SHOULD I stay or should I go? Twist or stick? Every now and then big decisions come our way, and to the businesses we work within – whether we like it or not. Sometimes they have big consequences.

In the current economic situation, many businesses in this trade (and others) have been in the position where they have needed to make some big decisions about the future and make a strategic choice. Whether to cut a decades-old business relationship that isn’t working any more? Sell an asset to free-up cash flow? A once in a decade chance to buy an additional unit which will stretch the business as it currently is?

‘Refocusing on our core business’ is one of the phrases that have cropped up a lot, in interviews we’ve had and in press releases coming across CIN’s desk. Focusing on what you’re good at, is surely as sensible as any advice you could possibly hope to see. The converse option might be to become more of a one-stop-shop and try to hoover up share of the market, you can be good at that too, but that usually ties up cash flow and is therefore not a viable course for many.

For not the last time in this issue, let’s bring up Eurobike, which is at something of a fork in the road. Since shifting from Friedrichshafen to Frankfurt – a great example of a business making a big decision – the show is now strategically refocusing on its core business with the launch of a new show to handle micromobility, so Eurobike can get back to sports and performance. It’s a big statement and change of direction. The show organiser could have taken the other option of doing nothing and continuing with how things are, but that probably did not seem a wise course. Will it pay off? Time will tell.

Within these pages there’s an article on the pros and cons of bike shops opening seven days a week, bringing in sales data and expert opinion to examine the profit potential. It’s a strategic change of direction that may be available to your shop or business, if it proves to be viable.

Big decisions can seem even bigger when the market is tough, but choosing to do nothing is making a choice, nonetheless.

In the meantime, you can of course choose to join us at CIN Live 2025 on 14-15 September – register for free via p18 and p48 of this issue!

Jonathon Harker

jon@cyclingindustr y.news

Publisher Jerr y Ramsdale jerr y@cyclingindustr y.news

Editor Jonathon Harker jon@cyclingindustr y.news Sales Manager Lloyd Ramsdale Lloyd@cyclingindustr y.news Reporter Simon Yuen Simon@cyclingindustry.news Head of Produc tion Luke Wikner production@cyclingindustr y.news

Arellano

y.news

Where does the trade expect market growth to come from? We look at the demographics retailers identify as the best opportunity to grow cycling, and look at how those dealer views have shifted in the past half decade…

Which demographics do bike shops view as the best opportunity to grow cycling in the near term? And how have these perceptions shifted in the last five years? There are a few surprises along the way and maybe some big conclusions we can draw too.

“SALES STATS DON'T MEASURE THE NUMBER OF CURIOUS PUNTERS WHO STEP THROUGH THE DOOR AND ASK ABOUT EBIKES... SO THESE STATS ARE AN INTERESTING INDICATOR OF FUTURE POTENTIALS”

ELECTRIC DREAM

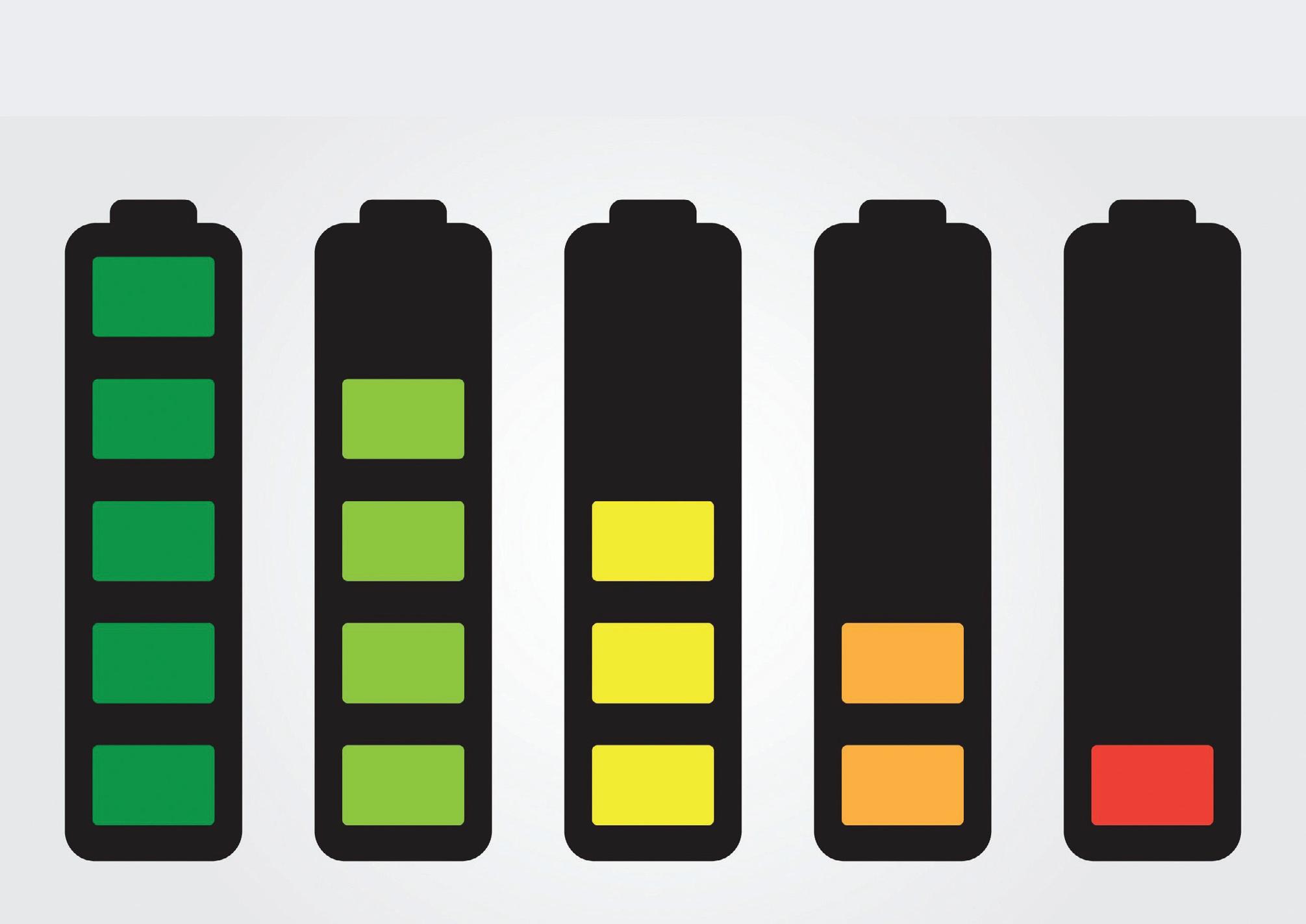

Electric bikes are, in 2025, facing a lot of challenges here in Blighty, but not enough to – yet – derail the sector from being viewed as absolutely key and most likely to grow the cycle market. In 2025, as in 2020, UK bike retailers see those drawn in by electric assistance as the key demographic set to expand cycling. If this was a triumph of optimism over reality, then shops would have changed in attitude in that five-year period. They have not, so logically there must be plenty of visible onthe-ground evidence at retail to show the electric bike sector is the primary avenue to grow cycling. Perhaps here is some measure of the unmeasurables, like the number of punters stepping through shop doors curious about eBikes yet not necessarily buying one and showing up on the sales stats. That may well be reflected in these retailer attitudes.

Thoselookingtosavemoneyontransportcosts

Sportscyclistsandexistingenthusiasts

Thoseentirelynewtocycling

Childrentrainedinschools

Logistics businesses and �eet operators

Sports cyclists and existing enthusiasts

This is an interesting one – shops view the category of sports cyclists and existing enthusiasts – essentially its current set of customers – as more likely in 2025 than in 2020 to grow cycling in the near term. Here’s a sign of doubling down on this demographic which is not necessarily a bad thing – there’s a strong argument made for companies to specialise harder and focus on what its good at, eg serving customers who already love cycling. It’s a more straightforward proposition. Can we see this as evidence of bike shops focusing ever harder on their core business and typical customer? You certainly could draw that conclusion.

Closely related, we see the demographic of ‘those entirely new to cycling’ appearing less likely prospects for growing the industry (from 36% in 2020 to 23%). With less spending cash flying around, those on the fence with cycling might choose to spend theirs elsewhere. That seems a reasonable assumption.

Over 50s consistency

When was the last time you saw a picture of someone over 50 used in bike marketing? That becomes an even more interesting question when we see that many shops see this category as a key demographic to grow the market. Ads may be more about aspiration (“bikes make you feel young”) and maybe that’s a discussion for another time, but it’s worth not losing sight of the category, if retailer insight is anything to go by (to be clear, we

think it is). The over 50s category is one that has been closely linked to eBikes (see above) and the way that genre of product can broaden the cycle customer base.

You might make generalisations about over 50s being of a generation that likes to speak to someone face-to-face about a major purchase of a product they perhaps feel they need some education about. With younger generations shopping habits formed more online, maybe it’s little wonder shops are looking closer at that more mature category more favourably. And with the western world getting older (and retirement ages climbing) the over 50s seems an assured bet.

More generally, it may seem rash to look for big conclusions from this data, but if you were tempted to… there does seem to be a five year gradual shift towards the traditional customer of the industry. Depending on your viewpoint, you may react to that with horror or see as a return to common sense. Or maybe a bit of both. Most likely, that is an effect of an industry still collecting itself and realigning in economically tough times. Doubtless, maybe when things ease a bit, focus on newer areas and demographics may bounce back.

Bike workshops and the mechanics that work within them have long been viewed as a vital part of the trade, but anxiety about attracting and retaining talent, providing a liveable income for mechanics and on the increasing expertise required of technicians are sizeable concerns for the viability of this vital cog in the bike industry machine.

The latest CIN Podcast tackles this topic and more, with regular host Sean Lally speaking with the vastly experienced Mark Barfield from Velometier –a former Technical Manager at UCI who has also worked with British Cycling and British Triathlon.

