ACCLAIM

RECOGNISING LEADERS AC ROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY THROUGH THE WealthBriefing AWARDS PROGRAMME

RECOGNISING LEADERS AC ROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY THROUGH THE WealthBriefing AWARDS PROGRAMME

Technology & Operations Trends in Wealth Management 2024

(in partnership with Alpha FMC)

This 12th edition of WealthBriefing’s Technology & Operations Trends in Wealth Management report, created with Alpha FMC, provides a global overview of how digital transformation is reshaping the wealth management sector. Firms across various regions are leveraging technology to enhance operational efficiency and client experience, while navigating evolving client expectations, regulatory changes, and a complex economic environment.

Philanthropy Evolved: How High-NetWorth Individuals are Redefining Giving, Ethics and Impact

(in partnership with Jersey Finance)

Philanthropy is undergoing a profound transformation as high-net-worth (HNW) individuals redefine traditional notions of giving, ethics, and impact. This report delves into these shifts, offering a comprehensive analysis of emerging trends, generational influences, and the evolving dynamics between wealth, altruism, and social responsibility.

The Bahamas: A Complete and Compelling Choice (in partnership with The Bahamas Financial Services Board)

The Bahamas stands out as a premier destination for business, blending political stability,

innovative financial structures, and an exceptional lifestyle. This report offers an in-depth exploration of its unique advantages as a financial hub, from wealth planning tools to cutting-edge FinTech initiatives, alongside its unparalleled appeal for high-net-worth individuals and global investors.

Directions for Rapidly-Expanding Sector (in partnership with UBS)

Our second report examining the growth of Asia’s EAM sector, covering both the powerhouses of Singapore and Hong Kong, and emerging markets like Thailand and the Philippines. This study looks at the growth prospects for independent advisors in the round as they seek to tap the region’s booming wealth and growing client acceptance of the EAM model.

Family Office Focus: An Update of the Industry's Efficiency in Accounting and Investment Analysis (in partnership with FundCount)

A deep dive into the key technological and operational challenges facing family offices in their accounting and investment analysis activities. Based on surveys and interviews among family offices managing over $72 billion in assets, this is an invaluable benchmarking tool for the sector which presents fascinating insights into future developments from a range of industry experts.

(in partnership with First Abu Dhabi Bank)

This ground breaking new research examines the growth of female entrepreneurship in the region. More specifically it looks at how women are driving family office strategy as well as the relationship between MENA’s UHNW female clients and the wealth management industry.

Applying Artificial Intelligence in Wealth Management - Compelling Use Cases Across the Client Life Cycle

(in partnership with Finantix & EY)

This comprehensive report identifies elements of the institution and advisor’s workloads that are ripe for AI amelioration, and points the way for firms seeking to maximise the competitive advantages offered by new technologies. AI experts and senior industry executives enrich each chapter, answering crucial questions on risk, KYC/AML, compliance, portfolio management and more.

With EY providing the overview, this report draws on the front-line experience of many of the technology sector’s biggest names, in recognition of the fact that they are the ones going in to solve wealth managers’ most pressing problems and have typically seen the ramifications of firms’ choices play out numerous times – not to mention in various contexts globally.

STEPHEN HARRIS CEO, WealthBriefing

The 2025 WealthBriefing Wealth For Good Awards mark a milestone in the global conversation around responsible wealth. Now in their fourth year, these awards continue to champion the conviction that wealth, at its best, is a force for long-term value, not only for families, but for communities, institutions, and the planet.

This year’s ceremony builds on the momentum of last year’s inaugural live gathering, with an even more ambitious program and broader international representation. Over 150 nominations were submitted spanning five continents, a 20% increase from 2024. The increased engagement underscores a pivotal shift within the wealth management sector: doing the right thing is no longer peripheral, it’s central to the mission.

From its inception, the Wealth For Good Awards have recognised those who look beyond the balance sheet. The programme celebrates firms, advisors, and families who act with integrity and clarity of purpose – whether through impactful giving, values-led investing, or setting standards in inclusion, sustainability, and transparency.

What distinguishes this year’s finalists is their ability to address today’s complex realities. In an era marked by inequality, climate urgency, and geopolitical volatility, wealth holders are engaging with purpose not only as a moral imperative, but as a stabilising force for future generations. This is a movement grounded in both conscience and continuity.

Notably, categories such as Impact Investing, Diversity & Inclusion, and Next-Gen Philanthropy saw the highest growth in submissions, highlighting shifting priorities among wealth holders and advisors alike. Judging panels were drawn from global leaders in private banking, multi-family offices and independent advisory firms, ensuring the awards reflect industry excellence with credibility and breadth.

Importantly, the awards also highlight the work still to be done. In a landscape where greenwashing and performative virtue are real risks, true leadership requires accountability, courage, and a long-term view. Tonight’s winners provide guiding examples for the road ahead.

The WealthBriefing Wealth For Good Awards continue to serve not as a destination, but as a compass, pointing our community toward a more equitable, responsible, and sustainable future.

Together, we move forward with humility, resolve, and shared purpose.

The 2025 WealthBriefing Wealth For Good Awards programme was focused around three main category groupings: experts (individuals and teams), products and services for wealth managers and clients, and institutions of all sizes and types in the global market.

Independence, integrity and genuine insight are the watchwords of the judging process with the judging panels made up of some of the industry’s top trusted advisors and bankers.

JENNIFER AYER Managing Director AlTi Tiedemann Global

CATH DOVEY Co-Founder Beacon Collaborative

ROOPALEE DAVE Partner & UK Wealth Management Lead EY

SIANNE HALDANE Founder Boon Impact Limited

MARK HUSSEIN CEO, HSBC Life (UK) and Head of UK Insurance HSBC Bank

NIGEL KERSHAW OBE Chair The Big Issue Group

XAVIER ISAAC Co-Founder & CEO Accuro

RACHEL DERRICK Head of Partnerships Global Returns Project

ELISE HOCKLEY Communications Director Ocean Risk and Resilience Action Alliance (ORRAA)

ANDREW KAUFMANN Founder Time to Give Network

KEITH MACDONALD Senior Advisor Wealth Management Various

HUGO SMITH Head of Private Wealth Team Broadfield

PHIL WATSON Founder and C Lightbox Wealth

MATTHEW SPENCER Advisor Various

JAMES QUARMBY Partner Stephenson Harwood LLP

MARYANN UMOREN SELFE Investment Solutions

Banque Internationale à Luxembourg (Suisse) SA

ALISON WHATNALL Founding Partner and Group Chief Operating Officer GSB

MELVYN YEO Co-Founder and Director TRIREC

Clients won’t tell friends how you invest their money. They will tell friends how you help them support their passions.

PROTECT RAINFORESTS.

REJECT GREENWASH IMPROVE AGRICULTURE. DEFEND OCEANS. SAVE WHALES. PLANT TREES. GATHER DATA. STOP OVERFISHING. HALT POLLUTION. RESTORE FORESTS.

RALLY GOVERNMENTS TAKE ACTION.. GROW SEAGRASS ENFORCE LAWS.. SAFEGUARD SPECIES.

PROMOTE BIODIVERSITY

CONSERVE MANGROVES.. REDUCE EMISSIONS END BOTTOM-TRAWLING.. MONITOR PROGRESS.

DELIVER IMPACT.

Moneda Capital’s Keystone II and Oakwood I bonds are now listed on the Vienna MTF, offering qualified investors access to structured income strategies linked to UK-based real estate and commercial assets.

We partner with IFAs, introducers, and family offices across the UK seeking differentiated, asset-linked solutions for High-Net-Worth individuals and Sophisticated investors.

