DEBT REVIEW STARTS IN THE FRIDGE

E XCE LL ENCE IS D OIN G ORD IN A R Y THING S

E XT R AO RD I N A RI LY W E L L

– John W. Gardner

DEBT REVIEW STARTS IN THE FRIDGE

WHAT STORY DOES YOUR FRIDGE TELL?

Open your fridge. Go ahead…i’ll wait.

Now ask yourself: What story does my fridge tell?

• Is it packed with leftovers and half used sauce bottles?

• Is it empty except for a soggy tomato and dried husk of half a lemon?

• Or is it stuffed with ready-to-eat microwave meals and no-name fizzy drinks?

Believe it or not, your fridge says a lot about your finances, especially if you're in debt review.

We all know that when your finances are under pressure, the fridge is often the first place that you feel it. It becomes ground zero for convenience spending, emotional snacking, and naughty “oops-I-was-hungry” purchases. Either that or it's as empty as your bank account.

But it’s also where some of the biggest changes can start … right next to the cheese.

DEBT REVIEW STARTS IN THE FRIDGE

CREDIT CRUNCH LEFT YOU NOTHING TO MUNCH?

When people run out of credit (because they’ve maxed out their cards or are too busy paying back debt) they often find themselves trying to live on less.

But instead of successfully adapting to their changed circumstances, many fall into a sort of survival mode.

The result?

If not an empty fridge, then maybe one full of cheap, processed food. Fewer vegetables certainly. More starch, sugar, and salt probably.

Others who are overworked or have no time, can quickly fall into the habit of relying on fast food or microwave meals. While not necessarily bad, these can quickly drain your wallet (and ironically lower your energy levels).

When days are dark… decent meals are few.

DEBT REVIEW STARTS IN THE FRIDGE

STRESS EATING AND SPIRAL SPENDING

Let’s be honest… stress eating is real.

When you're anxious about your finances, it’s easy to reach for something comforting. That’s why they call it comfort food.

• That chocolate bar.

• A nice salty packet of chips.

• A takeaway meal that you tell yourself you “deserve.”

These little buys (also called micro-spending) don’t always feel like real spending because they can be spread out and in smaller amounts, but they add up fast.

And they’re sneaky: they often happen on the worst days, when you're exhausted and least likely to track them, so the impact on your budget can be hard to understand.

Without a plan, emotional eating and impulsive spending go hand in hand, creating a frustrating cycle of guilt and money trouble. It can leave you feeling sad and reaching for a feel-good snack.

DEBT REVIEW STARTS IN THE FRIDGE

THE PROBLEM WITH POOR FOOD ROUTINES

Most people don’t think twice about their daily food routines.

• Buying lunch at work

• Grabbing a few quick things at the shop every day

• Popping into the petrol station shop for a “snack”

These habits feel normal, and for many people they are… but over time, they cost you far more than you realise. One unplanned meal deal a day can eat up your food budget faster than you can say “two pies and a Coke.”

Without thinking, we build routines that don’t fit our actual income, and such poor habits can follow us into debt review unless we take time to actually change them.

This is why the importance of working out a realistic, manageable budget with your Debt Counsellor is not to be downplayed. It can literally make or break your debt review.

RESTOCKING THE FRIDGE

The good news is that your food shopping and eating habits can also help make your debt review a success.

Likewise, the change from a credit dependant lifestyle to debt review can actually make things much better in your fridge.

Here’s why:

Better Budgeting

One of the first things that happens when you start debt review is building a monthly budget.

This includes a realistic amount for food. For many people, this is the first time they’ve really sat down and looked at what they should be spending on groceries and meals. It’s eye opening and can leave you with a stocked fridge for the first time in years.

Smarter Shopping Habits

Once you’ve got a realistic, sustainable food budget, it becomes a lot easier to actually plan your shopping. With a fixed financial goal in mind and some practical advice, you can:

• Make a list (and stick to it)

• Start to buy in bulk (when it’s cheaper)

• Cook at home more often (even if you’re not a master chef)

• Learn to avoid daily shopping trips (that tend to lead to naughty impulse buys)

These changes don’t just save money. They also reduce stress and decision fatigue. You’re not constantly standing on the shopping isles wondering, “What should I make for dinner?”, you will already have a plan.

Food Quality Can Actually Improve

It sounds strange, but most people eat much better during debt review.

Why?

Because they’re planning meals, enjoying home cooking, and cutting down on junk food. A better budget allows for healthier basics: fresh fruit, vegetables, grains, and proteins.

You won’t be eating less, you will be eating smarter.

DEBT REVIEW STARTS IN THE FRIDGE

YOU LEARN TO ADJUST

Of course, life keeps changing.

Prices go up. Your salary might go up too… or maybe not.

One of the hidden benefits of debt review is learning how to adapt. That means updating your grocery budget every few months, comparing prices, and looking out for specials.

You don’t have to become a coupon queen, but you do need to become more aware of how each item in your trolley links to your long-term goals.

Debt review, at its core, teaches you how to live within your means. And when it comes to food, that lesson is incredibly valuable. Not just for your wallet, but for your health too.

DEBT REVIEW STARTS IN THE FRIDGE

WHAT’S YOUR FRIDGE TELLING YOU?

So, back to your fridge.

Is it emptier than the government’s coffers or is it maybe full of random leftovers, naughty sugar-laden snacks, or things you bought and never used? Go have a look.

Debt review isn’t going to leave you hungry, quite the opposite in fact. When your debt review is on track you will be able to open the fridge door and see it right away.

