POST-FORUM REPORT:

Family Wealth Report

POST-FORUM REPORT:

Family Wealth Report

A critical deep dive into the escalating cybersecurity threats facing family offices, uncovering the alarming rise in cybercrime, risk mitigation strategies and the urgent need for robust defenses.

The Family Wealth Report Family Office Cybersecurity Forum 2025 revealed stark realities – from soaring attack rates to trillion-dollar losses – while equipping wealth managers with actionable insights to safeguard assets and ensure operational resilience.

WealthBriefing is the leading subscription-based business intelligence service for the wealth management community, with the latest news, analysis and in-depth features from around the globe. WealthBriefing subscribers are part of an international community for whom staying abreast of the latest industry developments is a crucial part of their professional practice. Readers find our content on topics such as strategy, M&A, important people moves, investment management and asset allocation to be an essential resource in a fast-moving world.

The Asia-Pacific region’s meteoric rise as a major wealth management market has sparked huge demand for region-specific business information. WealthBriefingAsia was launched in 2009 to satisfy this growing information requirement, and it is the only wealth management news site focusing exclusively on the Asia-Pacific region. Providing indispensable news, features and industry views that are always relevant and concise, WealthBriefingAsia allows subscribers to conserve that most precious of all resources: time.

The North American wealth management market is one of the largest and most diverse in the world, and is markedly different from those in Europe and the Asia-Pacific region. Multi and single family offices in particular are a well-entrenched,integral part of the private wealth management landscape. Family Wealth Report provides need to know business intelligence in a convenient and easy-to-read format – straight to subscribers’ inboxes every day. Nowhere else will you find such high quality, in-depth and often exclusive content all in one place.

A unique thought-leadership platform, WealthBriefing’s events foster intellectual debate on the challenges and opportunities facing the industry and are designed to be an optimal use of wealth managers’ precious time and present an excellent networking opportunity.

WealthBriefing has added to its offering for the global private banking and wealth management communities by running thirteen annual awards programmes for the family office, private banking, wealth management and private client communities. The awards programmes are focused around three main category groupings: experts (individuals and teams); products and services for wealth managers and clients, and institutions of all sizes and types

WealthBriefing has unrivalled access to the most senior wealth management professionals across the globe, meaning that our research reports represent guides to future best practice as much as being barometers of current industry trends.

Family Offices Face Protection Paradox: Cybersecurity Forum

Insider Threat - Governance, Incentivizing and Guiding Employee Behavior

Safeguarding Generational Wealth: How Family Offices Can Confront Growing Cybersecurity Risks

Cybersecurity Synergy: Legal, Insurance, and Technology Strategies for Family Office Protection

Move Fast. Stay Secure How AI is Reshaping Digital Defense for Family Offices

The Evolution of Data and Doxxing in a Post-UnitedHealthcare World

Expecting Risk in a Complex Landscape of Cyber and Physical Risks: A Guide for Family Office Managers

Sponsors & Partners

CHARLES PAIKERT

US Correspondent New York Family Wealth Report

The scale of threats and attacks on financial services and related sectors is high, and a major worry for groups such as family offices. In the first of two reports from the Family Wealth Report Cybersecurity Forum, held in Manhattan in June 2025, our correspondent sets out what people close to the action are seeing.

Global conflicts, tariffs and market uncertainty may be dominating the headlines, but cybersecurity concerns are what are keeping family office executives up at night.

Nearly half of family offices around the world experienced a cyber attack in the last 12 to 24 months, according to Deloitte’s most recent Family Office Cybersecurity Report. A staggering 83 per cent of single-family offices identify cyber attacks or data breaches as their biggest risk, according to a recent white paper from Comprehensive Cybersecurity for Family Offices. Losses from cybercrime around the world will exceed $10 trillion this year, according to JP Morgan Private Bank

“It’s mind boggling how much [cyber] criminal activity is happening,” Julia Valentine founder of the technology consulting firm AlphaMille, said at the opening panel of the annual Family Office Cybersecurity Forum, hosted by Family Wealth Report

Phishing, a type of cybercrime where criminals use deceptive methods to trick individuals into revealing sensitive information so they can steal identity or money, gain access to systems, or install malware, is the most common form of cyber breach seen by family offices, Forum panelists agreed.

“We’re also seeing more ransomware attacks, where data from family offices is held until the ransom is paid,” said Ben Tercha, chief operating officer for managed services company Omega Systems. “There’s more teeth to ransomware now and it’s gotten more sophisticated,” Imani Barnes, associate director for Risk Strategies’ national cyber risk practice agreed.

Family offices are also being victimized by cyberenabled identification theft, deep fakes, wire fraud and social engineering, panelists added.

Then there’s artificial intelligence, which has “reshaped cybersecurity,” according to Chris Wake, founder of early-stage venture fund Atypical. “AI can be an ally for prevention, but an adversary for harm,” Wake told Forum attendees. “AI is able to get into undetected entry points and expand the attack surface. Instead of having a fortress for security, family offices need intelligent coordinates across systems.”

Artificial intelligence has accelerated security risks by making phishing emails and video deep fakes “look more legitimate,” said Charlotte Edwards, vice president of operations for Cyberwolf, a cybersecurity firm specializing in UHNW individuals and families. “AI won’t make spelling or grammatical mistakes. It’s much harder to detect.”

AI “is being weaponized for targeted attacks on wealth,” added Ileana Van Der Linde, executive director and head of cyber advisory for JP Morgan Asset & Wealth Management. “You can’t tell if something is real or not.” What’s more, AI’s unprecedented ability to scale creates distractions that can “allow cyberattacks to happen,” said Anna Osborn, chief revenue officer of cybersecurity platform Blackbird.AI.

The biggest vulnerabilities for family offices are a sense of over-confidence that they aren’t vulnerable to cyberattacks and not keeping their cybersecurity up to date, Forum panelists agreed.

“Family offices have a false sense of security that they won’t be targeted,” said Barnes. BNY’s most recent Family Office Investment Report found that family offices “are either over-confident or their systems, policies and procedures are not up to date,” according to Matt Semino, senior client strategist for BNY Wealth.

Family offices need to realize that “there is no anonymity anymore,” said Tristan Flannery, managing partner of risk management firm Presage Global. Social media is largely to blame, panelists agreed. That digital ecosystem, Osborn explained, “puts your assets in harm’s way.”

As a result of the digital footprint we all leave behind, the ability of cybercriminals to target and breach “is at an all-time high,” said Dale Buckner, CEO and president of security firm Global Guardian. “No one can fly under the radar anymore.”

The personal devices owned by family office members and executives are especially vulnerable, panelists warned.

