WITH the bulk of 2025’s selling season behind us, with the honourable exception of Christmas, probably quite a lot of us now have a view on how successful the year has been for the bike trade.

We can pull together a few decent data points that are publicly available to help us in our assessment, not least those from the Bicycle Association’s Data service. Those subscribed will have more detail, but even the overview published on LinkedIn sounds promising: Seven consecutive months of growth for the UK cycle market, so 2025 is set to deliver the first full-year growth in four years.

If that doesn’t sway you, let’s look at Halfords, a retailer that has in the past claimed to own a third of the UK’s cycle market (and is a contributor to the BA stats). It recently previewed its interim results, covering April-September, which saw group sales growth of +4.1%, which it seems reasonable to assume cycle sales have contributed to. Elsewhere, the not inconsiderable Tandem Group noted its H1 2025 profits and revenue were up, with group revenue rising 14.3%.

It’s logical to assume the warm, dry weather has helped buoy sales and we can only speculate how those numbers would have been different had the weather been less clement. While there are still internal issues to get through and the overstocks situation is certainly still a significant factor (though less so than it was), it’s likely that economic conditions outside the cycling industry are probably now seen as more important to the short-term future of the market.

The UK’s economy is one of many hardly setting the world alight, with a lot of businesses nervously eying the November Budget and what it will bring. Internationally, there is uncertainty with the ongoing war on the Eastern fringes of Europe and a blinkand-you’ll-miss-the-latest volatile tariff war that looks to be unsettling not unimportant things like container prices.

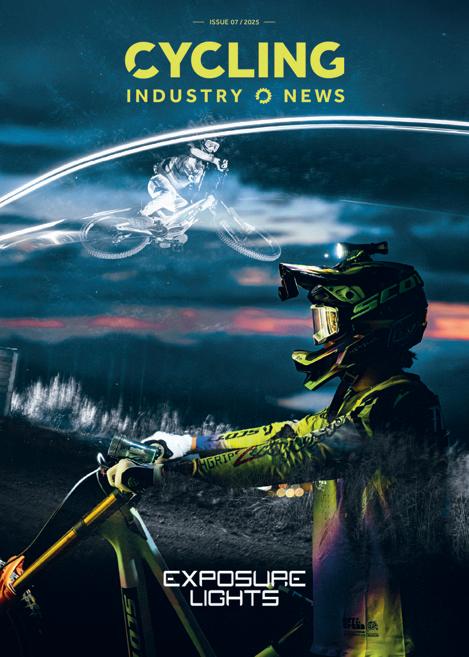

For now, we head into lights season grateful for the good weather we’ve had and hopeful of some forthcoming good news on the broader economic horizon.

Jonathon Harker

jon@cyclingindustr

Publisher Jerr y Ramsdale jerr y@cyclingindustr y.news

Editor Jonathon Harker jon@cyclingindustr y.news Sales Manager Lloyd Ramsdale Lloyd@cyclingindustr y.news Reporter Simon Yuen Simon@cyclingindustry.news Head of Produc tion

“THE

Jonas Nilsson has been with Accell for two and a half years and Chief Executive Officer since 2025 and has been in the thick of the cycling market’s disruption, as well as the transformation of the cycle (and P&A) brand powerhouse. Now, the group has reconfigured, reorganised and is clearly gearing up for the future. September’s CIN Live saw Accell UK & Ireland exhibit (following its debut at COREbike) as well as a keynote speech from Nilsson alongside Chief Commercial Officer, Gennady Jilinski. Following the speech, CIN grabbed some time with the Accell boss for his views on the past, present and future of the market…

Obviously the market’s going through a hugely disrupted half decade. What’s your view generally on the industry, on the overstock situation and the normalisation of the cycling industry… are we at that point yet, or is there still some way to go? First and foremost, we have to really anchor on the fundamentals and the mega trends. The medium and longerterm outlook is super strong for the cycling industry. ESG, electrification, urbanisation, the health dimensions, infrastructure investments… it’s all there. So, there’s no doubt at all that the longer term is strong.

There was a nice growth curve and everything was completely over amplified with two or three years of accelerated sales, right through Covid. In many minds, this was the new normal.

We now see many more data points: P&A has been growing as people are keeping their bikes for longer, bikes are getting a bit more complicated technically which is driving a new growth in service. Also, more people are using bikes, which is a very strong fundamental. Usage is growing.

And then we see some data points from ourselves that certain regions are strong like Western Europe, where we see growth in the 15-25% year-on-year range. Then you have other regions where it isn’t so positive. Germany is still quite muted and everybody’s playing there as it is the biggest market.

I believe some dealers and some OEMs still have too much stock, which you see in the discounting that is still ongoing, while Accell has done a good job and old inventories are more or less gone. Then we have other segments or categories, like road and gravel, which

“P&A HAS BEEN GROWING AS PEOPLE ARE KEEPING THEIR BIKES FOR LONGER, BIKES ARE GETTING A BIT MORE COMPLICATED TECHNICALLY WHICH IS DRIVING A NEW GROWTH IN SERVICE. ALSO, MORE PEOPLE ARE USING BIKES, WHICH IS A VERY STRONG FUNDAMENTAL”

are going very well in most regions, (but not everywhere).

There’s another dimension, by the way, D2C was a big grower but is not anymore, so there’s another shift.

The million-dollar question would be, is this the end of it? And I think that we’re seeing more signs that clearly indicate we’re coming to the end of the disruption. But it will be step-bystep, with geographical variations... you’re going to get some categories, channels and geographies that recover faster, because there are many underlying dimensions. But you’ve got a lot of indicators coming together that show we’re coming close to it.

I think 2025 is a year of transition, and it will be partly through 2026 as well. But again, pockets of the market are going to be faster, and some slower.

My key point is that there’s not going to be a month when you clearly see a transformation in the market. But clearly we’re getting much closer to it and there are more signs of it now that there have been in the last two and a half years.

Moving on specifically to Accell: A lot of companies have been hit by tough times and Accell has been through quite a disruptive period. You touched on this in your keynote, but is the dust settling on the changes? You have talked quite a lot about transformation and now looking towards the future…? Yes, we definitely accelerated Accell’s transformation, partly because we can, and partly because we had to.

We’re fairly unique and have built the business partly through acquiring brands. These were never properly integrated, and that’s precisely what we are now doing. So, we have moved from a brand-focused organisation to become more consolidated. Support functions were also more geographical and we are now bringing that into One Accell so we are more efficient, not spread out in too many locations, we have coherent procedures and processes across the company. And that’s a unique upside. I think not many of our competitors have that. This transformation into One Accell focused on integration, simplification

and streamlining we call “Fit to Ride” and we are nearing completion of these actions and initiatives.

The Fit to Ride phase has been mainly internally focused, as we are now nearing finalisation, we are ramping up for next phase that we call ‘Ride to win’. This phase is solely focused on our Brands, Bikes, Parts and Accessories. Before we had a very localised view on the brand positioning and the category, and now have a holistic view. So instead of being a house of brands, we now have a complementary brand portfolio where they are completely complementing each other, so that we can cover all the categories with strong brands, including P&A, becoming a unique one stop shop for the dealers.

I guess when you’ve taken on or acquired brands over the years, it doesn’t necessarily get all looked at in terms of ‘the big picture’… It was an extremely local view, and there was not a pressing need to change and consolidate because the industry

was doing quite well. Now, of course, we see the other side with new leadership. And, of course, the industry has forced us to look at it slightly differently.

Talking more specifically about the UK, Accell has been through a very transitional period there as well. It changed name this year and that followed the shift away from P&A in 2023, a new HQ and a new warehousing strategy... So it’s the same question, really: Is there a line in the sand, the dust is settling and it’s now about looking forward to the future?

Exactly. All those changes are completely in line with our One Accell strategy. It’s no longer a local brand. We are Accell. We have a whole portfolio of different brands and categories, covering every category with strong brands. So, the UK fits into that. We see UK as a core key market, now and into the future. There is a relatively low level of commuting on bikes, it’s at a sub-European level, so we see a tremendous opportunity. We have Lapierre and Haibike covering the sports market, but we want to develop in the mobility market in the UK, where we now have our newly launched Raleigh ONE.

UK cycling has been slower to develop in terms of the urban and transport side…

Yes and we are super proud to have such an iconic brand as our urban offer. In the UK and across Europe we think that Raleigh’s brand equity is fantastic. And we see strong potential on UK growth and in urban growth.

Let’s touch on eBikes. It feels like it’s an interesting period – there’s more competition in eBike motors, then in Germany eBikes sales have overtaken non-eBike sales and the leasing market is really growing. The UK is obviously lagging behind Europe a bit… But generally speaking are we seeing the eBike market beginning to mature?

