Sahara Investments, LLC Andrew S. Fonfa, Manager 9710 Tropicana Avenue, Suite 110 Las Vegas, Nevada 89147 702.241.5864 executivestaff@qcasinoresort.com Prepared August 2008 by Globalysis Ltd.

Globalysis Ltd. Disclaimer, Terms and Conditions of Use Globalysis Ltd. does not represent, through the information contained in this report, the views of any government, nor its agents, nor its officials, nor its affiliates. Globalysis Ltd. may, through its research and consulting relationships, financially benefit from the success of the subject matter discussed herein. Globalysis Ltd. is not a registered investment adviser in any jurisdiction, and it does not represent itself to be. Globalysis Ltd. does not provide any recommendations or opinions on financial securities. This research report does not constitute investment advice, financial advice, or advisory services. There could be gross errors contained in this report. No personal specific advice is provided within it. You, or the entity you are affiliated with, shall not use information in this research report as the basis for any decision making process. Globalysis Ltd., its officers, its members, its board of advisors, its board of directors and the author of this report shall not be held professionally or personally liable for any errors or omissions contained herein and are hereby indemnified in full by your agreement with these terms. By accessing, reading, storing, distributing and archiving this research report, you hereby agree, fully, and without dispute, to all terms and conditions contained in this ‘Disclaimer, Terms & Conditions of Use.’ All terms and conditions herein shall be subject to the full and primary legal interpretation and jurisdiction by courts located in the state of Nevada, United States of America. Globalysis Ltd. does not warrant or imply any guarantees or promises contained in this report; verbally expressed, either explicit or implicit. Globalysis Ltd. is a limited liability company formed and operating under the laws of the state of Nevada, United States of America.

The QCasino Resort Business Plan contains forward-looking statements within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act, as amended (“Exchange Act”), which are intended to be covered by the safe harbors created in the relevant provisions of those Acts. Forward-looking statements can be identified by the use of terms such as “anticipates,” “expects,” “believes” and other words having a similar meaning. Investors are cautioned that all forward-looking statements involve risks and uncertainty. Such forward-looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ from those expressed in any forward-looking statements made by us or on our behalf.

Table of Contents

1.0 Executive Summary

1.1 Investment Summary

1.2 Project Description

1.2.1 Renderings

1.2.2 Floor Plans

1.3 Keys to Success 2.0 Company Strategy 2.1 Legal Structure 2.1.1 Legal and Insurance 2.2 Management Partners 2.3 Management Team 2.4 Budget Summary 2.4.1 Hard Cost Estimate 2.4.2 Pro-forma 2.5 Location 2.5.1

FAA Approvals 2.5.2 Entitlements 3.0 Marketing Summary 4.0 Target Market Analysis 4.0.1 Market Trends 4.0.2 Market Size 4.0.3 Competitive Comparison 5.0 Marketing Strategy

5.0.1 Community Involvement 5.0.2 Hotel Advertising Strategy 5.0.3 Hotel Distribution and Sales Strategyzz 5.0.4 Hotel Condominium and Fractional Sales Strategy 6.0 Milestones 7.0 Mission Appendix

1.0

The QCasino Resort (the Q), a 45-story luxury casino hotel resort featuring worldclass amenities with hotel condominiums and fractional ownership opportunities, will be located in the “Entertainment Capital of the World” – Las Vegas, Nevada. Sophisticated and contemporary in design, the Q is being created specifically to attract the gay and lesbian community. The future site of this unprecedented property is near the corner of the famed Las Vegas Boulevard and Sahara Avenue. The owner/developer of this coveted site is Nevada-based Sahara Investments, LLC with partner Andrew S. Fonfa at the helm. Sahara Investments is seeking investors to fund the $400 million equity requirement.

To date, a luxury casino resort catering specifically to the gay and lesbian community does not exist, despite Las Vegas being the number two U.S. destination for gay and lesbian travelers. The Q will be the first of its kind in the world, providing luxury accommodations and amenities to this highly desirable, yet significantly underserved, niche market. Nationally, the gay and lesbian population is estimated at 10.9 million, and of this

population, over 9 million traveled in the last year. For travel in the United States, Las Vegas ranks second only to New York City as the most popular destination for gay and lesbian travelers. In 2007, Las Vegas played host to almost 1.9 million gay and lesbian visitors with an average stay of 3.5 nights, equating to 6.6 million room nights annually. With potentially 800 hotel rooms, the Q’s gay and lesbian annual visitor capture rate would need to be a mere 4.4% to obtain 100% occupancy. With this kind of demand combined with the limited supply, management expects to drive an average daily room rate comparable to that of the Strip’s luxury properties. These numbers do not take into account the immense population of international gay and lesbian travelers that visit Las Vegas annually. The capture rate for 100% occupancy drops even lower when international travelers are added to the equation.

As stated, research proves this to be a highly desirable niche market – one where dual income, no-kids (DINK) households make up the majority of the community, resulting in a higher than average discretionary income and one that has a propensity to travel, especially to Las Vegas. Las Vegas is a sought-after

6

QCasino Resort

vacation and convention destination offering 142,000 hotel rooms by year’s end with less than 30 lower-end, off-Strip hotel rooms dedicated to gay male travelers and zero hotel rooms dedicated to lesbian travelers. On average, Las Vegas enjoys a 90.4% room occupancy compared to the rest of the country’s 63.2% average room occupancy.

scene” in Las Vegas is disappointing and respondents surveyed expressed a willingness to extend their stay should there be more “gay appeal.” This translates into more gay and lesbian oriented venues including health spas, nightclubs, restaurants, shows and retail – all of which the Q will feature.

In a 2007 survey specifically studying the gay and lesbian Las Vegas visitor, 72% of all respondents said they mostly or exclusively prefer accommodations oriented toward the gay and lesbian community. Consistent with these results, when asked specifically about the Q, 62% responded that they would definitely stay overnight. For illustration purposes, if 62% of gays and lesbians who currently travel to Las Vegas annually booked their stay at the Q, the resort’s 400 hotel rooms and 400 hotel condominiums would be occupied every night 14 times over. As noted by having very few if any hotel rooms dedicated to gay and lesbian travelers, and none on “The Strip,” this niche market is significantly underserved in Las Vegas. In addition to very few hotel rooms, the “gay

Ultimately, the Q will become known as a “Hollywood-Broadway, celebrity driven gay and lesbian hotel casino resort.” The Q will cultivate its bicoastal celebrity relationships by appealing to their appreciation for social diversity. Celebrity participation will be encouraged in the Q’s development and operations, either through investment, direct affiliation, performing, and/or simply frequenting the Q to enjoy the myriad of distinctive offerings.