Barfield has founded the European Association of Professional Bike Mechanics (EAPBM) to represent and lobby on behalf of bike mechanics.

“I have been exposed to different types of training and approaches to the industry. I have seen some really good people enter the industry and stay, while I have seen some really good people leave. Fundamentally there has been no one really representing the bicycle mechanics.

“There’s been nobody making the case for or representing the bicycle mechanic. I think they are under-represented

and almost one of the most important cogs in the entire system. The bicycle mechanic does the final check on any bike that goes out the door… regardless of the brand or whoever sold it, they are responsible for that. In an increasingly online world, they will be the main touch point for a lot of consumers.

“I want to embrace the selfemployed mechanics. You don’t have to be full time. There are plenty doing two to three days a week, maybe semiretired… they still deserve representation and to be proud of what they do.”

Salary and wages in the UK are a big challenge, Barfield addresses: “Yes, but you can only really ask for better wages if you are adding value to a business. There are a huge amount working for small organisations… to be paid more they have to help the business generate more income.

“Not everyone is capitalising on the resource they have in a workshop and using it as a profit centre. Some shops see it as a ‘have-to-have rather than a profit generator in its own self.”

“One important angle is that a lot of people leave the profession because it doesn’t pay enough. There are a lot of self-employed mechanics… [for them to hear] different ways to generate

incomes – that is something that sits within the objectives of the EAPBM organisation… We want to highlight the businesses that are thriving, that are service-focused and are employing people with reasonable wages.

“Trying to help business owners or self-employed people to generate more profit from their business is a good thing.”

Barfield also share insights into the bike workshop sector from Europe and emphasises there are things that workshops can implement into their own businesses to increase profit, in the pod.

Sean posits the argument that the growth of eBikes is an opportunity for shops to jump on a different workshop business model.

Barfield says: “eBikes are bringing in new consumers to the bike shop. We had a customer complain their bike, after a service, wasn’t spotlessly clean. When you take a BMW for a service it comes back clean… so now our full service includes a basic clean. More consumers are used to the BMW service experience and the eBike fits into that category. Their screen said it needs a service so

“NOT EVERYONE IS CAPITALISING ON THE RESOURCE THEY HAVE IN A WORKSHOP AND USING IT AS A PROFIT CENTRE. SOME SHOPS SEE IT AS A ‘HAVE-TO-HAVE RATHER THAN A PROFIT GENERATOR IN ITS OWN SELF”

The fate of the bicycle workshop is inextricably linked with the cycling industry as a whole. The latest CIN Podcast covers this topic and more, in a discussion between host Sean Lally and Velometier’s Mark Barfield

they bring it in. It is a different consumer. They spent a lot of money on the product but have high expectations of what service will deliver.”

Barfield’s plan is for the EAPBM to hold information and release to members, to work with the governing bodies and industry bodies. And ultimately to raise the profile of the bicycle mechanic.

Bike mechanics to be a member – get the business owners on board too? Bike shop owners are probably mechanics or are interested in the workshop. Not always sure how to capitalise on it best… we would love to have corporate members…

That interest and commitment in training is often down to one person in an organisation.

The size of this challenge. This needs to be bigger than me. I would love to start this and hand it over to a board but [right now]

it needs doing, there is a demand for it, even if some parts of the industry don’t realise it. Let’s start this journey of a 1,000 miles with one step. It’s a long old road, but it is worthwhile starting.

www.eapbm.com/about-5

Barfield also spoke on a previous CIN Podcast about bike safety and standards

Mark Barfield can be contacted at contact@velometier.com

CIN also welcomes comments on the topic, via jon@cyclingindustry.news

To find out more about the Cycling Industry Podcast, contact: jon@cyclingindustry.news

The CIN Podcast regularly interviews industry names and panels of trade execs, with recent highlights including:

Up to standard: bikes, safety & independent testing

How connectivity & software is evolving the eBike market

Mentorship and diversity in the cycle industry

Head to Soundcloud for more: https://soundcloud.com/user-740094534

“I

WANT TO EMBRACE THE SELF-EMPLOYED MECHANICS TOO. YOU DON’T HAVE TO BE FULL TIME. THERE ARE PLENTY DOING 2-3 DAYS A WEEK, MAYBE SEMI-RETIRED… THEY STILL DESERVE REPRESENTATION AND TO BE PROUD OF WHAT THEY DO”

Chris Keller-Jackson visits Ananda HQ in Wuxi to see first-hand how the eDrive system specialist manufactures from the ground up, while also quizzing Ananda’s CEO Daniel Zhuo on tariffs, beating the eBike chippers and potential expanding production into Europe…

Shanghai, China and a trade trip to see Ananda in its headquarters in a sprawling Technology Park. Typifying manufacture in China, the production facility in Wuxi is based on a hybrid of TPS (the Toyota Production System) and Cellular Manufacturing methodologies to create reliable, quality and advanced Drive systems. This is not unexpected, it’s a tried and tested approach to total quality manufacturing.

Ananda is a full service manufacturer

and has been operating since 2011, producing open platform drive units for eBikes, eMotorcycles eScooters and others over the decade-plus of operation. Its product line-up includes gear drive hub motors, mid-motors, controllers, sensors and Human Machine Interfaces (HMIs) for comprehensive eDrive systems. I’m not at liberty to state one of their bigger UK customers, but you know them and Ananda make drive units for their very successful electrified products.

“I’M NOT AT LIBERTY TO STATE ONE OF THEIR BIGGER UK CUSTOMERS, BUT YOU KNOW THEM AND ANANDA MAKE DRIVE UNITS FOR THEIR VERY SUCCESSFUL ELECTRIFIED PRODUCTS”

