4 CAB Spring Forum Puts Focus On Sustainability

6 Origin Launches OW-70 Soho Window To Revolutionise Steel-Look Market

8 ASSA ABLOY Acquires Senior Architectural Systems 10 Comar Architectural Aluminium Systems Acquired By Bailey 11 Dutemann UK Closure Announced 12 New Endurance® Aluminium Site Means Business 14 Origin: The Impact Of Colour 16 Kombimatec Unveils New Products At FIT Show 2025

18 Myles Robinson: Big Nationals “Won’t Be Able To Compete” In A Digital Future

19 Glyngary Joinery Joins Forces With Global Windows For Timber Partnership

20 Building Our Skills Makes Statement 21 Fenestration Expert Holly Bramwell Joins Zehnder Group UK As Divisional Manager, Window Vents

22 Premier Arches Celebrates 20,000th Order Milestone

24 Premier Arches Launches ‘Arches Awards’ To Celebrate Outstanding Installations

26 The Talent Shortfall: What Needs To Be Done?

28 What Trump’s Tariffs Could Mean To UK Fenestration 30 Eurocell Acquires Alunet 32 Eurocell’s Full-Year Financial Results: A Resilient Performance Amid Turbulent Times 34 Forterro Completes Acquisition Of Orgadata 36 Likelihood Of A Recession In 2025 38 Ultion ALPS Now Shipping 39 Ultion ALPs Shatters Industry Standards With Cycle Test 40 A 5-year Market Analysis From Business Pilot 42 Builders Merchant’s Value Sales Down -2.3% In January Year-On-Year, With Prices -2.3% And Flat Volume Sales

44 Q4 Merchant Value Sales Dip -0.5% As 2024 Closes Down -4.1% On Last Year

Well, what can we take away from Q1 of 2025?

I don’t think anyone is going to remember it as one that set the industry alight. In fact quite the opposite. I suspect many will think that it was more difficult that we were all hoping for.

We continued to see a slew of companies sadly close their doors amidst the continued difficult trading conditions, following on from 2024, which saw the entire year littered with companies that could not survive the harsh economic conditions.

Sadly, the Labour Government has overseen a raft of higher taxes and living costs which have now hit people and businesses which is likely to see consumer and business confidence eroded further. It means Q2 could prove to be another difficult period.

What we will remember Q1 for is the immense M&A activity in the aluminium sector. Eurocell purchased Alunet, Bailey bought Comar, and ASSA ABLOY acquired SAS. All these deals were announced within just seven days and demonstrated that the attention of the market are firmly on aluminium right now It demonstrated to me that if there is going to be growth and opportunities in fenestration over the next few years, it is going to be in the aluminium space.

Whilst some areas of the sector are clearly struggling, there are areas which are not. If we are to find our way through this year with some level of achievement, we have to seek this niches of opportunity out and make the most of what is available.

It is another packed issue and we hope you enjoy!

DGB

The Council for Aluminium in Building has highlighted the significant opportunities sustainability delivers for the entire aluminium supply chain at the CAB Spring Forum.

Held at the Hilton and The Deep aquarium in Hull 27th February, the programme headline included presentations on aluminium recycling, the Building Safety Act and PAS2030/35, followed by an after-dinner speech by ex-Royal Marine and now marine biologist, Monty Halls.

The event started with an introduction from CAB Chief Executive, Nigel Headford, who highlighted a series of initiatives being launched by CAB this spring and summer, including the CAB Closed-Loop Recycling Scheme and its new U-Value Charter, which will be launched later this spring.

He provided an overview of a redesign of its training courses. This included an appeal to CAB members to tap into training opportunities with systems houses.

Nigel also delivered a sneak preview of the CAB stand at this year’s FIT Show (Stand R76, NEC Birmingham 29 April to 1st May), jointly sponsored by Ensinger and Jack Aluminium Systems.

He was followed by David Weatherall, Head of Business Development Hydro Extrusions. He gave an overview of Hydro’s net-zero strategy reporting that the aluminium extruder was on course to achieve a 30% reduction in carbon emissions by 2030.

David also highlighted the importance of focusing on sustainability in the design phase of products to make them easier to recycle at end of life.

He said: “The key bit for this is thinking about what you do [at end of life] at the start of the design process.

“There are things that we do in the design phase by default. Can we make the product simpler? Can we reduce the number of processes used in its manufacture? Can we include something in the aluminium that means we don’t have to machine it?

“The one thing that gets forgotten about at the

start – in that design phase – is making sure that that aluminium in that product is accessible at its end of life.

“We’ve had the design for assembly, and now it’s really talking about design for sustainability”

Nigel explained that the CAB ClosedLoop Recycling Scheme supports industry sustainability by isolating waste streams so

that higher value aluminium alloys used in construction are ring-fenced. This also means that manufacturers can command a higher price, from recycling specialists.

The next presentation was from Stephen Collings, SCCS on the Building Safety Act and PAS2030. He highlighted the new regulatory requirements in the post-Grenfell era, including the ‘golden thread’, which he explained touched every part of the supply chain, from extrusion to installation.

“There were warning signs on the installation side from the early 1990s. Grenfell Tower was simply another installation where bad practice in the construction industry was overlooked. It’s only the tip of the iceberg”, he said.

Stephen highlighted that 12,500 medium to high-rise buildings were currently classed as ‘high risk’, with further prosecutions for failures on the horizon. He said that companies who are now found to be in breach of the act will be excluded from future tenders as part of a blacklist.

Stephen added that in addition to improving safety, the Building Safety Act created an opportunity for improved communication within the building products supply chain from the systems company through to the installer.

He also provided an overview of PAS2030 and PAS2035, which place a requirement on manufacturers and installers to http://www.ca-b.org.ukapproach energy performance and ventilation holistically in public sector retrofit.

The afternoon event also included presentations from Andy Stevens, The Build Network UK, and Richard Ashcroft, Elmhurst Windows, who talked about the importance of mental health care in the industry and his personal journey.

The Forum then moved onto Hull’s The Deep, the globally recognised aquarium, where after dinner speaker Monty Halls, presented on the importance of leadership and teamwork, drawing on his experience in the Royal Marines and as a wildlife documentary maker and marine biologist.

“We’re working to push forward with a new agenda”, Nigel said, “Retaining opportunities for networking but also giving CAB members access to leading experts on regulation, industry innovation and sustainability.”

The next CAB event will be attendance at the FIT Show on 29th April, followed by the CAB Technical Conference at Loughborough University on 15th May.

For more information about the CAB events programme ort the CAB Closed-Loop Recycling Scheme visit www.c-a-b.org.uk. Alternatively, email enquiries@c-a-b.org.uk or call the team on 01453 828851.

Origin, the UK’s leading manufacturer of premium aluminium windows and doors, has launched its groundbreaking OW-70 Soho Window.

The exceptional design sets a new standard for steel-look aesthetics and performance and empowers its trade Partners to elevate their offerings and capitalise on the growing demand for statement glazing.

The OW-70 Soho Window delivers an authentic industrial look with its slim sightlines, square beading and true glazing divides. This meticulously crafted design also features superior thermal performance, which surpasses traditional steel windows and building regulations.

Daniel Baker, Managing Director at Origin, comments: “We’re thrilled to be able to launch the highly anticipated OW-70 Soho Window.

“We’re always driving forward to continually deliver the best for our Partners, so we’ve developed a new window solution that not only replicates the iconic and sought-after steel look, but also addresses the practical needs of modern living by delivering exceptional thermal efficiency. This therefore brings with it new business opportunities and growth potential for our Partners.”

• Authentic steel-look aesthetics: True glazing divides, ultra-slim sightlines of just 65mm and square beading

• Superior thermal performance: U-Values as low as 1.4 W/m2K which exceeds building regulations, ensuring energy efficiency and lower energy bills

• Unrivalled versatility: Available in casement, fixed frame and bay window configurations, can be specified in over 150 RAL colours including textured finishes, and is backed by an industry-leading guarantee of up to 20 years

• Unbeatable quality: Made bespoke using the highestgrade aluminium and powder coated to Qualicoat’s rigorous standard at Origin’s UK factories

• Seamless integration: Complements Origin’s existing Soho Collection, allowing trade Partners to offer a complete and cohesive solution to homeowners

The OW-70 Soho Window is now available to order on Origin’s online quoting and ordering system. This provides Origin Partners with easy access to pricing, specifications, and ordering information.

