What are the expectations for the commercial property market?

Due to higher interest rates, high inflation, and general uncertainty, the desire to invest has remained relatively high among investors. Only 57% of respondents expect to invest at the same level or more in 2023, which is a decrease of 23 percentage points compared to the previous year, where the desire to invest was 80%. For example, this is reflected in the possibilities for financing, where as many as 78% of respondents expect it to become more difficult. The corresponding share has been between 30-36% in the last three years.

Our Expectations Analysis

2023 is the eighth that we at EDC Poul Erik Bech have conducted. This year again, there were more than 1,700 companies and investors who took the time to respond, for which we thank all participants. With the high response rate – from all parts of Denmark – the survey provides a solid picture of how investors and businesses expect the commercial property market to develop in 2023.

Residential rental properties are peaking

Which property types do investors view as potential investments in 2023? The four most interesting potential investments all contain an element of housing. The respondents continue to see the greatest potential for investments related to residential rental properties, with as many as 80% expressing an interest in this segment in 2023. This is supported by the fact that 23% of the respondents see potential in plots to build homes, while 21% see potential in commercial properties for conversion to housing. In relation to warehouse/logistics, 21% expect to invest in 2023, while 17% will invest in office properties and 11% in retail properties.

If we look more closely at the respondents’ expectations for the market prices of residential rental properties, there has also been a drastic change here from 2022 to 2023. 68% expect falling prices in 2023, while only 13% expected a fall in the market price for the segment in 2022, i.e., a difference of 55 percentage points.

Green investments

For the past few years, our Expectations Analysis has also included an in-depth section on issues related to green

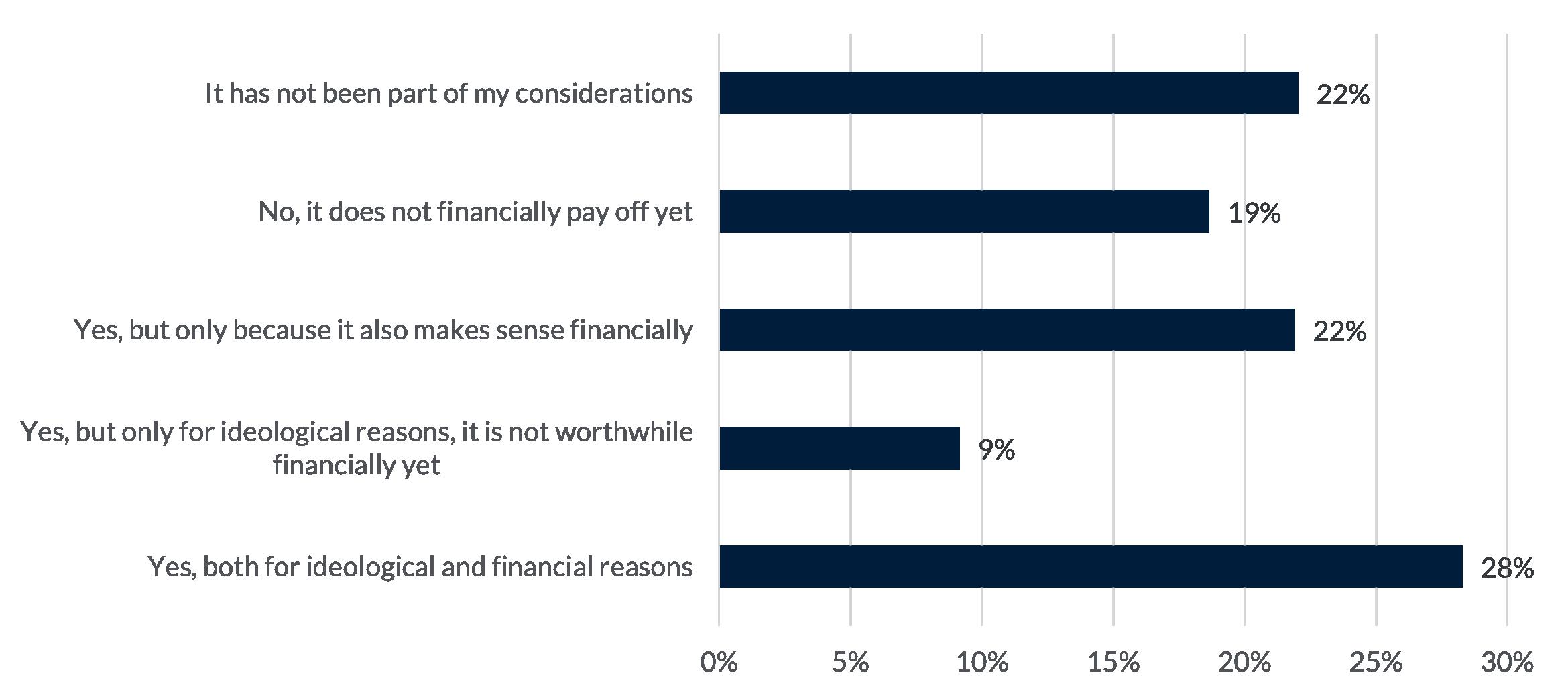

investments. This time, our survey shows that sustainability for economic and ideological reasons plays a role in 28% of respondents’ current investment strategies. This is an increase of 7 percentage points from 2022.

For 22% of respondents, sustainability also plays a role, but only because it is economically connected, which is an increase of 6 percentage points from 2022. For 19%, sustainability does not play a role, but this is because it does not pay off financially yet. Only 22% of respondents express that sustainability has not been part of the considerations for their current investment strategy, which is a decrease of 8 percentage points from 2022.

As many as 34% of the respondents who own their properties answer that they already have energy optimized one or more of their properties. This is an increase of 6 percentage points from 2022 when only 28% of respondents had carried out an energy optimization. 58% of respondents answer that they are willing to pay more for a sustainable property where location, condition and cash flows are the same. With this, the majority of respondents in 2023 are still willing to pay more for a sustainable property. The overall development in our survey shows that sustainability still plays a more prominent role for several actors within the commercial property industry.

For residential rental, retail and industrial & logistics properties, approx. 50% of respondents believe that tenants are willing to pay more for sustainable properties of the same size, condition and location, while 74% of respondents believe that tenants are willing to pay more for sustainable office leases.

4

Facts about the Survey

What is the size of your company?

51% of the respondents run businesses with 2-25 employees, while 29% run sole proprietorships. Of the respondents, 11% run a company with between 26-200 employees. Only 8% run businesses with 101-500+ employees.

Here, it is distributed such that 4% run businesses with between 101-100 employees and 4% run businesses with 500+ employees. The development is therefore largely unchanged from 2022.

500+ employees: 4% 2-25 employees: 51% 26-100 employees: 11% 101-500 employees: 5% 1 employee: 29%

5

Roskilde

Odense Aarhus Hillerød Silkeborg Viborg Vejle Esbjerg Næstved Slagelse Køge Aabenraa Kolding Copenhagen Herlev Herning Taastrup

Aalborg/ Vendsyssel

Sønderborg

Since 2021, there has been an increasing number of companies investing in properties not intended for their own use. In 2022, 59% of respondents expected to invest in properties not intended for their own use, while expectations for 2023 have increased slightly to 63%. Thus, the trend from 2021 continues.

Residential rental properties

There has been a drastic change in the respondents’ expectations for the market prices of residential rental properties from 2022 to 2023. 68% expect falling prices in 2023, while only 13% expected a fall in the market price for this segment in 2022. 37% expected an increase in the market price in 2022, while only 7% expect this in 2023. The difference of 55 percentage points clearly shows how the current situation concerning rising interest rates and inflation has had a noticeable effect on investor expectations for the coming year.

Do you invest in properties not for your own use?

6

What are your expectations for the development of the market prices in 2023 for …

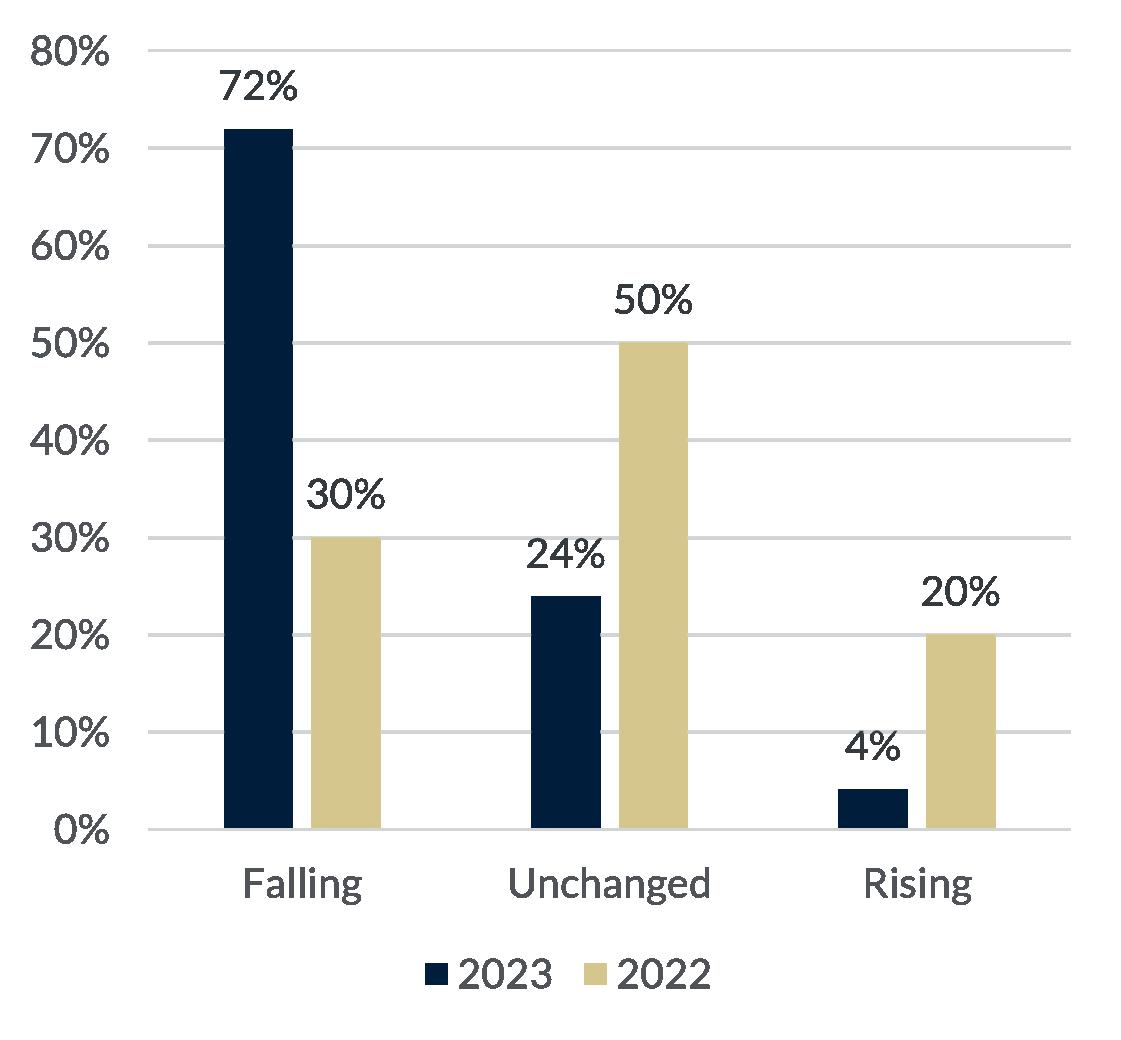

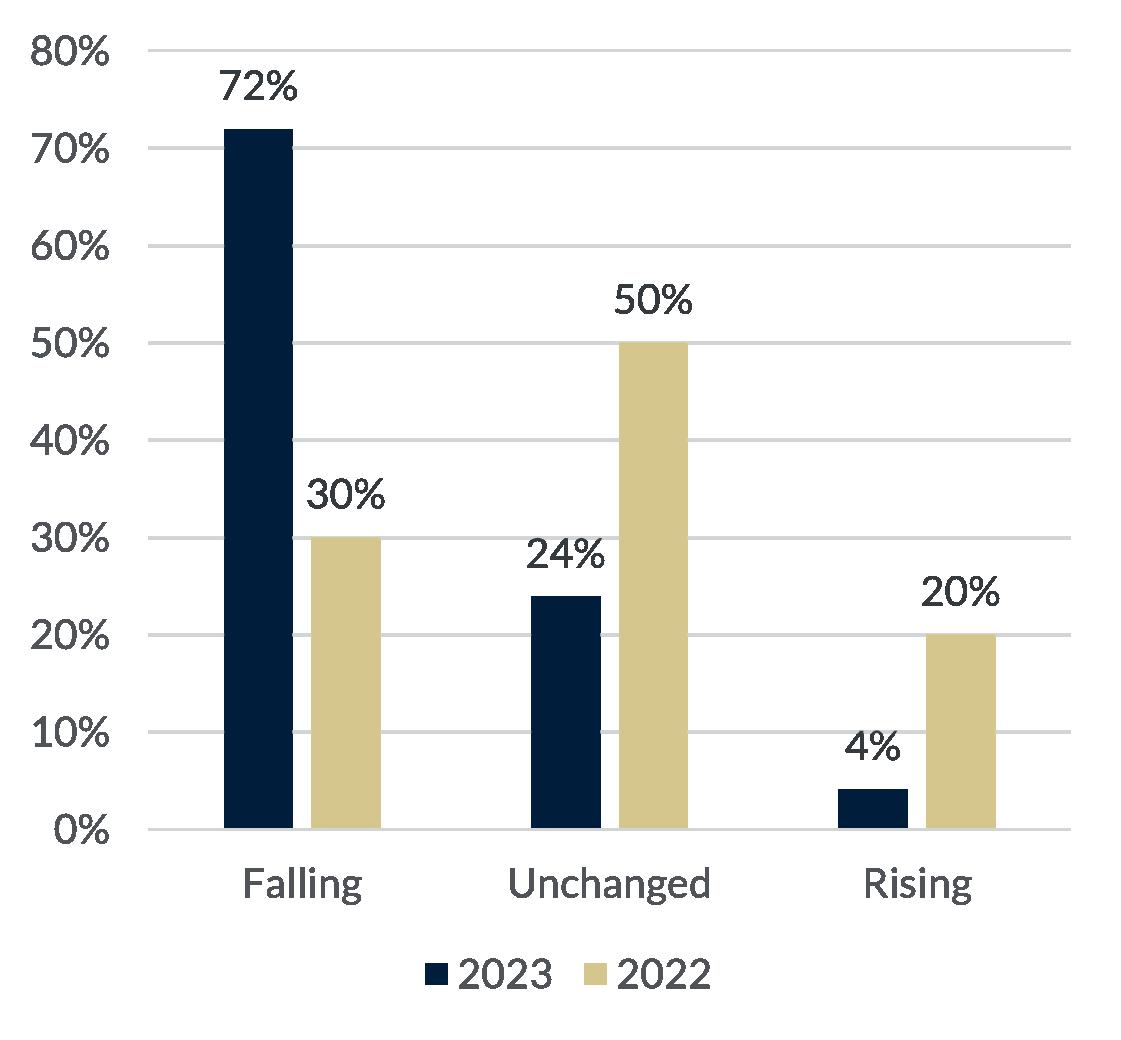

Office properties

Likewise, there has been a significant change in companies’ expectations of the market price for office properties. Only 30% of respondents expected a fall in market prices in 2022. In comparison, 72% expect falling market prices for office proper ties in 2023, which is 42% more compared to the previous year.

Warehouse/logistics properties

In the warehouse/logistics segment, 58% of respondents expected an increase in market prices in 2022, while 12% expect a market price increase in 2023. Although there has been a clear decrease, warehouse/logistics is the segment where the largest proportion expects an increase in market prices. Even though 12% is not a significant proportion, this shows that demand for this type of property is still expected.

