7 minute read

Exness Raw Spread vs Zero Account

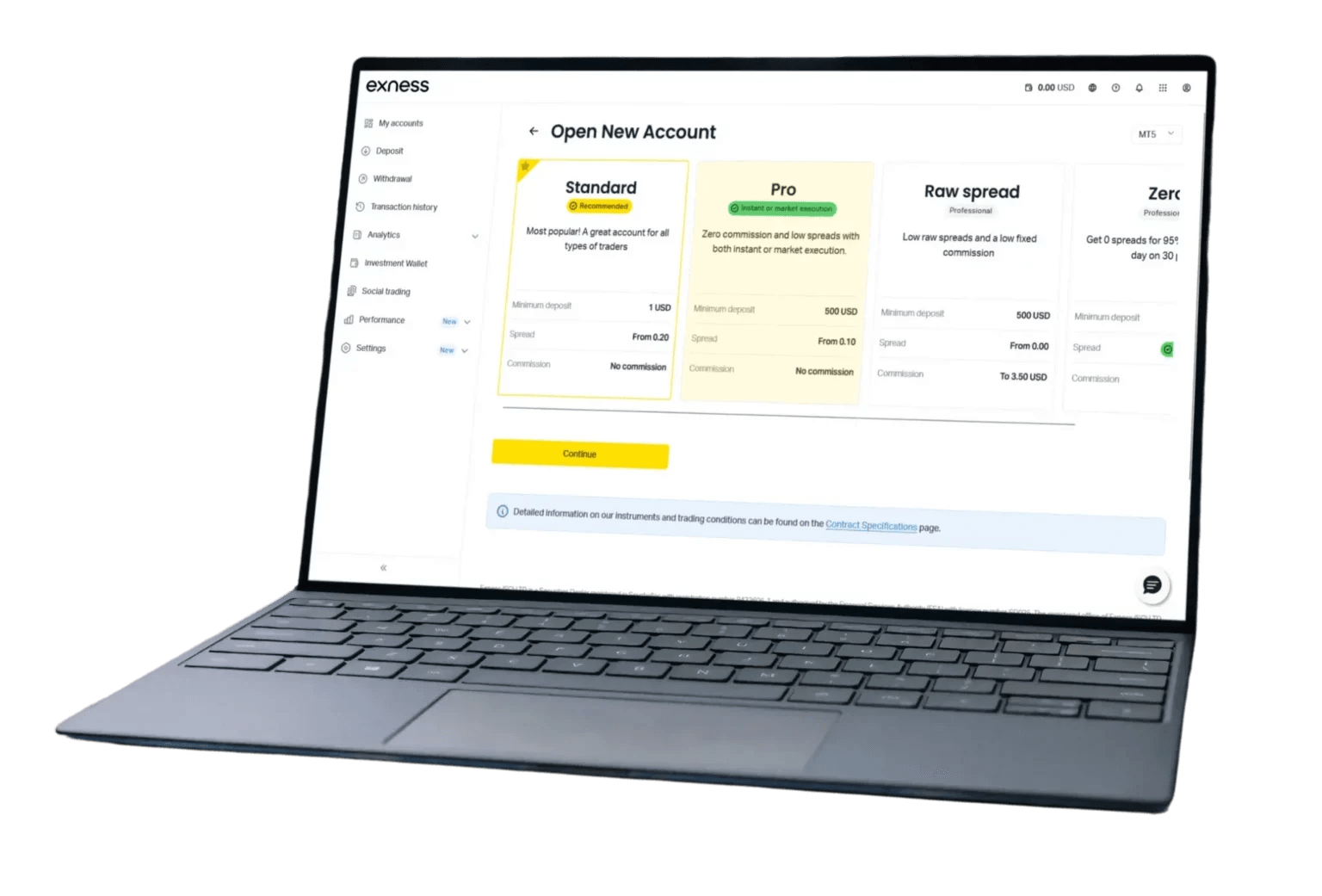

When choosing the right account type for trading on Exness, understanding the differences between the Exness Raw Spread Account and the Exness Zero Spread Account is crucial. Both accounts are designed to provide traders with low-cost trading conditions, but they differ in terms of spreads, commission fees, and other features. The Raw Spread Account offers near-zero spreads but comes with a fixed commission fee, making it suitable for high-frequency traders and scalpers. On the other hand, the Zero Spread Account provides zero spreads on major forex pairs but charges a commission on each trade. In this article, we will compare these two account types to help you decide which one aligns best with your trading style and cost preferences.

Exness Raw Spread Account

The Exness Raw Spread Account is ideal for traders looking for near zero spreads on major currency pairs, starting from 0.0 pips. This account type is specifically designed for traders who rely on scalping or high-frequency trading, where minimizing spreads is crucial for executing profitable trades. The key feature of this account is that traders pay a fixed commission per trade, which ensures transparency in trading costs.

Key Features of the Exness Raw Spread Account

Near Zero Spreads: Spreads start from as low as 0.0 pips on major pairs, which is excellent for high-frequency traders.

Fixed Commission: Traders pay a fixed commission for each trade, allowing for predictable trading costs.

Market Execution: Market execution ensures that trades are processed instantly, with no slippage.

Variety of Trading Instruments: Access to forex trading, commodities, and indices.

Minimum Deposit Requirement: The minimum deposit for this account is generally higher compared to other types.

Advantages of the Exness Raw Spread Account

Lower Costs for High-Frequency Traders: The near zero spreads make it a cost-effective choice for traders who execute numerous trades.

