A question is bubbling away in the background: “Is everything back to normal yet?”

The resounding answer is: “No, that’s impossible.” The UK cycle market has gone through too much change in recent years.

The obvious disruptive event was the industry’s rise and fall associated with the Covid lockdowns. It is almost possible to argue the market could ‘reset’ or return to normal after that. Sure, there’s probably going to be more caution on ordering and more focus on supply chains, but it seems possible that we could turn the page on that chapter in our collective history.

That other big recent disruption to the UK market, the enactment of Brexit, meant the position the UK had enjoyed of supplying a large chunk of cycle gear to overseas consumers was no longer quite as simple or competitive for those consumers, with big cash-flow-shaped consequences for anyone involved. Even if your company didn’t directly get hit by that one, it seems vanishingly unlikely you didn’t get some kind of associated consequence.

Those two factors, mixed with the broader economic and retail changes currently underway (tariffs, more online ordering, less physical retail footfall, high streets fighting with retail parks, etc) all add up to a UK cycling industry that has shifted beyond where it’s possible to ‘get back to normal’ or rewind the clock to 2019.

I promise that this wasn’t originally intended as an extended call to action to come along to CIN Live 2025 on 14-15 September, but in a way, that’s exactly what it is. There’s always a need to examine your business, question your choices, turn the spotlight on that corner of the shop that customers seem to avoid, or address why it’s so hard to keep hold of your workshop mechanic. The trouble is, there’s not always a great opportunity to do it. Those are some of the kinds of topics we hope to help you address at CIN Live 2025, and of course the show is a great chance to meet with industry peers and compare notes.

The industry has weathered a great many storms and adapted. You could argue it’s not always been great at accepting things have changed, but that’s another good reason to meet, listen, question and shoot the breeze at industry gatherings (like, indeed, CIN Live 2025)... so see you there!

Jonathon Harker

jon@cyclingindustr y.news

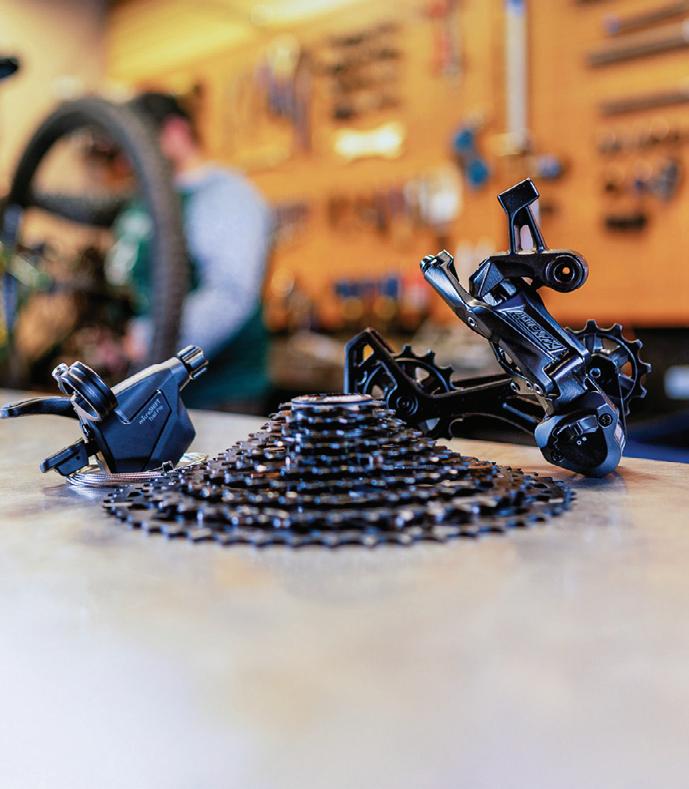

There’s a degree of unanimity that the workshop is vital for the retail trade, but are we seeing any evidence that the service side of independent retailers is in growth? Or do fairly static numbers indicate that the workshop is not yet fulfilling its potential for a large proportion of independents? We examine the stats from CIN’s Market Data

One of the benefits of having a few years behind the CIN Market Data project is that there is now just about enough data to compare results and pinpoint a few trends. Regular readers will have spotted us dipping into this honey pot of information of late in CIN and we’re taking the opportunity to do so again here, namely in examining the importance of the workshop.

The broad industry consensus is that the workshop is a critical part of not just keeping the nation’s cycle riders on their bikes, but also to keep bike retail businesses profitable. With a workshop, independents have the diversity of income of a service side and a retailing side. Given the recent market challenges with overstocks, it might have been logical to expect that shops would have focused harder on their service offerings and workshops, but – on the face of it – the stats don’t appear to support that belief.

In 2025, the bulk of independent bike shops saw the workshop represent up to 40% of their business. Rewinding back five years, pre-Covid and pre (implementation of) Brexit, it’s a picture that is surprisingly static. Back in 2020, the same number of shops were in the 0%-40% category.

Looking closer, shops where workshop trade represents 0%20% of their business has increased (2000: 21% versus 2025: 27%), indicating a fall in the importance of the workshop for a fair number of shops. Back in 2020, a chunky 27% of respondents said the workshop represented 80-100% of their business. In 2025, that total was down slightly to 23%, further hinting at some softening of the workshop share.

As always, there are a multitude of ways to interpret those stats – perhaps retail is growing over the workshop in turnover terms, particularly with sales on overstock items still making their way through the sales channels? Or maybe workshop recruitment has

“ONE FAIRLY IRREFUTABLE FINDING FROM THE STATS – SEEMS TO BE THAT THE WORKSHOP IS A ROCK SOLID RELIABLE CONTRIBUTOR TO MANY BUSINESSES”

been a challenge (as has been finding the cash to pay a mechanic head) so that side has been pared back, limiting the potential and workload that workshops have been able to handle?

One fairly irrefutable finding from the stats seems to be that the workshop is a rock solid reliable contributor to many businesses. While there may not be a great deal of change for the majority of retailers, that kind of stability is gold dust – not even a

market as severely disrupted as the cycle trade’s has been in the last five or six years has knocked the workshop significantly.

Nevertheless, it’s either a negative that the workshop hasn’t actually grown across the board, or it’s yet another nudge for shops that workshops are perhaps not yet fulfilling their potential and there’s room to grow the business, and profitability, through service.

Of course, the CIN Market Data is not perfect and, naturally, those that take the survey are probably fairly engaged with CIN. So we urge shops and workshops to use their voice and take part in the next survey and feel free to shoot us views and insights on the topic.

Finally, we’ve expended a lot of time writing and talking about the workshop for some the reasons outlined above, and that will be reflected in the seminar programme of CIN Live 2025. If you’re able to get along to Stoneleigh, there will be much content (and product) focused on the workshop and helping businesses make the most of theirs. Find out more at live.cyclingindustry.news

YReporting for CIN, Chris Keller Jackson gets an early look at a purpose-built ‘mega-factory’ for Tianjin Golden Wheel, 1,000 miles north of Shanghai. Golden Wheel is a huge player in the frame making and bike assembly business and recently struck a deal with small wheel and folding bike specialist Dahon…

ou probably don’t know of a company called Tianjin Golden Wheel. You should, but it’s unlikely that any of the bike brands that have their frames made there, or have their bikes assembled by them would thank you for revealing the ‘dark secrets’ of the badge engineering that goes on in the Far East. This is not intended to be clickbait – this is the reality of a global bike trade.

Badge engineering should be no dark secret to the trade, the bike trade have been getting expert third parties to make their frames and assemble their bikes, sometimes for cost reasons, sometimes for efficiency and sometimes for quality reasons, for many a year. Golden Wheel goes back to 1987, (reality check – that is 38 years ago!) Many big-name brands just don’t have the capability to build their own bikes en masse. China and Taiwan are the masters of this, along with emerging countries such as Vietnam and Thailand. Far from denigrating this approach, we should be championing these businesses, for they are the best

at what they do, for the markets they supply to, whether that is for cost, scale or quality.

Golden Wheel already make low cost through to ‘car priced’ bikes. They mass produce bikes, they weld aluminium into frames, they paint them and then add stocked parts to build up bikes to put into boxes. What makes this feature different is the very near future, with two investments at scale that are currently underway in the provinces of China. These are helping redefine mass manufacturing.

