AWARD WINNING

VALVE IN THE INDUSTRY?

no core = no clog

CLEAN UP WITH MUC-OFF THIS SPRING

SMALL FOOTPRINT, BIG PROFIT WITH HIGH-IMPACT MERCHANDISING

Available in multiple sizes

Illuminated for high impact

Detailed planograms for easy replenishment

MAXIMISE SALE OPPORTUNITY TO EVERY CONSUMER

The most comprehensive consumer focused product range

High stock turn, 365 days of the year

Proven to increase customers self-guided shopping and impulse purchases

JOIN THE MUC-OFF WAY AND MAKE AN IMPACT

Access to high-impact brand media for marketing

Additional instore branding, stickers, hang tags available

Access to footfall driving initiatives

Featured on the Online Store Locator

Linked workshop initiatives

Contact your Area manager or email ukorders@muc-off.com

FROM THE

PEDAL & POST’s administration at the top of the year had uncomfortable echoes of 2025’s start, which saw another significant cycle logistics specialist, Zedify, go under (though not permanently). For a sector that is still pretty new (with respect to the fixie cycle couriers, posties and other bike deliverers of former decades) it’s perhaps expected that cycle logistics firms will fall by the wayside as the market matures. While the sector is nascent, the risks (and rewards) are potentially high. Does it matter to bike shops that don’t touch B2B sales or cargo bike sales? I’d contend that it does. Not only is cycle logistics part of the broader bike eco-system, and another line of revenue heading the way of bike service providers and manufacturers, there’s also the point about normalisation of cycling – see more bikes on the road, including being used as tools, then it seems less of a barmy thing to do yourself. Human nature and all that.

Normalisation is one of the reasons that 2027’s Grand Départs are piquing my interest. This time around the finest pro road riders of the world will be visiting 10 towns and cities in the UK: Edinburgh, Carlisle, Manchester, Sheffield, Keswick, Liverpool, Leeds, Welshpool, Cardiff and London. It’s the first time both the Tour de France and Tour de France Femmes avec Zwift Grand Départs have taken place in the same country (aside from France, naturally).

12 years ago, I recall being on Cambridge’s Regent Street, which was thick with spectators on a gloriously sunny day, watching Stage three of Le Tour, with helicopters buzzing overhead, residents hanging out their windows to get a better view of the riders, bike shops with yellow jerseys in their windows… it was fun, certainly, but did it translate into bike sales? You’ll have to look back through your books to discern that (let us know!), but it left a particularly positive impression of cycling that would be something of a tonic for the market after what has been a sometimes gruellingly difficult time for the UK bike trade. It’s a while ahead yet, but it plays further into that viewpoint that the mid- to long-term future is strong and bright.

Publisher Jerr y Ramsdale jerr y@cyclingindustr y.news

Harker

y.news

Jonathon Harker

MORE BIKES PLEASE?!

While the consensus would suggest bike shops are steering clear of allocating extra space for any bike categories on their shop floor, a closer look at the data shows there are subtle pockets of growth in our ‘big picture’ long term outlook…

It might seem unthinkable that shops are willing to stock more bikes today than they were six years ago, with overstocks and margin-nullifying sales still severely impacting the market. However, the nuance behind the overstock headlines is that there are pockets of growth that have been identified, even in this current scenario. Arguably, it also reminds us how the market was pre-lockdowns, eg not in a wholly healthy state either.

On with the nuance: According to CIN Market Data stats, gravel, cargo bikes and – to a lesser extent – road and triathlon markets are seeing positive signs with shops looking to increase their stocks in those areas. Cargo bikes are perhaps the least surprising here, with this category generally seen a ‘slow burner’ which is gradually growing with bags of potential, particularly as the eBike and therefore ecargobike sector and broader ecosystem matures.

Road is more of an eye-opener, admittedly with a gentle rise in demand from shops. Triathlon too exhibits some modest rises.

Elsewhere, retailer demand for eBikes on the shopfloor has dropped, but this product category still remains incredibly strong with close to half of all respondents looking to increase electric bike stocks on the shopfloor. That’s no small claim, underlined by the fact that eBike increase of floorspace allocation dwarfs more traditional categories.

And then there’s gravel – as we’ve noted before, this category continues to roll forwards with no signs of slowing down.

We've more 'big picture' insights to come, while we await the results of the latest CIN Market Data. There's still time to take part (see right)...

NEEDS

We’re currently looking for independent bike shops, retailers and workshops to take part in our new Market Data survey. The data will be compiled and completely anonymised, then shared with survey participants, with snippets shared in CIN Mag (as in this article, also completely anonymised).

Take part here:

www.surveymonkey.com/r/ZZNFDK5

EUROBIKE AT A CROSSROADS

After the German industry associations ZIV and Zukunft Fahrrad walked away, Eurobike is facing a defining moment – one that puts its role, relevance and claim to leadership in 2026 under scrutiny. Werner Müller-Schell analyses the latest developments…

It landed like a thunderclap – and the echo is still rolling through the European bicycle business weeks later. On October 30th 2025, Germany’s two key bicycle industry associations, ZIV –German Bicycle Industry and Zukunft Fahrrad, announced they would end their cooperation with Eurobike. In doing so, they challenged something that had long felt immovable: Eurobike as the sector’s default meeting point, its annual reset button, and its most reliable barometer for the state of the market.

For more than three decades, Eurobike functioned as a kind of industry calendar anchor – a fixed point in the year where

brands, suppliers, retailers, media and institutions came together to “take stock” of where cycling stood and where it was heading. It was the moment when strategies were aligned, innovations were contextualised, and the state of the market was collectively assessed. But when the two associations – representing around 240 member companies –publicly announced that they would step back from that platform, the message was no longer merely organisational or procedural. It is existential. A leading trade fair only remains “leading” for as long as the market believes in its relevance and authority. And that belief, at least for now, is in short supply.

DECLINING VISITOR NUMBERS

Eurobike’s current strain did, of course, not appear overnight. In recent years, the criticism changed shape – from relocation debates to more profound questions about purpose. The move from Friedrichshafen to Frankfurt in 2022 prompted scepticism, but few saw it as a direct threat to the show’s identity. The later push towards internationalisation – including Eurobikebranded events in Istanbul and Jakarta from 2024 – likewise sparked debate without fundamentally questioning whether the core show still mattered. More recently, the discussion moved to the foundations: positioning, thematic breadth, scale and cost. The central concern is whether

courtyard marquee

Eurobike’s format still matches a market that has changed sharply since the pandemic boom, and then corrected just as sharply.

The turnout at Eurobike, which has long been acknowledged in the industry as “the world’s leading bicycle trade show” – a title it also claims for itself –reinforced the mood. After 35,080 trade visitors and 33,090 festival attendees in 2024, Eurobike 2025 recorded 31,270 trade visitors and 30,420 festival guests — roughly a 10% decline. In isolation, those totals still look substantial. But for a show that presents itself as the global centre of cycling, these figures send a clear message: Eurobike is losing its significance.

This applies all the more as Eurobike has been losing exhibitors that historically signalled status and momentum. Over the years, major groups and brands such as Accell Group, Pon, Specialized, SRAM, and Trek have disappeared from the exhibitor lists. In 2025, the withdrawal of the German buying groups Bico and ZEG meant that entire brand families were absent. ZIV’s and Zukunft Fahrrad’s decision to step away in 2026 is therefore not a single shock, but the latest heavy blow to the German event.

A FLAGSHIP UNDER PRESSURE

At the same time, competitive pressure is no longer coming only from smaller, niche-format events, but increasingly

from shows that combine scale with a more precise and more focused value proposition. Velofollies in Kortrijk, Belgium, held in January 2026, is the most recent and most cited example: a consumer-facing event with strong retail relevance, praised by both brands and visitors for high footfall, concrete sales leads and a tangible return on investment. Another case in point is Cyclingworld in Düsseldorf, Germany, which in recent years has gained significant attention by positioning itself clearly and aligning closely with both brands and specialist retailers.

Beyond Europe, the global trade show calendar has shifted as well. Taipei Cycle continues to function as a crucial sourcing and OEM platform, particularly for component suppliers and manufacturing partners, while Shanghai is steadily gaining relevance as China’s domestic market grows in confidence and its export ambitions realign. None of these events claim to replace Eurobike outright or assume its historical role—but together they fragment attention, budgets and strategic focus, challenging the longheld assumption that a single show can still serve as the bicycle industry’s unquestioned centre of gravity.

“Eurobike was trying to cater to too many categories and demographics at once—mobility, the Far East, last-mile solutions, and e-bikes—in a venue that

was far too large, while ignoring the core enthusiast bike market that lies at the heart of cycling,” summarises bicycle industry expert and The Business of Cycling Podcast host Wyatt Wees in an interview with Cycling Industry News, adding that “you can’t be everything to everyone. If you try, you are providing a mediocre product.” Looking at posts on platforms like LinkedIn or in the international bike media makes one thing clear: He’s not alone in his opinion.

ZIV’S AND ZUKUNFT FAHRRAD’S WITHDRAWAL

A closer look at the withdrawal of ZIV and Zukunft Fahrrad from the leading trade show reveals that a similar sentiment had taken shape among their 240 member companies. Through a comprehensive feedback process, the associations gathered input from their members, distilled the key points of criticism, and developed a “ten-point plan” — a package of measures intended as a basis for talks with the trade fair organisers. Among the key issues were streamlining Eurobike, sharpening its positioning, and aligning it more closely with the needs of specialist retailers. At the same time, the associations called for binding changes to cost structures and scheduling, as well as efforts to win back major exhibitors. In the end, however, no agreement could be reached, with the outcome now well known.

Affordable quality with 200kg carrying capacity, single or double battery options and a growing range of accessories to suit your customer needs. 2-year warranty with UK stock and support.

Industry-leading profit margin

Exclusive dealer territories

UKCA, EN and BS certificated

Proudly manufactured in Turkey with 50% less CO2e*

RRP from £1,800 tel

Statements from those responsible at ZIV and Zukunft Fahrrad provide more in-depth insight: “Over many months, we engaged in very intensive discussions with Eurobike and made it clear that fundamental changes were needed—both in terms of strategic direction and in how companies are treated. Our impression, however, was that a decisive part of the trade fair organisation was not prepared to move, either in terms of content or organisation. At the same time, we saw that key exhibitors no longer felt sufficiently heard and that there was a risk of renewed loss of trust. That would have further weakened the foundation of the show as an industry platform,” explained Burkhard Stork.

