11 minute read

Does Exness Have Volatility Index

Exness does not offer the Volatility 75 Index (VIX75) directly on its trading platforms, but it does provide access to a range of volatile markets and forex trading instruments. While the Volatility 75 Index is not available, traders can still engage with other indices, CFDs, and currency pairs, all of which can be highly affected by price fluctuations. Exness, a regulated forex broker with a financial services commission (FSC) license, offers several account types, including professional accounts, for individual investors and retail clients who want to trade in volatile conditions. Using advanced tools like Bollinger Bands, moving averages, and automated trading strategies, traders can manage high-risk situations and maximize profits. Exness also provides instant withdrawals, low spreads, and high leverage, but it’s important to understand the risk of losing money rapidly due to market volatility and leverage. If you're looking to trade in volatile markets, Exness offers a variety of resources and risk management tools to help manage your investment.

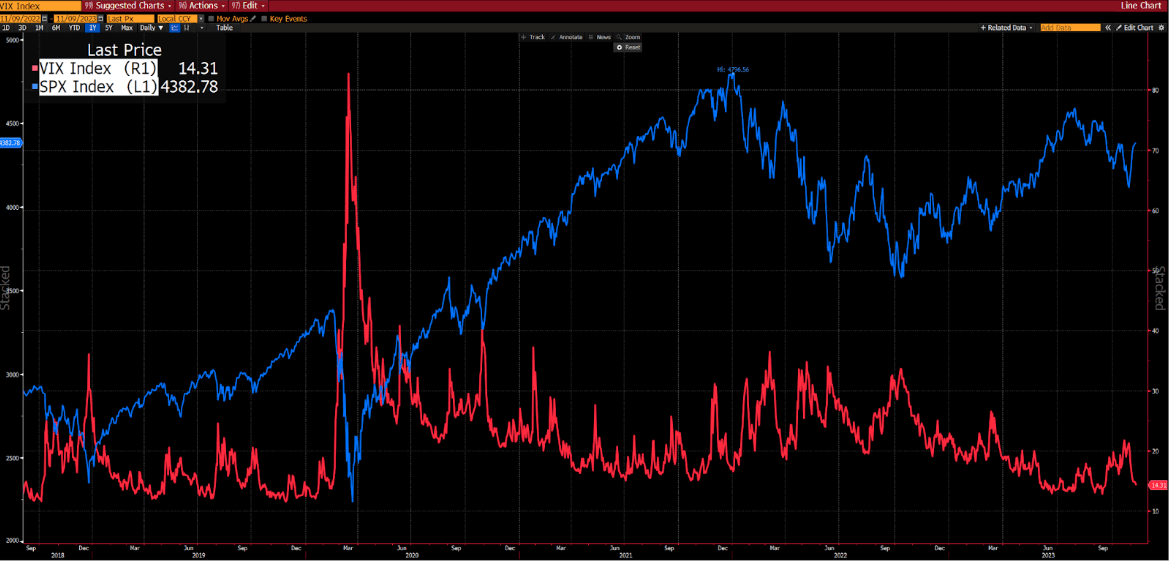

What is the Volatility Index?

The Volatility Index (VIX) is a financial instrument used to measure the expected volatility in the market, particularly in the forex and stock markets. It tracks price fluctuations and market movement over time, making it a popular tool for traders to gauge market risks. While Exness does not offer the Volatility 75 Index (VIX75), it does provide access to a wide range of other volatile markets through forex trading, CFDs, and commodity indices. These markets are influenced by similar price movements and can offer opportunities for high risk and profit potential.

The Volatility Index is especially useful for individual investors and retail clients looking to understand market behavior and adjust their trading strategies accordingly. By analyzing the VIX, traders can anticipate price fluctuations and tailor their trading platforms and account types to match the high risk associated with volatile markets. Exness’s advanced trading tools, such as Bollinger Bands and moving averages, help traders in assessing market trends and making informed decisions in volatile conditions, where leverage and market volatility are common.

Does Exness Offer the Volatility 75 Index?

As of now, Exness does not provide the Volatility 75 Index (VIX75) directly on its trading platforms. However, Exness offers access to a range of other indices, including stocks and commodities, as well as other volatile markets that can offer similar trading opportunities. For traders interested in high market volatility, Exness provides tools such as advanced charting, automated trading, and trading signals that can help them analyze market behavior and take advantage of price fluctuations.