Dahon partnering with Golden Wheel Dahon – who began producing bikes in 1982 – is a brand you will be familiar with, one of the venerable brands that have delivered successful small wheel and folding bikes to the UK market (shoutout to the UK small wheel pioneers – Moulton, Bickerton Portables and Andrew Ritchie). As the brand digs into eBikes they have developed a partnership with Golden Wheel to continue to deliver the quality products you’d expect from Dahon. I got a

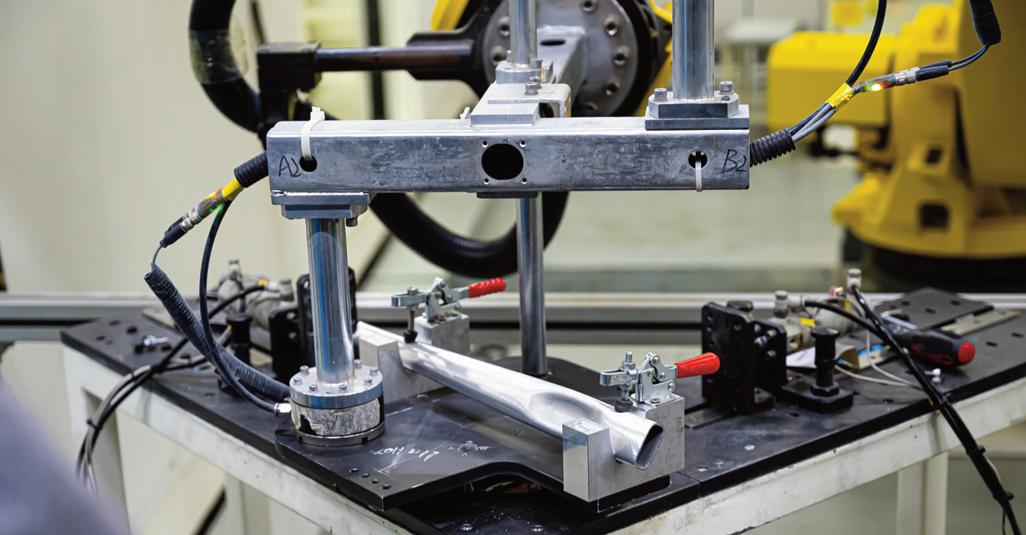

chance to see this facility in Tianjin, a province 1,000 miles North of Shanghai in May 2025, a month before we were told that it would be operational. On 10 May 2025, this enormous space (40,000m2) is half filled with stock that needs relocating, and half cleared flooring with advanced automation, robotic tooling and infrastructure waiting to be bolted to the floor. I’m told that a month from now (which will have passed by the time you read this article), there will be formal production in this plant for Dahon. Given the pace and efficiency I have seen in China on this trip, I can believe this bold claim. Nothing to ‘see’ other than a glimpse of the future partnership and the incredible efforts made to progress this facility, some test apparatus in an onsite testing lab and piles of past production and spare parts stocked in neat rows – the brands of which I can’t tell you about. It is forecast that his facility will product up to 400,000 eBikes, domestic scooters and three wheelers (think TukTuk) for Dahon per year.

The original all-weather, hi-vis cycling collection just got better. Designed to keep riders moving through dark evenings and unpredictable conditions.

WINTER 2025 COLLECTION AVAILABLE TO ORDER NOW Contact your account manager for details

Why the reason for this partnership?

Dahon has been at the pinnacle of folding bike and bike manufacture for 42 years and have recently launched a ‘Dahon 2.0’ campaign. This is a step change in technology, with this partnership with Golden Wheel forming a major part of this investment in the future. This change in focus comes with new models and promised improvements in folding technology resulting in improved ride stiffness and changes to frame structures in some of the range (Dahon call this Dahon-V). This all adds up to lighter and stiffer frames and better ride characteristics.

In addition to proposed changes to refine current models, new bikes will bolster the range including the impressive looking Vélodon C8 Di2 carbon fibre road bike, with an enhanced Eagle frame design, the sleek looking Télodon C8 AXS

“WE ARRIVE AT THE NEXT LOCATION, BEFORE US IS WHAT CAN ONLY BE DESCRIBED AS A ‘MEGA FACTORY’, PURPOSE BUILT WITH BRAND NEW ROAD INFRASTRUCTURE TO CONNECT TO ITS SUPPLIERS AND THE NEARBY PORT OF TIANJIN”

lightweight folding bike and the KFeather folding eBike, both with enhanced downtube rigidity and the proprietary Deltech frame tensioner. I’m looking forward to testing these.

We move on, get into a minivan and take a trip further into rural China. The cooperative partnership with Dahon was in an existing technology park and a repurposing of an existing building, but when we arrive at the next location, before us is what can only be described as a ‘Mega Factory’, purpose built with brand new road infrastructure to connect to its suppliers and the nearby Port of Tianjin. Here stands two very large multi-story purpose-built buildings joined by a connecting bridge. Pictures taken, I delve inside, and initially there is nothing here, except the occasional supporting pillar and

impressively skimmed concrete floors. I didn’t bring my roller skates.

With pride, we are told that this is Golden Wheel’s new factory ‘Jinjiu (Tianjin) Technology Co., Ltd’, primarily for eBikes. It’s truly enormous inside too, 100,000m2 over 4 floors (to put that in context, it’s about 15 Football pitches in total!), with an airbridge between the two buildings. This will build frames and paint them in one side, automate the transfer of frames into the second side then build the frames into bikes –sounds simple. Far from it, this is something from the manufacturing future, complicated and dedicated.

Exploring further on the ground floor of the ‘Frame side’, there are a host of enormous stillages with installed robotic arms, shrink wrapped and ready to position. There is a lot of machinery to install, similar to the Dahon / Golden Wheel partner-

ship I saw – but on a much bigger scale. Then something familiar but not seen in this trip. Side by side are three massive weaving looms, not the type you’d see in a Victorian Mill, all dusty with child labour fixing broken strands of cotton. Wider and deeper, this is the starting point for carbon weaving. I’m told that this factory is all about ultimate quality and that begins with the best Japanese fibres, and control of the weave, by weaving in house. Three looms means they can be self-sufficient, and weave different qualities and cloth patterns side by side. I’m not seeing any autoclaves (the pressure ovens used to ‘bake’ carbon fibre and resin into hard frames) but I’m told there will be plenty. I’m also told that when they are up to speed it is forecast to produce 5,000 carbon frames per month.

I also don’t see any of the jigs and

formers used as moulds for carbon frames. Some jigs will be manufactured in house and some will be outsourced, depending upon the company the frame is being made for. For optimal carbon frame quality there will probably need to be a clean room environment, with forced negative air and a controlled atmosphere when laying up the material.

The frame side of the factory will also make alloy frames, far more at a staggering 70,000 per month. Most of the robots on the ground floor relate to tube butting and welding of aluminium. Even with a concentration of machinery in place on the ground floor, I suspect there is more machinery to arrive – this building and the floorspace is truly vast.

The upper floor of this ‘Frame side’ is populated by a maze of central mezzanine structures, pipework and internal walls, as a building within a building.

This is the frame finishing area. This facility will utilise the latest ecological water-based paint techniques to prime and finish frames then put them into curing areas, QC and decal lines. Though the scale is massive, and the technology is impressive and highly automated, this is fairly straightforward, but on a larger scale. Next door is where the real ‘magic’ happens.

Frames are stored in Building One until ready for assembly, they are then transferred via the bridge using an AGV (Automated Guided Vehicle) to be placed at one of 14 production lines. As the frames enter Building 2, they pass through a sensor (most probably RFID, the same technology embedded in the sticker on your airline hold luggage) that identifies the product and its routing within assembly, downloads the parts needed (the Bill of Material) and automatically picks those parts from the Warehouse. These parts are then delivered from the Warehouse to the production line, ‘just-in-time’ for the bikes to be built. This is another facet of the efficient Toyota Production

System (TPS) in use within China.

The team had built one production line to test the process, having installed the visual screens, indicators and infrastructure, it was easy to envision how this might look when there were dozens of workers building up bikes on this line, but there would be 14 different lines over two floors, each dedicated to a run of a product. There will be over 1,000 workers here. The lines have flexibility to change to the next model with little dwell time. This combination of automation, humans assembling bikes, controlled by screens and detailed work instructions is key to the efficient, quality controlled and reproducible production, to see it on this scale (even if most of it is currently empty) is impressive. I really hope I get to see it in full production over the next few years.

Of what they have built so far, the jewel in their crown sat right at the end of the one production line in place. I’m sure it was operational just for us to witness. There was a roller conveyor taking boxed sample eBikes, automatically wrapping them in banding tapes

then delivering to a massive robot arm

This robot had a set of vacuum suckers as its ‘hand’, and picked and placed each box with a eBike inside onto a pallet. The cantilever strength in the arm, and the suction strength in the hand was very impressive. The ability to pick, flip and place boxed eBikes with such precision, and without human intervention is what automation and use of technology is about. No heavy manual handling, repeatable optically managed robot delivery to the pallet, then out of the door.

Tianjin Golden Wheel are placing a lot of trust in eBikes, for the domestic and export markets. This trust is underpinned by a belief in their strategic analysis of trends, and a sizeable investment in buildings, automation and technology. Perhaps this visit is two or three months premature, but to capture the ‘before’ to envisage the future, and potentially revisit the eventual reality is a tantalising glimpse into the future of Badge Engineering on such a massive scale.

