Technology & Operations Trends in Wealth Management 2024

(in partnership with Alpha FMC)

This 12th edition of WealthBriefing’s Technology & Operations Trends in Wealth Management report, created with Alpha FMC, provides a global overview of how digital transformation is reshaping the wealth management sector. Firms across various regions are leveraging technology to enhance operational efficiency and client experience, while navigating evolving client expectations, regulatory changes, and a complex economic environment.

Philanthropy Evolved: How High-NetWorth Individuals are Redefining Giving, Ethics and Impact

(in partnership with Jersey Finance)

Philanthropy is undergoing a profound transformation as high-net-worth (HNW) individuals redefine traditional notions of giving, ethics, and impact. This report delves into these shifts, offering a comprehensive analysis of emerging trends, generational influences, and the evolving dynamics between wealth, altruism, and social responsibility.

The Bahamas: A Complete and Compelling Choice (in partnership with The Bahamas Financial Services Board)

The Bahamas stands out as a premier destination for business, blending political stability,

innovative financial structures, and an exceptional lifestyle. This report offers an in-depth exploration of its unique advantages as a financial hub, from wealth planning tools to cutting-edge FinTech initiatives, alongside its unparalleled appeal for high-net-worth individuals and global investors.

Directions for Rapidly-Expanding Sector (in partnership with UBS)

Our second report examining the growth of Asia’s EAM sector, covering both the powerhouses of Singapore and Hong Kong, and emerging markets like Thailand and the Philippines. This study looks at the growth prospects for independent advisors in the round as they seek to tap the region’s booming wealth and growing client acceptance of the EAM model.

Family Office Focus: An Update of the Industry's Efficiency in Accounting and Investment Analysis (in partnership with FundCount)

A deep dive into the key technological and operational challenges facing family offices in their accounting and investment analysis activities. Based on surveys and interviews among family offices managing over $72 billion in assets, this is an invaluable benchmarking tool for the sector which presents fascinating insights into future developments from a range of industry experts.

(in partnership with First Abu Dhabi Bank)

This ground breaking new research examines the growth of female entrepreneurship in the region. More specifically it looks at how women are driving family office strategy as well as the relationship between MENA’s UHNW female clients and the wealth management industry.

Applying Artificial Intelligence in Wealth Management - Compelling Use Cases Across the Client Life Cycle

(in partnership with Finantix & EY)

This comprehensive report identifies elements of the institution and advisor’s workloads that are ripe for AI amelioration, and points the way for firms seeking to maximise the competitive advantages offered by new technologies. AI experts and senior industry executives enrich each chapter, answering crucial questions on risk, KYC/AML, compliance, portfolio management and more.

With EY providing the overview, this report draws on the front-line experience of many of the technology sector’s biggest names, in recognition of the fact that they are the ones going in to solve wealth managers’ most pressing problems and have typically seen the ramifications of firms’ choices play out numerous times – not to mention in various contexts globally.

STEPHEN HARRIS CEO, WealthBriefingAsia

Celebrating Excellence in Wealth Management: The WealthBriefingAsia & Greater China Awards 2025

The annual WealthBriefingAsia Awards for Asia & Greater China shine a spotlight on the individuals, teams, and firms driving excellence and innovation in the wealth management sector. At a time of rapid transformation and global uncertainty, these awards recognise those who continue to raise standards of service, adapt with agility, and remain steadfast in helping clients achieve their long-term goals.

This year’s winners have proven that success in wealth management requires more than ambition – it demands resilience, expertise, and a clear, client-centric focus. While it’s easy to talk about guiding clients through turbulent times, it’s much harder to truly deliver – and these winners have shown they can.

The awards encompass a wide range of categories, reflecting the diversity of today’s wealth management landscape – from differing business models and jurisdictional requirements to emerging technologies and evolving client needs. It’s a dynamic space, and staying ahead requires constant evolution.

We extend our sincere gratitude to the panel of judges, whose time, diligence, and discernment were critical in identifying the most deserving entries. We also thank all entrants, our sponsors, and the organising team – your collective efforts make this programme possible.

Beyond the accolades, these awards offer an invaluable platform for firms and professionals to enhance their visibility and strengthen business development. Hosting the ceremony at the iconic Fullerton Hotel in Singapore made for a truly memorable evening – an occasion to forge new connections and celebrate longstanding relationships.

I’ve seen firsthand how this programme helps us engage more deeply with the industry, understand its challenges, and celebrate its achievements. We are proud to continue recognising and supporting excellence across Asia’s wealth management community.

The APAC wealth sector defies easy generalisation. It saw a 4.8 per cent gain in wealth for high net worth individuals in 2024; the number of HNW people, however, rose more slowly, by 2.7 per cent. A rise in tech stocks – helped by the AI boom – helped propel the rise in wealth.

Fortunes are mixed: In China, HNW individual wealth rose, but its HNW population contracted, according to Capgemini. In South Korea, wealth slipped 3.8 per cent, and its population fell; on the flipside, HNW individual wealth and population rose in India by 8.8 per cent and 5.6 per cent, respectively. There were gains also in Australia.

All this variety means banks’ on-the-ground strategies must be flexible, and we’ve seen a partnership model operate among international banks tapping local expertise, such as with Julius Baer in Thailand, and Lombard Odier in Malaysia, Bordier & Cie in Vietnam, and other nations.

Local banks such as Singapore’s DBS, UOB and Bank of Singapore are significant regional players. Bank of China (Hong Kong), Nomura, BEA, ICBC and other banks leverage their regional knowledge. UBS, Deutsche Bank, Indosuez Wealth Management, HSBC, Pictet, Bank J Safra Sarasin, BNP Paribas and RBC Wealth Management continue to see the region as an essential source of business.

This news service also notes the continued growth of family offices in Asia: Singapore and Hong Kong compete as hubs. The same applies to independent wealth managers, aka “external asset managers”. Add in private client law firms, advisors of all kinds, concierge and related specialists, this is a richly varied market. That variety reflects the rise of secondand third-generation wealth, and more complex tasks around wealth transfer and protection. We also see evolution of regulations to build best practices and keep standards high.

The WealthBriefingAsia & Greater China Awards 2025 programme was focused around three main category groupings: experts (individuals and teams), products and services for wealth managers and clients, and institutions of all sizes and types in the Asian & Greater China markets.

Independence, integrity and genuine insight are the watchwords of the judging process with the judging panels made up of some of the industry’s top trusted advisors and bankers.

DR. MARIO A. BASSI Senior Advisor Private Wealth Management

ARJAN DE BOER Consultant

BOBBY BOK Head of Sales & Business Development, Asia Pacific Global Trading Network Group (GTN)

PIERRE DUPONT

Managing Partner WIZE by TeamWork

RICHARD GRASBY Partner Appleby (Hong Kong)

ELIZABETH HART CEO & Founder Legacy Wealth Advisors

SUZANNE JOHNSTON Partner Stephenson Harwood (Singapore) Alliance

JACQUELINE LOH Director, Head of Private Wealth, Asia Ogier Global

IAN POLLOCK Senior Advisor STS Capital Partners

JASON LAI CEO, Asia for Wealth Management Schroders Wealth Management Asia

KYLIE LUO Executive Director - Leader, Asset & Wealth Management (Tax) BDO

STEVEN SEOW Executive Director Singapore Consultancy

JARRAD BROWN

Financial Planner Global Financial Consultants

ROLF GERBER Member of the Board of Directors LGT Bank (Singapore)

SEB HILLS

Managing Director & CEO Alumni Services Holdings Pte Ltd

PHILIPPE LEGRAND Co-founder & CEO LCA Solutions

MICHAEL OLESNICKY Special Advisor (Retired) Baker & McKenzie

BRUCE WEATHERILL Chief Executive Weatherill Consulting

A shortlist was identified from the hundreds of entries received for these awards and a discussion took place with the judges to agree the winner of each category. The judges were split into three groups, dependent on their industry; a panel of trusted advisors were responsible for judging the private banking categories; a panel of private bankers judges the trusted advisor categories; and new for this year we had a specialist group of tech experts judging the technology categories. This was to ensure that commercially sensitive information was kept confidential and conflicts of interest were avoided.

