BTCDemandWeakens

TheUSEconomyin2025:Cooling Growth,CautiousEasing,anda ShiftingPolicyRegime

BTCDemandWeakens

TheUSEconomyin2025:Cooling Growth,CautiousEasing,anda ShiftingPolicyRegime

WelcometoourfinaleditionofBitfinexAlpha2025.Inthiseditionwelookbackat what influenced the market in 2025, and what we believe will determine performance in 2026.

In what was an end of an era, we saw a clear structural break from Bitcoinʼs traditional four-year, halving-driven framework. With annual BTC issuance now below 1 percent, the marginal supply shock from each halving has diminished, reducing its ability to dictate market cycles. BTCʼs price behaviour is therefore increasinglyshapedbydemand-sideforcesandmacroeconomicconditionsrather thanmechanicalscarcityalone.

Thisshiftwasevidentin2025.Despitehalvingmodelsimplyingacompletedcycle, Bitcoin avoided the deep drawdowns of prior eras. Structural inflows from ETFs, corporates, and sovereign-linked entities absorbed multiples of annual mined supply,compressingvolatilityandacceleratingrecoveries.Drawdownssince2024 haveremainedmateriallyshallower,reflectingamarketnowdominatedbypatient, long-termcapitalratherthanspeculativeretailflows.

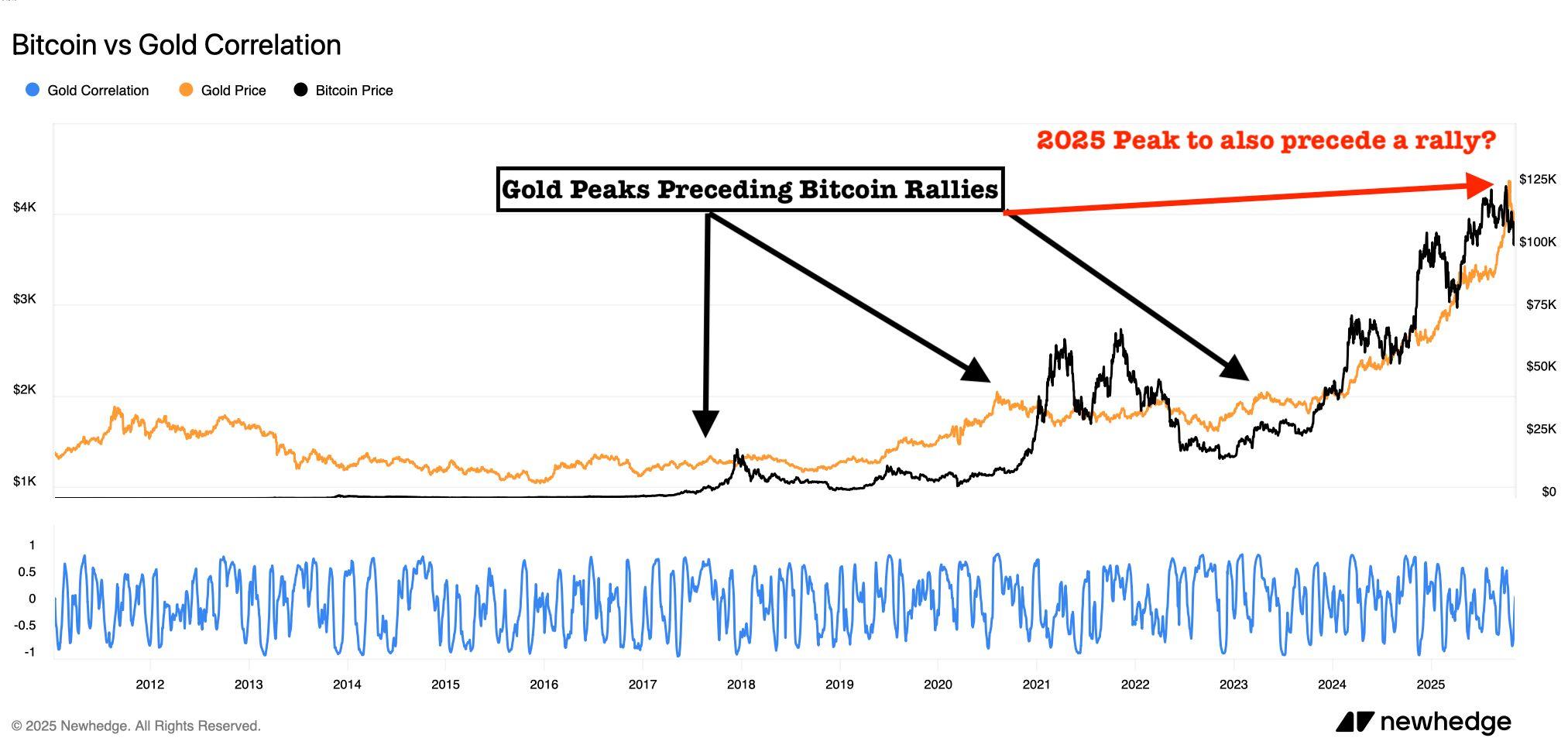

Atthemacrolevel,BTCʼsrolealongsidetraditionalhedgesdidhoweverstrengthen. Persistentfiscaldeficits,ratecutsamidabove-targetinflation,andrisingsovereign debt risks revived the hedge narrative. Gold led this move in 2025.

So what of 2026? Firstly, consistent with historical patterns in which gold outperformsatmacroturningpoints,webelieveBTCwillfollowwithalag.

Secondly, liquidity will increasingly drive BTC performance. Heavy Treasury issuance in 2025, prolonged quantitative tightening, and front-loaded fiscal programmes have lengthened the global liquidity cycle. Now as issuance moderatesandQTtapersintolate2025orearly2026,liquidityconditionsarelikely toturnmoresupportiveforBTC.

Thirdly, Institutional adoption continues to deepen. Crypto ETPs are now the primary access point for digital assets as regulatory barriers fall and sovereign interestgrows.WithCryptoETPAUMjustover$200billiontoday,weexpectitto exceed $400 billion by end-2026, reinforcing Bitcoinʼs shift toward a mature, macro-sensitiveassetwithlongerandlessvolatilecycles.

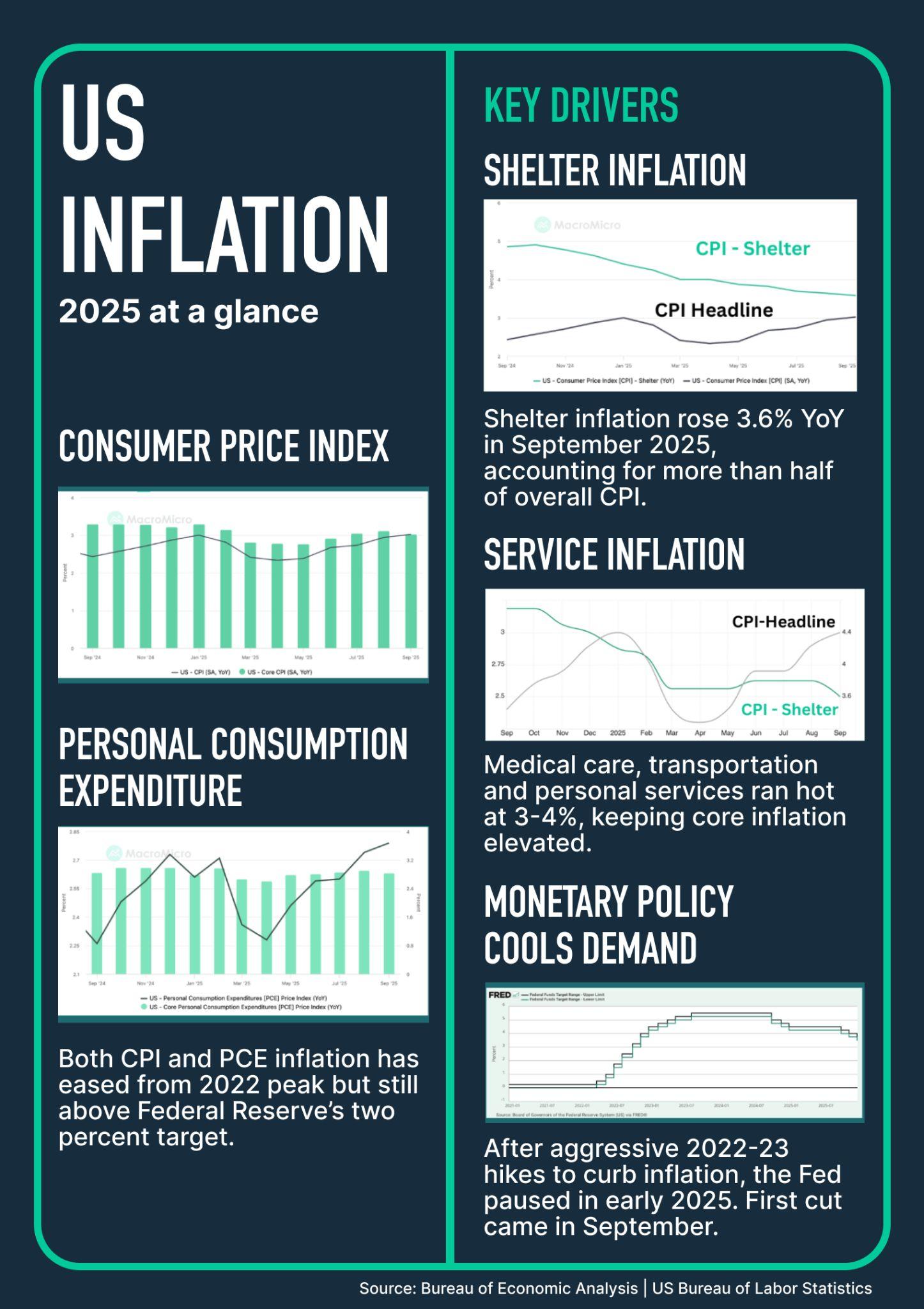

The US economy enters 2026 after a prolonged adjustment from the post-pandemicinflationshock.In2025,growthcooledwithoutbreaking,inflation eased but remained sticky, and the Federal Reserve cautiously pivoted toward gradualeasing.

Labour market conditions softened meaningfully. Hiring slowed, wage growth eased,andunemploymentdriftedintothemid-4percentrange,drivenbyweaker demandfornewworkersratherthanwidespreadlayoffs.Datarevisionsconfirmed weaker-than-initially reported job growth, consistent with a late-cycle, low-momentum environment. Looking ahead, the labour market is expected to remain soft but stable in 2026, with unemployment broadly holding near current levelsunlessconsumerdemandweakensmoresharply.

Inflation continued to ease in 2025, but unevenly. Goods prices cooled, while shelter and services kept headline inflation near 3 percent and core measures above the Fedʼs 2 percent target. PCE ran modestly lower than CPI, though persistentservicesinflationandrenewedtariffpressuresposedupsiderisks.We expect inflation to gradually ease in 2026, with potential near-term stickiness beforemovingclosertotargettowardyear-end.

Monetarypolicyadjustedcautiously.Afterholdingratessteadyformuchof2025, the Fed began easing in September, delivering three quarter-point cuts by Decemberwhilemaintainingadata-dependentstanceheadinginto2026.

