5 minute read

Renewables Market Trends

Reflecting on Q2 2022, the following trends are prominent in the U.S. renewables market:

Executive intervention aims to alleviate panel procurement difficulties

On June 6, the Biden Administration took an executive action aimed at quelling the solar panel procurementrelated uncertainty that has gripped the solar industry since late March. The President announced (1) an executive order to enact a 24-month tariff exemption on solar modules sourced from Thailand, Malaysia, Vietnam, and Cambodia, and (2) the use of the Defense Production Act to accelerate the manufacturing of equipment for the production and use of clean electricity generating fuels, specifically solar panel parts.

Solar project contracting had come to a near standstill at the end of last quarter, when the U.S. Department of Commerce announced it would investigate an accusation of Chinese solar panel tariff circumvention. The investigation’s preliminary conclusions will be announced in August 2022, with final conclusions to be revealed in January 2023. The pending uncertainty stalled much of the business in the solar sector, as the countries under investigation provide approximately 80% of the modules imported to the U.S.

The Biden Administration’s recent actions are expected to help mitigate, but not eliminate, the solar industry’s struggles. Positive impacts of the executive actions will likely take time to be reflected in PPA pricing, as developers need time to coordinate with manufacturers and offer pricing that accounts for the reintroduction of panels from previously impacted countries. However, some developers are still cautious about the executive action, as trade lawyers have indicated that it will likely face litigation.

Forced labor prevention law goes into effect, affecting solar supply chain

A new U.S. law addressing concerns around forced labor in the solar supply chain is in effect, as of June 21. The Uyghur Forced Labor Prevention Act (UFLPA) puts a sizable burden of proof on importers: they are required to present a complete record of transactions and supply chain documentation explaining all parties involved in the manufacturing, manipulation, or export of a particular good, and the country of origin for any material used in production. Products with insufficient documentation risk being detained by U.S. Customs and Border Protection.

It is still too early to assess the full impact of the UFLPA. An anticipated positive outcome is that buyers can have greater confidence that solar equipment used for their projects will have no ties to forced labor. However, responsible sourcing likely comes with heightened costs, due at minimum to the administrative burden of providing complete documentation for compliance.

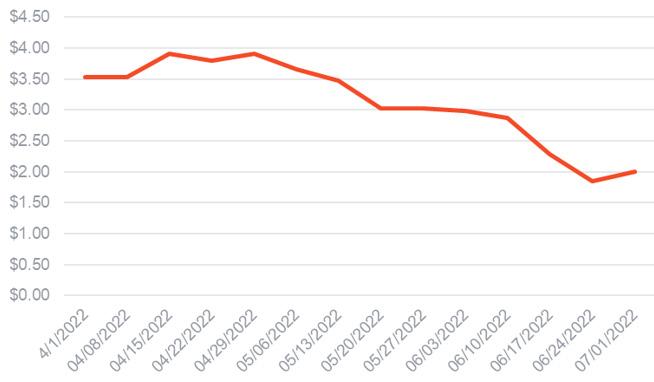

Global supply chain issues contribute to higher PPA prices

In line with their upward trajectory over the past two years, PPA prices for wind and solar continued to climb during Q2 2022. While the recent news of tariff delays may provide some relief for the solar market, the renewables market is still subject to current global macroeconomic factors. The cost of labor, raw materials, and shipping are continuing to rise, increasing the required capital expenditure by developers. The higher expense of project development and construction is ultimately passed through to buyers in the form of higher PPA prices, with the potential to mitigate somewhat contingent on contract terms.

Various line items in project financial models are seeing price pressures, exacerbated by the war in Ukraine and Covid-19.

For wind projects, raw materials such as steel and aluminum, which make up 90% of a turbine, have experienced sharp increases. Speaking to a 40% jump in European steel prices in a matter of weeks, wind turbine manufacturer Vestas’ CEO told investors, “We cannot price and we cannot do things we don't know of.” These sorts of spikes in raw materials have reverberating impacts, through increased turbine prices and ultimately increased PPA prices for offtakers.

Labor is also a challenge impacting the renewables sector. The diminished workforce as a result of the

Covid pandemic has not yet rebounded and has been compounded by reduced migrant labor flows, China’s zero Covid policy, and strict lockdown rules in other southeast Asian countries. With demand for renewables increasing and inflation rising, workers are demanding higher wages, resulting in higher prices for consumers.

Another ripple effect of the pandemic was an abrupt jump in ecommerce that the shipping industry was not equipped to handle. Costs and uncertainty around the shipment of materials to developers have grown, with suppliers unable to provide firm pricing on materials until orders have left the ports. The renewables industry is not insulated from the growing supply chain issues seen across the globe, and we continue to expect PPA prices to reflect the higher costs experienced by developers.

Project availability dropped 30% in Q2 as online dates of 2025 or later increase their market share

After three quarters of fluctuation, including a 25% drop in Q4 and a 29% increase in Q1, the inventory of projects on the U.S. market again dropped in Q2 by 30%. Uncertainty, coupled with buyer demand, were the primary driving factors behind this change.

As the second quarter kicked off with the announcement of the Department of Commerce tariff circumvention investigation, some developers paused marketing on solar projects due to uncertainty in their panel sourcing strategy, which pulled projects out of the inventory. For wind and solar projects that remained on the market, there has been greater buyer demand than project supply. Therefore, projects have moved into exclusive contract negotiations at a rapid pace.

Buyers will also find that anticipated online dates for marketed projects are shifting later as the year goes on. This quarter saw a 45% drop in projects coming online in 2024, and a 40% increase in projects anticipated to come online in 2025. Part of this is a natural, expected shift as nearer-term projects are contracted and move off the market. Other, more unique factors, include supply chain-driven constraints, solar panel sourcing uncertainty, and interconnection queue delays, which are typically delaying project schedules by one year or longer.