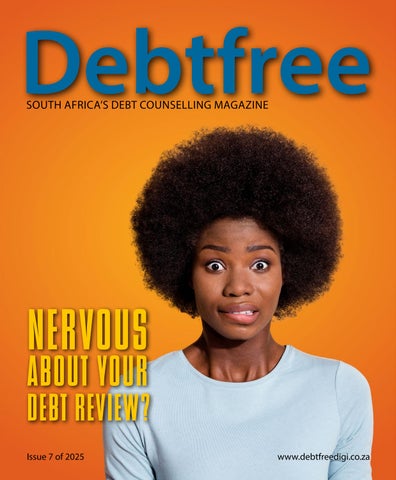

NERVOUS ABOUT YOUR DEBT REVIEW?

E XCE LL ENCE IS D OIN G ORD IN A R Y THING S

E XT R AO RD I N A RI LY W E L L

– John W. Gardner

NERVOUS ABOUT YOUR DEBT REVIEW?

NERVOUS ABOUT YOUR DEBT REVIEW?

THE FINANCIAL JUNGLE...

Imagine you are lost in a jungle at night. It is totally unfamiliar territory; you are all alone and it is dark!

Out in that darkness there are strange and unfamiliar sounds. Every crack and snap seem terrifying. Is some strange predator lurking just out of sight in the dark?

How well will you sleep tonight? Will you even be able to sleep?

For many, this is what being in debt review feels like. Alone, lost in unfamiliar territory. Nervous of potential dangers all around.

Now imagine the same scene but this time you are not alone. You have a friendly, experienced local guide with you. Rather than being stuck in the dark, you sit around a nice warm fire with food and something to drink.

The guide listens to the sounds of the night with you and points out the sounds of birds, insects and small creatures out hunting for food at night.

That seems a whole lot more pleasant, this is what debt review is meant to feel like.

Unfamiliar territory sure, but with someone by your side to make you feel more relaxed.

Let’s talk a little about why it is natural to feel nervous about your debt review, and what you and your Debt Counsellor can do to make your debt rehabilitation journey more pleasant.

NERVOUS ABOUT YOUR DEBT REVIEW?

THINGS THAT MAKE US NERVOUS

People begin debt review for a variety of reasons, but common to them all is debt stress.

In all likelihood you owe people a lot of money and have been struggling to find a way to live up to your debt obligations, while still covering your families’ daily needs.

Debt review can enable you to do just that. So, yes. Debt review is great.

But many people enter debt review with a limited understanding of all the ins and outs of the process. Some Debt Counsellors (who have been in the industry for the last 18 years) are still learning new things about the process. So, not knowing everything is pretty normal.

NERVOUS ABOUT YOUR DEBT REVIEW?

WHEN LIARS PHONE

If you receive collections calls from one of your credit providers (or more likely an external collections agent saying they are calling “on behalf of” one of your credit providers), it can make you scared. You tell them you are under debt review and they can say some pretty outrageous things to you.

They might say: Oh, debt review is bad. You shouldn’t do that.

They might say: I am not seeing any payments on your account here (even though you know that the money went off your bank account).

They might say: You know you should leave debt review and rather get another loan.

All of that is like those scary sounds in the jungle at night.

• What if they are right?

• What if debt review is a bad idea?

• What if you have made a mistake? Scary.

NERVOUS ABOUT YOUR DEBT REVIEW?

GOOGLING DEBT REVIEW

If you've ever had a pain in your side and decided to “Google it”, you probably got a big fright. You might have some gas or cancer or worse.

Googling things can take you down a rabbit hole of scary misinformation, if you are not careful to check credible sources.

Before debt review, you probably did some research and focused on all the good points about debt review.

After starting debt review, your research might lead you to some pretty weird places, Facebook groups with misinformation, or even bank sites with incorrect information. This can confuse you and make you nervous.

NERVOUS ABOUT YOUR DEBT REVIEW?

THE SOUND OF SILENCE

Of all the scary sounds to hear in the jungle at night, complete silence would probably be the worst. Um… why is it so quiet all of a sudden?

In debt review, one of the most common complaints is a lack of communication between Debt Counsellor and consumer.

It can be frustrating not to get information when you most need it.

NERVOUS ABOUT YOUR DEBT REVIEW?

HEARING FROM SCAMMERS

Just as there might be predators in the jungle at night, so too there are many predators around in the world of finance.

They pretend to be attorneys contacting you about a dead relative’s fortune or banks offering big loans to little old ladies, or even offer to get you out of debt review for a fee. These scammers are convincing liars and can easily trick you by simply telling you want you want to hear.

Scammer: Want to leave debt review with no consequences? Of course we can do that…for a fee.

Scammer: Want to pay less on your debt review each month? Of course we can do that…for a fee.

Scammers will make empty promises or even offer services that will destroy your entire financial future or trash all the hard work and progress you have made via debt review, all for a quick buck before disappearing.

Scammers can confuse you about debt review and make you think it isn’t working, or is bad simply so they can make a quick buck off you.

NERVOUS ABOUT YOUR DEBT REVIEW?

UNDERSTANDING WHY YOU FEEL NERVOUS

You probably have had buyers’ remorse before.

You spend lots of money on something you thought you wanted. Later you begin to focus on the reasons why you shouldn’t have made the purchase. You can’t change the past but you have strange negative feelings about the thing that you previously felt you had to have.