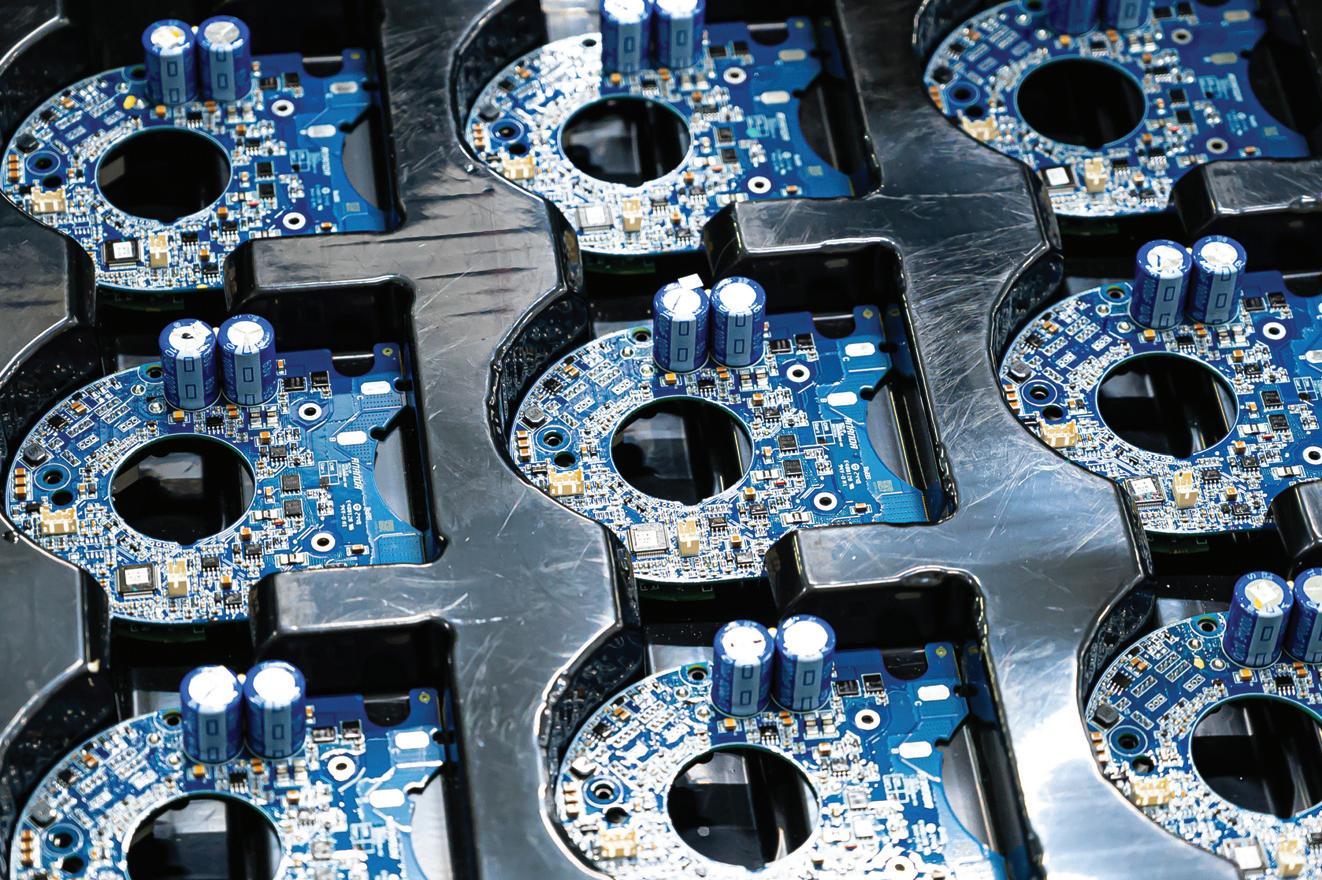

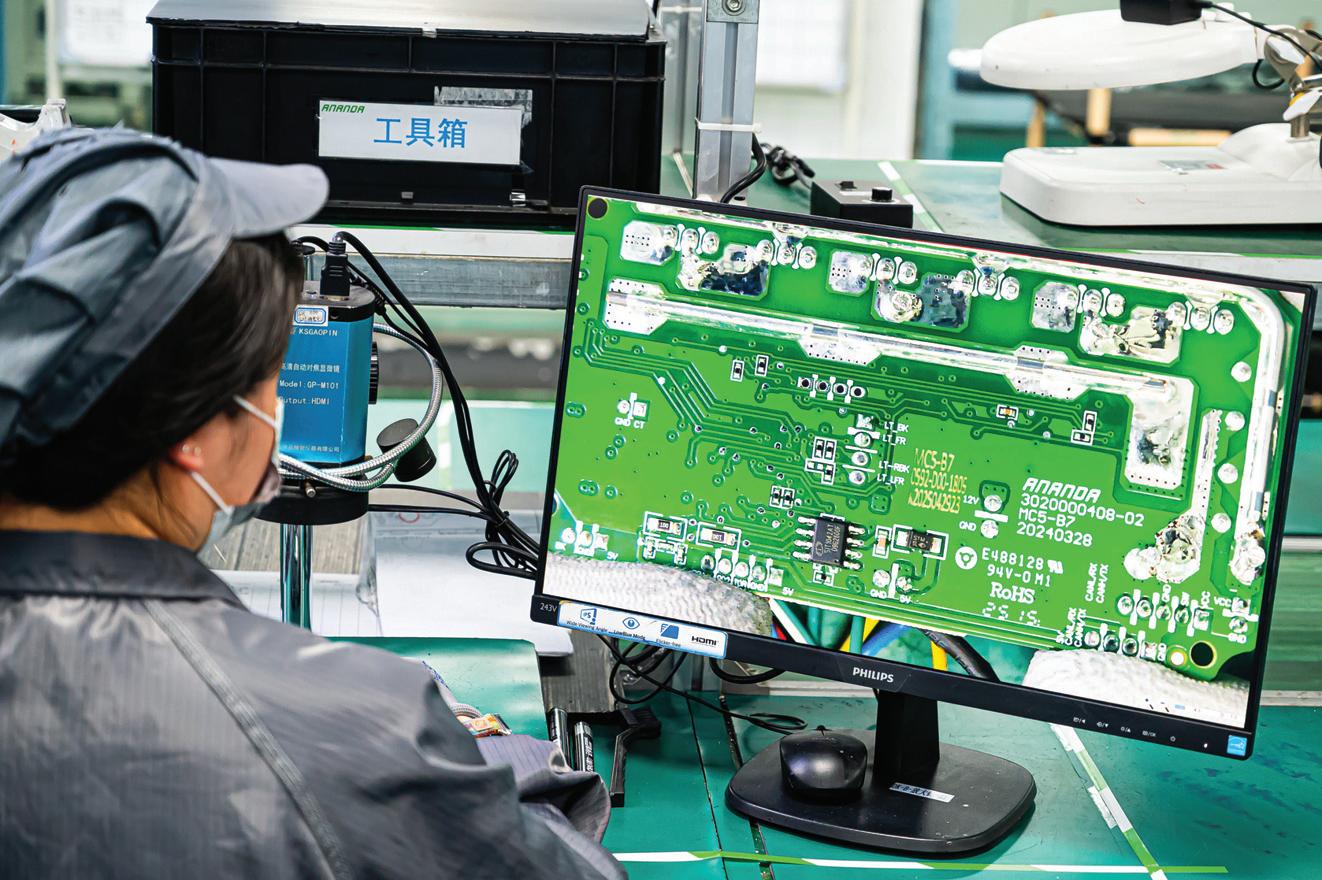

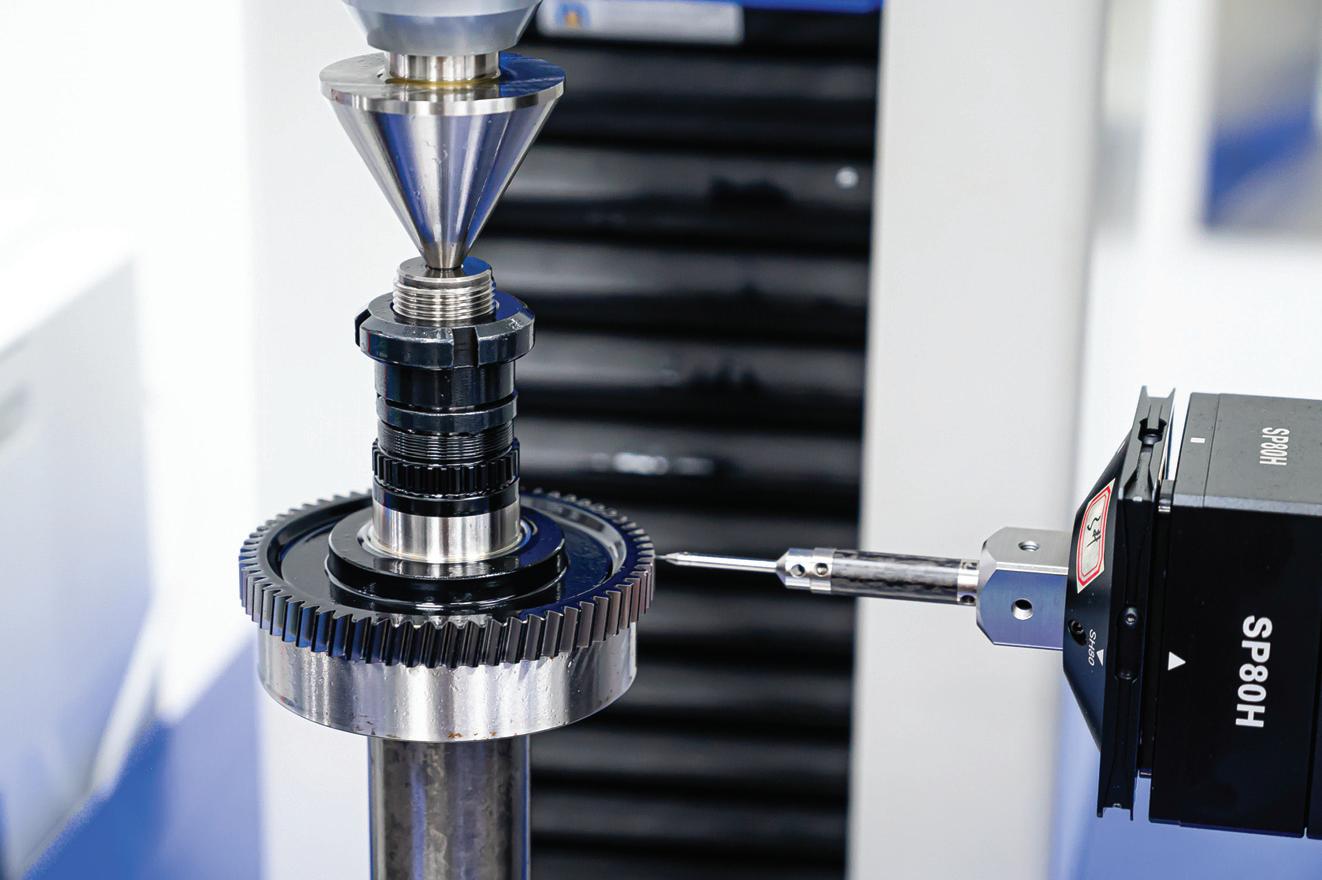

When I say that Ananda ‘make’ eDrive systems, control of quality is at the forefront of this business. Ananda wind their own brushless motors, they design, print and fabricate their own circuit boards, they cut their own gears in both alloys and plastics, they

design, mock up in 3D print then cast the housings and they code the logic to support the user interfaces and the component interconnects. Quality is controlled throughout production by being in control of all aspects of the products, measuring and testing each

unit throughout the production process and delivering eDrive ‘systems’, not just motors. Production is 100% tested to meet the needs of the customer, and to comply with territory regulations.

In terms of production quantities, Ananda produces approximately 7M units per year. Of the 7M units, the dominance of eMopeds in China and other Asian countries is still very high, though the brand is seeing a shift towards eBikes as a trend amongst the youth. The portion of production destined for the USA and EU markets is dominated by eBike systems. Ananda primarily manufactures in China across several facilities, but in 2023, it established a manufacturing base in Vietnam. Additionally, the company operates a European Service Centre located in Hungary.

After the impressive factory tour in Wuxi and a tour of Research & Development in the HQ, I sat down with Daniel Zhuo, the CEO of Ananda, to talk tariffs, the future of Ananda and their product launch at the recent China Cycle show.

Mr Zhuo did not seem overly phased by the thorny subject of the US tariff situation, partly as none of this had been finalised (at the time of the interview in May 2025). There was optimism around negotiations, and that Ananda was not wholly invested in supplying to the US market alone. Of great interest to the European reader, there are plans underway to convert part of the existing Service Centre in Hungary onto a production facility, specifically for the European markets. Products made in this facility would be closer to the European market, and therefore offer better support, parts availability, testing and repair facilities. Meanwhile, the Hungary facility, along with Vietnam

factories, will also serve as supply bases for the US market. In addition Ananda has service hubs in Italy, France, Poland and a European territory HQ in the Netherlands.

eBikes are a much bigger part of the European market than the US market for Ananda and they see continued expansion within Europe as a positive step, as well as offering a strategic benefit in more local manufacturing through Hungary. Whilst production lines are often more bespoke in China, and include other eMobility categories, Hungary will be kept more streamlined, and specific to eBikes.

I also asked Daniel about the future of products, specifically around the combination of Mid Motors and Gearboxes in one unit (Pinion call it an MGU). He reminded me of the very recent launch at China Cycle of the Ananda R900 Integrated Electronic 3-Speed Gear Hub Motor System (more on that later) but also said that they already had two years of research and development in motor gearbox units, partnering with an existing gearbox manufacturer in China. Whilst they had made some positive progress, he conceded that the biggest issues still relate to size and weight, neither of which he thought were yet surmounted. He saw initial applications in more simple 3 to 5 speed units, then eventually more gear range as the technology matures. We also discussed this combination alongside Belt Drives, which he agreed were the avenue they were exploring.

