Mary Kate Francis | Boston, MA

As the Senior Director of Energy Sourcing, Mary Kate leads the team responsible for renewables procurement. She works with project developers to find the right solution for each client to achieve their renewable energy goals.

Corina Melchor | Bucharest, RO

As a Clean Energy Advisor on our European team, Corina manages client relationships by bringing insights to life across our customer’s decarbonization journey. Corina's role is to understand the implications and interdependencies (risk, collateral, etc) that lie in a PPA acquisition and ensure that our tailored solutions meet their sustainability, financial, and strategic goals.

Charlotte Caldwell| Boston, MA

As a Senior Analyst on the Clean Energy Sourcing team at Edison, Charlotte advises clients on renewable energy strategy and economics. She leads the design and development of project economic models and communicates regularly with renewable energy suppliers across all of Edison’s major markets in the United States and Europe.

Kristi Ghosh | Utrecht, NL

As a Clean Energy Analyst on our European team, Kristi is responsible for analyzing renewable energy market risks and opportunities, including policy and regulation, and administration of the project database for market evaluation and diligence.

Andor Savelkouls | Utrecht, NL

As Senior Director of European Energy Advisory, Andor leads our European team (operating as Altenex Energy, a subsidiary of Edison Energy), focusing on both the business development and operational aspects of the company’s consulting activities across Europe.

Tim Broerse | Utrecht, NL

As a Clean Energy Origination Manager, Tim is responsible for leading commercial strategy, structuring energy contracts, and negotiating agreements on behalf of Edison’s clients seeking renewable energy through onsite and offsite generation in Europe. The Clean Energy Origination team focuses on continuous innovation in contract terms to match the fast-changing renewable energy industry and in particular, Tim is familiar with PPAs, ISDAs, proxy generation, and retail agreements for renewable energy.

John Egbuta | Utrecht, NL

As a Clean Energy Advisor on our European team, John helps navigate clients through their renewable procurement process, from early education and strategy development, all the way through contracting. He supports clients in balancing their particular priorities, risk tolerance and carbon reduction goals.

Avery Hammond | Boston, MA

As an Analyst on the Clean Energy Sourcing team, Avery focuses on following key policy and market drivers impacting PPA and REC procurement in North America.

Tim Hogan | Dublin, OH

As the Senior Energy Manager for the Clean Energy Advisory, Tim develops and manages client relationships and guides them through their clean energy journey. In this role, Tim supports clients with their clean energy strategy, analysis, and execution while balancing their internal and external complexities.

Elana Knopp | New York, NY

As a Senior Content Writer, Elana is responsible for leading content development, creating thought leadership pieces with Edison team members and industry experts, and crafting client engagement & communications strategies. Having been an investigative reporter for most of her career, Elana has covered topics from New Jersey politics, social justice issues, education, and the environment.

Grace Morrissey | Boston, MA

As a Manager on the Clean Energy Sourcing team at Edison, Grace works with a variety of clients pursuing offsite renewables procurement by advising them on strategic planning, goal setting, market education, competitive solicitation, analysis, and project selection.

Shannon Weigel | Chicago, IL

As the Head of Policy, Shannon tracks regulatory, legislative and administrative proceedings in North America and uses this information to help our clients make better energy procurement decisions.

Yasiru Jayakody | New York, NY

As a Sales Analyst, Yasiru is responsible for leading prospective client research and staying on top of the latest trends in corporate renewable procurement and broader decarbonization activities.

Patrick Mingey| Boston, MA

As a Sr. Clean Energy Analyst, Patrick analyzes renewable energy strategy and communicates forecasted project economics to clients. He interacts with renewable energy suppliers regularly and evaluates prospective projects throughout North America.

Ronny Tempel | Leamington, UK

As the Manager of European Market Insights & Analytics, Ronny uses his understanding of market evolution to support and educate clients as they set their sustainability strategy, evaluate on-site energy use, and sign renewable power purchase agreements

Austin Zaelke | Boston, MA

As a Clean Energy Associate on the Clean Energy Sourcing team, Austin is responsible for educating clients on market trends and running competitive procurements through the Edison Energy Insights platform. Austin performs financial modeling and qualitative due diligence assessments to support clients in selecting the best risk-adjusted renewable energy projects to meet their goals.

Buyers navigating this challenging landscape are working to understand the headwinds faced by developers and think creatively about how to move ahead and support the deployment of new renewable energy projects.

The quarter saw U.S. wind and solar PPA price increases across all regions, driven by global supply chain issues and policy uncertainty. Various line items in projects’ financial models are seeing price pressures, including cost of labor, raw materials, and shipping. Long-term wholesale energy market price forecasts have not risen comparably, causing the expected cost of a PPA to be significantly more expensive for a buyer today than in the past.

A similar scenario has played out in Europe, with PPA prices rising due to the geopolitical situation, supply chain issues, raw material price increases, and growing inflation. Despite these headwinds, demand for PPAs from corporate offtakers continues to rise. However, increased demand has not matched supply of projects, strengthening developers’ positions within the market.

In the U.S., inventory of projects on the market dropped by 30% in Q2, while anticipated online dates for marketed projects continue to shift later. Recent executive actions by the Biden administration are expected to help solar project developers bring projects back onto the market in the coming quarter, as the action provided some support for sourcing imported panels. However, supply chain-driven constraints and interconnection queue delays are causing some projects to face schedule delays of a year or longer.

U.S. REC prices fell to their lowest point in over a year, while the carbon offset market in both the U.S. and Europe has slowly recovered. With officially tagged carbon removal credits now available, developers and vendors are able to price tropical forests and nature-based removals at a higher price than they had previously, due to significant demand in this formalized category.

While a growing list of corporations expanded their renewable energy procurement goals in Q2, they continue to face high prices for wind and solar globally.

Prices shown reflect the median of flat, hub-settled, unit contingent offers received over time. Markets and technologies with offers from fewer than five distinct projects in a given quarter are not shown.