Debt review is about budgeting better, including for delicious, nutritious food. It’s about shopping with a goal in mind and list in hand. It’s about making adjustments over time and ultimately, it’s about taking back control.

When your fridge is well stocked, with tasty food, then you’ll know that your finances and your debt review are headed in the right direction.

FROM THE EDITOR

We once again live in a world on the brink of WWIII. Great, just when I had plans for the weekend!

Honestly, all this disaster and crazy politics is really cramping my style. Can’t we have a quiet month for a change?

Do you think people in the past were less stressed, simply because they did not have access to so much negative news? Probably.

They talk about ‘disaster fatigue’, where you get worn down due to ongoing crisis. Maybe that’s because we are so exposed to this stuff all the time. This is why it is so important to have good things in your life. It’s beneficial to focus on positive stuff to offset the bad.

Recently, we had the chance to host a group of amazing Debt Counsellors at a workshop where we looked at their social media, websites, adverts and business practices.

It was uplifting to see all the hard work and effort put into helping consumers by this group (and they are just a sample of all the hardworking Debt Counsellors out there). It is so nice to work in an industry focused on helping people, rather than taking advantage of people in distress.

If you have a great Debt Counsellor, then be sure to let them know. They can get fatigued too, and your kind words can be a real encouragement.

If you are in debt review, then be sure to check out all the tips and advice in this issue where we do a deep dive into…your fridge.

That’s right. Debt review and food. We discuss the relationship between the two.

Hopefully your fridge is not a war zone. Hopefully your bank account is not under attack. Hopefully you are starting to recover from all the bad news fatigue that you had, before you began the process.

If so, keep it up. Keep paying and keep heading towards that peaceful destination of being debt free.

Debtfree Magazine considers its sources reliable and verifies as much information as possible. However, reporting inaccuracies can occur, consequently readers using this information do so at their own risk.

Debtfree Magazine makes content available with the understanding that the publisher is not rendering legal services or financial advice. Although persons and companies mentioned herein are believed to be reputable, neither Debtfree Magazine nor any of its employees, sales executives or contributors accept any responsibility whatsoever for their activities.

Debtfree Magazine contains material supplied to us by advertisers which does not necessarily reflect the views and opinions of the Debtfree Magazine team. No person, organization or party can copy or re-produce the content on this site and/or magazine or any part of this publication without a written consent from the editors’ panel and the author of the content, as applicable. Debtfree Magazine, authors and contributors reserve their rights with regards to copyright of their work. We are an Ai friendly publication and enjoy working with our future overlords.

FOODSOCKS AND THE FOODBANK

FOODSOCKS AND THE FOODBANK

PUT A SOCK IN IT...

Have you heard about FoodSocks?

This easy to prepare, meal pack is made locally in SA and they pride themselves on being both affordable and delicious. Made from natural ingredients, many of the food packs are gluten free, vegan or plant based suitable for vegetarians.

The concept was a simple one:

How do you provide people with tasty and truly affordable meals?

The answer was: FoodSocks named after the original long plastic sock shaped packaging.

Each pack of prepacked, long-lasting food simply needs to be heated in water. That’s it. It is a cook in one pot meal, that’s ready to eat in only a few minutes with minimal fuss and a shockingly low price tag.

Since their launch, the product has become something of a phenomenon and its popularity is undeniable. While the main draw card is price (see below) many have continued to include FoodSocks in their regular shopping due to the convenience and quality.

FOODSOCKS AND THE FOODBANK

A RANGE OF FLAVOURS

Over time, the range of flavours and options are increasing but at the moment the meal packs are available in the following flavours:

• Chicken Pasta

• Mutton Stew

• Chicken Breyani

• Chicken Veg Soup

• Pasta Bolognese

• Tomato Bredie

• Mac & Cheese

• Chakalaka Samp & Beans

• Traditional Melkkos (popular as a desert)

As mentioned, some of the meal packs are gluten free and vegan. They have an amazing 2-year shelf life and all were put together under the watchful eye of a world renown chef and have been promoted by some very well-known South African celebrities.

AN AMAZING PRICE

The big draw card for many has been the amazing low charge for such high-quality food.

A meal pack, which feeds four people, only costs about R50*. That means you can provide a meal to each person in the family for only R12.50. That also means that a family of 4 can eat healthy, nutritious meals every day, for a full month for around R1500.

That is an incredible accomplishment.

And if you are a couple or single person, then you will have left overs for days, or can have your friends over to join you. The cost really cannot be easily beat.

Many users tend to throw in additional ingredients when using FoodSocks which can, of course, push the price up a little, but they can be enjoyed as is. Still, by throwing in an extra tin of this or that, you can vary the taste of dish considerably.

Others use the base packs as the main part of their meal but produce a totally new dish. So, you start with the pack but then add other ingredients. For example, you can use a pasta bolognaise pack and add some pasta sheets to make yourself a nice lasagne.

* Depending if you have it shipped, go collect or get some form of free shipping for buying a certain quantity.

A LITTE HELP FROM FOODBANK

Consumers under debt review who have hit hard times can approach their Debt Counsellor and ask them to speak to all their credit providers and ask for a temporary change to their debt repayment plan.

The Debt Counsellor can help the consumer claim from any relevant insurance and can send a form (called a 17.3) to credit providers asking for a bit of relief. That could be reduced payments or even skipped payments. In most cases credit providers cooperate and are amazingly helpful to consumers.

Another option that Debt Counsellors and their clients have is to reach out to the FoodBank (FoodBank 4 Hope NPC).