The list of prominent advocates from the two associations is long. “We were unable to see that both shareholders supported, with the same level of determination, the measures that would be necessary to make the show future-proof for the bicycle industry,” commented Bernhard Lange, ZIV Executive Board member and Managing Partner of Paul Lange, on the decision. “The members of Zukunft Fahrrad and ZIV – The Bicycle Industry have clearly articulated their expectations regarding the structural and content-related adjustments required. Unfortunately, we see no realistic chance of achieving these,” said Ulrich Prediger, Chairman of Zukunft Fahrrad and founder of JobRad. Claus Fleischer, ZIV Board member

and CEO of Bosch eBike Systems, added: “The industry expects fundamental changes as both a prerequisite and a clear signal for a successful future for Eurobike—and in the end, we do not see these.” One thing is already clear: the world’s largest e-bike motor manufacturer will not be exhibiting in Frankfurt in 2026. Bosch likely won't be the only big name missing from Eurobike 2026. As of late 2025, for example, Shimano's participation in Eurobike 2026 remains undecided. The absence of the Japanese industry giant would be another heavy blow to the Frankfurt trade fair. (Editor’s note: as this magazine goes to press, Shimano has confirmed it will not be exhibiting at Eurobike 2026.)

THE RESPONSE FROM THE EUROBIKE OFFICIALS

The Eurobike organisers are not standing idly by in the face of these developments. Although they initially appeared surprised by the withdrawal of ZIV and Zukunft Fahrrad, they responded quickly. By November, then show director Stefan Reisinger had already expressed openness to change in a press release: “We have taken the time to listen to our stakeholders, reflect and understand. As Eurobike, we remain in touch and are fully committed to dialogue,” he said. Just weeks later, however, organiser Fairnamic announced that Reisinger would step down as Managing Direc-

tor. From January 1st, his role was taken over by Philipp Ferger, Vice President of Consumer Goods Fairs at Messe Frankfurt, who now jointly manages Fairnamic with Stefan Mittag of Messe Friedrichshafen, while Reisinger remains involved during a transition phase.

According to Fairnamic, the leadership change is intended as more than a simple personnel adjustment. Under the new management, conceptual changes to Eurobike are already being prepared – initially for 2026, but more fundamentally from 2027 onwards. Fairnamic stresses that this process is being developed in close consultation with exhibitors, industry stakeholders and associations, supported by a newly established trade fair advisory board set to meet for the first time in early 2026. Backed by Messe Frankfurt’s international network and drawing on Ferger’s experience in repositioning large-scale trade fairs after the pandemic, the organisers signal a willingness to recalibrate Eurobike’s role and structure – as Ferger puts it, “we are dealing with a market and an event that have enormous creative potential, and that is always a good starting point.”

In the interview, Ferger repeatedly stresses that his starting point is neither crisis management nor cosmetic reform, but a structured rebuilding process rooted in dialogue and realism. Drawing on more than two decades at Messe Frankfurt, he

Wheels of change: Associations have reacted with cautious openness to changes behind the scenes at Eurobike

positions himself as someone accustomed to leading large international flagship shows through phases of consolidation and repositioning. “I know how to run global leading trade fairs, especially how to manage restructuring and how to deal with the demands of major brands,” he says, underlining that Eurobike’s situation is challenging, but far from hopeless.

Rebuilding trust with ZIV and Zukunft Fahrrad, he says, has already begun through direct talks and regular exchange, but he deliberately avoids detailing content at this stage.

At the same time, he tempers expectations for 2026, describing it as a transitional year with visible adjustments and initial course corrections, but not yet a fully reimagined show. “It will not look like Eurobike 2024 or 2025, but it will also not yet be the entirely new Eurobike of 2027,” he says. It is striking that Ferger – who is new to the bicycle industry – has already signalled a notably high level of openness and willingness to engage in his first days in the role, an approach he intends to pursue systematically. Among other measures, Fairnamic is planning in-depth interviews with leading industry players to align Eurobike's future direction more closely with the market's needs and expectations. Credibility, careful expectation management and a clearly communicated direction of travel, Ferger adds, will be decisive in restoring confidence in the platform across the

industry. The show organiser has also revealed it will have exhibitors in three halls instead of the previous four.

THE BICYCLE INDUSTRY: REACTION

Initial reactions from the associations suggest cautious openness rather than outright rejection. Burkhard Stork, Managing Director of ZIV – German Bicycle Industry, describes the announced changes as “a good basis to advance the cultural shift discussed in recent months,” noting that Eurobike has already briefed the association on planned adjustments. At the same time, he makes clear that any renewed cooperation would depend on the industry being “sustainably and bindingly involved in the conception and implementation of Eurobike – organised through the associations.”

“THE GLOBAL LEADING TRADE SHOW IS NECESSARY, BECAUSE THE CYCLING MARKET BY NATURE IS GLOBAL AND THIS MEANS ONE DESTINATION IS CONVENIENT AND IDEAL FOR LARGE SUPPLY CHAINS WITH DIVERSE PARTNERS”

Zukunft Fahrrad strikes a similarly measured tone. Managing Director Wasilis von Rauch welcomes Messe Frankfurt’s decision to decisively reposition Eurobike, arguing that “the need for an international industry platform is there, and leading a strong brand into the future offers real opportunities for the bicycle economy.” He confirms that discussions with Messe Frankfurt are ongoing and that a meeting with Fairnamic’s new management has already been scheduled. Whether these signals will translate into broader industry buy-in, however, remains an open question. Much will depend on whether the promised dialogue results in visible structural change – and whether sceptical exhibitors are willing to re-engage after years of frustration. As industry expert Wyatt Wees points out, the underlying need has not disappeared: “The global leading trade show is necessary, because the cycling market by nature is global and this means one destination is convenient and ideal for large supply chains with diverse partners.” The challenge for Eurobike will be to convince the broader market that it can once again be that destination –and to ensure that the thunderclap heard last autumn becomes the starting signal for renewal, rather than the echo of a fading institution.

Words: Werner Müller-Schell

PROFILE MUC-OFF’S ANTI-PUNCTURE PRODUCT SUITE

MUC-OFF

The multi-award winning Big Bore Tubeless Valves are proving they’re gaining new fans and are part of a broader anti-puncture ecosystem of product from the house of Muc-Off

‘Less time pumping and more time riding’ is the straightforward premise of a growing bunch of Muc-Off products that are getting the spotlight shined on them thanks to some recent award wins.