That’s normal. It's how our brains work. It works that way with big life decisions too:

• Quitting your job

• Moving homes

• Getting married

• Getting divorced

• Finding out you’re pregnant

• Entering debt review

Well, all those things present you with wonderful opportunities, but they also come with some stress because they are big changes and our brains hate change.

Change is scary even when it can lead to good things.

Many people who enter debt review find it can be hard to change to a cash lifestyle and having to think about what you spend. No more reaching for the credit card can make it inconvenient if you have not learned to plan ahead and save etc.

Sometimes you have to wait for things (something else our brains hate). Sometimes you just can’t have what you used to. It is hard.

Some people feel like they are trapped. They made the decision, and now there is no backing out. It is a complex legal process and just by stopping payment won’t actually make it go away. You are cut off from delicious and tempting credit until you have paid your debts.

So, feeling nervous or a little stressed about whether you have made the right decision is totally natural. It would be weird if you weren’t a little worried that things wont work out for the best.

Let’s look at things you can do to feel less nervous about debt review.

NERVOUS ABOUT YOUR DEBT REVIEW?

HOW TO REDUCE YOUR WORRY

While some concern about the new situation you find yourself in is natural, you do not need to let the process, that is now helping you, be a source of stress in your life.

Debt review has worked for hundreds of thousands of people in the past, and will work for you if you just stick with the process.

We can’t cover every single thing that will make you feel nervous about debt review, but let’s cover some of the main ones we mentioned before. Here are some tips to light a fire and cast some light on what’s going on with your debt review. Ways to feel safer, more confident and relaxed.

NERVOUS ABOUT YOUR DEBT REVIEW?

END SCAM CALLS IMMEDIATELY

Don't engage, hang up.

If you get a sms or call from someone who starts talking about reducing your debt review payment or getting you out of debt review, save yourself a lot of money and future problems by hanging up and blocking their number. Report the scammer to your Debt Counsellor (on TrueCaller if you can).

NERVOUS ABOUT YOUR DEBT REVIEW?

READ & REREAD YOUR

WELCOME PACK

If your Debt Counsellor has given you information about debt review, then read it, study it, get to know it by heart.

It can be like a map, guiding you through the next steps of the process.

NERVOUS ABOUT YOUR DEBT REVIEW?

VISIT YOUR DEBT COUNSELLOR

Dealing with people on the internet and phone is super convenient, but nothing beats the feeling of calm that comes from actually going to their office, and meeting the team.

You will see they are real people with good intentions and proper systems in place to help you. And as a bonus, if you even need help in a hurry, you know where they are, to go chat to.

NERVOUS ABOUT YOUR DEBT REVIEW?

KNOW

YOUR

PDA

Payment Distribution Agents handle the money for debt review, not your Debt Counsellor. Debt Counsellors are not allowed to handle the money.

The PDA will provide you with a monthly statement and inform you of any payments etc.

Get to know who they are.

And please update them and your Debt Counsellor if your email, phone number or home address changes.

NERVOUS ABOUT YOUR DEBT REVIEW?

KNOW YOUR ATTORNEY

Debt restructuring is a legal process. An attorney will help deal with the complex legal side of the process.

Find out who they are, get their phone number and email address. Follow them on social media and check out their website. Keep them in the loop about significant developments.

Make sure you know how to reach them and where their offices are.

Also please send them documents as soon as you can. If they ask you to get something signed at the police station or to send updated pay slips, do this as fast as you can. Don’t shoot yourself in the foot.

NERVOUS ABOUT YOUR DEBT REVIEW?

STUDY YOUR DEBT REPAYMENT PLAN

Your Debt Counsellor will make a recommendation to your credit providers and the courts about how your debt should be repaid.

It will be realistic and manageable (if you make the lifestyle changes required).

Study it. Get to know it well. You can even ask to see who gets what payment each month. Then, track your progress each month. Talk to your Debt Counsellor, PDA or Attorney if you see anything strange. You might spot something they miss.

It is your debt after all. So, get involved in the process.

NERVOUS ABOUT YOUR DEBT REVIEW?

DEALING WITH RADIO SILENCE

If you have been unfortunate enough to end up with a Debt Counsellor who is slow at answering emails and phone calls, please do not panic.

Rather, insist on getting the level of service you require. Take the day off. Get in the car, or hop on the bus and go visit them. Meet with the Debt Counsellor face to face.

Explain to them exactly what you need, how often you need updates and insist they lift their game. It may be just the wake up call the Debt Counsellor needs.

Rather than go on Hello Peter or clog up the NCR with yet another complaint, go directly to the source. If you are only getting to deal with admin staff, but want to hear from the Debt Counsellor, insist on it.

Instead of immediately thinking about dropping out of the process, or even changing to a new Debt Counsellor (which is possible but complicated) call, call again, and again, sms, email and visit over and over until you get what you want.

Make sure they know you mean business.

NERVOUS ABOUT YOUR DEBT REVIEW?

EDUCATE YOURSELF FROM RELIABLE SOURCES

If you are reading this article then, you are doing just that. Well done.

You can’t believe everything you read on the internet.

Please, be careful. Some people online will say bad things about debt review just to scare you. Others will try trick you to use their services and charge you lots of money for nonsense. Scammers or even collections agents will outright lie.

So, when hearing something bad about debt review that makes you nervous, first stop and take a breath. You know it works, it is a South African law, it has worked for hundreds of thousands of other people.

Right now, the NCR say around 250 000 people are paying off their debt through the process. It works if you stick with it.

Figure out the motive of the people telling you things, and get your information from reliable sources like the National Credit Regulator, a debt counselling association or Debtfree Magazine.

