ACCLAIM

RECOGNIZING LEADERS AC ROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY THROUGH THE Family Wealth Report AWARDS PROGRAM

RECOGNIZING LEADERS AC ROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY THROUGH THE Family Wealth Report AWARDS PROGRAM

Technology & Operations Trends in Wealth Management 2024

(in partnership with Alpha FMC)

This 12th edition of WealthBriefing’s Technology & Operations Trends in Wealth Management report, created with Alpha FMC, provides a global overview of how digital transformation is reshaping the wealth management sector. Firms across various regions are leveraging technology to enhance operational efficiency and client experience, while navigating evolving client expectations, regulatory changes, and a complex economic environment.

Philanthropy Evolved: How High-NetWorth Individuals are Redefining Giving, Ethics and Impact

(in partnership with Jersey Finance)

Philanthropy is undergoing a profound transformation as high-net-worth (HNW) individuals redefine traditional notions of giving, ethics, and impact. This report delves into these shifts, offering a comprehensive analysis of emerging trends, generational influences, and the evolving dynamics between wealth, altruism, and social responsibility.

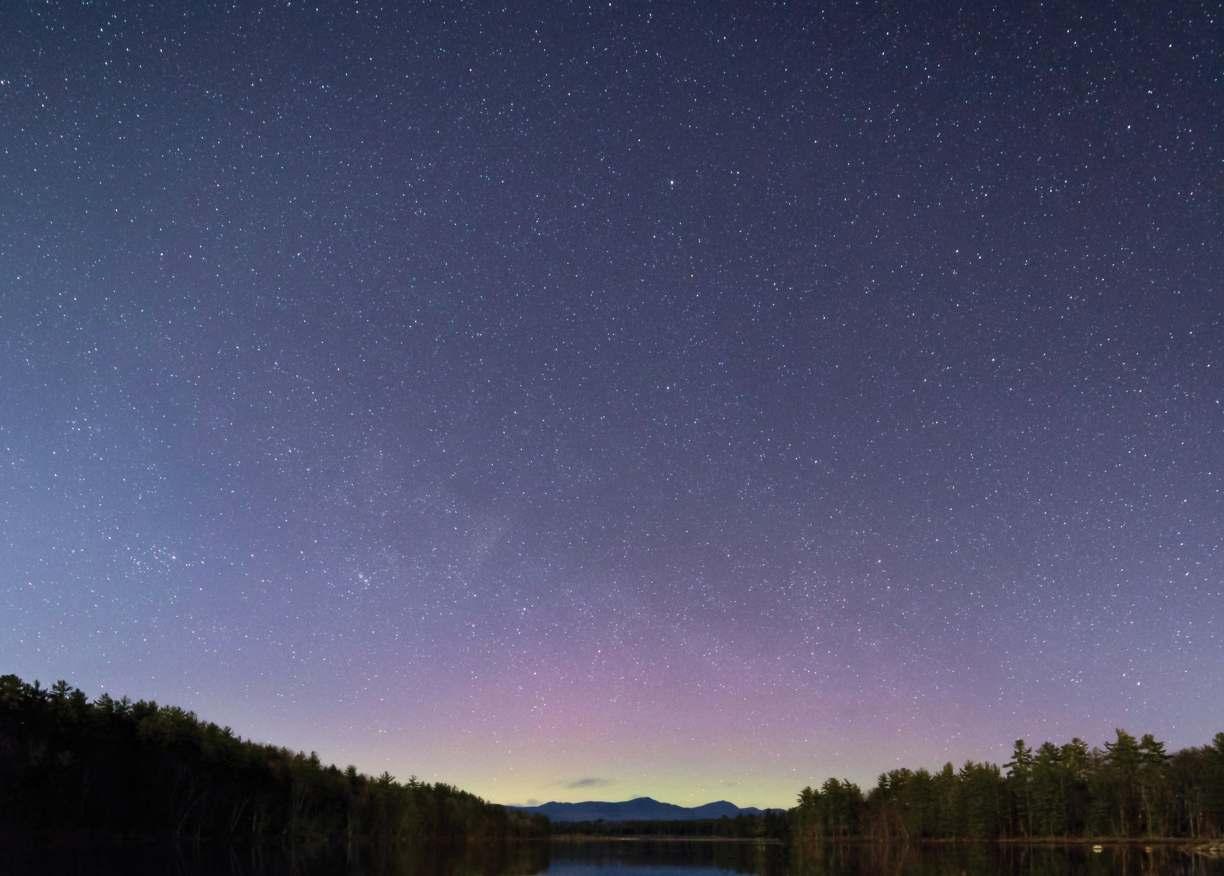

The Bahamas: A Complete and Compelling Choice (in partnership with The Bahamas Financial Services Board)

The Bahamas stands out as a premier destination for business, blending political stability,

innovative financial structures, and an exceptional lifestyle. This report offers an in-depth exploration of its unique advantages as a financial hub, from wealth planning tools to cutting-edge FinTech initiatives, alongside its unparalleled appeal for high-net-worth individuals and global investors.

Directions for Rapidly-Expanding Sector (in partnership with UBS)

Our second report examining the growth of Asia’s EAM sector, covering both the powerhouses of Singapore and Hong Kong, and emerging markets like Thailand and the Philippines. This study looks at the growth prospects for independent advisors in the round as they seek to tap the region’s booming wealth and growing client acceptance of the EAM model.

Family Office Focus: An Update of the Industry's Efficiency in Accounting and Investment Analysis (in partnership with FundCount)

A deep dive into the key technological and operational challenges facing family offices in their accounting and investment analysis activities. Based on surveys and interviews among family offices managing over $72 billion in assets, this is an invaluable benchmarking tool for the sector which presents fascinating insights into future developments from a range of industry experts.

(in partnership with First Abu Dhabi Bank)

This ground breaking new research examines the growth of female entrepreneurship in the region. More specifically it looks at how women are driving family office strategy as well as the relationship between MENA’s UHNW female clients and the wealth management industry.

Applying Artificial Intelligence in Wealth Management - Compelling Use Cases Across the Client Life Cycle

(in partnership with Finantix & EY)

This comprehensive report identifies elements of the institution and advisor’s workloads that are ripe for AI amelioration, and points the way for firms seeking to maximise the competitive advantages offered by new technologies. AI experts and senior industry executives enrich each chapter, answering crucial questions on risk, KYC/AML, compliance, portfolio management and more.

With EY providing the overview, this report draws on the front-line experience of many of the technology sector’s biggest names, in recognition of the fact that they are the ones going in to solve wealth managers’ most pressing problems and have typically seen the ramifications of firms’ choices play out numerous times – not to mention in various contexts globally.

STEPHEN HARRIS CEO, FamilyWealth Report

It is with great pride that we present the highlights of the twelfth annual Family Wealth Report Awards, a landmark event held this May at the Mandarin Oriental in New York. This prestigious gathering brought together the very best in North American family wealth management — a community defined not only by expertise but by deep-rooted relationships and a spirit of collaboration.

This year’s awards reflect a sector undergoing dynamic evolution, marked by increasing diversity, innovation, and a growing sense of identity among practitioners. The record number of nominations stands as testament to the outstanding work being done across the industry, and the independent judging panel faced an exceptionally high standard in selecting this year’s winners.

Beyond recognizing excellence, the awards serve as a vital moment of connection — an opportunity for peers to celebrate one another’s achievements and to strengthen the bonds that make this industry so unique. We extend our heartfelt congratulations to all winners and shortlisted nominees, and we are deeply grateful to our commercial partners for their continued support.

As the family wealth landscape continues to evolve, we remain committed to honoring the individuals and firms who shape its future with integrity, innovation, and dedication.

North America’s wealth sector was buffeted in the immediate aftermath of the pandemic, but latest data – for 2023 – from Capgemini showed an upward trend resumed. The population of HNW individuals rose 7.1 per cent in 2023; total wealth of this group rose 7.2 per cent, helped by rising markets. The percentage gain in HNW individual numbers beat growth for other global regions.

This is an industry wrestling with multi-trillion-dollar wealth transfer, the impact of digital technology like AI, regulation, cost pressures on business models, and as we see right now, market volatility. Two years ago, failures and rescues of banks reminded advisors why strong balance sheets and smart risk management matter.

Large banking groups such as JP Morgan, Wells Fargo, Citigroup, Bank of America, Morgan Stanley, Goldman Sachs, BNY

and Northern Trust are more dominant than ever. Scale counts, but so does the boutique. Large regional banks with a large presence, such as Key Bank, flourish if they get strategy right. There’s been continued M&A consolidation in the RIA and multi-family offices space; private equity money and other sources tap into it. And overseas buyers are in the mix, as in the Middle East involvement in the go-private move of Canada’s CI Financial.

The breadth of award categories reflects the complexity of a sector that must provide bespoke solutions to varied client needs, including work around healthcare, concierge, family dynamics, physical and cybersecurity, and more.

This is a sector that must find and nurture talent, including those not traditionally associated with banking and finance. A rising generation of wealth holders look for tech solutions, rapid responses, and new ideas.

