7 minute read

Exness Raw Spread Account

The Exness Raw Spread Account is designed for experienced traders seeking low-cost trading conditions. It offers access to some of the tightest spreads available, starting from as low as 0.0 pips on major currency pairs, making it ideal for scalpers and high-frequency traders. While the Raw Spread Account has a commission fee per trade, its low spreads help traders minimize overall costs. This account type also provides access to a wide range of financial instruments, including forex, commodities, and indices, making it a powerful option for those looking to trade with minimal slippage and maximum precision.

Key Features of the Exness Raw Spread Account

What Is a Raw Spread Account?

A Raw Spread Account refers to an account type where the spread is passed directly to the trader from liquidity providers, such as banks or institutional clients. These spreads are typically ultra-low, as the broker does not add any markup, allowing you to trade with more predictable costs.

Ultra-Low Spreads

One of the standout features of the Exness Raw Spread Account is the ultra-low spreads. Spreads in this account are as low as 0.0 pips, depending on the currency pairs being traded. This is especially beneficial in volatile market conditions, where spread widening could significantly impact profits.

Commission Structure

While the Exness Raw Spread Account offers low spreads, it also involves a commission structure. This commission is typically charged per trade and is based on your trading volume. The commission fee is transparent, allowing traders to calculate their total trading costs accurately.

Direct Access to the Interbank Market

With the Exness Raw Spread Account, traders have direct access to the interbank market, where liquidity providers set the prices. This means that trades are executed without any additional markup from Exness, resulting in predictable trading costs.

Minimum Deposit Requirement

The minimum deposit requirement for a Raw Spread Account is typically $200. This relatively low minimum deposit makes it accessible for traders of different budgets, whether you’re a retail trader or an institutional client.

Ideal for High-Volume Traders and Algorithmic Trading

For high-volume traders or algorithmic traders, the Raw Spread Account is ideal because of the low spreads and direct access to the market. With this account type, traders can optimize their trading strategies and achieve cost savings on large trading volumes.