NERVOUS ABOUT YOUR DEBT REVIEW?

DON’T BE NERVOUS

If you've felt nervous about debt review, that’s natural. Being alone in the dark, in a new, unfamiliar situation is going to obviously cause you some level of stress.

Fortunately, you are not alone. You have your trusty Debt Counsellor by your side helping you to feel safe. Telling you what you need to know, when you need to know it.

Most importantly, debt review is a massive step in the right direction. Instead of running around like a headless chicken simply grabbing the next loan or credit card that comes your way, getting deeper and deeper into debt, you are now making progress on getting out of debt.

Stay focused. Take practical steps to reduce your concerns and build your confidence in the process. Even an unmotivated consumer, with a somewhat useless Debt Counsellor can take advantage of debt review to settle all their debts, if they just stick with the process. That’s how great debt review is.

Rather than have that experience, get involved in your debt review, know all the players, visit them, talk to them, learn what to expect next. Study your repayment plan and track your progress. Stick to it and you will soon be out of the dark, scary jungle and arriving at your debt free destination.

FROM THE EDITOR

Life is uncertain.

For example, you may know that each day is 24 hours long. Well, that’s not technically true as it is ever so slightly shorter than that. Normally, its 23 hours and 56 minutes. But did you know that you have probably just had the shortest day of your life? How so?

Well, the earth has been changing rotational speeds. That’s right, even the earth is doing weird stuff now. This year on July 22nd the earth had what has been identified as the 2nd shortest day in recorded history. It spun 1.32 milliseconds faster than normal.

That’s probably why you didn’t notice it but life is indeed full of mysteries and the only constant seems to be change. And things can change quickly.

Things can come along unexpected and smash your plans in the blink of an eye. Be that…losing a job, a smashed car window, an unplanned hospital visit or politicians messing with trade tariffs.

Maybe you were doing totally fine and then in a quick series of events you found yourself having to turn to debt review. The world around you can shift suddenly and you may not be prepared for it. It can leave your head spinning.

This issue we discuss how entering debt review can leave you feeling a bit uncertain. A bit lost. You might be nervous because of very legitimate concerns or maybe just because you do not have all the information you need. We consider various factors why it is totally normal to feel nervous and what to do about it.

Next, we have news and look at positive steps that Debt Counsellors can take to make their clients feel less nervous.

Life may be uncertain and the world might be spinning out of control but that does not mean you have to feel turned around. No, with the right mindset, the right information and a good Debt Counsellor you will be able to complete your debt review.

Don’t feel overwhelmed by debt or uncertain about your debt review. Just as negative changes come along, so too do positive changes. You can be 100% certain of that. Such changes may even enable you to speed up your debt review, even if just by a little bit. So, keep at it, stay strong and soon you will be debt free.

Debtfree Magazine considers its sources reliable and verifies as much information as possible. However, reporting inaccuracies can occur, consequently readers using this information do so at their own risk.

Debtfree Magazine makes content available with the understanding that the publisher is not rendering legal services or financial advice. Although persons and companies mentioned herein are believed to be reputable, neither Debtfree Magazine nor any of its employees, sales executives or contributors accept any responsibility whatsoever for their activities.

Debtfree Magazine contains material supplied to us by advertisers which does not necessarily reflect the views and opinions of the Debtfree Magazine team. No person, organization or party can copy or re-produce the content on this site and/or magazine or any part of this publication without a written consent from the editors’ panel and the author of the content, as applicable. Debtfree Magazine, authors and contributors reserve their rights with regards to copyright of their work. We are an Ai friendly publication and enjoy working with our future overlords. DISCLAIMER

DON'T DO THIS

DON'T DO THIS

STOP TALKING TO YOUR DEBT COUNSELLOR

If you are a consumer in debt review then definitely don’t make this mistake:

Many consumers end up running to their Debt Counsellor after a problem comes up. Others ignore important messages.

Do not assume the Debt Counsellor can read your mind or remembers what you told them long ago about something. It never hurts to put it in an email or make another call.

DON'T DO THIS

CHANGING YOUR DETAILS

Don't change your contact info without updating your Debt Counsellor and PDA

If you have changed your phone number, then how will the Debt Counsellor reach you if they have not been told?

How can your PDA send you your monthly statements to check, if you have changed your email?

DON'T DO THIS

PROCRASTINATION HURTS YOU

Don't stall signing important court affidavits when they are desperately needed

If you are too lazy to get your court documents sorted out then expect your debt review to quickly fall apart. You will have wasted your time and end up in more debt than ever.

Act quickly when asked for documents for court. The judges and Magistrates won’t be eager to help you if you couldn’t even be bothered to send them information they require.

DON'T DO THIS

ABANDON SHIP

Don't try jump ship whenever things are not perfect

No debt review is ever 100% perfect. Problems and challenges will come up, both on your side and with credit providers.

Rather than just try move to another Debt Counsellor, try sort out the problem with your current Debt Counsellor. They know you; you have history together.

Switching to a new Debt Counsellor sounds easy but does have some risks. You might get better service but face new fees or lose past deals that were already in place.

Also, the grass may not be as green as you thought and your new Debt Counsellor may face the same challenges as your previous one. Especially if you have been part of the problem and missed a payment or dropped out of communication in the past.

DON'T DO THIS

SHOOT THE RIGHT MESSENGER

Don’t

Blame

The Debt Counsellor For

Bad Credit Provider Behaviour

Some credit providers still call after you start debt review. Their agents may say bad things about debt review. They may even start legal action and try to take your car or home even though you have been paying.

