7 minute read

Low-Cost Forex Trading with Exness Raw Spread Account

Exness has gained significant recognition among forex traders for its competitive pricing, user-friendly interface, and extensive range of account types. Among the various offerings, the Exness Raw Spread Account stands out as an ideal choice for traders who seek low-cost forex trading. This type of account allows access to the raw market spreads, meaning you can trade at prices close to those offered by liquidity providers. Whether you’re an experienced trader or new to the world of forex trading, the Exness Raw Spread Account can be a valuable tool in achieving efficient, cost-effective trading.

What is a Raw Spread Account?

The Raw Spread Account offered by Exness is designed to provide low trading costs by giving you access to spreads as low as 0 pips. This account type eliminates the broker’s markup, allowing traders to benefit from the most accurate market pricing. This makes it particularly appealing to institutional corporate clients, algorithmic traders, and day traders who need to minimize trading fees while maximizing trading volume. Traders can also utilize automated trading strategies on this account, making it suitable for both novice traders and more experienced professionals.

Key Features of Exness Raw Spread Account

The Exness Raw Spread Account offers traders the opportunity to engage in low-cost forex trading by providing raw spreads directly from liquidity providers. This type of account is designed for active traders, including retail clients, experienced traders, and algorithmic traders, who require tight spreads and fast execution for their trading strategies. With the Exness trading fees kept to a minimum, traders can focus on their trading volume and maximize profits, all while using the Exness Trade App or Exness Terminal for seamless trade execution. The account also supports automated trading and market execution, which is ideal for traders who use advanced trading strategies. Exness ensures that clients can access a wide range of currency pairs and underlying assets, including CFDs, with competitive leverage options up to 1:2000. However, it’s important to note that trading with high leverage carries a high risk of losing money rapidly due to market volatility.

Exness Raw Spread Account provides a low-cost option for retail clients and individual investors who are seeking efficient forex trading with minimized costs. The account is designed to offer multiple account types, including professional accounts, while ensuring that clients benefit from low spread pricing and a trading experience similar to that of institutional corporate clients. Exness UK Ltd, registered in Wales under Companies House, is authorized and regulated by the Financial Conduct Authority (FCA), ensuring that traders can trade with confidence. With Exness fees transparent and accessible, clients can access a wide range of payment methods, including payment methods for deposits and withdrawals. Additionally, Exness supports social trading, allowing traders to follow and copy strategies from strategy providers. The Exness client portal makes it easy to manage account settings, monitor trading conditions, and access support from the Exness customer support team.

How to Get Started with Exness Raw Spread Account

1. Register with Exness

To open a Raw Spread Account with Exness, you first need to create an account with Exness UK Ltd, which is authorised and regulated by the Financial Conduct Authority (FCA). You can start by visiting the Exness website and selecting the account type that suits your needs. After registration, you will be asked to complete the verification process.