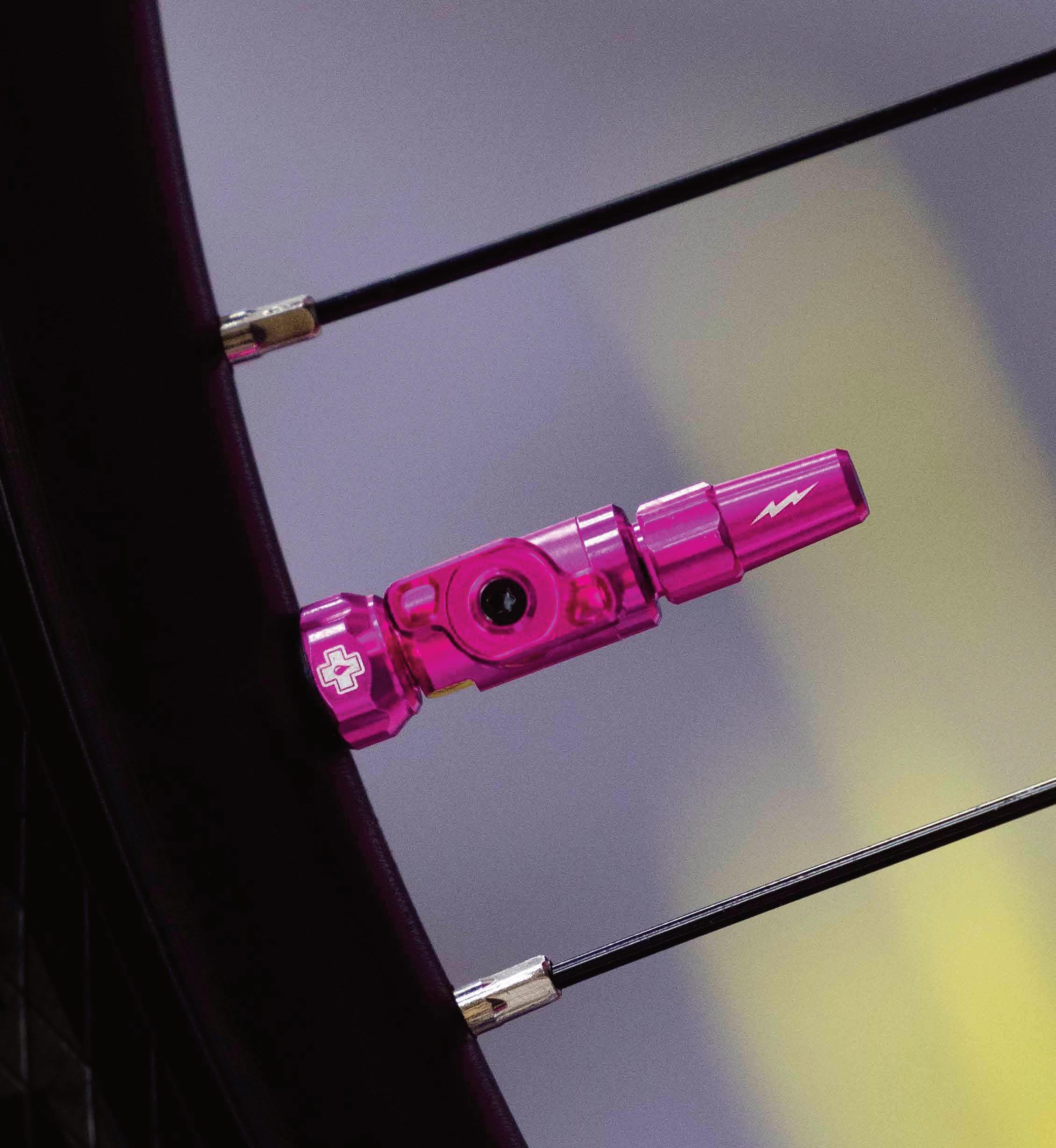

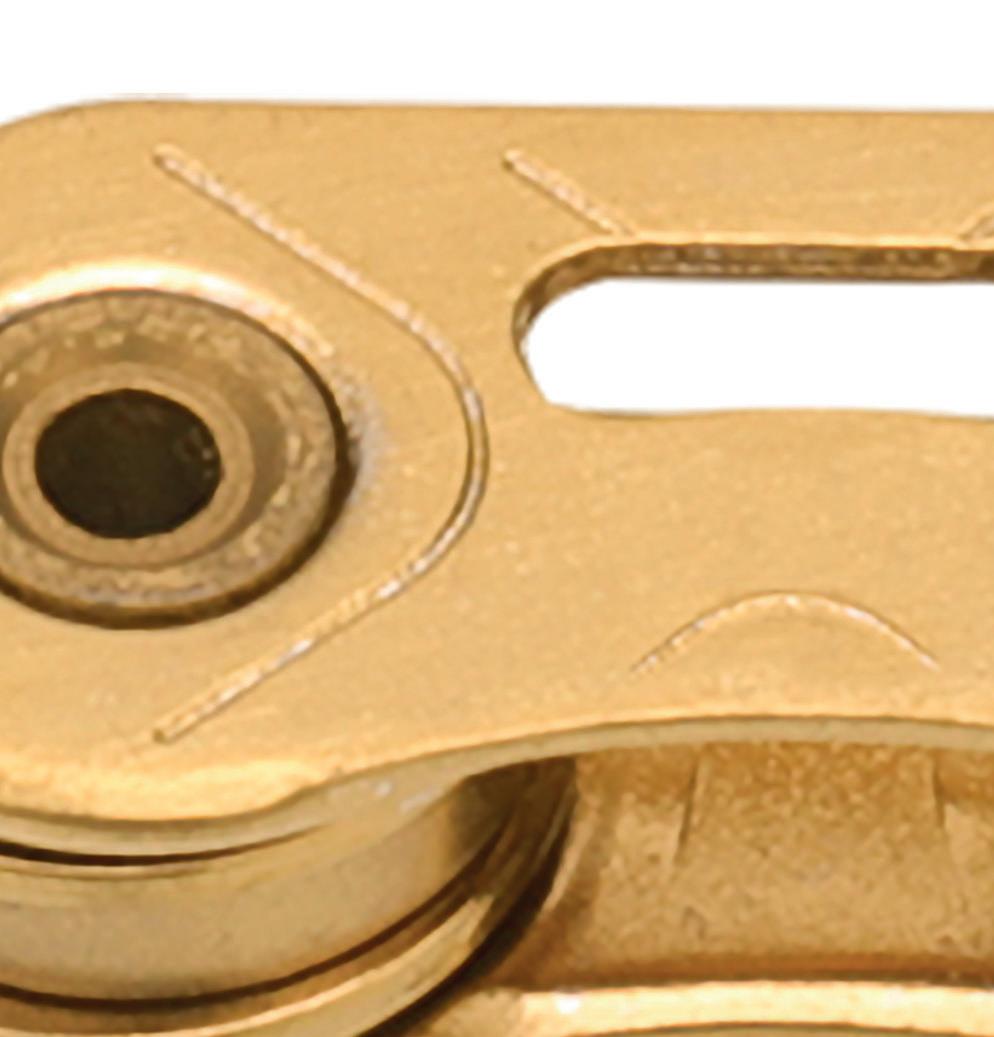

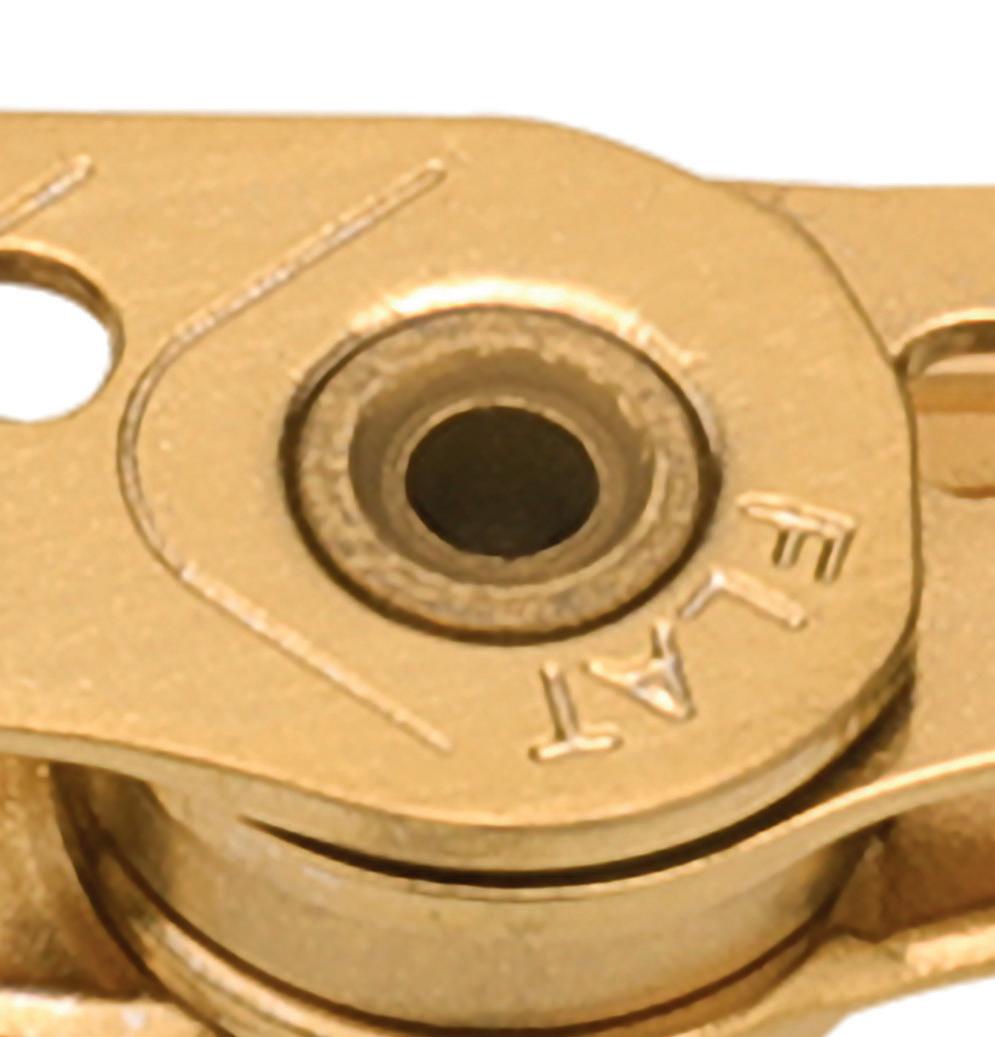

Muc-Off’s Big Bore Tubeless Valves won a Eurobike Award last year, and this year have picked up a Design and Innovation prize from Enduro Mountainbike Magazine in the components category, for delivering meaningful performance gains through practical engineering rather than incremental changes.

The multi-award-winning tubeless solution essentially looks to solve that persistent niggling problems in tubeless setups: Sealant clogging.

Developed around Muc-Off’s patented “Straight Through” coreless design, the Big Bore Valve system removes the need for a traditional valve core, dramatically increasing airflow allowing sealant to pass cleanly through the valve, eliminating clogging that commonly occurs with other tubeless valves.

“We didn’t set out to make a betterlooking tubeless valve – we set out to fix the things that frustrate riders every time they set up tubeless,” said Muc-Off CEO Alex Trimnell. “Clogging, poor airflow and messy sealant installs have been accepted for too long. Winning multiple awards for Big Bore shows that solving those problems properly still matters – we’re stoked to be recognised for it.”

Hey Dipstick

Further supporting those on a tubeless set up (or those setting up and maintaining a tubeless set up) is MucOff’s Hey Dipstick. It’s, yes, a dipstick designed to help keep sealant free-

flowing and performing optimally. It’s a quick and easy way to test sealant and is engineered to glide seamlessly through the stem of any Presta or Schrader valve with a removable core. In short, the health and level of sealant can be checked without needing to break the bead or remove the tyre. It features:

• Knurled handle gripper

• Aircraft grade CNC machined 6063 aluminium

• Durable 304 Stainless Steel dipstick with machined sealant level indicator gloves

• Lightweight

And naturally, Muc-Off also offers tubeless sealant options, including a line aimed at road and gravel tubeless users, as well as one for the MTB sector.

AirMach Electric Mini Inflator Pro

Sticking with the theme of keeping riders riding, Muc-Off’s AirMach Electric Mini Inflator Pro delivers up to 120psi of speedy inflation with electric effortlessness. Using clever brushless motor tech, this small but mighty

inflator is fast working and fast recharging too (in 25 minutes via USB-C). It switches between Presta and Schrader valves, and even features an LED display which shows real-time air pressure and battery level. So if you’ve a customer that prefers riding over pumping (presumably most of them?) then that’s a handy add-on sale. muc-offb2b.co.uk

POWER TO SHIFT YOUR PERSPECTIVE

With 500 lumens of bright night illumination and multiple daytime flash modes, the FR500 keeps you visible at all times. Its space-saving design fits under Garmin-style bike computers, while the smart auto on/off function ensures hands-free convenience. Built to handle any ride, it’s your ideal front light for safety riding.

BIKE LIGHTS • BIKE FENDERS CYCLING GLASSES • BIKE BELLS BIKE PUMPS • BIKE PHONE HOLDER

To find out more about Ravemen and our extensive range of products, contact your area sales manager, email us at sales@bob-elliot.co.uk or call us on 01772 459887 LIGHT THE WAY... WITH RAVEMEN AND

BOB ELLIOT & CO. LTD.

Born from a passion for cycling and a commitment to innovation, Ravemen is an independent brand dedicated to crafting intelligent lighting that enhances safety without compromising style. Ravemen lights combine smart technology with thoughtful design to help riders see clearly, be seen confidently, and explore endlessly – day or night, road or trail.

ON THE WHEELS IN TAIWAN

Exploring Taiwan’s approach to cycling infrastructure, safety and culture, CIN headed to the centrally located Sun Moon Lake at the tail end of 2025, as part of the Go Healthy with Taiwan team…

Cycling Industry News participated in the Go Healthy with Taiwan Media Tour in the second week of December, following an invitation from the Taiwan External Trade Development Council (TAITRA). Not only did we visit the Cycling Culture Museum in Taichung (issue 01 2026), but we also cycled for two hours, gaining first-hand experience of cycling at one of Taiwan’s most famous tourist attractions.

The journey began in the morning near the Sun Moon Lake Shuishe Wharf. We cycled slowly along the lake to enjoy the warmth and sunshine – a stark contrast with the UK and Europe during December. Well paved but sometimes narrow, the serpentine cycleway boasts multiple breakout areas for cyclists to rest and recharge while enjoying the beautiful scenery.

We soon arrived at Shuishe Dam, where

cyclists are required to dismount and walk with their bikes on the boardwalk. Both locals and tourists followed the rules.

We were asked to stop at the Xiangshan Visitor Center and return to the starting point. However, we went a little further, lured by the autumnal sight of a line of trees with red leaves set against the backdrop of Sun Moon Lake. We eventually stopped at a viewpoint along the lake, located about a five-minute ride away from the visitor centre, before returning to the starting point.

Wearables and IoT win awards

The media tour also took in the announcement of the winners of the Go Healthy with Taiwan campaign. The competition, one of Taiwan’s flagship international innovation initiatives, attracted 638 proposals from 55 countries. The top honours were awarded to

teams from the US, Ukraine and Switzerland, whose proposals introduced solutions in smart healthcare and integrated sports technology. Each winning team received an “Infinite Taiwan”-themed trophy and US$30,000 in prize funding.

A total of six teams, including the three winners, were shortlisted as finalists, with some showcasing innovation in cycling. For example, the Mexican team’s proposal, Smart Health Kids –Transforming Mobility into Health, uses Taiwanese smart bikes, wearables and IoT to combat childhood obesity and build health data platforms.

Meanwhile, the New Zealand team presented its proposal, Cycle Taiwan: Wellness Rides for New Zealand Adventurers, combining Taiwanese bikes with smart wearables to create cultural, health-focused bike tours that promote tourism and wellness.