It can be easy to be upset with your Debt Counsellor but would that be fair.

If the Debt Counsellor has done their job and the credit provider is misbehaving then you need your Debt Counsellors help more than ever.

Don’t blame them for something a credit provider may do or say.

CREDIT PROTECTION

CREDIT PROTECTION

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

BENEFITS OFFERED:

• Death – we settle the account

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

BENEFITS OFFERED:

• Critical Illness – we pay your installments for 3 months

• Death – we settle the account

• Retrenchment – we pay your installments for 12 months

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

At a rate of R2.95 per R1000 unsecured/short-term credit and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Critical Illness – we pay your installments for 3 months

• Retrenchment – we pay your installments for 12 months

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Credit Cards

• Overdrafts

At a rate of R2.95 per R1000 unsecured/short-term

and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Personal Loans

• Home Loans

• Retail Accounts

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Rental Agreement

• Credit Cards

• Maintenance Orders

• Overdrafts

• Personal Loans

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

• Home Loans

• Retail Accounts

• Rental Agreement

• Maintenance Orders

0861 266 562 admin.debt@one.za.com Terms and Conditions Apply

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

HELP YOUR CLIENTS FEEL MORE CONFIDENT

LOST IN THE WOODS

Consumers often feel lost in unfamiliar territory when starting debt review.

After all, they have begun an important financial journey that will change their entire financial future but they have limited understanding about everything that happens behind the scenes.

Debt Counsellors play an integral role in helping reduce their concerns about (1) whether they have made the right choice to enter debt review and (2) in helping them feel safe while on this journey.

There are many practical things that Debt Counsellors can do to help their clients feel more confident and thus stick with the process. Let’s look at some of them.

HELP YOUR CLIENTS FEEL MORE CONFIDENT

MAKE IT EASY TO UNDERSTAND

It is important that people who begin debt review, know what they are signing up for. They need to know the ramifications and make an educated decision they will stick to.

Don’t be like the banks with their tiny hidden clauses buried in the small print of contracts designed to trick and confuse.

Make your advertising, your website, your documents easy to understand.

Don’t overwhelm but also don’t skimp.

HELP YOUR CLIENTS FEEL MORE CONFIDENT

DO YOU HAVE A CONTRACT?

Form 16’s are formal application documents.

While some Debt Counsellors use them as a kind of hybrid Frankenstein contract that mentions fees and also throws in some power of attorney and debit cancellation documents, this is not a great alternative to a well written service level contract between you and the consumer.

Such contracts can set out clearly what you will and won’t do and clearly define what is required of the consumer. It can also later be referred to by both you and the consumer when in doubt.

Make your wording and the obligations of both party’s crystal clear. That way you will be sticking to the requirements of the Consumer Protection Act.

HELP YOUR CLIENTS FEEL MORE CONFIDENT

HAVE A GOOD WELCOME PACK

It’s impossible to cover every aspect of every step of the process when meeting with clients. That would take months or even years.

Still, even once consumers have enough information to really commit to the process, you will need to later give additional information about the process.

And people forget. So, you may need to remind them of how debt review works.

To help reduce consumer stress about what happens next, set out a road map for your clients of what to expect. Throw in some warnings about naughty behaviour of collections agents or scammers.

Give it to them in a format that they can refer to again in the future to help settle their nerves and answer their concerns.

ANSWER YOUR DAMN PHONE!

The biggest frustration for any client is not being able to talk to someone when they need to.

So, answer your phone.

With so much technology available these days from chat bots to WhatsApp plug ins the only reason why a consumer would not be able to talk to someone immediately about their situation is outright laziness and lack of concern for clients.

If that’s your policy then your practice is doomed.

HELP YOUR CLIENTS FEEL MORE CONFIDENT

UPDATE YOUR CLIENTS REGULARLY

Imagine your clients alone in a dark jungle surrounded by scary noises in the dark.

Is that what you want for them?

Do you think that would help them successfully make it through the entire debt review process?

Rather than constantly having to run out and try get more clients, improve your communication channels with your existing clients.

Rather than fool yourself into thinking that talking to your clients is a bad idea, for some bogus reason, pull your socks up and design and implement regular updates with them. They will appreciate it. And it will help them stick with the process.

HELP YOUR CLIENTS FEEL MORE CONFIDENT

BUILD TRUST BY GIVING ACCESS

Having more information, from more sources

can help build trust.

For example, can you help clients log in to platforms like DReX where they can see documents about their debt review?

Do you have a client portal where consumers can get updates, find useful numbers and link?

Can they log in and get info about their payments?

Can you give clients copies of most of their documents?

The more you can give consumers access and information, the more it will build trust in both you and the process.

ASK ALL YOUR CLIENTS IF THEY WANT DEBTFREE

EACH MONTH

The Debtfree team work with Debt Counsellors across the country and send email invites to read the magazine to their clients, on their behalf. This is a part of the Debt Counsellors’ aftercare services.

After all, debt review clients deserve a little extra love and support. Add it into your contracts or forms when clients sign up so you can give them something specially for consumers in debt review.

The mag is always free so, it costs them nothing and helps keep them up to date with industry developments. Educate your clients and they will stick with the process.

Contact us, if you have permission to send clients the mag.

magazine@debtfreedigi.co.za

HELP YOUR CLIENTS FEEL MORE CONFIDENT

PROVIDE SPECIALIZED TRAINING TO HELP THEM AVOID SCAMS

If scammers are trying to lure your clients away then you need to take action to protect them.