“There are a lot of blind spots on the personal side of family offices,” according to Paul Freeland, PwC partner heading the firm’s Wealth Compass managed service. “There’s no line between private and office devices,” Freeland said. “One in four family offices have malware on shared devices.”

In fact, noted Cyberwolf’s Edwards, mobile phones are the most targeted devices. Sophisticated technology uses “extreme timing and precision,” she explained, “to scrape information from your phone in a split second.”

Microsoft products were singled out as being particularly vulnerable to security breaches. Exiting employees, especially those leaving acrimoniously, are another major source of potential trouble, noted Lisa Nelson, director of family office services at Wealthing VC Club. And as far as cybersecurity consultant Matt Lamura is concerned, “default settings are your worst security nightmare.”

Published in Family Wealth Report on June 16.

In the second of a series of reports, our US correspondent spells out more of the discussions around cybersecurity at the Family Wealth Report Cybersecurity Forum in Manhattan.

When it comes to cybersecurity, family offices face a paradox, according to Matt Semino, senior client strategist for BNY Wealth: they have “significant wealth, but limited resources,” making them very vulnerable to cyberattacks and data breaches.

How family offices can best protect themselves was a major theme at the recent Cybersecurity Forum in New York City, hosted by Family Wealth Report

For starters, family offices need to recognize that in a digital environment of cloud applications and services, remote work, and employees using their personal devices for work, “the actual device is often less important than the identity of the person accessing the data, which is what must now be protected,” according to William Dixon, chief information security officer for cybersecurity service firm VioletX

Preventative anticipation, awareness, good governance and continual evaluation and assessment of digital resources are also critical, Forum panelists agreed.

‘YOU HAVE TO PRESSURE CHECK CONTINUALLY’

“It all starts with awareness,” said Tristan Flannery managing partner at risk management firm Presage Global. “Who has access and what are your assets?” As software is updated, tech stacks must be “constantly evaluated,” said Ben Tercha, chief operating officer for managed services company Omega Systems. “You have to pressure check continually,” added cybersecurity consultant Matt Lamura. “If not, you’re spinning your wheels.”

Cyber activity has to be a major part of family office governance, on the same level as legal documents such as wills and trusts and estates said Byron Loflin, global head of Nasdaq’s advisory board. “The core framework of good governance is humility,” Loflin said. “You have to recognize your need and acknowledge that there are bad actors who want to steal from you.”

People, Loflin added, “make governance difficult,” a sentiment shared by other panelists, including Lisa Nelson, director of family office services at Wealthing VC Club. Nelson urged family offices to monitor employee

satisfaction and how exiting employees were treated. Unhappy employees and a hostile work environment “could escalate to retaliation,” she warned.

Employees should be encouraged to report any internal or third-party cybersecurity weaknesses, and be rewarded for good behavior, said Karen Pocious, head of risk manager WTW’s financial services group for North America.

Web sites employees visit should be monitored and data loss prevention tools employed, said Matthew Webster, chief executive of cybersecurity firm Cyvergence. And family offices must make clear that anything employees create digitally belongs to the firm, added Tim Schnurr, managing partner at data protection firm LeastTrust.

Bring in third parties to evaluate and verify cybersecurity protocols, said Matt Loveless, head of data science and technology for data support firm Builders Vision. Training and testing processes and “internal threat exercises” were also critical, Loveless said.

Tabletop exercises that simulate real-world cyber incidents in a safe environment to identify gaps before bad actors find them “really do help,” said Lamura. “Find out if you can survive without Addepar for an hour.”

If a family office executive or family member is kidnapped or stranded in a foreign country, firms “should be able to wipe data from personal devices remotely,” advised Dale Buckner, CEO of security firm Global Guardian

New York City Police Department sergeant Greg Sanflippo, supervisor in the NYPD’s anti-terrorist and criminal Shield program, urged family offices to establish a relationship with local law enforcement in case of an emergency. “Invite the local precinct captain or community affairs coordinator to your office and get to know them before something bad happens,” Sanflippo said. “It makes a big difference.”

Cyber insurance, which usually covers loss of data, not money, can be a useful cybersecurity tool, but family offices should proceed with caution, panelists said.

Policies should be written down with a risk assessment and a plan to achieve full compliance, said William Roberts, partner and co-chair of data privacy, protection and litigation practice at Day Pitney. “Know your insurance broker and

what’s covered and what’s not,” Roberts counseled. “These policies have a lot of exclusions. Do your due diligence. If the policy doesn’t work, it’s the fault of the buyer, not the seller.”

Charlotte Evans, vice president of operations for Cyberwolf, a cybersecurity firm specializing in UHNW individuals and families, also urged family offices to carefully review cyber insurance policies, especially limits on extortion coverage. “I think a lot of families are getting snowed,” she said.

If family offices are hit with a ransomware attack, know who will make decisions in advance, Evans said. Above all, “understand where your risk exposure is coming from,” said Ileana Van Der Linde, executive director and head of cyber advisory for JP Morgan Asset & Wealth Management. “It’s all about making yourself a harder target,” said Justin Sellars, vice president, private clients for digital executive protection firm 360 Privacy

Published in Family Wealth Report on June 17.

Lisa Nelson

Investor,

Member & Director of Family Office Services - Wealthing VC Club Advisory Board Director - meetSynthia

Lisa Nelson is a board advisor, strategic operator, and investor with deep expertise in scaling high-growth companies, strengthening governance, and navigating regulated markets. She is currently a member, investor and Director of Family Office Services at Wealthing VC Club, a boutique investment club that offers access to vetted investment opportunities and post investment support designed for both impact and return. Lisa also serves on the board of meetSynthia, an employee-first, governance-focused AI company that delivers guardrails to mitigate compliance and data risks in enterprise AI deployments.

Karen Pocious Director - WTW

Karen leads the WTW’s Financial Services Industry Group for North America. She advises firms on a broad range of strategic, human capital and operational issues, including: target operating model design, governance, performance and cost management, risk and compliance management, strategic workforce planning, and incentive program design and implementation. Before WTW, Karen worked at Deloitte and AON on human capital optimization.

Matthew Webster Founder, CEO and CISO - Cyvergence

Matthew Webster is a seasoned cybersecurity leader with a career that began in 1997 at a university computer center and quickly advanced to the federal level. At the Centers for Medicare and Medicaid Services, he gained deep experience protecting sensitive systems under intense oversight, often facing multiple audits a year. This fast-paced environment prepared him for his first role as Chief Information Security Officer (CISO) at Healthix, where he built a cybersecurity program from the ground up to protect millions of health records daily.