At the same time, the Fed ended its balance-sheet runoff and initiated technical reserve-management purchases to stabilise money markets, actions aimed at maintaining financial plumbing rather than signalling aggressive easing. The current Fed forecast as indicated in the dot plot suggests there will only be one more cut in 2026, but we believe that there is considerable room for more looseningandthatpressurewillbuildformoreratecutstobeimplemented.With unemployment drifting higher, job creation slowing, and inflation continuing to ease, albeit remaining above target, we see scope for a more accommodative path.Ourbasecaseistwotothreeadditionalinterestratecutsin2026.

Financialmarketshavelargelyembracedthetransitiontoloosermonetarypolicy, despite weakening labour markets and sticky inflation. US equities advanced to record highs in 2025, supported by relative disinflation, policy easing, resilient corporate earnings, and sustained enthusiasm around AI-driven productivity gains.Treasuryyieldsmovedlower,particularlyattheshortend,asexpectations shifted toward a slower economy and further rate cuts, resulting in a modest steepeningoftheyieldcurve.Lookingahead,keyrisksincludeinflationsurprises, slowdowns in China and Asia, or renewed trade/policy shocks. But as of late 2025, markets appear priced for a benign 2026: solid growth 22.5 percent GDP, easing inflation and continued, but cautious, Fed easing. Under these conditions,weexpectfurthergainsinstocks(withS&Ptargetsinthe7,5008,000 pointsrange)andlowerTreasuryyields10-yearsub-4percent).Investorsremain watchful of the Fedʼs path: a more aggressive cut cycle could push stocks even higherandyieldslower,whereasanysignofinflationstickinesscouldrebalance expectations.

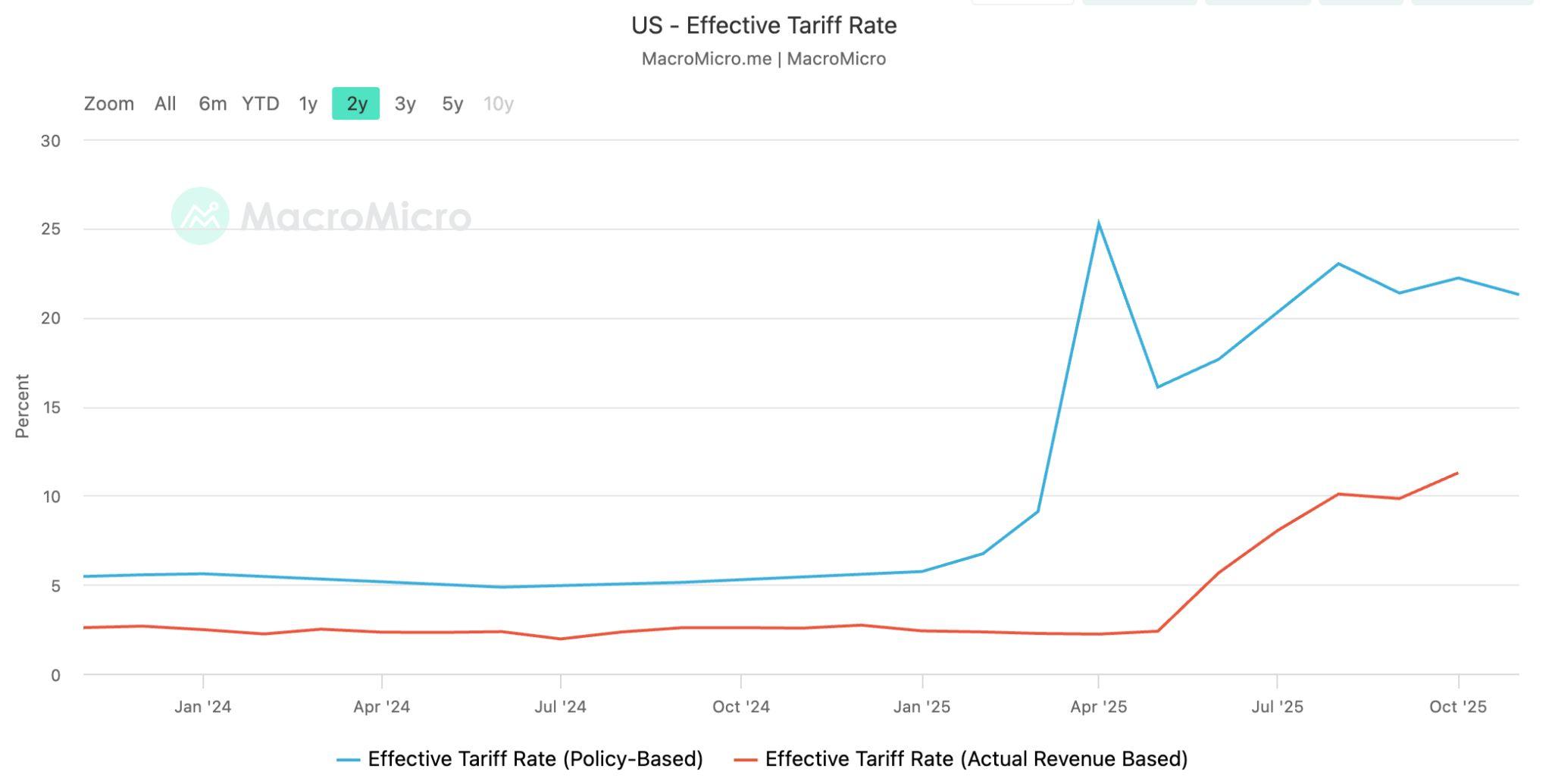

Overlaying these macro trends is a significant shift in trade policy. The Trump administrationʼs aggressive tariff regime sharply raised effective import taxes, compressed trade volumes, and narrowed the trade deficit, while also contributing to price pressures and global market volatility. Although the pace of escalationslowedlaterintheyear,tariffsremainelevatedbyhistoricalstandards and are likely to persist into 2026, introducing ongoing uncertainty for inflation, corporatemargins,andglobalgrowth.

As2025drawstoaclose,welookforwardtoanewyearwhereweexpecttosee BTC re-visiting its all time high $126,110, underpinned by further loosening monetary policy, increasing liquidity and the ongoing weight of continued crypto adoption.

Thanksforbeingwithusduring2025,andwehopeyouhaveappreciatedallthe insightswehaveprovidedduringthecourseoftheyear,justasmuchaswehave enjoyed giving them to you. We will be back in the New Year.

Inthemeantime,manyhappyholidaysfromBitfinex.

1.MarketSignals

● BitcoinʼsFour-YearCycleIsOver.

● IsBitcoinaRiskAssetoraMacroHedge?

● CryptoInstitutionalAdoptionWill ContinueGrowing.

2.GeneralMacroUpdate

● TheUSEconomyin2025Cooling Growth,CautiousEasing,andaShifting PolicyRegime.

3.NewsFromTheCryptosphere

● CFTCLaunchesPioneerDigital-Assets CollateralPilotforRegulatedUS DerivativesMarkets.

● USRegulatorsOpenDoorforCrypto FirmstoEnterFederalBankingSystem.

● JPMorganIssuesSolana-BasedUSCP TokentoPowerGalaxyDigitalʼsFirst On-ChainUSCommercialPaperDeal.

The markets in 2025 have underscored a clear structural shift in Bitcoinʼs behaviour. Historically, Bitcoinʼs programmed supply reductions - the halvinghavesettherhythmforbothralliesandcorrections.However,themarginalimpact of each successive halving is diminishing. Annual BTC issuance has now fallen belowonepercent,undercuttingevengoldʼslong-runinflationrate,whichreduces therelativesupplyshockdeliveredbyeachnewhalvingcycle.