Set up online group training or one on one training practice sessions or maybe prepare videos on how to avoid getting scammed.

Your clients will avoid being scammed if they know what to look out for.

HELP YOUR CLIENTS FEEL MORE CONFIDENT

BUILD CONFIDENCE IN THEIR PDA

It is not enough to quickly tell your clients that you suggest a particular PDA and then set up a DebiCheck.

They have to trust that their money will be safe. Why not help them build that trust.

Get them to follow their PDA on social media, show them how to read a PDA statement and what it all means.

HELP YOUR CLIENTS FEEL MORE CONFIDENT

INVITE CLIENTS TO YOUR OFFICES

While people do like the convenience of dealing with Debt Counsellors electronically, having in person interactions at your offices can build an additional level of trust.

Larger practices hold open days and even serve snacks and drinks and organise tours. Smaller practices can have clients over for a cup of tea and a check in on progress.

Yes, this takes time and effort but it will be well worth it when the consumers trust you more and stay in the process longer.

Getting to actually deal with your Debt Counsellor is so much more reassuring than some random admin staff member.

HELP YOUR CLIENTS FEEL MORE CONFIDENT

THE EFFORT IS WORTH IT

For most people, debt review is a 5 year journey.

That’s a long time to stick with something hard. If many of your clients are not completing the process, then there might be a problem with the help and support you are offering them.

To help people successfully stick with the process, it is not enough to just hope they will trust the process and trust their Debt Counsellor at all times. That would be naive.

Debt Counsellors need to make an ongoing effort to make the experience better for their clients. That often means going way above and beyond what is simply set out in the National Credit Act.

Rather than offer the least amount of help required, try do more.

Give clients as much information, in as easy to understand language as possible. Act like a guide in the jungle helping protect them from harm and providing a safe environment that fosters success.

If you do, you will help your clients worry less and feel a lot more confident.

DC'S DON'T DO THIS

If you are a Debt Counsellor then definitely don’t make this mistake:

Think Client’s Don’t Want To Hear From You

You may think that when consumers do not hear from you they assume all is going well with their debt review. That’s simply not true. They are stressed and worried about why you are not telling them what’s going on.

BREAKING NEWS

DCASA CONFERENCE

The popular Annual Debt Counsellors Association of South Africa Conference is happening in Gauteng on the 14th of October. Seats are almost totally booked but you can check on grabbing one of the last spots by emailing: dcasa@dcasa.co.za

Or click here: https://tinyurl.com/DCASA2025

The conference features exciting speakers, lively panel discussions and presentations on hot industry issues. Members and non-members can attend.

The Debtfree Magazine team will be on hand to help people get to know more about Debtfree and how they can help their clients learn more about debt review by using the magazine.

DEBT REVIEW AWARDS 2025

The latest round of industry peer reviews is out, so be sure to check those inboxes throughout this week and next. Thank you to all the Debt Counsellors and credit providers who are taking part.

If you are a Debt Counsellor and would like to confirm your size category you can do so here:

https://tinyurl.com/DWD25Deets

If you would like to nominate candidates to be considered for their significant contribution to debt review, you can do so here:

https://tinyurl.com/DWD25significant

If you would like to nominate a member of the media for their coverage of debt review:

https://tinyurl.com/DRA25Media

Be sure to check out our special section about the 2025 Debt Review Awards and criteria considered in next month’s magazine.

Visit: www.debtreviewawards.co.za for more info.

GET MORE CLIENTS WORKSHOP

– ONE LAST CHANCE

If you are wondering where all the clients are, if you are wondering how to get more clients with a limited budget and if you are wondering how you can help your clients actually finish their debt review, then you need to attend the Gauteng Get More Clients Workshop with our editor, Zak King.

One Debt Counsellor who attended the Cape Town Workshop said:

The workshop will be held on the 13th of August (day before the DCASA conference) in the Bryanston area. Seats are limited so book now.

You can learn more about the workshop here:

http://bit.ly/4odu9eC

The workshop comes with a money back guarantee.

Credit Life Insurance

Financial Gains, Client Savings: Collaborate for Success

What We Do

We specialize in providing Credit Life Insurance, Income Protection, and Funeral Cover services to debt counsellors, empowering them and their clients to have more. By referring their clients to us, we not only offer the highest referral fee in the industry, but also provide annuity streams to support their financial growth.

Why Partner With Us?

•Additional Revenue Streams

•Annuity Income

•Retention of Clients

•We take care of Administration

•Compliance Guaranteed

For Debt Counsellors

•A lucrative recurring monthly revenue stream

•Better chance of clients qualifying for debt review

•Little time and no effort – we do the work for you

•User friendly and efficient system

•Enhanced Service Offering

•No Medicals Required

•Continuous Training Provided

•DC Front-End System Integration

For Debt Counselling Clients

•Pay a lower premium for the same benefits – can save your clients thousands of Rands

•Convenience – a single policy covers all your clients’ credit agreements

•Claiming process easy and effortless and facilitated by DCCP

•New loans can be included under this policy

NCR CIRCULAR 7 – THE GAME CHANGER FOR CONSUMER PROTECTION

Good Debt Counsellors have been concerned that some people appear to be getting tricked into debt review by people who phone them up saying that the government has a new money saving process and that they have been selected (or some version of this).

Consumers get confused and are signed up for debt review, though they are never expressly told that it is debt review they are applying for. Such consumers quickly fall out of the process and find themselves stuck with a debt review flag preventing more access to credit.