Despite not offering the Volatility 75 Index, Exness still supports trading in volatile markets such as currencies, stocks, and CFDs (contracts for difference) that can mirror the price movements typically associated with volatility indices.

Exness and Volatility Index Trading: A Clear Overview

Exness does not offer the Volatility 75 Index (VIX75) directly on its trading platforms. However, Exness provides access to a variety of volatile markets and forex trading instruments that can offer similar high profit potential and market risk exposure. Traders looking for volatile market opportunities can explore other indices, commodities, and currency pairs, all of which are susceptible to price fluctuations similar to those in the Volatility 75 Index. While Exness doesn't directly list the VIX75, it still supports traders by offering tight spreads, high leverage, and advanced tools like the Exness terminal, which includes tools such as Bollinger Bands, moving averages, and automated trading to help manage risk and identify trading opportunities in volatile conditions. Traders who wish to benefit from price movements in these markets can still use the same risk management techniques and trading strategies to navigate the market safely.

What Indices Can Be Traded on Exness?

While Exness doesn’t offer the Volatility 75 Index, the broker does provide various indices that appeal to traders interested in speculative trading. These include:

Start Trading: Open Exness Account or Visit Website

Major Stock Indices:Exness offers access to major stock indices such as the S&P 500, Dow Jones, NASDAQ, and FTSE 100. These indices often experience significant price movements that traders can capitalize on.

Commodities and Other Volatile Markets:Exness also allows trading in commodities like gold and oil, which can be highly volatile and provide excellent profit potential for traders who use the right trading strategies.

Currency Pairs:Trading currency pairs is another way to engage in volatile markets. Exness provides tight spreads and high leverage, allowing traders to take advantage of rapid market fluctuations in forex trading.

How Does Exness Help Traders in Volatile Markets?

Although Exness doesn’t have the Volatility 75 Index, it provides a range of tools and features designed to assist traders when navigating volatile markets:

Exness Trading Platforms:Exness offers a proprietary trading platform known as the Exness terminal, as well as MT4 and MT5, which feature advanced charting tools and indicators like Bollinger Bands, Moving Averages, and MACD to help traders analyze market trends and anticipate price movements.

Leverage:Exness provides high leverage, allowing traders to open larger positions with a smaller initial investment. This is particularly useful in volatile markets, where price swings can offer higher profit potential, but also increase the risk of losing money rapidly. Traders can use leverage cautiously to manage their positions and minimize risk.

Risk Management Tools:With tools like stop-loss and take-profit orders, Exness helps traders manage their risk exposure, especially when trading in markets known for high volatility. These tools are essential for protecting funds and ensuring that traders exit their positions before incurring substantial losses.

Instant Withdrawals:For traders who want to access their profits quickly, Exness offers instant withdrawals, making it easier to manage earnings from volatile trades and access funds as needed.

Risk of Trading in Volatile Markets

Trading in volatile markets, such as the Volatility 75 Index, can present significant opportunities but also carries a high risk of losing money rapidly. While Exness offers advanced tools and trading platforms that allow access to these volatile markets, including forex trading and CFDs, it’s essential to understand the risks involved. The Volatility 75 Index, known for its extreme price fluctuations, can generate high profit potential for experienced traders, but it also exposes retail clients to the risk of losing money rapidly due to leverage. With the ability to trade with maximum leverage, traders may experience significant price movements that could lead to large losses. As a regulated forex broker under the Financial Services Commission (FSC) and with a Cyprus Securities license, Exness provides the necessary tools to manage this risk, but traders must approach such markets with caution.

In volatile conditions, tools such as automated trading, trading signals, and risk management strategies like stop-loss orders are vital to limit exposure. The Exness terminal offers features such as Bollinger Bands and moving averages, which can help traders track price movements and assess market trends. However, complex instruments and the high leverage available with Exness require a careful approach, especially when dealing with unpredictable markets. Although Exness offers low spreads, instant withdrawals, and various account types, it is important for individual investors to proceed with informed trading decisions and understand the circumstances in which they are trading. Remember, the risk of losing money increases significantly in volatile markets, and traders should be prepared for the challenges that come with volatile price fluctuations and rapid market changes.

Exness Approach to Volatility and Risk Management

Negative Balance Protection:Exness offers negative balance protection, ensuring that traders cannot lose more than their initial investment. This is particularly helpful when dealing with volatile markets, where rapid price movements can quickly lead to significant losses.