The clear data point is that the UK is behind when it comes to eBike penetration, there’s infrastructure and then there is the misconception that eBikes are only for the older generations… When you try an eBike, as I did myself for the first time when I started with Accell two and a half years ago you understand it’s a fantastic product, it’s absolutely stunning. Once people try

“You can’t have Raleigh trying to play every category”: Accell’s revised holistic approach to its sizeable brand portfolio is seeing a more focused approach for the likes of Raleigh, Lapierre, Haibike and the rest

it, and then understand the commuting dimension of it, or the leisure side and how the level of freedom increases... It’s just a matter of time and we will continue to push it.

Recently we’ve seen the UK diverge slightly from Europe on eBikes – we relaxed anti-dumping on non-folding eBikes from China, for example. Do you see the markets as splitting on eBikes and going along different paths? No, but it’s interesting point. The dialogue in Europe is a bit different. The UK needs to catch up, but in Europe there is another very important dialogue, and that is “what is an eBike?” This is very important. There are faster eBikes, people are having accidents and we need to preserve the definition of an eBike, which is limited in speed, limited in power, so we can keep the freedom of no helmets, no registration or driver’s licence. That is super important for the industry. So, that’s more the dialogue in Europe, but in the UK it is more about catching up to the user experience.

I don’t want to dwell too much on disruption, but obviously we’re halfway through a massive, tumultuous decade for the industry, and indeed, pretty much every industry. Do you think there have been lasting changes? Like local sourcing was such a big topic for a while, after long-winded supply chains helped cause over stocks?

The supply chain exposure is being

corrected step by step. Look at any industry, no one wants an exposed supply chain. That is def initely one of the lessons learned. I think the other point is the poor forecasting ability this industry has. So, if you think about those two in combination…

I’ve been in the automotive industry and I’ve been in the construction industry. I think automotive is really at the forefront. There are institutions helping assess the market and look at the mega trends. Then in construction you can see how much activity there is every quarter, every month…

This industry is lacking institutional support to predict the future, but also basic market share and general trends. When you make predictions and outlooks on a six, nine or twelve months with an exposed supply chain, the time to correct is extremely long. This is really an industry issue that is a key focus point for the industry, and is now being addressed with support of central organisations like CIE/Conebi.

As we’re in 2025, and there’s another half of the decade to go, what are your thoughts about the next five years, generally in the industry?

I remain extremely positive over the longer term. Infrastructure is getting better. In my presentation, I talked about the growth areas: Eastern Europe, UK, Southern Europe… I feel very strongly that the long-term perspective is very positive. We just need to get out

of the overstock situation, which we are doing step by step. Different product sectors are recovering at different rates, but it’s normalising for sure.

Also in your presentation, you mentioned about Accell as a one-stopshop when working with dealers. You said you would ‘lift up’ how you’re going to work with shops too. Is that something that is underway?

This is something we are rolling out. So, in the ride to win phase, the first anchor point is that we are very clear what each of our brand stands for. Accell has a unique and complementary portfolio across brands and across categories, with P&A as well. That’s the first basic block. And then within the rollout there’s commercial excellence; trade terms, definitions, training… it’s a range of commercial support that we’re going to give the dealers so we can execute the one stop shop concept.

It’s interesting having the brands you’ve got now focusing in on one segment of the market, it seems to make a lot more sense. Having all those legacy brands some consolidation was probably always going to happen at some point, but obviously it’s a painful time for it to happen. It probably should have happened. You can’t have Raleigh trying to play every category. You need to do thing holistically. In the longer term, I want to have a house of global brands that can play their role everywhere. So, the offer is not different for Raleigh in the UK versus Germany, or even outside Europe. It’s more transparent and the offer and proposition is the same for every market we play in.

Have you got a message for dealers?

We are committed for the long term. We are really unique in the fact that we have a house of brands that are complementary. And we are the only big player that also has P&A so we can really play all dimensions of the offer. The transformation internally is now more or less done, and we are now going to 100% focus then on the ‘ride to win’, which is really the proposition around the brands, around categories. So, the 2026 line-up is only the beginning. Stay tuned, stay with us and buy bikes!

www.accell-group.com

Now more than a quarter century old, the Cycle to Work scheme still accounts for one in four cycle and e-bike sales made in the UK. Cycling Industry News looks into the detail of a recent economic analysis and asks what’s next for the at times controversial sales tool…

HMRC has its eyes peeled for opportunities, inefficiencies and savings. Pressure on the Treasury’s budgets has never been so great and so ahead of a delayed Autumn budget, one wonders whether the oft-criticised Cycle to Work scheme could be on the Government’s mind. Sure, we know that for every £1 spent cycling multiplies the return, but a saving is a saving.

With alerts set on TheyWorkForYou and with an ear to the ground on All Party Parliamentary discussion, it seems as though the Cycle to Work scheme’s pros and cons have come under more scrutiny recently than at almost any time in the past decade. That’s not to say that we know of any imminent action, but for the first time in a long time, chatter is evident.

Published in April came an ‘Economic analysis of the bicycle market’s implications for the scheme’s success’. That catchily named paper sought to understand the worth of the scheme to the treasury, the positive externalities of the bikes and eBikes that it puts to market, and how that affects the economy. Of course, the scheme’s much-discussed flaws are not without careful scrutiny too.

Depending on where you are in the value chain, those flaws could be anything from not being able to access the scheme because you are paid only the minimum wage, or, as I expect is more relevant to readers here, your first

thought might be how much value the scheme has afforded to the bike retailer’s margins on associated sales. Whatever your position, you probably have some thoughts on how the scheme might improve in the future. Perhaps you’re even of the opinion that we need something totally different, be that a subsidy or to look toward the continent at successes made in leasing, for example.

Before we open the floor, a little from the paper presented to HMRC this spring with five inferred policy recommendations:

Promote competition by enhancing retail access

To allow or encourage multiple scheme providers or open access to a wider range of retailers to avoid localised monopolies.

Aid employers with comparative transparency

The provision of tools or guidance to help employers evaluate scheme providers on value, pricing and product range, not just administrative convenience or NICs savings. This way greater transparency and value is passed on to the employees.

Ensure price pass-through

There is a suggestion that providers have benefited from being able to control the pricing, which has put off price-sensitive customers. Therefore, the paper calls for

the implementation of safeguards or greater oversight to discourage providers or retailers from raising prices to capture tax relief benefits intended for employees.

Mandate broader product offerings

Require scheme providers to include a wider array of bikes and accessories, especially models that are affordable to new or lower-income cyclists, to reduce the distortion of choice.

Target potential new cyclists

Because there is evidence that the scheme isn’t hitting a majority of new cyclists, there should be adjustments to the scheme’s promotion and design to reach those who previously didn’t cycle, addressing non-price barriers like safety and distance in tandem with the scheme’s financial incentives. It has been found that six in 10 buyers already had access to a bike and many were higher-rate taxpayers.

What do the scheme providers think?

Discussion in the public domain has tended to focus on the availability of the scheme to those who currently cannot access it, namely the unemployed and low-paid who arguably most need it, plus the retired and selfemployed, both of whom could certainly benefit for differing reasons.

Joining some dots, the Chancellor could view the big picture of positive externalities around cycling – be that improved public health, reduced congestion, cleaner air, improved road safety, less sick days for employees –and conclude that betting big on the cycle to work scheme and expanding it

drastically is only likely to pay the public purse regular dividends. Active travel policy is apparently a hot potato with the voter-base, though (actually, studies show that’s vastly exaggerated), so let’s call that optimism for now.

So, addressing the chatter head-on, what do the scheme providers make of the 26th anniversary noise around the future of the scheme?

Joanna Flint at the Green Commute Initiative, a not-for-profit social enterprise version of the scheme’s facilitation network, told us that: “Never has one size fitted all, and therefore we believe it’s possible for different schemes to run in parallel to address different demographic groups. It’s perfectly possible for the C2W scheme to co-exist alongside schemes for those not in PAYE employment. (For example, the state benefit system has many different strands to address different groups of society.)”

That could be a quick and simple fix that would give an immediate shot in the arm both to the legislation, but also to the demand from could-be cyclists previously locked out. Combined, the volume of those unable to access the scheme outweighs those that can, so the sales uplift could enter the millions of units and at a steeper rate than when the scheme launched 26 years ago; after all, nowadays there is no spend ceiling limit and how vouchers are redeemed and with whom has unprecedented flexibility.

Many providers now even enable Cycle to Work scheme savings to be deployed against bike share use and bike subscriptions too, which was

never part of the original mechanism.

The Green Commute Initiatives’ Founder, Rob Howes, was in fact one of the original architects of the legislation, so unsurprisingly, it has played a key role in the scheme’s evolution to date.

Joanna says: “GCI pioneered and developed the plus £1,000 model to enable eBikes to be bought through the scheme and thus we have always seen a significant percentage of eBike orders. The proportion of eBikes has increased in recent years, but it remains fairly balanced against non-eBike models.”

The key for the retailer is what slice of the pie remains for the independent bike dealer in volume and margin terms. The Green Commute Initiative claims to have as low a commission rate as is available at 5%, capped at £300 for larger transactions. These numbers have been more broadly acceptable to retailers of late, but of course, in recent years, brand-direct sales have eaten at the volume of sales available to stores, in particular where direct-to-consumer labels with generally more competitive price points have been concerned. This evolution of the scheme has gone broadly unchallenged simply because consumers have come to expect it.