Bray Executive Search is the leading executive search service for wealth management firms focusing on family clients of significant wealth. Bray Executive Search recruits nationally with offices in Seattle and Philadelphia, and works exclusively in UHNW family wealth advisory.

Our history of recruiting the best talent in the UHNW industry is unsurpassed. We have partnered with some of the most distinguished family wealth management firms to find candidates who understand the complex challenges for clients of significant wealth, which is essential to growing your business and continuing your success.

Providing our clients with the best candidates is our mission and our passion. We readily accept the challenge and opportunity to partner with you in your quest to successfully bring aboard the best talent in the market.

We have a robust and extensive track record in sourcing and placing top UHNW industry talent including:

» Wealth Advisors

» C-Level executive leadership

» Financial and Tax Management

» Investment Advisory/Management

» Planning Professionals including Estate Planning Tax/ Trust Attorneys

We also place professionals in consultative multigenerational advisory roles including:

» Customized Family Education

» Governance

» Philanthropy

» Legacy Planning

» Family History

JEANNIE HWANG BRAY

The Family Wealth Report Awards 2025 judging process was guided and assisted by a panel of independent experts, each of whom has been actively involved in the wealth management industry for many years and have an in-depth knowledge of the North America sector.

Independence, integrity and genuine insight are the watchwords of the judging process with the judging panels made up of some of the industry’s top trusted advisors and bankers.

PATTI BOYLE Chief Marketing Officer Dstillery

BUZZ BRAY Principal Bray Executive Search

RICHARD CHEN Managing Partner Richard L. Chen PLLC

MICHAEL COLE Managing Partner R360

KELLY LORA EWART Head of Marketing Ballentine Partners

RONNA GYLLENHAAL Director of Strategic Marketing & Communications The Family Office at Synovus

CAROL R. KAUFMAN Founder and CEO Pinventory

GIO MASO Chief Financial Officer Jordan Park Group

THOMAS J HANDLER Partner Handler Law, LLP

LISA FEATHERNGILL National Director of Wealth Planning Comerica Bank

BRIAN. D HUGHES President & Founder Hughes Growth Strategies, LLC.

DENNIS MANGALINDAN Vice President SEI

JAMES H MCLAUGHLIN Founder and CEO J. H. McLaughlin & Co.

EDWARD V. MARSHALL Founder and CEO Presage Global

REBECCA MEYER Consultant Relative Solutions

NEIL NISKER Co-Founder, Executive Chairman and CIO Our Family Office

STEVE PROSTANO Partner, Head of Family Advisory Services PKF O’Connor Davies

JOSEPH W REILLY JR CEO and Founder Circulus Group

A shortlist was identified from the hundreds of entries received for these awards and a discussion took place with the judges to agree the winner of each category. The judges were split into three groups, dependent on their industry; a panel of trusted advisors were responsible for judging the private banking categories; a panel of private bankers judges the trusted advisor categories; and new for this year we had a specialist group of tech experts judging the technology categories. This was to ensure that commercially sensitive information was kept confidential and conflicts of interest were avoided.

APRIL RUDIN Founder and President The Rudin Group

SUSAN R SCHOENFELD CEO and Founder Wealth Legacy Advisors

MICHAEL WAGNER Co-Founder and Chief Operating Officer Omnia Family Wealth

MICHAEL ZEUNER Managing Partner WE Family Offices

MATTHEW WALKER Founder and Chief Executive Officer Fortitude Family Office

RUSDI SUMNER Consultant Various

BRUCE WEATHERILL Chairman ClearView Financial Media

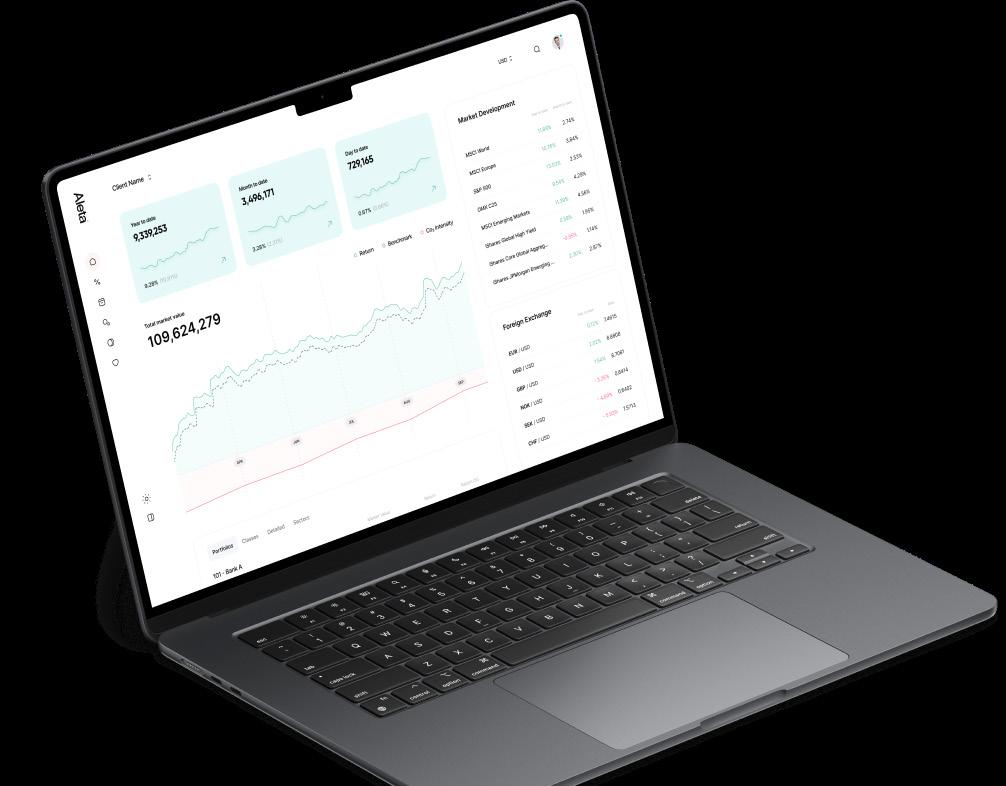

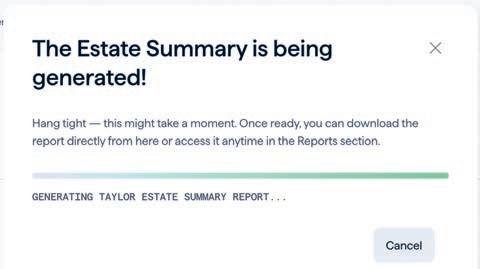

Move beyond spreadsheets with a next-generation wealth reporting platform for forward-thinking family offices.

discover

Deviate Consulting focuses on software selection and implementation for single and multi-family offices. Our software expertise includes a wide range of platforms that are prominent in the UHNW wealth management space.

Founded in 2015

Based in Indianapolis, IN 20 dedicated Consultants across the US

Independent & vendor agnostic

We work side by side with our clients throughout every step of their project. Deviate takes a thorough and honest approach to developing our project plans to set expectations and reach important deadlines.

www.deviateconsult.com

WealthBriefing is the leading subscription-based business intelligence service for the wealth management community, with the latest news, analysis and in-depth features from around the globe. WealthBriefing subscribers are part of an international community for whom staying abreast of the latest industry developments is a crucial part of their professional practice. Readers find our content on topics such as strategy, M&A, important people moves, investment management and asset allocation to be an essential resource in a fast-moving world.

The Asia-Pacific region’s meteoric rise as a major wealth management market has sparked huge demand for region-specific business information. WealthBriefingAsia was launched in 2009 to satisfy this growing information requirement, and it is the only wealth management news site focusing exclusively on the Asia-Pacific region. Providing indispensable news, features and industry views that are always relevant and concise, WealthBriefingAsia allows subscribers to conserve that most precious of all resources: time.

The North American wealth management market is one of the largest and most diverse in the world, and is markedly different from those in Europe and the Asia-Pacific region. Multi and single family offices in particular are a well-entrenched,integral part of the private wealth management landscape. Family Wealth Report provides need to know business intelligence in a convenient and easy-to-read format – straight to subscribers’ inboxes every day. Nowhere else will you find such high quality, in-depth and often exclusive content all in one place.

A unique thought-leadership platform, WealthBriefing’s events foster intellectual debate on the challenges and opportunities facing the industry and are designed to be an optimal use of wealth managers’ precious time and present an excellent networking opportunity.

WealthBriefing has added to its offering for the global private banking and wealth management communities by running thirteen annual awards programmes for the family office, private banking, wealth management and private client communities. The awards programmes are focused around three main category groupings: experts (individuals and teams); products and services for wealth managers and clients, and institutions of all sizes and types

WealthBriefing has unrivalled access to the most senior wealth management professionals across the globe, meaning that our research reports represent guides to future best practice as much as being barometers of current industry trends.

1834, a division of Old National Bank, was formed on the promise of building stable, enduring wealth management, banking and investment advisory relationships with high-net-worth individuals and institutions. The name honors the storied legacy of Old National Bank that was founded in 1834. The firm provides a boutique-style experience with integrated, customized wealth advisory and investment management services.