7

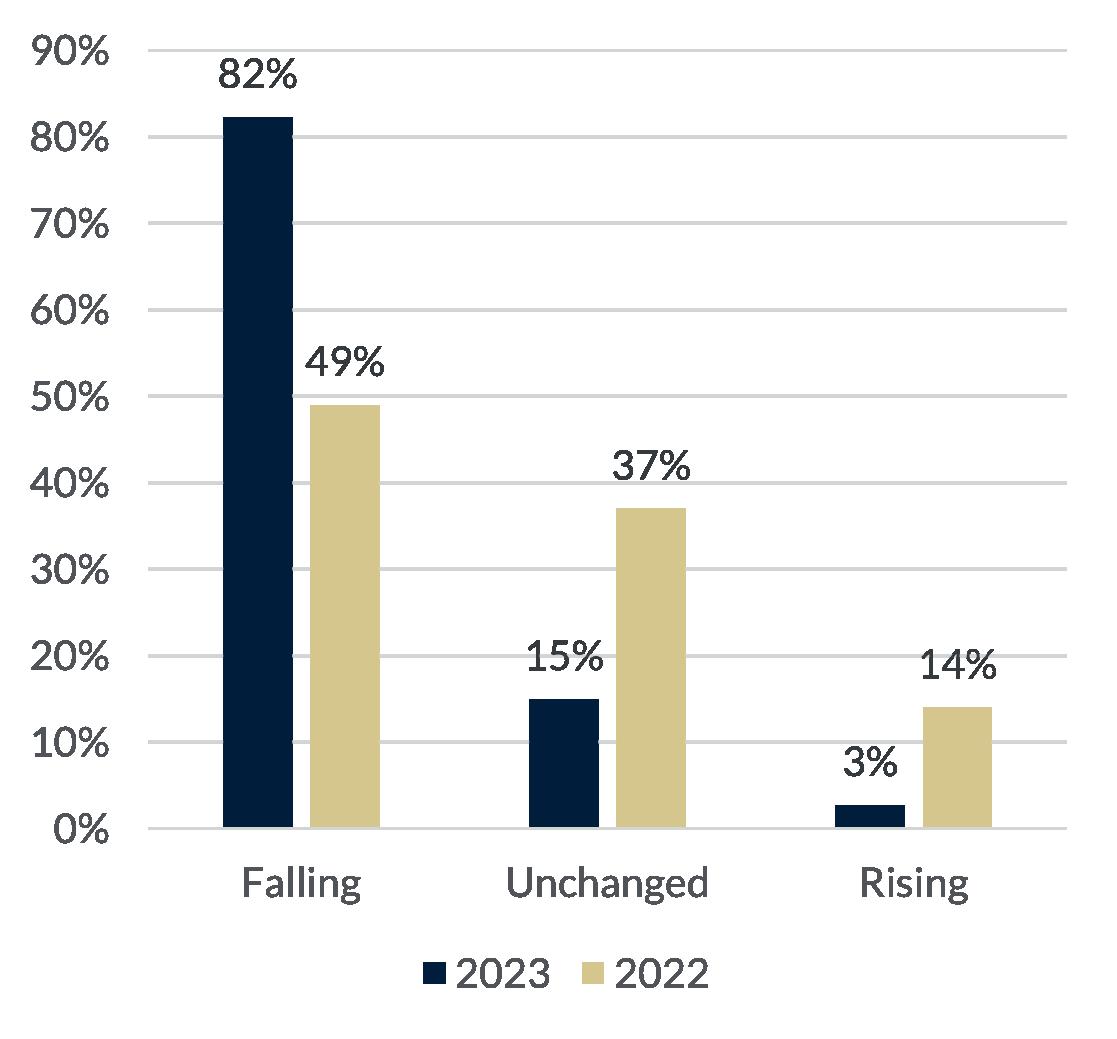

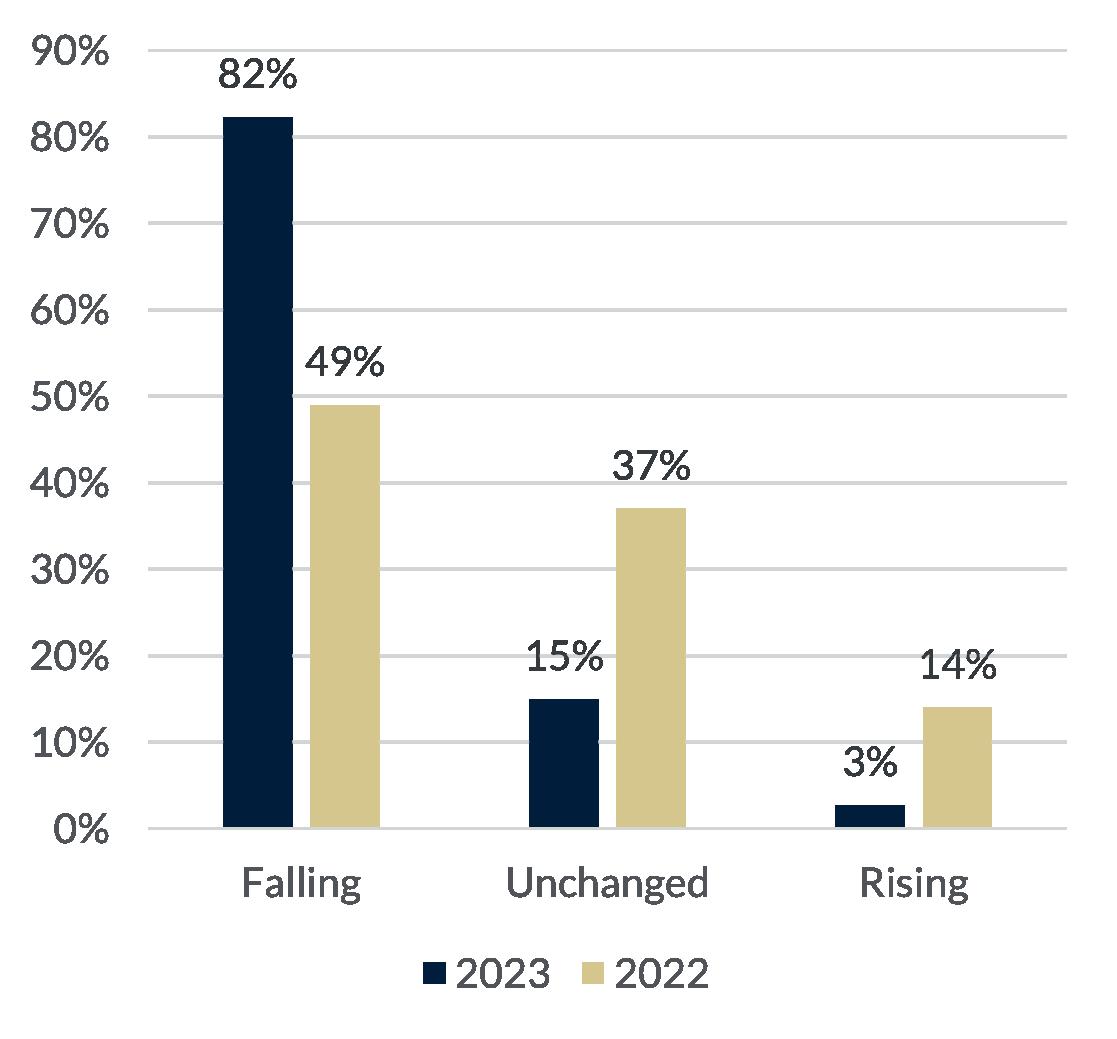

Retail properties

82% expect a fall in market prices for retail properties in 2023, while 49% expected the same in 2022. This shows that already in 2022, there was a relatively broad perception that market prices would fall. A year ago, there was not the same pronounced optimism for market prices in this segment as there was, e.g. for residential rental properties. 14% expected a rise in market prices in 2022, while 3% expected a rise in 2023. This is a decrease of 11 percentage points.

Commercial land

In 2022, 36% of respondents expected an increase in the market prices of commercial land, while just 4% expect the same scenario in 2023. This is a decrease of 32 percentage points. The largest proportion of respondents in 2023 expect a fall in market prices. In summary, it can be concluded that in the various segments there is a general expectation of falling market prices.

8

rent in 2023 …

Residential rental properties

The respondents have largely the same expectations for the market rent in 2022 and 2023, although a slightly larger proportion expects a decrease in 2023 than the case in 2022. In 2022, 8% of the respondents expected a decrease in the market rent for residential rental properties, while 15% expect a decrease in 2023. There is a rise of 7 percentage points of respondents who expect a decrease in the market rent for residential rental properties.

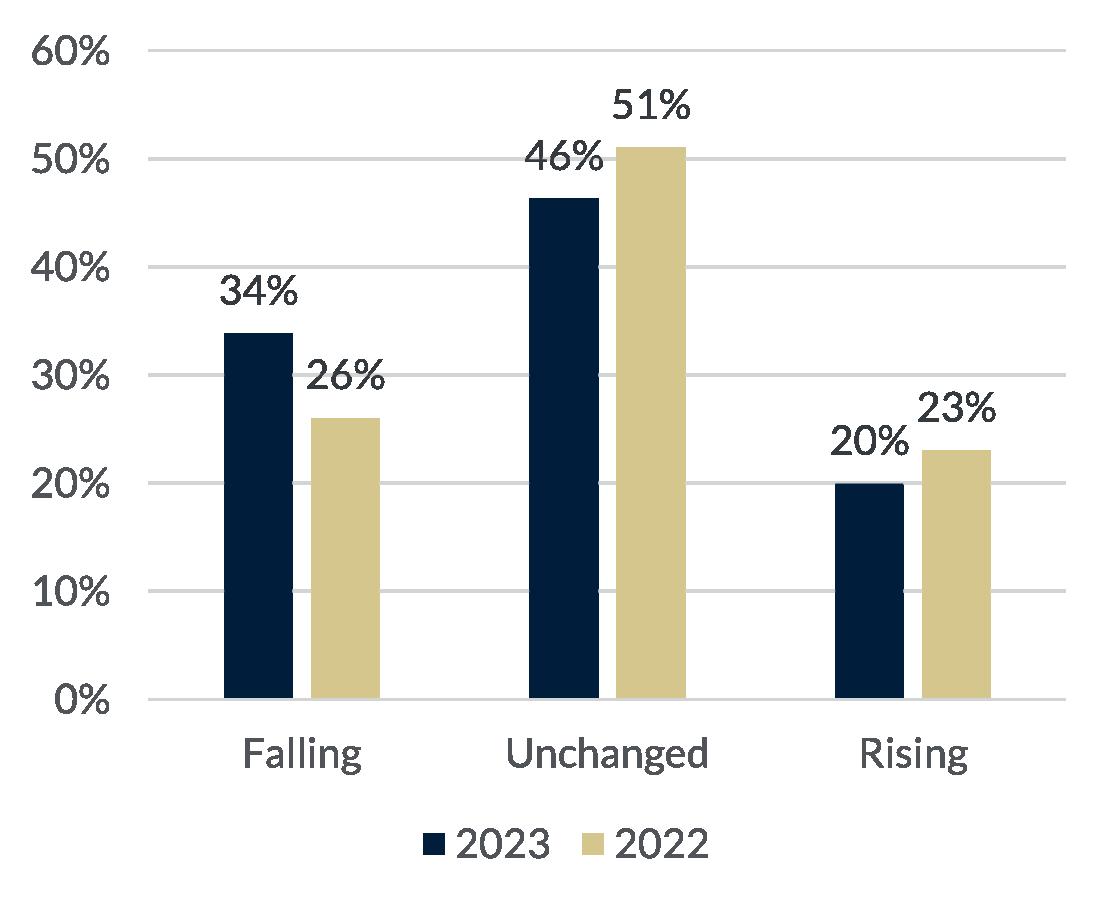

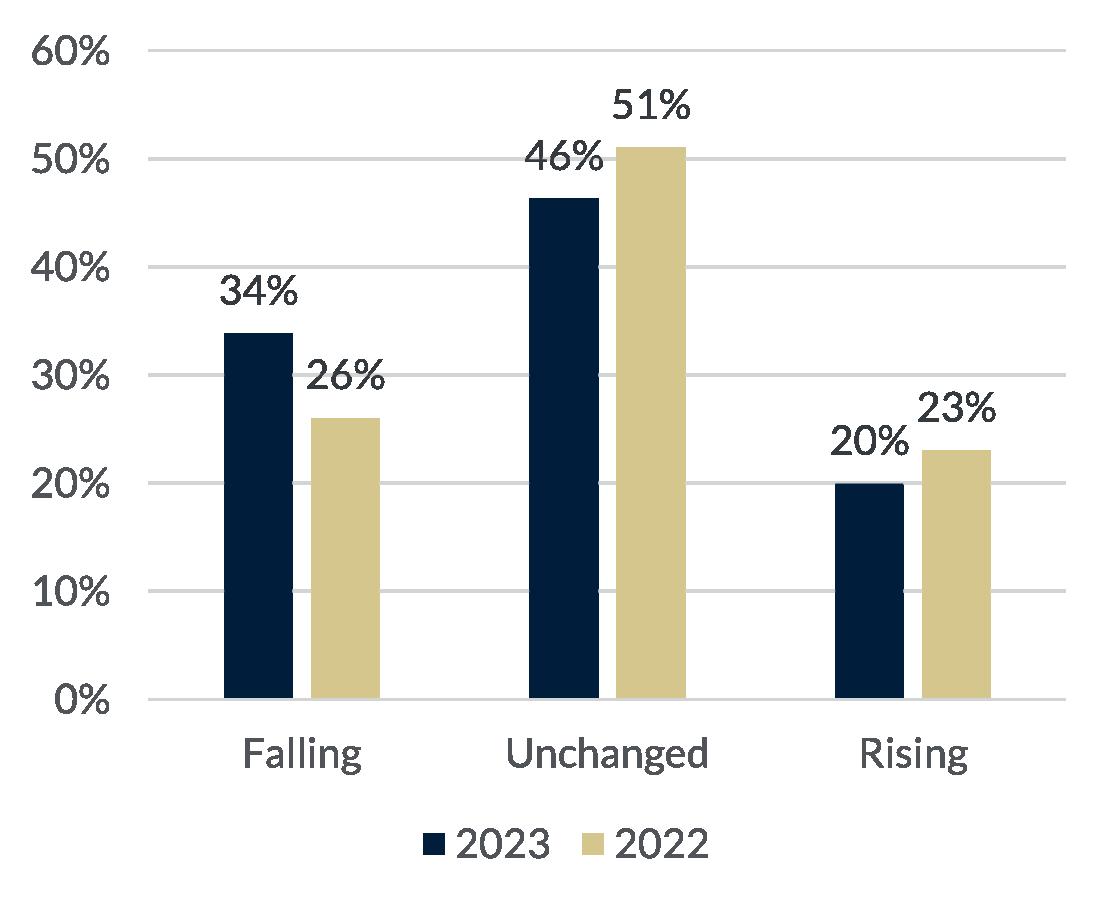

Office properties

A smaller proportion of respondents expect an unchanged or increasing market rent for office properties in 2023 com pared to 2022. 51% expected an unchanged market rent in 2022, while 46% have the same expectation for the year of 2023. However, there are more who expect a decrease in market rent in 2023 than in 2022. 26% expected a decrease in market rent in 2022, while the share increased to 34% for expectations in 2023, which is an increase of 8 percentage points.

Warehouse/logistics properties

Far more respondents expect a decrease in the market rent for warehouse/logistics properties in 2023 than was the case in 2022. Just 8% expected a decrease in the market rent in 2022, while 26% expect it in 2023. In 2022, 59% expected an increase in the rental levels, while only 30% expect the same in 2023. This is a fall of 29 percentage points for people expecting an increase.

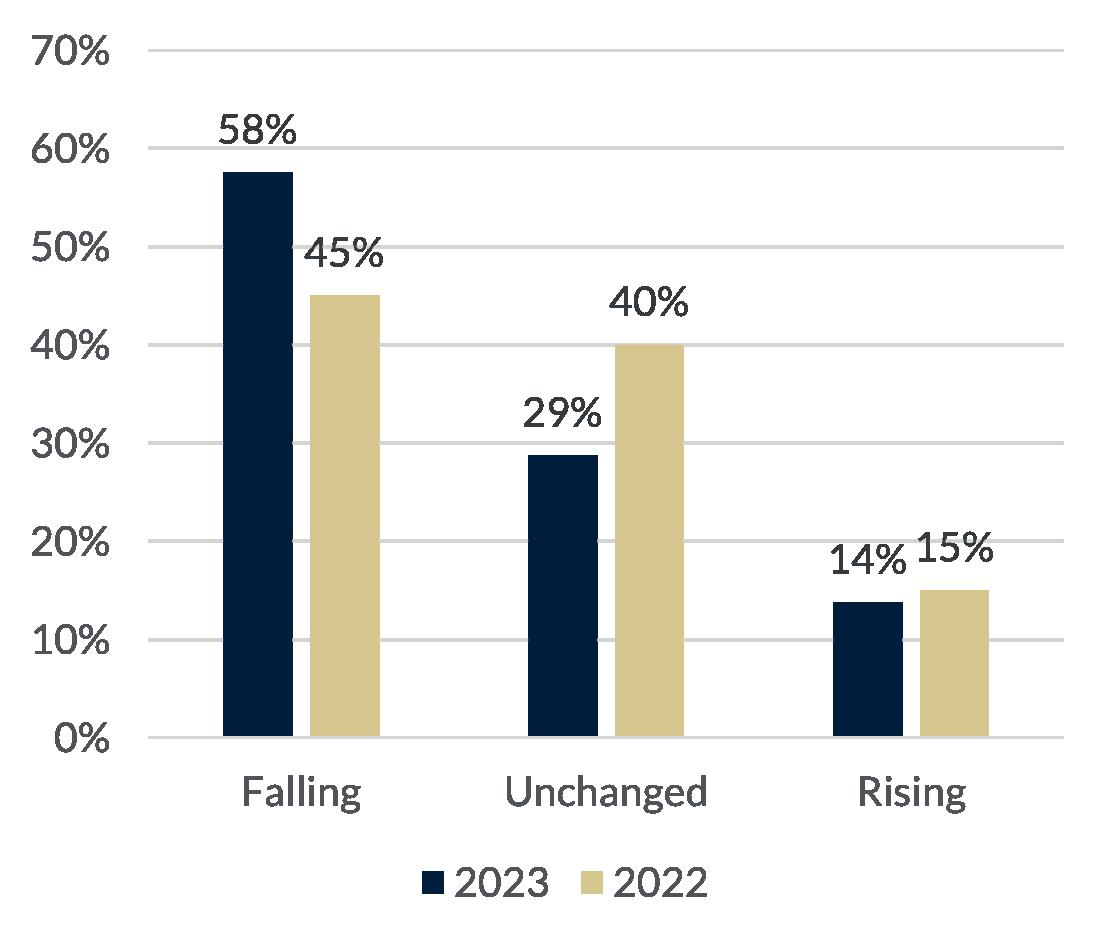

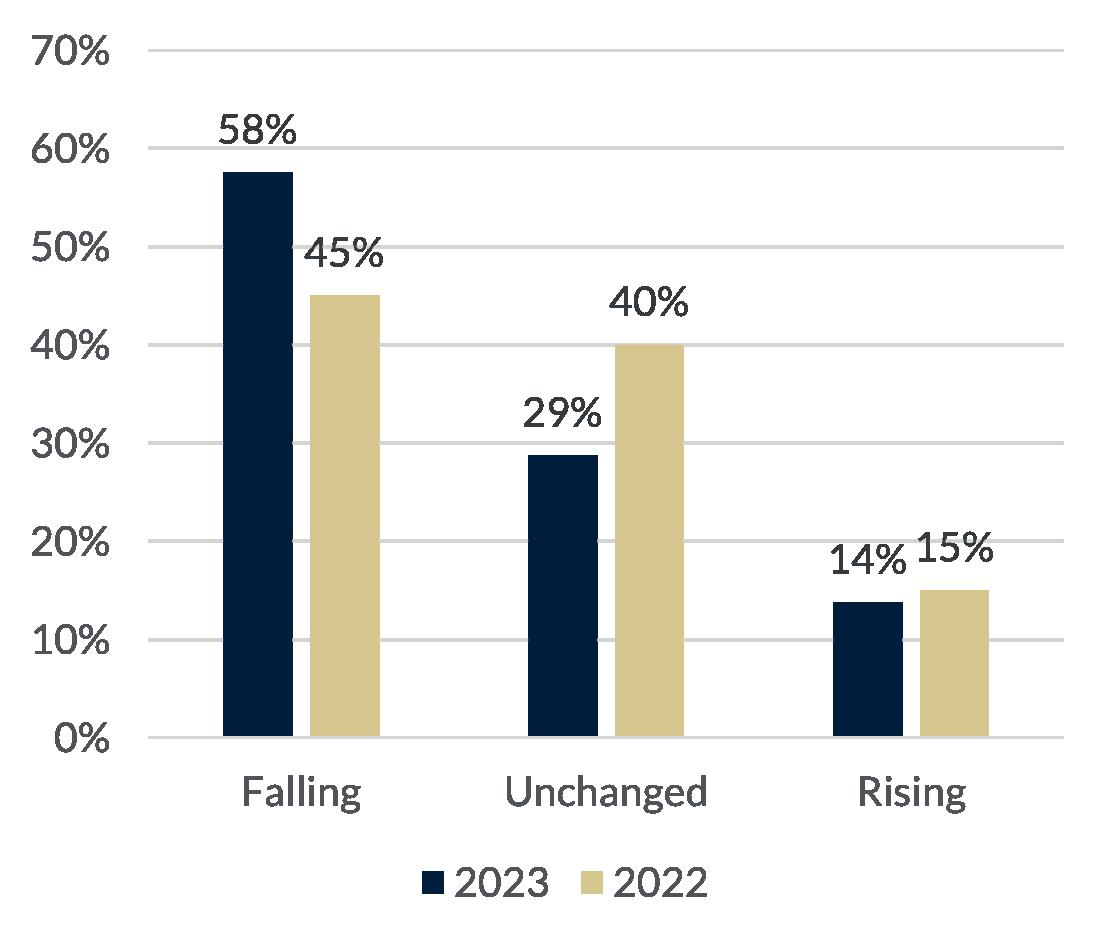

Retail properties

Overall, respondents expect a greater drop in market rents for retail properties in 2023 than they did the year before. 45% of respondents expected a decrease in market rent in 2022, while 58% expects a decrease in 2023. This is an increase of 13 percentage points for people who expect falling market rent levels. In summary, the respondents have a more negative expectation of the market rent than they had last year.

9

What are your expectations for the development of the market

Residential rental properties

Overall, there is no noticeable difference in the respondents’ expectations for the vacancy in 2022 and 2023 respectively. 23% of the respondents expected a decrease in the vacancy in 2022, while 17% expect it in 2023. 6 percentage points fewer expect a fall in vacancy in 2023 than was the case in 2022.

vacancy in 2023 for …

Office properties

33% of respondents expected an increase in office vacancy, while 50% expect an increase in 2023. This is an increase of 17 percentage points. 22% expected a decrease in vacancy in 2022, while only 11% expect this in 2023, which is a decrease of 11 percentage points. It can thus be concluded that there is generally a greater expectation among the respondents of an increase in the vacancy rate for office properties.