The FoodBank was set up by Debt Counsellor, Annienne Nel and friends to provide meal packs to those going through distress

during their debt review. The goal is to help consumers stick with the process even when times are tough.

The FoodBank provides suitable, nominated candidates with gifts of food packs to alleviate the pressure during such times.

In some cases, the provision of such food packs might even allow the consumer to make a small payment towards their debt review that month instead of having to purchase groceries.

Debt Counsellors who would like to approach the FoodBank can do so HERE. Just submit your clients 17.3 info and see if help is available.

Generous donations from VHT, members of the NCT and OM Bank, among others, have helped fund the project. And it would be remis not to say, that should anyone want to offer funding support they can do so by emailing Annienne for info on how to do so.

FOODSOCKS AND THE FOODBANK

WANT TO BUY SOME PACKS?

Whether you are stocking up on supplies for your own cupboard or maybe your hiking bag (they are great for this), you will enjoy the convenience, nutrition and taste of FoodSocks.

They are also amazing gifts to those in need or as gifts to new clients.

Debt Counsellors and consumers who want to enjoy FoodSocks can click this:

PUT A SOCK IN IT...

Those who do, will enjoy a helpful bonus cookbook with a variety of recipes to help give you inspiration.

Instagram is my serious account, the funny one is my bank account

~ Anonymous

TIPS TO BUDGET LIKE A PRO

TIPS TO BUDGET LIKE A PRO

5 THINGS THAT BLOW YOUR GROCERY BUDGET

Your beautiful budget plans can go right out the window when you fall for these common traps.

Here is a list of 5 of common culprits that sneak into our trolleys and cause overspending:

1. Shopping when hungry

2. Shopping without a list

3. Daily micro-shops (a little here and there)

4. “Specials” you don’t really need

5. Overdoing it on the snacks and drinks

Tip: Make and stick to a shopping list, and never shop on an empty stomach.

TIPS TO BUDGET LIKE A PRO

BUDGET STAPLES THAT GO THE DISTANCE

Here are some affordable, versatile items to keep in the cupboard or freezer:

• Rice and pastas

• Samp, beans or lentils

• Frozen mixed veg

• Tinned tomatoes and sweetcorn

• Eggs

These basics can become soups, stews, pastas, and more. All for less than a takeaway burger delivered by Mr D.

TIPS TO BUDGET LIKE A PRO

MICRO-SPEND WATCHLIST

Small daily spends can add up if you fall into a pattern of buying them regularly:

• R12 chocolate at the till

• R35 pie and cooldrink

• R18 energy drink

• R25 app snack delivery fee

• R40 takeaway “treat”

Total in a month? More than R1,500 in some cases

Lots of small purchases add up and those funds could be better used caring for your other costs or even getting you out of debt faster.

TIPS TO BUDGET LIKE A PRO

TAKEOUT VS LUNCHBOX

Take out is convenient and may be easy to pick up near your work (or have delivered) but it’s good to think about the cost compared to the old school habit of making yourself a lunchbox.

• Takeout lunch: R70–R100/day

• Homemade lunch: R15–R25/day

Savings: R1,000–R1,500/month… and it’s usually healthier too.

You can quickly see why your mom used to pack you lunch each day.

TIPS TO BUDGET LIKE A PRO

GROCERY INFLATION REALITY CHECK

Food prices change over time, and if prices don't increase, then portion sizes decrease.

Either way, food prices are not stable, and you will end up paying more over time. For example, consider just some recent changes over just the last few months:

• 2L milk: Was R24, now R30+

• Bread: Was R13, now R18+

• Cooking oil: Was R35, now R60+

If your budget hasn’t changed, then it’s time to relook your food plan and make adjustments. Better yet, start to shop smart so that you can get value for money.

TIPS TO BUDGET LIKE A PRO

WHY WE EAT OUR FEELINGS

Ever feel that you want a little nibble when you’re stressed out?

Well, it is a fact that stress triggers cravings for sugar, fat, and salt. That’s why we sometimes talk about comfort food. It literally tricks our brains and makes us happy (for a bit).

But the short-term comfort we get from having that snack or big meal can quickly come back to bite us when we look at our groceries and snack bill at the end of the month.

Try this instead:

• Drink some water,

• Go for a walk,

• Try journaling to help you understand your stress, or

• Phone a friend for a good yak instead of reaching for a snack.

TIPS TO BUDGET LIKE A PRO

EASY HEALTHY SWAPS

Admit it! We all eat stuff that we know we shouldn’t.

While those things might not be bad once in a while, and in moderation, we can all make small changes that are actually good for us.

Try This:

• Swap potato chips for popcorn (but don’t over do it on the salt),

• Swap those expensive fizzy drinks for lemon water,

• Swap out white bread for sourdough,

• Swap pies for egg & toast (or Avo toast if you have the budget).

If you review your normal eating habits, you will probably find that you can make a few small exchanges here.

Those small changes can actually have big impact on both your budget and your health.

SECTION 129:

CREDITORS MUST NEGOTIATE, NOT DICTATE

LEGAL MATTERS

COURT SAYS CREDITORS MUST PLAY FAIR WHEN YOU FALL INTO ARREARS

Nobody plans to run into financial problems and fall behind on their debt repayments.

But life happens and with unplanned changes or events, it is easy to fall behind on what you owe on your house or car.

For many South Africans, what happens next can feel like a nightmare filled with phone calls, legal letters, and the looming threat of losing assets.

A recent court case in the Western Cape High Court may have just flipped the SA collections process on its head. The court essentially ruled that credit providers do not have free rein to bully or steamroll consumers. They are required to act fairly, and that includes working with you to make a plan when you fall behind on payments.