DAVID WILSON APAC Wealth Management Lead Accenture

ANTON WONG Managing Director, Head of Taiwan Market BNP Paribas Wealth Management, Asia Pacific

YAO Counsel Carey Olsen

Over the past decade, Annum Capital has advised Asia’s UHNW clients across public markets and private markets, with special focus on portfolio resilience and performance sustainability in a changing world.

In the alternative space, Annum Capital is respected for our deal access, due diligence rigour, performance track record, operational excellence, and of course our strong ties with global GPs including Schroders Capital, The Carlyle, Nuveen, Brookfield, and so on.

Annum Capital is proud of our dual DNA - a leading EAM counselling clients on investing and succession, and an investment house delivering alpha generation with a high touch.

Thriving amidst giants

Traditionally, alternatives were dominated by global houses, across venture capital, private equity, hedge funds, and real estate.

In the recent decade, local alternatives managers began to flourish, backed by sectoral insights, local deal sourcing, access to sovereign allocations, and in the case of Annum Capital, strong client franchise and advisory know-how.

This award is a tribute to Annum Capital’s buildout in the alternatives space, but also a recognition that boutiques players can thrive in the alternatives eco-system that’s dominated by giants.

Inhouse alternative funds

Over the years, we have achieved superior track record in private equity (Annum Global PE Fund I SP), global real estate (Annum Global Private Markets Fund SP), Asia equities long-short (Annum Global Mega Trends Fund SP), and Asia convertible arbitrage (Annum A.N.D.I. Fund SP).

Nick Xiao - Founder and CEO

Aaron Sung - Head of Asset Management Annum Capital

• Best Alternative Investment Manager

We have also been at the forefront of investing into AI, electric mobility, and healthcare, offering clients a range of participation vehicles and delivering excellent exit multiples.

We take special pride in the fact that Annum Capital has helped multiple global managers to launch their new strategies in Asia and gain initial scale. Our expertise in narrating sophisticated investment theses to family offices has been applauded by Asian clients.

Annum Capital provided strategic advisory to CEOs of asset managers in US, Europe, and Australia, on how to set up Greater China asset gathering machinery, leveraging local private banks, EAMs, independent wealth managers, and various cross-border mechanisms when it comes to China.

Annum Capital holds the Vice Chair of Hong Kong Limited Partnership Fund Association, the largest private equity fund association in Hong Kong, and champions this relatively new fund regime among global institutions.

Annum Institute® works as an empowerment platform for “new to market” LPs in Asia, with research and advisory services on GP selection, due diligence, secondaries, financing, and operationspreparing asset owners for alternative investing.

Annum Capital runs an annual internship programme, nurturing talented young people on starting a career in alternative investment.

Annum Capital is widely quoted by Bloomberg, FT, CNBC, AVCJ, the Asset, etc, contributing insights from our work matching the most exclusive managers with the shrewdest investors in Asia.

Yatin Shah Co-Founder

Please explain why your business was able to reach this award-winning level?

At 360 ONE Wealth, our success is rooted in a relentless focus on understanding our clients’ needs and building solutions that deepen relationships and grow talent.

We believe wealth management must constantly evolve – adapting products, platforms, and ideas to keep pace with regulatory changes and emerging asset classes. Innovation is essential.

We also strive to balance the interests of our three key stakeholders: clients, employees, and shareholders. Long-term success depends on creating value for all three.

In FY25, our wealth management ARR AuM grew 27% year-on-year, driven by strong performance across core segments. We’ve built disciplined investment processes that translate ideas into portfolios and results. Managing money isn’t just about picking winners – it’s also about managing risk and avoiding poor choices. That discipline has helped deliver steady, reliable returns.

A continued focus on research, risk management, and scalable processes has allowed us to grow, retain clients, and achieve this recognition.

What was the way your colleagues made a difference?

Our culture is our foundation. We’ve built a team that aligns closely with our clients’ long-term goals, fostering trust through shared values and incentives.

We see wealth management as deeply personal – it’s about understanding clients, their families, and aspirations. Our senior leadership actively engages with clients to ensure every interaction reflects our values. In the past year alone, we onboarded over 440 new clients with an ARR AuM of over ₹10 crore each.

This cultural alignment drives high retention among both clients and employees, creating a strong and self-reinforcing ecosystem.

How do you intend to remain on the front foot and continue to set high standards?

We stay ahead by focusing on four pillars: product innovation, platform

strength, proposition, and people. At the same time, we remain agile in response to changing markets and regulations.

Our strategic partnership with UBS is a key milestone – combining our domestic strength with their global reach to serve global Indians both onshore and offshore.

Our acquisition of B&K Securities enhances our capabilities in broking, equity capital markets, and corporate treasury – further strengthening our leadership in wealth and alternatives.

We’re also exploring a partnership with a leading US-based investment fund managing over $2.8 trillion, to bring globally diversified, best-in-class portfolios to our clients.

Looking ahead, our growth will come from:

1. Expanding our base of first-time wealth clients.

2. Deepening share-of-wallet with existing clients.

3. Maintaining high client retention.

4. Empowering new bankers and expanding to new geographies.

Where do you see the wider wealth management sector going in the next five years?

The wealth industry is undergoing a transformation, driven by economic shifts, rising wealth, generational transitions, and digital disruption.

India, with GDP expected to exceed USD 5 trillion, will be central to this change. Our 360 ONE Wealth Creators List, with Crisil, identifies over 2,000 individuals with INR 100 trillion in wealth – plus INR 50 trillion in complex structures.

As wealth becomes more institutionalised, demand will rise for cross-border advisory, family offices, next-gen engagement, private equity, and sustainable investing. Alternatives like private credit, pre-IPO deals, REITs, and InvITs will grow in importance.

At 360 ONE, we’re not just managing wealth – we’re helping build enduring legacies across generations and geographies.

Please explain why your business was able to reach this award-winning level?

Across Asia, wealth management is being redefined by digital expectations. With smartphone adoption exceeding 90% in key markets and a growing mass affluent segment, clients expect personalised, real-time access to financial services on their terms.

additiv’s Digital Financial Services platform empowers institutions to meet these expectations, enabling them to launch and scale innovative, compliant wealth propositions that are contextual, accessible, and built for digital-first engagement – all without replacing core systems. Our strength lies in combining a modular platform with deep regional expertise. With teams across Singapore, Indonesia, and the Philippines, we deliver solutions that are globally competitive and locally relevant.

A standout example is our work with ATRAM, the largest independent wealth manager in the Philippines. Together, we launched Wealth360 – a digital-first platform offering real-time portfolio access, planning tools and seamless communication. Since go-live, ATRAM has nearly doubled its AuM and redefined digital wealth in its market.

How do you intend to remain on the front foot and continue to set a high standard?

We’re committed to reimagining how wealth services are designed, delivered, and consumed. We co-develop solutions that align with client goals, infrastructure, and market realities.

We continue to enhance our AI and automation capabilities, powering hyper-personalised engagement, streamlining advisor workflows, and accelerating time to market.