At the awards ceremony, Susan ChiChuan Hu, Deputy Director General of the International Trade Administration (MOEA), comments: “Go Healthy with Taiwan is not only a call for proposals; it is a global journey that connects creativity and drives the health industry forward. Taiwan’s industrial strengths continue to attract worldwide participation, bringing us closer to the shared vision of building a healthier future together.”

Looking ahead, Go Healthy with Taiwan will continue as a long-term initiative, with organisers aiming to build a global innovation platform, strengthen commercial opportunities and inspire new models for collaborative health development worldwide.

gohealthy.taiwanexcellence.org

Teravail’s Circos gravel rim and Fluent mountain bike rim will join the brand’s established tyre range in the Ison display

COREBIKE CRIB SHEET

There’s been a lot of news from COREbike exhibitors and brands over the course of the past few weeks, so we’ve handily compiled some of the highlights to help guide your route through Whittlebury Hall…

NEW DISTRIBUTION DEAL:

Coast Optics on the Extra UK stand One of a number of interesting distribution deal signings, Coast Optics has joined the Extra UK portfolio, taking on exclusive distribution duties across the UK and Ireland.

Coast Optics was founded by two Brits, Alex and Sam, with the aim to provide high-performance, sustainably sourced, quality eyewear with a minimal environmental impact. By using sustainably sourced, biodegradable materials, Coast Optics products aim to provide a greener alternative, whilst maintaining the quality and performance required to tackle gnarly trails and conditions. Stock of Coast Optics will be available from March from Extra UK in the UK and through Cyclex in Ireland.

Ison Distribution showcasing Surly, Teravail, Ass Savers and HT products

With Ison Distribution, Straggler 2.0 features a series of upgrades designed to refine Surly’s signature steel ride feel. Its geometry, wheel size and tubing

have been optimised for improved handling and comfort, while front and rear thru-axles deliver more precise, confident control on varied terrain.

Meanwhile, Teravail’s Circos gravel rim and Fluent mountain bike rim will join the brand’s established tyre range on display. Both models feature hookless construction with thick flanges, designed to withstand the demands of singletrack and gravel riding. Ison will offer the Circos and Fluent rims as standalone options or built with Halo hubs, with complete wheel builds set to be shown at COREBike 2026 for the first time, and potentially in the UK.

There’s also new mudguards from Ass Savers and updated finishes on HT’s classic pedal range.

Ass Savers will introduce the new Win Wing MTB, a wider rear mudguard designed to accommodate larger tyres, complementing the existing Win Wing Road and Win Wing Gravel models. HT, meanwhile, will be showcasing several new finishes across its well-known pedal portfolio.

Optics

The much-anticipated Root Beer finish makes its debut, offering a subtle yet distinctive pop of colour. New for 2026, Green and Grey Camo finishes will be available across a number of models and are set to attract strong interest. Also returning is the popular PA03A pedal. A multiple award winner praised across the industry for its simple, no-nonsense and effective design, the PA03A is now available in 12 different colours.

HT will also display its full range of clipless pedals, including the flagship T2 and M2 models, as well as its updated road offerings, the PK02G and PK02 Carbon.

NEW DISTRIBUTION DEAL: Rocky Mountain signs with Adaptive DCS

Adaptive DCS is continuing to grow its distribution portfolio with a new exclusive deal with North Vancouver performance MTB brand Rocky Mountain. Under the new commercial structure, Adaptive DCS will be responsible for UK

sales and marketing, in addition to providing logistical support. Adaptive DCS will build on existing relationships with current stockists while expanding Rocky Mountain’s reach across the UK retail landscape. The brand will also make what is reportedly its UK trade debut at COREbike 2026.

Tern’s Gen4 Vektron heading to COREbike 26

In the Hungaroring room at COREbike, Tern’s UK distributor OGA will showcase recent additions to the range, including the Gen4 Vektron. This a folding eBike ideal for commuters, leisure riders or campervan and caravan owners. The Vektron P5i features a Bosch motor and a 400wh powerpack. It also features a Shimano Nexus 5 internally geared hub and a low maintenance Gates Belt Drive.

Tern will also be showcasing its adventure-inspired, but urban ready Tern Orox. This ‘go anywhere do anything’ eBike has a tough build designed for any terrain, any weather condition and optimised to haul a passenger, a four-legged friend or a heavy load of cargo.

NEW DISTRIBUTION DEAL:

Extra UK signs up Rozone manufacturer of ROwasher Another brand newly landing with Extra UK is Rozone and its ROwasher parts washer and consumables.

While already established in the UK cycle industry, this new partnership will bring quicker and easier supply of ROwasher machines and consumables

Skarper's click-on, click-off e-drive system is exclusively now available through ZyroFisher

MiRiDER is looking to cement dealer relationships at CORE

to UK dealers and workshops.

Stock of consumables is available now from Extra UK in the UK and through Cyclex in Ireland.

MiRIDER to build on 200 shop roster UK compact folding electric bike brand MiRiDER is sighting expansion in Europe, seeking “the right longterm partners” as it looks to scale internationally.

The brand now lists in excess of 200 UK retailers from a standing start of zero when it launched five years ago. The family-owned business will be seeking to cement current relationships and forge new ones at CORE

NEW DISTRIBUTION DEAL:

ZyroFisher partners with Skarper, Click-On, Click-Off E-Drive

Skarper, the British company behind the click-on, click-off high-performance e-drive system, is exclusively now available through ZyroFisher to the trade.

Skarper’s patented DiskDrive® system delivers lightweight electric power that clicks on for the commute and off for the weekend ride – all without altering the bike’s frame. Developed in collaboration with Red Bull Advanced Technologies, Skarper’s award-winning design has earned honours at Eurobike, Red Dot, and iF Gold.

NEW DISTRIBUTION DEAL:

ZyroFisher lines up apparel brand Spatzwear

Also at ZyroFisher is newly signed Spatzwear, the cycling apparel compa-

ny and brainchild of former pro cyclist

Tom Barras. The distributor now supplies UK retailers with the range that is touted as highly innovative, considered and comfortable.

Push.bike ecommerce sessions

At COREbike, Push will be running private 30-minute ecommerce sessions for retailers who want to sanity-check how their site is being experienced by customers.

These are short, focused conversations led by a team that works exclusively in cycling ecommerce, across retailers of all sizes and trading models. The aim is not to sell a platform, but to help retailers understand which customer-perceived category they currently sit in and whether their site reflects how they actually trade.

Some retailers will leave reassured that their numbers make sense. Others will leave with clarity on why traffic is not turning into confidence. Details are available at go.push.bike/core.

Santini SS26

For SS26, Santini is focused on raising the innovation bar with an even stronger focus on aerodynamics, sustainability and next-generation performance. Highlights include the new AERO RACE CC jersey developed and refined in the wind tunnel. Exclusive to Santini, crafted from Polartec® Power Dry™, this jersey features an ultra-light, highly breathable fabric engineered to quickly wick moisture away from the skin and toward the outer layers. Its bi-component knit

structure ensures fast drying, soft next-to-skin comfort, and optimal temperature regulation—even during the most intense efforts.

Another highlight of the SS26 Santini collection is the expanded UNICO line, which further elevates its signature second-skin fit and premium comfort. The line includes a unisex short-sleeve jersey and a unisex long-sleeve jersey, as well as bib shorts available in both men’s and women’s versions.

Exposure Lights updated Sirius 11 light

Exposure Lights’ significantly updated Sirius 11 light benefits from fast and convenient USB-C charging. The Sirius 11 can provide up to 1,300 lumens of white light, but can also flash for up to 130 hours, ideal for those who wish to see and be seen.

Made from 6063 machined aluminium, the Sirius 11 weighs only 90g. This “pocket powerhouse” is compatible with Exposure’s extensive range of brackets and mounts – there are numerous options for mounting the Sirius 11 on the handlebars, on a helmet or neatly underslung beneath an out-front mount, for an elegant solution.

NEW DISTRIBUTION DEAL:

Lyon Cycle signs up uvex cycling helmets and eyewear

Lyon Cycle is becoming the official UK distributor for uvex sports for its premium range of cycling helmets and performance eyewear, bringing the trusted European protective gear name to UK riders through Lyon Cycle’s established dealer network.

ACT debut

Incredibly, it will be the first time the Association of Cycle Traders (ACT) participates at COREbike. The ACT stand will highlight the latest developments in the E-Bike Positive campaign. Visitors can also learn about key ACT initiatives and essential business services supporting specialist cycle retailers, including Cytech training, advocacy work and the new revenuegenerating OWNit service from Renticy, a ‘try before you buy’ solution.

Upgrade: DMR & Kinesis

Upgrade’s house brand Kinesis has released highly effective mudguards, the Kinesis Fend Offs, with a metal black finish in the premium, permanent mudguard solution space. Coming five years after the launch of its DH-R EVO brake which received praise for its consistency, power, and unique colourways, TRP are introducing a new and improved brake dubbed the EVO PRO.

Hope launches Pro 5 Hook

Flange hub for Berd fibre spokes

Hope Technology has expanded its Pro 5 hub range with the launch of a Hook Flange version designed for use with Berd’s ultralight fibre spokes.Developed to complement Berd’s high-strength textile spokes, the Pro 5 Hook Flange hub combines Hope’s precisionmachined aluminium hub shell with a bespoke spoke interface engineered to suit Berd’s looped spoke construction. The result is a hub aimed at riders looking for reduced system weight without sacrificing durability or stiffness.

Wildoo to exhibit new product ranges at COREbike26

Wildoo has recently added three new custom product lines, including headset top caps, CNC-machined from aluminium and available in a selection of anodised stock colours, with inhouse laser etching for custom designs. For bulk orders, Wildoo also offers fully bespoke options, including a wider anodised colour palette and oil-slick finishes.

The company has also expanded into custom keyrings, offering jersey-style and traditional round PU leather designs with full-colour printing. Completing the new line-up are reinforced tyre levers, manufactured in Europe and featuring a clip-together design.

NEW DISTRIBUTION DEAL:

Extra UK signs INPEAK power meters

Also at Extra UK will be newly signed INPEAK, the rapidly growing brand high-precision and accessible cycling power meter brand, based in Wrocław, Poland.

INPEAK is well-regarded in the power meter market, earning a reputation for precision and high-quality craftsmanship, with its products being fitted by some of the largest cycling brands, including Van Rysel and Willier. Its products are available in Twin or Single variants with rechargeable or replaceable battery-powered options across a wide range of Shimano cranks.

COREbike 2026 runs over 22-24 February at Whittlebury Hall, Towcester. Find out more at www.corebike.co.uk

CONFIDENCE FOR EVERY RIDE

COREbike Show 2026 – Stand S27

Come see the full collection and discover why KENDA is trusted across the UK — from core riders to rental fleets.

THE GROWING APPETITE FOR SIMPLIFICATION & AFFORDABILITY PROFILE

Fresh from its launch at Velofollies, Ananda’s M7000 Series promises to take the pain and complication out of eBike motors for the trade, and OEMs in particular. CIN catches up with the brand on its way back from the Belgium-set show…

IN THE BEGINNING…

Early in January, drive systems specialist Ananda cut the ribbon on its brand new M7000 Series, pitched as a new generation of mid-drive motors designed as a scalable platform rather than a single product.