7 Business Plan

8 QCasino Resort Total Equity Investment Equity Investors (Cash) $ 400,000,000 83.33% Sahara Investments (Land) $ 80,000,000 16.67% Total Equity Investment $ 480,000,000 100.00% Proposed Capital Structure Total Equity Investment $ 480,000,000 40.00% Development Construction Loan $ 720,000,000 60.00% Total Project Development Cost $ 1,200,000,000 100.00% Interest in Project Profits Equity Investors 80.00% Project Sponsorship 20.00% Equity Cash Flow Dynamics 1. Preferred, cumulative, non-compounded return on outstanding equity paid to equity partners using 100% of cash flow whether from capital events or operating income. 8.00% 2. After preferred return is paid, operating cash flow is split as follows: Equity 80.00% Sponsors 20.00% 3. After preferred return is paid in full, equity partners receive 100% of cash flow from capital events until full capital is returned. 100.00% 4. After preferred return and return of capital are paid in full, additional cash flow from capital events is split: Equity

Sponsors 20.00% Equity Return Projections Total Equity Investment $ 480,000,000 Total Projected Return on Equity Investment $ 1,000,426,000 Projected Total Percentage Return on Invested Equity 208.42% Projected Annualized Return on Invested Equity 26.05% Projected Investors’ IRR 20.37% 1.1 | Investment Summary | The above representations of development cost, cash flow and return are based on Sahara Investments best current estimate of development/construction costs, operating results and sales scenarios associated with the proposed development,

the financial analysis section,

Sahara Investments and Globalysis Ltd. do not guarantee,

outcomes represented

Potential investors are urged to

and consult

their investment, tax and legal advisors, prior to investing in the Venture Entity.

80.00%

as detailed in

2.2.2.

either implicitly or explicitly, the ultimate achievement of the stated

herein.

perform their own analysis

with

1.2

Large by any city’s standards yet a boutique hotel by Las Vegas standards, the Q will be the preferred choice for gay and lesbian travelers. The Q will feature the following:

• A 45-story, 1,000-unit tower featuring 400 hotel rooms, 400 hotel/condominium units and 200 luxury fractional units.

• A 61,440 square foot casino featuring table games, slot machines, a poker room and a race and sports book.

• A 38,000 square foot state-of-the-art meeting and convention space.

• 30,000 square feet of shopping – from designer boutiques to the Q signature shops.

• Seven world-class formal and casual restaurants.

• Four bars, one lounge and two nightclubs providing a variety of entertainment experiences—everything from high energy to more intimate experiences.

• A 1,200-seat Las Vegas-style showroom featuring the city’s most unique entertainment.

• An 8,000 square foot, four-screen art cinema.

• One acre of lushly landscaped pool area including private cabanas.

• A 36,700 square foot full-service spa, salon and fitness facility.

For detailed information regarding the Q’s architectural program, please reference Appendix 1A or contact Sahara Investments at 702.241.5864.

9 Business Plan | Project Description |

10 QCasino Resort | Project Renderings | 1.2.1

11 Business Plan

12 QCasino Resort | Project Floor Plan | 1.2.2

13 Business Plan

14 QCasino

Resort

1.3

• The Q will be the only luxury casino resort in the world designed specifically for the gay and lesbian community.

• The Q will be located in Las Vegas, Nevada, the number two U.S. destination for gay and lesbian travelers.

• The Q will provide world-class entertainment, restaurants and amenities complemented by beautifully appointed and well designed hotel rooms and stunning exterior architecture.

• The Q will have the most well respected and highly experienced management partners (including the construction development partner, the hotel operating partner and the casino operating partner) in the resort development industry.

• The local, national and international gay and lesbian community is significantly underserved in Las Vegas and the Q will fill this void.

15 Business Plan | Keys to Success |

2.0

Las Vegas-based Sahara Investments, LLC, is the owner/developer of the property designated as the future site of the Q. Sahara Investments has taken several significant steps toward parcel development including assembling a highly qualified and respected development team. This team has successfully completed the full entitlement process and is poised to proceed with schematic drawings (SD’s) followed by design documents (DD’s) and finally construction documents (CD’s) needed for building permits.

Sahara Investments is currently seeking an equity raise totaling approximately $400 million through a private placement memorandum (PPM) which should be completed no later than January 2009. Due to today’s challenging lending environment, Sahara Investments’ goal is to achieve a 40% hard equity position ultimately allowing for a 60% construction loan. Sahara Investments believes that at this equity level, there will be no current monetary constraints for moving forward with SD’s, DD’s and CD’s. In this way, Sahara Investments may retain the flexibility to finance the Q’s construction as primarily a stand-alone casino resort property without the lending requirement to pre-sell a percentage of the hotel condominiums.

16 QCasino

Resort

| Company Strategy |

Upon a successful equity raise through the attached Private Offering Memorandum, the Venture Entity will be formed as a Nevada Limited Liability Company for the purpose of developing, constructing, owning and operating the Q.

Sahara Investments will act as the Venture Entity’s Manager. Sahara Investments will also invest in the Venture Entity by contributing the land’s current development status, including all tangible and intangible real and personal property, in exchange for Class “A” membership units valued at $80 million. Outside investors are being offered the opportunity to purchase up to $400 million in Class “B” membership interests in the Venture Entity.

Together the total $480 million of equity investment in both Class A and Class B units (“total equity investment”) gives all investors, subject to the specific distribution procedures outlined in the operating agreement, the prorata rights to:

• 100% of the cash flow from operations and capital events until an 8% cumulative noncompounded preferred return is paid on outstanding capital.

• Then, 100% of cash flow from capital events until full capital is returned.

• Then, 80% of cash flow from operations after the preferred return.

• And finally, 80% of cash flow from capital events after preferred return and return on capital.

Please read the entire Private Offering Memorandum and operating agreement, and consult with your investment, legal and tax experts to ensure your complete understanding of the Private Offering Memorandum and Operating Agreement’s terms and conditions before you choose to invest in the Venture Entity.

17 Business Plan

| Legal Structure |

2.1

2.1.1

Former Senator Richard Bryan has been retained to address many of the local legal issues. Senator Bryan holds the distinction of being the only Nevadan to have served as a State Legislator, Attorney General, Governor of Nevada, and United States Senator. Senator Bryan is currently a shareholder at the law firm of Lionel, Sawyer, & Collins, and a member of their Executive Committee. He is also the law firm’s designated representative for Lex Mundi and for the State Capital Global Law Firm Group. Senator Bryan is an Arbitrator for the American Arbitrator Association. He is on the Board of Trustees for the Nevada Development Authority, Economic Development Authority of Western Nevada, and the Las Vegas Chamber of Commerce. Senator Bryan is also Chairman of the Board for Preserve Nevada. The law firm of Jeffer Mangels Butler & Marmaro LLP, Los Angeles, California has been engaged to assist Sahara Investments on matters related to the hotel management agreement and the equity offering of the Venture Entity.

The consolidated insurance program (CIP) will be provided by Kaercher Campbell & Associates Insurance Brokerage, Las Vegas, Nevada.

A CIP is a centralized and controlled insurance, loss control and claims management program whereby all insurance and related services for the project will be purchased and managed by the developer. The program covers all participating contractors and subcontractors and provides General Liability, Excess Liability, Workers Compensation Insurance and Builders Risk Insurance. The financial benefits of a CIP are realized through the efficiencies associated with having a single, large insurance program.

18 QCasino Resort

| Legal and Insurance |

2.2

Strategic relationships are critical components for the Q‘s success. These relationships include, but are not limited to, a construction development partner (CDP), a hotel operating partner (HOP), and a casino operating partner (COP).

Construction Development Partner

Andrew Fonfa and Las Vegas-based GSG Development have formed a joint entity called QCDP which has been contracted to develop the Q. This well respected development team has a combined 50 years of development experience and has produced several billion dollars worth of real estate projects across the country. QCDP will engage only the most qualified consultants, contractors and subcontractors, all of whom will work closely with the project’s hotel operating partner and casino operating partner.