We’re scaling our open sourcing model. By connecting institutions to a growing ecosystem of regulated partners, we enable rapid deployment of new services across existing and new distribution channels. While deepening our regional presence to stay close to market dynamics, we remain focused on a global vision: wealth services that are more accessible, inclusive, and aligned with how clients live

and engage today. That means enabling digital-first, self-service, hybrid, and embedded delivery – empowering clients to engage on their terms and bridging the advice gap with affordable, contextual, personalised solutions.

Innovation. Automation. Open sourcing. These aren’t features –they’re the foundations of a better wealth model. We’re proud to help our clients lead that change.

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

Integrating into legacy environments, especially across regulated markets, remains a key challenge.

Our API-first platform is designed to add – not replace – core systems, enabling low-risk transformation while combining internal capabilities with third-party services.

We’ve also learned that transformation doesn’t require a “big bang.” It’s about rapid iterations with clear outcomes – efficiency, revenue, or engagement. Start small, scale fast, and deliver measurable impact from day one.

Where do you see the wider wealth management sector going in the next five years?

Wealth will become more embedded, intelligent, and radically accessible. Clients want seamless access to investment, credit, and protection via platforms they already trust – super apps, bank apps, lifestyle portals. Wealth will be delivered contextually, not separately. AI will automate tasks, augment advisory journeys, and deliver more intuitive, personalised user experiences. Clients expect choice – switching between self-service, hybrid, or advisor-led models with hyper-personalised engagement at every step.

As embedded finance matures, it will expand access to underserved segments with affordable, goal-based planning, risk-managed investments, and contextual protection.

additiv is helping institutions lead this transformation – delivering digital-first experiences across every segment, channel and market.

Anthonia, what drew you into the wealth management industry?

I’ve always believed that wealth is about more than just numbers - it’s a powerful tool for transformation. I began my career over four decades ago, drawn to the industry by the principle of partnership. What excited me was the opportunity to work closely with families, not just to help them achieve financial success, but to align their wealth with their values, purpose, and long-term vision. Throughout my journey - from launching my own business to working across major financial centers - I’ve seen how helping clients find alignment between their portfolios and their lives creates a lasting impact. Regardless of age or geography, that connection resonates deeply, and it’s what continues to make wealth management so interesting and rewarding.

As one of the early trailblazers in independent wealth management in Singapore, what obstacles did you face and what leadership lessons have stayed with you through the journey?

When I launched an independent wealth management firm in 2007, it was still unfamiliar territory in Asia. At the time, clients

Anthonia Hui Head of Singapore

AlTi Tiedemann Global

were more accustomed to traditional private banks, so educating the market and building trust around a new model was a significant challenge. Coming from a humble background and being a woman in what was a male-dominated industry, I knew I had to work hard to establish myself - not just on my own account, but for others in similar positions. Co-founding AL Wealth Partners and the Association of Independent Wealth Managers Singapore, and eventually becoming Head of Singapore for AlTi, has been part of a broader journey.

What I’ve learned along the way is that success is driven by showing up with integrity, working hard and looking at the bigger picture, whether that’s through philanthropy, mentorship, or building a better industry. Those lessons continue to guide me today.

Why has giving back been such a central part of your career?

Because wealth, at its core, is about purpose, I’ve always encouraged clients to consider not just what they have, but what they want their wealth to stand for. That same philosophy applies to my own life.

Whether it’s mentoring the next generation of professionals, contributing to industry development, or supporting causes I care deeply about, like early childhood nutrition or elder care, giving back keeps me grounded in the “why” behind my work.

Why is now a great time to be a woman in the wealth management industry?

The industry is currently undergoing a generational and cultural shift. With the largest wealth transfer in history underway, clients are looking for deeper alignment, empathy, and purpose in how their wealth is managed. I believe these are areas where women have long excelled but are now being recognized and valued more than ever. It’s an exciting time to lead not just with expertise, but with authenticity. And it's a moment for women to shape the future of the industry.

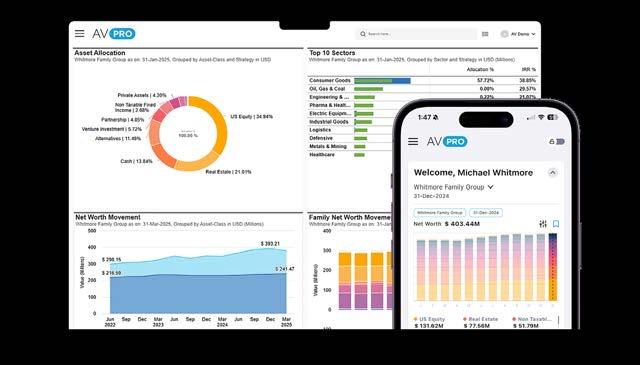

Asset Vantage (AV) is a best-in-class family office software designed to empower families and their trusted advisors to make better investment decisions by offering a fully integrated general ledger and performance reporting system.

Please explain why you/your business was able to reach this award-winning level?

Asset Vantage was born out of the real-world needs of a single family office, giving us a unique lens into the complexities and nuances of managing family wealth. As a UNIDEL company, we carry forward a legacy of building sustainable, high-integrity businesses that solve real problems.

What sets us apart is our culture, anchored in Innovation, Dependability, Excellence and Agility (I.D.E.A). These aren’t just values on a wall – they guide every product decision, every client interaction, and every internal conversation.

We’ve built our platform with a long-term vision and a deep, intuitive understanding of the modern family office. We sell and serve the way we would have wanted to be sold to and supported – with empathy, clarity, and accountability.

Our team is deeply customer-centric, and we constantly evolve our product to meet the needs of our clients and their users.

What was the way your colleagues made a difference?

Our teams made a difference through seamless cross-functional collaboration and a client-first mindset. Client-facing teams actively gather insights and share them for product enhancements in reporting, accounting, and document management.

Our managed services team go beyond support, helping clients uncover gaps they hadn’t even considered – prompting the right questions at the right time. By aligning product, service, and support, we ensure families have not only the right tools but also the confidence and clarity to use them effectively.

How do you intend to remain on the front foot and continue to set a high standard?

At Asset Vantage, we stay ahead through product-led innovation, agile delivery, and deep client partnership. Most importantly, we evolve with our clients – continuously releasing new features that address real-world complexity in reporting, accounting, and compliance. With proactive support and rapid enhancements, we don’t just respond to needs – we anticipate them, consistently setting a higher standard for a modern family office software.

Shaan Dalal Director Asset Vantage

Office Solution

Whom to look for, either inside or outside your business, for ideas and inspiration?

We look both inside and outside for ideas and inspiration.

Inside Asset Vantage, our clients and frontline teams provide valuable insights through the challenges they face and the creative solutions they find.

Outside, we draw inspiration from fintech, enterprise software, family office leaders, and thought leaders who challenge conventional views on wealth, legacy and technology.

Staying connected to both those living the problem and those rethinking the future keeps us grounded and forward-looking.

What will winning this award do for your business and colleagues?

Winning this award is a powerful validation of the hard work, vision, and dedication our team brings every day. It reinforces our belief that we’re solving meaningful problems for modern family offices and doing so with excellence.

For our colleagues, it’s a moment of pride – a recognition of their commitment to innovation, client success and cross-functional collaboration.

It’s not just a milestone – it’s motivation to keep raising the bar.

Where do you see the wider wealth management sector going in the next five years?

In the next five years, family offices will prioritise data ownership, real-time insights, and efficiency, many evolving into Virtual Family Offices with leaner teams.

Unified platforms that reduce manual work and offer control, transparency and flexibility across global assets will be essential. Asset Vantage supports this transformation by seamlessly integrating investment accounting, performance reporting, and document management, empowering family offices to operate efficiently and make confident, smarter decisions.