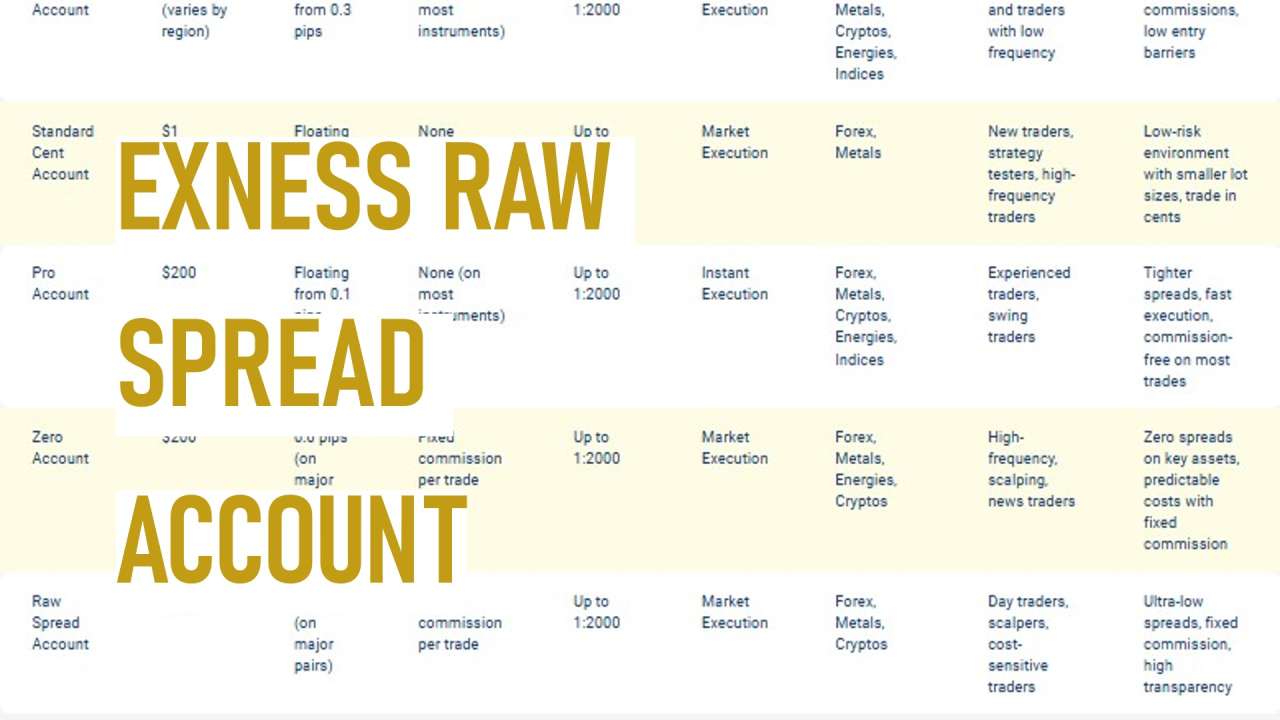

2. Choose the Right Account Type

Exness offers multiple account types, including Standard Accounts, Pro Accounts, and the Raw Spread Account. Each has different trading conditions and minimum deposit requirements. The Raw Spread Account is designed for active traders and algorithmic traders who prefer tight spreads and lower trading costs. You’ll also have the option to explore other Exness account types, such as professional accounts for institutional clients, or demo accounts to practice before committing real money.

3. Fund Your Account

Exness requires a minimum deposit for the Raw Spread Account, which can vary depending on your jurisdiction. The available payment methods include bank transfers, credit/debit cards, and various online payment systems. Once your account is funded, you can start trading.

4. Download Exness Trading Platforms

Exness provides a wide range of platforms for trading, including Exness Terminal and the Exness Trading App for mobile users. These platforms offer access to currency pairs, CFDs, and other underlying assets. You can trade directly from the platform using market execution and leverage, allowing for efficient trade execution.

5. Choose Your Trading Strategy

With a Raw Spread Account, traders often use more advanced trading strategies like scalping or automated trading. The low-cost structure makes it ideal for those who use high-frequency trading techniques or rely on algorithmic trading. Exness also offers tools such as Trading Central and market analysis to assist you in developing your strategies.

Exness Fees and Costs

While the Exness Raw Spread Account offers ultra-low spreads, it’s important to be aware of the overall trading costs. Exness charges a small commission on each trade, which is added to the raw spread. However, even with this commission, the overall cost of trading with Exness remains competitive compared to other brokers. Here’s a breakdown of Exness fees:

Raw Spreads: As low as 0 pips on major currency pairs.

Commission: A small commission is charged per trade (depends on the account type and volume).

Inactivity Fee: If your account remains inactive for a certain period, Exness charges a fee to encourage active trading.

Start Trading: Open Exness Account or Visit Website

Advantages of Low-Cost Forex Trading with Exness

Competitive Spreads. One of the main attractions of the Raw Spread Account is the ultra-low spreads. This allows traders to enter and exit positions with minimal slippage, which is especially beneficial in fast-moving markets. The raw spread helps reduce trading costs, allowing you to retain more profit from your trades.

High Leverage. Exness offers high leverage, allowing traders to maximize their exposure without needing significant capital. For retail clients and individual investors, leverage is a powerful tool that can help amplify gains, though it also increases the high risk of losing money rapidly due to leverage.

Advanced Tools for Trading. Exness provides access to sophisticated trading tools like Trading Central, market analysis, and auto trading features. These tools enhance your ability to make informed trading decisions and streamline your trading process.

Access to Multiple Asset Classes. With a Raw Spread Account, traders can access a wide range of currency pairs, CFDs, and other underlying assets. This allows for diverse trading opportunities across global financial markets.

Exness Support and Services

Exness offers robust customer support for traders through various channels. Whether you’re a retail client or a professional trader, the Exness support team is ready to assist you with any issues regarding your account, trading strategies, or payment methods. Exness is also committed to providing regulated services, ensuring that all trading activities are in line with the industry’s best practices. For more detailed support, the Exness client portal gives you access to your account settings, account history, and the option to contact support directly.

FAQ

What is the minimum deposit for Exness Raw Spread Account?

The minimum deposit for a Raw Spread Account with Exness depends on your location and the payment method used. Typically, the minimum deposit ranges from $200 to $500.

Are there any hidden fees with Exness Raw Spread Account?

Exness offers transparent trading costs, with no hidden fees. The only fees you will encounter are the commission per trade and the inactivity fee if your account is not used for a certain period.

Can I use automated trading with Exness Raw Spread Account?

Yes, Exness supports automated trading on the Raw Spread Account. You can use algorithmic trading or trading robots to automate your trading strategies.

What is the spread on Exness Raw Spread Account?

The spreads start from as low as 0 pips on major currency pairs, depending on market conditions.

Is Exness regulated?

Yes, Exness is regulated by the Financial Conduct Authority (FCA) in the UK, ensuring that it adheres to industry standards and provides a secure trading environment for its clients.