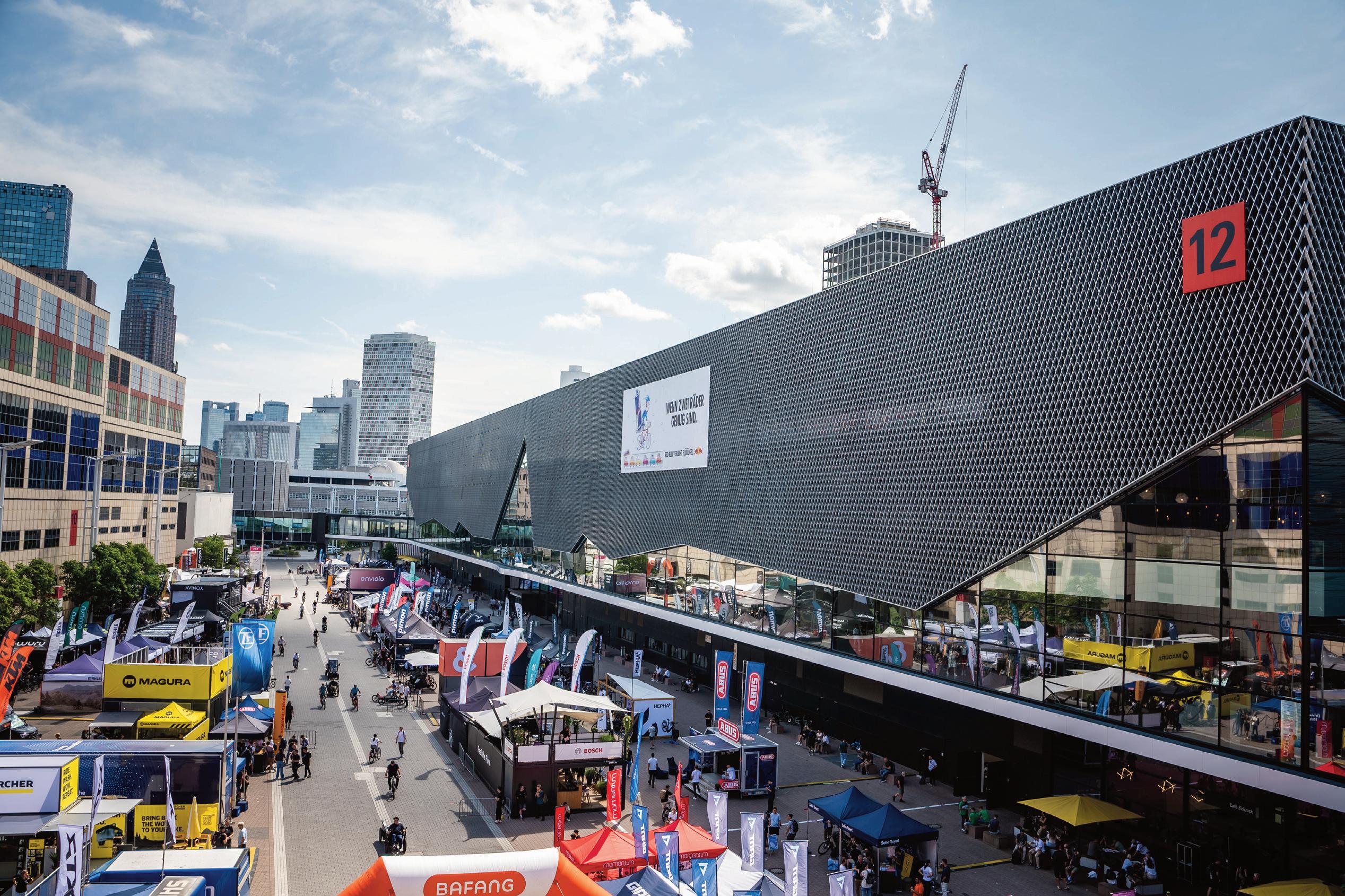

State of the Bicycle Industry: after years of turbulence, the bicycle industry is showing cautious signs of stabilisation. But Eurobike 2025 revealed: challenges remain –from weak trade show dynamics to renewed geopolitical headwinds. Cycling Industry News contributor Werner Müller-Schell reports from Frankfurt...

If there’s one place in the world that captures the mood of the global bicycle industry the most, it’s Eurobike. For over three decades, the German trade show has served as the sector’s emotional and economic epicentre—a space where optimism is measured in footfall and floor space, where innovation meets market reality. It is therefore no coincidence that in 2025, as the industry continues to grapple with pandemic aftershocks, lingering overstock and

shifting global dynamics, all eyes turned once again to Frankfurt am Main, where Eurobike took place from June 25th to 29th. The mood, however, was neither upbeat nor despairing, but something more subdued – measured, even tentative. There were signs of recovery: deeper conversations, renewed energy, a hint of forward motion. Yet, many left with more questions than they arrived with. Eurobike 2025 didn’t mark a turning point. What it delivered was something quieter

but equally telling: a glimpse of an industry caught between reflection and reinvention.

The context for this cautious optimism has been years in the making. After the record-breaking boom during the pandemic – when bicycles

became both lifestyle symbols and global scarcity goods – the industry was left with the consequences of its own success. Overstocked warehouses, disrupted supply chains and collapsing margins defined much of 2022, 2023 and 2024. Retailers strug-

gled with liquidity, manufacturers throttled production, and the market, once overheated, cooled dramatically. Discounting became the norm, and the optimism of the boom years gave way to a more sober realism. By the time Eurobike 2025 rolled around, the worst had arguably passed – but the damage lingered. Inventories were still being cleared, many dealers remained cautious, and confidence had yet to return in full. The trade show took place in an industry that is slowly finding its balance again – walking the line between consolidation and renewal. And while signs of recovery were visible, they stood on ground that still felt anything but solid.

The good news first: After two sobering years, the latest financial statements from publicly listed bicycle companies suggest that the long-awaited recovery may have finally begun. German online retailer Bike24 posted a remarkable 17.8% revenue increase in Q1 2025, driven by international growth and better inventory control. Shimano, still a bellwether of global cycling trends, reported a 15.6% rise in bicycle segment sales and a 38.5% jump in operating profit, pointing to a normalising supply chain in Europe. Merida impressed with a 29% revenue surge, while even Giant –despite shrinking profits – managed modest sales growth. And though Fox Factory’s CEO Mike Dennison advised caution, the American company still posted a 6.6% gain in its bicycle business. The tone across reports was strikingly similar: cautious optimism, improving topline figures, and better planning—but persistent pressure on margins and profitability. In short: the storm may be passing, but clear skies are not yet guaranteed.

The mood at Eurobike received a further boost from fresh domestic data. Just days before the fair opened its doors, the German bicycle industry association ZIV published its Q1 2025 figures—marking the first tangible signs of recovery on the national market. According to the report, German retailers sold 885,000 bicycles and eBikes in the first three months of the year, an 11% increase compared to Q1 2024. eBike sales alone jumped from 450,000 to 500,000 units, while traditional bicycles grew by 10%. After months of stagnation, these numbers were widely seen as a turning point— albeit a tentative one. Inventory levels are still high, and consumer confi dence remains fragile. But for an industry starved of positive news, the signal was clear: demand is not dead. And for companies in Frankfurt, it offered just enough encouragement to believe that the worst might, at last, be behind them.

Cracks beneath the surface Eurobike 2025 may have opened on a note of cautious optimism, but it didn’t take long for cracks beneath the surface to appear. Despite upbeat financial reports and signs of stabili sation across the market, the trade fair itself revealed a more complex picture—beginning with a noticeable drop in attendance compared to the

previous year. According to organiser fairnamic, just over 31,000 trade visitors made the trip to Frankfurt, almost 4,000 fewer than in 2024. The consumer weekend also fell short, with visitor numbers declining from 33,090 to 30,420. More than 1,500 exhibitors from around the world still filled the halls and open-air areas, but the energy on the show floor felt noticeably muted. Aisles were wider, foot traffic lighter, and conversations less spontaneous.

That subdued mood was amplified by the absence of several key players. German industry heavyweight ZEG and its brands chose not to exhibit, Pon.Bike prioritised its own Ride On events, and Specialized limited its presence to a small test fleet outside. But they were not alone: a number of well-known European and American brands were also notably missing. In their place, much of the floor space was filled by Asian component suppliers and OEM manufacturers—under-

D e signed f o r beginne r moun t a in bike rider s

• 12 moulded traction pins each side (with different shape)

• Reinforced composite body

• Chromoly steel spindle

• Upgraded, fully serviceable IGUS bearings & seal system

• 5 year warranty improve every rider experience

Distributors noted that many brands had begun reducing SKU complexity, prioritising core categories over breadth

scoring a shift in who shows up, and why. The result was a trade fair that felt thinner in presence and in atmosphere. Behind the scenes, questions about Eurobike’s direction became increasingly difficult to ignore. A preshow survey by German trade magazine SAZbike revealed that more than 40% of industry professionals were dissatisfied with the Frankfurt venue, and nearly half rated the event’s costbenefit ratio as poor. For a fair long regarded as the beating heart of the global bicycle industry, these figures struck a nerve.

And yet, despite the thinner crowds and high-profile absences, the atmosphere in Frankfurt was marked by a quiet, measured confidence. The conversations no longer revolved around existential threats or shortterm crisis management, but around repositioning, rebalancing, and rebuilding. Buyers spoke of noticeably improved delivery reliability, more accurate demand planning, and cleaner, more curated product portfolios. Distributors noted that many brands had finally begun adjusting pricing structures, reducing SKU complexity, and prioritising core categories over breadth. On the services side, concrete enquiries were coming in for integrations, digital tools and retail support initiatives – projects that had been shelved since the early

“THE CONVERSATIONS NO LONGER REVOLVED AROUND EXISTENTIAL THREATS OR SHORT-TERM CRISIS MANAGEMENT, BUT AROUND REPOSITIONING, REBALANCING, AND REBUILDING”

days of the downturn. The paralysis of the past two years had begun to give way to more structured planning and deliberate, if cautious, investment. Across the board, leaner inventories, stricter cost controls, and more realistic sales targets signalled a shift away from volume-chasing toward healthier, margin-focused business models. Eurobike 2025 reflected that transition. The scars of the reset were still visible – but so too was a sharpened focus on consolidation, quality, and long-term resilience in a market that has learned the hard way how fragile unchecked growth can be.