Avendus Wealth Management, part of the Avendus Group, manages USD 8.2 billion in assets and has been serving clients since 2010. Its clientele includes family offices, ultra-high-networth individuals (UHNIs), and corporates. The firm specialises in crafting bespoke, high-conviction solutions to help clients grow and protect their wealth across various stages of life.

Key stats:

• USD 8.2 billion in AuM

• Serving 1,850+ UHNI/HNI families & corporate treasuries

• 45%+ of clients have net worth exceeding INR 2 billion

• Presence in 11 geographies, covering 40+ cities across India

• ~170 employees

• 300+ years of combined leadership experience

India’s wealth management landscape is evolving, with shifting client demographics and growing demand for tailored, forward-looking advice. As wealth grows beyond tier-1 cities, Avendus is expanding its physical presence in tier-2 and tier-3 markets through local offices, enabling deeper, more consistent engagement.

Clients now expect more than traditional advice – they seek foresight and access to domestic and offshore opportunities across public and private markets. In response, Avendus has invested in new capabilities, including a Singapore expansion and plans to enter GIFT City. It is also deepening expertise in areas such as private markets, REITs, InvITs, and private credit.

A dedicated team now supports succession planning and family governance, helping clients structure generational wealth transitions with clarity and foresight. Moving forward, Avendus will focus on three core priorities: attracting top talent, expanding its client base by tapping into India’s economic momentum, and increasing wallet share through deeper, more strategic relationships.

Avendus colleagues have driven success by strengthening the platform, innovating products, and elevating client experience. Their efforts resulted in several large client wins, especially around key liquidity events. Momentum was strong across structured credit, private equity, and REIT/InvIT offerings, while the broking desk excelled through timely execution and short-term trades.

Avendus’ cross-functional platform –with access to 50+ sectors and 2,500+ client relationships – delivered synergistic outcomes, such as private market fundraises and differentiated access to exclusive deals. On the client experience side, the firm enhanced personalisation through data and analytics, and deepened relationships via tailored content and curated events.

Talent acquisition and retention remain industry-wide challenges. Avendus addressed this by recruiting individuals with the right mindset, even if they lacked prior wealth experience. For instance, corporate bankers in certain regions successfully transitioned into wealth roles, leveraging local relationships and expertise.

Geographic concentration was another hurdle. Instead of relying on citybased bankers to cover peripheral regions, Avendus is investing in local teams for better client coverage and engagement.

Finally, today’s clients demand proactive, customised solutions. Avendus embedded a culture of anticipatory service, encouraging teams to craft strategic offerings in advance. Regulatory changes are also embraced as opportunities to build a more sustainable and resilient business.

Over the next five years, the industry is expected to shift from distribution-led to advisory-led models. Clients increasingly prefer fewer, more capable partners who offer holistic,transparent solutions.

Avendus is well-positioned to lead this transition through deep advisory capabilities, trust and relationship strength.

Based in Switzerland, Azqore is a global leader specialising in Business Process Outsourcing (BPO) and Software as a Service (SaaS) for the wealth management sector. For over 30 years, Azqore has supported private banks in their transformation, completing more than 70 successful banking migrations and enhancing their operational efficiency. Beyond providing innovative solutions to transform, digitise and improve the client experience of private banking players, Azqore offers banks the option of fully outsourcing their back office from its hubs in Switzerland and Singapore. Azqore serves today 25 clients in Europe and Asia totalling more than CHF 215 billion in assets under management with proven experience of numerous migrations. Azqore is a subsidiary of Indosuez Wealth Management (the global wealth management brand of the Crédit Agricole Group and a leader in the field) and Capgemini (a global leader in consulting, technology services and digital transformation). With the support of these two shareholders, Azqore can combine in-depth banking expertise with a leading edge technological approach.

At the heart of Azqore's success lies our extraordinary team. Our BPO solution thrives on the dedication and expertise of our professionals, who relentlessly pursue excellence and innovation. We firmly believe that investing in our people and nurturing their potential is the cornerstone of delivering exceptional services. This commitment is reflected in the following distinctive factors:

• Efficiency: Industrialised processes with a proven track record of handling diverse and complex products and processes, which require continual flexibility.

• High quality combined with thorough Risk Management: Emphasis on quality awareness and long-term thinking,

Gaël Lang CEO, Singapore Azqore

coupled with a strong risk culture through strict and rigorous quality control. A robust frameworks validated by ISO 9001 / 27001 and ISAE 3000 / 3402 certifications ensures aligned processes across all operational centres.

• Strong Customer-centric mindset: Our commitment to understanding our clients' needs and going the extra mile to support their success makes us a trusted partner in wealth management. We prioritise our clients' unique needs, offering tailored solutions and personalised support. As a subsidiary of Indosuez Wealth Management, this customer-centric approach and deep understanding of Wealth Management are strongly rooted in our DNA.

• Communication and transparency: Direct contact between Azqore's operations team and the client's middle office enables a collaborative and hands-on approach to facilitate business growth.

Where do you see the wider wealth management sector going in the next five years and how do you intend to remain on the front foot and continue to set a high standard?

In Asia, Singapore and Hong Kong are pivotal players in the wealth management landscape and they will not stop growing in the next five years. The wealth management industry in this region will continue its significant shift towards digital and data-driven solutions thanks to the focus on innovation led by the local authorities, with the added challenge of efficiently integrating AI into its processes. Concurrently, regulatory evolution will become increasingly complex, driven by factors such as complex products, digital assets, cybersecurity, and customer protection. Our mission is clear: to support tomorrow’s private bankers and wealth managers as they navigate this rapidly changing environment. By annually investing over CHF 40 million in technological and functional advancements, proactively monitoring and implementing regulatory changes and integrating AI and data analytics into our offers, Azqore is wellpositioned to be the preferred partner for those seeking digital transformation and operational excellence.

What was the way your colleagues made a difference?

What truly set our colleagues apart was their ability to stay close to clients through changing conditions, offering clarity, confidence, and continuity.

They showed exceptional agility in anticipating needs, navigating complexity, and collaborating across teams and geographies to deliver integrated solutions.

Their professionalism and consistency made a tangible impact, not just in outcomes, but in how clients experienced us as a trusted investments advisor.

How do you intend to remain on the front foot and continue to set a high standard?

We stay ahead by continually investing in our capabilities, be it talent, technology, or insights. Our focus is on staying relevant to clients, especially as their priorities become more global, more complex, and more nuanced.

We’re enhancing our advisory solutions, strengthening expertise across asset classes, and building tools that give clients better visibility and control. At every step, the aim is to raise the bar on relevance, responsiveness, and results.

Nitin Singh Head of Asia Pacific Barclays Private Bank

• HNW Team

• Private Banking Employer or Talent Management Initiative

• NRI/NRP Offering

Whom to look for, either inside or outside your business, for ideas and inspiration?

Inspiration often comes from within - from colleagues who bring fresh thinking and challenge the status quo. I also learn a great deal from the next generation of clients and professionals, who bring new perspectives on entrepreneurship, innovation and value creation.

Beyond our industry, I look to sectors where client experience and technology intersect, as they often offer lessons on how to stay sharp and adaptable in a fast-changing environment.

Where do you see the wider wealth management sector going in the next five years?

Wealth management is evolving to meet more sophisticated and international client needs. In Asia, we’ll see stronger demand for tailored solutions, cross-border capabilities, and a higher level of engagement across investment, succession, and liquidity planning.

The ability to offer depth across jurisdictions, while delivering consistent service and strategic insight, will be key. Organisations that can combine global connectivity with local understanding will be best placed to lead.

