Hello and welcome to the November edition of the DGB Digital magazine!

We have had an early taste of Winter, with snow and ice hitting many parts of the country during November. Something I am sure our sector’s installers would have rather done without!

Perhaps it was a foreshadowing of things to come. The economic outlook and trading conditions look very frosty right now. We are ending the year with the demise of some well-established names in our sector, and this is before the traditionally difficult Q1 period and before the new Budget measures kick in. The mood at the moment is that of concern and trepidation.

But, tis the season for mince pies and mulled wine to help lift our spirits. And whilst this year has been pretty tough for most of us, that should not stop us from making positive plans for 2025. We can either roll over and let the economic mire take over, or we can suit up and do our best to find new opportunities for next year. We are never without them, we just have to be smart about it.

One thing we need to keep an eye on once again is inflation. It spiked in October and with the Budget measures announced it looks likely to rise again. Interest rate cuts are off the table once again.

There’s lots to chew on at the moment.

We hope you enjoy this month’s edition.

DGB

A new branch and trade counter from home improvement specialists, Eurocell, is opening in Bishop’s Stortford, with the ‘most complete range’ of products for local tradespeople.

Situated at Unit 12, Raynham Close, Bishop’s Stortford, Herts CM23 5PJ – just off the A12, the branch is ideally positioned in a busy hub for trade businesses and suppliers.

Opening on Monday, November 11th, it will be a one-stop-shop for building products for trade professionals looking for PVC-U windows and doors, conservatories, composite doors, rainwater and roofline solutions, outdoor living products including composite decking, fencing, and much more.

The new branch will be open from 7:00am to 4:30pm on weekdays and from 8:00am to 12:00 noon on Saturdays. It will offer tradespeople clickand-collect and delivery options to support supply around their busy schedules – helping them to keep on track with projects in their diary.

range of silicones, sealants, fixings, and tools.

For those uncertain about their requirements, a knowledgeable team stands ready to provide expert advice, ensuring the ideal products are selected for any project, no matter the scale or complexity.

Commenting on the new opening, Regional Manager Stephen Clowes said:

Inside the new branch, trade professionals will discover a vast array of PVC-U products, available for immediate collection. It will also offer everything from soffits & fascias, guttering, and cladding to conservatory roofs, solid conservatory roofs, Skypod Lantern Roofs and a complete

“Our new store offers the local trade community the most complete range of products for home improvement projects. We have a great space where we will display and demonstrate the quality and credentials of our extensive range, to help our customers complete their projects to the highest standard. We’re looking forward to welcoming the trade community in the coming weeks.”

The Bishop’s Stortford location will be the latest branch to open in Eurocell’s expansive network of over 210 branches. Trade professionals are encouraged to open a Eurocell Trade Account, providing access to credit and fixed pricing across all branches, ensuring consistency and convenience nationwide.

For more information about the new branch, visit; www.eurocell.co.uk/branch-finder/bishopsstortford

John Fredericks (JFP) has released its new Architects and Specifiers Guide for PVC-u and Aluminium Windows/Doors, providing a comprehensive resource detailing everything from design options to energy efficiency and building regulations compliance.

With cutting-edge production facilities in Huddersfield, JFP has built a reputation for delivering high-quality and innovative products. This guide aims to equip architects and specifiers with the tools and knowledge they need to integrate John Fredericks’ extensive range of PVC-u and aluminium products into their projects.

highest quality products and expert support for the construction industry,” said Mark Dicconson, Managing Director of JFP. “We’ve worked closely with architects and specifiers for decades, and this guide offers the technical details and customisation options they need to create high-performance, aesthetically pleasing designs.”

In addition to detailed product information, the guide outlines John Fredericks’ production process, including the use of advanced CNC machinery, barcoding for product traceability, and comprehensive customer support through a CRM system, along with a full list of

Key features of the guide include design support, a wide range of product options, details on customisation and versatility, advanced ventilation and security features, along with guidance on achieving the best U-values and G-values, helping architects meet stringent energy performance standards.

“Our new Architects and Specifiers Guide reflects our commitment to providing the

accreditations and certifications.

For more information or to download the Architects and Specifiers Guide, visit www.johnfredericks.co.uk/architects-specifiers/ or contact our Head of Commercial Sales daniel@jfpl.uk.

Read more: www.doubleglazingblogger. com/2024/11/jfp-named-pvc-fabricator-of-theyear-at-national-fenestration-awards/

A new study has uncovered that over a third of British homeowners are dissatisfied with the exterior of their homes, citing kerb appeal concerns.

One of the key findings from the research is that 40% of respondents are unhappy with the exterior of their homes, noting unattractive kerb appeal as a major concern.

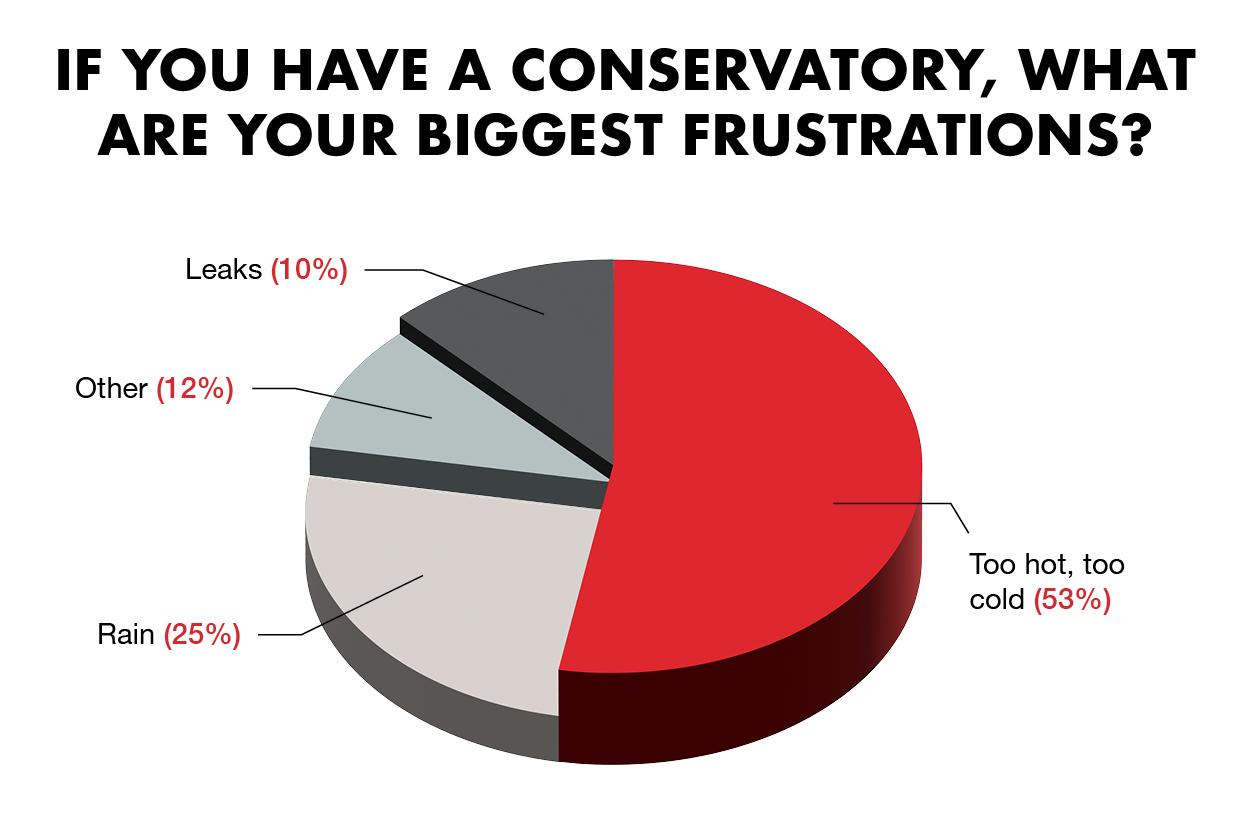

The Conservatory Census, commissioned by home specialists Eurocell, asked 550 UK homebuyers for their thoughts on their conservatories, as well as asking Brits what their main concerns about their home exteriors are.