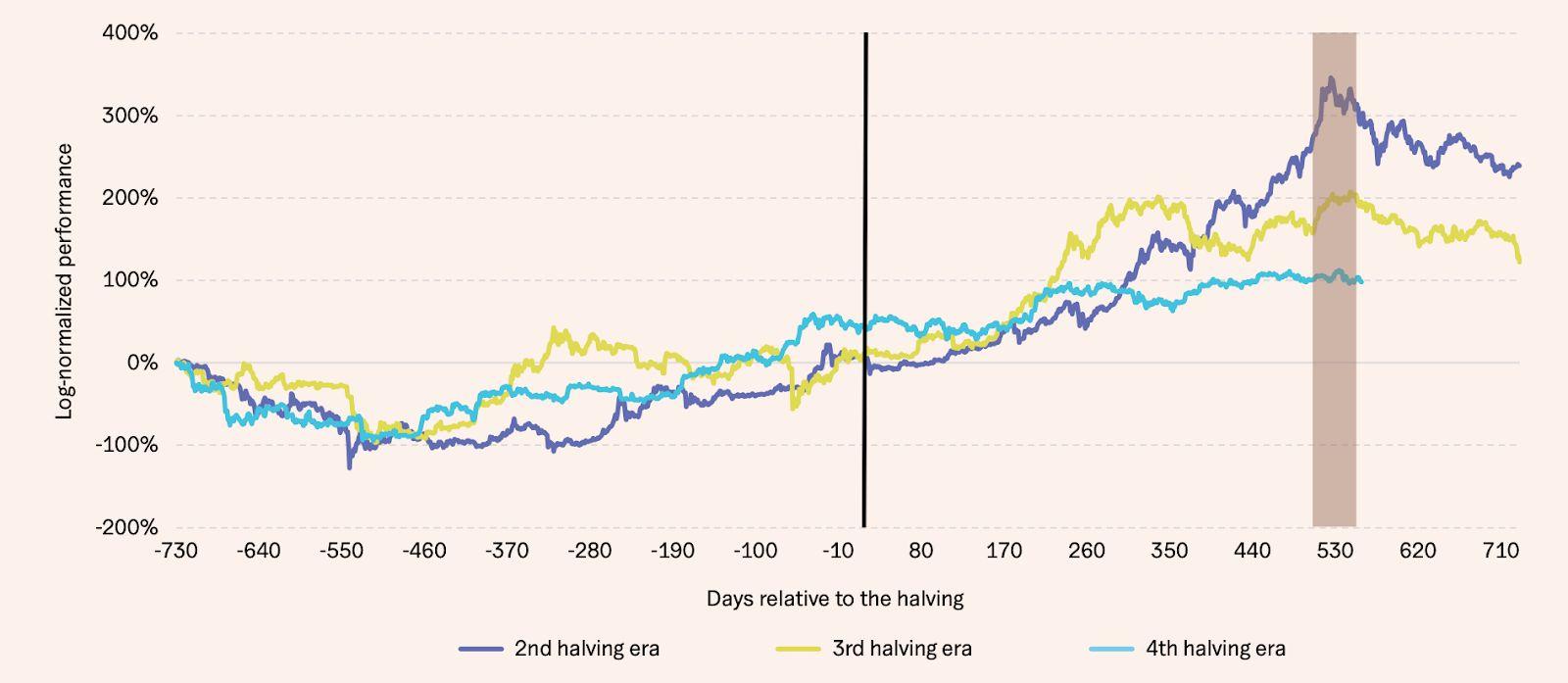

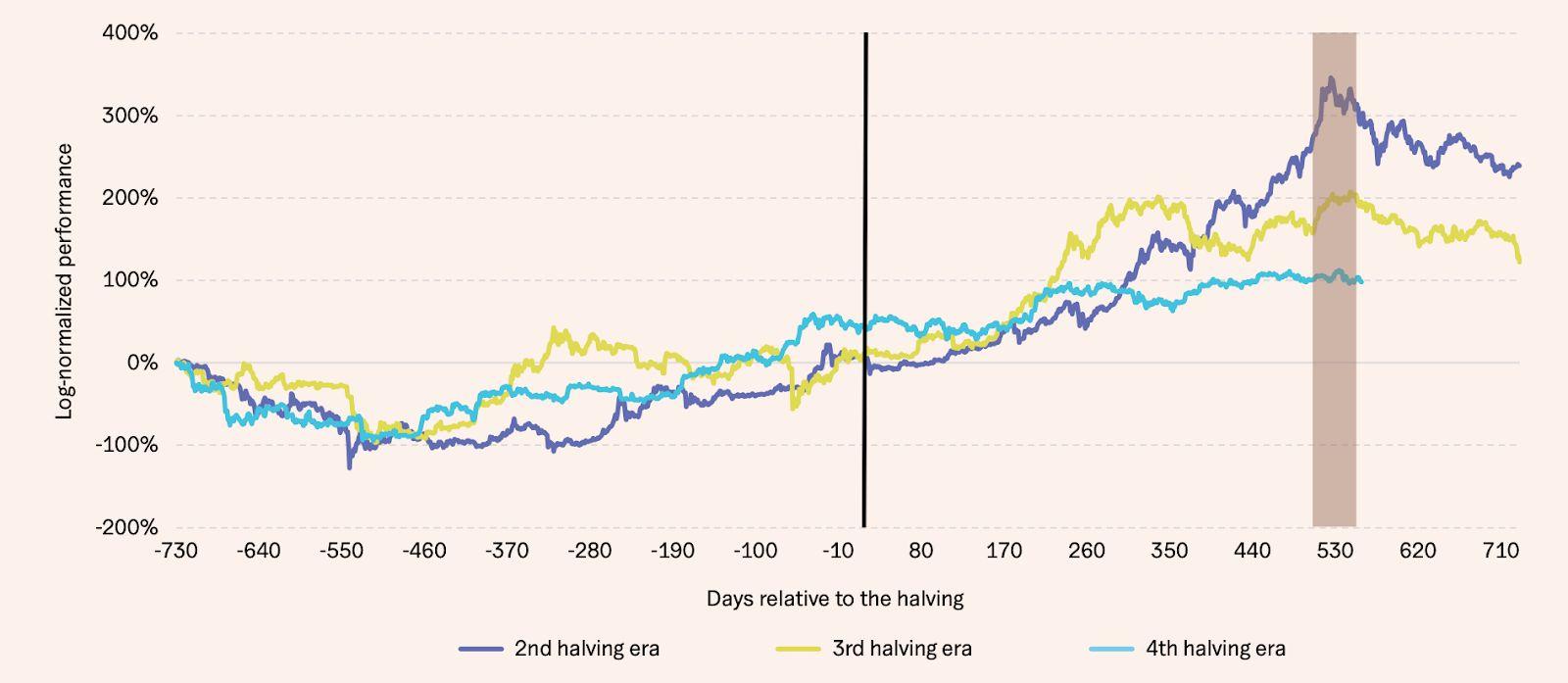

From a cyclical perspective, historical halving-based models suggest that cycle peaks have typically occurred within 500550 days following a halving event, a windowthathasnowpassed.Whilethisframeworkwouldimplythatthecycletop isalreadyinplace,thestructuralchangestothemarketsuggestamorenuanced outcome. The combination of patient capital, reduced supply growth, and expanding macro relevance increases the probability that BTC can revisit its all-timehighs,evenifthecycleultimatelyresolveswithlowervolatilityandaless extremeterminalphasethanthoseseeninearlieryears.

Figure1.BitcoinMulti-CycleOverlapAsDaysRelativetoHalving.Source:Bitbo)

Ratherthanbeingdrivenprimarilybysupplydynamics,BTCʼsperformancein2025 was fuelled by sustained structural inflows from exchange-traded funds, corporate treasuries, and sovereign-linked entities. Collectively, these participants absorbed morethansixtimesthetotalamountofBTCminedduringtheyear.Thiscapitalhas proven distinctly patient in nature, reshaping market structure and compressing volatility.

Since2024,drawdownsfromall-timehighshavenotexceeded30percent,asharp contrast to the 60 percent or greater corrections that characterised prior cycles. Recoverieshavealsooccurredmorerapidly,reflectingadeeperandmoreresilient bid.

As a result, BTCʼs behaviour increasingly resembles that of a mature macro asset rather than a retail-driven, high-beta trade. Long-term conviction now dominates market structure, with ETFs, corporates, and sovereign-aligned buyers forming a durable ownership base. This shift has materially altered volatility dynamics, producingshallowercorrectionsandfasterstabilisationaftersell-offs.

At the macro level, this transition has expanded BTCʼs addressable market. Persistentfiscaldeficits,ratecutsimplementedagainstabackdropofabove-target inflation, and rising stress within sovereign debt markets have revived the hedge narrative. In 2025, gold attracted approximately $50 billion in net inflows, while BTC drew close to $20 billion, reinforcing its emerging role alongside traditional macrohedgesratherthaninoppositiontothem.

Thegloballiquiditycyclealsoappearstobelengthening,markingadeparturefrom the traditional four-year rhythm that characterised prior periods of tightening and easing(forexample,20112015,20152019,and20192023.Agrowingnumberof macrostrategistsnowarguethatthecurrentcyclehasextendedtowardafive-year framework.

● First, record US Treasury issuance throughout 20242025 absorbed a significant share of private-sector liquidity, offsetting much of the Fedʼs quantitative tightening. Despite restrictive monetary policy, fiscal support remainedelevatedwellinto2025.

● Second, the tapering of quantitative tightening QT) was delayed from an original expectation that it would be completed by Q2Q3 2025. In fact, balance sheet runoff persisted through 2025, QT is now expected to ease onlybylate2025orearly2026,havingjuststartedonDecember1,andhas effectivelypostponedthenextliquidityexpansionphase.

● Third, large debt repayments alongside front-loaded fiscal programmes, particularly those tied to industrial policy and green investment, have kept liquidityconditionstighterforlongerthaninpreviouscycles.

Lookingaheadto2026,theimplicationsareincreasinglyconstructiveforBTC.Net Treasury issuance is projected to decline as tax receipts improve and fiscal deficits narrow. At the same time, a tapering of QT should reduce liquidity headwinds. Taken together, these dynamics suggest that the next “boomˮ phase oftheliquiditycycleislikelytobegininlate2025orearly2026.

Such a shift would provide a more supportive macro backdrop for risk assets broadly, reinforcing the view that the current consolidation may be a transitional phase ahead of a renewed expansion driven by improving global liquidity conditions.

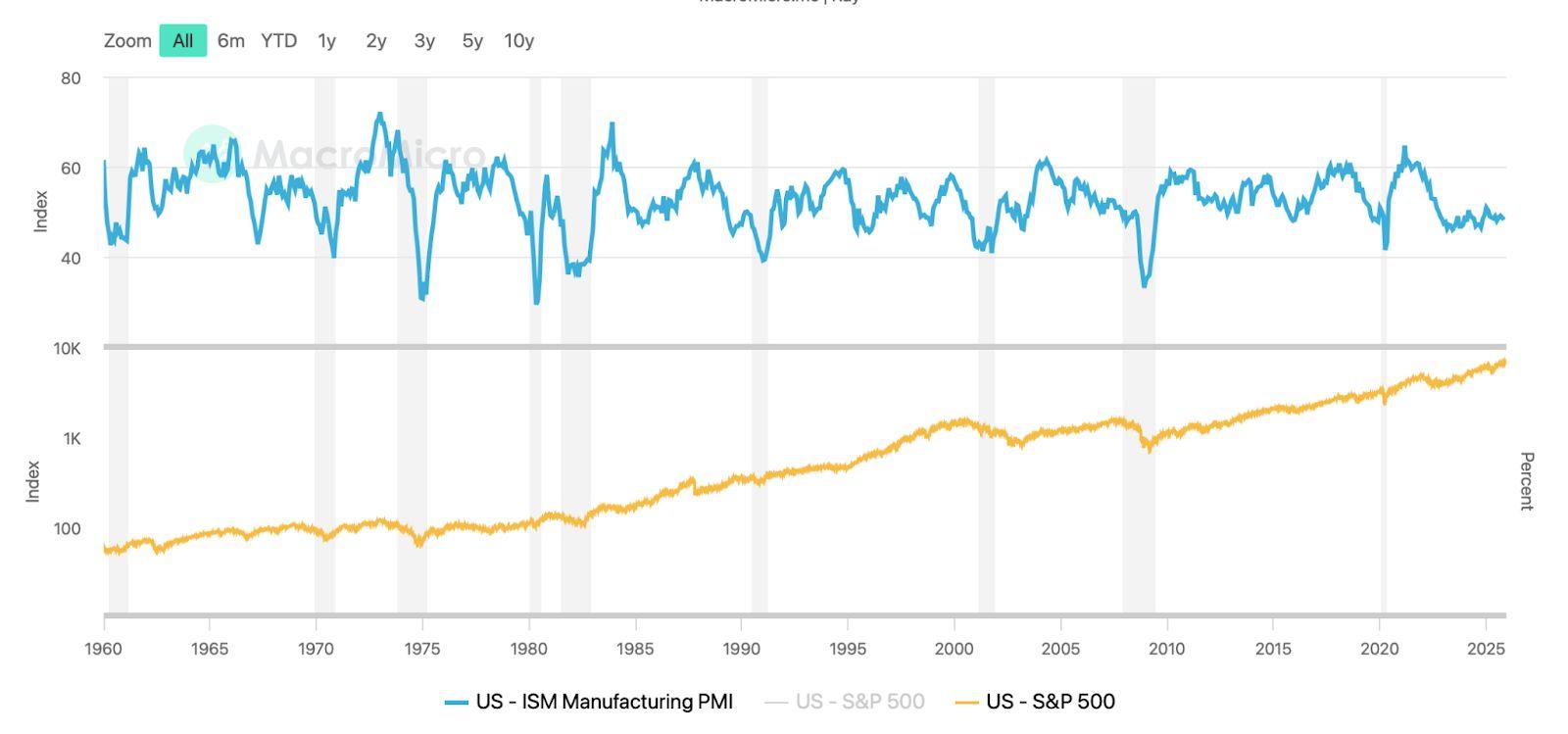

The ISM Manufacturing PMI is the equally weighted summation of the diffusion indexesoffiveindicators:neworders,production,employment,supplierdelivery, and inventory. The ISM Manufacturing PMI is an important economic indicator becauseitnotonlyprovidesarepresentationoftheconditionsoftheUSeconomy, but is also a good indicator of global demand. For our purposes it is also a key component of our argument regarding liquidity conditions across the economy, and how this will affect risk assets in general and BTC in particular. The ISM Manufacturing Purchasing Managersʼ Index PMI) has historically served as a leadingindicatorofcyclicalturningpointsineconomicactivity.Notably,majorBTC cycle peaks have tended to align closely with highs in the ISM PMI. As the index rolls over and trends lower, particularly when it falls below the neutral 50 threshold,forwardreturnsforbothBTCandequitymarketshaveoftenimproved.