“The recovery is far from uniform”

But while the industry may be regaining its footing, the fair itself exposed a deeper uncertainty – particularly around the future of large-scale trade events. The more focused, strategy-driven conversations on the show floor stood in stark contrast to the halfempty aisles on key days, especially Friday. Attendance was down, and the energy lacked the urgency or excitement of past editions. This disconnect highlighted an ongoing shift: while companies are clearly investing in recalibration and long-term planning, they’re becoming more selective about where and how they engage. Eurobike wasn’t alone in feeling this hesitation. Early signals from this year’s Taichung Bike Week suggest a broader trend of declining commitment to major exhibitions. Rising costs, evolving marketing strategies and changed post-pandemic habits are challenging the traditional trade show model. For a globally fragmented industry that once relied on these fairs as anchor points, this growing reluctance has the makings of a structural transformation—raising the question of whether the old rhythm of the cycling calendar is still fit for the future.

New global risks emerge

This is all the more true given that the international trade environment

“TAKEN AS A WHOLE, THE STATE OF THE BICYCLE INDUSTRY IN MID-2025 REFLECTS A SECTOR IN TRANSITION – RECOVERING, BUT NOT YET RECOVERED”

is becoming increasingly volatile again. The Trump administration’s tariffs, set to take effect in early August, are already casting a shadow over global supply chains. Import duties on bicycle components and related goods will rise sharply, for example to 40% for goods from Myanmar, 36% for goods from Cambodia and Thailand, and 25% for goods from Japan. For many in the bicycle industry – already weakened by years of oversupply, margin pressure, and a cooling consumer market – these geopolitical tensions pose a serious risk. Rising import duties on bicycle parts and components threaten to push prices up, disrupt planning security, and put further strain on already thin margins. While some see opportunity in shifting production or sourcing, most companies are approaching the coming months with concern. In an industry as globally interconnected as cycling, trade wars don’t just hurt margins – they shake the very foundations of an already fragile recovery.

Taken as a whole, the state of the bicycle industry in mid-2025 reflects a sector in transition – recovering, but not yet recovered. Encouraging financial data, improving stock turnover, and more stable planning conditions suggest that the worst of the crisis may

indeed be behind us. Yet the recovery is far from uniform. Profitability remains under pressure, consumer confidence is still fragile, and structural challenges – such as excess capacity, shifting retail dynamics and evolving consumer habits – continue to weigh on the industry. Trade shows, once reliable pillars of exchange and visibility, now face scrutiny over their cost and relevance.

At the same time, new external threats are emerging. The return of trade tensions, especially in the form of fresh tariffs from the Trump administration, threatens to destabilise already vulnerable global supply chains and add new layers of uncertainty to pricing and procurement. What lies ahead is not a straightforward rebound, but a strategic recalibration: less volume, more value; fewer promises, more execution. It’s a time for careful rebuilding, smarter decisions, and stronger partnerships. In short, Eurobike 2025 didn’t offer easy answers. Instead, it made one thing clear: the bicycle industry's future won’t be defined by recovery alone, but by how it chooses to rebuild in an increasingly complex world.

Words: Werner Müller-Schell

Oxford is the one-stop solution for lighting this Autumn & Winter with a comprehensive range across both the Oxford & Sigma brands for all rider categories. Become an Oxford light stockist and enjoy the benefits below:

• Up to 60% dealer margin

• Sensible dealer stock commitment

• Ongoing preferential pricing until April 2026

• Free in-store POS

• Excellent stock availability

• Max output 300lm

• Run-time 2-16hrs

• 3 steady, 2 flashing modes

•

• Run-time 3-10hrs

• 6 modes including ‘auto-on’

• Max output 75lm

•

•

• Run-time 3.5-8.5hrs

•

•

• Run-time 3.5-8.5hrs

•

•

•

• Charging possible during operation

•

•

•

Become an Oxford light stockist and take advantage of our commitment to help you achieve the right retail environment for our products to sell.

Our lighting POS is designed for use as a counter-top or slat wall mounted solution to display both Oxford and Sigma ranges along with key product features and QR code links to more detailed product insight.

OXFORD LIGHT DISPLAY

TOP BAR

Ultratorch CL1600

Ultratorch CL1000

Ultratorch CL500

Ultratorch CL200

MIDDLE BAR

Ultratorch ST500

Ultratorch ST300

Ultratorch ST100

Ultratorch CubeX Front

BOTTOM BAR

Ultratorch R75

Ultratorch R50

Ultratorch Mini+ Rear

Ultratorch CubeX Rear

Not an Oxford customer? Please scan the QR code, email info@oxprod.com or call 01993 862300 for information on how to open an account.

SIGMA LIGHT DISPLAY

Buster 1600 Headlight

Buster 1100 Headlight

MIDDLE BAR

Buster 800 Headlight

Buster 400 Headlight

Buster 150 Headlight

BOTTOM BAR

Buster RL 150 Rear

Buster RL 80 Rear

Blaze Rear

Infinity Rear

An appendectomy was the unlikely catalyst behind the founding of Veloforte, a familycreated brand that prides itself on being 100% natural. That foundation – ever more timely as consumers focus on what they are using to fuel their bodies – has brought the brand plaudits. Co-founder Marc Giusti explains to CIN how surgery recovery prompted the creation of Veloforte and what’s next for the company…

Marc Giusti

Weirdly, it all came from a ruptured appendix. Before founding Veloforte, I had launched a brand and product innovation consultancy – having spent 25 years working with some of the biggest brands in the world across their digital and advertising strategies.

One sunny February morning whilst crossing Leicester Square, my appendix randomly and unexpectedly ruptured, requiring significant abdominal surgery and months of rehab. It was to become a sliding-doors moment for me and my wife, Lara [Giusti].

My focus turned heavily towards fitness and nutrition, re-igniting my passion for long distance cycling alongside a horrifying realisation of the ingredients being stuffed into the recipes of typical energy and nutrition products.

That set our perspective from day-one. To build a brand that could actively feed our health-wealth and performance from only natural ingredients. No labs, no gunk, no junk. Just delicious real food, fit for purpose, fit for body. With my all-new insides recently repaired, we weren’t going to go anywhere near the ‘fake goop in tubes’ found on all the shelves.

Getting to our first few products meant leaning heavily on Lara’s 20 years experience as a cardio-respiratory specialist alongside her side-hustle passion for baking multi-award-winning Panforte (an Italian speciality ‘cake’ from Sienna in Tuscany –driven by my family’s Tuscan heritage).

She set about making what were to become our three first energy bars: Classico, Ciocco and Di Bosco. As soon as I started sharing these homemade bars with my ride buddies, everyone wanted some. And that was where it started.

I built our first website in a weekend, reached out to events companies and retailers (Sigma Sports were our first) and before long demand grew and our home became a bakery, warehouse and dispatch all at once, with our young kids sticking the labels on the boxes and our friends hand-cutting the bars Lara was making.

After some time, whilst climbing the Puig Major in Mallorca, I found myself riding next to someone called Steve [Marson]. We got talking, he tried some of the bars and a few months later he became the third Partner in Veloforte, bringing decades of blue-chip operations and finance experience.

From there, the three of us turned Veloforte into a real thing, with real manufacturing and real customers and our house and kitchen could finally return to normal.

“REAL FOOD THAT REALLY WORKS”

It’s in our nature. The world doesn’t need yet more artificial foods. It needs real nutrition. At Veloforte, we're dedicated to one thing... crafting delicious real food that really works – helping you #fuelbetter every day with a range of nutrition that puts you in charge of your healthwealth. Real performance and vitality,

"They’re

real taste and quality takes more than mere science.

When it comes to physical performance, nutrition is the only thing you put inside you, everything else you put on or around you. Cyclists, runners, all active people dedicate a lot of their time and money to their passion and performance. From their kit to their wider lifestyles and diets.

Yet, all nutrition brands insist on stuffing their products with artificial ingredients, synthetic or lab-derived flavourings, preservatives, bulking agents and more – hiding their ingredients in small print, making ‘natural’ claims that have little substance.

To us, this is totally unnecessary and completely ignores the values and health benefits inherently found in great quality, real nutrition – it’s an industry-wide behaviour driven by commercial desires for greater margins and convenience. It’s not about performance. It’s simply untrue that we cannot produce exceptional performance nutrition or healthy eating products from all natural ingredients.

Our products prove that. Look at the macros of any of them – from our allnatural 20g Protein bars to our new CollagenPro, our natural Energy Gels to our Energy Chews – they deliver every

ounce as much performance as any artificial alternative, yet with all the health, taste and motivational benefits of real food – in exactly the portable formats our customers need.

Our first three energy bars became seven flavours. Then pure electrolyte powders, followed by a category-first all natural range of energy gels. From there we developed all-natural high protein and recovery powders and our marketleading soft energy chews (the original soft chews).

From there we expanded into wider healthy-eating products, helping our customers to continue their commitment to natural nutrition into their daily lives too with a nutritionally complete range of high-protein overnight oats and gut-healthy oat snack bars.

Most recently, we launched an exceptional daily collagen supplement called CollagenPro, specifically targeted at supporting whole-body health – feeding not only muscles, joints and bones, but cognitive function, vitality and immunity too. It’s a unique blend of Type I&III collagen with organic vitamins C, D and Zinc. We’re delighted with the responses we’re seeing, especially with almost half of our sales coming from men.