Tim Schnurr Managing Partner Inquisitive IT

Tim is a managing partner at LeastTrust. Leasttrust advises mid sized companies on insider threat defense and proprietary data protection. Previously, Tim co-founded a cybersecurity SaaS product focused on DLP and data access management. Earlier in his career he was an IP and cyberse strategist at Deloitte and ICAP Ocean Tomo.

Threats from “insiders” can often be as serious, if not more so, than when they come from outside an organization such as a bank or family office.

In other summary and overview of a panel discussion about threats that family offices face – held at Family Wealth Report’s Family Office Cybersecurity Forum in Mahattan –the speakers discuss “insider threats.” More on the panelists below the article.

The panel on insider threats brought together industry experts to address one of the most pressing security challenges facing modern organizations: malicious insider threats. Unlike negligent behaviors such as clicking phishing links or falling victim to social engineering, this discussion focused specifically on deliberate actions by employees who misappropriate data assets when transitioning to new roles. Schnurr is a legal expert specializing in intellectual property protection; Nelson is a risk management consultant focused on data governance; Pocious is a compliance and governance specialist; and Webster is a chief information security officer.

Their collective insights provide a roadmap for organizations seeking to build comprehensive insider threat programs that balance security with operational efficiency.

Schnurr emphasized the critical importance of establishing robust legal foundations for insider threat protection, drawing from recent high-profile cases such as the Deel versus Rippling litigation. His approach centers on creating multiple layers of legal protection that enable organizations to pursue remedies across various jurisdictions.

Key elements include clearly defining trade secrets, implementing reasonable protection measures, and ensuring comprehensive intellectual property contracts with work-for-hire provisions. He said effective programs require structured training documentation and systematic exit checklists that create legal accountability. Organizations must mandate employee disclosure requirements, ensuring new hires cannot bring trade secrets from previous employers while establishing clear protocols for handling potential conflicts of interest. Perhaps most importantly, Schnurr said that even without sophisticated detection tools, visible legal frameworks create significant preventive effects, as potential bad actors are deterred by the prospect of facing consequences across multiple legal venues.

Nelson positioned data governance guardrails as crucial to preventing insider threats, advocating for systematic approaches that embed security into daily operations rather than treating it as an afterthought. She recommended integrating compliance expectations directly into employment contracts and performance evaluations, requiring employees to provide specific examples of how they adhered to cybersecurity protocols during year-end review processes. She emphasized the importance of documenting how employees handle pressure to deviate from established policies,

creating both accountability and learning opportunities. For family offices, Lisa offered a clear takeaway: Data governance must scale beyond individuals to become part of institutional memory. This is especially critical when assessing or managing portfolio companies.

Governance maturity, including how founders handle sensitive data, communicate exits, and respond to pressure, should be part of extended due diligence and are central to the investment thesis. Nelson said proactive, transparent governance not only mitigates risk but signals operational readiness and leadership integrity, which are key drivers of long-term value. Her approach fosters sustainable compliance cultures that protect sensitive information without stifling agility, making it a model for both in-house operations and portfolio oversight.

Pocious focused on the foundational role of leadership commitment and organizational culture in creating effective insider threat programs. She argued that sustainable compliance requires genuine leadership advocacy rather than superficial policy implementation, emphasizing that leaders must actively model ethical behavior while integrating compliance into core business strategy and objectives (i.e. “tone at the top”). Her framework requires leadership to provide adequate support for compliance functions, demonstrating organizational commitment through resource allocation rather than mere policy statements.

She extended this philosophy to family offices, noting that family members must support organizational compliance by following security protocols, including using firm-approved email accounts, communication portals, and VPN requirements. Pocious called for clear, acceptable use policies that are regularly updated to reflect changing technology and external threats, emphasizing transparency and accessibility as crucial elements for fostering cultures where compliance is understood and valued.

Her approach includes comprehensive training programs using interactive scenarios and case studies, combined with open communication channels that encourage employees to report concerns without fear of retaliation.

Webster brought CISO perspective that extended well beyond technical controls, emphasizing the cultural, behavioral, and leadership dimensions of cybersecurity.

Rather than relying solely on tools, Webster focused on creating a risk-aware environment where employee behavior is shaped through thoughtful incentives, workflow feedback, targeted training, and a culture of accountability.

Webster said aligning cybersecurity efforts with business priorities is essential – security cannot be effective if it operates in isolation. By embedding risk-based thinking into everyday decisions, Matt helps organizations focus on what matters most, avoiding both over engineering and blind spots. He

advocated for tying incentives to outcomes that reduce risk, while also encouraging employees to identify process gaps or third-party exposures. While using technologies securely, behavioral baselining plays a role, Webster said that true resilience stems from empowering people, simplifying compliance, and ensuring that security supports – rather than slows – the mission. For Webster, cybersecurity is ultimately a business function, and leadership must treat it as such.

Family offices face unique insider threat challenges given their handling of highly sensitive financial information, personal family data, and often limited cybersecurity resources compared with larger institutions. The panel’s insights provide a practical framework for family offices to develop proportionate insider threat programs that protect family privacy and wealth while maintaining operational efficiency.

The legal framework elements are particularly crucial for family offices, which often handle multi-jurisdictional assets and require protection across various legal systems. Schnurr’s emphasis on trade secret protection and clear contractual obligations provides essential foundations for family offices managing investment strategies, family business information, IP rights, and personal financial data.

Nelson’s data governance guardrails offer family offices a systematic approach to protecting sensitive information while enabling necessary business operations. Her focus on

positive behavioral nudging through performance integration and training documentation creates sustainable compliance cultures that extend beyond individual employees to organizational knowledge and their portfolio companies. Pocious’s leadership commitment framework is especially relevant for family offices where family members often serve in governance roles and must model appropriate security behaviors for staff.

Webster’s technical controls provide family offices with scalable approaches that can grow with organizational needs while maintaining cost-effectiveness. The integration of incentive alignment with compliance performance provides family offices with practical tools for encouraging appropriate behavior among staff who often have access to highly sensitive family and financial information.

The panel’s collective wisdom suggests that family offices should implement graduated approaches, starting with essential legal frameworks and basic policies before advancing to comprehensive technical controls and cultural integration. The key insight for family offices is that effective insider threat protection requires treating security as an organizational capability rather than a compliance burden, creating environments where protecting family interests becomes part of institutional DNA rather than external obligation (NDA). Success depends on family leadership commitment, systematic implementation of controls, and continuous adaptation to evolving threats while maintaining the personal service and flexibility that characterize effective family office operations.