Joanna says of the natural expansion of the scheme online: “This reflects consumer buying behaviours and it’s only right that the scheme has evolved to include these; however, caution must be used to ensure the customer is not compromised by product or experience. Although the scheme may have originally centred on independent retailers, this itself was not the purpose of the scheme.”

Compromising experiences have

become another concern of late in relation to market-direct eBikes that may not conform to local laws. For providers like the Green Commute Initiative, this requires constant policing, because some outlets have played loose with advice to the consumer about what is road legal and available to buy on the various schemes. This is just another example of a scheme that has not necessarily kept up with the pace of change and is due for its next evolution to tighten up and refine the legal text.

For Cycle Solution’s Founder Steve Edgell, who is also Chair of the Cycle to Work Alliance, there is already clarity on this issue. He says: “Providers must ensure that only road legal equipment is available with limits on non-EAPCs, eBikes that do not meet the UK legislation and e-scooters.”

Modern challenges aside, few can argue that an estimated 280,000 sales per year through the scheme at current sales rates is to be sniffed at; it is more than just a fraction of the total market and often responsible for the higher value sales. An estimated £72 million in economic benefit comes attached over and above the retail sales, so estimates the HMRC paper. Separately, Steve says that as of the close of 2024, Cycle Solutions saw 22% of all vouchers put through his business being aligned to pedal-assisted sales, a portion that has been steadily increasing over time. The voucher scheme is selling eBikes where, it’s fair to say, access may otherwise have been lessened on account of the above-average ticket prices. In a down economy, it’s moving sticky units and new bikes alike, which is generally much preferred to no stock turn at all. To be precise, over 500,000 new customers have gone through the Cycle to Work Alliance’s five Cycle to Work scheme facilitators in the past three years (40% of which you have to assume are brand new bike owners).

Where we can be sure of new cyclists emerging is bike share, more so since the return of tube strikes in the capital, which from one week to the next prompted an over 50% hiring spike in the first two weeks of September. Whether or not these go on to be bicycle or eBike buying customers is a subject for another day, but what is for certain is that newer cycle to work scheme operators like Dash Rides are tapping into the movement.

With its Dash Flex product, Dash Founder David Watkins told us that customers can flexibly flip flop between bike sharing providers depending on the availability of the location they are in, all the while benefiting from cycle to work savings on the per-minute rates charged.

“With Dash Flex you can ride a Forest eBike in morning and then flip to a Lime bundle for the rest of week,” he explains of a system that could well be the cheapest way to access an eBike, not to mention that this will appeal to Londoners both on account of the lowered theft risk and the lack of requirement to find storage for a bike in London accommodation where floor space is notoriously shrinking fast.

David is a believer that share schemes are the introduction and do not replace sales later, and he would know, since Dash also handles bike sales and subscriptions on its Cycle to Work product.

He concludes: “From our experience so far, I see it as a sliding funnel. Bike sharing can be the introduction for

Over 500,000 new customers have gone through the Cycle to Work Alliance’s five C2W scheme facilitators in the past three years

many people, while subscriptions offer up further flexibility for those who need it. Going into purchasing, we would tend to see a more traditional cyclist at that stage, someone who has put in some mileage and knows by then how they’ll use the bike, or eBike and where they’ll lock it, so they’re also now looking to factor in the accessories needed to make the experience more complete. That can be done on the same voucher, of course. I have seen some of these buying journeys already, but it’s still early days looking at this data. Anecdotally, it does feel like that happens and, of course, many will continue to use share alongside their own bike too, all while banking the benefits of the cycle to work scheme.”

How would you like to see the Cycle to Work scheme evolve? As ever, you can let us know on the dedicated Cycling Industry News Facebook Group, found by searching Cycling Industry Chat. This group now hosts over 3,300 trade members, all of whom are free to ask questions and pitch their own ideas.

ProGuard Bolt On V2 COMPATIBLE WITH ROCKSHOX, FOX, OHLINS, EXT AND MORE

Adapters available separately for all major fork brands

Three sizes - Mini | Standard | Max Protection

Improved bottom out clearance

Increased fork seal protection

Available to order at www.extrauk.co.uk or speak to your Area Sales Manager for details on becoming a stockist. Exclusively distributed in

and Ireland by

ABUS had a significant shake up of its approach to the UK in early ’24. Has that change paid off? CIN hits the road for Portishead to speak with Simon Ford, Sales and Marketing Director, ABUS UK Mobile Security…

ABUS has long been a fixture in the UK cycling market, operating in partnership with some highly respected distributors. But a transformational change 20 months ago saw the German security and safety brand undergo an ambitious UK restructure that saw it vastly increase the size of its sales team and invest heavily in infrastructure in stocks and facilities. A year a half on, that decision appears to have paid off, with record-breaking results and a more responsive, agile model.

As you’ll no doubt know, ABUS switched away from a single distributor model – it’s traditional UK approach for well over a decade. Simon Ford, Sales and Marketing Director of ABUS UK Mobile Security, tells us: “At the moment, it’s growing unbelievably, July saw record invoices and order volumes. And then this was bettered in August and then September. September 2025 sales were the largest in ABUS UK’s history.

“It wasn’t about swapping a like-for-like distributor with another, but a complete rethink about how we engage with the market.”

Since February 2024, ABUS has been working with two distributors – Upgrade Bikes and Bob Elliot – and, crucially, took the decision to ramp up its own UK operation, including its own sales team and the setting up of its own UK warehouse in Portishead. While the global stock hub remains in nearby Germany – described as a “honeypot of stock” – the UK operation itself has significant levels of product, freshly installed flow racking and subsequently fast turnaround times. “Distributors have to choose what they are going to stock and fit into their warehouse,” Simon explains. “The beauty of this arrangement is that I order every week from Germany, from which we can access millions of helmets and locks, delivered into the UK inside 2 weeks. The Distributors and ABUS UK have similar access so availability and short lead times from European stock is a major win for all.”

Not only that, but the UK facility also has a new workshop for pinning locks and key cutting being developed, further enhancing service capabilities.

“ABUS proved it was willing to invest in the UK and that investment pays back,” he adds.

Feet on the ground & shop-in-shop

“IT WASN’T ABOUT SWAPPING A LIKE-FOR-LIKE DISTRIBUTOR WITH ANOTHER, BUT A COMPLETE RETHINK ABOUT HOW WE ENGAGE WITH THE MARKET”

Central to ABUS’ UK transformation has been its investment in shop relationships, via boots on the ground. Two key hires –Craig Denning, and David Wilkinson have been on the road since Feb ’24 selling product and supporting dealers. They spend time in stores, helping with merchandising, point-of-sale materials and staff training. Their presence ensures that ABUS products are not only stocked but understood and promoted effectively. A third hire is currently underway, with a new position being added to better support customers in London and the Home Counties.

Simon explains: “It’s a numbers game, the more people you have makes a difference. From ABUS’ point of view, we get three times the number of conversations –we have our sales team, plus those of our two distributors.”

Face-to-face interactions, plus the chance to give dealers touchy feely time with new product is crucial, says the brand: “You can’t just do it on an email or a Teams call. You need to touch and feel the product, then you can follow up digitally.”

More people and ABUS’ own sales team has also increased the speed ABUS can react to customer feedback. Distributor info has long been fed back into ABUS, but through ABUS’ own sales team that feedback loop is now faster and means the firm can be more reactive, faster.

The investment in people is paying off. ABUS has placed five extra staff on the team through the changes since early 2024, with now almost 30 people in sales, logistics support, marketing and customer service.

Almost from its beginning, ABUS was fast to realise the value of the export market –one of its first products, the Iron Rock padlock, was developed for overseas in a time when this was not the done thing (1924, fact fans). Times have changed, but ABUS in the 21st Century is equally keen to lean into its international presence, with execs from different territories regularly meeting to compare notes and approaches to the market. Occasionally, it has illustrated the UK’s differences, not least in terms of ABUS’ shop-in-shop concept. Shop-in-shop set-ups provide retailers with branded display areas designed to elevate the in-store experience. Often provided free-of-charge, they usually yield such positive results that shops are back on the phone requested more metres be installed, we’re told.

Traditionally, this has not been an area that ABUS UK has focused on and when comparing how many shop-in-shop metres have been installed in each ABUSselling nation, the UK hasn’t really measured up. Not so, anymore. In 2024, ABUS UK placed 60 metres of shop-in-shop displays and this year that number will reach 100 metres. It’s a decent measure of how ABUS’ approach to the UK has transformed in less than two years.

While the industry’s accountants are totting up exactly how 2025 has fared, the innovators have continued to stay busy and perhaps nowhere more so than at ABUS. A casual observer of the Eurobike Award winners from year-to-year will see

plenty of ABUS entries make the shortlists and regularly win.