Throughout 2025, the ISM Manufacturing PMI remained below the 50 level for sevenconsecutivemonths,signallingpersistentunderlyingeconomicweakness.

Historically,extendedperiodsofsub-50PMIreadingshaveprecededthetransition into Bitcoinʼs next expansionary phase, rather than marking its end. This pattern supportstheviewthatamajorcyclicalbottomcouldformtowardlate2025,withthe subsequent recovery and bull phase potentially extending into mid to late 2026 as economicmomentumstabilisesandliquidityconditionsimprove.

TheprecedingchapteroutlineshowBitcoinandthebroaderdigitalassetmarket havematuredintomacro-scaleassets.Asaresult,correlationswithtraditional macro hedges, particularly gold, have become increasingly relevant. At this stageofmarketdevelopment,assessingBTCʼsbehaviourrelativetosafe-haven assets,rather than focusing narrowly on equity correlations,provides a more robustframeworkforunderstandingcycledynamics.

Figure5.RelativePerformanceOfBitcoin,GoldandSPXSinceTheBeginningOfThe CycleIn2023.Source:CounterFlow)

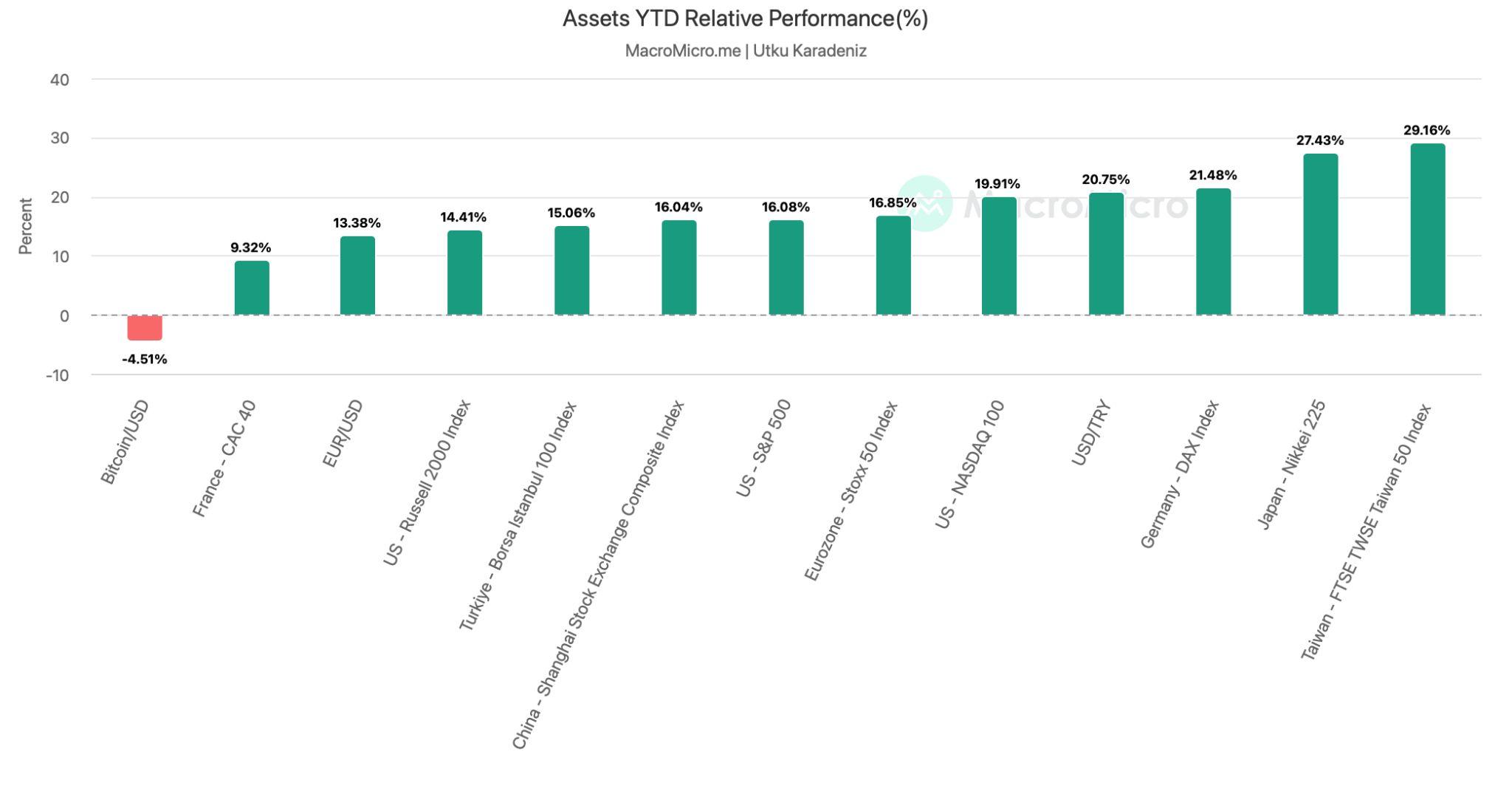

WhileBTCʼsperformancethrough2025hasbeencomparativelymuted,goldhas delivered one of its strongest rallies in decades. By late October 2025, the S&P GSCI Gold Spot Index had risen approximately 55.6 percent year-to-date. On a trailingtwelve-monthbasisintolateOctober,gainsexceeded50percent.Another widely used proxy, the SPDR Gold Shares GLD ETF, recorded a year-to-date returnofmorethan63percentbymid-December,placingthismovearound1.75 standard deviations above goldʼs long-term average performance. Historically, this implies that gold has outperformed roughly 95 percent of all comparable twelve-monthperiodssince1970.

Severalstructuralforceshavedriventhisexceptionalperformance:

● Central bank accumulation: Major buyers, including China, Poland, and India,increasedgoldreservesaggressivelythroughout2025.

● Geopolitical and fiscal uncertainty: Persistent tariff disputes, geopolitical tensions, and expanding sovereign deficits reinforced demand for traditionalsafehavens.

● Shifting monetary policy expectations: The Federal Reserveʼs transition from tightening to an easier stance, boosted demand for non-yielding assets.

● De-dollarisationpressures:Countriesexposedtosanctionsriskcontinued toaccumulategoldasapoliticallyneutralreserveasset.

MarkethistorysuggeststhatgoldoftenleadsBTCatmacroturningpoints,with BTC following several months later. This pattern has repeated across multiple cycles, including 20122013, 20152017, and 20192021, where gold broke out firstbeforeBTCenteredamorepronouncedexpansionphase.StatisticallyBTCʼs positive annual volatility expands quickly, i.e. percentage price movements towardstheupsideoccurs100150tradingdaysafteraGoldpeak.

Thislead–lagrelationshipcanbeexplainedthroughseveralchannels:

● Riskhierarchy:Goldiswidelyperceivedastheprimarysafe-havenasset. DuringperiodsofrisingmacrostressandUSdollarweakness,institutional capital typically rotates into gold first. BTC, still viewed as higher beta, tendstobenefitlaterasrisktoleranceimproves.

● Liquidity sequencing: Early stages of rate cuts compress real yields, favouring gold. As liquidity conditions continue to ease, investors increasinglyseekhigher-returnassets,allowingBTCtooutperforminlater phases.

● Inflation and debasement expectations: Gold responds quickly to concernsaroundfiatdebasement.BTC,positionedas“digitalgold,ˮtends tofollowonceadoptionbroadensandinstitutionalconvictionstrengthens.

In 2025, this dynamic appears to be re-emerging. Goldʼs exceptional rally reflectsheightenedmacrouncertaintyandsustainedcentral-bankdemand.

Inthemeantime,BTChaslargelytradedsidewayswithamodestnegativereturn. Ifhistoricalsequencingholds,itmaybegintorespondmoreforcefullyoncegoldʼs momentum stabilises, potentially extending the cycle beyond the traditional four-yearframework.

BTChasevolvedfromaniche,retail-driveninstrumentintoanassetincreasingly governed by macroeconomic variables. Liquidity conditions, real interest rates, theUSdollar,andinflationexpectationsnowexplainagrowingshareofitsprice behaviour.

OnecommonanalyticalpitfallisoverrelianceonBTCʼscorrelationwithequitiesin the technology sector. While BTC often trades alongside the Nasdaq during risk-onphases,thisrelationshipcanbreakdownwhenliquiditydynamicsdiverge. A clear example occurred during 20232024, when BTC rallied strongly despite underperformanceintechstocks,drivenbyimprovingnetliquidityconditions.

MoreeffectiveindicatorsfortrackingBTCʼsmacrobackdropinclude:

● Net liquidity, defined as the Federal Reserve balance sheet minus the TreasuryGeneralAccountandtheReverseRepoFacility.

● Realyieldsandinflationbreakevens,asBTChashistoricallyperformedbest whenrealyieldsfallandinflationexpectationsrise.

Viewed through this lense, BTCʼs recent consolidation appears less anomalous and more consistent with a macro asset transitioning toward maturity, one that increasingly responds to the same forces shaping global capital flows and safe-havendemand.