Become an Origin Partner and start specifying the OW-70 Soho Window today.

Another week another acquisition, and this one is a big one in the aluminium space once again.

Juggernaut group ASSA ABLOY have announced they have acquired UK-based Senior Architectural Systems (SAS), with its HQ in Yorkshire for an undisclosed sum.

SAS was established in 1981 and employs 150 people. The company joins the vast global group which continues the general trend of consolidation as the UK economy struggles to find any sort of meaningful momentum.

This was the announcement made on the ASSA ABLOY website:

ASSA ABLOY has acquired Senior Architectural Systems (“SAS”), an independent supplier of innovative aluminium windows, doors and curtain wall systems and thermally efficient fenestration systems into the commercial construction sector in the UK.

“I am very pleased to welcome SAS to ASSA ABLOY. This acquisition delivers on our strategy to add complementary products and solutions to our core business,” says Nico Delvaux, President and CEO of ASSA ABLOY.

“SAS is an exciting addition to our UK business, and I am delighted to welcome the team to ASSA ABLOY, says Neil Vann,

Executive Vice President of ASSA ABLOY and Head of EMEIA Division.

“SAS offers an innovative and high-quality range of window and door profile systems including market leading thermally efficient technology. Their portfolio will further extend the ASSA ABLOY offering in the commercial OEM market in the UK.”

SAS was established in 1991 and has some 150 employees. The main office and factory are located in Yorkshire, UK.

Sales for 2024 amounted to about MGBP 50 (approx. MSEK 680) with a strong EBIT margin. The acquisition will be accretive to EPS from the start.

Read the original article here.

SAS also provided a statement via their website:

As part of the company’s longterm growth strategy, Senior Architectural System is pleased to announce that it has been acquired by ASSA ABLOY, an international manufacturer of entrance solutions best known for the Yale and UNION brands.

With around 61,000 employees and sales close to €12.3 billion, ASSA ABLOY’s head office and main manufacturing centre is in Willenhall in the West Midlands. Established in 1991, Senior has become one of the leading UK based manufacturers of aluminium fenestration solutions, including doors, windows and curtain wall systems, and has two manufacturing facilities in Yorkshire and a distribution centre in Scotland.

Commenting, Senior Architectural Systems’ managing director Mark Wadsworth said:

We are delighted to join ASSA ABLOY Group and combine our heritage as one of the leading UK aluminium fenestration systems suppliers with ASSA ABLOY’s international scale and world leading brand and technology in access solutions.”

“This is an exciting next step in our journey, creating opportunities to enhance our offering through the complementary capabilities of both businesses, and ultimately achieving our growth ambitions.”

Harry Warrender, Senior Vice President and Head of ASSA ABLOY UK & Ireland adds:

“Senior is an exciting addition to our UK business, and I am delighted to welcome their teams into ASSA ABLOY.”

“Senior offer an innovative and high-quality range of window, door and curtain wall systems including market leading thermally efficient technology. Their portfolio will further extend the ASSA ABLOY offering into the commercial market in the UK.”

You can read the SAS statement here.

This follows on from the news that Eurocell have also acquired fellow Yorkshire-based Alunet in a deal with £29m. You can read more about that by clicking here. There is significant movement in the aluminium market right now, as larger suppliers seek to take advantage of the significant rise in the popularity of aluminium windows and doors against a tough market backdrop.

This wave of consolidation within the fenestration market is really picking up pace as yet another acquisition of an aluminium systems company has just been announced.

Building envelope solutions specialists

Bailey has announced that it has acquired The Parkside Group, which contains Comar Architectural Aluminium Systems and Axim.

This is the official statement from Bailey published on their website just a few hours ago:

Bailey Expands Total Building Envelope Offering With Strategic Acquisition Of The Parkside Group

Bailey, a leader in flat roofing and building envelope solutions since 1975, today announced the acquisition of the assets of The Parkside Group, bringing the renowned Comar architectural aluminium systems and Axim hardware brands into its comprehensive product portfolio.

This strategic acquisition significantly enhances Bailey’s capabilities in the construction sector, expanding its total building envelope offering to include aluminium window and curtain walling systems.

Since its founding in 1975, Bailey has evolved from flat roofing specialists to become an industry leader in the design and manufacture of aluminium façades. The addition of the Comar and Axim brands represents a natural progression in Bailey’s growth strategy, creating a more comprehensive building envelope solution for its customers.

Daniel Gilmore, CEO of Bailey, commented: “This acquisition marks an exciting development in our commitment to providing the highest

quality building envelope solutions. By bringing Comar and Axim into the Bailey family, we’re strengthening our capability to serve our customers with an even broader range of products and expertise.”

Peter Dziurzynski, Managing Director of Comar & Axim, added: “Joining Bailey opens exciting new possibilities for the Comar and Axim brands. Our architectural aluminium systems and door hardware solutions complement Bailey’s existing product range perfectly, creating a truly comprehensive building envelope offering. We look forward to combining our strengths to deliver enhanced value to our customers across the construction industry.”

Bailey has confirmed that the acquisition will not disrupt current service to customers of either business. Existing relationships, contacts, and support channels with across Bailey, Comar and Axim will remain unchanged throughout the integration process.

The expanded portfolio will enhance Bailey’s ability to meet customer needs through greater expertise and resources, while maintaining the high levels of service that customers of both companies have come to expect.

Read the original article here: https:// builtwithbailey.com/bailey-expands-totalbuilding-envelope-offering-with-strategicacquisition-of-the-parkside-group/

This is the third acquisition in the space of a week where an aluminium systems company has been acquired by a larger organisation. I will explore this trend in an article later this week, but there is more certainly something significant ongoing in the aluminium space in

In an emotional statement published on Linkedin this morning, Dutemann UK Ltd owner announced that the company has now been forced to closed due to the difficult economic and trading conditions. This was the statement in full:

It was with a heavy heart that yesterday I closed the doors at Dutemänn for the final time. The simple fact is that the market conditions during 2024 and early 2025 simply did not favour a quality trade aluminium door manufacturer. Our core product range “Bifolds” have simply been commoditised. We at DUTEMÄNN UK LIMITED team tried to expand the range, the customers although extremely positive about our revised offering, simply could not convert that positivity into orders. On a general note, our customers, who are situated across the UK, are all reporting exactly the same market conditions. Enquiries are up but converting them into orders is a real struggle. Given the uncertainty in the UK and wider world I guess that is no surprise. I want to say thank you to my team who have been brilliant and to our customers who have remained loyal over the years. It has been a pleasure working alongside you all. I wish every one, all the very best for the future in both business and more importantly health.

As most of you are aware 2024 was personally very tough with ill health blighting the first six months (luckily, I’m fine now)

Always remember Wealth is Health

Link to the original post here: https:// www.linkedin.com/feed/update/ urn:li:activity:7303704200293601280/

In his post, he points to the difficult trading conditions that continue to persist in the sector. He sheds light on what his own client base is experiencing, which is good levels of quotations, but difficulties in turning them into orders. This points to a high level of hesitation from the public in their willingness to part with their hard-earned money. In my own experience this year, I can relate to this. Quote levels are good, but there certainly is a lot of hesitation when it comes to placing orders.

So whilst people may well remain interested in improving their homes, harsh financial realities are likely putting the brakes on those plans at the moment.

With the outlook for the UK very difficult at the moment, I fear that just as we saw in 2024, 2025 will see a continued stream of closures of some of our most recognised brands and companies.

Following its successful launch onto the market earlier this year, Endurance® Aluminium has unveiled a new online presence.

www.endurancealuminium.co.uk showcases the comprehensive product range and capabilities of the new fabricator which produces premium quality, technically innovative aluminium windows, doors and internal screens.