10

What are your expectations for the development of the

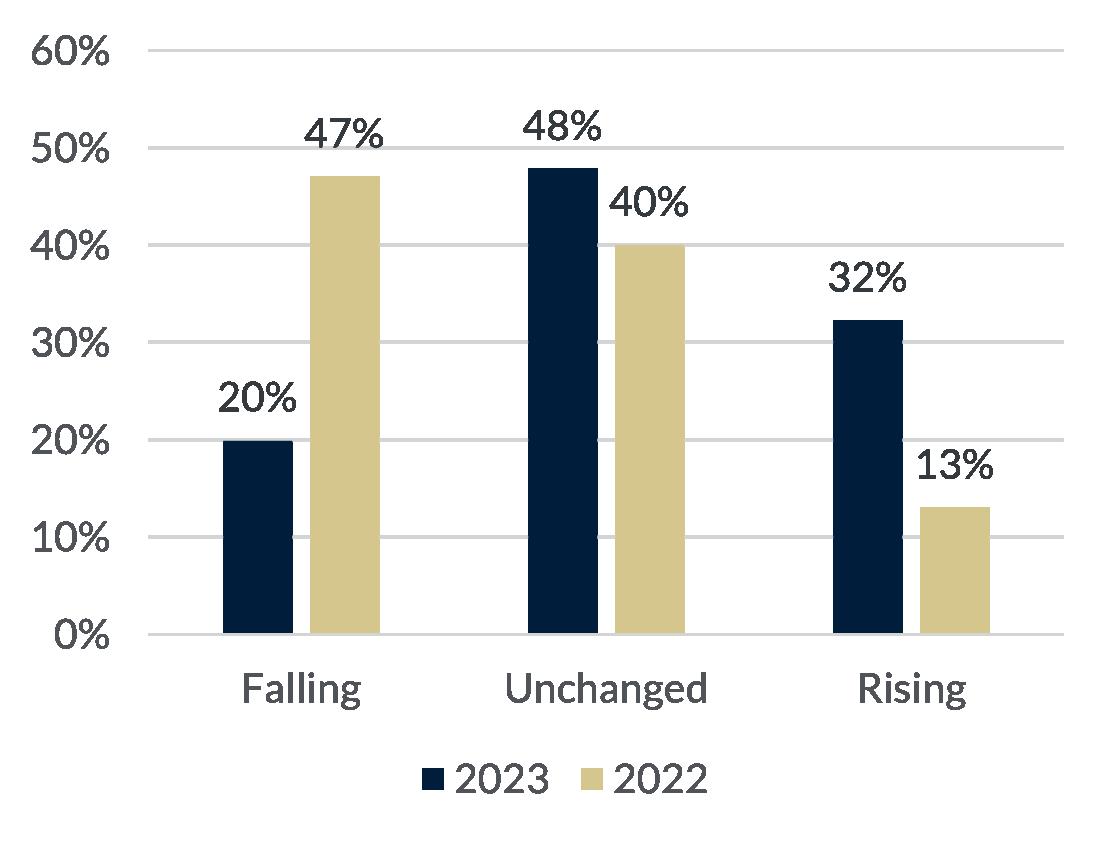

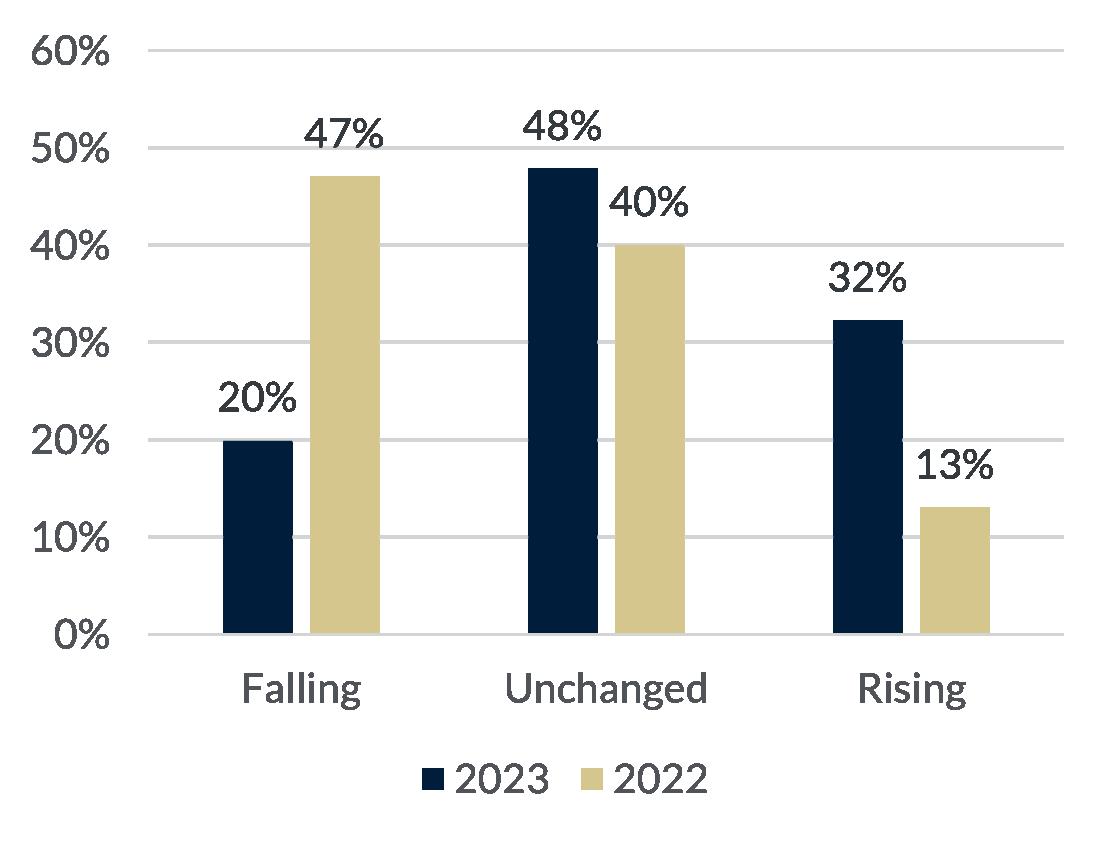

Warehouse/logistics properties

47% of respondents expected a decrease in the vacancy rate for warehouse/logistics properties in 2022, while only 20% expect the same in 2023. 13% expected an increase in 2022, while 32% expect this scenario in 2023. This shows a significant change in the previous expectation of the falling vacancy, now there is a majority of people who expect an increase.

Retail properties

45% of respondents expected an increase in vacancy in 2022, while 66% expect an increase in 2023. This is an increase of 21 percentage points. As many as 35% expected an unchanged vacancy in 2022, and just 17% expect this in 2023. Overall, it can be concluded that the respondents have more negative expectations for the vacancy for retail properties in 2023 than was the case in 2022.

11

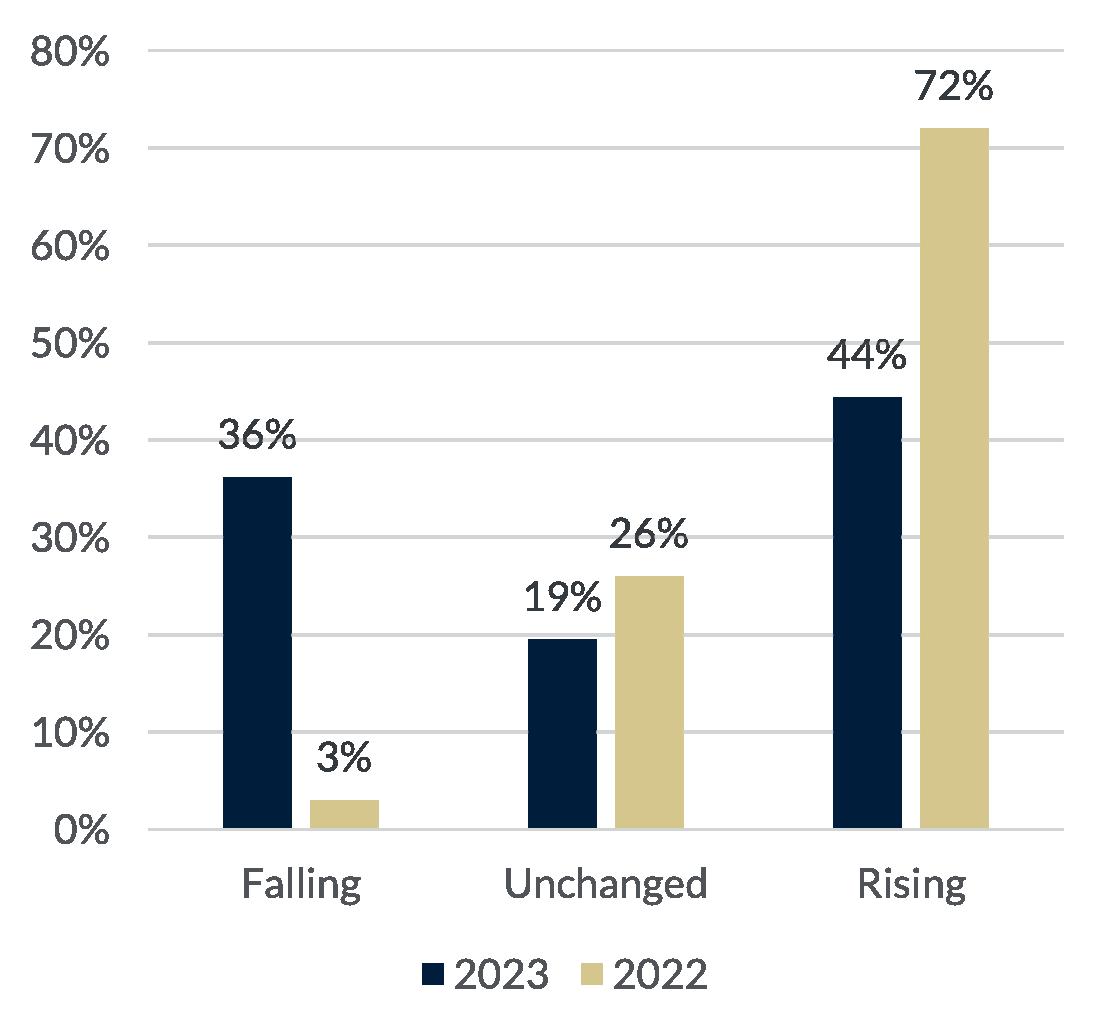

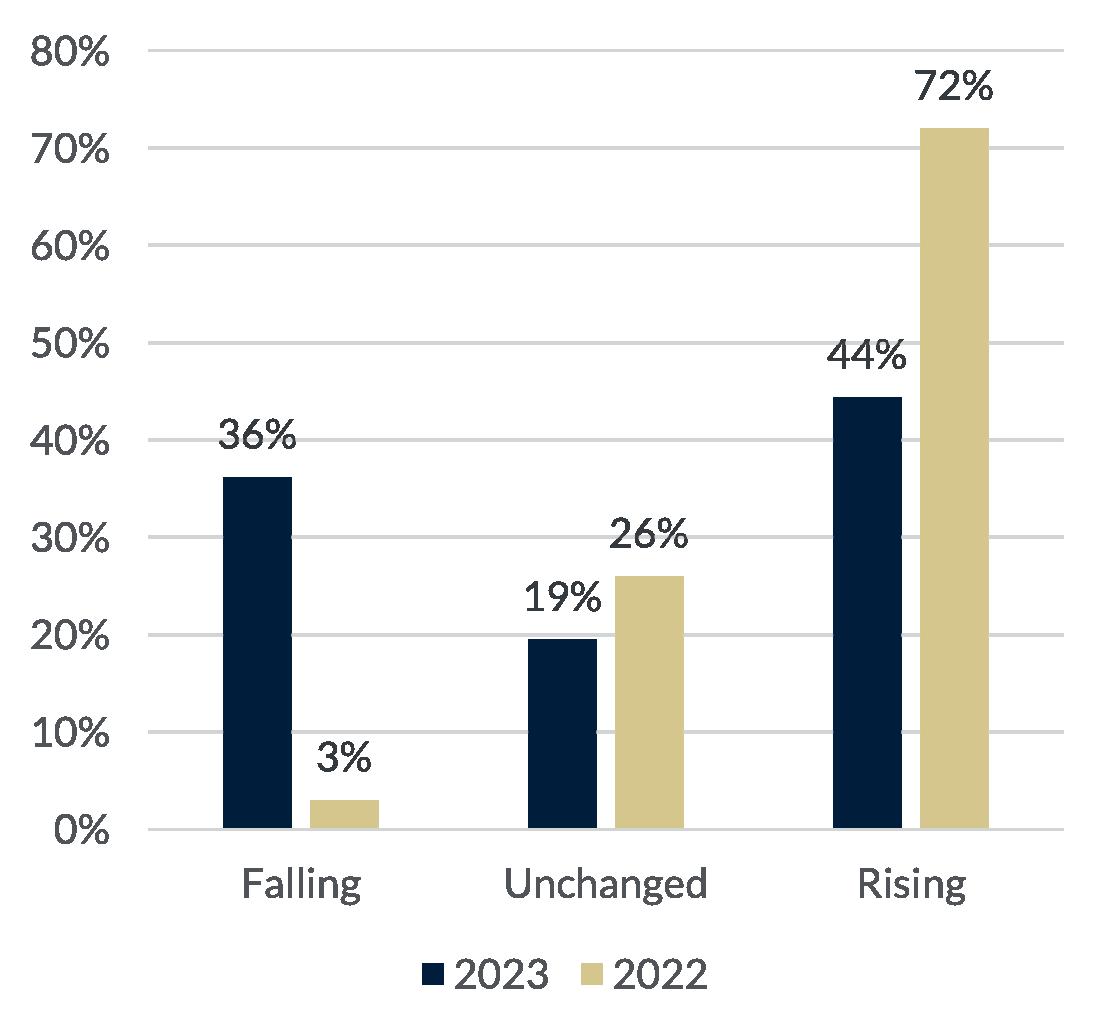

Inflation

29% of respondents expected inflation to be either decreasing or unchanged in 2022. In comparison, 56% expect the above scenario in 2023. This is an increase of 27 percentage points. As many as 72% expected inflation to rise in 2022, while just 44% expect this in 2023. With this, we can conclude that the respondents generally expect a fall in inflation in 2023.

2023 of …

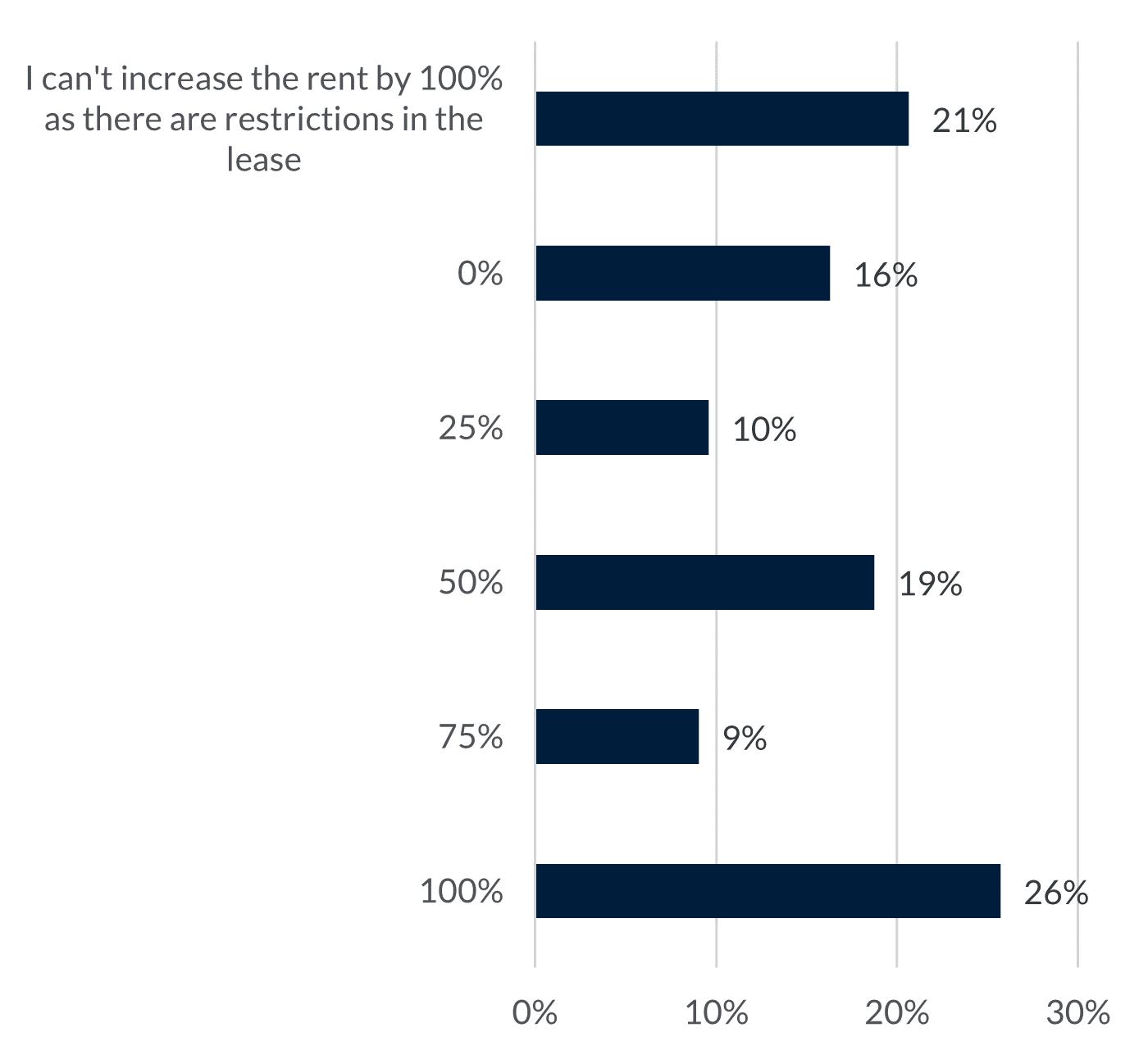

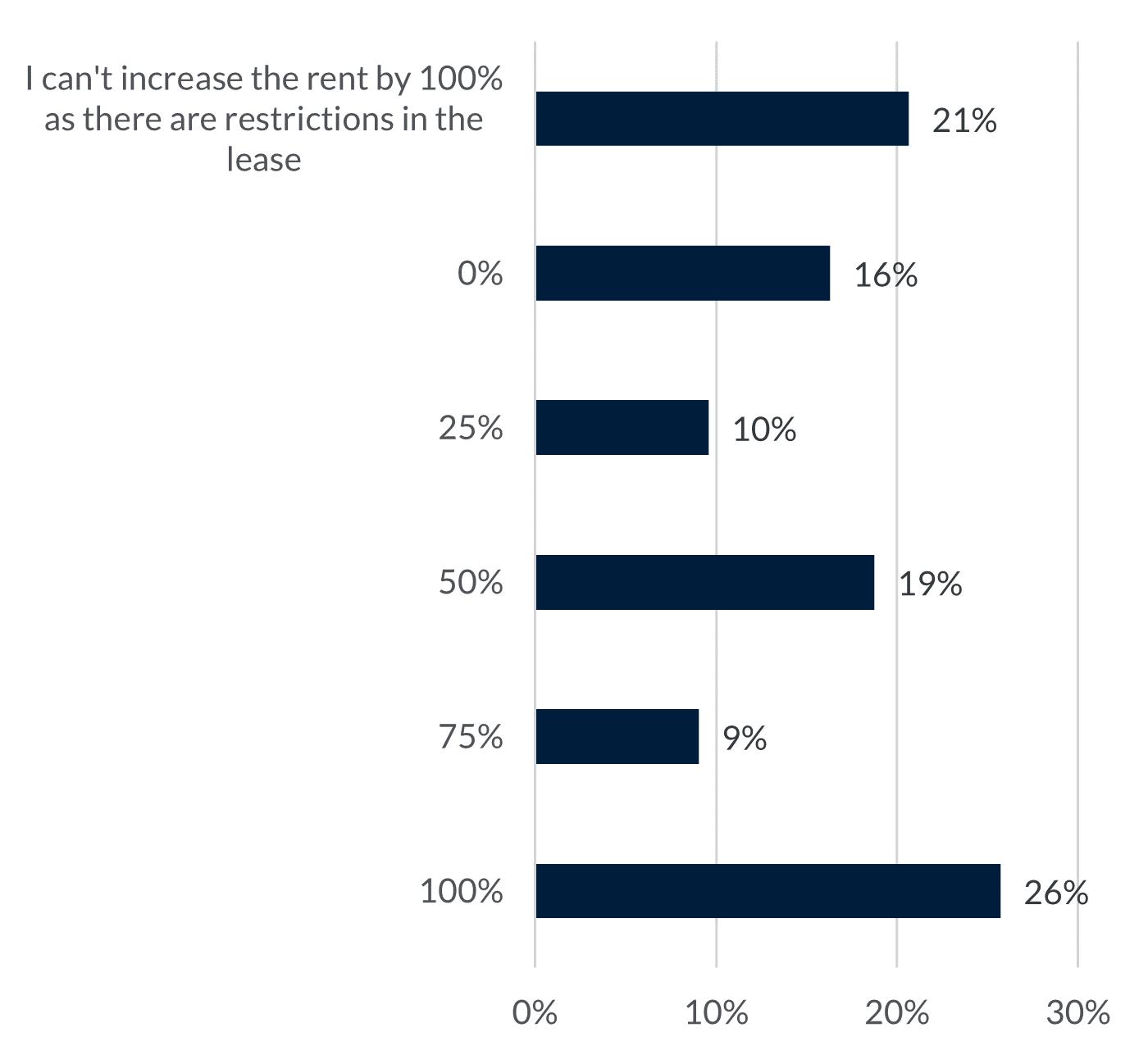

By what percentage of inflation (NPI) would you like to raise the rent?