Hotel Operating Partner

Sahara Investments continues to work with Wyndham Hotel Group, one of the largest hotel groups in the world, to be the Q’s HOP. Sahara Investments and Wyndham Worldwide have executed a “nonbinding” term sheet defining preliminarily agreed to terms and conditions which will form the basis for drafting a final “binding” hotel management agreement between the parties.

The

19 Business Plan

|

Partners |

Wyndham Hotel Group encompasses nearly 6,500 franchised hotels and more than 551,000 hotel rooms worldwide under the Super 8®, Days Inn®, Ramada®, Wyndham Hotels and Resorts®, Baymont Inn & Suites®, Wingate by Wyndham®, Travelodge®, Howard Johnson®, AmeriHost Inn® and Knights Inn® brands.

Managment

QCasino Resort

Wyndham’s outlook on diversity and their existing relationship with the gay and lesbian community make it a most appropriate HOP for the Q. Wyndham, in fact, is one of the most “gay and lesbian-friendly” hotel operators in the world, having won numerous awards over the past several years for their continued contributions to, and participation within, the gay and lesbian community.

Casino Operating Partner

The Q’s casino operations will be managed by a third party casino management group. This group shall be led by Andrew Fonfa (Casino Group), the Manager of Sahara Investments. Mr. Fonfa has been a resident of Las Vegas for 33 years. He has held a Nevada Gaming and Liquor License for 13 years. Within his numerous shopping centers he has owned, and still owns, various bars and convenience stores with gaming devices that have required his licensing.

Mr. Fonfa currently owns the Indian Springs Hotel and Casino, and his application seeking an “unrestricted gaming license,” the same license that would be required for the casino operations at the Q, is now being processed by the Nevada Gaming Commission (NGC). His current expectation is to be approved for, and receive, the unrestricted license before the end of 2008.

As a result of Mr Fonfa’s past and current experience with the NGC, Sahara Investments is confident that once again Mr. Fonfa would be approved to operate the casino at the Q.

Once the QCasino Resort, LLC is formed, the Casino Group will enter into an agreement with the company to lease the casino for approximately $90 million per year, with annual 5% escalations in the lease rate, but subject to a renegotiation clause after the first 2 years of operation. The Casino Group will earn a $6 million fee (also with a 5% escalation clause, but subject to a renegotiation clause) for operating the casino in accordance with all applicable regulations and rulings. As such, the

20

| Managment Partners |

Casino Group will maintain any and all gaming revenues for their own account, in accordance with NGC regulations.

Per Sahara Investments’ gaming attorney, Mr. Ismail Amin, given the “private” nature of Sahara Investments’ offering memorandum, the NGC has “full and complete legislative and executive authority to ascertain the identity of gaming license applicants, affiliates and investors” (see Appendix 7B). Thus, any investor must be aware of this potential. Mr. Amin believes that, in general, the larger the investor; the more likely that particular investor “may be subject” to further inquiry by NGC. Full transparency, with disclosure of all relevant information regarding the Venture Entity and Mr. Fonfa’s main sponsorship during the initial gaming license application process should help reduce the level of additional inquiry into individual investors. However, the NGC has ultimate authority in this arena. A potential investor who has any trepidation in this regard should seek legal and other

professional counsel to garner enough information so the investor can make an informed investment decision regarding the Q. To review the Q’s casino operating partner’s opinion letter, please reference Appendix 7B or contact Sahara Investments at 702.241.5864 for further information.

21 Business Plan

| Management Partners |

2.3

Sahara Investments will assemble a highly experienced and capable management team to run the world’s first gay and lesbian hotel casino resort. This management team will consist of individuals that are regarded as the best and the brightest in their respective industries. Each member of the management team will be hand selected once the hotel operating partner and casino operating partner agreements have been secured.

22 QCasino

Resort

| Managment Team |

23 Business Plan Hard Cost $ 613,000,000 See following budget detail Soft Cost $ 327,000,000 See budget detail in Appendix 2C FFE $ 160,000,000 See budget detail in Appendix 2A Land $ 100,000,000 $80m existing site, $20m rear parking site to be acquired Total Project Cost $1,200,000,000 Sources of Funds Cash Equity $ 400,000,000 See offering memorandum Land Equity $ 80,000,000 Existing ground to be contributed by Sahara Investments Debt $ 720,000,000 Financed construction loan 60% of cost Total Fund Available $1,200,000,000 Income Sell of Hotel Condos $ 385,162,000 400 condos = 272,440 sf @ $1500 psf less commissions (1) Sell of Fractionals $ 514,330,000 200 units = 221,200 sf @$2500 psf less commissions (1) Sell of Hotel/Casino $1,254,200,000 Based on $129.3m income in 2016 less 3% Total Income from Capital Events $ 2,153,692,000 Less Capital Expenditures $ (55,400,000) Projected for first four years of operation Plus Four-Year Net Operating Income $ 376,175,000 TOTAL $ 2,474,467,000 Value over seven years 2009 – 2016 $ 1,274,467,000 (1) Commissions taken out of closing is 4% on presales and 8% on post opening sales based on 225 hotel/ | Budget Summary | 2.4

The construction hard cost estimate was compiled through a three-step process to obtain a sound, valid estimate of the costs to construct a new hotel casino. After the project team had established the program for the Q, GSG Construction Management prepared the initial project estimate. The program requirements were then provided to Turner Construction (a well respected high rise/casino general contractor in the Las Vegas Valley) who then prepared an estimate from a general contractor’s perspective. Finally, Rider Levett Bucknall (a large, international construction management and estimating firm) prepared a third party independent estimate based on the project program.

2.4.1

GSG Construction Management’s experience and similar data from the other team members. Costs per square foot were inclusive of general contractor fees, general conditions, insurances and bonds. Contingency, escalation through project development and value engineering were added to the bottom line.

General Contractor Estimate

Turner Construction prepared a construction estimate based on the project program requirements. Turner used data from similar hotel casino projects they had served as the general contractor on in recent years.

GSG Construction Management Estimate

The initial program estimate was prepared by GSG Construction Management in conjunction with the rest of the project team. Input from the project team was provided by the project architect, the developer and key consultants. Costs per square foot were assigned to each of the identified areas of the hotel casino program. The cost per square foot estimates were based on historical data from recent construction projects on the Las Vegas Strip and from

Turner was able to apply similar construction methodology, recent construction cost data and historical cost escalation figures to the program to develop a detailed cost estimate. Turner’s estimate was based on project direct costs with contingency, general contractor fee, insurances and bonds all being added to the bottom line. Lastly, escalation and value engineering were both added to the project costs.

Third Party Estimate

Rider Levett Bucknall (RLB) was tasked with developing a third, independent project cost estimate from the project program. Their

24 QCasino

Resort

| Hard Cost Estimate |

detailed estimate was derived from a very large database of similar hotel casino projects across the country as well as some recent projects in the Las Vegas Valley. RLB took a dual approach by applying cost per square foot figures to the program and preparing a detailed estimate based on the construction elements necessary to construct a new hotel casino of the Q’s magnitude. To the resulting direct costs, RLB added general conditions, general contractor fees, insurances, bonds, contingency, escalation and value engineering.