Please explain why you/your business was able to reach this award-winning level?

Our ability to reach this award-winning level is directly attributed to the strength, passion, and dedication of our team members. Attracting and retaining high-performing financial professionals has been central to our growth and success. The launch of 1834—our division focused on high-networth individuals—was only possible because of the extraordinary talent we have been able to bring in and the culture we’ve fostered. The Old National Bank story, its deeply rooted values, and commitment to excellence have consistently resonated with top-tier talent in the industry. This has allowed us to strategically expand into new markets and build out the 1834 brand with seasoned wealth leaders who share our vision. Each team member plays a critical role in delivering exceptional service and building lasting relationships with clients, and it is this collective effort that has elevated us to this level of industry recognition.

In what ways were you able to deal with challenges and problems?

The merger of equals between Old National Bank and Chicago-based First Midwest Bank, which was finalized in 2022, presented both significant challenges and substantial opportunities. Merging two like-sized institutions naturally came with complexities—blending different cultures, systems, and strategies. However, rather than viewing this as a hurdle, we approached it as a transformative moment. It gave us a unique opportunity to harness the strengths of

both organizations and apply them directly to our Wealth Management division. This led to the formation of 1834, a unified platform that elevated our service offering. We integrated the best wealth services and expertise from both banks to better meet the needs of our higher-net-worth clientele. In doing so, we were also able to introduce a broader investment platform, enhance our financial planning offerings, and implement a robust Wealth IT infrastructure that includes client-facing digital tools designed to meet the expectations of today's sophisticated investors.

What was the way your colleagues made a difference?

I am incredibly fortunate to lead a team of individuals who are not only skilled professionals but also deeply committed to our mission. My leadership style is that of a coach—I provide guidance, insight, and the necessary tools for success, but the credit for our accomplishments goes to the team. The 1834 team has truly embraced our vision of client-centered service. They have adopted a team-based approach to prospecting and client engagement, which has allowed us to offer more personalized, high-touch service. From senior executives to our wealth advisors, private bankers, investment strategists, and financial planners, there’s a shared sense of purpose and pride. This collaborative spirit and commitment to excellence have been critical in building trust and delivering value to our clients.

What does winning this award do for your business and colleagues?

Winning the Outstanding CEO in the Banking Category is a tremendous honor and serves as a powerful affirmation of the work we are doing. It validates what we as a team already believe—that Old National Bank and our 1834 division are delivering something truly exceptional. This recognition not only boosts morale but also reinforces our reputation as an industry leader, inspiring us to continue exceeding client expectations.

Chady AlAhmar CEO

1834, a division of Old National Bank

Helping changemakers create lasting, impactful legacies for a better world.

Our dedicated team has twenty years of experience helping families and individuals realize bold visions that go from idea to impact.

Strategic philanthropy

Grantmaking

Social impact

Wealth management

Value-driven change

Learn more at arabellaadvisors.com

Please explain why you/your business was able to reach this award-winning level?

Arabella Advisors was founded to guide ultra-high-net-worth (UHNW) families and individuals through the process of integrating philanthropy and impact investing into their legacy and core values. Along our 20-year journey, we’ve strengthened and grown our practice, helping hundreds of families navigate complex changes while leading them to scale their impact and find joy in the process. Our far-reaching team collaborates with family office advisors to navigate the intricacies of philanthropy, maximize effectiveness, and empower clients to create meaningful change.

As family dynamics and trends shift, our bespoke and holistic approach sets us apart in this space. Rather than focusing on philanthropy as a siloed service, we bring everything together—social impact, wealth management, family engagement, and governance—to help families create stronger, more impactful legacies that are built to last. Our unique positioning as a sophisticated, boutique, yet resource-rich organization allows us to remain nimble and deeply personal when navigating family relationships, client goals, and today’s complex environment.

What was the way your colleagues made a difference?

Our uniquely skilled advisors guide leaders to create change by bringing the invaluable human element to the work Arabella does every day. With expert knowledge in philanthropic structure and strategy, family systems and dynamics, issue area expertise, overcoming obstacles to achieve real results, and the technical knowhow to manage the operations of a family’s philanthropy, we strive to be the trusted partner to UHNW families. Our colleagues share their hands-on expertise, navigate common barriers and challenges with purpose, understand family values and objectives, and approach every client with humanity, empathy, and insight.

Betsy Erickson

Joseph Brooks - Managing Director

Arabella Advisors

How do you intend to remain on the front foot and continue to set a high standard?

Our 20+ years as industry leaders serving some of the most impact-driven families have given us a unique perspective into the wealth management space, generating a library of extensive knowledge that we pour back into our practices. Our leadership roles in organizations such as the Purposeful Planning Institute and UHNW Institute, as well as partnerships with other best-in-class firms, allow us access to real-time results that we apply to our client work. We go beyond strategy and implementation to stay on the cutting edge of research and leadership in the family office and wealth management industry. By transforming roadblocks into opportunities, we continually elevate our services while infusing valuable learnings to best serve families’ needs today and in the future.

Where do you see the wider wealth management sector going in the next five years?

The wealth management sector is evolving—families are increasing their philanthropic investments, new generations are stepping forward, and we’re seeing a more varied group of leaders, especially women. Additionally, the wealth management domain itself grows increasingly complex with new opportunities and emerging tools garnering interest. As families navigate the changing landscape, Arabella Advisors is bolstering our position in the market by offering specialists who take a holistic approach—understanding family values, navigating family systems and dynamics towards engagement and collaboration, and working toward strategic family goals. As our industry adapts, we welcome the challenge to be more purposeful, impactful, value-driven, and open-minded to new collaborations with industry partners and new wealth management firms, using our comprehensive methodologies to navigate the complex environment of philanthropy in the most meaningful way possible for our clients.

Ascent Private Capital Management® of U.S. Bank was created to address the unique complexities that ultra-high-networth (UHNW) families and their family offices face. Operating as a boutique within U.S. Bank—the fifth-largest commercial bank in the country—Ascent blends institutional strength with deeply personalized service. We help families preserve and grow their wealth through a multidisciplinary approach that integrates traditional wealth management with innovative, forward-looking strategies. Our model prioritizes close coordination with family office executives, outside advisors, and individual family members to deliver holistic, high-impact solutions.

Please explain why you/your business was able to reach this award-winning level?

Winning the 'Family Wealth Counseling' award is a meaningful recognition of our team's dedication to serving families with intention and integrity. It validates our belief that exceptional family office service is grounded in empathy, precision, and partnership. We see this award not only as a milestone but as a catalyst to elevate our offering even further. It inspires our team to continue innovating, listening closely to our clients, and delivering value that is both strategic and personal.

How do you intend to remain on the front foot and continue to set a high standard?

To remain at the forefront of the UHNW space, we continue to refine our integrated platform. Families are navigating increasingly complex financial, legal, and interpersonal challenges. In response, we provide tailored guidance supported by strong governance, tax optimization, risk management, and investment expertise. Our

John Zimmerman President

Ascent Private Capital Management of U.S. Bank

services are unified under one roof, enabling clients to reduce operational friction, simplify decision-making, and scale more efficiently.

We also embrace technology as a critical enabler. By incorporating advanced tools to automate workflows, enhance reporting accuracy, and boost operational transparency, we allow families to focus on long-term strategy rather than administrative demands. Yet, we are firm in our belief that technology must enhance—never replace—the human connection central to our work.

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

Throughout this journey, we’ve embraced a consultative and disciplined mindset. It has helped us remain resilient in the face of market volatility and client shifts. One of the most important lessons we’ve learned is the power of alignment—between strategy, service delivery, and client values. Every engagement is a chance to deepen trust and unlock generational impact.

Whom to look for, either inside or outside your business, for ideas and inspiration?

Our inspiration comes from both within and beyond our firm. Internally, Ascent's collaborative, interdisciplinary culture sparks continuous learning and evolution. Externally, our visionary clients and partners challenge us to think expansively and act boldly. These relationships fuel our commitment to excellence and push us to redefine what’s possible.

What will winning this award do for your business and colleagues?

Ultimately, this recognition is a celebration of the trust our clients place in us—and the care with which we approach that responsibility. Ascent remains committed to delivering an unparalleled experience for the families we serve, raising the bar for what family wealth counseling can and should be.

Pierre Gabris Founder Managing Partner

Alpen Partners International Freienbach | Zurich | Geneva | Lugano | Switzerland

SEC-registered, serving US clients info@alpeninternational.com +41 58 105 75 50 | USA: +1 212 461 3684 | alpeninternational.com

Unlock intelligence, strengthen relationships, and drive enduring performance across every investment, entity, and generation with Altvia—the only platform your family office will ever need.

The Private Risk Management Association (PRMA) is a nonprofit organization, comprised of over 6,000 dedicated risk management professionals committed to serving affluent families, individuals and their trusted advisors.

EDUCATION • NETWORKING • COLLABORATION • COMMUNITY

Peace of mind doesn’t come from having a lot of wealth. It comes from knowing all facets of your financial life are under complete control. Then you can relax and focus on what’s most important to you.

