3 minute read

PPA Pricing Trends

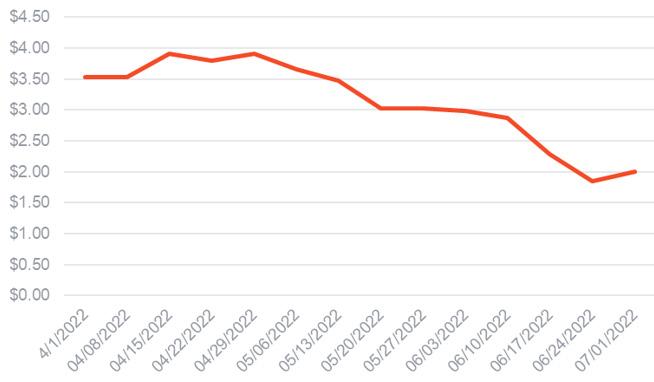

Figure 9. Current PPA Prices Q2 2022

Upper Whisker — Maximum PPA Price

Inter- Quartile Range of PPA Prices

Lower Whisker — Minimum PPA Price

PPA prices shown above reflect flat, unit-contingent offers received in Q2 2022. Markets and technologies with offers from fewer than three distinct projects are not shown. Some offers shown may no longer be on the market.

PPA prices have increased in the past quarter to reflect the high volatility caused by a number of factors, including the geopolitical situation, supply chain issues, raw materials price increases, growing inflation, and the gas crisis in Europe.

• Spain continues to offer the strongest opportunities for corporate offtakers and we are seeing high project availability in this market, predominantly solar. Offtakers can find offers with fixed and discount-to-market with floor price structures. Currently, the most common type of price structure in Spain is pay-as-produced, with developers typically offering 10-year project terms.

• Italy follows Spain when it comes to pricing and types of offers. We have been seeing fixed and discount-to-market with floor offers as well as mixed structures, e.g., fixed price for half of the project term, followed by discount-to-market with floor. The most common project term is 10 years, although slightly shorter terms are also available. healthy market for corporate offtake. With PPA prices slightly higher than in continental Europe, buyers can choose from a range of solar and wind projects, a variety of price structures, and risk mitigation mechanisms.

• The UK offers a solid renewable energy pipeline for corporates. While project developers have an attractive opportunity to secure subsidized offtake through the UK government, the supply of projects exceeds the government’s target. Thus, there is a • Due to its proximity to the center of geopolitical instability, Q2 energy prices in Poland rose significantly, causing an increase in PPA prices. Added to these concerns was the slow project development process including securing land, grid connection, and permitting; a high-carbon intensive grid; and rising demand from corporates seeking to meet ambitious sustainability targets. In the Polish market, matching buyers with sellers of renewable projects remains more challenging, particularly around meeting deadlines.

• Overall, Q2 2022 has brought more uncertainty to the PPA market. Increased demand for renewable energy in Europe has not matched availability of supply of projects. These factors have strengthened developers’ positions within the market and added additional considerations beyond the realm of pricing. Our general recommendation for renewable energy offtakers is to be nimble and flexible when it comes to project requirements.

PPA Landscape Across Europe

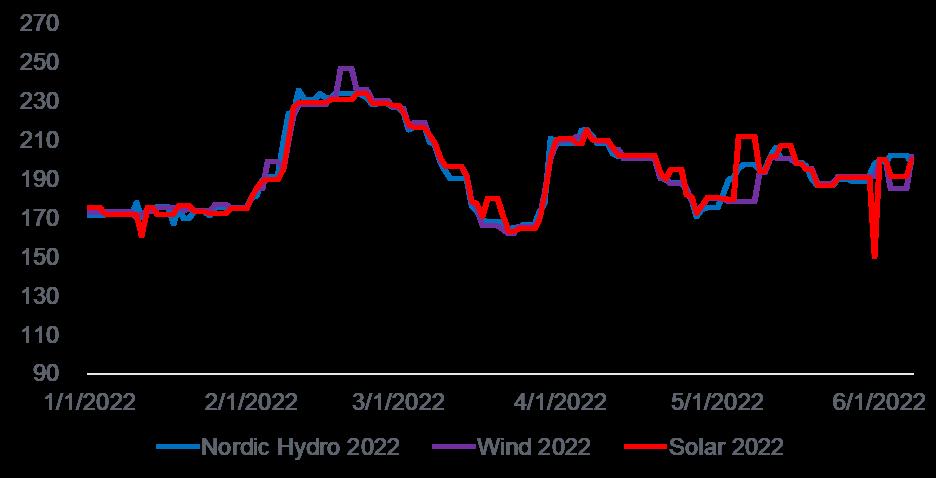

Figure 10. European Renewable Energy Markets Maturity Heat Map

Source: BNEF

Spain continues to take the top spot in terms of transactions and market opportunities in the fastgrowing corporate PPA market. This leadership position is built mainly on the abundance of solar resources, a considerable supply pipeline, a relatively illiquid futures and forward contract market, and a government support scheme that is highly favorable, making PPAs an attractive option for energy intensive companies from a credit perspective. Together, these factors will continue to support robust PPA market development in the region.

The Nordic region, specifically Sweden and Norway, also rank high in the European footprint in terms of market adoption of PPA instruments. Historically, the market has been driven by extensive expertise in hydro assets, a large share of energy intensive purchasers, and strong government support.

We are seeing positive signs from the Italian market after an extended standstill, with new transactions clearing this quarter and, more importantly, projects being expedited through the administrative process. At the legislative level, there are wins towards increased permitting for agrivoltaics in Italy - historically, a hurdle for renewable build - as it entails the simultaneous use of land areas for both solar photovoltaic power generation and agriculture. This will be a market to continue to watch.

France’s renewable energy pipeline continues to grow, offering higher project availability. Governmental subsidies are still strong and attractive to renewable energy developers in France.

Similarly, Poland presents potential, especially given some movement around removing the 10H rule that has historically held back renewable installations. The 10H rule states that the distance between a wind turbine and a built-up area must be at least 10 times the height of the turbine, limiting the amount and size of wind installations in the area. If the proposed draft is enacted into law, we anticipate increased interest from investors and corporations.

We are actively monitoring projects from less mature markets across Eastern and Southeastern Europe including Hungary, Romania, Croatia, Serbia, and Greece. While PPA markets are in nascent stages and renewable pipelines still at reduced levels, we are seeing promising signs across the region.