“WE RECENTLY LAUNCHED OUR NEW PROTEIN CRUNCH BARS… 20G OF COMPLETE PROTEIN, 5G OF PURE COLLAGEN AND 0G OF ARTIFICIAL NONSENSE”

We recently launched our new Protein Crunch Bars… 20g of complete protein, 5g of pure collagen and 0g of artificial nonsense. They’re the first proper protein bars with nothing to hide – nothing artificial, just ingredients found in kitchens, not in small print.

NPD comes from a whole host of inputs. Driven, designed and developed by Lara, she looks at how naturally delicious ingredients can form recipes that exceed their synthetic alternatives and develops products that complement our customers' needs, giving them ultimate confidence in their nutrition goals.

Trends and customer feedback play a big part for sure, but we have a simple three-part rule. If a product isn’t as natural as it is functional as it is delicious, then we simply won't make it.

We have some very exciting products in the pipeline, all helping our customers to stack their health and performance odds in their favour.

What you put in, you get out. If you’re really interested in eating clean, feeding your health and building your performance, you need to consider your whole day, not just your training or riding. That’s why we’ve created something we call the Power System – P.W.R

Our exciting new range of KX Wheels are produced right here at Bob Elliot HQ Utilising our specialist machinery, we prepare the hubs using reliable, economical, high quality componentry and lace the wheels before finishing them to precise tolerances with the use of a robot which are then quality checked to deliver the perfect wheel every time. Competitively priced replacement wheels offering a wide selection for 700C and all MTB disciplines.

Built here at Bob Elliot HQ IN THE UK

All wheels FInished to exacting tolerances Comprehensive range, PRICED competitively

Quality componentry from all around the World

Over 50 years combined wheel building experience

Next day delivery available

(Performance, Wellness and Recovery). Our range is deliberately designed to help you do this.

For instance, starting your day with a simple cup of coffee and a scoop of collagen, a bowl of our overnight oats and a protein crunch bar at 11.30am means you'll have had a nutritionally complete morning with up to 55g of protein. Not only does this help you stay fuller for longer (staying away from snacks), it supports your recovery, muscle development, immunity and daily performance. All from a deliciously simple and easy breakfast on the way to work.

With that kind of quality nutrition behind you, your training or competing can be optimised with all natural ingredients, electrolytes, carbs and proteins from our range of performance sports nutrition. A complete 360 view, powered by nature.

The Great Taste Awards represent ‘the Oscars of food’. In our space, with our real food proposition, being recognised for the quality of our products, by some of the UK and Europe's most celebrated food critics, chefs and producers is fundamental.

Our 43 golds make us the most highly decorated natural nutrition brand – no other brand comes anywhere close. When you couple this with over 30,000 5-star reviews direct from our customers, it’s humbling and immensely motivating to see the impact we are

having on our sector and our customer’s health, performance and enjoyment.

Like you, we love the planet we live on. We want all our 100% natural products to provide a positive contribution to your life and our planet – this includes the ingredients we source, how our products are produced and packaged. We wholeheartedly support the push towards plastic-free & non single-use plastics and are well ahead of the UK Govt’s latest 2027 plans for improved kerbside recycling – something the UK’s infrastructure has struggled to deliver on compared to other European countries.

For example, all our bars and chews wrappers are recyclable in-store (major supermarkets) as well as through our own free-return recycle programme –an active initiative we’ve had in place since 2019. We are thrilled to be currently trialling the latest recyclable materials across our multi-serve pouches, electroly te sachets and gels too, expecting to fully adopt them across the range in 2025.

Our ingredients are sustainably sourced too. From high-welfare farms and producers and manufactured in state-of-the-art facilities in the UK.

Lastly, when it comes to our warehousing, distribution and order fulfilment, all our packing is paper-based and widely recyclable from your own home – including the box tape.

DISTRIBUTION THROUGH EXTRA UK

Extra UK has made a huge impact on our abilities to reach and engage with IBDs. Before appointing them, we handled most of our sports distribution in-house. With our small team, it’s extremely hard to make this work well without the kind of resources and talent Extra UK have in abundance. Specifically for IBDs it means fast, flexible ordering and reordering, good commercial terms, the right POS and shelf appeal plus the confidence in continuity of supply and quality needed to help stores stand out and deliver the kind of repeat orders our products are built on.

In an ever more health-conscious world, being able to stock IBDs with the most contemporary natural nutrition products that directly answer customer needs on quality, efficacy, provenance, natural diets, sustainability and performance is something we’re deeply committed to.

www.extrauk.co.uk

veloforte.com

bob-elliot.co.uk

bob-elliot.co.uk/twitter

bob-elliot.co.uk/facebook

bobelliot-online

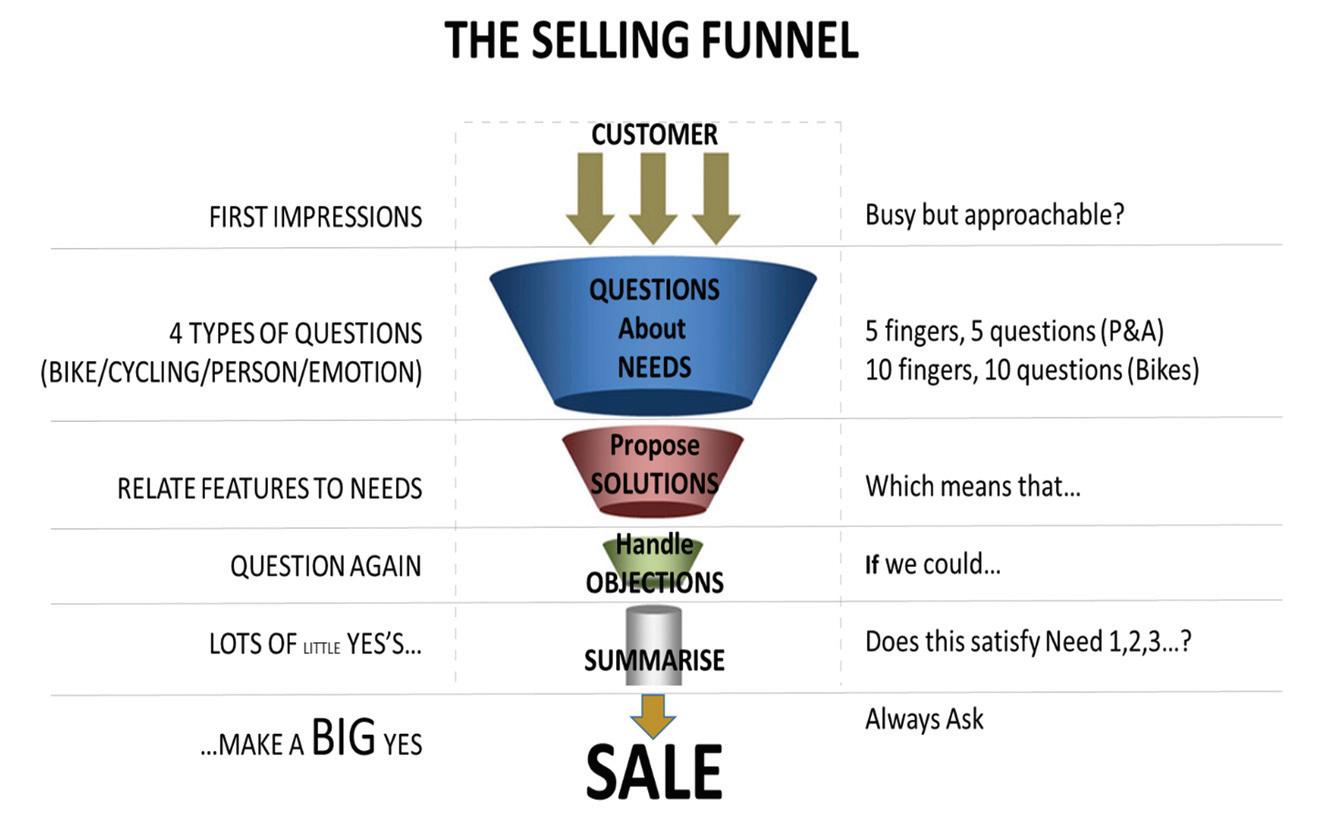

Objection overruled: How do you deal with that awkward moment in a conversation where the consumer says that whatever you’ve offered isn’t quite right? Knowledgeable cycle sales veteran John Styles examines some of the strategies to keep the conversation going and steer customers towards a sale…

In my last article, we talked about questions. I promised you we would talk about objections next. Now there is a step in between asking questions and dealing with objections which is about proposing a solution. Taking out a product and relating it to the consumer’s (stated) needs and suggesting it as the solution. I’m not going to summarise that stage, because from what I observe in stores, most staff are really good at that bit of the conversation!

It’s the next stage in the sales process, an objection (as it’s called in classic Needs Based Sales Training) where I’ve seen many people struggle. It’s that awkward moment in a conversation where the consumer says that whatever you’ve offered isn’t quite right. I’ve seen a lot of sales lost where the salesperson accepts that at face value and the conversation finishes.