Eagle-eyed on trends in the market, Ananda has designed the platform to accommodate the twin aspirations of simplification and affordability that are becoming more prevalent in the sector.

Simplification

An Ananda spokesperson tells CIN: “One of the core ideas behind the M7000 Series is simplification. By moving to a shared platform with common integration standards, electronics, communication protocols, and system logic, we reduce complexity for OEMs across development, sourcing, production, and longterm management.

“By allowing the exchange of key components – motor, battery, display, sensors and controllers – across the same platform, OEMs can serve multiple appli-

cations while managing fewer variants and reduced stock positions. A singlefamily design also ensures visual consistency across different segments.

“From development to production, the platform simplifies processes. Universal documentation allows teams to do the work once and efficiently adapt it across projects. A single mounting standard and reduced number of parts mean less complexity in frame design, logistics, assembly and aftersales handling.

“Familiarity is another key advantage: once teams learn the system, they know it across all applications – from product management and production to sales and service.

“The result is clear: lower costs, less complexity, and greater flexibility – reducing effort while expanding possibilities.”

Speaking of the show, which is grabbing a few extra headlines as the global business deliberates on the future of the bike trade shows in Europe, how was Velofollies for Ananda?

“The launch went very well. Velofollies was the right place to introduce the M7000

Proud to be Look’s New UK Distributor

PROFILE

“WE SEE A STRONG SHIFT TOWARD COMPLETE SYSTEM SOLUTIONS AND LONG-TERM PLATFORMS RATHER THAN ISOLATED COMPONENTS. OEMS ARE INCREASINGLY FOCUSED ON REDUCING COMPLEXITY, CONTROLLING COSTS, AND SHORTENING TIME-TOMARKET WHILE STILL DELIVERING DIFFERENTIATED PRODUCTS”

Series, as it allowed us to present not just a new motor, but a complete platform approach,” the spokesperson tells CIN. “From day one, we saw strong interest from OEMs, retailers and media, with many in-depth discussions around system flexibility and positioning as a credible alternative to established market leaders.

“The show itself felt busy and constructive. Attendance was solid, conversations were business-oriented, and there was a clear appetite for wellthought-out, long-term system solutions rather than isolated components. Velofollies is also an important touchpoint with dealers, which made the timing of the launch particularly relevant.

“Velofollies also confirmed that the European bike market has entered a more stable and professional phase after a difficult period. Volumes are more realistic than during the postCovid peak, but confidence is returning, and brands are clearly focused on efficiency and long-term strategies –exactly where the M7000 platform fits.”

The O2feel is one brand that recently switched from Shimano to Ananda, which piqued interest among a decent proportion of show visitors: “this naturally generated curiosity and discussion around our technology.”

Beyond the M7000 Series, Ananda also used Velofollies to highlight its R900 electronic 3-speed automatic gear hub system, with demo bikes available in the test area. Visitors could experience this technology first-hand, which will be available on customer bikes in 2026 and 2027.”

Pace of development

With consumers becoming ever more aware of the brand, Ananda is keen to impress upon potential OEM partners that it is designing systems that work for them too. This latest series launch is consciously a move away from the “one motor, one application” mindset, the firm explains: “We created a modular mid-drive platform that allows OEMs to cover multiple segments using the same core architecture.”

It’s a move that will likely speed up development for OEMS: “Rather than starting from scratch for each project, brands can work from a proven foundation and adapt it to different bike concepts – from urban to trekking or eMTB. This shortens development cycles, reduces engineering effort and R&D costs, and helps brands bring new models to market faster while maintaining consistent ride quality and brand differentiation.”

Affordability moves into the driving seat

Those themes have a positive knock-on effect on those seeking greater affordability, as the firm points out: “We see a strong shift toward complete system solutions and long-term platforms rather than isolated components. OEMs are increasingly focused on reducing complexity, controlling costs, and shortening time-to-market while still delivering differentiated products. Flexibility, serviceability, and platform scalability are becoming essential requirements, not optional extras. At the same time, the market remains highly price-sensitive, making value for money, service support, and long-term reliability just as important as peak performance figures.

“This is exactly where the M7000 Series is positioned.”

According to the brand, the affordability factor is now more important than ever, with urban and city eBikes (for example) priced above €5,000 largely reaching saturation point, and most potential customers already equipped. The firm says: “Growth now lies with first-time buyers and noncyclists entering the eBike market, typically targeting bikes priced below €3,000. This segment represents the core of today’s market and still offers

ONEWAY BIKE

YOUR PARTNER TO HELP YOU BUILD YOUR BUSINESS

√ 24 years of experience √ Customer & sales support

√ Customized marketing activities √ Delivery from stock

√ Place orders 24 hours a day 7 days per week

For more info about our brands, send a message to sales@onewaybike.nl or give us a call: +44 1527 958331

Website: shop.oneway.bike

PROFILE

“FOR THESE NEW RIDERS, SIMPLICITY IS AS IMPORTANT AS PRICE”

significant untapped potential for brands able to deliver strong value without unnecessary complexity.

“For these new riders, simplicity is as important as price. They are looking for robust, intuitive bikes that are easy to use, easy to maintain, and reassuring

in everyday riding. Complex systems or manual gear management can quickly become a barrier to adoption. Automatic gear shifting is particularly relevant for this audience, simplifying the riding experience and reducing maintenance concerns. This thinking directly inspired the R900 electronic 3-speed hub system, launched at Eurobike. By combining automatic shifting with low maintenance, it addresses the needs of new riders seeking a stress-free, intuitive riding experience.

“Overall, Ananda’s strategy is clearly focused on serving real riding needs while making life easier for OEMs –combining platform efficiency, accessible performance, and user-friendly system solutions.”

Ananda sees the M7000 Series as a key milestone in its development and – perhaps crucially – its perception as a serious long-term partner in the European market: “Designed to evolve over time, the M7000 platform ensures continuity, investment protection, and the flexibility for our partners to respond quickly to changing market demands.”

www.ananda-drive.com

M7000 SERIES IN BRIEF

Ananda takes us through the M7000 need-to-knows:

● “The M7000 Series is a platform, not a single product, designed to scale across multiple segments

● “It offers OEM flexibility through open, coherent system integration rather than a closed ecosystem

● “It delivers strong performance and a natural ride feel at a very competitive value level

● “It reflects Ananda’s evolution toward more integrated, premium and future-ready solutions.

“The M7000 Series is built around a platform approach: one shared foundation that supports multiple bike categories and use cases.”

Natural Power Precise Control

Total Integration

SIMPLE SALES TIPS 7 WHAT MAKES A GREAT “ABOUT US” PAGE

Before they step through your door, there’s a big chance that customers have checked your shop out before leaving their house. So, is your “About us” page up to scratch? John Styles examines the areas where shops can refine their web page to try and make a difference…

In previous articles we focused on greeting new customers and relationship building, through body language, questioning and conversations. But what if your new customer who walks through the door already feels like they know you? Is already convinced that they have come to the right place, for the right thing? That’s where a strong “About us” page can help.

According to many sources, when looking for a local store to visit, the “About us” Page is the second most visited page after the homepage. So, consumers clearly value it for making their decisions.

People buy from people. And they

ABOUT

visit more or spend more when they like what they see. So much so, that some unscrupulous website owners have created fake back stories with fictitious store owners. Last year, the BBC ran a story detailing how a scammer faked, using AI, a UK family-run business to trick "customers". You can read about that here (BBC – ‘Scammers using AI to lure shoppers to fake businesses’ https://www.bbc.co.uk/news/ articles/ced5wvn48q5o)

This got me thinking about all of the genuine store owners, managers and staff I’ve met in our trade along the years. I know them to be hard-working, knowledgeable, dedicated people

who know their product. But how well do they sell their backstory?

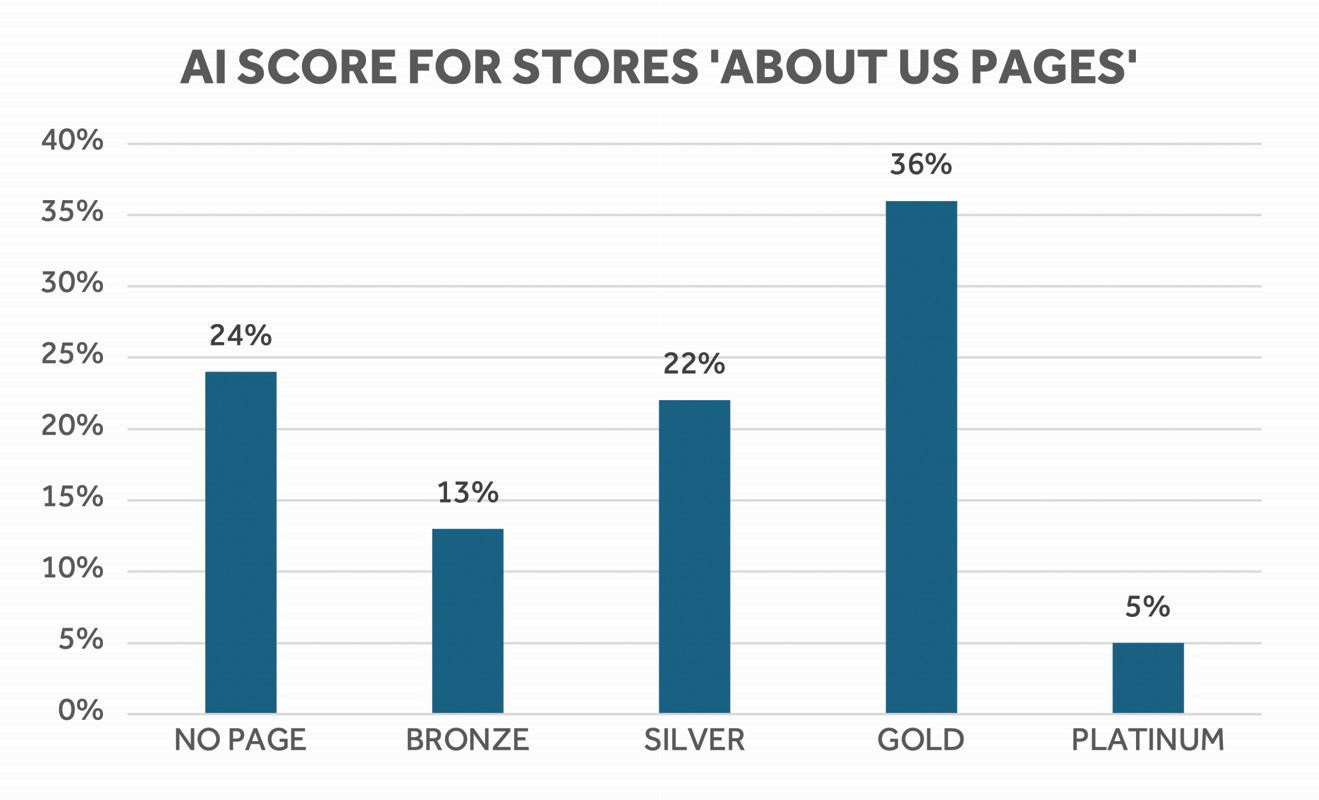

So, I ran an online tool to visit and ‘scrape’ the “About us” text from a sample of 100 UK bike stores. Then I used an AI workflow to qualitatively and quantitatively assess the content of those pages (which takes longer than you might think!). Here’s what we found. Firstly (quantitatively), what elements make a good “About us” page and how many stores include them?