Transparency: With a fixed commission structure, traders know exactly how much they are paying per trade, helping them manage costs effectively.

Ideal for Automated Trading: The low spreads and market execution are perfect for automated trading strategies, where precision and speed are essential.

Disadvantages of the Exness Raw Spread Account

Commission Fees: While raw spreads are tight, the commission fee per trade can add up, especially for traders making frequent transactions.

Higher Minimum Deposit: The minimum deposit requirement for this account type can be higher, making it less accessible for some traders.

Exness Zero Spread Account

The Exness Zero Spread Account offers traders zero spreads on major currency pairs, but there is a commission fee per trade. This account type is particularly suited for traders who want to avoid the spread costs entirely and are willing to pay a fixed commission fee instead. Like the Raw Spread account, the Zero Spread account provides excellent trading conditions with market execution, making it ideal for traders who rely on precise and rapid trade execution.

Key Features of the Exness Zero Spread Account

Zero Spreads: As the name suggests, this account provides zero spreads on major forex pairs.

Commission Fee: Traders pay a commission fee per trade, typically at a lower rate than the commission for raw spread accounts.

Market Execution: Market execution ensures that orders are processed instantly at the best available price.

Access to Trading Instruments: Offers access to a range of forex trading, commodities, and indices.

Minimum Deposit Requirement: The minimum deposit for the Exness Zero Spread Account is usually lower than that of the Raw Spread Account, making it more accessible for beginners.

Advantages of the Exness Zero Spread Account

No Spread Costs: Traders benefit from zero spreads, making it easier to calculate the exact cost of a trade.

Lower Minimum Deposit: The lower minimum deposit requirement makes it a more accessible option for new traders.

Cost-Effective for Active Traders: With zero spreads, traders only need to focus on the commission structure, which can be beneficial for those looking for transparent, low-cost trading.

Disadvantages of the Exness Zero Spread Account

Commission Fee: The commission fee may increase overall trading costs, especially for traders who place numerous trades.

Limited to Certain Pairs: While zero spreads are available on major currency pairs, the Exness Zero Spread Account may not offer the same benefits for less liquid instruments.

Key Differences Between Exness Raw Spread and Zero Account

1. Spreads

Exness Raw Spread Account: Offers near zero spreads, starting from 0.0 pips, but comes with a fixed commission.

Exness Zero Spread Account: Offers zero spreads on major currency pairs, but traders are charged a commission fee per trade.

2. Trading Costs

Exness Raw Spread Account: The trading costs are primarily driven by the raw spread and a fixed commission fee.

Exness Zero Spread Account: Traders avoid spread costs but must pay a commission that can add up depending on the number of trades executed.

3. Commission Structure

Exness Raw Spread Account: Traders pay a fixed commission fee per trade, making costs predictable but potentially higher for frequent traders.

Exness Zero Spread Account: Traders also pay a commission fee, but this account type is more suited for those who want to trade without worrying about spread costs.

4. Minimum Deposit Requirement

Exness Raw Spread Account: Typically requires a higher minimum deposit than the Exness Zero Spread Account, which can be a barrier for beginner traders.

Exness Zero Spread Account: The minimum deposit requirement is generally lower, making it more accessible for new traders.

Start Trading: Open Exness Account or Visit Website

Who Should Choose the Exness Raw Spread Account?

The Exness Raw Spread Account is best suited for experienced traders, especially those who engage in high-frequency trading or scalping. The tight spreads allow for cost-effective trading, but traders must be prepared for the commission fee. If you’re an active trader who values precision and is capable of managing commission costs, the Raw Spread Account is a great choice.

Who Should Choose the Exness Zero Spread Account?

The Exness Zero Spread Account is ideal for traders who prefer zero spreads and are comfortable paying a commission fee instead. It is a good choice for traders who trade major currency pairs and are looking for an account with a lower minimum deposit. This account type is also suitable for those who want to avoid spread-related confusion and prefer a more transparent trading cost structure.

Final Thoughts: Which Account Is Right for You?

When choosing between the Exness Raw Spread Account and the Exness Zero Spread Account, it ultimately comes down to your trading style and priorities. If you prefer the flexibility of near zero spreads and are comfortable with the commission fee, the Raw Spread Account might be the better choice. However, if you want to completely eliminate spread costs and can manage the commission fee, the Zero Spread Account could be the most cost-effective option. Both accounts offer excellent trading conditions and access to the financial markets, so your decision should be based on your individual trading experience and cost preferences.

Frequently Asked Questions (FAQ)

What is the minimum deposit for Exness Raw Spread Account?

The minimum deposit requirement for the Exness Raw Spread Account is typically higher than for other account types, depending on the region and currency of your account.

Do I pay commission on the Exness Zero Spread Account?

Yes, traders pay a commission fee per trade when using the Exness Zero Spread Account, but they benefit from zero spreads on major forex pairs.

Which account is best for scalping?

The Exness Raw Spread Account is ideal for scalping due to its near zero spreads and market execution, allowing for quick entry and exit from trades.

Can I trade with automated strategies on both accounts?

Yes, both the Exness Raw Spread Account and Exness Zero Spread Account are suitable for automated trading strategies due to their low spreads and fast execution.

Are there any hidden fees with Exness accounts?

Exness provides transparent pricing, and there are no hidden fees. However, traders should be aware of the commission fees associated with both the Raw Spread Account and Zero Spread Account.