IWarren Finkel Managing Director, Northeast - Omega Systems

As Managing Director of Omega Systems’ Northeast Region, Warren Finkel leverages decades of experience and deep-rooted relationships within the financial services sector. Prior to Omega’s acquisition of ACE IT Solutions in 2022, where he founded and served as leader for 14 years, Warren cultivated a reputation for delivering exceptional, bespoke IT solutions to family offices, private equity firms, hedge funds, RIAs, and alternative asset firms. His proven ability to combine strategic IT vision with outstanding customer service makes him a highly sought-after advisor.

n this article, we talk to the headline sponsor of FWR’s recent forum on cybersecurity issues about the challenges and potential solutions covering a multitude of threats.

As the Headline Sponsor of the 2025 Cybersecurity Forum, Omega Systems is not just leading the conversation, it’s leading the charge. With deep experience securing high-networth environments, Omega is on the front lines helping family offices navigate the realities of risk, resilience and readiness. In this exclusive Q&A, Family Wealth Report sat down with Warren Finkel, managing director at Omega Systems, to explore the evolving threat landscape and how family offices can strengthen their defenses for the road ahead.

Why are family offices such appealing targets for cybercriminals?

Family offices sit in a unique position of high value and low visibility. They often manage significant wealth, personal data, and private investments – but without the robust security frameworks or regulatory requirements of larger financial institutions. That combination makes them extremely attractive to bad actors. Throw in limited IT staff and lean operational teams, and it’s easy to see why hackers are taking aim.

What cybersecurity risks are unique to family offices compared with other organizations?

Many family offices still rely on legacy systems or public tools to manage sensitive information. That might include unsecured file-sharing platforms, outdated infrastructure, or little to no identity access management. Plus,

cybersecurity awareness and training often fall by the wayside, meaning that employees aren’t always following the best security practices and might not know what red flags to look for. We’ve seen increasingly sophisticated phishing, smishing, and even AI-generated deepfakes that can deceive even well-trained users, which makes it more likely that untrained users may fall victim. Unfortunately, without proper security controls like multi-factor authentication or endpoint security in place, these risks can escalate fast.

CURRENT TRENDS IN THE CYBER THREAT LANDSCAPE

What has changed in the family office threat landscape over the past few years?

Cyber threats have gotten smarter – and faster. We’re seeing attackers use new technologies like AI to create scams that feel incredibly real, whether it’s a fake email from a trusted contact or a message that looks like it came from a family member. At the same time, the way these attacks happen has shifted. It’s no longer just about hacking into systems – it’s about tricking people, exploiting relationships, and sneaking in through less obvious doors, like vendors or partners. For family offices, the damage isn’t just financial – it’s personal and reputational, and that can be much harder to recover from.

Are you seeing certain types of attacks rise faster than others?

Absolutely. Business email compromise (BEC), credential harvesting, and ransomware remain among the most common threats. But what’s alarming is how personalized these attacks are becoming – cybercriminals are researching individuals, tailoring their approaches, and exploiting trust.

Voice cloning, fake wire requests, and fraudulent investment correspondence are all tactics that can be deceptively used against family offices to gain access to their sensitive data and financial details.

As a managed IT service provider for family offices, Omega Systems is on the front lines witnessing these types of attacks and implementing processes and controls to thwart them. What is Omega’s general approach to security in this evolving threat landscape?

To start, we strongly believe that there is no one-size-fits-all approach to cybersecurity. There are key hallmarks within certain sectors and industries and shared knowledge, but effective risk management today is about combining the strength of enterprise-grade security with the agility and white-glove service that family offices demand.

That approach doesn’t have to be cost-prohibitive either; it just needs to be thoughtful. Our model is built on defensein-depth – meaning we layer detection, protection, and response technologies to reduce gaps and decrease the chance that any single point of failure will compromise the entire operation. Beyond developing robust solutions, it’s also our commitment to security education and strategic advisory that sets us apart in this space.

How does Omega tailor its services to fit the needs of family offices?

We begin with a comprehensive risk assessment to uncover blind spots. From there, we design a roadmap tailored to the office’s size, structure, and operations – everything from cloud security and endpoint protection to backup and incident response planning. Importantly, we help establish a culture of security. That means training family members and staff, creating clear playbooks for responding to incidents, and ensuring that systems can scale securely over time as the office grows or evolves.

What’s the first move a family office should make if they want to strengthen their cybersecurity?

Start with better visibility. You can’t protect what you don’t know you have. Many family offices lack a complete inventory of their digital assets, user access, or even where sensitive data lives across their network. That’s a critical first step. Next, work with a trusted partner – like Omega – who can help design a strategy, implement security controls, and offer continuous monitoring and response. This is not a “set it and forget it” exercise. These threats evolve daily, and so must your defenses.

Any final thoughts or best practices to share with our readers?

Years ago, it was easy to overlook security or let it fall to a lower priority while you focused on other operational details. With the threats we’re seeing today, that’s no longer a reality. For family offices stewarding generational wealth, the stakes are incredibly high. We’re proud to be a trusted advisor to the family office community and remain committed to helping them build smarter, stronger, and more secure operations for the future.

As managing director of Omega Systems’ Northeast Region, Warren Finkel leverages decades of experience and deep-rooted relationships within the financial services sector to bring meaningful IT solutions to his customers. In his 25+ years in the IT industry, Warren has cultivated a reputation for delivering exceptional, bespoke IT solutions to family offices, private equity firms, hedge funds, RIAs, and alternative asset firms. His proven ability to combine strategic IT vision with outstanding customer service makes him a highly sought-after advisor.

Imani Barnes

Associate Director National Cyber Risk Practice - Risk Strategies

As a solutions-oriented insurance professional, Imani brings a strong background in enterprise risk management, client service and relationship management. Additionally, she has diverse industry knowledge in verticals like Real Estate, Construction, Healthcare, Fine Arts and more. Recognized for crafting and executing an efficient client engagement strategy, Imani has become known for her collaborative leadership style. She is also known for her expertise in insurance program evaluation, marketing, design, claims handling and overall risk management for Cyber and Professional Liability lines of insurance. Imani possesses the skillset to effectively inform, build trust, and produce results for clients.

Operations - Cyberwolf

Charlotte Edwards is the Vice President Operations of Cyberwolf. Cyberwolf is a VIP cybersecurity boutique firm, specialized in personal cybersecurity for company leadership and UHNW individuals and families. Charlotte has worked in IT and Cybersecurity for the last 7 years and joined Cyberwolf two years ago. She successfully spearheaded the US branch of Cyberwolf as the company continued its European success story in North America. In an era where digital threats are at an all-time high, she has successfully brought personal cybersecurity to Fortune 500 leadership, nobility and wealthy families.