(This question only applies to commercial properties, as there is a political majority for a rent ceiling of 4% annually on residential rental properties)

As many as 63% of respondents expect to raise the rent in 2023, of which 21% are limited in their regulation. Therefore, 26% respond that they will raise the rent with a share of 100% of inflation, 9% respond with a share of 75%, 19% respond with a share of 50% and 10% respond that they will raise the rent with a share of inflation of 25%. Only 16% of respondents will not raise the rent by a proportion of inflation. Thus, it can be concluded that there is a general tendency to raise rents by a certain proportion of inflation.

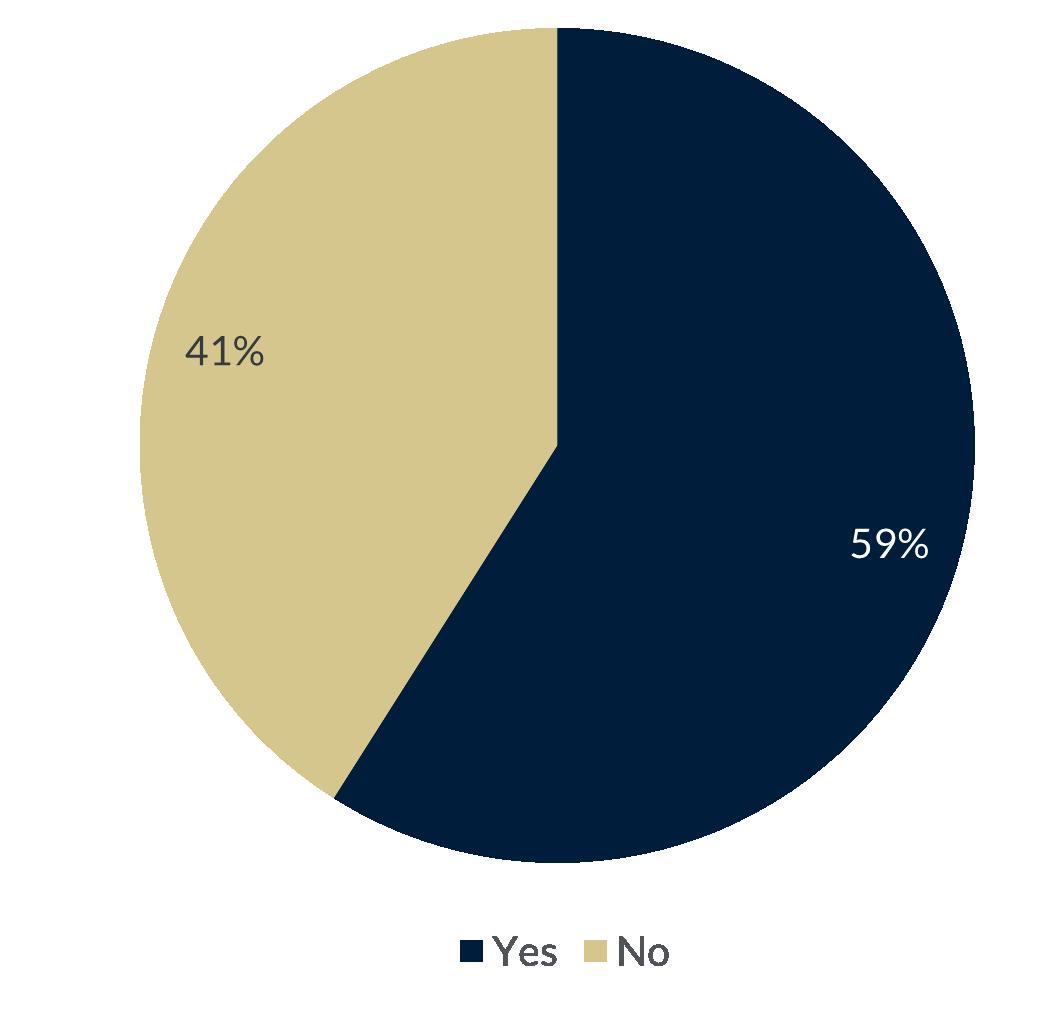

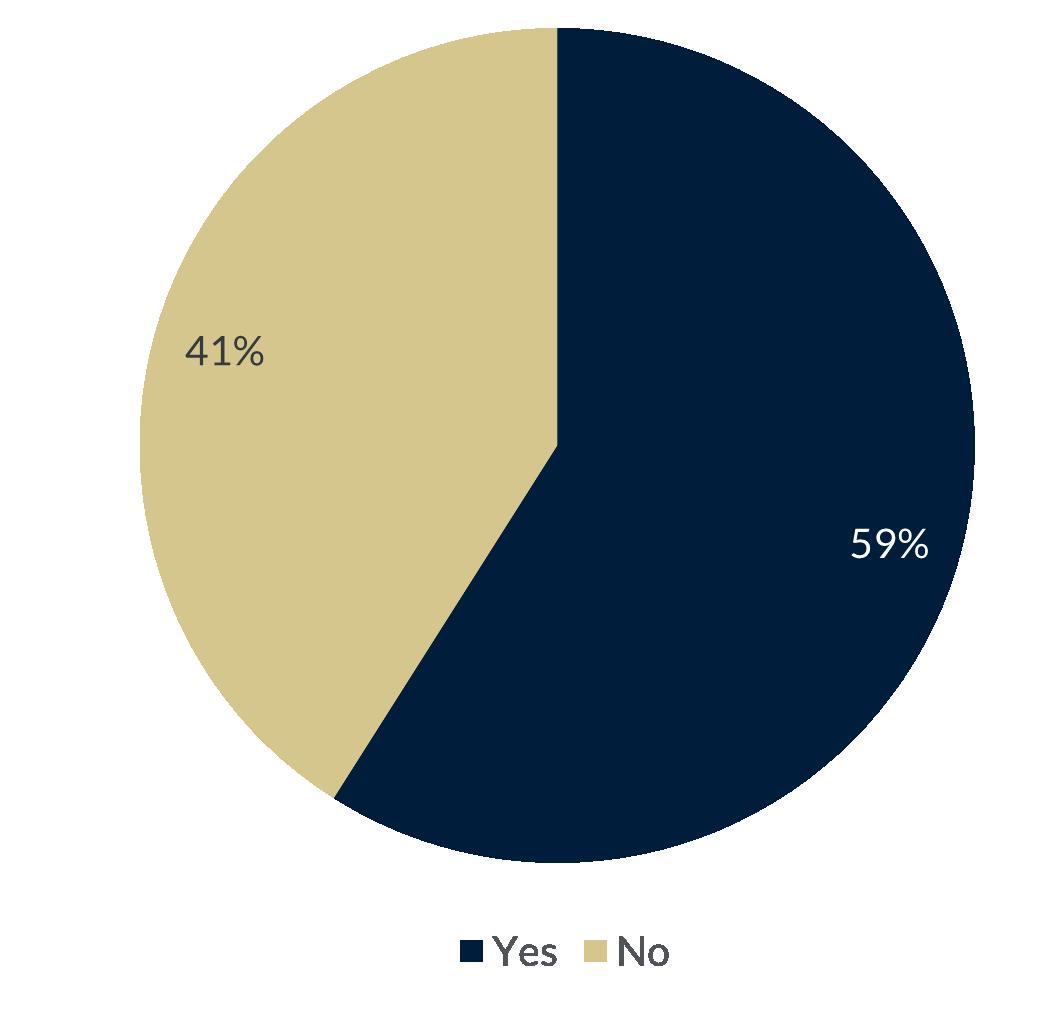

As many as 59% of those questioned answered that the current development in inflation affects their long-term inflation goals, while the remaining 41% answered that the current situation has no effect.

12

What are your expectations for the development in

Does the current trend in inflation affect your long-term inflation target?

Interest rate

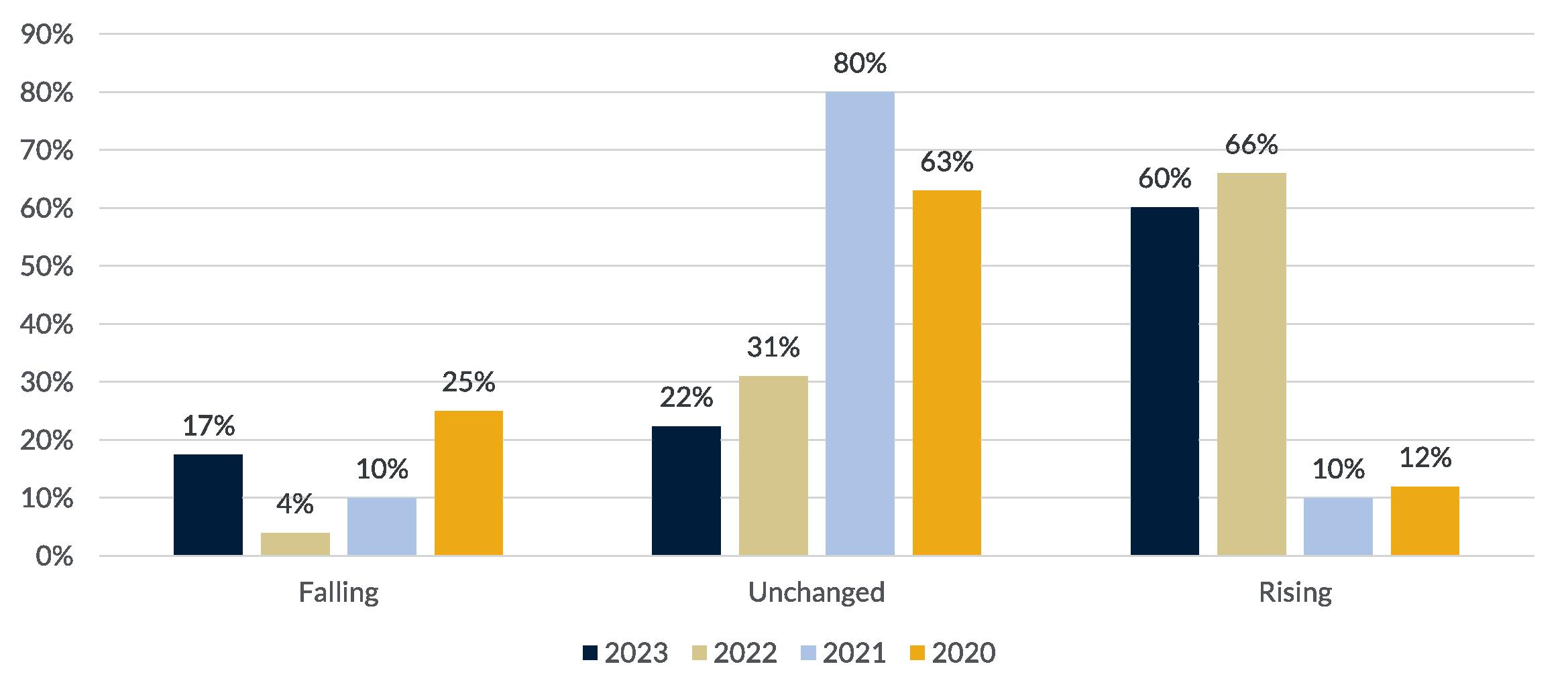

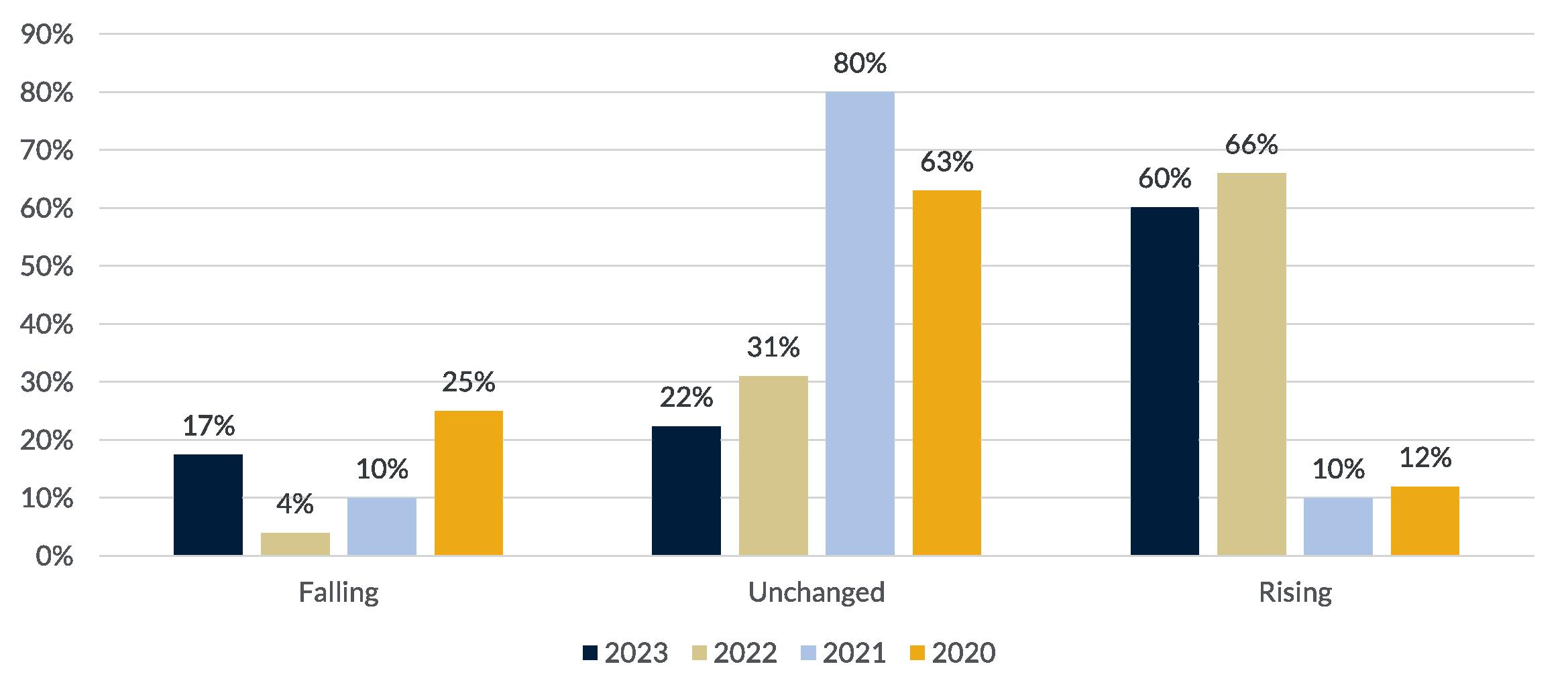

Overall, the respondents’ expectations for the level of interest rates are very similar to last year, although there are more who expect a fall in interest rates. 66% of respondents expected a rise in 2022, while 60% expect a rate hike in 2023. This is a minimal decrease of 6 percentage points.

In 2021, however, only 10% of respondents expected an increase in interest rates. 4% of respondents expected a falling interest rate in 2022, while 17% expected a fall in interest rates in 2023.

13

78% of respondents expect that in 2023, it will become more difficult to obtain financing for real estate invest ments. This is an increase of 42 percentage points. It can

thus be concluded that there is broad agreement among respondents that financing property investments will be much more difficult to obtain in 2023.

Most respondents, 44%, use a combination of fixed and variable interest as a form of financing for their property investments. In contrast, 26% use variable interest as financing, while 19% use fixed interest as financing. As many as 10% of the respondents use 100% self-financing for their property investments.

14

How do you perceive the possibilities of obtaining financing for property investments in 2023?

What form of financing do you typically use for your property investments?