According to the Royal Institution of Chartered Surveyors (RICS), kerb appeal can make or break a sale, with the property’s value being increased or decreased by up to 10%.

While major home renovations to improve a property’s aesthetics aren’t always possible, smaller DIY tasks— such as planting flowers or adding a fresh coat of paint—can help make a home more attractive from the outside.

For those looking to make big changes to their homes, investing

in new doors, windows or exterior cladding can enhance both the appearance of the home and its sale value. It can also help make the home more secure, another tangible benefit people look for when hunting for a new property to buy.

Commenting on the results of the survey, Beth Boulton, marketing director at Eurocell said:

“The fact that nearly half of the respondents are unhappy with the exterior of their homes is a surprising statistic. Just like refreshing our wardrobe, it’s important to breathe new life into our homes, as this is where we spend most of our time.

“Homeowners looking to fall in love with their space again can explore a range of solutions to refresh and modernise their home. Upgrading windows and doors not only enhances kerb appeal but also improves energy efficiency, keeping your home warm and lowering energy bills. For outdoor spaces, stylish and durable decking can create a space to relax or entertain in. Sometimes all that’s needed to really lift a space is a lick of paint!”

Freefoam Building Products Ltd has updated its fascia, soffit and accessory ranges. Three new woodgrain foil finishes have been added to the roofline range, including Matt Black, Matt Anthracite Grey, and White Woodgrain.

The Matt Black and Matt Anthracite Grey have been introduced (and RAL-coded) to complement aluminium black and grey windows and bifolds. Both colours have RAL codes which helps stockists and their installers to tap into this colour trend, and upsell a full suite of matching building elements.

“It’s a fantastic opportunity for installers to sell a higher-end look that can transform houses in a few days,” explains Colin St John, Freefoam’s Commercial Director. “We even offer cladding to match. It gives installers the edge to win business, sell more products, and make better margins.”

The new finishes are offered in 10mm Square Leg and Magnum Square Leg Fascia, General

Purpose Soffit Board, and Hollow Soffits, and come with a range of trims in the same colour options.

Additional product sizes have been added to Freefoam’s foiled fascia too. Freefoam’s 10mm Square Leg fascia is available in Irish Oak, Chartwell Green, and Cream woodgrains while the 18mm Square Leg range now comes in Light Oak, Black Ash, Anthracite Grey, and Agate Grey woodgrains.

“We’re now manufacturing one of the most comprehensive fascia ranges on the market,” adds Colin.

See the full range at www.freefoam.com/ geopanel or call Freefoam on 0800 002 9903 to add the new roofline colours and sizes to your portfolio.

(OB-36 + )

Steel-look design meets unparalleled thermal performance. Complementing the highly sought after Internal Door, this latest launch is the right product to be offering at the right time.

Leading arched and angled frame specialist

Premier Arches is now manufacturing more than 150 frames per week from its purposebuilt state-of-the-art facility in St Helens, while maintaining its impressive quality and service standards.

The milestone follows a significant £100K investment in new machinery earlier this year, including a new copy router, four-head welder, two new ovens, and additional saws and finishing tools at its 10,000 sq. ft manufacturing facility.

Despite the increased production volumes, Premier Arches continues to deliver outstanding performance metrics, with over 98% OTIF (on time, in full) delivery and an impressive 98.5% ‘right first time’ rate.

Sean Greenall, Managing Director of Premier Arches, commented: “Reaching over 150 frames while maintaining our high standards of quality and service is a testament to both our strategic investment and our skilled team.

“As the UK’s leading manufacturer of arched and angled frames, we’re committed to taking the complexity out of non-standard designs

for our customers and the machinery upgrade at the beginning of the year has significantly enhanced our manufacturing capabilities and efficiency.”

Premier Arches specialises in manufacturing arched, angled, gabled, circular and entirely bespoke window and door frames across various systems, including popular profiles like Residence 9, Rehau and Liniar. The company can manufacture complete products, fabricating both curved sashes and outer frames.

“The Premier Arches model has always been about growth,” added Sean. “As demand continues to increase, we’re already looking at further investment opportunities to enhance our manufacturing capabilities in the future.

“Our focus remains on delivering exceptional products while maintaining the high levels of service for our customers, so they can expand into more complex designs.”

www.premierarches.co.uk

LINK: https://www.doubleglazingblogger. com/2024/11/premier-arches-hits-newproduction-milestone/

In an open letter, Anglo’s managing director David Evans argues that 2025 should bring new opportunities – if you’ve used your time wisely in 2024.

We’ve all had a challenging 2024, and when you compare the last 12 months to the previous two years, you can see that many factors have contributed to the tough trading conditions.

Geopolitical tensions, such as the wars in the Middle East and Ukraine, have put huge pressure on global trade, and have contributed to volatile energy prices and inflation. Changes in government in the UK and the United States have both created market uncertainty. And China’s supply of steel into Europe has affected the market both in terms of cost and existing supply chain partnerships.

While many of these factors remain as we close off 2024, I’m reasonably optimistic about what 2025 will bring, and I think that we will see an improvement in the market conditions for our sector.

I don’t think it will be the step-change that we would like to see, but it should be slow and steady.

Take government policy for example. That seems to be going in the right direction. If they manage to achieve their ambitious new house build targets, then that will benefit everybody in the fenestration industry.

And we should see continued improvements in consumer confidence, with key indicators heading in the right direction: the October Budget confirmed an increase in the UK’s adult rate minimum wage (a 6.7% rise to £12.21/ hour), the Bank of England reduced its base interest rate to 4.75%, and inflation fell to below 2% in September.

Most windows go into replacement and home improvement projects, so extra money in homeowners’ pockets is no bad thing!

Success in 2025 will have its roots in 2024. I believe that if you’ve used the downturn to invest in your businesses – whether capital equipment or training people – then you will be well placed to benefit when a market upturn does materialise.

At Anglo, we’ve invested in new and efficient machinery, as well as in our workforce.

Our capital equipment investment includes a new £1 million double-sided roll-forming line, which allows us to retool one side while the other is running; and we have developed inhouse training, both at our site in Manchester and within our wider Amari Metals Engineering Group family.

These targeted areas of investment have helped us to improve efficiencies, which have reduced costs and improved quality.

I am confident that we will see a recovery in 2025, and – like those other companies that have continued to invest during 2024 – Anglo will be well placed to capitalise on that upturn.

For more information, please visit anglometal.co.uk or call 0161 231 2354.