Founder and CEO - Atténuer Risk

Kate Norris is a recognized industry expert, having served hundreds of family offices and wealth advisory firms for over 25 years working on the broker, carrier, wealth advisory and consultancy sides. Kate founded Atténuer Risk in 2021 and serves her clients as a fee-only risk and resiliency consultant. Kate maintains her insurance licensing and graduated from the University of Kansas. She serves on the Advisory Board of the Council for Insuring Private Clients & High-Net-Worth Individuals and is a faculty member for the National Alliance–CPRM designation.

William Roberts

Partner, Co-chair of the Data Privacy, Protection, and Litigation Practice - Day Pitney

William J. Roberts is a nationally-recognized data privacy and cybersecurity advisor to businesses, nonprofit organizations, government entities, and families worldwide. He is a Partner at the firm, co-chair of the firm’s data privacy and cybersecurity practice, and an Adjunct Professor of data privacy law at the University of Connecticut School of Law. He has received numerous accolades for this work advising family offices across the country on data privacy and cybersecurity matters.

This session focused on the evolving cybersecurity landscape and its implications for family offices, with three key areas of discussion:

1. Cyber Insurance - Imani Barnes, Risk Strategies

Panelists explored common misconceptions about cyber insurance, current market capacity, and the coverage limits family offices are purchasing. They emphasized the importance of understanding policy exclusions and aligning coverage with actual risk exposure.

2. Cyber Profiles and Risk Exposure - Charlotte Edwards, Cyberwolf

The discussion highlighted how an individual’s or family office’s online profile can significantly increase their vulnerability to cyber threats. Panelists explained why visibility matters and how it can make high-net-worth individuals prime targets for cybercriminals.

3. Regulatory and Compliance Requirements

- Bill Roberts, Day Pitney

Bill Roberts of Day Pitney shared real-world examples of how family offices have faced challenges with compliance and regulatory obligations related to cybersecurity. The panel stressed the importance of proactive governance and internal controls to avoid legal and reputational risks.

Cybersecurity for family offices extends well beyond technical controls and vendor vetting—it is now a board-level governance issue with real regulatory, reputational, and legal implications. Family offices, while often operating under the radar, are increasingly falling within the scope of both sector-agnostic and industry-specific privacy and cybersecurity frameworks. This trend is driven by the sensitive personal, financial, and biometric data they process and the growing sophistication of threat actors targeting high-net-worth individuals (HNWIs).

Emerging Threats Specific to Family Offices through the eyes of these experts:

Personal device & account targeting: Infiltration often happens through personal devices, accounts etc that sync with business accounts but where not security is enabled (or where exceptions to security were made).

Threat actors conduct extensive research on family member’s digital footprint to find the path of least resistance.

Multi-vector deepfake social engineering: Coordinate campaigns with multiple AI generated personas that are psychologically difficult to detect (they create a context where it’s difficult to speak up or challenge the request).

• APT campaigns (Advanced Persistent Threat):

Threat actors spend weeks to months studying family operations, getting to know the target (nicknames, interests, tone of voice, people they frequently interact with…). They patiently prepare an attack plan and strike

at a vulnerable moment (example discussed: wife buying furniture for the 2nd house or when they travel).

• Deepfake-Enabled Social Engineering: Attackers are now leveraging generative AI to impersonate family members or key staff via voice/video—undermining verification protocols and enabling fraudulent instructions.

• Supply Chain Intrusions Through “Trusted” Vendors: We’ve observed a spike in breaches via IT consultants, concierge firms, private aviation services, and luxury security providers—vendors often trusted implicitly but lacking in cyber hygiene

• Privacy-Centric Extortion Campaigns: Threat actors increasingly threaten to release personal photos, private family communications, or sensitive location data—not just financial records—in extortion attempts targeting HNW families.

The session concluded with a set of best practices for family offices, including:

• Conducting regular cyber risk assessments.

• Implementing robust incident response plans.

Educating family members and staff on cyber hygiene Ensuring cyber insurance policies are tailored to specific risks.

Staying current with regulatory changes and compliance obligations. Understand what activities may trigger may trigger obligations under laws like state privacy laws (e.g., CCPA in California), GDPR (if operating in the EU), and state data breach response laws.

Operationalized incident response plans and test them. operationalized (e.g., incident response plans remain untested).

Formalize and update your Third-party risk management. In addition to technical controls, the legal team should be engaged early in cyber readiness planning.

This includes:

Conducting tabletop exercises with legal/regulatory scenarios.

Mapping data flows to assess cross-border risks and vendor exposure.

Aligning incident response with privilege protections and breach notification triggers.

Hire specialized partners: Trust experts who are used to working to your context (wealth, family office). Do not opt for a generic provider. Family office context requires a specialized approach.

Harden personal devices & accounts: Hardening means enabling the default security settings that are already there (e.g. on iPhone > run ‘Apple Security Check’; only use 6 digit codes instead of 4, enable MFA on accounts. And help families build a security posture by: recommending professional parties to provide the technology and help them ask questions in family context: e.g. what information is off-limits to share online for our family?

Focus on the human aspect: People are often the weakest link. Be aware of that, help them grow in the world of security and make sure they trust you. Because they will need you when an incident happens.

As cyber threats continue to evolve in complexity and precision, family offices must adopt a proactive, holistic approach to cybersecurity. This means going beyond traditional IT solutions to include legal, regulatory, and human-centric strategies. The insights shared during this session

underscore the urgency of building a culture of cyber awareness, investing in tailored protections, and engaging trusted experts who understand the unique dynamics of high-networth families. By embedding cybersecurity into governance and daily operations, family offices can better safeguard their assets, privacy, and reputation in an increasingly hostile digital landscape.

TChris Wake Founder, Atypical

Chris Wake is the Founder of Atypical, an early stage venture fund investing in plausible science fiction. He brings two decades of experience as an operator to his investing, including work on both hardware and software in the fields of aerospace, AI, and cybersecurity. Chris was a co-author on Commercial Space Systems Security Guidelines, and he has advised and invested in a number of foundational security and AI ventures. For instance, he has invested in AI infrastructure, supercomputing, AI semiconductors, xIOT security, continuous authentication, trust infrastructure for payments, and search rebuilt for AI. Two noteworthy investments for the Summit audience include: BKLN and Norm, each of which serve major asset managers.