Fixed-rate investment programmes designed for use by UK wealth professionals. For collaboration opportunities or to request documentation:

Proud of our awards for Innovation in ESG and Philantropy Service Offering

ABN AMRO has won the 'Innovation in ESG' award at the European WealthBriefing Wealth For Good Awards 2025. ‘I see it as a great recognition that we are moving in the right direction,’ says Iris Mekers, head of Sustainability Wealth Management Clients Europe. ‘Sustainability is a common thread in everything we do. Together with our clients in the Netherlands, Germany, France and Belgium, we are setting course for a sustainable future.’

The jury praised the private bank for seamlessly integrating sustainability into its core strategy. ‘Our client advice always includes the client’s entire situation,’ Iris explains, ‘sustainability is an integral part of it.’ Together with its clients, the bank wants to realise as much impact as possible. ‘It is a social and liveable future that connects us, that is the starting point. Each client has its own vision, goals and wishes, which we discuss with each other.’

In line with its purpose “Banking for better, for generations to come”, the bank is committed to creating a liveable world for future generations. ‘We want to accelerate the transition to a sustainable society and economy,’ says Iris. ‘To achieve this, we focus on three themes: Climate Change, Biodiversity &

• Innovation in ESG (Global Reach)

Circularity, and Social Impact.’ That social aspect is at least as important to clients as the environment. ‘Our clients are as committed to financial resilience as they are to green energy.’

The private bank assists its clients at all important moments. ‘Whether it’s buying a house, starting a business or taking a fresh look at investments,’ Iris outlines. ‘Precisely at those moments of change, clients expect progress, and want to increase their impact.’ In a world that is rapidly changing, it is not easy to oversee everything. ‘Every decision requires a careful assessment of opportunities and risks, which is no different with sustainability. We are there to guide clients in this process.'

The bank has a wide range of sustainable products. ‘We assist clients with shaping a sustainable investment portfolio, advise them on making their commercial property more sustainable, and help them with a sustainable mortgage.’ Clients can also invest in sustainable frontrunners. 'With impact investing, clients invest directly in companies that lead the way in sustainability. In this, we are unique as a private bank in the Netherlands. Due to our scale, clients can start investing from a relatively low amount.’

WealthBriefing is the leading subscription-based business intelligence service for the wealth management community, with the latest news, analysis and in-depth features from around the globe. WealthBriefing subscribers are part of an international community for whom staying abreast of the latest industry developments is a crucial part of their professional practice. Readers find our content on topics such as strategy, M&A, important people moves, investment management and asset allocation to be an essential resource in a fast-moving world.

The Asia-Pacific region’s meteoric rise as a major wealth management market has sparked huge demand for region-specific business information. WealthBriefingAsia was launched in 2009 to satisfy this growing information requirement, and it is the only wealth management news site focusing exclusively on the Asia-Pacific region. Providing indispensable news, features and industry views that are always relevant and concise, WealthBriefingAsia allows subscribers to conserve that most precious of all resources: time.

The North American wealth management market is one of the largest and most diverse in the world, and is markedly different from those in Europe and the Asia-Pacific region. Multi and single family offices in particular are a well-entrenched,integral part of the private wealth management landscape. Family Wealth Report provides need to know business intelligence in a convenient and easy-to-read format – straight to subscribers’ inboxes every day. Nowhere else will you find such high quality, in-depth and often exclusive content all in one place.

A unique thought-leadership platform, WealthBriefing’s events foster intellectual debate on the challenges and opportunities facing the industry and are designed to be an optimal use of wealth managers’ precious time and present an excellent networking opportunity.

WealthBriefing has added to its offering for the global private banking and wealth management communities by running thirteen annual awards programmes for the family office, private banking, wealth management and private client communities. The awards programmes are focused around three main category groupings: experts (individuals and teams); products and services for wealth managers and clients, and institutions of all sizes and types

WealthBriefing has unrivalled access to the most senior wealth management professionals across the globe, meaning that our research reports represent guides to future best practice as much as being barometers of current industry trends.

ABN AMRO Philanthropy won the award for best 'Philanthropy Service Offering' at the European WealthBriefing Wealth For Good Awards 2025. ‘Our clients want to realise positive impact with their assets. It is our mission to guide them on this path. This recognition makes us very proud and happy,‘ says Frank Aalderinks, Head of Philanthropy.

The team is spread across the Netherlands, Germany, France and Belgium. ‘The fact that it is an award for our entire European service makes it even more special,’ he continues. ‘Our employees are very passionate. By working together, we increase our impact. Every day we share knowledge and experience and learn from each other. Together, we build bridges in the world of philanthropy, across themes and national borders.’

Tarek Hegazy, a philanthropy specialist and member of the board of the Bethmann Bank Foundation in Germany, is one of those passionate employees. ‘I too am very happy about this recognition for our work. I see it as a great opportunity to raise awareness that everyone can make a difference in the world, according to preference and ability. By giving money, or by making time or a network available.’

Of the private bank's clients, 85% want to contribute to society in an effective way. ‘We accompany them on their journey,’ Tarek says. ‘Philanthropy is not a sprint, it is a marathon. It starts with serious questions and bigger goals, then you talk about themes like education, health and climate. Then we help them formulate their dream - the mission - and a giving plan. Ideally, investment

Frank Aalderinks - Head of Philanthropy

Tarek Hegazy - Philanthropy Specialist

ABN AMRO

• Philanthropy Service Offering (Europe) Winner

and philanthropy complement each other, so clients can increase their positive impact. We are therefore in close contact with our investment specialists.’

ABN AMRO Philanthropy is an important flag bearer for the bank's purpose “Banking for better, for generations to come”. ‘Our customers want to leave the world a better place for generations to come,’ Frank explains. ‘Increasingly, they are involving the next generation in their philanthropic activities. We guide them to give this form and substance and give all family members a voice.’ Besides setting up a family foundation, the team also helps entrepreneurial clients who want to establish a corporate foundation.

ABN AMRO Philanthropy enabled the allocation of over €350 million to endowment funds and charities in 2024. ‘It's a synergy,’ says Frank. ‘Clients want to make an impact with their assets, we give them confidence that we can guide them well.’ Tarek nods in agreement. ‘It's a combination of a personal approach and expertise. A lot is happening in the world, philanthropy can be a catalyst in many situations. We know the charity sector and know what's going on. This allows us to properly assist our clients with any question they may have.’

Knowledge is also shared with external partners. ‘We are active in the Philanthropy Advisors Within Financial Institutions Network,' Frank continues. ‘We also publish articles, issues and studies. Frequently, we organise events on topics such as art and culture, mental health, sport and inclusion, and biodiversity.’

Helping changemakers create lasting, impactful legacies for a better world.

Our dedicated team has twenty years of experience helping families and individuals realize bold visions that go from idea to impact.

Strategic philanthropy

Grantmaking

Social impact

Wealth management

Value-driven change

Learn more at arabellaadvisors.com

Arabella Advisors is a certified B Corp and mission-driven professional services firm that supports nonprofits, foundations, and individual donors. With over 400 employees across six offices, Arabella’s services extend to more than $4 billion in philanthropic assets annually. Since 2016, we’ve facilitated more than 8,400 grants to over 3,500 grantees in 105 countries. Among our firm’s core strengths is helping ultra-high-net-worth individuals and families navigate complex philanthropic challenges while deepening family engagement and maximising social impact.

Our approach to ESG goes far beyond encouraging sustainable investing. We help clients develop integrated strategies that address systemic issues through multiple philanthropic tools – grantmaking, impact investing, advocacy, and direct services. As a certified B Corp, we’re committed to building more sustainable and equitable communities globally.