The new site has also been developed with lead generation in mind. It has a deliberately retail-orientated feel and provides information that’s focused on selling the lifestyle and aspirational benefits of owning Endurance® Aluminium products to the homeowner.

Scott Foster, Sales and Marketing Director at the Endurance group, explains: At Endurance® Aluminium and across all the brands within the wider Endurance group, we know our success is directly intertwined with that of our installer partners.

“That’s why our marketing efforts are about more than simply promoting and raising the profile of our own business. They’re also specifically geared towards creating enquiries which we can then help our installer partners to convert into actual sales.”

To help realise this goal, the new Endurance® Aluminium website employs a number of carefully considered features.

As well as detailed information on its products, this includes case studies so

that prospective purchasers can see how past customers have used the fabricator’s products to transform their own homes.

There are also image galleries offering an inspirational look at Endurance® Aluminium products in-situ across a wide variety of properties, whilst a regularly updated blog provides useful tips and advice on product performance and choices, helping to simplify the buying process.

In addition, the new Endurance® Aluminium website benefits from a Frequently Asked Questions section.

This removes potential sales barriers by addressing some common homeowner queries and concerns, such as whether aluminium windows and doors are energy efficient and whether they last and perform as well as wood or timber products.

Scott adds: “Within the Endurance group, we have extensive experience and a proven track record of creating well recognised and respected consumer brands as shown by our achievements with Endurance® Doors.

“It was always our intention to use that same expertise to replicate our brand-building success with Endurance® Aluminium. The launch of the new website is evidence of that plan in action.

“It is just one part of a far wider programme of marketing activity that will help to generate leads and business for Endurance® Aluminium’s installer partners.”

Ben Brocklesby, Director at the UK’s leading manufacturer of aluminium doors and windows, Origin, discusses the impact of colour and offers practical advice to builders. The decisions are endless for homeowners renovating their properties. From floor plans and materials to products and functionality, each aspect impacts the final result. Beyond functionality, builders are increasingly being asked to advise on aesthetics. Homeowners are ditching the bland greys and neutral colours of recent years for bold colours to add personality and character to their homes – a trend which extends to doors and windows.

Gone are the days of generic white windows and doors. Today’s homeowners are looking for ways to make their homes unique, and coloured doors and windows are a great way to achieve this. But choosing the right colour isn’t just about aesthetics; it’s about understanding how colour can impact a space. Different colours evoke distinct emotions and can influence how different areas of the home feel. For example:

• Red is associated with energy, passion, and excitement

• Blue is often linked to calmness, serenity, and trust

• Yellow can evoke feelings of happiness, optimism, and warmth

• Green is associated with nature, growth, and harmony

Before recommending coloured doors or windows to your clients, it’s important to consider a few factors:

• Planning restrictions: Properties located in conservation areas will require permission before homeowners can make exterior modifications

• Interior design: Since doors and windows are typically replaced less frequently than interior wall colours are updated, it’s wise to choose a colour that complements a variety of design schemes

• Exterior cladding: Consider the overall

colour scheme of the house’s exterior, including brickwork, cladding, or render. Dual-coloured doors and windows can be a great solution, with a neutral colour on the interior and a bolder shade for the exterior

While a bright red door might seem like a great idea today, it’s important to remember that colour choices can affect a property’s resale value and homeowners should be made aware of this. Research shows that unappealing colour schemes can reduce a property’s value by up to 5%. The key is to strike a balance between being bold and timeless. Builders can help homeowners by advising colours like deep burgundy, which offers more personality than grey, but still feels sophisticated.

When it comes to coloured doors and windows, quality matters. Products that are powdercoated using a rigorous process, like those offered by Origin, are an indication of quality.

High-quality powder coating ensures a durable, chip-resistant finish that will look great for years to come. At Origin, we recently took a significant step in our commitment to quality by launching our very own in-house powder coating facility. With everything in our control, it means we can set our own standards of quality and consistently deliver an exceptional product every time.

Our process begins with pre-treatment. The meticulous cleaning and preparation process includes the use of a unique linishing machine to ensure our aluminium is removed of scratches. From there, we then exceed the industry norm of pre-treatment cleaning of 5-7 stages by undergoing 10 stages of pretreatment, to ensure the profile is primed for a flawless and exceptional finish.

Having powder coating in-house also means we can offer a wider range of colour options, including textured finishes, to deliver truly bespoke solutions for homeowners. Find out more about Origin here: https://trade.originglobal.com/

Kombimatec will debut its latest innovation, the AMC328 CNC Machining Centre, at FIT Show 2025, showcasing cutting-edge technology for working extruded aluminium and PVC profiles. Designed for a range of applications, including window and door systems, conservatories, partitioning, and curtain walling, the AMC328 is set to revolutionise the fabrication process.

The AMC328 offers significant improvements in efficiency by automating traditionally labourintensive tasks, enabling fabricators to achieve greater accuracy and enhanced finished quality.

Key Features of the AMC328:

>User-Friendly Operation – Featuring a colour touchscreen control and automatic clamp positioning, the AMC328 automates the entire cycle, allowing operators to focus on other tasks once the cycle is initiated.

>Precision Engineering – The three-axis CNC control ensures excellent accuracy and repeatability, while the intelligent tool-change function automatically adjusts for different tool specifications.

>Enhanced Performance – With four adjustable pneumatic clamps, variable electronic speed control up to 18,000 rpm, and a 3,000 mm longitudinal stroke, the AMC328 is designed to deliver exceptional results.

David Parsons, Director at Kombimatec, highlights the significance of innovation at events like the FIT Show: “Exhibitors should present new products, and visitors should discover the latest advancements in the market. Attending the FIT

Show is a valuable opportunity to explore the best solutions available.”

In addition to the AMC328, visitors can also explore the highly popular 1HD Variable Angle and Twin Reverse Butt Welder and the MGS460 Up Stroke Mitre Saw at Stand M80, Hall 8. The 1HD Welder delivers precise welding with tight bead control, eliminating the need for additional grooving or polishing, while the MGS460 Mitre Saw provides excellent cutting capacity, improved safety features, and operator-friendly design.

Kombimatec Machines Ltd. brings over 40 years of experience in manufacturing highprecision machinery for window and door fabrication. With a global reach, the company continues to lead the industry with cutting-edge solutions.

Don’t miss the chance to visit Kombimatec at FIT Show 2025 and be one of the first 100 visitors to receive a free gift!

Kombimatec Machines Ltd., FIT Show 2025, NEC Hall 8, Stand M80

MR Home Improvement Marketing Director predicts that innovative home improvement companies like his are well on their way to becoming the status quo.

Home Windows is disrupting the window and door industry with cutting-edge tech and automation. For 2 years, they have led a digital transformation in the door industry, redefining how customers purchase home improvement products.

Built with cutting-edge technology and automation, the company offers a seamless online purchasing experience for fully fitted and supply-only windows and doors.

First, they purchased valuedoors.co.uk, a 27-yearold window and door company with national coverage. They took an old website with a very low amount of leads and invested significant amounts in online door and window builders and marketing.

With 72% of their business 60 miles from London, they are competing and winning business from paper-based local companies and utilising tech to drive online sales for fully fitted doors.

In just year two, from a standing start, they grew to just shy of £5,000,000 in installed/delivered business.

In just two months since launching in January 2025, Home Windows has achieved a remarkable turnover of £300,000 just in Yorkshire, showcasing its rapid growth and market demand. Now, they are going to London and looking for further rapid growth and are on target to exceed £10,000,000 with attractive profitability in year 3.

As part of its ambitious expansion plans, Home Windows is leveraging the expertise of a highly experienced Sales Manager, Greg Jewitt, who has previously managed teams for one of the UK’s largest brands.

This strategic move is set to accelerate growth and customer engagement, rapidly growing the company’s market share in the window and door industry.