• Between Q1 and Q2, Edison saw median PPA prices increase across all markets and technologies. In addition to net price increases, many markets also experienced their highest price growth rate in several quarters. While Q1 saw median price increases between 3% -16%, Q2 ranged from 5% - 33% by market. This trend suggests the widespread impact of recent policy uncertainty, rising costs of inputs, and heightened corporate demand.

• Solar median PPA prices in ERCOT and PJM experienced their largest ever quarterly increase. ERCOT solar broke its previous record of 13%, set in Q3 2021, for a gain of almost 18% ($6). Similarly, PJM solar surpassed its Q4 2021 record of 9% with a 20% ($10) jump this quarter. Both markets’ inventories of available projects were lower in Q2 than in Q1, as solar tariff uncertainty paused project marketing for multiple developers.

• SPP’s median wind price also saw its highest quarterly increase, rising 33% since Q1. In a region with historically low wind PPA prices, the contracting of the most competitive projects last quarter has combined with current market pressures for an $11 jump in SPP wind. In contrast, SPP solar experienced the mildest change this quarter, increasing 5% ($2).

• MISO’s median solar PPA price increased 10%, maintaining several quarters of fluctuating growth rates. After 6 consecutive quarters of widely varying median price changes, including one 5% drop in Q2 2021, MISO solar has continued the trend with a $5 price increase. In the past four quarters, MISO solar median PPA price increases have ranged from 5% to 17%.

PPA prices shown above reflect flat, hub-settled, unit contingent offers received in Q2 2022. Markets and technologies with offers from fewer than five distinct projects are not shown. Some offers shown may no longer be on the market.

Prospective buyers should be aware of two components of the PPA market: raw pricing (Figure 4), and the forecasted economic performance of PPA contracts (Figure 5). As there are many variables that will ultimately impact a PPA’s cash flows, Figure 5 shows a range of three investment expectations in each market.

By contracting with a new-build renewable energy project, a buyer achieves several objectives:

• Purchases RECs to comply with their renewable energy or emissions reduction target

• Enables the financing and construction of a new power plant, and

• Brings environmental and economic benefits to the local community.

As some of those achievements are challenging to capture in a single figure, some buyers choose to

compare the forecasted cash flows to the cost of RECs the buyer would otherwise need to purchase on the spot market. This past quarter, the average spot price for a national REC was $3.22, while the average PJM Tier 1 REC price was $23.91. Forecasted project cash flows in ERCOT, SPP, and MISO are at an investment premium compared to current national REC costs in most scenarios, while PJM’s forecasted cash flows are closer to current PJM Tier 1 REC costs in two out of three scenarios.

Edison’s ERCOT analysis anticipates an annual $20-30/MWh cost in the early years, declining over time. Edison Energy produces proprietary forecasts for wholesale power prices in the ERCOT market. Figure 5 shows Edison’s Spring 2022 Base Case scenario, with three natural gas price sensitivities. Given recent changes in the natural gas market, the high natural gas price sensitivity is considered the most likely scenario1. For the sample solar project pricing around $42/MWh, settling at ERCOT North hub, and coming online at the end of 2025 with a

Forecasted cash flows shown above reflect scenarios for PPA settlements on sample median-priced flat, hub-settled, unit contingent solar offers received in Q2 2022. All cash flows are undiscounted. Regarding scenarios, the ERCOT bid was evaluated using three proprietary Edison Energy forecasts, while MISO, SPP, and PJM used forecasts published by ABB and IHS.

15-year contract, the annual generation-weighted market prices are anticipated to be below the strike price throughout the contract term, under all Base Case natural gas price sensitivities. While the low and mid gas sensitivities anticipate a cost/MWh between $20-30/MWh each year for the full term, the high gas sensitivity anticipates the annual cost of the PPA would decrease over time, to approximately $2.50/MWh in its final year of settlement.

Across third party forecasts, SPP solar is expected to be less costly than MISO and PJM solar. The remaining markets displayed in Figure 5 show sample project settlements under third party forecasts, ABB Base Case (Spring 2022), IHSM Planning Case (June 2022) and IHSM Fast Transition (June 2021). While market dynamics factor into each project’s forecasted settlement, raw PPA price also has an influence. SPP’s median solar price of approximately $47 is meaningfully lower than that of MISO at ~$53 and PJM at ~$60. Under the most recently published scenario from IHSM, an offtaker from this sample SPP solar project would anticipate an approximate annual cost of $14-$24/MWh over the course of the

contract term, while a MISO offtaker would anticipate spending $23-$35/MWh and in PJM, $25-$31.

PJM solar costs are largely forecasted to be a bit above the cost of PJM Tier 1 RECs. Under the two most recently published ABB and IHSM scenarios, a median-priced solar bid of nearly $60/MWh is forecasted to result in costs to the buyer ranging between $25 to $31/MWh. Recognizing PJM Tier 1 RECs have recently priced around $24, this cost is not too far above the value of the RECs the project would generate. For buyers seeking the highest local impact possible, forecasted project economics could justify a PPA that includes regional RECs. If the buyer does not have a mandate to keep the regional RECs, the high value of PJM RECs leaves room to arbitrage them – selling the PJM Tier 1s at their current value of around $24/REC, and replacing them with national RECs, currently valued around $3/REC - resulting in more positive cash flows for the buyer.

Note: Edison Energy plans to publish analysis for the SPP, MISO and PJM markets using its own forecasts later this year.

21. The Uyghur Forced Labor Prevention Act (UFLPA) puts a sizable burden of proof on importers: they are required to present a complete record of transactions and supply chain documentation explaining all parties involved in the manufacturing, manipulation, or export of a particular good, and the country of origin for any material used in production. Products with insufficient documentation risk being detained by U.S. Customs and Border Protection.

On June 6, the Biden Administration took an executive action aimed at quelling the solar panel procurementrelated uncertainty that has gripped the solar industry since late March. The President announced (1) an executive order to enact a 24-month tariff exemption on solar modules sourced from Thailand, Malaysia, Vietnam, and Cambodia, and (2) the use of the Defense Production Act to accelerate the manufacturing of equipment for the production and use of clean electricity generating fuels, specifically solar panel parts.

