7 minute read

Exness Overnight Charges

Exness Overnight Charges are an important aspect of trading costs that traders should be aware of when holding positions overnight. These charges, also known as swap rates, are applied to positions that are left open after the market closes, affecting the overall profitability of trades. Unlike hidden fees or currency conversion fees, Exness overnight charges are typically transparent, allowing traders to evaluate the fees involved before taking action. Traders using the Exness Pro Account or engaging in high-frequency trading may encounter different overnight charges, depending on the currency pair, such as EUR/USD or USD/INR. Understanding how swap rates work and comparing them to other brokers is essential for individual investors to manage their trading strategies effectively, ensure low spreads, and maximize their profit potential.

What Are Exness Overnight Charges?

Exness overnight charges are fees that traders incur when they hold positions open overnight. These charges are part of the swap rate, which reflects the difference between the interest rates of the two currencies in a currency pair. For example, if you’re trading the EUR/USD pair and hold your position overnight, the swap rate will depend on the interest rates set by the European Central Bank (ECB) and the Federal Reserve. The overnight charges are added or subtracted from your account depending on whether the swap rate is positive or negative.

Exness applies these charges on a daily basis for positions left open after the market closes. The charges can vary depending on the currency pair, the market conditions, and whether you're in a long or short position. Traders should ensure they are aware of these fees, as they can significantly affect the overall trading costs of a position.

How Do Exness Overnight Charges Work?

Exness applies overnight charges based on the swap rates of the specific currency pairs being traded. Here’s a breakdown of how the charges work:

Long Positions: If you’re holding a long position (buying) in a currency pair, the swap rate can either add a fee or give a credit depending on the interest rate differential between the two currencies.

Short Positions: If you’re holding a short position (selling), the swap rate will be the opposite. For example, if the interest rate in the base currency is higher, you might receive a credit, but if it’s lower, you might incur a charge.

The overnight charges are typically calculated based on the difference in interest rates between the two currencies in the pair you are trading. For example, a USD/JPY pair will have different swap rates compared to an EUR/USD pair due to the differing interest rates between the US dollar and the Japanese yen or Euro.

Factors Affecting Exness Overnight Charges

Several factors can influence Exness overnight charges:

Currency Pair: Different currency pairs have different swap rates. Pairs with higher interest rate differentials will typically have higher overnight charges. For example, trading a pair like EUR/USD may result in a different swap rate compared to a pair like USD/INR.

Market Conditions: The interest rate environment in the countries whose currencies you are trading can affect the overnight charges. If central banks raise interest rates, swap rates may change, impacting the charges or credits you receive.

Broker’s Policies: Each broker has its own approach to overnight charges. While Exness strives for transparency with its charges, other brokers might have different policies or hidden fees related to overnight positions.

Comparing Exness Overnight Charges with Other Brokers

When evaluating Exness overnight charges, it’s important to compare them to other brokers to ensure you’re getting a competitive rate. While Exness generally offers competitive swap rates, other brokers may offer lower fees or no swap charges at all, especially on Islamic accounts. However, these accounts may come with other costs or restrictions, so it’s important to consider all aspects of the account type before proceeding.

Managing Exness Overnight Charges

Since Exness overnight charges can have an impact on your trading profitability, it’s essential to manage them effectively. Here are a few tips:

Use a Demo Account: Before opening a real account, use Exness demo accounts to practice trading and understand how overnight charges affect your trading costs.

Minimize Position Holding: If possible, avoid holding positions overnight to avoid swap fees. Close positions before the market closes to avoid paying for overnight charges.

Evaluate Swap Rates: When trading, be mindful of the swap rates associated with the currency pair you’re trading. Exness provides swap rate information for each pair, so check the current rate before executing trades.

Consider the Leverage: Using leverage can amplify trading costs, including overnight charges. It’s important to use leverage responsibly, especially when holding positions overnight.