Conclusion

Based on the three estimates provided by

GSG Construction Management and the consultants, the project team believes that the Q can be constructed within the proposed hard cost budget developed by the project team. The general contractor’s estimate provided by Turner Construction was 9% higher than the project team’s estimate, and the third party independent estimate provided by Rider Levett Bucknall was around 6.6% lower. It is important to note that general contractors are typically at least 15% higher when providing un-negotiated budget estimates without any design documents to use as a basis. All parties agree that the project can be constructed within the $613 million construction hard cost

25 Business Plan

26 QCasino Resort | Hard Cost Estimate | Area Description Total # of Units SF Per Unit Total SF Cost Per SF Total Cost Hotel 400 Standard Rooms 375 475 178,125 $250.00 $44,531,250.00 Luxury Suites 25 1,615 40,375 $275.00 $11,103,125.00 Condo/Hotel 400 Standard Rooms 288 560 161,280 $275.00 $44,352,000.00 1-1/2 Bay Suites 67 840 56,280 $275.00 $15,477,000.00 2 Bay Suites 37 1,120 41,440 $275.00 $11,396,000.00 3 Bay Suites 8 1,680 13,440 $275.00 $ 3,696,000.00 Fractionals Private Residence Club 200 1 bedroom 50 840 42,000 $325.00 $13,650,000.00 2 bedroom 130 1,120 145,600 $325.00 $47,320,000.00 3 bedroom 20 1,680 33,600 $325.00 $10,920,000.00 Hotel/Hotel Condo Common Areas 490,940 33% 162,500 $175.00 $28,437,500.00 Hotel/Hotel Condo Lobby 1 9,360 9,360 $500.00 $ 4,680,000.00 Back of House 1 9,620 9,620 $200.00 $ 1,924,000.00 Fractional Common Areas 221,200 30% 65,300 $175.00 $11,427,500.00

27 Business Plan Area Description Total # of Units SF Per Unit Total SF Cost Per SF Total Cost Building Shell Casino 1 61,440 61,440 $525.00 $32,256,000.00 Back of House 1 18,670 18,670 $200.00 $3,734,000.00 Buffet 1 8,000 8,000 $500.00 $4,000,000.00 Back of House 1 9,000 9,000 $300.00 $2,700,000.00 Restaurants 6 5,383 32,300 $650.00 $20,995,000.00 Back of House 6 2,567 15,400 $200.00 $3,080,000.00 Food Court Front of House 1 2,300 2,300 $400.00 $920,000.00 Back of House 1 2,300 2,300 $400.00 $920,000.00 Restaurant Office /Staff Dining 1 12,400 12,400 $200.00 $2,480,000.00 Showroom (1,200 Seats) 1,200 16 19,600 $550.00 $10,780,000.00 Back of House 1,200 17 20,000 $300.00 $6,000,000.00 Lounge (200 Seats) 200 31 6,150 $500.00 $3,075,000.00 Back of House 200 30 6,000 $200.00 $1,200,000.00 Bars 4 1,538 6,150 $650.00 $3,997,500.00 Back of House 4 750 3,000 $200.00 $600,000.00 Convention 1 38,000 38,000 $280.00 $10,640,000.00 Back of House 1 15,000 15,000 $200.00 $3,000,000.00

28 QCasino Resort | Hard Cost Estimate | Area Description Total # of Units SF Per Unit Total SF Cost Per SF Total Cost Retail (Includes Promenade) 1 30,000 30,000 $325.00 $9,750,000.00 Back of House 1 7,500 7,500 $200.00 $1,500,000.00 Spa 1 36,700 36,700 $500.00 $18,350,000.00 Back of House 1 3,300 3,300 $200.00 $660,000.00 Nightclubs 2 11,750 23,500 $700.00 $16,450,000.00 Back of House + Patio 2 3,845 7,690 $300.00 $2,307,000.00 Movie Theater 1 8,000 8,000 $400.00 $3,200,000.00 Ticketing and Pre-function 1 6,500 6,500 $450.00 $2,925,000.00 Pool Area 1 40,000 40,000 $600.00 $24,000,000.00 Offices/Warehouse/ Receiving/Engineering 1 74,300 74,300 $200.00 $14,860,000.00 Vertical Transportation 1 15,000 15,000 $600.00 $9,000,000.00 M/E Vert. Chase/ Exiting Stairwells/Misc. 1 43,700 43,700 $200.00 $8,740,000.00 Total Excluding Parking Garages 1,530,820 $307.70 $471,033,875.00 Parking Garage Below Grade 250 350 87,500 $50,000.00 $12,500,000.00 Above Grade 1,850 350 647,500 $18,000.00 $33,300,000.00 Landscaping/Hardscaping 1 Allowance 1,000,000 $1.00 $1,000,000.00

29 Business Plan Area Description Total # of Units SF Per Unit Total SF Cost Per SF Total Cost Offsite Improvements (Roads, San. Sewer, Storm Sewer, Water, Gas, Electric, Phone, Cable, Misc.) 1 LS 10,000,000 $1.00 $10,000,000.00 Onsite Improvements (Grading, Paving, Site Concrete, Site Electrical, Porte-Cochere, Misc.) 1 LS 5,000,000 1.00 $5,000,000.00 Subtotal Hard Costs $532,833,875.00 Contingency 10% of Hard Costs $53,283,387.50 Subtotal $586,117,262.50 Escalation 10% of Hard Costs $53,283,387.50 Subtotal $639,400,650.00 VE/Buyout Credit (-5% of Hard Costs) -$26,641,693.75 Total Including Parking Garages 2,265,820 $270.44 $612,758,956.25 For detailed information regarding the Q’s hard cost construction budget, general contractor estimate and third party estimate and/or soft cost estimate, please reference respective Appendices 2B and/or 2C or contact Sahara Investments at 702.241.5864.

QCasino Resort

Sahara Investments and Globalysis Ltd. have diligently investigated and analyzed historical Las Vegas hotel casino development costs and operating results, in conjunction with specific niche market research provided by Community Marketing, Inc., to establish realistic development cost and operating assumptions that form the basis for the attached Q pro-forma financial analysis.

pleased to present for your review the following analysis of potential investment participation in the development of the Q.

2.4.2

As with any analysis package, the results are only as good as the input. Sahara Investments and Globalysis Ltd. have made every effort to develop realistic cost and operating assumptions as required. Potential investors are urged to consult with their investment, legal and tax advisors to ensure complete understanding of the analysis assumptions, including the potential risks and returns associated with an investment in the Venture Entity.

Sahara Investments and Globalysis Ltd. are

Equity Investor Return Projections

As shown in the investment summary, the projected investor internal rate of return for the Q development is 20.37%. In light of the 40% equity portion of the capital stack, an investment in the Venture Entity exhibits highly favorable potential returns to an equity investor. The investors’ overall projected return on the equity investment is 208% over eight years, or 26.05% on average per year. Please review the Q investor pro-forma for specific annual projected cash flows associated with the development.

30

| Pro-forma |

Hard Cost Estimate

The hard cost estimate generated in Section 2.4.1 is a result of several months of work with the coordinating architectural team and the Q’s construction development partner. The first step in this effort is detailed in Appendix 1A in which the optimal architectural program associated with the Q’s development was formulated.

• Insurance premiums will include total risk mitigation package and construction defects coverage.

• Marketing includes preopening hotel marketing budget, fractional and hotel condominium sales marketing budget, sales center construction and the hotel collateral budget.