Solar project contracting had come to a near standstill at the end of last quarter, when the U.S. Department of Commerce announced it would investigate an accusation of Chinese solar panel tariff circumvention. The investigation’s preliminary conclusions will be announced in August 2022, with final conclusions to be revealed in January 2023. The pending uncertainty stalled much of the business in the solar sector, as the countries under investigation provide approximately 80% of the modules imported to the U.S.

The Biden Administration’s recent actions are expected to help mitigate, but not eliminate, the solar industry’s struggles. Positive impacts of the executive actions will likely take time to be reflected in PPA pricing, as developers need time to coordinate with manufacturers and offer pricing that accounts for the reintroduction of panels from previously impacted countries. However, some developers are still cautious about the executive action, as trade lawyers have indicated that it will likely face litigation.

A new U.S. law addressing concerns around forced labor in the solar supply chain is in effect, as of June

It is still too early to assess the full impact of the UFLPA. An anticipated positive outcome is that buyers can have greater confidence that solar equipment used for their projects will have no ties to forced labor. However, responsible sourcing likely comes with heightened costs, due at minimum to the administrative burden of providing complete documentation for compliance.

In line with their upward trajectory over the past two years, PPA prices for wind and solar continued to climb during Q2 2022. While the recent news of tariff delays may provide some relief for the solar market, the renewables market is still subject to current global macroeconomic factors. The cost of labor, raw materials, and shipping are continuing to rise, increasing the required capital expenditure by developers. The higher expense of project development and construction is ultimately passed through to buyers in the form of higher PPA prices, with the potential to mitigate somewhat contingent on contract terms.

Various line items in project financial models are seeing price pressures, exacerbated by the war in Ukraine and Covid-19.

For wind projects, raw materials such as steel and aluminum, which make up 90% of a turbine, have experienced sharp increases. Speaking to a 40% jump in European steel prices in a matter of weeks, wind turbine manufacturer Vestas’ CEO told investors, “We cannot price and we cannot do things we don't know of.” These sorts of spikes in raw materials have reverberating impacts, through increased turbine prices and ultimately increased PPA prices for offtakers.

Labor is also a challenge impacting the renewables sector. The diminished workforce as a result of the

Reflecting on Q2 2022, the following trends are prominent in the U.S. renewables market:

Covid pandemic has not yet rebounded and has been compounded by reduced migrant labor flows, China’s zero Covid policy, and strict lockdown rules in other southeast Asian countries. With demand for renewables increasing and inflation rising, workers are demanding higher wages, resulting in higher prices for consumers.

Another ripple effect of the pandemic was an abrupt jump in ecommerce that the shipping industry was not equipped to handle. Costs and uncertainty around the shipment of materials to developers have grown, with suppliers unable to provide firm pricing on materials until orders have left the ports. The renewables industry is not insulated from the growing supply chain issues seen across the globe, and we continue to expect PPA prices to reflect the higher costs experienced by developers.

Project availability dropped 30% in Q2 as online dates of 2025 or later increase their market share

After three quarters of fluctuation, including a 25%

drop in Q4 and a 29% increase in Q1, the inventory of projects on the U.S. market again dropped in Q2 by 30%. Uncertainty, coupled with buyer demand, were the primary driving factors behind this change.

As the second quarter kicked off with the announcement of the Department of Commerce tariff circumvention investigation, some developers paused marketing on solar projects due to uncertainty in their panel sourcing strategy, which pulled projects out of the inventory. For wind and solar projects that remained on the market, there has been greater buyer demand than project supply. Therefore, projects have moved into exclusive contract negotiations at a rapid pace.

Buyers will also find that anticipated online dates for marketed projects are shifting later as the year goes on. This quarter saw a 45% drop in projects coming online in 2024, and a 40% increase in projects anticipated to come online in 2025. Part of this is a natural, expected shift as nearer-term projects are contracted and move off the market. Other, more unique factors, include supply chain-driven constraints, solar panel sourcing uncertainty, and interconnection queue delays, which are typically delaying project schedules by one year or longer.

National REC prices fall to the lowest point seen since early 2021

National Green-e REC prices fell to around $2/REC for the 2022 vintage, making this the lowest pricing seen since Q1 2021. This steep price drop has generally been attributed to a significant supply of RECs on the market coupled with a typical lower demand for voluntary RECs in the summer season.

PJM RECs prices remained high in Q2

Compliance RECs in PJM have remained at historically high levels, with REC prices peaking over $25/REC for PJM Tier 1 RECs during Q2. At the time of this report’s publication, REC prices have cooled slightly to approximately $23-24/REC. Alternatively, for those looking to buy PJM RECs, the price of Ohio-eligible RECs has fallen significantly to around $6/REC. This is due to a change in regulation that allows RECs from non-PJM sited projects that connect into Ohio to qualify for this REC type, greatly increasing supply and thus lowering the price.

Since a significant market price drop in March, the carbon offset market has slowly recovered, with traded nature-based solutions once again passing $10/tonne. However, traded pricing is still far below the peak it saw at the beginning of this year.

Despite the generally lower pricing of the standard product, high-demand projects - including tropical forests and nature-based removals - have continued to increase in price, as the rising level of demand for that category of projects exceeds supply. Pricing varies significantly based on each project and vintage year, with current pricing on nature-based reductions with strong United Nations Sustainable Development Goal alignment in the $14-18/tonne range, and nature-based removals mainly being sold in the low $20/tonne range.

The American Carbon Registry (ACR) began officially tagging eligible project credits as removals in Q2. Previously, the distinction between a removal and a reduction credit was not officially recognized. With the official tag now in place, developers and vendors are able to price those removal credits at a higher price than they had previously, as there is significant demand in this category. Many buyers seek removal credits, as they can be used in accordance with a Science-Based Target Initiative (SBTI) net-zero goal.

An effort to reform the mid-Atlantic region’s interconnection queue process took a step forward this quarter, with PJM submitting its filing to the Federal Energy Regulatory Commission (FERC). However, the impending process is expected to impose a significant slow-down on project development for years to come.