Talk with us at aspiriant.com

Please explain why your business was able to reach this award-winning level?

Aspiriant's rise to an award-winning level stems from our pioneering multi-family office model and steadfast dedication to client success. We deliver a truly comprehensive, 360-degree wealth management experience, provided entirely in-house by a seasoned team of experts. Many of our professionals have been with Aspiriant for over 20 years, offering integrated, customized solutions in wealth planning, investment management, tax services, estate planning, strategic philanthropy, risk management, family governance and education, accounting and banking, and enhanced reporting. This collective expertise under one roof enables seamless, holistic service.

Our commitment to excellence is reflected in our Net Promoter Score (NPS) of 79 from ultra-high-net-worth clients who participated in a 2024 survey by Family Wealth Alliance.1 This “excellent” rating underscores client appreciation for our support, clarity, and the trust-based relationships we build. Comments like “you make it easy to offload my financial worries,” and “you are trusting, caring, and a part of the family” speak to the strong connection we foster with clients.

Additionally, our 100% employee-owned model and intentional succession planning reinforce our long-term alignment with client interests. This structure offers continuity and confidence to families we serve across generations.

What was the way your colleagues made a difference?

Our colleagues make a difference through their depth, collaboration, and care. Picture CPAs, JDs, CFP® professionals, and CFA® charterholders working together under one roof to address a client’s complex financial life from all angles—legal, tax, investment—in real time. This synergy leads to truly integrated, expert advice.

More than technical expertise, our team fosters exceptional client intimacy. The 100% employee ownership model aligns our interests with those of our clients, creating a collaborative culture

Lisa-Colletti Managing director Aspiriant

• Multi-Family Office ($5 billion to $15 billion AuM/AuA)

that attracts top talent. Recent senior hires joined Aspiriant for our independence and human-centric approach. This caring culture empowers our professionals to build deep, enduring relationships and serve as trusted advisors to families across generations.

How do you remain on the front foot and continue to set a high standard?

Evolving to meet the changing needs of wealthy families is core to Aspiriant’s identity. Since Lisa Colletti became head of our Exclusive Family Office in 2021, we’ve advanced in multiple areas. We've made strategic acquisitions and key hires, including a dedicated leader for Accounting and Banking, and merged with Murray, Stok & Company to strengthen our Tax Planning and Compliance Group. We’ve also enhanced financial reporting technology to give clients a comprehensive view of their wealth.

Our investment platform has evolved too, expanding access to sophisticated private investment opportunities. We’re also deepening services in strategic philanthropy and family governance to help clients achieve lasting impact and smooth intergenerational transitions.

Where do you see the wider wealth management industry going in the next 5 years?

We expect continued consolidation, largely driven by private equity. While it reshapes the landscape, it raises concerns. As more firms are acquired, potential conflicts between short-term investor interests and the long-term needs of ultra-high-net-worth families may grow. We believe independent, client-aligned firms like ours will stand out by staying focused on multi-generational relationships and enduring value.

¹ Net Promoter Score (NPS) of 79 based on a fall 2024 survey conducted by Family Wealth Alliance of approximately 176 Aspiriant ultra-high-net-worth clients, with a 30% response rate. Results may not be representative of all clients. NPS is a client loyalty metric with a range from -100 to +100. Scores above 70 are considered excellent.

Please explain why you/your business was able to reach this award-winning level?

For generations, Bank of America Private Bank has been a trusted partner to ultra-high net worth individuals, families, and institutions. While we have always been known for our exceptional client service, in today’s digital age, client service looks different. Financial institutions must meet clients when, where and however they need. To meet this moment, we are committed to delivering innovative products and services backed by a high-tech, high-touch client experience, elevating our white glove service.

This approach has helped us garner recognition among the industry and clients. Digital engagement recently hit at an all-time high with 93% of Private Bank clients actively using the company’s online or mobile platforms. Our digital capabilities set us apart.

What was the way your colleagues made a difference?

There is a real benefit to having a team around you that you can lean on. At Bank of America Private Bank, we have a team of problem solvers that bring a wealth of knowledge and expertise to deliver the innovative solutions our clients need.

As those needs evolve, we must challenge ourselves to think outside of the box and bring people into the conversations. We are incredibly fortunate at Bank of America Private Bank to be surrounded by people with so much expertise, wisdom, and willingness to help.

I am proud to be supported by Paula Hanson, who leads our platforms, transformation and enablement work, as well as her team of exceptional transformation and enablement specialists, who alongside so many others at Bank of America, make this work possible.

Shim Sameer Head of Products, Solutions & Platforms Bank of America Private Bank

• Customer Facing Digital Platform Winner

How do you intend to remain on the front foot and continue to set a high standard?

Our digital strategy remains core to our client experience. We listen, and we respond. We continue to invest in two critical areas, our technology and our people, to remain an industry leader and uphold a standard of excellence for clients and employees. Our priorities are streamlining client management; implementing easier, faster, and smarter processes; and transforming our investments experience.

We prioritize implementing feedback from clients and employees to deliver new solutions and innovative enhancements based on what we hear directly from them. Throughout 2024, Bank of America Private Bank integrated feedback across more than 60 initiatives, funded by over $100 million.

In 2024, our new and enhanced initiatives included the launch of our Collaborative Onboarding Experience, which streamlined a previously highly manual, paper-intensive onboarding process into a digitized workflow, and enhancements to Erica, our 24/7 virtual financial assistant, with new responses tailored to Private Bank clients’ unique questions.

In 2025, our objectives remain focused on relentless innovation, simplifying processes, and investing in our people. Our north star will continue to be delivering modern, elevated client experiences primed for responsible growth.

Where do you see the wider wealth management sector going in the next five years?

The future of wealth management will unify simple and intuitive digital solutions and platforms with expertly tailored advice and individualized support from client teams. Our clients will increasingly look to their teams to serve as a one-stop-shop for their holistic needs. This integrated approach, paired with digital solutions, will shape the future of client and employee experience.

Because there’s more to wealth than creation.

Pre-liquidity planning. Tax advisory. Investment strategy. Preparing the Next Generation.

Significant wealth brings opportunity. It can also be surprisingly complex, with goals that span family, business, lifestyle and legacy. BMO Family Office is here to guide you and your family through the many components of wealth management. From planning for a liquidity event to investment strategies to preparing the next generation, we can help you protect, manage and grow your wealth.

To discover how BMO Family Office can help you pursue your goals, please contact us at bmofamilyoffice.com

Congratulations on BMO Family Office receiving two prestigious honors at the 2025 Family Wealth Report Awards. What does this recognition mean to your team?

Amy Griman (Global President, BMO Family Office): Thank you. Receiving the 'Women in Wealth – Company Contribution' award is a tremendous honor and reflects our long-standing commitment to advancing real financial progress for women, both within our organization and for the clients we serve. More than 40 percent of BMO’s senior leadership roles are held by women. At BMO Family Office, we actively build initiatives that support, empower, and elevate women at all stages of their wealth journey. This recognition reaffirms that we are on the right path and inspires us to continue driving meaningful progress.

What are some of the specific initiatives that contributed to the Women in Wealth recognition?

Amy Griman: We launched the Women & Wealth program to support women clients through personalized strategies and education. We also created the Women & Wealth Collaborative to guide more than 50 senior advisors across 24 markets in deepening their practices to better serve women. In just two years, these efforts led to $146 million in new assets and nearly $1 million in revenue. We publish proprietary research, host events, and spotlight inspiring women through our Bold(h)er podcast series. These efforts are part of a broader movement at BMO to help women pursue every opportunity with confidence.

• Credit Solution • Women in Wealth Management (Company) Winner

Garrett, BMO Family Office also received the Credit Solutions award. What distinguishes your credit advisory services in the ultra-high-net-worth space?

Garrett Johnson (Head of UHNW Banking, BMO Family Office): Our credit solutions extend far beyond conventional lending. We provide strategic liquidity tailored to the complex financial lives of ultra-affluent families. This includes financing for private aircraft, monetizing concentrated equity positions, or structuring credit around illiquid assets such as hedge funds and private equity. What makes us unique is our deep experience working with family offices and our ability to create flexible, customized solutions that align with long-term goals.

Can you share an example of how that expertise made a difference?

Garrett Johnson: Certainly. One standout example involved a $75 million revolving line of credit designed for a family office with a highly diversified and complex asset base. The client needed strategic flexibility to fund future opportunities quickly. We collaborated across teams to analyze the full portfolio and develop a tailored credit facility. The family told us that only BMO could have delivered such a nimble and effective solution. That kind of feedback is deeply meaningful to us. It is what sets our team apart.

How do these awards reflect BMO Family Office’s broader mission?

Amy Griman: Both awards reflect our commitment to placing clients at the center of everything we do. Whether we are helping women gain financial confidence or enabling families to access strategic credit, our goal is to be thoughtful, proactive partners in their success. We are grateful to the Family Wealth Report for recognizing our work, and even more grateful to our clients for trusting us with their most important financial decisions.