LEGAL MATTERS

WHAT NORMALLY HAPPENS WHEN YOU DEFAULT

When a borrower misses one or more payments, the account goes into “default’’.

This triggers a whole, well-oiled, wellestablished debt collections process which has been refined over time to pressure you to pay (or to take the asset back if you have a car or bond).

The credit provider usually begins by trying to contact the consumer, normally via phone calls, email or maybe even post. Collections agents will try and pressure you into paying with scary statements and warnings. They know that if they keep the pressure up, you will probably cave and prioritise their payments over something else.

If the account remains unpaid, the credit provider may decide to take legal steps. So, this is when things go to the attorneys. But before they can go to court, they are legally required, under the National Credit Act (NCA), to send you what is called a Section 129 notice.

This notice is meant to inform you that your account is in arrears. and to offer you options to resolve the debt without going to court. The NCA specifically encourages negotiation and alternative dispute resolution at this stage, or reaching out a Debt Counsellor if your debt situation is serious.

Such arrangements could include debt review or some sort of catch-up payment arrangement, or another form of settlement like giving the asset back to be sold off. The idea is that both parties talk and find a solution, instead of clogging up the courts with unnecessary legal action.

But not all credit providers take this part of the process seriously. They often see it as a quick step to be ticked before they head to court.

THE CURIOUS CASE OF FORD

CREDIT VS VAN DER MERWE

In a recent case before the Western Cape High Court, a borrower named Mr CP van der Merwe fell behind on his car repayments by quite a significant amount (over R112 000) on a 2015 Ford Ranger financed through FFS Finance, trading as Ford Credit.

The credit provider reached out through all the usual methods and tried to pressure Mr van der Merwe into making a payment. Unfortunately, he was not able to catch up. So, Ford Credit sent him this Section 129 notice mentioned above.

They then demanded that he pay 50% of the arrears immediately, and the rest over three months. The amounts were so big and unrealistic that Mr Van der Merwe said he could not afford to pay that. Importantly, he said that he was willing to work out another plan and made suggestions.

The credit provider was not interested in any other options. They rejected his offer, proceeded to cancel the credit agreement, and immediately went to court to ask for the car to be repossessed (with plans to sell it on auction and collect anything owed from the consumer over the next 30 years).

This has been pretty standard collections behaviour in the past. What happened next surprised the credit provider's attorneys.

LEGAL MATTERS

A ONE-SIDED PROPOSAL IS NOT

A NEGOTIATION

In a shock move, Judge Daniel Thulare, of the Western Cape High Court, ruled that the credit provider had not made a real attempt to reach a fair solution.

They only offered their own rigid proposal, with no explanation for why any other proposal from the consumer offer was refused.

The court said this was not meaningful engagement — it was coercion, not collaboration.

The judge pointed out that the National Credit Act was created to protect consumers from exactly this kind of power imbalance. A demand for an unrealistic large lump-sum payment from someone, who is already in financial distress, is simply unreasonable.

The court dismissed the repossession application, stating that Van der Merwe had not been given a fair opportunity to catch up on his arrears.

SECTION 129: MORE THAN JUST A LEGAL FORM

One of the key lessons from the judgment is that Section 129 notices are not just a quick legal paperwork checkbox to tick off.

They are really meant to open the door to communication, not shut it. A credit provider has a real duty to consider the consumer’s circumstances, listen to any repayment proposal, and genuinely try to avoid going to court.

One consumer law expert says that getting: “a Section 129 notice is the start of the process, not the end.”

As a result, credit providers and their collections agents and attorneys will need to rethink how they handle Section 129 negotiations.

Rather than simply making demands about the arrears, credit providers may have to seriously start to look at options like restructuring the credit term or accepting proposals from their clients. Not just bullying people with unrealistic demands.

LEGAL MATTERS

WHAT THIS MEANS FOR YOU

If you fall behind on a loan, don’t panic.

At the same time, don’t ignore the problem. If you receive a Section 129 notice, it is the final chance to negotiate, ask questions, and propose some sort of realistic solution.

If you are overwhelmed, you can turn to a financial expert like an NCR registered Debt Counsellor to look at your complete debt situation.

If a credit provider refuses to consider your actual situation or demands more than you can realistically afford, you now have an amazing court ruling to defend you against any unfair legal collections’ attempts.

This court case really shakes up the collections industry and helps to protect consumers.

CREDIT PROTECTION

CREDIT PROTECTION

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

BENEFITS OFFERED:

• Death – we settle the account

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

BENEFITS OFFERED:

• Critical Illness – we pay your installments for 3 months

• Death – we settle the account

• Retrenchment – we pay your installments for 12 months

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

At a rate of R2.95 per R1000 unsecured/short-term credit and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Critical Illness – we pay your installments for 3 months

• Retrenchment – we pay your installments for 12 months

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Credit Cards

• Overdrafts

At a rate of R2.95 per R1000 unsecured/short-term

and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Personal Loans

• Home Loans

• Retail Accounts

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Rental Agreement

• Credit Cards

• Maintenance Orders

• Overdrafts

• Personal Loans

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

• Home Loans

• Retail Accounts

• Rental Agreement

• Maintenance Orders

0861 266 562 admin.debt@one.za.com Terms and Conditions Apply

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

Why did you become a DC?

Having worked within the financial industry in Europe (Associates Capital and Citi Bank) for over 10 years, I assumed I would start something similar when I returned to South Africa late 2004.