For those with interest in the mid-Atlantic region, buyers must pay close attention to the following:

• Assigned queue positions for projects under consideration, as those in the AG1 class or earlier are proposed to be prioritized; and

• Project online dates, as it is unlikely that projects in the AG2, AH1 class, or later will come online any earlier than 2026.

While the industry is anticipating that PJM’s proposed reform process will proceed as they have outlined, the proposal must first receive the green light from FERC. PJM filed its reform proposal with FERC this quarter, with FERC required to respond by early October.

PJM’s interconnection process - the procedure in which development-stage projects are reviewed and approved to connect to the PJM power gridwas originally designed to review traditional power resources. The queue has been overwhelmed for some

time, with over 2,500 projects stuck in the queue, many of which are smaller-scale solar assets. This overhaul of the queue process is meant to streamline the interconnection study process by utilizing cluster studies to determine upgrade costs and weed out speculative projects via more robust deposit requirements throughout the process.

Against the backdrop of broader industry headwinds, the delays associated with queue reform place prospective PJM buyers in a challenging situation. As the inventory of mature projects dwindles, buyers are encouraged to move as swiftly as possible and keep their institutional deadlines and renewable goals top of mind when considering projects that may slip into 2026 and beyond for commercial operation. This would create further uncertainty for buyers, as developers are struggling to determine costs for EPC and equipment for near-term projects, let alone projects four or more years away from operation.

If approved by FERC, PJM will stop accepting new interconnection applications after October 1, 2022, to work through the backlog. They plan to work on two transition studies, the first of which is expected to conclude in 2025, and the second in 2026. Assets projected to have minor upgrade costs and low grid impact will be ‘fast-tracked’ and studied in a parallel process.

In Q2 2022 we are seeing the following trends:

• PPA prices continue to rise due to significant supply chain constraints and an increase in raw material prices, inflation and interest rates, and energy prices. Despite this, demand for PPAs from corporate offtakers continues to rise, turning more and more European markets into seller’s markets.

• Permitting and grid connection issues in some markets are causing significant delays for renewable energy projects and PPAs. The European Commission has proposed a new package that should streamline the permitting process and release projects from bureaucratic and administrative delays.

• Supply chain remains a major challenge for renewable energy developers, causing a significant PPA price increase.

• The Russian invasion of Ukraine has triggered a desire to end gas dependency on Russia. As part of this strategy, the European Union has introduced REPowerEU, a package focused on energy saving, energy diversification, accelerating green energy, and investment and reform. The new legislation aims to unlock renewable energy potential even further and reduce high gas imports.

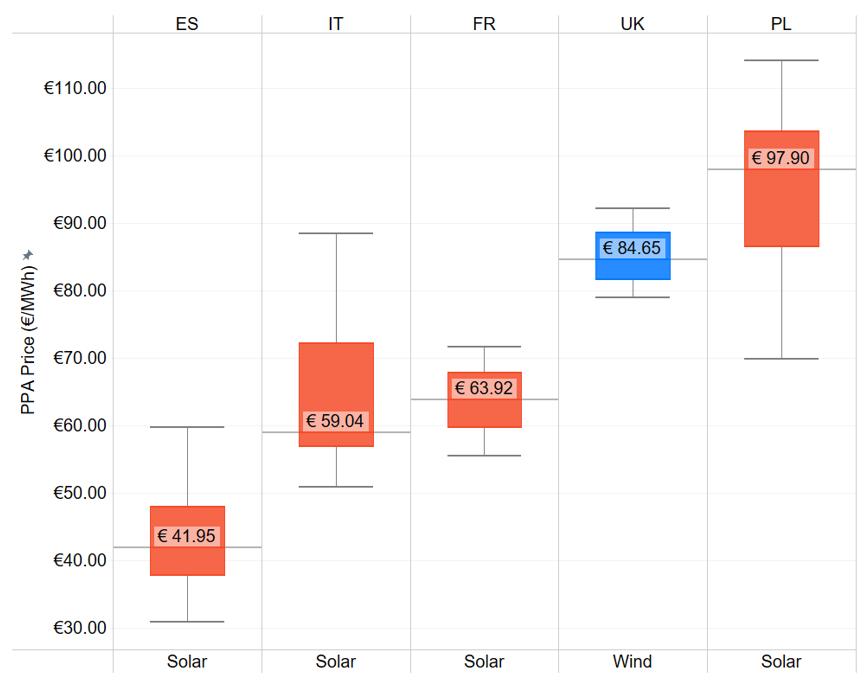

PPA prices shown above reflect flat, unit-contingent offers received in Q2 2022. Markets and technologies with offers from fewer than three distinct projects are not shown. Some offers shown may no longer be on the market.

PPA prices have increased in the past quarter to reflect the high volatility caused by a number of factors, including the geopolitical situation, supply chain issues, raw materials price increases, growing inflation, and the gas crisis in Europe.

• Spain continues to offer the strongest opportunities for corporate offtakers and we are seeing high project availability in this market, predominantly solar. Offtakers can find offers with fixed and discount-to-market with floor price structures. Currently, the most common type of price structure in Spain is pay-as-produced, with developers typically offering 10-year project terms.

• Italy follows Spain when it comes to pricing and types of offers. We have been seeing fixed and discount-to-market with floor offers as well as mixed structures, e.g., fixed price for half of the project term, followed by discount-to-market with floor. The most common project term is 10 years, although slightly shorter terms are also available.

• The UK offers a solid renewable energy pipeline for corporates. While project developers have an attractive opportunity to secure subsidized offtake through the UK government, the supply of projects exceeds the government’s target. Thus, there is a

healthy market for corporate offtake. With PPA prices slightly higher than in continental Europe, buyers can choose from a range of solar and wind projects, a variety of price structures, and risk mitigation mechanisms.

• Due to its proximity to the center of geopolitical instability, Q2 energy prices in Poland rose significantly, causing an increase in PPA prices. Added to these concerns was the slow project development process including securing land, grid connection, and permitting; a high-carbon intensive grid; and rising demand from corporates seeking to meet ambitious sustainability targets. In the Polish market, matching buyers with sellers of renewable projects remains more challenging, particularly around meeting deadlines.