With 25 years of investment experience, Sinead Colton Grant serves as chief investment officer for BNY Wealth, a provider of bespoke wealth and investment management solutions to ultra-high-net-worth individuals and institutions. As the firm’s first female CIO, Sinead leads a team of professionals who manage around $300B in client assets. She leads BNY Wealth’s portfolio strategy and performance groups, as well as research and investment products across equities, fixed income and alternative assets.

What challenges did you surmount to reach this level and how do you excel in such a fast-paced industry?

My passion for learning and my tireless work ethic were instilled in me from a young age. I grew up in Dublin and was raised by my mother, who bravely left her family farm to achieve her dream of working as a nurse. My father was similarly driven; he left a career in restaurant management mid-life for one in accountancy. I witnessed my parents’ tenacity, and I carried it to my studies at Dublin City University, London Business School, and ultimately throughout my entire career.

Additionally, discipline has helped me go against the grain when my conviction dictated a non-consensus move. For example, in 2024, when it seemed the entire world expected the U.S. would hit a recession, my team and I made the call for U.S. outperformance, which drove our tactical decision to overweight U.S. large cap stocks, benefiting client portfolios with our contrarian view.

Sinead Colton Grant Chief Investment Officer BNY Wealth

• Women in Wealth Investment (Individual)

What is your leadership strategy, particularly as the first female CIO at your firm?

My leadership philosophy centers on inclusivity, transparency and empowerment. I have always worked in groups with female senior leaders and at firms where there were opportunities for women to run businesses, business lines and teams, and hold highprofile C-suite roles. Leadership is also how you think about where your business will be in five to 10 years. It’s thinking through how you deliver results and how you create the best career growth opportunities for your team.

Where do you see the wealth management industry going in the next five years?

The face of wealth is changing. According to research by McKinsey, by 2030 roughly two-thirds of the private wealth in the U.S. will be held by women, representing the largest wealth transfer by gender in history. Beyond that, I see new asset classes and strategies becoming a central part of portfolios, whether it’s sports investing, luxury assets, cryptocurrency or private assets that are becoming a growing part of client portfolios.

Lightning round: Tell us three things about you that we couldn’t glean from your LinkedIn profile?

I love horror movies, and I count myself as a good judge of their quality. It’s a difficult genre to master. One film that kept me up at night was 28 Days Later. I couldn’t even finish it.

I also love to travel and worked as a tour guide in college. I still remember the script I used.

Lastly, I’m half of a musical couple. I play piano and my husband works in the music industry. Music is ingrained in the fabric of our life.

Botoff Consulting is the premier provider of compensation data and consulting services to family offices and family investment firms. We conduct the leading compensation studies in the industry.

▪ Family Offices ▪ Family Investment Firms ▪ Private Companies

Family Business Enterprises

Private Trust Companies

Family Foundations

Purchase & Participate* In Botoff Consulting Surveys :

Flagship Survey: Family Office Compensation

Estate & Household Staff Compensation

Family Governance and Compensation

and Talent Planning

UK and Europe Family Office Compensation

Survey participants receive complimentary reports

▪ Compensation Strategy ▪ Compensation Benchmarking ▪ Compensation Structure ▪ Incentive Plan Design

Benefits Benchmarking

Governance Compensation and Board Support

Performance Management

Litigation/Expert Witness Support

Botoff Consulting provides compensation and strategic advisory services for family offices and family investment firms globally. The firm has become a trusted resource in the family office and family business advisory sector, focusing on gathering and delivering accurate data related to compensation for family offices, family investment firms, and private/family trust companies.

We work with dozens of family offices in consulting engagements each year, and, across more than decade, we have built, grown, and enhanced our database with participation from thousands of family offices collectively. Our small team has made a meaningful impact to families around the world, helping align their mission, vision, values, and goals with the talented teams that support them.

Trish Botoff founded the firm in 2014 with a goal of providing better compensation data to family offices. Today, clients and industry-trusted advisors regularly refer to Botoff Consulting’s data and work as the “gold standard” for family organizations.

We have continued to grow our consulting practice and continue to evolve the surveys that we conduct – expanding survey roles from 4 in 2015 to 42 in 2025, adding new surveys to address gaps in market data, and expanding geographically. We have provided significantly better market data to all family offices as a service to the industry. And for our clients, we provide customized, bespoke analysis based on peer groups of “like” family offices – incorporating executive compensation and institutional best practices.

Botoff Consulting • Outstanding Contribution to Wealth Management Thought Leadership (Company) Winner

Please describe how your colleagues made a difference?

Receiving the 2025 Family Wealth Report Award for Outstanding Contribution to Wealth Management Thought Leadership is an incredibly flattering recognition of the dedication our team contributes to serve clients with strategic guidance and meaningful data. Together, our collaborative approach and industry-leading data support thoughtful, strategic considerations, enabling the Botoff team to deliver bespoke service and meaningful reference points for confident, practical decision-making.

It is intensely rewarding to hear and to see how our team has become synonymous with trust in the family office and private wealth advisory space. It is the unique combination of each team member’s strengths—spanning data rigor, strategic insight, and client-focused service—that fuels this reputation.

Trish Botoff leads with deep subject matter expertise, relational insight, and a passion for demystifying compensation strategy. Hunter Guice provides steady leadership and sector-specific insight to clients, balancing strategic thinking with sound legal judgment. Jennifer Adams is a compensation expert, ensuring precision in execution, combining analytical skills with strong client ties. Ron Botoff leverages deep corporate experience to provide strategic and financial acumen with operational rigor that strengthens every engagement. Sheila Burkett combines market-informed judgment and clear communication to deliver organized, thoughtful support across client engagements. Andrew Carlburg, our data analyst, is a key driver of our survey excellence—his meticulous approach is foundational to our impact to be selected for the thought leadership award. And kudos go to our support team—Charlotte Cannon, Scott Weber, Christy Dukes and Paige Zito—who consistently deliver high-quality, responsive service to our network of family offices, industry partners, and clients.

Thoughtful investing is the aspiration of each Brown Advisory colleague and is our promise to clients.

Danielle is a partner and client advisor based in Brown Advisory’s New York office, where she plays a key leadership role in serving both domestic and international family offices. Danielle’s approach is collaborative and client-centric, embodying Brown Advisory’s mission to make a material, positive difference for its clients. She leverages the firm’s expertise to guide families through portfolio management, investment strategy, estate and tax planning and intergenerational wealth transfer. By coordinating resources across the firm, Danielle delivers tailored solutions that address each family’s distinct needs and long-term goals.

In addition to her client-facing responsibilities, Danielle leads the firm’s strategic growth efforts in the New York market, helping to expand its presence and reach in one of the world’s most dynamic financial centers. She partners with portfolio managers and senior advisors to develop strategies for engaging prospects and fostering new business relationships with professional partners.

Before joining our firm, Danielle was a Partner at Hillview Capital Advisors, where she managed a diverse portfolio of client relationships. In this role, she served as a trusted advisor to high-net worth families, developing tailored investment strategies aligned with their long-term objectives. Danielle also held a leadership position in business development, driving the firm’s growth and client acquisition efforts. Her experience at Hillview sharpened her ability to balance deep technical financial knowledge with the interpersonal skills needed to foster lasting client trust.

• Asset Management Firm Serving Family Offices and Private Banks • Rising Star under 40

Danielle Barrett Partner and Client Advisor Brown Advisory

Earlier in her career, Danielle served as an Assistant Portfolio Manager at Davy Stockbrokers in Ireland, one of the country’s leading financial services firms. There, she supported portfolio management functions and gained valuable international experience that continues to inform her global perspective on wealth management today.

Danielle holds a dual degree in Business and French, as well as a Master of Science in Finance, both from Trinity College Dublin, one of Europe’s most prestigious universities. Her educational background combines analytical rigor with cultural fluency, equipping her to navigate the nuanced needs of a global client base.

In addition to her professional responsibilities, Danielle is deeply engaged in the broader wealth management community. She currently serves on the board of both the New York Estate Planning Council and STEP New York (Society of Trust and Estate Practitioners), where she contributes to advancing best practices and thought leadership in estate and trust planning.

Her achievements have not gone unnoticed: In 2025, Danielle was recognized as a 'Rising Star Under 40' by the Family Wealth Report Awards, a testament to her impact, leadership, and potential in the field of wealth management. With a unique blend of global experience, technical acumen, and a client-first mindset, Danielle continues to be a driving force in shaping the future of family office advisory services.

What was the rationale for creating a Tax Overlay program for ultra-high-net-worth clients?

At Callan Family Office, we’ve advised ultra-high-net-worth families for decades and have seen how much value can be gained through tax-aware decision-making. These families often face a level of complexity that off-the-shelf solutions weren’t built to handle. Yet many wealth managers lack the tools or infrastructure to manage taxes effectively. As a result, portfolio rebalancing often overlooks tax consequences, leading to missed opportunities and avoidable capital gains.

We wanted to change that. By combining our experience with purpose-built technology, we built a program that enables more tax-aware portfolio management. This includes managing appreciated positions across direct indexing and active strategies, coordinating manager changes, and harvesting losses or deferring gains. While most firms stop at direct indexing or opportunistic tax-loss harvesting, we go further by integrating both active and passive strategies within the household to deliver a unified process aligned with each client’s goals.