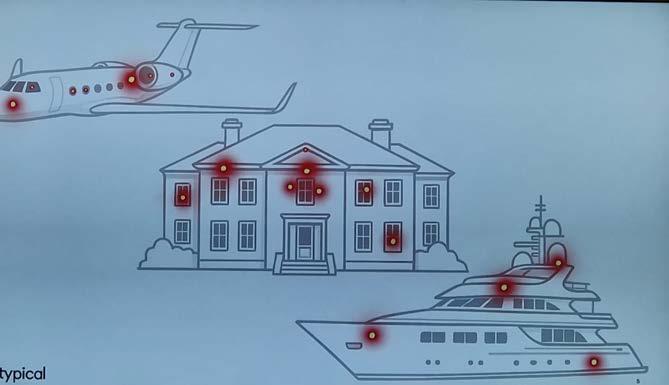

he same technologies that enabled generational wealth creation have become the greatest threat to preserving it. This paradox lies at the heart of modern cybersecurity challenges facing ultra-high-net-worth families and their offices.

For generations, wealthy families understood a fundamental truth: speed creates opportunity. Faster capital movement, quicker decisions, and real-time market access each provided competitive advantages that built fortunes. But here’s what wasn’t anticipated – every system that increased velocity also increased visibility, and every efficiency created a new attack surface.

The evolution from physical ledgers to computers to smart phones to AI assistants has been a double-edged sword. Each technological leap forward that made family offices more efficient also made them more exposed. Virtually every family office that once operated in relative obscurity now has a digital footprint spanning continents.

Traditional social engineering was a slow, methodical approach to infiltrating organizations. Today’s threat landscape has evolved into something far more sophisticated: social architecture. Adversaries aren’t using just one AI tool anymore – they’re orchestrating entire ecosystems of artificial intelligence.

The speed differential is staggering. Modern AI systems can create a fake consulting firm in 60 seconds, complete with AI-generated headshots and LinkedIn profiles, then target family members or board members with direct outreach. Where social engineering was slow and labor-intensive, social architecture is incredibly fast and scalable.

Consider this scenario: An AI-powered attack begins targeting your family office. Within the first minute, AI systems have initialized, scraped public data, and identified target profiles while your organization continues normal operations, completely unaware.

By 30 seconds in, fake personas are generated and outreach content is created. At 45 seconds, a coordinated attack launches across multiple vectors — and only then do you receive your first security alert. Within 60 seconds, the breach is achieved with complete social architecture deployed, while your security team is just beginning to mobilize.

This isn’t theoretical—this represents the current speed gap between AI-powered attacks and human response capabilities.

Perhaps even more concerning than social engineering attacks is how AI can exploit systems directly, without needing to trick humans at all. What appears as a secure digital ecosystem to IT teams — with all systems showing green status indicators — looks entirely different through an AI lens.

Where humans see individual, secure systems, AI identifies interconnected vulnerabilities and maps attack paths. It might start with weak guest access in collaboration tools, harvest credentials, access email systems, find cloud storage keys, and ultimately compromise investment platforms. The front door may be locked, but AI can identify dozens of windows that humans never knew existed.

The traditional cybersecurity approach of building higher walls and stronger defenses is fundamentally mismatched to this new threat landscape. The future of family office security isn’t about creating impenetrable fortresses—it’s about intelligent coordination.

AI defense systems operate on an entirely different paradigm. While human security teams are still assembling to respond to an alert, AI defensive systems can detect threats, coordinate across dozens of different systems, block attacks globally, share intelligence with other defensive networks, and update security protocols—all in under a minute.

This represents a shift from reactive, human-dependent security to proactive, coordinated defense. Traditional security operates at human speed; AI defense operates at machine speed with human oversight.

The solution isn’t to slow down operations for security—it’s to speed up intelligently. The same velocity that created success can protect it when properly harnessed. Rather than building fortress walls around assets, family offices should focus on creating or purchasing intelligent networks that share threat intelligence instantly.

This approach provides coordination at machine speed while maintaining human oversight and decision-making authority. It’s about moving from defensive thinking to intelligent offensive security—using AI to fight AI.

The fundamental question facing family office leadership isn’t whether AI will reshape cybersecurity—it already has. The question is: who’s holding the technological lever? As Archimedes said, “Give me a lever long enough, and I shall move the world.” AI has become that lever in cybersecurity.

The challenge for family offices is determining whether they’re moving at the speed of trust or still operating at the speed of fear. Those who embrace intelligent, AI-powered defensive systems will maintain their competitive advantages while protecting their assets. Those who rely solely on traditional security approaches will find themselves increasingly vulnerable to attacks that move faster than human response capabilities.

The technologies that built generational wealth don’t have to become their undoing. By understanding the new threat landscape and embracing AI-powered defensive coordination, family offices can turn their greatest vulnerability— speed and interconnectedness—back into their greatest strength.

Speed built these fortunes. Speed, protected by artificial intelligence, will preserve them for generations to come.

Tom Aldrich Chief Revenue Officer - 360Privacy

Tom Aldrich joined 360 Privacy in 2022 after having worked at Goldman Sachs as a private wealth advisor. He came to Goldman from the US Army, where he served as a Green Beret and functioned as both a communications and intelligence subject matter expert. He deployed overseas four times, where he was responsible for tactical and strategic targeting, intelligence, and digital exploitation. Tom is a Certified Ethical Hacker and obtained his CIPP/US certification from the International Association of Privacy Professionals.

Managing Director - 360 Privacy

Trinity Davis boasts an 18-year tenure in the Executive Protection Industry, during which he has expertly cultivated and guided cross-functional teams. His unwavering commitment has been pivotal in safeguarding the security and privacy of executives and their families across diverse sectors, including private industry, Social Media, FinTech, and the Private Family Office Space. Through his exceptional leadership, he has consistently ensured the highest standards of safety and confidentiality, earning trust from those he has been charged with protecting, and peers alike.

Supervisor in the NYPD Shield program, Major in the U.S. Army Reserves

Sergeant Greg Sanfilippo joined the NYPD in 2008. He currently serves as a supervisor in the NYPD Shield program, acting as a key liaison with private sector security executives to help deter, detect, and identify terrorist and criminal activity in New York City. The Shield program is an internationally recognized public-private partnership that provides vital information and collaborative support to its stakeholders. In addition to his NYPD role, Sanfilippo is a Major in the U.S. Army Reserves, where he commands Detachment 1 of the 10th/80th Battalion (OES).

Vice President Private Clients - 360 Privacy

Justin Sellars is a seasoned professional with over 20 years in law enforcement, including his time with the NYPD’s Harbor Unit in the Special Operations Division. During his career, he was involved in the planning and execution of large-scale waterfront events, dignitary protection, and critical rescue missions, including the “Miracle on the Hudson.” For the past two years, Justin has worked in digital executive protection, leveraging his security expertise to protect high-profile clients in the digital realm. He is also a proud 9/11 first responder, U.S. Coast Guard veteran, and former NYC paramedic.

