14 minute read

What Trading Account Types Are Available at Exness?

When choosing a broker, selecting the right trading account type is crucial for your trading success. Exness offers a range of account types tailored to suit traders of all experience levels, from beginners to seasoned professionals. Each account comes with its own unique features, such as varying spreads, leverage options, and commission structures, designed to match different trading styles and strategies.

Exness, including the Standard, Pro, Zero, and Raw Spread accounts. Discuss the features, benefits, and ideal use cases for each account, helping you decide which one is best suited to your trading needs. Whether you are just starting your trading journey or are an experienced trader looking for advanced features, Exness has an account type that can provide the flexibility and tools needed to navigate the markets effectively.

Overview of Exness Account Types

Exness offers a range of trading account types designed to meet the needs of various traders, from beginners to professionals. The Standard Account is ideal for newcomers to the market, offering floating spreads with no commissions, making it a straightforward and cost-effective way to begin trading. For more experienced traders, the Pro Account provides tighter spreads and a commission per trade, which is perfect for those who want to minimize their trading costs. The Zero Account, designed for scalpers and active traders, offers zero spreads on major pairs, coupled with a small commission, ideal for traders who make frequent trades. Meanwhile, the Raw Spread Account offers the tightest spreads directly from the market, with commission charges, making it suitable for professional traders seeking optimal conditions.

Exness also accommodates traders who prefer swap-free accounts, allowing them to trade without overnight interest (swaps), making it a good option for those who follow Islamic trading principles. Additionally, all account types are available in demo format, allowing traders to practice and familiarize themselves with the platforms without financial risk. With leverage of up to 1:2000 available across most accounts, Exness offers flexibility in terms of capital control and position sizing, ensuring that traders, regardless of their experience, can find an account type that fits their trading strategy and risk tolerance.

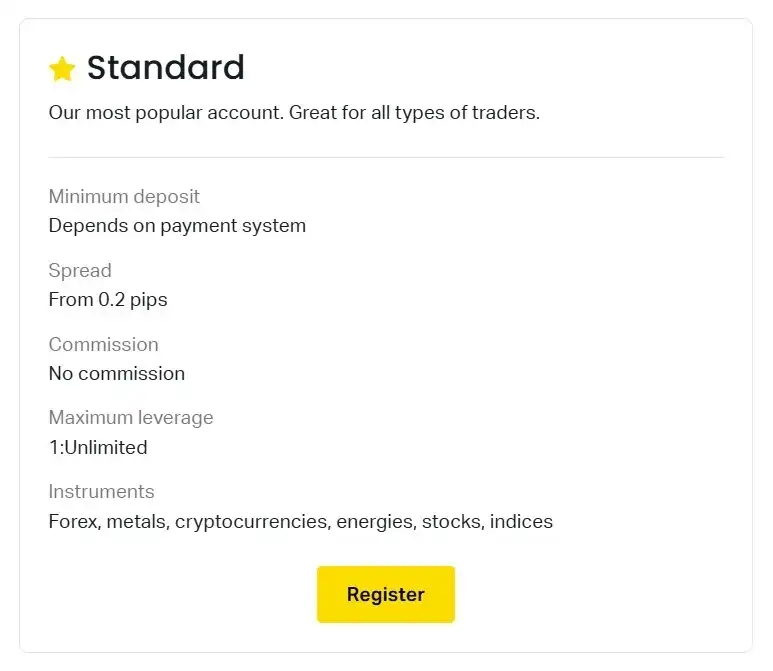

Standard Account

The Standard Account at Exness is one of the most popular and accessible account types, designed for beginner and intermediate traders. It offers a simple, straightforward trading experience with no commissions and relatively low trading costs, making it a great choice for those just starting out in the financial markets. This account type is ideal for traders who prefer not to deal with complex fee structures and want to focus on building their trading skills.

Key Features of the Standard Account:

Spreads: The Standard Account offers floating spreads, which can vary depending on market conditions. Typically, the spreads are competitive, although they may widen during periods of high market volatility.

Commissions: One of the key benefits of the Standard Account is that it does not charge commissions on trades, making it simpler and cost-effective for traders who want to minimize trading fees.

Leverage: Exness offers high leverage of up to 1:2000 on this account type, allowing traders to control larger positions with a smaller initial deposit. This is especially advantageous for traders looking to amplify their potential returns (with the understanding that higher leverage also increases risk).