Further strengthening its offering, Home Windows has partnered with its sister company, Green Central, to provide homeowners with a comprehensive package of energy-efficient home upgrades.

Customers can now purchase windows, doors, solar panels, heat pumps, and EV chargers in a single appointment—streamlining the process and making sustainable home improvements more accessible, again with a digital journey from enquiry to aftercare.

With a combined Trustpilot score of Excellent 4.8 out of 5 and over 10,000 reviews, Home Windows and Green Central set new standards for customer satisfaction and forward-thinking purchasing experiences.

Their expansion roadmap aims to extend full coverage across England, Scotland, and Wales by 2027, solidifying their position as pioneers in the home improvement sector.

For more information on this digital transformation and Home Windows’ industry-leading approach, contact Myles Robinson at myles@mrhi.co.uk.

Myles is spearheading the rapid evolution of how home improvement products are purchased.

You can also connect with him on LinkedIn: Myles Robinson LinkedIn.

References: homewindows.co.uk | valuedoors. co.uk | supplyonlydoors.co.uk | saas-central.co.uk | ukcompositedoors.co.uk

Glyngary Joinery is proud to announce a new partnership with Global Windows, Sheffield’s highest-rated window and door company. This collaboration will see Glyngary’s high-quality timber windows and doors added to Global’s product range, marking a significant step in expanding access to premium timber solutions in Yorkshire and beyond.

For years, Global Windows has built an outstanding reputation in the industry, supplying and installing uPVC, composite, and aluminium windows and doors, and has become a trusted name for homeowners in the region. Recognising the increasing demand for sustainable, energyefficient home solutions, Managing Director Liam Hulme saw an opportunity to introduce a premium timber range.

“Homeowners are becoming more conscious of sustainability and energy efficiency, and timber is the perfect solution,” said Liam Hulme. “By partnering with Glyngary, we’re able to offer our customers beautifully crafted timber products that combine traditional aesthetics with modern performance.”

As a specialist in bespoke timber manufacturing, Glyngary has long been committed to providing exceptional craftsmanship and outstanding service to installation businesses across the UK. Partnering with Global Windows – a company known for its dedication to quality and customer satisfaction – ensures that more homeowners can benefit from the sustainability, energy efficiency, and timeless appeal of timber windows and doors.

Joe Trueman, shareholder at Glyngary, expressed

his enthusiasm for the collaboration: “We’re thrilled to be working with Global Windows. They’re a well-established, highly respected installer with a fantastic showroom and a commitment to delivering quality. This partnership is a great example of how forward-thinking businesses are responding to the growing demand for timber products.”

Glyngary not only supplies premium timber products but also provides marketing and showroom support to help installers drive sales and maximise profit margins. The introduction of timber windows and doors to Global’s portfolio is set to provide customers with more choice, enabling them to opt for a natural, sustainable material that offers exceptional thermal performance and longevity.

As the industry moves towards more ecoconscious solutions, the partnership between Glyngary and Global Windows is perfectly positioned to meet this demand. Both companies are excited about the opportunities this collaboration presents and look forward to bringing

high-quality timber windows and doors to even more homeowners across Sheffield and beyond.

To find out how you could partner with Glyngary, go to www.glyngary.co.uk.

More information on Global Windows is available at www.global-windows.co.uk

In a short statement issued today on their website and social media channels, industry-leading skills platform Building Our Skills have said the following:

Building Our Skills – Making Fenestration, Glass and Glazing a Career of Choice has ended its relationship with GQA Qualifications Limited.

In recent months it has become evident that the values of the new team of directors at GQA do not align with our own.

Building Our Skills is, and has always been a separate legal entity to GQA.

We look forward to an exciting 2025 as we continue to raise awareness of the fantastic career potential in our industry, supported by an ever growing group of industry partners.

You can read the original statement here: https://buildingourskills.co.uk/news/bos-ends-itsrelationship-with-gqa/

Leading provider of indoor climate solutions, Zehnder Group UK, is pleased to announce the appointment of Holly Bramwell as its new Window Ventilation Divisional Manager.

In her new role, Holly will be responsible for overseeing the popular Zehnder product range of high-quality passive ventilation solutions, which were previously known under the Greenwood brand that was acquired by Zehnder in 2008. She will play a central role in ensuring Zehnder products continue to support window fabricators across the UK and leading the management of innovative, regulation-compliant window ventilation.

Holly brings extensive experience in the fenestration industry, having worked with some of the largest fabricators and housebuilders in the UK, including Eurocell, Synseal and Origin. With a passion for delivering great customer service and experience in leading large sales teams, she will be a key driver in strengthening client relationships and expanding the company’s presence in the market. Her focus will be to align business development efforts with Zehnder’s longterm strategic objectives in this market.

Commercial Director, Stuart Smith, at Zehnder Group UK said: “We are delighted to welcome Holly Bramwell to Zehnder as our new Window Vent Divisional Manager. Holly’s extensive experience in the fenestration industry, combined with her deep understanding of passive ventilation solutions, makes her the ideal leader to drive the continued success of our window ventilation product range.

“With a clear focus on supporting window fabricators and ensuring our ventilation solutions meet evolving regulations, Holly will play a crucial

role in strengthening our market presence and delivering high-quality, integrated solutions,” Smith continued. “We look forward to seeing her leadership take Zehnder’s window ventilation division to new heights.”

Zehnder trickle vents are designed to work harmoniously with the brand’s dMEV extractor fans, forming an effective whole-home ventilation system. By allowing a continuous flow of fresh air into a property, these vents work in tandem with the extractor fans, which efficiently remove stale, moisture-laden air from wet rooms. This intelligent air flow system not only enhances indoor air quality but also helps prevent common issues such as condensation and mould, ensuring a healthier living environment for occupants. Ideal for modern window installations, Zehnder trickle vents offer an essential upgrade for fabricators looking to add value and performance to their products.

Holly’s first action as divisional head will see her expand the window ventilation team at Zehnder. Her first appointment is Jose Costa, who joins as Business Development Manager. Jose’s experience encompasses roles in specification and business development for leading UK manufacturers, making him an essential addition to the team. Long-standing Zehnder employee and specialist in Passive Acoustic Ventilation Solutions, Nick Evans, completes the team to help further promote better air quality in homes.

Commenting on her new role, Holly Bramwell, said: “I’m thrilled to join Zehnder Group UK and take on this position. Zehnder has a fantastic reputation for delivering high-quality ventilation solutions, and I’m excited to work with our customers and partners to further strengthen the window ventilation product range.

“My focus will be on supporting window fabricators with innovative, regulation-compliant solutions that enhance indoor air quality and integrate seamlessly into modern window systems. With a great team in place, I’m looking forward to driving growth and making a real impact in the market.”

For further information visit Zehnder.co.uk

Premier Arches, the UK’s leading specialist in arched and shaped uPVC frames, has reached a significant milestone by fulfilling its 20,000th order in February. Since its inception, Premier Arches has established itself as a trusted partner for fabricators, installers and branch networks, providing precision-engineered, bespoke uPVC arched and angled frames. This latest achievement highlights the company’s rapid growth and continued commitment to quality, reliability, and customer satisfaction.

“Reaching our 20,000th order is a fantastic milestone for the business and a testament to the hard work and dedication of our team over the last 10 years,” said Sean Greenall, Managing Director of Premier Arches.

“Our success has been built on three core principles: exceptional manufacturing quality, honest customer service, and making life easy for our customers. By sticking to these core principles, we’ve developed strong partnerships across the industry and cemented our reputation as the go-to supplier for arched and shaped frames.”

Premier Arches has experienced significant growth by focusing on quality and service, ensuring its customers receive bespoke, high-quality frames with minimal hassle. The company has also invested heavily in its machinery, processes and technology, making it easier than ever for fabricators, installers and branch networks to order complex frames with confidence.

Sean added: “This is just the beginning for us. With increasing demand for bespoke shaped frames, we’re committed to expanding our capabilities and continuing to provide the industry with the best possible products and service. We are continuously developing our online pricing and ordering portal, and with plans to implement AI this year, our customers will see some very exciting developments that will significantly help with the process of ordering angles and arches.”