This panel, hosted by 360 Privacy, gathered real-world experience and lessons-learned from security practitioners who have spent decades serving and protecting ultra-high net worth (UHNW) families and Fortune 500 enterprises. From protests which ended at the home of a family’s primary residence, to online threats and doxxing (and in rare cases even physical incidents), protectors and family office professionals are called upon to mitigate risks of all types.

Doxxing has been traditionally defined as the act of publishing personally identifiable information on the internet, typically with malicious intent. According to recent study by SafeHome.org, approximately “4% of Americans, or an estimated 11 million people, reported that they’ve personally been victims of doxxing attacks”. Additional metrics from that study point out that half of all victims claim that their home addresses were involved, and 20% of those incidents involved information about their families. The most common side effects of doxxing were damage to professional reputation, physical safety risks, mental health impacts, and financial losses.

The panel first heard from Trinity Davis, who has spent over two decades managing operations and the overall protection strategy for UHNW families. Trinity described various incidents in his career where he was tasked with managing a crisis, which oftentimes began in the digital space and then migrated to the physical world. A large part of his successes and lessons learned came from a multi-layered approach to protection, including outside vendors to assist with personal information removal from the internet, leveraging free resources and managing relationships with local municipalities, and public-private partnerships. Through each experience, the panel also touched upon the importance of incident response, managing expectations and outcomes, and how communication with the families, executives, and offices evolved over time.

Justin Sellars and Greg Sanfilippo then expanded upon the public-private partnership piece by discussing a doxxing event that occurred in late May 2025. When a particular website came to the attention of 360 Privacy, Justin and Greg began leveraging their networks to help crowdsource a solution for those effected. This particular URL, which at the time was not indexed by search engines, exposed the names, email addresses, phone numbers, and email addresses of over 1,000 companies and 23,000 individuals. The title of the URL had ties to the UnitedHealthcare incident which

took place in December 2024. Through his extensive experience working with NYPD SHIELD, Greg helped introduce Justin to the head of the FBI’s public-private partnership, Infraguard. Over the course of 72 hours, these teams were able to help with the removal of the website from public viewing and educate clients and concerned citizens alike on various proactive steps they could take to further “harden” their own digital footprints.

An often overlooked, though widely available resource, is a digital risk and/or vulnerability assessment. This can be done through a third-party who specializes in open-source intelligence work, or through an IRC Reg. 132 assessment, which carries potential tax savings based on the risk tied to the executive(s) because of their title(s). To ensure thoroughness, it is recommended that these reviews include analysis of exposures on the open, deep, and dark web, with a particular focus on disclosure (and potential compromise) of personally identifiable information.

Outside of paid services, family offices also have access to free resources that can aid in reducing the overall exposure of personal information. Google recently introduced their “PII Removal Tool”, which helps de-index certain search results that are tied to data aggregator websites (think Spokeo.com, BeenVerified, WhitePages, etc.). The process is fully automated and, assuming that the result qualifies under Google’s Terms, the procedure takes less than 24 hours from start-to-finish.

At the state level there are also resources like the Safe At Home / Address Confidentiality Program. In New York, qualified individuals can take advantage of this program offered by the Attorney General’s office to obtain a unique, non-attributable physical address (oftentimes used for personal and professional purposes). In Suffolk County, homeowners can register for the Homeowners Watch List (HOWL). This free resource allows individuals, families, or family offices to “receive email notifications any time a deed or land record affecting their property is recorded and/or filed with the Suffolk County clerk.”

Lastly, registration and participation with public-private partnerships like Infraguard can help assist teams and family offices alike in managing information, intelligence, and expectations during doxxing events. Partnerships like NYPD SHIELD even have sub-groups within certain industries and verticals for information sharing and intelligence purposes.

IDale Buckner CEO - Global Guardian

Dale Buckner is the CEO and President of Global Guardian, LLC. He has been leading Global Guardian since its inception in March 2012 and is directly responsible for the dayto-day operations and its growth. He is a decorated Combat-Commander with multiple combat tours and classified operations in Iraq, Afghanistan, Colombia, Haiti and Cuba and executed deployments to Russia, El Salvador, Honduras, Chile, Panama, Kuwait, and Qatar. Dale served in the United States Army Infantry (9 years), Military Intelligence (2 years), and Special Forces Green Berets (13 years). He commanded 5 organizations including an Infantry Reconnaissance Platoon, Special Forces Scuba Team, Special Force Counter-Terrorism Team, a Special Forces Counter-Terrorism Task Force, and a Special Troops Battalion.

Ileana van der Linde is an Executive Director and a member of the J.P. Morgan Private Advisory leadership team, a cross-disciplinary group of over 100 global specialists who collaborate to deliver innovative and forward-thinking strategies, working closely with Private Bank Advisors to help clients make well-informed decisions and achieve their goals. As Head of Cyber Advisory, Ileana educates clients and employees globally on how to better protect themselves, their families and their businesses from increasing cybersecurity threats. Ileana and her team develop timely cybersecurity educational materials on various topics to help address the needs of wealthy individuals, family offices, businesses and other centers of influence so that they are better prepared to deal with the reality of cyber threats.

n today’s interconnected world, the landscape of risks faced by family offices has evolved dramatically. Understanding and mitigating these risks is crucial to safeguarding the wealth and well-being of your clients.

Cybersecurity remains the top concern for family offices around the globe, as highlighted by J.P. Morgan’s Private Bank 2024 Family Office Survey. Family offices, tasked with managing financial and reputational risks, are rightfully concerned, as cybercriminals target their wealthy targets. While one in four family offices have already experienced breaches, this number rises to 40% for those managing assets exceeding $1Bn. The financial impact of cyber breaches can be staggering, with losses projected to rise to $10 trillion in 2025. This underscores the critical need for family offices

to prioritize cybersecurity measures and protect their assets from evolving threats.

With artificial intelligence fueling more sophisticated attacks, cyber risks are evolving at an unprecedented pace. Family offices must remain vigilant against threats like phishing, social engineering, deepfakes, data poisoning, disinformation, and weaponized AI.

“In their rush to embrace AI, some families may not appreciate how much information is being collected about them via the AI tools and apps. It is so important to implement these tools securely, and implementing robust cyber protections across personal and professional domains is essential.”

- Ileana van der Linde

As more personal information becomes available due to numerous data breaches, the interconnected nature of cyber and physical risk is heightened. Wealth has long been a target, but recent events in Canada, France, and New York indicate that crypto wealth is becoming a new focal point in an increasing wave of threats, not only leading to digital compromise, but also physical danger for some victims.