BDO Singapore has over 650 staff. The Asia-Pacific BDO Private Client Services (“PCS”) practice is spearheaded by our Singapore team which now has over 100 committed PCS specialists, spanning across key functions. Our specialists lead a network of over 1,000 local experts based in 25 countries.

Our specialists work with high-net-worth individuals (“HNWIs”), families, business owners and Family Offices who want their global tax affairs managed proactively and seamlessly.

Our global reach means that we are not restricted by geographical boundaries. For each client, we draw on our global network and assemble the best team with the right expertise. Having people with the necessary cultural intelligence and knowledge of the subject matter, we can find the right solution for each client, regardless of where they may be based.

We are truly focused on private clients and on delivering exceptional client service through practical, bespoke advice, tailored to client priorities.

We offer a unique “one-stop-shop” approach for clients, capitalising on the dedicated teams in various departments at BDO in Singapore and our international network. Our service excellence is what sets us apart from the rest of the industry.

Instead of using complex technical jargons, we speak the same tongue as our clients. We use plain, straightforward terms which our clients can comprehend, in languages that they are comfortable with, be it English, Mandarin, Cantonese or Bahasa.

• Accountancy Team

• Accountancy Team (Greater China Region)

• Tax Team (Greater China Region)

In BDO, we listen, we plan, and we provide strategies, in-depth technical and practical advice tailored to the specific needs and objectives of each client. We bring the solutions to our clients, and we take a practical and hands on approach in the implementation, ensuring that they understand every step of the process.

Even in times of the pandemic and amidst the ever-changing global environment, we kept ahead of the changes and ensured that our clients’ needs are well taken care of.

With our efforts, BDO is known in the industry as the go-to-taxfirm for HNWIs and ultra HNWIs. We work closely with all the major financial institutions and have implemented more than 50% of the tax structures in the market. As the market leader, we are also constantly in dialogue with government agencies, providing constructive feedback for the industry.

This award is an affirmation of our efforts and an encouragement to our team to keep up our efforts. We are thankful for the support that our various stakeholders have provided us with.

We will continue to support our private clients through any new laws and regulations and assist them to better manage their family wealth. As the regional economy grows and the number of affluent individuals/ families in the region increases, we see more opportunities for the industry. These families would want to put in place structures to better manage and preserve their family wealth. They would also want to ensure that their family wealth persists for multiple generations. We at BDO understand our clients’ requirements and we strive to provide the best solutions for them, even amidst a changing landscape.

Founded in 1844, Bordier has built a legacy of integrity, innovation, and client-centricity. Evrard Bordier, Managing Partner and a fifth-generation member of the Bordier family, moved to Singapore in 2011 to establish the Asia headquarters. In 2025, Valérie d’Argembeau took over from Evrard as CEO of the Singapore office and retains the bank’s firm commitment to providing bespoke wealth management solutions tailored to clients' evolving needs.

Independence is central to Bordier’s philosophy. With no external shareholders, the firm makes decisions solely in clients’ best interests, ensuring transparency and alignment with their financial goals. Its open architecture framework enables the curation of tailored investment solutions, ensuring a personalised approach to wealth management. More than financial advisors, Bordier serves as trusted stewards of wealth across generations.

With 180 years of expertise, Bordier upholds credibility and accountability. Managing partners bear unlimited liability, emphasising capital preservation and risk management. The firm takes pride in its financial strength, having maintained profitability without a trading loss since 1950.

Its Tier 1 ratio exceeds 30%, and liquidity far surpasses regulatory requirements, reinforcing its commitment to safeguarding client assets. The firm’s assets under management have grown steadily, reaching about CHF 19 billion as of December 2024.

Bordier embraces innovation to stay ahead in private banking. By integrating secure custody solutions, robust risk management, and seamless trading infrastructure, Bordier empowers clients to

• Boutique Private Bank Winner

Bordier & Cie (Singapore)

access and invest in digital assets with confidence. This initiative reflects the bank’s commitment to innovation and its readiness to meet the evolving needs of modern investors.

To remain competitive, Bordier leverages technology within its internal processes and client communications. The firm’s use of AI enhances efficiency, responsiveness, and the personalisation of services, ensuring they maintain the highest standards while staying aligned with clients’ interests. Through these innovations, Bordier continues to redefine boutique private banking with tailored solutions and excellence.

Bordier’s professionals are more than financial advisors – they are trusted stewards of generational wealth. Their expertise, dedication, and ability to foster deep relationships with clients define the firm’s reputation. Every team member plays a vital role in delivering personalised strategies aligned with clients’ long-term objectives.

Collaboration and innovation are embedded in Bordier’s culture. By anticipating market trends and ensuring agility in decision-making, the firm drives value beyond financial returns. Its unwavering commitment to integrity and excellence reinforces its standing as a leader in boutique private banking.

Winning the recognition as Boutique Private Bank validates the dedication of Bordier’s team and strengthens its resolve to continue pushing the boundaries for Private Banking in the Asian region. As the firm celebrates this milestone, it remains focused on delivering innovative solutions, maintaining its tradition of excellence, and ensuring clients remain at the heart of everything it does.

Butterfield

Let’s start a conversation about how we can help meet your needs visit us @ Butterfieldgroup.com.

Why Butterfield Was Able to Reach

This Award-Winning Level:

Butterfield’s success stems from a combination of its 150-year legacy of excellence, a commitment to personalised service, and strategic growth initiatives. The firm has maintained a reputation for trust and fiduciary services, positioning itself as a leader in the wealth management industry. Key to this achievement is its expansion through strategic acquisitions, such as the purchase of Deutsche Bank’s Global Trust Solutions and Credit Suisse’s trust business, which have significantly increased its footprint in Asia. This, combined with cutting-edge technology, client-centric service, and a deep understanding of complex wealth structuring, has led to sustained growth and recognition.

How Colleagues Made a Difference:

The dedication and expertise of Butterfield’s staff have been critical in its success. Colleagues consistently deliver high-quality service, with many holding advanced qualifications. Their deep industry knowledge and collaborative approach ensure that the firm's clients receive personalised, innovative solutions. Furthermore, several team members are recognised in the Private Client Global Elite, a testament to the calibre of professionals who contribute to Butterfield’s reputation for excellence.

To remain a leader, Butterfield is focused on continuous innovation. This includes leveraging emerging technologies, enhancing operational efficiency, and embracing changes in regulatory landscapes. The firm also invests in regular training and development to keep staff ahead of the curve. Butterfield is committed to maintaining high standards by constantly refining its services, engaging with industry forums, and ensuring it is adaptable to evolving client needs.

with Challenges and Lessons Learned:

Butterfield has navigated various challenges, from establishing a strong brand in competitive markets to adapting to new

regulations and responding to the pandemic. The company responded with agility, reinforcing communication and risk management. It learned that adaptability, paired with its core values of trust and client service, is essential to overcoming obstacles and turning them into growth opportunities.

Internally, Butterfield draws inspiration from its seasoned professionals who bring decades of experience and expertise. Externally, the firm looks to industry thought leaders and global forums to stay informed on the latest trends, regulatory changes, and best practices. Butterfield also engages with client needs directly to tailor its services and ensure continuous improvement.

Winning this award reinforces Butterfield’s reputation for excellence, serving as a powerful affirmation of the team’s hard work and dedication. The accolade not only boosts staff morale but also enhances the firm’s credibility, strengthening relationships with existing clients and attracting new ones. It serves as a recognition of Butterfield’s commitment to delivering exceptional service, further solidifying its position as a trusted partner in the wealth management sector.