Eurocell is launching Euroverge, a new dry verge system designed to enhance roof protection and aesthetics.

This new system conforms to BS8612 and BS5534 and is available from November 25th in all branches and online. Customers will benefit from dedicated in-branch displays, making it easy to find the right product for their needs.

Euroverge is compatible with concrete, clay, and plastic roof tiles, as well as all Eurocell PVC-U roofline products. The system is suitable for use on existing and new roofs and provides an attractive finish to a property, with four available colours: Grey, Black, Brown and Terracotta. The system can be installed on both the left and right of the gable end, thanks to its universal design.

Designed to cover a wider range of batten centres between 255 – 345mm, it can also be installed on a 12.5deg minimum roof pitch. Euroverge offers enhanced protection against water ingress, insects, birds, and other pests. The easy-to-fit system ensures quick installation and low maintenance. The range includes Dry Verge Units, Starter Kits, Angled and Half Round Ridge Caps.

Euroverge will be available in all branches and online from November 25th, with dedicated

displays to help customers find exactly what suits their needs and designs.

Ian Kernaghan, Head of Product, Design & Development at Eurocell, says:

“We are thrilled to launch Euroverge, which offers a practical and durable solution for roof protection. Its compatibility across most roof types and its universal design make it an excellent choice for a wide range of roofing projects.

“Designed to prevent water penetration and wind uplift in tiled roofs, it provides a secure, maintenance-free alternative to traditional wet mortar bedding, making it a popular choice for the homeowner. Euroverge ensures maximum protection against weather damage and minimises the need for repair and replacement. Whether you’re a homeowner or a professional roofer, dry verge is an excellent investment for any property.”

KH Roofing was able to test the products, feeding back that the product is ‘strong and versatile’.

Ian added, “We have taken a product range that is widely used and made improvements based on what installers want. The design of the verge unit means that it can be used on a wider range of batten spacing and we’ve created a starter unit, with a guide feature, to assist with positioning the first verge piece.”

For more information about Eurocell, visit www. eurocell.co.uk.

The managing director of Endurance® Doors has received a coveted industry award.

In recognition of his commitment and achievements at the helm of the manufacturer of solid, secure and stylish composite doors, Stephen Nadin was recently named Managing Director of the Year at the 2024 National Fenestration Awards (NFAs).

Founded in 2013, the NFAs were created in response to a groundswell of support for an awards event for the UK’s fenestration and related industries that was both inclusive and independent.

They remain highly significant and sought after due to the way in which winners are decided. There are no judges or judging panels. Instead, the recipients of each award are chosen based on the votes of their customers, colleagues, suppliers and competitors using an online voting system. The NFAs are true industry awards judged by the industry itself.

Last year, Endurance® Doors won the Composite Door Manufacturer of the Year award whilst this year, the business and several members of its team were shortlisted in multiple categories. This included Fabricator

of the Year, Business Development Manager of the Year and Young Person of the Year.

Stephen has held his role as managing director of Endurance® Doors and its sister businesses within the wider Rocal group since 2003.

During this time, his vision and drive has helped Endurance to evolve into a highly recognised and respected consumer facing brand.

His focus on ensuring sustainable and long-term success has also resulted in a programme of continued investment back into the business and its team with a particular emphasis on succession planning.

Many of the individuals who voted for Stephen commended his entrepreneurialism and his leadership abilities, as well as his creative thinking and his steady stream of new ideas for enhancing Endurance and its offer.

Commenting on his award, Stephen said: “I am understandably proud to have won the 2024 National Fenestration Award for Managing Director of the Year, and especially as the winners of these awards are chosen on merit, based on the views and opinions of colleagues and peers.

“Success as an MD is always easier when you are the leader of a talented team, and I am fortunate enough to be surrounded by a group of professionals who are all exemplary in their fields and who share my passion for the Endurance® Doors’ brand.

“Our focus now is to build on this and our other recent NFA wins to keep the business growing, evolving and improving.”

Celebrating the very best of the industry, the 2024 National Fenestration Awards were held at Doncaster Racecourse on Saturday, 26 October, and saw John Fredericks (JFP) named winners of the prestigious ‘PVC Fabricator of the Year’ category.

This is the latest in a series of accolades for the Huddersfield-based window and door manufacturer after taking the prize for Manufacturer of the Year in the 2024 Insider’s Made in Yorkshire Awards and SME of the Year at the Business for Calderdale Awards last year.

“We’re incredibly proud of this achievement,” said Mark Dicconson, Managing Director of John Fredericks. “PVC Fabricator of the Year is a fiercely fought category and it’s a true testament to the hard work of the entire JFP team.

“This particular award is especially important as it’s voted for by installers and people across the whole supply chain, so it reflects

the continued loyalty and support from all our customers and shows that we are a valued partner.

“As a company, we’ve been trading continuously for nearly 55 years and throughout that time we’ve constantly strived to provide our customers with the very best products and exceptional service.

“The fact that we’ve been named PVC Fabricator of the Year shows that what we’re doing is appreciated and I’d like to say a massive thank you to everyone who voted for us.”

The National Fenestration Awards, launched in 2013, is the industry’s fastest-growing and most inclusive awards event, celebrating excellence across the sector. Now in its 11th year, the winners are decided solely by industry votes – making it a uniquely rewarding recognition.

Web: https://www.johnfredericks.co.uk/

A Buckinghamshire-based door and window manufacturer is expanding to provide new services for customers, after investing in a new specialist division that will see 25 new skilled jobs brought to the area.

Origin Frames Ltd, headquartered in High Wycombe, has designed a £10m purpose-built powder coating facility in Bicester, adjacent to its existing warehousing and storage depot bringing an integral part of its customer offering in-house.

Following a £2.5M asset finance loan from Lloyds, Origin Frames will be able to purchase state-of-the-art technology to coat specialist aluminium frames, bringing roles in-house and creating more jobs.

The firm manufactures more than 130,000 frames a year and is now predicting to increase this to 150,000 during the next 12 months, as the new powder coating plant becomes fully operational. The group, which employs around 400 people, is also targeting expansion in the Middle East and US, where demand is said to be rising for its products.

The family-owned business has been operating since 2002 and has earned a reputation as one of the UK’s go-to makers of bespoke aluminium windows and doors. Its high-quality products are supplied to more than 1,500 commercial clients across the country for new builds, extensions and home improvements.

Ben Brocklesby, sales and marketing director, at Origin Frames Ltd, said: “Powder coating used to be the domain of just a small handful of suppliers, but as technology’s advanced, we’ve spotted an opportunity to capitalise on that and ensure the process meets our high standards. It also means we can keep our costs lower – savings which make a significant difference to housebuilders and homeowners.

“This investment, supported by Daren and the team at Lloyds, follows 22 years of consistent growth for the business and will ensure we continue that trajectory. Our new plant will allow us to continue offering our bespoke products but with an even quicker delivery time for our customers that make sure they are getting good value for money.”

Daren Rose, relationship director at Lloyds, said: “Origin Frames is an example of a business that’s not just asking how it can improve, but how the entire sector can move forward. Technology is a key part of unearthing innovation and creating new efficiencies, and it’s something I hope firms across the South East can take inspiration from.

“At a time when costs are rising in this sector, this represented a golden opportunity for Origin to make its business more costeffective. We know that this is a top priority for all businesses this year, and we’ll be by their side to help them do the same.”