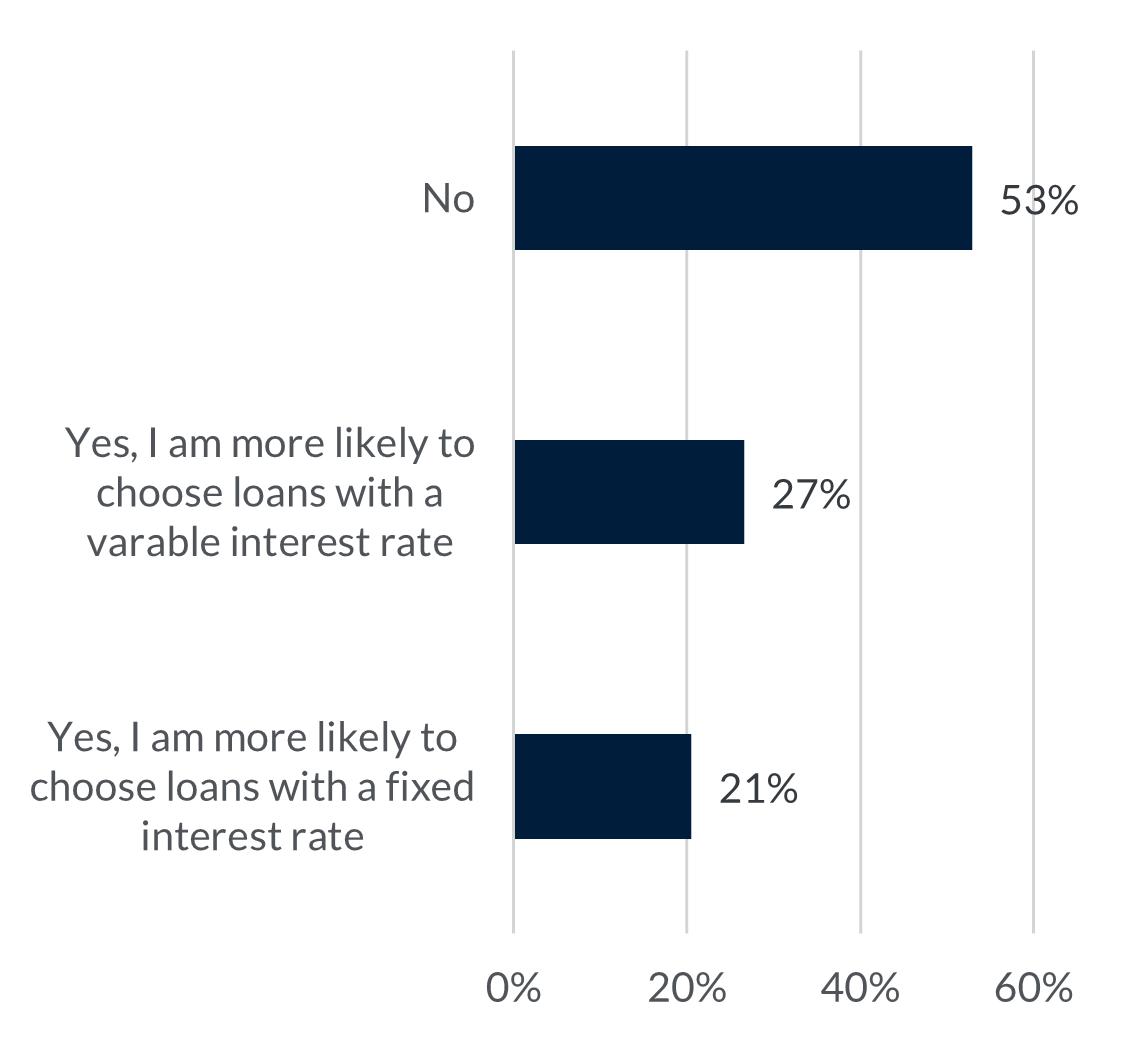

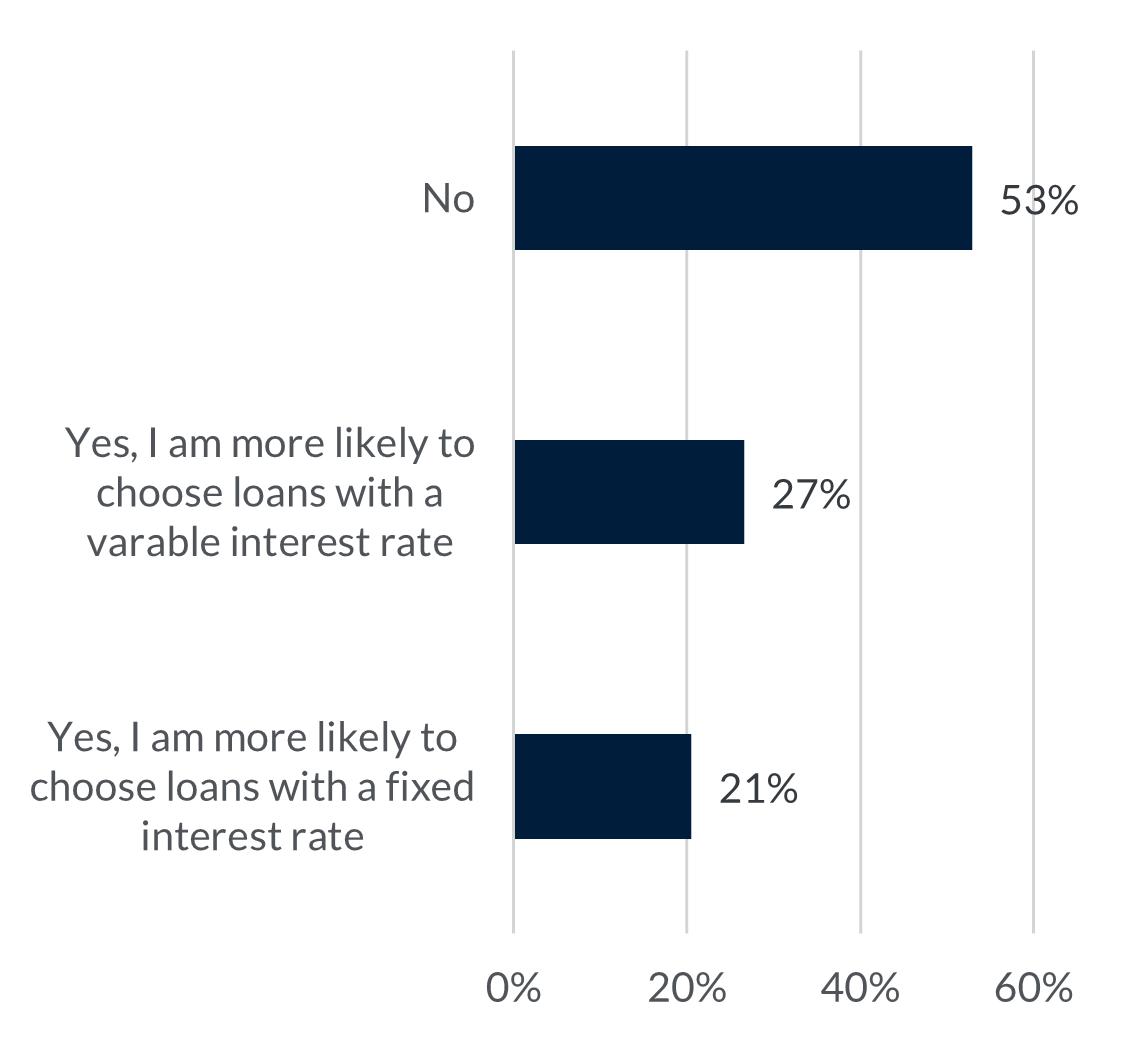

The majority of those questioned, 53%, say no to the fact that interest rate developments in recent months have influenced their attitude to the choice of financing. The remaining 47% of respondents answered yes to having been influenced by the situation. Here, 27% are more likely to choose a loan with a fixed interest rate, while 21% are more likely to choose a loan with a variable interest rate.

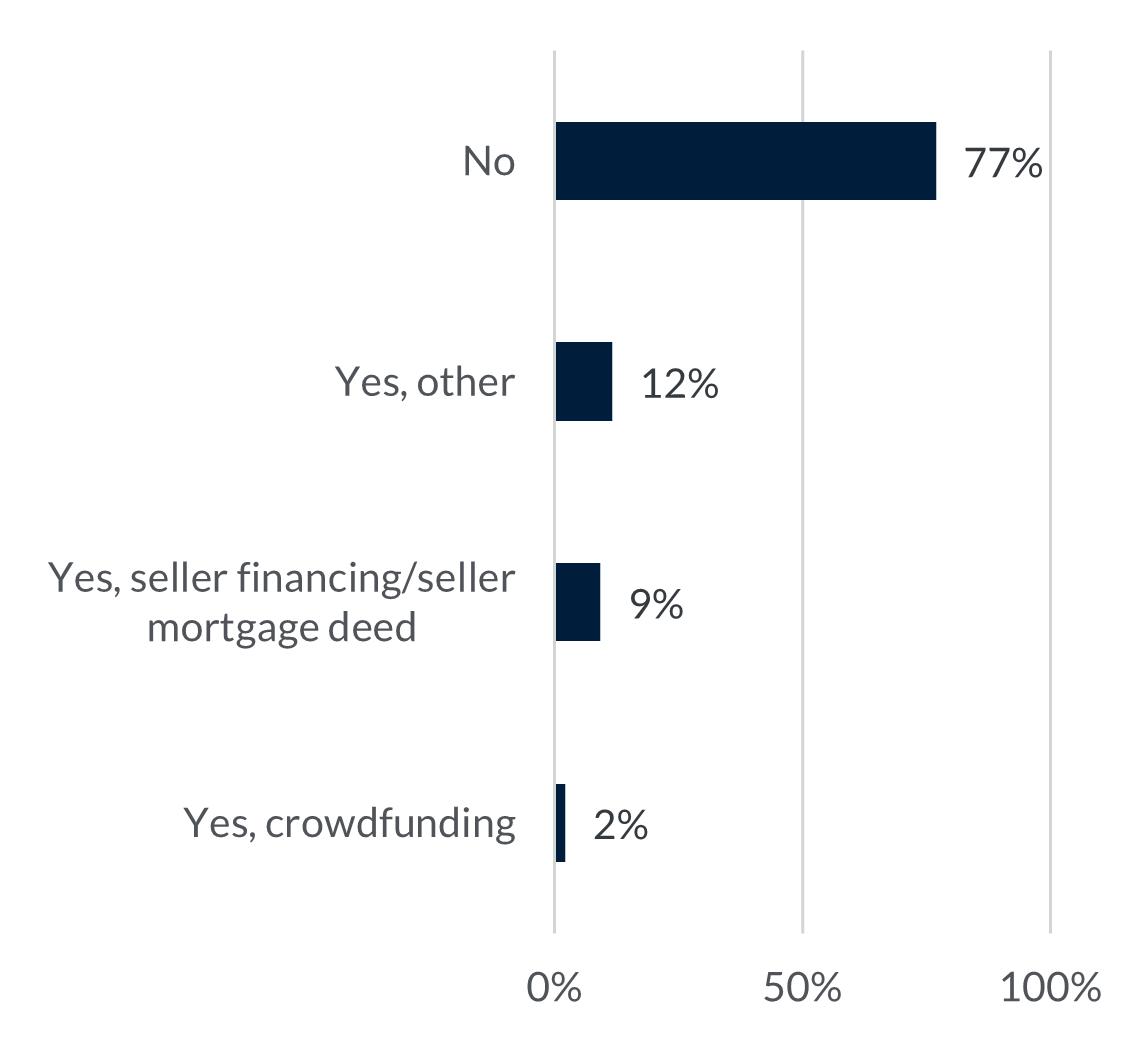

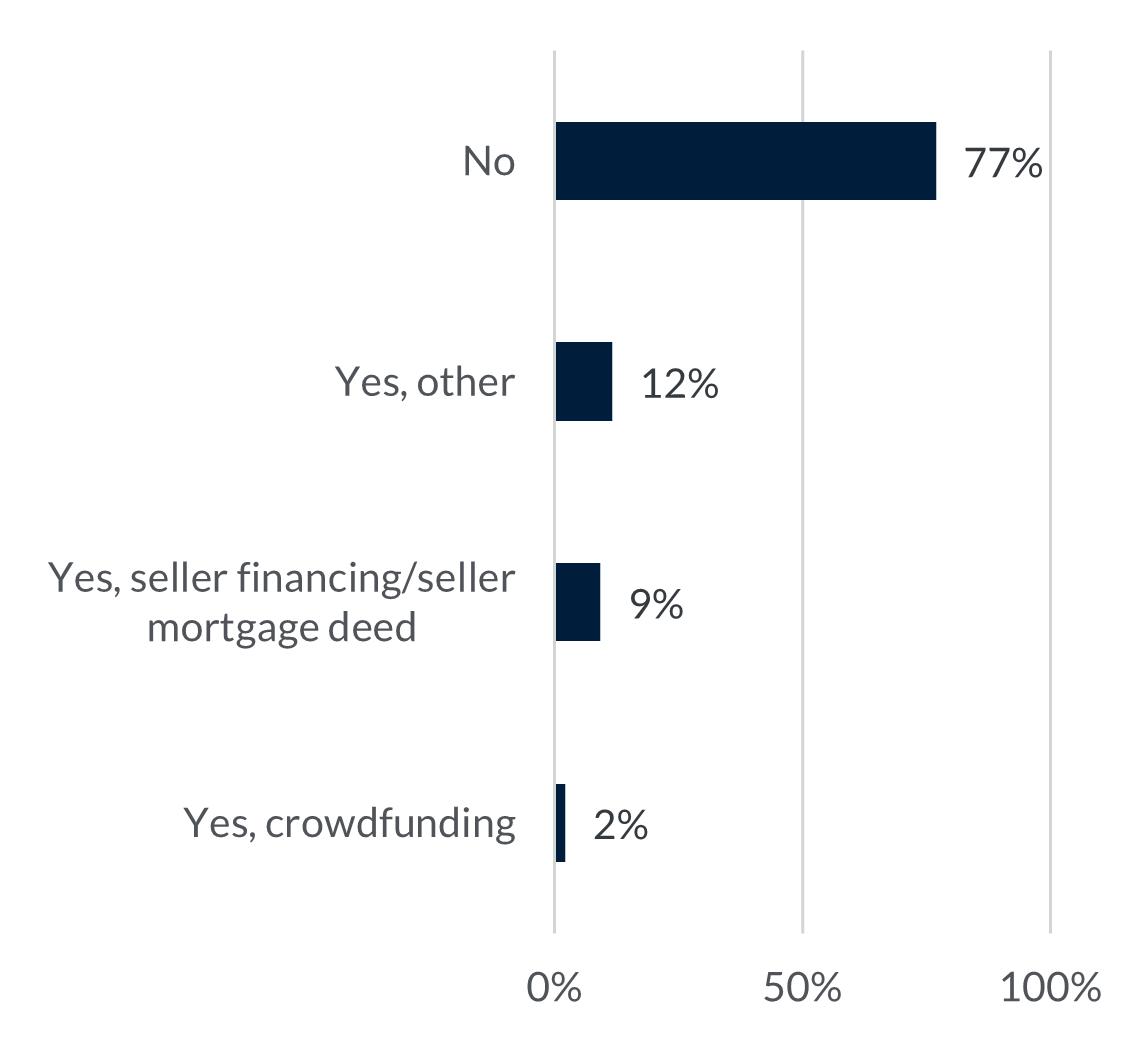

Very significantly, 23% of the respondents say that in 2023 they are considering using alternative sources of financing other than mortgages and banks. Here, 9% and 2% are considering using respectively seller financing/seller mortgage and crowdfunding, while the remaining share of 12% is considering making use of a third form of financing. The remaining 77% of respondents do not consider using alternative funding sources.

15

Has the interest rate trend in recent months affected your attitude toward the choice of financing for your property investments?

Are you considering using alternative fun ding sources other than mortgages and banks in 2023?

Which profile of properties do you invest in?

In 2022, 70% expected to invest in core properties, while 56% of respondents expect to invest in this type of property in 2023. 48% of respondents expected to invest in value-add

properties in 2022, while 37% expect to invest in this type of property in 2023. Overall, there has not been much change in the types of properties that investors expect to invest in.

16

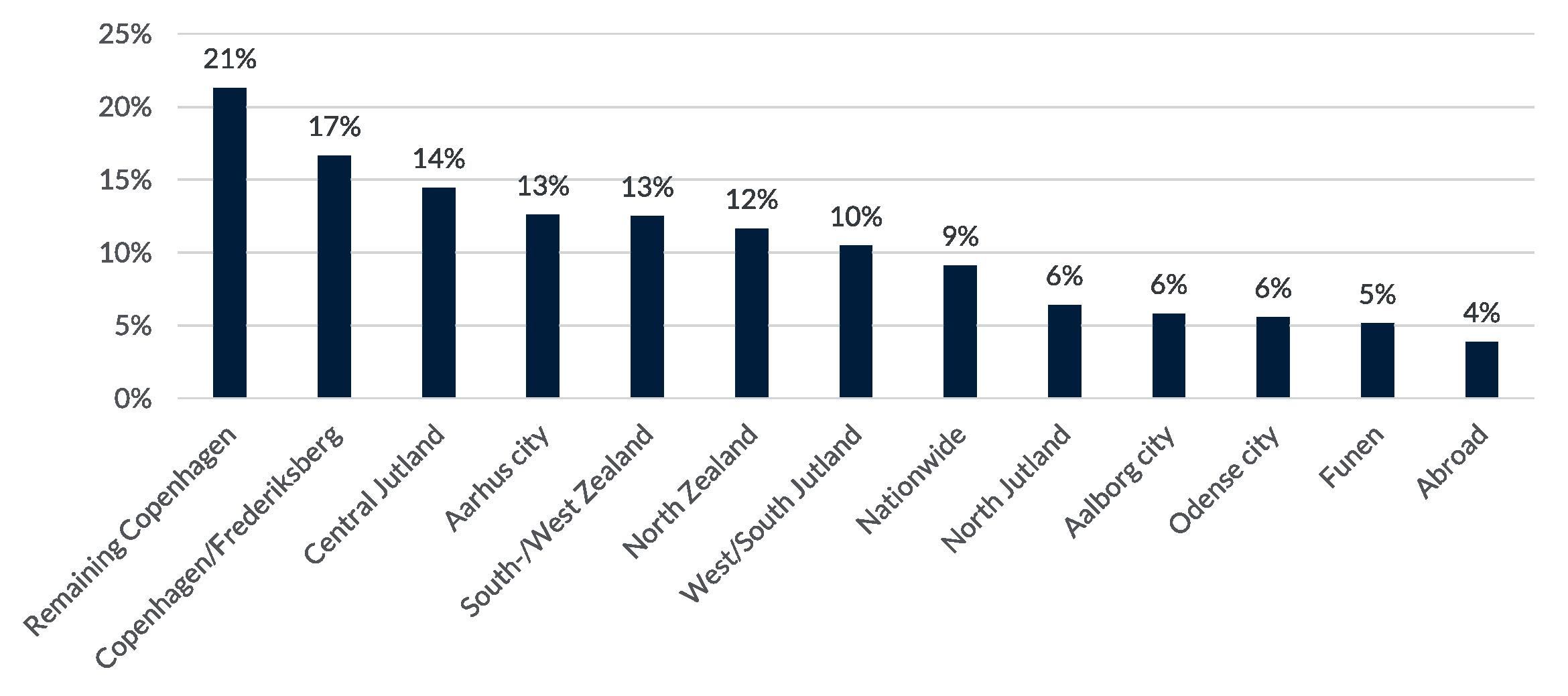

Where are you investing today?

Overall, there is not much difference between 2022 and 2023 regarding how investors invest geographically. Most investments are still located in Copenhagen/Frederiksberg or the Greater Copenhagen area. The general trend of

investment in larger cities remains intact. The biggest change is that 18% have invested in Central Jutland in 2022, while 14% have invested in this area in 2023.

17

Only 21% of respondents answer that they intend to spend more money on real estate investments in 2023, which is a significant drop of 27 percentage points from 2022 when the share was as much as 48%. In other words, 30% of the respondents answered that they expect to spend less money on property investments, which is an increase of 10 percentage points since 2022. The share that expects to spend an unchanged amount of money is more stable at 36%. It can therefore be concluded that recent unrest as well as the interest rate and inflation increases have had a major impact on the desire to invest.

18

Do you intend to spend more/less money on property investments in 2023?

Which property types are potential investments for you in 2023?

In general, the respondents continue to see the greatest potential for investments related to residential rental properties, with as many as 80% of the respondents expressing an interest in this. This is substantiated by the fact that 23% of the respondents express that they see potential in

plots for housing, while 21% see potential in commercial properties for conversion to housing. In addition, 17% see the potential for investments in office properties, 21% for investments in warehouse/logistics, and 10% for retail properties.