In the mobile security segment (bicycle locks and helmets), the company now offers around 1,000 different locks, including 300 eBike battery lock options – a category in which it holds a dominant market share. That innovation has seen ABUS dramatically broaden its knowledge base into software and app-based security systems where users can grant access remotely and manage security digitally.

New physical products like the Goose lock, the Yarnit (a knitted-style chain lock), and the HYPE helmet are fairly recent fruits of the ABUS R&D team’s efforts. The company releases four to five new locks each year, a pace that is unmatched by many competitors, says the firm: “Even while we’re seeing some rein in their efforts, we are investing in the new.”

This innovation is not limited to cycle or even consumer products. ABUS is also expanding in industrial safety, with growing demand for lockout/tagout systems and safety helmets, as well as in the equestrian sector too.

One of the challenges ABUS faces is changing the way retailers and consumers think about locks. Too often, locks are an afterthought and tacked on after the excitement of buying a new bike. ABUS is working to reframe this conversation. The firm acknowledges it can be a challenge to not puncture the elation of a bike purchase with warnings that it might get nicked, but there are methods it can advise on.

Sales staff are encouraged to present locks like a wine list: not just offering the cheapest option, but a range that allows customers to choose based on value and protection. “If you spend £2,000 on a bike,” ABUS regularly frames the conversation, “would you spend £200 to get it back if it were stolen?” It’s a compelling argument that will likely resonate with retailers and riders alike.

This approach is especially relevant in the UK, where bike theft remains a serious issue. We’re told that angle-grinder resistant locks are not as pertinent to the European market as they are to the UK, where there are tales of people riding around in vans on the lookout for poorly secured bikes.

Some insurers now require bikes to be locked within shops, even during opening hours, further underlining how security should be far from an afterthought. Naturally, ABUS has solutions, from heavyduty ground anchors to café-stop-friendly portable locks and everything in between.

ABUS’ transformation in the UK is still underway. There’s more consumer advertising planned for 2026, continued investment in warehousing and service and a growing team on the ground. Now with over a year and a half of detailed sales data behind it, ABUS UK is learning and focused on bringing in more stock with faster turnarounds for shops. Ultimately, the goal is straightforward, Ford explains: “Working closely with dealers is key. We want every bike shop to buy ABUS.”

www.abus.com

As of early 2024, within these walls is the ABUS UK warehouse. While the global stock hub remains in nearby Germany, the UK operation has significant levels of product, with freshly installed flow racking and subsequently fast turnaround times.

“EVEN WHILE WE’RE SEEING SOME REIN IN THEIR EFFORTS, WE ARE INVESTING IN THE NEW”

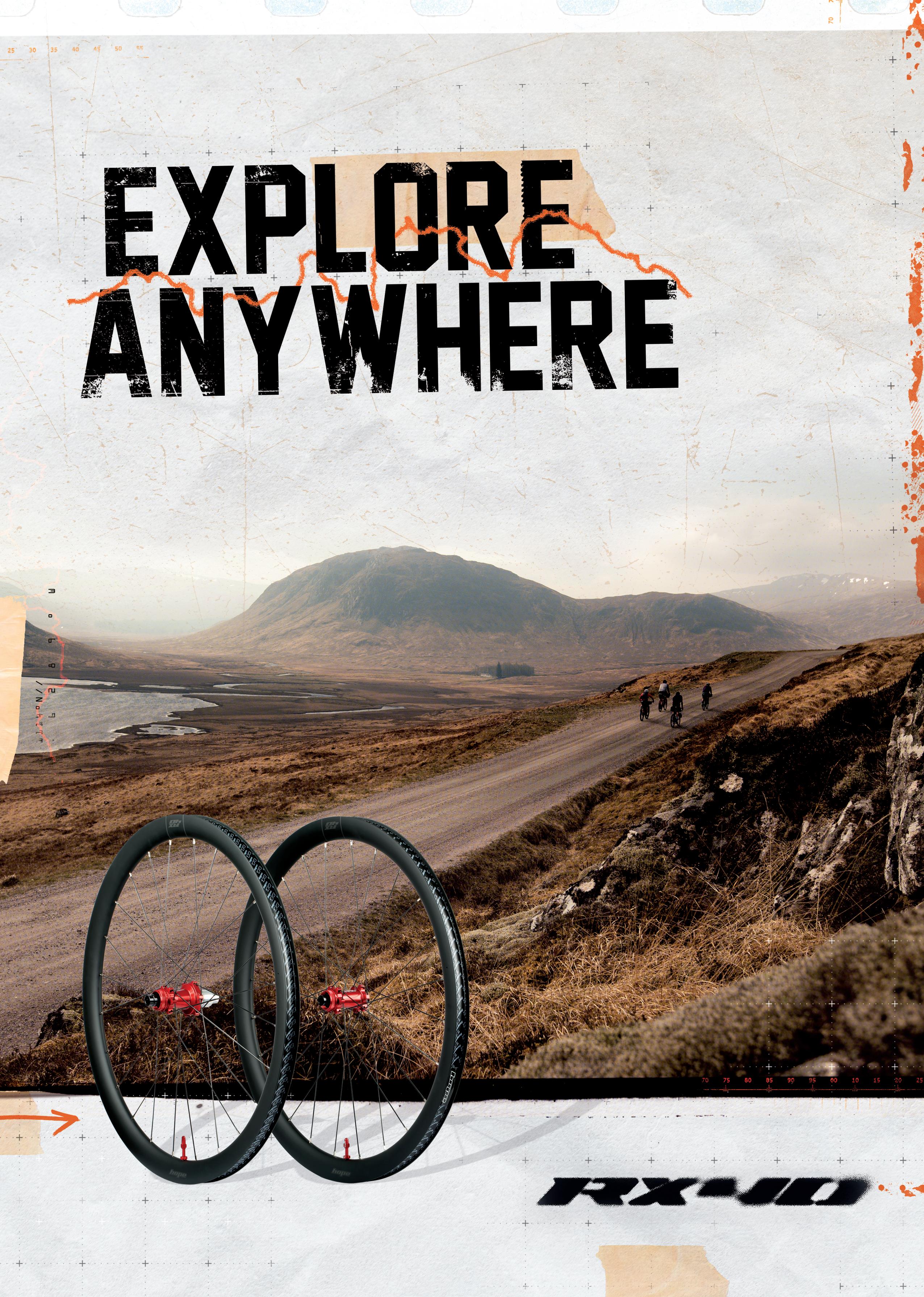

Founded in 2014 in the Netherlands, Scope Cycling specialises in high-performance carbon wheels, making use of pioneering cutting-edge technologies. From its early days as a small startup, Scope has gone on to launch Artech wheels which are not only being ridden by three WorldTour teams, but also featuring in stage wins. Scope Co-Founder Nieck Busser tells us more…

“We founded Scope Cycling in 2014 in Eindhoven, the Netherlands. Rik and I first met at university, where we studied together – but more importantly, we discovered a shared passion for cycling and a belief that wheels could be designed smarter and better. From the very beginning, we set ourselves apart by choosing to do everything in-house. That decision gave us full control over performance and quality. Before long, we began distributing our wheels across Europe, and our small startup grew into a team of likeminded people, united by the same blend of engineering expertise and passion for cycling.

In the early days, innovation seemed easier. Rik and I were brimming with ideas, and we were among the first to launch a full range of road wheels that were both tubeless and disc-brake ready. It was simply our vision,

It’s been a big year for Scope, with 3 WorldTour teams riding its wheels

combined with a conviction that the market was ready for this new technology. That belief gave us a strong start and tremendous energy. But as more brands entered the market, we quickly realised we had to push ourselves even further. We grew our engineering team, invested more time and resources, and kept challenging ourselves to improve. That drive to raise the bar has been with us from the very beginning – and it continues to power Scope today.

What makes Scope different?

“At the end of the day, it all comes down to people, our relentless drive for innovation, and our determination to win –to be the best. At the start of our development cycle, we give ourselves the freedom to think openly and creatively. At this stage, we’re not designing a specific wheelset to fit a rigid brief; instead, we focus on exploring a concept or technol-

ogy. Once that concept has been proven, we translate it into a wheelset that meets our performance goals.

To stay at the forefront of product development and continue delivering the best wheels on the market, we’ve built a unique structure within our engineering team. We run multiple projects in parallel, fully aware that many will never make it to production. But the ones that do are what set us apart.

Our Artech wheels represent the pinnacle of what we do at Scope – where exceptional engineering meets creative minds inspired by nature. The Artech series showcases our latest technologies, designed with one goal: pure performance. It delivers the fastest and lightest wheelsets in our portfolio - and among the very best on the market.

From a climbing wheelset weighing just 965 grams to an aero-focused 65 mm wheelset at only 1244 grams, Artech delivers significant performance gains and sets a new benchmark in the cycling industry. The wheels are built on advanced, in-house–developed technologies – including 3D-printed hubs, Aeroscale rim technology, Carbonlite Aerospokes, and the Diamond Ratchet engagement system.