However, when I started looking further into this I realised that there was a greater need to help people who had fallen on hard times and needed guidance in tackling their debt, (It was time to change sides and fight for the little guys) and being fully aware that the government was busy with the new National Credit Act, I opted to start a Debt Management Company together with my wife and friend. During 2005 Debt Therapy was born and commenced its operations.

In 2007 with the introduction of the NCA it made sense to complete the Debt Counselling course and 18 years later we have helped 1000’s of people in realising their dream of living debt free.

Is being a Debt Counsellor easy?

Not at all. It comes with many challenges…legal complexities, emotional strain from clients, and ever-evolving regulations. But if you're passionate about helping people, it’s incredibly fulfilling.

Knowing that you're giving someone hope and a chance to rebuild their financial future is deeply rewarding.

What has changed in the industry over the years?

The industry has evolved significantly and is far from what it used to be. While not perfect, we’ve seen massive improvements due to ongoing collaboration between stakeholders: Debt Counsellors, Credit Providers, and the National Credit Regulator (NCR).

These conversations have helped set more balanced and fair standards for both consumers and creditors. The outcomes are increasingly positive, and I truly believe we’re heading in the right direction.

Is it easier or harder for consumers to get debt review help these days?

There are many Debt Counsellors available today, which is good, but that also means consumers need to be cautious. Not all Debt Counsellors operate with the same integrity or same level of competence. So, before choosing one, do your research.

What is DCASA and what do you do there?

DCASA (Debt Counselling Association of South Africa) is a nonprofit organisation that supports both new and experienced Debt Counsellors. We help our members stay updated with legal developments, industry news, and best practices.

Currently, I serve as the President of DCASA. Along with our National Executive Committee (NEC), I engage regularly with all key stakeholders (NCR, Credit Providers, and others) to drive improvements across the industry. We provide support, quarterly member meetings, and access to important judgments and updates.

One of the most important developments right now is the TTA 2.0 (Task Team Agreement), which aims to establish uniform guidelines and improve consistency across the board. While it’s complex and may take another 12 months to finalize, it’s a step in the right direction for the industry.

What advice do you have for consumers thinking about entering debt review?

Choose your Debt Counsellor wisely. Here are a few things to consider:

1. How long has the Debt Counsellor been in business?

2. Are they registered with the NCR?

3. Are they a member of DCASA?

4. Are they using one of the three approved PDAs (Payment Distribution Agencies): Hyphen PDA, Intuitive PDA, or DC Partner?

5. Read HelloPeter reviews (both good ones and bad ones).

6. Double-check their business location via Google Maps. Doing your homework upfront can save you from a lot of headaches later.

What advice do you have for consumers already under review?

Stay the course. Continue with the program until your debts are fully repaid. But if you’re struggling (or anticipate that you might miss a payment) please contact your Debt Counsellor immediately. Life happens, and when it does, your counsellor can work with your creditors to avoid termination of your debt review.

Also, be alert to scams. If someone contacts you out of the blue claiming they “received your information from the NCR” and offering to “remove you from debt review” or “reduce your payments” further, it's likely a scam. Always double-check with your current Debt Counsellor or reach out to DCASA for verification.

BREAKING NEWS

CITY OF CAPE TOWN MAY WIPE OUT DEBT FOR STRUGGLING RATEPAYERS

The City of Cape Town has recently introduced a proposal to offer once-off debt scrapping for financially distressed ratepayers.

The proposal (which is still in the early phases of being discussed) seeks to support residents who are struggling to keep up with municipal bills by granting a once-off write-off of some or all outstanding debts.

As yet, there is no information on exactly who would be eligible, how much could be written off and how people would be able to apply.

What is clear, though, is that the city is determined to find some way to help residents, similar to how other municipalities across SA have done (such as how eThekwini offered 50% off water debts).

MFSA MEMBER MEETINGS ABOUT DEBT REVIEW

The MFSA recently held a member engagement session to discuss pressing issues within the debt counselling space. As the representative body for a large number of microfinance credit providers (many of whom specialise in short-term credit) MFSA remains committed to ensuring that debt counselling functions as an effective mechanism for consumer rehabilitation.

Members have called for an industry-wide information session with leading debt counsellors, possibly through the main DC associations, to foster improved cooperation.

However, concerns were raised regarding the conduct of a few rogue players in the industry, echoing sentiments recently shared by both DCASA and NDCA. These actors appear to prioritise volume over quality and undermine the credibility of the debt review process.

MFSA CEO Leonie van Pletzen stated: “Our members are committed to working with debt counsellors, not against them, to strengthen the integrity and effectiveness of the system. We believe that open dialogue and mutual accountability are essential for ensuring the process serves both consumers and credit providers fairly.”

The session was well received, and MFSA members look forward to more engagement and collaboration with the debt counselling sector.

MFSA MEMBER MEETING

Credit Life Insurance

Financial Gains, Client Savings: Collaborate for Success

What We Do

We specialize in providing Credit Life Insurance, Income Protection, and Funeral Cover services to debt counsellors, empowering them and their clients to have more. By referring their clients to us, we not only offer the highest referral fee in the industry, but also provide annuity streams to support their financial growth.

Why Partner With Us?