Web: origin-global.com/

Leading aluminium manufacturer DAWS has appointed Steve Williams, an experienced fenestration industry professional, as National Sales Manager, New Products as part of the company’s strategic plans for growth across its core and new product ranges.

Steve, who joined the North West-based fabricator in October, brings a wealth of 35 years’ experience, having previously held various director-level, manufacturing, retail installation, and sales positions with PVC and aluminium companies in the industry.

His responsibilities include promoting the company’s high-quality aluminium windows and doors to trade customers predominantly in the North West, alongside driving sales of the new range of complementary aluminium products nationally. Introduced in October 2024, verandas, carports, fencing and side gates are proving popular with DAWS’ growing installer base and helping them to grow their businesses.

Commenting on his role, Steve says: “DAWS is a unique company, and that uniqueness is the people that are there, such as the management team, whom I’ve known for a long time. As a forward-thinking company,

they’ve got a great high-quality product range, and the service for customers is second-tonone.

“I couldn’t have chosen a better company to work for in the industry. I’m delighted to bring my experience and industry contacts to DAWS and contribute to the company’s business growth and that of their customers.”

Welcoming Steve, Phill Cresswell, Sales Director at DAWS says his appointment comes at an exciting time for the company, coinciding with the launch of their expanding aluminium product range, including lantern roofs and steel-look products.

Phill adds: “It’s great to have Steve on board. His extensive experience and knowledge of the fenestration industry will be an asset to the whole team and further enhance our philosophy of being the trade aluminium supplier that you can rely on.”

DAWS, the trade supplier you can rely on. For more information about DAWS, please visit www.daws.co.uk or call 0151 374 2851.

Read more: www.doubleglazingblogger. com/2024/09/daws-launches-its-guaranteedno-bow-all-aluminium-composite-door-range/

Victoria Brocklesby of Origin discusses how coloured doors and windows can transform home design, and offers practical advice on using colour to boost kerb appeal, enhance light, and add value.

The decisions are endless when designing and building a home: from floor plans to materials, and naturally, aesthetics.

Colour plays a crucial role in residential properties, influencing mood, atmosphere, and the overall feel of each space. In recent years, the trend of aggressively grey and neutral interiors has started to shift, leaving many homeowners feeling bored and uninspired.

While these muted tones were once popular for their simplicity, more homeowners are now drawn to bold colours to bring personality and energy back into their homes.

Just as a building’s exterior colour or wall paint creates a distinct feel, the colour of a door or window can significantly boost kerb appeal and set the aesthetic tone. For example, a front door’s colour can make a powerful first impression, while the colour of door and window frames can either complement or contrast with the building’s architectural style.

Before specifying coloured doors or windows, builders will need to consider any restrictions on the property. In conservation areas, for instance, there may be limitations on colour choices that don’t align with the character of the area.

It’s also important to think about how the interior colour scheme will interact with doors and windows. Rooms are redecorated by homeowners frequently, so choosing a versatile colour that can adapt to various decor changes is crucial. Exterior materials, such as brickwork or cladding, should also be factored into colour decisions. Dual-colour options on bespoke doors and windows allow for different interior and exterior frame colours, which can further enhance design flexibility.

Although neutral or grey hues may seem like a safe choice, carefully selected contrasting or statement tones can bring a unique edge to a building. For example, a red front door or pastel window frames inject personality into the property.

When building homes, saleability is always on the mind. Research of 2,000 UK prospective homeowners found that they are likely to pay an average of 5% less for a property with an unappealing colour scheme. Notably, almost a fifth of people believe a bad colour scheme – either on the inside or outside of a property –knocks over 10% off the value of a house.

So which colours tend to discourage buyers? Yellow is perceived as the ‘cheapest’ looking colour, with pink considered as the ‘tackiest,’ and neutrals the most ‘boring.’ However, whites, blues, and reds are widely regarded as stylish and timeless.

With a vast selection of doors and windows on the market, it’s essential for builders to recommend systems that prioritise quality. Quality doors and windows are defined by several key features that combine craftsmanship, durability, and aesthetic appeal.

The highest-quality fenestration is often British-made, and valued for its craftsmanship, durability, and precision. British manufacturers adhere to strict quality standards, ensuring products are robust, long-lasting, and fit seamlessly.

When prioritising quality, material choice plays a vital role. Aluminium is a superior material for doors and windows due to its exceptional strength and durability, yet it is also lightweight. It offers superior performance compared to other materials, ensuring that the door remains robust and performs well for years.

Given the investment in fenestration and the impact of colour, builders shouldn’t compromise on quality. For clients interested in unique colours, selecting a manufacturer that offers bespoke products ensures a range of colour choices and an assurance of quality.

Web: origin-global.com

As part of its recent rebrand and relaunch, Glyngary Joinery is offering a comprehensive support program for trade customers, including training for installers looking to expand their services to include timber windows and doors. It provides essential skills, product knowledge, and marketing strategies to successfully navigate the transition and take advantage of its increasing rise in timber popularity.

Installers receive in-depth guidance on materials, from the superior durability and eco-friendly properties of Accoya®, which is used as standard by Glyngary, to specific handling techniques. It includes the fundamentals of the sustainability, environmental and energy efficiency benefits of the product, which make it a dream to sell once people understand its true potential.

Aside from training, there’s a range of physical and digital marketing assets that Glyngary have created specifically for their trade customers, including frame and corner samples for sales demonstrations, the stylish ‘Inspirations’ brochure showcasing the numerous benefits of timber windows, access to Glyngary’s digital asset pack, including high-resolution imagery

and videography, plus a range of branded postcards, roller banners & posters. Bespoke showroom support and onsite trade exhibition days are also available.

“Glyngary is a fabricator, not an installer, so we don’t compete with our customers – we’ve made it our mission to provide them with as many tools to support and grow their businesses as possible. We are getting our installer customers ‘setup to sell’ Glyngary timber.” says Joe Trueman, shareholder at Glyngary Joinery.

“As well as the comprehensive support initiatives that we’ve introduced for our customer base, we felt it was also important to offer the training aspect of it to attract installers that may have never dealt with timber before. We understand that some may find it daunting, but we’re here to help them make a smooth transition so that they can take advantage of the opportunities in this premium market, and the comeback of timber in the UK.”

To find out more about Glyngary or for more information on becoming an approved installer, check out the new-look website at www. glyngary.co.uk.

PVC-U based products, like windows and doors, often end up in landfills when they aren’t recycled, contributing to environmental damage, increasing carbon emissions, and wasting raw materials.

As a leader in PVC-U recycling, Eurocell recognised the need to offer its trade customers a comprehensive recycling solution that would not only reduce waste but also enhance their own sustainability efforts.

With a long-standing commitment to sustainable practices, Eurocell aims to create a closed-loop recycling process that collects

used PVC-U directly from customers, recycling it into new products for the construction and fenestration industries.

To achieve this, Eurocell sought a partner with extensive waste management experience and the infrastructure to provide a reliable, scalable solution. There was no better choice than Biffa, which offered the expertise and logistical support to implement a PVC-U collection service tailored for Eurocell’s trade customers, including fabricators and installers.

In February 2023, Eurocell and Biffa launched a trial of a domestic PVC-U collection service within a 30-mile radius of NE28 – this covers a

large part of the North East.