The wealth management industry, particularly in Asia, is expected to see a surge in demand due to the growing population of UHNWIs and family offices. As wealth transitions across generations, there will be an increased need for complex cross-border estate planning, philanthropy, and sustainable wealth management solutions. Technology will play a significant role in delivering personalised services, but it must be complemented by the hightouch, relationship-driven approach that defines the industry. Butterfield aims to continue leading the sector by combining innovation with its longstanding commitment to client service.

Mark Florence Executive Chairman, Asia Butterfield Trust, Singapore

Alice Lau Senior Executive Director & Head of Private Client, Asia Pacific

CSC is a trusted provider of trust and family office services across Asia, offering tailored solutions for high-net-worth individuals, families, family offices, and owner-managed businesses. With more than 125 years of experience and a global presence spanning 140 jurisdictions, we specialise in delivering tailored, practical, and flexible solutions to meet the evolving needs of our clients.

Operating in key financial hubs such as Hong Kong, Singapore, Luxembourg, Guernsey, and the Cayman Islands, we pride ourselves on building long-term partnerships rooted in mutual trust. As a privately owned organisation with over 8,000 professionals, we combine market-leading expertise with an unmatched global reach to provide innovative and proactive Private Client services.

Please explain why you/your business was able to reach this award-winning level?

Our broad global scale and 24/7 followthe-sun service model allows us to serve clients seamlessly across time zones, while our deep understanding of Asia’s unique regulatory and cultural landscape ensures tailored solutions. Whether it’s establishing private trusts for Chinese IPOs, supporting family offices throughout Southeast Asia, or guiding philanthropic endeavors, CSC combines global capabilities with local insights to deliver exceptional results.

What was the way your colleagues made a difference?

Our Fierce Client Spirit is alive in all of us. But it’s a collection of attributes that we instantly recognise: Precision, Diligence, Accuracy, Excellence, Speed, Responsiveness, Dedication, Warmth, Authenticity. Our Fierce Client Spirit drives us to exceed expectations and deliver with excellence. It’s what elevates our work. It’s what ensures that we are always 100% focused on achieving outstanding client outcomes.

How do you intend to remain on the front foot and continue to set a high standard?

CSC believes that continued investment in technology is a real differentiator and will continue to drive its transformation programme in becoming a trusted techenabled service provider. The company is committed to build the next generation of specialised administration services.

What will winning this award do for your business and colleagues?

This is the ninth year CSC has received 'Best Independent Trust/Fiduciary Company - Greater China'. This accolade affirms our commitment to service excellence, innovation, and global responsiveness. This great achievement further bolsters the market position of CSC to stand out in the private wealth industry, strengthening its industry credibility to existing and prospecting customers.

• Independent Trust or Fiduciary Company (Greater China Region)

Led by Alice Lau, a 25-year veteran at CSC, our APAC Private Client Team is a testament to stability and expertise. Over 62% of our staff have been with CSC for more than 10 years, and 29% boast over 15 years of tenure. Our team’s qualifications are equally impressive, with many holding the highest ICSA and STEP certifications. This blend of experience and professionalism ensures our clients receive best-in-class service.

Alice Lau, Head of Private Client - APAC, CSC said: Winning this award is a testament to the culture we’ve built, the trust we’ve earned, and the impact we make each day. It would recognise not just our success, but the values that drive us forward—putting people first, delivering with integrity, and setting the bar for what exceptional client service should be.

What was the way your colleagues made a difference?

We are glad to be able to say that we work together well as a team, and across teams. At Dentons, we work in a collaborative manner and support each other across practice areas, even jurisdictions, to meet our clients’ needs.

Each colleagues’ individual expertise can be tapped into to address our clients’ queries and find solutions expertly and creatively.

How do you intend to remain on the front foot and continue to set a high standard?

We must always remain sensitive to our clients’ needs and expectations, on a legal, practical, and even personal level. We always start by identifying all the potential issues which could arise or be of concern to the client.

Legal issues aside, different clients have different goals and levels of sensitivity to different matters, and it is key for us to recognise these. We hope to continue to build long-lasting, genuine relationships with our clients, built on mutual understanding and trust, so that we can always look out for our clients’ best interests.

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

The best way to deal with challenges is to adopt a solution-oriented mindset and figure out what is the best way to move forward. Even when it seems that there is no good solution available to the client, we must do our best to reframe the issues and find a way to achieve some, if not all, of the client’s goals.

It is also crucial to deal with problems calmly and with sensitivity, to avoid flares in tensions and miscommunications. Open and level-headed communication, internally and externally, is key to resolving conflict.

This is helpful even in the situation where it appears that there is no good solution available to the client, since it is then important to communicate to the client what the issues are, why the issues have been encountered, and what we shall do to tackle them.

What will winning this award do for your business and colleagues?

We are very grateful to be recognised for our hard work! We believe that we will be able to continue servicing clients at a consistently high standard. With these awards, we hope that our clients and contacts will recognise our efforts and continue to put their trust in us as a team.

Edmund Leow, SC (left) Senior Partner

Nicolette Lee (right) Senior Associate

Dentons Rodyk & Davidson LLP

Why do you think your business was able to reach this award-winning level?

At Eightstone, we have built a culture that is deeply sceptical of noise – market, media, or industry hype. We focus instead on clarity and long-term relevance. That mindset, paired with rigorous discipline and real alignment with our clients, is what helped us cut through the crowd. We are not in the business of gathering assets, we are in the business of protecting and growing real wealth, over real time.

What was the way your colleagues made a difference?

This award belongs to a team that quietly does the hard work. There’s no fanfare, just a deep commitment to doing what’s right for the client. Whether it’s our investment professionals designing resilient portfolios, our risk team safeguarding against blind spots, or our operations team executing with Swiss-watch precision, each person shows up with purpose. That collective mindset of accountability makes all the difference.

How do you intend to remain on the front foot and continue to set a high standard?

By staying lean, curious, and allergic to complacency. In a world that is increasingly automated, we believe in taking advantage of that while staying human – high conviction, high touch, high trust. We will continue investing in people and platforms, but never at the expense of independent thinking. Standards rise when you surround yourself with individuals who ask better questions, not just give quicker answers.

Chiara Bartoletti Managing Partner, Chief Operating Officer Eightstone Pte Ltd

• Private Bank or Wealth Manager (Singapore)

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

We embraced complexity without being consumed by it. Navigating volatile markets, cross-border structuring, or generational shifts in client priorities required adaptability and clear judgment. We have learned that simplicity is not the absence of complexity, it’s the mastery of it. The real challenge is staying true to your principles in a world of shortcuts.

Whom do you look to, either inside or outside your business, for ideas and inspiration?

We draw inspiration from the founders and families we serve –people who take calculated risks, who think generationally, and who stay grounded in their values. Internally, I find fresh insight in our youngest team members. They challenge legacy thinking and force us to explain ‘why’ – a question we should always be asking.

What will winning this award do for your business and colleagues?

Externally, it validates what our clients already know – that Eightstone is a firm of substance and integrity. Internally, it’s a moment of quiet pride. We don’t set out to win awards, but recognition like this affirms that it’s possible to stay independent, focused, and principled – and still succeed.

Where do you see the wider wealth management sector going in the next five years?

Looking ahead, the wealth management sector is facing a bifurcation. One path leads to consolidation, commoditisation, and algorithmic decision-making. The other embraces nuance, judgment, and long-term thinking. We are betting on the latter. Clients are global, values-driven, and more selective than ever. The future belongs to firms that understand that wealth is not just capital – it’s purpose, continuity, and trust.

Please explain why your business was able to reach this award-winning level?