Premier Arches enjoyed 18% year-on-year sales growth in 2024 which has come from a combination of new customers joining and existing customers selling more arches. “This growth, in what has been a difficult year for the industry, is a testament to our efforts to continually develop and improve the business in line with our three core principles,” adds Sean.

With an exciting year ahead, Premier Arches remains dedicated to setting new standards in the shaped frame market, helping its customers grow while staying true to the values that have defined its success.

For more information visit www.premierarches.co.uk or email sales@premierarches.co.uk.

Premier Arches, the UK’s leading manufacturer of arched and angled frames, has launched ‘The Arches Awards,’ a brand-new competition recognising the outstanding work of its customers. Kicking off in April, the initiative forms a key part of the company’s 10th anniversary celebrations.

The competition, which will run throughout 2025, invites Premier Arches customers to submit photographs of their completed projects featuring the company’s high-quality bespoke frames. Each month, an outstanding project will be crowned the winner, earning a £50 Amazon voucher and a special ‘Arches Award’ trophy.

Plus, Premier Arches will arrange a professional photoshoot of selected winning projects, providing the customer with high-quality images for use on their website and marketing materials, too.

At the end of the year, an Overall Winner will be selected from the monthly winners, receiving a grand prize of £1,000 to treat their team to a Christmas celebration, as well as being presented with ‘The Grand Arches Award’.

“Our customers do incredible work installing our bespoke arched and angled frames, and

we want to showcase their efforts while giving something back in return,” said Sean Greenall, Managing Director of Premier Arches.

“As we celebrate our 10th anniversary this September, we’re reflecting on the thousands of stunning products we’ve crafted over the years. But once they leave our factory, we rarely get to see them in place. The Arches Awards will not only showcase how these products look when installed but also give installers the recognition and reward they deserve for their craftsmanship.”

To enter, customers simply need to submit photographs of their completed projects featuring Premier Arches products to awards@ premierarches.co.uk. Entries will be judged by their ‘arch master craftsmen’, who will be looking for standout projects – whether they’re impressively designed, uniquely creative, or simply breathtaking.

For more details on how to enter and to keep up with the latest winners, follow Premier Arches on social media or contact awards@ premierarches.co.uk.

Neil Evans, Managing Director, VEKA plc.

Securing over 250,000 skilled workers by 2028 may seem a difficult challenge, yet the Construction Industry Training Board insists that this is precisely the volume of talent required to sustain current demand. A lack of technical know-how, decline in apprenticeships and an ageing workforce, has left the industry with a long-established and growing skills shortage. The fenestration sector, integral to the construction supply chain, is also struggling with the gap.

It’s not just manufacturers like VEKA, who are reliant on hiring locally, but businesses across our sector, including fabricators, specifiers and installers.

The Government launched its Planning and Infrastructure Bill to Parliament on 11 March. This will see significant measures introduced to speed up planning decisions to boost housebuilding and remove blockers, and challenges to the delivery of other developments such as roads, railway lines and windfarms. The hope is to boost economic growth, connectivity and energy security whilst also delivering for the environment.

And in a February interview with the BBC, Deputy Prime Minister Angela Rayner declared there were ‘no excuses’ for failing to deliver on Labour’s pledge to build 1.5 million new homes. Yet analysis from the same outlet reveals that homebuilding figures have already faltered in the government’s first six months.

With a shortage of skilled labour and doubts over the construction sector’s capacity to scale up quickly enough to build the ‘new towns’ that the Government has set its sights on, the challenge extends beyond housing. Questions

persist over whether the UK’s building industry can expand sufficiently to meet not only its housing targets but also the demands of largescale infrastructure projects that have been labelled as crucial to the country’s economic growth – which the Chancellor has said is ‘the number one mission’ of the Labour government.

Economic growth in the UK hinges on filling the skills gaps that exist in many industries. Addressing sub-industries like plumbing, electrics, ground working and, of course, fenestration is equally as important as core construction jobs to prevent potential supply chain delays during the building process. And I can’t see a real plan to address this.

Outside of economic growth, we also have a significant retrofit challenge. It’s no secret that the UK has some of the oldest housing stock in the world and according to the Connected Places Catapult, over one million UK properties must undergo retrofit each year to meet targets and achieve NetZero emissions by 2050. While windows alone cannot solve the NetZero issue, they can contribute significantly to the energy efficiency of properties. This target presents an opportunity for VEKA customers to make a real difference to both the country’s climate target and homeowner energy bills, addressing the gap between the supply of technically skilled workers and the demand for them is again crucial here.

While the Autumn Budget had a focus on employment and skills development, at the same time, it delivered businesses the challenge of the increase in both minimum wage and national insurance contributions. Meaning that employers are understandably looking at their recruitment and employee costs, and, for many, opening new vacancies right now is not realistic.

Addressing these challenges requires collaboration on multiple levels.

Many young people and their families still view construction jobs as limited to manual labour with little career growth. To overcome this, we need to showcase the diversity, rewards and

technological advancements in construction and fenestration. From high-tech design roles using AI and VR to sustainability-driven engineering projects, there is no shortage of exciting career opportunities. By engaging with schools and colleges early, we can inspire the next generation to see this industry as a viable, exciting path.

Apprenticeships and vocational training are powerful tools but remain underutilised. Clearer pathways from learning to employment are needed, developed collaboratively between educators and employers. For example, organisations like VEKA are prioritising training and upskilling, working closely with regional education providers. Initiatives like these directly tackle skills shortages in high-demand technical roles by aligning training with real-world industry needs.

Skills gaps don’t just start with recruitment, they are exacerbated when current employees don’t have access to opportunities for growth. Retention can improve considerably when employers invest in upskilling their teams. From courses in advanced glazing techniques to management certifications, continuous training not only addresses skills shortages but also reassures workers that their contribution is valued. Employers who invest in their employees’ growth, like VEKA, build loyalty and see lower turnover.

Around one-fifth of UK adults are economically inactive. There must be a concerted effort between employers and the Government to make work pay and to get as many people into roles where they can grow their skills.

Government and industry collaboration is vital to solving the talent crisis. The upcoming Modern Industrial Strategy must provide a strong commitment to employment initiatives that prioritise closing skills gaps. Additionally, investment incentives, simplified planning systems for new projects and tax relief for professional development programmes are policies that could directly benefit the

VEKA has always prioritised training and upskilling its team, aligning with the Government’s push to integrate more individuals into the workforce. This is an opportunity we are eager to support at both our Burnley site and Wellingborough recycling facility, and we recognise the potential for regional growth and development.

We need to see the Government aggressively providing breakthrough solutions that close skills and technology gaps, supporting both manufacturing and construction to deliver growth, improve productivity and meet building targets. At the same time, as an industry, we should collectively work together to promote the benefits of working in the sector and support more people into roles to secure its future.

Creating a sustainable talent pipeline also means diversifying hiring practices. Underrepresented groups are vital to broadening the talent pool. We must lower the barriers preventing these groups from choosing fenestration and construction careers.

Neil Evans is Managing Director of VEKA plc. VEKA plc is the UK arm of global company, VEKA – the world’s largest supplier of PVCu. Based in Burnley, Lancashire, it employs over 400 people, making it a major regional employer.

www.vekauk.com

An already complicated and difficult trading picture for our sector just got a little bit more so as the US implemented 25% tariffs on UK and EU steel and aluminium. It was hoped that the UK would be granted a reprieve as talks are ongoing about a trade deal with America. Disappointingly this turned out not to be the case, with the Prime Minister not ruling out some form of retaliation.

UK exports of steel and aluminium to the US make up only around 5% of America’s total imports. But, the tariffs themselves, both on the UK and EU are going to have ripple effects here at home for the UK fenestration sector. With the use of AI analysis, I have tried to break down the various implications these tariffs may well have on our sector, as well as ways to mitigate them.