An innovative model was introduced, where Eurocell worked with smaller traders and collections could be booked alongside new product orders. Collected PVC-U was then consolidated at hubs and transferred to Eurocell’s recycling facility, ensuring that materials were repurposed into new products through a closed-loop process.

Samantha Wood, Corporate Account Manager at Biffa said:

“We’re proud to deliver comprehensive waste management solutions that support our partners in achieving their sustainability goals. Our collaboration with Eurocell is a prime example of how we can support a closed-loop recycling system that keeps valuable materials out of landfills and contributes to a greener future.”

Since the trial began, the Eurocell and Biffa partnership has achieved significant milestones:

195 collections were completed, with zero failed collections—a 100% success rate.

A total of 2,568 PVC-U frames were collected and recycled, which would have otherwise ended up in landfill. This equates to over 25 tonnes of PVC-U.

Eurocell has enhanced its feeder stock with

recycled PVC-U, reinforcing its position as a market leader in sustainable recycling for the construction and fenestration industries.

The closed-loop recycling process is actively reducing carbon emissions and supporting a circular economy by reclaiming valuable raw materials that would otherwise end up in landfill.

Sandra Gaspar, Head of Recycling, at Eurocell said:

“Our partnership with Biffa has had a tremendous impact on our sustainability efforts, allowing us to recycle over 2,500 PVC-U frames, keeping our precious plastic feedstock out of landfill. This collaboration perfectly aligns with our commitment to a closed-loop recycling process, reducing waste and supporting a more sustainable future for both our customers and the environment.”

The trial has been so successful that Eurocell and Biffa plan to expand the PVC-U collection service further by January 2025, extending the reach to more customers and locations. This expansion will provide even more trade customers with a sustainable, easy-to-use waste management solution.

With over 100 years of expertise, Biffa is an established leader of sustainable waste management in the UK.

Our purpose is to change the way people think about waste and our team of more than 10,000 key workers provide unrivalled end-to-end waste and recycling solutions for thousands of businesses and millions of households each day.

Underpinned by our low carbon collection network, we’re at the forefront of enabling the UK circular economy by continuing to build our plastic recycling capacity, investing in energy recovery and growing the amount of surplus produce we redistribute through Company Shop.

Since 2002 we’ve cut our carbon emissions by 70% and aim to be net zero by 2050. Our long-standing Biffa Award programme and our proud partnership with WasteAid also contribute to major environmental benefits for the UK and beyond.

Visit biffa.co.uk or find us on LinkedIn, Facebook and X.

The latest Builders Merchant Building Index (BMBI) report, published in October, shows builders’ merchants’ value sales in August were down -5.6% compared to the same month in 2023. Volume sales dropped -5.7% with little movement in price (+0.2%). With one less trading day this year, like-for-like value sales were down -1.1%.

Seven of the twelve categories performed better than Total Merchants year-on-year, with Services (+2.5%), Workwear & Safetywear (+2.3%), and Decorating (+0.2%) ahead the most. The two largest categories – Heavy Building Materials (-6.1%) and Timber & Joinery Products (-8.2%) – were weaker than Total Merchants. Renewables & Water Saving was the worst performing category, falling -30.8%.

Month-on-month, August total value sales were -8.1% lower than July. Volume sales fell -9.2% and prices edged up +1.2%. All categories sold less, and just three performed better than Total Merchants: Services (-4.4%), Timber & Joinery Products (-7.4%) and Decorating (-7.5%).

Plumbing Heating & Electrical (-10.0%), Renewables & Water Saving (-11.3%) and Workwear & Safetywear (-14.7%) were the worst-performing categories. With two fewer trading days this month, like-for-like value sales were marginally higher (+0.7%).

In the 12-month period between September 2023 and August 2024, total value sales were down -5.7% compared to the same period the year before (September 2022 to August 2023). Volume sales were -8.5% lower and prices increased +3.1%. With three more trading days in the most recent 12-month period, like-

for-like value sales were -6.8% lower. The two largest categories

– Heavy Building Materials (-7.5%) and Timber & Joinery Products (-9.0%) – declined by more than Total Merchants, while Workwear & Safetywear (+10.4%) increased the most.

Total value sales from January to August were down -5.4% on the first eight months of 2023.

Mike Rigby, Managing Director of MRA Research which produces the BMBI report says: “August was another unsettling month for the building sector. Strong winds, heavy rains and thunderstorms undoubtedly contributed to an anaemic construction output, which increased by a meagre +0.4%, according to the latest ONS data. Overall new work was up +1.6%, refurbishment and maintenance work down -1.0%.

“Extremely gloomy Government warnings of what may be in its October 30th Budget are blamed for a sharp fall in the GfK’s Consumer Confidence Index. After holding steady in August, the index for September shows a sharp seven-point fall in consumer confidence to -20, and major hits to the way people feel about their personal finances (down -9 points) and the general economic situation over the next 12 months (down -12 points).

“While construction output and consumer confidence stats paint an underwhelming picture, the metrics from the housing market

and economy paint a better outlook. UK house prices continue to climb (up +1.5% in August compared to July) and mortgage approvals were at their highest level since August 2022. Better still, inflation has fallen to 1.7%, below the Bank of England’s 2% target, and there are expectations of two further cuts to the bank rate before Christmas. There are also reports of more bulk cement being delivered to housebuilders for newly built foundations, which means more new homes and buildings in the first half of 2025.

“Will the new Government put our money where its mouth is? A lot hangs on Labour’s first budget on 30 October!”

Set up and run by MRA Research, the BMBI –a brand of the Builders Merchants Federation –is a monthly index of builders’ merchant sales and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 88% of total sales from builders’ merchants

throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

August’s BMBI report is available to download at www.bmbi.co.uk.

When it comes to home security, staying ahead of burglars is a relentless battle. That’s why Heritage Trade Frames has teamed up with Brisant Secure, makers of the industryleading Ultion locks, to make sure their customers’ doors are equipped with the best protection on the market.

Last year, the discovery of two new attack methods shook the industry, revealing previously unknown vulnerabilities in most door locks. In response, the British Standards Institution (BSi) introduced stricter PAS24 standards to keep homeowners protected.

Heritage Trade Frames have long known the value of security when selling doors, indeed they were one of the first major fabricators to standardise 3-star security with Ultion back in 2016. For Paul Culshaw and the team, simply meeting the updated requirements is not enough, they want to exceed them.

After conducting their own tests, the team at Heritage were highly impressed by the Ultion lock with ALPs technology. Not only was it the first lock to meet the new standards, but it’s also the toughest they’ve ever seen.

“We take security seriously because we know our customers do too. This lock isn’t just ahead

of the game, it’s the gold standard. It’s built to protect against everything burglars can throw at it, and then some.” said Paul Culshaw, Managing Director at Heritage Trade Frames Locks with ALPs technology offer unmatched protection against every known attack method, including the newly identified thermal manipulation and twist techniques. This advanced system ensures that the moment you remove your key, the lock activates its advanced security features, keeping homes secure even if the cylinder is tampered with.

Alex Dutton, Sales Director at Brisant Secure explains “when we learned about these new attack methods, we knew we couldn’t wait for the standards to catch up, we needed to act. The Ultion ALPs is a product of that determination to stay ahead of burglars. Partnering with forward-thinking companies like Heritage Trade Frames shows that the industry can rise to meet these challenges head-on.”

