7 minute read

Exness Market Close Time

Exness Market Close Time is an important consideration for both retail clients and institutional clients when planning their trading strategies. Exness UK Ltd, registered in England and Wales under Companies House register number 08861481, offers services to retail clients and individual investors, as well as institutional corporate clients. Exness UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA), with the registration number 730729, ensuring that all operations comply with the financial conduct authority regulations. It’s important to note that Exness UK does not offer services related to complex instruments, which are subject to a high risk of losing money rapidly, especially when using leverage. The market close time varies depending on the type of asset being traded, so traders must carefully monitor market hours to avoid unexpected market movements or the risk of losing money due to fluctuations that occur as the market approaches its close. For more details on Exness UK and its operations, you can visit their website and review the information and contact details available.

What Is Exness Market Close Time?

Exness market close time refers to the time when trading on Exness trading platforms ends for a specific asset or market. Different markets and instruments have different trading hours, influenced by global financial markets and time zones. Understanding market close times is crucial for retail clients and institutional clients, as it helps in making trading decisions such as closing positions or planning trades for the next market open.

Exness Trading Hours Overview

Exness offers a range of financial instruments, including forex, indices, and commodities. The trading hours for each instrument are based on the global financial markets and their respective exchanges. Here’s an overview of the typical trading hours for different assets on Exness:

Forex Trading:Forex trading on Exness operates 24/5, starting on Sunday evening and closing on Friday evening. The market opens on Sunday at 10:00 PM GMT and closes at 10:00 PM GMT on Friday. Forex markets are highly active during peak trading hours, with the most significant price movements typically occurring when major financial markets overlap.

Stock Markets:Stock market trading on Exness varies depending on the exchange. For example, the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE) have specific market close times. The typical trading hours for these exchanges are from 9:30 AM to 4:00 PM (New York time) for the NYSE, and from 8:00 AM to 4:30 PM (London time) for the LSE. These markets usually close for a lunch break between 12:00 PM and 1:00 PM.

Indices:Indices such as the Dow Jones, NASDAQ, and S&P 500 typically close at the same time as their respective stock markets. Exness offers trading in various indices with their respective market close times being aligned with the local stock exchanges.

Commodities:Commodities like gold, silver, and oil have specific market hours that may differ based on the exchange. Generally, commodity trading on Exness is available from Sunday to Friday, with market closes on Friday at 10:00 PM GMT.

Understanding Exness market close time is crucial for managing risk and ensuring that trades are closed at appropriate times. The market close time for different financial instruments can influence your trading positions and help you make better decisions based on market volatility and the likelihood of price fluctuations. Here are a few reasons why the market close time is important:

Plan Your Trades: Knowing the exact market close time helps you plan when to enter and exit trades.

Avoid Sudden Price Movements: Some traders prefer to avoid trading right before market close due to the risk of volatile price movements.

Effective Risk Management: Closing positions before market close helps traders avoid unexpected volatility that might affect their profits or result in significant losses.

Leverage and Margin: Exness offers high leverage, which can lead to rapid market fluctuations. Knowing when markets close gives you better control over your leverage and capital.

Exness UK Ltd and Its Regulatory Compliance

Exness UK Ltd is registered in England and Wales under the Companies House with the registration number 08861481. It is authorized and regulated by the Financial Conduct Authority (FCA) with the registration number 730729. As a regulated broker, Exness UK Ltd ensures that all retail clients and institutional clients are provided with services that comply with FCA regulations. The FCA is one of the most trusted regulatory authorities in the financial industry, providing traders with the assurance that Exness is operating under stringent rules for client protection, including negative balance protection.

Market Close Time Variations Based on Location

Since Exness operates in various countries, the market close times can differ depending on your location and the trading platform you use. Time zone differences play a significant role in how market hours are affected. For instance, New York is 5 hours behind London, meaning that market open and close times vary depending on your location. Traders in different regions must adjust their trading hours based on their local time zone to ensure they are aware of when the market closes in their region.

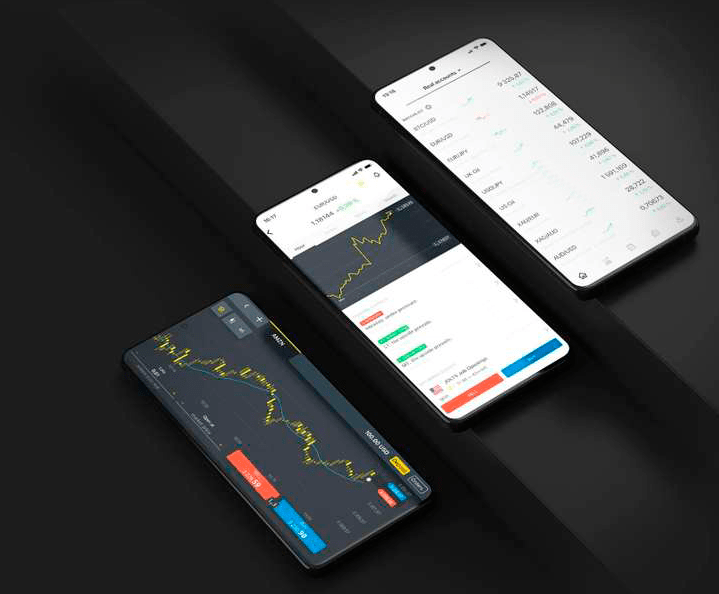

To accommodate these differences, Exness platforms automatically adjust market hours to your local time zone. This feature allows you to easily track when markets will close based on where you are located. Whether you are using MT4, MT5, or the Exness terminal, the platform will display accurate market close times for all financial instruments, ensuring that traders can manage their positions efficiently, regardless of their time zone.

How to Manage Your Trading During Exness Market Close

Plan Ahead for Market Volatility:Market volatility can increase near market close, particularly during peak trading hours when financial markets overlap. Be prepared to manage positions during this time, especially if you’re using leverage.

Set Stop-Loss and Take-Profit Orders:To avoid unexpected losses as the market approaches close, use stop-loss and take-profit orders to automatically exit the market once specific price levels are reached.

Monitor Your Positions:If you're using a mobile trading platform, ensure that you are actively monitoring your positions close to the market close time. Being able to quickly adjust your positions can be crucial when dealing with high market volatility.

Avoid Holding Positions Over the Weekend:Since the forex market closes on Friday, avoid holding positions over the weekend if you’re not prepared for the possibility of price gaps when markets open on Sunday.

Start Trading: Open Exness Account or Visit Website

FAQs About Exness Market Close Time

What is the market close time for Exness?

The market close time for Exness depends on the asset you’re trading. Forex trading generally closes at 10:00 PM GMT on Friday, while stock markets and indices follow local exchange hours.

Does Exness offer 24/7 trading?

Exness offers 24/5 trading for forex, with markets closing on Friday at 10:00 PM GMT and reopening on Sunday at 10:00 PM GMT. Commodity markets and stock indices have their own specific trading hours.

How do time zones affect Exness market close?

Exness trading platforms automatically adjust the market hours according to your time zone, making it easy to track when markets close in your local time.

Can I trade during market close?

While you can technically place orders near market close, it’s important to understand the risks involved, especially during high volatility and the potential for price gaps.

What should I do before the market closes?

Before the market closes, ensure that you have closed any active positions or set stop-loss orders to protect your capital from sudden market movements.