Harold Mendiola Manager, Customer Support (Asia) ERI

ERI’s success is driven by a strong focus on client-centricity and a deep understanding of the unique challenges faced by wealth management and private banking professionals, both in the Asia Pacific region and globally. With a track record of over 400 successful implementations in more than 60 countries, ERI has cultivated deep operational and technological expertise. This extensive experience allows us to proactively anticipate market developments while ensuring the OLYMPIC Banking System consistently delivers high performance and seamless usability in day-to-day operations. Through continuous engagement with users and the integration of their feedback, we refine our platform and solution suite in line with evolving client expectations and international best practices.

Our core banking platform, OLYMPIC Banking System, is standing out as being capable of addressing the key challenges faced by private banks and wealth managers in the region. It addresses a unique combination of market diversity, regulatory complexity, and rapid digital transformation.

How do you intend to remain on the front foot and continue to set a high standard?

A flexible, scalable core banking platform that integrates easily with third-party systems is essential for banks to remain competitive. It enables rapid product launches, faster time to market, and advanced digital capabilities. With rising customer expectations – especially in open banking markets like Singapore and Australia – features like instant payments and real-time risk monitoring are now baseline. Core systems must support consistent, tailored, compliant and innovative services across channels to meet evolving client needs.

Banking Software Winner

Whom to look for, either inside or outside your business, for ideas and inspiration?

When seeking inspiration and ideas for development, whether to enrich a product roadmap, anticipate market shifts, or respond to evolving client demands, it is essential to engage a diverse network of both internal and external stakeholders. Each brings a unique perspective that, when harnessed strategically, can accelerate innovation and drive value creation.

As expected, placing the client at the centre of our strategy is fundamental. This approach enables us to support clients throughout their transformation journey and provides a strong foundation for their growth ambitions. Clients are often the most valuable source of input, offering practical insights that directly shape the evolution of our solutions.

Conversely, new market entrants, particularly non-traditional players such as fintech start-ups, bring innovative approaches to user experience. While they may lack deep expertise in banking operations, their use of advanced technologies in areas such as predictive analytics, cybersecurity, and digital engagement tools presents valuable benchmarks. These innovations must be carefully assessed to determine their applicability and value within the context of wealth management.

Finally, we continuously evaluate the positioning of our platform against market expectations. Our active participation in industry benchmark reports and analysis initiatives enables us to capture emerging trends and identify strategic gaps. In parallel, we maintain a close watch on evolving regulatory frameworks, ensuring we can proactively manage risk and anticipate rising operational costs.

EtonAI™, developed by Eton Solutions, is an advanced AI system designed to automate middle and back-office operations with precision and security. It processes complex documents and responds in natural language, transforming how teams access and manage information. Integrated within Eton Solutions’ ERP platform AtlasFive® or used standalone, EtonAI™ enhances workflows for Single and Multi-Family Offices, RIAs, Private Equity firms, and more. Eton Solutions currently manages over $936 billion in assets globally.

Please explain why you/your business was able to reach this award-winning level?

We built EtonAI™ from first principles, recognising that good AI depends on clean, structured data. Many providers have either advanced AI with messy data or clean data without AI depth – we had both. Embedding EtonAI™ within our cloud-native AtlasFive® ERP gave us a unified data model from the start, allowing us to build AI on order rather than chaos.

We use a vector database that eliminates standard LLM context limitations, enabling semantic search across massive document sets. Our patent-pending knowledge graph connects entities, transactions, and accounts – anchoring the AI in real-world context. With seven patents filed, our AI architecture stands apart. What differentiates us is our ability to make data AI-ready, then build explainable, domain-specific applications. Our secure, governed, and scalable system integrates private client data, pre-trained LLMs, and real-time market data, powering next-gen automation in wealth management.

How do you intend to remain on the front foot and continue to set a high standard?

We’ve created a hybrid AI ecosystem—combining leading LLMs with proprietary infrastructure – targeting the real issues in enterprise AI: trust, security, explainability, and responsible deployment.

Murali Nadarajah Chief Information Officer Eton Solutions

Our Co-Pilot model emphasises AI as a human performance enhancer. While we remain tech-agnostic regarding LLMs, our deployment philosophy is strict: transparency, traceability, and privacy are essential. Our systems run in secure cloud environments certified to global standards including ISO 42001, 27001, 27701, and SOC 1 & 2.

Seven patents and continued investment in proprietary tech give us a lasting edge. EtonAI™ is built with feedback loops – learning continuously, refining document extraction at scale, and logging prompts for traceability. We're also advancing into autonomous agents and multi-modal capabilities to stay ahead.

Where do you see the wider wealth management sector going in the next five years?

Wealth management is shifting toward intelligent automation. AI agents will increasingly manage middle and back-office functions like reviewing statements, handling capital calls, and creating reports – freeing humans to focus on relationships and strategic thinking.

Client communication will become real-time and hyperpersonalised, powered by secure, explainable AI. The most successful firms will integrate structured systems with responsible, embedded intelligence – similar to what EtonAI™ already delivers.

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

The main challenge with generative AI isn’t technical ability – it’s trust. LLMs lack true contextual understanding. Preparing data for AI isn’t a one-time fix.

We tackled this by designing robust systems: centralised data models, vector databases, retrieval-augmented generation, private LLMs, and knowledge graphs. Crucially, we built the system to recognise when it lacks knowledge – and to go get it.

The key lesson? Safe, scalable AI requires centralised data, bestin-class components, and secure, cloud-native deployment.

Please explain why you/your business was able to reach this award-winning level?

Farro Capital’s recognition across six prestigious categories is a direct result of our holistic approach to wealth management, deep commitment to excellence, and strategic alignment with the future of global family offices. At the core of our success is a bespoke, client-centric philosophy that views wealth as multidimensional – encompassing structure, preservation and growth, succession, impact, and legacy. Our ability to deliver clarity in a complex world, adapt to the fast-changing regulatory and geopolitical landscape, and tailor solutions that cross borders and generations is what distinguishes us.

In a region where family offices are evolving rapidly, Farro has led the way by embracing cutting-edge technologies into our investment and client service platforms, offering fully customised planning for global families, and developing wealth planning frameworks that harmonise international structures with each family’s unique vision. From billionaires to first-generation entrepreneurs, our strategic guidance, investment acumen, and legacy planning have earned us the trust of the world’s most discerning clients.

What was the way your colleagues made a difference?

Farro Capital’s success is built on our people. Our colleagues bring together a rare blend of technical excellence, cultural fluency, and genuine empathy. Whether structuring cross-border trusts, managing intricate succession and family governance plans, or identifying global multi-asset investment opportunities, every team member is empowered to go beyond the expected. We have cultivated a culture of deep collaboration, relentless curiosity, and service excellence.

Our team demonstrates unparalleled understanding of cross-jurisdictional issues. We are recognised for sophisticated advisory that aligns with the complex needs and passions of ultra-wealthy families. We also help clients navigate through tax, trust, and regulatory change with precision and foresight, while providing access to a range of bespoke solutions including citizenship/residence planning, deal support and ecosystem access. Each professional embodies the firm’s values daily delivering impact with confidence, and trust. Together, our teams collaborate while working closely with clients to help them achieve their long-term vision.

Where do you see the wider wealth management sector going in the next five years?

Over the next five years, we see the wealth management sector becoming more interdisciplinary, values-driven, and globally fluid. The role of the advisor will expand from investment guidance to holistic stewardship – balancing performance, family dynamics, governance, and global mobility. Technology will continue to transform client interaction and risk management through AI, while cybersecurity and data integrity will become non-negotiable priorities.

We foresee a major generational shift in client expectations, with the next generation placing more emphasis on purpose, sustainability, and digital engagement. Regulatory complexity will grow, but so will opportunities for firms that can provide strategic clarity.

Farro Capital is uniquely positioned for this future. Our global outlook, innovation-first mindset, and unwavering focus on personalised, ethical service ensure that we are not only prepared for what’s next – we are actively shaping it.