Of course, sometimes the objection is so big, or strongly expressed, that we really do need to accept it. But a lot of the time what the consumer is really saying is “I’d really like to buy this product but…” The trick is understanding the “but.” Maybe it’s the colour, the price, perhaps the product seems too basic for them or perhaps too complex. Sometimes it can be a combination of things.

The process of objection handling In theory, handling an objection can be as easy as 1,2,3 – but of course it takes consistent practice to build up a good habit until it becomes second nature. So, try this 3-Step process if you can, and be patient – it may take a few goes until you feel it’s working for you...

(1) Lean In

So, the first thing to do is to lean towards (as opposed to away from) their objection by asking more questions, for example: What don’t you like about it?

(2) Accept

Second, demonstrate that you have listened and accept their answer, no matter your own personal feelings on it. For example, you might think this year’s eye-popping orange is fantastic, but if the consumer really hates fluorescent orange, it’s better to validate their personal opinion than challenge them.

(3) Isolate

The third thing that can help you is to isolate objections. So, if they have voiced one objection, be sure to check there are no more. Is that the only thing that’s troubling you?

After you’ve followed that simple three step process, it often feels natural to suggest another solution. So: “If we could solve that issue by offering you another colour would that work?”

The other thing you may want to do is give the consumer some time and space. The reason why many consumers leave at this point is not because of the objection itself. It’s because they are feeling overwhelmed. They’ve already invested emotional time and energy in the conversation, and at this point, dealing with something about the product that isn’t quite right can be a bit much. Now can be a great time to offer them a catalogue, a review or a cup of tea and somewhere to sit down.

When you return, you can get straight back into open questioning with things like: How are you getting on? Has a little time helped clarify things? Notice the focus is on them, not the product.

The person

Now that’s a little bit about the process, but I also want to talk about people. Everyone’s different and you’ll see a range of different emotions and reactions when people reach this point in the purchase process.

The angry objector

Sometimes when people get to this point, they can demonstrate annoyance, irritation or even be outright angry. And our normal human instinct when someone shows that emotion is to back up and back off.

Often though, in this situation it can be good to lean in closer, listen and accept. Because nine times out of ten, they aren’t annoyed with you, or the shop and you haven’t done anything wrong. They are simply frustrated that they haven’t yet solved their problem.

An example might be the 6’4” “never cycled before rugby player” who needs an XXL road bike for a charity ride in three weeks’ time and it quite simply has to be red to match the team kit. Of course, you know that’s going to be hard to find but explaining why may simply antagonise this consumer. It may be best just to simply agree, console and offer as many close alternatives as you can find.

The quiet objector

The other object to that is hard to deal with is the quiet objector. Someone who voices that there’s something not quite right with what you’re offering but isn’t quite willing to say, or doesn’t quite know.

Now in theory all of your questions earlier in the process should have brought out all of their needs. But of course, in practice, people are complex and subconscious or hidden needs are often lurking which tends to show up later in this process.

It could be that the budget doesn’t quite match their aspirations and really they need to be shown the model down. Sometimes the reverse, that they came in with a sensible budget in mind, and now feel they need a “higher status” machine to keep up with their pack.

Sometimes they have a question or an objection that they think you would find silly, so sometimes summarising the previous questions can help bring this out. A classic example would be “I don’t like the saddle, but I feel silly asking if it can be changed”.

The showroomer

And of course, there is always the possibility that they were intentionally showrooming you, never had any intention to purchase and were simply wanting to use your knowledge and experience for free. I guess we can’t win them all.

It all else fails, try a digital handshake

If both you and the consumer have invested time exploring their needs, but you haven’t quite got to a solution, there’s no harm in asking for their mobile number or email address to send them some more information. You might need to spell out that this is for you individually on a one-to-one basis to send them something that’s relevant to them. That you’re not adding them to any kind of mass mailing list or circular driven system (and be careful that you don’t unless they actually want to sign up).

You can also suggest that you’re very open to continuing the conversation digitally so that you can help to guide them to the right solution and that they are very welcome to return. For every showroomer who wants to ‘steal’ your time, there’s another consumer who is worried about taking up too much of your time.

Now I’ve seen this technique used

by only a handful of people, often bike fitters in high end road stores. The reason I’m summarising it here is that often I see stores (instead) make a sharp distinction between the digital world and the real world. That is, there are conversations in store, and there are mass (e)mailings, social media campaigns and the website on the other hand. That consumers are somehow binary, either being online or instore shoppers, but of course we’re all shades of grey.

Sometimes the opportunity for an extra sale lies between the two, a oneto-one digital conversation that carries on when the consumer leaves the store. So don’t be afraid to try that, it might only lead to one or two more bikes being sold that week, but that may be the difference between profit and loss.

Of course, there are many ways to sell, this is just an example from one school of thought, one system/process of selling. So next time I’ll take a look the five main ways that sales skills are taught, and why “Sales” is often a word, subject and skillset that many tend to avoid.

John Styles is a veteran of the cycling industry, having worked with leading distributors and brands across the sector. With a well-rounded perspective on the opportunities and challenges facing the sector, backed by a Bachelors Degree in Economics, John Styles is an expert consultant for the bike trade. He will be hosting a sales workshop interactive session at the forthcoming CIN Live, 14-15 September 2025.

Influencers. Most of them are rubbish, heck, some aren’t even real nowadays. The truly influential, that’s a different story. Mark Sutton argues that surrounding yourself with smart people and listening carefully is a great way to improve your business’ future...

Next year will be my 20th year writing about the bike business and that milestone has given me great pause for thought. I came into the bike trade, as most do, with only enthusiasm for tinkering with bikes and, luckily, some journalism qualifications that counted for enough to land a job with what was at the time the only B2B cycling title in town.

Nobody gets through two decades in one line of work without maintaining a certain level of enthusiasm, and to this day, I’ll maintain that it is only rubbing shoulders with the best regularly enough that their smarts rubs off that just about gives me the credibility to write within these pages. So, it’s time to name-check a few influential people, and their methods, that have helped shape some of my thinking about what factors line up to deliver the recipe of a truly great bike shop. I’ll pair this with observations from hundreds of bike shop visits that I’ve racked up over the years, but forgive me if those names I do not recall so sharply.

The teachings of a sales trainer

A regular on these very pages in days gone by was the now retired bike industry veteran sales trainer Colin Rees, the man I credit with first introducing me to the term “revenue is vanity, profit is sanity”, or more specifically net profit, he would go on to emphasise.

Colin was and probably still is one of a staggeringly small catalogue of sales trainers wholly focused on the bike industry, and I really think they are business essentials; I can’t fathom why we don’t have more professionals in this field. If you think about it, chucking a junior onto the sales floor and expecting them to sell anything other than their enthusiasm is a bit silly. A few tailored structural prompts can, over time, stack up to a better consistency of sales.

Colin drove into my mind that discounting was to be avoided at all costs and that, given that the bike shop has somehow engineered itself into the position where even asking is culturally acceptable, this was no easy task. So, you and your sales staff have to be armed and ready at all times to anticipate questions on price and be prepared to demonstrate to the customer the value your business adds to completing the purchase here and now. Better still, find a way to upsell in the same motion if you can, perhaps clear some deadwood.

“I have seen this bike online, it’s £300 cheaper,” says customer A. Do your shop floor staff know how to handle that fairly intimidating approach? Choose an answer from the following that you believe is the right way to handle this customer, Colin might have said in his training sessions:

1: Go and buy it there, then?

2: We will (reluctantly) price match

3: We have that bike in stock, in your size and we can have it PDI’d and fitted to your body this afternoon. If you’re up for it, we’ll give you a three-month check-up free, plus we’ll give you a set of (old stock) lights for 50% off.

In two of those scenarios, you may have a customer on the books thereafter, but in only one scenario have you attempted a sale that’s compatible with your margin requirements. In scenario two, the customer expects a discount and hasn’t had to engage mentally, but in scenario three the beginnings of a relationship have been built on fair value, the compulsive urge to own (and sell) things now and respect.

This is of course a very basic framework, not applicable to every encounter, but used as a basic rebuttal to the request for money off can only add up to marginal gains. You don’t want a reputation about town as the shop, or brand, that always gives an extra discount, especially if an item already has a ‘sale’ handlebar tag. However, in denying a discount, try also not to risk leaving a negative emotion with the customer. Instead, try to understand more about their needs, leading the conversation back to neutral ground and then sell from there.

“IT’S TIME TO NAME-CHECK A FEW INFLUENTIAL PEOPLE, AND THEIR METHODS, THAT HAVE HELPED SHAPE SOME OF MY THINKING ABOUT WHAT FACTORS LINE UP TO DELIVER THE RECIPE OF A TRULY GREAT BIKE SHOP”

“Surrounding

If this strategy is successful a quarter of the time, with each and every staff member using the same methods to reach that average, then that’s 25% more sales, each made at full, or closer to full asking. Over time, that will make a noticeable difference and, yes, targets hit should mean commissions earned, because nothing breeds further success like being personally invested in the outcome.

Another influential character that I encountered while exploring the subject of merchandising was Gosia Adamska, with further credit given to John Styles, both of whom have been prior (Ed’s note: and current) columnists for Cycling Industry News.

These two professionals have often given me psychology lessons that have stuck in my mind, each simply by using imagery. I distinctly remember John sending me a high-resolution image of inside a Boots store, taken at eye level. That’s critical, because when you enter a store, if you are an active shopper you will immediately be looking for cues.