The budgeting finalization was based on three separate hard construction cost estimates. The Q’s construction development partner believes they can construct the Q within the projected hard cost budget presented herein.

Soft Cost Estimate

The soft cost estimate, as shown in Appendix 2C, was generated by the Q’s construction development partner working through each soft cost category associated with a development of the Q’s scope. Budgeted soft costs include:

• Architectural and engineering costs.

• Permits and fees determined in consultation with the City of Las Vegas’ permit and fee technicians and through the use of a utility consultant.

• Overhead and supervision consists of a 4.5% development fee and a 1.5% construction management fee based on hard costs only.

• Financing fees include expected costs associated with the equity raise, debt acquisition, bank fees, closing costs and construction loan interest.

• Sales commissions include all sales commissions for fractional and hotel condominium sales and other consulting fees.

• Pre-opening expenses include budgeted pre-opening salaries/ expenses, hiring/training and working capital.

Thus, the total projected cost for the Q has been established at $1.2 billion as summarized in Section 2.2 herein.

31 Business Plan

Income from Capital Events

Also summarized in Section 2.2 herein is the expected total income associated with sales of the Q hotel condominiums, the Q fractional residences and a potential sales scenario of the hotel casino in 2016. The following pro-forma spreadsheet shows the expected income from these sales and reveals the assumptions associated with said cash flows.

Income from Operations

The financial projections used to determine the Q’s operating income beginning in 2013 are generated by first determining what a hotel casino of the Q’s anticipated size and scope should earn in today’s dollars (USD2007) utilizing historical operating data for existing Las Vegas hotel casino operations. The results of this analysis are summarized in Appendix 2F (operating income). The five-year operating forecast as seen in Appendix 2D is developed by inflating the USD2007 results at historical average growth rates through the 2013-2017 timeframe. The average daily room rate (ADR) at the Q is assumed to be $299 (USD 2007) per night. Hotel condominium sales are assumed with an average price of $1,500 per square foot (psf), with fractional sales assumed at $2,500 psf. Additional assumptions regarding time of cash flows are detailed in the Q’s investor pro-forma spreadsheet.

32 QCasino

Resort

| Pro-forma |

closings in last quarter of 2012 and 50 closing in 2013, 25 presales and 25 new sales. Then 50 closings in 2014 and 2015 wi th the last 25 closings in 2016.

7. This is the net debt outstanding each year. Debt pay down is estimated. Will be dictated by actual loan terms, release p rices and sales velocity. Two-thirds (150) of 2013 sales will be presales and 1/3 (75) will be post opening sales. Then 50 units closing during each of 2 014 and 2015. Less 4% sales commissions on presales and 8% on post opening sales. 4. Fractionals are a six-year sell out. 2011 through 2016. With 221,200 sf @ average price of $2500 psf. Closings happen ove r four years. Less 4% on presales and on 8% post opening sales. Average sales price of $2,765,000.

5. Based on a 2016 projected cash flow of $129.3 million sold at a 10% cap rate less 3% transaction fees.

6. See five-year operating forecast in Appendix 2D for annual capital expenditures.

This is the total preferred return paid in given year whether out of capital events or operating cash flow. 11. Based on $50 million of TIF financing @ 7.5% $3 million/year will be received from the City of Las Vegas, half of which wi ll flow through to investors. In 2016 remaining $45 million is discounted back @10% and sold. 12. This is a cumulative, but non-compounding preferred return of 8% paid to investors on outstanding equity amount. 13. Since the preferred return has "first outs" 100% of available cash flow from capital events and operating income pays inve stors preferred return until caught up. 8. Based on detailed projections see Appendix 2D.First quarter discounted 20% because of inefficiencies of opening. 2016 is o nly 3 quarters income based on a sale in the fall. 9. All construction period financing costs are included in Soft Cost development budget. Then interest for each year is base d on 8% of amount outstanding. 2016 is on nine months figuring sale in fall.

10. This fee is paid for outside casino management.

Casino/Hotel Sold in Fourth Quarter 2008 2009 2010 2011 2012 2013 2014 2015 2016 TOTAL480,000,000 320,000,000 400,000,000 73,559,000 217,611,000 46,996,000 46,996,000 385,162,000 66,360,000 129,995,000 127,190,000 127,190,000 63,595,000 514,330,000 1,254,200,000 1,254,200,0006,700,000 12,100,000 17,900,000 18,700,000 55,400,000 139,919,000 340,906,000 162,086,000 156,286,000 1,299,095,000 2,098,292,000 100,000,000 300,000,000 100,000,000 100,000,000 120,000,000 720,000,000 39,919,000 40,906,000 62,086,000 38,400,000 37,000,000 218,311,000 17,886,000 462,114,000 480,000,000679,981,000 679,981,000320,000,000 620,000,000 320,000,000 220,000,000 120,000,00020,000,000 104,500,000 113,500,000 123,200,000 96,975,000

equity usedin soft costs in soft costs49,600,000 25,600,000 17,600,000 7,200,000 100,000,000 1,500,000 6,000,000 6,300,000 6,615,000 6,945,750 27,360,7501,500,000 1,500,000 15,000,000 18,000,000 18,500,000 48,900,000 83,100,000 100,485,000 97,829,250 376,175,000 18,500,000 48,900,000 20,089,000-63,011,000 100,485,000 97,829,250 376,175,000 38,400,000 76,800,000 115,200,000 153,600,000 133,581,000 82,175,000 38,400,000 37,000,000 58,419,000 89,806,000 82,175,000 38,400,000 37,000,000 247,381,000 95,181,000 43,775,000--17,886,000 462,114,000 480,000,000--

-50,408,800 80,388,000 78,263,400 209,060,200$ ($480,000,000)$$ $58,419,000$89,806,000$132,583,800$136,674,000$1,121,362,200$1,480,426,000 20.37%

33 Business Plan For detailed information regarding the Q’s five-year operating forecast, operating income forecast and/or hotel revenue trends please reference respective Appendices 2D, 2E and/or 2F or contact Sahara Investments at 702.241.5864.

458,175,000

543,984,800 543,984,800

14.

Investor IRR 1. Ground valued at $80 million contributed by Sahara Investments plus $400 million in cash equity. 2. Equity will be used first during 2009 for design work and the first

of construction

bank

3. 400 units or 272,440 sf @ average price of $1500 psf. 75 units of presales closing

14. Return of capital Investors percent of remaining capital events income 80% Investor percent of net operating income 80% Investor Total Cash Flow Remaining cash flow from operations for partner distribution 12. Unpaid preferred return 8% 13. Total preferred return payments this year Remaining unpaid preferred return 10. Less casino operations expense 11. Plus cash flow from TIF financing Net Cash Flow from Operations Less cash flow from operations used to pay preferred return 7. EOY outstanding debt Income from Operations 8. Cash flow from operations 9. Less interest carry Less cash from capital events used to pay down debt Less cash available from capital events used to pay preferred return Less cash from capital events used to return equity Remaining cash from capital events for partner distribution 4. Income from sale of fractionals 5. Income from Sale of Hotel/Casino 6. Less cash spent on capital expenditures Cash Available from Capital Events 1. Equity 2. Construction debt Capital Events 3. Income from sale of condo/hotel

25

year

(2010). Therefore,

construc tion financing is utilized during the last two years of construction.

in fourth quarter of 2012 as soon as t he building is delivered and another 225 units closing in 2013. Average sales price $1,021,650.