For example, we supported an EU-based family office in evaluating nearly 20 years of grantmaking across focus areas including arts and culture and biomedical research. Our analysis led to strategic refinements and operational improvements for their foundation. In another case, we coordinated $10 million in humanitarian aid to global conflict – delivering ambulances, ultrasound systems, and portable X-ray machines – demonstrating how philanthropic strategy can address both urgent crises and long-term needs.

One of our biggest challenges has been balancing clients’ desire for immediate impact with the need to create lasting change. We've learned that this requires addressing both technical questions – like selecting the right philanthropic vehicle – and adaptive challenges, such as managing family dynamics across generations.

Betsy Erickson - Managing Director, Co-Head of Family and Individual Services

Joseph Brooks - Managing Director, Co-Head of Family and Individual Services

Arabella Advisors

• Philanthropy Consultancy (Americas)

Our work with next-generation wealth holders has been particularly instructive. These philanthropists want their giving to reflect personal values while fostering authentic family connections. To meet these needs, we’ve developed specialised expertise in adult learning and multi-generational facilitation, helping families build knowledge, confidence, and cohesion through philanthropy.

To stay ahead of client needs, we continue to evolve and innovate. In just the past three years, Arabella Advisors has made several acquisitions, increasing our capacity to support nonprofit operations, growing our expertise to support consulting clients who are tackling society’s biggest challenges, and expanding opportunities for technology-driven fiscal sponsorship solutions.

Looking forward, we’re deepening our expertise across the full philanthropic toolkit and growing our capacity to convene funders around collaborative solutions. We believe that many of today’s most pressing global challenge – climate, health, and equity –require joint action that no single donor can achieve alone.

Our team brings deep expertise in philanthropy, systems change, and family dynamics. With backgrounds in fields ranging from international development to organisational psychology, our colleagues help clients tackle the most intricate philanthropic challenges. Whether behind the scenes or leading a complex initiative, they deliver creative, empathetic and effective solutions.

Arabella was founded twenty years ago on the belief that family philanthropy could create both greater impact and deeper meaning. Today, we continue to fulfill that vision – at a scale and level of sophistication that sets a new standard for strategic giving.

Charities face an unenviable task: delivering on long-term missions while navigating short-term volatility. Against that backdrop, ARC offers trustees something rare in the investment world: clarity. Over the past 30 years, ARC has become a trusted adviser to more than 20 charities with assets under advice exceeding £2.1 billion, within a wider client base of 200 groups and total advised assets of £18.4 billion. With regulatory oversight in five jurisdictions and a strict policy of independence, the firm provides strategic advice, manager evaluation and performance assessment.

It’s a model that appeals to fiduciaries looking for objectivity and insight. “Charities operate in a world of competing pressures,” says Grant Wilson, ARC’s Chief Investment Officer. “Our role is to provide trustees with the tools, evidence and perspective needed to make investment decisions confidently and responsibly.”

Please explain why your business was able to reach this award-winning level?

“Our independence means we can focus solely on helping trustees answer a simple but critical question: is our investment approach delivering?” says Wilson. “We support the creation of investment policy; help define objectives and provide robust benchmarking to track outcomes over time.”

Since 2012, ARC’s Charity Indices (ACI) have become the sector’s definitive reference point. “Charities can compare their performance to peers using real, net-of-fee data, not marketing narratives,” he adds. “And the insights come at no cost. That’s part of our commitment to supporting the sector as a force for good.”

Andrew Kettlety - Director

Dimitrios Mitsopoulos

Senior Investment Analyst

Asset Risk Consultants (UK ) Limited

• Innovative Offering or Advice (Global Reach)

What was the way your colleagues made a difference?

“Clients are matched with consultants based on experience and interpersonal fit,” says Wilson. “That ensures the advice is technically robust but also grounded in a practical understanding of each charity’s mission, constraints and priorities.”

Each relationship is led by a senior consultant, supported by a small team of analysts and quality-assured by an alternate director. “It’s a structure that ensures continuity and accountability,” he adds. “More importantly, it means we’re not just delivering data, we’re interpreting it to support governance and decision-making.”

How do you intend to remain on the front foot and continue to set a high standard?

ARC continues to invest in tools that improve transparency and oversight. Alongside the Charity Indices, ARC publishes the Charity Multi-Asset Fund Review, a free quarterly assessment of the pooled funds used by smaller charities.

“These resources make oversight easier for trustees, especially those without the scale or expertise to run their own mandates,” says Wilson. “We’re also refining our reporting dashboards and expanding our peer group datasets to keep pace with the evolving landscape.”

Where do you see the wider wealth management sector going in the next five years?

Wilson expects transparency and accountability to become the norm. “Whether large or small, charities will face increasing pressure to show their investment arrangements are fit for purpose. That means setting clear objectives, measuring outcomes and being willing to act if things drift.”

“In a sector built on trust, that’s the kind of rigour trustees deserve and the kind of support we’re proud to provide.”

atomos is a wealth management company with headquarters in London and a network of regional offices across the UK. Our experienced financial planners and portfolio managers support more than 13,000 people a year to reach their money goals and get what they want out of life.

In January 2023, atomos formed a strategic alliance with global financial services firm WTW, unlocking a unique opportunity to bring institutional-grade investment capabilities to our retail clients.

This collaboration combines WTW’s global scale and in-depth research with our commitment to delivering high quality investment solutions to help our clients meet their financial goals. Through WTW’s global network - including over 20 full-time equivalent sustainable investing specialists and more than 70 climate experts - we bring institutional-quality ESG expertise and stewardship to every client portfolio.

For instance, we firmly believe that stewardship and engagement are vital components of a successful sustainable investing strategy. As part of our alliance with WTW, our portfolios benefit from their relationship with EOS at Federated Hermes (EOS), who deliver corporate engagement on issues such as biodiversity to modern slavery and human rights. They have huge leverage in the corporate world because they represent a pool of assets worth £1.6tn, which commands attention and drives accountability. In 2024 alone, they engaged with approximately 1,000 companies on 4,250 different issues.

This award recognises the strong performance of our proposition over the past two years - and more importantly, it highlights the value our clients have seen from our continued collaboration with WTW.

• CSR Strategy and Implementation (UK)

• Investment Performance (UK)

Rowan Stone Investment Director atomos Investments Limited

We are continually evolving our offering and are always looking to implement new strategies. A key advantage of our alliance with WTW is the ability to adopt innovative solutions developed through their research and insights. One such example is our work to introduce a strategy based on the Global Equity Diversified Index (GEDI), which is an index that WTW launched in conjunction with MSCI. GEDI provides ‘whole of equity portfolio’ smart beta exposures whilst integrating sustainability considerations, a forward-looking climate risk metric and decarbonisation pathways. It combines WTW’s best thinking in multi-factor investing – using diversified signals across value, quality, and momentum – with robust ESG and climate transition risk considerations.

A key source of inspiration is our connection with the Thinking Ahead Institute, a global think tank founded by WTW. This platform enables collaboration with like-minded institutions, giving us access to pioneering research and ideas that help shape the future of investing. Being part of this ecosystem allows us to integrate forward-thinking investment and sustainable investing insights into our offering.

Our colleagues at atomos and WTW have brought our investment proposition to life for our clients, so to be recognised by the Wealth For Good awards is a testament to our successful alliance and the continued efforts of our colleagues. Receiving external recognition for both investment performance and our ESG approach gives clients reassurance that their portfolios are built not only for strong long-term returns, but with sustainable investing at the core.

At Right To Play, these three words guide everything we do. We harness play, one of the most fundamental forces in a child’s life, to reach millions of children each year, helping them to stay in school, resist exploitation, overcome prejudice and heal from the trauma of war and displacement. Visit righttoplay.org.uk/donate-uk to transform children’s lives today.

Your support helps us protect, educate and empower children around the world every day. righttoplay

Isabelle Hayhoe Senior Philanthropy Advisor Barclays Private Bank

In what ways does your firm make a distinctive offering around Philanthropy?