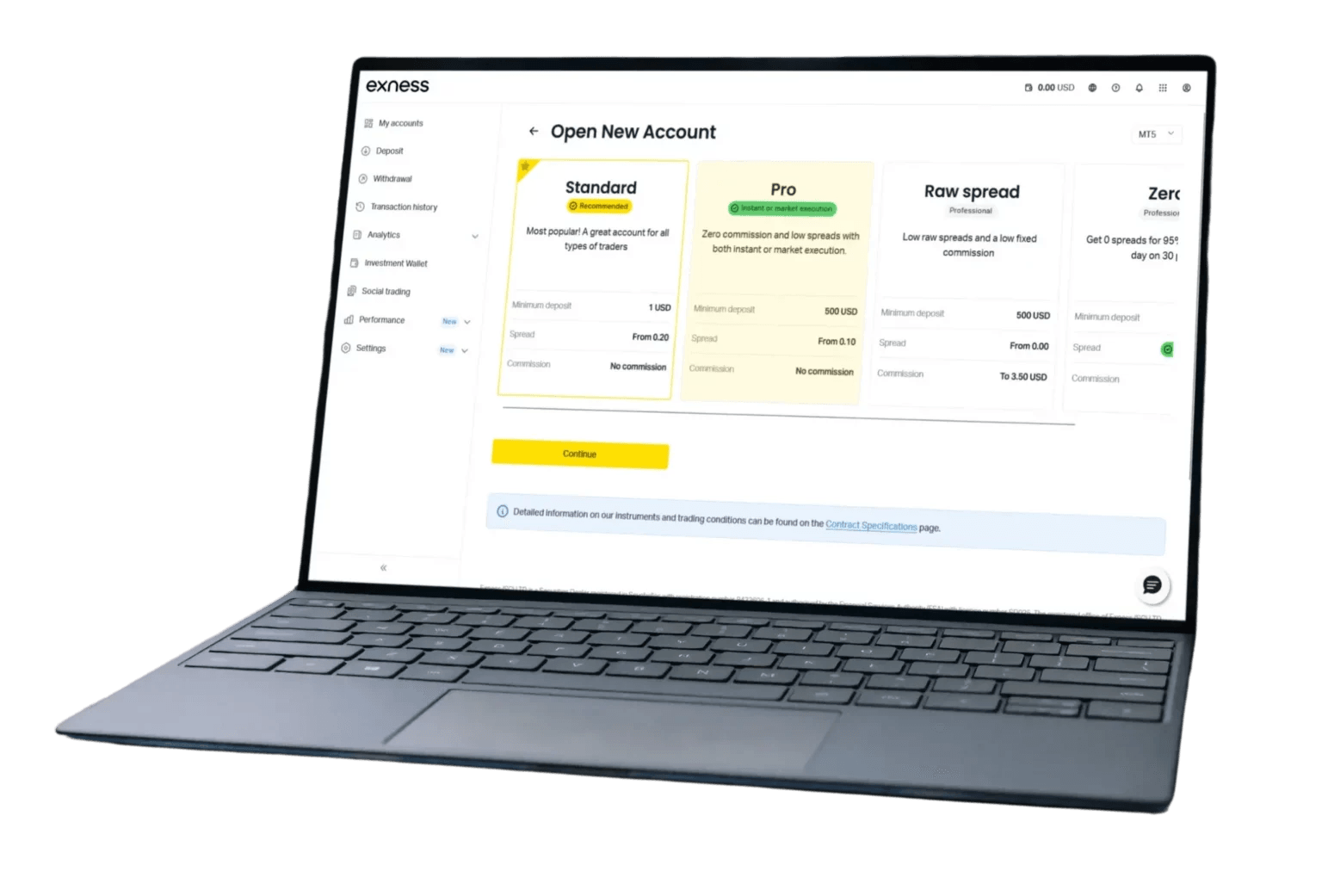

Available Trading Platform

Exness offers a variety of trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which support the Raw Spread Account. These platforms provide advanced charting tools, real-time data, and a stable environment for executing trading strategies.