2.5

The Q will be located just west of the corner of Las Vegas Boulevard and Sahara Avenue – directly across from the proposed 40-acre, $5 billion MGM Mirage/Kerzner development. From all indications, the Q is poised to be in close proximity of where the majority of new development and redevelopment is occurring on the Las Vegas Strip. The following illustrates current and planned activity.

• The Venetian’s sister property The Palazzo Resort Hotel Casino opened in December 2007.

• Wynn’s sister property Encore is currently under construction and is scheduled to open December 2008.

• The Plaza (El AD Group) recently imploded the Frontier property and is in the planning process of a $5 billion hotel casino and mixed-use development.

• The $4.8 billion Echelon (Boyd Gaming) is currently under construction and is slated to be an 87-acre hotel casino and mixeduse development opening in third quarter of 2010.

• The La Concha property located next to the Riviera recently sold for $34 million per acre as part of a future 15+ acre project by Triple Five Development.

• The $2.9 billion 24-acre Fontainebleau property is currently under construction and is slated to open fall of 2009.

• The Sahara Hotel was recently purchased by SBE Entertainment. Located on the corner of Sahara Avenue and Las Vegas Boulevard, the property is currently in the planning process for a total refurbishment and repositioning campaign.

• As mentioned above, the MGM Mirage/Kerzner $5 billion, 40-acre development will be located directly across the street from the Q. Planning is ongoing with an anticipated groundbreaking slated for third or fourth quarter of 2008

34

QCasino Resort

| Location |

• An additional 38-acre parcel of land located adjacent to the MGM Mirage/ Kerzner development is planned for a future casino hotel and mixed-use project. As a result of these developments and continuing investment activity in the area, the Q’s property has become extremely valuable as a development site. In fact, the development of Allure Las Vegas, a completed condominium project adjacent to the Q, has been one of the main catalysts for many of the above projects moving forward on the North Las Vegas Strip location.

The Q has received its FAA 7460-1 approvals for proposed building heights as required by the Clark County Department of Aviation and the Federal Aviation Administration. Substantial design revisions will be subject to further Clark County Department of Aviation and the Federal Aviation Administration review and approval.

2.5.1

For detailed information regarding the Q’s FFA Approval, please reference Appendix 2H or contact Sahara Investments at 702.241.5864.

35 Business Plan

|

Approval |

FAA

2.5.2

Sahara Investments’ management team has worked diligently since October 2006 to bring this project to fruition.

Sahara Investments is contributing a fully entitled piece of ground with the following entitlements, approvals and terms in place:

• Perimeter wall and fencing built to secure the property

• Entitlements approved by the City of Las Vegas to build a hotel casino with hotel and/or residential units for sale, allowing for construction of up to 72 stories, with a maximum 1,340 units (keys) including the following specific approvals:

Rezoning approval ~

Site development review approval ~

Special use permit to exceed height restriction approval ~

Special use permit to allow for mixed-use approval ~

Special use permit to allow non-restrictive gaming approval ~

• Development Team Formation

The Q construction development partner (QCDP) is in place ~ bringing together an excellent development group, GSG Development, with the existing Fonfa development group. Working with the lead architectural team (see below), the ~ QCDP has identified its proposed architectural program and associated budgets, with hard cost budgets verified by Turner Construction and Rider Levitt Bucknall, construction consultants.

36 QCasino Resort

| Entitlements and Development costs |

•

Hotel Operating Partner

Over one year of negotiations with Wyndham Hotel Group has resulted in the mutual execution of a “non-binding” term sheet indicating Wyndham’s desire to manage and operate the Q, subject to the execution of a “binding” hotel management agreement between Wyndham and the Venture Entity.

For detailed information regarding the Q’s entitlements, please reference Appendix 2I or contact Sahara Investments at 702.241.5864.

•

Lead Architectural Team

Local coordinating architect in place, Ed Vance and Associates has been working with the construction development partner in the space design and budget costing as found in our pro-forma analysis

Through Sahara Investments’ efforts to date, with the contribution of its land and multiple development efforts and entitles, the Venture Entity would be positioned to move quickly with its schematic drawings, design documents, construction documentation, civil engineering, etc., immediately upon a successful equity raise and resultant Venture Entity formation.

37 Business Plan

The Q’s customized marketing plan will support its opportunity to become the world’s first hotel casino resort designed specifically for the gay and lesbian community. The marketing plan will specifically support revenue drivers including rooms, gaming, shows, restaurants, bars and retail. In addition, the marketing plan will support the Q’s opportunity to become the premier gay and lesbian meeting and convention venue and to serve the room needs of gay and lesbian travelers to Las Vegas for meetings and conventions held elsewhere. The marketing plan will also support the sale of the Q’s hotel condominiums and luxury fractional units.

oriented towards the gay and lesbian community. Consistent with these results, when asked specifically about the Q, 62% responded

According to a 2004 study conducted by one of the world’s preeminent resources for gay and lesbian market research, Community Marketing, Inc. (CMI), many of those surveyed believed the “gay scene” in Las Vegas was disappointing and those visiting would stay longer if there was more “gay appeal.” CMI conducted a 2007 study specific to the Q that revealed, of those surveyed 72% mostly or exclusively prefer accommodations

38 QCasino Resort

| Marketing Summary |

3.0 4.0

that they would definitely stay overnight while another 26% responded that they would at least want to visit the property. Additional activities such as attending shows and going to bars and nightclubs returned similar results.

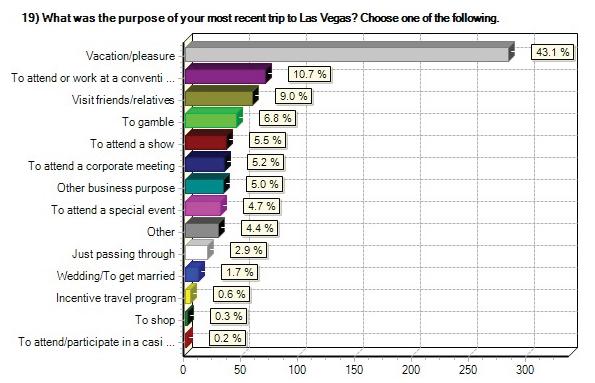

Although the gay and lesbian community is estimated to be 4-6% of the overall population, this overwhelmingly strong response is encouraging even if the property does not attract a significant share of the remainder of Las Vegas visitors. However, the Q can expect to capture the majority of gay and lesbian visitation, increasing revenue generated from gaming, food and beverage, entertainment and shopping. Furthermore, the Q may induce additional visitation from those seeking an alternative resort experience that embraces diversity. Information on the broader, existing tourist base (which includes current gay and lesbian visitation) is published by the Las Vegas Convention and Visitors Authority (LVCVA) and is used for comparison purposes here. Based on survey results, it appears that spending in categories that are focused on-site should be above those reported by all visitors to Las Vegas. Gay and lesbian visitors reported that on their

39 Business Plan

Target Marketing Analysis |

last trip to Las Vegas they spent more than the average visitor on key elements including lodging, food and beverage, entertainment and shopping.