• Overall, Q2 2022 has brought more uncertainty to the PPA market. Increased demand for renewable energy in Europe has not matched availability of supply of projects. These factors have strengthened developers’ positions within the market and added additional considerations beyond the realm of pricing. Our general recommendation for renewable energy offtakers is to be nimble and flexible when it comes to project requirements.

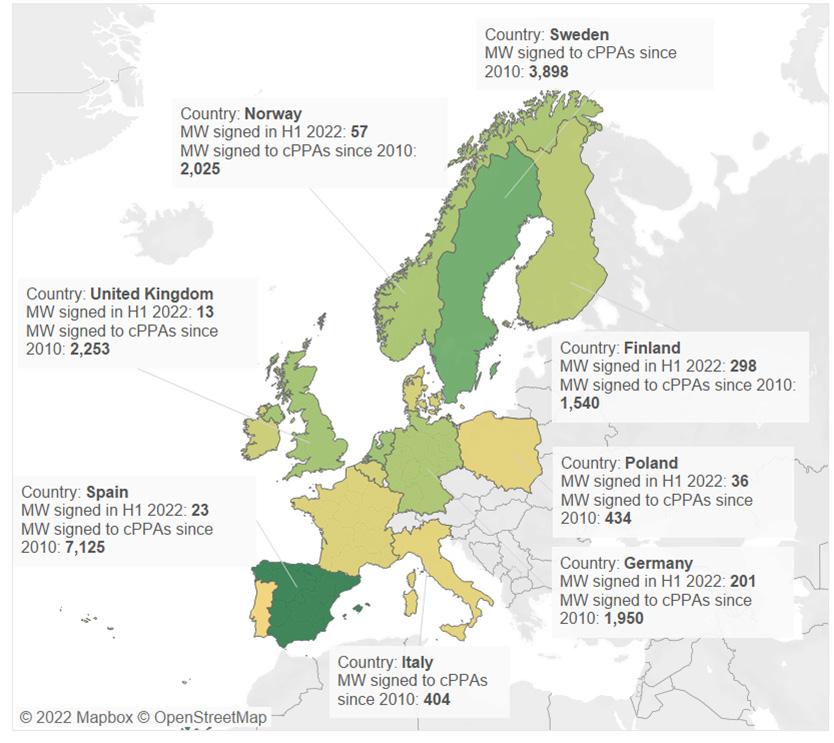

Spain continues to take the top spot in terms of transactions and market opportunities in the fastgrowing corporate PPA market. This leadership position is built mainly on the abundance of solar resources, a considerable supply pipeline, a relatively illiquid futures and forward contract market, and a government support scheme that is highly favorable, making PPAs an attractive option for energy intensive companies from a credit perspective. Together, these factors will continue to support robust PPA market development in the region.

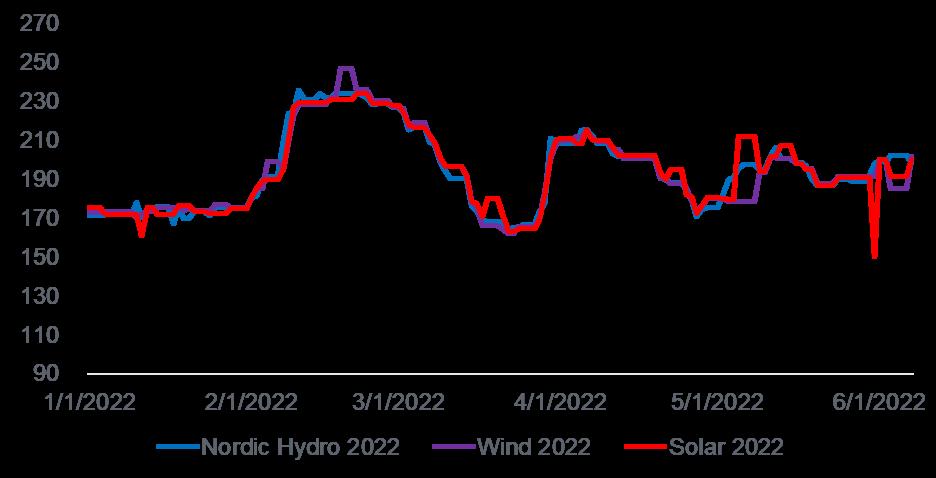

The Nordic region, specifically Sweden and Norway, also rank high in the European footprint in terms of market adoption of PPA instruments. Historically, the market has been driven by extensive expertise in hydro assets, a large share of energy intensive purchasers, and strong government support.

We are seeing positive signs from the Italian market after an extended standstill, with new transactions clearing this quarter and, more importantly, projects being expedited through the administrative process. At the legislative level, there are wins towards increased permitting for agrivoltaics in Italy - historically, a hurdle for renewable build - as it entails the simultaneous

use of land areas for both solar photovoltaic power generation and agriculture. This will be a market to continue to watch.

France’s renewable energy pipeline continues to grow, offering higher project availability. Governmental subsidies are still strong and attractive to renewable energy developers in France.

Similarly, Poland presents potential, especially given some movement around removing the 10H rule that has historically held back renewable installations. The 10H rule states that the distance between a wind turbine and a built-up area must be at least 10 times the height of the turbine, limiting the amount and size of wind installations in the area. If the proposed draft is enacted into law, we anticipate increased interest from investors and corporations.

We are actively monitoring projects from less mature markets across Eastern and Southeastern Europe including Hungary, Romania, Croatia, Serbia, and Greece. While PPA markets are in nascent stages and renewable pipelines still at reduced levels, we are seeing promising signs across the region.

Market turbulence persists for European Guarantees of Origin (GO)

Markets in 2022 continue to face headwinds, driven by rising energy prices and uncertainty among stakeholders. The current constraints have echoed across GO markets. Prices have stabilized at around €2.00/MWh, with movements up or down at around 10%. Overall, we are seeing fewer fluctuations compared to the yearly peak of ~€2.40/MWh and the yearly low of ~€1.60/MWh.