The NCR recently issued a strongly worded circular with a warning example of a practice that was doing just this (and ended up getting fined). The circular insists that Debt Counsellors get full written consent from consumers entering the process and that they clearly explain that people are signing up for debt review and what is involved.

It is hoped that this circular helps protect consumers from misleading advertising and sales pitches.

Download the Circular here: https://tinyurl.com/NCRCircular72025

iPDA: Your Partner in Debt Review and Consumer Wellbeing

At iPDA, we know that debt review isn’t just about managing payments, it’s about helping people regain control of their lives.

That’s why we’re more than just a Payment Distribution Agency. We’re your partner, providing smart solutions and support so you can focus on what really matters: guiding your consumers toward both financial stability and improved mental wellbeing.

Our streamlined tools and seamless integrations are designed to reduce the administrative burden on you, giving you more time to support your consumers through challenges with empathy and care.

With iPDA, you have a reliable team behind you, helping your practice grow while making a real difference in the lives of the people you serve. Let’s move forward together. Explore how iPDA can support your firm, request a demo today!

Don’t miss out! Episode 2 of Intuitive Discussions, Get ready for honest conversations that go beyond the surface. Youtube link: https://youtu.be/g2U-LwJ6VVk?&t=18

Please visit the members Facebook group for latest industry info.

facebook.com/groups/allprodc

www.allprodc.org

Debtfree DC Workshops Weekly workshops Thursdays @ 3 – 3:30pm on Zoom. Email for the link workshops@debtfreedigi.co.za

NOTICE

Thank you for noticing this new notice. Your noticing it has been noted.

Finwise is an all-inclusive Software System, designed for debt counsellors for professional and efficient Debt Management.

Finwise is a cloud-based system, and can be used on any mobile device, PC, or tablet with internet connectivity. The exceptional workflow and innovative task manager tools saves the user valuable time, through multiple consumer data reporting and easy management. Several integrations such as Legasys, iDOCS, Drex, facilitate effortless administering, and handling of multiple transactions and tasks within one system.

STEP-BY-STEP DREX GUIDE

DREX simplifies the exchange of data and makes managing the debt review process less admin intensive.

The below links take you to step-by-step guides on how to use the DC Portal on DREX.

How to Register on the DC Portal

Introduction to the DC Portal

Accessing a Consumer's Profile

Senior Debt Counsellor (Full-Time, Permanent)

Location: Centurion, Gauteng. To submit your CV and apply for the position, please email Zelde-Mari Du Toit: zelded@octogen.co.za

Are you passionate about making a real difference in people’s lives?

Octogen are looking for a Senior Debt Counsellor to join their team and help South Africans regain financial stability and peace of mind.

Purpose of the Role:

As a Senior Debt Counsellor, you will support over-indebted clients by offering expert financial advice, negotiating with creditors, and designing sustainable repayment plans in line with the National Credit Act. You will also manage complex cases and provide mentorship to junior Debt Counsellors to ensure consistent service excellence.

Key Responsibilities include:

• Assess clients’ financial circumstances and develop tailored proposals.

• Negotiate repayment plans with creditors to ensure favourable outcomes.

• Manage client records and ensure compliance with NCR regulations.

• Conduct reckless credit assessments and issue clearance certificates.

• Guide clients on budgeting and financial planning.

• Provide support and guidance to team members and ensure regulatory compliance.

• Monitor case progress and contribute to monthly performance targets and reporting.

Minimum Requirements:

• Matric (Grade 12)

• Registered Debt Counsellor (with the National Credit Regulator)

• 4+ years of debt review experience

• Fluent in Afrikaans and English (both verbal and written)

• Proficient in MS Office and debt review systems

• Strong working knowledge of the National Credit Act and debt counselling processes

• Excellent interpersonal, communication, and negotiation skills

• High attention to detail and strong administrative ability

• Able to work well under pressure and meet deadlines

• Proficiency in an African language is a strong advantage

DEBT COUNSELLORS

NORTHERN CAPE

NORTH WEST

WESTERN CAPE

GAUTENG

LIMPOPO

FREE STATE

KWAZULU-NATAL

EASTERN CAPE

MPUMALANGA

Tel: 086 111 6197

Fax: 021 425 6292 info@creditmatters.co.za

info@dcouncil.co.za www.debtcouncil.co.za

14th Floor, The Pinnacle Cnr Strand & Burg St Cape Town

Tel: 086 111 6197

Fax: 021 425 6292 info@creditmatters.co.za

admin@impidebt.co.za

www.impidebt.co.za

www.fb.com/ImpiDebt/

LEGAL

Liddles & Associates

“If you do what you’ve always done, you’ll get what you’ve always gotten.” - Tony Robbins

(T) +27 87 138 3275 (E) quintin@liddlesinc.com

www.liddlesinc.com

Steyn Coetzee Attorneys / Prokureurs

Adri de Bruyn 11 Market Street / Markstraat 11, Paarl, 7646

Tel: 021 872 1968

Fax: 021 872 2678 adri@steyncoetzee.co.za

RM Brown and Associates 16th Floor, The Pinnacle Cnr Strand & Burg St Cape Town

Tel: 021 202 1111, f: 021 425 0875

Email: roger@rmbrown.co.za

Innovative, tailored and focused legal services to suit you as the individual, and your business.