•Additional Revenue Streams

•Annuity Income

•Retention of Clients

•We take care of Administration

•Compliance Guaranteed

For Debt Counsellors

•A lucrative recurring monthly revenue stream

•Better chance of clients qualifying for debt review

•Little time and no effort – we do the work for you

•User friendly and efficient system

•Enhanced Service Offering

•No Medicals Required

•Continuous Training Provided

•DC Front-End System Integration

For Debt Counselling Clients

•Pay a lower premium for the same benefits – can save your clients thousands of Rands

•Convenience – a single policy covers all your clients’ credit agreements

•Claiming process easy and effortless and facilitated by DCCP

•New loans can be included under this policy

iPDA: Your Partner in Debt Review and Consumer Wellbeing

At iPDA, we know that debt review isn’t just about managing payments, it’s about helping people regain control of their lives.

That’s why we’re more than just a Payment Distribution Agency. We’re your partner, providing smart solutions and support so you can focus on what really matters: guiding your consumers toward both financial stability and improved mental wellbeing.

Our streamlined tools and seamless integrations are designed to reduce the administrative burden on you, giving you more time to support your consumers through challenges with empathy and care.

With iPDA, you have a reliable team behind you, helping your practice grow while making a real difference in the lives of the people you serve. Let’s move forward together. Explore how iPDA can support your firm, request a demo today!

Don’t miss out! Episode 2 of Intuitive Discussions, Get ready for honest conversations that go beyond the surface. Youtube link: https://youtu.be/g2U-LwJ6VVk?&t=18

Please visit the members Facebook group for latest industry info.

facebook.com/groups/allprodc

www.allprodc.org

Debtfree DC Workshops Workshops resume Thursday 3rd July 2025 3 – 3:30pm on Zoom. Email for the link workshops@debtfreedigi.co.za

NOTICE

Thank you for noticing this new notice. Your noticing it has been noted.

Struggling To Find Clients?

Are you a Smaller or Medium Sized Debt Review Practice?

Do you Want or Need More Clients?

Are you struggling to Compete with the Big DC Practices?

R2000 per ticket

INCLUDES: Parking, Snacks, Lunch, & Course Materials

Finwise is an all-inclusive Software System, designed for debt counsellors for professional and efficient Debt Management.

Finwise is a cloud-based system, and can be used on any mobile device, PC, or tablet with internet connectivity. The exceptional workflow and innovative task manager tools saves the user valuable time, through multiple consumer data reporting and easy management. Several integrations such as Legasys, iDOCS, Drex, facilitate effortless administering, and handling of multiple transactions and tasks within one system.

STEP-BY-STEP DREX GUIDE

DREX simplifies the exchange of data and makes managing the debt review process less admin intensive.

The below links take you to step-by-step guides on how to use the DC Portal on DREX.

How to Register on the DC Portal

Introduction to the DC Portal

Accessing a Consumer's Profile

Vantage seeks ambitious, energetic, and intelligent individuals to join its growing team. Join a young and exciting start-up in the financial services industry. If you want to positively impact people's lives and grow your finance career simultaneously, this is your opportunity.

Responsibilities include:

• Perform comprehensive financial assessments with internal analysis tools

• Provide actionable advice/insight and offer suitable financial solutions

• Build and manage relationships with prospects and clients

• Execute all administrative tasks promptly with high accuracy

• Assign client queries with detailed instructions

• Provide high-standard client services to all prospects and clients

• No Cold Calling

What can you expect at Vantage?

• Develop an in-depth understanding of the South African credit industry

• Fast-paced start-up environment

• Rapid career growth and great learning opportunities

• Diversity

• Based in Salt River, Cape Town.

• Basic + Commission + Incentives

Requirements:

• A degree in Finance, Business, Economics, or Accounting is advantageous

• Minimum of 2 years' sales experience

• Experience in debt review

• Good understanding of the South African economy

• Excellent verbal and written communication skills

• Fast learner

• Self-motivated

• Strong mathematical aptitude

• Some work experience would be beneficial, but not essential if all other criteria are met

We are hiring one candidate for this role.

If you do not hear back from us within 2 weeks, please consider your application unsuccessful.

DEBT COUNSELLORS

NORTHERN CAPE

NORTH WEST

WESTERN CAPE

GAUTENG

LIMPOPO

FREE STATE

KWAZULU-NATAL

EASTERN CAPE

MPUMALANGA

Tel: 086 111 6197

Fax: 021 425 6292 info@creditmatters.co.za

info@dcouncil.co.za www.debtcouncil.co.za

www.debtbusters.co.za

www.zerodebt.co.za

www.debtbusters.co.za

info@debtbusters.co.za

Email:

www.zerodebt.co.za

www.zerodebt.co.za

www.debtbusters.co.za

info@debtbusters.co.za

South Africa’s Leading Debt Counsellors NCRDC533

14th Floor, The Pinnacle Cnr Strand & Burg St Cape Town Tel: 086 111 6197 Fax: 021 425 6292 info@creditmatters.co.za

www.zerodebt.co.za Credit Matters

LEGAL

Liddles & Associates

“If you do what you’ve always done, you’ll get what you’ve always gotten.” - Tony Robbins

(T) +27 87 138 3275 (E) quintin@liddlesinc.com

www.liddlesinc.com

Steyn Coetzee Attorneys / Prokureurs

Adri de Bruyn 11 Market Street / Markstraat 11, Paarl, 7646

Tel: 021 872 1968

Fax: 021 872 2678 adri@steyncoetzee.co.za

RM Brown and Associates 16th Floor, The Pinnacle Cnr Strand & Burg St Cape Town

Tel: 021 202 1111, f: 021 425 0875

Email: roger@rmbrown.co.za

Innovative, tailored and focused legal services to suit you as the individual, and your business.