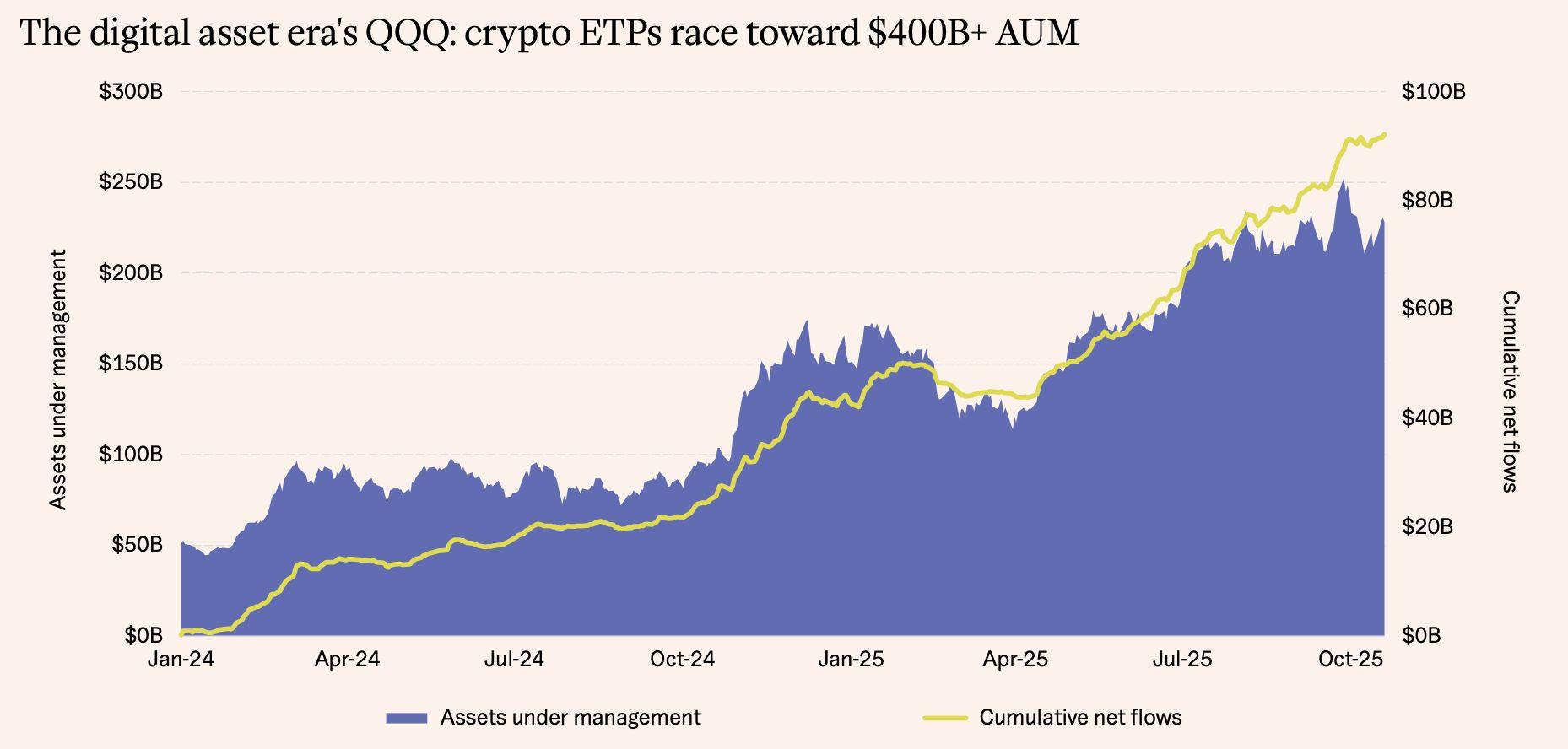

Cryptoexchange-tradedproductsETPshaverapidlyemergedastheprimary access point for traditional investors seeking exposure to digital assets.Last year,weprojectedthatglobalcryptoETPswouldsurpass$250billioninassets under management AUM) at their peak — a milestone that was briefly achievedinOctober2025.Lookingahead,weexpectthisgrowthtrajectoryto acceleratefurther,withglobalcryptoETPAUMontracktoexceed$400billion by the end of 2026, potentially overtaking the size of the Nasdaq-100 ETF QQQ,oneofthelargestandmostestablishedequityETFsglobally.

Source:21shares/ Bloomberg)

Bitcoin ETPs alone now hold more than $140 billion in assets, equivalent to roughly 7 percent of total BTC supply. These vehicles have evolved beyond tactical trading instruments into strategic allocation tools. Alongside individual wallet holdings, ETFs and funds now represent the largest share of BTC held, underscoringthegrowingdominanceofpatient,long-termcapitalinthemarket.

Retailaccesshasalsoexpandedmeaningfully.MorganStanleyadvisersarenow permitted to recommend Bitcoin ETFs, while the $9.3 trillion US 401(k) market has opened the door to allocations in both BTC and Ethereum. Current US 13F filings show that non-institutional accounts hold approximately 73 percent of BTCETPshares,withinstitutionsaccountingfortheremaining27percent.

Thisskewhighlightshowearlyinstitutionalpenetrationstillis,whilealsoreflecting the inherently retail-native design of these products. Low minimum investment thresholds,ticker-basedaccessacrossmajorbrokerages,availabilitywithinIRAs, and potentially 401(k)s combined with one-click recurring purchases have positionedcryptoETPsasadefaultchoiceforeverydayinvestors.

Structural barriers in the US are also being dismantled. The Securities and ExchangeCommissionʼsintroductionofgenericlistingstandardshasremovedthe need for asset-by-asset approval processes, representing a significant breakthroughfortheindustry.Thischangehasopenedthedoorformorethanten additionaleligibleassets,includingSolana,XRP,andDogecoin.Bylate2025,over 120cryptoETPapplicationswereawaitingreviewintheUS,settingthestagefor abroadexpansionofregulatedexposurebeyondjustBTCandETH.

Globally, adoption is accelerating in parallel. The UK has lifted its retail ban on crypto ETPs, while Luxembourgʼs sovereign fund made its first allocation, committing1percentofits$764millionportfoliotoBitcoinETFs.Pakistanandthe Czech Republic are exploring the establishment of national BTC reserves, and across Asia and Latin America, regulatory frameworks are taking shape. Together,thesedevelopmentsarepositioningcryptoETPsastheglobalstandard forregulateddigitalassetaccess.

This expansion creates a powerful flywheel effect. As AUM grows, bid–ask spreads tighten, volatility compresses, and liquidity deepens all of which attract incremental capital. Should BTCʼs market capitalisation reach the $56 trillion range, even a modest 1015 percent allocation through ETPs would imply total assets well in excess of $400 billion, reinforcing the central role these vehicles arelikelytoplayinthenextphaseofdigitalassetadoption.

2025markedatransitionyearfortheUSeconomy,definedlessbycrisisand more by adjustment.Inflation continued to cool from its post-pandemic peak but remained stubbornly above target, the labour market softened without breaking, and the Federal Reserve cautiously pivoted from restraint toward gradualeasing.

Financial markets responded unevenly: equities pushed to record highs on expectationsoflowerratesandresilientearnings,whileTreasuryyieldsdeclined as policy and growth expectations shifted. Overlaying these domestic dynamics was a renewed turn toward protectionist trade policy, with aggressive tariff actions reshaping global trade flows and injecting new uncertainty into the inflation and growth outlook. This report examines how these forces interacted acrosslabourmarkets,prices,monetarypolicy,assetmarkets,andtradeoverthe courseof2025,andwhattheyimplyheadinginto2026.

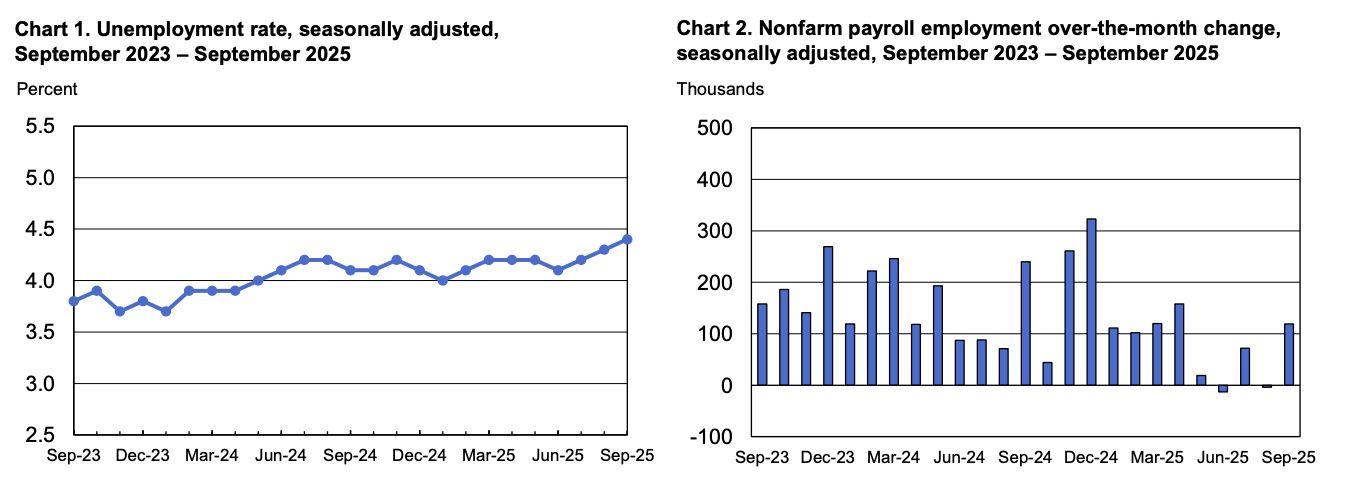

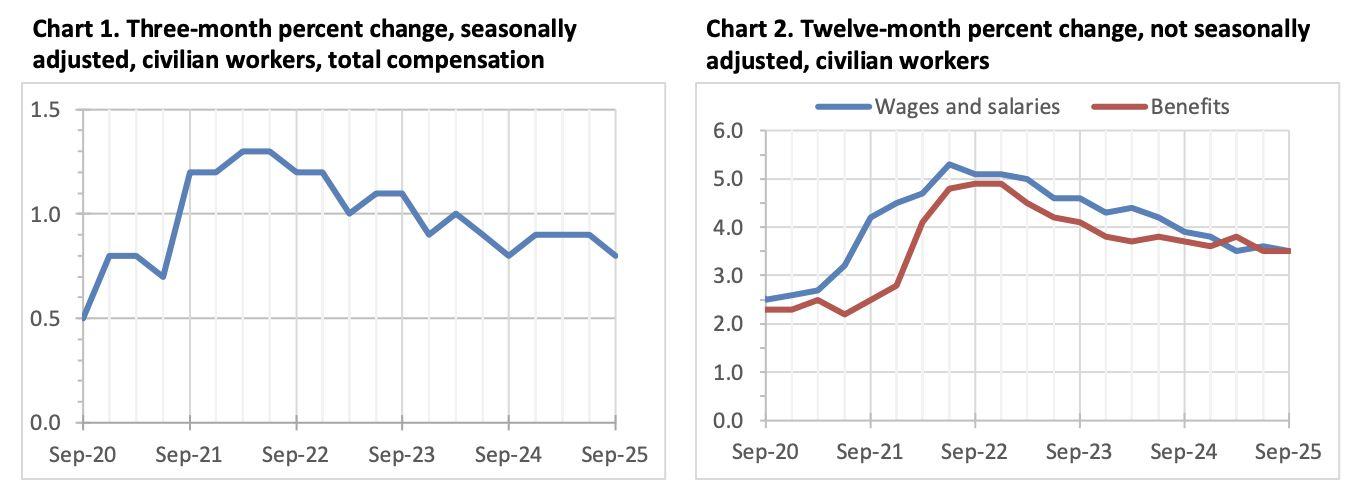

The US labour market showed clear signs of cooling in 2025. By the end of the yeartheunemploymentratehad creptuptoabout4.4percent,roughlya4‑year high, as job growth slowed. Monthly payroll gains averaged only around 60120,000bymid‑2025,wellbelowthe150200,000gainsseenduring202122.

Wage growth also moderated: average hourly earnings were up about 3.8 percent year‑over‑yearinSeptember,downfrom56percentgrowthin2021.Jobopenings and quits have likewise eased. For example, October Job Openings & Labor Turnoverdatashowedopeningsrisingonlyslightlyto7.67millionwhilehiringfell. Layoffs were also little changed from September to October. In short, 2025 the labour market bore all the hallmarks of a “no‑hire, no‑fireˮ environment: companies were cautious about hiring more workers, and quits stalled, leaving the labour marketlooserthanayearearlier.

Over the course of 2025, Bureau of Labor Statistics revisions confirmed this softness. As was highlighted by the White House itself, the regular revisions to official labour data showing job gains during the course of the year resulted in the 12‑monthperiodendingMarch2025beingreviseddownby900,000,anaverageof 75,000permonth.

Asaresult,althoughemploymentroseonanetbasisduringthecourseoftheyear,it didsoatamuchslowerpacethanbefore.TheFederalReserveʼsDecember FOMC statementdrewthesameconclusion,notingthatjobgainshaveslowedduring2025, whileunemploymenthasrisen.

Labour force participation has been roughly steady 62.362.6 percent), so the uptick in unemployment largely reflects weaker hiring rather than more people enteringthejobmarket.