Lastly on the Drive System agenda was the topic of ‘chipped’ motors and how this impacted legislation, the perception of eBikes in a speed and power limited traffic infrastructure, and how chipping reduced safety, where products for specific markets were tested against those road rules. Daniel agreed that changing the parameters of one of their systems was a safety concern that they address in modern systems through robust software and hardware features. Preventing 3rd party tools and software changes performed by consumers is critical to ensuring that there is trust in the brand, and that the certification attained can then be adhered to in daily use. Some of the online searches prove that it’s possible to defeat power and speed limiting functions with both software and hardware, it remains to be seen how resilient the latest generation of Ananda systems are.

“PREVENTING 3RD PARTY TOOLS AND SOFTWARE CHANGES PERFORMED BY CONSUMERS IS CRITICAL TO ENSURING THAT THERE IS TRUST IN THE BRAND”

At the end of the visit, there was an opportunity to ride some of the hub and mid-motored products, including the new R900 Integrated Electronic 3Speed Gear Hub Motor System. This demo bike assembled with a belt drive (this was also on display at Eurobike) from the crank to the rear hub performed flawlessly. The test route included a significant climb gradient and whilst the bike was under geared for the hill, you are unlikely to meet this climb very often. Power take-up and gear changes were very smooth and fast, with the display showing the gear you were in which is a custom feature they were able to add as part of the ecosystem they deliver. There are plans for additional gears in future iterations. This product is ideal for commuter and leisure eBikes, it was simple and intuitive to ride.

In addition to the catalogue drive units on test was something new to ride. The Ananda M7600 unit is preproduction. This is the first rideable iteration of the product and is called the ‘eMountainking’. This is an eMountainbike mid motor with a very impressive form factor and output. The statistics are 250W at max torque 100Nm and a peak power of 720W in this iteration, this is intended to be around the 2.7 kilo mark for the finished drive system. Whilst this was not yet ready for launch, with a scheduled production date of December 2025 there was a buzz around aesthetics, performance and rideability. It was noted that the integration into the frame for the motor and display was very neat, making the mid motor look smaller than it probably is. I’m looking forward to seeing how this performs upon launch, and it shows how Ananda is responding to changes in the market.

I’m unable to fault Ananda for its quality of production and testing, of their commitment to developing drive systems, nor for their ambition to develop new and innovative products. I look forward to production coming out of Europe, and the newer developments entering the market. I’d like to thank Ananda for their courtesy in opening up these facilities for such scrutiny.

www.ananda-drive.com

“THE INTEGRATION INTO THE FRAME FOR THE MOTOR AND DISPLAY WAS VERY NEAT, MAKING THE MID MOTOR LOOK SMALLER THAN IT PROBABLY IS”

‘This lock is exceptional, outperforming every lock in our angle grinder-resistant test. It’s also the cheapest and lightest lock on test...

Cycling Weekly

Packed with features inside and out, OnGuard make the meanest, toughest locks in the business

• Sold Secure Diamond rated locks from £49.99 SRP

• Secured by Design accreditation on 19 locks

• Very competitive dealer margins

| EXCLUSIVELY DISTRIBUTED BY

ZyroFisher is one of the cornerstone businesses in the cycle trade. The North East England-based business distributes a portfolio of some of the most prestigious names in the industry, including its own Altura brand. The business’s roots go back to the 1930s, but the company that we know today is celebrating its 30th birthday this year. From its state-of-the-art, bonded 100,000 ft² warehouse in Darlington, the firm supplies the trade with more than 28,000 product lines. Now employing over 140 staff, ZyroFisher is a key partner for both the brands that it represents and a vast network of specialist independent and multiple retailers around the UK and Eire. With ZyroFisher’s birthday celebrations looming large, Cycling Industry News caught up with CEO Tom Ainscough and chief commercial officer Nadine Thompson

ZyroFisher reaches a significant milestone this year – how is the business reflecting on that and marking it?

TA: We are really happy to mark a major milestone this year in ZyroFisher’s journey, proudly celebrating three decades supporting and promoting the cycling industry, particularly in parts, accessories and clothing. From our roots, to becoming a trusted partner, to representing some of the world’s most respected brands and retailers, we’ve stayed true to what we do best: Equipping riders with the products that enhance their ride.

We have an amazing team that not everybody gets to see so we’re celebrating the incredible passion behind the scenes, the product specialists, customer support, logistics and brand teams who have helped build our reputation over all these years. Internal events and storytelling campaigns will highlight the people and milestones that have shaped our journey.

NT: PAC has always been at the heart of ZyroFisher, it is a category where we bring real value to connections between brands and retailers. As we mark this milestone, we’re reaffirming our leadership in this space by continuing to offer market-leading customer service, AI driven data technology and insights, deep technical knowledge and a comprehensive, curated portfolio for every type of rider.

Tom, you’ve been leading the company since 2023 – what have been the key developments at ZyroFisher since you arrived?

TA: Moving to a values-based leadership model has been key, releasing the creativity and autonomy of our teams by providing clear strategic direction. A new company vision has helped focus our organisation and tell our story, which has reinforced ZyroFisher’s position as the leading accessories and clothing brand partner in the cycling industry.

We have returned to profitability by tightening commercial discipline, controlling costs and prioritising marginenhancing initiatives. Alongside that, our use of AI and data analysis to focus on inventory optimisation means that we can retain value for all within the cycling industry and stabilise cash flow needs for us and our customers.

We made a deliberate choice on a streamlined brand portfolio, to focus on high-performing, strategically aligned partners. In doing this, we took the difficult decision to exit from brands and channels that we felt were not part of our core values, mission and vision. This has allowed us to

elevate the core brands already within our portfolio while also securing new premium brand partnerships that align with our vision and channel strategy.

We reduced and rebuilt the senior leadership team to gain agility through faster and more autonomous decision making and ensure alignment with commercial goals and accountability for performance. In all of this, we consistently foster a high-performance culture focused on teamwork, integrity, excellence and passion.

All this work has built a strong foundation for sustainable, profitable long-term growth, through smarter planning, dataled decision making, and stronger brand and retailer relationships.

The company has come a long way since 1995, and of course its origins go back another 60 years. Looking at the bigger picture, what do you think are the key differences in running a distributor now compared to 30, 20 and 10 years ago?

NT: 30 years ago, distribution was largely about moving boxes – warehousing, delivery and basic sales support. Today, we like to think of ourselves as adding value to the cycling industry as fullservice partners, offering marketing, digital expertise, consumer insights and end-to-end brand representation.

The importance of digital and data has accelerated over the past 30 years. 20 years ago, ERP systems were just emerg-

ing, with most operations manual or semi-digital. Today, our operation is fully digital, giving us the ability to make decisions based on real-time data, AI driven data insights and analysis, B2B ecommerce and CRM tools, all allowing us to remain competitive and efficient.

There has been a significant shift in the retail landscape and consumer expectations over the past 30 years. 10 years ago, we primarily supported brick and mortar retailers with stock and displays. Today, we support those same retailers across a variety of platforms, ensuring seamless brand presence through in-store, online and D2C channels.

In a world dominated by digital, how important is it to keep supporting the bricks and mortar specialist retail sector?

TA: While routes to market may have evolved, at the heart of it, the consumer is still the same. Bricks and mortar remains critical for brand experience and building a community. Our consumers are often dedicated and passionate cyclists, who rely on specialist retailers as their go to for expertise, service and trust, that digital channels alone can't deliver. The physical retail environment is an important place to foster loyalty, grassroots engagement and generate advocacy in a category where passion and knowledge drive purchasing decisions.

NT: Many of our brands offer highly technical products that benefit from

ZyroFisher’s sizeable and state-of-the-art 100,000 ft² warehouse in Darlington

“WE LIKE TO THINK OF OURSELVES

AS ADDING

VALUE

TO THE CYCLING INDUSTRY AS FULL-SERVICE PARTNERS, OFFERING MARKETING, DIGITAL EXPERTISE, CONSUMER INSIGHTS AND END-TO-END BRAND REPRESENTATION”

a winner: Supporting brands boosts the cycle retail ecosystem

CIN Live’s seminar programme is focused on skills, education and insights that will benefit bike shops and workshops.

Grow your network

With a significant crosssection of the industry, there’s opportunity to speak with bike dealers, brands, distributors, associations and numerous industry players.

All under one roof – with more suppliers being added every day! CIN Live 2025 brings together some of the largest and most significant bike and P&A distributors and suppliers, all under one roof. Including...

“WE HAVE BUILT LONG-TERM RELATIONSHIPS WITH SOME OF THE MOST RESPECTED AND INNOVATIVE BRANDS IN THE INDUSTRY”

hands-on advice, learning, fitting and aftersales support, an area where our specialist retailers excel. The pandemic highlighted that although people appreciate the efficiency of digital, they still value human and physical interaction at their local bike shop. It is not about digital or brick and mortar, but both. Supporting our partners with digital tools, real-time stock data, and consumer marketing can boost their competitiveness and extend brand reach. A strong retail presence complements digital growth, ensuring brand consistency and availability wherever the consumer shops.

ZyroFisher has been a significant player in the cycling industry for many years – how do you think it has established and sustained that position?

TA: We have built long-term relationships with some of the most respected and innovative brands in the industry. In doing so, we have consistently delivered value through brand building, strategic marketing, and strong in-market execution.

Our significant investment in logistics, warehousing, and technology has ensured industry-leading service levels and speed to market. We’ve scaled that up while sustaining operational excellence, allowing us to support growth without compromising quality and reliability. Add in a committed and knowledgeable team with a shared passion for cycling and the outdoors, and that combination has been the foundation of our success. We’ve fostered a culture of collaboration, accountability and consumer focus from warehouse to boardroom.

You have a large portfolio of brands. While many of them are complementary, they must all have distinct needs and demands. How difficult is it to manage?

NT: Every brand has unique needs, from positioning and pricing to marketing and channel strategy. We succeed by tailoring our approach to their individual needs. The challenge lies in maintaining operational efficiency while still offering a bespoke, brand-specific service.