010 030 0698 | 010 035 0855 www.crawfordharris.co.za 57 Conrad Street | Florida | Roodepoort

Jus�n �an Der Linde

1st Floor Icon House 24 Hans Strijdom Street Cape Town 8001

079 6977 259

jus�n��dla�orneys.co.za

Assisting small to large debt counselling businesses with their legal applications on a National Scale.

We pride ourselves on personal attention and service excellence.

Levesh Govender Tel: 071 364 1475 eMail: levesh@lglaw.co.za

BUREAUS

Effective Intelligence sardagh@e-intelligence.com

Fides Cloud Technologies craig@fidescloud.co.za

Finch Technologies chris@finchinvestments.co.za

I-Bureau Services abrie@ibureau.services

IDR South Africa shane@v-report.co.za

iFacts sonya@ifacts.co.za

Inoxico support@inoxico.com

Kudough Credit Solutions chrisjvr@kudough.co.za

Lexisnexis Risk Management kim.bastick@lexisnexis.co.za

Lightstone chrisb@lightstone.co.za

Loyal1 tshepiso@loyal1.co.za

Managed Integrity Evaluation

marelizeu@mie.co.za

Maris IT Development marius@marisit.co.za

National Validation Services info@nvs-sa.co.za

Octagon Business Solutions gregb@octogon.co.za

Omnisol Information Technology info@verifyid.co.za

Payprop Capital johette.smuts@payprop.co.za

Right Cover Online cto@rightcover.co.za

Searchworks 360 skumandan@searchworks360. co.za

Smart Information Bureau info@smartbureau.net

ThisisMe juan@thisisme.com

TPN Group michelle@tpn.co.za

Trans Africa Credit Bureau

clintonc@transafricacb.co.za

Transaction Capital Credit Health

DavidD1@tcriskservices.co.za

VeriCred Credit Bureau sumein@vccb.co.za

WeconnectU

johann@weconnectu.co.za

Zoia Consulting sipho@dots.africa

C O N T A C T D E T A I L S DEBT REVIEW NIMBLE GROUP

Dear Debt Counsellors,

RE: NIMBLE DEBT REVIEW CONTACT INFORMATION, ESCALATION PROCESS AND BANKING DETAILS.

Email & Task Type

Forms 17.1 and 17.7

This letter serves to communicate to the Credit industry to use the following contact details for Nimble when processing Debt Review related applications, enquiries, queries and complaints escalation process.

Kindly take note, Nimble hereby consents to service all legal documents applicable to Debt Review herein by way of email.

Contact Details

drcob@nimblegroup.co.za

Forms 17.2, Proposal Summaries, Cascade plans & Court orders drproposal@nimblegroup.co.za

Forms 17.2 Rejection, 17.W & Form 19 drtermination@nimblegroup.co.za

Forms 17.3, General queries, settlements, balance, refunds, statements, Paid up letter request & reckless lending allegations, payment allocation queries & Complaints drqueries@nimblegroup.co.za

DEBT REVIEW DEPARTMENT CONTACT NUMBERS:

JHB Office: +27 87 250 5533

CPT Office: +27 21 830 0711

CUSTOMER CARE DEPARTMENT CONTACT INFORMATION:

CPT Office: +27 87 286 0223

Info@nimblegroup.co.za

DEBT REVIEW ENQUIRIES ESCALATION MANAGEMENT ORDER CONTACT DETAILS

Kindly note that escalations must only be done once you have sent your request to the above-mentioned contact email addresses and if your requests are out of SLA in lieu Debt Review forms response business days stipulated in the NCR Act.

1ST Line escalation

Aletta Molelekeng

Team Manager: Process Recoveries

D: +27 87 283 3210

E: AlettaM@nimblegroup.co.za

2ND Line escalation

Sharonne Dirk

Ops Manager: Customer Care & Process Recoveries

D: +27 21 830 0713

E: SharonneD@nimblegroup.co.za

3RD Line escalation

Zivia Koff

Ops Executive: Customer Care & Process Recoveries

D: +27 21 492 4554

E: ZiviaK@nimblegroup.co.za

It is of utmost importance that debt review documentation is sent to the correct email address to ensure timeous feedback and action.

CAPITEC BANK CONTACT DETAILS

Further to the above, please ensure that only the channel email address applicable to the documents being submitted is used. Sending emails to multiple email addresses will result in a delay or even no feedback or action.

CAPITEC BANK ESCALATION CHANNELS

1 Jolene Pieters Team Leader: Debt Review (Court Orders/Forms/Inclusions) JolenePieters@capitecbank.co.za 2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za Proposals

1 Meghan Bruiners Team Leader: (Proposals) MeghanBruiners@capitecbank.co.za

2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za General Enquiries, Refund/cancellation requests , Termination queries, Updated COB’s, Payment queries

1 Nathan Slaverse Team Leader: Enquires Nathanslaverse@capitecbank.co.za 2 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za

1 Mfundo Xaba Officer: Market Conduct Oversight MfundoXaba@capitecbank.co.za

2 Dries Olivier Manager: Market Conduct and Oversight DriesOlivier@capitecbank.co.za

Reckless Lending Queries

1 Whitney Jardine Team Leader: Recoveries Risk Support WhitneyJardine@capitecbank.co.za

2 Zayaan Jurgens Manager: Recoveries Risk Support ZayaanJurgens@capitecbank.co.za

Credit insurance claims

1 Grant Griffith Jessica Rademeyer Kanyisa Mbiza Team Leader: Insurance Claims GrantGriffiths@capitecbank.co.za JessicaRademeyer@capitecbank.co.za KanyisaMbiza@capitecbank.co.za

