2 minute read

Environmental Commodities Markets

Market turbulence persists for European Guarantees of Origin (GO)

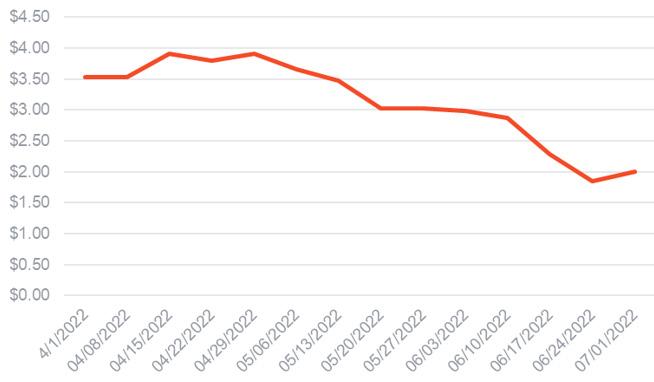

Markets in 2022 continue to face headwinds, driven by rising energy prices and uncertainty among stakeholders. The current constraints have echoed across GO markets. Prices have stabilized at around €2.00/MWh, with movements up or down at around 10%. Overall, we are seeing fewer fluctuations compared to the yearly peak of ~€2.40/MWh and the yearly low of ~€1.60/MWh.

We continue to see buyers shifting liquidity to physical commodity markets as they try to weather uncertain markets and regulations. Bearish sentiments may continue to persist in the short term, as evidenced by lower and relatively stabilized GO prices. This has encouraged large corporate buyers to take long-term positions, as the market continues to offer lower-priced GO products.

One significant development that has impacted the GO markets is related to the new RE100 guidance on geographic boundaries. Up until now, clients who made RE100 commitments could consider the entire EU footprint as eligible. However, that guidance was not aligned with the CDP framework, which uses AIB geographic boundaries. That gap has now been closed and RE100 will follow CDP guidance. For corporations that have already been reporting to CDP, there is no major impact. Corporations that only report to RE100 will need to ensure that all renewable purchasing is sourced within the AIB framework going forward to count towards their RE100 goals. The differences in the two levels of guidance are most notably the UK, Poland, Bulgaria, and Romania. There are certain exceptions for physical cross-border delivery, but that is an unlikely avenue to scale.

Overall, we may see certain impacts around prices for EACs, which will likely increase. As GOs in the AIB footprint become the more desired commodities to meet RE100 targets, increased demand could send bullish signals. However, the inability for some buyers to use AIB GOs to offset load in non-AIB countries may send opposing signals around GO pricing.

Similarly, if a client has load in non-AIB countries, they will need to source from the national registry for local attributes, which will likely result in price increases as well. Overall, splitting the area guidance can lead to decreased price optimization across European markets.

Figure 11. GO Pricing (Eurocents) Carbon market slowly recovers in Q2 while removal credits gain more momentum with official tags

Since a significant market drop in March, the carbon offset market has been slowly recovering, with traded nature-based solutions once again surpassing $10/ tonne. However, traded pricing was still far below the peak at the beginning of this year. Despite generally lower pricing of the standard product, high-demand projects - including tropical forests and nature-based removals - have continued to increase in price as demand ramps up for those projects with limited associated supply. Pricing varies significantly based on each project and vintage year, with current pricing on nature-based reductions with strong UN SDG alignment in the $14-18/tonne range, and nature-based removals primarily being sold in the low $20/tonne range.

Additionally, voluntary registries have begun the process of officially tagging credits as removals, with the American registries (American Carbon Registry and Climate Action Reserve), already providing (American Carbon Registry) or expected to provide the credits this year (Climate Action Reserve). Verra and the Gold Standard – the main international registries – are earlier in this process. With the official tag, developers and vendors are able to price those removal credits at an even higher price than previously, as many buyers look towards removals since they are in accordance with an SBTI net-zero goal.

Source: Greenfact