Hemant Surenderjit Tucker Co-Founder & CEO Farro Capital

• International Clients Team

Planning Team

Offering • Leading CEO - Private Bank

Please explain why you/your business was able to reach this award-winning level?

FGA is redefining wealth management by seamlessly integrating legacy trust solutions with the dynamic opportunities of the Web3 era. While traditional institutions often struggle with rigidity and outdated processes, we serve as a bridge between institutional-grade security and the agility demanded by today’s innovators. Our digital trust platform empowers high-net-worth individuals, particularly those shaping the future in blockchain, digital assets, and decentralised ecosystems, and often mobile-driven Gen Z, to protect and grow their wealth with structures that are both compliant and adaptive. By leveraging cutting-edge technology, we eliminate legacy-system inefficiencies, offering real-time transparency, rapid execution and tailored solutions that traditional providers cannot match.

How do you intend to remain on the front foot and continue to set a high standard?

At FGA, our motto is to anticipate challenges before they arise. We don’t wait for gaps to widen; we proactively identify friction points at the intersection of traditional wealth management and emerging digital economies. By deeply understanding our clients’ evolving needs – whether they’re navigating Web3 complexities or seeking seamless 24/7 solutions – we design bespoke yet scalable frameworks.

Our approach balances two pillars: customisation and standardisation. And to really achieve it, we use AI a lot in our daily operations. Embedding automation and AI-driven analytics to streamline processes, reducing administrative burdens while enhancing precision.

Whom to look for, either inside or outside your business, for ideas and inspiration?

At FGA, innovation is deeply rooted in our internal collaborative culture, though we remain attuned to external insights that align with our vision.

Internally, our primary engine for ideas is our cross-functional team. By fostering daily discussions across departments – from blockchain specialists to compliance experts—we transform challenges into opportunities. For example, weekly "solution labs" encourage teams to present emerging client pain points, such as managing tokenised assets or navigating governance regulations. These sessions are not just brainstorming exercises; they’re structured to dissect problems, test hypotheses, and rapidly prototype solutions. This iterative process ensures that inspiration flows organically from the ground up, driven by those closest to the evolving needs of our Web3-savvy clients.

Where do you see the wider wealth management sector going in the next five years?

The wealth management sector is poised for transformative shifts over the next five years, driven by evolving investor preferences, technological advancements, and regulatory pressures.

Alternative investments are transitioning from niche offerings to core components of modern portfolios. Research suggested that by 2030, they are expected to account for 20–30% of high-net-worth (HNW) portfolios, up from 10–15% in 2024.

Another thing is the rising concern about privacy, which is why we see more and more people using trust. As global regulations are getting stricter, investors and high net worth individuals would like to keep profiles as low as possible.

And the rise of AI will shape both the investing and compliance world. Algorithms help investors to identify trends, boosting alpha generation, and AI also helps to streamline KYC and AML checks, reducing operational costs by at least 30%.

Helen Chen - CSO

Kavi Harilela - Business Director

As trusted advisers to individuals and their families across Asia and beyond, our approach to Family Governance is truly unique.

Placing a significant emphasis on psychology as well as the legal and technical aspects, we look at the overall picture of what the family is seeking to achieve.

We take the time to understand each family member and the family as a whole. This allows us to uncover challenges and support them in achieving their goals and long-term prosperity.

] Estate & Succession Planning

] Family Governance

] UK and International Tax

] Trusts Structuring

] UK Residential & Commercial Property

] Matrimonial & Divorce

] Trust & Estate Disputes

Please explain why your business was able to reach this award-winning level?

Forster’s is a full-service London based law firm with a cross-departmental legal team dedicated to advising high net worth clients in South-East Asia. Led by our preeminent Private Wealth Asia experts in tax, trusts and estates, the team includes specialists in Matrimonial/Family, Corporate & Banking and UK Residential & Commercial Property.

With over 34 years’ experience in the region, the team has cultivated strong relationships with many in the private wealth industry and are renowned for our responsiveness, sensitivity to cultural attitudes and user-friendly delivery of practical and commercial advice.

We believe that Forster’s approach is unique, particularly in the family governance context for multi-generational business families. Making it a priority to understand the psychology of the family, in order to preserve family wealth and mitigate the risk of family disputes.

We guide families through the family governance process, from the initial psychological groundwork discussions to the drafting of any legal documents required to “hardwire” the planning.

What was the way your colleagues made a difference?

The best part of our role as advisers is the positive impact that we have with the international multi-generational families that we work with. By getting to know each family member independently, we build trust across the generations, enabling us to uncover the issues and deal with them head on.

We create bespoke succession and estate planning structures that help establish family harmony and ensure the successful transition

of wealth from one generation to the next. Although we are lawyers who enjoy structuring, we focus on the family’s psychology which enables us to advise complex families on ways to hold the business and family together.

What will winning this award do for your business and colleagues?

Our team is well-known for its expertise in estate and succession planning with a cross-border focus. This award provides us with the industry recognition that we also provide best-in-class legal advice to our clients in South-East Asia across a wide spectrum of specialisms including family, trust and estate disputes, real estate, and immigration.

The award also further showcases our continued commitment to serving families in South-East Asia and beyond. Whilst we do not have an office in Asia, our lawyers travel to the region monthly to advise clients. The team are renowned for their ability to co-ordinate complex, cross-border advice involving multiple jurisdictions.

Where do you see the wider wealth management sector going in the next five years?

The future of the industry, and a key role for Forster’s within it, will be to place greater resources and focus on guiding the next generation on their journey to inheriting the family wealth. Younger generations are wealth-inheritors; their experience and relationship with wealth is different to their predecessors.

Next Gens commonly want to exert more independence, whereas older generations display more collectivist attitudes for their family, especially those from Confucius cultures. Understanding this distinct psychology of Next Gens is, and will be, essential for us in the industry when helping families with (often vast) intergenerational wealth transitions over the coming years.

Every client is unique and so are our solutions. Our Private Wealth team is trusted for our integrity, discretion and highly personal approach. We tailor each structure to fit your specific needs, ensuring every solution is practical, compliant and built to last across borders and generations.

We’re Harneys, an international law firm with entrepreneurial thinking.

Please explain why you/your business was able to reach this award-winning level?

Harneys has developed a market-leading private wealth and M&A practice by combining deep technical strength with commercial insight and client-focused execution. Our ability to seamlessly integrate transactional and structuring advice across the British Virgin Islands, Cayman Islands, and Bermuda positions us as a trusted partner for ultra-high-net-worth individuals, family offices and private capital platforms throughout Asia and beyond.

A key differentiator is our Singapore office, where our private wealth lawyers are not only experts in trusts and estate planning, but also bring significant M&A and corporate transactional experience. This dual capability enables us to provide a value-added service across the full spectrum of client needs, from structuring and governance to acquisitions, exits, and succession planning. By offering a more holistic and strategic advisory approach, we consistently deliver exceptional value to our clients.

What was the way your colleagues made a difference?

This recognition is a testament to our team’s deep commitment to exceptional service, collaboration and excellence. Our lawyers work across jurisdictions and time zones to deliver seamless advice on complex, multi-jurisdictional transactions. The Singapore team delivers a high-touch, personalised service that resonates with our private clients and intermediaries.

Our strength lies in our diversity and effective communication. With fluency in English, Mandarin, and Cantonese, we can engage meaningfully with clients across Asia and build trust in culturally and commercially sensitive situations. Our team is known for being responsive, commercial, and proactive, and we consistently deliver a product and a level of service that clients value most.

• M&A Advisor

Henno Boshoff - Counsel