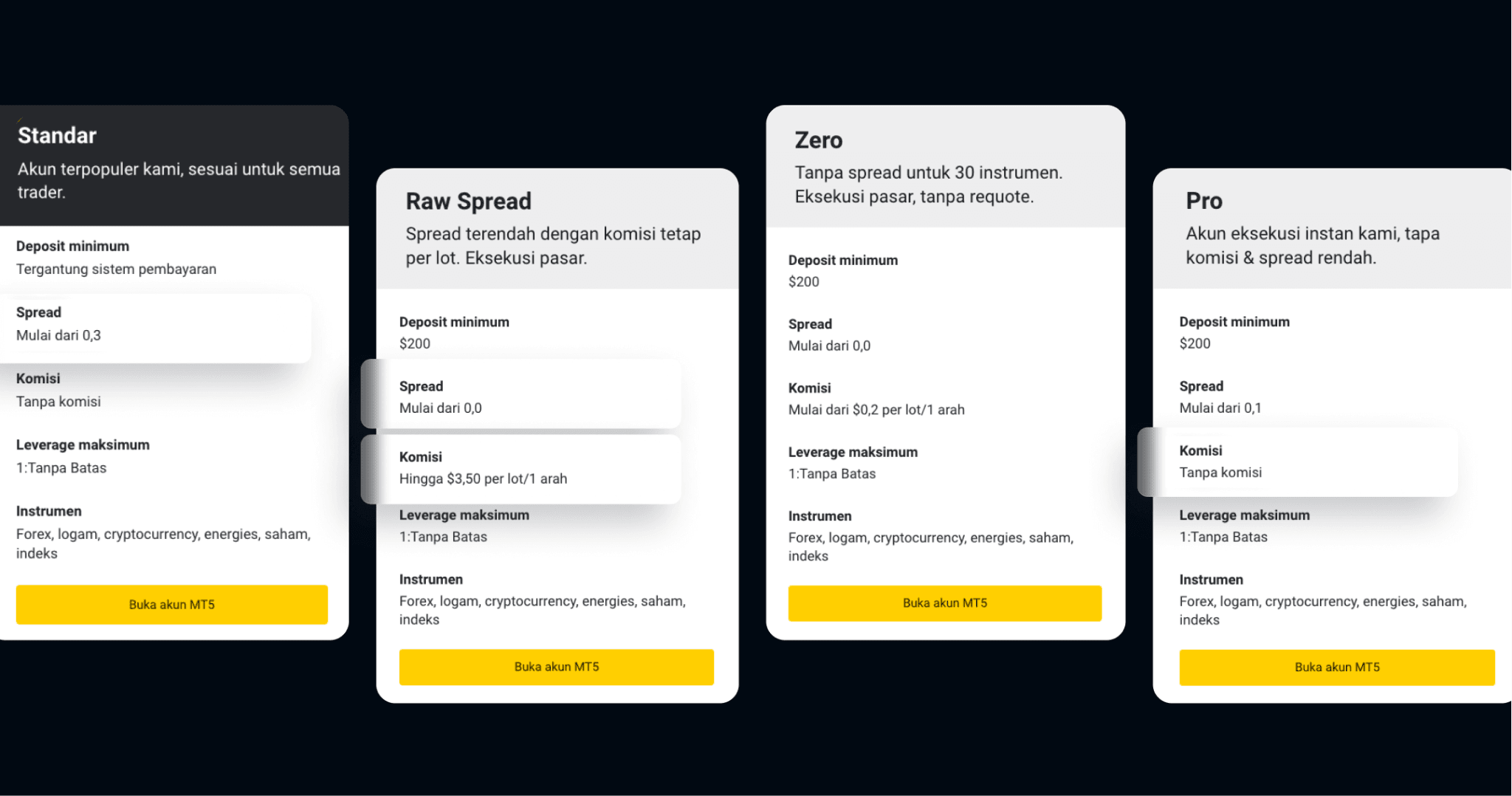

Key Differences Between Raw Spread and Zero Spread Accounts

Both the Raw Spread Account and the Zero Spread Account are designed to offer low trading costs, but there are key differences.

Spreads

Raw Spread Account: Spreads are close to 0.0 pips, with a commission on each trade.

Zero Spread Account: Offers zero spread, but traders pay a higher commission on trades.

Commission

Raw Spread Account: Commission is charged based on the trading volume, and it varies depending on the instrument.

Zero Spread Account: No spread is charged, but commissions are higher than those in the Raw Spread Account.

Best for

Raw Spread Account: Experienced traders, high-volume traders, and algorithmic traders.

Zero Spread Account: Retail traders who want to avoid spread costs but are okay with higher commissions.

Who Is the Exness Raw Spread Account For?

Experienced Traders

The Raw Spread Account is most suitable for experienced traders who have a solid understanding of market dynamics. Since it involves low spreads and commission costs, it allows traders to have more control over their trading costs.

High-Volume Traders

For those who engage in high-frequency trading or place large volumes of trades, the Exness Raw Spread Account offers cost predictability and the ability to execute trades at ultra-low spreads.

Algorithmic Traders

The Raw Spread Account is ideal for algorithmic traders, as it provides direct access to the market without any broker-added spread markup. This allows algorithms to operate in a low-latency environment and execute orders quickly.

Trading Styles and the Raw Spread Account

The Exness Raw Spread Account caters to different trading styles, including:

Day Traders

Day traders benefit from the ultra-tight spreads provided by the Raw Spread Account. These traders rely on small price movements and need low costs to maximize their returns from frequent trades.

Swing Traders

Swing traders, who hold positions for several days, also benefit from the predictable costs offered by the Raw Spread Account, as it allows them to manage their trading expenses effectively.

Scalpers

Scalpers, who rely on making quick profits from small price movements, can benefit from the low spreads available on the Exness Raw Spread Account. The lower the spread, the less the price needs to move for a scalper to make a profit.

How Exness Compares to Other Brokers

Exness offers a range of account types and features that set it apart from other brokers. Here’s why the Exness Raw Spread Account stands out:

Ultra-low spreads and predictable trading costs.

Direct access to the interbank market, ensuring cost efficiency.

Regulated by the Financial Conduct Authority (FCA), ensuring a high level of security.

Offers services to retail clients and institutional clients.

Risks Involved in the Exness Raw Spread Account

While the Exness Raw Spread Account offers low trading costs, it’s essential to be aware of the risks involved:

High Risk of Losing Money Rapidly Due to Leverage

Leverage is a powerful tool, but it also magnifies both profits and losses. It is crucial to understand the risks of leverage and use proper risk management strategies.

Volatile Market Conditions

In times of market volatility, spreads can widen, affecting your trading costs. While the Exness Raw Spread Account offers low spreads, these can still increase in times of extreme market conditions.

Exness Raw Spread Account: Pros and Cons

Pros

Ultra-low spreads, even in volatile markets.

Direct access to the interbank market.

Cost predictability for high-frequency traders.

Commission-based pricing ensures transparency.

Cons

Commission charges on trades.

Not ideal for traders who prefer zero-spread accounts.

Requires a higher level of experience in trading.