|

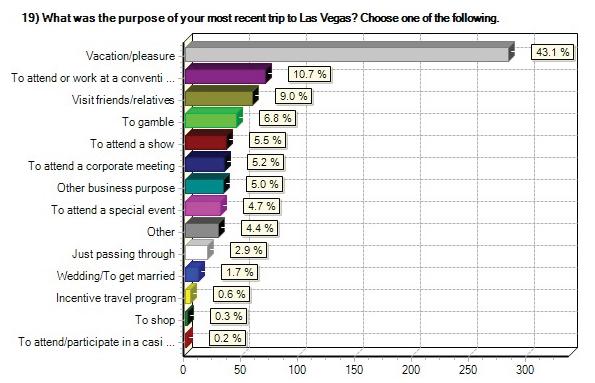

40 QCasino Resort The following chart

travel

gay

12th Annual Gay & Lesbian Tourism Study, a survey of over 7,500 gay and lesbian consumers. In CMI’s

survey conducted specifically for the Q, of the 1,681 respondents in the study, 28% had visited Las Vegas

last year and 39% had visited two or more times in the last five years. These respondents

the 1,681 respondents, 641 said the availability of hotel condominiums, private condominium residences or fractional ownership condominiums

this gay and lesbian casino resort would influence their interest

the property. These respondents are

Ranking Gay Men Lesbians GenY GenX Boomers Seniors GenY GenX Boomers Seniors 1 New York 1 1 1 1 3 3 2 6 2 Las Vegas 2 2 2 3 2 1 1 10 3 San Francisco 4 4 3 5 1 4 3 3 4 LA/Weho 3 3 6 6 4 7 11 17 5 Fort Lauderdale 9 6 5 2 N/R 12 19 7 6 Palm Springs 12 9 4 3 15 9 13 7 7 Chicago 7 5 7 10 11 8 17 14 8 San Diego 8 10 8 8 7 10 9 2 9 Washington DC 6 8 10 7 7 14 11 11 10 Miami 5 7 10 8 12 19 16 14 11 Provincetown 18 11 15 13 4 6 4 1 | Market Trends | 4.0.1

illustrates U.S.

destinations of the

and lesbian community by generation. This data was derived from CMI’s (2007)

recent

in the

are termed “Visitors.” Of

in

in

termed “Purchasers.”

Of the Las Vegas “Visitors” as defined above, the median visitor most recently visited Las Vegas in the last 12 months, and visited four times in the last five years. 70% stayed in a casino resort on the Strip and 5% stayed in a gay and lesbian resort or guesthouse. The median visitor spent three nights on their most recent visit. The median spending per person for a Las Vegas “Visitor” was as follows:

Lodging $375 Food/Dining $250 Local Transit $60 Entertainment $200 Sightseeing $0 Bars/Nightclubs $100 Shopping $100 Gambling $250

TOTAL: $1,335

19% of gay and lesbian visitors spent a total of $2,000 or more on a Las Vegas vacation. It is interesting to note that the majority of “Visitors” came to Las Vegas for a purpose that is intended to be filled by the Q.

To review Community Marketing, Inc.’s complete Gay & Lesbian Research Custom Study, please reference Appendix 4A or contact Sahara Investments at 702.241.5864 for further information.

41 Business Plan

There are an estimated 10.9 million gay and lesbian adults in the U.S. alone. Based on CMI’s Gay & Lesbian Consumer Index, 84.8% of gay male and 83.6% of lesbian consumers traveled in the last year (and spent $500 or more). That’s over 9 million U.S. gay and lesbian travelers.

4.0.2

visited Las Vegas in 2007 for some purpose. That equates to about 1.9 million gay and lesbian visitors to Las Vegas last year alone.

Las Vegas is the number two leisure destination for U.S. gay and lesbian travelers; 14.3% of all gay and lesbian consumers surveyed visited Las Vegas in the last year, and of those, 7% traveled for business related purposes.

In the survey conducted specifically for the Q, it was found that 28% of survey respondents

42

QCasino Resort

| Market Size |

As the only luxury casino resort designed specifically with the gay and lesbian community in mind, the Q will thereby distinguish itself from all other leading luxury properties located along the Las Vegas Strip. These resorts include Wynn Las Vegas, Bellagio Las Vegas, The Venetian, The Palazzo and soon to be joined by Echelon Las Vegas, CityCenter and Encore Las Vegas. As research gathered within the gay and lesbian community indicates, the Q will be extremely popular within its targeted customer base and will differentiate itself from the broader market and facilities that would otherwise be comparable in quality with an equal array of

4.0.3

amenities. Other Las Vegas resorts, as noted above, have realized the importance of attracting gay and lesbian travelers and have recently begun making efforts to specifically appeal to this sought-after niche market.

To review gay and lesbian targeted print advertising and/or recent related news articles, please reference respective Appendices 4B and/or 4C or contact Sahara Investments at 702.241.5864 for further information.

43 Business Plan

| Competitive Comparision |

5.0

Although the gay and lesbian travel market is not a new market, it is only recently that it has been recognized by the travel industry as an appealing market and thus specifically targeted creating a more competitive environment. Competition for the gay and lesbian vacation dollar is strongest among resort destinations. Las Vegas is already a popular vacation destination for many segments of the gay and lesbian community, but not for the same reasons as most other gay and lesbian resort destinations. Other resort areas, such as Palm Springs, San Diego, Fort Lauderdale, San Francisco, etc. have well-established gay communities and gay infrastructures (bars, clubs, book stores, cafes, events, etc.).

Las Vegas is behind in all of these critical categories. This presents both a challenge and an opportunity for the Q. Currently, most gay and

lesbian visitors are coming to experience the entertainment, food, shopping and casinos of the destination; they are not coming for the “gay” elements that most other destinations feature. However, the Q will specifically be designed to present all of these opportunities and attractions near the Las Vegas Strip. This is a marketing and competitive edge for the project. Promotion of the destination will not be required as it is already number two in the U.S. Promotion of the Q and its features will need to be communicated. Besides standard

44 QCasino Resort

| Market Strategy |

45 Business Plan marketing and advertising approaches, among the best channels for this initiative will be community involvement: sponsorships, donations, etc. The opportunity for communicating that the Q is by and for the community will be capitalized on through its genuine community involvement. With a firm foundation of community involvement and support established, the Q will simultaneously be developing and implementing marketing and advertising strategies appropriate to the markets it is serving. Based on market research and experience, key markets in order of priority include: 1. California 2. Other western and southwestern states including Nevada 3. Upper midwest and central states 4. New England/Mid Atlantic 5. Canada 6. England 7. Germany 8. Spain 9. Mexico/Latin America To review the Q’s SWOT analysis, please reference Appendix 5A or contact Sahara Investments at 702.241.5864 for further information.

5.0.1

Key to the marketing success of the Q will be community support and involvement. Although traditional means of communication will be utilized, such as print and internet advertising, direct mail and public relations, establishing a strong foundation of community connections will be essential for the Q’s success. Approaches will be made on the local Las Vegas, national and international levels.

Community involvement:

• Donations made to local gay and lesbian community charities and associations.

• Prominent participation in Las Vegas events such as the HRC (Human Rights Campaign) Annual Dinner

• Offering event space for local gay and lesbian community meetings

• Offering office space to local gay and lesbian organizations and associations

• Membership in, and sponsorship of, national/international organizations looking after the community’s social, political, health and professional interests

These are comparatively inexpensive investments, and if implemented properly, the bottom line results are likely to be enjoyed for many years to come. American Airlines, one of the pioneers of gay and lesbian tourism marketing since 1993, established itself as a true and genuine community citizen by sponsoring gay charities and events right from the start. In fact, the carrier has been the number one choice for the gay and lesbian community since CMI’s gay and lesbian travel surveys began in 1994, and has maintained that enviable position ever since. The reason is clearly that they invested in the community, led the way for gay and lesbian employment equality and supported the community even when challenged by boycotts in the mid-90’s.