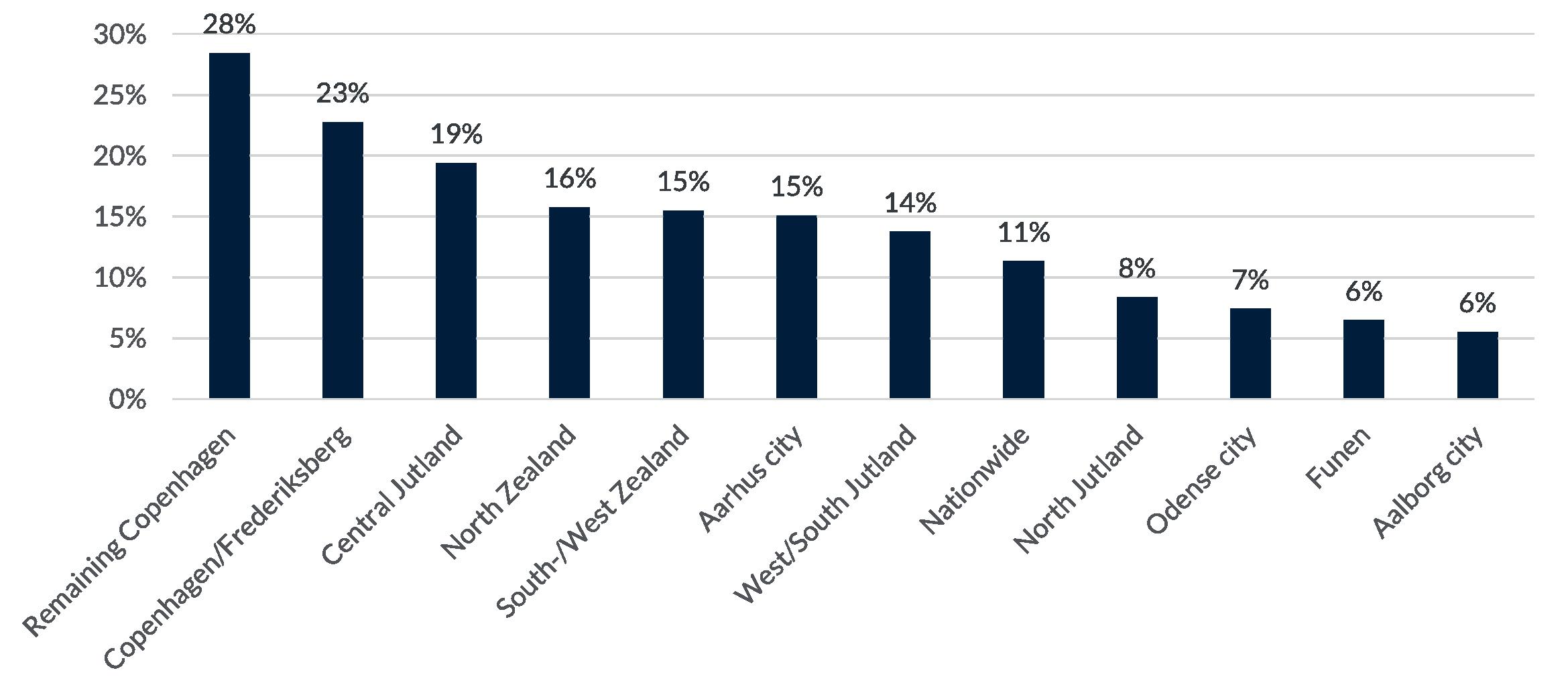

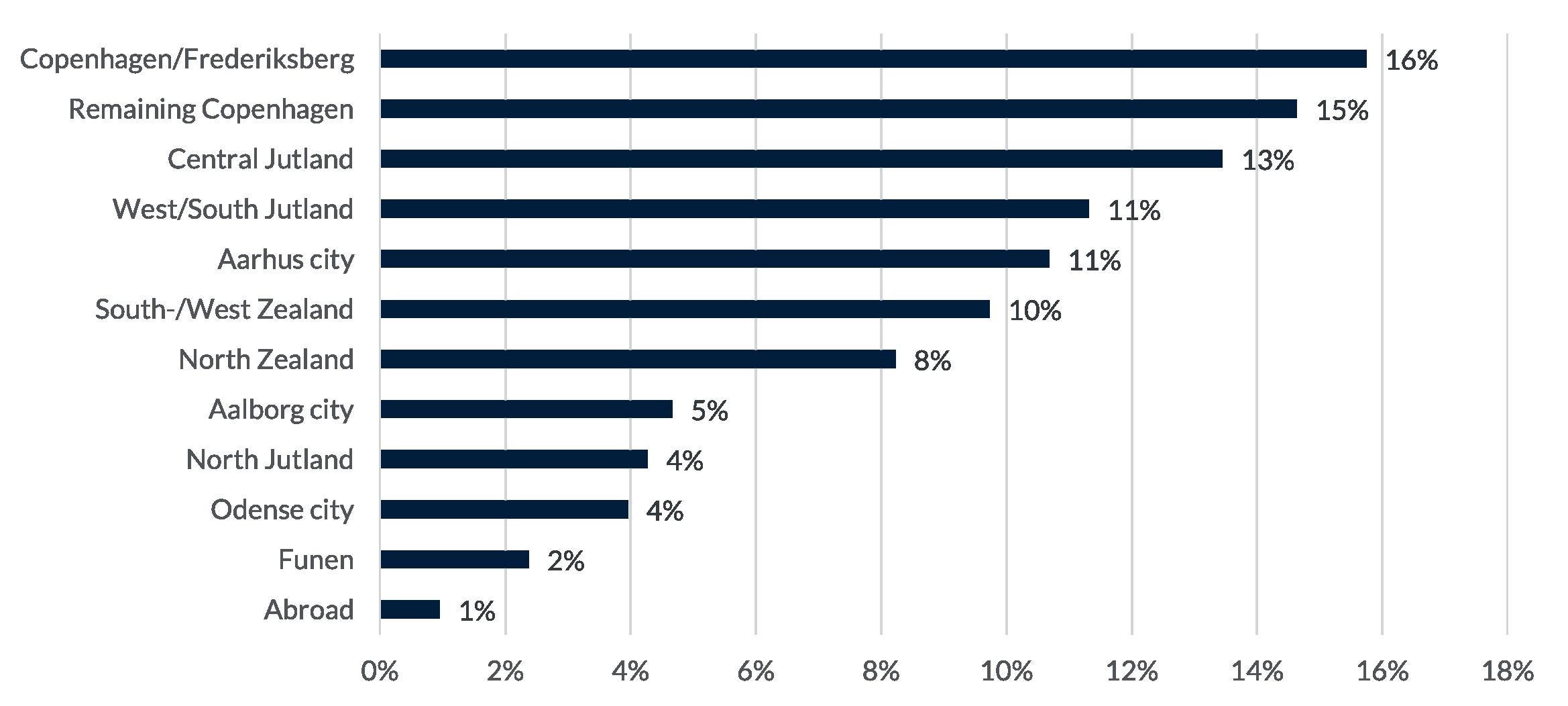

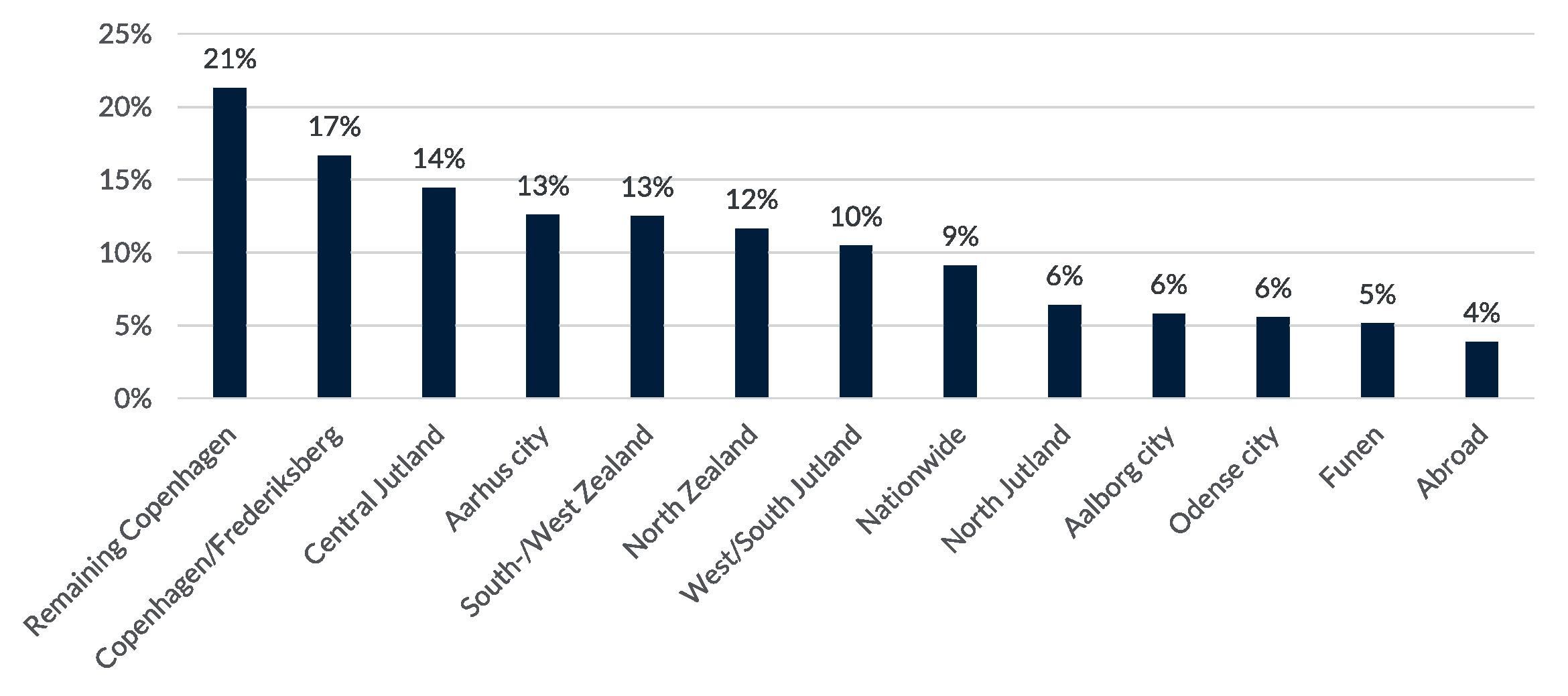

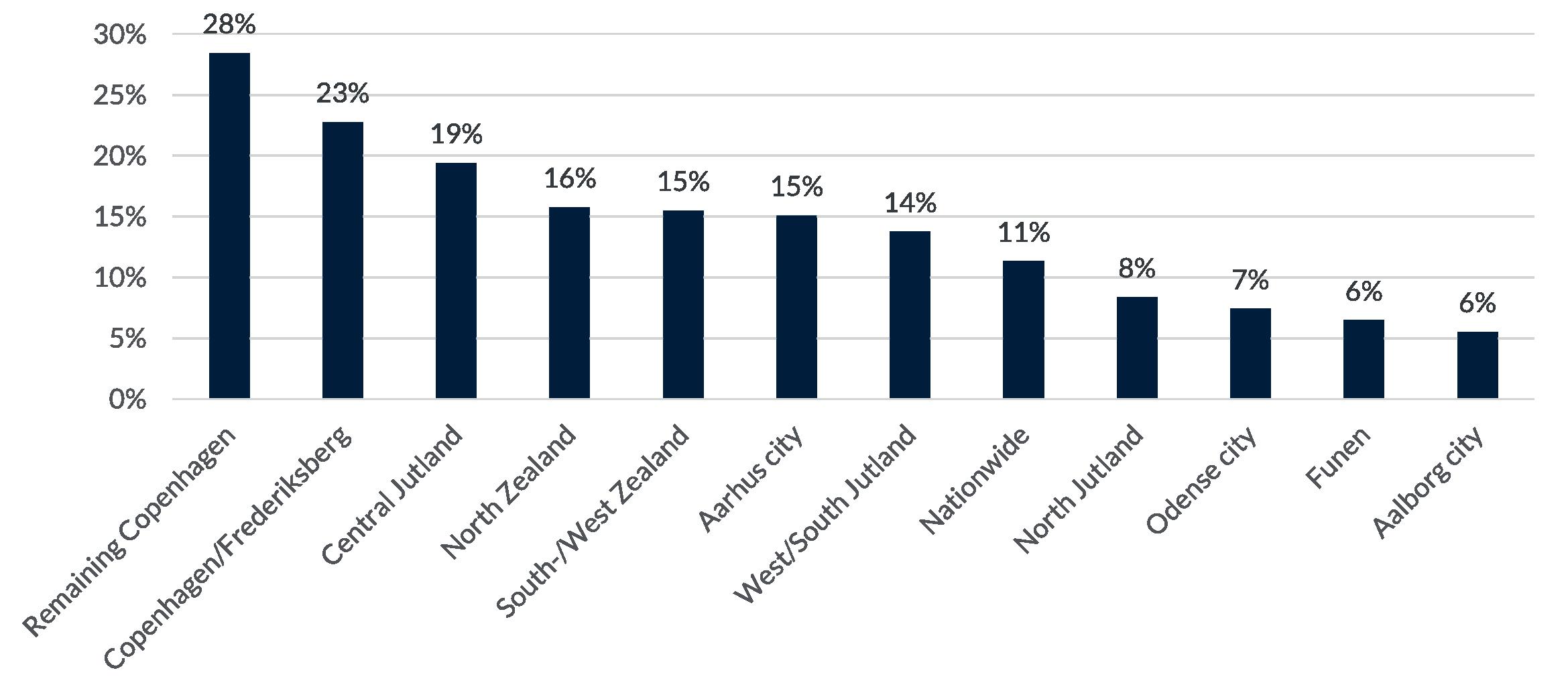

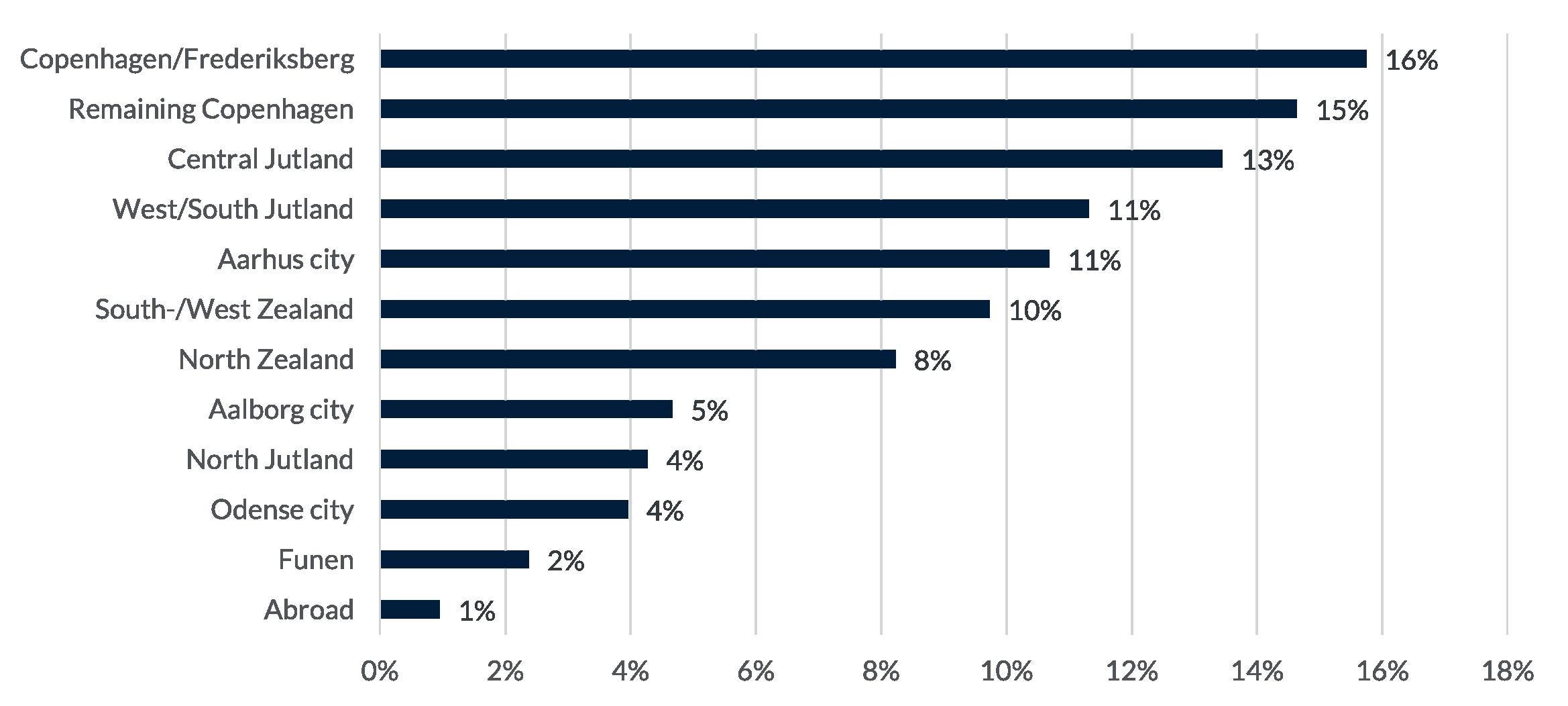

Which areas do you expect to invest in, in 2023?

Most respondents still expect to invest in properties near Greater Copenhagen in 2023. More precisely, 23% and 28% indicate that they expect to invest in Copenhagen/ Frederiksberg and the Greater Copenhagen area. A large part of investors also expects to invest in Region Central

Jutland in 2023. Here, 19% and 15% of the respondents say that they expect to invest in Central Jutland and Aarhus. It can therefore be concluded that it is still the most densely populated part of the country that is most sought after to make property investments in.