Nearly 50% of data breach content is personally identifiable information1, making personal attacks much easier to conduct. Recognizing the intersection of physical and digital risk is crucial as family offices manage and plan for the family’s physical security, particularly at home and during travel.

Unpredictability has become the new normal not only in financial markets, but also in geopolitical affairs, with reverberating effects on families at home and work. Significant economic and geopolitical shifts, trade policy uncertainty and shifts in long-standing security stances have further intensified cyber and physical risk and have left many in global community unsettled.

“Boards and leadership are now grappling with the unavoidable realities of geopolitical tension and economic fragmentation. Ignoring these factors is no longer an option—it’s a liability” - Dale Buckner.

At this stage, one has to expect the unexpected anytime, anywhere in the world, making risk preparedness a critical component of family office operations. A broad digital footprint leads to heightened risk. Even within the perceived bubbles of safety many families believe they live in, understanding the connection to physical risk is important, and preparing for unpredictability needs to be the new normal.

Closer to home, the targeting of corporate executives and sports figures with known itineraries increases risk at residences and during travel. Sophisticated criminal groups are targeting wealthy families when they are known not to be home, using cyber techniques such as home Wi-Fi jamming, disabling alarm systems and cameras. As families travel close or far from home, commute to and from work, or students study abroad – again, preparing for eventualities is key.

Family offices must anticipate risk of all kinds and be prepare for potential disruptions. Engaging with experts and having contingency plans in place can mitigate the impact of these conflicts on family wealth.

1. Integrate Security into Decision-Making: For a family office, it’s critical to keep cyber and physical risk top of mind as part of readiness discussions for families as they need support at home and while travelling. Be aware of the geopolitical tensions and economic fragmentation that can cause an escalation.

2. Stress-Test Emergency Plans: Ensure that any and all emergency plans are stress-tested before incidents occur. Establish relationships with security providers, legal advisors, PR, and cyber risk mitigation providers before a crisis.

3. Reduce Digital Footprints: Take an active approach to reduce the public exposure and digital footprint of family members to minimize potential physical and cyber threats. Implement cyber defenses and privacy tools daily to keep risk exposure to a minimum.

4. Plan for Emergencies: Before family members or office staff travel for business or pleasure, plan for emergencies. Determine how you or the family will handle a crisis before it occurs. Hire professionals and experts to guide you in the event of medical emergencies, natural disasters, or other needed evacuations.

As global uncertainty increases, it impacts us through geopolitical conflict affecting trade, travel, and physical security. Our digital footprints can be accessed by nearly anyone from the other side of the globe, causing risk and disruption close to home. Expect risk, play offense, and be prepared for increasing eventualities.

By taking these proactive steps, family offices can better navigate the complexities of today’s risk landscape, ensuring the safety and security of their members and assets.

1 https://secureframe.com/blog/data-breach-statistics

HEADLINE SPONSOR

As a multi-award-winning managed service provider (MSP), Omega Systems is passionate about delivering the security and compliance expertise today’s businesses need alongside the responsive and reliable managed IT support they deserve.

Omega’s service-driven IT solutions portfolio includes 24x7 managed IT support, cybersecurity risk management, managed detection & response (MDR), backup and disaster recovery, IT compliance services and more.

Serving financial firms across the U.S. and internationally – including family offices, RIAs, hedge funds, and other investment firms – Omega Systems delivers a superior and satisfying customer experience unparalleled by other MSPs.

For more information visit: www.omegasystemscorp.com

VENUE SPONSOR

BNY is a global financial services company that helps make money work for the world – managing it, moving it and keeping it safe. For more than 240 years BNY has partnered alongside clients, putting its expertise and platforms to work to help them achieve their ambitions. Today BNY helps over 90% of Fortune 100 companies and nearly all the top 100 banks globally to access the money they need. BNY supports governments in funding local projects and works with over 90% of the top 100 pension plans to safeguard investments for millions of individuals, and so much more. As of Dec. 31, 2024, BNY oversees $52.1 trillion in assets under custody and/or administration and $2.0 trillion in assets under management.

For more than 50 years, BNY Wealth has been a trusted partner for family offices, delivering tailored family office services that enhance operational efficiency, reduce risk, and safeguard generational wealth. These results stem from a family office investment strategy built on deep expertise and a collaborative approach that starts from day one. Few family office service providers understand the complex financial and investment needs of wealthy families like BNY Wealth. Solutions include Family Office Wealth Management, Governance, Philanthropic Advisory, Technology Consulting and Trust Planning. BNY Wealth provides educational resources covering family office strategies, financial education, leadership development, and succession planning-along with best practices in cyber, physical, and personal risk management.

For more information visit: www.bny.com

360 Privacy’s mission is to protect the digital identity and reputation of high-profile executives, professional athletes, ultra-high-net-worth families and family offices.

With experts from Special Operations, Intelligence Community, Corporate Security, Finance, and Technology sectors, we give our clients the ability to regain control over their personal information and privacy by reducing digital risk.

We combine our decades of professional experience with propriety technology to provide the most comprehensive and customized Digital Executive Protection available.

For more information visit: www.360privacy.io

Cyberwolf is an exclusive cybersecurity suite that protects the private lives of VIPs, such as corporate executives, board members, high-net-worth individuals and their families. Imagine having a personal bodyguard for your entire online life, without compromising on convenience or privacy, so you can relax and focus on what matters.

Our personal cybersecurity service combines the best enterprise-grade security technology with a collective of cyberexperts ready by your side.

We’ve got their digital backs. Worldwide, 24/7.

For more information visit: www.cyberwolf.io

Day Pitney, an East Coast-based law firm with national and international reach, has more than 300 attorneys in 13 offices in Boston, Connecticut, Florida, New Jersey, New York, Providence, and Washington, DC.

The firm offers clients strong corporate and litigation practices, with experience on behalf of large national and international corporations, as well as emerging and middle-market companies. With one of the largest and most sophisticated private client practices in the country, the firm also has extensive experience helping individuals and their families, fiduciaries and tax-exempt entities plan for the future.

For more information visit: www.daypitney.com

Risk Strategies, the 9th largest U.S. privately held insurance brokerage firm, specializes in providing comprehensive insurance solutions, expert risk management advice, and consulting services designed to meet the unique needs of businesses and individuals across the country. Our Private Client Services team, together with our Cyber liability experts, focus on preparing family offices and successful families to face a complex future with confidence. We offer a full suite of Private Client insurance solutions to protect our clients’ assets and passions, including their homes, vehicles, collector cars, yachts, equine interests, aviation exposures, fine arts, private collections, data, personal information, and more.

For more information visit: www.risk-strategies.com