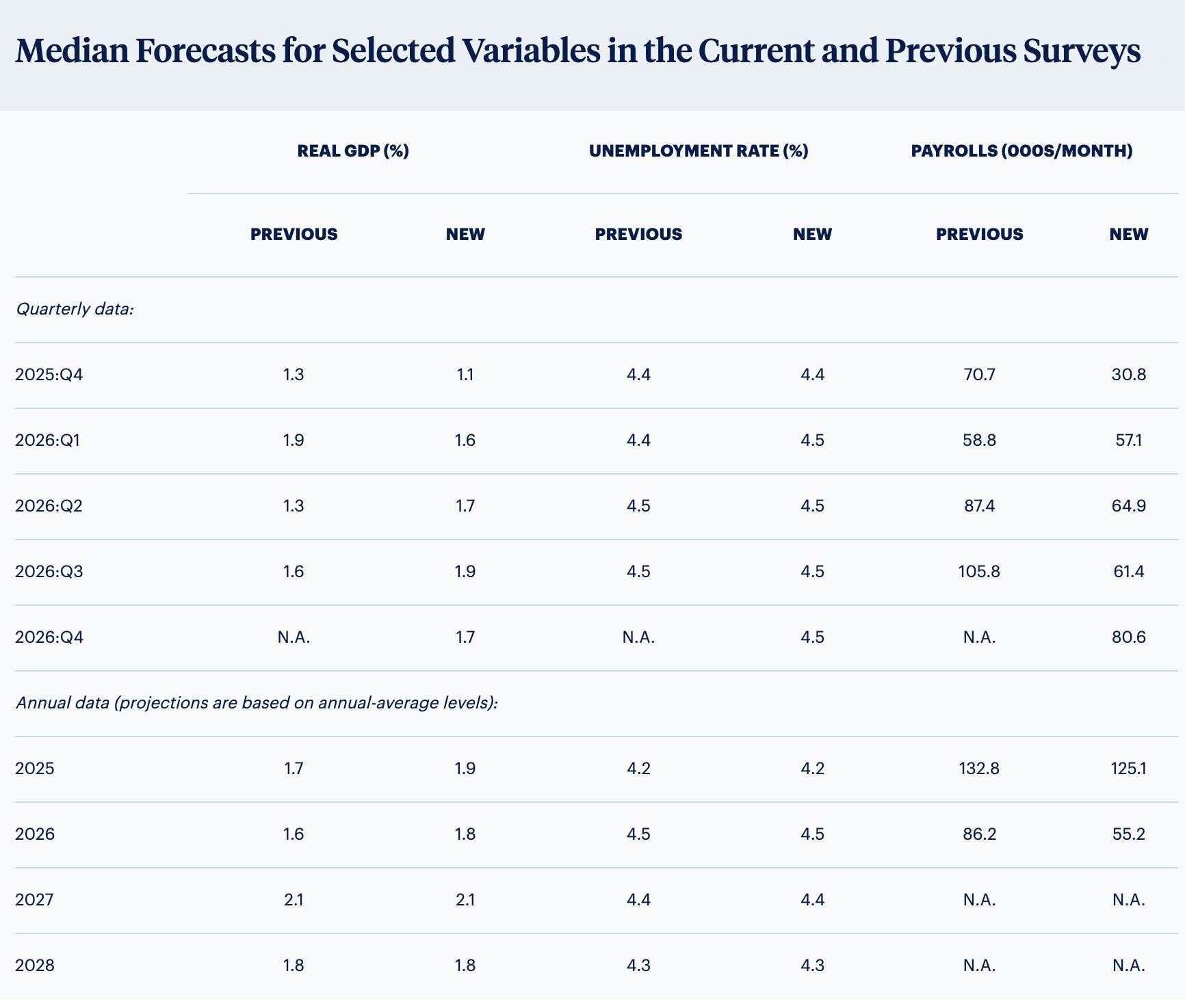

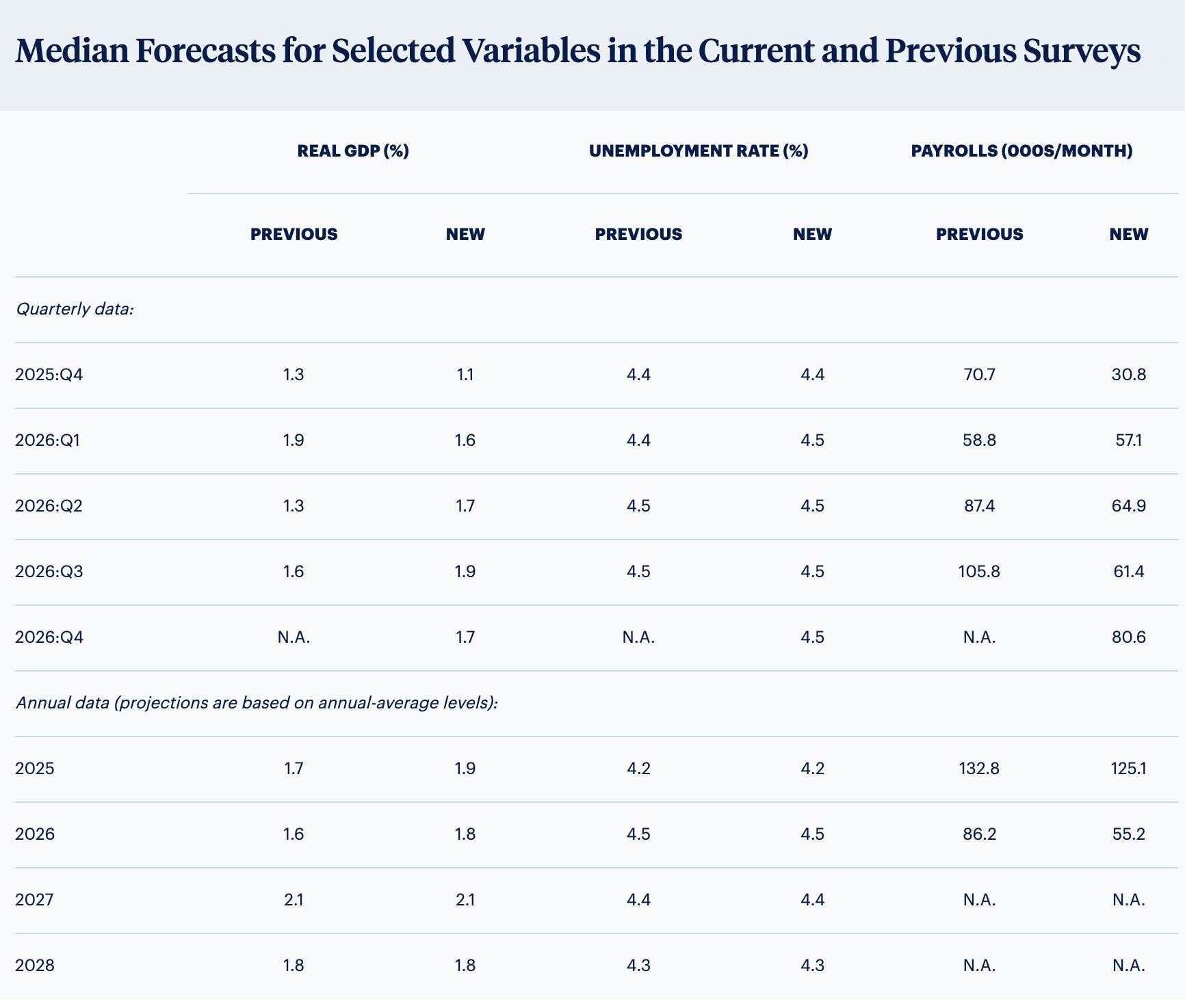

Looking ahead, we expect only modest labour-market strain in 2026. The Federal Reserveʼs latest economic projections (as of December 2025) project the unemployment rate to remain near 4.44.5 percent through 2026. A Philadelphia Fed survey Q4 2025) similarly projected unemployment rising to about 4.5 percent in 2026. Payroll gains are expected to slow further, roughly 57,000jobs/monthonaverageinthefirstquarterof2026versus110,000jobs permonthinthefirstquarterof2025.ConsensusforecastsseerealGDPgrowth atonly1.8percentin2026.Theoutlookfor2026suggestsalabourmarketthat remains soft but stable. Employers are likely to require fewer new workers as growthslows,yetwithoutwidespreadjoblosses.Withhiringsubdued,quitslow, layoffs contained, and labour force participation steady, unemployment is expected to hold near current levels rather than rise sharply. Of course, risks remain:asharperpullbackinconsumerdemandortradeuncertaintycouldforce jobcuts,inwhichcaseunemploymentwouldrisemoresignificantly.

We expect wage growth to decelerate further. With a drop in quits and weaker jobpostings,wagegainsarelikelytoslowinto2026.Labourcostmeasures(the ECI already show the slowest annual rise since 2021 (about 3.5 percent year‑on‑year through Q3 2025. In short, firmsʼ wage pressures should ease, which,inturn,supportstheinflationoutlook.