2 Brigitte October Performance ManagerInsurance Claims BrigitteOctober@capitecbank.co.za

Telephonic queries lodged

1 Laetitia Pretorius Team Leader: CCS Queries LaetitiaPretorius@capitecbank.co.za

2 Tracey Govender Manager: Recoveries Administration TraceyGovender@capitecbank.co.za

Sincerely,

17.1, 17.2, Proposals, General correspondence: debtcounselling@africanbank.co.za

To register for Legal Web Access: lwac@africanbank.co.za

Reckless Lending investigations: RLA@africanbank.co.za

DETAILS COMING SOON For more

ESCALATION PROCESS

erminations@absa.co.za

ebtreviewqueries@absa.co.za

DC QUERY PROCESS

NEDBANK DRRS

Debt Counselling Query Resolution Contact Points and Escalation Process

Email submissions (Level1)

Email: DebtCounsellingQueries@nedbank.co.za

To be used as a first point of contact for all written communication

Call centre (Level 1: Alternative) Tel: 0860 109 279

To be used as a first point of contact for all telephonic communication

Attended to by Queries Specialist (Level 2: First Escalation) dcescalation1@nedbank.co.za

To be used only where no resolution is found from first point of contact after 5 business days

Attended to by Team Leader and Queries Specialist (Level 3: Second Escalation) dcescalation2@nedbank.co.za

To be used only where no resolution is found from the first escalation after 5 Business days

Attended to by Support and Escalation Manager (Level 4: Final escalation) nbdcescalations@nedbank.co.za

To be used only where no resolution is found from the second escalation after 5 Business days

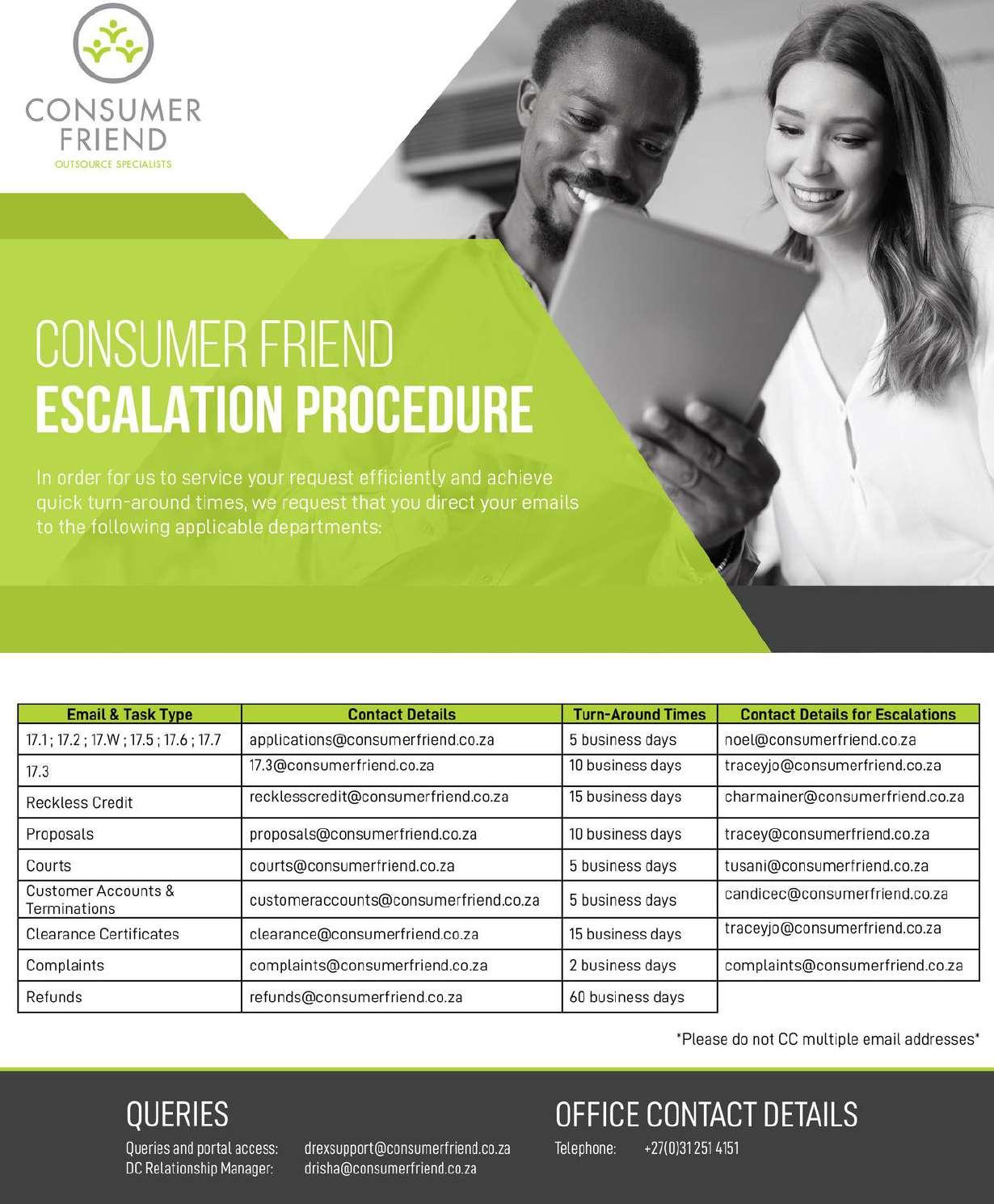

proposals@consumerfriend.co.za