The new PAS24:2022+A1:2024 standard became the benchmark for door security at the end of September, and Heritage Trade Frames is proud to say they’re leading the pack. Web: www.brisant-secure.com

Glass Futures announces the appointment of Justin Kelly as new CEO effective 4th November 2024 whilst founding CEO Richard Katz is appointed President.

Justin is a Chartered Engineer with a BEng (Hons) in Computers, Management and Electronics. He began his career at Siemens where he held several roles over nearly three decades culminating in his appointment to the Siemens Executive Management Board in 2017.

Committed to driving innovation, Justin was the founding CEO of the Sustainable Materials and Manufacturing Centre in Greater Manchester to benefit both the economy and the environment. In 2023 he became NonExec Chair of Sustainable Ventures North, an organisation dedicated to supporting sustainability-focused start-ups across the country.

Richard Katz, the first Glass Futures employee in January 2020, has been appointed President and will continue to work closely with the new Government to help them understand how Glass Futures’ research, development and innovation enables growth, particularly with reference to identifying what works and, more importantly, what doesn’t work for industrial decarbonisation in the fight against climate change.

Glass Futures was a concept developed some 10 years ago by Richard together

with Dave Dalton, CEO of The British Glass Manufacturers’ Confederation, the representative body for the UK glass industry, as an independent not-for-profit organisation to enable the glass industry to have access to an industrial scale experimental pilot plant. The facility has been designed and built by the industry to allow practical experimentation with alternative low-carbon sustainable energy sources to replace high-carbon natural gas to decarbonise glass manufacture toward a sustainable future.

Funding in the order of £75 million has been provided by National, Regional and Local Government together with the industry to build Glass Futures’ 165,000 sq.ft Global Centre of Excellence in St Helens on Merseyside, the home of Pilkington’s revolutionary Float Glass development.

Aston Fuller, General Manager at Glass Futures said “Having been the second employee at Glass Futures, I’m extremely proud to see the exponential growth of the organisation in such a short period of time. These important changes will support our growth and impact with our ever-growing diverse membership across the global glass supply chain sharing our collaborative ethos, with our own team who’ve developed and grown our vision”

“I look forward to continuing to support our members on this journey through an ever-

changing world of sustainability and resource efficiency technologies alongside Justin and Richard in the coming years”

This next phase of Glass Futures continues with new appointments to the Board of Directors, including Mike Houghton, Chief Commercial Officer of Process Industries Software at Siemens as Chair and José Miguel Ivorra, Vice President of Global Business Development at Guardian Industries in place of Dr Richard Hulme whose long-term secondment is drawing to a close. They are welcomed by current Board members including newly established Deputy Chair, Adrian Curry, Executive Director and Chief Decarbonisation Officer at EET Fuels, Dr Ludovic Valette, Vice President of Technology and Engineering at O-I Glass, Inc. USA, Dave Dalton, CEO of The British Glass Manufacturers’ Confederation, Professor Anthony Hollander, Pro-Vice-Chancellor for

Research at the University of Liverpool, and Sean Murphy, Managing Director of Encirc.

Mike Houghton said “On behalf of the Board we would like to thank Richard Katz for his valuable contributions over the last 10+ years as Chief Executive, turning a vision into reality. Also great thanks to Guardian Glass’ Dr Richard Hulme who was instrumental in ensuring Glass Futures’ technical strategy reflected our member’s needs.”

“We welcome Justin to Glass Futures as we move into the next phase of the organisation’s evolution as an operational research facility. His wealth of experience in leadership, strategy, transformation, sustainability, marketing, governance and a passion for responsible business will be indispensable to the continued growth of Glass Futures towards a sustainable and innovative future.”

Read the original article here by clicking here.

Reflecting its commitment to achieving excellence across every area of its manufacturing operations, Endurance® Doors has appointed a new safety systems manager. Samantha Vigors takes on the newly created role and will build on the business’ safety first culture. She will also ensure continued compliance with the health and safety requirements of Endurance’s ever-growing array of accreditations and certifications.

Sam moves into her new position with a unique mix of expertise and insight. She was previously production manager at Endurance’s sister business within the wider Rocal Group, Rocal Extrusion.

Sam has also worked as a production operative and as a production team leader

as well as a performance improvement coordinator. This latter role equipped her with valuable knowledge of driving continuous improvement and of internal auditing.

In addition, Sam recently played a key part in Endurance® Doors’ certification to ISO 45001 standards.

Commenting on her appointment, Sam said: “My ability to evolve into the new role of safety systems manager highlights the Rocal Group’s focus on offering its team good scope for progression and for personal and professional development.

“I am looking forward to the challenges the post will bring as well as the opportunity it will offer me to add value and to make an impact using the specialist knowledge I have gained to date.”

Garry Brewin, operations director at Endurance® Doors, added: “We’re delighted to have Sam at the helm of our safety systems. Her hands-on experience and deep understanding of both production and compliance make her ideally suited to lead this area of our operations as we look to maintain the highest industry standards for the benefit of both our colleagues and our customers.”

Web: endurancedoors.co.uk

Read more: www.doubleglazingblogger. com/2024/08/new-glazing-options-fromendurance-doors

(OB-36 + )

Steel-look design meets unparalleled thermal performance. Complementing the highly sought after Internal Door, this latest launch is the right product to be offering at the right time.

Freefoam Building Products has helped complete the build of a new garage for a crucial lifeboat service in Carmarthen, Wales. Freefoam donated 28 lengths of its Fortex® Double Shiplap Cladding in Storm Grey, with matching trims and fascia, via stockist LBS Builders Merchants.

The Ferryside Lifeboat station is one of around 80 independent lifeboats operating in the UK with HM Coastguard to save lives at sea, including the life of a young father earlier this

year. Set up in 1835, it covers the Towy/Three Rivers Estuary in Wales, and its service –manned entirely by volunteers and available 24/7 – has evolved from ‘oar-power’ to a stateof-the-art RIB (Rigid Inflatable Boat).

The newly built garage houses a second ‘Surf Boat’, used when the tide is out, or launched with the larger boat is on a big ‘shout’ (a response to a distress call). The Surf Boat was previously housed in a shed/building on the other side of a railway crossing. “If a train

was in the station it would delay the response by up to 20 minutes!” explains Ned Stephens, one of Ferryside Lifeboat’s Trainee Crew, who fitted Freefoam’s cladding to complete the build. “The new garage’s location makes it much easier to get to the estuary and improves response times.

“It costs around £25,000 a year to service and maintain the boats and equipment,” adds Ned, “and this has been increasingly hard to raise over the last few years. We’d managed to build a garage for the boat, put a roof on and order a garage door – but the project stalled due to lack of funds. We approached Freefoam because the main Lifeboat station was fitted with Fortex® cladding several years ago, and it’s still going strong.

“We were delighted with Freefoam’s response – the garage is 100% better to use and will make it easier to save lives.”

Steve Shaw, Freefoam Area Sales Manager –South Wales & South West, comments: “We have customers throughout the UK but we like to get involved with our local suppliers to support causes that are important to them. We’re really happy to support this important project.”

Donate to Ferryside Lifeboat’s running costs at www.justgiving.com/fundraising/ferrysidelifeboat.

For more on Freefoam’s products, service and support visit www.freefoam.com or call 0800 002 9903.

If I were to describe this year in a single word it would be “cruel”.