Rather than outsourcing implementation to third-party managers with a limited view, our portfolio managers retain control over the process. This allows them to tailor decisions based on each client’s ownership structure and tax profile, while relying on technology to ensure consistency and discipline.

How do you access investment models and ensure they are right for the clients?

When we launched the program, one of the first steps was working with the institutional investment managers our clients have invested with for years. We asked them to share their model

portfolios so we could implement their strategies directly in client accounts with tax overlay management. For many of these managers, that was a significant ask—model delivery is something that several managers had previously never offered. But they were willing to partner with us because of the long-standing relationships we've built over time.

Client input plays a central role in how these models are applied. The more specific the goals and preferences, the more precisely we can implement trades that reflect their objectives. As managers update their models and strategies, we continuously integrate those changes while ensuring they align with each client’s unique circumstances and portfolio activity. The result is that every trade reflects both the market environment and the family’s long-term plan.

How important is technology in this process?

Technology is foundational to how we deliver. When we launched the firm in 2022, we had the rare opportunity to build a modern platform from the ground up, without the constraints of legacy systems. That allowed us to design a solution tailored to the needs of ultra-high-net-worth families, where portfolios often include multiple accounts, trusts, foundations, and taxable entities.

We partnered with Aris Investing to help make that possible. Aris provides the technology that analyzes daily portfolio data, including holdings, tax lots, model portfolios, and client-specific tax settings, and produces trade scenarios that reflect each family’s structure and tax situation.

These kinds of comparisons help our investment team weigh the tradeoffs and select the best path forward. The result is a process that allows us to personalize portfolios in a consistent and disciplined way.

Dan Burke Chief Technology Officer and Investment Partner Callan Family Office

Tim Loughrey Head of Client Success

Canoe Intelligence

At Canoe Intelligence ('Canoe'), we aim to redefine the alternative investment industry with smarter data management powered by cutting-edge technology. We are at the forefront of Artificial Intelligence and Machine Learning applications in the wealth management sector. Our cutting-edge solutions leverage information extraction, classification, and Large Language Models (LLMs) to significantly accelerate the processing and analysis of complex financial documents — empowering wealth managers to make data-driven decisions with unprecedented speed and accuracy.

Please explain why your business was able to reach this award-winning level?

Canoe has experienced tremendous market demand, which has sharpened our focus on scaling efficiently—particularly when it comes to onboarding new clients. In many organizations, onboarding is considered a function that belongs solely within the professional services team. However, at Canoe, it’s been elevated to a strategic initiative directly overseen by our C-Suite. This top-down prioritization ensures we not only recognize its importance but also dedicate the resources needed to succeed. We’ve made significant investments, from hiring strong, experienced leadership to developing product features specifically designed to streamline and accelerate the onboarding process.

Moreover, Canoe operates from a foundation of deep domain expertise. We were originally spun out of a Family Office, and that heritage continues to influence how we build our product and support our clients. Being purpose-built for this market means we bring an insider’s understanding to the problems we solve. Our knowledge of the workflows, the stakeholders involved, and the data complexities at play is unmatched. This allows us to offer solutions that are both intuitive and impactful. Our ongoing relationships and access to General Partners and Limited Partners further strengthen our position, enabling us to shape and adapt to evolving industry standards with agility and authority.

What was the way your colleagues made a difference?

The strides we’ve made are not the result of any one individual or team—they’re a true reflection of company-wide alignment and commitment. The push to reduce timeto-value for our clients and streamline onboarding has touched every department. Whether it’s product teams optimizing user experiences or client success teams proactively guiding users through onboarding, everyone has played a role. Our people understand that this initiative is core to delivering value and building trust, and they’ve rallied behind that vision. And we’re not done yet— this remains a continuous focus as we strive to improve further.

How do you intend to remain on the front foot and continue to set a high standard?

The answer is simple: we stay close to our clients. We deeply value their feedback, and we see every interaction as an opportunity to learn and refine. Our product and service evolution is directly informed by their needs, challenges, and aspirations. That proximity allows us to anticipate shifts in the market and be proactive rather than reactive. It’s not just about solving problems—it’s about co-creating the future of this space alongside our clients.

Where do you see the wider wealth management sector going in the next five years?

We anticipate continued and growing investment in alternative assets within the wealth management sector. As the Limited Partner landscape broadens—from institutional investors to ultra-high-networth, high-net-worth, and mass affluent individuals—the pressure to operate with greater efficiency will increase. That shift will demand more scalable, automated, and transparent processes. Firms that are operationally sound and technologically forward-thinking will be best positioned to capture this momentum and thrive.

your legacy. Realize your future goals.

Baker Tilly is a leading private wealth advisory CPA firm that serves family offices, high-net-worth individuals and families with decades of experience. Family office and tax compliance and advisory services are at the forefront of Baker Tilly’s Private Wealth strategy for the future, as showcased by our combination with Seiler in July 2024. We offer bespoke, advanced family office, trust, estate and tax advisory services to our clients, ensuring that we give each client what is most important: the gift of time.

Congratulations to our Family O ce Practice and Private Client Department for being named a finalist in five categories at the 2025 Family Wealth Report Awards. The five categories are “Legal Team of the Year,” “Family Wealth Counselling,” “Solutions for International Americans,” “Wealth Planning,” and “Outstanding Contribution to Wealth Management Thought Leadership (Company).”

At Cayside Partners, no two families are the same. While traditional firms offer standardized solutions, Cayside prioritizes highly customized investment strategies. With exclusive access to unique investment opportunities, they craft solutions designed to align with their clients’ goals, ensuring a bespoke experience that goes beyond the conventional.

Cayside Partners was recently awarded with the ‘Top Investment Management Team – Miami’ and ‘Next Generation Program – Miami’ awards by the Family Wealth Report.

Raised in the local Jupiter community, Cayside Partners is committed to supporting local efforts such as the Jupiter Medical Foundation, Nicklaus Children’s Health Care Foundation, and The Benjamin School.

Cayside Partners offers sophisticated wealth management solutions that cater to the unique needs of high-net-worth families. Their multi-family office approach integrates investment advisory, estate planning, tax strategies, and philanthropic giving to ensure long-term financial security across generations.

Founded in Jupiter, Florida, Cayside Partners is a multi-family office and independent registered investment adviser built to serve families with complex needs, shared entrepreneurial roots, and long-term investment horizons. At our core, we offer a tailored, client-centric approach that blends institutional expertise with family-first values. We are proud to serve as long-term stewards and strategic partners to our clients, helping them align wealth with purpose across generations.

Winning Formula: Purpose-Driven, Client-First

Cayside Partners’ success is rooted in three pillars: alignment, independence, and accessibility. Our founding team—Todger Strunk, TJ Strunk, and Colin Hickey—brings decades of experience from both institutional investment firms and entrepreneurial ventures. This blend fuels our differentiated approach to family wealth: bespoke advice, open-architecture portfolios, and family governance frameworks that adapt to each client’s evolving needs. We intentionally reject “one-size-fits-all” models. Our fiduciary structure ensures clients benefit from conflict-free advice and broad investment access, including private markets, alternatives, and co-investment platforms sourced through strategic partnerships. Our size gives us the ability to deliver personal attention and portfolio management with institutional rigor.

In 2025, Cayside Partners received dual honors from the Family Wealth Report Awards for 'Investment Management Team – Miami' and 'Next Generation Program – Miami'. These accolades underscore our commitment to innovation, particularly in empowering

• Multi-Family Office (New Entrant)

Cayside Partners

rising generations through curated next-generation education, family office services, and investing experiences. We’ve deepened partnerships with Fidelity and U.S. Bank to offer sophisticated securities-based lending solutions and can work with the leading financial and banking institutions to best serve our clients. Our focus on providing value added family offices services, including but not limited to consolidated reporting and philanthropy advisory such as charitable fund management, has helped add tremendous value for the families we serve.

We continue to invest in technology to elevate service delivery. From real-time portfolio intelligence to integrated digital dashboards, clients access a panoramic view of their financial world. Our cybersecurity protocols and data transparency standards ensure a secure, high-touch experience. Despite these tools, we believe our relationships drive long-term success. Our approach is grounded in communication and a shared vision with the families we serve. We are proud that many clients have become multigenerational stewards of both capital and values with us.

Our ambition is clear: to be the most trusted financial partner for families seeking clarity, confidence, and continuity. Cayside Partners is more than a wealth advisor—it’s a family office platform for families to achieve more from their professional advisory relationships. By combining world-class investment expertise with personal understanding, we help clients build lasting legacies.

Please explain why you/your business was able to reach this award-winning level?

Achieving this recognition is a direct reflection of the collaborative efforts and unwavering commitment of our entire team at CIBC Private Wealth, US. Our success is deeply rooted in our ability to understand the unique aspirations of our clients and deliver tailored solutions that align with their financial goals. We prioritize a culture of open communication, which fosters trust and facilitates long-term relationships, and is evidenced in our 95% client retention rate.1 This award is a testament to the collective determination to consistently deliver exceptional value, while remaining agile and responsive to the nuances of the ever-changing market landscape. By focusing on personalized service and proactive engagement, we have established ourselves as trusted advisors who are dedicated to navigating the complexities of wealth management alongside our clients.