The Artech series is available for Road, All-Road, Gravel, and Triathlon.

A big year for Scope

“2025 has been an incredible year for Scope. With the launch of our new Artech wheels, we knew we had the right tools to compete at the WorldTour level—but we could never have imagined starting the season with three WorldTour teams riding our wheels. The results quickly followed: Mads Pedersen wore the pink jersey in the Giro on our

TT wheels, and Daan Hoole delivered our very first WorldTour stage win, also in the Giro. At the Tour de France, Mathieu van der Poel raced in the iconic yellow jersey on our wheels, while Oscar Onley secured an outstanding fourth place overall. Moments like these give us even more energy to keep pushing ourselves and to maintain our position at the forefront of cycling innovation. On the product side, 2025 has been just as exciting. We expanded the Artech range with new Gravel and Time Trial/Triathlon wheelsets. Building on the same engineering DNA, we also introduced the all-new R-Series, designed to bring revolutionary technology to a broader audience. The R-Series delivers best-in-class aerodynamics at true race-ready weight. By adopting the

proven rim profiles of the Artech series (without the Aeroscales) the R-Series guarantee optimal aerodynamic performance. Setting a new benchmark, the RSeries comes with steel spokes and weighs just 1,349 grams for the R4 (45 mm) all-round wheelset, and 1,525 grams for the R6 (65 mm) aero wheelset. Like Artech, the R-Series is available for Road, All-Road, Gravel, and Triathlon. Beyond product innovation, 2025 has also been a year of unique new partnerships with leading high-end bike brands. Most recently, we partnered with Bianchi on their limited-edition Founders Edition bike and collaborated with Argon18 on the new Nitrogen, where we optimised the entire rolling chassis for maximum aerodynamic efficiency. These projects reflect our ongoing

mission: to push boundaries, work with the best, and shape the future of cycling.

The product roadmap

At Scope, innovation always comes first. Our product roadmap is already mapped out for the next five years, so you can expect a steady flow of groundbreaking technology and new products from us. At the same time, we’re developing some exciting new partnerships that we can’t reveal just yet – but we can promise that next year will bring just as much excitement as this one, if not more.

Scope is distributed to the UK cycle trade through Extra UK, and Cyclex into Ireland.

www.extrauk.co.uk www.cyclexie.ie

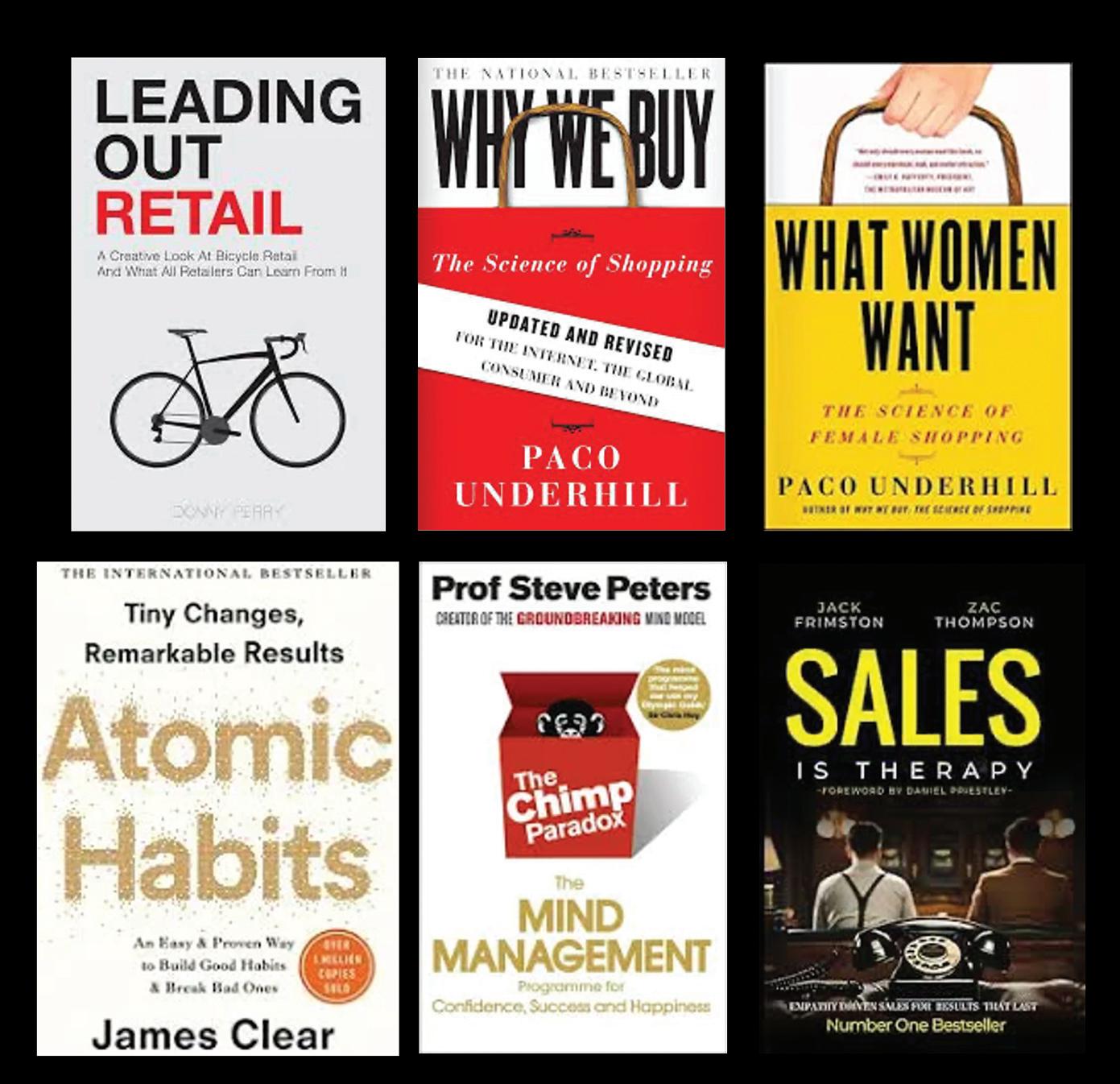

What are your preconceptions about sales? That it’s generally undesirable and pushy? That it’s something that can’t be learned. That it’s only for a certain few people with a “natural talent”? John Styles continues his ‘sales secrets’ series by bursting a few misconceptions and encouraging execs to explore their own sales path…

Sales is a dirty word. For many, it conjures up images of being stopped in the street by charity subscription sellers when you’re in a hurry. Someone knocking on your door to sell you double glazing. Used car salesman or estate agents with dodgy practices (plenty of that in the news right now, bad news travels fast, and sells more papers).

Now if you define sales exclusively as a pushy, overly extrovert, or even manipulative type of “in your face” activity, I think you’d be right to avoid it. And you’d also be right to say that it doesn’t really happen too often in bicycle retailing. But that doesn’t mean we shouldn’t want to learn anything about sales – i.e. good and professional sales techniques.

There are lots of good things we do in the industry, that really are selling, but we just don’t label it that way. Below is a summary of the main ways that I observe people selling, and I imagine you can probably spot some of the things that you, or people around you, do in store on a day-today basis?

1 // Push

This is the type of selling that we all label as bad and seek to avoid. The seller assumes that everyone should buy what they have to sell. And they will push that product to anyone they can. There’s no questioning for actual need. Tactics can include begging, guilt tripping, or overwhelming people with high-pressure, immoral or manipulative techniques.

Any questions tend to be “loaded” and focused solely on getting people to sign. Whether or not they need or can afford the product. Hence “Pushy Salespeople” or “The Hard Sell” is something we all tend to avoid. And we remember and talk about our worst experiences, spreading the notion that “Sales is Bad”.

2

This type of selling is the exact opposite of a Push sell. It assumes that the consumer doesn’t know what they want and it’s your job to help them find it. And with the right questions, you can establish their needs and only sell them the right thing. This system is often taught as needs-based selling.

3 // Companion

This approach assumes the consumer is well researched already and knows what they want. It’s your job to help them to buy what they need, and to verify the research they’ve already done. The best examples of this are

included in the well-known book Leading Out Retail by Donnie Perry.

4 // Expert

Selling from expertise is something that many people do naturally within the cycle trade, adding their experience and opinion to the product to make a firm recommendation of what they think is best for that customer. The best example of this is bike fitting. Selling from expertise can sometimes get a little ugly though. If expert terminology and strong opinions are used inappropriately, they can put off some less informed or less enthusiastic consumers.

5 // Subliminal

Subliminal selling relies on understanding people’s inner drives, for example, status, fear, ambition, hope or a sense of belonging. There can be many reasons why people enjoy cycling, or want to make that next purchase, and it’s not always about the bike or the latest technology. This is also where we find the root of a slightly dangerous myth, that only certain ‘types’ of people can sell. It’s true some are naturally better than others, but in every store, everyone sells to some extent, so everyone can improve.