Market Access: The Standard Account provides access to a wide variety of financial instruments, including forex pairs, commodities, cryptocurrencies, and indices. This makes it an excellent choice for traders who want to diversify their trading portfolios.

Minimum Deposit: The minimum deposit requirement for the Standard Account is low, making it accessible to traders with smaller capital, which is particularly appealing for those who are just starting out.

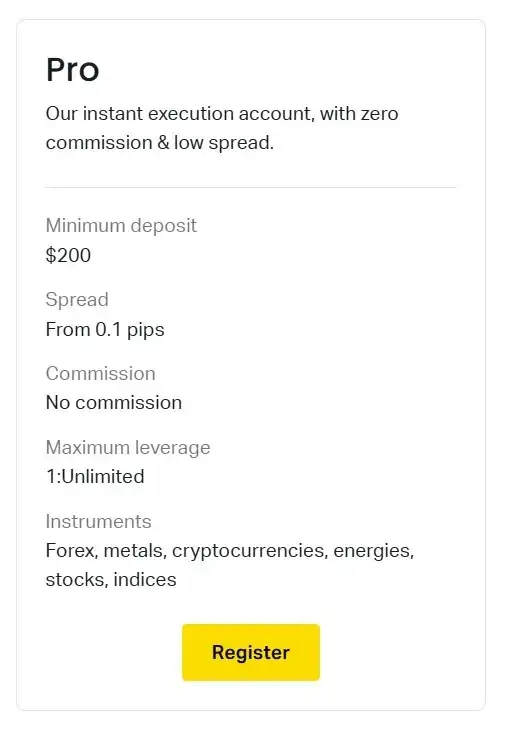

Pro Account

The Pro Account at Exness is designed for intermediate and advanced traders who require tighter spreads and are comfortable with a commission-based pricing structure. It offers a more professional trading experience, making it suitable for traders who actively manage positions and seek lower trading costs through tighter spreads. The Pro Account provides enhanced trading conditions that cater to those who prioritize precision and efficiency in their trades.

Key Features of the Pro Account:

Spreads: The Pro Account offers tighter floating spreads compared to the Standard Account. This allows traders to access more competitive pricing, especially during normal market conditions. Spreads are typically lower, making it a preferred option for traders who need to minimize their transaction costs.

Commissions: Unlike the Standard Account, the Pro Account comes with commission-based pricing, meaning a small fee is charged per trade. The commission is generally low, but it is important for traders to be mindful of this structure, especially if they trade in large volumes.

Leverage: Traders on the Pro Account can access leverage of up to 1:2000, allowing for greater control over positions with relatively smaller capital. This high leverage offers flexibility for traders looking to manage larger positions while maintaining the ability to control their risk.

Market Access: The Pro Account gives traders access to a broad range of forex pairs, commodities, stocks, and cryptocurrencies, enabling traders to diversify their trading strategies and explore different markets.

Minimum Deposit: The Pro Account generally requires a higher minimum deposit compared to the Standard Account, making it more suitable for those with a bit more capital to invest. This account type is ideal for traders who are serious about their trading and are looking for a more professional level of service.

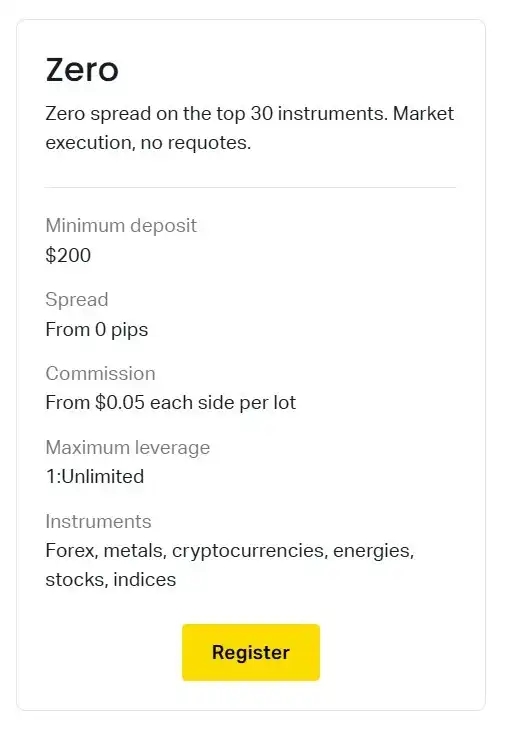

Zero Account

The Zero Account at Exness is specifically designed for scalpers, high-frequency traders, and those who prefer to execute short-term strategies in the forex market. With its ultra-tight spreads and low commission structure, the Zero Account is tailored for traders who require the best possible pricing and fast execution for their trades. This account is perfect for those who make a high volume of trades and need a broker that can offer competitive rates and minimal costs.