We continue to see buyers shifting liquidity to physical commodity markets as they try to weather uncertain markets and regulations. Bearish sentiments may continue to persist in the short term, as evidenced by lower and relatively stabilized GO prices. This has encouraged large corporate buyers to take long-term positions, as the market continues to offer lower-priced GO products.

One significant development that has impacted the GO markets is related to the new RE100 guidance on geographic boundaries. Up until now, clients who made RE100 commitments could consider the entire EU footprint as eligible. However, that guidance was not aligned with the CDP framework, which uses AIB geographic boundaries. That gap has now been closed and RE100 will follow CDP guidance. For corporations that have already been reporting to CDP, there is no major impact. Corporations that only report to RE100 will need to ensure that all renewable purchasing is sourced within the AIB framework going forward to count towards their RE100 goals. The differences in the two levels of guidance are most notably the UK, Poland, Bulgaria, and Romania. There are certain exceptions for physical cross-border delivery, but that is an unlikely avenue to scale.

Overall, we may see certain impacts around prices for EACs, which will likely increase. As GOs in the AIB footprint become the more desired commodities to meet RE100 targets, increased demand could send

bullish signals. However, the inability for some buyers to use AIB GOs to offset load in non-AIB countries may send opposing signals around GO pricing.

Similarly, if a client has load in non-AIB countries, they will need to source from the national registry for local attributes, which will likely result in price increases as well. Overall, splitting the area guidance can lead to decreased price optimization across European markets.

Since a significant market drop in March, the carbon offset market has been slowly recovering, with traded nature-based solutions once again surpassing $10/ tonne. However, traded pricing was still far below the peak at the beginning of this year. Despite generally lower pricing of the standard product, high-demand projects - including tropical forests and nature-based removals - have continued to increase in price as demand ramps up for those projects with limited associated supply. Pricing varies significantly based on each project and vintage year, with current pricing on nature-based reductions with strong UN SDG alignment in the $14-18/tonne range, and nature-based removals primarily being sold in the low $20/tonne range.

Additionally, voluntary registries have begun the process of officially tagging credits as removals, with the American registries (American Carbon Registry and Climate Action Reserve), already providing (American Carbon Registry) or expected to provide the credits this year (Climate Action Reserve). Verra and the Gold Standard – the main international registries – are earlier in this process. With the official tag, developers and vendors are able to price those removal credits at an even higher price than previously, as many buyers look towards removals since they are in accordance with an SBTI net-zero goal.

Source: Greenfact

Midway through 2022, Altenex Energy anticipates the following trends:

The current high-pricing environment is here to stay - until at least 2023, according to the European Commission. This is longer than people anticipated last year. In the meantime, the Russian war in Ukraine has reshuffled the deck completely, resulting in the need for EU gas supplies to be re-filled again faster and an increase in security concerns now that Russia has stymied the supply of natural gas to many countries. This has highlighted the need for energy sovereignty across Europe. Unfortunately, sovereignty - and energy sovereignty in particular - comes at a cost. We are currently seeing that being reflected in rising PPA prices, as well as prices across other energy markets. While the impacts of volatile short-term market pricing on long-term PPA prices are still unclear, the current rising PPA prices are impacting buyers, who now face higher costs, as well as sellers, who face uncertainties that are difficult to price.

Insufficient gas supply across Europe - and specifically in Germany and Italy - continues to be a significant concern, particularly with the approach of the winter season. This could potentially impact companies and consumers. This has driven some companies to request “Significant Grid User” status within TSOs in order to keep gas supply moving.

As we have seen before, the high pricing environment has historically existed across the European market. One important lever to mitigate energy costs has always been the installation of onsite facilities. In the current market, onsite renewables are an impactful way to maximize benefits in the midterm while additional hedging strategies are in effect. Currently, onsite facilities are more strongly supported by improved economics when market prices are considered. The same holds true for energy efficiency projects, which remain a great avenue for lowering emissions across the board.

This is heavily supported by the EU Solar Strategy that was delivered alongside the updated REPowerEU framework. The EU Commission deems solar to be critical to drive energy independence and has put forward a long-awaited rooftop solar mandate. As such, EU Solar Strategy’s EU Solar Rooftop Initiative is proposing compulsory solar rooftops on all new residential buildings by 2029, and on all suitable public and commercial buildings by 2027. We are tracking these proposals as they incorporate into legal frameworks within the coming months.

At the local level, a recent example of this increased focus has been the new energy savings mandate from the Dutch government. The new energy saving rule will require large users (companies that consume at least either 50,000 kWh/year of electricity or 25,000 cm/year of gas) to invest in all possible energy-saving measures if the investment can be recovered within five years.

In Europe, we are starting to see more actions taken by local governments to address the high cost of energy bills and to mitigate impact to consumers. However, there is a fine balance between short-term protectionist actions and long-term market distortion. The EU Commission has given general guidance and recommendations, but it is ultimately the decision of national governments around the structure, implementation, and duration of such measures.

Many jurisdictions such as the UK, France, Germany, Italy, Denmark, Norway, Spain, and Sweden have focused on broader aid packages, such as bill credits to consumers. Another common supplemental strategy has been a reduction in energy taxes in countries like the Netherlands, Spain, and Poland.

To fund these initiatives, Italy, Spain, and Portugal have implemented aid measures like the clawback mechanism, which is a tax on windfall profits that renewable projects will garner based on the current high-pricing environment.

The Italian government has also proposed a law to clawback income above a historical average until the end of 2022 for renewable power plants that meet certain criteria. Examples include PV plants that benefit from a FiT (feed-in tariff) mechanism and renewable projects that came online before 2010 that do not receive benefits. Reference prices are based on zone pricing and revolve around €56-61/MWh (except for Sicily at €75/MWh). The Italian Regulatory Authority for Energy, Networks and Environment (ARERA) issued regulations in June to implement these new provisions, with an initial payment required from producers in October 2022 for the February to August timeframe.

A joint action by the Spanish and Portuguese governments to implement the “Iberian exception” has been piquing interest in the market. Notably, Italy and Greece are considering the same gas price cap as Spain.