19

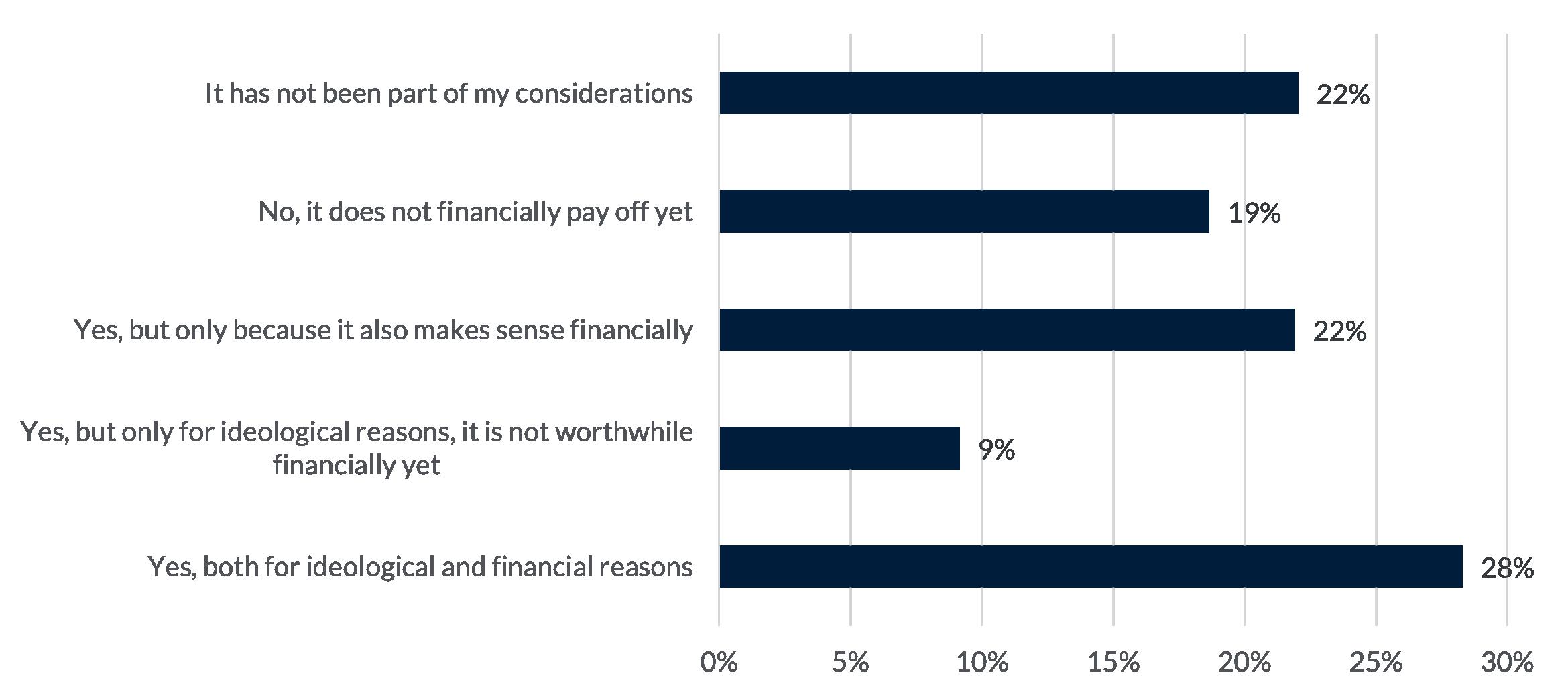

For economic and ideological reasons, sustainability plays a role in 28% of respondents’ current investment strategy, which is an increase of 7 percentage points from 2022. For 22% of respondents, sustainability also plays a role, but only because it is economically related, which is an increase of 6 percentage points from 2022. For 19% of respondents, sustainability does not play a role, but this is because it

does not yet pay off financially. Only 22% of the respon dents express that sustainability has not been part of the considerations for their current investment strategy, which is a drop of 8 percentage points from 2022. It can therefore be concluded that sustainability plays a still greater role for more people.

20

Does sustainability play a role for you in relation to your current investment strategy?

As many as 34% of the respondents answer that they have already energy-optimized one or more of their properties. This is an increase of 6 percentage points from 2022 when only 28% of respondents had already completed an energy

optimization. 16% of the respondents answer that they have considered optimizing their properties but have not completed the project due to a lack of profitability. This is a decrease of 3 percentage points from 2022.

21

Have you considered optimizing your property(s) in terms of sustainability? For example, energy renovation

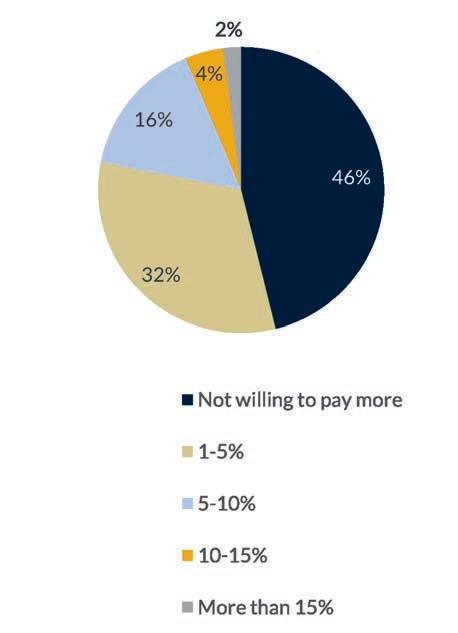

58% of respondents answer that they are willing to pay more for a sustainable property where location, condition, and cash flow are the same. This is the same share of respondents who were willing to pay more for a sustainable property in 2022.

Likewise, 42% of the respondents are still not willing to pay more for a sustainable property with the same location, condition, and cash flow, as they do not think sustainability has any significance for the price. In summary, the majority is still willing to pay more for a sustainable property.

22

Are you willing to pay more for a sustainable property - where location, condition, and cash flow are the same?

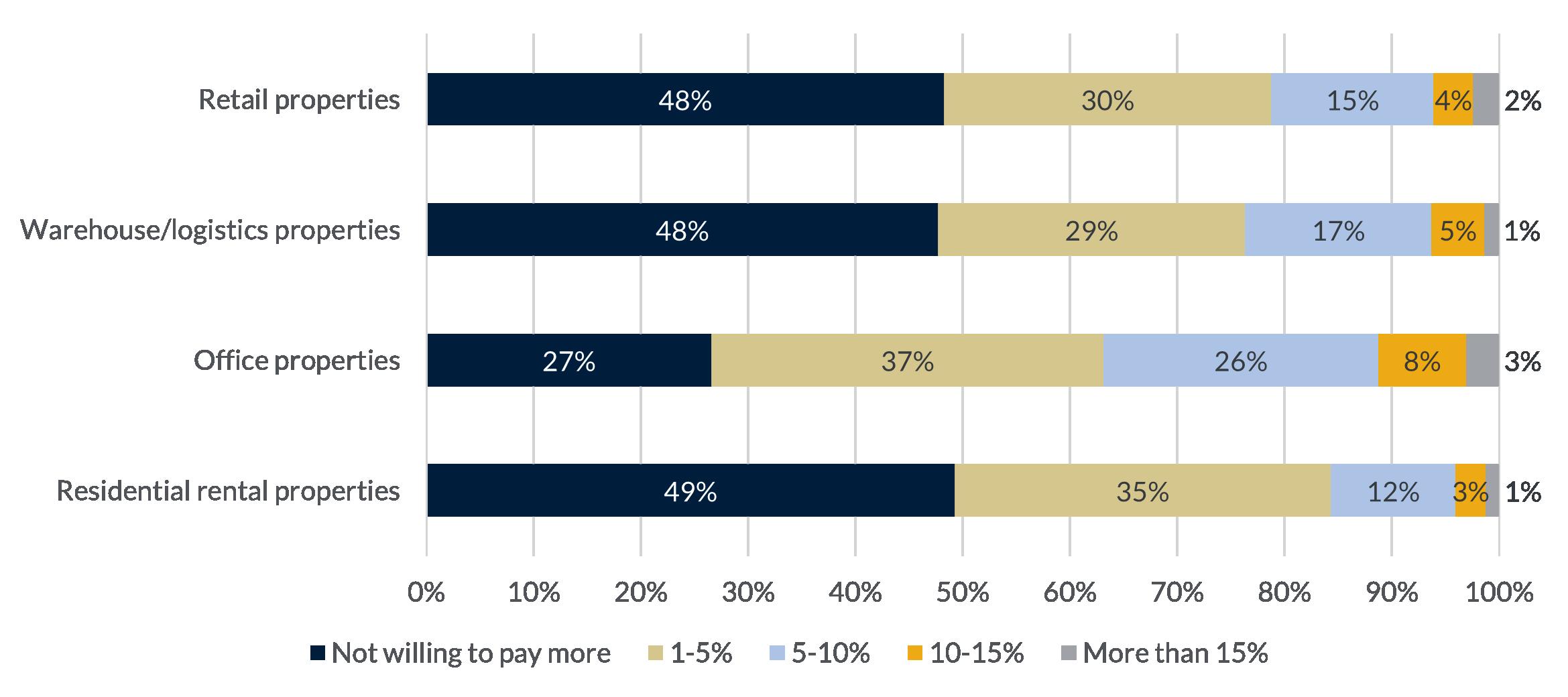

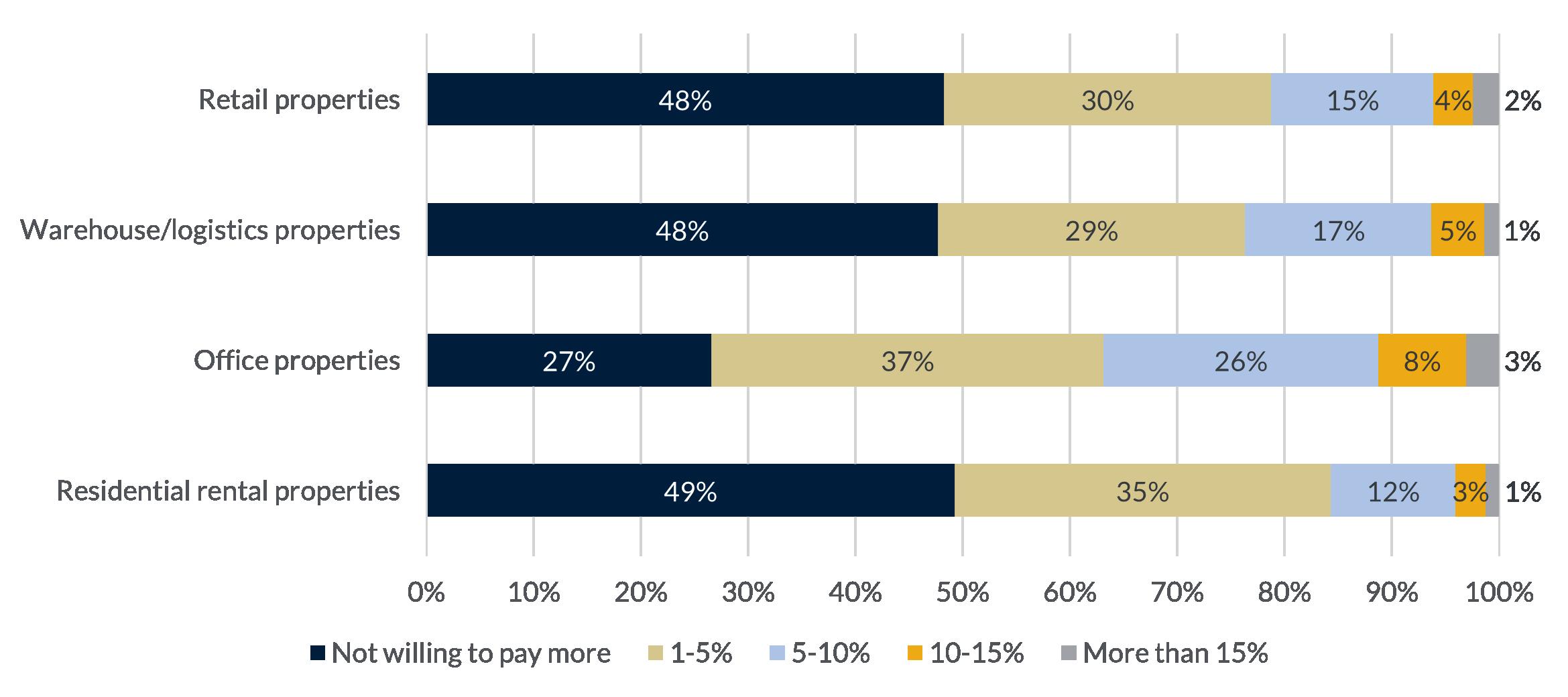

to tenancies of the same location, size, and condition)

For residential rental, retail and warehouse/logistics properties, approx. 50% of respondents believe that tenants are willing to pay more for sustainable tenancies of the same size, condition, and location. Here there is a broad consensus among the respondents that they primarily believe that tenants are willing to pay between 1-5% more, while fewer believe that tenants are willing to pay 5-10% more. Far fewer believe that tenants are willing to pay 10-15% more for resp. residential rental, retail and industrial & logistics properties. On the other hand, a whopping 74% of respondents say that they believe that tenants are willing to pay

more for sustainable office leases. More precisely, 37% of respondents believe that tenants are willing to pay 1-5% more, and 26% of respondents believe that tenants are willing to pay 5-10% more. Only 8% and 3% of the respondents believe that the tenants are willing to pay, respectively 10-15% more and more than 15%. There is thus broad agreement that especially tenants of office properties are willing to pay more for sustainable tenancies, and the distribution of the respondents’ answers are therefore largely unchanged from 2022.

sustainability, including, for example, the type of energy label?

As many as 93% of respondents answer that they believe that the property tax or other property-related taxes will be affected by the property’s sustainability. 16% believe that the impact is to a great extent, 47% believe that the impact is to some extent, and 37% believe that the impact is to a lesser extent. Only 7% respond that they do not think there will be any impact at all. The development is therefore largely unchanged from 2022.

23

To what extent do you think that tenants are willing to pay more for sustainable tenancies in … (compared

To what extent do you think that the property tax or other property related charges will be affected by the property’s

Most respondents, 41%, currently use private accommodation for their own business. After this, 37% of the respondents use the office/education/clinic for their own business. Only 13% and 9% of the respondents use respectively warehouse/logistics and retail for their own business. The development is therefore largely unchanged from 2022.

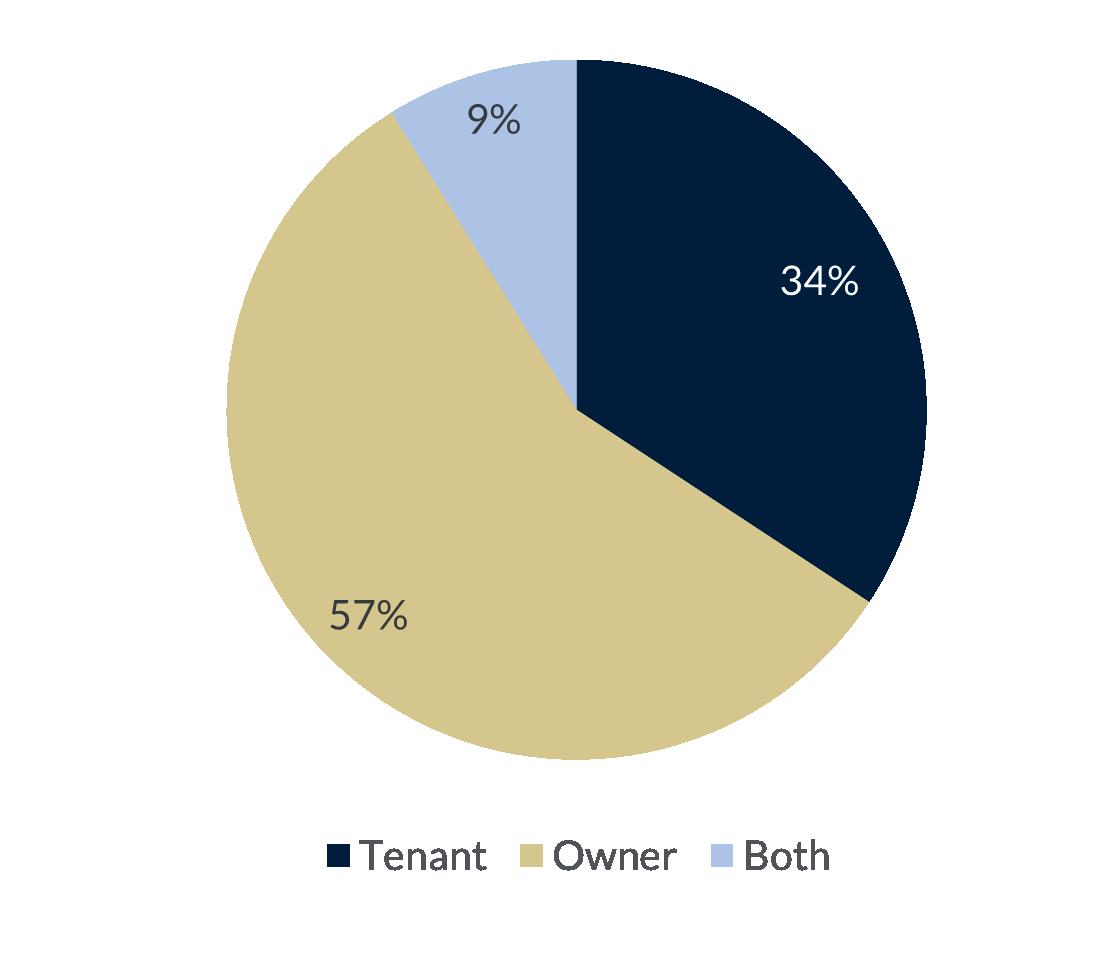

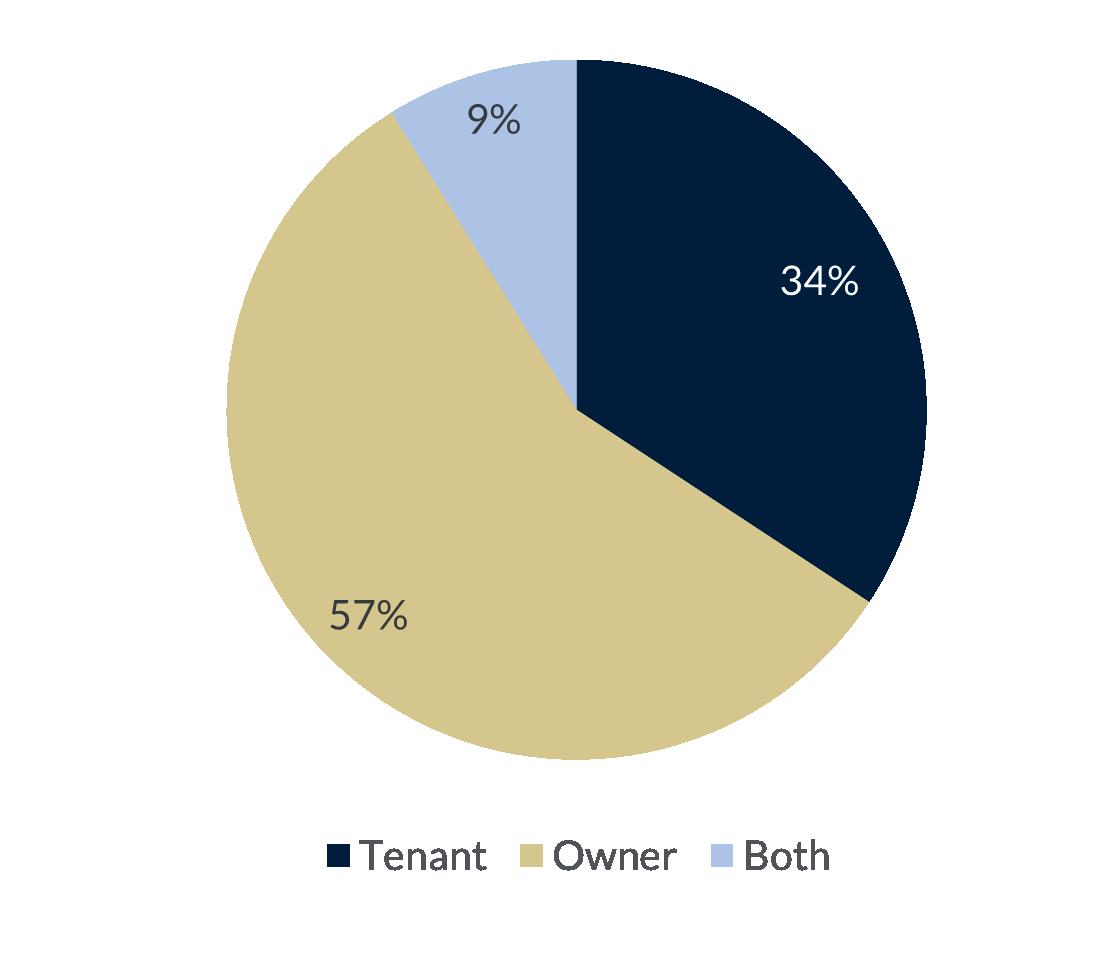

The majority, 57% of the respondents, own the premises they use. 34% of the respondents rent the premises they use and only 9% of the respondents both rent and own the premises they use. The development is therefore largely unchanged from 2022.