Key Features of the Zero Account:

Spreads: The standout feature of the Zero Account is its zero spreads on major currency pairs. This means that traders can access raw market spreads, which are typically the lowest available, especially for the most liquid and frequently traded pairs.

Commissions: Although the Zero Account offers zero spreads, it charges a small commission per trade. The commission is relatively low, but traders should be aware of it, as it applies to both buy and sell transactions. This commission is especially cost-effective for high-frequency traders who prioritize tight pricing over small commission fees.

Leverage: The leverage on the Zero Account can go up to 1:2000, giving traders significant flexibility to control larger positions with a smaller amount of capital. This is particularly useful for traders who engage in short-term strategies like scalping or news trading.

Market Access: Like other Exness accounts, the Zero Account provides access to a wide range of financial instruments, including forex pairs, commodities, cryptocurrencies, and indices. This diverse access is beneficial for traders who wish to trade across multiple asset classes.

Minimum Deposit: The minimum deposit for the Zero Account is generally higher compared to the Standard or Pro accounts, making it more suitable for traders with a larger capital base who require tight spreads and low commissions.

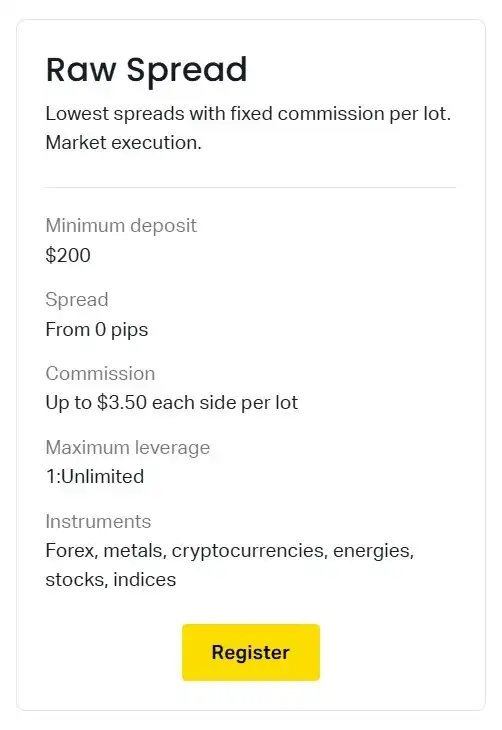

Raw Spread Account

The Raw Spread Account at Exness is designed for professional traders and institutional clients who need the tightest possible spreads and are comfortable with paying commissions per trade. This account is ideal for traders who engage in high-volume trading or employ advanced strategies that require optimal execution and minimal trading costs. By offering raw spreads, this account ensures that traders are getting the best available pricing directly from the market, making it the preferred choice for those who require the most precise and competitive trading conditions.

Key Features of the Raw Spread Account:

Spreads: The key feature of the Raw Spread Account is its raw spreads, which are the tightest spreads directly from the market. These spreads are typically much lower than the standard floating spreads seen in other accounts, especially on major forex pairs. This makes it ideal for traders who need the best possible execution and trading costs.

Commissions: While the Raw Spread Account offers the tightest spreads, it comes with a commission on each trade. The commission is relatively low, but it is important for traders to be aware of this cost when calculating potential profits. The low spread combined with the commission is an optimal structure for traders who focus on high-volume trading.

Leverage: The Raw Spread Account offers leverage up to 1:2000, providing traders with the ability to control larger positions with a smaller amount of capital. This level of leverage is especially useful for professional traders who want to amplify their potential returns, though it also requires careful risk management.

Market Access: Like other Exness accounts, the Raw Spread Account provides access to a wide range of financial instruments, including forex pairs, commodities, cryptocurrencies, and indices, allowing traders to diversify their portfolios and take advantage of different market conditions.