6 // Network

Network selling is about being aware of the network of decision-makers that may influence a purchase decision. We tend to naturally spot this when a family come in shopping for a kid’s bike, one person may be conscious of

“PEOPLE HAVE FOUND THEIR OWN WAY TO SELL, BASED ON THEIR OWN PERSONALITIES AND EXPERIENCES. IT’S NOT COMMON IN MANY STORES FOR ANY FORMAL TRAINING OR SALES SYSTEM TO EXIST”

budget, another more excited about the product, another focused on the colour. We also see it when selling to companies or larger organisations. It’s important to remember that from time to time you’ll be presented with a single consumer, but there may be multiple decision makers they are holding in mind. Perhaps the E-Cycle purchaser who is buying the bike mainly for them themselves, but family members A, B and C will all have occasional usage (or so they keep telling themselves).

How did you do? Were you aware of these different approaches to customers? Were you aware of which ones you’re already using?

In many stores, you may also notice that some people do some of these things, and others do things differently. That is, people have found their own way to sell, based on their own personalities and experiences. It’s not common in many stores for any formal training or sales system to exist. And while you don’t want to bolt everyone down to the same methods, some training can go a long way to help people develop.

As a teenager, my first two sales jobs gave me the wrong impression about sales. Working in a High Street clothing retailer, we were all pressured to

sell more jeans, but none of the managers could explain exactly how to do that. Most of the advice came down to anecdotes “I don’t know, I just…”. Everyone did things a different way, built around their own personalities. Some were better than others. Which gave all of us new starters the impression that (a) sales is something that can’t be taught, and (b), it’s just a natural inbuilt thing – either you have it or you don’t. And (c) don’t bother to ask for training, there really isn’t any.

My Sunday job was serving as many roast dinners as I could in a wellknown High St chain of pubs. The ‘Sales Training’ there was a twominute pep-talk before every shift where the manager would instruct us to ask the following question “which bottle of wine would you like to accompany your meal”? Because, head-office had a rule about boosting the average spend per table. I later learned this was a technique called an Alternative Close. The pre-shift peptalk gave all of us new starters the impression that ‘Sales Training’ was, well, a bit ‘Pushy’ and bit awkward. Now, I’m guessing I’m probably not the only one who may have had that first experience of sales. Especially when coming into retail environment in your late teens or early 20s. Have a think about your beliefs about sales. That it’s generally undesirable and pushy? That it’s something that can’t be learned. That it’s only for a certain few people with a “natural talent”?

That any training you are given might be turning you into something you don’t want to become?

Perhaps, as stores struggle in these challenging times, it might be time to re-examine that belief? As we all know, every additional sale above your overheads is profit to the bottom line. So, while any extra attention to sales skills / training might only boost your sales by a small %, your profit % will of course be higher still. And in a time when many stores are struggling, it could make all the difference.

Another way we pick up the impression that sales is a bad thing are the countless horror stories around misselling. Whether it’s timeshares or pensions, car loans or sharp estate agency practices, we all know someone or have read a story in the media about unscrupulous sales practices that manipulate and deceive unwary consumers. Typically, around highticket items, e.g. cars, houses, financial products. What ties these situations together is that the product is complex and the seller has more information than the buyer. The power dynamic is one sided. Is it any wonder that a consumer looking spend several £000s on an e-cycle approaches the task with caution. It’s not your fault they’ve been mis-treated

bob-elliot.co.uk

bob-elliot.co.uk/twitter

bob-elliot.co.uk/facebook

bobelliot-online

“LEARNING SALES SKILLS MAY BE THE THING GIVES YOU THE CONFIDENCE TO GO-IT-ALONE OR THAT SETS YOU APART FROM OTHERS. SO, IF YOU WANT TO START LEARNING BY YOURSELF, HERE ARE SIX GREAT BOOKS YOU MIGHT WANT TO DIP INTO”

in other high-ticket industries.

So, naturally none of us really want to be associated with that kind of selling. And here’s the super-positive thing about the bicycle trade. Although our product can be complex (and a lot of the time store staff have more knowledge than the consumers they are selling to), we don’t generally get that sort of reputational harm that other industries suffer.

In my 20-plus years out on the road, standing in hundreds of stores, I don’t think I’ve ever heard a single staff member, owner or mechanic say anything that was remotely misleading to any consumer. We are an industry of passionate enthusiasts who like to sell the right product, to the right person, for the right reason. To provide an appropriate solution. I think one of the reasons why both individuals and organisations don’t spend time investing in sales skills is because, deep down, they worry it may lead them away from their already good and honest values. Which leads us the situation that…

Last week I was in a store, and someone introduced themselves as the Sales Manager. It’s rare in bikes stores that this task would be someone’s specific responsibility and that they would name it, own it and deliver on it. Most of the time, I meet store owners, managers, deputy managers, mechanics, associates, team members

and the like. Rarely do I meet anyone in store with “Sales” in their job title.

In most stores, sales appears to be a kind of diluted, unnamed, team effort. We all do it, but no-one really owns it. Everyone sells, but no one really admits to it. Sales, or anything perceived to be selling, is kind of that dirty word again. So, as an industry, we tend to label it as something else. We tend to describe it as serving customers, helping people out, giving advice or providing a service. And I suspect that as the topic is avoided and no one person “owns it” that may be the reason that formal training, and self-learning are less common in our industry than perhaps they could be?

If it’s your ambition to own a store one day, or perhaps be a sales rep for a

bike brand or distributor, learning sales skills may be the thing gives you the confidence to go-it-alone or that sets you apart from others. So, if you want to start learning by yourself, here are six great books you might want to dip into, and best of all, they’re not all about sales.

Leading Out Retail – Donny Perry

Why We Buy – Paco Underhill

What Women Want – Paco Underhill

Atomic Habits – James Clear

The Chimp Paradox – Steve Peters

Sales Is Therapy – Jack Frimston and Zac Thompson

There are of course some great training resources out there within the industry, some online, some delivered by brands, some delivered in store –especially larger chain stores. You can gather knowledge whenever and wherever it is offered, because you never know when you perhaps might need it. So, to any new starters or those who feel uncomfortable about selling, my humble advice would be: keep an open mind, explore and make it your own.

John Styles is a veteran of the cycling industry, having worked with leading distributors and brands across the sector. With a well-rounded perspective on the opportunities and challenges facing the sector, backed by a Bachelors Degree in Economics, John Styles is an expert consultant for the bike trade.

Sustainability and ESG is an evergreen topic and perhaps particularly timely as a certain well-known bicycle manufacturer is currently mired in a controversy over forced labour allegations. With expectations of supply chains now rightly higher than ever and international legislation tightening, CIN speaks with two-wheel drive system specialist Ananda about values and social responsibility…

Once upon a time, a bicycle business might have sat back, content that it was a ‘green’ business because bicycles are more ecologically sound than, say, cars. Times have well and truly changed and the bar is set considerably higher.

"ANANDA IS ONE OF THE BUSINESSES THAT HAVE SIGNED UP TO THE SCIENCE BASED TARGETS INITIATIVE (SBTI) WHICH ALIGNS WITH THE PARIS AGREEMENT’S 1.5C TRAJECTORY"

Ananda’s European Service Centre handles inspections, repairs and refurbishments of mainly motors, but also controllers

Not only that, but now we have the likes of CBAM, ETS and right to repair, some examples of legislation that is embedding sustainability within the statute books, which should be enough of an encouragement for businesses to firm up their ESG policies.

A number of international operators are well ahead of the legislative curve, having had measures and initiatives in place for years now, designed not just around producing sustainable product but taking into account the supply chain, manufacturing, worker conditions and more besides.

As one of the manufacturers operating in the cycle market, Ananda has more elements to attend too than an importer, with everything from worker conditions in its production halls to the supply chain and what happens to its products when they need repair.

Since 2021, Ananda has operated a European Service Centre in Hungary. Thomas LeCoq, Marketing Director Europe at Ananda, who works closely with the company’s ESG initiatives picks up the story: “The centre handles inspections, repairs and refurbishments of mainly motors, but also controllers. The aim has always been to

extend product life and minimise waste –turning “repair, don’t replace.

“It’s important to note that repaired motors never return to OEM partners but help reduce waste and extend product life keeps riders on their bikes, and supports a more sustainable service ecosystem.”

Ananda is one of the businesses that have signed up to the Science Based Targets initiative (SBTi) which align with the Paris Agreement’s 1.5 C trajectory. It’s been laying the foundations for its Wuxi factory to run on 100% green energy by 2026 – it generated a whopping 303,000 kWh of solar power last year. What’s more, the firm runs uber modern Industry 4.0 factories, with MES-driven monitoring, intelligent warehouses and over 100 digital traceability points that not only improve internal efficiencies and provide transparency to OEM partners, but crucially also cut waste.

Not only that, but Ananda is innovating in terms of material innovations to reduce reliance on virgin resources. Its approach is backed by ISO standards for quality, environment, safety, energy efficiency and carbon footprint.