How do you intend to remain on the front foot and continue to set a high standard?

To maintain our leadership position in the wealth management sector, we emphasize a culture of accountability and collaboration across our team. We uphold high standards through regular evaluation of our practices and actively seek input from clients and colleagues. Our investment team, comprising of >75 active managers with an average of over 20 years of industry experience, brings together diverse thinking styles, flexible strategies and a unified objective of outperformance. This depth of expertise ensures we are wellequipped to navigate the complexities of wealth management. By

David L. Donabedian, CFA

Outstanding Chief Investment Officer CIBC Private Wealth US

• Outstanding CIO (Chief Investment Officer) Winner

fostering an environment where professional development and open discussions are encouraged, we create a space for innovative ideas to flourish, enabling us to refine strategies consistently, and remain aligned with our clients’ evolving goals.

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

Recently, we faced significant market volatility, prompting us to reassess our strategies. We prioritized transparent communication with our clients, guiding them through their concerns and reinforcing our commitment to their financial well-being. This experience underscored the importance of agility and teamwork. One key lesson learned is that diverse perspectives are invaluable when tackling challenges. By leveraging the varied expertise within our team, we can develop comprehensive solutions that address our clients’ needs more effectively, ensuring they receive well-rounded guidance in uncertain times.

Where do you see the wider wealth management sector going in the next five years?

As we look ahead, the significance of building strong relationships and delivering personalized service will remain paramount. While technology will play a pivotal role in enhancing accessibility and transparency, it is the human element of our service that will continue to differentiate us. Our focus will be on integrating these advancements while ensuring we remain deeply connected to our clients’ aspirations, ultimately helping them achieve their financial goals.

11-year retention for clients with >$5M in AUM y/y as of 1.31.2025.

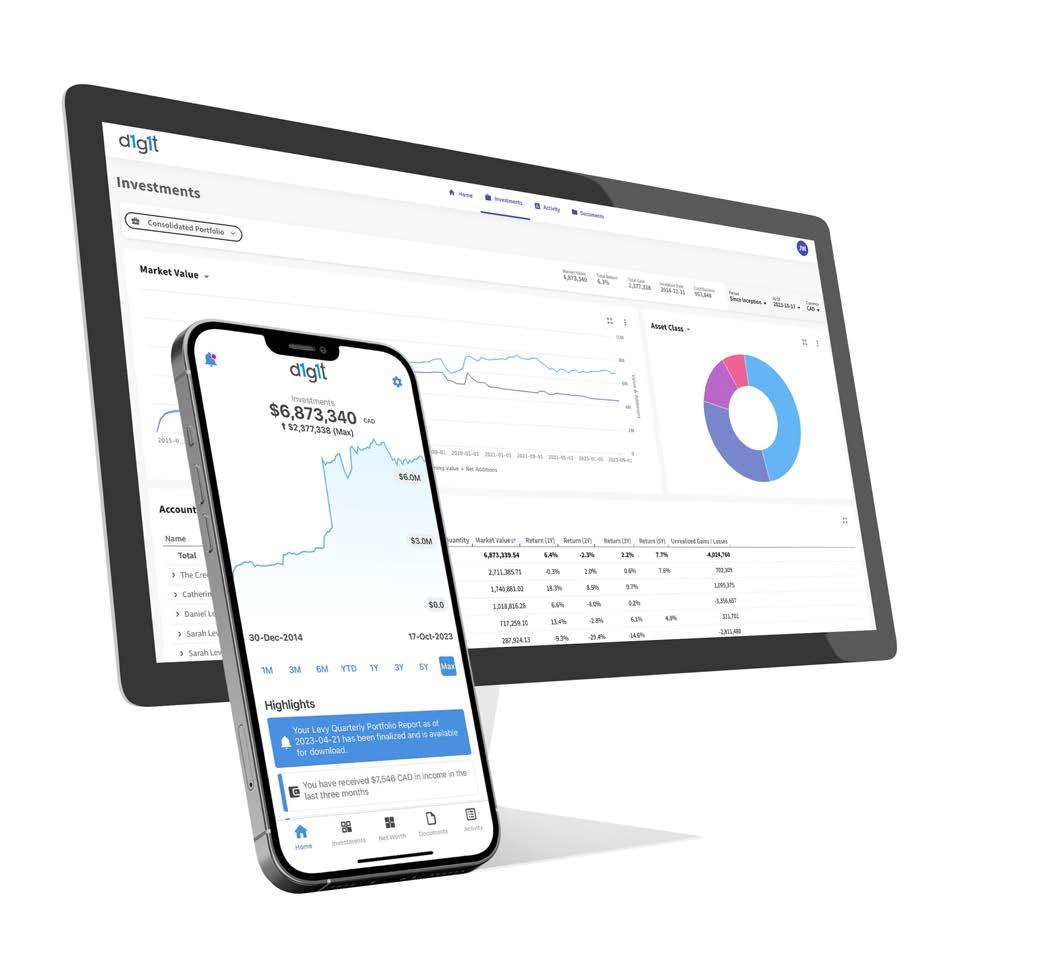

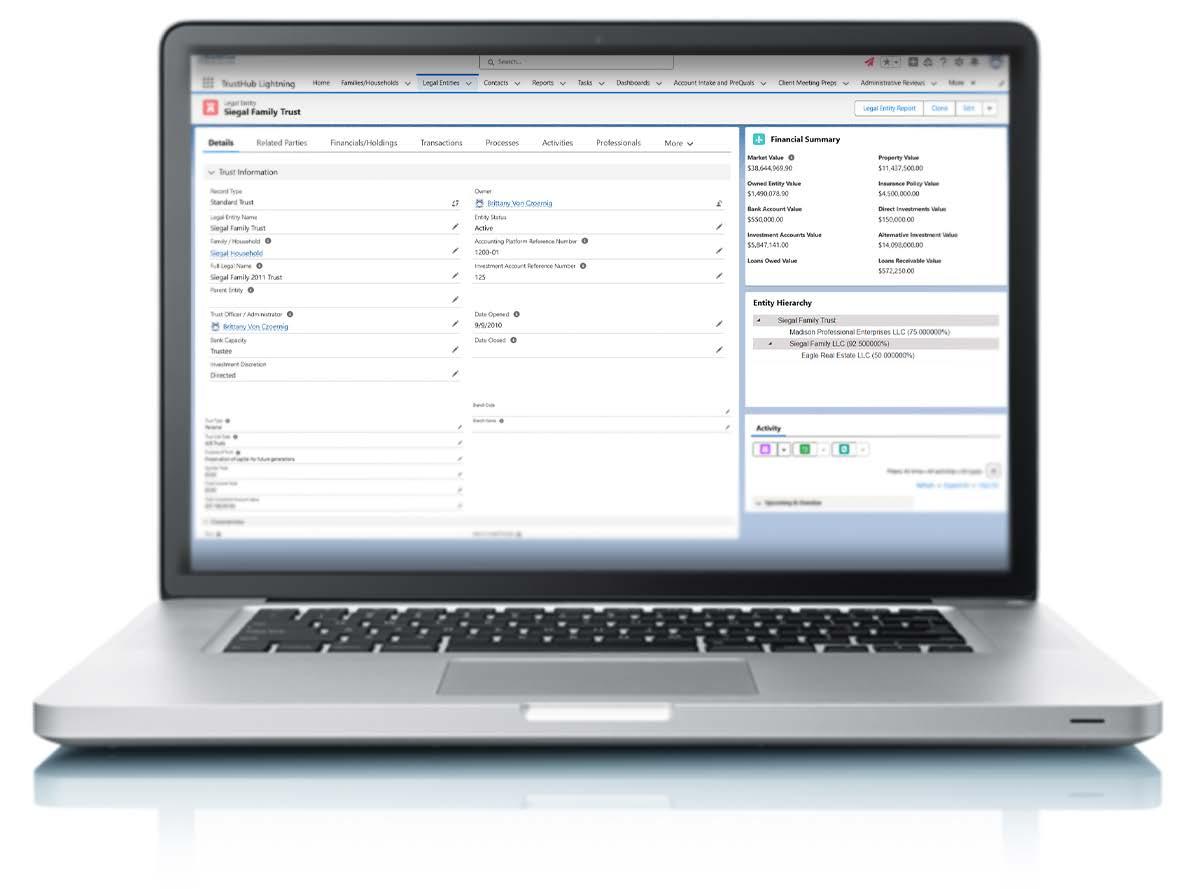

Please explain why you/your business was able to reach this award-winning level?

d1g1t was created to consolidate fragmented legacy systems into a unified, institutional-grade wealth management platform that delivers operational efficiencies at scale for Multi-Family Offices. Powered by an institutional-grade performance and risk engine, d1g1t provides on-demand analytics consistently used across integrated workflows for reporting, portfolio management, billing, and client engagement. The platform enhances client advisory services through its dynamic interface, enabling firms to provide exceptional digital experiences while optimizing portfolio construction and investment outcomes.