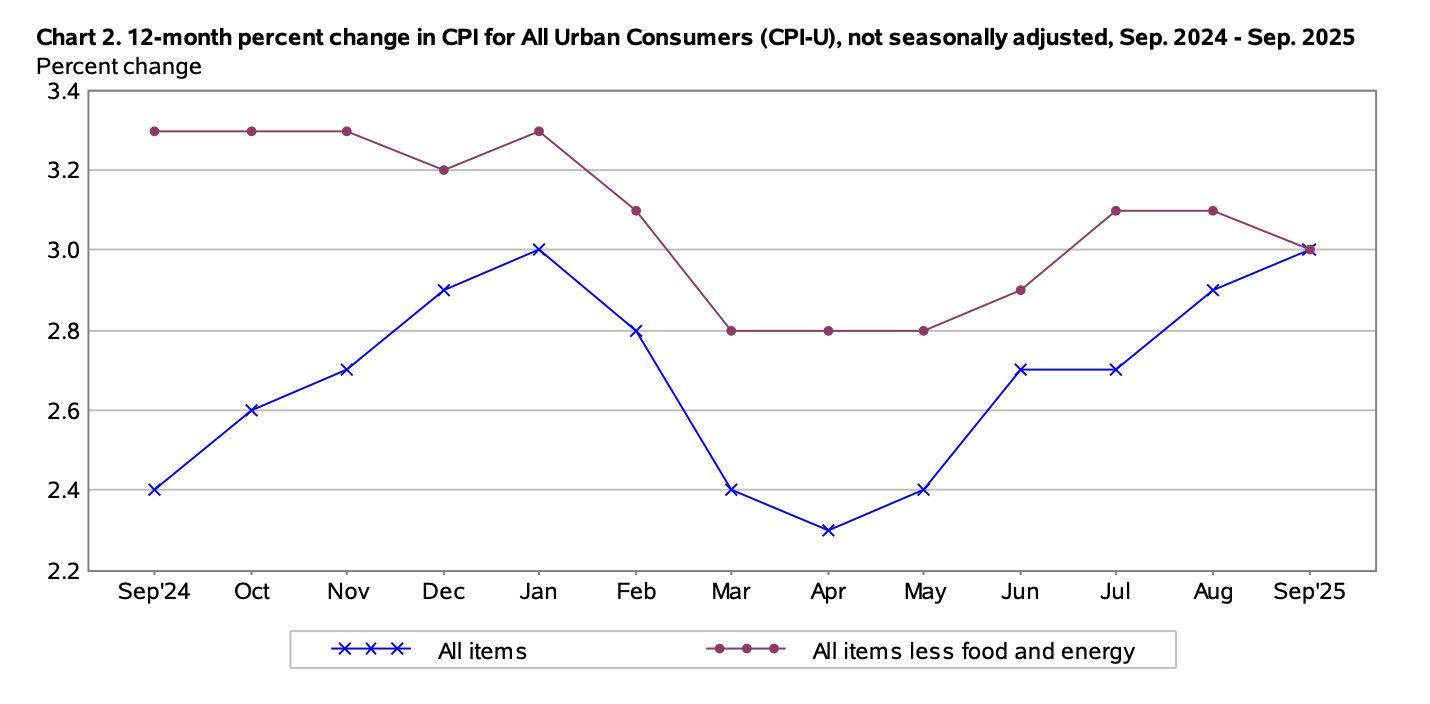

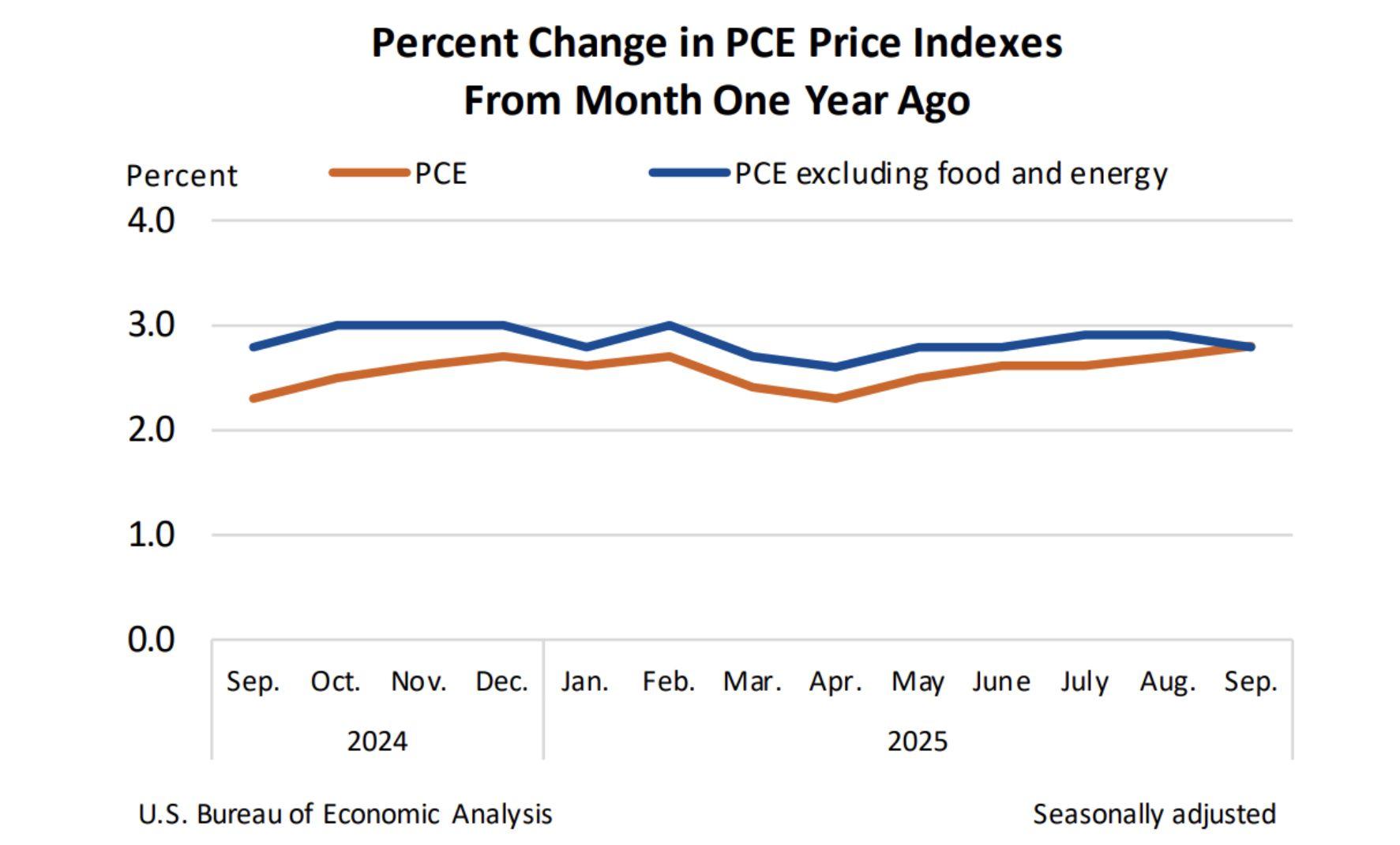

US inflation in 2025 continued to moderate from the highs reached in 2022, but nottoalevelthatitreachedtheFederalReserveʼs2percenttarget.BySeptember 2025, headline CPI Consumer Price Index) inflation was about 3 percent year-over-year,withcoreCPI(excludingfoodandenergy)also around3percent. The Fedʼs preferred gauge, the PCE Personal Consumption Expenditures) price index, ran a bit lower at 2.8 percent year-over-year for both headline and core PCE in September. Importantly, inflation decelerated compared to late 2024 strong price pressures in late 2024 gave way to more moderate increases from JanuarytoSeptember2025.

While the CPI and PCE indices are both measures of consumer inflation, they have important differences. CPI is based on a fixed “basketˮ of goods and servicespurchasedout-of-pocketbyurbanconsumers,whereasPCEcapturesa broaderrangeofexpenditures(includingthosepaidonbehalfofhouseholds,like employer-covered healthcare) and uses a chain-weighted formula that accounts for consumers substituting cheaper goods. As a result, CPI tends to run slightly higher than PCE. CPI also gives more weight to housing costs, whereas PCE assignsgreaterweighttohealthcareandislessvolatileduetoitsmethodology.

ShelterandHousingCosts:These werethesinglelargestcontributorstoinflation in 2025. As of September, shelter prices were up 3.6 percent year-over-year. Because housing carries a significant weight in consumer baskets, it ended up accountingforabout1.7percentagepointsoftheoverall3percentoverallinflation rate in 2025 - an indication of how much shelter costs accounted for overall inflation.

Services and Wages: Categories like medical care, transportation services, and personal services had inflation in the 34 percent range, contributing significantly to core inflation. Sticky services inflation, tied to wage pressures and steady demand for services, kept core inflation above 2 percent. Even if goods and housinginflationeases,servicesinflationremainsakeydriverofinflation,andwill remainelevatedunlesswagegrowthcoolsfurther,orproductivityrises.

Monetary Policy and Demand: Itʼs important to note the backdrop of Fed policy in curbing inflation. The Federal Reserve raised interest rates aggressively in 20222023,bringingthefedfundsrateto5.5percentbyJuly2023,thehighest in decades, to suppress demand and tame inflation. These higher rates slowed interest-sensitive spending (such as housing investments and durable-goods purchases),helpingtocoolpricepressures.Aftercompletingitsinitialroundofrate cutsinDecember2024,theFedheldpolicysteadyforanextendedperiod.Onlyin September 2025, as inflation continued to moderate, did the Fed begin cutting ratesagain.

Looking ahead, we expect inflation to gradually ease in 2026, though not without somebumpsalongtheway.InflationislikelytostayabovetheFedʼstwopercent goal for most of 2026, only approaching 2 percent by the end of the year. The Philadelphia Fedʼs Survey of Professional Forecasters Q4 2025) projects CPI inflation(headline)ofaround2.8percentQ4/Q4)in2026,abitlowerthan2025ʼs 3 percent pace, but still elevated. Their outlook for PCE inflation is slightly more optimistic, at about 2.6 percent by Q4 2026 (with core PCE 2.7 percent). The Conference Board forecasts that PCE inflation will peak slightly above 3 percent year-over-year in early 2026 (partly due to some tariff-related price increases) beforeeasingto2.3percentbylate2026.Insummary,itislikelythatinflationwill plateauoreventickupinthefirsthalfof2026,beforeresumingadownwardtrend inthesecondhalfoftheyearasone-offpressuresfade.

TheFederalReserveʼs2025policymarkedashiftfromearlierrestrainttogradual easing.InJanuary,theFedhelditstargetrangeat4.254.5percent,notingitwas in no hurry to cut until clearer data emerged. Starting in September however, the Fed did begin to cut: it lowered rates by 25 bp to 44.25 percent in September, and again to 3.754 percent in October, and finally to 3.53.75 percent in December as inflation remained elevated even as the labour market began softening. The latest Fed forecast (“dot plotsˮ) suggests that there will be one more cut in 2026 additional 2026 cut. In sum, 2025 ended with the Fed easing cautiously (net 75 bp), balancing still-high inflation against signs of slowing growth.

As these changes to monetary policy were executed, the Fed also continued its quantitative tightening QT process, first initiated in 2022, by allowing maturing Treasuriesandmortgage-backedsecurities torunoffthebalancesheet,reducing total assets from a peak of nearly $9 trillion to approximately $6.6 trillion amid emerging money market strains, including spikes in repo usage and short-term rates.

In late October, the FOMC announced that it would cease this balance-sheet runoff, effective December 1, reinvesting all maturing securities, rolling over Treasuries,anddirectingMBSprincipalpaymentsintoshort-termTreasurybillsto stabilise holdings. New Fed Governor Stephen Miran supported ending QT immediatelyratherthaninDecember.

At the December FOMC meeting, the Federal Reserve initiated reserve managementpurchasesRMPsofTreasurybills,beginningonDecember12atan initial monthly pace of approximately $40 billion. These technical operations, focused on short-term bills (or coupons with maturities of 3 years or less if needed), aim solely to maintain ample bank reserves, offset seasonal and trend growth in non-reserve liabilities (such as currency in circulation), and ensure effectivecontroloverthepolicyratewithoutsignalingbroadermonetaryeasing.

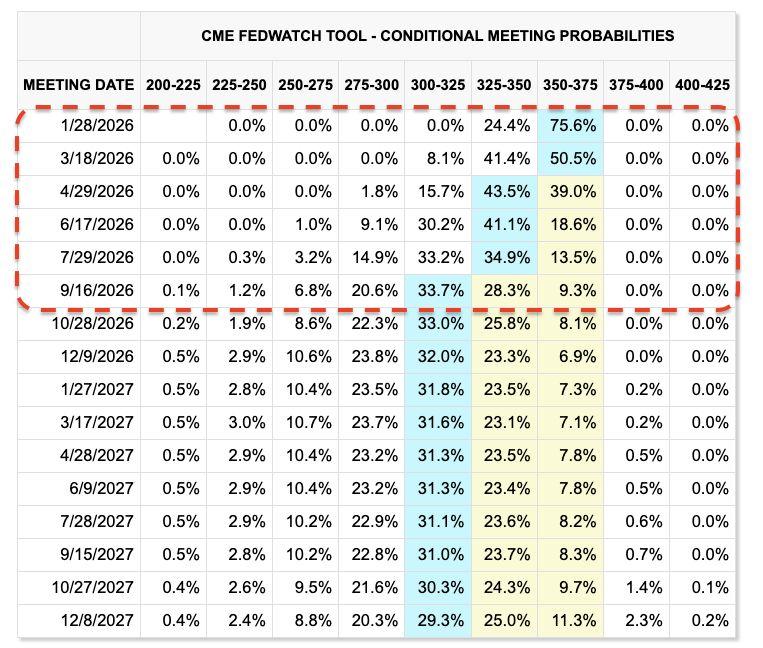

WhiletheFedFundsrateisnowat3.503.75 percentwithonlyonefurthereasing forecast in the current Fed dot plot, we believe there is further room to cut. With unemploymentdriftinghigher,jobcreationslowing,andinflationcontinuingtoease, albeit remaining above target, we see scope for a more accommodative path. Our base case is two to three additional rate cuts in 2026, a view that aligns with the CME FedWatch Tool, which currently assigns higher probabilities to three rate reductionsovertheyear.