Minimum Deposit: The minimum deposit for the Raw Spread Account is generally higher than other accounts like the Standard or Pro accounts, making it more suitable for experienced traders or those with larger capital. This higher deposit threshold aligns with the professional nature of this account.

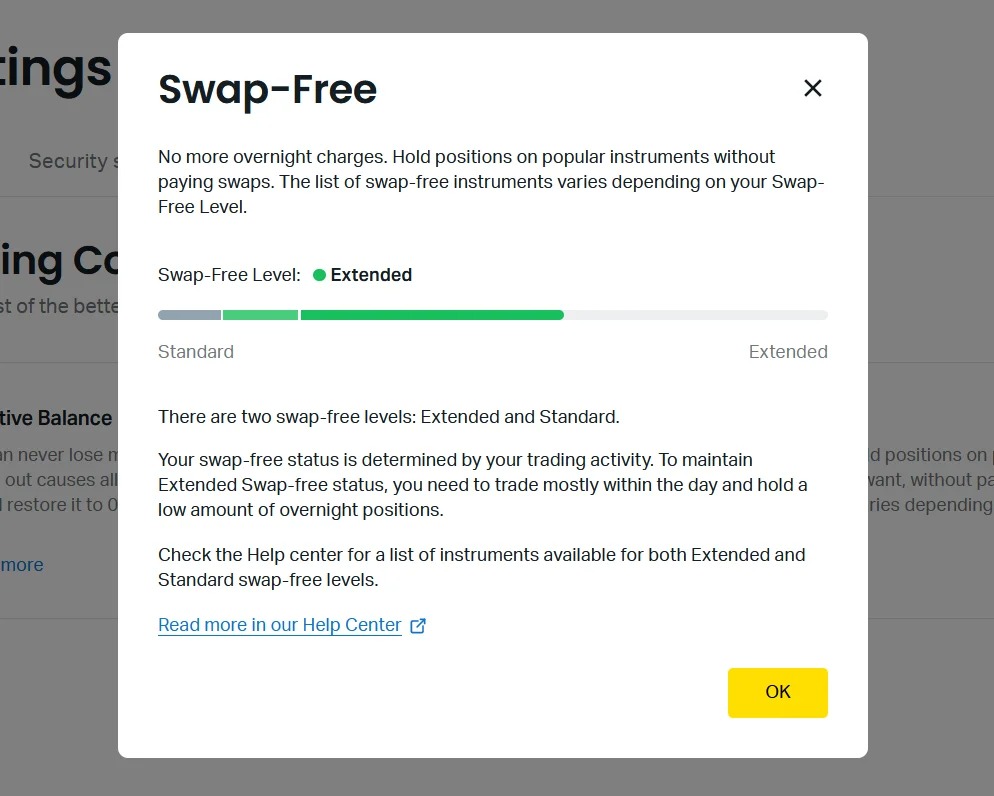

Swap-Free Accounts

A Swap-Free Account at Exness is an account type designed for traders who cannot engage in transactions involving overnight interest or swaps due to religious reasons, such as traders following Islamic principles. This type of account operates without the application of swap fees, which are typically charged or credited on positions that remain open overnight. Instead, Exness offers alternative fees, allowing traders to participate in the markets without violating their religious beliefs.

Key Features of Swap-Free Accounts:

No Swap Fees: The primary feature of a swap-free account is that no overnight interest is charged or credited on positions held overnight. This means traders will not incur or receive any swap fees, regardless of how long their positions remain open.

Available on Multiple Account Types: Swap-free conditions are available on Standard, Pro, and Zero accounts. Traders can choose from these accounts and still benefit from the swap-free feature, making it accessible for both beginner and advanced traders who require this setup.

Leverage: The leverage options available on swap-free accounts are the same as those on regular accounts, with leverage up to 1:2000. This provides traders with flexibility in managing their positions, especially with the added benefit of avoiding swap fees.

Market Access: Swap-free accounts provide the same access to forex pairs, commodities, stocks, and cryptocurrencies as regular accounts, giving traders the ability to diversify their portfolios without worrying about swap charges.