ABOUT US PAGES – KEY ELEMENTS THAT MAKE A GOOD PAGE

The results surprised me, firstly that around ¼ of stores don’t have an

US PAGES > KEY ELEMENTS THAT MAKE A GOOD PAGE

1

Just having a page in your website called “About us” 2

3

4 HISTORY

5 SERVICES

6

7

8 WORD

Describes bike parking, public transport and car-parking options

When the store was founded, who by and why, and how it’s evolved to present day

Not just the workshop services, but bikefit, hire, bike doctor, pick up/drop-off etc

Mentions of ‘types of people’ and staff generally ‘what we are like’

Gives full names of founders and all staff – the real ‘who we are’

An average page is 210 words (some were very short or blank)

9 PICTURES 7% Does the page include staff pictures in-store or out and about on bikes?

(NB %s for elements 2-9 were calculated from the subset of stores who have and “About us” page)

“About us” page at all (that being said, many stores without a page included welcoming details on other pages, they were just scattered or not-so easy to find as a single “About us” page). Another surprise was that only around half included staff names and just 7% included pictures. Although stores are very consistent about mentioning location, services and the general ‘type’ of store/people they are, specifics (which can build trust/relationships) were lacking in many pages.

So, while some disingenuous sellers are overselling their backstory – to the extent of creating fake people – this data seems to suggest many very genuine stores who have real skills and experience are under-selling their story.

ABOUT US PAGES – HOW WELL DO UK BIKE STORES TELL THEIR STORY?

Secondly (qualitatively), I prompted the AI tool to look at how well each store told their story. For example, is the history vague or does it mention exactly where, when and who founded store including a date? Or, how well the store describes its specialism, such as bike-fitting.

Here the AI was assessing the quality of the narrative as well as the number of elements included in it – so it gave a combined overall score for each store. And the result? Only 5% of the stores included all the elements and told their story exceptionally well (Platinum). Over half of stores told their story quite well (Silver and Gold).

“SO, WHILE SOME DISINGENUOUS SELLERS ARE OVERSELLING THEIR BACKSTORY – TO THE EXTENT OF CREATING FAKE PEOPLE – THIS DATA SEEMS TO SUGGEST MANY VERY GENUINE STORES WHO HAVE REAL SKILLS AND EXPERIENCE ARE UNDER-SELLING THEIR STORY”

While approximately 1/3rd of stores didn’t have a page or had a very small amount of text which lacked many elements on their page.

WHY “ABOUT US” PAGES REALLY MATTER TO SHOPPERS

Now I guess it’s fairly obvious that having a good “About us” section may encourage more consumers to visit your store and set their expectations around your services. But there’s another subtle benefit which we can find in another of Paco Underhills books, this time “What Women Wantthe science of female shopping”. This is

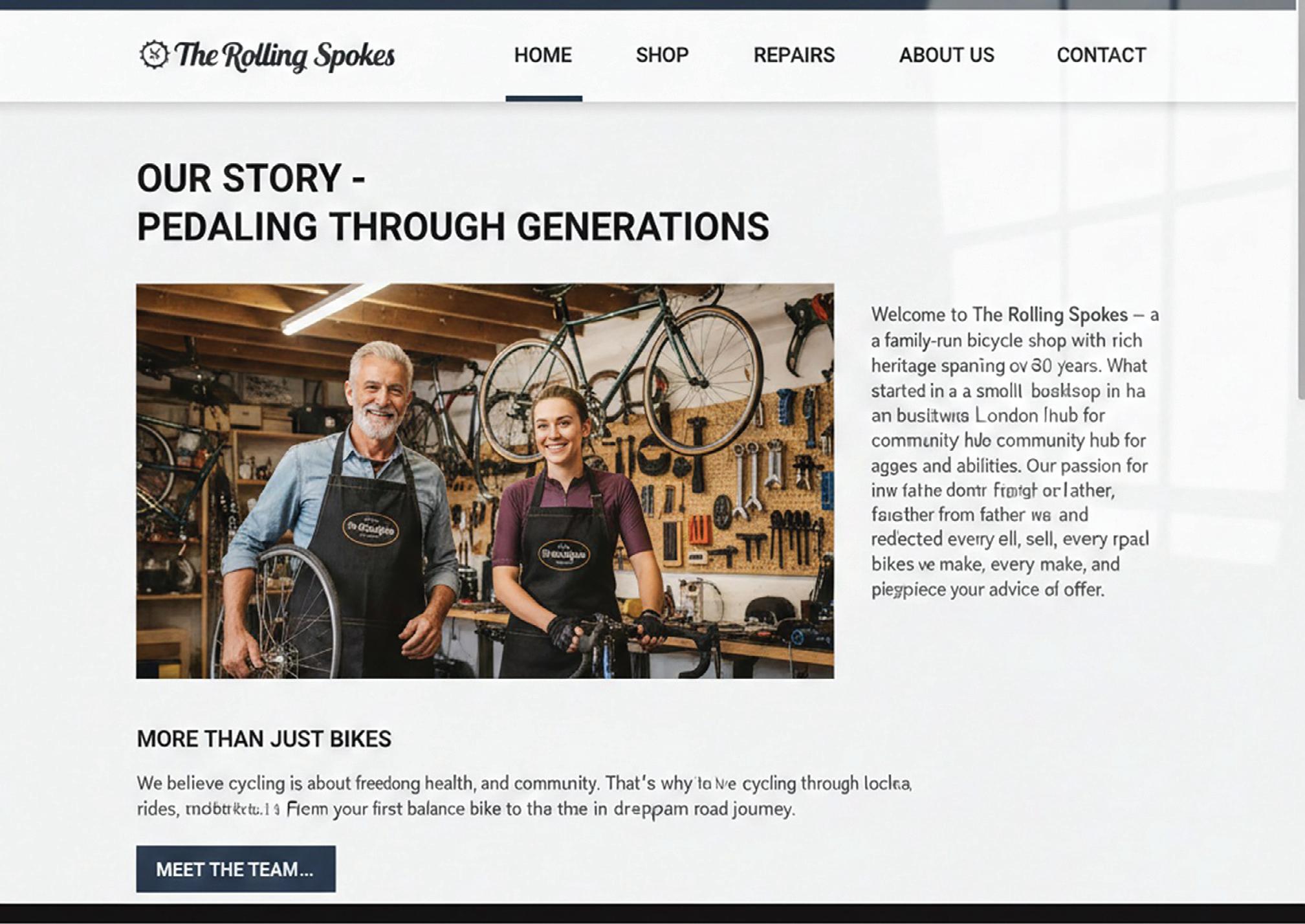

Below: A decent “About us” page can provide a very re-assuring backstory before someone even visits, and the data suggests plenty of shops can upgrade their efforts

another huge resource for improving your store and here I’ll just talk about one tiny section.

Paco boiled down the essence of a welcoming and ‘female focused’ shopping environment to four things:

1. Safe – an environment that is accessible, accountable, public, secure

2. Clean – a light, bright and open space

3. Control – clear navigation and routing so you can make your way without hesitation

4. Consideration – staff who are attentive, knowledgeable but not overwhelming

(And by the way, he also found male shoppers wanted these things too, they were just less vocal about needing them and more tolerant of shopping in environments without them).

So an “About us” page that talks about qualifications, experience and, most of all, lists staff names, cycling interests and skills, and ideally provides genuine photos, gives a very re-assuring backstory before someone even visits. If a consumer is reviewing two local stores, they might choose the one with the backstory over the one without it. Why? Because wearing your credentials on your sleeve provides trust through visibility and accountability.

UPDATING YOUR “ABOUT US” TEXT USING AN AI?

So, next time you’re updating your website, maybe take a look at your “About Uus” page and ask yourself does it accurately, fairly represent the people and the services that your store truly provides? And if you are under selling your services, maybe this needs an update. It wouldn’t take you long to write it, especially if you use the checklist above to create a prompt for an AI tool. Just be careful to use the ‘AIM’ framework and check it afterwards. Because, as we all know, as well as being a useful business tool, AI can also very quickly just make stuff up. And you wouldn’t want a fake back story that’s full of typos! (like this one above!)

John Styles is a veteran of the cycling industry, having worked with leading distributors and brands across the sector. With a well-rounded perspective on the opportunities and challenges facing the sector, backed by a Bachelors Degree in Economics, John Styles is an expert consultant for the bike trade. Get in contact via johnstyles2002@yahoo.co.uk

COUNTING THE COST

2026 seemed to have dawned with a new sense of optimism until trouble starting Brewing over the Atlantic. Mark Sutton looks at some onward trends we may wish to keep close tabs on in the months ahead…

Commodities prices

Catching sight of the silver price recently gave me reason to check in with some of the other commodities that are likely to be reactive to instability on the global stage. There’s good news and bad news for business, all subject to change, flip and reverse by the time you read this on account of the extreme volatility once again thrust upon us.

First of all, oil feels like an obvious place to begin, since a poorly disguised quest to secure it has dominated our headlines thus far. Analyst forecasts, in the face of ample supply, tend to put 2026’s average supply at around $50 to $56 a barrel, which will be an approximately 35 to 40% yearon-year drop. This, you’d think, should help a reduction in transport costs for goods. Volatility is probably to be expected, but for now oil is trading at a multi-year low.

As for metals and the key elements used for electric bike production, the picture for the year ahead looks no less muddy. Starting with aluminium, prices have started to head sharply north, in the past nine months gaining about 25% and at the time of writing the widely used metal is trading bang on the 2021 high. You’ll remember well the conditions in 2021, I’m sure.

On to the elements that feed our appetite for pedal-assisted riding and

the general trend is again up. By midJanuary the opening month’s volatility had seen a 66% increase in lithium prices, which outpaced even silver’s growth. Nickel added 30% in this time frame and cobalt nearly 7%. Steel was perhaps the only key element used within cycling that had a relatively calm start to the year rising in the low single digits.

Utilities

The price of electricity is a subject that causes plenty of contention in the UK at present as we continue to have some of the greatest electricity expenses in Europe, something which every business will be feeling. The wholesale price of our energy is set by the marginal cost of the most expensive energy used to meet demand, which in the UK is typically gas. This then determines the prices for all energy types under marginal cost pricing. This detail means that we have been particularly vulnerable to the ripple effects of cutting off Russian supplies and with that war still raging on, the UK Government is doing all it can to convince the public of the power of renewables. Here, there were some major announcements already in 2026, many of which were framed very poorly in the press at large, many ignoring the cost of building and bringing online the infrastructure needed to operate

different energy forms, infrastructure that it would seem is needed to meet rising demand.