In 2025, US stocks rallied significantly, with large-cap indices hitting record highs by year-end. The S&P 500 gained roughly 19 percent YTD, the Nasdaq Composite about 21 percent, and the Dow roughly 14 percent. Equities staged a notable early-yearsell-offontrade/tariffjittersandstalledgrowth,butreboundedstrongly thereafter. Key catalysts included disinflationary pressures, Federal Reserve rate cuts, strong corporate profits, and renewed investor enthusiasm for AI-driven technology.

Meanwhile,US Treasury yields trended lower over 2025. In January, the 10-year yield peaked near 4.8 percent, fueled by elevated inflation expectations and fiscal deficits. But as the Fed paused and then began cutting rates, yields eased. By mid-December, the 10-year yield was about 4.14 percent and the 30-year around 4.79percent.Short-termratesfellevenmore:thetwo-yearyield,whichhadbeen roughly4.28percentearlyintheyear,droppedtoabout3.5percentbyDecember 12.Insum,theyieldcurvesteepened,withshortratesfallingfasterthanlongrates, asdisinflationtookholdandtheFederalReserveshiftedtowardeasierpolicy.

In2025,theperformanceofbothUSequitiesandTreasurybondswasshapedbya confluence of moderating inflation, softening labour market dynamics, and a decisivepivotinFederalReservepolicy.Labourmarketdataconfirmedaslowdown in hiring, with unemployment rising to 4.4 percent by late 2025 and wage growth easingto3.8percent,contributingtoasofteningincoreinflation.Inresponse,the Fed cut rates three times between September and December, and ended its quantitativetighteningprogram.

These moves, aimed at supporting liquidity and countering a decelerating economy, fueled investor optimism and improved financial conditions. In the bond market, Treasury yields declined throughout the year, particularly at the short end ofthecurve,asmarketsanticipatedfurtherratecutsinto2026.

Lookingahead,keyrisksincludeinflationsurprises,slowdownsinChinaandAsia, orrenewedtrade/policyshocks.Butasoflate2025,marketsappearpricedfora benign 2026: solid growth 22.5 percent GDP, easing inflation and continued, but cautious, Fed easing. Under these conditions, we expect further gains in stocks (with S&P targets in the 7,5008,000 range) and lower Treasury yields 10-year sub-4 percent). Investors remain watchful of the Fedʼs path: a more aggressivecutcyclecouldpushstocksevenhigherandyieldslower,whereasany signofinflationstickinesscouldrebalanceexpectations.

In 2025, President Donald Trump's second-term trade agenda centered on an aggressive tariff strategy aimed at addressing persistent US trade deficits, protecting domestic industries, and forcing fairer terms from global partners. Dubbed"AmericaFirst,"thepolicykicked offdramaticallyonApril2,onwhatTrump called "Liberation Day", with the declarationofanationalemergencyunder the International Emergency Economic Powers Act IEEPA. This paved the way for a baseline 10 percent tariff on nearly all imports from every country, effective April 5, followed by higher "reciprocal" rates on dozens of nations with the largest deficits or perceived unfair practices.

The approach escalated quickly: steel, aluminum, and copper tariffs rose to 50 percent, while imported automobiles faced 25 percent duties. Targeted hikes hit Canada,Mexico(initially25percenttiedtomigrationanddrugissues),andChina (up to 2030 percent combined with fentanyl-related measures). By mid-year, averageUStariffratessoaredtoaround27percent,thehighestinoveracentury, generating hundreds of billions in revenue but sparking global retaliation and marketvolatility,includingabriefstockcrash.

Yet flexibility emerged amid rising consumer prices and economic pressures. TrumpnegotiatedframeworksanddealswithpartnerslikeJapan,SouthKorea,the EU,andseveralLatinAmericannations,leadingtoexemptionsforkeyagricultural productsinNovembertoeaseaffordabilityconcerns.Thetradedeficitnarrowedto itslowestinyearsbyfall,withimportsdroppingsharply.

As 2025 draws to a close, the Trump administration's tariff regime appears headed toward a period of relative stabilisation in 2026, though significant uncertaintiespersist.Thepolicies,whichelevatedtheaverageeffectiveUStariff rate to around 1618 percent (the highest since the 1930s), have generated substantial revenue while contributing to import compression and inflationary pressures. We expect limited new broad escalations, with focus shifting to enforcement of existing duties, ongoing negotiations, and potential legal resolutions.

Thecore2025frameworkisexpectedtoremainlargelyintactinto2026,including the 10 percent baseline on most imports, higher reciprocal rates on dozens of countries (often 2050 percent for sectors like autos, steel, aluminum, and copper), and targeted duties on China (cumulatively 2040 percent in many cases,tiedpartlytofentanylandtradeimbalances).

TheUSeconomyhadclearlymovedoutofitspost-inflationshockphaseandinto a period of recalibration. Inflation continued to trend lower but remained structurally sticky, the labour market softened without tipping into contraction, andtheFederalReserveshiftedtowardcautiouseasingwhileprioritisingfinancial stability and reserve management. Looking into 2026, the central theme is not acceleration but stability. Growth is likely to slow modestly, inflation should continue its gradual descent, and policy easing is expected to proceed carefully rather than aggressively. At the same time, elevated tariffs and geopolitical frictions introduce upside risks to prices and downside risks to growth, reinforcingahigherbarforpolicyerror.

The US Commodity Futures Trading Commission CFTC unveiled a landmark digital-assets pilot programme that permits Bitcoin BTC, Ethereum ETH, and the stablecoin USD Coin USDC) to be used as collateral in regulated derivatives markets. The move represents a significant policy evolution in how federal regulatorstreatdigitaltokenswithintheframeworkofUSfinancialoversight.

Under the initiative, Futures Commission Merchants FCMs and other qualified intermediaries may, for the first time under clear regulatory guardrails, accept thesecryptocurrenciesasmargincollateralforfutures,clearedswaps,andother derivativesproducts,ashiftdesignedtobringcrypto-linkedleverageandliquidity onshoreandunderCFTCsupervision,ratherthanleavingitlargelyoffshoreorin lightlyregulatedvenues.

Acting CFTC Chair Caroline Pham framed the pilot as part of a broader modernisation effort following the enactment of the GENIUS Act, with the aim of expanding tokenised collateral use while maintaining investor protections and rigorous monitoring. The program requires participating firms to submit weekly reports on digital-asset holdings and immediately notify the regulator of any material operational issues, providing the CFTC with real-time insights into collateralflowsandriskdynamics.

As part of the rollout, the CFTC also issued updated guidance on tokenised collateral,includingstandardsforlegalenforceability,custody,andvaluation,and withdrewoutdatedstaffadvisoriesthatpreviouslydiscouragedtheuseofcrypto assets as margin, reflecting a broader philosophical shift toward technology-neutral regulation that integrates digital and traditional financial instrumentsunderconsistentrisk-managementprinciples.

Industry leaders have welcomed the programme as a critical step toward institutional adoption, noting that enabling crypto collateral within a regulated derivative structure can reduce settlement frictions and enhance capital efficiency,whilealsosupportingthedevelopmentof24/7marketsintheUSunder acompliantframework.

Severalmajorcryptofirms,includingRipple,Circle,BitGo,FidelityDigitalAssets, andPaxos,havereceivedconditionalapprovalfromUSregulatorstooperateas federallyregulatednationaltrustbanks.

TheOfficeoftheComptrolleroftheCurrencyOCCannouncedonFridaythatit hadgrantedconditionalapprovalforthecreationofRippleNationalTrustBank, an entity affiliated with Ripple Labs, the company closely associated with the XRPLedger.

Circle also secured conditional approval tied to a newly formed entity, First National Digital Currency Bank. In a statement, Circle CEO Jeremy Allaire described the approval as a significant milestone that would provide greater regulatory certainty for institutions building on Circleʼs infrastructure as stablecoinsandblockchain-basedfinancialservicesgainbroaderadoption.

In addition, the OCC approved applications from BitGo Bank & Trust, Fidelity DigitalAssets,andPaxosTrustCompanytotransitionfromstate-charteredtrust companiesintonationaltrustbanks.

If finalised, these limited-purpose banking charters would allow crypto firms to custody client assets under federal oversight, though they would not be permittedtotakedepositsorissueloans.Still,theapprovalsmarkameaningful steptowarddeeperintegrationbetweendigitalassetmarketsandthetraditional financialsystem.

The push for federal trust bank charters comes amid a more accommodating regulatory stance toward crypto under the current Trump administration. OCC ComptrollerJonathanV.Gouldemphasisedthatwelcomingnewparticipantsinto thefederalbankingframeworkbenefitsconsumers,thebroaderfinancialsector, andtheoveralleconomy.

JPMorgan has created a Solana-based US Commercial Paper USCP) token to facilitate a landmark debt issuance on the Solana public blockchain for Galaxy Digital Holdings. This represents one of the earliest instances of a major traditional financial institution executing a corporate debt offering on a public blockchain and a significant step in institutional adoption of blockchain-based capitalmarketsinfrastructure.

In the transaction, JPMorgan served as the arranger, and issued the on-chain USCP token representing Galaxyʼs short-term corporate debt, which was purchased by institutional investors Coinbase Global and Franklin Templeton, though the exact size and terms were not publicly disclosed. Both the issuance and eventual redemption proceeds are settled in Circleʼs USDC stablecoin, anotherfirstfortheUSCPmarketandanexampleofintegratingregulateddigital cashintotraditionalsecuritiesissuanceandsettlementworkflows.

JPMorgan said that executing this trade on Solana demonstrates not only institutional appetite for digital-asset innovation but also the bankʼs capability to securely bring new financial instruments on-chain, leveraging Solanaʼs high throughput and efficiency. For Galaxy, this represents its first US commercial paper issuance, with the on-chain format intended to strengthen short-term funding capabilities and broaden access to institutional investors by incorporatingblockchain-basedmoney-marketinstrumentsintotheirportfolios.

Coinbaseʼsroleextendedbeyondjustinvestmentinthetoken,asitalsoprovided private-key custody and wallet services for the USCP token and supported onand off-ramp services for USDC, reflecting deeper ecosystem collaboration between traditional financial institutions and digital-asset infrastructure providers. The deal follows broader experimentation with tokenised financial instruments across public chains and underscores how blockchain technology could reshape capital markets by offering programmable, transparent, and real-timesettlementalternativestolegacyprocesses.