At Barclays Private Bank, we believe helping to leave the world a better place is one of the greatest privileges of wealth. That’s why we’ve developed our Philanthropy Service –a complimentary, values-led offering that helps clients use their wealth for good.

Our offer is designed to educate, inspire and connect clients wherever they are on their philanthropy journey, and I see it as a reflection of our purpose as a business and our belief in using capital as a force for good.

We support clients on a range of topics –from identifying values and motivations to structuring their giving, ensuring accountability, and developing strategies for impact. Often, we act as a sounding board or critical friend.

Our team brings over 35 years of combined experience across frontline charities, foundations, family offices, and wealth management. I also hold a specialist Philanthropy MSc and a PgDip in Charity Management, adding academic rigour to the guidance I provide.

We host curated events to encourage peer learning and connection, and share insights through articles, podcasts, and research. For example, we recently explored intergenerational philanthropy and shared panelists’ views on making family giving a rewarding experience.

• Outstanding Contribution to Wealth For Good Initiatives (U40'S) (UK)

• Sustainable Investment Performance (UK)

• Philanthropy Service Offering (UK)

We’re passionate about philanthropy done well – thoughtful, informed, and led with care, humility, and heart. Our publicly available Guide to Giving brings this to life through insights and case studies from leading philanthropists and sector experts across our networks. By sharing knowledge openly, we hope to help more people use their wealth and social capital to create positive change.

Working with individuals and organisations who are at the forefront of social and environmental change is incredibly inspiring. Our team has built strong

relationships across the sector – both in the UK and internationally – keeping us closely connected to the realities facing charities and communities.

These insights, combined with best practice, ensure our guidance is informed, credible, and focused on meaningful impact. From grassroots initiatives to large NGOs, we actively seek out the perspectives of diverse social leaders to enrich our work.

The generosity, curiosity, and commitment our clients bring to their philanthropy continually shapes my thinking. Many offer deep expertise and lived experience, and I learn a great deal from their reflections and ambitions. Whether just beginning or giving for decades, their willingness to lead with purpose is a constant source of motivation.

To stay ahead and at this level, what will you do next? Any new initiatives in the works?

To foster a stronger culture of philanthropy, we must understand both the evolving needs of the charity sector and the role philanthropists can play in meeting them.

I’ve been working with The Beacon Collaborative and Savanta on an in-depth qualitative study exploring the attitudes and giving behaviours of high-net-worth individuals (HNWIs) in the UK.

The research will offer a nuanced view of what motivates wealthy donors, the barriers they face, and the influences shaping their decisions. These insights will be valuable not only for philanthropists and charities, but also for policymakers, regulators, and others working to strengthen the philanthropy ecosystem.

In parallel, we’re supporting efforts to better quantify high- and ultra-high-networth giving in the UK – an essential step in understanding the full potential of private capital for public good.

We look forward to sharing findings from both projects in late 2025 and using them to inform and inspire philanthropic engagement.

Kylie Luo Executive Director, Practice Leader BDO

BDO Singapore has over 650 staff. The Asia-Pacific BDO Private Client Services (“PCS”) practice is spearheaded by our Singapore team which now has over 100 committed PCS specialists, spanning across key functions. Our specialists lead a network of over 1,000 local experts based in 25 countries.

Our specialists work with high net-worth individuals (“HNWIs”), families, business owners and Family Offices who want their global tax affairs managed proactively and seamlessly.

Our global reach means that we are not restricted by geographical boundaries. For each client, we draw on our global network and assemble the best team with the right expertise. Having people with the necessary cultural intelligence and knowledge of the subject matter, we can find the right solution for each client, regardless of where they may be based.

We are truly focused on private clients and on delivering exceptional client service through practical, bespoke advice, tailored to client priorities.

• Internal Equality, Diversity and Inclusion Practices or Program (Global Reach)

• Leading Individual in Wealth For Good (Global Reach)

We offer a unique “one-stop-shop” approach for clients, capitalising on the dedicated teams in various departments at BDO in Singapore and our international network. Our service excellence is what sets us apart from the rest of the industry.

Instead of using complex technical jargons, we speak the same tongue as our clients. We use plain, straightforward terms which our clients can comprehend, in languages that they are comfortable with, be it English, Mandarin, Cantonese or Bahasa.

In BDO, we listen, we plan, and we provide strategies, in-depth technical and

practical advice tailored to the specific needs and objectives of each client. We bring the solutions to our clients, and we take a practical and hands on approach in the implementation, ensuring that they understand every step of the process.

Even in times of the pandemic and amidst the ever-changing global environment, we kept ahead of the changes and ensured that our clients’ needs are well taken care of.

With our efforts, BDO is known in the industry as the go-to-tax-firm for HNWIs and ultra HNWIs. We work closely with all the major financial institutions and have implemented more than 50% of the tax structures in the market. As the market leader, we are also constantly in dialogue with government agencies, providing constructive feedback for the industry.

This award is an affirmation of our efforts and an encouragement to our team to keep up our efforts. We are thankful for the support that our various stakeholders have provided us with.

We will continue to support our private clients through any new laws and regulations and assist them to better manage their family wealth. As the regional economy grows and the number of affluent individuals/ families in the region increases, we see more opportunities for the industry. These families would want to put in place structures to better manage and preserve their family wealth. They would also want to ensure that their family wealth persists for multiple generations.

We at BDO understand our clients’ requirements and we strive to provide the best solutions for them, even amidst a changing landscape.

As an investor, you want to make a positive impact with your wealth. We offer innovative sustainable investment solutions across all asset classes so that you may align your wealth with what matters to you.

BNP Paribas Wealth Management is a leading global private bank and the largest in the Eurozone, with around 471 billion Euros of Assets under Management (as of 30 June 2025). With 6,700 professionals worldwide, we support ultra- and high-net-worth individuals, entrepreneurs, and families in protecting, growing and passing on their wealth.

Our clients benefit from a diversified and integrated model across the BNP Paribas Group. Responsible investing sits at the core of our strategy, reflecting both our purpose and our clients’ values. We aim to support the transition to a more sustainable economy by combining our financial expertise with our clients’ influence and commitment to addressing global challenges.

In the Middle East, BNP Paribas has had a presence since the early 1970s. Today, we operate across key Gulf centres – Bahrain, Dubai, Abu Dhabi, Jeddah, Riyadh and Doha – with over 500 employees. We serve entrepreneurs, expatriates, and families through experienced bankers located both in the GCC and Europe, reflecting our long-term commitment to the region’s economic development.

Winning at the 2025 WealthBriefing Wealth For Good Awards – in categories such as CSR Strategy and Implementation, Sustainable Investment Performance, Innovation in Impact Investing, and Innovation in ESG – reaffirms our dedication to sustainable finance. These awards reflect the passion and professionalism of our teams and strengthen our shared ambition to shape a more sustainable future, for our clients, colleagues, and wider communities.

• CSR Strategy and Implementation (MENA)

• Sustainable Investment Performance (MENA)

• Innovation in ESG (MENA)

• Innovation in Impact Investing (MENA)

Antoine

Our ESG offering is distinctive for its depth, customisation, and long-standing commitment. For over 20 years, we have applied a structured, expert-led approach that integrates financial returns with environmental and social impact.

Key to this is our MyImpact tool, which helps define each client’s sustainability profile. Relationship managers and ESG experts work with clients to align investment goals with their values, whether through targeted ESG investing, bespoke philanthropy, or broader sustainable strategies. Clients can then choose from proposals tailored to their unique ambitions.

Our mission is to fund the real economy while guiding clients with insight and integrity. We stay ahead of regulatory and market shifts to help them navigate the evolving ESG landscape with confidence.