Our industry has lost a lot of names and brands this year, some very well-known and with genuine history and heritage. All parts of our supply chain have taken a hit without exception. Tough trading conditions, tougher than we perhaps thought they might be at the start of the year, and certainly tougher than the industry seems unwilling to admit in public, have taken it’s toll.

Sadly, Dempsey Dyer, a company founded in 1977 in Pontefract, West Yorkshire, is to close its doors later this week.

Word began to spread about the fate of Dempsey Dyer at the back end of last week when staff on Linkedin began to publish posts about their demise and looking for new employment.

In the posts it states that Dempsy Dyer are due to close their doors at the end of this week. It would mark the end of a 47 year history in which the company grew out of Pontefract in West Yorkshire to become very well known throughout the country.

Dempsey Dyer fabricates both PVCu and

timber windows and doors, and serve both the residential and commercial sides of the fenestration sector.

The Dyer family are also well-known throughout the sector and are well-respected members of the fenestration community. No doubt the family and indeed employees at the business will be deeply saddened at the events unfolding.

Seeing a near 50-year-old company decide to close its doors is a sad thing to see. Companies of that age are not a common thing in the wider fenestration sector. But, what it does demonstrate is that no one is immune from the very hard trading conditions we find ourselves in.

2024 has been a frankly torrid year for our sector, with what seems like an almost relentless stream of companies going into administration. The first 6 months were particularly brutal. I was speaking with an industry friend earlier in the year and we both agreed that the last time things were like this was during the 2008/2009 financial crisis and the huge recession that brought on. The difference this year is that we were not in the type of recession that we saw in 2009. The financial landscape is different now, with a cost

of living crisis, inflation and wars being the order of the day.

As I write this, there are rumours about the fate of another very large business in our sector. What is concerning is that Q1 is generally when we see casualties due to tax bills not being able to be paid. As we head towards the end of the year, it does look like we’re going to see a continuation of the turmoil we saw at the start of the year.

2025 for our sector is going to be hard. The recent Budget saw a number of measures, including tax increases and wage rises which are going to cause inflation across the economy and our sector. Our margins are going to be squeezed and costs are going to have to be passed down to the consumer. Job losses are likely and any further interest rate cuts are probably now off the table for a while. To find success next year we are going to have to be agile, creative and proactive. Marketing is going to be the single most important thing you can do over the next 12 months. This is not the time to bury your head in the sand, no matter how tempting that is.

I hope that everyone at Dempsey Dyer can pick up new roles as swiftly as possible and I wish the best to the owners of the business going forwards from here.

In a significant blow to the UK retail landscape, Homebase, the prominent DIY and home improvement chain, has announced it is entering administration, putting thousands of jobs and hundreds of stores at risk across the country. The company, which has long been a staple for British homeowners seeking tools, garden supplies, and home improvement essentials, has faced mounting challenges from shifting consumer habits, inflation, and an increasingly competitive market.

Homebase’s troubles have been compounded by economic factors affecting the wider UK retail industry. Rising costs for goods, particularly in DIY and gardening categories, coupled with high energy prices, have created immense financial pressure. Moreover, the ongoing cost-of-living crisis has meant that more consumers are cutting back on discretionary spending, directly impacting Homebase’s sales. This is in addition to the aftermath of the COVID-19 pandemic, which saw rapid growth in online shopping at the expense of traditional brick-and-mortar stores.

Recent efforts by Homebase to turn around its business included an overhaul of store layouts, improved product offerings, and collaborations with well-known brands to enhance its appeal. However, these measures appear to have been insufficient to counteract the strong headwinds in the retail sector.

Homebase has had a turbulent history in recent years. Originally acquired by Australian conglomerate Wesfarmers in 2016 for £340 million, the brand struggled under a failed rebranding strategy that led to significant losses. In 2018, the chain was sold for a symbolic £1 to retail restructuring specialists Hilco Capital, who have since worked to streamline its operations and stabilize the business. Despite these efforts, Homebase continued to struggle in the face of increased competition from online retailers, including Amazon, and other UK DIY stores like B&Q and Wickes.

In recent months, Homebase executives were reportedly exploring options to secure fresh investment to sustain operations. However, potential investors were deterred by the challenging economic environment and the level of debt on Homebase’s books, ultimately leaving administration as the only viable option.

Homebase operates approximately 150 stores across the UK, employing over 5,500 people. With the company now in administration, thousands of jobs hang in the balance, and communities that rely on local Homebase stores face uncertainty. Many UK towns and smaller cities where Homebase is a major retailer may be particularly hard hit by closures if a buyer does not emerge.

Industry experts say that Homebase’s fall into administration reflects the broader pressures facing UK retailers as they battle changing consumer behaviour, high operational costs, and economic turbulence. The company’s decision could have a ripple effect across the retail sector, potentially influencing other home improvement and DIY chains.

Administrators will likely begin assessing Homebase’s assets and evaluating options, including potential buyers or restructuring plans. While some retail analysts speculate that parts of Homebase’s business could attract interest from investors seeking to acquire assets at a reduced price, others argue that the brand’s debt and competition from online players could dissuade potential buyers.

With its extensive history and a loyal customer base, Homebase’s administration marks a pivotal moment for the UK retail sector, reflecting the changing dynamics of consumer demand and financial challenges within the industry. As administrators take control, the future of Homebase remains uncertain, and the company’s ultimate fate will depend on whether viable restructuring options can be found in the coming months.

In a statement, Homebase CEO Damian McGloughlin said:

It has been an incredibly challenging three

years for the home and garden improvement market. A decline in consumer confidence and spending following the pandemic has been exacerbated by the impact of persistent high inflation, global supply chain issues and unseasonable weather.

Against this backdrop, we have taken many and wide-ranging actions to improve trading performance including restructuring the business and seeking fresh investment. These efforts have not been successful and today we have made the difficult decision to appoint administrators.

My priority is and continues to be our team members, and I recognise that this news will be unsettling for them. The sale of up to 70 UK stores to CDS is expected to protect up to 1,600 jobs and the remaining 49 UK stores will continue to trade as normal while the administrators complete discussions with potential buyers. I want to thank our team members and supplier partners from the bottom of my heart for their hard work and commitment over many years.

For customers, Homebase has indicated that all stores will remain open during the administration process, and it has assured shoppers that gift cards, returns, and orders will be honored for the time being.

The retail industry and the broader public will now be watching closely to see if one of Britain’s most recognizable home improvement brands can find a path forward, or if the rise in online and discount competitors will signal the end of an era for Homebase in the UK.

International Decorative Surfaces (IDS), the UK’s largest distributor of decorative surfaces, has ceased operations and entered administration, marking a significant disruption in the construction and interior design sectors. The Newcastle-under-Lyme-based company, which supplied products such as kitchen worktops and bathroom wall panels under brands like Showerwall and Splashpanel, announced its closure on November 13, 2024. This decision leaves hundreds of employees and numerous industry partners facing uncertainty.

IDS, which employed nearly 400 staff across 12 sites in the UK, struggled with financial difficulties driven by a slowdown in the construction and property markets. These challenges made it impossible to secure the funding required to sustain operations. The company had been supported by Chiltern Capital and had undergone a management buyout from French multinational Saint-Gobain in 2022. Despite investments in warehousing, delivery logistics, and product lines, the economic headwinds proved insurmountable.