Delivering a new record in 2025, at just shy of 43% of the UK’s energy supply was renewable energy, the largest portion of which was wind at 22.7%. Gas is still our largest energy source at 27.1% and coal no longer exists at 01.% of supply. Times are changing, but not without sustained attacks on clean energy.

All things considered, for the time being, electricity prices have still risen by about 15% since the beginning of 2025, though it is typical to see rises into winter and declines out of spring. Though any rise may not feel pleasant, price volatility here is at least declining little by little and, so long as the wind still blows, should continue to into the future.

Shipping prices

2026 has started reasonably calmly on the high seas, with shipping rates for a 40ft container sent from Asia to Europe not that far off the lows of 2023 when demand had slowed right down in the face of oversupply. Year-on-year, World Container Index prices have fallen from around $4,000 to just under $2,500 by mid-January this year. That said, back in October 2025, the price was as low as $1,600, so this is one cost for importers to keep tabs on, especial-

“INDEPENDENT RETAILERS ARE SUFFERING THE SAME PRESSURES AS PUBS – SIGNIFICANT INCREASES IN RATEABLE VALUES, LOW SALES DUE TO POOR CONSUMER CONFIDENCE, AND RISING LABOUR COSTS”

ly at a time when tensions in the South China Sea look to be elevated.

Business rates

Perhaps one of the sharpest pains for the bike shop network in the UK comes from business rates, an issue that the ACT’s parent, the British Independent Retail Association, is lobbying the Chancellor to get a handle on before the pain becomes too great to bear. Presently, BIRA is asking for equal treatment to a proposed watered-down set of business rates for pubs across the indie retail network. It forecasts an approximately 15% increase for many businesses and a

typical shop with a rateable value rising from £30,000 to around £39,000 will see a bill rise of around £1,347, from £8,982 to £10,329.

“Independent retailers are suffering the same pressures as pubs – significant increases in rateable values, low sales due to poor consumer confidence, and rising labour costs,” said BIRA CEO Andrew Goodacre. “Our business model is under real stress, and we also have to deal with online retail giants and low-value imports escaping duty.”

Though under pressure, as it stands, the November budget means that retail businesses are contending with

a scaled-back business rate discount, cut from 75% to 40% and then to zero discount at all by April.

Heading into the spring, this is the last thing many retailers will need to cap what has thus far been a very wet winter. If you’re not yet aware, ACT members can tap into a discounted service offered in partnership with Appeal Business Rates, which has a team of experts that can determine on your behalf if you are eligible for rate relief.

What costs are most concerning to your business heading into 2026? Let us know on our Facebook group, found at Cycling Industry Chat.

LIVE 202620-21SEPTEMBER2026

20-21 SEPTEMBER 2026

CYCLING INDUSTRY NEWS LIVE RUNS AT NAEC STONELEIGH, WARWICKSHIRE

Building on the opening edition, CIN Live 2026 is open to all the industry, combining education, training and new products with face-to-face time with the trade.

An extensive programme of talks and workshops runs alongside the traditional trade show element, with long-established UK and international cycle industry brands alongside new and upcoming names, all looking to engage with the trade.

Networking is another lynch-pin of the event, from good old fashioned bumping-into-that-personyou’ve-not-seen in ages in the show hall, to tailored events like the industry BBQ. Stay tuned to CIN Magazine and website for updates on the show.

THE THINKING BEHIND CIN LIVE 2026

Work is underway behind the scenes, lovingly preparing Cycling Industry News Live for its second year of industry networking this September, at NAEC Stoneleigh…

CIN Live is a little way away and, in the midst of the Q1 show season, it’s reasonable that shops won’t be thinking too hard about coming along just yet – there’s a lot to get through before booting up Google Maps and plotting your course to Stoneleigh Park. Consequently, we’re not going to go too heavy on what’s coming up in the 2026 show, and instead have some straightforward ‘take homes’ for you…

THUMBS UP ON THE TIMING

Having a cycling industry show in the latter half of the year, with the bulk of the summer selling season in the rearview mirror, proved a popular move. Plugging a years-old hole in the trade show calendar appears to have worked and that’s why CIN Live 2026 will be sticking close to the same timing for 2026. The show returns Sunday 20 September 2026 and closes on Monday 21 September 2026. So that’s slightly later, a move made following feedback and also to put a little extra distance

between the selling and race season. There’s also the whole ‘sticking to the same timing helps visitors remember it’ thinking behind the retained September dates too.

SEMINARS: MORE OF THE SAME

Seminars were at the core of CIN Live concept and our seminar programmers ended up booking a whopping nine and a half hours of talks, panels and seminars – a heady concentration of mechanic training, shop viewpoints, top down big boss keynotes, specialists in handling carbon components, sales techniques workshops and a lot, lot more.

We’re still very much working on the schedule for 2026, but suffice to say it will be more of the same. Simply put, the seminars are not seen as an ‘add on’ but a primary reason for hosting the show. Indeed we had a number of visitors make the trip firstly to listen to the expert speakers and glean insights.

LIVE 202620-21SEPTEMBER2026

The seminar programme is filling up – details will be shared soon – and interested parties are welcome to get in touch with jon@cyclingindustry.news to put their hat in the ring.

THE POWER OF FACE-TO-FACE & EXHIBITORS AHOY

Like TV and the radio, the internet didn’t quite kill exhibitions – not least because there’s nothing quite like getting face-toface with the rest of the trade. Those long-running and hugely successful shows like iceBike* and COREbike in Q1 have long leveraged this fact and CIN Live follows in their footsteps. From those bumping into moments in the hall, to speaking with suppliers, handling product, seeing peers and getting a gauge on the industry… there’s nothing quite like being in front of someone. And at CIN Live 2026 there will be a huge chunk of returning exhibitors signed up and new names booking their space at the show. There’ll be some purposefully designed networking opportunities too, building on those of last year.

live.cyclingindustry.news

FIND OUT MORE

Prospective exhibitors can register interest at Lloyd@cyclingindustry.news

Visitors should watch this space for when pre-reg opens later this year

WHAT EXHIBITORS SAID ABOUT CIN LIVE ‘25...

“For Bob Elliot & Co, it was our first exhibition for over seven years so we met it full of enthusiasm and excitement. For us, it felt matched by the dealers who attended and collectively there was an appreciation for a show at that time of year, with a traditional feel. With it being CIN’s first walk into producing a show – there was of course a lot of trepidation about how it would work and what sort of attendance could be expected. For us, we saw a lot of dealers, and a lot of good quality. For 2026 we will be back, bigger and better and on approach to the show we will have a much louder voice in inviting customers over to see us, based on a positive 2025 experience”

Paul Elliot, Bob Elliot

“It was a fantastic event for the industry as a whole. It was well set up and supported in a great location. CIN Live was a great opportunity to showcase our product range and meet the faces of the industry. It’s was also a fantastic platform for meeting current and prospective customers, connecting with fellow exhibitors, and discovering new opportunities. Looking forward to CIN Live 2026.”

Tiger Cycles

MAKING CYCLING MORE INCLUSIVE: HOW BRANDS AND RIDING GROUPS CAN IMPROVE DIVERSITY AND INCLUSION

Avoiding making assumptions is the golden rule when it comes to embracing diversity, explains Emma Karslake. Brands, shops and cycling groups can all play their part…

M“INCLUSIVITY IS ABOUT PROVIDING EQUAL ACCESS TO PEOPLE WHO ARE UNDER-REPRESENTED OR MARGINALISED, AND RECOGNISING THAT DIFFERENT GROUPS FACE DIFFERENT BARRIERS TO ENTRY”

ost UK group rides, sportive start pens and cycling clubhouses are still dominated by white men. While this is slowly changing, the Walking and Cycling Index showed that in the UK, twice as many men as women cycled at least once a week in 2023. Only 20% of British Cycling memberships are held by women.

Many barriers to commuting by bike are down to urban design, lack of infrastructure or socio-economic factors that businesses can’t singlehandedly tackle. However, cycling brands, shops and cycling groups can encourage diversity within their community. From an economic point of view, inclusivity represents untapped growth opportunities for cycling brands and retailers. Many organisations recognise this in principle, but acting on it isn’t always straightforward. Worse, some well-meaning attempts at inclusion end up being ineffective, or even counterproductive.

This article sets out a practical framework for improving inclusivity in cycling, targeting women in particular, for brands and riding groups wanting to grow participation and sales by making cycling more inclusive.

THE ISSUE OF INCLUSIVITY IN CYCLING Inclusivity is about providing equal access to people who are under-represented or marginalised, and recognising that different groups face different barriers to entry.

In UK cycling, those groups most often include women, people from ethnic

minority backgrounds, riders with lower disposable incomes, and riders who don’t fit the traditional ‘fast cyclist’ stereotype. To foster inclusivity, brands and riding groups have to first identify obstacles that prevent new riders from engaging, then work with them to broaden participation.

WHY IT MATTERS FOR RETAILERS

There is an ethical case for inclusivity, rooted in fairness and representation. But there is also a cold, commercial reality. Cycling participation in the UK has plateaued in many segments. Growth will not come from selling more bikes to the same demographic, but from expanding the market and gaining loyalty.

From a business perspective, more inclusive brands access larger customer bases. Inclusive shops benefit from stronger community loyalty. On the other hand, exclusive or intimidating messaging can shrink the market and convey a negative image to many prospective customers. Representation, i.e. seeing different sociodemographics in a brand or group, drives aspiration, which drives sales.