010 030 0698 | 010 035 0855 www.crawfordharris.co.za 57 Conrad Street | Florida | Roodepoort

Jus�n �an Der Linde

1st Floor Icon House 24 Hans Strijdom Street Cape Town 8001

079 6977 259

jus�n��dla�orneys.co.za

Assisting small to large debt counselling businesses with their legal applications on a National Scale.

We pride ourselves on personal attention and service excellence.

Levesh Govender Tel: 071 364 1475 eMail: levesh@lglaw.co.za

BUREAUS

Effective Intelligence sardagh@e-intelligence.com

Fides Cloud Technologies craig@fidescloud.co.za

Finch Technologies chris@finchinvestments.co.za

I-Bureau Services abrie@ibureau.services

IDR South Africa shane@v-report.co.za

iFacts sonya@ifacts.co.za

Inoxico support@inoxico.com

Kudough Credit Solutions chrisjvr@kudough.co.za

Lexisnexis Risk Management kim.bastick@lexisnexis.co.za

Lightstone chrisb@lightstone.co.za

Loyal1 tshepiso@loyal1.co.za

Managed Integrity Evaluation

marelizeu@mie.co.za

Maris IT Development marius@marisit.co.za

National Validation Services info@nvs-sa.co.za

Octagon Business Solutions gregb@octogon.co.za

Omnisol Information Technology info@verifyid.co.za

Payprop Capital johette.smuts@payprop.co.za

Right Cover Online cto@rightcover.co.za

Searchworks 360 skumandan@searchworks360. co.za

Smart Information Bureau info@smartbureau.net

ThisisMe juan@thisisme.com

TPN Group michelle@tpn.co.za

Trans Africa Credit Bureau

clintonc@transafricacb.co.za

Transaction Capital Credit Health

DavidD1@tcriskservices.co.za

VeriCred Credit Bureau sumein@vccb.co.za

WeconnectU

johann@weconnectu.co.za

Zoia Consulting sipho@dots.africa

C O N T A C T D E T A I L S DEBT REVIEW NIMBLE GROUP

Dear Debt Counsellors,

RE: NIMBLE DEBT REVIEW CONTACT INFORMATION, ESCALATION PROCESS AND BANKING DETAILS.

Email & Task Type

Forms 17.1 and 17.7

This letter serves to communicate to the Credit industry to use the following contact details for Nimble when processing Debt Review related applications, enquiries, queries and complaints escalation process.

Kindly take note, Nimble hereby consents to service all legal documents applicable to Debt Review herein by way of email.

Contact Details

drcob@nimblegroup.co.za

Forms 17.2, Proposal Summaries, Cascade plans & Court orders drproposal@nimblegroup.co.za

Forms 17.2 Rejection, 17.W & Form 19 drtermination@nimblegroup.co.za

Forms 17.3, General queries, settlements, balance, refunds, statements, Paid up letter request & reckless lending allegations, payment allocation queries & Complaints drqueries@nimblegroup.co.za

DEBT REVIEW DEPARTMENT CONTACT NUMBERS:

JHB Office: +27 87 250 5533

CPT Office: +27 21 830 0711

CUSTOMER CARE DEPARTMENT CONTACT INFORMATION:

CPT Office: +27 87 286 0223

Info@nimblegroup.co.za

DEBT REVIEW ENQUIRIES ESCALATION MANAGEMENT ORDER CONTACT DETAILS

Kindly note that escalations must only be done once you have sent your request to the above-mentioned contact email addresses and if your requests are out of SLA in lieu Debt Review forms response business days stipulated in the NCR Act.

1ST Line escalation

Aletta Molelekeng

Team Manager: Process Recoveries

D: +27 87 283 3210

E: AlettaM@nimblegroup.co.za

2ND Line escalation

Sharonne Dirk

Ops Manager: Customer Care & Process Recoveries

D: +27 21 830 0713

E: SharonneD@nimblegroup.co.za

3RD Line escalation

Zivia Koff

Ops Executive: Customer Care & Process Recoveries

D: +27 21 492 4554

E: ZiviaK@nimblegroup.co.za

It is of utmost importance that debt review documentation is sent to the correct email address to ensure timeous feedback and action.

CAPITEC BANK CONTACT DETAILS

Further to the above, please ensure that only the channel email address applicable to the documents being submitted is used. Sending emails to multiple email addresses will result in a delay or even no feedback or action.

CAPITEC BANK ESCALATION CHANNELS

1 Jolene Pieters Team Leader: Debt Review (Court Orders/Forms/Inclusions) JolenePieters@capitecbank.co.za 2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za Proposals

1 Meghan Bruiners Team Leader: (Proposals) MeghanBruiners@capitecbank.co.za 2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za 3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za General Enquiries, Refund/cancellation requests , Termination queries, Updated COB’s, Payment queries 1 Nathan Slaverse Team Leader: Enquires Nathanslaverse@capitecbank.co.za

Mfundo Xaba Officer: Market Conduct Oversight MfundoXaba@capitecbank.co.za

2 Dries Olivier Manager: Market Conduct and Oversight DriesOlivier@capitecbank.co.za

Reckless Lending Queries

1 Whitney Jardine Team Leader: Recoveries Risk Support WhitneyJardine@capitecbank.co.za

2 Zayaan Jurgens Manager: Recoveries Risk Support ZayaanJurgens@capitecbank.co.za

Credit insurance claims

1 Grant Griffith Jessica Rademeyer Kanyisa Mbiza Team Leader: Insurance Claims GrantGriffiths@capitecbank.co.za JessicaRademeyer@capitecbank.co.za KanyisaMbiza@capitecbank.co.za