We don’t take a one-size-fits-all approach. We build individual commercial and go to market plans that reflect each brand’s stage of growth, target audience, and strategic objectives. This requires constant coordination between sales, marketing, brand and supply chain.

We use digital tools and insights and AI to monitor performance, forecast demand and make agile decisions, ensuring that we meet brand expectations without compromising service levels. Brands increasingly rely on us for data-led insights and feedback loops that inform product development and strategy.

Maintaining effective logistics is a critical success factor for an organisation like ZyroFisher. What is special about your operations that enables you to do what you do at such a large scale?

NT: Logistics is a cornerstone of ZyroFisher’s proposition, and our state-of-the-art 100,000 ft2 distribution centre is designed to handle high volumes efficiently, while maintaining accuracy and speed. With 28,000 thousand SKUs across multiple categories, our systems are built for both scale and flexibility.

We target ourselves on next-day delivery across the UK and Ireland on orders placed up to 16:00, with high order accuracy and fulfilment rates in excess of 95%. Our logistics reliability gives our retail partners and brand clients confidence in our execution.

Our operation handles a wide range of PAC from clothing to small, technical accessories. We also deliver individual packages to our D2C consumers, pallets to our large nationals and everything inbetween. This requires careful space planning, custom packaging solutions and customer-specific workflows.

Increasingly, there is overlap between sectors like cycling, running, outdoor, camping and general athleisure. That must present the clichéd ‘challenges and opportunities’ – how is ZyroFisher adapting to address these?

TA: The convergence of active sectors is indeed both a challenge and an opportunity for ZyroFisher. We’ve evolved from being a pure cycling distributor to a multi-category brand partner, but only where this makes sense for our brands and customers.

We’re actively curating a portfolio where brands complement across categories. This allows us to create bundled propositions, shared marketing opportunities and richer consumer engagement.

Which sectors do you think present the biggest opportunities for future growth and why?

TA: ZyroFisher is best placed to make the most of future opportunities by drawing on the diverse perspectives and experiences of its people, to better understand and connect with the full spectrum of today’s cyclists.

Consumers are increasingly blending sport, travel, and lifestyle, and this creates a demand for products that deliver versatility and performance. The outdoor sector continues to grow postpandemic, making it a natural extension of our core cycling and current offering.

Meanwhile, e-bikes, scooters and urban cycling gear are booming due to sustainability, congestion, and health trends. This segment brings new consumers, from commuters to older riders and creates opportunities for accessories, apparel and service products.

NT: The female market is historically underserved in cycling. It’s a segment that continues to provide an opportunity for growth through the right product offering. Brands that innovate and market authentically to women represent a major opportunity for the industry.

TA: Whatever we do with this business in the future and however we do it, you can be sure that our deep passion for cycling will underpin that work and continue to characterise ZyroFisher.

Can you name a highlight moment from your time at ZyroFisher?

NT: One of the standout moments during my time at ZyroFisher was successfully bringing globally respected brands like Leatt and Gaerne into the portfolio, plus taking sole distribution in the UK for SRAM and Continental. These additions represented a clear signal to the market that we were raising the bar on the quality, performance, and diversity of the brands we represent.

TA: A standout moment was seeing the pride and joy from our team in delivering

year one of our long-term business plan. Among other things, this encompassed a return to profitability after a challenging period of industry-wide disruption. It was a turning point that demonstrated the strength of our team, the resilience of our model and the importance of having a clear strategic focus.

Look ahead to 2035 – what do you think will be the key themes and messages framing ZyroFisher’s 40th birthday celebrations?

TA: First, a celebration of ZyroFisher’s long-standing leadership in cycling and outdoor distribution across the UK and Ireland. Second, a recognition of how the business evolved from a traditional distributor to a strategic brand growth partner across multiple sectors. Third, marking multi-decade partnerships with worldclass brands showing that trust, performance and shared values still matter.

NT: By 2035, we expect transport to be significantly greener and more active, with ZyroFisher having played a central role in enabling that shift. In another ten years. We will be celebrating our contribution to the rise of eBikes, cargo bikes and sustainable commuting solutions, helping reduce emissions, congestion and overcoming barriers to active transport.

TA: We will also be celebrating progress in making cycling and the outdoors more inclusive, across gender, race, ability and background. ZyroFisher will be seen as a company that helped reshape the industry culture, both internally and through the brands that it champions.

www.zyrofisher.co.uk

The ZyroFisher customer service team: “We’ve fostered a culture of collaboration, accountability and consumer focus from warehouse to boardroom”

“CONSUMERS ARE INCREASINGLY BLENDING SPORT, TRAVEL, AND LIFESTYLE, AND THIS CREATES A DEMAND FOR PRODUCTS THAT DELIVER VERSATILITY AND PERFORMANCE”

A new law means that police will have greater powers to enter a property if a GPS indicates stolen goods inside. Cycling Industry News speaks to security specialist BackPedal and asks, ‘Has the tide just turned on e-bike theft?’

BActually, the crime statistics published by most police forces have shown it’s been a near-perfect run. In the vast majority of cases, bike theft reports will return a ‘case closed’ verdict within 24 hours of being reported in many parts of the country. A handful of highprofile thefts have illustrated how far down the priority list bike recovery has fallen.

for National Statistics says. This roughly works out to a new bike stolen every seven minutes in England and Wales, or, if you account for unreported thefts, possibly less than half that timeline.

“IF WE HAVE A GPS OR BLUETOOTH SIGNAL CONFIRMING A BIKE’S LOCATION, WE BELIEVE IT’S REASONABLE TO INVESTIGATE FURTHER”

Remember when the BBC Economics Editor Faisal Islam told the MET Police he had the GPS coordinates of his stolen bike, but could not get the force to attend and investigate? That has become the norm as stretched resources pull police away from what may be considered less serious crimes and onto more pressing matters.

If you remember at the time of Faisal Islam’s social media complaint, The Telegraph newspaper shortly afterwards followed with a scan of national data in which it was revealed that a whopping 87% of UK neighbourhoods did not see a single resolved bike theft claim. In that same piece, the newspaper calculated a national average of just a 1.4% chance of a suspect ever being identified when bike crime was reported. Ultimately, that means that convictions are blindingly rare.

Fast forward to the present day and bike theft data is quite thin on the ground, but we’re now at a junction, according to stolen-bike.co.uk, where 71% of people don’t even report bike crime to the police. Of those that do, they help us build up the insight that 77,313 bikes are stolen on aver-

Little wonder, then, that one private security startup spotted an opportunity to buck a dire trend. For those who have not yet encountered BackPedal, they are a team of private recovery experts with a central data centre and a team of hired hands, often security or police professionals, who will do the dirty work of attempting to recover a bike, aided by the marvel that is GPS technology. Needless to say, they’ve made a lot more progress since eBikes really took off and claim an above 80% success rate on account of the tracking technologies they deploy.

Anyhow, you’re only as successful as the law allows you to be and sometimes even BackPedal have to give up on a lead. That, however, might be subject to change, or at least their cooperation with the police may be about to become a whole lot more effective.

Though it has its controversial elements, there is a clause in the Crime and Policing Bill that is very likely to have a positive impact on the police’s ability to act on bike theft if the location of the vehicle is beyond doubt. Here’s the detail:

Clause 12 of the Crime and Policing Bill “Create a new targeted power for the police to enter premises to search for and

Hub, pivot, headset bearings, bottom brackets, pulley wheels and professional tool solutions. From ABEC 3 bearings for day-to-day repairs to Maxhit™ components and XD15 bearings which are guaranteed for life, Enduro Bearings cover all your workshop bearing needs.

A wide range of shift and brake cable systems, brake pads, hoses, disc rotors and problem solvers for both aftermarket and workshop use. Jagwire are committed to producing quality and consistent products at an affordable price.

The world’s largest chain manufacturer, KMC brings 40 years of experience to produce the highest quality, most durable drivetrain components for every bicycle category on the market. GO Wax factory pre-waxed chains now available.

A comprehensive range of eco-friendly maintenance and care products including grease, lube, cleaner, fork oil and brake fluid, all produced in Switzerland and specially formulated for cycling.

Extra UK is proud to distribute a number of leading workshop brands. Visit www.extrauk.co.uk to view our full product range, or email enquiries@extrauk.co.uk to request an account.

seize electronically tracked stolen goods, ranging from mobile phones to stolen vehicles and agricultural machinery, and expansion of the lawful purposes by which law enforcement agencies can access the DVLA driver licence records.”

For James Dunn, the Founder of BackPedal, this is reason for optimism that in the years to come the tide can be turned on bike theft after decades of dwindling success. With the bike industry’s buy-in, his firm is building the foundations of a tracking, recovery and insurance product that could finally give peace of mind to consumers. After all, time and time again, in survey after survey, consumers have cited bike theft as a top three reason for not cycling, often behind safety concerns and the British weather.

So James, how do you currently operate within the frameworks of the law?

We follow a common-sense approach and always stay within the law. Most of what we do—like tracing a stolen bike to a specific area, knocking on doors, or checking gardens, is completely legal, provided we respect privacy laws. For instance, you can’t continue observing a private garden if a family is using it, but most are empty when we check.

We don’t trespass on or search properties without consent. However, if we have a GPS or Bluetooth signal confirming a bike's location, we believe it’s reasonable to investigate further. There are clear boundaries. For example, we never use force or intimidation. People often ask if we confront thieves, but that’s neither ethical nor legal. The person with the bike might not be the thief; they could’ve bought it unknowingly.

Ultimately, our approach is proactive and grounded in legality and reason.

Given the scale and impact of bike theft, we believe a practical, rightsrespecting approach is necessary.

What limitations exist in your work, and how does this proposed law change help your odds of recovery?