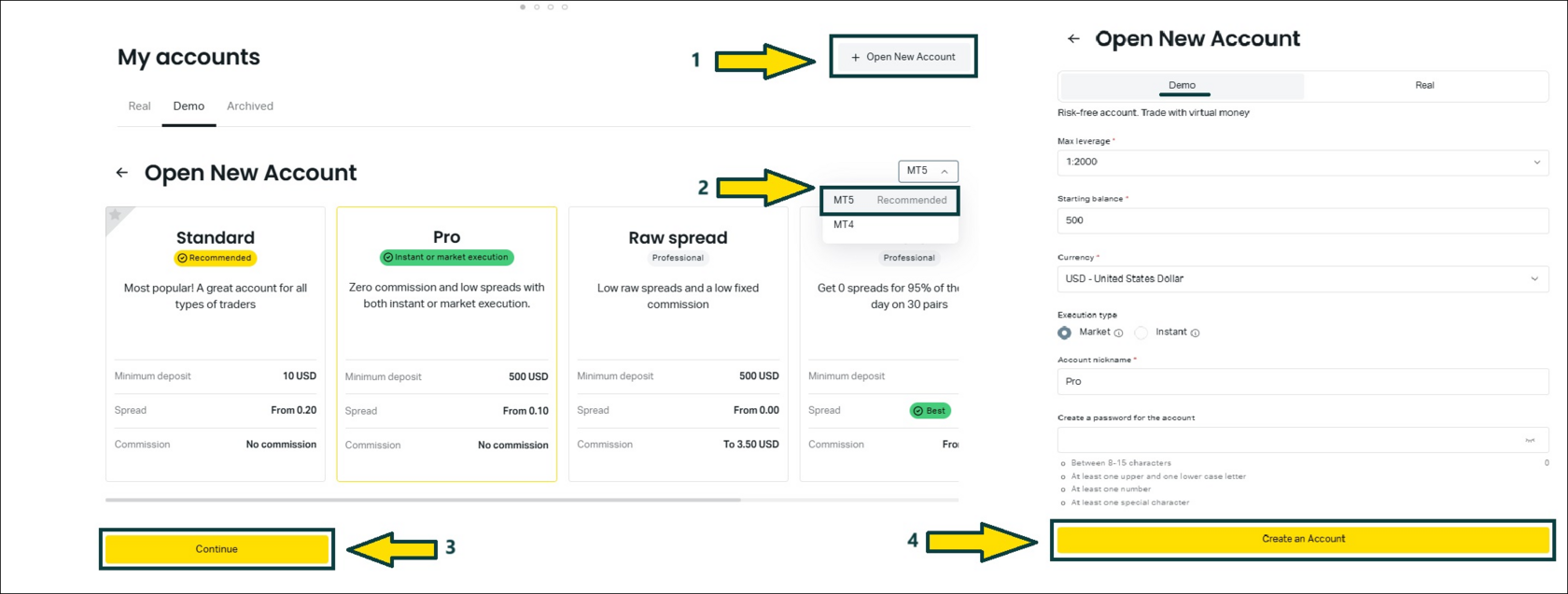

How to Open an Exness Raw Spread Account

Step-by-Step Guide

Register on the Exness Website: Go to the Exness website and click on the “Open an Account” button.

Provide Personal Details: Fill out the required personal information and verify your identity.

Choose Account Type: Select the Raw Spread Account during the account setup.

Deposit Funds: Deposit the required minimum amount to activate your account.

Start Trading: Once your account is set up, you can begin trading with low spreads.

Start Trading: Open Exness Account or Visit Website

Conclusion

The Exness Raw Spread Account is an excellent choice for traders who seek low trading costs, predictable spreads, and direct access to the interbank market. Whether you’re an experienced trader, an algorithmic trader, or someone who focuses on high-volume trading, this account type provides an ideal platform to implement your trading strategies. However, it is crucial to be aware of the risks involved and ensure proper risk management techniques are in place.

FAQs

What is the minimum deposit for the Exness Raw Spread Account?

The minimum deposit requirement for the Exness Raw Spread Account is $200.

Is the Exness Raw Spread Account suitable for beginners?

The Raw Spread Account is better suited for experienced traders who are familiar with market conditions and trading strategies.

Does Exness offer any other types of accounts?

Yes, Exness offers a range of accounts, including Standard Accounts and Zero Spread Accounts, each with its features and benefits.

Are there any hidden fees with the Exness Raw Spread Account?

No, all fees and commissions are transparent, allowing you to easily calculate trading costs in advance.

Is Exness regulated?

Yes, Exness is regulated by several authorities, including the Financial Conduct Authority (FCA) in the UK, ensuring a secure and reliable trading environment.