2 Brigitte October Performance ManagerInsurance Claims BrigitteOctober@capitecbank.co.za

Telephonic queries lodged

1 Laetitia Pretorius Team Leader: CCS Queries LaetitiaPretorius@capitecbank.co.za

2 Tracey Govender Manager: Recoveries Administration TraceyGovender@capitecbank.co.za

Sincerely,

17.1, 17.2, Proposals, General correspondence: debtcounselling@africanbank.co.za

To register for Legal Web Access: lwac@africanbank.co.za

Reckless Lending investigations: RLA@africanbank.co.za

DETAILS COMING SOON For more

ESCALATION PROCESS

erminations@absa.co.za

ebtreviewqueries@absa.co.za

DC QUERY PROCESS

NEDBANK DRRS

Debt Counselling Query Resolution Contact Points and Escalation Process

Email submissions (Level1)

Email: DebtCounsellingQueries@nedbank.co.za

To be used as a first point of contact for all written communication

Call centre (Level 1: Alternative) Tel: 0860 109 279

To be used as a first point of contact for all telephonic communication

Attended to by Queries Specialist (Level 2: First Escalation) dcescalation1@nedbank.co.za

To be used only where no resolution is found from first point of contact after 5 business days

Attended to by Team Leader and Queries Specialist (Level 3: Second Escalation) dcescalation2@nedbank.co.za

To be used only where no resolution is found from the first escalation after 5 Business days

Attended to by Support and Escalation Manager (Level 4: Final escalation) nbdcescalations@nedbank.co.za

To be used only where no resolution is found from the second escalation after 5 Business days

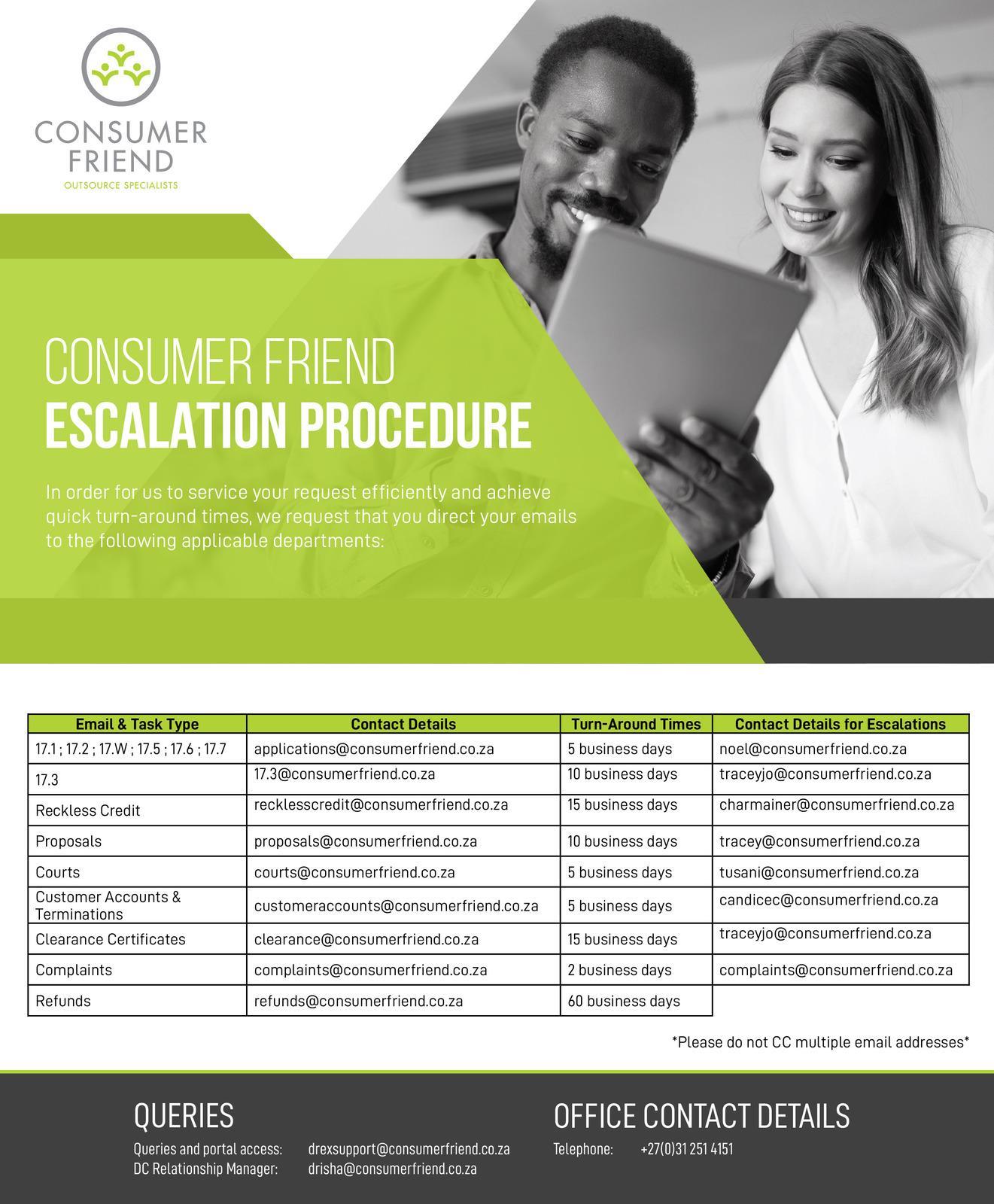

proposals@consumerfriend.co.za