Our biggest limitation has been the lack of police response, even when we know a stolen bike is in a specific location. Using proximity beacon technology, we often have 95–99% certainty that a bike is in a given location. Most of the time, a simple conversation with the residents at the property resolves the issue. But in about 10 to 20% of cases, the bike isn’t returned, and we need police assistance. Too often, police have so far declined to help, citing the need for a warrant. But legally, a warrant isn’t always required if there are reasonable grounds, such as a clear GPS and Bluetooth data signal showing the bike is there. The new law change will help clarify this and should encourage officers to act more often.

This might not dramatically improve our recovery rate, we do already revisit properties multiple times, four or five times sometimes, but it will speed things up on average. Instead of waiting weeks, we’ll be able to resolve cases more efficiently, likely nudging our recovery rate from around 80% to perhaps 82–85%.

You are now working directly with bike brands to ensure eBikes are secure from checkout. Why is this an important step?

Yes, we’ve just launched a partnership with Estarli, and there is strong demand for this. Mid-to-premium tier eBikes, especially those used by commuters and families, are major targets for theft. Cargo bikes in particular seem to be prominent targets. For many, a stolen bike means missing work or not being able to take kids to school. Insurance may cover some costs, but not the disruption to people’s lives.

Bike brands tend to understand that theft concerns affect sales. Customers want assurance that their investment is protected. By integrating recovery tech at the point of sale, we are helping reduce that anxiety and protect their mobility.

What trends have you noticed lately when recovering stolen bikes?

The main trends remain consistent: opportunistic theft due to poor or no locking is a primary cause for bikes

Opportunistic theft due to poor or no locking remains a primary cause for bikes going missing

going missing. One notable trend is a rise in battery theft. Batteries are easy to remove, conceal, transport, and resell, plus often they are worth anything between £500 to £1,000. This potentially carries fresh dangers for consumers.

So, we’ve recently begun recovering stolen batteries for clients. Trackers allow us to act quickly and confront sellers with clear evidence. This has proven successful and will likely become a bigger part of our recovery work, especially as more batteries are fitted with trackers.

You now have a link with insurance when subscribing to the BackPedal service. How does this benefit the customer? Yes, for the past 18 months we’ve partnered with Sunday's Insurance, one of the UK’s leading bike insurers. The process is simple: we always try to recover the stolen bike first, no matter the circumstances. If we’re unable to recover it, customers can claim through the insurance.

This gives users peace of mind, knowing there’s a dedicated recovery effort before any insurance process begins.

How’s business developed in the past 18 months and what are your future plans? Business has grown strongly. We’re featured in an upcoming BBC TV series, similar to Motorway Cops, with 15 episodes following our recovery

efforts. That should air soon.

Bike theft is a massive issue across the UK. As more people rely on bikes for daily life, the demand for theft recovery services continues to rise. People recognise that police often lack the resources to respond effectively. We’re stepping in to fill that gap.

Ultimately, we can’t just rely on insurance to fight theft, we need tools and services that actively recover bikes and deter thieves.

Have you any good theft recovery stories from recent jobs?

Yes. We had one notable example involving using our drone technology. We were tracking a stolen Cowboy electric bike in a high-rise block, but couldn’t pinpoint the flat. So, we launched a drone to scan the building. It spotted the bike on a balcony.

That allowed us to identify the exact unit. We then knocked on the door and recovered the bike. The resident claimed they’d bought it, but we had clear evidence it was stolen. The full story is on our Instagram with the footage of the recovery.

Drones are now part of our team’s recovery toolkit. They give us better visibility and increase our chances of success, especially in difficult or dense urban locations.

www.backpedal.co

Our exciting new range of KX Wheels are produced right here at Bob Elliot HQ Utilising our specialist machinery, we prepare the hubs using reliable, economical, high quality componentry and lace the wheels before finishing them to precise tolerances with the use of a robot which are then quality checked to deliver the perfect wheel every time. Competitively priced replacement wheels offering a wide selection for 700C and all MTB disciplines.

Built here at Bob Elliot HQ IN THE UK

All wheels FInished to exacting tolerances Comprehensive range, PRICED competitively

Quality componentry from all around the World

Over 50 years combined wheel building experience

Next day delivery available

Specifically tailored for the needs and demands of cycling, Enduro Bearings uses high spec bearing steel and unique cyclingspecific bearing test machines in the R&D process. We take a deep dive into the world of bearings with Andy Searcy, Brand Manager for Enduro Bearings at Extra UK…

Can you fill us in on the beginnings of Enduro Bearings?

Matt Harvey and Mike Alders founded Enduro Bearings in 1996, in the attic of Mike’s father’s forklift repair shop. 30 years later, Enduro is a global company with two divisions. Mike leads the industrial division while Matt leads the cycling division. Enduro Bearings’ California headquarters totals 60,000 ft2 with additional manufacturing and distribution facilities in Singapore, Taiwan and a joint venture in China. The cycling group’s friendly, experienced staff serves the bearing and component needs of global bike brands, distributors, retailers and riders, providing everything from affordable ABEC 3 bearings to high performance, lifetime warranty XD15 bearings and Maxhit™ components. Enduro bearings are fitted annually onto millions of bikes.

And what about Enduro’s cycling roots? What’s the back story?

By age 13, Matt Harvey was breaking BMX bikes and working in bike shops. He met Mike Alders in high school and the schoolmates first worked together assembling

kids bikes during the holidays. Matt went on to earn an engineering degree, which led to design work at Gary Fisher Bicycles, White Industries and Bianchi. He was

involved in such notable projects as the Fisher RS-1 full suspension MTB, White Industries bottom brackets and hubs, and the radical fully suspended Bianchi race bike that Johann Museeuw piloted in the Paris-Roubaix cobbled classic.

Mike Alders, meanwhile, was working at his dad’s forklift business and had resorted to custom machining massive forklift mast guide bearings; bearings which were no longer readily available for older forklifts. With no access to engineering drawings, Mike called on his friend Matt to render designs in AutoCAD. Matt immediately realised the ginormous bearings he was designing – full of balls with no retainer ring – could be scaled down perfectly for the high load demands found on bikes, which would result in dramatic improvements in reliability and lifespan. In 1998, Enduro introduced their first MAX suspension pivot bearings.

What’s different about Enduro Bearings compared to other well-known brands? Every bearing in Enduro’s line-up is designed and purpose-built for its location on the bike. Other brands lean on decades of industrial bearing standards focused on the higher RPMs and lighter loads of electrical motors. To validate Enduro’s bearing design solutions, Matt Harvey built a cycling-specific bearing test machine that replicates the lower rotational speeds and high multi-directional loads of road and off-road riding.

Can you share specifics on the design differences between Enduro’s bike bearings and the competition?

To rotate quietly at extremely high RPM and not have grease foul the motor, industrial bearing designs typically feature smaller balls, single-lip seals and minimal grease-fill. Bikes roll slow by comparison and the loads are much higher. Imagine what a tiny hub or suspension bearing endures under a pro rider sprinting for the win or careering down a rocky off-road descent.

The important design and performance features hidden inside Enduro bearings include fewer and larger balls cradled in deeper bearing race grooves. In combina-

tion, under the extreme axial loads found in cycling, larger balls rolling in deeper grooves improve rolling efficiency and extend bearing life. To further improve performance, Enduro only specs the highest grade bearing steels machined to exacting tolerances, finished with tightly controlled post machining treatments.

Often overlooked, yet critical to extending bearing life and decreasing rolling resistance, are bearing seals and grease. Enduro bearings feature a unique double-lip seal captured in machined recesses on both the inner and outer bearing races. While more expensive to manufacture, double-lip seals riding in a grease-filled groove offers superior shielding against contaminants while improving grease retention over time.

Other manufacturers only capture the seal in the outer race, with a single lip floating on the surface of the inner race. A single lip seal lets the bad stuff in as grease easily migrates out. A dry bearing with a dry seal creates 20x the friction compared to properly greased double-lip seal.

Enduro uses specific grease formulas for each location on the bike. With suspension pivot bearings and headset bearings that only rotate a few degrees and encounter harsh loads, a high viscosity, impact absorbing MAX (Almagard) grease fills the bearing. In bearings that spin 100 to 200 RPM, Enduro’s lifetime warranty bearings are filled with XD15 (Klüber) high-performance grease. The more affordable

ABEC series bearings are filled with Enduro (Mobil) performance grease. All Enduro bearings feature 80% grease fill to fully lubricate seals and significantly reduce friction under load.

For those unfamiliar, can you distill 1000plus Enduro products into a few words? The company’s ‘good, better, best’ product hierarchy makes sense. Why spend more than needed if you’re a fair-weather rider? All Enduro bearings incorporate the same design principles – bigger balls, deeper grooves and such – the difference is material cost, finishing treatments and corrosion resistance.

Enduro’s very affordable and very good ABEC 3, ABEC 5, and MAX bearings perform quite well for quite a long time in dry and occasionally wet climates. When rusty, they spin okay but not like new, as a result of the double-lip seals doing their job. Eventually, these bearings will need to be replaced.

Enduro’s better bearings include a two-year warranty. These bearings feature higher grade, corrosion resistant materials and post machining treatments such as black oxide. MAX Solid Lube pivot bearings include a proprietary solid lube formula ideally suited for harsh climates.

At the top are Enduro’s high performance, lifetime warranty products: XD15 hub and bottom bracket bearings, 440C headset bearings, Maxhit bottom brackets and headsets and Directline derailleur pulleys. These products are incredibly efficient, spin great when abused and require little to no service.

Enduro also offers a full ensemble of professional grade bearing removal and installation tools.

How long has Extra UK been working with Enduro? How has that relationship developed and how does it link in with dealers? Having worked with Enduro Bearings for over 10 years, we (Extra UK) have established a strong relationship with their vastly experienced team and established the brand as a staple in IBDs. The range of products cover most general bearing needs for day-to-day repair work but over the last few years we have seen huge growth in lifetime warranty products at the premium end, especially bottom brackets. For the UK riders that want performance AND longevity the XD15 and Maxhit products really do stand out from the crowd. We offer POS units to showcase the differing products alongside other promo items to really enhance the visibility of the brand in store. Bearings are hidden for the most part so having brand visibility in store really helps to place the brand name with the customer.