The imposition of 25% tariffs on steel and aluminium imports by the United States has profound implications for multiple industries, including the UK fenestration sector. This sector, which encompasses the manufacturing and installation of windows, doors, and associated architectural components, is highly dependent on these raw materials. This analysis delves deeper into the specific technical and economic effects of these tariffs, highlighting their impact on pricing structures, supply chains, and market dynamics, while also exploring strategic responses and mitigation measures.

Steel and aluminium account for a significant portion of the raw material costs in the fenestration sector. The imposition of tariffs disrupts pricing structures through multiple channels:

Direct cost increases: UK manufacturers sourcing steel and aluminium from suppliers affected by tariffs will face higher import costs. The cost increases are likely to be passed

down the supply chain, ultimately raising the price of fenestration products.

Secondary price effects: Even if UK manufacturers source metals domestically or from tariff-exempt countries, global price adjustments due to supply chain shifts will likely drive up costs. Increased demand for non-tariffed metal supplies can lead to artificial inflation in these alternative markets.

Exchange rate fluctuations: If trade tensions escalate, currency devaluation can further exacerbate raw material costs. A weaker pound against the US dollar or euro could make imports even more expensive.

The introduction of tariffs is expected to alter established supply chains in the following ways: Shift in supplier focus: Many suppliers previously exporting to the US may pivot to other markets, increasing competition among UK firms for available stock.

Longer lead times: Increased demand for alternative supply sources could lead to extended delivery schedules, delaying production cycles.

Reduced inventory reliability: Just-in-time (JIT) manufacturing practices, commonly used in fenestration, could be disrupted due to uncertain material availability, forcing companies to increase buffer stocks and thus driving up holding costs.

Competition from tariff-free markets: Nontariffed countries will have a cost advantage, allowing their fenestration manufacturers to price products more competitively in the UK market.

Increased domestic consolidation: Smaller manufacturers struggling with cost inflation may be forced to merge with larger firms or exit the market altogether.

Market segmentation shifts: Companies may focus on premium, high-margin products rather than cost-sensitive segments, affecting affordability for end-users in the residential and commercial sectors.

UK fenestration companies exporting to the US market will experience:

Reduced competitiveness: Higher material costs will make UK exports less price-competitive against domestic US manufacturers.

Potential retaliatory tariffs: If the UK government responds with counter-tariffs, this could further escalate trade barriers, affecting UK businesses relying on exports.

Market reorientation: Companies may seek to diversify into European and Asian markets to mitigate losses from reduced US demand.

Sourcing from alternative markets: Expanding supplier networks beyond affected tariff regions can help mitigate cost volatility.

Exploring recycled materials: Recycled aluminium and steel offer cost-effective, tarifffree alternatives that align with sustainability trends.

Research into composite alternatives: Materials like uPVC, fibreglass, and hybrid composites could reduce dependence on steel and aluminium.

Lean manufacturing techniques: Optimizing production to minimize waste and reduce dependency on raw materials.

Automation and advanced machining: Investing in precision manufacturing can improve material efficiency and lower per-unit costs.

Customizable modular designs: Standardizing

components across multiple product lines can reduce material waste and improve scalability.

Adjusting pricing strategies: Companies may implement value-based pricing models, focusing on quality and energy efficiency to justify cost increases.

Enhanced contract negotiations: Long-term agreements with suppliers could secure stable pricing and mitigate price volatility.

Cost-sharing with customers: Gradual price adjustments and financing options could make price increases more manageable for endusers.

Lobbying for trade relief: Industry bodies can push for exemptions or tariff adjustments.

Exploring government subsidies: Seeking financial support for energy-efficient fenestration solutions that align with UK sustainability targets.

Strengthening domestic production incentives: Encouraging UK-based steel and aluminium production to reduce reliance on imports.

The 25% tariffs on steel and aluminium will have extensive repercussions for the UK fenestration sector, affecting costs, supply chains, competitiveness, and export potential. Companies must proactively implement strategic responses, including supply chain diversification, innovation, pricing adjustments, and government engagement, to navigate these challenges. By adopting these measures, UK fenestration businesses can maintain resilience and remain competitive in a rapidly evolving global trade environment.

In yet another sign of the growing significance of aluminium in the residential sector of our industry, Eurocell as announced today that they have acquired Alunet in a £29m deal.

This marks a major step up for Eurocell in the aluminium space and will further increase the amount of competition within the residential part of the market. They released this statement to the market this morning:

Eurocell plc, the market-leading, vertically integrated UK manufacturer, distributor and recycler of innovative PVC window, door and roofline products, today announces that it has completed the acquisition of Alunet (the “Acquisition”) for consideration of £29 million on a debt / cash free basis, comprising an initial payment of £22 million and deferred consideration of approximately £7 million payable in four annual instalments beginning in 2026. In addition, there is the potential for performance related payments of up to £6m over the same period.

Strategic Rationale and Background to Alunet

The Acquisition advances Eurocell’s strategy, significantly strengthening the Group’s position in residential aluminium systems and composite doors, and adds garage doors to our product portfolio.

Alunet includes a stable of innovative fast growing home improvement brands and comprises four businesses, as follows:

Alunet Systems: An innovative aluminium systems house focused on the residential sector, with a full range of window and door solutions, including bifold and sliding patio doors, sold under the Aluna brand

Comp Door: A fast-growing manufacturer of premium solid core timber doors

JDUK: A supplier of sectional aluminium garage doors and components

UK Doors (Midlands): A manufacturer of aluminium roller shutter garage doors

For the year ended 31 December 2024, Alunet delivered unaudited revenue of £43 million and EBITDA of £4.5 million (on a pre-IFRS 16 basis).

Alunet’s retained team, led by Chief Executive Steve Hudson, will strengthen the Group’s management and Steve will join our Executive Committee. Alunet employs approximately 200 people.

The consideration of approximately £29 million represents a multiple of 6.5x Alunet’s EBITDA for the year ended 31 December 2024.

Additional contingent consideration may become payable, subject to an earnout mechanism, in four annual instalments beginning in 2026, based upon Alunet’s EBITDA in the preceding calendar year. The maximum of £6 million, if achieved, would result in a total consideration of £35 million, representing a multiple of c.4x Alunet’s projected EBITDA for the year ended 31 December 2028.

Approximately £1 million of the initial consideration will be in the form of ordinary shares in Eurocell plc and satisfied out of shares currently held in treasury, with the remainder payable in cash, funded from the Group’s existing £75 million revolving credit facility.

As of 31 December 2024, the Group’s pre-IFRS 16 net debt was £3.1 million. Pro forma for the acquisition, net debt is expected to be below 1.0x EBITDA at 31 December 2025.

The acquisition is expected to be accretive to the Group’s underlying earnings for 2025.

Darren Waters, Chief Executive Officer,

commented:

“Alunet is a great acquisition for Eurocell. It significantly strengthens our position in aluminium, enhances our composite door offering, and adds a premium range of aluminium garage doors to our portfolio of home improvement products.

“Alunet has grown rapidly since its establishment in 2013, and under Eurocell’s ownership, we will leverage our leading market positions in new build, trade fabrication and distribution, to help the business reach its full potential.

“On behalf of the Board I am delighted to welcome the management and employees of Alunet to the Group.”

Read the original article here:

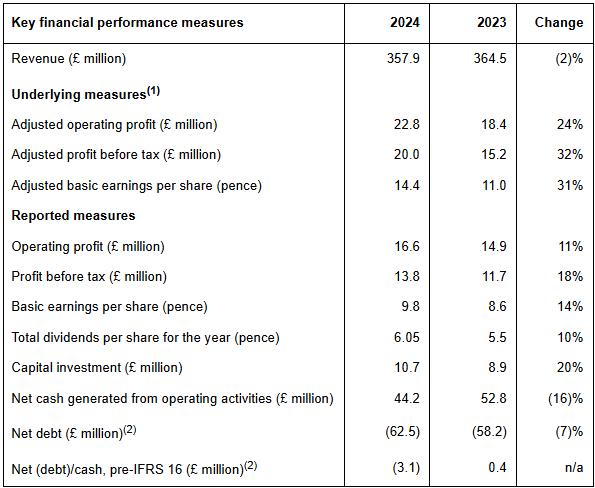

Eurocell Plc, a leading UK-based manufacturer and distributor of PVC-U building products, recently released its full-year financial results for 2024, offering a glimpse into how the company has navigated a challenging economic landscape. With adjusted profit before tax rising by an impressive 32% to £20 million despite a 2% decline in sales revenue to £357.9 million, Eurocell’s performance underscores a story of resilience, strategic adaptability, and operational efficiency. However, beneath the surface of these headline figures lies a more complex narrative—one that reflects both the company’s strengths and the broader headwinds facing the construction and home improvement sectors.