Looking ahead, our strategy is rooted in deep client understanding and global collaboration. Whether advising first-generation entrepreneurs or multi-generational families, our relationship managers draw on expertise from across the BNP Paribas Group to support every step of the financial journey.

Innovation remains central to our approach. A key initiative is The Clover Methodology, our proprietary sustainability rating system. It assesses 100% of our recommended investment universe – across all asset classes – providing clients with a clear view of the sustainability levels of each investment and of their overall portfolio.

Through innovation, collaboration, and a strong focus on positive impact, we aim not just to maintain our standards, but to raise them further.

What sort of challenges have you had to deal with to reach this level, and what lessons have you learned and would pass on?

CAF has existed for over 100 years. That gives us an incredible wealth of knowledge and over the course of that time we have obviously met many challenges, but I believe this can encourage a culture of innovation. Over the years, we have been instrumental in the introduction of important new giving mechanisms and incentives, such as Gift Aid, Payroll Giving, social investment and CAF American Donor Fund. CAF has helped to unlock much more generosity, but I think the most important lesson is that innovation doesn’t happen in a vacuum. We achieve much more when we listen and collaborate, as colleagues, within the sector, with policymakers, and with donors.

Tell us how your colleagues have made a difference

CAF’s Private Clients team partners with 3,100+ (U)HNW clients to drive positive change in the UK and globally. The team offers a highly personalised service that provides guidance, inspiration, charity connections, and access to in-depth sector knowledge, governance expertise and bespoke giving solutions, enabling and inspiring clients to create philanthropic impact that is unique to them.

• Initiative or Program (Global Reach)

Mark Greer Managing Director Charities Aid Foundation (CAF)

By working closely with clients’ families, we are engaging the next generation of wealth holders in effective giving and responsible stewardship. For example, we supported a client’s succession plans as his daughter took the lead on the family wealth and designed a bespoke session to introduce a client’s 11-year-old child to philanthropy. This kind of activity is crucial to the future of philanthropy.

How do you hope winning this award will affect your business, colleagues, and clients?

I am incredibly proud of the Private Client team at CAF. The breadth of the expertise, enthusiasm and backgrounds of our advisers ensures our clients receive exemplary support in their giving, and to have it recognised externally by their peers is so valuable.

Our research shows that technical knowledge of philanthropy in professional services remains low, so awards like this raise the profile and understanding within the sector. I hope our win demonstrates to wealth managers, financial advisers, and family offices the value such expertise brings.

Many of our clients are very private about their giving, but I hope they see this award as recognition of their generosity and a celebration of a more strategic approach to philanthropy.

From whom and where do you get ideas and inspiration?

I continue to be inspired daily by what my colleagues’ hard work and our clients’ generosity accomplishes. We pride ourselves on problem-solving and fulfilling complex requests so it is exciting when we provide an innovative solution that can be offered to others. Whether that’s facilitating social bonds for renewable energy or supporting loans for critical relief in Sudan. Witnessing the great work of charities around the world in challenging circumstances drives me to achieve more.

Knowledge

Mark Trousdale Chief Growth Officer Communify Fincentric

Can you tell us about Communify Fincentric and what makes your approach distinctive?

Communify unifies client and market data through best-in-class digital experiences, transforming how wealth managers deliver personalised insights at scale. Led by former InvestCloud founders, we acquired Fincentric from S&P Global in August 2024. We operate from 8 global offices with 550 professionals, serving over 50 clients who collectively manage $20+ trillion in assets.

We stand out through our revolutionary data visualisation, powered by a unified knowledge base and dual AI strategy — combining deterministic AI for precision with probabilistic AI for rich, personalised experiences. This approach transforms thousands of data feeds into intelligent insights, delivering high-end services to all wealth tiers, with proven engagement rates of 45%.

What sort of challenges have you had to deal with to reach this level, and what lessons have you learned?

The wealth management industry's greatest challenge isn't data scarcity, it's data fragmentation. Market information streams through countless feeds while client data remains trapped in disconnected systems, creating fractured views that hinder decision-making. We've spent decades mastering complex data normalisation across inconsistent formats, varying update frequencies, and disparate taxonomies.

Our approach harmonises diverse feeds first, ensuring every data point is properly contextualised before transforming into engaging visual formats.

In what ways does your firm make a distinctive offering around ESG?

Rather than treating ESG as a separate consideration, we've seamlessly integrated three premier ESG data providers and over 10,000 distinct ESG metrics into our comprehensive platform. This integration transforms sustainability data from isolated reports into naturally embedded components of every client interaction through intuitive visualisations.

Our approach makes values-aligned investing understandable and actionable through clear, personalised data delivered with engaging data visualisation techniques, think interactive charts showing portfolio impact, sustainability scorecards, and ESG trend analysis. By eliminating artificial barriers between traditional and sustainable investing and empathising with the audience through compelling visual storytelling, we've enabled wealth managers to incorporate sustainability considerations naturally without requiring separate systems or workflows. This democratises responsible investing, making it actionable for all clients, not just the wealthy few.

To stay ahead, what will you do next?

Any new initiatives in the works?

The future belongs to firms that transform data from a burden into a competitive advantage through clear insights and intelligent visualisation. We're continuously expanding our AI Suite Digital Apps, focusing on behavioral science principles that drive client engagement and action through visual design.

We're launching MacroScore™, powered by The Economist Intelligence Unit – bringing nearly two centuries of trusted global economic analysis directly into everyday investment decisions through compelling visual intelligence.

This represents a breakthrough in addressing the critical intelligence gap in modern investing: making sense of world events and their portfolio impact. MacroScore™ transforms The Economist's sophisticated institutional-grade analysis into clear 0-100 risk scores and engaging visual formats – personalised podcasts, automated briefings, and real-time portfolio exposure monitoring powered by our MIND™ AI Suite.

The key is recognizing that data visualization creates experiences that educate, inform, and inspire action. By combining our comprehensive data foundation with cutting-edge visualisation techniques, we're setting new standards for how wealth managers communicate with clients in an increasingly sophisticated marketplace.

In what ways does your firm make a distinctive offering around ESG?

Our commitment to ESG principles drives our initiatives that help empower both our clients and the wider society.

We develop insightful thought leadership that helps clients to navigate ESG complexities and facilitate their credibility and transparency. We also facilitate industry collaboration through roundtables, such as our ESG Regulatory Reporting Roundtable Series, which enables the sharing of best practices to drive positive ESG actions.

In addition, our client-centric approach focuses on understanding both our clients and their end-customers fostering deeper relationships by recognising the motivations behind sustainable investing. We offer risk management services to reduce greenwashing risks and establish clear definitions for ESG products, helping clients navigate the evolving regulatory landscape.

We have a deep commitment to social mobility and use our ESG knowledge to contribute to UK-based programs like our EY Sustainable Futures, which is dedicated to help empower young people from low-income backgrounds, particularly those eligible for free school meals, by showcasing exciting pathways into careers in sustainable finance and helping them build a brighter future.

What sort of challenges have you had to deal with to reach this level, and what lessons have you learned and would pass on?

There have been challenges. The various regulations and guidance, for instance, can sometimes be complex and tricky to navigate, so it’s meant we’ve had to closely monitor developments and focus on pragmatic solutions for our clients.

We’ve also had to ensure data collection and integration is sufficiently high quality, as this can sometimes be deprioritised when it comes to ESG reporting. We assist clients in overcoming these

Naheed Tapya Partner, Wealth and Asset Management

Sustainable Finance Lead EY

• Philanthropic Initiative (Europe)

• Thought Leadership (Europe)

data challenges by streamlining collection processes and enhancing reporting quality.