Finally, Enduro have some excellent UK based ambassadors who have been riding their products for a number of years with great success and little maintenance. Check out Nic Vieri, Guy Kesteven, Josh Ibbett and Josh Reid for some real world, genuine product feedback!

Enduro Bearings is distributed by Extra UK www.extrauk.co.uk

All performance, no compromises. Force AXS wins with fully wireless technology, refined ergonomics, and further AXS integration. This pro-level, lightweight drivetrain delivers e ortless braking and faster front shifting so you can focus on performing your best on the road.

Continuing a series of articles from knowledgeable cycle sales veteran John Styles, ‘Bike Trade Sales Secrets’ continues with some tips on leading conversations with customers on the shop floor and the art of asking the right questions…

In my previous article, I suggested setting up your position / body language in a triangle between you the consumer and the product, so that you could focus more on the consumer and less on the product. From this starting point you’re in a better position to get to know your customer by asking questions. And questions can be your best friend.

When you’re just starting out on the shopfloor, selling can feel a little daunting. You’ll see more experienced colleagues talking fluently and knowledgeably about a wide variety of products. You’ll see them warmly and naturally greeting their regular customers, guiding them through sales almost effortlessly. So much so, it doesn’t even look like selling.

It can also feel like there is pressure from a manager or colleagues to compete and perform. Perhaps your confidence has been knocked when the owner or senior staff member “hovers” or swoops in over the top of the conversation you were starting? I’ve lost track of the number of times that store owners have told me “I wish my staff were more confident to sell, but I just

“SALES TRAINING IS FEW AND FAR BETWEEN IN OUR INDUSTRY, A VAST AMOUNT OF TIME AND RESOURCE IS INVESTED

IN TECHNICAL, MECHANICAL AND PRODUCT TRAINING, BUT PRECIOUS LITTLE IN PERSONAL DEVELOPMENT, INCLUDING SALES SKILLS”

Get in touch with John via: johnstyles2002@gmail.com

feel like I have to do most of it myself”. It can also feel like there is pressure from consumers, to find what they need quickly – and that can lead to quite hurried, functional conversations.

Sales training is few and far between in our industry, A vast amount of time and resource is invested in technical, mechanical and product training, but precious little in personal development, including sales skills. The result: most new staff pick it up through a combination of observing others, common sense and trial and error.

This often means that those with “natural talent” (often those with an outgoing or confident personality or an instinct of how to get a consumer from A to B) tend to thrive. While those who are more thoughtful or introverted, perhaps shy even, tend to recede. This can foster a false belief that sales skills can’t be learned. It can perpetuate the myth that sales is a dark art only for those who have it already built-in. And that simply isn’t true.

Sales skills, like anything else, can be learned. Whilst a talented person, if they apply themselves, can learn even more and go further still, the

Do you have a specific type of bike in mind?

Do you have a specific brand in mind?

What features are you looking for?

What bikes do you have already?

Where have you travelled from today?

What keeps you busy when you’re not out on your bike?

Does anyone else in your family cycle?

Do you have any health issues that affect your cycling or choice of bike?

How often do you ride? ...For how long and where?

Are you in a cycling club?

Are you entering any events, charity rides or races?

Do you cycle with friends or in any groups?

What’s the main reason for you to cycle?

Is cycling a sport for you, a necessity or a passion?

Do you wish you could cycle more (less?)

Do you have any specific cycling goals?

Does cycling support your personal goals?

What is this new bike going to do for you?

What does it mean for you?

4 stage questions: To get a fuller picture of the person, get to know their needs, what’s driving their purchase and what's holding them up, we have to get out of Box 1, through Boxes 2 and 3, aiming for Box 4

challenge for most of us is to be the best salesperson that we can be, competing only with ourselves.

This combination of pressure, and a lack of training can lead to a lack of confidence in many store staff. So they don’t ask enough questions. I observe this as a lost opportunity in many sales conversations. And it boils down to 3 things: (1) Too few questions (2) The wrong type of questions (3) Limited or “safe” subjects – mainly “the bike”.

What do I mean by this?

1. Too few questions

Many interactions I’ve listened to channels the customer very quickly towards a store’s favourite or bestselling product, it goes something like this:

How can I help you today?

I’m looking for a pump.

Is it to go with you, on your bike or leave behind in your garage?

Well, I’m not quite sure but probably, I might need to take it out with me.

Well, our bestselling (portable) pump is this one. It’s from brand A, who are really reliable. We like it because it has ABC features and we recommend this one. Would you like to take this one today?

I’ve seen similarly short conversations for bike purchases. And yes, some consumers are genuinely in a hurry and just want your first and best recommendation to solve the problem. Others could benefit from a little more help, which comes from a few more questions about their needs.

TIP: Aim for 5 Questions. You could try counting how many questions you ask in a conversation. Try holding one hand out at your side, or behind your back, and count on your fingers when you have asked five questions. That sounds easy. You might be surprised how long it takes to develop this new habit. When you’re managing five consistently, try for 10 on your next bike sale.

2. The wrong type of questions

In the earlier example the salesperson only asks one question, and it’s a closed question. Open questions are better (at the beginning of a conversation). This is because they give the consumer more chance to talk and reveal more information.

3. Limited or “safe” subjects – mainly “the bike”

I wouldn’t be the first industry commentator or sales trainer to suggest that store staff often spend too much time focusing on the product and not enough time focusing on the person (which by the way, is natural and understandable, after all we know a lot more about the product than we do the customer). With that in mind, have a look at the questions in each of the boxes below. Ask yourself honestly, which kinds of questions do I use most often? If you’re staying mostly in Box 1 (see above), you may be missing out on the chance to know your customer better.

To get a fuller picture of the person, we have to get out of Box 1, through Boxes 2 and 3, aiming for Box 4. To really to get to know their needs, what’s driving their purchase and what’s hold-

ing them up. These questions are just examples, if you remember the 4 boxes, you’ll come up with more of course.

TIP: Maybe keep a copy of this and challenge yourself to expand your questioning, one box at a time?

Again, this is a confidence thing and perhaps for the newest or youngest staff, the life experience needed to ask and interpret some of these questions may be daunting. And that’s why I would say to the newest people on the shopfloor – give it a try. It might not feel comfortable to begin with, but over time you can make this your own. There are many ways to sell but asking enough questions, in the right way to understand your customer, is common to most of them. And what you may find is that the right type of questions reveals the customer’s worries or hesitations about their purchase. Their “Objections” – that awkward moment you’ve bene dreading – when they say “No”, and you’re not sure quite why, or what to do about it. More about that next time.

John Styles is a veteran of the cycling industry, having worked with leading distributors and brands across the sector. With a well-rounded perspective on the opportunities and challenges facing the sector, backed by a Bachelors Degree in Economics, John Styles is an expert consultant for the bike trade. He will be hosting a sales workshop interactive session at the forthcoming CIN Live, 14-15 September 2025.

If you have ever had the creeping suspicion that you might be losing out on sales by not opening on Sunday, then you’re not alone. But are such worries well placed? John Styles brings in retail opinion and market data to examine the question…

It’s been over 20 years since I started in the industry, managing a retail store. One thing I clearly remember was the staff rota, the same every week. I took Sunday-Monday off and the deputy manager’s weekend was Friday-Saturday. We took turns managing the busiest period.

Why? Our store had a sales target over £1 million and we were part of a large chain of stores, we had to be open every day. Head office had a clear mantra. Rent is fixed overhead, and if you’re not open seven days a week, you’re not ‘Trading to the Max’. For mainstream stores who sell bikes, such as Halfords, Go-Outdoors, Decathlon and other national chains, the seven-day trading mantra is still very present of course.

Simon Irons, former Group Cycling Director at Halfords and BA Data & Insights Director comments: “Halfords opening at the weekend was just a simple case of being open when our [mainstream] customers weren’t at work and want to shop, especially in the summer when the sun is shining!”

The industry norm for IBDs –Sunday/Monday closing

One of the first things that surprised me when I started visiting IBDs was how many trade five or six days a week. Sunday/Monday closing appears to have evolved as the industry standard. Of course, after 20-plus years in the industry I now know many stores trade five days a week and really kind of work seven-day, it’s a labour of love for so many IBDs. But the questions still arises, how much could IBDs be missing out when they are closed?

IBDs who buck the trend

Recently, I noticed a handful of stores moving to seven-day a week opening, announcing it on social media or putting out big banners on the side of the store. And that made me curious, what made them want to buck the trend? So, I asked one of them and here’s what they told me:

“There were a couple of factors that led to us opening seven days a week. Firstly, we found our smaller satellite store hadn’t been working out the way we thought. We had a couple of great staff there we didn’t want to lose, so we gave them the option of coming over to the main store. This built our team up to a level where we could be flexible and offer that seven day a week opening.

“The second thing that got us started was the demand from our local customer base to be available when they needed us. We’ve kind of been like the ‘Bike AA’ of the local area, we even collect people locally if they’re broken down. So being open seven days a week means that we really are there to get people going again when-

5 DAY WEEK

Simple. Direct Control. Uniformity of service. No Handovers needed. Worry-free downtime. Everyone gets same two days off, no rota needed.

Less consumer choice. Doesn’t fully utilise fixed overhead. Can stifle staff progression. Potential for missed sales. Service times can be limited by work-stand access.

7 DAY WEEK

More consumer choice. Fixed overhead fully exploited. Spread out servicing workload. Better bike sale opportunities. Saviour stories, PR, reviews. Destination store. Greater Geographical reach. Staff Growth and development.

Service may vary. Handovers needed. Delegation and motivation essential. Greater potential for errors/omissions/mix-ups. Harder to dis-engage in downtime. Complex Staff rota and/or more staffing required.

ever they need us.