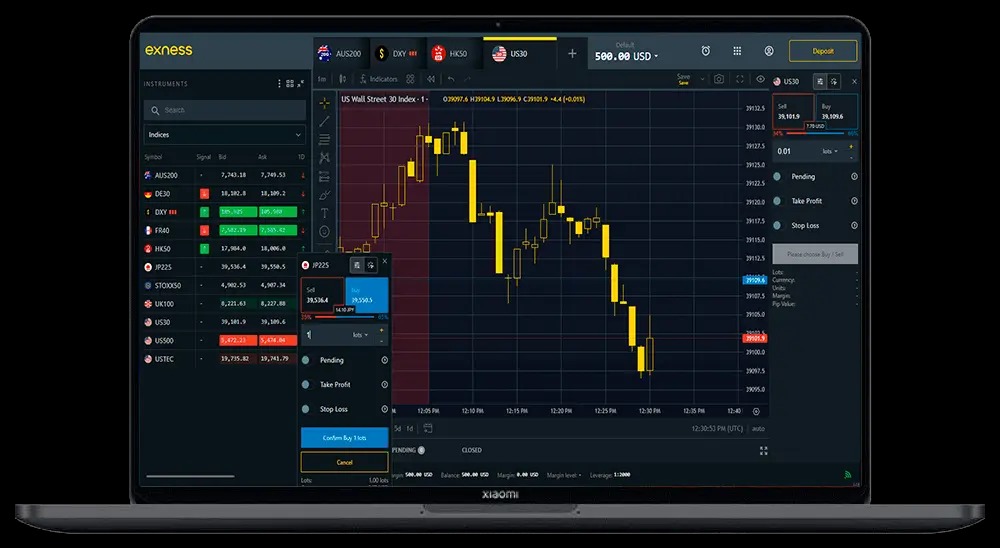

Start Trading: Open Exness Account or Visit Website

Exness Pro Account and Overnight Charges

The Exness Pro Account is tailored for high-frequency trading and professional traders, offering lower spreads and access to advanced tools. However, the overnight charges for Pro Accounts may be higher depending on the leverage and currency pairs traded. Traders using the Pro Account should keep in mind that overnight charges could impact their profitability due to the high leverage involved. It's crucial to understand how these charges work and factor them into your overall trading strategies.

Tips for Reducing Exness Overnight Charges

Trade Short-Term Positions: Avoid holding positions overnight if you want to minimize overnight charges.

Use Instruments with Low Swap Rates: Some currency pairs or CFDs have lower swap rates, which can help reduce your trading fees.

Monitor Market Changes: Interest rate changes and central bank announcements can influence swap rates. Keep an eye on economic calendars to anticipate any changes in the overnight charges.

Conclusion

Understanding Exness overnight charges is crucial for managing trading costs and maximizing profitability. While overnight charges are a common feature in forex trading, they vary depending on the currency pair, leverage, and market conditions. By carefully managing your positions, using risk management strategies, and evaluating swap rates, you can minimize the impact of these charges on your trading performance. Whether you're using a Pro Account or a demo account, make sure you're aware of the fees and charges associated with holding positions overnight.

FAQs About Exness Overnight Charges

What are Exness overnight charges?

Exness overnight charges are swap rates applied to positions that remain open after the market close. These charges can either be a fee or a credit, depending on the currency pair and the interest rate differential.

How are Exness overnight charges calculated?

Overnight charges are calculated based on the difference in interest rates between the two currencies in the pair being traded. They are added to or subtracted from your account at the end of each trading day.

Are Exness overnight charges the same for all currency pairs?

No, Exness overnight charges vary depending on the currency pair. Pairs with higher interest rate differentials will generally have higher swap rates.

Can I avoid Exness overnight charges?

You can avoid overnight charges by closing your positions before the market closes. Alternatively, consider trading with an Islamic account, which may not incur swap fees.

How can I find the swap rates for Exness?

Exness provides swap rate information for each currency pair on their website. You can check the current swap rates before placing your trades.