In a Boots store, it’s very obvious because at eye line and sometimes closer to the ceiling are clear indicators of where certain departments are. Is this something that’s viable in your store? Would your customer base appreciate the guidance?

Stand behind the counter and observe for a day people react in their first 30 seconds in the store. Of course, usually you may seek to greet them

within that time, but if on the occasion you’re unable, are they comfortable in that early interaction with your environment? Is the lighting and imagery in store inviting and does it show visuals of the kind of customer your store hopes to attract and indeed some that it has not yet attracted too for balance?

Once they are comfortably inside, what items and displays are at people’s general eyeline? Are those displays showing items you actively want to sell more of, that is profitable or high volume items? Is service pricing displayed clearly and easily understood? If you do have discounted items, are they at the back of the store, meaning your customer has to pass all the items you wish to sell at full price first and afterwards?

“THE THING ABOUT NATURALLY BUILDING A COMMUNITY WITH YOURSELF AT THE HUB, WITH CUSTOMERS, OR SUBSCRIBERS CONSTANTLY LOOKING OUT FOR YOUR NEXT INSIGHT, IS THAT YOU CAN TAKE THE PRESSURE RIGHT OFF THE SALES PROCESS”

The formula of a great bike shop is not necessarily something you can easily pin down and replicate, but listening to the methods of some influential bike trade minds is a fine way to start and indeed evolve what works for your own business

There are other senses shoppers use unconsciously when buying too. Do you remember a time when you were put off by a bad smell in a shop or restaurant? That will immediately be detected on entry, so it’s far better to actively provide a scent that is comforting and in keeping with your products. If you sell mountain bikes, a pine scent with bark chipping on a display works well. Once I saw a drilled-out log stuffed with handlebars for sale, creating a tree-like effect. That merchandising was free of charge, pinched from a local woodland and crafted to incredible effect.

Content is king

Over the years, a surprising chunk of my influence and thinking has stemmed from Americans in the bicycle business. Donny Perry’s Leading

Out Retail book was on my desk for years and remains a pretty good reference point to this day despite the retail landscape’s massive changes since it was published. Jay Townley’s Human Powered Solutions newsletters I subscribe to to this day, and wish I had more time to digest in detail. Another influence has been Arleigh Greenwald, known way back as Bike Shop Girl, then as a cargo bike shop owner in Colorado, now as the Founder of the Cargo Bike Life Community. She’s worked for Tern, too, among others. At each and every junction she has produced fantastic, thought-provoking and engaging content. The bottom line is, Arleigh has been excellent at reinventing herself around her passion and drawing others in, building a community

around passion. She does this through relentless content generation, something that has nowadays even become a bike retail model with businesses like Electroheads, and arguably many publishers who sell bikes via affiliatelinked traffic.

The thing about naturally building a community with yourself at the hub, with customers, or subscribers constantly looking out for your next insight, is that you can take the pressure right off the sales process. Trust is built, conversations flow naturally, and with the value you give away, you can gain loyalty in return. You can embed subtle sales links, of course, but that’s not the focal point of your content. People know what you’re about and experts are valued, now more than ever. Your opinion, if genuine, will sell the products.

YOUR PARTNER TO HELP YOU BUILD YOUR BUSINESS

√ 24 years of experience √ Customer & sales support

√ Customized marketing activities √ Delivery from stock

√ Place orders 24 hours a day 7 days per week

For more info about our brands, send a message to sales@onewaybike.nl or give us a call: +44 1527 958331

Website: shop.oneway.bike

“USING YOUR PASSION TO DRAW OTHERS IN AND BUILDING A COMMUNITY CAN BE DONE THROUGH RELENTLESS CONTENT GENERATION, SOMETHING THAT HAS NOWADAYS EVEN BECOME A BIKE RETAIL MODEL”

There are no greater perfectionists in the bike trade than bike fitters. Change my mind.

I can single out two that have left a distinct impression on me over the years and both took the hard road, pioneering their craft, fundamentally understanding it, taking no shortcuts, before rising to the top. Those two (and there are others) are Jon Iriberri and Phil Cavell.

Phil is obviously one part of the bike fitting retail experience pioneers at Cyclefit. He’s also the author of The Midlife Cyclist, and has been a curator of an international conference on bike fitting that has shaped much of the shared knowledge now guiding professionals in this field. Jon Iriberri has done similar things and, to my knowl-

edge, has pioneered products, bike fitting techniques, fitted pro tour teams and had the energy left to survey the bike fitting world and give us some of the only available data on what a bike fit costs, on average internationally, among other findings.

Deeply knowing your craft, that is turning you back on ‘learning’ by AI and really starting from scratch with each foundational pillar, means that you will never second-guess yourself in your career. In the case of Cyclefit, building a bike retail model around fitting was a masterstroke and one that meant, by definition, Cyclefit would only ever sell top-tier, bespoke performance gear and never at a discount. Having created an experiential retail service, Cyclefit and others like it have been able to roll out the appointment-

only model, placing a firm value on time as well as sales. The niche knowhow was able to expand into things like nutritional guidance and aerodynamics. A specialist craft is a profitable one; the value comes from being a trusted source for the elite customer who is willing to pay for the best. Who influenced your journey through the bike trade, and how has it shown in their trade? We would love to hear your stories on our Facebook group – Cycling Industry Chat.

Cycling Industry News would love to hear your views on those who have influenced your journey through the bike trade. Talk to us on our Facebook group - Cycling Industry Chat.

bob-elliot.co.uk

bob-elliot.co.uk/twitter

bob-elliot.co.uk/facebook

bobelliot-online

With over two decades of R&D focused on rider comfort and control, Ergon has specialised in what it means to interface with your bike. From its Koblenz, Germany HQ, the brand’s ergonomic expertise pushes at the boundaries...

Since its founding in 2004, Ergon has established itself as one of the leaders in ergonomic bicycle accessories. Ergon’s founder and CEO Franc Arnold was driven to find solutions to the physiological problems that can occur during cycling and – in general – make cycling more comfortable. Arnold has built a team of top biomechanical engineers, sports scientists and industrial designers to develop all types of touchpoint products – from saddles to bar tape and pedals to bar-end grips. With everything designed and prototyped inhouse – with teams of in-house experts and pro riders in the field – Ergon synchronises design, R&D, tooling and production so that that every component meets its exacting standards before getting in the hands of riders.

GP1 – the invention of the wing bicycle grip by Ergon

Ergon’s breakthrough came with the GP1 grip, which redistributes pressure across the palm while preventing excessive wrist flexion. This new design turned heads, and the GP1 ultimately proved that its radical design helps prevent pain and numbness in the fingers, hands, arms and shoulders and reduces the risk of carpal tunnel syndrome. The brand points out that the grips provide more comfort and better bike control - and led to the entire market re-evaulating its approach to grip design in order to incorporate ways to prevent numbness and fatigue. This improved performance for pro riders and helped keep casual riders comfortable.

The GP1 has long held the torch as Ergon’s first and most popular product

and in 2024 Ergon revealed the GP1 Evo, ushering in a new generation of GP-family grips, including the GP2, GP3 and others.

The Ergon Method Ergon’s three departments of ergonomics, design and engineering work together, using an approach similar to the scientific method to find the best solutions for solving cycling-specific and physiological problems of cyclists, an approach termed the “Ergon Method”.

“A bicycle saddle may seem simple at first glance, but from an ergonomic point of view, it is the most crucial interface to the human body,” says Ergon’s head of ergonomics Simon Schumacher. “Before we put a saddle into production, it has gone through as many as 15 iteration loops over the course of one to two years. Only then does it fit perfectly to the respective application and gender.”

“Science-driven, anatomy-perfected saddles”

Ergon develops saddles that are specially adapted to the anatomical differences between women and men. Ergon’s new Allroad saddle range, for example, represents the culmination of extensive research and athlete feedback, delivering comfort for road and gravel riders.

Ergon recognises that male and female pelvic structures differ not only in width but in sit-bone orientation and soft-tissue sensitivity. Each Allroad Men and Allroad Women model feature not only a shape differences, but specific graduated foam densities and relief channels precisely engineered to alleviate pressure below the genital area ensuring that every millimetre of curvature and cushioning works in harmony

Three-time Downhill World Champion Vali Höll is one of 150 top athletes that rely on Ergon products

Anatomically speaking: Ergon takes into account sit-bone orientation in the design of its saddles

with the rider’s anatomy.

“Every saddle we create follows a function-first philosophy, marrying rigorous science with intuitive design to deliver an experience that truly goes ‘beyond better’,” adds Schumacher. Ergon is distributed in GB through Extra UK.

www.extrauk.co.uk

WSCAN HERE TO JOIN US!

hen we first started discussing CIN Live with the industry in October 2024, just 11 months ago, we weren’t entirely sure how it would go down. That’s always the challenge when you launch something new, but when you’re doing it at a time when the market has been through significant pain, there was an added question mark

But there were a few early positive factors: trade shows were proving to be hugely popular and useful to the market, there weren’t many/any opportunities for the whole industry to get together, and there were very few timed for late in the season. And we had a firm belief that the nation’s bike shops and workshops were keen to examine opportunities to grow their businesses.

And the trade got behind CIN Live beyond our initial expectations. Some of the biggest names in the market – both in the UK and Europe –signed up to exhibit, making the show a “who’s who” of key players and brands, which of course represents a big opportunity for visitors.