As of mid-June, Spain and Portugal will be capping the price of gas used for power generation. The support will take the form of a direct payment to electricity producers to finance the difference in fuel costs. The reference price cap in this case starts at €40/MWh within the first 6 months, rising to €70/MWh by the one-year mark. EU gas prices have continued to set records overall, although the caps are a significant reduction from the currently traded volatile levels of between €100- 200/MWh.

This mechanism will be financed from congestion income from cross-border power traded between France and Spain, and a charge on buyers benefitting from this measure.

Currently, there is a push to add a new tax on utility and bank profits in Spain, similar to legislation passed in Italy. The Italian government has placed a tax levy of 25% on energy companies with a certain upswing in profits (excess profits of over €5M over the October to March year over year). Further discussion on additional clawback mechanisms to be placed on renewable projects continues to fuel uncertainty across these markets.

There is concern that these measures could slow down the move towards merchant renewables, a growing segment and one that is key for the renewables market in the region to progress. This casts doubts on the credibility of these governments among renewable investors, who already have a significant pipeline of projects in both Spain and Italy.

As we continue to see uncertainty across the energy sector in the long-term, countries are expected to continue to enact or extend these packages, as they currently sit at the intersection of a high-pricing environment, political ramifications in the long-term, and elections in the short-term.

As part of the ongoing energy crisis, the existing EU targets for renewable energy installations have been updated to reflect current geopolitical constraints. The new EU target for 2030 will nearly double the current share of renewables in the EU, to at least 40% of all its energy to come from renewable sources - up from the previous 32% target. Amended national energy and climate plans are expected to follow suit. Additionally, the new framework sets a quota of a 1.1%/year increase in renewable energy use for industry, alongside energy efficiency measures. With the increased adoption of hydrogen, the EU is pushing for a target of 35% of the hydrogen used in industry to be powered by renewable fuels of non-biological origin (RFNBOs) - mainly green hydrogen - by 2030.

Ongoing electrification measures will continue to shift energy needs from fossil fuels to cleaner, more sustainable energy. These efforts will ramp up in the current environment, driven by the need for commonsense climate action and to help meet energy independence mandates.

Increasing corporate demand for renewable energy continues to be strong. RE100 is the global corporate renewable energy initiative that brings together businesses committed to 100% renewable electricity by no later than 2040. Since the start of the Covid pandemic, RE100 membership has almost doubled to 370 corporations, with 45% of their electricity consumption coming from renewables. This has increased each year, showing a strong commitment from the private sector to reduce greenhouse gas emissions. Additionally, RE100 members continue to increase their use of impactful procurement methods such as PPAs, which currently make up a third of green sourcing being conducted globally.

We are also seeing one of the highest carbon tax mechanisms in the EU set in place by the Danish government. Starting in 2025, companies subject to the EU Emissions Trading Scheme (ETS) will incur an additional tax of ~€ 10/tonne, rising to €50/tonne by 2030, to be paid in addition to the EU ETS fee, with lower tax levels for certain industries. For companies outside of the EU ETS, the fee will be twice as much ~€ 100/ tonne by 2030. Therefore, we see a continued need for corporations to lower emissions across their operations in the long-term.

Within the realm of green energy procurement, corporations are also increasingly investing in emissionality, a method of procuring renewable energy in higher impact locations by assessing the avoided emissions variance for each project. Altenex Energy, together with Edison Energy, has partnered with WattTime to help corporate renewable energy buyers achieve carbon emission reductions by leveraging data to measure and compare avoided emissions of potential renewable energy projects. This will soon be added to the toolbox of metrics that are used to provide a holistic assessment of carbon impact.

Energy intensive buyers are changing the demand landscape towards fixed volume structures

As noted in the Q1 2022 Market Report, high energy prices are driving certain customers - notably energyintensive manufacturing industries - to seek long-term contracts to help mitigate impacts of the high-pricing environment in the long-term. For example, large manufacturing operations require similarly sized energy consumption, coupled with a large share of energy costs out of total production costs. This exposes this market segment to the volatility and market uncertainties currently at play in the energy market. PPAs are a longterm solution that would enable these players to sustain operations in a profitable, predictable manner.

However, the load profile of these energy consumers is better aligned towards a baseload shape profile, which is a flat consumption pattern that is predictable. To mirror that need, we are seeing developers offering this firm structured product to corporates.

Notably, in one of the largest deals this year, Alcoa entered into a PPA with Greenalia for 183 MW of renewables projects in Spain. The aluminum producer has secured baseload power for 10 years, enabling it to resume operations in the region. Energy will be sourced from 29 wind projects in various stages of development within the same region.

Other similar contracts have been signed in Norway between battery manufacturer FREYR and Statkraft. The sourcing arrangement entails 23 MW of baseload power for 8 years in order to power battery manufacturing plants. The renewable energy will be produced from a nearby hydropower plant, further underscoring the fact that corporations are adding locality to their decision making.

Supply chain constraints continue to impact projects

Improvements in supply chains are unlikely to continue with the war in Ukraine and the zero-Covid policy in China. Although the long lockdown of the Port of Shanghai has had no direct or immediate impact on PPA prices in Europe, the congestion of ships will exacerbate current high transportation prices.

Beyond this, shortages in material and labor will continue to disrupt production and transport. Overall demand for technical personnel is increasing, while baby-boomers – which make up the majority of current technical personnel - will retire in the coming years. Due to these circumstances, it is difficult for manufacturers to commit to prices for engineering, procurement, and construction.

Despite these challenges, there have been some positive developments. During her opening keynote at the start of the recent SolarPower Summit, Energy Commissioner Kadri Simson said that the EC would do “whatever it takes” to bring the manufacturing of PV modules and inverters back to Europe, mirroring Mario Draghi’s famous words in 2012 as then-President of the European Central Bank (ECB).