At first glance, the juxtaposition of a significant profit increase with a sales decline might seem counterintuitive. Yet, this achievement speaks volumes about Eurocell’s ability to optimize its cost structure and maintain profitability in a tough market. The company attributes this success to operational efficiencies, a focus on higher-margin products, and disciplined cost management—moves that have clearly paid off. Gross margins improved to 52.1% from 49.7% in 2023, a testament to Eurocell’s strategic shift toward value-added offerings like its fabricated window systems and roofing products.

However, the 6% drop in sales revenue— from £364.5 million in 2023 to £357.9 million in 2024—cannot be overlooked. This decline reflects weaker demand in the newbuild housing and repair, maintenance, and improvement (RMI) markets, driven by high

interest rates, inflationary pressures, and a sluggish UK construction sector.

Eurocell’s leadership, under CEO Darren Waters, has leaned heavily into diversification and sustainability as pillars of its strategy. The company’s Profiles division, which manufactures extruded PVC-U products, saw a modest revenue dip of 3%, cushioned by stable demand for fabricated windows. Meanwhile, the Building Plastics division, which supplies products like roofline systems and cladding, faced a steeper 8% decline, highlighting the uneven impact of market conditions across its portfolio.

Darren Waters, Chief Executive of Eurocell plc said:

“Our financial performance in 2024 was resilient, in the context of trading conditions that remained challenging. We delivered an increase of 32% in adjusted profit before tax, as we continued to proactively manage gross margin and benefited from a reduction in input cost pricing. Our cash generation was solid and our financial position remains strong, following completion of a £15 million share buyback programme.

“We invested to generate momentum with our strategy, and I am pleased with the good early progress we have made across a broad range of initiatives. The recent acquisition of Alunet is a compelling strategic fit for Eurocell: it addresses a growing trend towards aluminium fabrication across the fenestration sector, significantly strengthens our position in composite doors, and adds aluminium garage doors to our home improvement product portfolio.

“Demand in our core RMI market remains sluggish. We have seen some early signs of an improving picture in new-build housing, albeit from a very low base. We will therefore continue to focus on

cost reduction and operational improvements to drive efficiencies, to mitigate against the impact of a slower market recovery. We are confident in delivering another year of good progress in 2025, as we continue to execute on our growth strategy. The medium and long-term growth prospects for the UK construction market remain attractive and we are well positioned to drive sustainable growth in shareholder value.”

One bright spot is Eurocell’s recycling initiative. In 2024, the company recycled 24,600 tonnes of PVC—an increase from 23,400 tonnes the previous year—reinforcing its commitment to a circular economy. This not only aligns with growing environmental expectations but also provides a cost-effective source of raw materials, reducing reliance on volatile virgin PVC prices. It’s a savvy move that bolsters both the bottom line and the company’s ESG (environmental, social, and governance) credentials, a factor increasingly important to investors and customers alike.

Eurocell’s results must be viewed in the context of the UK construction industry’s broader struggles. High borrowing costs have dampened housebuilding activity, while consumer caution has slowed RMI spending—a double blow for a company whose products are tied to both markets. The 8% drop in Building Plastics sales, for instance, mirrors a trend of homeowners delaying discretionary upgrades like new doors or decking. Similarly, the Profiles division’s performance, while relatively robust, reflects a new-build sector grappling with planning delays and affordability challenges. Yet, Eurocell has not simply played defence. Its focus on operational leverage—evidenced by a £4.5 million increase in adjusted profit despite lower volumes—demonstrates a proactive approach to profitability. This contrasts with competitors who may be more exposed to raw material cost spikes or less diversified in their offerings. Eurocell’s ability to pass on price increases selectively, without alienating customers, further highlights its market agility.

Eurocell’s 2024 results are a mixed bag, but one that leans toward cautious optimism. The profit growth is undeniably impressive,

especially against a backdrop of declining sales, and it signals a business that’s adept at squeezing value from a shrinking pie. The recycling efforts and margin improvements are forward-thinking, positioning Eurocell as a player that’s not just surviving but preparing for a greener, leaner future.

That said, the sales decline is a red flag. A 6% drop might be manageable in the short term, but prolonged weakness in demand could test even Eurocell’s formidable cost controls. The UK construction sector shows little sign of a near-term rebound, with interest rates likely to remain elevated into 2025 and consumer confidence shaky at best. Eurocell’s reliance on housing-related markets leaves it vulnerable if these conditions persist.

Moreover, while recycling and operational efficiency are laudable, they’re not gamechangers in a competitive landscape where innovation and market expansion could provide more sustainable growth. Could Eurocell explore new geographies or product lines to offset domestic softness? The company’s £38.3 million net debt—down from £43.5 million— offers some financial flexibility, but it’s unclear whether management will prioritize investment or shareholder returns (like the proposed 7.0p per share dividend) in the year ahead.

Eurocell’s 2024 financial results paint a picture of a company that’s mastered the art of resilience. By boosting profits in a declining market, it has defied expectations and showcased the strength of its business model. Yet, as the construction sector’s woes linger, resilience alone may not suffice. The challenge for Eurocell in 2025 will be to translate this defensive strength into offensive growth— whether through innovation, diversification, or a bolder push into sustainability.

For now, Eurocell deserves credit for navigating a stormy year with skill and pragmatism. But as the economic clouds linger, the question remains: can it build on this foundation to thrive, not just survive, in the years ahead? Only time—and perhaps a few more recycling tonnes—will tell.

Read the full release here:

European software provider Forterro has successfully completed its acquisition of Orgadata AG, following regulatory approval, marking a major milestone in the company’s expansion into the window, door and façade industry. This deal follows the recent acquisition of BM Group, further strengthening Forterro’s footprint in the fenestration software market and creating significant opportunities for innovation and market growth.

With the completion of the Orgadata acquisition, Forterro now officially integrates Logikal, Orgadata’s market-leading software for designing, calculating and producing windows, doors and curtain walls, into its software portfolio. At the same time, the addition of BM Group, the UK and Ireland’s leading fenestration software provider, brings complementary solutions such as Evolution and Touch, solidifying Forterro’s position as a dominant player in the industry.

“This marks an exciting new chapter for Forterro,” said Marcus Pannier, President for all Lines of Business within Forterro. “With Orgadata and BM Group now part of Forterro, we have an unmatched ability to serve the windows and doors market with industryleading software technology. The combination of Logikal’s global footprint and BM Group’s expertise in fabrication and order processing solutions creates an incredible synergy that will drive digitalisation and efficiency for our customers.”

Entering a new market is a strategic move that enhances Forterro’s capabilities, market reach and innovation potential. Orgadata’s strong presence across Germany and international markets, combined with BM Group’s deep expertise in the UK and Ireland, will enable Forterro to support manufacturers across multiple geographies with cutting-edge solutions.

“Together, we are creating a stronger, more connected ecosystem for the fenestration industry,” said Bernd Hillbrands, Founder of Orgadata and Managing Director of this newly created Line of Business for Forterro. “Our goal is to continue innovating and providing customers with the best tools to digitalise their workflows, improve efficiency and stay competitive in an evolving market.”

Forterro’s expansion into the window, door and façade industry reflects its broader mission of powering the businesses that power the future. With an emphasis on scalability, customer success and software excellence, Forterro will continue investing in its newly acquired companies to accelerate their growth and enhance their product offerings.