Our platform streamlines every aspect of portfolio management— from construction and rebalancing to trade execution. Firms gain access to comprehensive real-time analytics and bulk trading functionality, with direct communication capabilities to brokers and custodians. This enables sophisticated portfolio construction strategies that enhance diversification and maximize returns.

The integrated Unified Managed Accounts framework allows portfolio managers to execute complex investment strategies efficiently and cost-effectively. Rebalancing becomes straightforward with guided workflows, while trade execution leverages industrystandard FIX protocols for reliability. One advisor using the platform cut a three-day portfolio rebalancing process down to hours.

Built around a comprehensive household-centric approach, d1g1t enables advisors to monitor, compare, and analyze portfolios across multiple accounts and family structures. Interactive dashboards deliver immediate insights into returns, capital gains, volatility, and liquidity positions. Advisors can track performance trends over time and ensure investment strategies align with specific client objectives.

What was the way your colleagues made a difference?

d1g1t is proud to have one of the strongest financial engineering teams in the industry. Our platform reflects the expertise of professionals with comprehensive backgrounds spanning finance, technology, and operations and who have successfully built and launched complex systems for top-tier multi-family offices, investment banks, asset managers, and wealth management firms.

How do you intend to remain on the front foot and continue to set a high standard?

At d1g1t, we're dedicated to fostering a culture of continuous innovation. We regularly deliver new capabilities and improvements through systematic product updates. Our development and innovation groups work to guarantee that our platform delivers best-in-class performance and scalability, maintains the strictest security standards, and supports the daily operational requirements of our clients.

Whom to look for, either inside or outside your business, for ideas and inspiration?

Our clients inspire our work, challenging us to build technology that solves their most pressing issues. Understanding their priorities enables us to translate concepts into meaningful platform improvements. This partnership approach has enabled us to build a robust platform that enables advisors to deliver an exceptional client service. Their ongoing input reinforces our focus on relentless innovation, helping us stay responsive to their evolving demands.

What will winning this award do for your business and colleagues?

We’re incredibly honored to win the Portfolio Management category. This recognition fuels our drive to keep innovating and developing solutions that deliver real value to our clients.

Delegate Advisors was founded in 2012. Since then, our firm has grown and transformed, yet our core focus remains the same—to provide highly customized investment and planning advice to our clients.

We’ve continued to grow each year and now serve approximately 40 families across the country. With roughly $2.5B in assets under advisement, our team is small and highly experienced, with numerous accreditations and designations under our belt.

Our growth, specifically among families of this size and complexity, underscores our business and service model and the desire for independent advice and a commitment to solving for client objectives.

Please explain why you/your business was able to reach this award-winning level?

When a client calls with a unique issue, we get to work and provide a solution tailored to their needs.

In the past year, we have helped clients with numerous, complex wealth challenges that ultimately helped them make informed decisions, resulting in positive outcomes that have multi-generational impact.

How do you intend to remain on the front foot and continue to set a high standard?

At Delegate, excellence is woven into the fabric of our operations and client services. In an ever-evolving financial landscape, we understand that stagnation is not an option. Our team is committed to learning and seeking ways to serve our clients better.

Our strategy is multi-faceted, focusing on continuous improvement, proactive adaptation, and an unwavering dedication to our clients’ success.

What was the way your colleagues made a difference?

At Delegate, we believe in a team first culture. We tell our clients they’re important, but we make sure to take care of our team so they can grow and build the type of work-life balance that will ensure they want to be around to serve our clients for many years.

We know our team is the driving force behind the exceptional service we provide. The difference they make stems from a deeply collaborative culture, shared commitment to excellence and a collective dedication to our clients’ well-being.

In short, the difference our colleagues make at Delegate is the difference between a collection of individuals and a powerful, unified team. It’s the difference that allows us to deliver personalized, sophisticated and seamless wealth management solutions that truly make an impact on our clients’ lives.

Where do you see the wider wealth management sector going in the next five years?

The wealth management industry is heading towards a future where AI and technology will enable greater efficiency. When you combine highly experienced, empathetic advisors with advances in technology, we expect advisors will have more time to utilize their soft skills.

Data analytics and artificial intelligence will enable wealth managers to gain deeper insights and offer more sophisticated investment strategies.

However, maintaining human touch and building strong client relationships will remain essential.

Andrew “Andy” Hart CEO Delegate Advisors

"You help your

Who is helping you?"

The top wealth management firms focus on helping their clients manage and grow their wealth. But who helps wealth management firms find their top-performing employees?

Enter ECG Resources, a boutique Executive Search Firm focused exclusively on the wealth management industry.

Founded in 1981, ECG works with top-tier firms, whose clients typically have between $10 million and several billion in assets. ECG is known for recruiting elite professionals, offering an unmatched blend of discretion, industry expertise, and relationship-driven search.

We spoke to ECG Resources President Dave Glaser about why ECG has become the #1 rated recruiting company in the wealth management industry.

What sets ECG Resources apart?

We specialize exclusively in placing top talent in elite wealth management firms. Most recruiters are generalists—we’re not. In fact, even within the wealth management space, we specialize in finding advisors and executives, who work with clients having between $10 million and several billion in assets. Our clients need candidates who can walk into a room with an ultra-high-net-worth family and earn trust.

Why do your clients prefer to work with you and not to advertise roles publicly?

Several reasons. Firstly, discretion is essential. Firms managing high-net-worth assets want to keep key transitions confidential. We work behind the scenes to protect everyone’s reputation and avoid disruption.

Secondly, we save our clients, time, money and effort in their search for the right hire. We recruit potential candidates, preinterview them and only pass on candidates to our clients that we know are a potential fit.

• Wealth Management Executive Search Firm Winner

Dave Glaser (left) President

Isaac Amar (right) Senior Executive Recruiter ECG Resources

We will work with a client until the position is filled. Our experience allows us to understand exactly what each client needs and identify the right people quickly.

You’ve said 98% of your candidates aren’t even looking for jobs. How does that work?

That’s our model. We don’t wait for résumés. We go directly to top professionals who are already succeeding in their roles. These are people who would never apply online. They take our calls because we’ve earned their trust over decades.

What’s your process for understanding who’s the right fit?

We don’t just screen for skills—we assess fit on a deeper level. What kind of firm is this? What’s their leadership style? What kind of personality will thrive there? A good search isn’t just about credentials; it’s about predicting chemistry. We also speak directly with previous colleagues and clients when needed. We take nothing for granted.

What impact does being recognized with the Family Wealth Report Award for Excellence in Wealth Management Recruitment have on you and ECG Resources?

It’s a meaningful validation of the work we’ve done for decades. We’re humbled and honored to be recognized for helping wealth management firms make the right hires to support their continued growth. It affirms our commitment to integrity and long-term relationships, and it motivates us to keep raising the bar.

What’s changing at ECG today?

We’ve recently brought in the next generation. Isaac Amar joined the firm and brings a fresh outlook, a strong sense of where younger professionals are coming from, and new tools. I’m proud that we offer the wealth of four decades of experience coupled with understanding today’s growing landscape.

In an industry weighed down by legacy systems, fragmented data, and strict regulations, Eton Solutions is transforming how ultrahigh-net-worth families, family offices, and private equity firms leverage AI.

Managing nearly $1 trillion in assets across 12 countries, our cloud-native platform, AtlasFive®, unifies accounting, investment reporting, trust administration, tax, bill pay, and document management into a seamless system of record.

At the center is EtonAI™, our proprietary AI engine that goes beyond automation—delivering intelligent document processing, contextual insights, and natural language querying. It powers 400+ practical applications that solve complex operational challenges with precision.

What key insight helped you break through and lead innovation in AI-powered wealth management?

We recognized early on that AI couldn’t be an afterthought. Wealth management is complex—spanning legacy documents, inconsistent data formats, siloed systems, and strict, varied compliance demands.

For example, many family offices still process K-1 tax forms manually, despite the dozens of formats they arrive in.

Our breakthrough was embedding AI directly into AtlasFive®. We built workflows to handle messy, real-world data—recognizing tax document structures, linking investment reports to accounting, and ensuring security and auditability.

Instead of flashy, disconnected tools, we created a system aligned with how wealth managers work—automating tedious tasks and freeing teams for higher-value decisions. That practical, client-first mindset sets us apart.

• Bill Pay

How will you sustain leadership amid rapidly evolving AI technologies?

AI evolves rapidly, but many new models lack the domain expertise and governance controls wealth management requires. Our platform is technology-agnostic, enabling integration with emerging large language models (LLMs) while avoiding vendor lock-in.

We’ve heavily invested in proprietary technology—backed by seven patents—that links AI to structured family office knowledge graphs and enforces strong guardrails to prevent hallucinations and ensure data integrity. We collaborate closely with clients to refine these safeguards based on real-world needs and evolving regulations.

Rather than chasing trends, we focus on practical innovations that solve known challenges while embedding rigorous governance—keeping us both cutting-edge and reliably compliant.

What major obstacles did you face integrating AI, and how did you overcome them?