On top of that, we’ve managed to collect a range of industry experts to take part in our seminar programme. Many of those are familiar

SOME OF THE BIGGEST NAMES IN THE MARKET –BOTH IN THE UK AND EUROPE – SIGNED UP TO EXHIBIT

names, some of whom have written articles for CIN over the years, but all are focused on helping bike shops, workshops and mechanics develop and grow.

And there are networking opportunities too –whether that’s bumping into someone in the halls or at the BBQ taking place at nearby Woodland Grange hotel.

If you’re able to make it, we’d urge you to come along. It won’t be perfect, but its heart is in the right place and it’s hopefully the first step to making it a cornerstone event that serves up something useful for the trade. CIN has always focused on being a resource for the market and we fully intend the show to continue in that tradition. See you at NAEC Stoneleigh.

Come and see us at Stand A8 at CIN Live 2025 to discuss Cytech training and Apprenticeships for your staff.

We are also running a couple of talks each day at CIN Live 2025 to talk about the content of the Cytech training courses and how you can access Government funding for the Apprenticeship Scheme:

What is involved in doing a Bicycle Mechanic Apprenticeships > guidance for prospective apprentices and employers as well as an overview of the course content (plus brief overview of Cytech)

What can you learn by doing your Cytech training courses > An overview of the course syllabus/content for Cytech Technical One, Two,Three and E-bike courses

Founded in 1987 in Girona, Spain, Megamo is built on nearly 40 years of cycling passion and innovation. From high-performance gravel, road, and MTB bikes to cutting-edge e-bikes such as the DJI Avinox-equipped eMTB Reason, the Bosch SX eGravel Lande, and the Bosch Gen 5 CX-R eMTB Flame.

Ride Different, Stay True! www.megamo.com

CaGo designs high-quality e-cargo bikes engineered for safety, utility, and family life. Made in Germany, Bosch powered, especially known for its safety-first approach and innovative design. The new compact ‘CS’ cargo bike features 3 loading areas.

Load up on Life! www.cagobike.com

THE ORIGINAL compact eBike from Germany. The unisex perfectly thought-out frame geometry make the i:SY iconic. Bosch or Pinion MGU powered. A full suspension longtail with pinion MGU coming this year!

Ride it! Love it! www.isy.de

EXPERIENCE THE FUTURE OF BIKE SHOP MANAGEMENT

Hub, pivot, headset bearings, bottom brackets, pulley wheels and professional tool solutions. From ABEC 3 bearings for day-to-day repairs to Maxhit™ components and XD15 bearings which are guaranteed for life, Enduro Bearings cover all your workshop bearing needs.

A wide range of shift and brake cable systems, brake pads, hoses, disc rotors and problem solvers for both aftermarket and workshop use. Jagwire are committed to producing quality and consistent products at an affordable price.

The world’s largest chain manufacturer, KMC brings 40 years of experience to produce the highest quality, most durable drivetrain components for every bicycle category on the market. GO Wax factory pre-waxed chains now available.

A comprehensive range of eco-friendly maintenance and care products including grease, lube, cleaner, fork oil and brake fluid, all produced in Switzerland and specially formulated for cycling.

Extra UK is proud to distribute a number of leading workshop brands. Visit www.extrauk.co.uk to view our full product range, or email enquiries@extrauk.co.uk to request an account.

Cycling Industry News Live’s carefully curated seminar programme is focused on providing valuable insights that visitors can take back home with them. How-to guides for enhanced retailing, a big focus on workshop optimisation and training, sales techniques, insightful panels and more form the backbone of a concentrated collection of seminars, the likes of which are rarely available under one roof…

Session 1

Going Full SUS

Rozone’s Rowasher Team will share ideas and simple wins that can help Workshops increase their sustainability credentials whilst at the same time increasing throughput, efficiency and therefore revenues / profits, whilst at the same time reducing waste and hidden operational costs –a WIN all round …

Session 2

Activate Cycle Academy: What is involved in doing a Bicycle Mechanic Apprenticeship?

Guidance for prospective apprentices and employers as well as an overview of the course content (including brief overview of Cytech training)

Session 3

Activate Cycle Academy: What can you learn by doing your Cytech training courses?

An overview of the course syllabus/content (and benefits for mechanics and shops) for Cytech Technical One, Two,Three and E-bike courses (using props such as wheels, forks, shocks, e-gears, e-bike, specialist tools and having a short Q&A about the finer details of what is in the course)

Shop-Floor Sales Tips Workshop

The Cycling Industry News sales workshop will be hosted by two of the industry’s most experienced salespeople. John Styles will share expert learnings, best practices and effective sales habits gathered from a combined 30+ years of visiting over 1,000 stores across the UK. With a “pick and mix” menu of more than a dozen quick insights, workshop participants can choose the sales habits they would like to practise and take away.

• Marginal Atomic Straws

• Everyone Sells, But…

• The Good, the Bad and the Ugly – 5 Types of Selling

• The Relationship Triangle

• Busy but Approachable

• The Right (Side) Approach

• The First, Best and Last Question You’ll Ever Need

• F.O.R.D = 4 (Questioning)

• 10 Fingers, 10 Questions

• Avoid the Budget!

• Show, Not Tell

• Upsell Everything!

• The Runway Strip

• What Women Want

• Warranty Conversations –Upside Down & Back to Front

• Chimp Hijacks

• Digital Handshakes

• Objection!

• Why Won’t You Close?

• NANI at the Till

The workshop is suitable for everyone – from new starters to experienced sales staff or store owners looking to boost their sell-through. While the focus is on big-ticket bike sales, P&A, servicing and warranty conversations are also included.

The Profit and Loss of Bike Fit – Why Comfort Equals Cashflow

When a customer walks away from a sale – or returns a bike –it’s rarely the product that’s the problem. In this fast-paced, practical session, IBFI President Lee Prescott reveals the hidden costs of poor bike fit and the untapped profit potential of getting it right. Discover how fit can boost sales, reduce returns, and turn one-time buyers into lifelong customers.

With a well-curated portfolio of third party and owned brands, Madison is the biggest distributor of cycling parts and accessories in the country.

Combining fast, reliable logistics, with extensive retail tools, marketing expertise and technical training, Madison is a comprehensive retail support partner for independent bike shops across the UK and Ireland.

DON’T MISS OUT

AND MORE...

As well as featuring a wide range of new products, including A/W lines, and an in-depth seminar programme, B2B-orientated CIN Live 2025 will also be an opportunity to network with the rest of the industry. Given the breadth and depth of the exhibitor list, perhaps more broadly than has been possible in the UK cycle trade for some time. While industry visitors and exhibitors will have plenty of time to mix and network at the show and over lunch on both days, there’s also a CIN Live BBQ set up to take place after the first day of the show (Sunday 14 September). The BBQ will be hosted at nearby hotel Woodland Grange, with vegetarian and vegan options available. Tickets cost £30 per person.

To book, simply email enquiries@makevenues.co.uk

The venue is an old hand at hosting outdoor-orientated events, with opportunities for demonstrating product. CIN Live includes outdoor space where exhibitors have the opportunity to host clients and customers in the Great British weather to experience products in the flesh, with a dedicated cycle route for trying new products.

By road

From London / M40: Leave the M40 at junction 15 and head onto the A46 towards Coventry. Follow the signs to Stoneleigh Park main entrance or NAEC on the B4113.

From the M6/M9: Leave the M6 at junction 2 and head onto the A46 towards Warwick or at the end of the M69, head onto the A46 towards Warwick and the M40. Follow the signs to Stoneleigh Park main entrance or NAEC on the B4113.

From the M1 (Northbound): Leave the M1 at junction 17 and join the M45 heading towards Coventry. Pick up the signs for the A45 Coventry (NOT Daventry). Stay on the A45 heading towards the A46, follow the signs to Stoneleigh Park main entrance or NAEC on B4113.

By rail

Royal Leamington Spa, Warwick and Warwick Parkway rail stations are situated on the main London Marylebone line. The Birmingham line stop for the Virgin West Coast Mainline. London Euston – Coventry services every 30 minutes weekdays. London Marylebone – Warwick Parkway services every 30 minutes.

Birmingham – Coventry frequent services from Birmingham New Street, Birmingham International and Coventry.

From these mainline stations you will need to take a short taxi ride. Taxi ranks are based at both Warwick Parkway and Coventry stations, approximately 5 miles from Stoneleigh Park.

There are 10,000 FOC parking spaces, allocated on a first-come, first-served basis. Using Sat Nav? Please use this postcode: CV8 2LZ and make sure that you follow the AA road signs to find the main entrance to the site.

Gazelle, your trusted partner in premium E-bikes

With over 130 years of Dutch cycling expertise, Gazelle offers premium e-bikes built with innovative design, smart innovations, always prioritising comfort and quality.

Trusted Dutch quality since 1892 l Full sales & after-sales support l Tailored marketing materials l Fast delivery from stock l Easy to order via our dealer portal l VIP training sessions and product workshops

Want to join the Gazelle dealer network? Email us at m.isaac@gazelle.nl or call 07541 895015 www.gazellebikes.uk

“Could

Advanced pH neutral cleaning

Excellent on bike parts, frames and wheels

Specially developed solu琀on for cycle industry

Up

Less

Increase

Cheaper

Easy

Parts

Full stock of spares and service