“2025 is set to be a year of growth and transformation,” added Marcus Pannier. “Our commitment to supporting small and mid-sized craft and industrial businesses remains at the heart of everything we do. With Orgadata and BM Group, we are not just expanding our portfolio—we are reinforcing our ability to deliver meaningful solutions that help our customers succeed.”

With both acquisitions now finalised, Forterro is positioned as a leading software provider in the fenestration sector, setting the stage for continued growth, innovation and customer

success in the years ahead.

Since its foundation in 2012, Forterro has grown into one of the leading software providers for industry, with offices in the most important production countries in Europe as well as regional service and global development centres. From more than 40 locations, more than 1,800 employees provide and support software solutions for more than 16,000 industrial companies. Forterro’s products are customised to meet the needs of each region and industry, enabling customers to strengthen and accelerate their business, operate efficiently and compete effectively.

Orgadata AG was founded in 1999 in Leer, Germany. Today, it is the leading provider in Germany with its Logikal software and sells its products in over 100 countries. More than 600 employees work at 24 locations worldwide. A large proportion of the employees come from the skilled trades themselves and contribute valuable industry experience to the further development of the software. Together with the software developers, system providers and customers, Orgadata is in constant dialogue to ensure that Logikal optimally covers the needs of modern window, door and curtain wall construction.

At the heart of the UK fenestration industry for more than four decades, the Business Micros Group has built its reputation on partnering with fabricators and installers supplying the retail, trade and commercial sectors and helping them make the most of their investment in software, web and digital solutions – from Evolution and EvoNet, to LogiKal and Touch. It employs more than 60 staff based at four locations across the UK and has over 4,000 customers.

The UK economy faces several challenges that increase the risk of a recession, commonly defined as two consecutive quarters of negative GDP growth. Key factors include:

Recent Economic Performance: The UK economy shrank in September and October 2024, with zero growth recorded in Q3 2024. If Q4 2024 also shows a contraction (data not fully available as of now), the UK would already be in a technical recession entering 2025. Forecasts from the Bank of England and others suggest weak growth, with some expecting stagnation or slight declines in early 2025.

Policy Impacts: The October 2024 Budget, introduced by Chancellor Rachel Reeves, raised employers’ National Insurance contributions and increased the minimum wage. Over 70 major businesses warned of job losses and price hikes, potentially costing £7 billion annually. The Office for Budget Responsibility (OBR) and economists suggest these measures could dampen growth, with the Bank of England halving its 2025 growth forecast to 0.75% from 1.5%.

Inflation and Interest Rates: Inflation rose to 2.6% in November 2024, above the Bank of England’s 2% target, and some predict it could exceed 3% by spring 2025 due to budgetary pressures. The Bank is expected to cut rates (possibly three times in 2025, per KPMG, to 4%), but persistent inflation may limit reductions, keeping borrowing costs high and constraining growth.

Global and Domestic Headwinds: Weak demand in Europe, potential U.S. tariffs under a new administration, and subdued

consumer confidence (57% of Britons expect a recession, per Ipsos) add pressure. Business investment is forecast to grow modestly (e.g., 0.8% per BCC), but confidence is low post-Budget.

Forecast Variability: Projections differ widely. The OECD forecasts 1.7% growth, KPMG predicts 1.7%, while the British Chambers of Commerce (BCC) downgraded its estimate to 0.9% for 2025. The Bank of England’s 0.75% forecast reflects pessimism, and some analysts (e.g., James Moore in The Independent) predict a shallow recession in early 2025. The OBR’s 2% growth assumption looks optimistic given recent data.

Given these factors, the likelihood of a recession appears significant—perhaps 40-60%—though not certain. The economy could avoid it if Q4 2024 surprises with growth or if policy adjustments (e.g., faster rate cuts) bolster activity. However, stagnation or mild contraction in Q1 2025 seems plausible, potentially tipping the UK into recession if Q2 follows suit.

If a recession occurs, its severity depends on depth, duration, and mitigating factors. Here’s an evaluation:

Depth: Most forecasts suggest a shallow downturn rather than a severe collapse. Historical comparisons (e.g., the 2008 recession saw GDP fall 6% peak-to-trough) indicate 2025 would be milder—perhaps a 0.2-0.7% GDP decline per quarter, per EY ITEM Club’s past recession models, adjusted for current context. The BCC and Bank of

England expect weak but positive growth overall, implying any contraction would be limited.

Duration: Analysts like Moore predict a “brief and shallow” recession, possibly lasting two quarters (e.g., Q1-Q2 2025). The UK’s 2023 recession lasted two quarters with a 0.4% total drop, and 2025 could mirror this if recovery kicks in by mid-year, driven by lower interest rates and stabilizing inflation.

Mitigating Factors: Real incomes are rising (wage growth outpaces inflation, e.g., 4% vs. 2.6%), consumer savings are relatively high, and the housing market shows resilience (swap rates have eased post-Budget). Government spending increases, though backloaded, could also cushion the fall later in 2025.

Aggravating Risks: Rising unemployment (4.3% in late 2024, projected to hit 5% by some), business closures (e.g., Shoe Zone citing Budget costs), and stagflation risks (stagnant growth with 3%+ inflation) could deepen the impact. A global slowdown or trade disruptions (e.g., U.S. tariffs cutting UK GDP by 0.4%, per KPMG) might worsen outcomes.

Per Capita Impact: Even without a technical recession, GDP per capita could decline due to population growth outpacing output, as seen in 2024. This “recession in living standards” (noted by the Conservative opposition) might feel severe to households

despite mild aggregate figures.

In a plausible scenario, a 2025 recession might see GDP fall by 0.5-1% over two quarters, with unemployment peaking near 5% and inflation hovering around 3%. This would be less severe than the 2008 crisis or the 2020 COVID downturn but more impactful than the 2023 dip, given policyinduced pressures. A “stagflation-lite” outcome (low growth, sticky inflation) is also possible, prolonging economic discomfort without deep contraction.

The UK faces a moderate-to-high chance of recession in 2025, driven by weak momentum, policy headwinds, and external risks. If it occurs, it’s likely to be shallow and short-lived—less severe than past major downturns—thanks to resilient household finances and potential monetary easing. However, uncertainty remains high, and outcomes hinge on Q4 2024 data (released later), policy responses, and global conditions. Critical examination of optimistic forecasts (e.g., OBR’s 2%) suggests they may overestimate recovery speed, while pessimistic views (e.g., stagnation fears) might overstate immediate collapse risks. Monitoring early 2025 indicators will be key.

The Ultion 3-Star PLUS with ALPS has started to ship. Designed to be the most secure door lock available, it is also the first and only lock to defend against every known attack method. After months of anticipation, this groundbreaking security solution is now in the hands of installers across the country.

Ultion 3-Star PLUS with ALPS is built to offer the highest level of security. Unlike many locks that claim to be secure but fail when tested, Ultion 3-Star PLUS has set a new benchmark. It is the first lock to pass the rigorous Sold Secure Diamond 2024 security test, proving its ability to withstand even the most sophisticated break-in attempts. It is also the only lock currently tested to the rigorous BS048 security standard.

Trusted by the Trade Ultion has been working closely with installers, visiting showrooms across the UK to update locks to Ultion ALPS. The response has been overwhelmingly positive.

Paul Culshaw, Managing Director at Heritage Trade Frames, said: “We take security seriously because we know our customers do too. This lock isn’t just ahead of the game, it’s the gold standard. It’s built to protect against everything burglars can throw at it, and then some.”

Jeff Dunn, Sales and Commercial Director at Glazerite, added: “At Glazerite, we’re always looking for ways to help our installers succeed. The Ultion ALPS gives our installers something unique to offer their customers: the highest level of security, backed by real-world testing.”

Ultion 3-Star PLUS with ALPS is easy to install, built to last, and engineered for real security. With ALPS, protection starts the moment the key leaves the lock, keeping homes secure around the clock.

Ready to be part of the next generation of home security?