That sustainability commitment slots neatly into the aforementioned CBAM (Carbon Border Adjustment Mechanism). For the uninitiated, this is widely seen as an internationally leading piece of legislation designed to equalise the CO2 impact of imported goods. Brought in by the EU, it requires details of carbon emissions right

The R900 brings a new level of intelligence to e-drive systems by integrating the motor and a 3-speed gear shifting mechanism into a single, compact housing.

through the supply chain and being CBAMready is no mean feat in the early days of this legislation. Currently only applicable to certain goods, it’s surely only a matter of time before CBAM applies to most goods coming into the EU. Thomas notes: “You can already see that many bicycle brands are paying more attention to this and are selecting their suppliers accordingly. Of course, this shift is partly driven by EU regulations, but there’s also a growing awareness among riders themselves, who are making more conscious choices for sustainable mobility – especially eBikes –to help create a better climate. Since Ananda operates at the very start of the supply chain, we are in a strong position to truly make a difference by being CBAM ready, and in doing so, contribute to accelerating e-mobility worldwide.”

“The Ananda facilities are modern, clean and equipped with advanced technology. We’ve made significant investments in new machinery and automation – not only to increase efficiency and quality, but also to improve working conditions for our employees.

“Ananda is a modern, internationally oriented company with strong European ties and also European staff. Perhaps we are ahead in some areas, but we are not alone – several of our partners, such as our battery suppliers, are also taking similar steps to ensure responsible and safe production environments.”

“SUSTAINABILITY AT ANANDA ALSO MEANS RESPONSIBILITY TO PEOPLE”

Ananda’s self-stated ESG policies emphasise its attitude to workers: “Sustainability at Ananda also means responsibility to people. The company is committed to providing safe and supportive workplaces for all employees, while one-third of board management positions are now held by women – underlining Ananda’s dedication to inclusion and diversity.”

Ananda’s certifications include BSCI for fair labour (supporting fair labour practices within supply chains) and has 97 safety and ergonomics upgrades to ensure a safe and supportive environment.

CIN asks whether Ananda would consider itself an industry pioneer in this respect. Thomas says: “It’s hard to say whether Ananda is a trendsetter. Our focus on employee well-being is not driven by comparison but by our own internal values and our commitment to long-term social responsibility. If you randomly look at facilities in China, I believe that is different from what people might expect.

Looking ahead, Ananda is developing an internal ESG framework to support annual sustainability reporting and setting science-based emissions reduction targets for the entire organisation. At the same time, the company is expanding its programmes for repair, refurbishment and component reuse, while advancing new motor technologies like the new M7000 platform will have a strong upgrade in modularity and repairability.

“Ananda is an e-drive expert with an open and flexible system approach,” Thomas adds. “Our platform allows full adaptability – we can customise software, and customers can configure their own components. If a customer prefers to work with their own battery supplier or a different display, that’s entirely possible.

“The same philosophy applies to sustainability. From our base in China, we are actively pursuing more sustainable practices. One of Ananda’s key strengths is that we have full control over the entire production process and source many raw materials ourselves. Because everything is managed in-house, we can carefully decide which components and materials we use –and which we don’t.”

www.ananda-drive.com

Did you know that two-thirds of journeys made by car are less than five miles? Or that if you used an electric bike for that same trip, you would only spend 5/7th of a penny in used electricity cost versus 80 pence in a petrol car?

Mark Sutton explores the reasons why we really should all be selling the positives of cycling…

As cyclists, each of us will advocate for the positives that we have experienced from our pastime and those, I’d wager, are subtle sales tools that we have all used to sell products in store. Yet composing a point around the benefits of cycling is too often anecdotal and, while passion shines through, we also have a wealth of data and research from across the globe to hand that should not only convince our customers, but our councillors and Chancellors too.

Covering only five topics, I will detail why we should invest in cycling, why customers should strongly consider committing to active travel and why we should all become advocates, even if you drive to work more than you cycle, as even many cyclists do.

Some of the best research into the health benefits of cycling stems from Scotland. Published in the BMJ Public Health archives, the peer-reviewed paper ‘Health benefits of pedestrian and cyclist commuting: evidence from the Scottish Longitudinal Study’ has some astonishing highlights. Studying 82,000 adults aged 16 through 74 across an 18-year period, the paper is great news for anyone reading. Assuming you ride regularly, you can bank on a 47% lower risk of premature death, a 10% lower risk of ending up in hospi-

tal for any reason and even a 20% lower chance of being prescribed any medication for mental health issues. With the cancer rate sadly meaning most of our lives end up touched in one form or another at some stage, it’s further reassuring to know that cyclists presented a 51% lower risk of death caused by cancer.

Now, by the time you read this, Rachel Reeves will be a little closer to delivering a budget that was delayed to buy some time for the Government in the face of nervous markets. A large consideration will be where money can be saved and, on account of lowering heart disease-related hospitalisation by 24%, getting the population cycling habitually might be a money saver.

Here, a French study titled the ‘Untapped health and climate potential of cycling in France’ published in the Lancet Regional Health Europe found that cycling and walking incentives aimed at drawing people out of cars could easily rack up £29.5 billion (€34 billion) in health benefits and that would result in a downstream medical cost saving of £165.7 billion (€191 billion). To achieve this, just 25% of short car trips would need to be shifted to active travel.

By the way, did you know that electric bike riders are exercising almost as much as cyclists without pedal assistance? The ‘cheating’ myth has now

been blown apart by a few studies, but some data snippets from various European papers include the finding that a pool of electric mountain bike riders were registering 95% of the heart rate registered by a pedal-only mountain bike rider on a pre-set loop.

A separate Norwegian study found ebike riders had only a 12% lung capacity use difference while cycling, even while on the highest assist setting. Here, measurements taken of a heart rate under moderate to vigorous activity conditions found that the e-biker was judged to be exerting themselves over 90% of the time.

It goes without saying that the typical eBike rider is riding more often, for more trips and for longer distances too. Arguably, you’re getting more exercise with pedal-assist.

TRANSPORT SYSTEMS: EBIKES AND INFRASTRUCTURE

In 2024, a study published detailing ‘Mobility in Germany’ found that ‘43.1% of electric bicycle trips and 63.2% of electric bicycle mileage would have been undertaken using a car if no eBike had been available.’

This goes a long way to illustrating why there exists such a monumental opportunity to sharply chop into the driving rate alluded to in our opening statistics. If two-thirds of driven journeys are under five miles, these are trips

“SOME DATA SNIPPETS FROM VARIOUS EUROPEAN PAPERS INCLUDE THE FINDING THAT A POOL OF ELECTRIC MOUNTAIN BIKE RIDERS WERE REGISTERING 95% OF THE HEART RATE REGISTERED BY A PEDAL-ONLY MOUNTAIN BIKE RIDER ON A PRE-SET LOOP”

made easily by most able-bodied people on an eBike. Imagine the dent in rush hour traffic that could be made if only a fraction of people flipped one car journey a week to cycling. A recent YouGov study of attitudes to eBikes suggested that a quarter of people are simply waiting for the opportunity to try an eBike, emphasising the importance of demos in the community.

The potential of this traffic-eating trend is demonstrated nowhere more than in London, where bike share is surging on account of granting broader access to the population at large, making driving the less obvious choice where schemes exist. London now boasts one-third of the dockless bike share trips in all of Europe, with 29 million journeys made last year.

The net result of this has been a tipping point, where London’s transport ecosystem has permanently changed, as has the public’s perception. Cycle counts taken in the City of London in October 2024 recorded 139,000 daily trips, versus 89,000 in 2022, a growth that has made cycling in London now heading on twice as popular as driving during the day.

During peak hours, cycle traffic represents 56% of above-ground commuter movements on the roads.

What has caused this surge in London’s cycling rates? As of late 2024, Transport for London had laid over 400 kilometres of cycleways, a fourfold increase since 2016.

Tying all of this together, what’s the impact, you may wonder? Well, with a

Assuming you ride regularly, you can bank on a 47% lower risk of premature death

few assumptions made based on the best available estimates, if those 29 million bike share trips had instead been driven, then the carbon cost in C02 emissions would equate to 44,805 tonnes based on an average petrol car’s emissions of 309 grams of C02 per mile. That would take two million trees planted and matured to offset and, to take this into even more eye-watering territory, based on the 2024 average petrol price of £1.48 per litre and a 40mpg consumption, drivers would have spent £24.4 million in fuel.

Now tell me that cycling doesn’t make more sense.

ECONOMIC BENEFITS

If the argument for salvaging the NHS budget with better active travel provi-

“ALL OF THE FUSS ABOUT CYCLE LANES COSTING BUSINESSES PASSING TRADE IS NOW DECISIVELY DISPROVEN”

sion wasn’t enough for the Chancellor, perhaps the following data points will do it.