The immediate closure of IDS has caused ripple effects throughout the kitchen, bathroom, and construction industries, which relied heavily on its supply chain. Businesses are now scrambling to find alternatives for products previously sourced from IDS. Delays in project timelines and increased costs are anticipated as companies adjust to the sudden disruption.

Smaller contractors, in particular, may face severe financial strain due to the loss of IDS’s competitive pricing and product availability.

FRP Advisory, appointed as administrators, is currently exploring options to sell the business and its assets, which include extensive warehousing, a fleet of delivery vehicles, and over 6,000 product lines. Despite these efforts, some staff have already been made redundant, while others await clarity on the future of the company’s operations.

Notably, IDS’s flagship Showerwall brand remains operational and continues to accept orders, offering a lifeline to some businesses dependent on its products.

Founded from the merger of L Bloom and Meyer Laminates in 1999, IDS was a cornerstone in the decorative surfaces market for over 25 years. Its closure marks the end of an era and highlights the broader economic challenges currently facing the construction and home improvement sectors.

For affected customers and suppliers, administrators have assured that all outstanding orders will be fulfilled, and support channels are in place for employees impacted by redundancies.

This development underscores the fragility of even well-established firms in today’s volatile economic climate, leaving a significant gap in the decorative surfaces supply chain.

We were warned that the collapse of construction giants ISG would have ripple effects, and the fenestration sector would not be spared from that fallout.

And so it comes to pass, as Vitrine Systems Limited has been placed into administration by advisory firm Quantuma.

As expected, the collapse of ISG, and the immense sums it owed to subcontractors and others was always going to damage others. For Vitrine Systems Limited they were hit with a £187,000 loss. Ultimately it was that which saw the end of the company, somewhat unfairly as it was something out of their own control. 23 staff have been made redundant.

The business was formed in 1995, nearly thirty years ago. In 2023 they posted turnover of £8.8m.

This is the statement issued by Quantuma on their website:

all roles at the business were made redundant by the company.

Experts from business advisory firm Quantuma were appointed as Joint Administrators of architectural and structural glazing specialists, Vitrine Systems Limited, on 21 October 2024. Quantuma’s Nick Simmonds and Chris Newell were appointed as Joint Administrators to oversee the process.

Vitrine Systems entered administration as part of the fallout from the ISG administration. This resulted in a large bad debt which effected viability of the company, as well as lost projects and pipeline. As a consequence, the company was unable to continue to trade and entered administration shortly thereafter. Vitrine Systems employed a team of 23 staff –

Based in Camberley, Surrey and working throughout the UK, Vitrine Systems was founded in 1995. The company provided specialist commercial glazing for the Construction and Building Management markets – designing, fabricating, installing and maintaining glazing products. The business reported turnover of c.£8.8m in 2023.

Quantuma managing director and Joint Administrator Nick Simmonds said:

“It is deeply regrettable that Vitrine Systems has been forced to cease trading, due to a series of challenging circumstances. This was a sad ending for a well-established company. As Joint Administrators, our immediate priorities have been to provide appropriate support to those whose jobs have been affected whilst seeking to obtain maximum value for the Company’s creditors. To date, the Company’s assets including the Vitrine brand, and a selection of current projects have been acquired, novated and continue to trade as Vitrine Glazing.”

The worry will be that there will be other casualties across the construction sector, as well as within fenestration, due to the collapse of ISG. This may take some time as these things generally do, but my fear is that our sector will be exposed further to the ISG losses and that may play out in the months to come.

You can read the original statement by Quantuma here: www.quantuma.com/insights/ surrey-based-commercial-glazing-businessenters-administration

Just like a remake of a movie that no one asked for, we might be on the cusp of another rise in inflation. Our industry, along with the rest of the country has only just gotten over that last inflation crisis, spawned from the COVID-induced measures around the world.

Now, as energy prices go up and the reality of budget measures begins to sink in, we are likely looking at another round of inflation.

Inflation figures released today made for ugly reading. It rose from 1.7% in September to 2.3% in October – a 0.6% increase and the steepest in two years. This was mainly down to energy prices and the cap being lifted in October.

Energy costs affect everyone, from individuals to small businesses to large businesses and in all sectors. It is a cost that trickles down into all products and was one of the main reasons why inflation spiked so high not so long ago.

The energy price cap is due to rise further in January, which again will have an inflationary effect. But it’s not just energy costs that we have to be keeping an eye on. The recent Budget measures on National Insurance, business rates and the National Minimum Wage are going to play a role in 2025.

Many of you will have seen the pretty severe backlash from the business community, SMEs and large businesses, over the past few weeks. The Chancellor has been warned that rather than growing the economy, her measures are going to prevent companies from hiring, with job losses expected, roles being moved abroad and higher costs in the billions having to be passed down to the consumer. Not exactly a recipe for growth. Indeed, the ingredients for more inflation. For businesses in our supply chain, every company is going to be hit twice. Once by price increases by their suppliers, and then again by their own rising costs. For example, we have already had one supplier email saying that from February next year, they will be implementing a circa 6% increase due to their own costs increasing from their suppliers and costs at their own business. Now remember that 6% has to be passed down to installers, who themselves will face rising costs due to the measures mentioned above.

Installers will not be able to absorb that and will therefore have to pass that down to the consumer. In the end, consumers could end up paying a good chunk more for their new windows and doors by the Spring of next year, not long after huge increases caused by the last inflation spike just a couple of years ago.

As I am writing this, there are rumours abound about a number of companies in difficulty. A theme of turmoil that has run throughout the year, last comparable to the years of the financial crisis. But with a slow pre-Christmas period, and the traditionally quiet first quarter of a new year coming up, the next few months look particularly hazardous.

Economists are looking at inflation rising to around 3% next year. That’s an average estimate. We got average estimates last time around and look how they turned out. The full effects of rising inflation will be felt gradually through Q1 and Q2 as a combination of rising energy costs at the start of the year and Budget measures kicking in in the new financial year in Q2 become felt in the economy. 3%, although not far over the BoE’s target of 2%, feels underdone. What rising inflation will also do is reduce any further chances of interest rate cuts. It had been predicted that there might have been room for one more cut this year. That’s about as likely as Santa walking through your front door on Christmas Eve. And if inflation does continue to rise in the first half of next year, the central bank will remain on the cautious side. As a result, mortgages for those having to renew next year will go up significantly,

removing spendable money from people’s pockets, and continuing to put strain on the cost of living for many.

So what can our sector do? As we have seen this year, the part of the market that has been hit hardest is the volume-based businesses. Those who rely on the people who have been hit hardest by inflation, the cost of living, mortgage increases etc. If you are an installer or fabricator that is not aimed at the new-build sector, then you’re going to have to seriously pivot to the higher end of the market. Some are already. I have seen a good number of installers and fabricators add timber and aluminium products to their portfolios to attempt to attract the wealthier bracket of people. But we’re going to need to double down on that next year.

One stat I once read that has stuck with me is that the top 20% of earners in the UK fund around 80% of all home improvement work. That’s quite a meaty chunk of potential to aim at. It is not easy transforming your business that aimed at one part of the market to suddenly aim at another area. But if we don’t, then we’re going to find the next couple of quarters very difficult indeed.

The aluminium and timber markets present good opportunities for growth, especially for installers. That is where it’s worth looking at in 2025.