From all these experiences, we have learned that effective communication is key, and engaging openly with stakeholders builds trust and helps to align ESG strategies. Additionally, recognising the cross-functionality of ESG change is vital, as all business units must understand the various functions involved. Flexibility in adapting to regulatory changes allows us to proactively adjust our strategies to meet compliance and client needs.

To stay ahead and at this level, what will you do next?

Any new initiatives in the works?

We are focusing on several new initiatives to help ensure our clients continue to receive the very best advice. We are supporting clients in developing holistic operating models that enable quicker adaptation to market changes and regulatory shifts, and developing innovative products and services that help our clients remain agile and responsive to the changing geopolitical landscape.

Furthermore, we continue to invest in developing improved reporting and disclosure frameworks that align with evolving regulatory requirements and emerging data needs, and can provide our clients with a streamlined approach to their corporate reporting obligations.

Tell us how your colleagues have made a difference?

Our global organisation is the driving force behind our success. The dedication and collaborative efforts of our colleagues help embed ESG considerations into all of our operations and client solutions. Their passion for sustainability is evidenced by their participation in industry events, such as London Climate Action Week. Together, we strive to help empower our clients and create a sustainable future for all.

Empower the next generation of financial planners and wealth managers through mentorship, coaching, and community.

The FinServ Foundation, founded in 2019 by Jamie Hopkins, Esq., LLM, CFP®, ChFC®, CLU®, RICP®, was created to address the high attrition rate in the financial planning profession and to help build a workforce that better reflects the diverse communities it serves. Each year, the foundation selects a total of 200 students across its spring and fall cohorts, drawing talent from more than 40 partner universities nationwide.

We are looking for new mentors and donors! It costs $2,000 to send each student through the program.

FinServ Foundation’s structured 6-month mentorship program connects aspiring financial planners with one of 250+ volunteer financial professionals.

Through the FinServ Fellowship, students receive two years of monthly group coaching guided by our four core learning modules.

FinServ Fellows attend a premier industry conference at no cost and gain valuable opportunities to connect with peers and professionals.

If you want to see change, be the change. If you want the worked done, do it yourself. These have been mantras the FinServ volunteer and leadership community have lived by for years. Since 2019, the FinServ Foundation has awarded over 700 Fellowships, partnered with more than 40 colleges and universities, and participated in over 40 industry conferences. But those numbers only begin to tell the story and need to be multiplied to propel our noble financial services industry forward.

At its heart, FinServ Foundation is about people. It’s about changing the trajectory of young lives – and in doing so, changing the future of financial services. The industry often talks about the need for talent, diversity, innovation, and leadership. But too often, those conversations stall without action. That’s where FinServ steps in.

The Fellowship program is more than a résumé booster – it’s a launching pad. Fellows are paired with mentors, receive real-world coaching, and engage in high-impact events that teach them not just how to pass exams, but how to build relationships, communicate value, and become trusted financial professionals. We are building advisors, not just credential-holders. We are building leaders, not just followers. We are building great people, not just numbers.

Mentorship is the core of this movement. It’s what makes the difference between someone seeing a job and someone discovering a calling. We’ve seen firsthand how one mentor conversation can shift a student’s entire path – giving them confidence, clarity, and connection. The Fellows don’t just grow – they thrive. And in return, they bring energy, perspective, and purpose back into our industry. Ive been told this at countless conferences now – how impressive the Fellows are to talk to, how smart they are, how prepared they are, and how passionate they are for this industry. None of this occurred by accident.

• Initiative or Program (Americas)

FinServ Foundation

But here is the sad truth: FinServ is doing this work because so many others aren’t.

Corporate training budgets are shrinking. Internal development programs have been sidelined. The technical education many receive – while important – isn’t enough. It doesn’t teach the skills that make an advisor successful: how to build trust, have hard conversations, and stand out in a relationship-driven field. Designations alone don’t prepare someone for a career – they prepare them for a base level of competency.

That’s why FinServ focuses on the intangibles. We teach young professionals how to network with confidence, how to lead with empathy, and how to build lasting client relationships. And then we bring them to conferences – over 40 and counting – where they can practice what they’ve learned in the real world. They shake hands with CEOs, share meals with thought leaders, and take the stage alongside seasoned professionals. This isn’t theoretical – it’s transformation.

If we want to shape the future of financial services, we can’t sit on the sidelines. We must be the ones who step up. This work isn’t optional – it’s essential.

Every firm, every leader, every advisor has a role to play. Whether you host an intern, become a mentor, or help fund the mission, your involvement matters. Because if we don’t build the next generation – who will?

The time to act is now. The opportunity is here. And the future is watching.

To learn more or get involved, visit www.finservfoundation.org. Let’s do the work together.

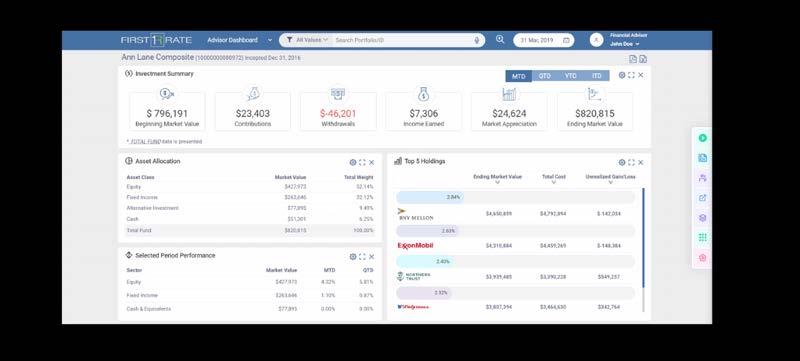

First Rate, Inc. is a global financial solutions, services, and data partner. Founded in 1991, First Rate is headquartered in Arlington, Texas, and has offices in seven countries. First Rate is a privately held firm that serves global financial services firms, including wealth management, asset management, and bank and trust companies, with innovative financial technology. Delivering tailored solutions that enhance decision-making, strengthen client relationships, and create a lasting global impact, First Rate’s culture prioritizes giving back to the industry and local communities.

At First Rate, we believe the business of wealth is deeply personal, and deeply impactful. Since our founding in 1991, we’ve been on a mission to empower wealth management firms with the performance, client reporting, and data aggregation solutions they need to better serve investors. Today, we support over 350+ firms globally and have $4 trillion in assets under management, but our vision remains rooted in something far greater than numbers: our co-workers, clients, and community.

As Chairwoman and Co-Founder, I’ve had the privilege of shaping not only our solutions, but also our culture — anchored in servant leadership and social impact. Our ethos of “Love, Give, Serve, and Enjoy” permeates everything we do, from the way we innovate to the way we invest in our communities. First Rate is not just a WealthTech firm. We are a purpose-driven organisation committed to transforming both the industry and the lives it touches.

In what ways does your firm make a distinctive offering around ESG?

ESG isn’t a category we’ve tacked on, it’s embedded in our DNA. Our solutions help firms track and report on ESG metrics, align portfolios with investor values, and deliver transparent performance insights. But equally important is how we operate. From offering paid volunteer hours to investing in underserved communities through our global impact work, we model the kind of change we believe wealth can enable.

What sort of challenges have you had to deal with to reach this level, and what lessons have you learned, and would you pass on?

Leading a tech company in a male-dominated industry while staying true to a values-first approach hasn’t always been easy. There were times early on when choosing people over profit felt like the slower road, but it turned out to be the most sustainable one. I’ve learned that leadership isn’t about always having the answers; it’s about listening well, acting with integrity, and staying fiercely aligned to your mission. My advice? Define success on your own terms and let purpose guide your growth.

Tell us how your colleagues have made a difference.