Starting with the tourism impact, the best example we have of a widely accessible, high-quality infrastructure network is the Eurovelo network. This criss-cross network covering the continent delivers 2.3 billion cycle trips annually, which is calculated to be worth €44 billion in economic activity and responsible for the sustenance of 525,000 jobs. On a more micro level, high modal share Holland is quite attractive for cycle tourists and that results in 4.5 million visits worth €1.2 billion annually. Given the high levels of infrastructure investment, the Netherlands knows very well the investment case and, after years of development, puts the return at

UK

found

provision of cycle

between €5 and €19 per 41 invested in cycle superhighways.

Zoom in further and all of the fuss about cycle lanes costing businesses passing trade is now decisively disproven. Cycling UK research found that provision of cycle parking actually yielded a fivefold higher retail spend in the local area when benchmarked against the same space given to car parking. Furthermore, 85% of London's Business Improvement Districts report that cycling is a positive for traders and combined with accessibility for walking without traffic equates to a 17% decline in retail vacancy rates (according to a Transport for London report). Shoppers are revealed to stay longer and spend more when streets are relaxed and only accessible outside of the car.

According to ResearchGate, in

Austria, shopping by bike was measured as being worth €2.53 billion annually to the economy and, that for every one percentage point cycling rates increased, there was a €87.6 million kickback for the country’s economy.

SOCIAL AND SOCIETAL BENEFITS

Providing for cycling and active travel has some surprising social benefits and some you might not have considered. Opposition to low traffic neighbourhoods might well decrease fast once it is understood that a study of 253,000 house sales in Manchester over nine years found that having a cycle network artery within 1km of your property increased sold values by 2.8% on average, rising to 7.7% in central Manchester. This isn’t a one-off either, in Greater London a similar

YOUR PARTNER TO HELP YOU BUILD YOUR BUSINESS

√ 24 years of experience √ Customer & sales support

√ Customized marketing activities √ Delivery from stock

√ Place orders 24 hours a day 7 days per week

For more info about our brands, send a message to sales@onewaybike.nl or give us a call: +44 1527 958331

Website: shop.oneway.bike

study replicated the 7% purchase premium and a 20% premium on rental pricing. The best bit, you needn’t do anything to your property to attain that value.

Noise pollution, which has recently been revealed to have major health effects ranging increased blood pressure and hypertension, each of which can increase the likelihood of heart attacks. It is recommended by researchers in this space to keep noise levels below 45dB at night. Google turns up a range of papers that put mean street noise in an urban environment at 73dB. Needless to say, lining streets with cycle paths and traffic calming is a good thing.

Accounting for the effects of building

“RESEARCH HAS SHOWN THAT WITH TRAFFIC-CALMED STREETS, CIVIC BONDS STRENGTHEN”

an environment that is friendly to active travel, in London the increasing number of segregated cycle ways has been attributed to a 20% reduction in roadside N02 levels per metre of road too.

On this same train of thought, other bodies of research have shown that with traffic-calmed streets, civic bonds strengthen. When streets are not lined with cars, or open wide to speeding traffic, neighbours find it easier to communicate and social participation strengthens, not to mention making it safer for children to play outside.

WEATHER

To finish us off, there’s something on the could-never-be-a-cyclist’s hitlist that we can’t do much about and, so

says the data, is actually getting worse (perhaps excluding 2025). That’s the weather, or more specifically, how often it rains. Yep, the weather is a topcited reason for people not cycling, or claiming you can’t possibly from November through February. Is it true? We know it’s not, Norway has a higher modal share for cycling than the UK and they have snow for a chunk of the year. We’re a bit soft, maybe. But is it in our heads?

For a bit of fun, I tried to look up as much weather data as I could to suss out how often it really rains. The Royal Meteorological Society says that in recent memory, we can account for one in three days delivering some rain at some stage of the day, on average. A fair estimate is 150 days of rain annu-

“WEATHER IS A TOP-CITED REASON FOR PEOPLE NOT CYCLING... ALTHOUGH NORWAY WITH ITS SNOWY CLIMATE HAS A HIGHER MODAL SHARE FOR CYCLING THAN THE UK”

Don’t pack your mac: There’s a statistically low chance of getting rained on during your cycle commute (only it doesn’t feel like that on the occasions when it does)

ally and your average commute may well be two hours out of the day. This travel time window reduces the odds of getting wet significantly, accounting for only a twelfth of the day. At this point, it’s a little complicated, but let's suppose rain is localised to around 40% of a properly rainy day. Well, that means you actually have a less than 1.5% chance of it raining on your commute, or of 260 working days, only 3.7 will deliver you a soggy ride.

Cycling Industry News would love to hear your views on those who have influenced your journey through the bike trade. Talk to us on our Facebook group – Cycling Industry Chat.

Storytelling, information, atmosphere… when you’re looking to optimise the layout of your retail space to maximise sales potential, the science and principles behind shop floor layouts can seem complex and brutally hard to grasp. But help is at hand for those who want to ease customers journeying to their shop counters. Forming part of our recent suite of CIN Podcasts designed to help bike shops boost profitability, retail design expert Gosia Adamska of WHiCH Interiors chats with Sean Lally

The Cycling Industry News Podcast has recently taken a swerve towards ‘how-to’ guides and discussions aimed at shops wishing to make the most of their potential to yield profit. Last time, regular CIN Podcast host Sean Lally spoke with John Styles about bike shop sales techniques and, this time around, Lally chatted with retail design expert Gosia Adamska about some of the dos and don’ts on bike store layout and atmosphere.

Adamska’s experience is gleaned from multiple industries, including architecture and project management, plus many years working directly with bike shops in the UK and Europe to help them shift from chaotic, cluttered spaces to more boutique style settings that enhance customer comfort and increase sales.

The significance of storytelling, community engagement, the efficient use of space and the good old concept of making a customer feel comfortable are some of the elements Adamska emphasises when helping shops attract and retain customers, and ultimately enhance business profitability.

Before you begin…

“I think the first biggest challenges are the state of mind. [Store owners] feel

the need to show every single bike they have in stock and that if customers do not see it available straight away in the colour they want and the size they want, then they will lose the customer to the next shop. I have had lots of shop owner conversations about that.

“They need to understand that less is more. Don’t show every single bike. If you can create a good emotional connection with a customer then they will wait…

“That’s the most challenging thing –change the bike store owner’s point of view that redesigning the bike store is actually going to make it better.”

“The walk of shame”

“The walk of shame is when a customer comes in with their bicycle for repair. They come into this environment with new shiny bikes everywhere, and then their bike is maybe 10 or 20 years old…

The walk of shame is the distance from entry to the service area.

“And when your customers come in and they do not know where to go, they do not want to wander around the store with bike, so you can create signage that shows where to go. You can create a bicycle service entrance not far from the entrance… without disturbing the flow around the store.

“And if you see customer struggling like that, just go towards them and help them out. Start the conversation with them sooner and don’t judge… you know, just help them out.”

The benefits of physical retail

“The advantage of having a physical store is that you can create a changing room. I’ve been to the store where the changing room was created in a dirty toilet… imagine sending your customer there. It would put me off straight away and I’m sure most people would be put off as well. So, creating a changing room is something that you can easily add to your store. A proper changing room with a mirror and good lighting. Some stores are restricted because of the size. But you can create something that makes them comfortable that will do the job as well.

“And then how you display your clothes? You can display the clothes like a clothing boutique, say on a wall you’ve got a cardigan, a shirt, you’ve got trousers… all in nicely matching colours. And the person can see themselves wearing these clothes. And it’s similar with bikes. And make sure that after customers are looking at something, you tidy up after they leave. You can colour code clothing… you can add

“CUSTOMERS WILL GO BACK TO YOU OR RECOMMEND THE STORE THAT THEY GO INTO WHERE THEY FEEL WELCOME, WHERE THEY CAN HAVE COFFEE AND HAVE A CHAT”

some graphics and dress up a mannequin with a bike next to it and just create the story how this gravel bike that you’re selling could be dressed with all the accessories. There are lots of tricks.”

Communities and emotional connections

“Create a home community and create an emotional connection. Customers will go back to you or recommend the store that they go into where they feel welcome, where they can have coffee and have a chat. In these times, everybody is behind their laptops and phones. There is not as much social interaction face-to-face. We are social animals and if you create an environment where people like a store… people will spend more time in your store and are more likely to buy something. If they feel welcome and comfortable and nice, they will recommend that store.

“Not every store has space for a coffee area and so far, but a small coffee machine where people can just grab coffee on the on the go, maybe a community board announcing any of the rides, organising rides from the store… It’s always good PR and creates this special bond with the staff and with the owner.”

In the customer’s shoes

“If you are looking at something every day,

you might not see things clearly. It’s very often important to step back and just really be observant of your own store. Look how things are operating, look at your display, and put yourself in the customer’s shoes… maybe ask some people who come into the store, or maybe members of your family, or somebody that doesn’t normally come to your store. Ask them to come and have a look and give their honest opinion about it. Do they think the store is chaotic? Do they think it’s somewhere they would like to buy a road bike? Sometimes it’s nice to just take step back and just, like, look at the whole picture.”