This is evident in the recently announced plans by SMA Solar Technology to build a new manufacturing plant for inverters in Germany to increase its production from 21GW to 40GW per year. In addition, Romania aims to develop a large-scale battery sector while also committing to the training of 20,000 workers to prepare for this expanding sector. Plans have also been announced in countries like Spain and Germany to open new manufacturing plants. These commitments show not only the development of additional capacity, but critical investments in innovation and job training to prepare the region for the clean energy transition.

The current energy landscape has made reshoring supplies and production even more challenging. However, given the protracted timeframe, reshoring will likely prove to be more costly and lead to higher PPA prices. Although natural gas prices are trading at exceptionally high levels, EU member states will need to fulfill their natural gas storage capacity to 80% each year prior to the winter season, according to the European Commission. PPA buyers should anticipate further price increases due to these combined factors.

Delayed and cumbersome permitting procedures limit the number of projects available

As part of its ongoing efforts towards energy security, the EU council has passed new legislation around permitting, which has historically been a significant challenge for renewable energy developers. Complicated bureaucratic procedures and unending delays have made it difficult for developers to commit to specific online dates and for corporate offtakers to create a pathway to achieve their sustainability goals.

The legislation enables renewable energy resources to override public interest concerns if the project offers environmental benefits such as biodiversity protection. This special status will allow renewable energy projects to overcome potential legal and environmental challenges and will remain in effect until the European Union achieves its 2050 climate goals.

Additional legislative provisions are expected to make it onto the agenda, including “go-to-areas” and, more critically, permitting deadlines, with progress on these two measures expected by later this year.

The imbalance of supply and demand across the corporate PPA market significantly impacts the availability and pricing of projects.

When selecting a renewable energy project, Altenex Energy advises paying close attention to the project development status and counterparty risk.

Offtakers should choose reliable counterparties based on their experience with project development in chosen geographies as a way to mitigate the risk of failed negotiations.

We meet our clients wherever they are in their electrification journey. Fill out the form below to get in contact with a member of our team and learn more about our work in the eMobility space. Get in touch

Supreme Court restricts, not eliminates, EPA authority to limit power plant emissions

By Matt Donath, Senior Policy AnalystRethinking onsite energy solutions will be key for corporates to meet sustainability goals: “It’s critical not to look at these solutions as binary”

An interview with Matt Dodson, Director of Energy Supply Advisory, Edison Energy

Lying, fire, and a bear market – Oh my!

By Jeff Bolyard, Principal, Energy Supply AdvisoryTurning the tide of the clean energy transition

By Elana Knopp, Senior Content WriterWith a strategy of additionality and flexibility, Novartis aims for carbon neutrality across its global operations

Featuring James Goudreau, Head of Environmental Sustainability External Engagement, NovartisWhat is “Greening of the Grid?”

By Erin Williamson, Manager, Energy & Sustainability StrategyBiden’s Executive Action Aims to Ease Solar Market Uncertainty

By Matt Donath, Senior Policy Analyst; Mackenzie Kuran, Associate Project Engineer; and Shannon Weigel, Director of PolicyCharge Up Your Electric Vehicle Infrastructure Plan with Due Diligence

By Kerylyn Goldwyn, Senior Project Manger, and Simon Horton, EV Infrastructure Lead

By Kerylyn Goldwyn, Senior Project Manger, and Simon Horton, EV Infrastructure Lead

Thermal decarbonization for institutional and C&I users could be the next big climate frontier

Featuring Blaine Collison, Executive Director,Renewable Thermal Collaborative (RTC)

With Canada’s net zero target, significant “accommodation of change” will be needed to spur renewable energy investments

By Elana Knopp, Senior Content WriterWhat Does the REPowerEU Plan Mean for Business?

By Shannon Weigel, Head of Policy, and Matt Donath, Sr. Policy AnalystAmid the ongoing energy crisis in Europe, corporates seeking to decarbonize are moving beyond “vanilla” strategies

By Elana Knopp, Senior Content Writer

By Elana Knopp, Senior Content Writer

Across Europe, a growing number of companies and investors are turning to renewable hydrogen as the missing link to fully decarbonize

By Elana Knopp, Senior Content WriterLooking for more insights?

Check out these ongoing series on our website:

Edison Plugged In shines a spotlight on the people, projects, and perspectives of the Edison Energy team.

Our Visionary Voices series features conversations with leading experts from across the industry. These thought leaders are driving innovation in energy markets and available solutions for commercial, industrial and institutional energy buyers. Their diverse perspectives and experience offer a real-time view into the transformation happening in the market today.

Hannah Badrei Vice President, Energy Supply Advisory +1-206-718-6828

Hannah.Badrei@EdisonEnergy.com

Andor Savelkouls

Senior Director, European Energy Advisory, Altenex Energy, BV +31-30-800-9276

Andor.Savelkouls@AltenexEnergy.com

Shannon Weigel Head of Policy +1-773-897-3907

Shannon.Weigel@EdisonEnergy.com

Emily Williams Vice President, Strategy & Sustainability +1-617-681-4208

Emily.Williams@EdisonEnergy.com

Edison Energy provides independent, expert advice and solutions to help large corporate, industrial, and institutional clients better understand and navigate the choices and risks of managing energy. We enable decision-makers in organizations to deliver on their strategic, financial, and sustainability goals.

Through a comprehensive portfolio approach, we work with our clients to help them resolve the key challenges of cost, carbon, and the increasingly complex choices in energy.

For more information about Edison Energy visit www.edisonenergy.com.

Edison Energy operates under the name of Altenex Energy in Europe? With locations across The Netherlands, UK, Spain, and Romania, our team specializes in delivering integrated strategies that best meet the needs, goals, and objectives of our European clients in an evolving energy market. Visit www.altenexenergy.com to learn more.

Edison Energy, LLC and its affiliate, Altenex, LLC, are registered as Commodity Trading Advisors (“CTA”) with the Commodity Future Trading Commission (“CFTC”) and additional information on Edison Energy and Altenex is available at https://www.nfa.futures.org

© 2022 Edison Energy Exchange Place, 53 State Street, Suite 3802 | Boston, MA 02109

WTC Utrecht, Stadsplateau 7, 3521 AZ | Utrecht, NL

Global presence in: North & South America, Europe and Asia-Pacific