This recognition isn’t just mine; it’s shared with every person at First Rate who believes in our vision. From developers pioneering our state-of-the-art solutions, to our co-workers who are impacting the community around them, our people embody our purpose. What makes our team different is that they don’t just clock in - they show up. They care. They lead with their hearts and think beyond themselves. That’s what makes us strong.

How do you hope winning this award will affect your business, colleagues, and clients?

This award is an affirmation that doing good and doing well are not mutually exclusive. For our colleagues, it reinforces that our values are our superpower. For our clients, it offers another layer of trust that they’re working with a partner who sees beyond the bottom line. And for the next generation of women in tech and finance, I hope it serves as a signal: you belong here. Keep going.

Trina Stone Chairwoman & Co-Founder First Rate, Inc.

• Female Executive (Europe)

• CSR Strategy and Implementation (Americas)

• Thought Leadership (Global Reach) Winner

What sort of challenges have you had to deal with to reach this level, and what lessons have you learned and would pass on?

One of the biggest challenges has been bridging the gap between what clients expect – comprehensive, purpose-driven financial advice – and what legacy wealth management technology can actually deliver. While fintech has transformed areas like investing and payments, it has largely neglected philanthropy, estate planning, and tax strategies. This left advisors without the right tools to support clients in these critical conversations.

At Foundation Source, we saw an opportunity to lead. We developed cloudbased, enterprise-grade technology that enables wealth managers to seamlessly integrate philanthropy into their services. I’ve worked closely with our product and engineering teams to ensure the platform is intuitive, data-rich and scalable – meeting advisors where they are.

The key lesson I’ve learned is that innovation often happens at the edges of what’s been automated. When you actively listen to advisors and clients, you uncover unmet needs that, if solved thoughtfully, can unlock meaningful growth and value.

How do you hope winning this award will affect your business, colleagues, and clients?

This recognition affirms our belief that philanthropic technology is a powerful growth engine for advisors. It deepens client relationships and creates new avenues for engagement. Today’s wealth holders increasingly want financial strategies that align with their values, and philanthropy is a key way to achieve that.

When advisors support clients meaningfully in this area, it builds trust that extends beyond investment returns. Clients stay longer, refer others, and entrust more of their financial lives to the advisor. This award validates our commitment to building specialised technology – designed for philanthropic planning, not retrofitted

from other tools – to meet a rising and underserved demand.

From whom and where do you get ideas and inspiration?

I draw inspiration from being immersed in the wealth management space and from consistently listening to advisors and clients. My career path has taken me through some pivotal industry transformations. At FolioDynamix, I helped create investment programs tailored to scalable client needs. Later, during our integration with Envestnet, I saw firsthand how powerful tech-enabled platforms can be. Earlier on, I worked on the Unified Managed Account, which reshaped investment transparency and flexibility.

These experiences instilled a core belief in building technology that is both scalable and advisor-centric. At Foundation Source, client feedback fuels our innovation and ensures we stay aligned with real-world needs.

To stay ahead and at this level, what will you do next? Any new initiatives in the works?

We're focused on deepening partnerships with financial institutions – from global firms to independent RIAs – to help them offer scalable, efficient, and values-aligned philanthropic solutions. Demand for integrated giving strategies is growing, and firms want to meet it without adding operational burdens.

This year, we’ve partnered with Northern Trust to strengthen foundation services and with Callan Family Office to support ultra-high-net-worth clients. These alliances reflect a larger trend: philanthropy is becoming central to modern wealth management.

Looking forward, we’re enhancing our platform with smarter analytics, simplified onboarding and greater configurability –so advisors can scale personalised service without sacrificing compliance. We’re excited to lead the charge in helping firms differentiate through meaningful, values-based planning.

Joe Mrak CEO Foundation Source

• CEO: Technology (Americas) Winner

Gillian Howell National Philanthropy Executive Foundation Source

• Thought Leadership (Americas) Winner

What sort of challenges have you had to deal with to reach this level, and what lessons have you learned and would pass on?

One of the biggest challenges has been helping the wealth management industry recognise philanthropy as a strategic – not peripheral – part of comprehensive financial planning. High-net-worth families increasingly expect to discuss charitable giving with their advisors, yet many firms haven’t had the tools or resources to support those conversations with the same fluency as other financial topics.

We saw this as both a challenge and an opportunity. Education proved to be the most effective catalyst for change. We invested in building accessible resources that demystify philanthropy – from choosing charitable vehicles to aligning giving with legacy planning and impact measurement.

Drawing on 70 years of combined experience supporting foundations, nonprofits, and charitable assets, we've created actionable toolkits, checklists, research, and podcasts to help advisors engage clients with confidence and clarity.

The key lesson we’d share: when a client priority is underserved, that’s an opening for innovation. Address the gap with education, empathy, and expertise, and you’ll build trust, drive growth and deepen relationships.

To stay ahead and at this level, what will you do next? Any new initiatives in the works?

We're energised by our expanding work across RIAs, IBDs, family offices, private banks, and wirehouses. As firms seek to offer more sophisticated philanthropic strategies, we’ve developed a flexible, enterprise-caliber suite of services that integrates with high-net-worth offerings.

This platform includes specialised support in private foundations, donor-advised funds, and planned giving – delivered by a team of experts and backed by exclusive thought leadership.

Next, we’re scaling our impact through technology. That includes enhancing our digital platform with a modern interface, data-driven insights, and customised reporting to help wealth managers offer tailored philanthropic planning.

By embedding philanthropy into the core wealth experience, we help firms differentiate their services, deepen relationships, and uncover new growth opportunities. We’re excited about continued innovation and upcoming strategic partnerships.

Tell us how your colleagues have made a difference?

This recognition truly belongs to our Philanthropic Advisory Services team. Their depth of expertise and commitment to collaboration have been essential in embedding philanthropy within the wealth management framework.

Our team brings decades of experience in areas like foundation governance, program design, next-gen family engagement, and impact reporting. They not only guide clients through complex giving decisions but also create the educational content and tools that empower advisors across the industry. Their work has strengthened our offering and the value we deliver every day.

How do you hope winning this award will affect your business, colleagues, and clients?

Winning this award reinforces our mission: to equip advisors with the tools and confidence to support clients at every stage of their philanthropic journey – from firsttime givers to multigenerational families with advanced strategies.

For our colleagues, it’s meaningful recognition of their expertise and impact. For our clients and partners, it signals they’re working with a team setting the standard for philanthropic excellence in wealth management.

Your investments. Your mission. Your wealth.

Whether you’re an institutional or individual investor, important decisions start with important conversations. At Glenmede, you receive sophisticated wealth and investment management solutions combined with the personalized service you deserve.

How does your firm make a distinctive offering around ESG?

Our sustainable investment offering is differentiated due to its design explicitly aligned with Glenmede’s overarching core value proposition: to serve as reliable stewards for our clients. Our process for aligning a client’s values or mission with their portfolio is not siloed but rather embedded within the rigorous, fiduciary-driven investment processes we have honed over nearly 70 years and underpinned by the belief that financial returns and positive environmental and social outcomes are not mutually exclusive but deeply interconnected. Currently, our platform contains more than 60 investment strategies that range from integrated and mandated approaches to thematic and high-impact concessionary options, all grounded in fiduciary principles and supported by customised impact measurement.

What challenges have you had to deal with to reach this level?

A constant challenge in this space has been cutting through the noise – the headlines, the politicisation, and the shifting narratives around sustainable investing. It's easy to get pulled off course, but staying focused on the financial materiality of the issues that matter and not on the distractions is essential. From the start, our approach has been anchored in identifying financially material factors that can enhance long-term value – both financial and impact – for our clients. That consistency of purpose has been a critical lesson. Continuously refining our offerings and maintaining a thorough focus on financial materiality, investing over divesting, and active ownership is how we help drive meaningful change for our clients. Ultimately, our job is to help clients align their investments with their financial goals and values. Staying grounded in that mission, amid the noise, has been key to both our resilience and our impact.