Start Trading: Open Exness Account or Visit Website

Demo Accounts

Exness offers Demo Accounts for traders who want to practice their strategies, test new trading tools, or get familiar with the platform before trading with real money. A Demo Account replicates real-market conditions, allowing traders to execute trades in a risk-free environment using virtual funds. This is a valuable resource for beginners looking to build their confidence and for experienced traders wanting to test strategies in various market conditions without the risk of losing real capital.

Key Features of Exness Demo Accounts:

Virtual Funds: Demo accounts come with virtual funds that mimic real money. This allows traders to explore the platform and practice trading strategies without any financial risk. The virtual funds can be replenished if needed, enabling unlimited practice.

Real-Market Conditions: The demo account provides a realistic trading environment, with live market prices and execution conditions. This allows traders to test how strategies would perform in the real world, without the risk associated with actual trading.

Full Access to Trading Platforms: Demo accounts offer full access to Exness's popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Exness WebTrader. Traders can experiment with charting tools, technical indicators, and automated trading features in the same way they would on a live account.

Customizable Settings: Exness allows traders to adjust the settings on demo accounts to suit their specific preferences, such as adjusting leverage or selecting different instruments for trading.

Risk-Free Learning: Whether you're new to trading or an experienced trader looking to experiment with new strategies, a demo account provides a safe space to learn without the fear of losing real money.

Start Trading: Open Exness Account or Visit Website

How to Choose the Right Exness Account

Choosing the right Exness account is essential for tailoring your trading experience to your goals, risk tolerance, and trading style. For beginners, the Standard Account is a great choice, offering low entry barriers with no commissions and competitive floating spreads, making it ideal for those just getting started in the forex and CFD markets. As traders gain experience and require more advanced features, the Pro Account offers tighter spreads and a commission-based pricing model, perfect for those who make more frequent trades and want to optimize trading costs. For active traders or scalpers, the Zero Account is designed with ultra-tight spreads and a low commission structure, providing the best conditions for high-frequency trading.

Traders with larger capital or those looking for professional-grade conditions may prefer the Raw Spread Account, which offers the tightest possible spreads directly from the market, along with a commission per trade. This account is ideal for those who require the lowest transaction costs for high-volume trading. Additionally, swap-free accounts are available for those who follow religious principles that prohibit trading with overnight interest, making Exness an inclusive option.

Conclusion

Exness offers a variety of trading account types, each designed to cater to different traders' needs, from beginners to professionals. The Standard Account is perfect for new traders looking for a simple, commission-free experience, while the Pro Account is ideal for intermediate traders seeking tighter spreads and commission-based pricing. For scalpers and high-frequency traders, the Zero Account offers ultra-tight spreads, making it a go-to option for short-term strategies. The Raw Spread Account is designed for professional traders requiring the lowest possible spreads and commission-based pricing for high-volume trading.

Exness accommodates traders who need swap-free accounts to align with religious guidelines, ensuring inclusivity for all traders. With access to high leverage, the ability to trade a wide range of instruments, and a demo account for risk-free practice, Exness provides a flexible trading environment. By selecting the right account type based on your trading style, experience level, and goals, you can optimize your trading experience and maximize your potential for success.

FAQ

What is the best Exness account type for beginners?

The Standard Account is ideal for beginners. It offers no commissions, competitive floating spreads, and a simple structure, making it an accessible option for traders new to the markets.

Does Exness offer swap-free accounts?

Yes, Exness offers swap-free accounts on the Standard, Pro, and Zero account types. These accounts are designed for traders who cannot engage in swap-based transactions due to religious reasons.

What are the commissions for the Pro Account?

The Pro Account charges a commission per trade, which varies depending on the trading volume and the instruments being traded. This account type offers tighter spreads compared to the Standard Account, making it suitable for traders who make frequent trades.

What is the minimum deposit for the Exness Zero Account?

The Zero Account requires a higher minimum deposit compared to the Standard Account, typically around $200. This account is designed for scalpers and active traders who need tight spreads and are comfortable with commission-based pricing.

Can I use Exness demo account for all account types?

Yes, Exness provides demo accounts for all its account types, including Standard, Pro, Zero, and Raw Spread. A demo account allows traders to practice and test their strategies risk-free with virtual funds.

What leverage does Exness offer on different account types?

Exness offers high leverage of up to 1:2000 on all account types, including Standard, Pro, Zero, and Raw Spread accounts. Leverage can help traders manage larger positions with smaller capital, though it also increases potential risks.