecting our rural/farming communities,” one said.

“They (the government) are happy to see our farming communities up sticks and come to town, selling up for a pittance to corporate farms. We need to support our rural communities, which are the lifeblood of our economy and nation. I’m a townie but even I can see ‘no farmers, no food’.”

Another thought the government had an image problem in terms of its spending priorities.

“I live in Hawke’s Bay and see daily the shocking repercussions and ongoing struggles of farmers hit by Cyclone Gabrielle. Maybe they could forgo their junkets overseas, their new bar in the Beehive, and the hideous pensions paid to ex-prime ministers and caucus members. Just a thought.”

so far reluctant to commit include South Korea, Indonesia, and Ukraine. China and Taiwan have applications pending.

“Because its dispute settlement has been able to resolve a dispute it tells those countries that the CPTPP has got teeth and it works,” the insider said.

This may give the long line of countries interested in joining the CPTPP the confidence to finally make good on their intentions.

It is possible that such a jolt to the CPTPP’s stocks may even have been a factor in Canada’s decision to finally roll over in the dairy quota dispute with NZ.

Here’s something to ponder as the world loses its head daily over the latest tariff headlines: could it be that the threat of a tariff is what is needed to get the other side to remove a tariff? Or a non-tariff barrier for that matter?

If NZ hadn’t been ready to take up its legal right to hit back at Canada with retaliatory tariffs, how long might dairy exporters have had to wait to take advantage of the low-tariff quotas they thought had been agreed with its government almost a decade ago?

Last week’s question: Do you think central government contributes enough to help rural communities recover from extreme weather events?

Letters of the week Making a mockery of Molesworth

Bernard Lilburn

Feilding

THE Molesworth is an iconic property owned by ALL New Zealanders.

To read in Farmers Weekly that the manager has resigned “without notice” is indeed concerning. And why?

The loyal 24-year stewardship of Jim and Tracey Ward and their staff has been exemplary in preserving, protecting and improving this extensive property in a challenging environment.

I hope this hasn’t been caused by officebound bureaucrats and politicians who haven’t even been to Molesworth.

If we are to believe what we are reading and hearing, that Pāmu and DoC have decided to plant Molesworth in the green insidious weed that is pine trees is an absolute mockery. These weeds could be considered a second mortgage, but are pine trees the best option to be considering for New Zealand’s most iconic farm?

I’ll wager that if it is planted in trees, Pāmu and DoC will close the station to public access – as it will become a fire risk. That would be the greatest travesty.

Save Molesworth wilderness

Alan Simmons

Outdoors and Freedom Party

THE idea dreamed up in the bowels of the Department of Conservation that Molesworth Station could be turned into a giant pine monoculture is crazy. It’s even more crazy coming from DoC, which has failed to control wilding pines on public lands it is entrusted by parliamentary law to manage.

The Branch, Leatham and Waihopai catchments just through mountain saddles from Molesworth Station are similarly beset with the spread of wilding pines – not surprising because the westerly winds blow seed over into Molesworth.

It should not be forgotten that Molesworth is an iconic environment owned by the New Zealand public and valued for its vast wilderness landscape.

DoC is also responsible for safeguarding the environment and should not be advocating more pine trees because of their detrimental environmental effect.

Molesworth needs to remain a vast wilderness for future generations to enjoy. Past experience with forests once owned by New Zealanders is that they end up overseas owned and the public end up locked out.

This week’s poll question (see page 5):

Do you think it has become easier to attract people to work in the food and fibre sector over the past year?

Lessons from Elephant Eaters: Patrick Aldwell

In this series, the regular Eating the Elephant contributors ask big questions of food & fibre New Zealanders with a history of taking on big challenges.

DR PATRICK Aldwell has quietly shaped generations of food and fibre sector thinkers. Before retiring recently as academic director of the Kellogg Rural Leadership Programme, Aldwell devoted 25 years to building the leadership potential of more than 600 of that programme’s 1100-plus alumni.

While his CV is impressive –including 20 years at the Forest Research Institute, working on land use issues internationally on projects for the United Nations and World Bank and service as dean of the Faculty of Commerce at Lincoln University until 2012 – it is his genuine empathy for people that sets him apart.

For many emerging leaders across our sector, his patient guidance, encouragement and strategic guidance have been life-changing.

Why did you choose a life in food and fibre?

It’s a long story, but initially, the reason was easy. Like many boomer Kiwis, especially those of us from the regions, Tolaga Bay and Gisborne in my case, I spent much of my early life on friends’ sheep and beef farms.

After completing school, among

other jobs, I worked on farms and went to Lincoln to do a Dip Agr. During that time, I had a serious car crash and was told I needed to find something else to do. That took some time to sort out, as I had my heart set on having my own sheep and beef station.

However, while at Lincoln I caught the learning bug. With that bug, compounded by the effects of the car accident, I went back to university and then to the Forest Research Institute.

Think critically about the information you receive and work with, by checking sources are relevant, reliable and reputable.

Then, for about 20 years, I did research on large-scale land use change, technological change and studied and worked internationally.

Finally, I returned to Lincoln as the dean of the Faculty of Commerce, and in various roles worked with the Kellogg Rural Leadership programme until I retired (with difficulty).

What are you most proud of and why?

My experiences in teaching and learning create the greatest pride. Based on feedback, I believe I have made a positive difference to the lives and livelihoods of many people in the wider food and fibre sector.

What is something unusual about yourself that you love?

As a creature of habit, I am an avid coffee drinker at my local cafés and, in my 70s, I’m a regular gym user. Through these two activities I have made new friends in most age groups, kept in touch with Lincoln, and developed new networks – something that many older men (in particular) are not good at.

What is the best investment that you’ve ever made (time, money, energy, product, etcetera).

The best investment I think you can make is in learning how to learn, and the consequent actions you choose to implement. With the right motivation, through this process you can create and develop new opportunities, which may or may not include the help of others.

What two books changed your life and why?

Tim Marshall’s book Prisoners of Geography is about developments in geopolitics, tariffs and how control of shipping lanes determines freedom on the high seas. This is especially important for New Zealand, with its dependence on exports of timesensitive food and fibre products. Joseph Schumpeter’s Capitalism, Socialism and Democracy is an oldie but a goodie and influenced how I see technological change. His ideas about “gales of creative destruction” can be applied to

examples such as the internet’s impact on communication and access to knowledge, shipping containers on multimodal freight, and the effects of artificial intelligence on work, industrial processes and agribusiness.

What advice would you give to a young person today?

Be insightfully aware by using trusted and different sources to keep informed of relevant world events and their local implications. Consider why these events are happening, their implications for your family, your business and you. Think critically about the information you receive and work with, by checking sources are relevant, reliable and reputable.

What is the biggest thing that makes you optimistic for the future?

The networked talent of younger generations, particularly their problem-solving ability and the technologies available to them, point to successful futures. My time working with so many younger people in the food and

fibre sector gives me great hope in the future.

What is the biggest thing that makes you pessimistic for the future?

Global geopolitical, economic and climate uncertainty and instability. These three forces have been around for generations, especially in the food and fibre sector. How well future generations deal with these, and how long particular events last, will depend on how well informed they are, their ability to respond in a timely way, and in the quality of the networks they have to support each other.

What will the food and fibre sector of 2040 look like?