“Our sales are up 30% to 40% many months this year, so it must be part of something we’re doing right. Although we’re outside of the high street, we really are a resource for the local community and being open seven days a week really helps us to play our part fully.”

Len Simmons, Highway Cycles, Hertford

Certainly, consumers seem to agree judging by their 5/5 Google Ratings and quotes like this: “Fantastic service from the guys who were in store on a Sunday morning…. Thank you!”

And those who don’t…

I also asked a selection of stores who don’t open seven days a week. There were a number of themes and here’s some of what they told me:

“We’ve tried various opening times, five, six, seven days per week and

“OUR SALES ARE UP 30% TO 40% MANY MONTHS THIS YEAR. ALTHOUGH WE’RE OUTSIDE OF THE HIGH STREET, WE REALLY ARE A RESOURCE FOR THE LOCAL COMMUNITY AND BEING OPEN SEVEN DAYS A WEEK REALLY HELPS US TO PLAY OUR PART FULLY”

Len Simmons, Highway Cycles, Hertford

“54% OF IBDS ARE CLOSED ON SUNDAYS”

*Source: Citrus Lime Retailer Panel

we’ve found over the years that the turnover ends up pretty much the same, we tend see the same faces, just at different times.”

“We’d like to try that, but our team is pretty small and we work really well together, breaking up that kind of flow might not work so well.”

“Being city based, seven -day trading just wouldn’t make any sense, all our customers are out of town on the weekends.”

Needing a certain minimum team size, to ensure safe working, a bit of camaraderie and a good mix of skills also emerged as a key consideration.

How many stores are open?

Next, I became curious about the picture of store opening hours and here’s what Citrus-Lime, one of the UK leading Retail Solutions providers, were able to tell me:

“NEEDING A CERTAIN MINIMUM TEAM SIZE, TO ENSURE SAFE WORKING, A BIT OF CAMARADERIE AND A GOOD MIX OF SKILLS ALSO EMERGED AS A KEY CONSIDERATION”

Source: BA Market Data Service (https://bicycleassociation.org.uk/pages/market-data) NOTE: DATA IS STACKED IN VALUE ORDER, NOT BY DAYS OF THE WEEK

“Cloud-based POS gives independent retailers powerful visibility into how their businesses are really performing. Because the data is confidential, we can only talk about overall patterns, but even those can be eyeopening. For example, Sundays stand out as quieter days across the board, with takings coming in at less than half those of other days. That lines up with the fact that only 46% of stores are open and actively trading on Sundays. Mondays show a similar pattern, with a notable number of stores closed. When you compare the figures with takings on other days, it looks like missed opportunity to me.

“My recommendation would always be to open seven days a week if you can. If you can’t, explore other ways to keep trading on those days, such as Ecommerce. If you’re relying on the store alone, and you look at the total

“IF YOU’RE RELYING ON THE STORE ALONE, AND YOU LOOK AT THE TOTAL MONTH OF TIME YOU’RE OPEN AS A PERCENTAGE OF THE TRADING WEEK, EVEN EIGHT HOURS A DAY, SEVEN DAYS A WEEK, IS ONLY 33% OF THE TIME YOU COULD BE TRADING”

Grant Hadwin, Head of Sales, Citrus-Lime

month of time you’re open as a percentage of the trading week, even eight hours a day, seven days a week, is only 33% of the time you could be trading.”

Grant Hadwin, Head of Sales, Citrus-Lime

Of course, this sample is limited and amongst those without an EPOS system, the % could be higher still.

To get a picture of the overall trading pattern by value, I approached The Bicycle Association, and their Market Data threw up a bit of a surprise. In the chart above you can see IBD turnover for each day of the week. The turnover for Sundays starts out at 11% of weekly takings in 2019 but declines rapidly in 2021 – during lockdown. And it doesn’t recover; it remains at just 3% in 2025. Whether this is something on the

“A

STORE OPENING MOVING FROM SIX TO SEVEN DAYS A WEEK MIGHT BOOST THEIR WEEKLY TURNOVER BETWEEN 4% AND 8%. AND A STORE MOVING FROM FIVE TO SEVEN DAYS MIGHT ACHIEVE OVERALL SALES GROWTH OF 7% TO 14%”

supply side or the demand side is unclear. Perhaps overworked retailers decided to close their doors on Sundays? Maybe consumers transferred their Sunday spending to other days of the week? Monday, Thursday and Friday are slightly up (between 2% and 4%) over time, so this could reflect work-fromhome behaviours, where consumers shop either side of the weekend?

The Sunday Squeeze – are some stores missing out?

Another possibility is a shift towards online spending. Further context comes from Citrus-Lime whose revenue-by-day data (the detail of which I can’t share here) shows there is a strong demand for online purchasing on Sundays. These purchases are often delayed in processing until early the following week, showing up in those days’ f igures.

So, the picture is a little unclear, but it may indicate that lockdown shifted some behaviours for both retailers and consumers, and that there may be some lost turnover there to be recovered?

A tricky question is: if you’re closed,

where does lost turnover that go? Do people return another day? (Returns). Do they shop with a local competitor or online instead? (Losses). Or is the turnover lost entirely, after all, if you’re not open, they may have to do that repair themselves (Total Losses).

I did some basic modelling on that, assuming an equal three way split between “Returns, Losses and Total Losses”. Now I can’t reveal the exact baseline numbers that Citrus-Lime and the BA discussed with me, but the %’s are what really matter to a business owner in any case. And without revealing the exact mechanics of how I put these two sets of data together, the answer is ‘Most likely, Yes’.

And if so, by how much – somewhere between 4% and 14%?

Broadly speaking the data suggests that a store opening moving from six to seven days week might boost their weekly turnover between 4% and 8%. And a store moving from five to seven days might achieve overall sales growth of 7% to 14%. Of course, that’s on an average or aggregate basis. If

yours is the only store that’s open in a cluster of four or five towns, and you’re sure to shout about it, the sales growth could well be more. Whether that extra revenue is meaningful to the business, or if can be done without a tricky/complex staff rota, or incurring extra costs is another question.

An open question for owners

Everyone’s business is different and there’s no real right or wrong to this question, so, from these observations I’m just left with a couple of open questions for business owners.

If this is something you’re already thinking about, could summer 2025 be the right time to try out seven days a week opening? And, if you’re not open seven days a week, is it because you don’t feel the store can’t really trade or function effectively without you – that the store to some extent is you? So, could you potentially be missing the best opportunity to train up the person who is going to buy the business when you retire?

Send us your thoughts jon@cyclingindustry.news

Mark Sutton has assessed the pros and cons for the bike industry, its people and the planet. He argues that we are at an inflection point where following blindly is not wise without an education on the pros and cons…

You’ve no doubt seen a spike in quirky AI-generated imagery of late. Trends that encourage the masses to generate an AI-generated avatar of oneself, or posts flanked by what might otherwise have been a stock image, instead headed by an often oversaturated image that takes a mish-mash of prompts and attempts to make sense of the subject matter. Perhaps you too have dabbled in generating something with AI. An email, some research, an article.

I’ll level with you, out of morbid curiosity, I have too. Hearing that “90% of news will be written by machines in 15 years,” according to Kristian Hammond chief scientist of Natural Sciences, well, that made me sit up and listen.

Yet long before I first used the basic AI tools I had read The Age of AI, a book co-authored by Henry Kissinger, a name you’ll recognise as a US secretary of State in the 70s. The history books tend to cast him as a man of war, so his name featured on the cover alongside former Google CEO Eric Schmidt and a dean of MIT computing is curious. I’d read this book and then forgotten about it for 18 months, unable to grasp some of the ideas at the time. Fast forward to today and things that seemed fantastical then are very real now. It’s like we’ve been here before; the dawn of a new age of promise. Probably.

My first true experiment with AI was a bit of an information-gathering exercise. A few years back, I had wanted to learn the basics of coding, but new hobbies take time and investment. Now, with AI, I gathered that I could bypass the need to learn the fundamentals of even the basics and just issue prompts that would generate the code I needed. My experiment was to create a bike sizing tool to embed into an article. Five minutes later, I had the code. I wish it were more complex than that, but all that was required was some refinement to ask for tailoring to the male and female form and I had created something that a decade ago might have taken the publishers I have worked with over the years perhaps a few days to deliver in the precise, brand aligned, table format I’d sought. Ultimately, it’d need a chain of execution delivered to whatever timeframe the collective could muster.

Possibly I could have fudged it through faster, but generally, for print, the process would have involved my manual research, writing, a designer and a proofreader to be sure of the accuracy. Now that the entire collective of work, inclusive presumably of the coder I might have required to make the interactive calculator element function online, was now redundant. On the one hand, I thought myself lucky not to have invested the

time in learning a new skill, one that seemed to be pretty future-proofed as a societal need. On the other, I wondered how many people might be put out of work if my experience were extrapolated. If you listen to the Institute for Public Policy Research, an estimated eight million jobs are ‘at risk’ from AI, potentially with no GDP gain. I have not dabbled much since that day, other than continuing to learn about AI in a hands-off way. I know that I could use it very effectively to cheat code plenty of day-to-day tasks, but as a journalist with the hard-fought relationships and certificates to somewhat validate my career choice, there’s lots that’s not sitting right at the time of writing, inclusive of skipping the vital research and data collection components of my role, and I’ll go on to ask you to reflect in the same way that I have on how you choose to deploy these potential playing field levellers.

So, what if I had told you that to this point, this article had been written by AI? You’d feel cheated, surely? Like you’d committed more time to this moment than I had spent writing it.

There is no spoiler alert, this should pass the AI detection tool. Yet, that’s how you should feel. I recently read something by an industry colleague with a non-insubstantial reach. It felt… off. I ran it through a trio of AI detection tools and confirmed that I

Each packet of Torq Jellies contains six energy-rich soft chews, providing a total of 30g with a 2:1 glucose: fructose carbohydrate ratio.