(E.g. moving, expanding to new premises, downsizing to smaller premises)

As many as 69% of the respondents do not expect changes in their needs for premises, which is a decrease of 4 percentage points since 2022. On the other hand, 31% expect to experience changes in their needs. 15% expect to experience a change in the next year, while 16% only expect to

24

What type of property/premises do you currently use for your business?

Do you own or rent the primary premises you use?

Do you expect changes in your needs for premises?

Where is your company located today?

If you have offices in several places around the country, we ask you to choose the department where you are located.

Most of the respondents’ primary business is in the Capital Region, with 16% and 15% in Copenhagen/Frederiksberg and the Greater Copenhagen area. In addition, 13% of the respondents’ primary business is in Central Jutland, 11% in Aarhus, 11% in West/South Jutland, 10% in South/West

Zealand, and 8% in North Zealand. The fewest is in Region North Jutland, Odense and on Funen with respectively 4%, 4% and 2%. The development is therefore largely unchanged from 2022.

25

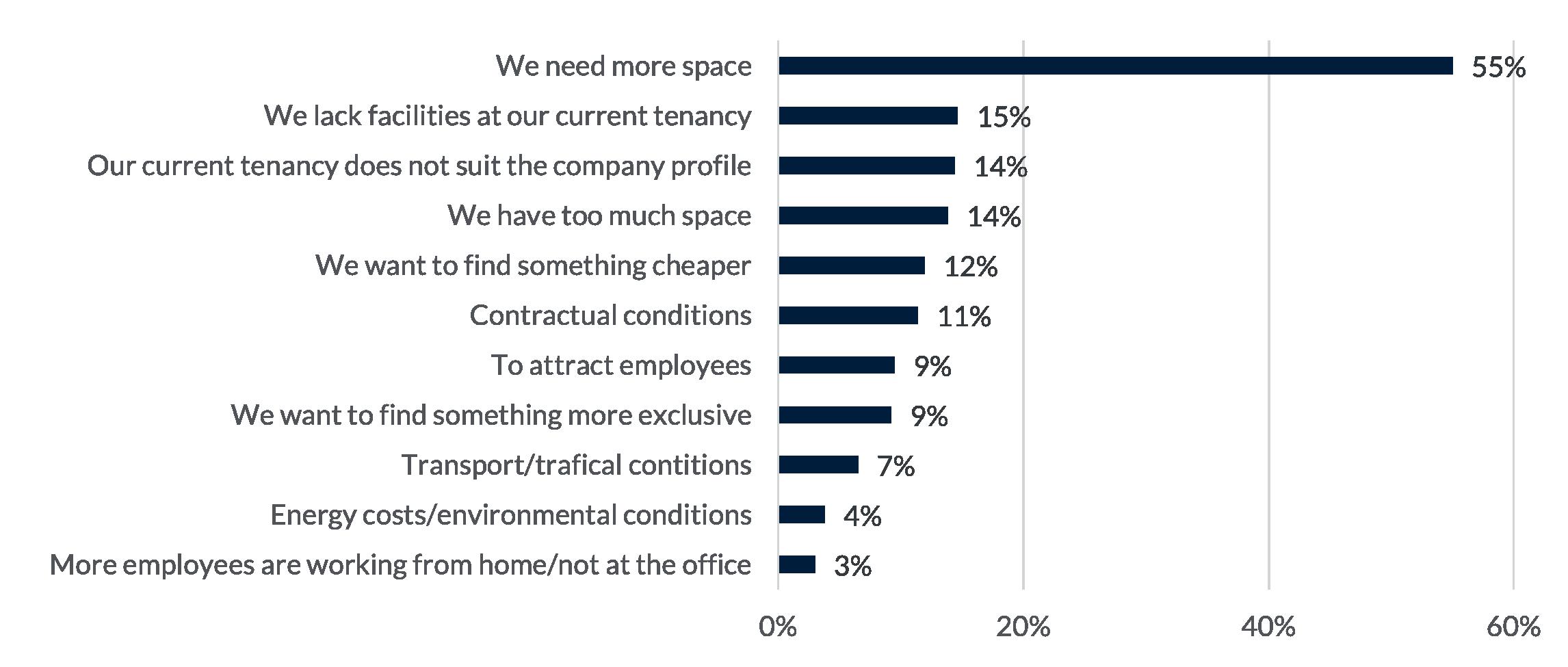

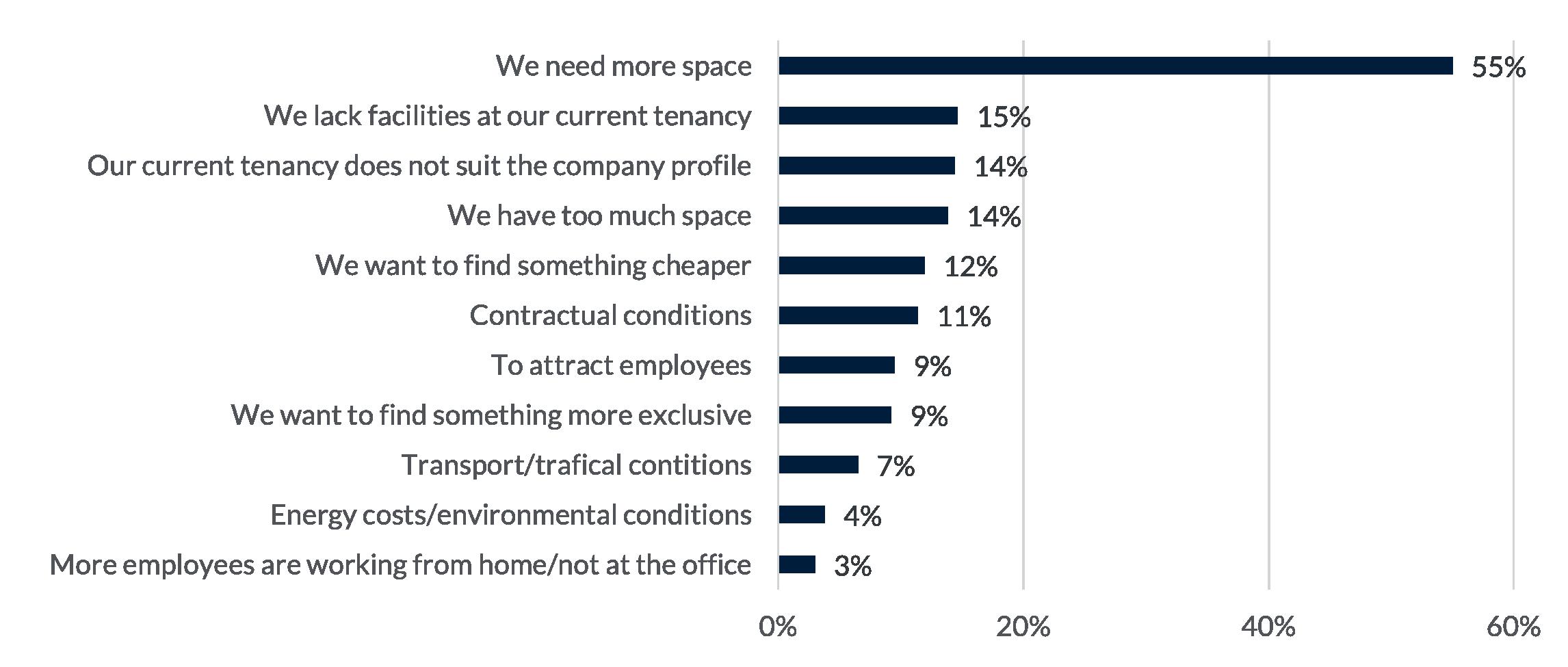

Lack of space is by far the biggest reason why respondents experience a change in their needs for premises. 55% answered that they currently do not have sufficient space, which is an increase of 5 percentage points from 2022. In addition, 15% of the respondents answer that the change is due to the lack of facilities in their current premises. In

addition, 14% and 9% respectively reply that their current premises do not have the right profile for the company and that the change is due to the company wanting to attract employees. On the other hand, 14% and 12% of the respondents answer that the change is because they have too much space and that they wish to find something cheaper.

26

What are the reasons for changes in the requirements for premises?

(You can select more than one option)

Among the respondents, 49% would like to move to Copenhagen and the Greater Copenhagen area, while 28% want to move to Central Jutland and Aarhus. A proportion of 11% and 10% want to move to North Zealand and South/ West Zealand. Respectively 5% and 4% want to move to

Funen and Odense, while 9% and 6% want to move to respectively West/South Jutland and Aalborg. These are overall the same places that the respondents wanted to move to in 2022, and the development is therefore largely unchanged.

27

Where would you like to move to?

(You can select more than one option)

Overall, there has not been a major change in companies’ preferences when selecting premises. The most important factor is still the price/rent. In 2022, 46% of respondents expected that the most important thing would be that the

premises have the right profile for the company, while 41 % consider this to be the most important factor in 2023. This is a decrease of 5 percentage points, which is the biggest change among all the categories.

What is most important to you when you choose premises?

(You can select more than one option)

28

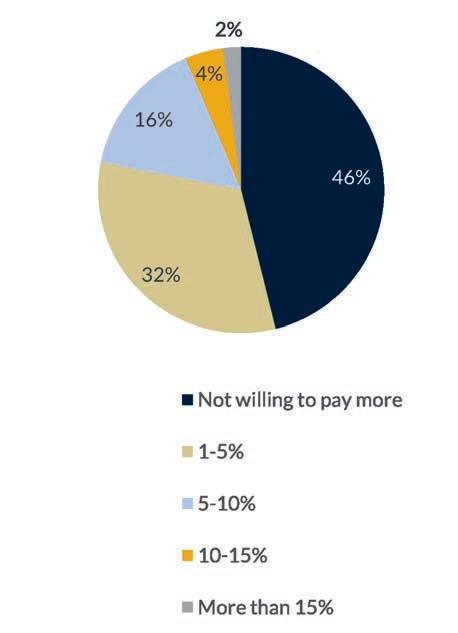

Of those surveyed, 54% are willing to pay more for sustainable tenancies that are of the same location, size, and condition. Of this, 32% and 16% are willing to pay, respectively. 1-5% and 10-15% more, while only 4% are willing to pay more than 15%. A large proportion of 46% is not willing to pay more for sustainable tenancies, which is 2 percentage points more than in 2022.

Of the respondents, 52% do not have a policy that sustainability should play a role in the choice of premises. On the other hand, 32% of respondents have considered such a policy without having one. Only 17% of respondents have a policy that sustainability should play a role in choosing premises. The development is therefore largely unchanged from 2022.

To what extent are you willing to pay more for sustainable tenancies in . . . (Compared to tenancies of the same location, size and condition)

Do you or your company have a policy that sustainability should play a role in choosing premises?

29

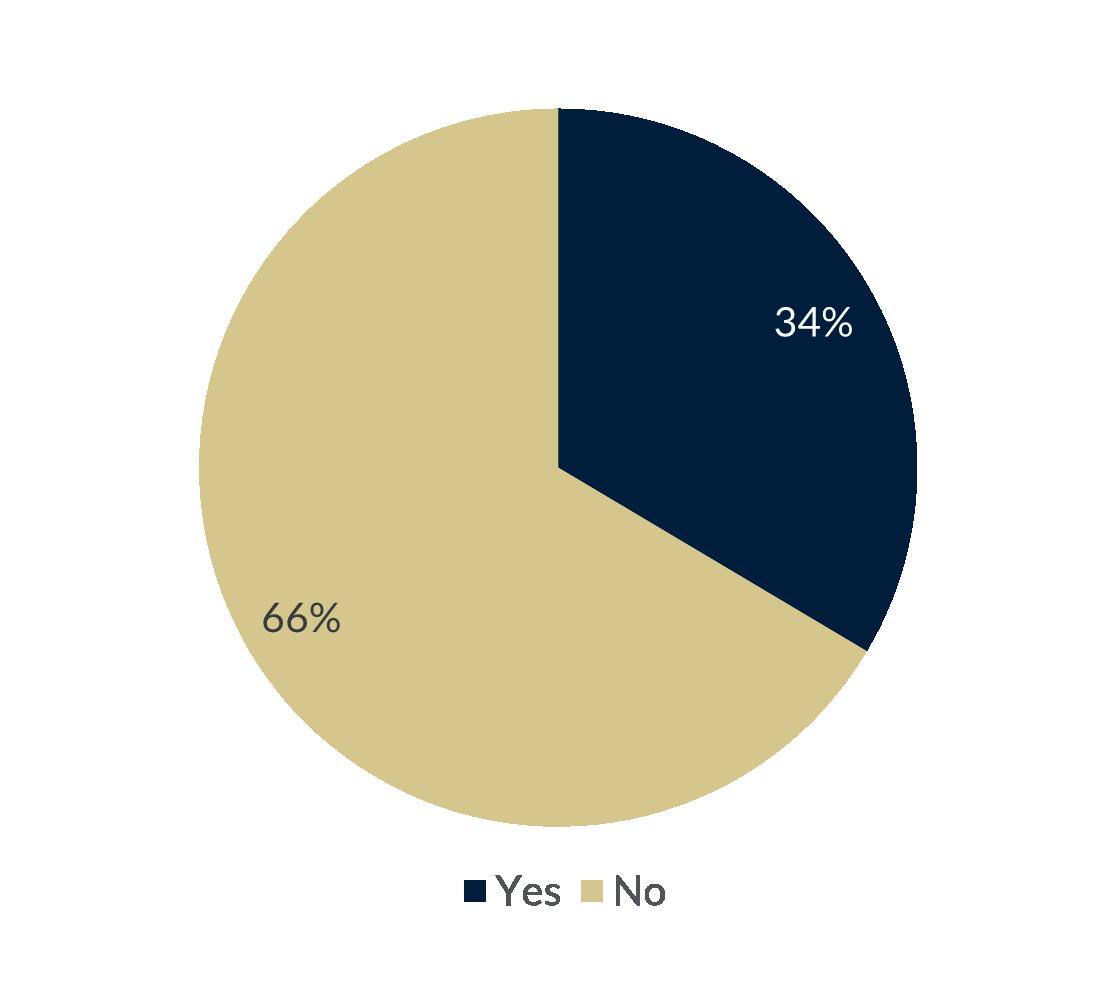

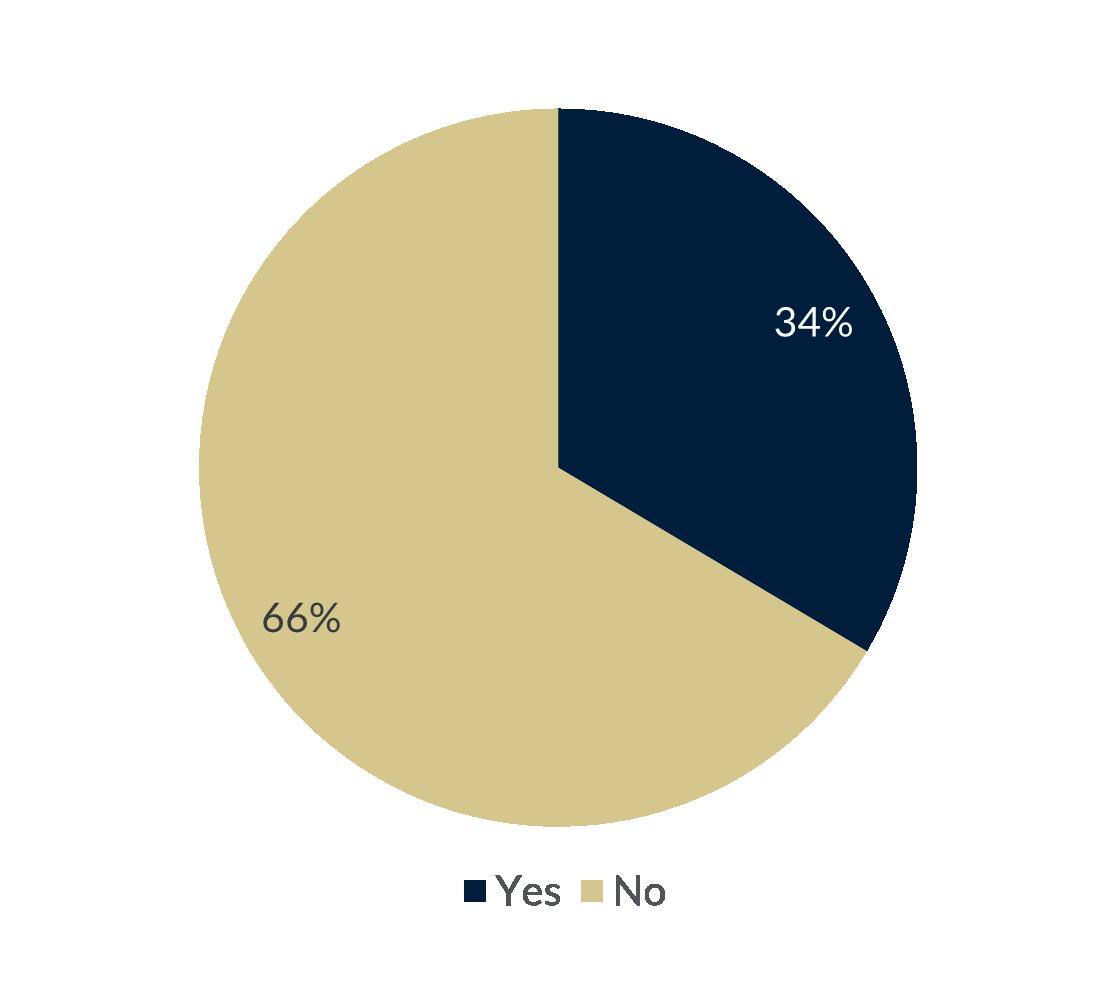

Only 34% of respondents answered yes to the question if they could consider selling their premises to rent something instead, which is a decrease of 8 percentage points. This means that 66% of the respondents would not consider renting rather than owning. Thus, it can be concluded that fewer of the existing owners will move from owner

Of the respondents, 58% answered that they would consider buying something instead of renting, which is an increase of 10 percentage points from 2022. So, 42% answered that they would not consider buying instead of renting. Thus, it can be concluded that fewer of the existing tenants will move from tenant to owner.

30

Could you consider selling your premises to rent something instead?

Would you consider buying something instead of renting?

BUY • SALE • RENT • ADVISING FIND YOUR ESTATE AGENT ON THE BACKSIDE

65% of respondents expect to spend an unchanged amount of money on business premises. Here comes that 20% expect to spend more money on business premises, while 15% expect to spend less money. The development is therefore largely unchanged from 2022.

31

Do you expect to spend more/less money on business premises?

32 Do you want to stay updated with the commercial property market? See the latest news here www.poulerikbech.dk/en/about/news/ Copenhagen +45 5858 8378 Herlev +45 5858 8376 Hillerød +45 5858 8377 Roskilde +45 5858 8395 Taastrup +45

8472 Køge +45 5858 8379 Næstved +45

8380 Slagelse +45

Odense +45

Kolding +45

Aabenraa +45

Sønderborg +45

Esbjerg +45

Vejle +45

Herning +45

Silkeborg +45

Aarhus +45

Viborg +45

Aalborg +45

Vendsyssel +45

International +45 5858 8563 Research +45 5858 8564 Argiculture +45 5858 8574 Project +45 5858 8487 Capital Markets +45 5858 8572 International Poul Erik Bech

5858

5858

5858 8396

5858 8397

5858 8399

5858 8425

5858 8422

5858 8398

5858 8423

5858 8567

5858 8427

5858 8670

5858 8424

5858 8449

5858 8487