Educational Resources:Exness provides educational resources designed to help traders understand the risks of trading in volatile markets. Whether through online courses, webinars, or demo accounts, Exness equips traders with the knowledge they need to make better decisions and enhance their trading skills.

Account Types:Exness offers multiple account types designed to suit different trading preferences. Whether you're a beginner trader or an experienced trader, Exness has a solution that matches your risk tolerance and investment goals.

Start Trading: Open Exness Account or Visit Website

Exness Trading Tools and Features for Volatile Markets

Although Exness doesn’t offer the Volatility 75 Index, it provides traders with various tools to trade effectively in volatile markets. For example, Exness trading platforms support CFD trading, which allows traders to speculate on price fluctuations of volatile assets like stocks, commodities, and currencies. Using automated trading, trading signals, and real-time market analysis, traders can manage their positions more effectively. Furthermore, Exness offers negative balance protection, ensuring that traders can’t lose more than their initial investment in volatile markets. This feature, combined with instant withdrawals and a variety of account types, provides traders with the necessary tools to engage in high-risk trading while ensuring they are protected against unexpected losses. Exness also provides educational resources to help traders understand how to navigate complex instruments and trade in rapidly moving markets.

Understanding the Risks of Trading Volatile Markets with Exness

Trading in volatile markets comes with high risk, especially when using leverage. The potential for significant losses due to rapid price movements is a major concern for traders who are not fully prepared. Exness offers high leverage, which can amplify both profits and losses. Traders need to understand that the risk of losing money rapidly increases in volatile environments, and it’s essential to use effective risk management strategies like stop-loss orders and position sizing. Exness provides tools that help manage this risk, but it's crucial for traders to remain cautious and informed when entering such markets.

How to Effectively Use Leverage in Volatile Markets with Exness

Leverage is a powerful tool in forex trading, but it can also increase the risk of losing money rapidly in volatile markets. Exness allows traders to use high leverage, which enables them to control larger positions with a smaller capital investment. However, leveraging too much in volatile markets can result in substantial losses if the market moves against the trader’s position. To manage this, traders should use risk management tools like stop-loss orders and trade with leverage that aligns with their risk tolerance. Understanding the potential impact of price fluctuations and managing leverage carefully can help traders mitigate risks while benefiting from market volatility.

Best Practices for Trading in Volatile Markets with Exness

When trading in volatile markets, such as those involving the Volatility 75 Index, it’s crucial to implement effective strategies to minimize the risk of losing money rapidly. While Exness doesn’t offer the Volatility 75 Index, it provides access to several other volatile instruments, including forex trading, CFDs, and commodities, where price fluctuations are common. To protect funds and enhance trading performance, using risk management tools like stop-loss orders and take-profit orders can help traders navigate unpredictable market conditions. Exness’s proprietary trading platform, such as the Exness terminal, supports these strategies by offering advanced charting tools and indicators like Bollinger Bands and moving averages to help identify market trends and potential turning points.

Another best practice for trading in volatile markets with Exness is to manage leverage carefully. Exness offers maximum leverage, which increases both the profit potential and the risk of losing money rapidly. Traders should use leverage cautiously and choose an account type that aligns with their risk tolerance. For individual investors and retail clients, it’s important to proceed with caution, particularly in high-risk markets, and to only use leverage within their financial capacity. Exness also offers instant withdrawals, providing flexibility for traders to access profits quickly, while automated trading and trading signals can assist in executing trades based on pre-set criteria, minimizing human error in volatile conditions. By applying these practices, traders can manage volatile markets more effectively and ensure a better trading experience.

FAQs

Does Exness offer the Volatility 75 Index?

No, Exness does not offer the Volatility 75 Index (VIX75). However, it provides access to various other volatile instruments like currencies, indices, and commodities.

Can I trade in volatile markets with Exness?

Yes, Exness offers trading opportunities in volatile markets such as forex trading, stock indices, and commodities. Traders can take advantage of high volatility with the help of advanced trading tools and risk management features.

How can I manage risk when trading in volatile markets with Exness?

Exness provides risk management tools such as stop-loss and take-profit orders, along with negative balance protection to help manage risk in volatile markets.

What is the benefit of using leverage in volatile markets?

Leverage can amplify your potential profits in volatile markets, but it also increases the risk of losing money rapidly. It’s important to use leverage cautiously and implement proper risk management strategies.

Does Exness provide educational resources for traders?

Yes, Exness offers a wide range of educational resources to help both beginner traders and experienced traders understand forex trading, market trends, and how to trade in volatile markets.