Sustainable Investing Team

Glenmede • Investment Advice or Service Provision (Americas) Winner

To stay ahead, what’s next? Any new initiatives in the works?

As our firm positions itself for the next chapter of sustainable investing, we aspire to bolster our investment capabilities within single-theme solutions intended to prioritise areas of resilience and opportunity in today’s evolving regulatory and political environment, such as “energy resiliency,” capturing the need for a diversified energy mix to capture energy demand created by AI expansion; circular economy, focusing on companies with an edge in recycling in a trade-constrained world; and responsible AI, recognising the need to better understand its implications and externalities. We are complementing this thematic focus with a newly formed partnership with CapShift to expand our highly localised, place-based capabilities.

How do you hope winning this award will affect your business, colleagues, and clients?

Our north star remains the same: enhancing our ability to help individuals and families achieve their goals. This award provides meaningful market recognition of both our commitment and the thoughtful approach behind it. It gives us a stronger platform to continue to do so in practice while also opening the door to connecting with new audiences and expanding the ways we can support our community. It is a recognition that reinforces and signals our continued efforts, and we welcome anyone interested to reach out and engage with us.

• Sustainability Program (UK)

Stephanie Glover Strategy and Sustainable Finance Director Guernsey Finance

ince 2018, Guernsey has been a global leader in the field of sustainable finance. Guernsey Finance, the agency tasked with promoting and connecting Guernsey as an International Finance Centre in its key markets, has worked to ensure that sustainability is the ‘golden thread’ running through every sector of Guernsey’s specialist financial services industry.

Guernsey has developed two world-first regulated sustainable fund regimes – the Guernsey Green Fund regime, launched in 2018, and the Natural Capital Fund (NCF) regime, created in 2022.

The Guernsey Green Fund (GGF) regime provides a framework for funds that aim to mitigate environmental damage and contribute to a positive environmental impact. These funds must meet strict eligibility criteria, with at least 75% of their assets invested in designated "green" areas like renewable energy, energy efficiency, and sustainable agriculture.

The Natural Capital Fund (NCF) regime aims to enhance investor access to the natural capital investment space by offering a transparent and trusted product that contributes to reducing harm to or positively impacting the natural world.

The Guernsey-headquartered International Stock Exchange (TISE) is home to Europe’s most comprehensive sustainable segment, with more than £25 billion listed on TISE Sustainable. The GGF and NCF regimes collectively boast a total Net Asset Value (NAV) exceeding £5 billion in regulated green funds.

Guernsey also works with international partners to support the global development of sustainable finance, including being a founding member of United Nations Financial Centres for Sustainability Europe.

Collaboration with this group, alongside insights from practitioners and the local Sustainable Finance Guernsey Council – which meets monthly to discuss current sustainable finance themes – demonstrates Guernsey’s breadth and depth of expertise. This

engagement fuels Guernsey’s drive to remain at the forefront of sustainable finance.

For the private wealth sector, Guernsey Finance has developed educational reports for practitioners, including guidance on developing sustainable trust deeds, a guide to impact investing and sustainable finance, and a report on private finance and its role in supporting the transition to net zero. These resources ensure that practitioners are equipped with up-to-date knowledge to lead innovation in sustainable finance.

Practitioners from Guernsey's insurance and pensions sectors have developed the world's first ESG frameworks for insurers and pension providers respectively. These frameworks are designed to guide providers in integrating ESG principles into their operational practices.

Guernsey has become a central hub and innovator in disaster response initiatives and catastrophe bonds. This is exemplified by the island’s collaboration with the European Bank for Reconstruction and Development (EBRD), through which a £90.7m guarantee scheme was launched to provide reinsurance capacity to private-sector insurers in response to the challenges of the war in Ukraine. Similar initiatives include addressing wildfire risk in California and delivering humanitarian aid with the Danish Red Cross.

And finally, looking forward at international sustainability standards, the Guernsey Financial Services Commission (GFSC) – the financial services regulator in Guernsey – issued a discussion paper in 2024 on sustainable reporting, including the work of the International Sustainability Standards Board (ISSB). Guernsey will next confirm how international standards can be applied in a pragmatic, appropriate, and proportionate manner for regulated funds and businesses, so that the jurisdiction can continue to support investment and innovation in sustainable finance.

In what ways does your firm make a distinctive offering around ESG?

• Philanthropic Initiative (Americas)

• Female Executive (Global Reach)

Danita Harris Managing Member, Director of Philanthropy GUICE Wealth Management

GUICE Wealth Management delivers a distinctive ESG offering by integrating purpose-driven investing with alternative asset strategies. We help clients align their portfolios with their values through customised legacy planning, socially responsible investments, and tangible assets like art, real estate, and collectibles. Our approach empowers clients to build meaningful, long-term wealth while driving positive impact across environmental, social and governance priorities. We specialise in transforming wealth into a force for sustainability, equity, and generational legacy. Our distinctive offering lies in combining alternative asset acquisition and legacy planning with philanthropic matchmaking, enabling clients to drive social good while preserving generational wealth.

What sort of challenges have you had to deal with to reach this level, and what lessons have you learned and would pass on?

At GUICE Wealth Management, reaching this level required navigating the disconnect between traditional financial planning and values-based legacy building. Bridging that gap – especially with the integration of the GUICE Foundation – meant challenging outdated norms in wealth stewardship. We’ve learned that true impact requires conviction, collaboration, and a willingness to innovate. The biggest lesson we pass on: wealth is most powerful when it's intentional, inclusive and structured for both growth and generosity.

To stay ahead and at this level, what will you do next? Any new initiatives in the works?

To stay ahead, GUICE Wealth Management is launching a philanthropic-alternatives platform, blending legacy planning with impact investing. With our Nonprofit Organisation launch, GUICE Foundation, we’re expanding access to art donations, athlete-led giving, and bespoke ESG-aligned portfolios – empowering

clients to build wealth while creating lasting social change.

Tell us how your colleagues have made a difference?

At GUICE Wealth Management, our colleagues are the heartbeat of our impact. Their diverse expertise fuels innovative legacy strategies and alternative asset growth. Additionally, through deep collaboration with GUICE Foundation, they help clients transform wealth into purpose – guiding high-net-worth families, athletes, and business leaders to align their capital with their values and communities.

How do you hope winning this award will affect your business, colleagues, and clients?

Winning this award would affirm GUICE Wealth Management’s commitment to redefining legacy through purpose-driven wealth strategies. It would inspire our colleagues to continue bridging philanthropy and financial innovation, while showing clients the powerful impact of aligning their portfolios with social good. In partnership with the GUICE Foundation, it strengthens our mission to turn capital into lasting change.

From whom and where do you get ideas and inspiration?

For over two decades, I’ve witnessed the missed opportunities at the intersection of philanthropy and wealth management. My inspiration stems from identifying those gaps – especially for those who have the resources to make an impact but lack the guidance to align wealth with purpose. I’ve committed my work to helping individuals, families, and institutions diversify their portfolios with true alternative assets – such as art, collectibles, and philanthropic ventures –while establishing legacies that transcend generations. The mission of GUICE Wealth Management and GUICE Foundation is a direct reflection of that passion: to help people live richly, give boldly, and invest in what truly matters – for both returns and impact.

www.lgt.com

As a leading international private bank, LGT is taking concrete steps to address climate change - not only within its own portfolios, but together with clients. Christopher Greenwald, Head of Sustainable Investing in Europe, shares how LGT is developing pioneering solutions and engaging investors on the path to a low-carbon future.

In what ways does your firm make a distinctive offering around ESG?