This demonstration of unwavering community involvement on all levels set American’s position as the preferred airline, a standard against which other airlines – even other industries – measure their status and growth in the gay and lesbian market. Only now (2008) is American Airlines starting to purchase and place advertising in the gay media. Other tourism and hospitality corporations have followed their lead, including Delta Air Lines (a major sponsor of Pride events), Hyatt, Hilton,

46 QCasino Resort

| Community Involvement |

Kimpton, Wyndham, as well as other industries, led by IBM, Wells Fargo, Subaru, and others.

5.0.2

Elements of the marketing plan will include a welldesigned, interactive website featuring the Q’s hotel operating partner’s proprietary booking engine. The website will be complemented with traditional print advertising in leading local, regional, national and international gay and lesbian publications. In addition, print advertising will be provided for event program guides for key, targeted gay and lesbian events. This will prove to be extremely effective by complementing the overall strategy. Internet advertising will include opportunities with referenced publications, events and social networks including banners, email broadcasts and promotions. Additional elements of the advertising outreach plan include:

• Media relations program (individual press visits, themed press events, media room rates, etc.)

• Direct mail (including the development of attractive and appropriate collateral, which can also

be used as a fulfillment piece, distributed at events, etc.)

• Trade show marketing at such leading events as the Gay Life Travel Expo series, the Gay & Lesbian Business Expo and the Gay Life Expo, as well as targeted gay and lesbian business association events

• Quarterly email newsletters, targeted based on interests (casino, entertainment, events, F&B, etc.)

• Product placement, e.g., the Q hosting popular gay-themed TV shows and films

• Merchandising the Q brand via logo stores within the hotel and online in an effort to emulate the strategies of existing brands such as Harley Davidson and Hard Rock that have leveraged their liberated images to achieve phenomenal merchandising success.

48

QCasino Resort

| Hotel Advertising Strategy |

5.0.3

Key to the long-term success of the marketing initiative will be to collect a strong database of current and potential guests identified by their particular interests. By establishing this valuable database, the Q will be enabled to perform permission marketing, and leverage the database for profit opportunities.

Gay and lesbian travel and hospitality distribution channels have changed significantly over the past decade. Just 10 years ago, gay and lesbian travel agents (including gay-friendly ones) served local community travelers with dedicated services. At that time gays and lesbians were more than twice as likely to have used the services of a travel agent in the past year (over 80% gay and lesbian vs. approximately 40% mainstream). Currently the proportions have switched, and U.S. gays and lesbians have migrated to the internet for all but the most exotic travel itineraries. Therefore, the Q’s sales and distribution strategy builds its strength from the internet.

That said, the importance of working with tour coordinators and internationally-based travel agents will remain part of the Q’s overall strategic plan. The Q’s sales and distribution strategy includes:

• Featuring the hotel operating partner’s booking engine on the Q’s website, e.g., online reservations, special offers, packages, price guarantees

• Partnerships and promotions via Travelocity, Orbitz and Expedia, as well as airline and tour operator sites dedicated to the gay and lesbian community

• Partnerships and promotions via gay-dedicated travel sites

• Partnerships and promotions via affiliated but non-competitive gay and lesbian travel product (most notably gay and lesbian cruise lines including Atlantis/RSVP, Olivia and Family), tour packagers, as well

49 Business Plan

|

|

Hotel Distribution and Sales Strategy

50 QCasino Resort

as other hotels.

• Partnerships, promotions and product placement via gay themed TV, radio, film and podcasts.

• Affiliate programs via gay and lesbian organizations, and businesses to multiply exposure (paying a small referral commission to the originating site)

• Event sales: Placing the Q booking engine on gay and lesbian event websites

• Familiarization trips for national and international travel agents and tour operators who serve gay and lesbian customers. The sales of hotel condominiums will occur through an allocation method of units to agents specializing in gay and lesbian real estate worldwide. Units will be released to recognized markets in nominal groupings of three to five units at any given time. As a result, the Q will easily

identify those markets with “excess” demand relative to markets with “minimum” demand, allowing for reallocation of units to the most desirable markets. The key to this strategy will be increasing the number of saleable units while raising unit pricing in high demand markets at the release of secondary and tertiary unit groupings. The bulk of the luxury fractional unit sales will likely occur once the Q is open and will capitalize on the high volume of guests staying and visiting the property. The Q is a one-of-a-kind development offering limited ownership opportunities and community interest in purchasing will be significant. Once all units have been sold, there will be no other opportunity to purchase this unique type of residence except in a secondary market.

Regional, national and international sales promotions will be developed and managed in those particular regions due to varying laws, culture, community relations, strategies and tactics needed. Dedicated brochures, websites, affinity marketing tactics and other approaches will be developed and implemented for the

|

| 5.0.4

Hotel Condominium and Fractional Sales Strategy

51 Business Plan immediate offering of sales once licenses and permits are obtained. Land Purchase February 12, 2007 Development Entitlement Received March 19, 2008 Equity Raise August 1, 2008 – Dec 31, 2008 Civil Design January 3, 2009 Building Design Begin Design January 3, 2009 • Schematic Design Complete March 31, 2009 • Design Documents Complete July 31, 2009 • Construction Documents Complete December 31, 2009 • Plan Check/Building Permits Submit Grading/Site Utilities (Civil Plans) September 2009 • Submit for Building Permit January 3, 2010 • Pull Grading/Site Utilities Permits - • Commence Site Work (Grading & Utilities) January 2010 • Pull Building Permit March 31, 2010 • Total Construction (Including Site Work) 33 Months Grand Opening October 1, 2012 Post equity milestones are contingent upon achieving equity requirements on or before December 31, 2008. | Milestones | 6.0

52 QCasino

Resort

The Q’s mission will be to provide luxury accommodations and world-class amenities to the significantly underserved gay and lesbian market, while maintaining an upscale professional “hetero-friendly” environment and achieving operating profit and capital return objectives for its owners/investors.

53 Business

Plan

| Mission |

7.0

Sahara Investments, LLC Andrew S. Fonfa, Manager 9710 Tropicana Avenue, Suite 110 Las Vegas, Nevada 89147 702.241.5864 executivestaff@qcasinoresort.com Prepared August 2008 by Globalysis Ltd.

Appendix

Appendix 1A

Architectural Program

FF&E Forecast

Appendix 2A

Hard Cost Construction Budget

Appendix 2B

Appendix

2C Soft Cost Estimate

FIve-Year Operating Forecast

Appendix 2D

Operating Income

Appendix 2F

Hotel Revenue Trends

Appendix 2G

Appendix 2H FAA Approval

Appendix 2I Entitlements

Community Marketing, Inc.

Gay & Lesbian Market Research Custom Study

Appendix 4A

Gay & Lesbian Targeted Print Advertising

Appendix 4B

Appendix 4C

News Articles: The Advocate - March 25, 2008 Gay and Lesbian Times - June 26, 2008 Las Vegas Review Journal - July 1, 2008

SWOT Analysis

Appendix 5A