1. HOW BRANDS CAN IMPROVE INCLUSIVITY

INCLUSIVE

DESIGN

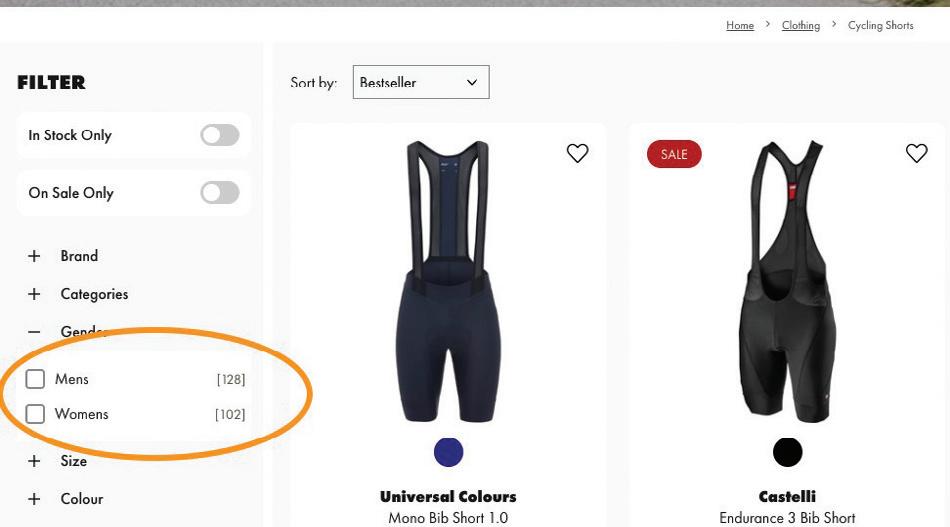

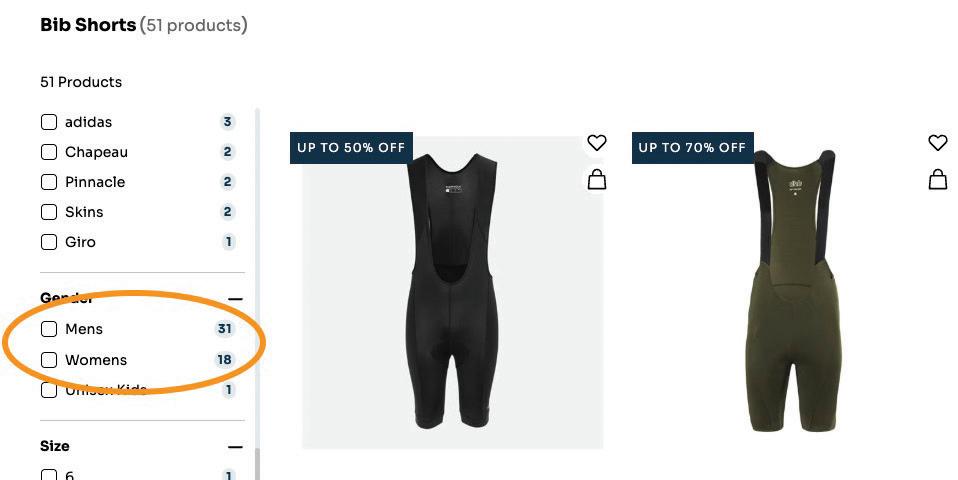

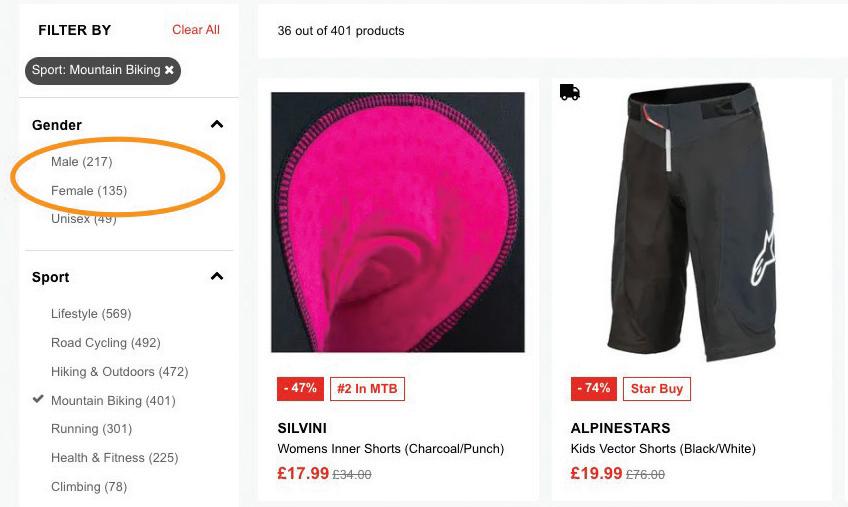

One of the clearest signals of inclusion –or lack of it – is product range and design. When women’s ranges are dramatically smaller than men’s, or treated as an afterthought, it signals that they are not the priority customer.

True inclusivity in design requires diverse design teams or, at the very least, meaningful testing by diverse riders. Selling winter bibs designed for endurance without a solution for easy nature breaks raises the question of whether the product has been tested by women in real winter riding conditions, having to strip down to their bra to go to the toilet.

While gendering products is sometimes necessary, it can be off-putting or narrow the market in other cases. We have already seen a move from calling saddles men’s or women’s to long-nosed or short-nosed; traditionally shaped women’s bikes with heavily sloping top-tubes are now more often referred to simply as step-through bikes. These changes make products less prescriptive and open up potential customers to a wider offer.

Finally, it is important to market products as unisex only if they truly are a good fit for everyone: many women report that unisex jerseys rarely suit them. Unisex products typically have a straight cut that will fit fewer women than men. Chamois creams often specify that the product should not come into contact with any mucous membrane, which in practice, makes them unsuitable for women. Some products are best gendered, and it is as important to recognise this as to avoid needlessly gendering other products.

MARKETING AND REPRESENTATION

Advertising that consistently shows one type of rider comes across as communicating who belongs and who does not. Representation matters not only in marketing imagery, but across staff,

ambassadors and leadership. Seeing their own demographic represented in a brand helps people identify with it.

The range of a brand’s offer can also serve as a signal of inclusivity or overrepresent a gender. Filtering major cycling retail websites by gender shows the large gap between the number of specialist cycling kit on offer for men and women. As a brand, offering significantly more choice to men than to women sends the message that the latter group matters less.

The more extreme version of choice inequality, offering a male line with no female counterpart, can send a negative message to female customers. Oakley illustrates how legacy brands can lag behind market reality. While the company sells eyewear to men and women, and offers women’s clothing in other sports, its cycling apparel range caters only to men. I invited Oakley’s PR team to comment, but after an initial contact, I did not receive a response.

2. How group rides can improve inclusivity

GOING BEYOND CLAIMING TO BE INCLUSIVE

Many organisations describe themselves as inclusive, but fewer deliver an experience that consistently feels welcoming to under-represented riders. Claiming to be inclusive may attract a broader audience initially, but if newcomers do not feel like they belong, the result is disappointment and disengagement. At best, this is ineffective. At worst, it damages trust.

For a cycling group to be inclusive, it needs to encourage an open-minded

culture and one of feedback between its members. For example, the average price of bikes used on club rides in London is what many people would consider very high. Casually referring to a multi-thousand pound bike as ‘an old winter bike’ in front of members with more modest means can feel as alienating as a mean-spirited comment.

REPRESENTATION

DRIVES PARTICIPATION

A strong driver of inclusion is visibility. When people see others like themselves participating – whether in marketing, on rides, or behind the counter – it signals safety and belonging.

Communities need visible role models within clubs and ride groups. As communities become more diverse, word of mouth amplifies that effect and newcomers arrive, improving both representation and inclusion.

Creating women-only rides or partnering with existing groups dedicated to diversity in cycling, such as the Black Cyclists Network, will broaden the reach of organised rides.

SAFE

SPACES AND ENTRY POINTS

In cycling, safe spaces such as womenonly groups can help riders to participate without fear of judgement or exclusion. In many clubs, women-only rides act as confidence-building gateways, reduce intimidation for newcomers, encourage progression into mixed rides, and strengthen overall participation. Crucially, riders should be encouraged to move fluidly between women-only and mixed environments if

“The

industry does not lack goodwill and inclusivity is not about being perfect. It’s about listening, adapting and recognising that growth depends on welcoming riders who do not already feel at home in cycling culture”

they wish to. Inclusivity is not about confinement; it is about choice.

EDUCATING EVERYONE

Inclusivity requires cultural awareness across the entire community. Cycling has deeply ingrained performance hierarchies, where speed is often equated with value. Even in well-intentioned groups, subtle pressures can undermine inclusion.

While encouraging everyone to participate and improve is a positive, how this is done is crucial, as badly formulated good intentions can be counterproductive.

A good rule of thumb is to address everyone in the same way and ask ‘Would I say this to a middle-aged man?’. For example, ‘You’re strong!’ is a comment I have heard many times from a male to a female rider singled out in a male-dominated group. If a woman shows up to a group ride that advertised a certain expected speed, she likely already knows she can maintain that speed. Expressing surprise or encouragement in this situation can feel patronising, even when well-intentioned.

INTENT VERSUS IMPACT IN GROUP INTERACTIONS

Compliments do not need to be banned, but they do have to be targeted and thoughtful, not simply based on assumptions around appearance or gender. ‘You’re fast!’ is a suitable compliment for someone who has done well in a race, or who you have seen improve over the last year, not for a female rider you have just met and who did no more than ride in a group, with plenty of other people who could also keep up.

THE GOLDEN RULE: AVOID MAKING ASSUMPTIONS

Staff should avoid assuming that a customer on an older commuter bike lacks technical knowledge, just as ride leaders should avoid assuming that a female newcomer will be the slowest of the group.

I once mustered the courage to join a faster group than usual within my cycling club. I turned up at the meeting point and, before we had even set off, a man announced he would drop back and ride with me instead of the fast group because he felt sluggish that morning. Nothing had been said about my ability, but the assumption was clear.

“STAFF SHOULD AVOID ASSUMING THAT A CUSTOMER ON AN OLDER COMMUTER BIKE LACKS TECHNICAL KNOWLEDGE, JUST AS RIDE LEADERS SHOULD AVOID ASSUMING THAT A FEMALE NEWCOMER WILL BE THE SLOWEST OF THE GROUP”

Experiences like this matter. For riders who are already under-represented, one moment of being singled out or underestimated can be enough to discourage them from returning. That is how clubs lose capable members, how progression pathways narrow, and how reputations

form. If joining a ride requires a mental pep talk before leaving the house, many riders will simply not return.

CLEAR RIDE DESCRIPTIONS AND DIVERSE PARTICIPATION

The way rides are described frames the type of participants they attract. Cycling language can be exclusionary without intending to be. Describing a club or shop as simply ‘fast’ sends a strong signal, often discouraging riders who might otherwise be capable but lack confidence.

For cycling clubs and ride leaders, identify where diversity drops off, particularly in faster or more advanced groups. Offer clearly described rides with transparent pacing rather than vague labels. Create women-only or beginner-friendly entry points and actively encourage progression into mixed rides. Most importantly, ask under-represented riders what attracted them to the group and what would make the experience better.

THE PATH FORWARD

The cycling industry does not lack goodwill. It often lacks tools, awareness and honest feedback. Inclusivity is not about being perfect. It is about listening, adapting and recognising that growth depends on welcoming riders who do not already feel at home in cycling culture.

For brands, bike shops and riding groups, the opportunity is clear. Those who build genuinely inclusive environments will not only do the right thing, they will build stronger, more resilient businesses and communities. In a mature market, inclusion is not optional. It is the future of growth.

A DECADE OF

10 years since it launched, we take a look back at what was going on when CIN first started out…

significantly, the year saw the launch of Cycling Industry News.

The big trade stories

While Chris Froome was winning Le Tour with Team Sky, Eurobike was still in Friedrichshafen and Interbike ran in Las Vegas... and there were a number of big trade news stories grabbing the headlines:

Fisher Outdoor acquired by Zyro: The years may have dulled the impact of this acquisition, but it was a seismic change for the UK trade. April saw the then St Albans distributor of 82 years bought by relative whipper snapper Zyro of Darlington to form Zyro-Fisher, with a combined might of £70 millionplus in sales.

Another UK trade story with global impact was the merger of CRC and Wiggle. In hindsight, the timing of this deal was to prove absolutely key to its glum future of sliding into administration (in 2023). That factor was Brexit. The merger was announced in Febru-